#FLEXCUBE consulting services

Explore tagged Tumblr posts

Text

Top Flexcube Core Banking Solutions & Tech Challenges for Banks in 2025

Customization complexity, system integration, and regulatory compliance are major hurdles for financial institutions. That’s why we decided to consult with API Connects—a leading IT services provider in New Zealand—to explore how advanced technologies are overcoming these challenges and optimizing Flexcube core banking solutions.

Key Tech Solutions for Banking: 🔹 Tailored Customization – Customizes Flexcube core banking solutions to meet specific banking needs while maintaining system stability. 🔹 Seamless Integration – Connects Flexcube with digital platforms, payment gateways, and third-party systems for an optimized customer experience. 🔹 Flexcube Upgrades & Migrations – Ensures smooth system updates, preserving customizations and minimizing downtime. 🔹 Regulatory Compliance – Keeps Flexcube in line with evolving global regulations like KYC, AML, and GDPR. 🔹 Scalable Architecture – Designs Flexcube core banking solutions to support growth in transaction volumes and user base. 🔹 Legacy System Integration – Seamlessly connects Flexcube with legacy systems for continued operational efficiency. 🔹 Expert Support – Provides proactive support and liaises with Oracle for rapid issue resolution.

Conclusion: Banks are modernizing core banking systems through tailored Flexcube core banking solutions, ensuring efficiency, compliance, and future scalability. With API Connects' expertise, financial institutions can transform operational challenges into growth opportunities, ensuring a seamless banking experience for all.

Don’t forget to check their most popular services:

Automation Solutions

robotic process automation solutions

machine learning services

core banking solutions

IoT business solutions

data engineering services

DevOps services

mulesoft integration services

ai services

0 notes

Text

Oracle Flexcube Online Course for Professionals: Advance Your Career in Core Banking Solutions

In a international where economic institutions are swiftly adopting digital platforms to enhance operational performance, professionals inside the banking and IT sectors want to stay beforehand of the curve. One of the maximum broadly applied core banking structures throughout the globe is Oracle Flexcube — a effective solution designed to streamline and modernize banking operations. For specialists looking to grow in the banking and fintech sectors, enrolling in an Oracle Flexcube Online Course is a strategic and profession-defining decision.

Why Oracle Flexcube?

Oracle Flexcube is a complete center banking answer advanced by Oracle Financial Services. It supports each retail and company banking operations and is depended on by way of masses of banks global. Its key strengths encompass:

Real-time transaction processing

Product configurability

Seamless integration with 0.33-birthday party structures

Multi-forex and multi-entity guide

Compliance with global regulatory standards

Professionals who master Flexcube advantage the potential to work on excessive-impact initiatives in implementation, customization, aid, and consulting roles inside the BFSI (Banking, Financial Services, and Insurance) region.

Course Overview

The Oracle Flexcube Online Course for Professionals is designed to provide a sensible and comprehensive know-how of the way Flexcube works in actual-world banking environments. Unlike fashionable theoretical publications, this schooling focuses on arms-on revel in, real-time eventualities, and enterprise-relevant practices.

Key Modules Covered:

Introduction to Core Banking and Oracle Flexcube

Customer Information File (CIF) Management

Account and Product Configuration

Loan and Deposit Processing

Payments and Transfers

End-of-Day (EOD) Operations

Integration with External Systems (APIs, Interfaces)

Reporting, Auditing, and MIS

Flexcube Technical Customization and Extensions

This direction is adapted to each practical and technical specialists, supplying role-particular insights and activities.

Who Should Take This Course?

This on-line training is good for mid-degree and skilled specialists in:

Banking operations

IT consulting and software development

Core banking aid roles

Business evaluation in financial domains

Project management in banking transformation tasks

It’s also ideal for professionals transitioning from a conventional banking background right into a greater IT-focused or hybrid function in digital banking.

Benefits of the Online Format

Learning online offers most flexibility, mainly for working professionals. The direction shape includes:

Live instructor-led sessions and recorded videos

Hands-on sporting events and real challenge scenarios

Interactive Q&A classes with expert mentors

Downloadable assets and documentation

Certification final touch for credibility in the activity market

Professionals can take a look at at their personal pace at the same time as applying what they analyze directly of their work environments.

What You’ll Gain

By the quit of the path, contributors will:

Understand the overall lifecycle of middle banking operations

Configure and manipulate purchaser information and banking merchandise

Execute and reveal monetary transactions in Flexcube

Perform troubleshooting and help sports

Communicate efficaciously with technical and enterprise groups all through implementation

Most importantly, freshmen will be process-ready for roles in Oracle Flexcube implementations, assist, or transformation tasks.

Career Opportunities After Training

Completing this route opens doors to high-demand roles which include:

Oracle Flexcube Functional Consultant

Technical Consultant or Developer (Java/XML/PLSQL-primarily based)

Core Banking Support Analyst

Business Analyst – BFSI Domain

Quality Assurance Tester for Flexcube Projects

Banks and IT corporations global are actively recruiting professionals with Flexcube understanding because of the vital nature of middle banking modernization tasks.

Conclusion

In the digital age, banking structures are evolving — and so need to your profession. The Oracle Flexcube Online Course for Professionals is designed to empower you with the realistic skills, hands-on experience, and enterprise know-how you need to excel in center banking roles. Whether you're in IT, finance, or operations, this route will enhance your profile and function you as a valuable asset in any center banking transformation mission.

[email protected], +91-9148251978,+91-9008906809

0 notes

Text

What are the learning prerequisites for Oracle Flexcube?

Oracle FLEXCUBE Online Training & Certification Course by ProExcellencyLearn is one of the best core banking products with ProExcellency's expert-led online training. Learn about retail, corporate, and digital banking, as well as how to install, customize, and integrate. Get hands-on experience, best practices, and ready for certification to drive your career forward in the banking industry. Sign up now and enhance your skill in Oracle FLEXCUBE!

What is Oracle Flexcube?

Oracle FLEXCUBE is a core banking technology developed by Oracle Financial Services to help banks and financial institutions streamline their operations. It provides account management, payments, loans, trade finance, treasury, and digital banking services to retail, corporate, and investment banking clients. Oracle FLEXCUBE helps financial institutions drive efficiency, customer experience, and change in response to the evolving banking landscape through robust automation, risk management, regulatory compliance, and API integration.. Its scale-invariant architecture provides smooth digital transformation, rendering it a bank of choice globally.

What are the learning prerequisites for Oracle Flexcube?

Prerequisites for Learning Oracle FLEXCUB

Although Oracle FLEXCUBE training is intended for both freshers and experienced professionals, the following knowledge will prove useful:

Basic Banking Knowledge – Knowledge of banking fundamentals, financial deals, and banking activities.

Database & SQL – Acquaintance with Oracle Database as well as SQL queries can assist in customization and reporting.

ERP & Financial Systems – Familiarity with banking ERP packages or financial management solutions is a plus.

IT & Programming (Optional) – Java, APIs, and integration frameworks knowledge is beneficial for technical positions.

Banking Regulations & Compliance (Optional) – Industry regulation awareness can assist in implementation and compliance management.

Modules of Oracle FLEXCUBE Covered in Training:-

ProExcellency's Oracle FLEXCUBE Online Training includes key modules to enable you to master this core banking solution.

1. Core Banking Operations

Customer Account Management

Deposits & Loans Processing

Payments & Fund Transfers

Interest & Charges Management

2. Retail & Corporate Banking

Retail Banking Services

Corporate Banking Solutions

Trade Finance & Treasury Management

Wealth & Asset Management

3. Digital & Internet Banking

Omni-Channel Banking

Mobile & Internet Banking

Customer Onboarding & Self-Service

4. Risk & Compliance Management

Regulatory Compliance & Reporting

Fraud Identification and Risk Control

AML (Anti-Money Laundering) and KYC (Know Your Customer)

5. Technical & Customization

FLEXCUBE Architecture & Database

APIs & System Integrations

FLEXCUBE Customization & Configuration

Troubleshooting & Support

Who Should I Take Oracle FLEXCUBE Training?

Oracle FLEXCUBE training is suitable for professionals wishing to develop knowledge in core banking solutions. The course is most appropriate for:

Banking & Financial Professionals – Individuals employed in banks, financial institutions, and fintech firms.

IT & Software Professionals – Software developers, system administrators, and IT consultants engaged in banking technology.

Business Analysts & Functional Consultants – Individuals examining and streamlining banking operations.

Database Administrators (DBAs) – Individuals dealing with Oracle databases in banking setups.

Project Managers & Implementation Consultants – Professionals managing FLEXCUBE implementation and integration projects.

Fresh Graduates & Career Switchers – Professionals who want to make a career transition into the banking technology sector with in-demand skills.

Topics Covered in Oracle FLEXCUBE Training:-

ProExcellency's Oracle FLEXCUBE Online Training is aimed at offering a thorough knowledge of this core banking solution. The following are the major topics covered in the course:

1. Introduction to Oracle FLEXCUBE

Overview of FLEXCUBE and its architecture

Key functionalities and features

FLEXCUBE versions and industry adoption

2. Core Banking Operations

Customer account creation and management

Deposits, loans, and lending process

Fund transfers and payments

Interest, charges, and fee management

3. Retail & Corporate Banking

Retail banking workflows

Corporate banking processes

Trade finance and treasury operations

Wealth and asset management

4. FLEXCUBE Digital Banking

Internet and mobile banking solutions

Omni-channel banking experience

Customer onboarding and self-service

5. Risk & Compliance Management

Regulatory compliance and reporting

Fraud detection and risk mitigation

KYC (Know Your Customer) and AML (Anti-Money Laundering) integration

6. FLEXCUBE Technical & Customization

FLEXCUBE database and architecture

APIs and system integrations

Customization and configuration

Troubleshooting and issue resolution

7. FLEXCUBE Implementation & Administration

FLEXCUBE installation and setup

User roles and access management

Performance monitoring and maintenance

Why Choose ProExcellency for Oracle FLEXCUBE Online Training?

ProExcellency provides top-rated Oracle FLEXCUBE training that enables you to become an expert in core banking technology. Here's why we are the best choice:

Expert-Led Training – Learn from certified experts with hands-on FLEXCUBE experience.

In-Depth Course Content – Core banking, retail & corporate banking, digital banking, risk management, and technical customization.

Hands-on Learning – Real-world exercises, live case studies, and live demonstrations.

Flexible Online Training – Instructor-led or self-directed sessions to accommodate your schedule.

Access to Recorded Sessions – View sessions anytime for improved understanding.

Certification Assistance – Get prepared for Oracle FLEXCUBE certification.

Job-Oriented Training – Acquire industry best practices and career advice.

0 notes

Text

Proexcellency offers expert-led Oracle Flexcube Online Training, designed to provide in-depth knowledge of Oracle’s core banking solution. This course covers essential modules such as retail and corporate banking, customer service management, loan processing, and risk management. With hands-on exercises and real-time scenarios, participants gain practical expertise in implementing and managing Oracle Flexcube. Whether you are a banking professional or an IT consultant, this training will enhance your skills and career prospects. Enroll with Proexcellency today and master Oracle Flexcube with flexible online learning.

0 notes

Link

Flexcube Implementation- We have unparalleled expertise & experience in implementing IT solutions for Banks and financial institutions with referenceable clients worldwide.

#Flexcube Implementation#Flexcube Implementation partner#Flexcube Implementation partners in india#Flexcube Implementation partner in bangalore#Flexcube Implementation and consulting services#Flexcube consulting services

0 notes

Link

Our specialized banking advisory services aid banks in making a thought driven and strategic decision. We do this by a thorough analysis and computation of the various requirements of the organization. Our advisory services offer Request for Proposal , Requirement Gathering and Process Consulting.

0 notes

Text

Oracle Flexcube: A Comprehensive Examination of its Role in Automation Solutions

Oracle Flexcube is an integrated, enterprise-wide software that provides a single platform for all financial product processing activities by providing centralize data management and enhanced automation workflow processes. In this article, we'll take a closer look at how Oracle FlexCube can be used to streamline enterprise operations across the entire organization.

Oracle Flexcube is designed to provide users with an end-to-end platform that simplifies financial product processing and increases operational efficiency of the customer-centric services. The software offers features such as one view reporting, dynamic business rule creation engine, personalized dashboard designer, maximum utilization of existing resources and extensive support for multiple languages. It also integrates with a variety of existing solutions provided by Oracle to automate activities that are necessary to effectively run the business.

These features give organizations the tools they need to efficiently manage customer relationships and transactions on a wide range of devices including web-based applications and mobile phones. With Flexcube’s data integration technology, organizations can access their customer information from any location without additional hardware or IT infrastructure investments. This helps them increase their performance in customer service as well as reduce IT costs associated with manual data entry tasks.

Flexcube also provides advanced analytics capabilities which enable businesses to gain insights into customer behaviors and interactions through data analytics tools such as machine learning algorithms and natural language processing (NLP) technology. By leveraging these technologies businesses can ensure that customers receive better services in both online and offline channels; this leads to a higher level of satisfaction among clients who actively participate in the process through self-service options or real-time interactions with support representatives via chatbot conversations or virtual assistants.

With its advanced analytics capabilities, businesses can use Flexcube not only for automation but also for predictive scenarios such as market segmentation or proactive marketing campaigns which can help enterprises stay ahead of the competition by recognizing market changes earlier than its rivals do. Ultimately, Oracle Flexcube has become an increasingly valuable tool for organizations looking for optimized solutions within increasingly demanding industries such as banking & finance, insurance & healthcare, or retail & logistics due its capability to integrate easily with enterprise systems while providing robust data management capabilities across multiple dimensions including customers, accounts/transactions., products portfolios & markets served.

#RPA software#RTA software#RMA software#EOD process#Banking and financial Automation#Oracle Flexcube Automation#Insurance automation#Healthcare automation#IT and Consultancy services automation#Intelligent Document Processing#Banking and financial services#IT and Consultancy services#iBorg automation#iBorg automation tool#all in one hybrid automation tool#iBorg hybrid automation tool#Automation Tool#Automation Software#Robotic Process Automation#Robotic Test Automation#Robotic Mobile Automation#Intelligent Process Documentation#Oracle flexcube#automation solution#robotic automation#Banking software

0 notes

Text

WHY DO WE NEED RPA IN BANKING?

The primary aim of RPA in the banking industry is to assist in processing the banking work that is repetitive in nature. Robotic process automation (RPA) helps banks & financial institutions increase their productivity by engaging customers in real-time and leveraging the immense benefits of robots.

Robotic Process Automation (RPA) is a form of business process automation that allows anyone to define a set of instructions for a robot or ‘bot’ to perform. In other words, RPA is an application of technology, governed by business logic and structured inputs, aimed at automating business processes. Using RPA tools, an organization can configure software, or a “robot,” to capture and interpret applications for processing a transaction, manipulating data, triggering responses, and communicating with other digital systems and many more.

What is IMPACTO iBorg?

“IBorg” is an “Intelligent RPA tool” from IMPACTO which makes use of Artificial Intelligence and Machine Intelligence to help business operations with getting increasingly nimble and practical through automation and rule-based back dull office processes. It permits clients to use similar automation situations for the lifecycle of the considerable number of applications utilized for their business processes. With IBorg, clients approach a single platform to serve the automation needs of their company, development, and operations teams.

WHY CHOOSE SIRMA BANKING SERVICES?

Sirma India spends lot of efforts in Research & Development and has developed effort effective solutions which brings in not only saving cost and time for Flexcube Banks, but also provides effective solutions that improves operational efficiency. At Sirma we believe we are the extended arm of the institution and it our responsibility to take the complexity out of banking technology, so banks can focus on providing what they are for: ''Customer Delightful banking experience”. Sirma offers a range of Consulting, testing, RPA and Managed service offerings which will help banks stay on top of the cutting-edge technologies. Being Oracle go to Gold Partner provides you with the confidence that you are dealing with an authority when it comes to Oracle enterprise solutions and services.

Sirma Business Consultancy has been chosen as The Best Banking Technology Provider as we always try to reach the peak where we make lives simpler by using our technology. Sirma Business Consulting provides the best services around Oracle Flexcube for Core banking implementation, Testing, customizations, managed services and various other Flexcube services for banking & financial services, insurance, Credit unions, Cooperative societies and so on.

#oracleflexcube#robotic process automation#flexcube upgrade#test automation#banking software#digital banking#rpa robotic process automation

1 note

·

View note

Link

Course Information

Nisa Trainings

· Oracle Flexcube Online Training

· Duration: 25 Hours

· Timings: Weekdays (1-2 Hours per day) [OR] Weekends (2-3 Hours per day)

· Training Method: Instructor Led Online One-on-One Live Interactive Sessions.

#oracleflexcubetraining#oracleflexcubecourse#oracleflexcubetutorial#oracleflexcubejobs#oracleflexcubecertifcation#oracleflexcubesoftware#whatisoracleflexcube#oracleflexcubecorporatecourse

0 notes

Link

#oracleflexcubetraining#oracleflexcubecourse#oracleflexcubetutorial#oracleflexcubejobs#oracleflexcubecertification#oracleflexcubesoftware#whatisoracleflexcube#oracleflexcubecorporatecourse

0 notes

Text

Oracle FLEXCUBE Online Training: A Complete Guide

Introduction to Oracle FLEXCUBE

Oracle FLEXCUBE Online Training Top of Banglore 2025 is a comprehensive core banking solution used by financial institutions worldwide to streamline banking operations, improve customer service, and enhance regulatory compliance. It provides an integrated platform for retail, corporate, investment, and Islamic banking. FLEXCUBE’s powerful automation and real-time processing capabilities enable banks to manage accounts, transactions, risk, and compliance efficiently.

With the increasing demand for skilled professionals in banking technology, Oracle FLEXCUBE Online Training has become a popular choice for individuals and banking professionals looking to upgrade their knowledge. This training helps participants gain expertise in implementing, managing, and customizing FLEXCUBE to meet business needs.

Why Choose Oracle FLEXCUBE Online Training?

Online training offers numerous advantages, making it a preferred mode of learning for professionals and beginners alike. Some key benefits include:

Flexible Learning Schedule – Online training allows participants to learn at their own pace without affecting their work commitments.

Expert-Led Sessions – Courses are conducted by industry experts with hands-on experience in banking and Oracle FLEXCUBE.

Practical Hands-on Experience – Training includes live demonstrations, real-world case studies, and hands-on exercises in a simulated environment.

Certification Preparation – Many courses prepare students for Oracle FLEXCUBE certification exams, increasing job opportunities.

Cost-Effective Learning – Online training eliminates travel and accommodation costs associated with traditional classroom training.

Key Topics Covered in Oracle FLEXCUBE Online Training

1. Introduction to Oracle FLEXCUBE

Overview of core banking solutions

Architecture and components of FLEXCUBE

Understanding banking workflows and processes

2. FLEXCUBE Functional Modules

Customer Management – Creating and managing customer profiles, account types, and banking relationships.

Deposits and Loans – Configuring savings accounts, fixed deposits, loans, and overdrafts.

Payments and Settlements – Processing funds transfers, SWIFT payments, and remittances.

Trade Finance – Managing letters of credit, guarantees, and trade transactions.

Risk and Compliance – Implementing AML (Anti-Money Laundering) and KYC (Know Your Customer) policies.

3. FLEXCUBE Technical Configuration

System setup and user management

Parameter configuration and workflow customization

Integration with external banking applications

4. Reporting and Analytics

Generating financial and compliance reports

Analyzing customer data for business insights

Automating regulatory reporting requirements

5. FLEXCUBE Implementation and Customization

Deployment models: On-premise vs. cloud

Customizing FLEXCUBE to meet specific business requirements

Testing and troubleshooting FLEXCUBE configurations

Who Should Enroll in FLEXCUBE Online Training?

This training is suitable for:

Banking Professionals – Employees working in financial institutions who want to enhance their technical and functional understanding of FLEXCUBE.

IT Professionals – Developers, system administrators, and consultants involved in banking technology projects.

Business Analysts – Individuals responsible for banking process optimization and digital transformation initiatives.

Students and Fresh Graduates – Those looking to build a career in banking IT and financial software solutions.

Career Opportunities After Oracle FLEXCUBE Training

Completing Oracle FLEXCUBE training opens up numerous job opportunities in the banking and financial services industry. Some potential career roles include:

FLEXCUBE Functional Consultant

Core Banking Solution Architect

FLEXCUBE Technical Consultant

Business Analyst – Banking Technology

Oracle FLEXCUBE Developer

System Administrator – Core Banking

With the widespread adoption of FLEXCUBE by banks and financial institutions globally, certified professionals are in high demand.

Choosing the Right Oracle FLEXCUBE Online Training Provider

When selecting an online training program, consider the following factors:

Trainer Expertise – Ensure that the instructors have real-world experience with Oracle FLEXCUBE implementation and customization.

Course Curriculum – Check if the course covers both functional and technical aspects of FLEXCUBE.

Hands-on Practice – Look for training that includes access to a FLEXCUBE sandbox environment for practical exercises.

Certification Guidance – If certification is a goal, choose a provider that offers exam preparation support.

Student Support – Ensure the training provider offers post-training support, discussion forums, and mentorship.

Conclusion

Oracle FLEXCUBE Online Training is an excellent investment for professionals looking to enhance their expertise in banking technology. With a structured curriculum covering key functional and technical aspects, this training equips learners with the knowledge to implement, configure, and manage FLEXCUBE solutions effectively. Whether you are a banking professional, IT consultant, or student aspiring to enter the financial services industry, FLEXCUBE training can significantly boost your career prospects.

By enrolling in a reputable online training program, you can gain the skills required to work with Oracle FLEXCUBE, stay ahead in the competitive job market, and contribute to the digital transformation of the banking sector.

0 notes

Text

Staff Consultant Job For 3-9 Year Exp In Micros Systems India - 3981933

Staff Consultant Job For 3-9 Year Exp In Micros Systems India – 3981933

OFSS Consulting is part of Financial Services Global unit and provides a variety of consulting services covering new implementations, upgrades, Customization and Managed services for a variety of Industry leading products like FLEXCUBE, DIGIX – Oracle Digital Banking experience, Analytics, Pricing and Billing, Leasing and Lending and Oracle Banking Products covering Retail, Corporate, Investment…

View On WordPress

0 notes

Link

Flexcube implementation- Trempplin is an Oracle Gold Partner specialized in Oracle FLEXCUBE/OBDX/OFSAA Implementation, Upgrades, Support, Training and IT Staff Augmentation Services specializing in Financial Industry.

#Flexcube implementation#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore#Flexcube Implementation partners#Flexcube Implementation Partner#Flexcube implementation and consulting services#Flexcube Consulting services

0 notes

Link

Flexcube Core Banking Solutions - Trempplin is an Oracle Gold Partner with extensive implementation experience across applications in the Banking and Financial Services domain. expertise on Training & Implementation on Flexcube in India.

#Flexcube Core Banking Solution#Flexcube Core Banking System#Flexcube Implementation in Bangalore#Flexcube Consulting in Bangalore#Flexcube Training Center in Bangalore#Digital Banking Solutions#Flexcube Testing Services

1 note

·

View note

Text

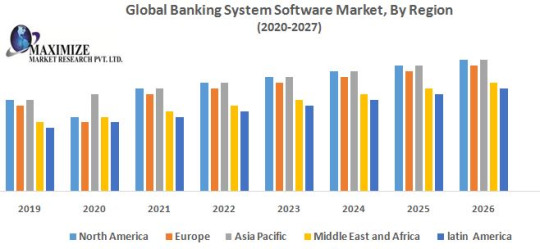

Global Banking System Software Market : Industry Analysis and Forecast (2019-2026) – by Type, Application,Core Banking Software, Features of core banking software,and Region

Global Banking System Software Market size was US$ 26.71 Bn in 2019 and expected to reach US$ XX Bn by 2026, at a CAGR of XX % during forecast period.

The report includes the analysis of impact of COVID-19 lock-down on the revenue of market leaders, followers, and disrupters. Since lock down was implemented differently in different regions and countries, impact of same is also different by regions and segments. The report has covered the current short term and long term impact on the market, same will help decision makers to prepare the outline for short term and long term strategies for companies by region.

Banking system software market is segmented by type, application, and region. On basis of type banking system software market is segmented into core banking software, multi-channel banking software, bi software, and private wealth management software. Application segment is divided by risk management, information security, business intelligence, training and consulting solutions. Geographically, banking system software market is spread by North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa.

Increasing implementation of online banking and mobile banking by customers which appearances high level of inclination towards accessing their account details and perform financial actions by digital platform driving the demands for banking system software .Customer can use their laptops, smartphones, tablets and emerging trends such as patch management is expected to provide numerous opportunities banking system software market growth. Banking system software market is driven by rising necessity to increase productivity and operational efficiency of banking industry. Furthermore, Concerns regarding information security and high costs of moving from legacy systems to the new automated systems limits the growth of this market.

Mobile Terminal Segment represented the major share in the global banking system software market owing to its high prevalence in the global market. The increase in cell phone purchasers has basically determined the market for mobile banking software. Advances in digital technology has offered countless of channels for customer interaction. Customer interaction via digital channels is generating beneficial transactional data. Mobile banking has been increasing with the growing number of smartphone owners with a bank account.

North America is projected to be the dominant region on account of the prevalent banking sector and high attentiveness of online banking. North America Market is followed by Asia-Pacific mainly on a result of the government initiatives in the banking industry. Remarkable demand is witnessed by developing nations such as India and China are accounted development of private and rural banking.

Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Tata Consultancy Services Limited., Infosys Limited, Capgemini, Accenture., NetSuite Inc., and Deltek, Inc., Millennium Information Solution Ltd., Strategic Information Technology Ltd., Aspekt, Automated Workflow Pvt. Ltd, Canopus EpaySuite, Cashbook, CoBIS Microfinance Software, Probanx Information Systems, Megasol Technologies, EBANQ Holdings BV, Kapowai, Crystal Clear Software Ltd., Infrasoft Technologies Ltd., Misys, Banking.Systems, ABBA d.o.o., SecurePaymentz, TEMENOS Headquarters SA.

The objective of the report is to present comprehensive analysis of Global Banking System Software Market including all the stakeholders of the industry. The past and current status of the industry with forecasted Market size and trends are presented in the report with analysis of complicated data in simple language. The report covers all the aspects of industry with dedicated study of key players that includes Market leaders, followers and new entrants by region. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors by region on the Market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give clear futuristic view of the industry to the decision makers.

The report also helps in understanding Global Banking System Software Market dynamics, structure by analyzing the Market segments, and project the Global Banking System Software Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Global Banking System Software Market the report investor’s guide.

Global Banking System Software Market Request For View Sample Report Page :@https://www.maximizemarketresearch.com/request-sample/16011

The scope of Global Banking System Software Market

Global Banking System Software Market, by Type

• Windows • Android • iOS

Global Banking System Software Market , by Core Banking Software • Temenos Core Banking • MX for Banking • Oracle FLEXCUBE • Plaid • Q2ebanking • Others Global Banking System Software Market , by Features of core banking software

• Others Recording of transactions • Passbook maintenance • Interest calculations on loans and deposits • Customer records • Balance of payments and withdrawal • Others Global Banking System Software Market, by Application

• Risk management • Information security • Business intelligence • Training and consulting solutions Global Banking System Software Market, by Geography

• North America • Europe • Asia Pacific • Middle East & Africa • Latin America Key Players Global Banking System Software Market

• Microsoft Corporation • IBM Corporation • Oracle Corporation • SAP SE • Tata Consultancy Services Limited. • Infosys Limited • Capgemini • Accenture. • NetSuite Inc. • Deltek, Inc. • Millennium Information Solution Ltd. • Strategic Information Technology Ltd. • Aspekt • Automated Workflow Pvt. Ltd • Canopus EpaySuite • Cashbook • CoBIS Microfinance Software • Probanx Information Systems • Megasol Technologies • EBANQ Holdings BV • Kapowai • Crystal Clear Software Ltd. • Infrasoft Technologies Ltd. • Misys • Banking.Systems • ABBA d.o.o. • SecurePaymentz • TEMENOS Headquarters SA

Global Banking System Software Market Do Inquiry Before Purchasing Report Here @ :https://www.maximizemarketresearch.com/inquiry-before-buying/16011

About Us:

Maximize Market Research provides B2B and B2C market research on 20,000 high growth emerging technologies & opportunities in Chemical, Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.

Contact info: Name: Vikas Godage Organization: MAXIMIZE MARKET RESEARCH PVT. LTD. Email: [email protected] Contact: +919607065656 / +919607195908 Website:www.maximizemarketresearch.com

0 notes

Text

BENEFITS AND FEATURES OF FLEXCUBE CORE BANKING SYSTEMS

What is core banking?

Core banking is defined as a back-end system that processes banking transactions across the various branches of a bank. Core banking systems processes and services include servicing loans, calculating interests, processing deposits credit processing, and customer related management.

What is Flexcube?

FLEXCUBE is developed and introduced by oracle financial services, it is an automated universal core banking software that is designed as a solution for financial organizations and banks.

What are the Companies that have Oracle Core Banking Systems?

PNC: PNC offers a wide range of services for all our customers, from individuals and small businesses, to corporations and government entities. It uses Flexcube Core Banking system to provide efficient services to its clients

CITI BANK: Citi India's products and services are organized under two major segments: Institutional Clients Group (ICG) and Global Consumer Bank (GCB).

WELLS FARGO: The name Wells Fargo is forever linked with the image of a six-horse stagecoach thundering across the American West, loaded with gold. It is today a known user of Flexcube Core Banking System.

SVB BANK: For over 35 years, SVB has helped businesses grow and thrive across the innovation economy. It has worked hard and today it is known among the Top Banks in the world. It too uses Oracle Flexcube for Core banking system for implementation of Banking Services.

SIRMA BUSINESS CONSULTANCY: Sirma Business Consulting is an Oracle Flexcube Gold Partner that provides services around Oracle Flexcube for Core banking system and implementation, Testing, customizations, and managed

Features of Oracle Core Banking System

Responsive UI

Personalized UX

Core functionalities for a traditional and non-traditional banking

Machine Learning

Blockchain

Data privacy and regulatory compliance

Biometric face recognition

Multi-language, multi-currency, multi-entity operations

Security management covering application and role-based access

Online validations and automated exception processing

Centralized, decentralized, and combination deployments

Benefits of Oracle Core Banking system

Enable up-selling and cross-selling through intelligent dashboards

Monitor, manage and regulate processes, compliance, and reporting

Deliver product extensibility and increase flexibility and interoperability

Replace legacy systems with a universal solution.

Get a holistic view of customers.

Integrate with other applications.

Move to the centralized processing of big data.

Use analytical tools to evaluate customer needs in new products and services.

Provide high-level customer support.

Processes large transaction volumes round the clock

Supports multiple channels and interfaces

Ensures security across application and systems with role-based access

Leverages its service-oriented architecture to support agile business process management

Uses components-based architecture to build scalable and reusable solutions

Highlights of Oracle Flexcube Core Banking System

Drives enhanced customer engagement and value with next-generation digital capabilities and user experiences

Improves insight generation and enhances straight-through processing with intelligent decision-making and automation using technologies like machine learning and natural language processing

Enables rapid and secure integration and collaboration with third-party firms and ecosystems through externalized business services and an open architecture

Supports multiple deployment options across on premises and cloud and multiple deployment models

CONCLUSION

Oracle Flexcube Core banking system benefits a lot of companies with its easy and modern banking solution that helps growing companies.

0 notes