#Flare Monitoring Market

Explore tagged Tumblr posts

Text

#Flare Monitoring Market#Flare Monitoring Market size#Flare Monitoring Market share#Flare Monitoring Market trends#Flare Monitoring Market analysis

0 notes

Text

The Villainous Paranoiac Sues for Character Defamation (2)

“Nii-san?!”

The lump in Idia Shroud’s bed lets out a pitiful groan.

“Nii-san, are you alright?! Are you hungry?! Sick?!” Ortho demands. “Hold on, I’ll do a scan to see what’s wrong!”

A pale, long fingered hand emerges from beneath the covers. It points languidly.

“…sekai…”

“Eh?” The android crowds closer to the bed. “What is it Nii-san? Your computer? Did something bad happen in one of your games? To Precipice Morai? Did an anime get cancelled?”

“…Isekai…”

“Isekai?” The android asks, confused. “Nii-san, what—?”

“I CAN’T ACCEPT THAT A REAL LIFE ISEKAI WOULD COME FROM SUCH A LAME LIGHT NOVEL!!”

It’s with this impassioned cry that Idia Shroud throws off his duvet, hair flaring wildly.

“After all, there are so many worlds that would be so much more likely to be real?! A tech punk world like LoPri just violates several laws of physics, not to mention thaumaturgy?? Plus the characters are so bland and uninspiring, how is it meant to enrich the blackened hearts of this Wonderland if they’re real?! At least if they were from Hyrule or Laputa or Exandria, they could teach us valuable life lessons that would lead to world improvement!”

His fist hits the mattress. “But no! And on top of that, this happens at the same time as they’re leaking that a LoPri movie is in the works?! That’s so cheap!! It’s like an awful marketing tactic that takes your cherished childhood hopes and dreams and crushes them for a few wads of madol!! I can’t believe—”

“Nii-san, wait!” Ortho begs. “What do you mean, there’s been a real life isekai? The sensors you installed should have noticed a large amount of energy coming from something like a world-crossing event.”

Idia jabs an accusatory finger at his computer screen, where the illustration and photo are posed side by side. “Apparently, not if they hijack Night Raven’s carriages to get here!”

Ortho’s optic sensors dilate and contract as his facial recognition software runs.

“…It’s a match.” He says. “Barring the 4% deviations from differing mediums, this person looks almost exactly like the illustrations from Lost Princess. And the Dark Mirror reported they’re entirely magicless…”

Idia jumps when the facsimile of his younger brother appears in his space. “Nii-san, what should we do?! If she really is from this other world, she’s a criminal, isn’t she? Should STYX take her into preventative custody??”

“Eh—Calm down, Ortho.” The elder Shroud says sternly, as if he hadn’t been in near hysterics only a moment ago. “It’s illegal to lock people up if they haven’t done anything wrong yet.”

“But Nii-san—!”

“Besides, as a bad guy she’s like, seriously wimpy.” It takes a moment or two of flailing in the bedclothes before Idia’s phone is retrieved. “See? According to the wiki, even the worst stuff she does is thanks to abusing her rich family’s power and money. Without that, she’s as pathetic as some hero who’s had all his strength sucked out. Even more harmless than a level one slime.”

Ortho’s synthetic brow furrows. “I guess…”

“Heh. Some of those LoPri simps online might even say that this is divine retribution. Getting banished to a world where she’s worth less than nothing.” Idia slumps, flicking through his apps idly. “Ah, the fates are cruel. Why’d I have to be inflicted with this?”

“I will monitor the villainess, Nii-san.” Ortho announces. “If she attempts to partake in any criminal behavior, it will be reported to the authorities, so Nii-san’s daily school life may continue unimpeded.”

“Eh? Well, uh.” Idia’s attention fights with the gacha he’s just opened, but ultimately surrenders to the colorful world within. “Only if it’s a low priority thing, okay?”

“Roger!”

***

Vil is distracted.

Not enough for his makeup to be anything less than perfect. Certainly not enough to make his class work, modeling, or acting suffer.

But enough that the poison apple he’s trying to polish has nearly given him the slip twice already.

That is unacceptable. If he cannot maintain a firm standard of discipline, how is this Epel meant to absorb any of his lessons?

Vil cannot allow this to continue.

He saw the villainess the magicless interloper yesterday morning, on his way to History class. Wearing some truly shapeless castoffs that can only have come from the dumping ground that passes for a Lost and Found, raking leaves away from the statue of the Beautiful Queen.

Vil had mostly convinced himself that it was purely his imagination. An unfortunate side effect of working on so many projects at once.

Surely what he had heard was merely a word that sounded like the fantasy names his script contains. The author had to take inspiration from somewhere, after all. And word association tricked him into believing that some potato who bore a little resemblance to his mental image of the villainess was, in fact, the person in question.

An honest, if slightly embarrassing mistake.

And then Rook reported over breakfast that the magicless janitor had somehow wormed their way into becoming a student, and a Prefect. Of the most prestigious magic school in the country. Despite the aforementioned complete lack of.

And all those foolish doubts Vil had spent so long laying to rest reared their ugly heads again.

A long, perfectly manicured finger taps the cafeteria table.

The potato is sitting with Clover and Diamond from Heartslaybul, alongside two first years and that little monster. From his position, Vil can see the back of their head if he inclines his own just slightly.

“Epel.” The boy in question jumps at the sound of his name. “Tuck your elbows in, your dorm mates shouldn’t need to defend themselves every time you lift food to your mouth.”

“My ba—ah, I mean! I, I apologize.”

Immediately, his arms go from imitating a chicken’s spread wings to an eastern dragon’s bent forelegs.

Behind Epel and slightly to the left, Rosehearts blocks Vil’s view of the magicless prefect. With the way his shoulders are tensing, his voice raising, he’ll likely be there a while as he metes out his slovenly attempts at discipline on his juniors.

Vil suppresses a grimace as he sighs. He’s going to get frown lines at this rate…

He needs to put this from his mind. If the sheer force of his not inconsiderable will is somehow lacking, then he needs to try something else. Obtain some definitive proof one way or the other so this irritating matter can be settled once and for all.

Proof…

A collection of ideas begin swirling in Vil’s head. Nothing concrete, just associations and possibilities of possibilities. Not enough for a proper plan of action.

Not yet, anyway.

***

Idia’s back cracks as he stretches.

“GG Muscle Red-shi,” He mutters as he types. “You carried hard for that secret boss encounter.”

Only a few moments after he hits send, Muscle Red’s response pops up.

Muscle Red: You give me too much credit, my friend. It was your strategic thinking that won us the day.

Muscle Red: This old man will need to log off shortly, but I wish you a pleasant evening and good hunting.

Gloomurai: NP Muscle Red-shi! GN

He tries to ignore the disappointment in his chest as Muscle Red’s avatar disappears. It’ll be hard to top the fun he had in that raid, so he may as well just log off this game. Maybe catch up on some of the anime he’s been letting build up so he can binge it all at once…

Ah, but there was that one that Ortho said he might be interested in, but that Idia had been too busy to start watching yet! The one about an otaku security robot that was exasperated with the scientists it had to look after…

“Hey, Ortho, we can start I’m a Murderbot But I’m Keeping A Diary…” Idia turns to where his brother is meant to be charging in the power station in the corner.

It’s empty.

“Ortho?”

There’s no one in the room except Idia right now.

He tries to tell himself that it’s fine, that Ortho’s fine, he’s probably just…just gone on a snack run? Yeah, he must’ve realized Idia was getting low on food and decided to help! What a good, kind brother Idia has! There’s no way he’s in any kind of trouble that he needs Idia to save him from, right?

Right??

Idia’s able to stave off the anxiety for a record-breaking four point two seconds before he turns to his computer, bringing up the “Find My Brother” program and sending his tablet whizzing out the door to the coordinates it brings up.

Why is he in the library at this time of night? Idia gnaws on his fingernails as the tablet gets closer, and prepares to use the mic once he can see Ortho’s back.

“…you’re planning to cause trouble, I will report you to the Headmaster and the relevant authorities.”

Idia straightens at his brother’s serious tone coming through the speakers.

It’s the work of a moment to gain access to the feeds of the library’s security cameras. Although there’s only three of them, and they’re really shoddily placed for actual monitoring purposes…

“Oh that’s rich.” The villainess scoffs, low voice made tinny over his speakers. “I’m not the one causing trouble here. Besides, it’s a public library. All students are free to look up reference materials on whatever they’d like.”

“Materials on restricted subjects are monitored.” Ortho declares. “Failure to return them to the library is logged against a student’s profile. You have not returned [SEVEN] books by their assigned due date.”

“So, Overblot is considered a restricted subject then.” Uh, hard pass on the villainess’ tone in that reply, it’s just as sus as some sixth ranger smiling to themselves while everyone else’s back is turned. “Why exactly is that? Is it the same reason there’s no primary sources on it in any of the history books or scholarly articles?”

“That is classified information.” His baby brother says coolly. “You do not have even the lowest level clearance, so it does not concern you.”

The villainess’ voice drops dangerously. “Doesn’t concern me?”

Idia begins prepping to set off the fire alarms in the headmaster’s suite. If the villainess makes any move against his brother, he’ll not only make sure the ultimate authority figure is there to catch her, he’ll publish her past and every embarrassing search she’s made since coming to Twisted Wonderland online for everyone to see. Maybe even post her address online so those LoPro simps can avenge their faves in person?

“Things that jeopardize my safety don’t concern me? Things that endanger my wellbeing don’t concern me? Threats to my life don’t concern me?!”

It’d be easier to watch if the villainess hit the wall, flipped a table, threw some books on the floor, something. Instead Idia’s on the edge of his seat, eyes fixed on his monitor like he’ll get jumpscared if he looks away.

He flinches when the villainess does, movement made jerky by the old cameras. Seriously, this is why he can’t stand live action analog horror!

But it is kinda weird how the figure opposite his brother is hunching over the table like that. Almost as if standing is difficult?

“..f you think,” Ortho’s mics can barely pick up the sound. “That I’m just going to wait in the wings until another one finally kills me—that I’m going to die quietly—then you’re sorely mistaken. I don’t care who you are. I’m not going to let anyone or anything stop me. I refuse to end up in some forgotten grave in this twisted world!”

Kind of a mid monologue tbh. He was low-key expected something…more villainous? But considering how trash LoPri is it makes sense.

It’s the kind of cringe that almost makes you feel bad for the one you’re meant to be rooting against.

“You’re injured.” Ortho says, uncertain. “Partially healed rib fractures and a torn posterior tibiotalar ligament. How—?”

“Sorry, but I’m afraid that doesn’t concern you…?”

“Ortho Shroud.” His kindhearted brother supplies.

“Shroud-san.” The first year bows stiffly. “I’d like to say it’s been nice to make your acquaintance, but it really hasn’t.”

The villainess attempts to stride away from Ortho—well limps is more like it, holding herself stiffly and putting much more weight on her left ankle than her right, when did that happen? Surely it would’ve been flagged somewhere in the school records if something serious enough to cause those injuries had happened. It’d be noted in her student file, if nothing else.

Idia frowns. Then he accesses the school’s mainframe.

Wow this is. Really half-assed. You’d think the headmaster would put a bit more effort into filling out this kind of thing!

It’s a weird parody of the file Idia created for himself and Ortho in his second year at Night Raven, which the headmaster was too inept to create himself. In Idia’s, Ortho is nominally listed as a student, even if he doesn’t get graded or even enrolled in any classes like a regular student.

In the villainess’, half of that careful formatting has been thrown out the window in the name of grading a “two in one” student. Some of the information is missing or contradictory, and the rest seems to focus on the magical familiar rather than the human prefect.

There is a section way down the bottom of the file where there’s some notes from Nurse Kamac recording visits to the infirmary. But for some reason, the broken ribs have the amendment from the headmaster of “incurred before enrollment” and so don’t list how it happened, and the only notes for the ankle injury are that it occurred a few days later during a “Heartslaybul dorm head challenge”.

Idia pushes his fingers against his eyes as he groans, stretching his aching back and trying to crack it again.

This has nothing to do with him and Ortho. That much the vi—Prefect had gotten right. It may be weird that sh-they’re checking out all the books on Overblot the library has to offer, and are this badly injured only within a few days of starting the new semester, but it could be nothing! Certainly it’s not enough to be worth reporting to their parents.

“Ah, Nii-san? Were you looking for me?” Ortho sounds apologetic over his speakers. “Don’t worry, I’ll come back to the dorm right away!”

“Mm. I was thinking we could start binging that series together…”

“It’s not good for you to stay up late watching anime, Nii-san!” His younger brother scolds. “…But, I guess a few episodes of I’m a Murderbot But I’m Keeping A Diary can’t hurt!”

He grins. “I’ll get it queued up for when you get back. TTYL.”

Yeah, this is definitely worth more of his time than worrying about some weird magicless Prefect. Even if part of him itches at the memory of h-them saying “another one finally kills me”…

Definitely not his problem. Definitely not gonna think about it.

Definitely

***

It would seem that the Headmaster has decided to make the magicless Prefect into a gopher-slash-amateur investigator rather than looking into the mysterious injuries of each dorm’s Magift players himself.

Vil’s heard from Rook and from some of his other dorm members that the first year and their little monster have been interviewing everyone involved in an accident.

Of course, it’s only a matter of time until they begin questioning those who have not been affected, to rule out some causes if nothing else.

So, when Rook spots them, along with a redheaded potato, a blue potato, and Diamond, he motions his vice dorm head to bring them over.

“You must have had some reason for spying on us.” He says to the motley group. “Out with it and maybe I’ll let you off with a warning.”

“Busted~” Diamond says cheerily. “Well, can you guys keep a secret?”

“Mais, bien sûr Monsieur Magicam!” Rook proclaims. “Consider our lips sealed!”

“We think that the injured Magift players are being deliberately targeted.” The blue haired second potato says. “We’re investigating potential suspects who could be behind the a—”

“Dude!” The redheaded first potato hisses. “You can’t just TELL ‘em!”

“Yeah!” The monster yowls. “They’re suspects!! If we tell ‘em that, they’ll know we think they’re suspicious!!”

“You just told them anyway…” The magicless first year mutters.

“Hm.” It doesn’t surprise him as much as it should to hear that this year’s games are being deliberately sabotaged. And given a certain someone’s uncharacteristic enthusiasm at the dorm head meeting recently, he’s fairly sure he knows who’s behind it.

“While it is rather rude of you to cast aspersions on myself and my vice dorm head like this, I believe we could provide some assistance with this matter.”

The monster perks up. “Great! Then—”

“However.” Vil crosses his arms. “I’m a busy man. I can’t offer my assistance without being assured that it’ll be worth my time. I need something in return first.”

“Man, shoulda figured.” Potato #1 sighs. Potato #2 shakes his head. “Nothing’s ever easy, is it?”

Diamond hushes both of his underclassmen. “So? Whaddya need, Vil-san?”

Vil carefully does not smile. Not yet. “You. I need you to help me with something.”

The magicless prefect blinks at the end of his pointer finger. “Huh? Wh—if you don’t mind my asking, why me?”

“Your presence compared to the others’ makes you most suited for the task.” He turns to his bag and flicks through the contents until he finds what he’s looking for. “It’s hardly a trial. I just need someone like you to fill in for a certain role.”

Vil holds out a copy of the script.

The magicless prefect reaches out warily, as if Vil’s handing them a serpent rather than a few pieces of paper.

“This is the script for a movie I’ll be starring in.” He says. “I’d like you to help me practice my cues. You’ll be reading the lines that aren’t highlighted.”

And, seeing Diamond’s hand creep towards his phone, he adds. “Given that this is confidential until the film’s release, the production company has been assured that I refuse to be party to any leaks, and will prosecute those who create them to the fullest extent of the law.”

Diamond’s hand suddenly changes direction to scratch his cheek instead.

The Prefect takes the script, eyes scanning over it.

“Eh—how come the names are blacked out?” Potato #1 asks.

“To prevent leaks, of course.” Vil lies smoothly. “Now, do you want my help, or don’t you?”

The villainess’s teeth snag on her lower lip. Vil keeps his own from curling at the sight of the dry and torn skin there.

“Alright.” The villainess says. “How does this work?”

Vil straightens. It wouldn’t do to show his triumph at this juncture.

“If you start halfway down the page, I will respond. Make me aware if I deviate from what’s on the page in any fashion.”

The villainess nods, clearing her throat. “He-hem. You wished to see me, brother?”

Vil slips into the character as easily as buttoning a shirt. “My wishes are immaterial. But we need to talk.”

“What could be so important to waylay the young heir?” The villainess’ lip curls as she reads. “I hardly merit the attention, usually.”

“You know what I’m talking about.” He snaps, dignity and guardianship offended. “Your behavior is completely inexcusable.”

The villainess balks, her tone hardening from mockery. “My behavior? I do believe I need clarification, brother. I have done nothing to dishonor our family—”

“If that’s what you think, then you’re even blinder than I imagined.” His fury is ice, solidified through years of abnegation and honor. “Your conduct towards our sister has been abominable. Either you correct it, or I shall correct you.”

“C-correct?!” The villainess stutters, unsightly for a scene partner. Vil will need to recommend someone else for the final production. “I have done nothing to—”

“For once we agree.” Righteousness straightens his spine, quickens his stride. “You have done nothing to make her feel welcome or as if she belongs. Ignoring her at school? Making snide remarks to tear down her confidence? Who do you think you are, to commit these acts with such audacity? It seems you’ve forgotten who has the natural right to live in this household, and who is here merely due to Father’s generosity and goodwill.”

“I—”

“I don’t want to hear your excuses.” He scolds the unsightly cuckoo before him. “I am telling you what will happen. You will be civil towards our sister. You will be polite to her. And you will still your sharp tongue every time it decides it wants to say something unkind. If that means you never speak again outside the necessities, then so be it.”

“Wait, please wait, please, stop—”

And now going off script? Will blunders never cease? Vil continues the monologue as best he can in the face of such unprofessionalism.

“And if you disregard my words—if you fail my instructions in any way? Well.”

He tilts his head, channeling Gracey Enji in every pore of his being. “What will happen to you will make the punishment you received for ruining Asahiko’s high school debut feel like the gentlest kindness by comparison.”

And the villainess—

The Prefect flinches, curling in on themself as if in anticipation of a blow.

Their eyes are staring down, unseeing, as their mouth babbles, clearly not even trying to stay on script any more.

“No, no, I’m sorry, I won’t, I, I didn’t—!”

But somehow still reciting exactly what’s written on the page despite that.

There are two ways to read these lines, Vil is suddenly realizing.

One is as a hero decisively warning a scheming villainess that his patience with her wiles has run dry and that there will be consequences for her actions.

And the other…

“The hell do you think you’re doing?!”

Potato #1 has moved into Vil’s space, shoulders tensed like the first year was about to lay hands on him if not for Rook’s intercession. His vice-warden’s grip strength clearly has taken the potato by surprise, uniform wrinkling as he attempts to yank himself free.

Potato #2 is hovering around the Prefect, the monster whining and tearing holes in their too-long trousers. “Prefect, are you okay? Do, do you need something, a, ah, some water maybe? Hey, hey, Prefect, Yuu, look at me, please?”

“Ooh-kaaay!” Diamond pops up between Vil and his underclassmen, perfectly fake smile not quite as magicam-ready as it usually is. “Not that this hasn’t been su~uper interesting, you’re a master of your craft Vil-san, really, but y’know we’ve gotta lot of work to do with this investigation thing, hate to see the dorm head if he thought we were playing around, you know how it is, right~? C’mon guys, we’d better get moving, this is an important date and we can’t be late!”

Potato #2 nods at Diamond, an arm tight around the Prefect’s trembling shoulders as he pulls them away, still murmuring low platitudes. Potato #1 is still glaring daggers at Vil even as he shrugs out of Rook’s grip. He picks up the copy of the script on the ground—when had it fallen?— and shoves it at his vice dorm head.

“Next time someone tells you they wanna stop,” He spits. “Maybe listen instead of just doin’ what you please. Freaking tyrant.”

The insult stings, but Vil controls himself as Potato #1 scoops up the whining monster and strides after the rest of the motley little group.

He can still hear the panicky, shuddering hitches in the Prefect’s breathing, after all.

“Roi du Poison?” He blinks back into himself to see Rook peering at him in concern. “Vil? Are you all right?”

“F-fine, I’m fine.” He turns sharply on his heel. “Come, Rook. It’d be best to return to the dorm for now. Epel may be attempting to shirk his etiquette lessons again.”

“…Oui, Roi du Poison.”

He doesn’t say another word the entire walk back to the Mirror Chamber, which Vil finds deeply irritating as it means his thoughts keep circling back to the other interpretation that dawned on him for this role.

But it’s ridiculous, he assures himself as they emerge outside of Pomefiore. Just a combination of his previous experience and some, some personal issues the Prefect clearly has that have mixed poorly in his mind. Gracey Enji is the male lead. Vil’s chance to play the hero, for once in his career. There’s no way that Bella DeNiâmerée intended for the character to come across in any other fashion than the style in which Vil has been playing him. No chance in the slightest.

Certainly not as a high school senior threatening a child five years his junior in a way that they cannot defend themselves from.

#twisted wonderland#twst#idia shroud#twst idia#vil schoenheit#twst vil#twst yuu#twisted wonderland yuu#villainous paranoiac yuu#twst ortho#ortho shroud#cater diamond#ace trappola#deuce spade#twst grim#gracey enji#vil & idia in reverse isekai land#part 2 electric boogaloo

53 notes

·

View notes

Text

WIP Wednesday

Not a wip, but here's another of those discord live writing things, which I think inspired my more recent story Rescue. Little different, but the bones are the same.

~~~~~

They’d appeared while the family had been visiting the local farmer’s market.

The bounty hunters had tracked him down, appearing through a ring portal and surrounding him. Knuckles had fought, but when he realized the threat the hunters posed to the rest of the town, he did the only thing he could.

He jumped through the portal, drawing them away.

He’d been gone for a months, and the Wachowskis are desperate to find him.

Tails monitored every broadcast, every news source, every transmission he could hone in on in the galaxy, hoping for a tiny shred of info regarding the wayward echidna. Maddie had to force the Miles Electric out of his hands so the kid would sleep. They all took turns keeping it with them, as it would ping if it picked up any utterance of "Most Dangerous Warrior", "Echidna" or "Knuckles".

One day they got a ping.

Knuckles had been running since the day he was taken. Staying out in the galaxy, keeping the bounty hunters away from Earth and Green Hills. But his luck ran out, he slept somewhere that wasn't as safe as he thought, and he was captured again.

"The most dangerous warrior in the galaxy, back to defend his title!" the announcer cried.

The Wachowskis geared up for a rescue mission.

Tails had been working hard on weapons and defenses and all sorts of gizmos and gadgets for just this occasion. The entire family were ready to take down anyone who got in their way to retrieve their boy.

The news outlets reported on the spectacle that disrupted the greatest arena match in the history of the galaxy.

The place was packed. The entire galaxy watching. There were cameras everywhere, broadcasting what promised to be the most impressive arena match to have ever occurred.

Knuckles was chained in the middle of the arena, hands and feet bound to prevent him from escaping. The crowds cheered, and he flinched. That sound was so familiar, but so painful to him.

His challenger was brought in. A great giant creature, with claws and teeth and razor sharp spines.

The battle was short. Knuckles defeated his foe easily, ignoring the crowd's chant to "KILL KILL KILL"

Knuckles did not want to kill his opponent. Chances were this other creature was there against its will, too.

The defeated challenger was dragged out. Another took its place.

Knuckles fought.

Knuckles won.

Knuckles fought again.

On and on this went until the boy was exhausted, his punches growing weary and slow. His latest opponent, a large rhino-like beast, hit him square in the chest, sending the boy flying.

The crowd began its chant. "KILL! KILL! KILL!"

The rhino approached the downed echidna.

As the beast's shadow covered him, Knuckles prayed to whatever gods may be listening that his family would be safe now. And then he told his fallen tribe he'd be with them soon.

And that's when the lights went out.

A blue streak of light appeared in the arena, zipping around so fast no one could see what it was. When the lights came back on, Knuckles was gone.

And then all hell broke loose.

All the cages that held the captured creatures awaiting their turn with the most dangerous warrior in the galaxy opened at once. These creatures, many which had indeed been brought against their will, began fighting with the guards set up to keep them under control.

The crowd panicked, and tried for the exits. All of which were now locked tight.

The announcers tried to regain control, tried to calm everyone, but halfway through their own panicked speech, their microphones went dead.

A single spotlight flared to life, centering on people standing in the middle of the arena. Two humans, a hedgehog, and a fox. The most dangerous warrior in the galaxy lay in the middle of their little ring, and the male human addressed the crowd.

"This warrior is no longer for your entertainment. He has been defeated. He is ours now. If any of you think you can take him from us, step forward."

The arena masters would not let this stand, and sent the other captured creatures forward with the promise of freedom. Many took them up on it. Many were much larger than the humans.

What followed was the talk of the galaxy for weeks.

The humans and hedgehog took down every creature that approached, easily and without breaking a sweat. The fox held a device that scrambled any attempts at capturing the family, and searched the arena's business practices--which he broadcast directly to the galactic authorities.

Gambling and kidnapping were generally frowned upon, even in 'legitimate businesses' such as this.

Within 15 minutes, every challenger had been defeated, the galactic police were on their way, and Tails had essentially wiped every credit from all bank accounts associated with the arena and everyone associated with it.

The Wachowskis had taken down the longest running gladiator fighting ring in the galaxy.

"Anyone who comes after the warrior, or any of us, will NOT return," the woman called, her voice strong and fierce. "Stay away from Earth. Stay away from us. You will NOT receive another warning."

And with that, the fox threw a ring, and the family disappeared, carrying their injured warrior.

22 notes

·

View notes

Note

Serena, what's your least favorite thing about the Kalos region? They say that Kalos is a wonderful place to live, but if you could change one single thing about the region as it is today, what would you change and how would you want it to be changed? If it were changed that way, what do you think would be the side effects of that change?

"I don't know if this truly counts as a 'single' thing, and it is... almost impossible to do, at this point... however... I think it covers both what is my least favourite part, and what I wish could be changed..."

"I would like it if Kalos could completely abandon using anything that was produced by Lysandre Labs. Holo Casters, medical and laboratory equipment, machines... all of it. We already know now that, for as long as Team Flare was operational, Lysandre was monitoring and recording our calls. Texts, pictures— everything. And if that is only the surface of it... It terrifies me to think of what the full extent of their surveillance on the people of Kalos was. Or even on worldwide scale, since... well, his inventions were also sold to international buyers and companies. And his plan was to wipe out all life on the planet, save for Team Flare, who would be immortalised. People... forget that bit, and think he was only targeting this region,"

"If it were possible, and if it had to be done, we would need to find replacements beforehand that could do all of those tasks just as effectively. That is why I believe it is an impossible change, at this point. Lysandre started with good intentions. He wanted to help people, and... I would argue most of his inventions did— to a level far better than other varieties available in the market. And with how secretive I could imagine he became over time... as his greed worsened and his view became more jaded... I doubt we could find the plans for those machines we'd need to replace."

"It would take a long, long time at best... and forever at worst. Not to mention, the cost... But, that is the one thing I would change about life in Kalos. We need to move on from anything related to Lysandre... but he so meticulously planned it in a way where we can't. Not without suffering greatly."

2 notes

·

View notes

Text

Crude, Gold & Yen on Edge: Markets Brace for U.S. Core PCE and Rising Geopolitical Risk

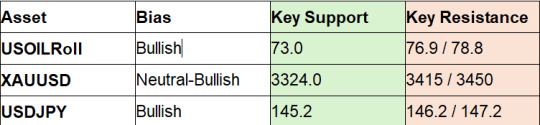

Following a week of tight ranges and intermittent volatility, markets enter the final full week of June with a clear focus: Friday’s release of U.S. Core PCE, the Fed’s preferred inflation measure. This data will serve as a key gauge for assessing the Federal Reserve’s rate path heading into Q3. At the same time, geopolitical risk is once again creeping into markets, with U.S. airstrikes in Iraq and Syria and increasing tension on the Israel–Lebanon border creating underlying support for oil and gold. Meanwhile, the Japanese yen remains pressured as USDJPY approaches the key psychological 146.00 zone, raising the risk of potential verbal intervention from Japanese authorities.

In this week’s report, we take a closer look at WTI crude oil (USOILRoll), Gold (XAUUSD) and USDJPY, identifying potential breakouts and macro drivers to watch. As always, our focus combines technical context with macro narrative, helping traders build scenarios around levels, data, and headlines. All times mentioned in this report are in BST.

Crude Oil (USOILRoll)

Crude oil (USOILRoll) is holding firm near recent highs, trading at $75.27 after rebounding sharply from a mid-June low of $64.95. The broader uptrend has been driven by improving risk sentiment, aggressive U.S. inventory draws, and geopolitical tensions flaring once again in the Middle East.

Last week’s news of renewed U.S. airstrikes in Iraq and Syria, alongside continued conflict between Israel and Hezbollah in Lebanon, has injected fresh risk premium into oil markets.

USOILROLL H1

Technically, the market staged a textbook V-shaped recovery and is now consolidating just under the recent swing high of $76.93. Price action has carved out higher lows and remains comfortably above $73.90, a zone that now acts as short-term support.

A breakout and close above $77.00 could trigger further upside momentum toward $78.80 and potentially $80.00. On the downside, any break below $73.00 might invite bearish pressure, especially if driven by risk-off flows or disappointing economic data.

This week’s main catalyst could come from Friday’s U.S. Core PCE inflation print. A softer-than-expected reading could ease Fed policy expectations and spur a broader rally across risk assets, offering indirect support to oil prices.

However, traders should remain cautious: if the conflict in the Middle East escalates or if Iranian-linked assets are further targeted, supply disruption risks may override macro influences, injecting sudden volatility into the crude space.

Gold (XAUUSD)

Gold (XAUUSD) has come under consistent pressure since mid-June, retreating from its recent high of 3450.14 to current levels around 3368.36. The metal briefly benefited from softer U.S. data but lost steam as real yields rose but lost steam as Treasury yields rebounded and Fed officials struck a hawkish tone, pushing real yields higher. Traders remain focused on inflation and yield dynamics as key macro forces driving gold’s direction.

XAUUSD H1

The technical picture reveals a decisive shift in sentiment. After a sharp rally earlier this month, gold rolled over from the 3450 level and entered a steady downtrend, now sitting closer to the lower third of the recent range.

Price has carved a series of lower highs and lower lows, with support forming near 3324. Immediate resistance lies at 3385, while reclaiming 3415 would be needed to reassert any bullish bias.

Despite its recent pullback, gold remains highly reactive to the U.S. macro landscape. Friday’s Core PCE inflation reading could be pivotal, if inflation undershoots expectations, gold may find fresh demand as real yields compress.

However, if the data comes in firm, continued upward pressure on yields could weigh further on the metal. Traders should also monitor geopolitical risk—particularly any escalation in the Middle East, which could revive safe-haven flows despite rising yields.

USD/JPY (USDJPY)

The USDJPY pair continues its relentless march higher, reaching 146.07 in early Monday trade and testing resistance at the June high of 146.16. With U.S. yields supported by sticky inflation expectations and no immediate rate cuts on the horizon, the dollar has remained in demand. Meanwhile, the Bank of Japan remains sidelined on the policy front, providing no counterbalance to rising USD strength.

USDJPY H1

Technically, the pair has carved a strong ascending channel, bouncing from a low of 143.02 and pushing steadily higher with minimal retracement. Price is now testing the 146.00–146.20 region, a key zone that previously capped rallies in early June.

A clear break and hold above this level could unlock the path toward 147.20. Conversely, a failure here might see a pullback toward support at 145.20, with stronger demand sitting around 144.60.

USDJPY’s trajectory remains primarily yield-driven, with Friday’s U.S. Core PCE data (likely serving as the next catalyst. A strong print would likely reinforce Fed patience and keep yields (and USDJPY) elevated.

However, any downside surprise in inflation could spark a quick correction, especially in such a technically stretched market. Traders should also remain alert to any BoJ comments, as verbal intervention risks increase above 146.00.

Key Levels to Watch

Forward-Looking Considerations

The spotlight this week is firmly on U.S. Core PCE (Friday 28 June). A stronger-than-expected reading could reinforce the Fed’s cautious stance, delaying any discussion of rate cuts and further bolstering the U.S. dollar and Treasury yields; a likely bullish signal for USDJPY, and potentially bearish for Gold if real yields extend higher.

Meanwhile, the geopolitical backdrop cannot be ignored. Following recent U.S. strikes targeting Iran-linked groups in Syria and Iraq, and a notable escalation between Israel and Hezbollah, traders are increasingly pricing in a risk premium across energy markets. WTI crude has responded with notable strength, reclaiming the $75 level and threatening a breakout above $77 if tensions worsen. If further military activity unfolds or if shipping disruptions occur in the region, upside in oil could accelerate sharply.

Beyond that, watch for Japanese government commentary around the yen. With USDJPY breaking above 146.00, levels that previously triggered concern from Japanese officials, there’s a growing risk of verbal or coordinated intervention. Such an event could create a sharp corrective pullback, especially if U.S. data underwhelms. Looking ahead to early July, traders should keep one eye on U.S. Nonfarm Payrolls (5 July) and FOMC minutes (3 July), both of which could reshape rate expectations. Until then, markets may remain data-sensitive but range-bound unless geopolitical shocks force a repricing.

0 notes

Text

Innovations in Oscillatory Therapy Boost Airway Clearance Segment

Global Mucus Clearance Devices Market to Surpass USD 847 Million by 2028, Driven by Rising Respiratory Health Challenges and Homecare Adoption

The Global Mucus Clearance Devices Market is projected to exceed USD 847 million by 2028, expanding at a compound annual growth rate (CAGR) of approximately 6.1%. This growth is attributed to the rising prevalence of respiratory illnesses such as chronic obstructive pulmonary disease (COPD), cystic fibrosis, bronchiectasis, and asthma, especially in aging populations and regions with high exposure to air pollution and smoking.

These devices are vital in managing mucus accumulation in the lungs, reducing infection risk, improving oxygen exchange, and preventing complications. Technologies such as positive expiratory pressure (PEP) devices, oscillatory PEP systems, high-frequency chest wall oscillation (HFCWO) vests, cough assist machines, and intrapulmonary percussive ventilation (IPV) are increasingly utilized across hospitals, homes, and clinics.

To Get Free Sample Report : https://www.datamintelligence.com/download-sample/mucus-clearance-devices-market

Key Market Drivers

1. Rising Incidence of Chronic Respiratory Diseases Chronic conditions like COPD and cystic fibrosis affect millions globally. For instance, over 16 million people in the U.S. have been diagnosed with COPD. Effective mucus clearance is essential to reducing flare-ups, hospitalizations, and mortality in these patients.

2. Global Aging Population Older adults are more prone to impaired mucociliary clearance, making them more dependent on mechanical airway clearance therapies. This demographic shift supports long-term market expansion.

3. Growing Adoption of Homecare and Self-Management Solutions The rise in remote patient care and non-hospital interventions has led to increased demand for user-friendly, portable devices. Home-based treatments reduce costs and support chronic disease management.

4. Technological Innovations The development of wearable HFCWO vests, app-enabled tracking, automated therapy control, and personalized treatment settings has made airway clearance devices more effective and accessible.

5. Rise in Post-COVID-19 Respiratory Support Needs Long-COVID has highlighted the need for airway support in recovering patients. Mucus clearance devices are increasingly used in post-infection rehabilitation programs.

Regional Market Insights

North America North America remains the dominant market, contributing over 40% of total revenue. This is driven by high diagnosis rates of chronic respiratory illnesses, greater awareness, well-established healthcare infrastructure, and significant homecare utilization.

Europe Europe is a mature market supported by public health reimbursement policies, aging populations, and national respiratory disease prevention programs. Germany, the UK, and France lead regional demand.

Asia-Pacific This region is expected to register the fastest growth through 2028, due to expanding healthcare infrastructure, rising urban pollution, and growing elderly populations. Countries like India, China, and Japan are investing in pulmonary care innovation and access.

Latin America & Middle East/Africa These markets are evolving as awareness increases and investments in healthcare modernization improve access to respiratory therapies.

Application Areas and End Users

Hospitals and Clinics These facilities represent the largest segment due to the need for clinical monitoring and advanced device capabilities in critical care and pulmonary rehabilitation.

Homecare Settings With the rise of outpatient and chronic disease management, homecare solutions are gaining momentum. Devices that are compact, battery-powered, and easy to use are leading in this segment.

Ambulatory Surgical Centers (ASCs) ASCs utilize mucus clearance devices for pre- and post-operative respiratory support, especially in patients with underlying pulmonary conditions.

Rehabilitation Centers Specialty respiratory rehab centers are adopting airway clearance devices for long-term disease management and post-surgical recovery.

Get the Demo Full Report : https://www.datamintelligence.com/enquiry/mucus-clearance-devices-market

Market Challenges

Cost and Reimbursement Barriers In developing markets, affordability and lack of insurance reimbursement for mucus clearance devices limit adoption.

Training and Compliance Issues Proper usage often requires patient education and periodic therapist supervision, which can be challenging in homecare settings.

Limited Awareness in Emerging Economies Despite growing respiratory disease prevalence, knowledge about airway clearance techniques remains low in many regions.

Industry Trends and Innovations

Smart Vest Systems High-frequency chest wall oscillation vests with Bluetooth-enabled control and real-time performance tracking are gaining favor in both hospitals and homes.

Telehealth Integration Airway clearance devices that transmit usage data to healthcare providers are supporting remote care models and improving therapy adherence.

Clinical Trials and Regulatory Approvals Several companies are conducting studies to demonstrate improved outcomes and secure approvals for broader indications.

Strategic Partnerships Mergers, acquisitions, and distribution collaborations are shaping market competition. Leading players are focusing on expanding product portfolios and regional penetration.

Key Players

Major companies in the mucus clearance devices market include:

Hill-Rom (now part of Baxter) – known for SmartVest

Philips Respironics

Electromed

Monaghan Medical Corporation

Smiths Medical

PARI GmbH

These players are actively investing in R&D, digital health integration, and global distribution to maintain competitive advantage.

Conclusion

The global mucus clearance devices market is entering a transformative phase, driven by rising chronic respiratory conditions, aging demographics, and increasing preference for home-based healthcare. With significant technological progress and wider clinical acceptance, the market is poised to exceed USD 847 million by 2028. North America remains dominant, while Asia-Pacific is set for rapid expansion. From smart vests to portable oscillatory devices, the future of mucus clearance will be shaped by innovation, accessibility, and patient-centric care models.

#Mucus Clearance Devices Market#Mucus Clearance Devices Market share#Mucus Clearance Devices Market size

0 notes

Text

Israel-Iran Escalation Spikes Oil and Sparks Market Volatility-

Investors have turned sharply risk averse after a dramatic military clash between Israel and Iran, sending oil prices to fresh highs and rattling global markets. On June 13 Israel launched air strikes on Iran’s nuclear and missile facilities – killing several senior commanders and scientists – prompting Iran to retaliate with ballistic missiles into Israel. The flare up forced Israel to warn of a “prolonged” operation and cancel nuclear talks with Tehran Even Iran’s state media reported fires at oil and gas sites, while Israel warned civilian ships to avoid Yemen’s Hodeidah port after striking Houthi run docks there The prospect of a broader Middle East war has stoked acute investor fear.

1• Brent crude jumped 7.0% on June 13, settling at $74.23/bbl (up ~$4.87)reuters.com, after intraday spikes above $78 – its largest move since early 2022. WTI rose 7.6% to ~$72.98reuters.com. Both benchmarks are ~12% higher than a week earlier. 2• Stocks fell worldwide: on June 13 the Dow fell 1.8%, S&P 500 –1.1% and Nasdaq –1.3%reuters.com. Europe’s STOXX 600 slid ~0.9% to three week lows, and Asian shares in Tokyo, Seoul and Hong Kong were down ~1% eachreuters.com. By Sunday June 15 Gulf stock indexes plunged: Qatar’s fell 2.9%, Kuwait –4.3% and Saudi Arabia’s Tadawul index –1.6%reuters.comreuters.com. Israel’s TA 35 initially dipped nearly 2% but recovered to +0.5% on June 15reuters.com. 3• Bond yields were mixed: U.S. 10 year Treasury yields jumped to about 4.41% (+5.6 bps)reuters.com as inflationary pressures from oil rose, while safe havens in Europe pushed yields down (e.g. 10Y Bunds dipped). Israel’s government bonds rallied ~+0.4% (yields fell)reuters.com as officials promised to keep markets open. 4• Currencies & safe assets: The US dollar index rose ~+0.5%reuters.com as traders fled risk. The Swiss franc and Japanese yen initially strengthened (JPY briefly touched 144 per USD)reuters.com, while the euro weakened ($1.15)reuters.com. Gold jumped +1.4% to ~$3,431/ozreuters.com, near record highs, and even Bitcoin fell amid the sell off. These moves reflect a classic “risk off” rotation. One analyst called the current phase a “controlled confrontation” – markets are jittery but have not priced in a full war yetreuters.comreuters.com. The CBOE Volatility Index spiked to 20.82 on June 13, a three week peakreuters.com. U.S. futures and Asian markets will reopen after the weekend with all eyes on whether tensions ease or spread.

Oil Market Impact-

Crude has borne the brunt of geopolitical risk. Brent crude on Friday (June 13) surged from ~$69 to ~$78 intradayreuters.com, before settling at $74.23 – a 7.0% jumpreuters.com. WTI reached ~$77.62 intra day (a ~14% spike) and closed $72.98reuters.com. These are the largest one day percentage moves since early 2022reuters.com. By Monday, prices held near six month highs (front month Brent ~$74.17 on June 13)spglobal.com. Analysts note that actual output so far remains uninterrupted: Iran’s state oil company reported that refineries and storage were undamagedreuters.com, and Western officials say Iran still exports ~2 million bpd. OPEC’s spare capacity (Saudi/Russia, etc.) is roughly Iran’s outputreuters.com. But any wider war could quickly choke supplies. About 20 million barrels per day (nearly 20% of world oil) transit the Strait of Hormuzreuters.comaljazeera.com. “Saudi Arabia, Kuwait, Iraq and Iran are wholly locked into one tiny passage,” noted Rabobankreuters.com. Israel’s strikes on an Iranian offshore gas platform (in the shared South Pars field)reuters.com and Tehran’s threats to close Hormuz have “sent shockwaves” through marketsaljazeera.com. In response, policymakers are treading carefully. The IEA says it is “monitoring” developments and stands ready to release crude from its 1.2 billion-barrel emergency stockpile if neededspglobal.com. OPEC’s secretary-general Haitham al-Ghais urged calm, insisting there are ��no developments in supply or market dynamics” that require new measuresspglobal.com. OPEC delegates note that, besides Iran, major producers (Saudi, UAE, Iraq) also ship via Hormuzspglobal.com, so full war would be a grave concern. Still, OPEC+ plans to boost output (adding ~2.2 mbd in July) are on trackspglobal.com, and one analyst reckons the cartel will stick to market share policies despite the crisisspglobal.com.

Global Equity Retreat and Safe Havens- The sudden risk shock knocked global equities off record highs. On Friday (June 13), major U.S. indexes fell: the Dow lost 1.8%, S&P 500 –1.1% and Nasdaq –1.3%reuters.com. European Stoxx 600 closed 0.9% lowerreuters.com, briefly hitting a three-week low, and MSCI Asia-Pacific slipped similarly. By Monday, U.S. futures and Asian bourses were poised for more weakness. Analysts attribute the broad sell off to “flight to safety” flows. Gold’s sharp rise to ~$3431/ozreuters.com and a rally in the U.S. dollarreuters.com signal that risk assets are under pressure. Volatility surveys confirm jitters: the VIX fear index jumped to 20.82 on June 13reuters.com. “Markets are struggling,” said one strategist, citing the inflationary oil shock (which should push bond yields higher) versus the safe haven bid (which drives yields lower)reuters.com. Indeed, U.S. 10-year yields briefly pulled back after the overnight shock, before trending up again. In Israel, markets are trying to stay open despite attacks. The Tel Aviv 35 Index erased early losses and closed up 0.5% on June 15reuters.com. Treasury prices rose (yields down ~0.4%)reuters.com and the shekel weakened from ~3.50 to 3.61 per USD by Fridayreuters.com. Finance Minister Smotrich hailed the “strong, stable, resilient” economyreuters.com, and the central bank stressed normal operations (banks and markets) would continuereuters.com. Nonetheless, forecasters warn that deeper conflict could eventually test even Israel’s robust finance.

Energy and Security Concerns-

Beyond financial markets, the standoff has raised energy-security fears. The most immediate worry is about oil chokepoints. If the Strait of Hormuz were disrupted, supply losses could be severe. One oil market strategist noted that any conflict “impacting output, shipping lanes like the Strait of Hormuz, or key infrastructure would directly affect global supply”spglobal.com. Al Jazeera reports that merchant shipping is still transiting Hormuz “on high alert,” and even talk of a closure has already pushed prices higheraljazeera.comaljazeera.com. A Houthi ultimatum also looms: Yemen’s Iran-aligned Houthis have begun targeting Israel (even claiming to fire missiles toward Tel Aviv)reuters.com and warned that Israel’s Haifa oil port could be hit next. Israel in turn struck the Red Sea port of Hodeidah on June 10, saying it was used by Houthis to funnel weaponsreuters.com. Such incidents threaten regional shipping in the Red Sea and Gulf of Aden – home to major oil and trade routes. Global shipping insurers have already raised premiums for Red Sea passages.

Policy Outlook and Investor Sentiment-

For now, central bankers appear reluctant to overreact to the shock. Experts point out that oil’s latest surge, while significant, may not derail monetary policy. “Long gone are the days when a central bank would hike rates because of a spike in oil prices,” said a Lombard Odier economist, noting that other producers (OPEC+ spare) can offset some Iranian cutsreuters.com. Still, officials will watch core inflation closely. The U.S. Federal Reserve meets on June 17–18 amid these tensions; Fed speakers may have to balance upside surprises from fuel costs against still weak growth signals. Government reactions have mostly aimed to contain panic. U.S. officials have urged calm, with President Trump (via social media) calling on Iran to negotiate rather than escalatereuters.com. Gulf Arab states (though sympathetic to Iran) held talks to defuse the crisis, and the U.S. Navy remains on alert to secure commerce. On markets, investors are in “wait-and-see” mode. One Washington CIO said the risk profile is “still too high” to jump back into stocksreuters.com. Indeed, funds have partially reversed recent bullish positions: commodity speculators piled into crude (raising net longs), but risk parities have reduced equity exposure. The bottom line: energy prices and risk sentiment are now hostage to the Iran-Israel skirmish. Markets will watch daily developments (rocket alerts, diplomatic moves, Houthi actions) for clues. If the confrontation remains limited, oil may retreat from its spikes; but any blow to Middle East output or chokepoints could send prices well above $80–$90/bbl. Until then, investors brace for volatility, with inflation expectations (driven by oil) and global growth outlook hanging in the balancespglobal.comreuters.com.

Sources: Reuters market reports and Middle East conflict updatesreuters.comreuters.comreuters.comspglobal.comreuters.com, Al Jazeeraaljazeera.com. All data as of mid-June 2025.

#IsraelIranConflict #MiddleEastTensions #Geopolitics2025 #GlobalConflict #WorldNews #BreakingNews #PoliticalAnalysis

0 notes

Text

Drone-Based Inspections for Oil and Gas Market Set to Transform Industry Monitoring and Maintenance

The Drone-Based Inspections for Oil and Gas Market is witnessing a technological revolution as unmanned aerial vehicles (UAVs) increasingly replace traditional, risk-prone inspection methods. With their ability to access hard-to-reach assets and deliver real-time data, drones are rapidly becoming an essential tool for ensuring operational safety and efficiency in the oil and gas sector.

This market is seeing strong momentum driven by the global demand for cost-effective, high-precision monitoring solutions. Drones are now deployed across upstream, midstream, and downstream operations to inspect pipelines, flare stacks, rigs, tanks, and refineries with unparalleled ease and accuracy.

According to Dataintelo’s latest findings, the adoption of drone-based inspection solutions is expected to accelerate substantially over the coming years, driven by cost savings, safety improvements, and regulatory compliance.

Key Drivers Fueling Market Growth

Enhanced Safety and Risk Mitigation Drone inspections significantly reduce the need for human exposure in hazardous environments, minimizing workplace accidents.

Operational Cost Savings Compared to manual inspections that often require shutdowns, scaffolding, or helicopters, drones offer a more economical and efficient alternative.

Real-Time Data Acquisition and AI Integration Equipped with sensors, thermal cameras, and AI-powered analytics, drones provide immediate insights, improving response times and asset maintenance.

📌 Request a Sample Report: https://dataintelo.com/request-sample/460442

Market Restraints and Challenges

Regulatory Restrictions on Drone Flights Strict airspace regulations and licensing barriers in certain countries limit commercial drone deployment in industrial zones.

Limited Flight Duration and Payload Capacity Most commercial drones have short battery lives and restricted payload limits, affecting their range and capability for long inspections.

Data Security and Privacy Concerns The collection and transmission of sensitive operational data raise cybersecurity challenges, particularly in geopolitically sensitive regions.

Opportunities Shaping the Future Landscape

5G Integration for Enhanced Connectivity The advent of 5G will enable faster data transfer and support real-time drone operations in remote oil and gas sites.

Predictive Maintenance with AI & IoT Combining drone data with IoT and predictive analytics helps forecast equipment failures, reducing downtime and improving ROI.

Offshore and Subsea Inspections Specialized drones designed for offshore and underwater applications are unlocking new opportunities in exploration and maintenance.

📌 View Full Report: https://dataintelo.com/report/global-drone-based-inspections-for-oil-and-gas-market

Global Market Dynamics and Outlook

The Drone-Based Inspections for Oil and Gas Market was valued at USD 1.2 billion in 2023 and is projected to grow at a CAGR of 12.8%, reaching approximately USD 3.8 billion by 2032. This rapid expansion reflects a paradigm shift in how oil and gas assets are monitored, inspected, and managed.

Regional Highlights:

North America: Leads the market due to early adoption, regulatory support, and the presence of extensive pipeline and refinery infrastructure.

Europe: Focuses on sustainability and preventive maintenance, pushing the adoption of drones in both onshore and offshore operations.

Asia-Pacific: Emerging as a high-growth region with expanding oil infrastructure and increasing digitization in countries like China, India, and Southeast Asia.

Segmentation Snapshot

To offer a strategic understanding of the market, segmentation is categorized by type, application, and operation:

By Drone Type

Rotary-Wing

Fixed-Wing

Hybrid

By Application

Pipeline Monitoring

Flare Stack Inspection

Offshore Platform Inspection

Refinery Maintenance

Storage Tank Surveillance

By Operation

Visual Inspection

Thermal Imaging

Gas Detection

LiDAR Mapping

📌 Check Out the Report: https://dataintelo.com/checkout/460442

Technological Trends and Industry Transformation

Autonomous Drones with GPS and AI Navigation Next-gen drones are capable of autonomous flight, route planning, and obstacle avoidance, reducing the need for manual piloting.

Cloud-Based Data Platforms Inspection data is increasingly stored in secure cloud systems, enabling real-time access and collaboration among stakeholders.

Drone Swarm Technology Coordinated drones performing simultaneous inspections are being explored to reduce survey time and increase coverage.

Industry Benefits of Drone Deployment

Reduced Downtime Inspections can be conducted without halting production, avoiding costly shutdowns.

Improved Asset Integrity Management Frequent and precise inspections help detect issues early, extending the life of critical infrastructure.

Compliance with Environmental and Safety Standards Drones support emissions tracking, leakage detection, and environmental monitoring, helping firms meet global compliance norms.

Future Outlook and Strategic Insights

The Drone-Based Inspections for Oil and Gas Market is positioned for remarkable growth as the energy sector continues to digitize. Market players and stakeholders must focus on:

Expanding their service offerings with end-to-end drone solutions

Collaborating with regulatory bodies to shape favorable drone usage policies

Investing in R&D for longer-flight, AI-enhanced drones tailored for industrial use

Dataintelo's comprehensive analysis provides stakeholders with the foresight and tools necessary to capitalize on this evolving market. As oil and gas companies prioritize efficiency, sustainability, and safety, drone technology is set to become an industry cornerstone.

Conclusion

The integration of drones into oil and gas inspections marks a pivotal step toward modern, data-driven asset management. With unparalleled access, safety, and accuracy, drone-based inspections offer immense value across the energy value chain.

Backed by technological innovations and regulatory momentum, the Drone-Based Inspections for Oil and Gas Market is rapidly transitioning from a niche application to a global industry standard.

0 notes

Text

USOIL Price Movement Today – Gold Market Trend Today

USOIL Price Movement Today – Gold Market Trend Today 📢USOIL Price Movement Today – Gold Market Trend Today 🔻 SELL SIGNAL • Sell Entry At : 65 • Stop Loss: 66 • Target: 63.90 • Current Market Price (CMP): 65 🟡 Daily Oil Market Report – June 11, 2025 🟡 focusing on USOIL (WTI Crude Oil): 📢USOIL Price Movement Today – Gold Market Trend Today🟡 Daily Oil Market Report – June 11, 2025 🟡 focusing on USOIL (WTI Crude Oil):🔑 Key Economic Highlights Driving Oil Prices Today📈 Market Snapshot (As of June 11, 2025, early ET) 🔑 Key Economic Highlights Driving Oil Prices Today 1. Oil Slides as Market Weighs Trade Framework WTI crude softened to around $64.76/bbl (down ~0.34%) amid investor caution following a U.S.–China trade framework announced in London, but not yet finalized by presidents Trump and Xi reuters.com+13tradingeconomics.com+13reuters.com+13. 2. Trade Talks Yield Cautious Optimism U.S. Commerce Secretary Lutnick announced that the framework covers rare earths and export controls—providing some relief—but broad concerns remain over demand and implementation timing reuters.com+10reuters.com+10marketwatch.com+10. 3. OPEC+ Output Rise Pressures Market OPEC+ recently increased supply by ~411 kbpd in early June, and Secretary‑General Al Ghais warned of sustained demand growth—suggesting long-term demand strength but added supply weighed on prices reuters.com. 4. Sluggish Chinese Demand Weak demand from China, despite positive trade signals, dampens oil sentiment amid cautious demand expectations tradingeconomics.com+13reuters.com+13reuters.com+13. 5. Inventory & Wildfire Supply Notes U.S. stockpile data due today may influence price direction; previous weeks saw draws (~3.1 M barrels) and Canada’s wildfires clipped supply—but the recent slide suggests pressure remains . AssetPrice/LevelChangeWTI Crude (USOIL)$64.76/bbl▼ –0.34%Brent Crude≈ $66.56–66.87/bbl▼ ~0.5%U.S. Dollar IndexSteady (~98.97)↔10‑Yr U.S. Treasury~4.47%↔S&P 500 FuturesFlat↔ 📈 Market Snapshot (As of June 11, 2025, early ET) 🧭 Analyst View & Market Outlook Short‑Term Trend: Oil remains range-bound between $64–66, as mixed signals from trade and demand create uncertainty. Forecast sensitive to today’s U.S. inventory (API & EIA) data. Medium‑Term Outlook: If China demand picks up and inventory draws continue, $65–68 could be tested. However, elevated OPEC+ output and geopolitical stability could cap gains. Bullish Signals: OPEC+ output discipline paired with encouraging trade dialogue. Early Canadian wildfire disruptions shave global supply. Bearish Risks: Lingering weak demand from China. Rising OPEC+ supply and risk of implementation delays in trade framework. Institutional Insight: Analysts at Bloomberg and Reuters suggest prices will remain clustered around current levels, barring surprise demand uptick or geopolitical flare-up. ⚠️ Important Note: Oil remains highly sensitive to surprises—from geopolitical shifts and stock data to U.S.–China trade clarity. Monitor EIA/API reports and trade/energy headlines closely. ⚠️ Disclaimer: This report is for informational purposes only and does not constitute investment advice. Commodity trading carries risk—please conduct your own analysis or consult a licensed professional. Topics Covered: USOIL price today, June 11 2025 oil update, WTI crude analysis, OPEC+ output, U.S.–China trade impact on oil, China demand outlook, oil inventory data, Canadian wildfires supply, global demand trends. ' https://classroomoftraders.com/trading-signals/usoil-price-movement-today-gold-market-trend-today/?fsp_sid=1239 #Commoditysignals #CrudeOilsignals #TradingSignals

0 notes

Text

The Villainous Paranoiac Sues For Character Defamation (1.5)

“Nii-san?!”

The lump in Idia Shroud’s bed lets out a pitiful groan.

“Nii-san, are you alright?! Are you hungry?! Sick?!” Ortho demands. “Hold on, I’ll do a scan to see what’s wrong!”

A pale, long fingered hand emerges from beneath the covers. It points languidly.

“…sekai…”

“Eh?” The android crowds closer to the bed. “What is it Nii-san? Your computer? Did something bad happen in one of your games? To Precipice Morai? Did an anime get cancelled?”

“…Isekai…”

“Isekai?” The android asks, confused. “Nii-san, what—?”

“I CAN’T ACCEPT THAT A REAL LIFE ISEKAI WOULD COME FROM SUCH A LAME LIGHT NOVEL!!”

It’s with this impassioned cry that Idia Shroud throws off his duvet, hair flaring wildly.

“After all, there are so many worlds that would be so much more likely to be real?! A tech punk world like LoPri just violates several laws of physics, not to mention thaumaturgy?? Plus the characters are so bland and uninspiring, how is it meant to enrich the blackened hearts of this Wonderland if they’re real?! At least if they were from Hyrule or Laputa or Exandria, they could teach us valuable life lessons that would lead to world improvement!”

His fist hits the mattress. “But no! And on top of that, this happens at the same time as they’re leaking that a LoPri movie is in the works?! That’s so cheap!! It’s like an awful marketing tactic that takes your cherished childhood hopes and dreams and crushes them for a few wads of madol!! I can’t believe—”

“Nii-san, wait!” Ortho begs. “What do you mean, there’s been a real life isekai? The sensors you installed should have noticed a large amount of energy coming from something like a world-crossing event.”

Idia jabs an accusatory finger at his computer screen, where the illustration and photo are posed side by side. “Apparently, not if they hijack Night Raven’s carriages to get here!”

Ortho’s optic sensors dilate and contract as his facial recognition software runs.

“…It’s a match.” He says. “Barring the 4% deviations from differing mediums, this person looks almost exactly like the illustrations from Lost Princess. And the Dark Mirror reported they’re entirely magicless…”

Idia jumps when the facsimile of his younger brother appears in his space. “Nii-san, what should we do?! If she really is from this other world, she’s a criminal, isn’t she? Should STYX take her into preventative custody??”

“Eh—Calm down, Ortho.” The elder Shroud says sternly, as if he hadn’t been in near hysterics only a moment ago. “It’s illegal to lock people up if they haven’t done anything wrong yet.”

“But Nii-san—!”

“Besides, as a bad guy she’s like, seriously wimpy.” It takes a moment or two of flailing in the bedclothes before Idia’s phone is retrieved. “See? According to the wiki, even the worst stuff she does is thanks to abusing her rich family’s power and money. Without that, she’s as pathetic as some hero who’s had all his strength sucked out. Even more harmless than a level one slime.”

Ortho’s synthetic brow furrows. “I guess…”

“Heh. Some of those LoPri simps online might even say that this is divine retribution. Getting banished to a world where she’s worth less than nothing.” Idia slumps, flicking through his apps idly. “Ah, the fates are cruel. Why’d I have to be inflicted with this?”

“I will monitor the villainess, Nii-san.” Ortho announces. “If she attempts to partake in any criminal behavior, it will be reported to the authorities, so Nii-san’s daily school life may continue unimpeded.”

“Eh? Well, uh.” Idia’s attention fights with the gacha he’s just opened, but ultimately surrenders to the colorful world within. “Only if it’s a low priority thing, okay?”

“Roger!”

#twisted wonderland#twst#idia shroud#twisted wonderland idia#twst idia#ortho shroud#twst ortho#twisted wonderland ��ortho#twst yuu#villainous paranoiac yuu#suing for character defamation#isekai#reverse isekai#kind of?

37 notes

·

View notes

Text

USOIL Price Movement Today – Gold Market Trend Today

USOIL Price Movement Today – Gold Market Trend Today 📢USOIL Price Movement Today – Gold Market Trend Today 🔻 SELL SIGNAL • Sell Entry At : 65 • Stop Loss: 66 • Target: 63.90 • Current Market Price (CMP): 65 🟡 Daily Oil Market Report – June 11, 2025 🟡 focusing on USOIL (WTI Crude Oil): 📢USOIL Price Movement Today – Gold Market Trend Today🟡 Daily Oil Market Report – June 11, 2025 🟡 focusing on USOIL (WTI Crude Oil):🔑 Key Economic Highlights Driving Oil Prices Today📈 Market Snapshot (As of June 11, 2025, early ET) 🔑 Key Economic Highlights Driving Oil Prices Today 1. Oil Slides as Market Weighs Trade Framework WTI crude softened to around $64.76/bbl (down ~0.34%) amid investor caution following a U.S.–China trade framework announced in London, but not yet finalized by presidents Trump and Xi reuters.com+13tradingeconomics.com+13reuters.com+13. 2. Trade Talks Yield Cautious Optimism U.S. Commerce Secretary Lutnick announced that the framework covers rare earths and export controls—providing some relief—but broad concerns remain over demand and implementation timing reuters.com+10reuters.com+10marketwatch.com+10. 3. OPEC+ Output Rise Pressures Market OPEC+ recently increased supply by ~411 kbpd in early June, and Secretary‑General Al Ghais warned of sustained demand growth—suggesting long-term demand strength but added supply weighed on prices reuters.com. 4. Sluggish Chinese Demand Weak demand from China, despite positive trade signals, dampens oil sentiment amid cautious demand expectations tradingeconomics.com+13reuters.com+13reuters.com+13. 5. Inventory & Wildfire Supply Notes U.S. stockpile data due today may influence price direction; previous weeks saw draws (~3.1 M barrels) and Canada’s wildfires clipped supply—but the recent slide suggests pressure remains . AssetPrice/LevelChangeWTI Crude (USOIL)$64.76/bbl▼ –0.34%Brent Crude≈ $66.56–66.87/bbl▼ ~0.5%U.S. Dollar IndexSteady (~98.97)↔10‑Yr U.S. Treasury~4.47%↔S&P 500 FuturesFlat↔ 📈 Market Snapshot (As of June 11, 2025, early ET) 🧭 Analyst View & Market Outlook Short‑Term Trend: Oil remains range-bound between $64–66, as mixed signals from trade and demand create uncertainty. Forecast sensitive to today’s U.S. inventory (API & EIA) data. Medium‑Term Outlook: If China demand picks up and inventory draws continue, $65–68 could be tested. However, elevated OPEC+ output and geopolitical stability could cap gains. Bullish Signals: OPEC+ output discipline paired with encouraging trade dialogue. Early Canadian wildfire disruptions shave global supply. Bearish Risks: Lingering weak demand from China. Rising OPEC+ supply and risk of implementation delays in trade framework. Institutional Insight: Analysts at Bloomberg and Reuters suggest prices will remain clustered around current levels, barring surprise demand uptick or geopolitical flare-up. ⚠️ Important Note: Oil remains highly sensitive to surprises—from geopolitical shifts and stock data to U.S.–China trade clarity. Monitor EIA/API reports and trade/energy headlines closely. ⚠️ Disclaimer: This report is for informational purposes only and does not constitute investment advice. Commodity trading carries risk—please conduct your own analysis or consult a licensed professional. Topics Covered: USOIL price today, June 11 2025 oil update, WTI crude analysis, OPEC+ output, U.S.–China trade impact on oil, China demand outlook, oil inventory data, Canadian wildfires supply, global demand trends. https://classroomoftraders.com/trading-signals/usoil-price-movement-today-gold-market-trend-today/?fsp_sid=1238 #Commoditysignals #CrudeOilsignals #TradingSignals

0 notes

Text

Saudi Arabia's Drone Revolution: What’s Coming Between 2025–2031

The future is flying—literally.

If you haven’t been paying attention to Saudi Arabia’s skies lately, now’s the time. The country is embracing drone technology at full throttle. From construction megaprojects to smart farming, drones are shaping industries in bold new ways.

And the forecast? 📊 Massive growth between 2025 and 2031.

✨ Why Drones Matter More Than Ever

Here’s why UAVs (unmanned aerial vehicles) are no longer just for hobbyists in Saudi Arabia:

🔹 Construction Projects Like NEOM Huge developments need constant visual tracking. Drones are perfect for aerial progress shots, mapping, and even 3D modeling.

🔹 Oil & Gas Goes Safer Flare stack inspections? Pipeline surveys? Now handled by drones—faster and safer than manual checks.

🔹 Smart Logistics in Smart Cities Drone delivery? It’s not sci-fi anymore. Saudi Arabia’s urban projects are testing it for real-world applications.

🔹 Tech-Driven Farming Thermal imaging, crop monitoring, and water tracking—drones are making desert farming smarter and more efficient.

📍 The Market Forecast: 2025 to 2031

Based on research from Studio52, we’re expecting:

✔️ Year-on-year growth in drone deployment ✔️ Demand explosion for aerial media, inspections & data capture ✔️ Increased investment in drone software & AI integration

✈️ Flight Plans Backed by Law

The GACA (General Authority of Civil Aviation) in Saudi Arabia isn’t holding tech back. Their licensing and regulation systems make commercial drone use easier than ever.

🎥 Not Just Pretty Footage—Powerful Tools

Drones help businesses:

Monitor real estate & site development

Promote with stunning aerial content

Cut inspection time and boost safety

Make data-driven decisions from above

📌 Bottom Line: Saudi Arabia is not just catching up with the drone revolution—it’s leading it.

💡 Want to capture the skies for your next project?

Studio52 offers drone filming services in Saudi Arabia for industrial, corporate, and cinematic needs. Let’s fly higher—together.

#drone filming services in saudi arabia#drone filming#saudi arabia drone filming in saudi arabia#drone photography

0 notes

Text

Atopic Dermatitis Market Intelligence: The Role of Artificial Intelligence in Drug Discovery and Diagnosis

Introduction

The Atopic dermatitis market is a chronic inflammatory skin condition that significantly impacts patients' quality of life. Recent advancements in artificial intelligence (AI) have revolutionized both the diagnosis and treatment of AD. AI's ability to analyze vast datasets and identify patterns has accelerated drug discovery processes and enhanced diagnostic accuracy, offering promising avenues for personalized medicine.

AI in Drug Discovery for Atopic Dermatitis

AI technologies have transformed the landscape of drug discovery, particularly in the realm of AD. Traditional drug development is often time-consuming and costly, but AI has introduced more efficient methodologies.

Target Identification and Validation: AI algorithms analyze genomic, proteomic, and clinical data to identify potential therapeutic targets for AD. For instance, Insilico Medicine utilizes AI to predict the efficacy of compounds against specific targets, expediting the identification of promising drug candidates .

Drug Repurposing: AI facilitates the repurposing of existing drugs for AD treatment by analyzing existing databases to find new therapeutic indications. This approach can significantly reduce development time and costs.

Predictive Modeling: Machine learning models predict the pharmacokinetics and toxicity profiles of drug candidates, aiding in the selection of the most promising compounds for clinical trials.

Clinical Trial Optimization: AI assists in designing more efficient clinical trials by identifying suitable patient populations and predicting potential outcomes, thereby enhancing the likelihood of trial success.

AI in Diagnosis and Monitoring of Atopic Dermatitis

AI's impact extends beyond drug discovery into the realm of diagnosis and monitoring of AD.

Image Recognition: AI-powered systems analyze skin lesion images to diagnose AD with high accuracy. For example, convolutional neural networks (CNNs) have been trained on large datasets of skin images to identify characteristic patterns of AD lesions .

Severity Assessment: AI models assess the severity of AD by analyzing clinical images and patient-reported symptoms. This objective assessment aids clinicians in determining appropriate treatment plans.

Wearable Technology: AI-integrated wearable devices monitor patients' scratching behaviors, providing real-time data on disease activity. Studies have shown that accelerometer-equipped wristwatches can detect scratching motions with high accuracy, offering insights into disease progression .

Predictive Analytics: AI analyzes patient data to predict flare-ups and disease progression, enabling proactive management and personalized treatment strategies.

Challenges and Ethical Considerations

Despite the promising applications of AI in AD, several challenges and ethical considerations must be addressed.