#FCF 2012

Note

Anon who was at the LA premiere following up. Let’s see… what else to report. I’ll just do a brain dump.

There was some drama with fans and the queue. The red carpet area was FCFS, limited capacity. Fans lined up/camped out early and had a well-organized line system, maybe 200 fans in total were in the line. Someone from the venue had said they would honor the fan-organized line. But later, some fans who arrived closer to the official open time and weren’t happy with the fan-organized line went straight to the security/door area. It worked. Security let in all 15 of them to the front of the line after much arguing, and they all got barricade on one side (which meant signatures and photos). I get being anti-camping but the way they did that was really shitty. Some of them had even had joined the fan-organized queue, then rubbed off their number, and jumped ahead.

On the red carpet, Louis was very accommodating to fans. He made sure to visit fans on each side of the red carpet twice, so fans got more chances for signatures and photos. The most interesting thing he signed was a cardboard cutout of fetus louis that a fan has had since 2012 and taken around to concerts. Louis also signed someone’s collarbone area, and they got the smiley face he had signed there tattooed afterwards right away. The phone case larrie is definitely delusional or just posting that shit about Louis smirking for attention, he was going so fast and trying to cover as many fans as possible.

The venue didn’t air the fan videos from all around the world to the red carpet area. I’m glad I saw them later though, they were amazing!

Some bleached blonde guy with a cool sparkly silver suit walked the carpet and I still have no idea who he is.

Louis disappeared once the movie started. I don’t think he took a seat in the theater, I think he went somewhere else to watch or maybe even left early.

There definitely seemed to be a lot of directioners and larries/harries. During the screening, a lot of people clapped and cheered when harry appeared on screen. That was annoying. We did all unite in boo’ing Simon together, that was fun. We also all cheered when Oli said Louis’ gig was better than a 1D gig and when Louis said he felt like he deserved it.

I’m still ?? about the whole veeps vs streaming platform thing and why they’re marketing AOTV so much more than FITF. But I put that aside to just enjoy being there. Louis was obnoxiously gorgeous, and it was such a treat to see/hear him in person and watch the film in a beautiful venue with a lively crowd. It was an incredible time overall.

The venue was magical and Louis looked gorgeous, so from an outsider's perspective it was amazing, but I'm glad to learn it was fun on site as well! Louis' attention to fans is so cute - I remember thinking he was super responsive to fans during the Q&A.

I too wonder about the whole event and hope this isn't the end of AOTV's public existence, but I won't complain too much, for it gave us another red carpet louis!

Thanks for all the deets! <3

#answered ask#anon#aotv la#'Some bleached blonde guy with a cool sparkly silver suit walked the carpet' MR O?????????? ARABELLA????

2 notes

·

View notes

Text

Quavious Keyate Marshall (born April 2, 1991), known professionally as Quavo is a rapper, singer, songwriter, and record producer. He is known as the co-founder and frontman of hip hop group Migos, being the uncle of late member Takeoff and cousin of Offset. He is a partial owner of the FCF Glacier Boyz.

He has been featured on several US top 10 hits, including Post Malone’s “Congratulations”, which was certified Diamond by the Recording Industry Association of America; as well as DJ Khaled’s “No Brainer” and “I’m the One”, the latter of which peaked at number one on the Billboard Hot 100. In 2018, he released his debut solo album Quavo Huncho, which peaked at #2 on the Billboard 200.

He was born in Athens, Georgia. The three members of Migos grew up together in Gwinnett County, attended Berkmar High School, and he was the starting quarterback of its football team during his senior year. He dropped out months before graduation. In May 2020, he announced he had graduated from high school after dropping out 11 years earlier.

Migos was formed in 2008 by him and fellow rappers Takeoff and Offset. The group was originally known as Polo Club and is from Lawrenceville, Georgia. They changed their name to “Migos” after deciding Polo Club was too generic. The group released their first full-length project, a mixtape titled Juug Season, on August 25, 2011. They followed with the mixtape No Label, on June 1, 2012.

After the success of Migos’ second studio album Culture, which reached #1 on the US Billboard 200 chart, he was featured on several popular songs outside of Migos, including “Congratulations”, “I’m the One”, “Portland” and “No Brainer”. In an interview with GQ, Houston-based rapper Travis Scott, with whom he worked on the Young Thug collaboration “Pick Up the Phone”, revealed he had a collaborative album with Quavo in the works.

In April 2017, he was featured on The Fate of the Furious: The Album on the song “Go Off” with Lil Uzi Vert and Travis Scott. The song was certified Gold by the RIAA. He released “Ice Tray” with Lil Yachty on December 14, 2017. The song peaked at #74 on the Billboard Hot 100. #africanhistory365 #africanexcellence

0 notes

Text

How will the metaverse affect META’s stock?

With every coming day comes more news about the Metaverse, although it is still such a new topic in today's world there is a lot of speculation if it will even survive let alone become an everyday part of society. There are many different opinions on whether WEB 3.0, NFT’s and the metaverse but META (previously known as Facebook) invested almost $36 billion dollars into their reality labs project and this can come as a scare to some investors. With all that being said, what will META as a stock look like in the coming years? The big question we need to ask is why are investors bearish on this stock and whether are they correct about their assumptions or if is META a truly undervalued stock.

META is listed on the NASDAQ and is currently trading at $117.10. META’s YTD is down 65% and many are speculating that it is going to continue to drop but is this really the case? When you think of what META has done some may think that they have wasted a lot of money investing into something that may never even take off but that just is not the case. Regardless of one's opinion on the metaverse many investors forgot what really makes up the META stock. The main components of the META stock consists of Facebook, Instagram,and WhatsApp, when buying the stock you also get Reliability Labs which many people are unaware of but only make up 2% of what META really is.

When we think about what makes a company money for the family of applications it is users, more importantly retention of users. In the graph below we can see how many users are continuing using the different platforms that META provides

Metas family of apps is consistently maintaining a steady growth in the billions which is very hard to do. From a user standpoint alone META is a stock that may be a diamond in the rough and very undervalued due to the negative attention Zuckerberg has been receiving with the investments of the Metaverse. It is also important to note that with more users comes an increase in advertising which in term generates more revenue.

Although this is already a strong case for why META could be potentially undervalued it is important to look at finances as they provide the bigger picture with what is happening with the company. Two important ratios that should be looked at are price to earnings and price to free cash flow, both of these ratios are very healthy ratios when it comes to how well a business can operate.

The P/E and P/FCF ratios can also be supported alongside some of the Cash Flow Statement statistics. This simple model below (In millions) can help an analyst better understand what the business can or cannot do, when it comes to META the growth % has been growing at a healthy rate alongside a stable free cash flow margin which is around 30% every year.

With all this information given and data provided it can be said that META is an undervalued stock, they have a very strong family of apps with great ratios. The risk to reward on META is amazing as they are already an efficient company trading at a low price with massive upside potential already but when you account for if the metaverse is successful the work that reality labs has put in will also account into growth for the stock. With all that being said I have created one last model to price what META should be and we can come to an unbiased result to see if it is a truly undervalued stock according to what it is currently trading at.

With this model using extremely conversative growth rates in all three cases we can see that META is very undervalued. META is currently trading at %117.10 and in the worst case we will see $85/share gains.

Meta is a great company, they bought Instagram for 1 billion dollars back in 2012 when it was fairly new which people speculated on for a while. Now, Instagram is generating almost $50 billion every year. In my opinion, I find it weird that Meta again is being called a bad company and people are investing in the metaverse, they are a great company and here to stay. Not only are they a great company but they are also an amazing investment.

1 note

·

View note

Note

i love my paint to death, but for the past two years i've been questioning if he's really the right horse for me. i want to switch to dressage bc its safer. but he's not taking to it. he's downhill as heck & has no reach. a guilty part of me wants to trade him for an english horse. but i can't afford most of 'em. would i have shot with a arab? i'm at 1st level but hope to get to at least 3rd.

It really comes down to the conformation of the individual. But I will say that of the non-traditional breeds, Arabians in general have an advantage over others like paints, quarter horses, and draft/draft crosses because they're naturally forward and it's easy to harness their energy to create impulsion. Compared to tbs, they're also more likely to have springy, cadenced gaits (but beware of the leg movers bred for saddleseat that have lift but no reach).

Historically, there have been Arabians that competed in dressage at the Olympics, and many partbreds. And recently there seems to be a preponderance competing at psg/fei level. Just off the top of my head, I can name FCF Oberon's Vanity, Echo Apollo, Beymoon Zela, Exquisite's Fantasy, Ea Cyngus, Edykt's Enchantress, Tuxedo Thyme, Abha Mahdi, OKW Entrigue, etc.

This is a pretty good article. Getting to third level on an Arabian is definitely not infeasible, but there are some things to consider. Some points the article makes -

“'One of the biggest limitations of the Arabian sport horse is the trainer,' says Karla Stanley. Arabs’ intellect helps them retain lessons and learn quickly, but most do not respond well to a rider who drills exercises repeatedly. Arabian trainers report that as their horses go up the levels, they often learn new skills faster than their bodies can execute properly, so upper-level Arabians require careful conditioning."

“The important part of the horse is behind the saddle,” she says. While praising the front-end motion and elegant arching neck of the Arabian, Longacre believes too many Arabians do not have the hindquarters the sport demands. ‘Years of breeding for the tabletop topline left the pelvis and hocks behind,’ says Longacre. ‘It was counterproductive because they lost that strong back, loin and hindquarter connection.’

I will push back on this point a bit by saying that while it's true that too many Arabians are being bred for exaggeratedly flat croups, there are a few horses on the list I mentioned that still overcame it. Abha Mahdi, for example, is sired by Marwan Al Shaqab, who is arguably the most famous halter sire still standing. While I would avoid a horse with an inverted croup at all costs, with careful and proper conditioning a horse with a flat croup is not necessarily going to fail. It would be great if you could find an Arabian with more powerful hindquarters, but unfortunately they're not the majority these days.

Other stuff from the article -

"According to USDF and USEF trend data examined by Jay Stevens at CenterlineScores.com, while overall participation in the sport contracted in recent years, notable growth has taken place in the Arabian breed. In an analysis entitled ‘Breed Classes: The Rise of the Arabian,’ Stevens found that from 2009 to 2012, there were four times the number of tests and double the number of breed shows offering dressage classes compared to the previous four years. Noting that the trend continued through 2013, Stevens attributes two-thirds of this new volume to Arabians."

"But can Arabians really hack it at FEI levels? One glance at the hardware on Grand Prix rider Mimi Stanley’s show coat answers that question. Competing mostly at open shows, Stanley, 24, has earned her USDF bronze, silver and gold medals and her freestyle gold bar on Arabians.

Stanley’s purebred Arabian gelding, EA Cygnus, was the second horse of any breed to earn a USDF Horse Performance Certificate at all nine levels of dressage—Training through Grand Prix—a feat requiring more than 90 qualifying scores. Before he passed away last December at age 23, Cygnus had completed 75 Grand Prix tests."

20 notes

·

View notes

Photo

MAJOR & @neweracap presents the return of the OG DC fitteds. Introduced first in 2012, this year marks the 10th Anniversary of the ever iconic TDOC arch by MAJOR 59Fifty Fitted. Back w/ the brightest glow-in-the-dark embroidery to date, featuring grey undervisor & white sweatband, this is the quintessential DC fitted!!! And the bonus release of the Olde English DC 59Fifty makes the cypher complete. Launches on Saturday 6.18 in store at 11 am FCFS. Don’t miss out cause it will be gone in a flash again! DO NOT MAKE APPOINTMENTS FOR THIS. ONLY AVAILABLE FOR THOSE IN LINE AT 11 AM. Masks required. (at MAJOR) https://www.instagram.com/p/Ce5GTIxsPQR/?igshid=NGJjMDIxMWI=

0 notes

Text

Consumer perception of situational appropriateness for fresh, dehydrated and fresh-cut fruits

In recent years, a decreasing trend in dehydrated fruits consumption has been detected in Mediterranean countries, with the consequent risk for the population’s health. The objective of this study was to obtain consumer knowledge that can be useful to promote fruit consumption by designing specific interventions. This study was conducted in Spain as its inhabitants have traditionally adhered to the Mediterranean diet.

Firstly, four fresh fruit types were identified based on the consumer perception of the fruit characteristics that condition the eating process (fruit size, the need for cutlery to peel/eat fruit, and susceptibility to be spoiled during transportation). Then consumer perception of situational appropriateness of six different fruit types (the 4 types of fresh fruit previously identified, dehydrated non-traditional fruit (DF), and fresh-cut fruit ready to eat on the go (FCF)) was investigated by the Item-By-Use method using Check-All-That Apply (CATA) questions. The potential of DF and FCF to broaden fruit consumption situations, and barriers for their consumption, were evaluated.

Fresh fruits, particularly ‘easyto-peel’ ones like mandarins or bananas, were those preferred by consumers in most evaluated contexts. DF were considered mainly appropriate to be consumed ‘As an ingredient’ and ‘As a healthy snack’, while FCF were more suitable ‘To be included in school lunchboxes’ and ‘To eat immediately’.

According to our results, these two processed fruit types can help to increase the fruit consumption of a non-negligible percentage of the population (38% of participants), but it is necessary to overcome the barriers related mostly to sensory properties, plastic packaging and consumer misperception of fewer healthy properties compared to fresh fruit.

In order to increase fruit consumption, it is necessary to understand consumer food choices. For such research, we need to answer questions like when and why different products are consumed. There are reports that the final decision to buy or consume a particular food depends as much on the anticipated usage context as it does on intrinsic product properties (Giacalone, 2019; Marshall, 1995; Ratneshwar & Shocker,1991). Hence the perceived situational appropriateness, defined as the extent of the match between a product and the intended usage situations, has been demonstrated as a predictor of consumer food choices (Giacalone & Jaeger, 2019).

Situational appropriateness is closely linked with the convenien ceconcept, which refers to the ease and adequacy of different food-related behaviours like shopping, storage, meal composition, meal preparation (how and by whom), eating patterns, cleaning and waste disposal (Swoboda & Morschett, 2001; Yale & Venkatesh, 1986). Convenience itself has been shown to have an influence on consumer food choice (Costa, Schoolmeester, Dekker, & Jongen, 2007).

We herein hypothesise that due to the particular characteristics of different fruit, which condition their eating process (think, for example, about what we need to eat a watermelon and what we need to eat grapes), the consumer perception of appropriateness should differ among different fruit types and contexts. This fact is indirectly reflected in previous studies on fruit consumption contexts: the appropriateness of fruit to be eaten as a snack has been evaluated by Jack et al., (1997), the effect of familiarity with fruit in the consumption context choice by Jaeger et al., (2005), and the characteristics of eating occasions that contain fruit by Bava et al., (2012). Curiously enough in the three aforementioned studies, the participants sample consisted only of women.

Despite these studies in the literature, the influence of the particular characteristics of different fruit on consumer perception of situational appropriateness has never been directly approached. We believe that understanding consumer perception in this sense may be extremely useful for designing interventions to promote fruit intake, and we believe it is interesting to include male and female consumers. Furthermore, increasing food convenience has been one of the food industry’s main objectives in the last few years, and has been achieved mainly by processing food products.

#frozen honeydew#frozen raspberries#frozen pineapple#frozen avocado chunks#frozen sugar grapes#frozen sea buckthorn berries#frozen mulberries#frozen grapes#frozen red grapes#frozen white peaches#frozen blueberries#frozen melon#frozen redcurrants#frozen coconut chunks#frozen pitaya#frozen lemon

0 notes

Text

FCF felicita a Mariana Pajón por la medalla de plata obtenida en los Juegos Olímpicos Tokio 2020 – TDI Colombia

FCF felicita a Mariana Pajón por la medalla de plata obtenida en los Juegos Olímpicos Tokio 2020 – TDI Colombia

El Comité Ejecutivo de la Federación Colombiana de Fútbol, felicita al Comité Olímpico Colombiano, a la Federación de Ciclismo y a la deportista, Mariana Pajón, por haber alcanzado la medalla de plata en los Juegos Olímpicos Tokio 2020.

Mariana Pajón con este logro deportivo, consigue tres medallas olímpicas en el mismo número de Juegos Olímpicos. Obtuvo medalla de oro en Londres 2012 y Río 2016,…

View On WordPress

0 notes

Text

In the year 2012, she played three matches for Colorado Rush in the W-League and even scored two goals. In the year 2012, she signed a six-figure contract with the professional French club, Paris Saint-Germain FC (PSG). She had an outstanding period of time playing with PSG as she scored 46 goals in 58 appearances for PSG. On December 5, 2015, she played her last game for PSG against FCF Juvisy. On January 4, 2016, her contract with PSG was officially terminated. On January 13, 2016, she signed with the Portland Thorns FC of the National Women's Soccer League (NWSL). Since then, Lindsey is having an outstanding run playing in central midfield for the Portland Thorns FC.

#LindseyHoran #NetWorth|Wiki|Bio|Career: A #SoccerPlayer, her earnings, goals, age, husband, family #football #soccer #FIFA #womenfootball

0 notes

Text

Workers on strike in Bataan freeport back to work

#PHnews: Workers on strike in Bataan freeport back to work

MARIVELES, Bataan – Workers on strike in one of the factories at the Freeport Area of Bataan here were back to work Thursday after the Authority of the Freeport Area of Bataan (AFAB) interceded in the settlement of the dispute between labor and management.

AFAB information officer Hazel Keith Ellorin said on Friday AFAB administrator Emmanuel Pineda immediately held a dialogue with leaders of the workers and management officials of FCP to thresh out the root of the problem complained by the workers.

Lt. Col. Cesar Lumiwes, Mariveles police chief, reported that more or less 1,000 FCP employees held a noise barrage in the factory premises Wednesday afternoon for delayed payment of wages and alleged non-remittance of Social Security System contributions.

Lumiwes said he deployed a police team to maintain peace and order in the area.

FCP is a Hongkong company engaged in the production of luxury handbags and small leather goods since 2012. North America, Asia, and Europe are its export markets.

Ellorin said the FCP on Thursday started paying workers their delayed salaries. A collective bargaining agreement is pending with the Department of Labor and Employment.

She said AFAB impressed upon the workers that it understood their plight but that safety protocols should be followed because of the ongoing pandemic.

"Nawa ay maunawaan din ng lahat na bagama’t may karapatan tayong magpahayag ay may pananagutan at responsibilidad din tayo sa pagpapanatili ng kaligtasan ng lahat sa gitna ng pandemyang ating kinakaharap (May everyone also understand that although we have the right to express ourselves, we also have obligation and responsibility to maintain the safety of all in the midst of the pandemic we are facing),” Ellorin said.

“Kaugnay nito, isinasagawa na ng AFAB ang mga nararapat na hakbang upang matugunan ng FCF management ang mga katanungan ng mga manggagawa nito para sa mabilis at mapayapang pagkakaroon ng resolusyon ukol sa insidenteng naganap noong Miyerkules (“In this regard, AFAB is already taking the necessary steps so that FCF management can respond to the questions of its workers for a quick and peaceful resolution of the incident that took place on Wednesday),” she said. (PNA)

***

References:

* Philippine News Agency. "Workers on strike in Bataan freeport back to work." Philippine News Agency. https://www.pna.gov.ph/articles/1127444 (accessed January 15, 2021 at 06:17PM UTC+14).

* Philippine News Agency. "Workers on strike in Bataan freeport back to work." Archive Today. https://archive.ph/?run=1&url=https://www.pna.gov.ph/articles/1127444 (archived).

0 notes

Photo

Markus Gelau

20 fakten zu syrien - die augenscheinlich immer noch nicht zu jedem durchgedrungen sind, dies aber tun sollten:

1. in syrien gab es keine "revolution" und: es gibt keine "rebellen" in syrien.

2. syrien ist das einzige säkulare land des nahen ostens. religion und staat sind strikt getrennt. zuletzt verbot syrien 2010 u.a. den "niqab" (gesichtsschleier) an allen universitäten des landes. schon 1998 betrug der anteil an frauen unter den studierenden an syrischen universitäten 40%. schon vor fast 20 jahren, im jahr 2000, waren über ein drittel aller frauen syriens berufstätig (quelle: world bank) - einmalig in der arabischen welt. in der türkei ist aktuell nicht mal ein viertel aller frauen berufstätig (quelle: apa).

3. frauen können in syrien schon immer arbeiten, auto fahren, reisen, wählen, studieren und selbstbestimmt leben. frauen leisten freiwilligen militärdienst, sind stark in der wirtschaft und politik. die aktuelle präsidentin des demokratisch gewählten syrischen parlaments ist eine frau. im syrischen parlament saßen frauen jahre vor der ersten frau im deutschen bundestag.

4. die eu unter der führung deutschlands verhängte seit 2011 die "härtesten sanktionen seit dem 2. weltkrieg" (laut uno) gegen das souveräne land syrien. diese sanktionen wurden auf persönliche entscheidung angela merkels erst kürzlich wieder verlängert. das blut von jedem kind, das in syrien nicht mit medikamenten versorgt werden kann (sanktioniert!) oder nicht ausreichend wasser bekommt (ersatzteile für pumpen: sanktioniert!) klebt an den händen der DEUTSCHEN regierung.

5. jahrzehnte lebten in syrien unterschiedlichste ethnien und religionen friedlich und durch einen starken staat geeint zusammen. noch im juli 2009 lud die universität heidelberg zu einem kolloquium ein, bei dem syrien als musterbeispiel eines friedlichen zusammenlebens verschiedener konfessionen dargestellt wurde.

6. in syrien findet kein "bürgerkrieg" statt.

7. der präsident syriens, baschar al-assad, wurde demokratisch gewählt. alle natoländer (inkl. deutschland) verboten syrischen flüchtlingen, an der letzten demokratischen wahl 2014 in den jeweiligen syrischen botschaften ihrer fluchtländer teilzunehmen.

8. die sogenannten "rebellen"milizen bestehen mehrheitlich aus ausländern. laut einer studie des firil center for studies (fcfs, berlin) kämpfen islamisten und terroristen aus 93 ländern gegen die legitime syrische regierung und die syrische armee. laut us state department sind es kämpfer aus "über 100 ländern". (quelle: wikipedia)

9. so etwas wie eine "fsa" (freie syrische armee) gibt es nicht.

10. in der syrischen armee sind sunniten in der großen mehrheit. sie kämpfen zusammen mit zehntausenden freiwilligen schiiten, alawiten, drusen oder orthodoxen christen und atheisten für ihr land.

11. die usa und die türkei sind (ebenso alle anderen westlichen mächte) völkerrechtswidrige invasoren syriens.

12. zeitweise bombardierten 11 länder syrien. dabei sind die EINZIGEN staaten, die völkerrechtlich um hilfe von der syrischen regierung gebeten wurden, russland und der iran.

13. die mehrheit der syrer steht fest hinter ihrer regierung um assad. das war bereits zu beginn des krieges laut westlichen studien so - und ist 2017 laut us-geheimdienststudien noch viel mehr der fall. daneben kämpfen aktuell (2018) ca. 200.000 menschen freiwillig für assad in der saa (syrisch-arabische armee) und den ndf (national defence force) - um ihr land, ihre familien und ihre regierung zu verteidigen. ein präsident, hinter dem nicht die mehrheit dieses volkes stünde, hätte sich in diesem konflikt nicht mal einen monat halten können. darüberhinaus ist assad kein diktator - sondern ein demokratisch gewählter präsident.

14. die "proteste" 2011 waren nicht friedlich. es wurden nach gängigem muster (kiew) sicherheitskräfte erschossen, um zu eskalieren. darauf wurde von den sicherheitskräften hart reagiert. zu beginn der "krise" wurden nachweislich "demonstranten" mit von der cia über den irak nach syrien geschmuggelten waffen ausgerüstet.

15. die golanhöhen sind syrisch und seit 40 jahren völkerrechtswidrig von israel besetzt.

16. die "weißhelme" sind nachweislich ein propagandatool der islamisten um al nusra, vom westen offen finanziert, von einem ehemaligen englischen geheimdienstler erfunden. der zivilschutz und die ersthelfer aller länder sind organisiert in der "INTERNATIONAL CIVIL DEFENCE ORGANISATION (ICDO)" einer ihrer gründer (!) war übrigens ein syrer. der ECHTE syrische zivilschutz ist so professionell und international respektiert, dass er in der vergangenheit viele partner anderer länder ausbildete.

17. würden der westen und die golfstaaten die finanzierung der terrorbanden in syrien morgen einstellen, wäre der krieg übermorgen zu ende.

18. die syrische regierung hat nachweislich vor jahren alle ihre verbliebenen chemiewaffen unter internationaler kontrolle abgegeben. die oberaufsicht darüber hatten die usa selbst, die waffen wurden mehrheitlich von DEUTSCHLAND vernichtet. die syrische armee hat im syrienkrieg noch nie chemiewaffen eingesetzt. james mattis - der verteidigungsminister der usa höchstselbst - gab vor wenigen wochen öffentlich zu, keinerlei beweise zu besitzen, dass die syrische armee JEMALS giftgas eingesetzt hätte.

19. deutschland unterstützt seit beginn des krieges offen und verdeckt nachweislich terroristen in syrien. schon 2012 versorgte offiziell ein deutsches spionageschiff vor der syrischen küste terroristen mit aufklärungsdaten über die syrische armee. die deutsche bundesregierung überwies den "white helmets", also al kaida, 2017 ganz offiziell 7 millionen euro steuergeld.

20. es gibt nur eine syrische flagge:

0 notes

Text

The Intrinsic Value of Kohl’s Corporation

Introduction

With over 1,150 stores across 49 states and its headquarters in Menomonee Falls, Wisconsin, Kohl’s Corporation is one of the United States largest traditional brick-and-mortar department stores. It has a wide range of product offerings, ranging from men’s and women’s clothing to cosmetics to home furnishings. Within its stores, it carries numerous national brands, such as Oakley, PUMA, and Adidas, as well as its own portfolio of exclusive brands (Simply Vera Vera Wang, LC Lauren Conrad, and Apt. 9).

At the time of this writing, the market capitalization for Kohl’s is about $8.34 billion and its revenue and cash flows for the 2018 fiscal year were $20.2 billion and $1.5 billion, respectively. Currently trading at about $51.83, the stock has hit a 52-week low of $50.40 and a 52-week high of $83.28. At today’s price of $51.83, is its stock undervalued?

The Intrinsic Value of Kohl’s Corporation

With the net income being easily manipulated and not a true representation of the cash available to a company’s owners, we prefer to use free cash flow to value a company’s stock. Using free cash flow instead of net income allows investors to value the company based on the actual cash it generated for its owners. Below is a chart of Kohl’s free cash flow for the past ten years.

With the exception of 2012, Kohl’s free cash flow has remained in a range between about $800 million and $1.4 billion from 2010 to 2017, as illustrated by the lines on the graph below. There certainly has been volatility from year to year, but it has been successful in maintaining relatively consistent free cash flow generation as e-commerce companies have attempted to replace traditional retailers. Looking at Kohl’s free cash flow more closely from 2012 to present, it appears it may be slightly trending upwards as it has made higher lows and higher highs. In future sections when we value the company, we will not rely on growth in free cash flow, but it is important to note that it may be trending upwards.

From 2009 to 2018, Kohl’s free cash flow actually contracted by about 2.5%, cumulatively. From its low in 2012, Kohl’s free cash flow has grown from $915 million to $1.5 billion, for a compounded annual growth rate (CAGR) of about 5.9% (67% cumulatively).

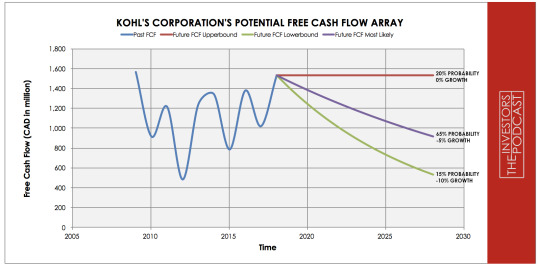

To value Kohl’s stock, its future free cash flows must be estimated. To do this, the array model below has been developed to account for three potential outcomes of Kohl’s future free cash flows.

The upper-bound line illustrates a 0% growth rate with a 20% probability of occurrence. This growth rate was assigned to allow for the potential of management to successfully maintaining its current free cash flow levels, while also considering the highly competitive nature of the retail landscape.

The middle line represents a -5% contraction with a 65% probability of occurrence. This outcome assumes that Kohl’s will be semi-successful competing in the increasingly competitive and changing retail industry, but will still see some of its free cash flow diminish.

Finally, the lower-bound line illustrates a -10% contraction with a 15% probability of occurrence. The contraction in Kohl’s free cash flow generation is assuming that competitors and online retailers continue to disrupt the retail industry, Kohl’s management fails in its new strategic initiatives, and the United States economy enters into a recessionary period, resulting in a significant slowdown in consumer spending.

Looking at these growth rates and probabilities, you will notice there is a skew towards negative growth or a contraction over the next decade. This may seem pessimistic, but it allows for a conservative valuation and to consider the potential downside risk. When creating a valuation model, one must consider the economic environment in which their investment would be made.

In today’s environment, it is likely wise to estimate growth rates very conservatively with a margin of safety. Any outperformance of the conservative growth rates would provide investors with additional returns above and beyond what was expected. It is also important to recognize that the above-estimated growth rates are not expected to be exact each and every year over the next decade. In fact, that is very unlikely. As they have since 2009, Kohl’s results will likely fluctuate from year-to-year. We do not attempt to estimate results on a yearly basis. Rather, we look to estimate accurate growth rates annualized over a decade. Assuming the estimated outcomes discussed above prove accurate, Kohl’s stock may be priced at a 13.1% annual return at today’s price.

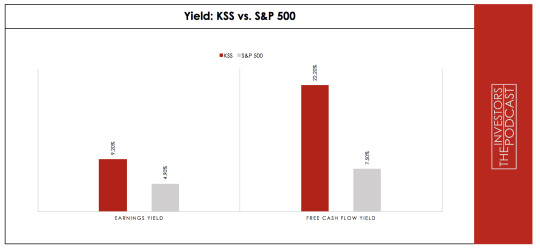

Two other valuable quantitative metrics to consider when analyzing a stock’s potential return are the earnings yield (inverse P/E) and the free cash flow yield (inverse P/FCF). At the time of this writing, Kohl’s current earnings and free cash flow yields are 9.2% and 22.2% respectively. Its earnings and free cash flow yields appear to be below and above our calculated expected return from our DCF analysis. Kohl’s also appears to be priced moderately better than the S&P 500 on an earnings yield basis and significantly better on a free cash flow yield basis. This relationship is not unexpected as it is indicative of investors having a higher required rate of return when investing in an individual company than they do when investing in a broad index, like the S&P 500, but it also puts into perspective the extra return an investor might be able to achieve by taking on more risk. The graph below illustrates the earnings and free cash flow yields for Kohl’s and the S&P 500.

Source: Morningstar

Up to this point, everything quantitative about Kohl’s valuation indicates it may be undervalued and priced to outperform the S&P 500 over the next decade. However, before we come to that as our final conclusion, let’s compare Kohl’s to its competitors.

In the graph below, you will see Kohl’s valuation metrics compared to that of the industry’s average on a P/E, P/B, P/S, and P/FCF basis. It is quite close on all of these metrics. Given Kohl’s competitive advantages that we will discuss in the next section, it is reasonable that Kohl’s should trade at a slight premium to the overall industry.

Source: Morningstar

The Competitive Advantage of Kohl’s Corporation

Kohl’s has multiple advantages that will be discussed in detail below:

Management. While other companies and management teams have struggled to adjust to the changing retail landscape, Kohl’s management team has excelled. It has been willing to think “outside-the-box” and look for unconventional ways to drive traffic to the stores and ignite growth. It has entered into two strategic partnerships (one with Amazon and one with Planet Fitness) that really help illustrates management’s ability to differentiate itself from its competitors.

Financial Strength. Despite a difficult environment over the past decade, Kohl’s has been able to grow its topline revenue, maintain high Returns on Equity and Returns on Invested Capital, pay down its debt and preserve a healthy cash position. It has consistently raised its dividend every year since 2012 and has bought back nearly half its stock.

Rewards/Loyalty Program. As illustrated from the likes of Starbucks and Domino’s, customer loyalty programs can drive great customer retention. Kohl’s is widely known for its “Kohl’s Cash” rewards program, which management continues to focus on and improve. This has helped management successfully achieve positive comp sales year over year, while many retailers are struggling to get customers to return to its stores.

Risk Factors

Although Kohl’s has competitive advantages, it is not without risks that could weaken an investor’s returns.

Severe Competition. It is no secret that the retail industry has become extremely competitive over the last 5-7 years, and this trend continues to this day. In addition to competing with major brick-and-mortar and e-commerce players like Walmart and Amazon, Kohl’s is increasingly having to compete with individual sellers and small businesses through platforms such as Etsy.

Lack of Switching Costs/Stickiness. When it comes to buying well-known, non-exclusive brands, consumers do not generally have a preference where they purchase the products from – their main focus is on price. It is difficult to convince customers to continually purchase products from Kohl’s when there are other stores offering the same products at a cheaper price.

Lack of Bargaining and Pricing Power. Due to the dynamic discussed in the previous bullet, this makes for a difficult bargaining and pricing power relationship for the retailers, such as Kohl’s. In general, an $11 billion retailer like Kohl’s cannot demand significantly better pricing from a major brand and/or manufacturer than other large, $290 billion retailers like Walmart can. This reduces its bargaining power and limits its ability to improve margins through lower cost of goods. On the other end of the transaction, Kohl’s also struggles with a lack of pricing power. Kohl’s cannot consistently demand a significantly higher price for its products when customers are able to get the same product at another retailer for a lower price. Lack of power on both the bargaining and pricing sides leads to increased pressure on Kohl’s margins.

Protecting Customer Data. With mass amounts of customer data, retailers have become a target for hackers. In 2018 alone, nine retailers (Macy’s, Adidas, Sears, Kmart, Best Buy, Saks Fifth Avenue, Lord & Taylor, Forever 21, and Gamestop) were victims of data breaches. It can be a short-term problem if handled appropriately, but it still poses a major risk to companies in possession of large amounts of valuable data.

Opportunity Costs

Although opportunity costs will not appear in your brokerage statements, it is a very real cost to investors that must be considered. When making an investment, an investor makes the conscious decision to forgo other investment opportunities for the one chosen. Despite having a positive real result, an investment could actually be negative when considering opportunity costs if capital is not allocated to its most successful and efficient use. Kohl’s is currently priced to return better results than the 10-year treasury and the S&P 500 over the next decade, but it may not offer the best risk-adjusted return in comparison to other individual companies.

Macro Factors

Attempting to time the market is rarely a recipe for success when investing, but it would likely be unwise to not at least consider the overall macro environment. Specifically, with brick-and-mortar retailers like Kohl’s, economic conditions play a pivot role in their success. During a recessionary period, consumer spending is significantly reduced, and retailers see their sales plummet. Unemployed is currently at, or near, 50-year lows, and US private debt levels have exceeded previous major financial crisis. With various economic indicators pointing to a potential peak, an investor should consider protecting oneself from an economic downturn.

Summary

While the current conditions of the retail industry have attracted many value investors, it is recommended you do extra due diligence when researching individual companies to help combat against the possibility of a value-trap.

Kohl’s skilled management and its ability to identify and implement intriguing strategic partnerships add potential upside that most retailers do not have. Although both initiatives are still in their infancy, Kohl’s has recently expanded its return-program partnership with Amazon to all its stores and plans to lease space to Planet Fitness next to ten of its stores this year. These characteristics do provide exciting potential upside, but the risks must not be forgotten. It currently trades at a discount to our calculated intrinsic value, but the risks may prove severe and dampen expected returns. Given the assumptions outlined in this analysis, a return of approximately 13.1% can be expected at today’s price.

Disclaimer: The author does not currently hold any ownership in Kohl’s (KSS), but may initiate a long position in KSS over the next 72 hours.

This article was written in collaboration with Robert Leonard from “The Investor’s Podcast.”

Stig Brodersen is the host of the business podcast “We Study Billionaires.” You can find his free intrinsic value index here of popular stock picks.

0 notes

Photo

January 2017 - Now

First Assistant Director (1AD) in commercials and short/feature films, TV-series

Productions: Radioactive (UA), Family Production (UA), Martini Shot (UA), Electric Sheep (UA), Adrenalin (UA), Pronto (UA), 2332 (UA), Limelite (UA), Shelter (UA), ESSE (UA), Omerta (UA), Partizan (BY), One Little (BY), Cuba Studio (BY), Bakehouse (RU), Laco Films (IL), Storytellers (IN), etc.

Clients: L’Oreal, Givenchy, Multiopticas, Kronenbourg, Wargaming, Ekzo, Work.ua, MTS, Virgin, Huawei, Lamoda, Eldorado, Kyivstar, A1, Beeline, Uklon, etc.

Directors: Cary&Jon, Vadim Perelman, Mike G, Stjepan Klajn, Bruce Paramore, Andrew Gnyot, Ilya Cherepitsa, Marcos Mijan, Fabio Jansen, Lorenzo Cisi, Julia Rogowska, Jeroen Mol, Marat Adelshin, Maged Nassar, Nathalie Cangulhem, Denis Rovira, Nastia Korkia, Ivan Proskuriakov, Arun Gopalan, Nacho Villar & Luis Valera, Nikola Lezaic, Anna Buryachkova, Zac Ella, Ken Karpel, etc.

Projects with Cuba Studio in 2012-2014 (Minsk)

LONG TERM PROJECTS / FILMS

2018 - historical VFX-films (all shot on green screen) for Museum of Mesada (IL), Museum of Caesaria (IL) and Museum of Hula (IL). Produced by Meta4 (IL)

2018 - TV-series L’Attache, 10 episodes (Laco Films)

2019 - TV-series Slavs, 2 episodes of 12 (Wandal Production)

2020 - Short movie “Jordan’96″ (Forefilms), presented at Cannes Festival 2022

2021/22 - feature film by Tonya Noyabreva “Do you love me?” (Family Production), presented at Berlinale 2023

HABIBA by Boef

Director - Madja Amin

Production Company - Cake Film

Producer - Allen Grygierczyk

Line Production - 2332 Productions / Dasha Deriagina

DP - Noel Schoolderman

MARKET.KZ

Director - Mike G

DOP - Anton Fursa

Production - 2332 Productions

Agency - Shots

WARGAMING BALANCE

Director - Denis Volkov

DOP - Jonathan Weyland

Production - Cuba Studio

Creative - Vera Feelenko

BROTHERS GRILL Renovation

Director - Andrew Gnyot

DOP - Anton Fursa

Production - Partizan

KINDER (Line service producer)

Director - Fernando Vallejo

DOP - Ilya Mayorov

Production - Okey Dokey

Production service - Partizan

MTS MAX OPTION

Director - Andrew Gnyot

DOP - Vadim Poteev

Production - Partizan

WARGAMING IMAGE CAMPAIGH

Director - Alexey Krupnik

DOP - Vladimir Ushakov

Production - Cuba Studio

BONFESTO RICOTTA & CREAM CHEASE

Director - Vytautas Chlebinskas

DOP - Audrius Budrys

Production - Cuba Studio

KINDER (Line service producer)

Director - Denis Rovira

DOP - Ilya Mayorov

Production - Okey Dokey

Production service - Partizan

WARGAMING NY

Director - Gleb Orlov

DOP - Evgeny Ermolenko

Production Service - One Little Production

GARAGE - GRANNY’S COMPOTE

Director: Jeroen Mol

DoP: Sergey Banderas

Production: Pronto Film

MTS NO LIMITS

Director - Anna Buryachkova

DOP - Sveta Aparina

Production - One Little Production

BITFURY

Director: Peter Storozhenko

DOP: Nikita Kuzmenko

Production: Electric Sheep Film

WoT BLITZ: RECRUITMENT, CARS VS TANKS

Director: Stjepan Klein

DOP: Vladan Pavic

Production - Partizan

FCF - Oh my dog

Director: Maged Nassar

DOP: Yves Sehnaoui

Production: Excuse My French

Service production: Radioaktive

MULTIOPTICAS - Screen Pollution

Director: Ignacio Angulo Villar, Luis Valera Rojo

DOP: Michal Babinec

Production: Garlic

Service production: Radioaktive

Sebastien - Sober

Director: Nathalie Canguilhem

DOP: Paul Oznur

Production - DIVISION

Service Production - FAMILY

LEFA - MAUVAIS

Director: Akim Laouar Aronsen

DOP: Joe Cook

Production - WANDA

Service Production - TOY PICTURES

OPPO

Director: Marcos Mijan

DOP: Octavio Olano Arias

Production - Filmplexe Production House

Service Production - FAMILY

GIVENCHY - L’interdit Thrill

Director: Lorenzo Cisi

DOP: Fabio Caldironi

Production - General Pop

Service Production - FAMILY

ALLO - SMARTACLAUSE

Director: Bruce Parramore

DOP: Nick Yefimenko

Production - Clever Studio

BEELINE - 777

Director: Courtney Phillips

DOP: Anton Fursa

Production: TOY PICTURES

LION - Be The King Of Your Jungle

Director: Julia Rogowska

DOP: Piotr Uzanski

Production company: Papaya Films London

Service Production: TOY PICTURES

LAMODA Spring 2020 + DIRCUT

Director: Ilya Cherepitsa

DOP: Zhenia Kozlov

Production company: Bakehouse

GIVENCHY - THRILL HUNTER

Director - Sarah Prinz

DOP - Romain Alary

Production - General Pop

Service Production - FAMILY

GODNYI GOD BY IVAN DORN

Director - Dima Avdeev

DOP - Eugeny Usanov

Production - Masterskaya

UKLON - YOUR LOVE, YOUR RULES s1-s2-s3

Director - Alexey Taranenko

DOP - Eugeny Usanov

Production - 120 seconds

KYIVSTAR - SUPERPOWER

Director - Alessandro De Leo

DOP - Nikita Kuzmenko

Production - NO STARS

ELDORADO - FOR FAMILIES

Director - Anna Buryachkova

DOP - Ilya Maksimenko

Production - NO STARS

KYIVSTAR - VSE RAZOM

Director - Peter Dietrich

DOP - Dima Nedria

Production - ESSE

PERSHA PRIVATNA BROVARNIA - UKRANIANS

Director - Ken Karpel

DOP - Dima Nedria

1AD - Mariko Becher

Production - ESSE

MONACO - BE HAPPY NOT IDEAL

Director - Fabio Jansen

DOP - Eugeny Usanov

Production - Shelter

MOONPIG ADVERTISING 2021/22

Director - Ben Reed

DOP - Zhenia Gubrenko

Production - Agile Films

Service Production - FAMILY

PUMB - COMMERCIAL 2021

Director - Vitaliy Yermak

DOP - Zhenia Gubrenko

Production - Rocket Juice

ZOLLA - AUTUMN/WINTER 21/22

Director - Caballo Pistola

DOP - Anatol Trofimov

Production - Bakehouse

MARTA LIPCHEI - TAM DE TY 2023

Director - Ken Karpel

DOP - Lena Chehovsky

Production - ESSE

AJ BELL - COMMERCIAL 2022

Director - Zac Ella

DOP - Spike Morris

Production - FAMILY

0 notes

Text

The Intrinsic Value of Tillys Inc.

Introduction

With 229 stores spread across the United States and its headquarters in Irvine, California, Tillys is a specialty brick-and-mortar apparel retailer with a growing e-commerce platform. Through its larger-than-average physical stores and its online store, Tillys sells various well-known brands, such as Nike, Vans, Adidas, and RVCA, as well as its own exclusive brands (Full Tilt, RSQ, Sky & Sparrow, White Fawn, Ivy + Main, and Blue Crown).

At the time of this writing, Tillys’ market capitalization is about $352 million and its revenue and cash flows for the 2018 fiscal year* were $598 million and $32 million, respectively. Currently trading at about $11.82, the stock has hit a 52-week low of $10.19 and a 52-week high of $25.46. At today’s price of $11.82, is Tillys’ stock undervalued?

*Note on Tillys’ Fiscal Years from its Annual Report: “Our fiscal year ends on the Saturday closest to January 31. For example, “fiscal 2018” refers to the fiscal year ended February 2, 2019; “fiscal 2017” refers to the fiscal year ended February 3, 2018; and “fiscal 2016” refers to the fiscal year ended January 28, 2017.

The Intrinsic Value of Tillys

With net income being easily manipulated and not a true representation of the cash available to a company’s owners, we will use Tillys’ free cash flow to value its stock. Using the free cash flow allows investors to value the company based on the actual cash it generated, which can be used to reinvest in the business, pay dividends, or buy back its own stock. Below is a chart of Tillys’ free cash flow for the past ten years.

Tillys’ free cash flow saw strong growth the three years prior to its Initial Public Offering (IPO) on May 4th, 2012. Likely in an attempt to win over the public markets, management began reinvesting heavily in the business, which significantly increased its capital expenditures (CapEx) and therefore reducing its free cash flow. After 2014, its most capital-intensive year over the past decade, management scaled back its CapEx spending in 2015 and continues to do so to this day. This reduced CapEx spending over the past five years has led to a generally increasing free cash flow trend, as illustrated by the black arrows in the graph below.

From 2010 to 2019, Tillys’ free cash flow grew from $18 million to $32 million, for a compounded annual growth rate (CAGR) of 6% (78% cumulatively).

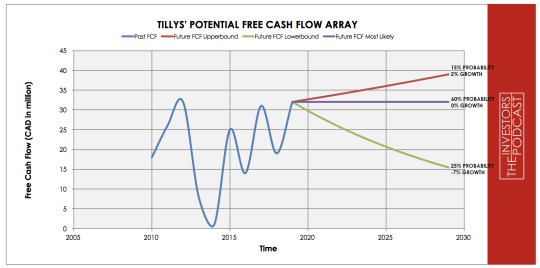

To value Tillys’ stock, its future free cash flows must be estimated. To do this, the array model below has been developed to account for three potential outcomes of Tillys’ future free cash flows.

The upper-bound line illustrates a 2% growth rate with a 15% probability of occurrence. This growth rate was determined by using the United States governments’ target inflation rate of 2%, as well as discounting Tillys’ current earnings yield (inverse P/E ratio) by about two-thirds (66%) in order to build in a margin of safety for the risks we will visit in the ‘Risks’ section below. It was assigned this probability to allow for the potential of some growth - conservatively estimated at the country’s target inflation rate - while also accounting for the challenges Tillys would face in the coming years, as its previously obtained growth rates are unlikely to materialize again over the next decade.

The middle line represents a 0% growth rate with a 60% probability of occurrence. This outcome assumes that Tillys will face competitive and economic pressure, but will be able to maintain its current free cash flow levels by using its large stores to provide an above-average experience for its customers and further improving its online presence.

Finally, the lower-bound line illustrates a -7% contraction with a 25% probability of occurrence. The contraction in Tillys’ free cash flow generation is assuming that online retailers, such as Amazon, continue to disrupt the retail industry and that the United States economy enters into a recessionary period, resulting in a significant slowdown in consumer spending on discretionary items.

The noticeable pessimistic skew of growth rates and probabilities to the downside and the 85% probability that Tillys will have zero or negative growth over the next decade may appear high, but this is to allow for a conservative valuation. Given where we currently are in the market cycle, it is likely wise for investors to err on the side of caution when creating valuation models, as we have done here. It certainly is possible for Tillys to outperform these estimates, but it behooves investors to add in a margin of safety and be a bit defensive, especially in market conditions like today. If the expected return is satisfactory with conservative estimates, any outperformance of these growth rates will provide investors with an added bonus.

It is also important to recognize that the above-estimated growth rates are not expected to be exact every year for the next decade. The growth rate is expected on an annualized basis. As they have from 2014 to 2019, Tillys’ results will likely fluctuate from year-to-year. We shall not try to estimate those results; rather we look to estimate accurate growth rates annualized over the next decade. Assuming the estimated outcomes discussed above prove accurate, Tillys’ stock may be priced at a 7.0% annual return at today’s price.

Two other valuable quantitative metrics to consider when considering a stock’s return are the earnings yield and free cash flow yield. At the time of this writing, Tillys’ current earnings and free cash flow yields (inverse P/FCF ratio) are 7.1% and 9.1%, respectively. Its earnings and free cash flow yields both illustrate a similar expected return to that of our discounted cash flow (DCF) analysis above. Tillys also appears to be priced for a better-expected return over the next decade than does the S&P 500. The graph below illustrates the earnings and free cash flow yields for Tillys and the S&P 500.

The Competitive Advantage of Tillys

Tillys has multiple advantages that will be discussed in detail below:

Financial Strength. As of its most recent 10-K, Tillys cash and cash equivalents total about $15 million more than its total liabilities. It has no debt, a growing cash position, and inventory levels that have remained satisfactory. Tillys current and quick ratios are 2.2 and 1.5, respectively. Over the last decade, it has shown revenue and free cash flow growth, while maintaining its margins. These characteristics not only allow Tillys to be in a position to take advantage of future opportunities, but it should also help the company weather an economic downturn.

Omnichannel Strategy. Tillys has been successfully implementing an omnichannel strategy that provides its customers with a better, more streamlined experience. Customers are able to purchase products through its e-commerce platform and pick them up in-store. This is an important feature, specifically for clothing retailers, because purchasing clothes/shoes/accessories online has been notoriously frowned upon by consumers. However, Tillys is able to provide a more pleasant experience for customers by allowing them to be able to see the items online and then trying the items on in-store – often preceding the tedious online shopping return process that might arise from purchasing clothing through other online retailers, such as Amazon.

Customer Experience. Tillys’ management team has been successfully following the trend of improving the customer experience to compete with online retailers. The physical stores have been designed to not only carry the trendiest clothing but to also provide a great atmosphere to shop. Tillys is also launching a promotion called “Second Saturdays” in which they host in-store parties. The success of this venture is yet to be seen, but it illustrates management’s focus on improving the customer experience.

Risk Factors

Although Tillys has competitive advantages, it is not without risks that could weaken an investor’s returns.

Large Stores. Tillys’ large stores are the proverbial double-edged sword. They allow Tillys to differentiate itself from its most direct competitors (Pac Sun and Zumiez) by carrying a much larger variety of products and being a destination retailer. When the economy is strong, this plays into Tillys hand by benefiting from strong consumer spending, but when the economy takes a turn for the worse, it has significantly more overhead than its competitors with a smaller store format.

Severe Competition. Tillys not only has competition from online retailers and other brick-and-mortar retailers, but it is also competing directly with the brands it sells, such as Nike. It is competing directly with the major brands it sells in two different ways; The first, Tillys has its own exclusive brands that it sells, which competes in-store with other well-known brands. The second, well-known brands have begun cutting out the middle-man, Tillys in this case, to go directly to the consumer. The rise of e-commerce and the strength of their brands has allowed large consumer brands to sell directly to its customers through its own online stores.

Lack of Switching Costs/Stickiness. Customers cannot get Tillys’ RSQ or Ivy + Main products in other stores, but they can get products very similar, as well as the other major consumer brands, in other stores. Customers are able to go to Pac Sun, Zumiez, Foot Locker, Target, Walmart, or various other stores to purchase many of the well-known non-exclusive brands that Tillys carries without suffering from any switching costs.

Opportunity Costs

It is not enough to simply analyze a company in isolation and make an investment decision. Investors must compare the expected return of one investment with the others available in the market. We previously saw that based on earnings and free cash flow yields, Tillys is expected to outperform the S&P 500 over the next decade. We also saw that our free cash flow estimates for Tillys led to a potential annual return of about 7.0%. Assuming the S&P 500 reverts to its long-term mean Shiller P/E ratio from its current level of about 29.4, the expected return for the S&P 500 is -1.4%. 10-year treasuries are currently yielding 2.451% at the time of this writing. These three comparisons indicate that Tillys may outperform the S&P 500 and 10-year treasuries over the next decade. However, there may be other individual stocks that offer a similar, or better, risk-adjusted return.

Macro Factors

Although individual investors should not attempt to time the market, it would be unwise to not at least consider the overall macro environment when making an investment decision. According to one of Warren Buffett’s favorite market valuation indicators, Wilshire 5000 Total Market Cap vs. GDP, the overall market is significantly overvalued, and at one of its most expensive points since 1971. The Wilshire 5000 Total Market Cap is currently at 163% of GDP, which is 63% higher than the peak before the Housing Crisis and 45% higher than the peak before the Dot Com Bubble.

The S&P 500 is currently priced over 70% higher than its historical average on a Shiller P/E basis. Unemployment is current at, or near, 50-year lows, and U.S. private debt levels have exceeded the previous financial crisis. It is not possible to accurately estimate when a downturn will come, but economic and stock market characteristics are pointing towards a potential peak.

Summary

Buffett recommends, “be fearful when others are greedy, and greedy when others are fearful.” The market is certainly being fearful towards the retail sector, which indicates there may be an intriguing opportunity for value investors. However, investors must also be careful of falling victim to a value-trap, which many retail companies have been as of late (for example, Bed Bath and Beyond and JC Penney).

Tillys is currently selling at a discount to our calculated intrinsic value due to its economic risk, large overhead costs, competition, lack of switching costs, and being a part of a sector that is out of favor. These risks are very real, and investors must consider them, but when doing so, they must be objectively and realistically compared to the potential upside and advantages Tillys has. Given the assumptions outlined in this analysis, a return of 7% can be expected.

Disclaimer: The author does not currently hold any ownership in Tillys (TLYS) and does not expect to within the next 72 hours.

This article was written in collaboration with Robert Leonard from “The Investor’s Podcast.”

Stig Brodersen is the host of the business podcast “We Study Billionaires.” You can find his free intrinsic value index here of popular stock picks.

0 notes