#ValueInvesting

Explore tagged Tumblr posts

Text

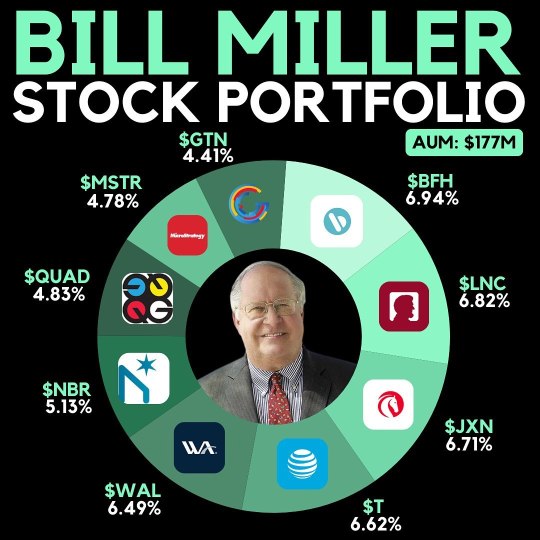

Bill Miller, a renowned hedge fund manager, recently disclosed the top holdings of his fund, which manages $177 million in assets. Here are his key investments: 1. Bread Financial: 6.94% 2. Lincoln National: 6.82% 3. Jackson Financial: 6.71% 4. AT&T: 6.62% 5. Western Alliance: 6.49% 6. Nabors: 5.13% 7. Quad Graphics: 4.83% 8. Microstrategy: 4.78% 9. Gray Television: 4.41% Have you considered any of these stocks in your portfolio? 💼 Investing wisely often requires understanding what successful managers are doing. It's essential to keep an eye on the strategies of experts like Bill Miller, as their insights can guide your own financial decisions. 💡 I believe that diversifying your investments based on proven strategies is key to achieving long-term financial success. Take charge of your financial journey today! 🚀

#BillMiller#HedgeFund#Investing#StockMarket#FinancialAdvice#PortfolioManagement#InvestmentStrategy#WealthManagement#FinancialSuccess#StockPick#Diversification#ValueInvesting#MarketTrends#InvestmentInsights#FinanceTips

2 notes

·

View notes

Text

Tech Stocks vs. Value Stocks: Navigating Your Investment Journey

Investing in the stock market is like exploring a vast landscape filled with diverse opportunities, each with its own level of risk, potential returns, and market dynamics. Among these opportunities, tech stocks and value stocks stand out as two distinct paths for investors. Understanding the characteristics, benefits, and risks of each is essential for creating a well-rounded, goal-focused portfolio.

Tech and growth stocks often grab the spotlight due to their innovative nature and rapid growth potential, while value stocks appeal to those seeking stability and long-term income. By delving into the core aspects of each, including value investing strategies, investors can better determine which approach—or combination of approaches—aligns with their financial goals and risk tolerance.

What are Tech Stocks?

Tech stocks are associated with groundbreaking advancements and disruptive innovations, attracting growth investors who are willing to embrace higher volatility for the potential of significant returns. These companies, active in the dynamic technology sector, are known for leveraging emerging trends and driving market growth. As a result, growth companies like tech stocks are favored by those interested in investing in the future expansion of industries such as artificial intelligence, cloud computing, and biotechnology.

What are Value Stocks?

On the flip side, value stocks are a favorite among investors who appreciate steady growth and reliable income. These stocks represent companies with solid fundamentals that are undervalued compared to their true worth. This appeals to value investors who are in it for the long haul. Value investing is all about discipline—buying shares at a bargain and holding onto them until the market recognizes their real value. This approach is perfect for those who prefer a more cautious investment style, aiming to keep risks low while enjoying regular dividend payouts.

Ultimately, whether you lean towards tech stocks, value stocks, or a mix of both depends on your personal investment goals, risk tolerance, and how you view the market. By understanding the key differences between these categories, investors can make smarter choices that fit their financial objectives and adapt to changing market conditions.

Understanding Tech Stocks

Tech stocks are shares of companies operating in the technology sector. This broad category includes firms involved in software, hardware, artificial intelligence, cloud computing, semiconductors, and cutting-edge innovations like robotics and biotech. Some big names in this space are Apple, Microsoft, Alphabet, and Nvidia. These companies are known for their scalability, rapid revenue growth, and ongoing investment in research and development.

The excitement around tech stocks comes from their potential to shake up industries and create entirely new markets. They usually operate in fast-moving sectors with lots of future demand potential. However, this focus on growth comes with high valuations and market sensitivity. During times of economic optimism, tech stocks often outperform due to high growth expectations. But they can also experience sharp declines in bearish market environments because they rely heavily on future earnings forecasts.

Defining Value Stocks

Value stocks are shares of companies considered undervalued relative to their intrinsic worth. These firms typically have stable earnings, solid fundamentals, and a track record of profitability. Common sectors for value stocks include finance, utilities, consumer goods, energy, and industrials. Well-known value stocks include Johnson & Johnson, Procter & Gamble, and JPMorgan Chase.

Value investing is about finding companies with strong business models that the market might be temporarily overlooking. Investors aim to buy shares at prices below the company's fundamental value, expecting the market to eventually recognize the undervaluation. Many value stocks also offer regular dividends, providing investors with a steady income stream while they wait for capital appreciation.

Key Differences Between Tech and Value Stocks

1. Approach to Growth

Tech stocks are growth-oriented, prioritizing market expansion and product innovation. They often reinvest profits rather than distributing dividends, aiming to fuel long-term scaling. In contrast, value stocks focus on maintaining steady earnings and returning value to shareholders through dividends and conservative financial management. Growth companies in the tech sector frequently leverage cutting-edge technologies and innovative business models to capture new market opportunities, while value companies emphasize preserving capital and generating consistent returns over time.

2. Volatility and Market Sensitivity

Tech stocks tend to be more volatile due to their reliance on growth projections and sensitivity to interest rates, economic data, and investor sentiment. Value stocks generally exhibit lower volatility and are seen as more resilient during market downturns or periods of economic uncertainty, though investing involves risk, especially regarding the market price. This stability is appealing to investors who prioritize capital preservation and predictable cash flows in non-technology sectors, especially during market corrections or economic downturns.

3. Valuation Metrics

Tech companies often trade at higher multiples, including elevated price-to-earnings (P/E) and price-to-sales (P/S) ratios. These valuations reflect investor expectations for future earnings based on their market capitalization. Value stocks, on the other hand, typically have lower valuation multiples, offering a margin of safety for investors focused on buying shares at reasonable prices. The valuation gap between growth and value stocks can widen during periods of market optimism, as reflected in the value index, but value stocks may provide a buffer against sharp declines in market sentiment.

4. Dividend Policies

Many tech companies, especially those in early growth stages within different asset classes, do not pay dividends. Instead, they reinvest profits into development and expansion. Mature tech firms like Microsoft and Apple are exceptions, offering modest dividends alongside continued growth, particularly during the business cycle. Value stocks are more likely to distribute a significant portion of earnings to shareholders, making them attractive to income-focused investors. The high dividend yield associated with value stocks can serve as a reliable income source, appealing to retirees and those seeking stable earnings.

Advantages of Tech Stocks

1. Exposure to Innovation

Tech stocks provide direct access to innovative trends shaping the future, including cloud computing, electric vehicles, fintech, and artificial intelligence. This exposure allows investors to participate in transformative shifts across industries that have been prevalent in the past decade. By investing in tech stocks, individuals gain the opportunity to be part of groundbreaking advancements that have the potential to redefine entire sectors and create new market opportunities.

2. High Growth Potential

The rapid expansion of technology-based services and products gives tech companies the potential for substantial revenue and earnings growth. When market conditions are favorable, this growth can lead to impressive capital appreciation. Tech stocks tend to thrive in environments where technological adoption is accelerating, much like the energy sector, enabling them to capture significant market share and drive exponential growth.

3. Scalability

Many technology firms operate scalable business models, particularly in software and digital services. These models allow for revenue growth without a proportional increase in operating costs, driving higher margins and profitability over time. The scalability of tech companies, coupled with their competitive advantages, often results in greater operational efficiency and the ability to quickly respond to changing market demands, further enhancing their growth prospects.

Advantages of Value Stocks

1. Income Generation

Dividend payments are a defining feature of value stocks. These consistent income generation streams are particularly beneficial for retirees or income-focused investors, offering a measure of predictability regardless of short-term market fluctuations. Value stocks often provide a reliable source of cash flow, which can be reinvested or used to meet financial needs, enhancing the overall financial security of investors.

2. Lower Valuation Risk

Because value stocks are often priced below their intrinsic value, investors are less likely to overpay. This conservative pricing approach can limit downside risk and offer protection during periods of market stress, leading to lower valuation risk for investors. Investing in value stocks allows investors to potentially acquire quality companies at a discount, increasing the likelihood of capital appreciation as the market recognizes their true worth.

3. Defensive Attributes

Value stocks tend to perform better in uncertain or declining markets. Their defensive nature and stable earnings can help cushion a portfolio during economic downturns. This resilience makes value stocks, compared to growth stocks, an attractive option for investors seeking to preserve capital and weather market volatility. Value stocks often belong to well-established companies with strong fundamentals, providing a sense of security in turbulent times.

Risks of Tech Stocks

1. Valuation Sensitivity

Tech stocks are often subject to high valuations, making them more vulnerable to market corrections if a company fails to meet growth expectations. Rising interest rates and shifts in market sentiment can heavily impact tech valuations. The rapid pace of technological change further exacerbates these risks, as companies must continuously innovate to stay ahead of competitors and justify their high valuations. Investors should be aware that the reliance on future earnings projections makes tech stocks particularly sensitive to economic fluctuations and market volatility.

2. Market Cyclicality

Tech stocks frequently follow a cyclical pattern, performing well during bull markets but experiencing sharper declines during periods of market stress or recession. This cyclical nature is influenced by broader market trends and economic conditions, which can lead to significant fluctuations in stock prices and investor sentiment. Investors must be prepared for the inherent volatility associated with tech stocks, as their growth counterparts tend to be more sensitive to changes in the economic landscape.

3. Intense Competition and Regulatory Risk

The technology sector is characterized by intense competition, requiring constant innovation to maintain market leadership. Additionally, regulatory scrutiny in areas such as consumer discretionary, particularly around data privacy and antitrust concerns, can introduce uncertainties. The global nature of tech companies means they are subject to international regulations, which can complicate compliance and impact profitability. Investors should consider the potential impact of regulatory challenges and competitive pressures when evaluating tech stocks.

Risks of Value Stocks

1. Value Traps

Not all undervalued stocks represent sound investment opportunities. Companies in structural decline may appear attractive based on valuation metrics but lack the competitive advantages and fundamentals to support recovery. Identifying these value traps requires careful due diligence. Investors must analyze financial statements, industry trends, and management effectiveness to avoid these pitfalls and ensure they are investing in companies with solid long-term potential.

2. Slower Growth Potential

Compared to tech stocks, value stocks typically offer lower growth prospects. While they may provide stability and income, they often underperform during market rallies led by high-growth sectors, highlighting that past performance is not always indicative of future growth results. The focus on established industries means value stocks might miss out on the explosive growth seen in emerging technologies or sectors with rapid expansion. Investors should weigh the trade-off between stability and growth potential when considering value stocks.

3. Sector-Specific Challenges

Value stocks are concentrated in traditional sectors that may be affected by long-term structural shifts, such as the transition to renewable energy or the digitization of consumer behavior. These shifts can lead to sector-specific challenges, changes in consumer preferences, and regulatory landscapes, potentially impacting the long-term viability of certain value stocks. Investors need to be aware of these dynamics and consider how they might affect the future performance of their investments. Staying informed about industry trends and adapting investment strategies accordingly can help mitigate these risks.

Developing a Balanced Investment Strategy

Many investors opt to diversify their portfolios by integrating both tech and value stocks. This hybrid strategy combines growth potential with income and stability, offering exposure to varying market conditions.

Strategic Allocation A typical approach involves designating a portion of the portfolio to high-growth tech stocks for long-term capital gains, while employing value stocks to generate income and offer protection against downturns. The exact allocation depends on factors such as an investor’s age, risk tolerance, and financial objectives.

Periodic Rebalancing Market performance can alter the balance of tech or value holdings over time. Regular portfolio assessments based on market performance and rebalancing are essential to maintain a diversified mix that aligns with an investor’s intended strategy.

Assessing Market Conditions During bull markets or periods of low interest rates, tech stocks may excel. Conversely, value stocks often take the lead during market corrections or times of economic uncertainty. Understanding these dynamics can inform investment decisions.

Identifying the Right Fit

Choosing between tech stocks and value stocks—or combining both—ultimately comes down to individual investor goals and risk tolerance. Tech stocks appeal to those seeking higher growth, innovation exposure, and the potential for outsized returns. Value stocks cater to investors prioritizing income, stability, and conservative capital appreciation.

Investors should assess their investment horizon, cash flow needs, and market outlook before deciding which strategy to emphasize. By understanding the strengths and limitations of both tech and value investing, market participants can construct resilient portfolios designed to perform in a range of economic scenarios.

A well-rounded investment strategy acknowledges that both growth and value have a place, and the most effective approach often lies in blending these elements according to personal financial priorities.

To further enhance decision-making, investors can consult with a financial professional who can provide insights into market trends and help tailor an investment strategy that aligns with individual objectives. Additionally, staying informed about broader market developments, interest rate fluctuations, and global economic conditions can aid in anticipating shifts in market sentiment and adjusting portfolios accordingly.

The key to achieving long-term financial success lies in remaining adaptable and open to evolving market dynamics. By embracing both ech stocks and value stocks,, investors can harness the growth momentum of innovative companies while benefiting from the steady earnings and defensive attributes of well-established firms. This balanced approach not only mitigates risk but also positions investors to capitalize on opportunities across various market cycles and economic environments.

#techstocks#valuestocks#investing#stockmarket#growthinvesting#valueinvesting#investmentstrategies#portfoliodiversification

0 notes

Text

youtube

TEM, POWL, and Value Investing - InvestTalk Caller Questions

This InvestTalk caller segment explores a wide array of investment topics, ranging from individual stock analysis (TEM, POWL, ATKR, BALT, FNV, CMCO, KVYO) to broader market concepts like short interest and value investing. It also touches on key economic policies such as Quantitative Tightening, offering listeners valuable insights into the financial markets and various investment strategies.

0 notes

Text

Bears growl, investors rise!📈

#stocks#stockmarket#stocktonontees#stockmarkettips#stockmarketnews#stockmarketcrash#stockmarketindia#stockmarketinvesting#stockmarketeducation#bearmarket#SmartInvesting#WealthWisdom#StockMarketTips#InvestmentStrategy#FinancialFreedom#MoneyMindset#BenjaminGraham#ValueInvesting#StockMarketEducation#GrowYourWealth#InvestWisely#TradingMindset#FinanceQuotes#InvestorMindset#MarketInsights

0 notes

Text

Warren Buffett’s Defensive Strategy Raises Questions Amid Record Cash Holdings

https://enterprisewired.com/wp-content/uploads/2025/02/EW-Warren-Buffetts-Defensive-Strategy-Raises-Questions-Amid-Record-Cash-HoldingsSource-kiplinger.com_.jpg

Source: kiplinger.com

Buffett’s Unexplained Caution Leaves Investors Puzzled

Legendary investor Warren Buffett has intensified his defensive approach, selling off more stocks and amassing a record $334 billion in cash. However, his latest annual letter provided little explanation for this move, leaving investors speculating about his rationale. Despite his preference for equities, Berkshire Hathaway has now sold stocks for nine consecutive quarters, including a significant reduction in its holdings of Apple and Bank of America.

Buffett addressed the mounting cash reserves but reassured shareholders that Berkshire remains committed to equities. “Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities,” he wrote in his 2024 letter. While investors had hoped for a clear strategy, his statements did little to clarify why the conglomerate continues to hold such substantial cash reserves in an environment where interest rates are expected to decline.

Market Concerns and Investment Hesitation

Warren Buffett’s reluctance to invest heavily comes at a time when the stock market has been performing strongly. The S&P 500 has gained over 20% for two consecutive years, yet Buffett has continued to avoid major investments. Despite rising operating earnings, Berkshire also halted its stock buybacks in the fourth quarter of 2023 and early 2024, signaling further caution from the company.

In his letter, Buffett subtly suggested that market valuations might not be attractive at present. “Often, nothing looks compelling; very infrequently we find ourselves knee-deep in opportunities,” he wrote. His restraint has led to speculation that Berkshire is strategically waiting for better investment opportunities rather than reacting to immediate market conditions.

Economic uncertainty, potential policy shifts under the new administration, and concerns about a slowing economy have created a complex backdrop for investors. While Berkshire Hathaway shares have performed well—rising 25% and 16% in the past two years and gaining 5% in early 2024—some analysts believe Buffett is preparing for potential volatility rather than chasing market momentum.

Transition to Greg Abel and Future Strategy

Warren Buffett also used his annual letter to reaffirm his confidence in Greg Abel, his designated successor, likening his investment acumen to that of the late Charlie Munger. Abel, who oversees Berkshire’s non-insurance businesses, will have the final say on investment decisions, including public stock holdings. Some analysts speculate that Buffett’s recent moves could be aimed at positioning the company for Abel’s leadership by reducing oversized positions and building liquidity for future investments.

Despite his overall cautious stance, Buffett hinted at one area of continued investment: Japanese trading houses. “Over time, you will likely see Berkshire’s ownership of all five increase somewhat,” he noted, signaling a strategic expansion in that sector.

As Warren Buffett remains tight-lipped about his cash-heavy strategy, investors must wait to see whether this defensive approach is a temporary measure or a long-term shift in Berkshire Hathaway’s investment philosophy.

0 notes

Text

Investing is an art, and Warren Buffett has mastered it. His timeless wisdom teaches the importance of patience, protecting capital, and trusting your instincts.

The best opportunities come when others hesitate. Learn how to navigate equity investing with confidence—watch the full video now!

#WarrenBuffett#InvestingWisdom#StockMarket#EquityInvesting#PersonalFinance#InvestmentStrategy#FinanceEducation#WealthBuilding#LongTermInvesting#ValueInvesting#FinancialFreedom#MoneyManagement#SmartInvesting#StockMarketTips#InvestorMindset#MarketTrends#1lakhbankersby2030#InvestmentTips#BusinessSuccess#FinancialGrowth#InvestingForBeginners

0 notes

Text

Value Stock Opportunities Identifying Market Gems.

Explore value stock opportunities and uncover market gems with high potential. Understand the key factors that make these stocks attractive and how they maintain strong positions in their respective sectors. Gain insights into the stability and growth potential these value stocks offer.

Read more :

https://kalkinemedia.com/us/stocks/value

0 notes

Text

Video: Important Stock Metrics

The video is about analyzing #valueinvesting for #dividends and what #metrics I find most #important during #stockanalysis. I review the various #ratios, such as #P/E, #P/B, #Debt-to-Equity, #fairvalue and talk about the overall approach. The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada. Visit: http://www.canadianmoneytalk.caThe Investing &…

View On WordPress

#approach#Debt-to-Equity#dividends#economicmoat#fairvalue#important#investing#metrics#P/B#P/E#ratios#stock#stockanalysis#valueinvesting

0 notes

Text

Warren Buffett and Berkshire Hathaway have reached a record cash pile of over $325 billion! Recently, Buffett resumed purchasing stocks, adding significant investments in Occidental ($409M), Sirius XM ($107M), and Verisign ($45M). With such a massive cash reserve, he has the power to acquire any of these companies outright. What would you do with $325 billion? I believe this is an opportune moment for strategic investments, rather than frivolous spending. It's essential to stay informed about market movements and heed the strategies of seasoned investors like Buffett. Let's learn from their decisions to shape our own investment strategies! 💼📈

#WarrenBuffett#BerkshireHathaway#InvestmentStrategy#StockMarket#CashReserve#FinancialWisdom#SmartInvesting#MarketTrends#ValueInvesting#WealthManagement#InvestmentOpportunities#StrategicInvestments#Buffettology#FinanceTips#InvestingGoals

0 notes

Text

Introducing our Benjamin Graham Calculator

Excited to share something new that I’ve been working on—our very own Benjamin Graham Calculator. If you’re interested in value investing, this tool might just become your new best friend.

For those who might not know, Benjamin Graham is often referred to as the “father of value investing.” He believed that by calculating the intrinsic value of a stock, investors could make smarter decisions, buying stocks that are undervalued by the market. This method helps reduce risk and maximize potential returns.

Our Benjamin Graham Calculator is designed to do just that—help you estimate the intrinsic value of a stock based on the principles laid out by Graham himself. All you need to do is enter the current share price, EPS (Earnings Per Share) for the last four quarters, the expected growth rate, and the current yield on AAA corporate bonds. The calculator will then provide you with an estimated intrinsic value per share and tell you whether the stock might be overvalued.

This tool is perfect for those who want to dive deeper into their investment research and make more informed decisions. It’s straightforward, easy to use, and built with value investors in mind.

If you’re curious about how it works or want to give it a try, head over to our Tools section and check it out. I’d love to hear your thoughts and see how it’s helping you on your investing journey! Check out: https://www.bearsavings.com/tools/benjamin-graham-calculator/

0 notes

Text

Warren Buffett Finally Reveals The Mysterious Company He’s Invested Billions Of Dollars In

Warren Buffett Finally Reveals The Mysterious Company He’s Invested Billions Of Dollars In

📖To read more visit here🌐🔗: https://onewebinc.com/news/warren-buffet-reveals-berkshire-hathaway-chubb-stake/

#warrenbuffett#investing#billionaire#stockmarket#mysteryrevealed#valueinvesting#berkshirehathaway#longterminvesting#financialguru#wallstreet

0 notes

Text

youtube

Value Investing's Comeback: 4 Reasons It's Set to Outperform Growth

Strategies for value investing are resurfacing, positioning themselves to surpass the growth-oriented techniques that dominated the market a few years ago. The valuation difference between value and growth companies may close as a result of a number of important variables, such as altering investor mood and evolving market conditions. Consequently, cautious investors using a "rope-a-dope" approach could benefit from the changing market environment.

0 notes

Text

When you’re stuck in the loop, it’s time for a smarter move. Let us guide you to financial clarity. 💵

#MarketMovers#Bullish#Bearish#StockGains#TradingLife#WallStreet#StockMarketSuccess#LearnToInvest#SmartInvesting#WealthMindset#InvestSmart#WealthBuilding#FinancialPlanning#ValueInvesting#BuyAndHold#StockMarket#Investing#StockMarketTips#StockTrader#StockMarketNews#StockMarketInvesting#StockTrading#StockMarketAnalysis#StockInvesting#StockMarketUpdates

0 notes

Text

A Mica Band Heater Manufacturer is a specialized entity dedicated to the production of mica band heaters, crucial components widely used in industrial settings for precise and efficient heating applications. These manufacturers play a pivotal role in supplying the industrial sector with high-quality heating solutions tailored to meet diverse operational needs across various industries.

#IndustrialHeating#MicaBandHeaters#Manufacturing#Customization#QualityMatters#TechnicalSupport#Reliability#ValueInvesting#BusinessSolutions#IndustrialAutomation#HeatManagement#ProductQuality#CustomerSatisfaction#Efficiency

0 notes

Text

Introducing Dhanvikas ,where your financial dreams find their path to reality. As your dedicated investment partner, we're committed to delivering personalized solutions and expert guidance to help you achieve your goals. Let's embark on this journey together. Let's grow together

#Dhanvikas#Finance#InvestmentStrategy#WealthManagement#CapitalGrowth#StockMarket#FinancialPlanning#AssetManagement#ROI#PortfolioManagement#EconomicOutlook#DividendInvesting#FinancialFreedom#RetirementPlanning#PassiveIncome#ValueInvesting#Diversification#MarketAnalysis#InvestmentOpportunity#InvestmentEducation

1 note

·

View note

Text

Value Investing Strategies for Long-Term Growth

Implement effective value investing strategies to find undervalued stocks with strong growth potential. Focus on identifying companies with solid fundamentals and low price-to-earnings ratios for long-term success in the stock market.

For more information visit at: https://cse.google.com.au/url?q=https://kalkinemedia.com/us/stocks/value

#ValueInvesting#UndervaluedStocks#StockMarket#InvestingStrategies#LongTermGrowth#StockTips#ValueStocks

0 notes