#ERP data to GSTN

Explore tagged Tumblr posts

Text

🧾 GST Billing & Invoicing Software – The Ultimate Solution for Small Businesses in India

In today’s fast-paced business world, managing GST invoices, stock, and accounts manually is not only time-consuming but prone to errors. This is where a smart GST Billing & Invoicing Software comes to your rescue.

Whether you run an optical store, retail shop, or small business — using automated GST software can save hours and boost productivity.

✅ Why You Need GST Billing Software

1. 100% GST Compliant Invoices - Create professional invoices with your GSTIN, HSN/SAC codes, and automated tax calculations — in seconds.

2. E-Invoice Generation - Connect directly with the GSTN portal for seamless e-invoicing and avoid penalties.

3. Integrated Stock & Inventory Management - Track your real-time stock levels, product batches, expiry dates, and low stock alerts — all from your billing screen.

4. Sales, Purchase, & Return Management - Handle sales orders, purchase orders, quotations, and returns with one-click conversion to invoices.

5. Tally Integration & Accounting - Export reports directly to Tally ERP and simplify your accounting process.

🔍 Top Features of GST Billing & Invoicing Software

📦 Inventory & Stock Control

💳 POS System for Fast Billing

🧾 GST Reports: GSTR-1, GSTR-3B, GSTR-9

📈 100+ Business Reports (Profit & Loss, Stock, Sales)

🧑💼 Multi-user Access with Role Permissions

☁️ Cloud Backup & Data Security

📱 Mobile & Desktop Compatible

👨💻 Who Is It For?

This software is ideal for:

🕶️ Optical Shops

🛍️ Retail Stores

🏥 Pharmacies

🧰 Hardware Shops

📚 Book Stores

🏬 Small & Medium Enterprises (SMEs)

🚀 Boost Business Efficiency Today!

Switching to a Partum GST billing software is not just about compliance — it’s about scaling your business smartly. With built-in automation, detailed reports, and error-free invoicing, your daily operations become faster and smoother.

📞 Book your FREE demo now! ✅ No credit card needed ✅ 17+ Software packages ✅ Trusted by 5,000+ businesses

youtube

#gst billing software#InvoicingSoftwareIndia#BillingAndInventory#RetailBilling#EInvoiceIndia#TallyIntegration#Youtube

2 notes

·

View notes

Text

Simplify Business Verification with GST Verification API by NifiPayments

In today’s fast-paced digital economy, businesses must verify their partners, vendors, and customers quickly and accurately to ensure compliance, reduce fraud, and streamline operations. One of the most essential verifications for businesses in India is the GST (Goods and Services Tax) verification.

That’s where NifiPayments GST Verification API comes in—providing a reliable, real-time solution for businesses to validate GST numbers (GSTIN) directly from the GSTN (Goods and Services Tax Network) database.

🔍 What is GST Verification API?

GST Verification API is a secure and robust tool that allows businesses to instantly validate a GST number and retrieve detailed taxpayer information such as:

Registered legal name of the business

Trade name

GST registration status

Constitution of business

Registration date

Nature of business (taxpayer, composition dealer, etc.)

⚙️ Key Features of NifiPayments GST Verification API:

✅ Real-Time GSTIN Validation Validate GST numbers on the fly, ensuring data accuracy and regulatory compliance.

✅ Data Directly from GSTN Information is fetched from the official GST portal, ensuring legitimacy and authenticity.

✅ Seamless API Integration Our easy-to-integrate RESTful API allows you to plug into your existing platforms with minimal effort.

✅ Bulk Verification Support Need to verify hundreds of GST numbers? Our bulk verification feature makes large-scale processing simple and efficient.

✅ Reduces Fraud & Enhances KYC Helps detect fake GST numbers, ensuring you deal only with compliant and verified businesses.

💼 Use Cases

Fintech & NBFCs – Streamline business loan KYC and reduce onboarding time.

Marketplaces & Aggregators – Verify sellers and service providers before listing.

Accounting & ERP Software – Automate GST validations within your software suite.

Logistics & Supply Chain – Ensure GST-compliant vendors and reduce tax risks.

🛡️ Why Choose NifiPayments?

NifiPayments is committed to simplifying financial infrastructure for businesses with scalable, secure, and developer-friendly APIs. With our GST Verification API, you not only save time but also improve operational efficiency and reduce regulatory risks.

🚀 Ready to Integrate?

Accelerate your business with automated GST verification.

👉 Contact us today to get started with NifiPayments GST Verification API. 🌐 [www.nifipayments.com]

0 notes

Text

Seamless E-Way Bill API Integration with Zwitch

Simplify your logistics and compliance process with Zwitch's E-Way Bill API Integration. Designed for businesses of all sizes, our solution enables smooth and automated generation, cancellation, and management of e-way bills directly from your ERP or application. Say goodbye to manual data entry and delays—Zwitch ensures real-time connectivity with the GSTN portal, enhancing operational efficiency and reducing errors. With secure APIs, robust documentation, and easy onboarding, Zwitch empowers your business to stay compliant and agile in the fast-paced world of logistics and GST compliance. Start streamlining your supply chain today with Zwitch.

0 notes

Text

GSTR 9: Annual GST Return

The annual return filing, known as GSTR 9, is required to be filed by every taxpayer before 31st December. This blog aims to provide a comprehensive guide to GSTR 9, helping businesses navigate through the complexities of this crucial annual return.

What is GSTR-9 annual return?

GSTR-9 is the annual return that every registered taxpayer under GST must file. It consolidates the details of all the monthly or quarterly returns filed during the financial year. The purpose of GSTR-9 is to provide a summary of the taxpayer's outward and inward supplies, tax liability, input tax credit (ITC) claimed, and other relevant details.

Who is liable to file GSTR-9, the annual return?

All taxpayers/taxable persons registered under GST must file their GSTR-9. Except:

Casual Taxpayers

Input Service Distributors

Non-resident Taxpayers

Taxpayers under composition scheme (They must file GSTR-9A)

E-commerce operators (They must file GSTR-9B)

TDS deduction or TCS collector under Section 51 or Section 52 of the CGST Act.

For FY 17-18 & 18-19, it is mandatory only if turnover exceeds Rs 2 crore.

What is the due date for filing GSTR-9?

GSTR 9 (GST Annual Return) is to be filed by 31 December of the year following the particular financial year. Accordingly, businesses should file GSTR-9 for FY 2022-23 by 31st December 2023.

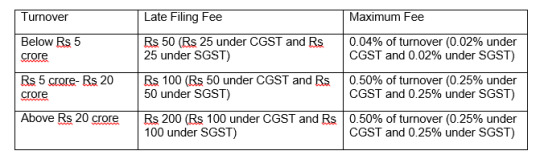

What is the late filing fee for GSTR 9?

The late filing fee for GSTR 9 has been categorized based on the turnover of the taxpayer w.e.f. FY 2022-23:

What details are required to be filled in GSTR-9?

The basic details which have to be provided in GSTR-9 are as follows:

Details of Sales with the breakup of those on which tax is payable and not payable.

Details of Purchases.

Tax payable.

Input Tax Credit available and reversed.

Details of transactions of sales and Input tax credit in the subsequent year but pertaining to the year for which return is being filed.

Besides that other details like HSN wise breakup of Sales & Purchases, Summary of Demands & Refunds, etc have to be provided.

For FY 17-18 & 18-19, some of the sections have been made optional.

Can a “NIL” GSTR-9 return be filed?

Yes, a Nil GSTR-9 can be filed if all the following conditions are satisfied:

No outward supply.

No receipt of goods/services.

No other liability to report.

Not claimed any credit.

No refund claimed.

No demand order received.

No late fees to be paid.

If the figure has to be reported in any of these, nil return cannot be filed.

How Web-GST simplifies your GST filing?

Web-GST is an across the board GST software that simplifies your GST return filing experience with useful tools & insightful reports.

No outward supply. Desktop-based Solution with 100% Data Security.

Easy & Prompt way to prepare & file GSTR 1, 3B, 9, & 9C etc.

Download GSTR-2A in one-click for the whole financial year or YTD.

Automatically identifies data mismatches for GST compliance.

Claim 100% accurate ITC with the Advanced Matching Tool.

Track GST Returns Filing Status on a single dashboard.

Experience Seamless Integration with ERPs and GSTN (Premium version).

1 note

·

View note

Text

ERP Software in India: Trends, Insights & Innovations in 2025

Introduction

India’s dynamic business environment is rapidly evolving with the push for digital transformation, government compliance mandates, and increased global competitiveness. In 2025, Enterprise Resource Planning (ERP) software continues to play a pivotal role in helping organizations streamline operations, manage regulatory obligations, and scale efficiently.

This blog highlights the latest ERP trends, industry updates, and innovations shaping the ERP landscape in India.

1. Cloud-First ERP Adoption

One of the most significant developments in the Indian ERP space is the cloud-first approach, especially among small and mid-sized businesses. With enhanced data accessibility and affordability, cloud-based ERP with CRM capabilities is now in demand, helping businesses unify sales, service, and support processes.

CRM integration within ERP allows organizations to:

Track customer interactions in real time

Streamline sales pipelines

Manage post-sales support within the same platform

This unified approach strengthens customer relationships while improving internal workflows.

2. AI & Automation in ERP

In 2025, ERP systems are becoming more intelligent through AI and machine learning integrations. Businesses are using predictive analytics to automate supply chain and inventory forecasting, particularly in sectors like manufacturing and distribution.

This has major implications for ERP for inventory management, where AI-driven stock level recommendations and automated reorder points are helping companies maintain optimal stock levels while avoiding overstocking or shortages.

3. GST & E-Invoicing Compliance

The push for greater compliance under Indian tax laws continues to influence ERP adoption. With e-invoicing now mandated for many businesses, ERP solutions in India are integrating directly with GSTN and e-way bill portals.

Companies in tightly regulated industries, such as the pharmaceutical sector, benefit from ERP systems that automate batch tracking, expiry management, and ensure GST-compliant billing. As a result, ERP for pharmaceutical industry operations is seeing robust demand due to its ability to maintain audit trails, support cold chain tracking, and comply with drug control regulations.

4. ERP for Industry-Specific Needs

As ERP adoption matures, generic solutions are being replaced with sector-focused ERP systems. Key industries demanding custom functionality include:

Retail & eCommerce — for inventory and POS integration

Pharmaceuticals — for regulatory compliance, batch control, and temperature-sensitive inventory

Manufacturing — for production planning and MRP

Logistics — for warehouse and shipment tracking

ERP for pharmaceutical industry requirements often include integration with regulatory databases, quality control systems, and license validation mechanisms — making it essential for compliance and traceability.

5. Mobile-First ERP Experience

With the rise of remote work and field-based teams, businesses now demand mobile-first ERP platforms that offer functionalities like:

Sales dashboard via mobile CRM

Stock checks using mobile inventory apps

Mobile approvals and document uploads

Expense and attendance tracking

Mobile-enabled ERP with CRM modules give sales and service reps access to customer history, enabling faster and more informed responses from anywhere.

6. Integration with Government Portals & APIs

Indian businesses are choosing ERP systems that natively connect with government APIs, enabling:

Real-time GST filing and e-invoicing

Compliance with DSIR and CDSCO norms for pharma

Seamless input tax credit (ITC) reconciliation

For industries like pharmaceuticals, API integrations are crucial for adhering to both domestic and international compliance frameworks.

7. Advanced Inventory & Supply Chain Management

Efficient inventory control is vital across sectors. In 2025, ERP for inventory management is more advanced, offering:

Real-time stock visibility across multiple locations

Automated purchase orders based on historical data

FIFO/LIFO support

Barcode and RFID integration

This is especially valuable for industries dealing with perishable or regulated goods such as the pharmaceutical industry, where traceability and accuracy are non-negotiable.

8. Security, Sustainability & Future-Proofing

As data regulations tighten under India’s Digital Personal Data Protection Act (DPDP), ERP platforms are adapting with advanced security features, including:

End-to-end encryption

Granular access controls

Audit-ready reporting

Meanwhile, businesses are also leveraging ERP systems to report on ESG metrics like energy usage and waste management. These insights support sustainable growth while ensuring compliance with emerging environmental standards.

Final Thoughts

ERP software in India is no longer a luxury — it’s a strategic necessity. In 2025, the demand is growing for ERP with CRM, ERP for inventory management, and ERP for pharmaceutical industry use cases. Businesses are looking for flexible, scalable, and industry-aligned solutions that integrate compliance, mobility, automation, and customer engagement into a unified platform.

By understanding and embracing these trends, Indian businesses can choose ERP systems that not only streamline operations but also drive growth, innovation, and long-term value.

0 notes

Text

GST & Compliance Made Easy with Udyog ERP

Running a manufacturing business in India requires a keen understanding of the ever-changing regulatory landscape. From GST compliance to e-way bills and tax filings, staying on top of these tasks can often feel overwhelming. But with Udyog ERP, the complexity of managing GST compliance is simplified, making life easier for your accounting team and allowing you to focus on growth.

In this blog, we’ll explore how Udyog ERP helps businesses streamline their GST and compliance requirements while ensuring that the entire process is automated, efficient, and foolproof.

Navigating GST Compliance in India

For manufacturers, GST compliance is not just a formality — it’s a critical part of doing business. The nuances of India’s GST system, along with the need to file returns on time and generate e-way bills, can be tricky without the right tools. That’s where best ERP software in India, like Udyog ERP, becomes a game-changer.

Udyog ERP takes the complexity out of GST compliance, automating tasks such as:

Generating GST-compliant invoices

Calculating tax liabilities automatically

Managing GST returns for different states

Simplifying the creation and management of e-way bills

With Udyog ERP, you’ll always stay ahead of the game when it comes to tax compliance.

Automating GST Returns with Udyog ERP

One of the biggest challenges businesses face is the manual process of filing GST returns. It can be time-consuming, error-prone, and often stressful. Udyog ERP streamlines this process, making it easier than ever to file returns.

Here’s how it works:

Automatically consolidates data from your purchase and sales invoices

Prepares the required GST returns in the correct format

Sends timely reminders so you never miss a deadline

Provides real-time validation for discrepancies

By integrating best ERP software in India like Udyog ERP, manufacturers can reduce the chances of errors and avoid penalties for late or incorrect filings.

E-Way Bill Management Simplified

Transporting goods across India? You’re familiar with the challenges of creating and managing e-way bills. This process can be time-consuming and tedious without automation. Udyog ERP simplifies this task by automatically generating e-way bills based on the shipment details entered in the system.

With features such as:

E-way bill creation from within the system

Automatic validation to prevent errors

Seamless integration with GSTN (Goods and Services Tax Network)

You’ll never have to worry about compliance issues during transit.

Real-Life Example: A Manufacturer’s Compliance Transformation

A Pune-based textile manufacturer was struggling to keep up with GST compliance and e-way bill requirements. Their manual processes led to delays, fines, and frustration. Once they integrated Udyog ERP into their system, things turned around quickly.

GST return filing time reduced by 50%

E-way bill generation became fully automated

Tax-related penalties and discrepancies dropped to zero

With Udyog ERP, they not only streamlined compliance but also improved operational efficiency. This is what best ERP software in India can do for you.

Why Choose Udyog ERP for GST Compliance?

Udyog ERP isn’t just another software tool; it’s an end-to-end solution that helps businesses stay compliant with minimal effort. Here’s why manufacturers trust Udyog ERP for their compliance needs:

Automated GST return filing

E-way bill management

Comprehensive tax calculations

Customizable for different industries

It’s the best ERP software in India for businesses that want to future-proof their operations while keeping compliance at the forefront.

Conclusion

Udyog ERP’s GST and compliance features aren’t just about meeting legal requirements — they’re about giving you peace of mind. With automated processes, real-time tax updates, and seamless integration, you can focus on growing your business while Udyog ERP handles the rest.

Stay compliant, stay efficient, and stay ahead. Udyog ERP is the key to unlocking smoother operations and a stress-free GST experience.

0 notes

Text

GSTIN Verification API India

✅ Instantly Verify GST Numbers with Ekychub’s GSTIN Verification API

In the digital age, businesses need fast, reliable, and secure tools to stay compliant with government regulations. One critical component of business verification in India is the GSTIN (Goods and Services Tax Identification Number). Whether you’re onboarding vendors, clients, or partners, validating their GSTIN is essential to avoid fraud, ensure compliance, and maintain clean business records.

That’s where Ekychub’s GSTIN Verification API comes in — a powerful tool designed to help businesses instantly verify GST numbers with real-time results directly from GSTN (Goods and Services Tax Network).

🚀 Why GSTIN Verification Matters

A fake or invalid GSTIN can lead to:

GST filing errors

Input tax credit issues

Non-compliance penalties

Fraudulent partnerships

Manually verifying GSTINs is time-consuming and error-prone. Automating the process with Ekychub's API helps businesses stay agile, compliant, and protected.

🔍 Key Features of Ekychub’s GST Verification API

✅ Real-Time GSTIN Validation

Our API fetches and verifies GSTIN details in real time from the official GST network.

🏢 Complete Business Details

You’ll receive the legal name of the business, trade name, GSTIN status, registration date, type of taxpayer, and state information.

📦 Bulk Verification Available

Onboard multiple vendors, sellers, or clients at once using our Bulk GST Verification option.

🔒 Secure & Compliant

Built with encryption and data protection in mind, ensuring that your verifications are safe and reliable.

⚡ Lightning-Fast Response Time

Verify thousands of GSTINs within seconds, perfect for high-volume onboarding or periodic compliance checks.

💼 Who Can Benefit from GSTIN Verification?

Ekychub’s GST Verification API is ideal for:

Fintech & Lending Platforms

E-commerce Marketplaces

B2B Platforms & SaaS Companies

Logistics & Aggregators

Accounting Software & ERP Tools

Basically, any platform that works with Indian businesses should verify GSTINs to protect against fraud and stay compliant.

🧠 How It Works

Send the GSTIN number to the API endpoint.

Receive verified details directly from the GST Network.

Use the data for onboarding, compliance, or reporting.

Integration is quick, and our developer-friendly documentation ensures you’re up and running in minutes.

✅ Why Choose Ekychub?

Real-time & accurate results

Affordable pricing plans

Bulk verification support

Developer-friendly API

Free trial available

Trusted by fintechs and startups across India

🌐 Get Started Today

Stay compliant, reduce fraud, and automate your vendor verification process with Ekychub’s GSTIN Verification API.

#tech#techinnovation#identityvalidation#aadhaarintegration#fintech#technews#ekychub#technology#kycverificationapi#aadhaarverificationapi#💼 “No more fake GST numbers. Use Ekychub’s API to verify GSTINs instantly and streamline your onboarding process.”#bankverificationapi#panverificationapi#aadharverificationapi#ekycverificationapi#GSTINVerification#GSTVerificationAPI#VerifyGSTIN#RealTimeGSTCheck#GSTINAPI#GSTAPIIndia#BusinessVerification#Ekychub

0 notes

Text

Preparing for Tally and GST Certification Exams: Tips and Resources

In today's competitive job market, having specialized skills in accounting software like Tally and a thorough understanding of Goods and Services Tax (GST) can significantly enhance your career prospects. Certification in Tally and GST is recognized across industries, and obtaining these certifications can open doors to various job opportunities. Here’s a comprehensive guide to help you prepare for Tally and GST certification exams, including tips and essential resources.

Understanding Tally and GST Certification

Tally Certification

Tally is a popular accounting software widely used by businesses for managing accounts, inventory, and other financial transactions. A Tally certification validates your expertise in using this software, ensuring you can efficiently handle financial data, generate reports, and maintain accurate records.

GST Certification

Goods and Services Tax (GST) is a comprehensive tax system in India that replaced multiple indirect taxes. A GST certification demonstrates your knowledge of GST laws, compliance procedures, and the ability to manage GST-related transactions and filings.

Tips for Preparing for Tally Certification

1. Understand the Exam Pattern and Syllabus

Familiarize yourself with the exam structure, including the types of questions, duration, and marking scheme.

Review the syllabus to identify key topics, such as accounting fundamentals, inventory management, payroll, and taxation.

2. Enroll in a Reputable Course

Join a recognized training institute in Mumbai that offers Tally courses. Classroom training or online courses can provide structured learning and hands-on experience.

3. Hands-On Practice

Practice using Tally software extensively. Create dummy companies, enter transactions, generate reports, and reconcile accounts to gain practical experience.

4. Utilize Official Study Materials

Refer to official Tally study materials and guides provided by the training institute. These resources are designed to cover the entire syllabus comprehensively.

5. Take Mock Tests

Attempt mock tests and practice exams to assess your knowledge and identify areas that need improvement. This also helps in managing exam time effectively.

Tips for Preparing for GST Certification

1. Understand GST Concepts Thoroughly

Study the fundamentals of GST, including its structure, registration process, filing returns, and compliance requirements. Familiarize yourself with terms like Input Tax Credit (ITC), Reverse Charge Mechanism (RCM), and GST returns.

2. Join a GST Training Program

Enroll in a GST certification course offered by reputed institutes in Mumbai. These courses provide in-depth knowledge and practical insights into GST laws and procedures.

3. Stay Updated with GST Amendments

GST laws are subject to periodic updates and amendments. Keep yourself updated with the latest changes by following official GST portals, attending webinars, and reading industry news.

4. Refer to Government Resources

Utilize resources provided by the GST Council and the Central Board of Indirect Taxes and Customs (CBIC). These include GST manuals, FAQs, and official guidelines.

5. Practice Filing GST Returns

Gain practical experience by practicing GST return filing using the GSTN portal. This will help you understand the nuances of filing accurate and timely returns.

Essential Resources for Tally and GST Exam Preparation

1. Official Websites and Portals

Tally Solutions: www.tallysolutions.com

GST Portal: www.gst.gov.in

2. Training Institutes in Mumbai

List of reputable institutes offering Tally and GST courses:

Institute A

Institute B

Institute C

3. Books and Guides

"Mastering Tally ERP 9" by Asok K. Nadhani

"GST Manual with GST Law Guide" by Rakesh Garg and Sandeep Garg

4. Online Forums and Communities

Join online forums and communities where you can interact with other learners, ask questions, and share knowledge.

5. Mobile Apps and Software

Use mobile apps and software tools designed for Tally and GST learning. These apps offer tutorials, practice questions, and real-time updates.

Conclusion

Preparing for Tally and GST certification exams requires a combination of theoretical knowledge and practical experience. By following the tips outlined in this guide and utilizing the recommended resources, you can enhance your preparation and increase your chances of success. Remember, consistent practice and staying updated with the latest developments are key to acing these certification exams. Good luck!

0 notes

Text

How GST Verification API Redefines Tax Management

Secure tax processing is agreeable and compliant with consistent regulations can be a daunting task for entrepreneurs. However, with the advent of technology, especially the GST Verification API (Application Programming Interface), tax governance has improved dramatically. This article delves into the transformative potentiality of the GST verification API and its striking on tax governance.

i] Sympathize the GST Verification API

Before delving into what it means, let’s first take a basic overview of the GST Verification API. Essentially, it is a software interface that allows business enterprise to verify GST (Goods and Services Tax) identification numbers. Introduced as part of the GST regime, the API facilitates real-time verification of GSTIN (Goods and Services Tax Identification Number) issued by suppliers, vendors or customers.

ii] Streamlining compliance measures.

The most important way GST Verification API is specifying the tax process is by simplifying compliancy procedures. Traditionally, GSTIN verification interested manual efforts, which were not only long but also error prone. However, by integrating the GST verification API into tax systems, businesses can automatize the certification process. This not only saves time, but also improves accuracy, reduction the risk of non-compliance and associated penalization.

iii] Increased truth and data integrity

Inaccurate information can distort tax procedures, resulting in discrepancies, accounting and financial losses. The GST authentication API addresses this challenge by providing increased accuracy and data integrity. By comparing GSTINs with official records maintained by the GST Network (GSTN), this API ensures that business enterprise is interacting with authorised entities and therefore companies can make informed decisions based on message reliable sources and provides trust and uncrowdedness in business.

iV] Facilitate seamless consolidation.

Integration is key to getting the most out of any technology solution, and the GST Verification API is no exception. This API integrates well with existing tax processing software, ERP (enterprise resource management) systems and e-commerce systems. Whether it’s invoice generation, inventory management, or reconciliation, businesses can leverage the power of the GST verification API at various touchpoints in their business. This interoperability not only increases productiveness but also provides a all-encompassing view of tax related activities.

V] Empowering both taxpayers and authorities

The proceedings of GST verification API not only benefits businesses but also empowers taxpayers and authorities. It guarantees taxpayers that they are dealing with compliant companies, thereby reducing the risk of fraud. On the other hand, tax authorities can use the API to execute simple audits and analysis, and guarantee consistency among all stakeholders. This empowerment creates a culture of compliance and responsibleness in the tax system.

Vii] Future perspectives and trends in adoption

As businesses embracing digital transformation, proceedings of GST verification APIs are poised to see significant growth. With progression in technologies such as AI (Artificial Intelligence) and blockchain, the potential of this API is expected to increase. In addition, regulatory changes and global initiatives to combat tax evasion could lead to greater proceeding of GST certified APIs across industries and geographies.

Conclusion

GST Verification API is a game-changer in tax processing, delivering uncompilable benefits in terms of compliance, truth and efficiency by automatize the verification procedure, ensure data accuracy and supply seamless consolidation, this API determine how companies manage their tax obligations. Looking to the future, the widespread proceedings of the GST verification API promises to usher in a new era of transparency and tax certainty.

0 notes

Text

A Deep Dive into GST E-Invoicing in India

In India's dynamic tax landscape, the introduction of GST e-invoicing marks a significant stride towards modernization, efficiency, and transparency in tax administration. In this blog, we'll explore the intricacies of GST e-invoicing, its implications for businesses in India, and the transformative potential it holds for streamlining tax compliance processes.

Understanding GST E-Invoicing in India

GST e-invoicing in India is a digital system mandated by the Goods and Services Tax Network (GSTN) that aims to standardize and automate the generation, exchange, and reporting of invoices between businesses. Under this system, certain categories of taxpayers are required to generate invoices electronically and upload them to the GSTN portal for validation and authentication.

Key Benefits for Indian Businesses

1. Simplified Compliance:

GST e-invoicing simplifies the compliance process for businesses by automating invoice generation, reducing manual errors, and ensuring consistency in invoicing data, thus easing the burden of tax compliance.

2. Enhanced Data Accuracy:

By digitizing the invoicing process, e-invoicing minimizes the risk of errors and discrepancies in invoice data, ensuring greater accuracy and integrity in tax reporting.

3. Real-Time Reporting:

Real-time reporting to the GSTN provides businesses with instant visibility into their invoicing data, enabling better decision-making, faster tax reconciliation, and improved compliance management.

4. Reduced Tax Evasion:

E-invoicing creates a digital trail of transactions that can be easily tracked and audited by tax authorities, helping to curb tax evasion, fraud, and revenue leakages.

Implementation Process for Indian Businesses

1. Mandatory Compliance:

E-invoicing is mandatory for businesses with an annual aggregate turnover exceeding a specified threshold, currently set at Rs. 50 crore, subject to periodic updates by the government.

2. Registration on the Invoice Registration Portal (IRP):

Businesses must register on the IRP, obtain a unique Invoice Reference Number (IRN) for each invoice, and digitally sign the invoice using a digital signature certificate (DSC) or Aadhaar-based authentication.

3. Integration with Accounting Systems:

Integration with accounting or enterprise resource planning (ERP) systems is essential for seamless e-invoicing implementation, allowing for the generation and transmission of invoices directly from the business's software.

Navigating Challenges and Opportunities

While the transition to GST e-invoicing presents challenges such as initial implementation costs, technical complexities, and adaptation to new processes, it also presents opportunities for businesses to optimize their invoicing workflows, improve operational efficiency, and stay ahead of regulatory changes.

Conclusion:

In conclusion, GST e-invoicing represents a monumental shift towards digital transformation in tax compliance for businesses in India. By embracing this technological innovation and leveraging its benefits, businesses can streamline their invoicing processes, enhance compliance, and contribute to a more efficient and transparent tax ecosystem. As India marches towards a digital future, GST e-invoicing paves the way for a brighter and more compliant tomorrow.

0 notes

Text

Complete F&Q All e-Invoicing Software

Q-1: What is e-Invoicing?

Answer: Electronic invoicing or e-invoicing is an invoicing process that allows other software to access invoices generated by software, eliminating the need for re-entry of data or errors. In less difficult words, it is an invoice created in a standard format, whereby the electronic information of the invoice can be shared with other people, which guarantees the compatibility of the information.

Q-2: What is the electronic invoicing process?

Answer: There aren't many changes; Companies can continue to generate their invoices from their existing software. To ensure a certain level of standardization, only one standard format is used, the e-invoicing schema. These systematic invoices are prepared by the taxpayer. When creating the invoices, you must report them to the GST Invoice Registration Portal (IRP). The portal then generates a unique invoice reference number and adds the digital signature along with the QR code to the e-invoice. The QR code contains all the information required for the electronic invoice. After this process, the electronic invoice is sent back to the taxpayer via the portal. IRP will also send a copy of the signed invoice to the seller's registered email address.

Q-3: Will the electronic invoice format be the same for all categories?

Answer: All companies/taxpayers that must pay GST must issue electronic invoices using the same scheme established by GSTN. The format has required and non-required fields. All taxpayers must complete the required fields and non-required fields are used as required.

Q-4: Is e-invoicing mandatory?

Answer: Electronic invoicing is mandatory for all companies with an annual turnover of Rs. Rs. 100 crores or more from 1st January 2021. Previously it applied to companies with a turnover above the limit of Rs. 500 million crores.

However, e-invoicing does not apply to the categories listed below, regardless of commercial invoicing, as per CBIC Notice No. 13/2020- Central Rate:

. An insurance company or a banking company or financial institution, including an NBFC . A Freight Transport Company (GTA) . A registered person offering passenger transportation services. . A registered person who provides services by way of admission to the exhibition of motion pictures in multiplex services . One SEZ unit (excluded by CBIC Report No. 61/2020 – Central Tax)

Q-5: What are the advantages of electronic invoicing? Answer: These are some of the benefits of electronic invoicing:

. Report B2B invoices once during generation, reducing reporting in multiple formats. . Most of the data on the GSTR-1 form can be kept ready to send while using the electronic billing system. . E-Way invoices can also be easily created with electronic invoice data. . There is a minimal data reconciliation between the books and the GST returns submitted. . Real-time tracking of invoices generated by a supplier can be enabled, along with faster availability of input tax credits. It will also reduce input tax credit verification problems. . Better management and automation of the tax declaration process. . Reduced fraud as tax authorities also has real-time access to data. . Elimination of false GST invoices that are generated.

Q-6: What deliveries are currently covered by e-invoicing? Answer: Electronic invoicing currently applies to:

. Deliveries to registrants (i.e. B2B deliveries), . Deliveries to ZEE (with/without payment of taxes), . Exports (with/without payment of taxes) and exports considered,

made by the Class of Notified Taxpayers.

Q-7: How will the e-invoicing model work? Answer: Under the e-invoicing model, companies will continue to issue invoices in their respective ERPs, as has been the case in the past. Only the standard, schema, and format for creating invoices are specified to ensure a certain level of standardization and machine-readability of these invoices. The preparation of the invoice is the responsibility of the taxpayer.

As it is generated, it must be reported to the GST Invoice Registration Portal (IRP). The IRP generates a unique invoice reference number (IRN) and adds the digital signature for the e-invoice along with the QR code. The QR code contains important parameters of the electronic invoice and sends it back to the taxpayer who created the document. The IRP also sends the signed e-invoice to the seller to the registered email id.

Q-8: What types of fields are there in an electronic invoice? Answer: The data of the fields marked as "required" must be entered.

. A required field that has no value can be reported as null. . Fields marked as "Optional" may or may not be filled out. They are only relevant to certain companies and only relate to certain scenarios. . Some sections of the electronic invoice marked as "Optional" may contain mandatory fields. For example, the E-Way Billing Details section is marked as Optional. However, in this section, the Transport Type field is required.

Q-9: Does the e-invoice need to be signed again by the supplier? Answer: The provisions of Rule 46 of the Central Goods and Services (CGST) Rules, 2017 apply here. According to Rule 46, the signature/digital signature of the supplier or his authorized representative is required while issuing invoices. However, a proviso to Rule 46 states that the signature/digital signature shall not be required in the case of issuance of an electronic invoice that is by the provisions of the InformationTechnology Act, 2000. Hence, it has been interpreted that in the case of e-invoices, a supplier will not be required to sign/digitally sign the document.

Q-10: What are the options for receiving electronic invoices registered in the IRP?

Answer: Several ways to record electronic invoices are provided in the Invoice Registration Portal (IRP). Some of the suggested modes are-

. Web-based, . API based, . Based on offline tools and . based on GSP.

Q-11: What is the final threshold for e-invoicing?

Answer: In a bid to step up measures against tax evasion, the government announced last week that GST e-invoicing will be mandatory for companies with a turnover of more than Rs 10 crore from October 1, down from the current Rs 20 crore, which will bring in another 0.36 million businesses in digital reporting.

2 notes

·

View notes

Text

STREAMLINE COMPLIANCE REQUIREMENTS WITH E-INVOICING

With stringent compliance needs and complex business cycles, enterprises are looking for more viable solutions to make ends meet. GST filing is one such complex, resource-intensive and time-consuming process that exists across all industries. However, this compliance gets more complicated in the world of infrastructure.

While many infrastructure organizations are filling GST manually through the government portal or taking the ASP-GSP route, they experience some anomalies, which eventually slows the business cycle. Some of the challenges actively faced by construction enterprises are –

Frequent delays in GST payment and filing returns

Errors in calculation leading to excess payment or less payment

Mistakes in filing leading to multiple rounds of efforts by the tax team

Mismatch between returns filed (Eg. GSTR 1 & 2A) requiring rework and extra effort by tax team

Mismatch between ERP data and data in returns filed without a proper document trail of changes

Mismatch between returns filed by the tax team and vendors

E-invoicing

E-Invoicing or electronic invoicing is a modernized B2B invoicing system where GSTN electronically authenticates invoices for further use on common GST portal. The e-invoicing system under GST works by issuing an unique identification number issued by Invoice Registration Portal (IRP). All invoicing information is then transferred from to the GST portal and e-way bill portal in real-time. This drastically reduces manual data management, bypassing the data directly by IRP to the GST portal.

Benefits of e-invoicing system for a construction organization

Other than reducing the intensity of manual work, e-invoicing brings a host of other benefits for construction companies like –

E-invoice bridged the significant gap in data reconciliation under GST to minimize mismatch errors under GST.

E-invoices generated on one platform can be easily read on another system bringing harmony and reducing data entry errors.

Real-time tracking of invoices prepared by the supplier to ensure maximum transparency.

Backward integration and automation of tax return filing. This results in relevant details of the invoice auto-populated in generating the part-A of e-way bill and other returns.

Quick availability of genuine input tax credit.

Fewer audit possibilities by tax authorities due to greater transparency at the transactional level.

A credible e-invoicing solution for GST will furnish real-time tracking of all invoices. The platform will host the invoices on a common portal and in turn help in multipurpose reporting. Once the invoice is analyzed and authenticated, the details get auto-populated to the GSTR-1 portal. The system shares the same information over email mentioned on the e-invoice.

E-Invoicing to curb tax evasion

E-invoicing curbs tax evasion in the following ways –

Tax authorities will have access to all the information needed in real-time since the e-invoice will have to be generated through the GST portal.

Fewer chances of invoice manipulation since the invoices are generated before the transaction.

Reduced scope for fake GST invoices as only genuine input tax credit can be claimed since all invoices are generated through the GST portal itself. The input credit can be matched with output and access the tax details to track fake tax credit claims.

The government has already established a roadmap to implement e-invoices on a national level. Not just it will cause a massive reduction in compliance, it will also be good for the taxpayers, streamline taxation and control GST frauds.

Highbar Technocrat Limited is one of the leading end-to-end IT solution providers for the Infrastructure, EC&O, Real Estate, and Power sectors. They are SAP Gold partner and offer a wide bouquet of digitally integrated solutions ranging from implementing SAP-based ERP solutions like Rise with S/4HANA, Cloud-based solutions to 5D BIM for mega infra-projects, RPA & IoT solutions, and many more. With an in-depth understanding and core competence of the construction & infrastructure industry, Highbar is the perfect blend of domain knowledge in the infrastructure business with a team that is well equipped to understand and relate to the requirements of the sector.

To know more write us at [email protected] or call +91 89767 11399

#sap#highbar technocrat#construction#E-invocing#gst#tax#infrastructure#realestate#einvoicing#technology#finance#billing#it#it software

2 notes

·

View notes

Text

Important features of Marg GST Software

After the implementation of GST, one of the biggest challenges faced by both taxpayer & accountants is the complexity in tax compliance. For example, tax compliance includes GST return filing, claiming a tax refund, multiple tax returns, etc. Similarly, taxpayers have to issue GST compliant e-invoices.

E-invoices need to have components like HSN/SAC Codes, GSTIN of the supplier and the recipient, GST Rates etc. Further, they face challenges in keeping the track of all new amendments introduced by the GST Council via notifications and circulars.

Such a complex situation makes it difficult for both taxpayer & accountants to file fully compliant GST returns on time. So, to avoid delays in taxes & such issues, businesses are advised to use GST Accounting Software.

A good GST Accounting Software enables the taxpayers, accounting professionals and business owners to generate GST ready invoices effortlessly, file GST returns timely, organize GST reports and maintain all accounting data seamlessly.

One such software is Marg GST software which is affordable & provides you with the best GST Billing and Returns Filing experience. Marg GST Billing software aims at reducing your business operation cost by significantly reducing the compliance time. It fastens the entire process of return filing as you can directly push transactions into Excel, JSON or CSV format from the software on to GST Portal & file returns in a few clicks.

Let us discuss few important unique features of Marg GST Billing software:

GST Invoices & Billing

With Marg GST invoice software you can generate GST compliant invoices in a few seconds and can also track invoice. It improves the billing speed by 40% with multiple advanced shortcuts & search options like Barcode etc.

GST Reports & Return Filing

One of the biggest advantages of Marg GST filing software is that it can create GST Invoices & push transactions directly into the GSTN portal in Excel, JSON or CSV Format & File GSTR 1, GSTR 2, GSTR 3B, GSTR 4, GSTR 9 directly from the software. This saves a lot of time & efforts that go wasted in filing return manually. Moreover, you are not dependent on any accountant for maintaining your books.

GSTR 2A Reconciliation

GSTR 2A reconciliation in Marg e-invoice software is very easy. Simply reconcile GSTR 2A of the entire year without even logging in to the GST portal frequently. Download GSTR-2A auto-populated purchase bills in order to match them in Marg GST software

Tax Clubbing

Automatically club together both input & output tax of a particular month and further pass a general entry at the end of the month required for GST Payable

Easy Accounting

No manual data entry required with Marg GST software. Easily import and export all data with just a click. Check Account Balance, Account History, Invoices, Quotations, Payments and Alerts everything that smooths your business accounting till maintaining the Balance Sheet. Marg GST software helps you at every step by digitizing & automating all your accounting.

E-Invoicing

Another challenge that is faced by the maximum of the small & medium-sized businesses. Marg e-invoice software is ready with e-invoicing. Marg GST software is equipped with all necessary e-invoice format & requirement notified by the government. You can gen Upload your B2B transaction invoices authenticated by Invoice Registration Portal (IRP) of Registered Party’s Credit & Debit Note on the GSTN portal electronically & reconcile directly

Internal Audit

Internal audit is an important process of accounting. Running an internal audit is a crucial part that you need to master to avoid any mistakes & errors. Well, Marg GST software automatically validates the data for any errors and gives you alerts during the internal audit. It is that simple with Marg ERP software. You don’t have to worry about anything. It also validates the GSTIN of the suppliers to file 100% error-free returns

GST RCM Statement & Eway bill

Marg software lets you generate GST RCM statement when GST is to be paid and deposited against the Goods/ Services. You can also generate Single, Multiple & Bulk e-way bill to directly upload on the portal. An E-way bill is the most important document that is required for the movement of goods. Manually creating e-way bills is very time consuming, therefore it is beneficial to generate e-way bill via software which will be then automatically shared with the buyer as well.

TDS/ TCS

Marg GST software provides the most simple & user-friendly interface for filing the 100% error-free TDS/ TCS returns online as per the norms of TRACES and CPC, India

Online Banking

Experience uninterrupted online banking inside Marg ERP integrated with ICICI Bank. Manage all type of bank transactions i.e. NEFT, RTGS etc. including Auto-Bank Reconciliation with 140+ Banks

Digital Payment

To simplify the payment & collection problems Marg ERP has launched India’s first B2B payment collection platform- MargPay. MargPay provides secure Payment Modes, Bill-by-bill Reconciliation, Same-day Settlement, Business Loans etc. to small & medium businesses for better financial growth.

Marg GST Software for Billing & Accounting can be customized as per the business you are doing without any hassle. Marg GST Software provides you with the option to send the bills through email automatically which saves time. With Marg GST Software, you can also switch over anywhere from bill to bill which saves a lot of time.

Marg GST Software enables you to easily reconcile GSTR 2, GSTR 2A without logging in to GST portal frequently and download the purchase bills in order to match them in the software. We always keep you up-to-date on all the critical numbers & taxes with 1000+ MIS reports that can be customized according to your company requirement. Marg GST billing software is the best way to file your taxes along with managing your business, as you get complete business solutions in one place. Stay GST Compliant with Marg ERP & leave your tax filing burden to us!

Bottom Line:

The technology trends that are equipped in Marg GST invoice software are constructive to streamline your business processes. You don't have to spend hours checking tax returns. You can easily sync your account books with GST returns using Marg GST software. All in all, GST solutions can make things more comfortable in your organization and give you the best returns on investment

#gst billing software#gst accounting software#gst filing software#gst invoice software#gst software#gst enabled software

1 note

·

View note

Text

Introduction: Navigating GST and E-Invoicing Compliance in India

Staying compliant with India’s constantly evolving tax laws can be a major challenge for businesses. With GST and mandatory e-invoicing thresholds now applicable to many companies, manual processes are no longer reliable or scalable. That’s where ERP software with integrated GST and e-invoicing features comes into play — offering automation, accuracy, and peace of mind.

What is ERP Software and Why It Matters for Compliance?

Enterprise Resource Planning (ERP) software centralizes and automates business processes like inventory, finance, sales, and procurement. When enhanced with GST-compliant invoicing and e-invoice generation, ERP becomes a powerful tool to ensure timely and error-free compliance with government regulations.

Whether you are a small trader or a large manufacturer, choosing the best ERP software company in India can dramatically improve your ability to stay compliant, efficient, and competitive.

GST Compliance: Why Automation is Critical

The Goods and Services Tax (GST) is a unified indirect tax that replaced multiple cascading taxes in India. But filing GSTR returns, reconciling mismatches, and tracking input tax credit (ITC) can be daunting without automation.

Here’s how ERP simplifies GST compliance:

Auto-calculation of taxes across CGST, SGST, and IGST

GSTR-1 and GSTR-3B auto-population from sales and purchase data

Multi-GSTIN support for businesses operating in multiple states

Error-free input tax credit tracking

Many companies now rely on the best ERP software for manufacturing industry to manage both compliance and production workflows from a single platform — minimizing downtime and tax errors.

Understanding E-Invoicing in India

The e-invoicing system introduced by the GST Council mandates businesses to upload invoices to the Invoice Registration Portal (IRP) for validation and unique Invoice Reference Number (IRN) generation.

Applicable businesses must:

Generate invoices in a standard schema (JSON format)

Upload them in real-time to the IRP

Print QR codes and IRNs on physical invoices

Non-compliance can lead to penalties and blocked ITC claims. Using the best ERP solutions in India ensures that your invoice data is accurate, validated in real-time, and meets all government norms.

Benefits of ERP Software with GST and E-Invoicing Features

Automated Invoice Generation Generate GST-compliant invoices with IRN and QR codes automatically.

Seamless IRP Integration Direct API integration with NIC or private IRPs for real-time invoice validation.

Error Reduction and Time Saving Eliminate manual data entry errors and reduce reconciliation time.

Faster GSTR Filing GSTR-1 data is auto-populated based on e-invoices, minimizing delays and mismatches.

Audit-Ready Reports Easily accessible audit trails and reports for tax scrutiny or internal audits.

Centralized Control Manage multiple GSTINs, branches, and locations through a single ERP platform.

Must-Have ERP Features for GST and E-Invoicing

When selecting an ERP system, ensure it includes:

GST tax slab management

Bulk e-invoice upload and generation

Custom invoice templates with IRN and QR code

Real-time error tracking and alerts

Multi-language and multi-currency support

API integration with GSTN and e-way bill portal

Case Study: How an SME Improved GST Filing Accuracy with ERP

A mid-sized manufacturer in Gujarat struggled with late filings and ITC mismatches. After implementing an ERP with GST and e-invoicing, they:

Cut filing time by 60 percent

Reduced notice frequency from GSTN

Saved ₹5 lakhs annually in penalties and compliance costs

Conclusion: Future-Proof Your Business with Smart ERP

With growing compliance demands, relying on spreadsheets or legacy billing tools is risky. Investing in a modern, GST-enabled ERP software with real-time e-invoicing features is no longer optional — it’s essential.

If you want to streamline tax compliance, reduce costs, and stay audit-ready, now’s the time to explore the best ERP solutions in India that are built for scale, speed, and government compliance.

0 notes

Text

E-Invoicing Under Goods and Services Tax (GST)

Introduction

E-Invoicing under the Goods and Services Tax (GST) regime is a digital invoicing system implemented for specific categories of taxpayers in India. It enables businesses to register and obtain digitally signed Electronic Invoices within the GST framework. In this article, we will discuss all about e-invoicing under GST, who are liable to issue e-invoice, who are exempted to generate e-invoice, benefits, etc.

What is E-Invoicing under GST?

E-Invoicing under GST is a system implemented for certain taxpayers where they can register and obtain digitally signed Electronic Invoices within the GST framework. This setup is specifically designed for Business to Business (B2B) transactions, where invoices are electronically authenticated by the GST Network through the common GST portal. The Invoice Registration Portal (IRP) issues a unique identification number for each invoice, which is managed by the GSTN.

Who is liable to issue E Invoice under GST?

The liability to issue E-Invoices under GST falls upon every registered taxpayer whose aggregate annual turnover has exceeded Rs. 20 Crore in any financial year since 2017–18. It’s important to note that this aggregate turnover includes the turnover of all GSTINs associated with a single PAN in India. The E-Invoice information is transferred from the E-Invoice portal to both the GST portal and E-Way bill portal in real-time. This eliminates the need for manual data entry during GSTR-1 Return Filing and generation of part-A of the E-Way Bills, as the information is automatically transferred from the Invoice Registration Portal (IRP) to the GST portal.

Documents required for E Invoicing

The documents that need to be reported to the Invoice Registration Portal (IRP) for E-Invoicing purposes are as follows:

Invoices issued by the supplier.

Credit notes issued by the supplier.

Debit notes issued by the recipient.

Any other document as notified under the Goods & Service Tax Act that requires reporting as an E-Invoice by the document creator.

Process to Get E Invoicing under GST

Here is the procedure to generate an E-Invoice under GST:

Generate a regular invoice on the software: Provide all the necessary details such as billing name and address, supplier’s GST number, transaction value, item rate, applicable GST rate, tax amount, etc.

Raise the invoice on the ERP software or billing software: After creating the invoice, upload the invoice details, especially the mandatory fields, to the Invoice Registration Portal. This can be done using a JSON file or through an application service provider (such as an app or a GST Suvidha Provider) or directly via API.

Generate the Invoice Reference Number (IRN): The Invoice Registration Portal will validate the key details of the Business-to-Business invoice, check for any duplication’s, and generate an Invoice Reference Number (IRN) as a unique identifier.

Create a QR code in Output JSON: Once the IRN is generated, the IRP digitally signs the invoice and creates a QR code in Output JSON format. If the supplier has provided their email ID in the invoice, they will receive an intimation of the E-Invoice generation via email.

Send details to the GST Portal and E-Way Bill Portal: The Invoice Registration Portal sends the authenticated invoice details to the GST Portal, which auto-fills the seller’s GST Return form (GSTR-1). Additionally, the details are sent to the E-Way Bill Portal for seamless integration with the E-Way Bill generation process.

Benefits of E-Invoicing under GST

E-Invoicing under GST streamlines data reconciliation, reducing mismatch errors between invoices and returns.

E-Invoices created on one software can be seamlessly read by another, promoting interoperability and minimizing data entry mistakes.

E-Invoicing allows for real-time tracking of invoices created by suppliers.

Relevant invoice details are automatically populated for filing GSTR-1 and generating Part A of E-Way Bills, simplifying the GST Return Filing process.

E-Invoicing facilitates faster availability of genuine ITC, enabling businesses to utilize it more efficiently.

E-Invoicing provides detailed transaction-level information, reducing the likelihood of audits and surveys by tax authorities.

To file your GST return online, gather the necessary documents and log in to the official GST portal. Select the appropriate GST return form, enter your business and invoice details, and validate the form before submitting it. If there are any tax liabilities, make the payment online. After submission, you’ll receive an acknowledgment receipt. Verify the return if necessary through digital signature or electronic verification code. Online filing provides convenience and accuracy for meeting GST obligations.

List of the Taxpayer that are not required to generate e-invoicing under GST

The following categories of taxpayers are not required to generate E-Invoices under GST, regardless of their turnover:

Insurance companies, banking companies, and financial institutions, including NBFCs.

Goods Transport Agencies (GTAs).

Registered taxpayers providing passenger transportation services.

Registered taxpayers providing services related to admission to the exhibition of cinematographic films in multiplex services.

Conclusion

The E-Invoicing system only requires these taxpayers to report their invoices electronically on the Invoice Registration Portal. So, while the reporting process is digital, the physical printing of invoices with logos can still be maintained.

0 notes