#FNMA

Explore tagged Tumblr posts

Text

Key Questions to Ask Your Mortgage Lender

When it comes to securing a mortgage, asking the right questions can make a significant difference in your financial future. Understanding the intricacies of mortgage loans can be overwhelming, but arming yourself with the right inquiries can help you navigate the process confidently. Here’s a comprehensive list of questions to consider when speaking with your mortgage lender.

1. What Types of Loans Do You Offer?

Different types of mortgage loans come with varying terms, rates, and conditions. Ask your lender about:

Fixed-rate vs. adjustable-rate mortgages (ARMs): Understand the pros and cons of each.

Conventional vs. government-backed loans: Learn about FHA, VA, and USDA loans and their eligibility criteria.

2. What Are the Interest Rates and APR?

Interest rates can significantly affect your monthly payments and the total cost of the loan. Clarify:

Current interest rate: Is it fixed or adjustable?

Annual Percentage Rate (APR): This includes fees and other costs, giving you a clearer picture of the loan’s total cost.

3. What Are the Closing Costs?

Closing costs can add thousands to your mortgage. Inquire about:

Estimated closing costs: Request a detailed breakdown.

Who pays closing costs: Understand if the seller might cover some costs.

4. What Is the Loan Term?

The loan term can greatly impact your financial obligations. Ask about:

Common loan terms: Typically 15, 20, or 30 years.

Prepayment penalties: Are there fees if you pay off your mortgage early?

5. What Is the Down Payment Requirement?

The down payment can influence your loan options and monthly payments. Discuss:

Minimum down payment: For conventional loans, this can vary significantly.

Private Mortgage Insurance (PMI): If your down payment is less than 20%, will you need PMI?

Conclusion

Choosing a mortgage is a significant financial commitment, and asking the right questions can help you make an informed decision. Before you sign on the dotted line, ensure you fully understand the terms and conditions of your loan.

A good mortgage lender will appreciate your inquiries and be eager to help you find the best mortgage solution for your needs. Take your time, do your research, and don’t hesitate to seek clarification on anything you find unclear. Your future self will thank you!

Contact me today to begin your homeownership journey.

Lanny Mixon, NMLS# 2450250

Private Mortgage Advisors, LLC

312 Hemphill St.

Hattiesburg, MS 39425

601-480-9659

Click Here to Apply

#home mortgage#first time home buyer#home loans#mortgage#fha loans#mortgage lending#usda loans#va loans#home buyers guide#home equity loan#FNMA#FHLMC

1 note

·

View note

Text

Federal National Mortgage Association (Fannie Mae) recently released its financial results for the October to December 31, 2023 period, revealing a combination of both positive and negative outcomes. These results provide insights into the companyns performance during the specified timeframe and shed light on future prospects.Revenue Growth:Fannie Mae witnessed a notable revenue increase of 95.908% during the October to December 31, 2023 period, reaching $7.56 billion. This surge is impressive, especially when compared to the $3.86 billion generated during the same period the previous year. However, it is worth noting that revenue declined by -13.564%, from $8.75 billion in the prior financial reporting period.Net Earnings and Shortfall:Unfortunately, Fannie Mae experienced a significant decline in net earnings during the Q4 2023 period. Net earnings dropped by -88.01% to $171.000 million, compared to $1,426.000 million gener https://csimarket.com/stocks/news.php?code=FNMA&date=2024-02-15162416&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

FNMA ie Fannie Mae rate forecast end of year 2026 5.875%.

Fannie Mae lowered their rate forecast for 2025 to 6.2% to 6.1% and for end of year 2026 from 6% to 5.8%. There are more than 4M borrowers with rates over 7% right now so this is welcome news. We can get you pre-qualified and ready to go when rates start dropping. Soft credit pull http://www.YourApplicationOnline.com Housing report Case-Shiller Home prices rose 3.4% year over year. What’s…

View On WordPress

0 notes

Text

Trump "Gives very serious consideration" to relax the US grip on Fannie and Freddie

President Trump had just noted that the federal government's grip on Freddie Mac's mortgage giants could (Fmcc) and Fannie Mae (Fnma), which would expire One of the oldest fights on Wall Street. “I give very serious consideration to bring Fannie Mae and Freddie Mac publicly,” Trump wrote actually social post Wednesday evening. Fannie and Freddie all play central roles at the US Housing Market, by…

0 notes

Text

Trump "Gives very serious consideration" to relax the US grip on Fannie and Freddie

President Trump had just noted that the federal government's grip on Freddie Mac's mortgage giants could (Fmcc) and Fannie Mae (Fnma), which would expire One of the oldest fights on Wall Street. “I give very serious consideration to bring Fannie Mae and Freddie Mac publicly,” Trump wrote actually social post Wednesday evening. Fannie and Freddie all play central roles at the US Housing Market, by…

0 notes

Text

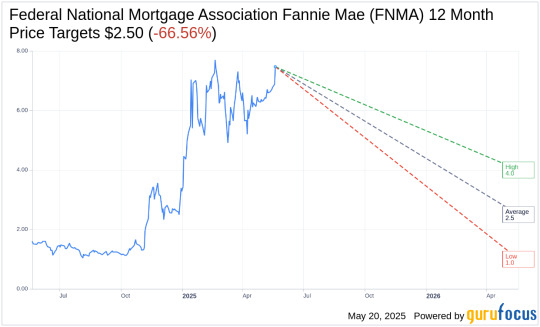

Fannie Mae (FNMA) Shares Jump on Savings Discovery by FHFA

Key Highlights: Fannie Mae’s stock rose 7.3%, driven by savings identified by the Federal Housing Finance Agency. Analysts forecast a potential downside with an average price target of $2.50 for the stock. Consensus brokerage recommendation indicates “Underperform” status for Fannie Mae. Fannie Mae (FNMA, Financial) experienced a notable 7.3% increase in its stock price, following reports that…

View On WordPress

0 notes

Text

Debate sugere mudanças no projeto sobre multas ambientais e bens apreendidos

News https://portal.esgagenda.com/debate-sugere-mudancas-no-projeto-sobre-multas-ambientais-e-bens-apreendidos/

Debate sugere mudanças no projeto sobre multas ambientais e bens apreendidos

A destinação do dinheiro arrecadado com multas ambientais em todo o país dividiu opiniões de especialistas em debate no Senado nesta semana. A cobrança dessas multas gera aos cofres públicos federais milhões de reais todos os anos. Atualmente, parte das multas vai para o Fundo Nacional do Meio Ambiente (FNMA), independentemente de onde ou de quem cometeu o crime ambiental. Mas outras áreas também recebem recursos, como a Defesa Civil. Quanto aos bens apreendidos, na maioria dos casos, eles são doados, revertidos ao poder público ou destruídos pelos órgãos ambientais.

Para a maioria dos especialistas ouvidos pelo Senado, o projeto de lei que altera essas regras com o objetivo de beneficiar os cofres municipais precisa de modificações. Alguns deles chegaram a sugerir o arquivamento da proposta que prevê a destinação de 50% das multas para os fundos municipais de meio ambiente.

O PL 5.142/2019 tem como autor o senador Zequinha Marinho (Podemos-PA). Ele afirma que as multas aplicadas e os equipamentos apreendidos acabam nas mãos da União e não chegam a compensar os municípios nem as populações mais prejudicadas. São muitos os tipos de crimes ambientais que ocorrem no Brasil cotidianamente, como destruição de matas nativas, contaminação de fontes e cursos de água, atividades de garimpo em áreas de preservação e exploração clandestina de madeira.

Os especialistas foram ouvidos pela Comissão de Meio Ambiente (CMA) do Senado na quarta-feira (7), em reunião conduzida pela senadora Eliziane Gama (PSD-MA), relatora do projeto.

— É fundamental a gente ouvir as autoridades, quem tem conhecimento na área, porque nos ajuda na formulação do nosso relatório. Eu tenho, na verdade, a honra de trabalhar essa pauta ambiental dentro do Senado Federal. Portanto, as contribuições de todos serão fundamentais para a finalização do nosso relatório — disse Eliziane ao final da audiência pública.

Órgãos ambientais

O diretor de Proteção Ambiental do Ibama, Jair Schmitt, manifestou-se radicalmente contra o projeto por entender que a mudança pode prejudicar o trabalho dos órgãos ambientais. Ele afirmou que o Brasil vive há alguns anos “um momento bastante crítico do ponto de vista ambiental”. Destacou que a crimes ambientais estão em crescimento no país e que muitos desses crimes são comandados por grupos criminosos organizados. Ele informou que a atual legislação já permite que recursos do FNMA sejam repassados a estados e municípios em determinados casos.

Schmitt lembrou que o município tem o dever de fiscalizar e impedir infrações ambientais. Mas afirmou que muitas prefeituras não o fazem, o que obriga o Executivo federal a agir. Ele também afirmou que o Ibama já destina bens apreendidos a municípios de maneira rotineira.

De acordo com o projeto em análise na CMA, os recursos arrecadados seriam destinados ao fundo municipal ambiental da cidade em que o crime ocorreu. Se o município não tiver esse fundo, o dinheiro poderá ser depositado no respectivo Fundo Municipal de Assistência Social. Cerca de 40% dos municípios brasileiros não têm o Fundo Municipal de Meio Ambiente, o que acabaria levando os recursos para outras áreas não ambientais.

— A aplicação desses recursos em fundos municipais estimula a pulverização, a fragmentação de políticas públicas, e isso acaba dificultando a geração de impactos de resultados significativos em prol do meio ambiente. (…) Tem um outro fator, a dificuldade de controle e uso desse recurso, seja pela estrutura administrativa desses municípios, principalmente os menores, mas também em relação ao controle, transparência e fiscalização do uso correto desses recursos em prol do meio ambiente — disse Schmitt.

Simone Nogueira dos Santos, coordenadora-geral de Proteção do Instituto Chico Mendes de Conservação da Biodiversidade (ICMBio), também posicionou-se contrária ao projeto. Ela afirmou que a Lei de Crimes Ambientais já prevê que valores arrecadados em pagamentos de multas por infração ambiental podem ser revertidos ao Fundo Nacional do Meio Ambiente, ao Fundo Naval, ao Fundo Nacional para Calamidades Públicas, Proteção e Defesa Civil, e aos fundos estaduais e municipais de meio ambiente.

Para ela, a mudança proposta no projeto pode enfraquecer a atuação fiscalizatória dos órgãos ambientais federais e o combate aos ilícitos.

— O ICMBio busca garantir a finalidade ecológica e preventiva da lei de crimes ambientais e a gente se coloca hoje como interessados para que haja um veto integral da proposta do projeto de lei, dadas as inconsistências que nós observamos na proposta inicial, e nos colocamos à disposição para respondermos aos questionamentos que se fizerem necessários — disse a coordenadora-geral de Proteção do ICMBio.

Municípios

Em contraponto, Raquel Martins da Silva, da Confederação Nacional dos Municípios (CNM), posicionou-se favorável ao projeto e lembrou que, de acordo com a Constituição Federal, cabe aos municípios, de forma compartilhada com a União e os estados, proteger o meio ambiente e combater a poluição. Ela disse que cerca de 70% dos municípios brasileiros não têm recursos para promover ações ambientais.

— A União precisa contribuir para auxiliar os municípios na missão de tornar o território mais sustentável e resiliente. Porém, de acordo com levantamento realizado pela confederação, dos R$ 46 bilhões executados pelo MMA de 2002 a 2024, apenas R$ 291 milhões foram destinados aos municípios, ou seja, menos de 1% — disse ela.

Com isso, avaliou a debatedora, os municípios têm dificuldades em executar as obrigações municipais ambientais, como fiscalização, arborização urbana, ações de adaptação climática, ampliação de áreas verdes, proteção de nascentes, entre outras.

— É importante encontrar mecanismos de financiamento para a gestão ambiental municipal, como sugerido no projeto de lei aqui apresentado, principalmente porque, com uma gestão eficiente, os municípios poderão realizar as suas obrigações de forma eficiente, incluindo ações de educação ambiental e soluções baseadas na natureza. Isso contribui diretamente para lidar com as mudanças climáticas (…). O projeto de lei representa uma demanda urgente e um avanço importante, pois oferece condições concretas, para que os entes mais impactados, que são os municípios, possam atuar de forma mais efetiva. Isso significa ampliar a capacidade de fiscalização, fortalecer as estruturas locais e responder com mais eficiência aos desafios ambientais — afirmou Raquel Silva.

Também participaram da audiência pública Alex Fernandes Santiago, promotor do Ministério Público de Minas Gerais; Fábio Ishisaki, advogado, professor de Direito Ambiental e integrante do Observatório do Clima; Marco Aurélio Villar, presidente da Associação Paraibana da Advocacia Municipalista; e Wallace Rafael Rocha Lopes, diretor da Associação Nacional dos Servidores da Carreira de Especialista em Meio Ambiente.

O presidente da CMA é o senador Fabiano Contarato (PT-ES), a vice é a senadora Leila Barros (PDT-DF). A audiência pública foi requerida por Leila, Eliziane, Tereza Cristina (PP-MS) e Marcio Bittar (União-AC).

0 notes

Text

How has international talent shaped the growth of Silicon Valley?

COMMENTARY:

Nixon’s banking and securities policies were far more instrumental in actually creating Silicon Valley than the players who ended up exploiting the opportunity he created, These policies were part of the “financialization” elements of the Nixon-Daniel Patrick Moynihan civil rights component of their Affirmative Action program created to comple Phase 2 of Eisehnower’s 1956 Presidential Platorm conceived by Eisenhower and Werner von Braun at Columbia University to transform the Military Indusrial Complex to the Aerospace-Entrepreneurial Matric necessary to sustain a lunar colony with a Trump Interstellar Hotel for 100 years, if not forever.

Players like Peter Thiel and Elon Musk from the Stanford-Silcon Valley ais of Project 2025 Oligarchs like to believe they created Silicon Valley, but they are basically like teenagers who believe they invented sex. The vact is that, as a consequence of Nixon’s China Policy, Moa adopted the Harvard MBA business model and Nixon-Moynihan finanncialization for the transformation fo the failing Sino-Soviet Maxism to something approaching Vietnam’s current Free Enterprise Marxism, which has fully integrated financialization at all strata of their economy,

When i got back from Vietnam in 1971, I went to work for a commercial bank in DC and was witness to the implemenation of financialization as a practical issue, This included FNMA and FreddieMac and other elements of the policies, At the time, there was an expressed resistance to these policies by the sebuir wgute Wasbubgtib estabkusgnebt load officers who were benefiting form the structural red-lining in 76% of the District of Columbia. At the time, I was a junior analyst in the headquartes located 13 blocks from where the burning from the MKD assassination stopped. Somehow, these white Georgetown particans couldn’t make the connection between their Jim Crow banking policies and the racial dystopia it creaated, As it turns out, all of these white bankers were like Peter Thiel and Eon Muxk and benefiting directly form Nixon’s Banking and Securitis policies.

However, they benefited even more directly when what has become project 2025 in the Reagan adminisration passed the criminal Marxist construct, Supply Side economics, into law with Bod Dole’s 1986 rax reorms and began to dismantle not just Affirmative Action but the New Hdeal, The historically unprecendent transfer of wwalth from the American middle class to the Oligarch strata of the economy with the Resolution Truxt Corporation was the first really big pay off for the John Birch society by vacating several strata of wealth, incluidnt the George Bailey S&L component of Eisehnowers’ economic model and Nixon-Moyniah financialization The current housing crises is a direct consequece of Dole’s legislation, which was componded by the Bush/Cheney Supply Side polices that led to the 2008 mortgage crises.

Here’s the thing: Donald Trump was at the leading edge of Carter’s domestic program in 1981 and was a cunt hair away from creating the national mobilization necessary to convert the Eisehnower-Reagan Star Wars economics into the Stardhip Capitalism of 2001:! Space Odyssey Without Stuaart Eizenstadt, Trump Tower would not have happened, but Eizenstadt recognized that the Trump Tower could lead nyc out of its slough of despond and bankfuptcy like an anchor store in a regional mall,

And it worked, In 1980, I was consulting to the South Bronx Community Developmeht Corporation in the neighborhood where the Clinton Foundation is currently located. The 22 projects Trump mobleted with Barbara Res had a shole lot more to do with the Big Apple’s response to 911 than anything Rudy Juliani povided besides being in office when it happened. In 1986, Trump was at the leading edge of Reagan’s New Federalism, which was the final structure of Phase 2 of Eisehower’s 1956 Presidential Platform, and was a cunt hair away from being the seed crystal to the general mobilazation for the Starship Capitalism of 2001: A Space Odyssey, If you replace the Pan Am logos for spacex, that’s where the workd would be today except for the vriminal Marxist construct of Supply Side economics and the nazification agenda of Porject 2025.

Here’s the thing: every time these dumb shit asshole Peter Thiel/Elon Muxk Oligarchs fuck with nixon’s banking and securitis polices, something like the Silicon Valey Bank blowing up happens or the Bush.Cheney 2008 mortgage crises, And the manifest agenda of Porject 2025 is to create the outcome of Atlas Shrugged in order to devastate the social and economic enterprise of American in order to acquire it as salvage. For example, the current burn pattern in Califonia is a direct consequence of Grover Norquist’s “starve the Beast” strategy as part of the Project 2025 naxification agenda.

I mean, before this currect fire season began, the mayor was having to make budget cuts to the Fire Department in ofder to finance the tax subsidies to Peter Thierl, Elon Musk, Jeff Bezos and thw whole band of idiots at Project 2025, If you have a friend who has lost a home, tell them to thak Grover Norquist .

The good news iis that implementing Senator Elizbeth Warren’s banking and security reforms more of less whole cloth will restore the America banking and seucrity system to is vigor before Bob Dole’s 1986 Tax Reform Ant Trump’s most imporatn Presidential legacy from his first term, th US Space Force, completed the exxential executive structure to the New Fedaralism of Phase 2 of Eisenhoser-Reagan New Federalism. All we need now is the general mobilization like after Pearl Harbor to complete the transformation of th Star Wars economcs Reagan inherited to the Starship Capialism required to fullfill Elon Musk’s wet dream of a Mars colony,

He;s too stupid to realiaze that the moon is to Mars what Britain was to D-day and VE Day.

The short answere is that international talent has enriched the culture of America and Silicon Valley, but the strategic structures of the adult leadership of Eisenhoser, Nixon and Moynihan created Silicon Valley These are all poeple who thought in terms of Hegel and Clausewitz.

Currently the only person inside the Beltway besides the Army War College who thinks in terms of Cluaewith is Ltc Tulsi Gabbard. People like Hegseth, Tuberville, and Tom Cotton don’t quite rise to the level of By Shouts.

0 notes

Text

youtube

From analyzing comparable sales to estimating construction costs and future income potential, there are techniques that offer powerful insights into real estate valuation.

Today's Stocks & Topics: GEV - GE Vernova Inc., Market Wrap, FNMA - Fannie Mae, How to Accurately Value Real Estate: 3 Proven Strategies for Investors, RDDT - Reddit Inc., ONON - On Holding AG, Headlines, TMDX - TransMedics Group Inc., TWLO - Twilio Inc. Cl A, TSLA - Tesla Inc.

Video Content Details

00:00 Intro 00:22 How to Accurately Value Real Estate: 3 Proven Strategies for Investors 07:00 MARKET WRAP 10:45 GEV 13:29 FNMA 16:10 RDDT 17:45 ONON 19:58 Headlines 26:58 TMDX 29:56 TWLO 31:31 TSLA

Call 888-99-CHART to hear your questions answered live.

0 notes

Text

$FNMA: Fannie Mae shares soared 24.4% to $4.23 after federal agencies revealed a privatization path.

0 notes

Text

$GME #SP500 #NASDAQ #SPX $ENJ-USD

--- Market Turmoil: Major Indices Sink Amid Earnings Disappointments and Economic Concerns In a stark reminder of the market's volatile nature, Wall Street has taken a significant hit today, Wednesday, September 11, 2024. As the dust settles, investors are left pondering the implications of a multifaceted economic landscape. Among the standout sufferers are GameStop Corp (GME) plummeting by a staggering -15.51%, Federal National Mortgage Association (Fannie Mae) (FNMA) down -9.45%, and Humana Inc. (HUM), declining by -5.29%. Earnings Reports and Economic Data Weigh on Market Sentiment The day began on a somber note as the U.S. Department of Labor released its Consumer Price Index (CPI) report for August 2024. The figures reflect persistent inflationary pressures, exacerbating investor concerns and contributing to the market selloff. Earnings reports further painted a gloomy picture, impacting several major players. Among the decliners, Coinbase Global Inc. (COIN) slid -4.90%, while Rockwell Automation Inc. (ROK), Carmax Inc. (KMX), and Whirlpool Corp. (WHR) declined by -4.55%, -4.50%, and -4.35% respectively. Bright Spots Amid the https://csimarket.com/news/news_markets.php?date=2024-09-11T14572&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

Difficulty branży nieruchomości Oszustwa hipoteczne

Problem branży nieruchomości – Oszustwa hipoteczne

Oszustwa hipoteczne mogą w dalszym ciągu nękać branżę nieruchomości. Być może widzę jedynie twenty% oszustw związanych z nieruchomościami/mieszkaniami, zgodnie z definicją Federalnego Biura Śledczego.

Powody, dla których oszustwa hipoteczne mogą trwać:

1) Rosnące koszty mieszkań i „amerykański Marzenie” o posiadaniu własnego domu.

2) Licencjonowanie agentów nieruchomości i brokerów kredytów hipotecznych jest zbyt łatwe. Wymogi dotyczące licencjonowania muszą wymagać wyższego poziomu wykształcenia, wyższego niż dyplom ukończenia szkoły średniej, jako warunku wstępnego uzyskania licencji, oraz bardziej rygorystycznych wymogów licencyjnych, takich jak szersza edukacja przed uzyskaniem licencji i trudniejsze testy. Spowoduje to, że lepsi ludzie i mniej osób będzie rozpoczynać pracę w branży nieruchomości.

3) Kredytodawcy muszą oferować mniej softwareów pożyczkowych, na przykład pożyczki z określonym dochodem (niektórzy nazywają to pożyczkami z zawyżonym dochodem) i brak dokumentów (brak pożyczki dokumentacyjne).

4) Większość pożyczkodawców wymaga formularza IRS (Inside Earnings Assistance) 4506 w momencie zamknięcia. Jest coś, o co ubezpieczyciel lub pożyczkodawca może poprosić o informacje i zatrzymać zawyżony (czyli stwierdzony) wniosek o kredyt hipoteczny o zawyżonym dochodzie. Jeśli kłamią w zeznaniu podatkowym, czy jest możliwe, że kłamią we wniosku o kredyt hipoteczny?

5) Brak methodów edukacyjnych w branży nieruchomości pozwalających zidentyfikować oszustwa hipoteczne – może to być pobożne życzenie ze względu na politykę prywatności Działaj – ale przynajmniej na początek. Miejsce, w którym osoby fizyczne i profesjonaliści mogą zgłaszać przypadki podejrzeń oszustw hipotecznych odpowiednim organom ścigania.

6) Method raportowania i punktacji kredytowej wymaga gruntownego przeglądu. Zbyt często znajduję błędy w raportach kredytowych, gdy kredytodawca nie przekazuje terminowych i dokładnych informacji. Na przykład klient w pełni rozliczył swoją akcję windykacyjną w drugiej połowie lutego 2006 roku. Pod koniec kwietnia firma windykacyjna nadal wykazuje część konta jako niezapłaconą z aktualną datą. Tak, zgłosili płatność, ale nie usunęli wynegocjowanej części salda.

7) Brak punktów kontrolnych w istniejącym systemie.

Co można zrobić, aby ograniczyć oszustwa hipoteczne:

/>1) Więcej kontroli i równowagi w systemie w celu identyfikacji potencjalnych sytuacji oszustw hipotecznych.

youtube

2) Więcej edukacji dla wszystkich profesjonalistów z branży nieruchomości – agentów nieruchomości, pośredników w obrocie nieruchomościami, ubezpieczycieli, pożyczkodawców itp.

3) Wyższe wymagania licencyjne dla wszystkich. Oraz wymogi licencyjne tam, gdzie obecnie nie są wymagane żadne licencje.

4) Wdrożenie systemu ochrony „sygnalistów” i infolinii telefonicznej.

5) Proaktywne działania zapobiegawcze ze strony pożyczkodawców.

6) Wykonanie sekcji IX – „POTWIERDZENIE I UMOWA” znajdującej się na stronie three jednolitego wniosku o pożyczkę mieszkaniową (FNMA 1003):

„Każdy z niżej podpisanych wyraźnie reprezentuje https://exaro.pl/ Kredytodawcę oraz rzeczywistych lub potencjalnych agentów, brokerów, brokerów, Kredytodawcy, podmiotom przetwarzającym, prawnikom, ubezpieczycielom, podmiotom obsługującym, następcom i cesjonariuszom oraz zgadza się i potwierdza, że: (1) informacje podane w niniejszym wniosku są prawdziwe i prawidłowe na

0 notes

Text

Great News! FHFA has announced higher 2024 Conforming Loan Limits. We are increasing the loan limit for FNMA loans to $766,550 on new originations for Conventional loans.

0 notes

Text

Mbs Pool Number: What It Is, How It Works

What Is an MBS Pool Number?

An MBS Pool Number, or Mortgage-Backed Security Pool Number, is a unique identifier assigned to a specific pool of mortgage loans that have been bundled together and securitized into a mortgage-backed security (MBS). These numbers are used to track and differentiate the various pools of mortgages that are packaged into MBSs, making it easier for investors and market participants to identify and trade these securities.

Here's a bit more detail on MBS Pool Numbers:

Creation of Mortgage-Backed Securities (MBS): Financial institutions, such as government-sponsored entities like Fannie Mae or Freddie Mac or private issuers, bundle together a large group of individual mortgage loans to create an MBS. These loans can vary in terms of interest rates, loan amounts, maturities, and other characteristics.

Securitization: The pool of mortgages is then securitized, which means they are transformed into tradable securities. These securities represent a share of the cash flows generated by the underlying mortgages, including principal and interest payments from homeowners.

MBS Pool Number Assignment: To uniquely identify each pool of mortgages, an MBS Pool Number is assigned. This number typically contains information about the issuer, issue date, and other relevant details. The structure of the Pool Number may vary between issuers, but it always serves the purpose of distinguishing one MBS pool from another.

Trading and Reporting: MBS Pool Numbers are essential for trading and reporting in the secondary mortgage market. Investors and traders can use these identifiers to buy and sell specific MBSs. Additionally, they help in accurately tracking the performance and payment distributions of individual MBS pools.

Investor Payments: Investors who hold MBS securities receive payments based on the cash flows generated by the underlying mortgage pool. These payments include both principal repayments from homeowners and interest income. The MBS Pool Number ensures that the correct payments are distributed to the appropriate MBS investors.

In summary, an MBS Pool Number is a unique identifier used to distinguish and track specific pools of mortgage loans that have been bundled together and securitized into mortgage-backed securities. It is a critical component of the secondary mortgage market, facilitating trading, reporting, and risk assessment for investors and other market participants.

Understanding an MBS Pool Number

An MBS (Mortgage-Backed Security) Pool Number is a unique alphanumeric identifier that is assigned to a specific pool of mortgage loans that have been bundled together and securitized. These pool numbers are used to differentiate and track individual MBS pools in the secondary mortgage market. Here's a breakdown of how to understand an MBS Pool Number:

Unique Identifier: An MBS Pool Number is a unique combination of letters and numbers that distinguishes one pool of mortgage loans from another. It is similar to a serial number or barcode and serves as a specific identifier for that particular MBS pool.

Issuer Information: Typically, the MBS Pool Number includes information about the issuer of the MBS. This may include abbreviations or codes that represent the entity or institution that created the MBS. For example, "FNMA" might represent Fannie Mae.

Issue Date: The MBS Pool Number often contains information about the issuance date of the MBS. This can help investors and market participants track when the MBS was created.

Additional Information: Depending on the issuer and specific MBS, the pool number may also include other details or codes that provide additional information about the pool. This could include details about the type of mortgages in the pool, the geographic region they cover, or other relevant characteristics.

Example: An example of an MBS Pool Number might look something like this: "FNMA 2023-10-01 A1." In this example:

"FNMA" represents Fannie Mae, the issuer.

"2023-10-01" signifies the issue date, which is October 1, 2023.

"A1" could represent additional details about the pool, such as its series or class.

Importance: MBS Pool Numbers are crucial in the secondary mortgage market because they help investors and market participants identify and trade specific MBS pools. They also play a role in tracking the performance of these pools, including the distribution of principal and interest payments to investors.

Trading and Reporting: When MBS securities are bought and sold, the MBS Pool Number is used to ensure that the correct securities are traded. It's also used for reporting purposes to track the performance and characteristics of different MBS pools.

In summary, an MBS Pool Number is a unique identifier that contains information about a specific pool of mortgage loans that have been securitized into an MBS. This identifier is used to distinguish and track MBS pools, making it easier for investors and market participants to trade, report, and analyze these securities in the secondary mortgage market.

MBS Pool Numbers vs. CUSIP Numbers

MBS Pool Numbers and CUSIP (Committee on Uniform Security Identification Procedures) numbers are both unique identifiers used in the financial industry, but they serve different purposes and are associated with different types of financial instruments. Here's a comparison between MBS Pool Numbers and CUSIP Numbers:

MBS Pool Numbers:

Associated with MBS: MBS Pool Numbers are specifically associated with Mortgage-Backed Securities (MBS). They are used to identify and track pools of mortgage loans that have been bundled together and securitized.

Issuer-Specific: MBS Pool Numbers are often issuer-specific. Different issuers of MBS (such as Fannie Mae, Freddie Mac, or private entities) may have their own numbering systems or conventions for MBS Pool Numbers.

Include Issuer and Issue Date: MBS Pool Numbers typically include information about the issuer of the MBS and the issue date, allowing for easy identification of the originator and when the pool was created.

Used in Mortgage Market: MBS Pool Numbers are primarily used in the secondary mortgage market for trading, reporting, and tracking the performance of MBS pools.

CUSIP Numbers:

Broad Application: CUSIP numbers are used for a wide range of financial instruments, not limited to MBS. They can be associated with stocks, bonds, mutual funds, and other securities.

Standardized Format: CUSIP numbers follow a standardized format, consisting of nine characters (letters and numbers) that uniquely identify a security. The first six characters identify the issuer, while the last three represent the specific security.

No Information about the Asset: CUSIP numbers do not inherently contain information about the underlying asset or security. They are purely identifiers.

Used for Trading and Record-Keeping: CUSIP numbers are used for trading, clearing, and settlement of securities. They also help with record-keeping, compliance, and reporting in the financial industry.

In summary, while both MBS Pool Numbers and CUSIP Numbers are unique identifiers, they are used for different types of financial instruments and serve distinct purposes. MBS Pool Numbers are specific to Mortgage-Backed Securities and provide information about the MBS pool itself, while CUSIP Numbers are more general and are used for a wide range of financial securities to facilitate trading and administrative functions.

Special Considerations

It seems like you're looking for information on "special considerations" in a financial or investment context. Special considerations can refer to various factors or circumstances that investors and financial professionals need to take into account when making investment decisions or managing portfolios. Here are some common special considerations:

Risk Tolerance: Assessing an individual's or institution's risk tolerance is a fundamental special consideration. It involves evaluating how much risk an investor is willing and able to tolerate. This consideration is crucial for determining an appropriate investment strategy and asset allocation.

Time Horizon: An investor's time horizon is another important factor. It refers to the length of time an investor expects to hold an investment before needing to access their funds. The time horizon can influence the choice of investments and asset allocation.

Liquidity Needs: Investors may have short-term liquidity needs or obligations, such as upcoming expenses or debt payments. Ensuring sufficient liquidity to meet these needs is a special consideration.

Tax Considerations: Taxes can significantly impact investment returns. Special attention should be given to strategies that minimize tax liabilities, such as tax-efficient investing, tax-deferred accounts, and tax-loss harvesting.

Diversification: Diversifying a portfolio by spreading investments across different asset classes can reduce risk. Special consideration is given to diversification to achieve the right balance between risk and return.

Specialty Investments: Some investors may have specific preferences or values that lead them to consider specialty investments, such as socially responsible investments (SRI) or environmental, social, and governance (ESG) investments.

Market Conditions: Current market conditions, economic indicators, and trends should be considered when making investment decisions. Special attention to market volatility, interest rates, and inflation can impact investment strategies.

Regulatory Changes: Changes in regulations and tax laws can affect investment decisions. Staying informed about regulatory developments is essential.

Financial Goals: Investors may have different financial goals, such as retirement planning, education funding, or buying a home. Special consideration is given to aligning investment strategies with specific goals.

Currency Risk: For international investments, currency fluctuations can impact returns. Special consideration is given to managing currency risk.

Emerging Trends: Staying informed about emerging investment trends, such as blockchain technology, renewable energy, or biotechnology, can be a special consideration for investors looking for growth opportunities.

Estate Planning: Investors with significant wealth may need to consider estate planning strategies to transfer assets to heirs efficiently.

Ethical and Social Considerations: Some investors may have ethical or social considerations when choosing investments. They may avoid industries or companies that conflict with their values or seek out those that align with them.

Geopolitical Risks: Geopolitical events, such as conflicts or trade tensions, can impact financial markets and investments. Special consideration should be given to assessing geopolitical risks.

It's important for investors and financial professionals to thoroughly assess these special considerations to make informed and suitable investment decisions that align with their goals, risk tolerance, and circumstances. Additionally, consulting with financial advisors or professionals can provide valuable guidance in navigating these factors.

Read more: https://computertricks.net/mbs-pool-number-what-it-is-how-it-works/

1 note

·

View note

Text

THE DBEX-COIN SCAM EXPOSED: THE DARK SIDE OF CRYPTOCURRENCY

Dbex-Coin is an online brokerage firm that promises to provide its clients with the best trading experience in the market. However, several red flags suggest that this platform may not be trustworthy. This article will review and explore why this broker may be a scam.

Company Overview

Dbex-Coin is an online trading platform that allows users to trade a variety of financial instruments, including forex, cryptocurrencies, and commodities. The company is based in the UK and claims to have a team of experienced professionals who provide excellent customer service.

Broker Name: Dbex-Coin

Website: https://dbex-coin.net

Location: Unspecified

Regulation: Not Regulated

Reviews: Negative

TEAM

They claim to have a team of experienced professionals who provide excellent customer service. However, the company does not provide any information about its team members on its website, which is a red flag.

SERVICES OR PRODUCTS

They provide trading services for various financial instruments, including forex, cryptocurrencies, and commodities. The company offers competitive spreads, low commissions, and fast execution times.

TRADING PLATFORMS

Dbex-Coin offers its clients access to the popular MetaTrader 4 (MT4) trading platform. Dbex-Coin only offers MT4 may limit the options of traders who prefer other trading platforms. We also have not found any demo account or demo for this platform.

License and Regulations

LICENSE STATUS

They claim to be registered and regulated by the Financial Conduct Authority (FCA) in the UK. However, a search on the FCA website reveals that Dbex-Coin is not licensed by the regulator.

REGULATION STATUS

The lack of a license from the FCA raises severe concerns about the legitimacy of Dbex-Coin. We also tried with FNMA and other organizations, but there were no results.

You also can go through our other scammer lists such as the SEC Blacklisted Companies, FCA Unauthorised Firms List, ASIC Blacklisted Companies, & Bank Guarantee/SBLC Review.

Why Dealing With Unlicensed Brokers Is Risky?

Trading with unlicensed brokers is risky because rules or regulations do not bind these companies. This means they can engage in fraudulent activities, such as manipulating prices, misusing client funds, and refusing to process withdrawals. If you trade with an unlicensed broker, you risk losing your entire investment.

LEGAL WARNINGS AGAINST DBEX-COIN

Several financial regulators have issued warnings against them. For example, the Australian Securities and Investments Commission (ASIC) has warned that Dbex-Coin is not licensed to provide financial services in Australia. The Financial Supervision Authority (FSA) in Estonia has also issued a warning against the company.

Client Feedback About Dbex-Coin

ABOUT TRADING

Dbex-Coin claims to offer competitive spreads, low commissions, and fast execution times. However, the lack of transparency about the company’s ownership and operations raises severe concerns about the legitimacy of its trading services.

ABOUT CUSTOMER SERVICE

This company claims to have a team of experienced professionals who provide excellent customer service. However, the fact that it does not provide any information about its team members on its website suggests that this claim may not be accurate.

How Can Reviewsadvice Help You If You Get Scammed?

If you have been scammed by Dbex-Coin or any other online brokerage firm, Reviewsadvice can help you recover your funds. You can submit your scam case to us. We will then provide a free consultation and service recommendations to help you recover the lost fund.

Final Thoughts

Dbex-Coin is an online trading platform that claims to offer competitive trading services for various financial instruments. However, the lack of transparency about the company’s ownership and operations, combined with the fact that any reputable financial regulator does not license it, raises serious concerns about its legitimacy. If you are considering trading with Dbex-Coin, we strongly advise you to reconsider and choose a licensed and regulated broker instead.

0 notes

Photo

Fannie, Freddie Earnings Improve Amid Signs of Housing-Market Recovery Government-controlled mortgage giants Fannie Mae and Freddie Mac said their earnings improved in the second quarter, adding to evidence of a rebound in the U.S.

#banking#corporate#credit#earnings#Fannie Mae#financial performance#financial services#FMCC#FNMA#Freddie Mac#general news#health#industrial news#infectious diseases#medical conditions#mortgage planning#mortgage refinancing#mortgages#National Association of Realtors#novel coronaviruses#personal finance#political#property#real estate#real estate credit#respiratory tract diseases#trends

0 notes