#usda loans

Text

For people wanting to own a house in country places, the USDA Home Loan program is like an awesome chance that only opens for them. It helps such folks reach their dream of becoming homeowners. This blog focuses on key aspects, benefits, and requirements for securing a USDA home loan, aiding home buyers in rural or small areas.

#property#real estate#united states#gustancho associates#gca mortgage#usa#va loans#fha loan#first time home buyer#bad credit score#usda loans#fha loans

2 notes

·

View notes

Text

Veterans and eligible service members may have the challenging task of finding which loan programs are right for the first-time home buyer process. While various options exist, The VA Loans stands out with its unique features and potential benefits. But how does it stack against conventional, FHA, and other loan programs? In this article you will learn the intricacies of VA loans, comparing them to other options and helping you to right choice for your dream home.

#loans#refinances#mortgage#mortgages#usa#real estate#fha loans#va loans#united states#gustancho#usda loans#loan programs#conventional loans#bad credit loans

0 notes

Text

Buying a Home in Atlanta

It’s Your Time to Buy, Sell, Build or Invest and we will be with you every step of the way.

We are Offering a Realtor Credit up to $1500 on New Construction Homes!

GA:678.278.9511 NC:336.638.1299

Email:[email protected]

We offer you 14 Years of Experience!

We also do Mortgage Loans to give you a one stop option!

We have access to Amazing Loan Programs including Down Payment Programs,…

View On WordPress

#Atlanta Agent#Atlanta Homes#Atlanta Realtor#Boost Credit#Buying a Home in Atlanta#Chenoa Program#Down Payment Assistance#Down payment programs#First Time Home Buyer#First Time Home Buyers#Georgia#Grants#New Construction Homes in Atlanta#New Home#USDA Loans

0 notes

Photo

Residents of rural areas having low-income or who cannot otherwise obtain a conventional mortgage can opt for a USDA home loan. It offers $0 money down and lenient eligibility requirements. At Right Key Mortgage, we can provide you with the best deals for USDA loans. Reach us today to know more.

0 notes

Text

How to cash in savings bonds in maiden name?

Yes, you can cash in savings bonds using your maiden name. This is especially true if the bonds were issued in your maiden name. When you apply for the savings bonds cash, then you will have to put the existing identity proofs there. Along with this, you will have to apply both the old name and the new name in the application. Along with this, the region of the name change will also have to be specified there.

This process is approved by the US Treasury. Because in this condition it has happened in many cases that when savings bonds are bought in the name of a girl, then her name is her maiden name. But after her marriage, the surname is added after her name.

Therefore, in this condition, on the official website of the US Treasury, Treasurydirect.gov, special separate information has been given about it. It is written in it that you have to show both the names there and also clear the name change region there. Even if you are married and even if you are a divorcee.

8 notes

·

View notes

Link

Smart Home.IQ Touch Panel.Sky Bell

#gulf coast#smart home#country living#country life#city country#fence#school district#biloxi#with acreage#land#new build#new constr#new construction#vinyl flooring#property#first time home buyer#va loans#fha#usda

2 notes

·

View notes

Photo

Hassle-free Reverse Mortgage In Muskegon

A reverse mortgage is not the same as other loans. It is a Home Equity Conversion Mortgage which is a very unique and different kind of loan for homeowners who are above 62 years of age. PierPoint Mortgage is the leading Reverse Mortgage provider in New Orleans and helps you to convert your home equity or a portion of it into cash. For more information visit our website.

16 notes

·

View notes

Text

USDA Home Loan Program in North Carolina

Looking to buy a home in North Carolina but not sure where to start? If you’re considering a USDA Home Loan, there are some specific areas in the state that are eligible for this type of financing. In general, you are looking for a spot that is outside of an Incorporated City Limit. We love the USDA Home Loan Program in North Carolina, because it has so many benefits, even if you aren’t a first…

View On WordPress

2 notes

·

View notes

Text

How to get best mortgage rates in Kentucky for FHA VA USDA and Fannie Mae conventional loans

How to get best mortgage rates in Kentucky for FHA VA USDA and Fannie Mae conventional loans

View On WordPress

#15 year rates#30 year fixed rates#Best mortgage rates in Kentucky for FHA#Credit score#fha rates#fha rates ky#First-time buyer#Kentucky#kentucky mortgage rates#kentucky rates#ky housing rates#ky mortgage rates#louisville#louisville ky rates#Louisville Rates#Mortgage loan#Refinancing#USDA#VA loan#Zero down home loans

0 notes

Text

USA, The Illegal Alien Home

June 5 2024By Kimberly Mann

Worldwide, our countries have borders that were established through tradition or through conquering by warfare. Our Constitutions were written to enforce laws within those borders, especially the borders.

When policy, not legislation, allows the majority of those who step foot upon our land to freely roam within the United States for years after encountering a Border…

View On WordPress

#BidenDestroysAmerica#border#border patrol#home loans#illegal aliens#immigration#money#undocumented#USDA

0 notes

Text

0 notes

Text

Mortgage Expert in Phoenix, AZ

Looking for mortgage loans in Phoenix, AZ? Ricky Miles has you covered! With years of experience and personalized solutions, we make the process simple and stress-free. Trust us for reliable and affordable mortgage solutions tailored to you. Visit our website today to learn more and start your journey towards homeownership!

#Mortgage Loans Phoenix AZ#Reverse Mortgage Phoenix AZ#Usda Loans Phoenix AZ#Fixed Rate Mortgage Phoenix AZ#Refinance Mortgage Phoenix AZ

1 note

·

View note

Text

USDA loans offer a pathway to homeownership for individuals and families in rural and suburban areas, providing attractive terms and benefits that make buying a home more achievable. By understanding the eligibility requirements, types of loans available, and the application process, prospective homebuyers can navigate the journey to homeownership with confidence. If you're considering purchasing a home in a rural or suburban area, exploring the possibilities of a USDA loan could be the key to unlocking your homeownership dreams.

#HomeLoan#NewBeginnings#DreamHome#HomeSweetHome#HouseHunting#HomeBuying#dreamhome#loanservices#investinyourfuture#RealEstate#homesweethome#homeloan#propertytips#finance#USDA Loan#USDA Home Loan

0 notes

Text

Startup Business Loans with No Revenue Bad Credit

A startup business loan is a type of loan service that is specifically designed for entrepreneurs who are starting a new business. Whenever someone wants to start a new business and does not have enough amount to start his business. So he takes a startup business loan so that he shows his business as starting.

3 notes

·

View notes

Text

USDA vs FHA - Which Loan Suits You Best?

When it comes to buying a home, financing is often a significant concern. For many prospective homebuyers, securing a mortgage loan is a crucial step in the home-buying process. The United States Department of Agriculture (USDA) and the Federal Housing Administration (FHA) are two government-backed loan programs designed to help individuals achieve their dream of homeownership. In this article, we will explore the key differences between USDA and FHA loans, helping you determine which option suits you best.

USDA Loans

Eligibility Criteria

USDA loans are specifically tailored for homebuyers in rural areas, promoting homeownership in less densely populated regions.

To qualify for a USDA loan, both the property and the borrower must meet certain eligibility requirements, including income limits.

Down Payment

One of the most attractive features of USDA loans is the low or zero down payment requirement, making it an ideal choice for those who may not have substantial savings.

Interest Rates

USDA loans often offer competitive interest rates, making them an appealing option for eligible borrowers.

FHA Loans

Eligibility Criteria

FHA loans are more widely accessible, and available to borrowers in both urban and rural areas, making them a popular choice for many homebuyers.

FHA loans have more lenient credit score requirements compared to USDA loans, making them accessible to a broader range of borrowers.

Down Payment

While FHA loans generally have a lower down payment requirement than conventional loans, they still require a down payment, typically around 3.5% of the home's purchase price.

Mortgage Insurance

FHA loans require mortgage insurance throughout the life of the loan, adding an extra cost to borrowers. This is an important factor to consider when evaluating the overall affordability of the loan.

Choosing the Right Loan for You

Location

Consider the location of the property you intend to purchase. If it is in a rural area, a USDA loan might be a suitable option. For urban or suburban areas, an FHA loan may be more appropriate.

Income and Credit Score

Evaluate your income and credit score. If you meet the income criteria for a USDA loan and have a good credit score, it could be a cost-effective choice. FHA loans are more flexible with credit score requirements.

Down Payment Capability

Assess your ability to make a down payment. If you are unable to provide a substantial down payment, a USDA loan might be a better fit due to its low or zero down payment requirement.

Both USDA and FHA loans serve as valuable tools for homebuyers with specific needs and circumstances. By understanding the key differences between these loan programs, you can make an informed decision that aligns with your financial situation and homeownership goals.

Whether it's the rural focus of USDA loans or the broader accessibility of FHA loans, each option offers unique advantages to help you achieve the dream of owning a home.

0 notes

Text

How to get best mortgage rates in Kentucky for FHA VA USDA and Fannie Mae conventional loans

To get the best Kentucky mortgage rates in Kentucky for FHA, VA, USDA, and Fannie Mae conventional loans, you should consider several key factors and steps:

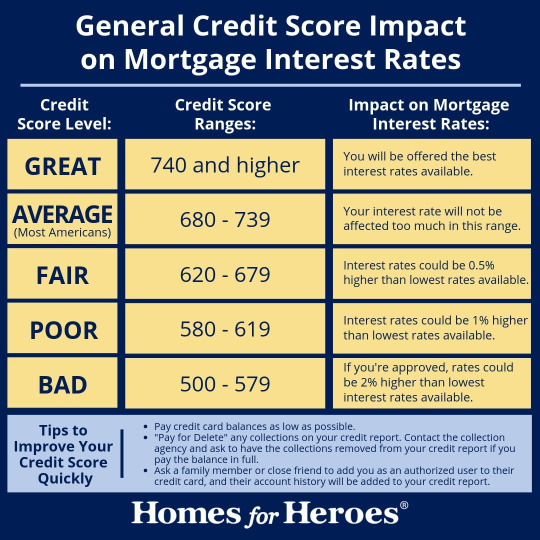

1. Improve Your Credit Score for best Kentucky Mortgage Loan Rate

Kentucky Credit Score Requirements:

Kentucky FHA Loans: Typically require a minimum score of 580, but better rates are available with scores above 780.

Kentucky VA Loans: No…

View On WordPress

#Bowling Green Kentucky#Elizabethtown Kentucky#Kentucky#ky first time home buyer#Mortgage loan#Refinancing#Rural development#USDA Rural Development#zero down kentucky home loan

0 notes