#gst invoice software

Explore tagged Tumblr posts

Text

What is a GST Invoice Generator? A Complete Guide for Businesses

Goods and Services Tax (GST) has transformed taxation in India, making invoicing an essential part of business operations. A GST Invoice Generator is a tool that helps businesses create GST-compliant invoices quickly and accurately. Whether you are a small business owner, freelancer, or enterprise, using GST Invoice Software can simplify tax compliance, reduce errors, and save time.

In this guide, we will explain what a GST Invoice Generator is, how it works, and why businesses need it. We will also cover the benefits of using an Online GST Invoice Generator and how it compares to manual invoicing.

What is a GST Invoice Generator?

A GST Invoice Generator is a digital tool that helps businesses generate GST invoices with all necessary details, such as invoice number, GSTIN, buyer and seller details, tax breakup, and total amount. These tools ensure that invoices comply with GST regulations, reducing errors and avoiding penalties.

Key Features of a GST Invoice Generator:

Automated GST calculations – Ensures accurate tax computation.

Pre-designed templates – Offers ready-to-use GST invoice templates for professional invoicing.

Multi-tax support – Handles CGST, SGST, IGST, and UTGST calculations.

E-invoicing under GST – Supports real-time invoice generation for compliance with government regulations.

Integration with accounting software – Syncs with GST filing software for seamless tax return filing.

Why is a GST Invoice Generator Important for Businesses?

For businesses of all sizes, a GST Invoice Generator provides multiple benefits:

Saves Time and Effort: Manually creating invoices can be time-consuming. An Online GST Invoice Generator automates the process, allowing businesses to focus on growth rather than paperwork.

Reduces Errors: Errors in invoices can lead to penalties. A Tax Invoice Generator ensures accuracy by applying the correct tax rates and following GST guidelines.

Improves Compliance: Using a GST Invoice Software ensures that all invoices meet the legal requirements, reducing the risk of compliance issues.

Professional and Organized Billing: A Digital Invoice Creation tool allows businesses to issue well-structured, professional invoices that enhance credibility and trust.

How to Generate a GST Invoice?

Generating a GST invoice manually can be challenging, but using a Free GST Invoice Generator makes it simple. Here’s how:

Enter Business Details: Add your business name, GSTIN, and address.

Add Buyer Details: Enter the buyer’s name, GSTIN, and address.

Include Invoice Details: Mention the invoice number, date, and due date.

Add Product/Service Details: Include the description, quantity, unit price, and tax rate.

Calculate GST Automatically: The tool applies CGST, SGST, or IGST based on the buyer’s location.

Download or Print Invoice: Save the invoice as a PDF or email it directly to the client.

GST Billing Process: Step-by-Step

Create Invoice – Use an Online GST Invoice Generator to input transaction details.

Apply GST Rates – Automatically calculate CGST, SGST, or IGST.

Issue Invoice to Customer – Send via email or print for record-keeping.

File GST Returns – Sync with GST filing software for easy tax submission.

Maintain Records – Store invoices digitally for future reference and audits.

Market Data: Why Businesses are Shifting to Digital Invoicing

According to a 2023 survey, 70% of Indian businesses use GST Invoice Software for compliance.

The digital invoicing market in India is growing at 12% annually, driven by GST regulations.

Over 80% of SMEs prefer Free GST Invoice Generators before switching to paid solutions.

GimBook: The Smart GST Invoice Solution

GimBook is a powerful GST Invoice Generator designed for businesses of all sizes. It provides a user-friendly interface, automated GST calculations, and customizable invoice templates. With GimBook, you can:

Generate GST invoices in seconds

Access pre-designed GST invoice templates

Use cloud-based storage for invoices

Integrate with accounting software for GST filing

Whether you’re a freelancer, small business, or enterprise, GimBook ensures hassle-free invoicing and compliance.

Boost Your Business with GimBook – Create GST Invoices Hassle-Free! https://gimbooks.com/

A GST Invoice Generator is a must-have tool for businesses in India. It streamlines invoicing, reduces errors, and ensures compliance with GST regulations. Whether you choose a Free GST Invoice Generator or a paid Best GST Invoice Software, the key is to find a solution that meets your business needs. Start using a GST Invoice Generator today and simplify your billing process effortlessly!

0 notes

Text

"Eazybills" emerges as the quintessential thermal printer companion for seamless billing solutions. Engineered to synchronize flawlessly with billing software, it epitomizes efficiency and reliability.

#invoicing software#free billing software#free invoice software#best invoicing software#gst invoice software#gst billing software#billing software#billingsoftware#eazybills#software for billing

0 notes

Text

GST Billing Software and Their Benefits to The Businesses in India

#billing software#free billing software#gst billing software#free gst biling software#best free billing software#invoice software#free invoice software#online invoice software#gst invoice software#gst invoicing software#invoicing software#online invoicing software

1 note

·

View note

Text

Online Invoice Software with GST Billing - Bharat Bills Online

Best billing software with GST and all invoice features, designed for the modern business in India. It's time to upgrade to the best gst billing solution!

for more information: https://bharatbills.com/e-invoicing-software/ and visit our website: https://bharatbills.com/

0 notes

Text

Common Mistakes to Avoid When Managing GST Ledgers in Tally

Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST). GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

#accounting automation software#GST Ledgers#GST#tally on cloud#automated bank statement processing#e invoice in tally#tally solutions

2 notes

·

View notes

Text

Optech Software offers one of the most reliable and user-friendly Billing Software in Coimbatore, tailored to meet the needs of businesses of all sizes. Whether you run a retail store, a wholesale unit, or a service-based company, Optech Software provides a seamless billing experience with features like GST invoicing, inventory management, e-invoice generation, and real-time reporting

#gst billing software#billing software#invoice software development bd#e-invoice#billing software in coimbatore

0 notes

Text

Revolutionizing Business Billing for Indian MSMEs: Meet Karosauda

Running a small business in India comes with its fair share of challenges from managing inventory and creating GST-compliant invoices to tracking payments and generating reports. Most MSME owners juggle multiple apps or, worse, still rely on manual registers and Excel.

That’s where Karosauda steps in.

Karosauda is a smart billing and accounting software made in India, for India. It's tailored specifically for MSMEs, traders, shopkeepers, service providers, and small manufacturers who want to simplify their day-to-day operations without needing an accounting degree.

From professional invoices to inventory tracking, multi-user support, and real-time GST reporting, Karosauda packs all essential features into a single, easy-to-use mobile and desktop platform.

Best of all? You don’t need to be a tech expert. If you can use a smartphone, you can use Karosauda.

With affordable pricing, cloud backup, and 40+ detailed reports, it’s the digital backbone every small business needs today.

✅ Fast ✅ Reliable ✅ Made for Bharat 🇮🇳

0 notes

Text

Understanding HSN/SAC Codes for Indian Businesses

For any business working in the Goods and Services Tax regime in India, understanding HSN codes and SAC codes or applying them correctly is not merely a matter of fulfilling a legal requirement-it is an important aspect of ensuring bills are correctly prepared, that the right amount of tax is calculated, and GST has been properly complied with.

At first glance, these codes can appear complicated, but that is far from the truth-just like everything is based on common sense—these codes were developed with the intention that they provide uniformity and clarity in respect of classification of goods and services. Any other form of misclassification may have various consequences like levy of wrong tax, imposition of penalties, and reconciliation problems.

Tririd Biz, your trusted accounting and billing software in India, believes that GST compliance can be a little less challenging if it is clear upfront. This comprehensive guide will clarify HSN and SAC codes, show why these matters are of significance to your business, and even walk you through how our software makes managing HSN and SAC codes quite simple.

What are HSN Codes and SAC Codes?

Briefly:

HSN Code (Harmonized System of Nomenclature): These are internationally accepted classification codes for goods. The codes were evolved by the World Customs Organisation (WCO) to classify traded goods the world over systematically. In India, these codes are used in GST to assess the rate of tax applicable to different products.

Structure: While HSN codes remain international only till 6-digits, India in reality uses an HSN code of 2, 4, 6, or 8 digits depending on the turnover of the business. The more digits the code has, the finer the classification.

SAC Code (Service Accounting Code): In the same manner HSN is structured for goods, SAC codes are used to classify services. These codes are restricted to India and were developed by the Central Board of Indirect Taxes & Customs (CBIC) for service tax purposes, which were subsequently taken over by GST.

Structure: The SAC code is of 6 digits only; the initial two digits are '99' for services, and the next four digits specify the exact nature of service.

Why are HSN/SAC Codes Necessary for GST Compliance in India?

The primary reasons HSN/SAC codes are mandatory under GST are:

Uniform Classification: They ensure that goods and services are classified uniformly across India, preventing ambiguity and disputes regarding tax rates.

Tax Rate Determination: Every HSN/SAC code is linked to a specific GST rate. Using the correct code ensures you charge and pay the right amount of tax.

Invoice Generation: It is mandatory to mention the HSN/SAC code on GST-compliant invoices, especially for B2B transactions, if your turnover exceeds certain limits.

GST Return Filing: HSN/SAC-wise summary of outward supplies (sales) is required in GSTR-1, providing granular detail to the tax authorities.

Data Analysis & Policy Making: The government uses these codes to analyze trade data, understand consumption patterns, and formulate economic policies.

How Many Digits of HSN/SAC Code Do You Need to Use?

The number of digits you need to declare depends on your business's aggregate annual turnover in the preceding financial year:

For Goods (HSN):

Turnover up to ₹5 Crore: 4-digit HSN code (mandatory for B2B invoices)

Turnover exceeding ₹5 Crore: 6-digit HSN code (mandatory for all invoices)

Exports & Imports: 8-digit HSN code is generally required.

For Services (SAC):

All Turnovers: 6-digit SAC code is generally required.

(Always refer to the latest notifications from the GST portal for the most accurate and up-to-date requirements, as these thresholds can be revised.)

How to Find Your HSN/SAC Codes

Finding the right HSN/SAC code relevant to your goods or services is extremely important. Some good ways include:

GST Portal: The GST portal at times has search methods or links to official HSN/SAC code lists.

CBIC Website: Lists of HSN codes for goods and SAC codes for services are available on the Central Board of Indirect Taxes & Customs (CBIC) website.

Industry Associations: Your industry association might have compiled lists or issued guidelines for your particular industry.

Tax Consultants: A professional tax consultant will assist in determining the correct codes for your particular offerings.

Through Your Accounting Software: A good smart GST accounting software like Tririd Biz will take away a lot of these worries.

Common Mistakes to Avoid with HSN/SAC Codes

Using Wrong Codes: It is the commonest mistake, and these wrong codes can lead to wrong tax calculations, penalties, and problems for the customers in claiming ITC.

Not Updating Codes: As products or services change, or as GST rules change, always ensure your codes are up to date.

Ignoring Compulsory Requirements: Not mentioning the HSN/SAC code in the invoice, when it is required to do so, or putting in lesser digits than required, with respect to the turnover.

Confusing Goods with Services: Remember to use the HSN for goods and SAC for services.

Lack of Documentation: Failure to maintain documentation explaining the basis for assigning a certain HSN/SAC code, especially in the case of complex items.

How Tririd Biz Accounting & Billing Software Simplifies HSN/SAC Management

Managing HSN/SAC codes manually for every product and service can be tedious and error-prone, especially for businesses with diverse offerings. Tririd Biz is designed to take this burden off your shoulders:

Product/Service Master Data: Easily store and manage your products and services, each tagged with its correct HSN/SAC code and corresponding GST rate, within our software.

Automated Tax Calculation: When you create an invoice in Tririd Biz, the software automatically picks up the HSN/SAC code and applies the correct GST rate based on your master data. This minimizes manual errors.

Invoice Printing: Your GST-compliant invoices generated by Tririd Biz will automatically include the required HSN/SAC codes, ensuring you meet legal requirements.

GSTR-1 Summary: Tririd Biz helps in generating HSN/SAC-wise summaries for your GSTR-1, streamlining your return filing process.

Seamless Data Management: Update codes centrally, and the changes reflect across all relevant transactions, ensuring consistency.

By leveraging Tririd Biz, you can focus on growing your business, knowing that your GST billing and accounting are accurate and compliant with the latest HSN/SAC regulations.

Ensure Compliance, Embrace Simplicity

Understanding HSN/SAC codes is a fundamental aspect of GST compliance for Indian businesses. By dedicating time to correctly classify your goods and services and utilizing smart tools like Tririd Biz, you can ensure accuracy, avoid penalties, and simplify your entire GST filing process.

Ready to streamline your GST compliance with intelligent HSN/SAC management?

Get a Free Demo of Tririd Biz Today! Learn More About Tririd Biz GST Software Explore Tririd Biz Features

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

#Tririd Biz Accounting Software#HSN SAC codes India#GST codes for goods and services#Understanding HSN code#What is SAC code in GST#GST invoice HSN SAC

0 notes

Text

GST-Integrated Billing Software That Simplifies Your Financial Processes

Go GST Bill is revolutionizing the way businesses manage their finances by offering innovative and easy-to-use accounting and billing solutions. Designed with user experience in mind, their products cater to businesses of all sizes, from startups to established enterprises. With a focus on simplifying complex financial tasks, Go GST Bill ensures that companies can focus on growth instead of grappling with accounting intricacies.

At the core of their offerings is software that seamlessly integrates key accounting functions, streamlining operations while maintaining accuracy and compliance. Whether it’s billing, inventory management, or financial reporting, Go GST Bill provides comprehensive solutions tailored to meet varying business demands. Their user-friendly interfaces and powerful features have set a new standard in the accounting software market. Many clients appreciate their free business accounting software, enabling businesses to access essential tools without financial strain.

Go GST Bill - All-in-One Financial Solutions for Businesses

Go GST Bill also simplifies the often-complicated process of generating professional business documents. Their intuitive systems offer a pre-designed purchase order format to help businesses efficiently manage procurement processes and maintain robust vendor communication.

For businesses dealing with the Goods and Services Tax (GST), Go GST Bill proves to be a valuable partner. Their smart software includes customizable templates, such as an accurate and professional GST invoice template, ensuring compliance with tax regulations. Additionally, they offer a detailed GST challan format that aids businesses in managing their tax records with precision and ease.

Go GST Bill’s commitment to empowering businesses reflects in every aspect of their service. By offering tools that simplify, streamline, and enhance financial processes, they’ve established themselves as a trusted partner for businesses aiming to achieve financial efficiency. Explore Go GST Bill’s innovative solutions today and take the first step toward smarter accounting and business management. With Go GST Bill, financial excellence is within reach.

0 notes

Text

"Effortless Invoicing: Streamline Your Business with EazyBills GST Billing Software"

#gst billing software#billing software#easy billing software#free gst billing software#billingsoftware#free invoicing#easy gst billing software#best gst billing software#gst invoice software

0 notes

Text

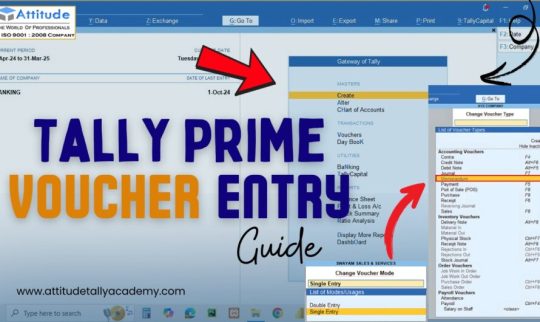

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

Ultimate GST Checklist for Indian E-Commerce Sellers. What’s in our FREE Checklist? ✔ Step-by-step GSTIN registration ✔ How to configure HSN codes ✔ Tools to auto-generate invoices (like WooCommerce GST Plugin!) ✔ Filing reminders 🔗 Download & Save for later: www.woocommercegst.co.in

#gstindia#woocommerce#ecommerce#gst#gst billing software#invoicing#gstcompliance#wordpress#wordpress plugins

0 notes

Text

0 notes

Text

How to Integrate Invoice Maker Tools with Your Accounting Software

In today's fast-paced business world, efficiency and accuracy are paramount when managing financial data. One essential aspect of this is invoicing. As businesses grow, manually creating and managing invoices becomes more cumbersome. That's where invoice maker tools come into play, allowing you to quickly generate professional invoices. However, to truly streamline your financial workflow, it’s important to integrate these tools with your accounting software.

Integrating invoice maker tools with your accounting software can help automate the process, reduce human error, and improve overall productivity. This article will walk you through how to integrate your Invoice Maker Tools with accounting software effectively, ensuring smoother operations for your business.

1. Choose the Right Invoice Maker Tool

Before integration, ensure you have selected an invoice maker tool that suits your business needs. Most invoice maker tools offer basic features such as customizable templates, tax calculations, and payment tracking. However, the integration potential is an important factor to consider.

Look for an invoice maker tool that offers:

Cloud-based features for easy access and collaboration.

Customizable templates for branding.

Multi-currency support (if you do international business).

Integration capabilities with various accounting software.

Examples of popular invoice maker tools include Smaket, QuickBooks Invoice, FreshBooks, and Zoho Invoice.

2. Check Compatibility with Your Accounting Software

Not all invoice maker tools are compatible with every accounting software. Before proceeding with the integration, confirm that both your invoice maker tool and accounting software are capable of syncing with each other.

Common accounting software that integrate with invoice tools includes:

QuickBooks

Smaket

Xero

Sage

Wave Accounting

Zoho Books

Most software providers will indicate which tools can integrate with their platform. Check for available APIs, plugins, or built-in integration features.

3. Use Built-in Integrations or APIs

Many modern invoice maker tools and accounting software platforms come with built-in integrations. These are often the easiest to set up and manage.

If you choose a platform that does not offer a built-in integration, you can use APIs (Application Programming Interfaces) to link the two systems. APIs are a more technical option, but they provide greater flexibility and customization.

4. Set Up the Integration

Once you've confirmed that the invoice tool and accounting software are compatible, follow the setup process to connect both tools.

The typical steps include:

Access your accounting software: Log into your accounting software and navigate to the integration settings or marketplace.

Search for the invoice maker tool: In the marketplace or integration section, look for the invoice tool you are using.

Connect accounts: Usually, you’ll be asked to sign into your invoice maker tool from within the accounting software and authorize the integration.

Map your fields: You may need to map invoice fields (like customer names, amounts, or due dates) to corresponding fields in the accounting software to ensure the data flows seamlessly.

5. Test the Integration

After the integration is complete, it’s crucial to test whether the connection between the invoice maker and accounting software is working as expected. Generate a sample invoice and check if the details appear correctly in your accounting software. Confirm that invoices are synced, and ensure payment status updates automatically.

Test for:

Accurate syncing of client details: Ensure names, addresses, and payment history are transferred correctly.

Real-time updates: Check that any changes made to invoices in the invoice tool reflect in your accounting software.

Reporting features: Verify that your financial reports, such as profit and loss statements, include data from the invoices.

6. Automate Invoicing and Payments

Once the integration is up and running, set up automated workflows. With the right integration, you can automate recurring invoices, late payment reminders, and payment receipts. This reduces manual effort and ensures consistency in your accounting.

7. Monitor and Maintain the Integration

Just because the integration is set up doesn't mean it's a "set it and forget it" situation. Regularly monitor the syncing process to ensure everything is working smoothly.

Make sure:

Software updates: Regular updates from either your accounting software or invoice maker tool might affect the integration. Always check for compatibility after any software updates.

Backup and security: Ensure your data is securely backed up, and verify that integration tools comply with security standards.

8. Benefits of Integration

By integrating invoice maker tools with your accounting software, you’ll enjoy several key benefits:

Time Savings: Automating the invoicing process frees up time for you to focus on other important aspects of your business.

Improved Accuracy: With automatic syncing, you reduce the risk of errors that often come with manual data entry.

Better Financial Management: Real-time data syncing allows for accurate tracking of income, expenses, and cash flow, which helps with budgeting and financial forecasting.

Enhanced Customer Experience: Timely and accurate invoicing helps maintain a professional image and reduces confusion with clients.

Conclusion

Integrating invoice maker tools with Accounting Software is a smart move for businesses that want to streamline their financial operations. By selecting the right tools, following the integration steps, and ensuring regular maintenance, you can save time, improve accuracy, and focus on growing your business. Don’t let manual invoicing slow you down—leverage modern tools to automate your processes and boost efficiency.

#accounting#software#gst#smaket#billing#gst billing software#accounting software#invoice#invoice software#cloud accounting software#benefits of cloud accounting#financial software#business accounting tools#cloud-based accounting#real-time financial insights#scalable accounting solutions#cost-effective accounting software#cloud accounting security#automated accounting software#business accounting software#cloud accounting features

0 notes

Text

#gst billing software#billing software#e-invoice#billing software in coimbatore#invoice software development bd

0 notes

Text

Karosauda: Empowering MSMEs with Smart, Hassle-Free Billing

The Story Behind Karosauda

India’s MSMEs are the backbone of our economy, yet over 80% of them still rely on manual billing systems that are error-prone, time-consuming, and outdated. We saw the gap and Karosauda was born. Karosauda isn't just another billing software. It’s a movement to empower MSMEs by digitizing their business operations with ease, affordability, and precision.

What is Karosauda?

Karosauda is a digital billing platform tailor-made for Micro, Small, and Medium Enterprises. Whether you're running a small retail shop, a wholesale business, or a service-based setup—Karosauda helps you:

Generate GST-compliant invoices in seconds

Track stock and inventory effortlessly

Monitor payments and receivables

Get real-time insights on business performance

Access everything from your mobile or desktop

Why Choose Karosauda?

Simple UI, no technical knowledge needed Fast & cloud-based access anytime, anywhere Designed for Indian businesses Budget-friendly plans with a free trial Secure, accurate, and paperless

The Impact So Far

Within months, Karosauda has helped 300+ MSMEs reduce billing errors, save hours every week, and get paid faster.

We’ve seen kirana stores, local distributors, and small manufacturers level up their operations without hiring extra help.

Our Vision

We aim to become India’s most trusted digital billing partner for MSMEs. Our mission is simple: Make every local business smarter, faster, and future-ready.

Try It for Free

We invite you to try Karosauda today and see the transformation. ✅ No credit card required ✅ Instant onboarding ✅ Start billing smarter in just 5 minutes

0 notes