#ERP Software Selection in Saudi Arabia

Text

Simple Tips to Automate Your Billing Process Easily

Automating your billing process might seem like a daunting task, but with the right approach, it can be both simple and highly beneficial for your business. In today's fast-paced digital world, efficiency is key, and manual billing processes can often be time-consuming, error-prone, and costly. By embracing automation, you can streamline your billing, reduce errors, and free up valuable time to focus on other critical areas of your business.

Automated billing systems allow you to generate, send, and track invoices with just a few clicks, making the entire process faster and more efficient. This not only reduces the risk of human error but also ensures that your invoices are sent out on time, leading to quicker payments and improved cash flow. Additionally, automation provides better transparency and control over your billing, as you can easily monitor invoice statuses, manage payments, and generate reports.

Implementing simple automation tips, like integrating billing software with your accounting system or setting up recurring invoices for regular customers, can make a significant difference in how you manage your finances. By taking the first step towards automation, you'll not only enhance your billing process but also position your business for greater efficiency and success.

Here are some simple tips for easily automating your billing process:

1. Select the appropriate automated billing program:

Follow these steps to find the automated billing software that works best for your company:

Step 1: Analyse internal workflows and metrics to determine areas that require improvement in order to uncover your billing pain spots.

Step 2: Find automatic billing software that solves your problems and fits your demands by doing some research.

Step 3: Check the billing software for important features, including the ability to generate bills based on localized taxes, late fees, and tiered pricing.

Step 4: Give top priority to software that can customize bills and deliver them according to the terms, cycles, and preferences of individual customers.

2. Embrace electronic or online invoicing:

Relying on manual paper bills in the fast-paced digital world of today would be like attempting to swim upstream. Automation is the way of the future for billing, and electronic invoicing is crucial to this shift. Businesses can greatly reduce the amount of time spent on manual data entry and streamline their billing procedures by adopting electronic invoicing. This lowers the possibility of human error while simultaneously guaranteeing the accuracy and professionalism of each invoice that is sent out.

There is no denying the effectiveness of automated invoicing systems. Compared to traditional paper techniques, invoices prepared and delivered promptly reach clients significantly faster. By shortening the invoice-to-cash cycle, this speed enhances cash flow for firms by enabling faster payment receipts. Additionally, electronic invoicing offers improved invoice tracking and management, which facilitates easier payment monitoring and account follow-up. You may concentrate more on expanding your company and less on collecting payments by automating your billing process.

3. Set up reminders for payments:

It is easy for payments to get lost in the shuffle in the hectic world of business. Sometimes clients just fail to make their payments on time, even when invoices have explicit terms regarding payment. But you can prevent forgetting and guarantee that your cash flow is consistent by setting up thoughtful reminders for your payments.

You may easily plan reminders to be sent to your clients at the ideal moment with an automated billing system, saving your accounts receivable team the trouble of following up on payments. Your trusted ally in receiving payments on time may be email. You can save yourself the trouble of hunting out unpaid bills by implementing an automated billing system. The system will handle scheduling reminders and giving your clients gentle reminders so they don't forget.

4. Possess a portal for consumer payments:

As part of your approach to billing automation, create a consumer payment site. Customers may quickly pay bills, check their balances, manage subscriptions, and update personal information by using this self-service portal. On-time payments rise when a consumer experiences a streamlined and comfortable one. Your accounts receivable team will also have less work to do because the portal saves them time resolving inquiries and validating payments. Furthermore, the payment gateway makes it easier for all parties involved to communicate effectively, guaranteeing transparency and enhancing billing process efficiency.

5. Construct dashboards for reporting:

By taking care of the labour-intensive tasks required to produce accurate and current reports, automated billing systems reduce the strain associated with human reporting.As part of your billing automation approach, create sophisticated reporting dashboards so that you can simply track customer data and key performance indicators (KPIs). Real-time insights into billing performance are provided by these dashboards, facilitating the discovery of trends and opportunities and enabling well-informed decision-making.Businesses can enhance their billing methods and propel growth and success by utilizing automation and real-time data.

Conclusion

Automating your billing process is a crucial step toward modernizing your business and enhancing efficiency. By adopting billing software, you can significantly reduce the time and effort spent on manual invoicing, allowing you to focus on more strategic aspects of your business. Automation ensures accuracy, minimizes errors, and accelerates payment cycles, ultimately improving your cash flow and financial management.

For businesses in Saudi Arabia, implementing e-invoicing software is particularly important, as it helps ensure compliance with local regulations while offering the added benefits of streamlined operations. E-invoicing software Saudi Arabia not only facilitates faster transactions but also provides greater transparency and control over your financial processes. It enables easy tracking of invoices, automated reminders for payments, and seamless integration with your existing accounting systems.

By following these simple tips and incorporating reliable billing and e-invoicing software, you can transform your billing process into a smooth, efficient, and error-free operation. This not only enhances customer satisfaction but also strengthens your business’s financial health. Embrace the power of automation today and set your business on the path to sustained growth and success in the increasingly digital economy.

0 notes

Text

Understanding Gulf VAT in Tally: A Comprehensive Guide

Introduction

The implementation of Value Added Tax (VAT) in Gulf Cooperation Council (GCC) countries has transformed the accounting landscape, necessitating a robust understanding of VAT compliance and reporting. Tally, a leading enterprise resource planning software, provides an efficient solution for businesses to manage VAT. This guide explores how to handle Gulf VAT in Tally, and offers insights into Gulf accounting courses that can enhance your expertise.

What is Gulf VAT?

Value Added Tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production or distribution. In the Gulf region, VAT was introduced to diversify government revenue away from oil dependency. The UAE and Saudi Arabia were the first to implement VAT in January 2018, followed by Bahrain, Oman, and other GCC countries.

Importance of VAT Compliance

Compliance with VAT regulations is crucial for businesses operating in the Gulf. Non-compliance can lead to hefty fines and legal complications. Accurate VAT accounting ensures:

Proper invoicing and documentation.

Timely filing of VAT returns.

Correct VAT payments and refunds.

Enhanced financial transparency and control.

Introduction to Tally

Tally is an ERP software widely used in the Middle East for its simplicity and effectiveness in managing business operations, including accounting, inventory management, and statutory compliance. Tally's VAT capabilities help businesses adhere to Gulf VAT regulations seamlessly.

Setting Up Gulf VAT in Tally

1. Update to the Latest Version

Ensure you are using the latest version of Tally, which includes features and updates for VAT compliance in the Gulf region. Regular updates ensure you stay compliant with the latest regulatory changes.

2. Enable VAT in Tally

To enable VAT in Tally:

Go to Gateway of Tally > F11: Features > Statutory & Taxation.

Enable VAT by setting it to Yes.

Configure the necessary settings like VAT details, effective date, and tax rates.

3. Create VAT Ledgers

Create VAT ledgers to manage input and output VAT:

Go to Gateway of Tally > Accounts Info > Ledgers > Create.

Create ledgers for Input VAT, Output VAT, and any other VAT-related accounts.

Specify the appropriate VAT rates for each ledger.

4. Update Stock Items with VAT Details

Ensure that all stock items are updated with VAT details:

Go to Gateway of Tally > Inventory Info > Stock Items > Alter.

Update each stock item with the applicable VAT rate under Statutory Information.

5. Create VAT Compliant Invoices

Tally allows you to create VAT-compliant invoices:

Go to Gateway of Tally > Accounting Vouchers > Sales.

Create a new sales invoice, ensuring VAT details are accurately captured.

Tally automatically calculates and applies VAT based on the configured rates.

Recording Transactions

Purchase Transactions

For purchase transactions:

Go to Gateway of Tally > Accounting Vouchers > Purchase.

Create a purchase voucher, selecting the relevant supplier and input VAT ledger.

Tally will calculate the input VAT and update your accounts accordingly.

Sales Transactions

For sales transactions:

Go to Gateway of Tally > Accounting Vouchers > Sales.

Create a sales voucher, selecting the customer and output VAT ledger.

Tally will calculate the output VAT and update your accounts.

Filing VAT Returns

Tally simplifies the process of filing VAT returns:

Go to Gateway of Tally > Display > Statutory Reports > VAT.

Generate VAT reports like VAT summary, VAT computation, and VAT returns.

Use these reports to file your VAT returns with the respective Gulf authorities.

Benefits of Using Tally for VAT Compliance

Using Tally for VAT compliance offers several benefits:

Accuracy: Automated VAT calculations reduce the risk of errors.

Efficiency: Streamlined processes save time and resources.

Compliance: Regular updates ensure adherence to the latest regulations.

Comprehensive Reporting: Detailed reports provide insights into your VAT liabilities and refunds.

Gulf Accounting Courses: Enhancing Your Skills

Understanding and managing VAT in the Gulf requires specialized knowledge. Enrolling in Gulf accounting courses can significantly enhance your expertise and career prospects. Here are some popular Gulf accounting courses:

1. VAT Training Courses

These courses focus on:

VAT fundamentals and regulations in the Gulf.

Practical aspects of VAT accounting and compliance.

Using software like Tally for VAT management.

2. Certified Gulf Accountant (CGA)

A comprehensive course covering:

Gulf-specific accounting standards.

VAT, income tax, and other regulatory requirements.

Financial management and reporting.

3. Advanced Tally Courses

These courses offer in-depth training on:

Tally ERP 9 features and functionalities.

VAT configuration and management in Tally.

Generating and analyzing financial reports.

Choosing the Right Course

When selecting a Gulf accounting course, consider:

Accreditation: Ensure the course is recognized by relevant authorities.

Curriculum: Look for comprehensive coverage of Gulf-specific accounting practices.

Practical Training: Hands-on experience with software like Tally is crucial.

Instructor Expertise: Learn from experienced professionals with a deep understanding of Gulf VAT and accounting.

Conclusion

Managing Gulf VAT in Tally requires a thorough understanding of both VAT regulations and Tally's features. By following the steps outlined in this guide, businesses can ensure accurate VAT compliance and efficient accounting processes. Additionally, enrolling in Gulf accounting courses can further enhance your knowledge and skills, making you well-equipped to handle the complexities of Gulf VAT and accounting.

0 notes

Text

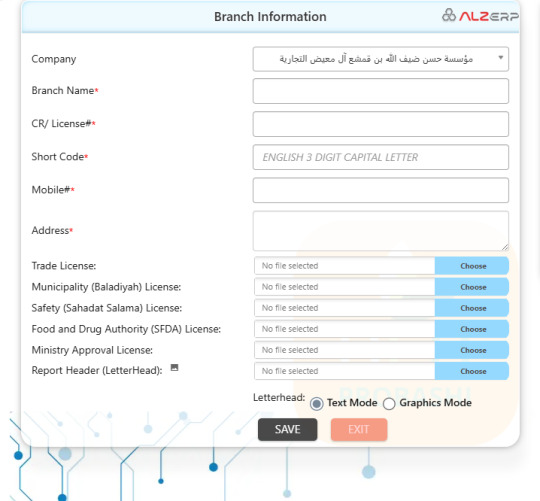

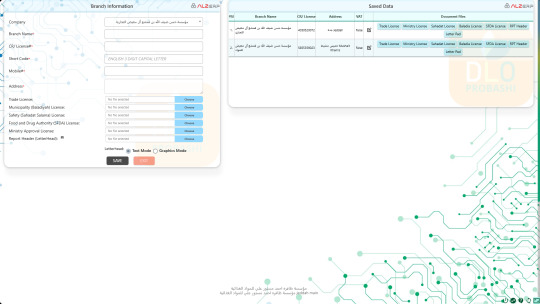

ALZERP, a leading Cloud ERP software in Saudi Arabia, empowers businesses like yours to manage your branch network effectively. ALZERP's Taxpayer Companies' Branches Information form simplifies branch data entry and document management, ensuring you have all the necessary information at your fingertips.

Seamless Branch Setup:

Company Selection: Choose the main company to which the branch belongs, ensuring accurate data association within the system.

Branch Details: Enter essential information for each branch, including:

Branch Name: Clearly identify your branch location.

CR/ License#: Capture the branch's Commercial Registration (CR) number or business license number for compliance purposes.

Short Code (Optional): Assign a unique short code (3 capital letters) for quick branch identification within ALZERP.

Mobile #: Provide the contact phone number for your branch.

Address: Ensure accurate registration with the Zakat, Tax and Customs Authority (ZATCA) by entering the complete branch address.

Centralized Document Management:

Upload License Files: Attach electronic copies of crucial licenses and permits specific to each branch, such as:

Trade License

Municipality (Baladiyah) License

Safety (Sahadat Salama) License (if applicable)

Food and Drug Authority (SFDA) License (if applicable)

Ministry Approval License (if applicable)

Report Header (LetterHead): Upload your company's letterhead for a professional touch on reports generated for that specific branch. (Optional)

Generate Reports Your Way:

Generated Reports Headers Mode: Choose how your branch information appears on reports:

Text Mode: Displays branch details in plain text format.

Graphics Mode: Incorporates your uploaded letterhead for a more visually appealing presentation.

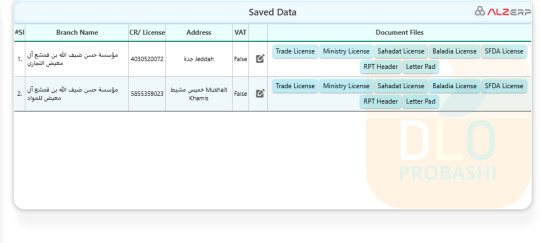

All Saved Branches Information Data: Easy Access & Control

On the right side of the screen, you'll find a comprehensive list of all your registered branches within ALZERP. This includes:

Serial Number (SL#): A unique identifier for each branch record.

Branch Name: The name of your branch location.

CR/ License: The branch's CR or business license number.

Address: The registered address of the branch.

VAT: (Optional) You can include the VAT applicability for the branch, if relevant.

Document Files: A list of uploaded documents associated with each branch, allowing for quick access and retrieval when needed. You can print these documents later for your records.

ALZERP: Your Complete Business Management Solution

ALZERP goes beyond branch management, offering a robust suite of features to elevate your entire wholesale, retail, and distribution business in KSA:

Best ERP Software in Saudi Arabia: Considered a top choice for businesses in KSA, ALZERP provides a comprehensive solution for managing all aspects of your operations.

Cloud ERP Software: Enjoy the flexibility and scalability of a cloud-based system, accessible from anywhere, anytime.

Cloud Accounting Software: Manage your finances efficiently, automate tasks, and gain real-time financial insights.

Cloud Inventory Software: Track your stock levels across all branches, optimize inventory management, and improve order fulfillment accuracy.

SAAS ERP: Benefit from the cost-effective subscription model, eliminating upfront software costs.

Business Management Software: ALZERP is more than just accounting or inventory software; it's a complete business management solution designed to streamline your entire organization.

Additional Features: Explore functionalities like Point-of-Sale (POS) systems for retail operations, order management, purchase order management, and more (optional add-on modules).

ALZERP: Your Cloud ERP Partner for Success in KSA

ALZERP empowers businesses in KSA to achieve operational excellence, enhance efficiency, and gain a competitive edge. Contact us today to learn more about how ALZERP's branch management features and comprehensive functionalities can streamline your wholesale, retail, and distribution operations, ensuring you stay compliant and achieve your business goals.

https://alzerp.com/kb/docs/branch-info/

0 notes

Text

The Ultimate Guide to Choosing an Odoo Partner in Saudi Arabia

In the realm of business management software, finding the right partner is crucial. For companies in Saudi Arabia seeking to leverage the power of Odoo ERP, selecting the ideal Odoo partner is paramount. Let's delve into what makes a great Odoo partner in Saudi Arabia and how to choose one that aligns with your business needs.

Understanding the Role of an Odoo Partner

An Odoo partner serves as a trusted advisor and implementation expert for businesses looking to integrate Odoo ERP into their operations. They provide a range of services, including consultation, customization, implementation, training, and ongoing support. As the liaison between the client and Odoo, a reliable partner ensures a smooth and successful adoption of the ERP system.

Key Qualities of an Odoo Partner in Saudi Arabia

Expertise and Certification: Look for partners with extensive experience in Odoo implementation and official certification from Odoo. This ensures they have the necessary skills and knowledge to deliver quality solutions.

Industry Experience: Choose a partner that understands your industry and business requirements. Industry-specific expertise allows them to tailor Odoo solutions to address your unique challenges and objectives effectively.

Customization Capabilities: A great Odoo partner should offer customization services to adapt the ERP system to your specific needs. This includes custom module development, workflow optimization, and user interface customization.

Dedicated Support: Ensure the partner provides comprehensive support services, including troubleshooting, maintenance, and updates. A responsive support team is essential for resolving issues quickly and minimizing downtime.

Client Success Stories: Review case studies and client testimonials to gauge the partner's track record of success. Positive feedback from satisfied clients is a strong indicator of a reliable and capable Odoo partner.

How to Choose the Right Odoo Partner

Evaluate Experience and Expertise: Assess the partner's experience, certifications, and industry knowledge to ensure they can meet your needs effectively.

Request References: Ask for references from previous clients to gain insights into the partner's performance, reliability, and customer satisfaction.

Discuss Customization Options: Inquire about the partner's customization capabilities and their approach to tailoring Odoo solutions to fit your business requirements.

Assess Support Services: Ensure the partner offers dedicated support services, including troubleshooting, training, and ongoing maintenance, to ensure the long-term success of your Odoo implementation.

Review Contract Terms: Carefully review the partnership agreement, including pricing, service level agreements (SLAs), and termination clauses, to ensure a clear understanding of the terms and conditions.

Conclusion

Choosing the right Odoo partner in Saudi Arabia is a critical decision that can significantly impact the success of your ERP implementation. By selecting a partner with the right expertise, experience, and commitment to customer satisfaction, you can ensure a seamless adoption of Odoo ERP and unlock the full potential of your business.

0 notes

Text

Revolutionizing Business Operations: ERP Software in Saudi Arabia

In the rapidly evolving landscape of Saudi Arabia's and uae business environment, staying competitive requires more than just traditional methods. Enter Enterprise Resource Planning (ERP) software – a game-changer for businesses looking to streamline operations, enhance efficiency, and adapt to market demands. Let's delve into the transformative power of ERP software in Saudi Arabia.

The Significance of ERP Software in Saudi Arabia:

Saudi Arabia's burgeoning economy spans various sectors, including oil and gas, construction, healthcare, and more. In this dynamic market, ERP software serves as a catalyst for organizational growth and sustainability. By centralizing core functions such as finance, human resources, supply chain, and inventory management, ERP systems offer a comprehensive solution tailored to the unique needs of Saudi businesses. and uae

Key Benefits of ERP Software in Saudi Arabia:

Enhanced Efficiency: ERP software automates manual processes, reducing time and effort while improving accuracy and productivity.

Regulatory Compliance: With stringent regulatory requirements in Saudi Arabia, ERP systems ensure adherence to financial reporting standards and tax regulations.

Improved Decision-Making: Access to real-time data and analytics empowers businesses to make informed decisions, driving growth and profitability.

Scalability: As businesses expand and evolve, ERP software scales seamlessly to accommodate changing needs and complexities.

Enhanced Customer Experience: ERP systems enable businesses to deliver superior customer service through efficient order management, inventory tracking, and personalized interactions.

Choosing the Right ERP Software Provider:

Selecting the right ERP software provider is crucial for successful implementation and long-term success. Consider the following factors:

Industry Experience: Choose a provider with a proven track record in delivering ERP solutions tailored to your industry.

Customization: Look for ERP software that can be customized to meet your specific business requirements and objectives.

Integration Capabilities: Ensure compatibility with existing systems and the ability to integrate with third-party applications.

Support and Training: Opt for a provider that offers comprehensive support services and training to facilitate a smooth transition and maximize ROI.

Security Measures: Prioritize data security and compliance with industry standards to safeguard sensitive information.

Conclusion:

In conclusion, ERP software has emerged as a cornerstone of modern business management in Saudi Arabia. By embracing ERP technology, organizations can unlock new opportunities for growth, efficiency, and innovation. Whether you operate in Riyadh, Jeddah, or elsewhere in the kingdom, investing in ERP software is a strategic decision that can propel your business towards success in the digital age.

#erp software#saudiarabia#uae#erpsoftwaresaudiarabia#erpsaudiarabia#erpsoftwaredubai#erpdubai#businesssoftwaredubai

1 note

·

View note

Text

''Navigating Business Excellence: Choosing the Right ERP Software in Saudi Arabia"

In the ever-evolving landscape of business in Saudi Arabia, organizations are increasingly turning to Enterprise Resource Planning (ERP) software to streamline their operations and stay ahead in the competitive market. As the demand for efficient business solutions continues to rise, finding the right ERP software tailored to the unique needs of the Kingdom becomes crucial.

Understanding ERP in Saudi Arabia

Enterprise Resource Planning is a comprehensive software solution designed to centralize and integrate core business functions seamlessly. In the dynamic business environment of Saudi Arabia, where industries like oil and gas, construction, and healthcare are experiencing significant growth, ERP plays a pivotal role in enhancing operational efficiency.

The WaslaSoft Advantage

Enter WaslaSoft, a top-rated customizable cloud-enabled ERP software in Saudi Arabia. With its cutting-edge features, WaslaSoft stands out as a leading choice for businesses looking to manage finance, human resources, supply chain, inventory, and more in a simplified manner. Its versatility and scalability make it ideal for businesses of all sizes, aligning with the diverse sectors in the Kingdom.

Benefits of ERP in Saudi Arabia

1. Enhanced Efficiency

Streamlining routine tasks to reduce time and effort, ensuring overall efficiency and productivity.

2. Better Compliance

Facilitating adherence to regulatory requirements, including financial reporting and tax filings, in line with evolving Saudi Arabian laws.

3. Improved Customer Service

Tracking customer orders, managing inventory levels, and ultimately elevating customer satisfaction and loyalty.

4. Cost Savings

Automating processes and optimizing workflows to cut down costs associated with manual labor.

5. Scalability

Adapting to changing market conditions and expanding operations seamlessly, ensuring business growth.

Factors for Choosing ERP Software Companies

When selecting an ERP software provider in Saudi Arabia, consider the following factors:

1. Experience

Look for providers with industry-specific experience and a proven track record of successful ERP implementations.

2. Business Goals Alignment

Ensure the chosen ERP aligns with your business requirements and goals, evaluating functionalities and features accordingly.

3. Scalability

Opt for customizable and scalable ERP solutions that can accommodate future business expansions.

4. Training & Support

Assess the vendor's training and support programs to guarantee effective implementation, technical assistance, and timely maintenance.

5. Security Measures

Prioritize ERP providers with robust security measures, ensuring compliance with standards such as ISO 27001 for data protection.

In conclusion, choosing the right ERP software in Saudi Arabia is a strategic decision that can significantly impact your business's success. By considering the unique needs of your industry, aligning with your business goals, and evaluating providers based on experience, scalability, and security measures, you can ensure a successful ERP implementation that delivers long-term value for your enterprise.

written by FK DIGITAL

1 note

·

View note

Text

Elevating Business Excellence with One of the Best ERP Software in Saudi Arabia

In the vibrant business landscape of Saudi Arabia, staying ahead of the competition requires more than just ambition; it demands the right tools and strategies. Amidst the myriad of choices in the ERP software realm, one name stands out prominently as one of the best ERP software in Saudi Arabia, consistently delivering on its promise to transform business operations.

Discovering the Pinnacle of ERP Solutions: One of the Best in Saudi Arabia

Enter the world of "one of the best ERP software in Saudi Arabia" - a remarkable solution that has been making waves in the Kingdom's business sector. This ERP software, known for its exceptional capabilities, is designed to meet the diverse needs of companies in Saudi Arabia. Its adaptability and versatility allow for customization to align with industry-specific requirements, making it suitable for businesses of all sizes and domains.

Why Choose "One of the Best ERP Software in Saudi Arabia"?

The decision to embrace this ERP software is underpinned by several compelling reasons. First and foremost is its ability to comprehensively manage key business functions, from financial operations to supply chains and human resources. This all-in-one solution simplifies complex processes, optimizing efficiency and effectiveness. Furthermore, the software's cutting-edge features ensure it remains at the forefront of technology trends, empowering businesses to remain competitive and adaptable in an ever-changing market.

In conclusion, selecting "one of the best ERP software in Saudi Arabia" is more than just a choice – it's a strategic move towards efficiency and excellence in business operations. As Saudi Arabia continues its remarkable growth journey across diverse industries, the need for advanced tools like this ERP software becomes increasingly evident. Embracing this solution is an investment in streamlined operations, cost-efficiency, and the ability to stay ahead in a highly competitive business landscape.

#erp#erp software#one of the best#saudi arabia#waslasoft#software#best#erp software in saudi arabia#in saudi#ksa

1 note

·

View note

Text

Empowering Financial Excellence: Accounting Software and Finance Modules in Saudi Arabia

In the dynamic and rapidly growing business landscape of Saudi Arabia, effective financial management is crucial for success. Accounting software and finance modules have emerged as indispensable tools for organizations seeking to streamline their financial processes, enhance accuracy, and maintain compliance with local regulations. In this blog, we'll explore the significance of accounting software and finance modules in the context of Saudi Arabia's financial environment.

The Economic Landscape of Saudi Arabia

Saudi Arabia is undergoing a significant economic transformation, diversifying beyond its traditional reliance on oil. The country is actively promoting sectors such as tourism, manufacturing, and technology, attracting both domestic and international investments. In this changing landscape, financial management is pivotal for businesses to adapt, thrive, and meet regulatory requirements.

Accounting Software - The Foundation of Financial Management

Accounting software is a central component of financial management. In Saudi Arabia, businesses benefit from these systems in several ways:

Automation of Financial Tasks: Accounting software automates routine financial tasks, such as data entry, reconciliation, and payroll processing.

Accurate Financial Reporting: These systems generate accurate financial statements and reports, ensuring compliance with local accounting standards and regulatory requirements in Saudi Arabia.

Real-time Financial Insights: Accounting software provides real-time visibility into financial data, enabling businesses to make informed decisions promptly.

Efficient Expense Tracking: Tracking expenses is critical for managing budgets. Accounting software helps Saudi Arabian businesses monitor expenditures, identify cost-saving opportunities, and optimize financial resources.

Finance Modules - Expanding the Horizon

Finance modules are often part of larger Enterprise Resource Planning (ERP) systems. They extend the capabilities of accounting software and offer a comprehensive solution for financial management in Saudi Arabia:

Integration with Other Business Functions: Finance modules within ERP systems integrate seamlessly with other departments like sales, procurement, and inventory management.

Streamlined Financial Workflows: Finance modules automate financial workflows, from procurement approvals to invoice processing and payment management.

Multi-currency and Localization: Given the international nature of Saudi Arabian business, finance modules often support multiple currencies and localization features, ensuring compliance with local tax regulations and currency requirements.

Advanced Analytics and Forecasting: Finance modules in ERP systems offer advanced analytics and forecasting capabilities, helping businesses in Saudi Arabia make strategic financial decisions based on historical data and future predictions.

Regulatory Compliance in Saudi Arabia

Saudi Arabia has specific regulatory requirements for financial reporting and taxation. Accounting software and finance modules are designed to help businesses maintain compliance with these regulations, reducing the risk of penalties and legal issues.

Choosing the Right Solution

Selecting the right accounting software or finance module for your business in Saudi Arabia is crucial. Consider factors such as scalability, support for local regulations, customization options, and integration capabilities. Engaging with experienced local vendors or consultants can greatly assist in making an informed choice.

Conclusion

In Saudi Arabia's evolving business landscape, effective financial management is essential for sustainability and growth. Accounting software and finance modules provide businesses with the tools they need to manage their finances efficiently, maintain compliance with local regulations, and make data-driven financial decisions. By harnessing the power of these technologies, organizations in Saudi Arabia can navigate economic changes with confidence, secure their financial stability, and seize new opportunities in this dynamic market.

Olivo Technologies is a comprehensive accounting software Saudi Arabia that caters to businesses of all sizes, providing tools for managing finances, invoicing, expenses, and much more. It simplifies your accounting processes and helps you stay on top of your financial data. It operates in Riyadh, Jeddah, Dammam, Saudi Arabia, Bahrain, and the UAE. click here:https://olivotech.com/accounting-software/

0 notes

Text

Key Considerations When Choosing Construction ERP Software for Your Dubai Projects

Introduction: In the dynamic and thriving construction landscape of Dubai, where ambitious projects shape skylines and redefine urban spaces, the role of technology has become paramount. Construction ERP software in Dubai has revolutionized project management and operational efficiency. But with a plethora of options available, how do you choose the right Construction ERP software for Dubai projects? In this blog, we explore the key considerations that will guide you toward making an informed and strategic choice.

1. Project Scope and Size: Begin by evaluating the scope and scale of your construction projects in Dubai. Consider whether the construction ERP software in Dubai can handle the complexity of your projects, whether they involve residential, commercial, or infrastructure developments.

2. Industry-Specific Functionality: opt for an ERP software solution tailored to the construction industry. Look for features like project cost management, resource allocation, procurement, subcontractor management, and compliance with Dubai's building regulations.

3. Integration Capabilities: Ensure that the chosen construction ERP software in Dubai consistently integrates with your existing systems and tools. It should connect various aspects of your construction operations, from financials and procurement to project management and reporting.

4. Cloud-Based vs. On-Premises: Decide whether a cloud-based or on-premises ERP solution aligns better with your Dubai projects. Cloud-based systems offer flexibility, scalability, and remote access, while on-premises solutions offer more control over data.

5. Mobility and Accessibility: In Dubai's fast-paced construction environment, remote access is crucial. Look for construction ERP software in Dubai that offers mobile applications or a responsive interface, enabling project managers and stakeholders to stay connected from anywhere.

6. Scalability and Future Growth: Choose an ERP solution that can grow with your projects and business. Dubai's construction sector is constantly evolving, and your software should accommodate expansion, additional projects, and changing requirements.

7. Local Regulatory Compliance: Dubai's construction industry is subject to specific regulations and standards. Ensure the construction ERP software in Dubai supports compliance with local laws, building codes, and reporting requirements.

8. Customization Options: Your projects may have unique requirements. Seek a construction ERP solution that offers customization options to tailor the software to your specific needs and workflows.

9. Data Security and Privacy: Protecting sensitive project data is crucial. Choose a construction ERP software in Dubai that offers robust data security measures, including encryption, user access controls, and regular data backups.

10. User-Friendly Interface: The software's usability is vital for successful adoption. Ensure the ERP solution has an intuitive interface that your team can easily navigate and use effectively.

11. Total Cost of Ownership: Evaluate the total cost of ownership, including licensing fees, implementation costs, training expenses, and ongoing maintenance. Consider how the ROI aligns with the benefits the software provides.

Conclusion: A Blueprint for Success Selecting the right Construction ERP software in Dubai projects is not just a decision; it's a strategic investment that can significantly impact your project outcomes and business growth. Cloud Me offers you the best ERP solution for construction industries in Dubai, UAE, Qatar, Saudi Arabia, Oman, Bahrain, etc. If you want to know more about our services, please call us at +971 564407916 or email us at info @ cloudmesoft.com,

#erp software#construction erp software#erp dubai#erp software for construction#construction erp system#best erp system#construction erp software in dubai

0 notes

Text

Sage X3 Business Consultant

In addition, Sage X3 allows firms to maintain consistency and tight controls or recipes to forestall tampering by requiring approval at totally different levels of development. Check out our selection and best-practices guides that will assist you speed up the method. Stay up-to-date with our firm information and announcements overlaying upcoming occasion, new product releases and feature updates. Whether you’re in search of trade insights, product particulars, upcoming events or our newest information — it’s all right here. Browse the categories below or get in touch with considered one of consultants when you have a question.

On the opposite hand, if your industry is more numerous, otherwise you require a broader range of modules, Odoo’s versatility and customizable nature can present a suitable answer. Greytrix Middle East Subsidiary of Greytrix India Pvt Ltd, Headquartered in Mumbai. It is a leading industries served sage x3 Sage enterprise associate and ISV Partner offering Consulting, Implementation, and improvement providers for Sage X3, Sage 300 People (HRMS), and Sage Intacct, which covers Dubai, Saudi Arabia, and Qatar area.

SEI is an built-in business intelligence and information management resolution that helps leaders make knowledgeable selections primarily based on real-time knowledge. As Starborn’s product lines and buyer base have grown, so has its need for reliable, transparent warehouse and supply sage x3 industries served chain capabilities. That has been particularly true over the previous few years, when containers grew to become practically inconceivable to acquire for overseas shipping, and the lead times for many merchandise multiplied.

This led to administration having to spend increasingly more time on analysing manufacturing, sales, distribution and monetary tendencies, which meant that priceless time was required from the departments. Sage X3 also provides executives at Darling better visibility into the enterprise. For example, they will see stock obtainable nationally in close to real-time and understand future delivery shortages upfront.

Turning enterprise issues into extraordinary digital experiences since 2015 along with 150+ staff members. Be it optimizing ERP features or enhancing e-commerce stores; we provide end-to-end solutions to assist your digitalization goals. It is designed to deal with these organizations’ complicated operational wants and industry-specific necessities. Odoo’s modular structure allows companies to begin out with a few essential modules and broaden as their wants grow. This scalability feature makes Odoo suitable for organizations that wish to begin small and gradually add modules or performance as their business expands. It can accommodate the expansion and altering requirements of companies without significant disruptions.

As a result of Sage Software's integration capabilities, companies can create a more cohesive and streamlined workflow, decreasing handbook information entry and growing efficiency. Businesses also can improve their decision-making and enterprise outcomes by integrating with other software functions. Sage ERP offers businesses real-time access to financial and operational information, allowing decision-makers to make knowledgeable choices about the company's future course.

For these customers wishing to view real-time KPIs, these are available on dashboards across gadgets. The software additionally enabled Darling Romery to automate various workflows, together with procurement. Over the years, the company’s volumes in transactions have grown tremendously.

As we talked about in final week’s weblog, How Business Management Software Aids Food & Beverage Industry Compliance, product remembers can value.. Its trendy design, visually interesting structure, and simple navigation make it comparatively simple to be taught and use, even for non-technical users. Sage presents all kinds of templates through its Sage Business Cloud Accounting Intelligence Reporting.

The API-level integration with Sage ERP ensures a quick and hassle-free deployment of the intelligent automation platform with minimal modifications to the underlying systems and processes. As you'll have the ability to see, with its vary of merchandise and deployment options, Sage software permits businesses to choose on the answer that most intently fits their needs and finances. If you’re a small or medium-sized enterprise proprietor, chances are you’ve heard of Sage software. This payroll and accounting software is extensively used by companies worldwide. At the tip of 2016, over a period of 5 years, various risks have been identified by the finance division on the old system.

0 notes

Text

How Can Large Retailers Seamlessly Generate B2C e-Invoices in KSA?

In Saudi Arabia, large retailers face the challenge of efficiently generating B2C e-invoices to meet the country's e-invoicing regulations. To make this process smooth, they need to adopt effective billing software and e-invoicing software solutions. These tools are designed to handle the complexities of creating, sending, and managing electronic invoices, ensuring compliance with the Saudi government's requirements.

Billing software enables merchants to automate their invoicing process, minimizing manual errors and increasing invoice generation speed. It works smoothly with other corporate systems, such as inventory and sales platforms, making it easy to track transactions and manage consumer data. E-invoicing software designed exclusively for Saudi Arabia ensures that all invoices adhere to local norms and standards, including the Zakat, Tax, and Customs Authority (ZATCA) recommendations.

Large merchants can use specialist software solutions to simplify their invoicing procedures, improve accuracy, and assure compliance with all legal requirements. This technique not only helps to avoid fines and penalties, but it also increases overall operational efficiency.

Here are some ways large retailers can seamlessly generate B2C e-invoices in KSA:

1. Complex structure:

High-end retailers often operate multiple storefronts across various locations, leading to numerous cash registers and billing counters. In Saudi Arabia, these businesses must issue B2C e-invoices, also referred to as simplified tax invoices, directly to customers during transactions. Each invoice must be accurately generated and then uploaded to the designated government portal within 24 hours. Managing this process can be complex due to the high volume of transactions and the need for real-time compliance with KSA’s e-invoicing regulations. Efficient e-invoicing software is essential to streamline this task and ensure timely and accurate reporting.

2.Centralized databases:

Unlike B2B e-invoices, which require real-time clearance, B2C e-invoices can be reported within 24 hours. However, large retailers generate a substantial volume of B2C invoices, necessitating a streamlined approach. Connecting store-level cash registers or billing systems to centralized databases is crucial. This setup allows the real-time transfer of all B2C invoice data to a central database. By consolidating data, businesses can efficiently manage and report invoices. This centralized system simplifies the generation and submission of simplified e-invoices, ensuring compliance with KSA's regulations and improving overall operational efficiency.

3. Identifying e-Invoice Generating Solution (EGS) Units:

Before starting e-invoice generation, it’s crucial to identify and implement the necessary number of e-Invoice Generating Solution (EGS) units. Businesses should evaluate how e-invoicing will affect their existing invoicing processes. This assessment helps determine the required number of EGS units to ensure seamless integration and uninterrupted invoice generation. By carefully selecting and onboarding the right EGS units, businesses can streamline their invoicing operations, comply with regulations, and enhance overall efficiency in generating and managing e-invoices.

4.seamless integration:

Retailers often manage extensive inventories with numerous items and detailed records. Therefore, the chosen e-invoice solution must integrate smoothly with existing ERP or order management systems. This integration ensures that all product information, pricing, and transaction details are accurately transferred from the inventory records to the e-invoicing system. A seamless integration minimizes data entry errors, enhances efficiency, and ensures that e-invoices are generated with accurate and up-to-date information. This process helps retailers maintain consistency across their systems and supports efficient operations, which is essential for meeting regulatory requirements and providing excellent customer service.

5.Quickly generate e-invoices:

Retail stores experience high foot traffic, making it essential to generate e-invoices promptly to avoid long queues at billing counters. The e-invoicing process must be efficient and seamless to ensure a positive customer experience. Implementing a system that allows for quick and accurate e-invoice generation minimizes wait times and enhances customer satisfaction. Additionally, focusing on reducing external dependencies and choosing a scalable e-invoicing solution can help handle increased transaction volumes effectively, ensuring smooth operations even during peak times.

6.Stable connectivity:

Retail outlets or businesses located in rural areas may face challenges with inconsistent internet connections or power supplies. To ensure that e-invoices are generated and reported reliably, businesses must implement solutions that can function effectively even under such conditions. This might involve using backup power sources, offline capabilities, or local data storage solutions that synchronize with central systems when connectivity is restored. Ensuring stable connectivity is crucial for maintaining compliance with e-invoicing regulations and preventing disruptions in the invoicing process, which helps in providing uninterrupted service and accurate reporting.

QR code compliance: Businesses must create a simpler e-invoice with a QR code to comply with phase 2 of KSA e-invoicing. The following are the required fields to be indicated on a simplified e-invoice QR code:

Seller's Name

Seller's VAT registration number.

Timestamp of the e-invoice, credit note, or debit note (CDN).

e-Invoice/CDN Total (including VAT)

VAT Total

The hash of XML e-invoices, or CDN

Cryptographic stamp created by the taxpayer's EGS.

The public key for the ZATCA platform

The public key for the EGS

Conclusion

Large retailers in Saudi Arabia can effectively streamline their B2C e-invoicing processes by adopting the right e-invoicing software. The key to seamless e-invoicing lies in choosing ZATCA-approved e-invoicing software Saudi Arabia, which ensures compliance with local regulations and simplifies the invoicing process. This software helps generate accurate, real-time e-invoices that are crucial for smooth business operations.

By utilizing e-invoicing software Saudi Arabia, retailers can automate and integrate their billing processes, reducing manual errors and improving efficiency. E-invoicing in Riyadh and across the country is increasingly becoming a standard practice, and adopting these technologies aligns with Saudi Arabia's vision for digital transformation.

Overall, the right software solution not only facilitates compliance with regulatory requirements but also enhances operational efficiency, enabling retailers to focus on growth and customer satisfaction. Investing in ZATCA approved solutions and staying updated with regulatory changes will ensure that large retailers can seamlessly generate B2C e-invoices and maintain a competitive edge in the market.

0 notes

Text

Proveedores de ERP en Uruguay

Proveedores de ERP en Uruguay

Edgard Zuluaga

Proveedores ERP en Uruguay El uso de una solución de software ERP eficaz es clave para lograr el éxito en la gestión de los procesos de negocios (BPM). El mercado uruguayo incluye muchos proveedores de este tipo de solución. Gecos (nosotros) Gecos Transformación Digital se especializa en implementar y administrar sistemas de gestión integrados, contando

Proveedores ERP en Uruguay

El uso de una solución de software ERP eficaz es clave para lograr el éxito en la gestión de los procesos de negocios (BPM).

El mercado uruguayo incluye muchos proveedores de este tipo de solución.

Gecos (nosotros)

Gecos Transformación Digital se especializa en implementar y administrar sistemas de gestión integrados, contando con clientes de primera línea, como SEVEL, Hospital Británico, Frigorífico Las Piedras, Organización Salhón y Universidad ORT, entre otros.

La visión de Gecos es ser un referente en soluciones de gestión y sistemas. Su misión es transformar digitalmente los procesos de las empresas para hacerlas más eficientes, eficaces y rentables.

Quiero una consultoría ERP

Encuentre en la lista a continuación las mejores empresas de software ERP, agencias, proveedores de servicios y revendedores de TI que se encuentran actualmente en nuestra plataforma para ayudarlo con los servicios de implementación, capacitación, soporte o consultoría en Uruguay.

Solicitud de Cotización

Filter Search Results:

Select Country

Afghanistan

Albania

Algeria

Andorra

Angola

Argentina

Australia

Austria

Azerbaijan

Bahrain

Bangladesh

Barbados

Belarus

Belgium

Benin

Bhutan

Bolivia

Bosnia and Herzegovina

Botswana

Brazil

Brunei

Bulgaria

Burkina Faso

Cambodia

Cameroon

Canada

Chile

China

Colombia

Congo

Costa Rica

Croatia

Cyprus

Czech Republic

Denmark

Dominican Republic

Ecuador

Egypt

El Salvador

Estonia

Ethiopia

Fiji

Finland

France

Georgia

Germany

Ghana

Greece

Guadeloupe

Guatemala

Honduras

Hong Kong

Hungary

Iceland

India

Indonesia

Iran

Iraq

Ireland

Israel

Italy

Jamaica

Japan

Jordan

Kazakhstan

Kenya

Kuwait

Laos

Latvia

Lebanon

Liberia

Libya

Liechtenstein

Lithuania

Luxembourg

Macedonia

Madagascar

Malaysia

Maldives

Mali

Malta

Mauritania

Mexico

Monaco

Mongolia

Morocco

Mozambique

Myanmar

Namibia

Nepal

Netherlands

New Zealand

Nicaragua

Nigeria

Norway

Oman

Pakistan

Panama

Paraguay

Peru

Philippines

Poland

Portugal

Puerto Rico

Qatar

Romania

Russia

Rwanda

San Marino

Saudi Arabia

Senegal

Serbia

Singapore

Slovakia

Slovenia

Somalia

South Africa

South Korea

Spain

Sri Lanka

Sudan

Suriname

Sweden

Switzerland

Taiwan

Tanzania

Thailand

Togo

Trinidad and Tobago

Tunisia

Turkey

Uganda

Ukraine

United Arab Emirates

United Kingdom

United States

Uruguay

Uzbekistan

Venezuela

Vietnam

Yemen

Zambia

Zimbabwe

Select City

Montevideo

SearchSort By:

Default Sort

A-Z

Z-A

Oldest to Newest

Newest to Oldest

OpenSurUna empresa uruguaya partner de Odoo desde 2014.

- Country: Uruguay

- City: Montevideo

Expertise

CRM ERP HR Administration MSPs

Odoo

View ProfileSolicitud de Cotización

QuanamQuanam tiene oficinas y operaciones directas en ocho localidades dentro de América Latina: Lima, México DF, Miami, Montevideo, Porto Alegre, Río de Janeiro, Santiago de Chile y San Pablo. Desde estas oficinas Quanam dirige las operaciones on-site,...

- Country: Uruguay

- City: Montevideo

Expertise

CRM ERP Supply Chain Management Analytics Software MSPs

IBM Odoo

View ProfileSolicitud de Cotización

NexitSoluciones de negocios de vanguardia basadas en software libre

- Country: Uruguay

- City: Montevideo

Expertise

ERP MSPs

View ProfileSolicitud de Cotización

CABATELVea las soluciones, los servicios y la cartera de productos de CABATEL

- Country: Uruguay

- City: Montevideo

Expertise

ERP VOIP MSPs

Odoo

View ProfileSolicitud de Cotización

Arnaldo C CastroNos enfocamos en la provisión de capacidades profesionales en informática y tecnología, basados en una minuciosa selección de recursos humanos, capacitados al más alto nivel y potenciados con la experiencia de realizar esta tarea a gran escala, en mú...

- Country: Uruguay

- City: Montevideo

Expertise

CRM ERP Business Intelligence Cloud Storage MSPs

Odoo APC CA Red Hat Dell Fortinet Vmware more

View ProfileSolicitud de Cotización

DynamoMejoramos procesos de negocio implementando soluciones de ERP y CRM. Somos el único Microsoft AX Gold Partner en Uruguay. ¡Consúltenos!

- Country: Uruguay

- City: Montevideo

Expertise

CRM ERP Business Intelligence MSPs

Dynamics Power BI

View ProfileSolicitud de Cotización

InvenzisSomos una empresa de actividad global que brinda soluciones en tecnología SAP, promoviendo la innovación y logrando resultados rentables a nuestros clientes

- Country: Uruguay

- City: Montevideo

Expertise

ERP Procurement Analytics Software MSPs

SAP Hana Ariba

View ProfileSolicitud de Cotización

TDT ConsultantsVea las soluciones, los servicios y la cartera de productos de TDT Consultants

- Country: Uruguay

- City: Montevideo

Expertise

ERP Supply Chain Management MSPs

Odoo

View ProfileSolicitud de Cotización

Sistemas InformaticosSisinfo empresa uruguaya líder en desarrollo de software de gestión gubernamental.

- Country: Uruguay

- City: Montevideo

Expertise

ERP MSPs

View ProfileSolicitud de Cotización

Arkano SoftwareArkano is a solution provider for enterprises that uses technology for digital transformation. 7 times Microsoft Partner of the Year.

- Country: Uruguay

- City: Montevideo

Expertise

CRM ERP Email Collaboration MSPs

Dynamics Microsoft 365 Microsoft Teams Microsoft

View ProfileSolicitud de Cotización

Dynamo GlobalBusiness Consulting Company with a Focus on Process Optimization through the Implementation of MS Dynamics 365 Finance & Operations and Support Services. UK & Latam

- Country: Uruguay

- City: Montevideo

Expertise

E-Signature CRM ERP eCommerce MSPs

Dynamics Microsoft Sana

View ProfileSolicitud de Cotización

InzolInzol se especializa en optimizar procesos de manufactura, mantenimiento y logística, a través de una metodología desarrollada especialmente para combinar la ingeniería de procesos con la incorporación de las últimas tecnologías en gestión in...

- Country: Uruguay

- City: Montevideo

Expertise

Enterprise Asset Management ERP MSPs

SAP SAP Business One Boyum IT Hana

View ProfileSolicitud de Cotización

Read the full article

0 notes

Text

Here are some benefits of using e-invoicing software

Enterprise Resource Planning (ERP) structures are incorporated software program packages that allow groups to manipulate and automate their enterprise processes, consisting of accounting, human resources, inventory, deliver chain management, and consumer courting management, amongst others. If you`ve in no way used an ERP machine before, right here are a few benefits to consider:

Improved efficiency: ERP structures streamline and automate enterprise processes, lowering the effort and time required to carry out ordinary tasks. This can result in progressed productivity, quicker reaction times, and higher decision-making.

Increased accuracy: By integrating records from specific departments and structures, ERP structures assist to lessen mistakes and inconsistencies, making sure that statistics is correct and up-to-date.

Better visibility: ERP structures offer real-time records and reports, giving managers and bosses a clean view of the organization's operations and performance. This permits them to make knowledgeable selections and reply fast to converting conditions.

Enhanced collaboration: ERP structures offer a centralized platform for personnel to percentage statistics and collaborate on projects, growing communique and teamwork throughout departments and locations.

Improved consumer service: ERP structures offer a complete view of consumer interactions and history, permitting groups to higher apprehend and reply to consumer wishes and preferences.

e-invoicing software Saudi Arabia provides many benefits for businesses. It can improve invoicing and payment processing, reduce errors and costs, improve accuracy and compliance, enhance security, improve customer relationships, and accommodate growth.

0 notes

Text

What should I look for when choosing e-invoicing solution providers in Saudi Arabia?

When choosing e-invoicing solution providers in Saudi Arabia, it's essential to consider several key factors to ensure you select the best partner for your business needs. Here’s what to look for:

Compliance with ZATCA Regulations:

Ensure the provider complies with the Zakat, Tax and Customs Authority (ZATCA) regulations, especially with Phase 2 requirements. This compliance is crucial for avoiding penalties and ensuring smooth operations.

Customization and Integration:

Look for providers that offer customized solutions tailored to your specific business needs. The e-invoicing system should integrate seamlessly with your existing ERP and accounting software to avoid disruptions.

Security and Data Protection:

The provider should prioritize data security and use advanced encryption methods to protect your sensitive information. Check for compliance with international data security standards.

User-Friendly Interface:

An intuitive and user-friendly interface is essential for ensuring that your staff can quickly adapt to the new system. Look for solutions that offer a simple and efficient user experience.

Comprehensive Support and Training:

Choose a provider that offers extensive training and round-the-clock support. This support is crucial for addressing any issues promptly and ensuring smooth operations.

Proven Track Record:

Research the provider’s track record and client testimonials. Providers with a history of successful implementations and satisfied clients are more likely to deliver reliable services.

Scalability and Flexibility:

Ensure the solution is scalable to grow with your business and flexible enough to adapt to changing regulatory requirements or business needs.

Cost-Effectiveness:

While cost shouldn’t be the only factor, it’s important to consider the overall value. Compare pricing models and ensure you’re getting a comprehensive solution that meets your needs without hidden costs.

At Awaltek Digital, we pride ourselves on being one of the leading e-invoicing solution providers in Saudi Arabia. We offer fully compliant, secure, and customized e-invoicing solutions that integrate seamlessly with your existing systems. Our team provides comprehensive training and 24/7 support to ensure your business operates smoothly. Ready to transform your invoicing process? Contact us at [email protected], for more information.

#E invoice phase 2 saudi arabia#e-invoicing solution providers#e invoicing solution company provider#phase2 e-invoice#Zatca e invoicing phase 2 requirements ksa#zatca e-invoicing phase 3#Zatca phase2 implementation#e-invoice phase-2#e-invoicing solution providers in saudi arabia#zatca e-invoicing phase 2#zatca e-invoicing phase 2 requirements#zatca e invoicing solution provider

0 notes

Text

Asset Management Software in Saudi Arabia: Mistakes, Truths & Best Practices

Erpisto #1 Asset Management Software in Saudi Arabia It is important to be able to comprehend the importance of applications for organizations, regardless of whether they are on-premise or cloud-based.

What do you have?

Who uses it?

How it is supported

What you're paying for

asset management software, processes that are well-designed and easily understood will help you get the most out of your software investments. It ensures you don't use more licenses than you pay for, leaving you vulnerable to legal consequences.

Let's talk about software asset management.

The concept

Common challenges

How to Avoid These

AMS tools: Best practices

Additional resources

Erpisto #1 Asset Management Software in Saudi Arabia

What is software asset management?

Asset management software in Saudi Arabia is an IT practice. Like the overarching practice of IT asset management (ITAM), the primary end goals of AMS are usually to:

Assure compliance

Reduce the risk of being penalized

Security breaches should be avoided

Reduce the risk of unexpected costs

Optimize your investments (i.e. lower costs)

Software is an ongoing, large-scale financial investment that all companies make. The ability for departments, or individual users, to acquire software licenses through software as a service (SaaS) providers means that it can be difficult to understand what software is being consumed by your organization, much less control the financial and legal implications of software use.

The image below illustrates the challenges of managing a wide range of assets. Many of these assets will be covered by your AMS practice.

AMS is now more important than ever. However, it's also more difficult to execute effectively because of the decentralization in software procurement. There is no easy button for asset management--regardless of the tools and content.

AMS has been called a "dark arts", which suggests that it is more than just a tool or technology. It takes skilled resources and the best technologies to cover all platforms and license models.

Common Asset Management mistakes

Because they are not familiar with the difficulties of building a AMS program, many organizations set unrealistic expectations. To build a sustainable and successful AMS program, you must first understand the most common problems.

When setting up a Asset management software in Saudi Arabia program, there are many mistakes that organizations make. These are the three most common errors I see when setting up a AMS practice.

Unrealistic expectations When planning and maturing a AMS program.

It is not possible to identify the source of the problems Roadmap A phased approach that prioritizes a list of essential requirements.

Infringing upon the due diligences AM vendors To fully comprehend the difference between what is possible out of the box and what needs to be customized, professional services or consulting, it's important to understand. This can have a major impact on the cost.

Each of these can cause a AMS project to be delayed or even stopped completely. There is a fourth error in the above list that could be even more dangerous.

Expecting a tool that does all the work. The saying goes, "A fool with A tool can do a lot for you by. "Software discover You can also count license usage. However, no one tool will be able to give you all the answers. It is very unlikely that you will be able to create a AMS practice that works before you implement a tool.

Asset Management Fundamental Truths and Challenges

These challenges are often overlooked or ignored by too many companies. As a result, their Asset management software in Saudi Arabia practices are less valuable. These mistakes are common and often caused by organizations.

Jumping in too fast without any experience

Unrealistic expectations

A phased approach to defining a narrow scope is not the best way to go

Below is a list of the most common AMS problems and their truths.

There is no single solution or tool.

One tool cannot discover all software or the data required to measure all licensing models. It is impossible to find an all-inclusive AMS solution that works for all software.

Certain tools work better with specific vendors or platforms than others. To broaden their reach, some vendors combine or partner with other technologies or content. Take, for example:

Some software, such as Oracle database licensing, requires specific configuration settings and usage information to be discovered.

On the licensing front, the product use rights (PUR) can be very complex--think MIPs and points-based licensing.

This level of specialization requires very specific knowledge on both sides. This is only one reason why a gradual approach to success is important.

Content drives automation

Content is essential in today's AMS environment. It is the responsibility of the customer to create and maintain content. This is difficult unless the scope is extremely narrow. The content covers many areas, including but not limited to:

Discovery

License models/SKUs/PURs

Maintenance

End of life

With product use rights, for example, the default license can be associated with the discovered software. This significantly reduces the effort required to measure compliance.

Complex and ambiguous

License models can be complicated and ambiguous and will continue to evolve. The most complicated software is datacenter software. It may prove difficult to obtain certain information necessary to assess compliance. Some vendor terms may not be clear or measurable, and new licensing models continue to emerge.

Tip: Make sure to verify all terms and conditions before you purchase any software. This will help avoid any confusion. You cannot be certain of your compliance if you don't know how to measure it.

Slow adoption of standards

To further improve automation and reduce dependency on content services, the primary standards (ISO/IEC 19770-1, 2, and -3) were slow to adopt.

These standards, especially -2 and 3 below, will increase adoption. This will decrease the dependence on content that is necessary today to drive automation and reduce AMS efforts.

ISO 19770-1 provides a process framework for AMS. This is an excellent standard for evaluating and establishing baselines for your AMS program.

ISO 19770-2 provides the standard for software tagging (discovery) which software vendors are slowly adopting.

ISO 19770-3 standard provides the transport format, which is intended to drive standardization on the entitlements front.

Cloud complexity

Cloud licensing adds complexity as this is typically (but not always) less of an issue regarding licensing and compliance and more about usage and optimization. Cloud vendors are improving their ability to control usage to avoid noncompliance. This shifts the focus to the customer in order to ensure that they don't purchase too much (i.e. Optimization over Compliance - An improvement over on-premises software.

As cloud services become more common, the tools and technology available to capture and manage cloud-based applications are becoming better.

Asset Management tools selection: Ask the right questions

When planning your AMS initiative, it is important to understand the complexity of your environment.

If you use technology only for basic productivity tasks, and your staff uses Microsoft Office 365 a lot, your licensing will be easier to manage and your scope easier to define. However, if you use many on-premise or cloud-hosted apps, which is very likely, then you need to plan accordingly.

It is crucial to understand the licensing terms that apply to each application when dealing with multiple vendors.

This table will give you an overview of the information that you should know when planning AMS in your company. Although this is not a comprehensive list, it will help you to understand the additional information that you need in order to manage your Asset management software in Saudi Arabia effectively.

Many of the organizations that I've worked with to create AMS were surprised or even shocked by what they discovered.

It was for many an unforgettable experience. Chance to save money Licenses not being used but paid for.

Others found out that they were over utilizing licensing. They are open to possible fines and other legal consequences.

Regardless of the situation, knowing the truth about your licensing status will allow you to know and ensure that you aren't over- or under-using software.

Asset Management resources

My experience shows that it's not impossible for organizations to handle the truth. They need to understand and find the truth before they can start a Asset management program. Now the question is "How can I find the truth?"

Services we Offer:

Erpisto ERP

Quick Overview

Financial Management

Microfinance ERP Software

Enterprises HR and Payroll

Budgeting and Financial Planning

CRM

Erpisto Sales Management

Inventory Management

Asset Management

Warehouse Management (WMS)

Point of Sales (POS)

Ready E-Commerce Shop

Production Management

Process Manufacturing

Discrete Manufacturing

Erpisto CRM

Quick Overview

SalesForce Management

Lead & Opportunity Management

Sales Pipeline & Management

Account Management

Sales Quotation Management

Contact Management

Campaign Management

Reseller Management

Customer Services Management

Asset & Inventory Management

Telemarketing

Salesforce Automation

Multi-lingual Support

Erpisto POS (ChecPOS)

ChecPOS by Erpisto Overview

Retail POS

QucikSerivce POS

Restaurant POS

Enterprise POS

POS Hard

Click to Start Whatsapp Chatbot with SalesMobile:

+966547315697

Email: [email protected]

#ERP Software in Saudi Arabia#Asset Management Software in Saudi Arabia#Inventory Management Software in Saudi Arabia#Production Management Software in Saudi Arabia#Cloud CRM in Saudi Arabia#Warehouse Management in Saudi Arabia#Trading ERP in Saudi Arabia#Automotive ERP in Saudi Arabia#Construction & Engineering ERP in Saudi Arabia#Aerospace ERP in Saudi Arabia#Pharmacy ERP in Saudi Arabia#Food & Beverage ERP in Saudi Arabia#Packaging ERP in Saudi Arabia#Distribution ERP in Saudi Arabia#ERP Software Selection in Saudi Arabia#ERP Implementation Services in Saudi Arabia#ERP Project Recovery Services in Saudi Arabia#IT & ERP Strategy in Saudi Arabia#Sales Optimization Services in Saudi Arabia#Digital Transformation in Saudi Arabia#Independent Verification Services in Saudi Arabia

0 notes

Text

كيف ستؤثر الفاتورة الإلكترونية في جدة بالمملكة العربية السعودية على الأعمال؟

الفاتورة الإلكترونية رقم 1 من Erpisto في جدة يعد نظام الفاتورة الإلكترونية معيارًا مجمعًا يتم تقديمه بحيث يمكن تنظيم كل طلب من طلبات العروض المدرجة في ضريبة السلع والخدمات (GST) وفقًا لمعيار مماثل من خلال جميع الأعمال التجارية وذات الصلة بجميع المنتجات و مراحل تبعا لذلك. الفاتورة الإلكترونية عبارة عن إطار عمل للإبلاغ عن طلبات B2B (الأعمال إلى الأعمال) لإطار ضريبة السلع والخدمات (GST) وبالتالي لتبسيط تسجيل العوائد الشهرية. في ظل الإطار الحالي ، يتم تقديم طلبات العروض من خلال برامج مسك الدفاتر المختلفة التي تستخدمها المنظمات المختلفة.

فاتورة Erpisto رقم 1 الإلكترونية في جدة

مزايا نظام الفاتورة الإلكترونية للشركات :

هناك العديد من المزايا لتطبيق الفاتورة الإلكترونية بجدة في نظام ضريبة السلع والخدمات:

خدمات أفضل لدافعي الضرائب:

ستعمل الفاتورة الإلكترونية في جدة على حوسبة مسار عصر طلبات GST. سيؤدي هذا تمامًا إلى تسريع التفاعل ، وتقليل التكلفة ، والاستغناء عن الخطأ البشري بسبب ضرورة وجود قسم معلومات يدوي في كل تقدم.

التخلص من مختلف المنظمات عبر حوسبة الكشف عن المعلومات استلام B2B (شراء، صفقة، وهكذا دواليك) في معا مقيدين والتكوين المحلي الذي تم إنتاجه لا حاجة لترتيبات مختلفة بالنسبة لعمر في GSTR 1 و E-الفاتورة في جدة مشروع قانون .

ترقية عملية الأعمال:

سيتحول التكوين إلى جزء من دورة الأعمال وممارسة المنظمة. بالنسبة للمؤسسات التي تستخدم حتى الآن الفاتورة الإلكترونية في جدة ، فإن تصميم إطار العمل المشترك عبر الأعمال التجارية سيساعد على الاتصال بين المؤسسات والبنوك والمراجعين والداعمين الماليين ، الذين يمكنهم الآن الوصول إلى المعلومات دون توقع التغيير أولاً في الترتيب الذي يستخدمونه. بالنسبة للشركات الخاصة ، التي لا تستخدم برمجة مسك الدفاتر الإلكترونية ، فإن مجلس ضريبة السلع والخدمات (GST) التابع للحكومة.

الانخفاض في قضايا التحقق من ضريبة المدخلات:

ضريبة المدخلات هي مقدار الرسوم المدفوعة مسبقًا للمكونات غير المكررة في العنصر (المدخلات) والتي يجب خصمها من المبلغ المتاح لعنصر النتيجة. تؤدي التقديرات اليدوية في توثيق عوائد ضريبة السلع والخدمات (GST) بشكل منتظم إلى إحداث أخطاء مزعجة فيما يتعلق بتخفيضات ضريبة المعلومات أو الإفراط في التأكيد عليها. الفاتورة الإلكترونية في جدة هي مقدار البدل المؤهل لنشاط تجاري مقابل رسم تم دفعه مسبقًا على العنصر. يمكن أن يؤدي الضمان الناقص للائتمان الضريبي على المدخلات إلى حدوث مصيبة كبيرة للشركة كمصروف إضافي وتكلف نفسها عناء إصلاح الأخطاء.

التحقق من المعلومات قبل الإقامة النهائية:

بعد تقديم المعلومات إلى نظام ضريبة السلع والخدمات (GST) ، سينتج إطار العمل عائد خطر يمكن تأكيده مقابل الفاتورة الإلكترونية الحقيقية للأعمال في جدة لضمان تقديم المعلومات الصحيحة. إذا لم يكن الأمر كذلك ، فيمكن للمشتري رفضه وبدء دورة أخرى. كلما اعترف المشتري وتأكد وسيؤدي الإطار إلى عائد أخير.

تعد خدمات MS Tableau في باكستان العامل الرئيسي لتوفير بطاقات الأداء والرؤى لمختلف إدارات المنظمة التي تعتبر خدمات Tableau في لاهور ، كراتشي ، إسلام أباد باكستان كعامل رئيسي لاستعادة وظائفها بمساعدة الأفكار التي طورتها خدمات Tableau في باكستان .

تبحث الشركات في باكستان دائمًا عن أفضل خدمات Tableau في باكستان من خلال شركاء رسميين لشركة Microsoft المعروفين باسم خدمات Tableau في لاهور ، كراتشي ، إسلام أباد باكستان لضمان تقديم أفضل دعم للشركات في باكستان لمشاريعهم بموجب خدمات Tableau المعتمدة في باكستان .

Microsoft هي شركة رائدة عالميًا تقدم أفضل حلول ذكاء الأعمال باستخدام خدمات Tableau في باكستان.

تعتمد الشركات على أفضل شريك Tableau في باكستان لبناء مستودع البيانات وطبقة تكامل البيانات لنمذجة البيانات باستخدام Tableau Partner في باكستان والتي تُعرف أيضًا باسم خدمات Tableau في باكستان .

فيما يلي قائمة بالميزات التي يمكنك الحصول عليها باستخدام PeopleQlik:

PeopleQlik كور

· برامج الموارد البشرية الأساسية- HRMS

· برامج إدارة الرواتب السحابية

· خدمات الموظف الذاتية

· برنامج تحليلات الموارد البشرية

· منصة العافية للشركات

برنامج إدارة الأداء

· نموذج التغذية الراجعة بزاوية 360 درجة

· إدارة وتخطيط التعويضات

· معروف اجتماعيا

إدارة القوى العاملة

· برامج إدارة الإجازة

· برامج إدارة الوقت والحضور

التحول والجدولة

· المطالبات والتعويضات

· برامج إدارة جدول المواعيد

انقر لبدء Whatsapp Chatbot بالمبيعات

الجوال: +966547315697

البريد الإلكتروني: [email protected]

#E-Invoice in Jeddah#E-Invoice Software#E-Invoice in Saudi Arabia#ERP Software in Jeddah Saudi Arabia#Cloud CRM in Jeddah Saudi Arabia#Warehouse Management in Jeddah Saudi Arabia#ERP Software Selection in Jeddah Saudi Arabia

0 notes