#BlueChipStocks

Explore tagged Tumblr posts

Text

We often find safer investments to save our money during the volatile stock market. Investing risks like financial insecurity, stock market volatility, and global shenanigans can trick even the most experienced investors in the industry. However, 5starsstocks.com Staples takes a wild card entry in this scene.

0 notes

Text

How Dow Jones Stocks Serve as a Pulse of Market Sentiment

The Dow Jones Industrial Average (DJIA) is among the oldest and most prominent stock market indices in the world. Composed of 30 large U.S. companies, it provides a reflection of market trends, corporate strength, and economic momentum. The performance of Dow Jones stocks offers a powerful snapshot of business cycles, sector shifts, and the broader state of the U.S. equity market.

The Composition and Methodology of the Dow

Unlike many indices that are market-cap weighted, the DJIA follows a price-weighted formula. In this structure, higher-priced stocks have a greater impact on index movement, regardless of their overall market size. This means that price changes in certain Dow Jones stocks can influence the index disproportionately, creating unique movement patterns when compared to broader benchmarks.

The companies selected for the index span various sectors including technology, industrials, consumer goods, healthcare, and financial services. Each firm is considered a leader in its industry, and inclusion in the Dow reflects a combination of longevity, financial strength, and reputational standing.

Blue-Chip Status and Business Maturity

Dow Jones stocks are often referred to as “blue-chip” companies—businesses that have demonstrated strong financial performance, operational stability, and global reach. These firms are typically associated with consistent earnings, solid balance sheets, and recognizable brand value. Their historical reliability and resilience through multiple market cycles make them foundational elements in long-term equity analysis.

The blue-chip status also means that these companies are less likely to exhibit extreme price volatility during periods of market stress. Their large-scale operations, diversified revenue streams, and management expertise contribute to a degree of stability not always found in smaller or more speculative equities.

Sector Diversity and Economic Representation

Despite including only 30 companies, the Dow maintains a well-rounded sector composition. From industrial manufacturers and financial giants to pharmaceutical leaders and technology innovators, Dow Jones stocks collectively reflect the breadth of the U.S. economy. This diverse mix makes the index a useful tool for assessing sectoral health and the direction of business investment across industries.

Changes to the index are infrequent but significant. Companies are added or removed to ensure the index remains aligned with the evolving structure of the economy. These changes maintain the Dow’s relevance as an economic indicator.

A Barometer for Market Sentiment

Movements in the Dow are often used to gauge overall market sentiment. When Dow Jones stocks rise, it is often interpreted as a sign of optimism about economic growth, business expansion, or policy developments. Conversely, declines can signal concerns about interest rates, earnings pressure, or geopolitical uncertainty.

Analysts frequently look to the DJIA for early signals of broader equity market trends. The index’s high visibility in financial media and its concentration of industry leaders enhance its role as a quick reference point for public and institutional sentiment.

Long-Term Trends Shaping Dow Jones Stocks

Over time, the DJIA has served as a reliable historical benchmark. The performance of Dow Jones stocks has spanned wars, recessions, booms, and policy transformations. These long-term patterns reveal the index’s ability to adjust to structural changes in the economy while remaining relevant as a tracking tool.

Its longevity also makes it useful in studying how corporate behavior shifts in response to macroeconomic changes. From automation and digital transformation to energy policy and healthcare reform, the Dow reflects the real-time adjustments made by some of the world’s most influential corporations.

Global Recognition and Institutional Use

The DJIA’s prominence extends beyond the United States. It is frequently cited in global financial reporting, used as a reference in institutional strategies, and tracked by analysts worldwide. Dow Jones stocks are considered key equity holdings in many diversified portfolios, serving as a representation of the U.S. market's leadership position in the global economy.

Their reputations, financial transparency, and governance standards often exceed global benchmarks, making the index a focal point for evaluating international confidence in U.S. markets.

Dividend Reliability and Financial Strength

While not selected solely for their income characteristics, many Dow Jones stocks have long histories of consistent dividend payments. This reliability adds to their appeal for those studying corporate financial discipline. Companies that maintain regular distributions across economic cycles are often viewed as having strong internal cash management and shareholder-aligned policies.

Dividend history is just one of many indicators used to evaluate company strength, but among Dow constituents, it often underscores broader themes of operational maturity and long-term vision.

The Enduring Value of a Legacy Index

Though the DJIA is smaller in scope than indices like the S&P 500, it holds a unique position in financial analysis. It provides clarity without complexity—delivering signals from some of the most impactful businesses in the U.S. market. Dow Jones stocks offer a focused, high-quality view of how leading corporations respond to challenges and opportunities across changing environments.

This blend of historical relevance, sector balance, and blue-chip consistency keeps the Dow central in understanding both short-term movements and long-term equity patterns.

0 notes

Text

#NigerianStockMarket#NGX#InvestorsGain#BullishTrend#MarketCapitalization#BlueChipStocks#AllShareIndex#FinancialGrowth

0 notes

Text

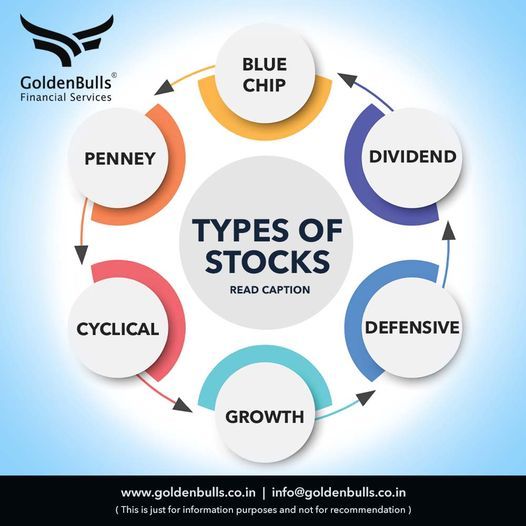

Blue Chip Stocks: These are shares of well-established, financially stable, and reputable companies with a history of consistent performance. Blue chip stocks are generally considered safe and reliable investments.

Dividend Stocks: Companies that distribute a portion of their earnings to shareholders in the form of dividends. These stocks are often favored by investors seeking regular income.

Defensive Stocks: Companies that tend to remain stable even during economic downturns. They are less sensitive to economic cycles, and their products or services are considered essential.

Growth Stocks: These are shares of companies expected to grow at an above-average rate compared to other companies. Investors in growth stocks are typically focused on capital appreciation rather than dividends.

Cyclical Stocks: Companies whose performance is closely tied to the economic cycle. These stocks often do well when the economy is booming but may suffer during economic downturns.

Penny Stocks: Stocks with a low market price, usually trading at less than $5 per share. Penny stocks are often associated with smaller, riskier companies and can be more volatile than stocks of larger, more established companies

Call us at : +91 8411002452 OR Visit: www.goldenbulls.co.in

#BlueChipStocks#DividendInvesting#DefensiveStocks#GrowthInvesting#CyclicalStocks#PennyStocks#InvestmentStrategies#DiversifyYourPortfolio#StockTips#MarketTrends#EconomicCycles#RiskManagement#Financialservices#FinancialWellness#Goldenbulls

0 notes

Video

youtube

How Can a Market Crash Make You Rich?

📉 Stock Market Crash? Why It Might Be the BEST Time to Buy Stocks 💸 A stock market plunge can feel terrifying—but for smart, long-term investors, it can also be a massive buying opportunity. In this video, I break down why downturns can lead to outsized returns—if you play it right. 🔍 What You’ll Learn: Why market crashes offer discounted prices on quality stocks How to avoid emotional investing mistakes during selloffs The critical mindset needed to invest during downturns Strategies like dollar-cost averaging and defensive sector picks What not to do when markets fall fast ✅ Key Takeaways: Focus on blue-chip companies with strong fundamentals Think long-term (3–5+ years) Keep cash reserves ready for deeper dips Avoid hype stocks and stay diversified 📊 Whether you’re navigating a 2025 market correction or just preparing for the future, this guide will help you approach crashes like a pro—not a panicked trader. 👉 Subscribe for more investing tips and market analysis: https://www.youtube.com/@UCYeO7auPodcecl2CnDskMNg 👍 Like if you found this helpful & comment below: Are you buying the dip or sitting it out? #StockMarketCrash #BuyingTheDip #LongTermInvesting #MarketPlunge #InvestingTips #BlueChipStocks #DollarCostAveraging #DefensiveStocks #StockMarket2025 #ValueInvesting

0 notes

Photo

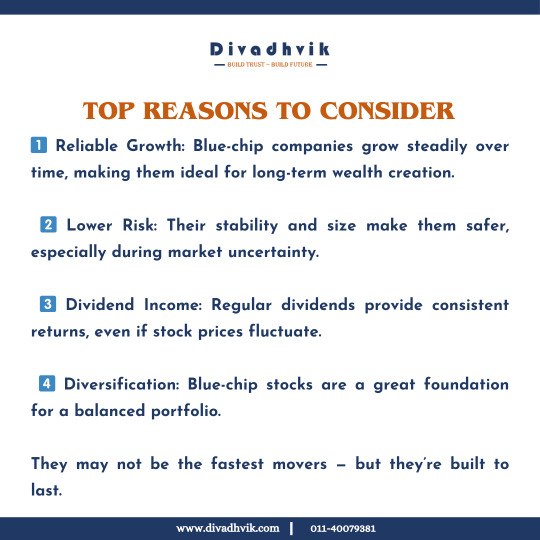

Start Investing in Blue-Chip Stocks Today With Divadhvik, explore top-performing blue-chip stocks and build a portfolio you can trust. ✅ Download the Divadhvik App or visit www.divadhvik.com to begin your journey toward stable and smart investing. #DivadhvikApp #BlueChipStocks #SmartInvesting #StockMarketBasics #WealthCreation

0 notes

Photo

#Wealthmanagement #Economics #Wealth #Liquidity #Forex $Igc $nspr $Gbtc $Btsc #Blockchain $Riot $Bcii $sing $x $mjna $Tops $Xxii $Fnma $Drys $Rven $Ustc $Ko $T $Ngg $F $Ge $Bac $owcp #Bluechipstocks #Pennystocks #Equity #Assets #Vwap #Finance #Financialfreedom #Futures #Generationalwealth #Financialfreedom💰 #Options https://www.instagram.com/p/B3CETYvjQ7B/?igshid=1q5iqv7l6emrd

#wealthmanagement#economics#wealth#liquidity#forex#blockchain#bluechipstocks#pennystocks#equity#assets#vwap#finance#financialfreedom#futures#generationalwealth#financialfreedom💰#options

2 notes

·

View notes

Text

TOP BLUE CHIP STOCKS IN INDIA 2023

Investment is one of the best ways to build wealth over time and is an excellent source of passive income. Since equities are the most popular form of investment that gives excellent returns, people opt for investing in stocks. This leads investors to seek out the top blue chip stocks in India 2023 for finding good investing opportunities.

Investments made for the long term almost always lead to capital appreciation and give excellent returns. These investments can be made in equity or debt, depending on the risk appetite and on the desired rate of returns.

Best Blue Chip Stocks in India

Let us look at the list of some of the best blue chips stock list so we can pick and choose the right ones for us. We will make our decision based on financial ratios since we use Fundamental Analysis for long term investment.

Net profit margin, earnings per share, price to earnings ratio, market capitalization, change in revenue and net profit, etc. are some of the fundamental analysis parameters we will take into consideration to select best blue chip stocks for long term investment.

Read more

1 note

·

View note

Text

2023 Blue Chip Stocks Guide: Top Picks for Investing

Expert insights and analysis on blue chip stocks. Invest with confidence and reap the rewards of investing in top-performing blue chip stocks.

#BlueChip#BlueChipStocks#StocksInsights#Stockstopick#StockScreenerIndia#StockScreener#StockMarketWebsite#ShareMarketWebsite#ToolforstockAnalysis#StockAnalysisTool#StockMarketBlogs

0 notes

Text

Promising Mid Cap Stocks for Long-Term Growth: Top Picks for 2024

Looking for mid cap stocks with strong growth potential? Explore a curated list of promising mid-cap stocks for long-term investment in 2024. These companies offer a balance of stability and growth, making them perfect for investors looking to diversify their portfolios. With potential for high returns, mid cap stocks are an attractive choice for long-term growth. Don’t miss out on these high-potential stocks to watch in the coming year.

For more information visit at : https://kalkinemedia.com/us/stocks/midcap

#BlueChipStocks#DividendIncome#StableInvestments#LongTermGrowth#StockInvesting#DividendStocks#ReliableStocks#SteadyIncome

0 notes

Text

blue chip stocks india

The returns generated through blue chip shares in long time are extra assured. How they're extra assured? In 3 ways: (

a) they could yield regular dividends,

(b) their incomes increase is extra certain,

and (c) their inventory charge is extra stable. Let’s recognize extra approximately those three points:

Consistent dividends: These are shares which has excessive marketplace proportion and also are very profitable. This manner they makes massive earnings. Such corporations regularly proportion their earnings with shareholders in shape of dividends. Hence blue chip corporations are regularly the exceptional dividend payers of the marketplace. Read extra approximately dividend paying shares.

Predictable increase: Strong enterprise basics of blue chip shares makes their destiny increase extra predictable. How? High marketplace proportion, excessive profitability, and coffee debt, makes them like invincible. It is tough of competition to conquer them of their game. This offers the pricing energy to blue chip shares – main to destiny increase. Read extra approximately pricing energy and why Buffett loves it.

Price stability: of blue chip shares in falling marketplace is one in every of its largest advantages. It does now no longer imply that charge of blue chip shares does now no longer fall while index is falling. Its charge may even fall, however the fall might be slower and healing might be faster. Read extra approximately why inventory charge differ so much.

0 notes

Photo

#Bondanalysis #Investors #Valueinvesting #Bluechipstocks #Economics #Finance #Bullmarket #Businessintelligence https://www.instagram.com/p/B4MyYw0jvkt/?igshid=74rcnmlw7u9m

#bondanalysis#investors#valueinvesting#bluechipstocks#economics#finance#bullmarket#businessintelligence

1 note

·

View note

Video

instagram

#nipponnfo #nipponmutualfund #newfundoffer #flexibility #marketcap #marketcapitalization #largecaps #midcaps #smallcaps #smallbusiness #bluechips #bluechipstocks #flexicaps #invest #mutualfunds #investorlife #investor #surat #suratcity https://www.instagram.com/p/CSEr3f0FbJK/?utm_medium=tumblr

#nipponnfo#nipponmutualfund#newfundoffer#flexibility#marketcap#marketcapitalization#largecaps#midcaps#smallcaps#smallbusiness#bluechips#bluechipstocks#flexicaps#invest#mutualfunds#investorlife#investor#surat#suratcity

0 notes

Photo

Again, You have to give people an idea of what they will have if they buy or purchase a product from you. As a business person you are solving problems, in my particular business I'm solving the problem of what specific decor or space is neefed in someone's Home, Hotel, commetcial Lobby, Loft, etc, etc. This painting is entitled "From C notes to C-notes" Size is 48in x 40in Style: Neo Expressionism Price DM me. www.kha-tees.com | problem solver | Artist #realestate #nyclofts #nyccoops #nychotels #nyfashionweek #nycrealestate #njrealestate #DouglasElliman #corcoran #halsteadproperty #citihabitats #compassrealestate #brownharrisstevens #brooklynrealestate #Artist #artcollectors #basquiat #jazz #BoomBip #black #JazzizHipHop #artbusiness #art #creating #artist #artcollectors #richartcollectors #wealthyartbuyers #bluechipstocks #cryptocurrency #bitcoins (at New York, New York)

#jazzizhiphop#realestate#brooklynrealestate#cryptocurrency#corcoran#nyccoops#brownharrisstevens#artist#basquiat#njrealestate#compassrealestate#art#douglaselliman#halsteadproperty#black#artcollectors#artbusiness#bluechipstocks#nyfashionweek#richartcollectors#nyclofts#boombip#nycrealestate#nychotels#bitcoins#citihabitats#jazz#creating#wealthyartbuyers

20 notes

·

View notes

Text

2023 Blue Chip Stocks Guide: Top Picks for Investing

Expert insights and analysis on blue chip stocks. Invest with confidence and reap the rewards of investing in top-performing blue chip stocks.

#BlueChip#BlueChipStocks#StocksInsights#Stockstopick#StockScreenerIndia#StockScreener#StockMarketWebsite#ShareMarketWebsite#ToolforstockAnalysis#StockAnalysisTool#StockMarketBlogs

0 notes

Photo

still dress the same ‘cause we still rep the same. ✈️ ft. @lightyearsawayfromhomme 🎥: @kaylasvisual @kayluhhj #farishstreetdistrict #brothers #family #mondaymotivation #jacksonms #ytbshorty #bluechipstocks #explore #nike #vans #stocks #exploremore (at Jackson, Mississippi) https://www.instagram.com/p/CbqJDiiu7OX/?utm_medium=tumblr

#farishstreetdistrict#brothers#family#mondaymotivation#jacksonms#ytbshorty#bluechipstocks#explore#nike#vans#stocks#exploremore

0 notes