#EconomicCycles

Text

Adnan Vadria's Insights into the Impact of Economic Cycles on Commercial Real Estate

In the dynamic realm of commercial real estate, navigating through economic cycles is pivotal for investors, developers, and stakeholders alike. Adnan Vadria, a seasoned expert in commercial real estate, sheds light on the intricate relationship between economic cycles and the industry's landscape. This podcast explores the fundamental aspects of how economic fluctuations influence the commercial real estate market, providing invaluable insights for professionals and enthusiasts.

#adnanvadria#economiccycles#commercial#realestate#markettrends#investmentstrategies#propertyvalues#riskmanagement#financialplanning

0 notes

Text

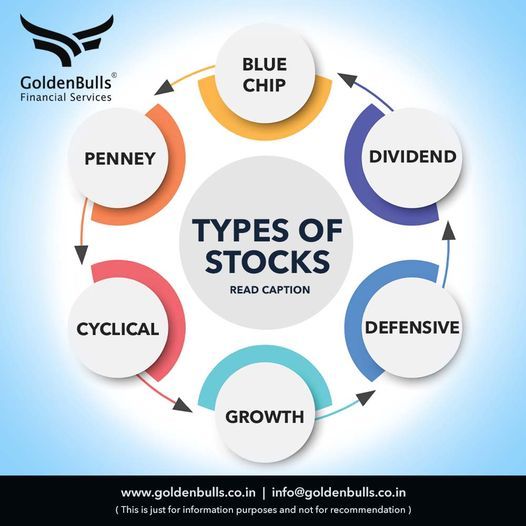

Blue Chip Stocks: These are shares of well-established, financially stable, and reputable companies with a history of consistent performance. Blue chip stocks are generally considered safe and reliable investments.

Dividend Stocks: Companies that distribute a portion of their earnings to shareholders in the form of dividends. These stocks are often favored by investors seeking regular income.

Defensive Stocks: Companies that tend to remain stable even during economic downturns. They are less sensitive to economic cycles, and their products or services are considered essential.

Growth Stocks: These are shares of companies expected to grow at an above-average rate compared to other companies. Investors in growth stocks are typically focused on capital appreciation rather than dividends.

Cyclical Stocks: Companies whose performance is closely tied to the economic cycle. These stocks often do well when the economy is booming but may suffer during economic downturns.

Penny Stocks: Stocks with a low market price, usually trading at less than $5 per share. Penny stocks are often associated with smaller, riskier companies and can be more volatile than stocks of larger, more established companies

Call us at : +91 8411002452 OR Visit: www.goldenbulls.co.in

#BlueChipStocks#DividendInvesting#DefensiveStocks#GrowthInvesting#CyclicalStocks#PennyStocks#InvestmentStrategies#DiversifyYourPortfolio#StockTips#MarketTrends#EconomicCycles#RiskManagement#Financialservices#FinancialWellness#Goldenbulls

0 notes

Text

Cryptocurrency Speculation and the Reinterpretation of Kondratieff Cycles

The rapid growth and volatility of the cryptocurrency market have introduced a new layer of complexity to the study of long-term economic cycles, such as the Kondratieff waves. These cycles, first proposed by the Russian economist Nikolai Kondratieff in the 1920s, describe the cyclical patterns of economic expansion and contraction that occur over a period of approximately 50-60 years. As the cryptocurrency market continues to evolve and exert its influence on the global economy, it has become increasingly important to examine how this new paradigm may be reshaping our understanding of these long-term economic trends.

Rethinking the Bull Cycle Narrative: Bitcoin Halving and Beyond

The Bitcoin halving, a programmed event that reduces the reward for Bitcoin miners by half, has historically been a key driver of bull cycles in the cryptocurrency market. This supply-side dynamic has been a central part of the narrative surrounding the cyclical nature of the cryptocurrency market. However, the growing speculation around the impact of the halving and the changing economics of cryptocurrency mining have raised questions about the continued relevance of this event in shaping Kondratieff cycles.

As the cryptocurrency market matures and new factors, such as the entry of institutional investors, come into play, the traditional patterns of boom and bust may no longer align as neatly with the Kondratieff cycle framework. This shift in market dynamics challenges the conventional interpretation of how technological innovations, like cryptocurrencies, influence the broader economic landscape.

A New Breed of Investors: Institutional Entry and Market Maturation

The increasing participation of institutional investors in the cryptocurrency market, facilitated by the introduction of cryptocurrency-based exchange-traded funds (ETFs), signals a significant shift in the market's composition and behavior. The influx of capital and expertise from these institutional players may alter the market's volatility, liquidity, and correlations with traditional economic cycles.

As the cryptocurrency market matures, the influence of these institutional investors and their more sophisticated investment strategies could potentially smooth out the cyclical patterns observed in the past. This could, in turn, complicate the interpretation of how the cryptocurrency sector fits into the broader Kondratieff cycle framework, requiring a more nuanced analysis of the interplay between these two spheres.

The Regulatory Enigma: Uncertainty and Its Ripple Effects

Regulatory uncertainty remains a persistent challenge in the cryptocurrency market, with policymakers and government agencies grappling with how to approach this new and rapidly evolving asset class. The impact of regulatory decisions, such as changes in taxation, licensing requirements, or even outright bans, can have significant implications for the stability and direction of the cryptocurrency market.

This regulatory uncertainty introduces an additional layer of complexity when attempting to align the cryptocurrency market's behavior with the Kondratieff cycle model. The unpredictable nature of regulatory interventions can disrupt the market's natural rhythms, making it more difficult to discern the underlying economic patterns that have traditionally been associated with these long-term cycles.

Beyond Speculation: A Multifaceted Analysis

To fully understand the interplay between cryptocurrency speculation and the reinterpretation of Kondratieff cycles, it is essential to adopt a multifaceted approach that considers a range of factors. This includes analyzing the technological advancements driving the cryptocurrency ecosystem, the broader global economic landscape, and the behavioral economics underlying the market's dynamics.

By taking an interdisciplinary perspective, researchers and policymakers can gain a more comprehensive understanding of how the cryptocurrency market is influencing and being influenced by the long-term economic cycles that have shaped the modern world. This holistic approach can inform more nuanced and adaptive strategies for navigating the complex and ever-evolving economic landscape.

Conclusion

The rise of the cryptocurrency market has introduced a new layer of complexity to the study of long-term economic cycles, such as the Kondratieff waves. Factors like the Bitcoin halving, the entry of institutional investors, and regulatory uncertainty are challenging the traditional interpretations of these cycles, necessitating a reexamination of how technological innovations and financial speculation intersect with broader economic trends.

As the cryptocurrency market continues to evolve and exert its influence on the global economy, it is crucial for researchers, policymakers, and market participants to adopt a multifaceted approach that considers the interdisciplinary nature of these dynamics. By doing so, we can gain a deeper understanding of the entangled web of cryptocurrency speculation and its impact on the reinterpretation of Kondratieff cycles, ultimately informing more effective strategies for navigating the complex and ever-changing economic landscape.

texto produzido com inteligência artificial

#CryptocurrencySpeculation hashtag#KondratieffCycles hashtag#BitcoinHalving hashtag#InstitutionalInvestors hashtag#RegulatoryUncertainty hashtag#EconomicCycles hashtag#MarketDynamics hashtag#GlobalEconomy hashtag#InterdisciplinaryAnalysis hashtag#FinancialSpeculation hashtag#EconomicTrends hashtag#MarketVolatility hashtag#PolicyImplications hashtag#ComplexEconomicLandscape

0 notes

Text

Video: Investing Themes & When to Use Which

I define #investing #themes or #factors #strategy and indicate which theme to use in each of the phases of the #economiccycle. You can implement this using #ETFs.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

Visit: http://www.canadianmoneytalk.caThe Investing & Personal Finance Basics course is at…

View On WordPress

#buildingwealth#dividends#economiccycle#ETF#factors#genzfinance#howtoinvestinstocks#investing#millennialmoney#passiveincome#stockmarket#stocks#themes

1 note

·

View note

Text

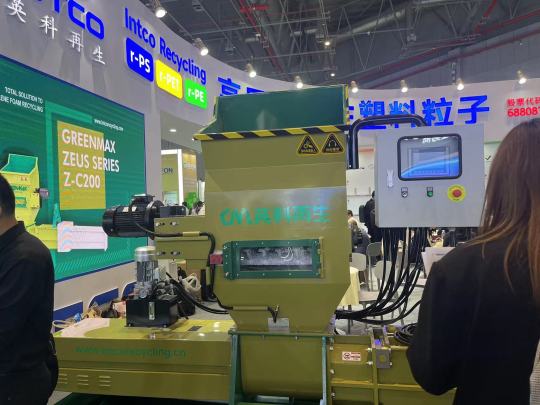

🔊 This year #CHINAPLAS showcases innovative, unique and innovative products and technologies that solve market concerns created by many industry leaders and technology pioneers. Manufacturers and product brands need to include sustainability in 🔎 product design, manufacturing, consumption and post-use disposal. Therefore, material selection, processing systems, post-consumer #plastic waste management are all highlights of this exhibition.

♻ The four environmentally friendly manufacturing themed areas bring together 250 exhibitors to showcase #recycling technology, recycled plastics, bioplastics, environmentally friendly additives and other solutions to buyers. ✅

🔔 Here, you can meet #INTCO Recycling. At the same time, INTCO's machinery brand #GREENMAX will also display high-quality foam recycling machines at the exhibition. Currently, with the continuous development of foam recycling technology, there are more and more types of #foam recycling machines, which can The types of recycled foam have also become rich and diverse. We look forward to meeting you at the exhibition! #Recycle#economiccycle

📍 National Exhibition and Convention Center(Shanghai)

📅 2024 4.23 - 4.26

Waiting For You:1.2D26 (INTCO Recycling& GREENMAX)

MORE INFO ABOUT MACHINE:https://www.greenmax-machine.com/

0 notes

Photo

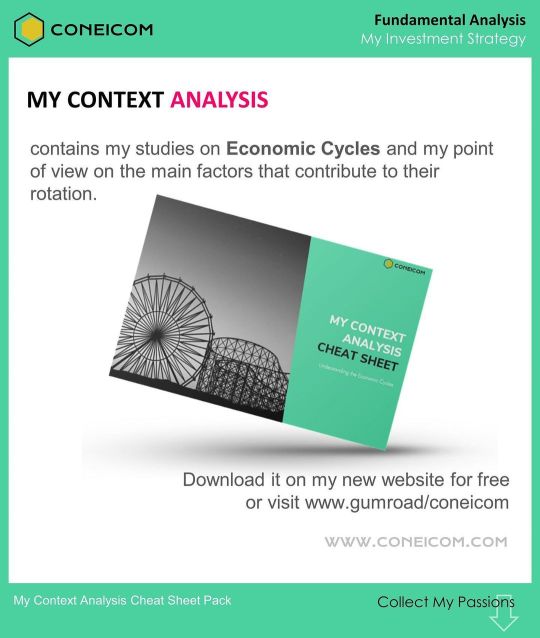

Scopri il mio punto di vista sull’Analisi dei Cicli Economici. Il download del Cheat Sheet Pack è possibile visitando il mio nuovo sito web o andando su gumroad. www.coneicom.com/freedownload www.gumroad/coneicom Buona lettura! #coneicom #analysis #economiccycle #economiccycles #businesscycle #businesscycles #gumroad #gumroadshop #freedownload (presso Forlì) https://www.instagram.com/p/CPXVlEtAiNr/?utm_medium=tumblr

#coneicom#analysis#economiccycle#economiccycles#businesscycle#businesscycles#gumroad#gumroadshop#freedownload

0 notes

Photo

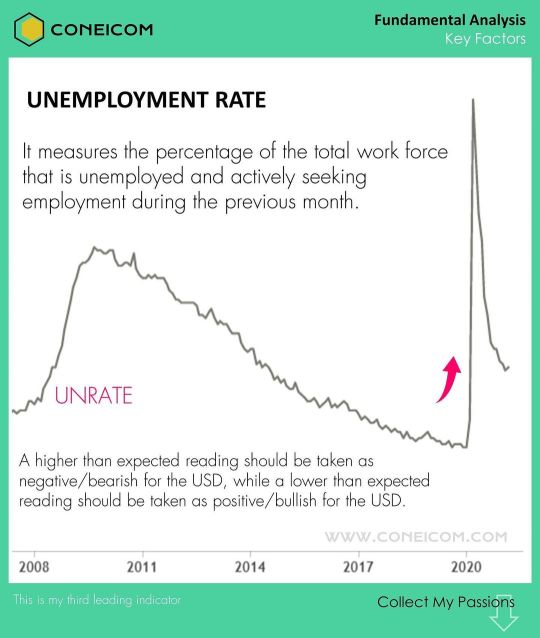

Questo è il terzo indicatore principale che monitoro per inquadrare lo scenario economico in cui ci troviamo. Tu lo monitori? #leadingindicator #leadingindicators #unemploymentrate #unemployment #fundamentalanalysis #economiccycle (presso Manhattan, New York) https://www.instagram.com/p/COuMXkAAABQ/?igshid=1o09iar9nro3f

0 notes

Photo

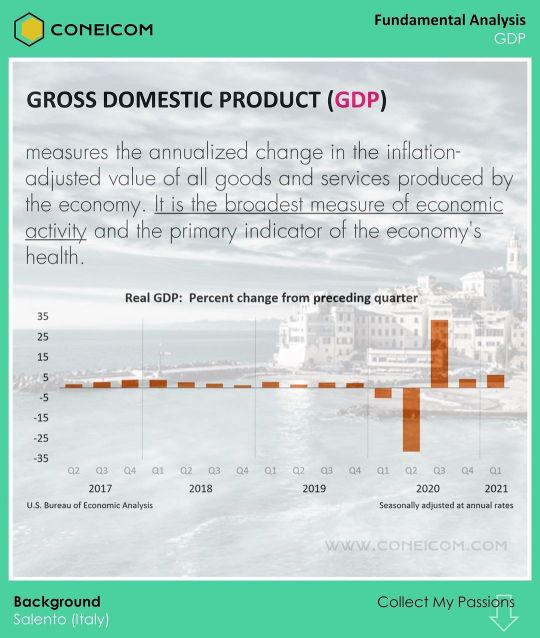

Il GDP (PIL in Italiano) è il primo dei fattori che monitoro per la mia analisi del contesto economico. E’ per me infatti molto importante valutare l’andamento di questo parametro per comprendere in quale fase economica ci troviamo. Se non lo monitori per le tue analisi di investimento, forse potrebbe essere il caso di farlo. Background: Salento (Puglia - Italia) Se non ci sei mai stato, non sai cosa ti perdi! Scopri le bellezze del #salento #gdp #pil #grossdomesticproduct #economiccycle #keyfactor #coneicom (presso Salento) https://www.instagram.com/p/COXH6xSAxCF/?igshid=za6glgd61ceo

0 notes

Photo

FUNDAMENTAL ANALYSIS Economic Cycle Phases - Key factors. Which factors do you usually monitor to understand in which economic phase we are in? These are the three most valuable for me. If you want more info, my new website (soon available) will help you! Background Black and white image: Pasta di Gragnano. Unbeatable! #keyfactors #economiccycle #gdp #interestrates #unemploymentrate #coneicom #pasta #gragnano #gragnanopasta #italiancuisine (presso Gragnano, Campania, Italy) https://www.instagram.com/p/COIREjTgnb-/?igshid=1u4kmf64mwj5b

#keyfactors#economiccycle#gdp#interestrates#unemploymentrate#coneicom#pasta#gragnano#gragnanopasta#italiancuisine

0 notes

Photo

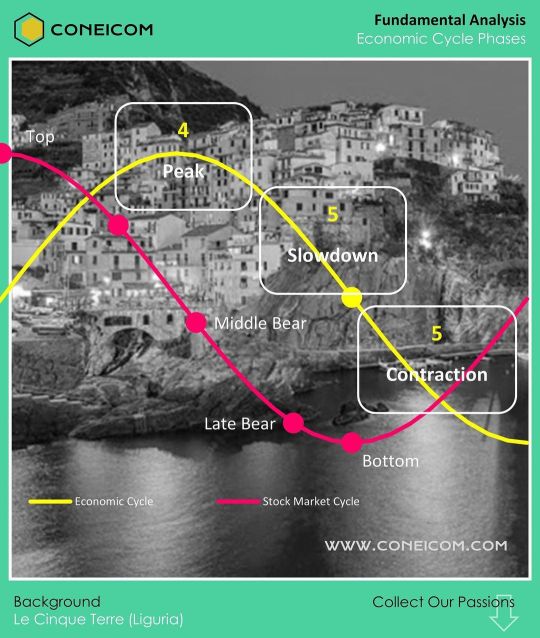

FUNDAMENTAL ANALYSIS Economic Cycle Phases Continua il dettaglio relativo all'analisi ciclica con l'introduzione delle ultime tre fasi del ciclo economico. Nell'immagine è possibile notare infatti le fasi di: Picco, Rallentamento e Contrazione. Ti piacerebbe se nel mio sito ci fosse una sezione dedicata ai cicli economici? #sezionededicata Nel frattempo, sapevi che che un ciclo dura mediamente circa 1,5 anni? ART Place to Visit. Le Cinque Terre sono antichi villaggi di pescatori situati lungo la frastagliata costa italiana. Ciascuno di questi borghi è caratterizzato da case colorate e da vigneti aggrappati ai ripidi terrazzamenti ricavati sulla costa. Non ci sei mai stato? Fossi in te, ci andrei presto! Curiosità Lo sapevi che le cinque terre dal 1997 fanno parte del Patrimonio dell'Unesco? Segui @coneicom per non perderti altri post sull'educazione finanziaria Scopri la magia delle #cinqueterre #art #placetovisit #fundamentalanalysis #economic #economiccycle #peak #slowdown #contraction #5terre #italy #liguria #investing #timetoinvest #investment #economy #milanofinanza #coneicom (presso Liguria, Italy) https://www.instagram.com/p/CNqJUv3AsxL/?igshid=ouweizenpyh7

#sezionededicata#cinqueterre#art#placetovisit#fundamentalanalysis#economic#economiccycle#peak#slowdown#contraction#5terre#italy#liguria#investing#timetoinvest#investment#economy#milanofinanza#coneicom

0 notes

Photo

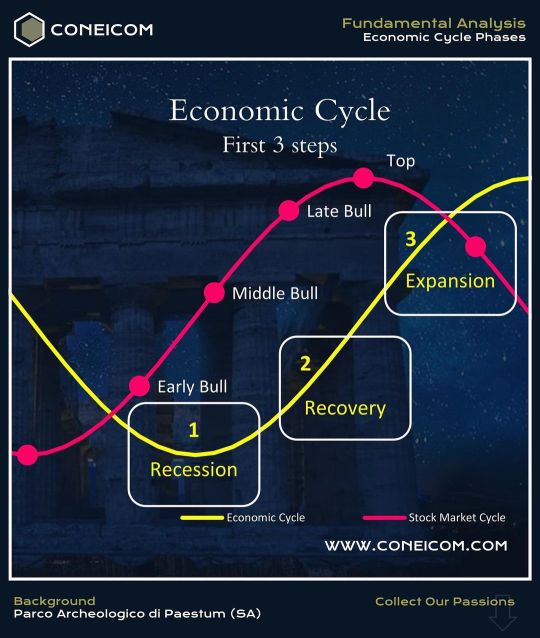

FUNDAMENTAL ANALYSIS Economic Cycle Phases Continua il dettaglio relativo all'analisi ciclica con l'introduzione delle prime tre fasi del ciclo economico. Nell'immagine è possibile notare infatti le fasi di: Recessione, Recupero ed Espansione. A breve nel sito www.coneicom.com sarà possibile consultare nel dettaglio queste fasi. Resta sintonizzato! Nel frattempo, sapevi che esiste una variazione di fase tra l’onda del ciclo economico e quella del mercato? ART Place to Visit. Paestum, con i suoi bellissimi Templi è sicuramente un posto incantevole, uno tra i miei preferiti, e non manco mai di visitarli quando sono in zona. Se non li hai mai visitati, potrebbe essere il caso di pensarci! Segui @coneicom per non perderti i post sull'Educazione Finanziaria Scopri la magia di #paestumtemple #economiccycle #stockmarket #stockmarketcycle #ciclieconomici #fase #recession #recovery #expansion #investor #tradingeducation #financialeducation #coneicom (presso Paestum) https://www.instagram.com/p/CNans4wADTo/?igshid=slhg0npwaxt1

#paestumtemple#economiccycle#stockmarket#stockmarketcycle#ciclieconomici#fase#recession#recovery#expansion#investor#tradingeducation#financialeducation#coneicom

0 notes

Photo

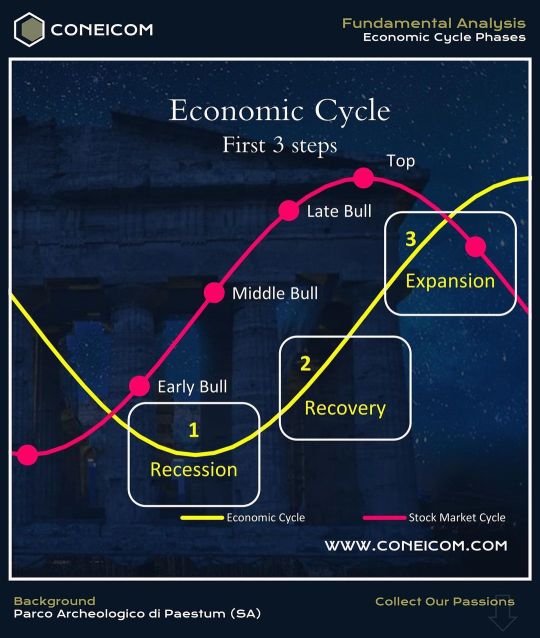

FUNDAMENTAL ANALYSIS Economic Cycle Phases Continua il dettaglio relativo all'analisi ciclica con l'introduzione delle prime tre fasi del ciclo economico. Nell'immagine è possibile notare infatti le fasi di: Recessione, Recupero ed Espansione. A breve nel sito www.coneicom.com sarà possibile consultare nel dettaglio queste fasi. Resta sintonizzato! Nel frattempo, sapevi che esiste una variazione di fase tra l’onda del ciclo economico e quella del mercato? ART Place to Visit. Paestum, con i suoi bellissimi Templi è sicuramente un posto incantevole, uno tra i miei preferiti, e non manco mai di visitarli quando sono in zona. Se non li hai mai visitati, potrebbe essere il caso di pensarci! Segui @coneicom per non perderti i post sull'Educazione Finanziaria Scopri la magia di #paestumtemple #economiccycle #stockmarket #stockmarketcycle #ciclieconomici #fase #recession #recovery #expansion #investor #tradingeducation #financialeducation #coneicom (presso Paestum) https://www.instagram.com/p/CNans4wADTo/?igshid=slhg0npwaxt1

#paestumtemple#economiccycle#stockmarket#stockmarketcycle#ciclieconomici#fase#recession#recovery#expansion#investor#tradingeducation#financialeducation#coneicom

0 notes

Photo

FUNDAMENTAL ANALYSIS Economic Cycle Phases La sola Analisi Tecnica non basta per essere un Trader di Successo. E' necessario infatti, non solo conoscere perfettamente le regole che governano i movimenti dei prezzi all'interno di un grafico ma, essere perfettamente a conoscenza del periodo economico/finanziario in cui ci si trova. Solo in questo modo sarà possibile aumentare il proprio vantaggio statistico ed avere più probabilità di Successo. Tu sai dove ci troviamo oggi? Nei prossimi post fornirò maggiori dettagli a riguardo. #staytuned ART Place to Visit Matera è una città tra le più antiche del mondo il cui territorio custodisce testimonianze di insediamenti umani a partire dal paleolitico e senza interruzioni fino ai nostri giorni. Rappresenta una pagina straordinaria scritta dall’uomo attraverso i millenni di questa lunghissima storia. Curiosità Lo sapevi che il Film "La Passione di Cristo" di Mel Gibson è stato principalmente girato proprio a Matera? Visita @coneicom per altri post sull'Educazione Finanziaria. Scopri la magia di #matera #materaitaly #economiccycle #stockmarket #stockmarketcycle #montagnerusse #tradingitalia #tradingforex #tradingstocks #coneicom #lapassione (presso Matera, Italy) https://www.instagram.com/p/CNA-6F8gcHh/?igshid=6gh8sk4k0efz

#staytuned#matera#materaitaly#economiccycle#stockmarket#stockmarketcycle#montagnerusse#tradingitalia#tradingforex#tradingstocks#coneicom#lapassione

0 notes