#iBorg automation

Explore tagged Tumblr posts

Text

Oracle Flexcube: A Comprehensive Examination of its Role in Automation Solutions

Oracle Flexcube is an integrated, enterprise-wide software that provides a single platform for all financial product processing activities by providing centralize data management and enhanced automation workflow processes. In this article, we'll take a closer look at how Oracle FlexCube can be used to streamline enterprise operations across the entire organization.

Oracle Flexcube is designed to provide users with an end-to-end platform that simplifies financial product processing and increases operational efficiency of the customer-centric services. The software offers features such as one view reporting, dynamic business rule creation engine, personalized dashboard designer, maximum utilization of existing resources and extensive support for multiple languages. It also integrates with a variety of existing solutions provided by Oracle to automate activities that are necessary to effectively run the business.

These features give organizations the tools they need to efficiently manage customer relationships and transactions on a wide range of devices including web-based applications and mobile phones. With Flexcube’s data integration technology, organizations can access their customer information from any location without additional hardware or IT infrastructure investments. This helps them increase their performance in customer service as well as reduce IT costs associated with manual data entry tasks.

Flexcube also provides advanced analytics capabilities which enable businesses to gain insights into customer behaviors and interactions through data analytics tools such as machine learning algorithms and natural language processing (NLP) technology. By leveraging these technologies businesses can ensure that customers receive better services in both online and offline channels; this leads to a higher level of satisfaction among clients who actively participate in the process through self-service options or real-time interactions with support representatives via chatbot conversations or virtual assistants.

With its advanced analytics capabilities, businesses can use Flexcube not only for automation but also for predictive scenarios such as market segmentation or proactive marketing campaigns which can help enterprises stay ahead of the competition by recognizing market changes earlier than its rivals do. Ultimately, Oracle Flexcube has become an increasingly valuable tool for organizations looking for optimized solutions within increasingly demanding industries such as banking & finance, insurance & healthcare, or retail & logistics due its capability to integrate easily with enterprise systems while providing robust data management capabilities across multiple dimensions including customers, accounts/transactions., products portfolios & markets served.

#RPA software#RTA software#RMA software#EOD process#Banking and financial Automation#Oracle Flexcube Automation#Insurance automation#Healthcare automation#IT and Consultancy services automation#Intelligent Document Processing#Banking and financial services#IT and Consultancy services#iBorg automation#iBorg automation tool#all in one hybrid automation tool#iBorg hybrid automation tool#Automation Tool#Automation Software#Robotic Process Automation#Robotic Test Automation#Robotic Mobile Automation#Intelligent Process Documentation#Oracle flexcube#automation solution#robotic automation#Banking software

0 notes

Text

WHY DO WE NEED RPA IN BANKING?

The primary aim of RPA in the banking industry is to assist in processing the banking work that is repetitive in nature. Robotic process automation (RPA) helps banks & financial institutions increase their productivity by engaging customers in real-time and leveraging the immense benefits of robots.

Robotic Process Automation (RPA) is a form of business process automation that allows anyone to define a set of instructions for a robot or ‘bot’ to perform. In other words, RPA is an application of technology, governed by business logic and structured inputs, aimed at automating business processes. Using RPA tools, an organization can configure software, or a “robot,” to capture and interpret applications for processing a transaction, manipulating data, triggering responses, and communicating with other digital systems and many more.

What is IMPACTO iBorg?

“IBorg” is an “Intelligent RPA tool” from IMPACTO which makes use of Artificial Intelligence and Machine Intelligence to help business operations with getting increasingly nimble and practical through automation and rule-based back dull office processes. It permits clients to use similar automation situations for the lifecycle of the considerable number of applications utilized for their business processes. With IBorg, clients approach a single platform to serve the automation needs of their company, development, and operations teams.

WHY CHOOSE SIRMA BANKING SERVICES?

Sirma India spends lot of efforts in Research & Development and has developed effort effective solutions which brings in not only saving cost and time for Flexcube Banks, but also provides effective solutions that improves operational efficiency. At Sirma we believe we are the extended arm of the institution and it our responsibility to take the complexity out of banking technology, so banks can focus on providing what they are for: ''Customer Delightful banking experience”. Sirma offers a range of Consulting, testing, RPA and Managed service offerings which will help banks stay on top of the cutting-edge technologies. Being Oracle go to Gold Partner provides you with the confidence that you are dealing with an authority when it comes to Oracle enterprise solutions and services.

Sirma Business Consultancy has been chosen as The Best Banking Technology Provider as we always try to reach the peak where we make lives simpler by using our technology. Sirma Business Consulting provides the best services around Oracle Flexcube for Core banking implementation, Testing, customizations, managed services and various other Flexcube services for banking & financial services, insurance, Credit unions, Cooperative societies and so on.

#oracleflexcube#robotic process automation#flexcube upgrade#test automation#banking software#digital banking#rpa robotic process automation

1 note

·

View note

Text

Bringing Efficiency Through Robotic Process Automation (RPA) Technology

Robotic Process Automation, or RPA for short, is one of the most popular and powerful technologies being used by businesses to automate tedious and repetitive processes. While it has been used in various industries for several years, its power has largely gone unnoticed until recently. Here's a look at why more companies are utilizing RPA technology to bring efficiency to their operations:

Reduce Human Error

When employees work manually, they can easily make mistakes. This can mean anything from entering incorrect data or overlooking important tasks. RPA essentially takes over these manual processes and makes sure that everything is done properly with minimal error. By automating these tasks, you can save time and money, freeing up human resources for more important tasks.

Increase Speed

RPA helps minimize human involvement so it can speed up process times considerably. Even complex processes that would normally take days or weeks when done manually becomes simple when automated with the help of RPA tools and software. As the technology continues to develop, more complex processes become simpler—leaving more time for employees to focus on higher value tasks.

Enhance Data Accuracy

Robotic Process Automation provides extremely accurate results when compared to manual labor. Because humans are not involved, there is also less chance of errors due to inaccurate or incomplete data entry or miscalculations caused by fatigue or distractions With robotic automation taking care of the processing commands accurately and quickly, organizations can rest assured knowing their operations are being handled reliably every single time.

Increase Productivity

Most importantly, robotic process automation increases productivity by removing the burden of tedious manual work from personnel while freeing them up to focus on making strategic decisions that will drive your business forward faster without any mistakes due to human fatigue or oversight in accuracy and compliance issues Additionally, since robots don’t need breaks like humans do, they can function continuously for hours on end without needing any rest periods in between meaning organizations get better return on investment in terms of working hours expended per task as opposed to having a person monitor the same activities throughout all day long .

Improve Scalability & Agility

Lastly robotic automation makes it easy for organizations to scale quickly as businesses expand into new markets because robots can learn new skills fast so that you don’t have spend months training your staff each time you enter a new territory . This means businesses are able quickly adapt their service offerings according customer demands from different cultures and markets . And with AI-enabled software bots capable of learning independently means they can continually add additional skills automatically such as advanced cognitive functions.

#robotic process automation#rpa software#rpa tool#rpa technology#robotic automation#automation solution#automation services#automation software#technology#iBorg#iborg inc#artificial intelligence#automation in banks

0 notes

Text

Unlock the Potential of Automation Services with Robotic Process Automation

Robotic process automation (RPA) is the use of software with artificial intelligence (AI) and machine learning capabilities to handle high-volume, repeatable tasks that previously required human labor. In recent years, businesses have embraced RPA for its ability to deliver cost savings, improve accuracy and efficiency across a range of processes. In this article, we’ll discuss how you can use RPA to unlock the potential of automation services for your business.

Understand the Benefits of RPA

One of the main benefits of robotic process automation (RPA) is its ability to automate mundane, manual activities quickly and efficiently. By using advanced algorithms and AI technologies, bots can review documents and process data faster and more accurately than humans. This not only increases the speed of the automated process but also ensures a higher quality output with fewer errors.

Identify Automation Solutions

The next step in unlocking the potential of automation services with RPA is choosing which solutions should be automated first. When selecting an automation service, it’s important to consider factors such as cost savings versus time saved for implementation, scalability across departments within your organization, and other services that will benefit from an automation boost.

Develop Automation Strategy

Once you have identified the areas in which you want to leverage automation services using RPA, develop an overall strategy that outlines your goals and how they will be achieved through robotic process automation. It’s essential that all stakeholders are included when developing your strategy so everyone has a clear understanding of what should be done, why it should be done, and how it will help achieve desired results.

Implement Process Improvements

After developing your plan for implementing automated processes using robotic process automation (RPA) technology, apply changes accordingly. Use analytics tools to measure results including cost savings or increased productivity across operations so you can determine whether or not further improvements are needed in order to maximize results from your automated solutions.

#automation solution#automation services#automation software#automation#technology#rpa software#robotic process automation#robotic mobile automation#robotic test automation#iborg#iBorg INC

0 notes

Text

Benefits of Automation Software in Key Industries

Automation software can be used to automate mundane tasks, streamline workflows and processes, and increase efficiency and productivity. Automation software helps companies in many different industries save time by eliminating tedious manual data entry tasks, reducing costly errors that would otherwise require manual correction. It also helps to improve customer service by automating customer support responses and communication. Automation software also increases data accuracy by ensuring consistency across all entries, so organizations can have confidence in their records. Finally, automation software can help organizations better understand the needs of their customers and create strategic plans to ensure they stay ahead of the competition.

#robotic automation#automation services#robotic process automation#automation software#iBorg#robotic test automation#automation#automation in banks#automation solution#banking software#iBorg INC

0 notes

Text

How Robotic Process Automation (RPA)can reduce workload in Personal Data Verification?

RPA (Robotic Process Automation) can be used to reduce the workload of personal data verification by streamlining and automating the verification process. RPA can automate the process of verifying personal data such as name, address, date of birth, email address, phone number, and other contact information. This can reduce the amount of manual data entry and reduce the amount of time it takes to complete the verification process. Additionally, RPA (Robotic Process Automation) can be used to automate the process of verifying documents such as passports, driver’s licenses, and other government-issued IDs. This can reduce the time it takes to verify documents as well as reduce the risk of human error.

#rpa#robotic automation#robotic process automation#robotic test automation#automation software#automation services#workflow automation#automation#robotic mobile automation#software#iBorg#iBorg INC

0 notes

Text

Advantage of automation tools instead of a manual approach

Using automated software testing tools can help to speed up the testing process, while providing more accurate and consistent results. Automated tools can also help to identify and eliminate errors more quickly than manual testing, as well as test larger sets of data and data combinations than would be possible with manual testing. In addition, automation tools can be used to repeat tests quickly and easily, allowing for a much faster feedback loop when making changes or improvements to the software. Finally, automated tools can help to reduce the costs associated with manual testing by eliminating the need for manual labor.

#robotic test automation#robotic process automation#automation software#automation in banks#automation#innovation#flexcube bank#iborg#oracle flexcube#banking software#automation solution#robotic automation#automation services

0 notes

Text

What iBorg can Offer ?

The artificial intelligence and machine learning capabilities of iBorg will enable autonomous operational capabilities, freeing employees from repetitive tasks and allowing them to perform more meaningful work. It can operate on a variety of devices, including desktop applications, AS400 screens, multiple web browsers, headless browsers, tablets, and mobile devices.

iBorg provides a comprehensive suite of services that help businesses improve their decision-making processes by providing accurate, reliable information.

iBorg is a leading-edge application for automating business processes and solutions. iBorg is specially developed for the banking and the financial industry with a broader test coverage across multiple systems. Our USP is our one-stop automation tool with additional add-ins and screen recorder with ultimate goal of achieving perfection in automation.

Totally non-invasive automation

Platform agnostic

End to end automation

Communicate with bank users through emails, SMS and WhatsApp

iBorg assists you to implement dependable, cost-effective automation solutions to maximize efficiency for business intelligence data, thereby increasing overall productivity and enhancing user experience by leveraging the power of an exceptional digital transformation.

#robotic process automation#workflow automation#automation services#automation software#oracle flexcube#robotic test automation#robotic mobile automation#automation in banks#automation solution#robotic automation#Banking software#flexcube bank#iBorg#iBorg INC#automation solutions#machine learning#artificial intelligence#digital transformation

1 note

·

View note

Text

Introducing iBorg INC

iBorg Inc is a new-generation automation enterprise set up in Delaware, USA. iBorg is a low-coded automation tool that provides Robotic Process Automation , Robotic Mobile Automation , and Robotic Test Automation using AI and ML technologies in one. iBorg Inc aims to "Make Automation Simple and Accessible for Everyone".

#robotic process automation#workflow automation#automation services#automation software#oracle flexcube#robotic test automation#robotic mobile automation#automation in banks#automation solution#robotic automation#Banking software#flexcube bank#iBorg#IiBorg INC

1 note

·

View note

Text

EOD Process Automation of EOD in Flexcube has been a dream for many. We are glad that iBorg has accomplished their dreams. This can be the first step in your automation journey.

0 notes

Text

TOP 5 RECOGNIZED ORACLE FLEXCUBE IMPLEMENTATION PARTNERS IN BANGALORE

Who introduced FLEXCUBE?

FLEXCUBE is an automated complete core banking software introduced by Oracle Financial Services Ltd. Oracle FLEXCUBE Core Banking Solution offers a unified central flexible understanding that meets the modern necessities of a Bank. It offers customer-based or customer-driven core banking functionalities and ensures and considers the complete opinion of all customers. It also augments the link between bank employees and consumers.

What is the Flexcube Implementation process?

STEP 1: Installation of Oracle Flexcube Universal Banking Solutions

STEP 2: Parameterization of individual modules with particular requirements

STEP 3: Migration from Legacy System to Oracle Flexcube Universal Banking system

STEP 4: Integration of third-party system

STEP 5: Addition of other capabilities like the transactional system and so on.

Who Are The Top 5 Partners of Oracle Flexcube?

1. JMR Infotech: JMR Infotech is one of Oracle’s earliest Platinum Partners in the BFSI space, globally. JMR is now recognized as one of the Important Technology Services companies that concentrate on Digital Transformation for Financial Services. Being a platinum partner, it is one of the Oracle Flexcube Implementation Partner located in Bangalore. JMR revolves its services around providing- Financial Services and Solutions, Digital and Enterprise solutions, and JMR Digital Platforms.

2. FINONYX: Finonyx Software Solutions has its delivery and development hub based out of Bangalore, India, and Subsidiary Office in Dubai, United Arab Emirates. Finonyx is an Oracle Platinum Partner that is focussed on providing services around Oracle financial Services. Focused on IT solutions and application development services for banks and financial institutions across the globe, Finonyx Software Solutions is a trusted Oracle Flexcube Implementation Partner as a Platinum member providing complete consulting, testing, and implementation services for the Oracle FLEXCUBE suite of products.

The services provided by Finonyx are:

Core Banking Transformation

Digital Transformation

Managed Services

Governance Risk & Compliance (GRC) Consulting

Infrastructure Transformation

Custom Development Service

3. TREMPPLIN INFOTECH: Trempplin is an Oracle Gold Partner focused in Oracle FLEXCUBE Implementation, Upgrades, Support, Training, and IT Staff Augmentation Services specializing in Financial Industry. Being an Oracle Flexcube Implementation Partner in Banking and Financial Domain, it provides the following services:

Testing Services

Consulting Management Services

Training services

Application Development

BAU Support

Staffing Services

The Solutions provided by Trempplin are:

Oracle FLEXCUBE Solution

OBDX (Oracle Banking Digital Experience)

Oracle Financial Services Analytical Application (OFSAA)

Digital Marketing

E-Learning Portal

Digitalization of sop’s in Banks

Web Technology

4 SIRMA BUSINESS CONSULTING: Sirma Business Consulting (India) Private Limited has been established in 2015 and is based out of Bangalore. Sirma provides Banking and Financial services that bridge the technology gap with its client-specific and process-oriented approach to transform business digitally. Sirma Business Consulting is an Oracle Flexcube Implementation Partner that provides services around Oracle Flexcube for Core banking implementation, Testing, customizations, Managed services, and various other Flexcube services for banking & financial services, and insurance. Sirma offers a range of Consulting, Testing, RPA, and Managed services which will help banks stay updated with modern technologies. Sirma is an Oracle Gold Partner that provides a range of services such as: https://www.sirmaglobal.com/about-us-flexcube-core-banking-solutions.html

Oracle Flexcube services

Managed Services

Business Intelligence & Data warehousing

Penetration Testing and Ethical Hacking

Testing Centre of Excellence

DataBase Tunning

Business Process Reengineering

Business Intelligence & analytics

Application Development & Maintenance

Database Activity Monitoring

Performance Tuning Services

Database Management Services

IT managed services

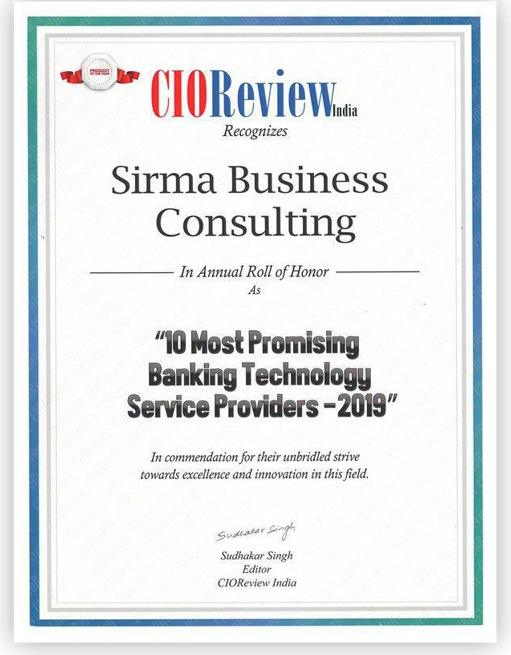

Sirma with its 100+ man-years of experience in implementing Oracle Financial Software Services’ banking products (Oracle FLEXCUBE UBS & Oracle Flexcube Investor Servicing), brings in industries’ best practices and process-oriented approach which makes the implementation process or Managed services easy. Sirma also has a suite of products “ImpactoXgen”. It includes Team Zoid, Trainz, Ambassador Banking, and iBORG. Sirma has also been awarded by CIO Awards as “10 Most Promising Banking Technology Service Providers 2019”.

5. Profinch is established in Bangalore to deliver a complete Banking experience to its customers. Profinch believes in providing a complete 360 Transformation of the Bank. The services it provides are:

Core Banking

Oracle Banking Digital Experience (OBDX)

Oracle Financial Services Analytical Applications (OFSAA)

Infrastructure Services

Digital Transformation

Reporting and Big Data Analytics

Managed Services

Profinch is one of the Oracle Flexcube Implementation Partner. It has two main products- Fincluez Data Hub and Finflowz Digitalization Hub.

What Benefits do Oracle Flexcube Partners get?

Fast implementation of innovation

Increased transaction security

Multidimensional agility

Enhanced connectivity

Reduced risk and improved regulatory compliance.

Reduced operational costs and optimal efficiency

Conclusion

FLEXCUBE Core Banking is planned to revolutionize a bank’s core systems professionally and transmute the bank to a digital connected bank of tomorrow. Being an Oracle Flexcube Implementation Partner is highly beneficial. It helps in the growth and development of the companies. There are many such partners and systems that support Flexcube.

Hope this article was helpful. Please let us know in the comment section below!

0 notes