#Forex Bot

Explore tagged Tumblr posts

Video

Forex Robot Made a 16% profit Win Rate in just 2 days! Best Forex Robot ...

#youtube#Forex Robot#Forex Ea#Scalping Ea#Forex Trading#Forex#Forex Live account#Best scalping Ea#Best Forex Robot#Best Forex Ea#Forex bot

0 notes

Text

What is trading robot?

Delving into the World of Trading Robot: Automation at Your Fingertips

Trading robots, also known as algorithmic trading systems or expert advisors (EAs), have become increasingly popular in recent years. These automated programs use algorithms to analyze market data and execute trades based on predefined rules.

In the fast-paced realm of finance, where markets churn and opportunities flicker, trading robot have emerged as intriguing tools for both seasoned traders and curious newcomers. But what exactly are these bots, and how do they operate? Buckle up, as we navigate the fascinating world of automated trading:

Understanding the Essence:

At their core, trading robots are software programs imbued with algorithms that analyze market data and automatically execute trades based on predefined parameters. Imagine a tireless assistant, constantly monitoring charts, identifying patterns, and executing your trading strategy without emotions or fatigue. Sounds tempting, right?

Potential Benefits:

They offer several potential benefits, it's crucial to understand both the advantages and drawbacks before diving in.

24/7 Trading: Unlike humans, robots never sleep. They can monitor markets around the clock, potentially capturing opportunities that you might miss due to limited time or sleep.

Emotionless Decisions: Human emotions like fear and greed can cloud judgment and lead to impulsive trades. Robots, devoid of emotions, can execute trades based on logic and predefined rules, potentially leading to more disciplined trading.

Speed and Efficiency: Robots can analyze vast amounts of data and identify trading opportunities much faster than humans. This speed can be crucial in volatile markets where quick reactions are essential.

Backtesting and Optimization: Robots allow you to backtest your trading strategies on historical data, helping you refine and optimize them before risking real capital.

Accessibility to Complex Strategies: Robots can execute complex trading strategies that might be difficult or time-consuming for humans to implement manually.

Risks:

They come with their own set of risks and limitations:

Overreliance and Neglect: Don't blindly trust a robot to make all your trading decisions. Always understand the logic behind its actions and monitor its performance closely.

Black Box Syndrome: Some robots are complex and their decision-making process can be opaque, making it difficult to understand why they make certain trades.

Technical Issues: Robots are software, and software can malfunction. Ensure your robot has robust error handling and security measures in place.

Market Changes: Robots are based on algorithms, which may not adapt well to sudden market shifts or unforeseen events.

High Costs: Some robots can be expensive to purchase or rent, and additional fees might be associated with their use.

Before using a trading robot, it's essential to:

Do your research: Understand how the robot works and the risks involved.

Backtest and optimize: Test the robot on historical data to see how it performs.

Start small: Begin with a small amount of capital and gradually increase it as you gain confidence.

Never set and forget: Always monitor your robot's performance and be prepared to intervene if necessary.

Delving into the Operation:

These bots’ function like mini-traders, following a set of instructions you provide. These instructions, often encoded in languages like MQL or Python, outline factors like:

Technical indicators: Moving averages, RSI, Bollinger Bands - the bot uses these to identify potential entry and exit points.

Risk management: Stop-loss and take-profit orders are crucial to limit losses and lock in gains.

Position sizing: The bot determines how much to invest in each trade based on your risk tolerance and capital.

The Allure of Automation:

Trading robot offer several potential benefits:

24/7 Operation: They tirelessly monitor markets, even while you sleep or pursue other endeavors.

Emotionless Trading: They remove human emotions like fear and greed, which can cloud judgment.

Backtesting: You can test their performance on historical data before risking real capital.

But Beware, the Caveats:

Despite their appeal, trading robots aren't magic bullets. Remember:

Not a "Get Rich Quick" Scheme: They require careful setup, monitoring, and adjustments.

Not Foolproof: Markets are unpredictable, and losses are still possible.

Technical Knowledge Needed: Understanding the algorithms and market dynamics is crucial.

Exploring Different Types:

The trading robot landscape is diverse, with options for:

Forex: Popular for their 24/5 operation, forex robots trade currency pairs.

Stocks: These bots navigate the dynamic stock market based on various strategies.

Cryptocurrency: Specialized bots cater to the volatile world of crypto, requiring extra caution.

Before You Dive In:

Remember, due diligence is paramount:

Understand the risks: Trading involves inherent risks, and losses are possible.

Research the bot: Check its creator's reputation, performance history, and user reviews.

Start small: Begin with a small investment and closely monitor the bot's performance.

4xPip:

4xPip provides the "best" way to use a trading robot. While 4xPip offers trading tools and resources, including robots, making such claims requires strong evidence and can be subjective and risky.

#black tumblr#black art#black history#black literature#black fashion#Forex Strategy#Forex Expert#Trading Algorithm#Trading Script#Forex Trading System#Forex Bot#Customize EA#Forex auto trading bots#Forex trading bots#automate trading bots#custom bot EA#auto trading bots#custom bots trading#Custom Bots

0 notes

Text

Contact me now. If you're struggling to get your prop firm challenge passed successfully, I can help you get it passed successfully within a few days.

#forex#forex online trading#trading bot#finance broker#broker plush#stock broker#real estate broker#insurance broker#mortgage broker#brokerage#forex factory#broker phighting

3 notes

·

View notes

Text

UAITrading (Unstoppable AI Trading): AI-Powered Trading for Stocks, Forex, and Crypto

https://uaitrading.ai/ UAITrading For On trading volumes offers, many free trade analysis tools and pending bonuses | Unstoppable AI Trading (Uaitrading) is a platform that integrates advanced artificial intelligence (AI) technologies to enhance trading strategies across various financial markets, including stocks, forex, and cryptocurrencies. By leveraging AI, the platform aims to provide real-time asset monitoring, automated portfolio management, and optimized trade execution, thereby simplifying the investment process for users.

One of the innovative features of Unstoppable AI Trading is its UAI token farming, which offers users opportunities to earn additional income through decentralized finance (DeFi) mechanisms. This approach allows traders to diversify their investment strategies and potentially increase returns by participating in token farming activities.

The platform's AI-driven systems are designed to analyze vast amounts of market data, identify profitable trading opportunities, and execute trades without human intervention. This automation not only enhances efficiency but also reduces the emotional biases that often affect human traders, leading to more consistent and objective trading decisions.

By harnessing the power of AI, Unstoppable AI Trading aims to empower both novice and experienced traders to navigate the complexities of financial markets more effectively, offering tools and strategies that adapt to dynamic market conditions

#Uaitrading#AI Trading#Automated Trading#Forex Trading AI#Crypto Trading Bot#UAI Token#Token Farming#Decentralized Finance (DeFi)#AI Investment Platform#Smart Trading Algorithms#AI Stock Trading#Machine Learning in Trading#AI-Powered Portfolio Management#Algorithmic Trading#Uaitrading AI Trading#Forex AI#Smart Trading#Stock Market#AI Investing#Machine Learning Trading#Trading Bot#Crypto AI#DeFi#UAI#Crypto Investing

2 notes

·

View notes

Text

Crypto-Forex Arbitrage: Strategies for Maximizing Profits

Crypto-Forex arbitrage involves leveraging the price differences between cryptocurrencies and traditional currencies across various exchanges. This strategy aims to maximize profits by exploiting these discrepancies. Understanding and implementing effective arbitrage strategies can help traders capitalize on market inefficiencies. Understanding Arbitrage Arbitrage is a trading strategy that…

#Arbitrage Strategies#Automated Trading#Bitcoin#Crypto#Crypto-Forex Arbitrage#Cryptocurrency#Exchange Rates#Forex#Forex Trading#Liquidity#Market Conditions#Market Inefficiencies#Market News#Market Volatility#Price Movements#Profitability#Security#Spatial Arbitrage#Statistical Arbitrage#Trading Bots#Trading Strategy#Transaction Costs#Triangular Arbitrage#Volatility

3 notes

·

View notes

Text

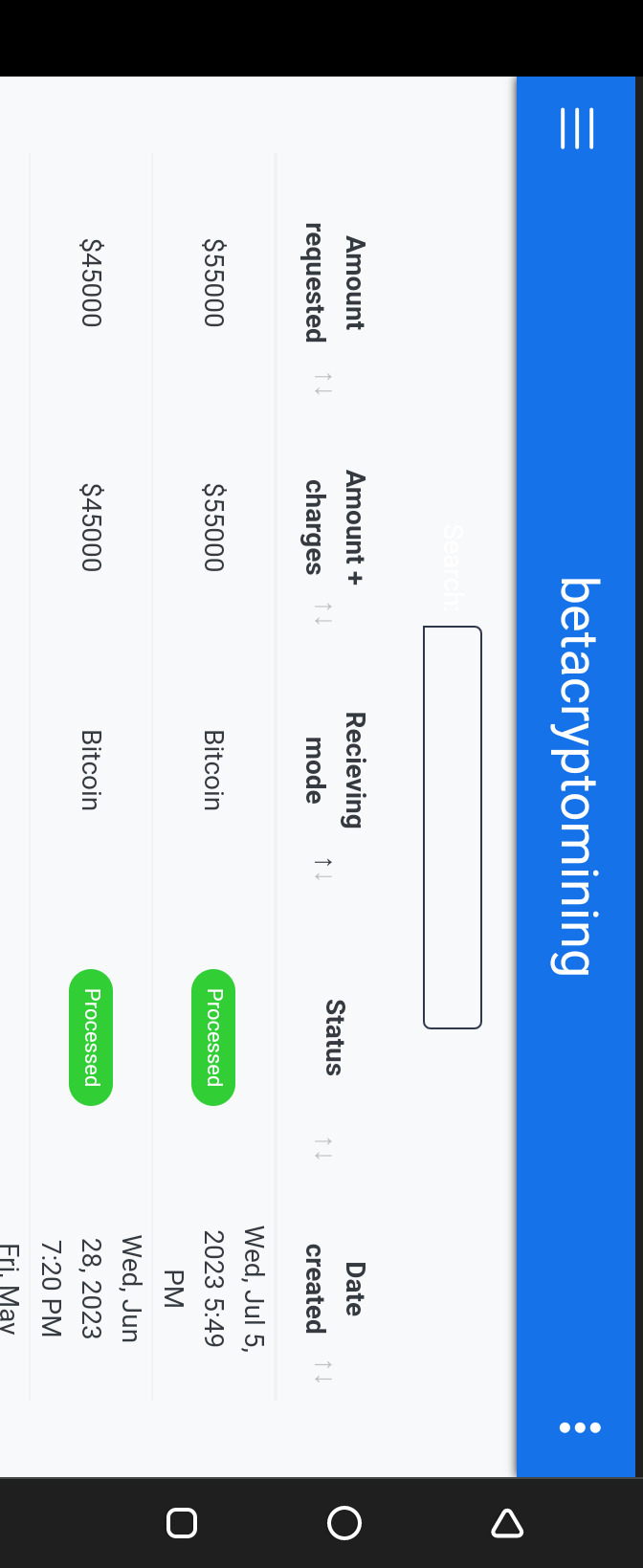

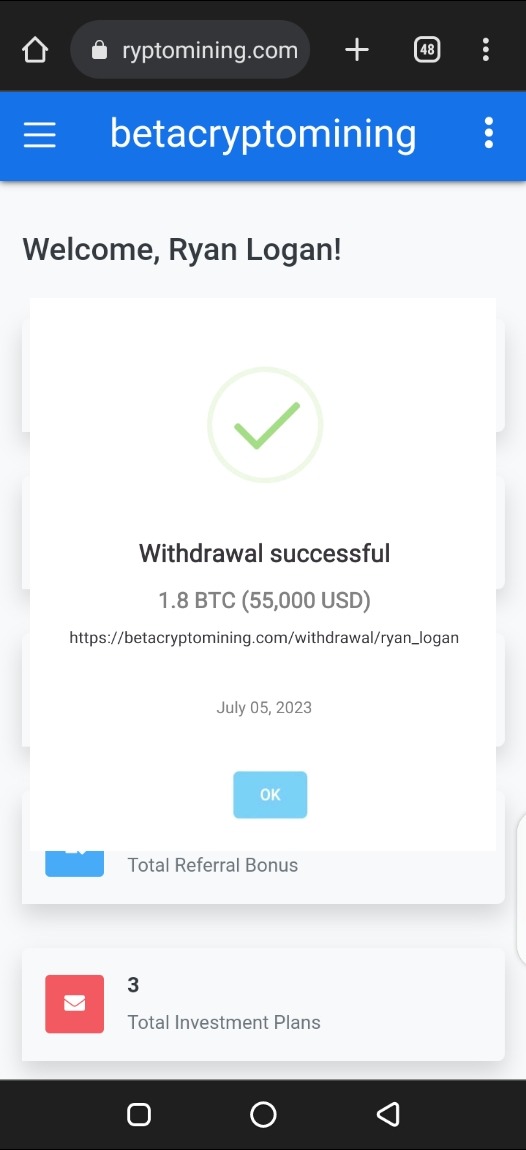

With This Platform You Can Make $5000 Weekly

Crypto trading platform you should not joke with, profit very high with their professional trading bot. 👇👇

#crypto trading#cryptocurrency news#btc latest news#workfromhome#work in progress#forexmarket#forex#forextips#trader#binance trading bot#binance clone script#binance clone software#binance smart chain#binance news#cryptocurrency news latest#coinbase#bitcoin latest news#south africa rugby#south africa luxury tours#zimbabwe#south america#westerncape#southernafrica#indonesia#indonesia vs argentina#malaysia tourist visa#malaysia business visa#malaysia vandi#malaysia boleh#philippines bl

14 notes

·

View notes

Text

Gambit is a company that offers forex trading courses, and referral programs.

Gambit is a company that offers forex trading courses, and referral programs. It recently held a forex expo in Bangkok, which aimed to inform people about forex trading and how Gambit uses artificial intelligence and machine learning to generate profitable signals and trades. Gambit also teaches its clients the gambit trading strategy, which is a method of sacrificing a small amount of money to gain an advantage over the market. By using Gambit’s services, clients can benefit from low-risk and high-reward forex trading opportunities.

#financialservices#forextrading#gambit#marketing#youtube#forexbot#accounting#forex online trading#wealthmanagement#forex#trading bot#tech#forex trading#tranding#usa#dollor

6 notes

·

View notes

Text

Speed, intelligence, and accuracy—these are the hallmarks of Golden Sapphire’s Forex trading bot offering high-frequency trading solutions. Whether the market spikes or drops, our bot reacts in milliseconds, locking in opportunities with precision. Developed by market experts and software engineers, our bot is your strategic tool in forex success.

0 notes

Text

Best Algo trading bot

0 notes

Video

The Ultimate The Power of Our 2024 Scalping EA Robot Maximizing Profits ...

#youtube#best scalping ea#forex robot#forex trading#forex ea#forex scalper#forex bot#forex system#forex live#forex market#forexsignals#forextrading

0 notes

Text

Mastering Forex Auto Trading Bots: A Comprehensive Guide to Automated Forex Trading

Introduction:

In the fast-paced world of Forex trading, staying ahead of the curve is essential for success. With markets operating 24/7 and prices fluctuating rapidly, manual trading strategies may not be sufficient to capitalize on every opportunity. This is where Forex auto trading bots come into play. In this comprehensive guide, we'll explore everything you need to know about Forex auto trading bots, from their benefits and functionalities to best practices for implementation and optimization.

Understanding Forex Auto Trading Bots:

Forex auto trading bots are sophisticated algorithms designed to execute trades automatically in the Forex market based on predefined rules and criteria. These bots leverage advanced technology to analyze market data, generate trading signals, and execute trades with speed and precision, eliminating the need for manual intervention.

Benefits of Forex Auto Trading Bots:

The benefits of Forex auto trading bots are multifaceted, offering traders a range of advantages that can significantly enhance their trading experience and performance. Let's delve deeper into each of these benefits:

Efficiency and Speed: Forex auto trading bots are designed to execute trades swiftly and efficiently, often in milliseconds. This speed far surpasses the capabilities of human traders, enabling bots to capitalize on fleeting market opportunities and minimize latency-related losses. By executing trades with lightning-fast speed, auto trading bots ensure that traders can enter and exit positions promptly, maximizing the potential for profit and reducing the risk of missing out on profitable trades due to delays.

Elimination of Emotional Biases: One of the most significant advantages of Forex auto trading bots is their ability to eliminate emotional biases from the trading process. Human traders are often susceptible to emotions such as fear, greed, and impatience, which can cloud judgment and lead to irrational trading decisions. By executing trades based solely on predefined rules and criteria, auto trading bots remove the influence of emotions from the equation. This leads to more disciplined and consistent trading, free from the psychological pitfalls that can plague human traders.

24/7 Market Monitoring: Forex markets operate around the clock, spanning different time zones and continents. For human traders, keeping track of market movements and opportunities can be challenging, especially during off-hours or when traders are unavailable due to other commitments. Forex auto trading bots address this challenge by operating continuously, providing traders with round-the-clock market monitoring and execution capabilities. This ensures that trading opportunities are captured promptly, regardless of the time of day or night.

Backtesting and Optimization: Forex auto trading bots offer the ability to backtest trading strategies using historical market data. This allows traders to evaluate the performance of their strategies, identify strengths and weaknesses, and optimize parameters for better results. Through iterative testing and optimization, traders can refine their trading strategies over time, improving profitability and reducing the risk of losses. By leveraging the backtesting capabilities of auto trading bots, traders can make informed decisions based on empirical evidence rather than guesswork or intuition.

Diversification and Risk Management: Auto trading bots enable traders to diversify their trading activities across multiple currency pairs simultaneously. This diversification provides several benefits, including spreading risk across different assets and reducing exposure to individual market movements. Additionally, auto trading bots can incorporate sophisticated risk management techniques, such as position sizing and stop-loss orders, to help traders manage risk effectively. By diversifying their trading activities and implementing robust risk management strategies, traders can mitigate potential losses and safeguard their capital in volatile Forex markets.

Forex auto trading bots offer traders a range of benefits, including efficiency and speed, elimination of emotional biases, round-the-clock market monitoring, backtesting and optimization capabilities, and diversification and risk management benefits. By leveraging these advantages, traders can enhance their trading performance, maximize profitability, and achieve their financial goals with confidence and consistency.

Implementing Forex Auto Trading Bots:

Define Trading Objectives: Before implementing Forex auto trading bots, clearly define your trading objectives, risk tolerance, and performance metrics. Determine whether you're aiming for short-term gains, long-term growth, or income generation. Establishing clear objectives provides a framework for selecting the right bot and designing a suitable trading strategy.

Choose the Right Bot: Select a Forex auto trading bot that aligns with your trading objectives, strategy, and technical expertise. Consider factors such as speed, reliability, performance, and compatibility with your trading platform.

Backtest Your Strategy: Backtest your trading strategy using historical market data to evaluate performance and identify areas for improvement. Adjust parameters and optimize the bot based on backtesting results to enhance its effectiveness and profitability.

Monitor Performance: Regularly monitor the performance of your Forex auto trading bot and make adjustments as needed. Evaluate key metrics such as profitability, drawdowns, and execution speed. Be prepared to adapt the bot's parameters and settings to changing market conditions.

Stay Informed: Keep abreast of market developments, news events, and economic indicators that may impact currency prices. Adapt your Forex auto trading bot to changing market conditions and refine your strategy accordingly to capitalize on emerging opportunities and mitigate risks effectively.

Conclusion:

Forex auto trading bots offer traders a powerful tool to streamline trading operations, enhance efficiency, and capitalize on market opportunities. By leveraging the benefits of automation, traders can eliminate emotional biases, optimize trading strategies, and achieve consistent results in the dynamic Forex market. With a well-designed strategy and the right Forex auto trading bot at your disposal, you can navigate the complexities of Forex trading with confidence and achieve your financial goals.

#Forex auto trading bots#Custom Bots#custom bots trading#auto trading bots#custom bot EA#automate trading bots#Forex trading bots#Customize EA#Trading Robot#Forex Bot#Forex Trading System#Trading Script#Trading Algorithm#Forex Expert

0 notes

Text

#trading community#investment insights#crypto signals#forex trading alerts#stock market updates#trading strategies#financial news#business growth#crypto airdrops#automated trading bots#secure wallets#profitable mining#market indicators#trading exchanges#swap deals#trusted trading platforms#passive income#wealth building#financial freedom#Rishtrade Telegram

0 notes

Text

Smart AI Forex Trading Bot for Automated Profitability

Are you looking for a smarter way to trade Forex and maximize your profits? Our smart AI forex trading bot is designed to help traders of all levels automate their trading strategies, minimize risks, and optimize returns. Whether you're a beginner or an experienced trader, this AI-powered bot ensures seamless, data-driven decision-making for enhanced profitability.

Why Choose Our AI Forex Trading Bot?

✅ Fully Automated Trading – Let AI execute trades for you 24/7 without manual intervention. ✅ Real-Time Market Analysis – Uses advanced algorithms to analyze market trends and make precise trade decisions. ✅ Risk Management Features – Stop-loss and take-profit settings to safeguard your investments. ✅ Customizable Strategies – Adjust trading parameters based on your risk appetite and trading style. ✅ High-Speed Execution – Lightning-fast order processing to capitalize on market opportunities. ✅ AI-Powered Decision Making – Eliminates emotional trading, ensuring logical and strategic moves. ✅ Multi-Currency Support – Trade various Forex pairs with a single AI system. ✅ User-Friendly Interface – Easy-to-use dashboard for seamless bot configuration and monitoring.

Who Can Benefit?

✔️ Forex traders looking to automate their strategies. ✔️ Beginners who want to trade with AI assistance. ✔️ Experienced traders aiming for efficiency and consistency. ✔️ Investors seeking passive income through algorithmic trading.

Conclusion

With our Smart AI forex trading bot, you can trade smarter, reduce risks, and increase your profitability—all on autopilot. It’s time to embrace cutting-edge technology and stay ahead in the Forex market. Start your journey with Ziplip Technology today and experience the power of AI forex trading and stock trading bot like never before!

#investing#stock market#business#AI forex trading#ai trading#forex trading#forex market#stock trading#trading bot#Ziplip Technology#Automated Trading

1 note

·

View note

Text

Congratulations to Erin for an incredible $5,853.67 profit payout with Blue Guardian 🙌

This isn't just another EA; it's a revolution in automated trading. Designed for traders who demand results. Our profitable EA bot consistently delivers success whether you're passing prop firm challenges or withdrawing life changing payouts 💸

#forex online trading#broker plush#broker phighting#forex factory#forex#forex market#trading bot#tradingexpert

0 notes

Text

Gold Price Forecast: XAU/USD Breakdown Levels Identified

Gold (XAU/USD) Technical Analysis

Gold breakdown analysis and levels to note

Retest of recent level of support (now resistance) adds to the bearish outlook

Momentum via the MACD supports lower prices while the RSI suggests more room to the downside is possible.

Gold Breakdown Analysis and Levels to Note

Gold has continued its decline that began after reaching an all-time high of 2081.82 in early May after a resurgence of regional banking woes in the US culminated in JP Morgan absorbing the troubled First Republic Bank. The move lower ran out of steam and entered into a period of consolidation near the lower bound of the ascending channel (refer to daily chart) before renewed bearish momentum resulted in a break and hold below the ascending channel on the weekly chart.

From current levels, 1875 appears as the most relevant level of support as it had acted as a pivot point on multiple occasions despite that coming in the form of resistance, capping higher prices at the time. Nevertheless, it is a crucial level for both bulls and bears. Now that prices have closed below the upward-sloping channel, the next level of resistance appears all the way at 1956 — a prior level that had kept bulls at bay.

Gold XAU/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

Textbook-like Retest Suggests Further Downside for Gold

Typically, breakouts and breakdowns have a tendency to retest the level that had just been broken, meaning pullbacks after breaks are often observed. Over the weekend geopolitical tensions picked up a notch in eastern Europe, seeing gold prices retest 1937 and the underside of the ascending channel before heading lower in subsequent trading sessions.

Prices now trade below 1915 which acted as support for the months of March and April last year. A close beneath this level on the daily chart adds to the bearish outlook, with ample room to run before the 1875 level and the 200 simple moving average comes into play. Resistance at 1937 on the daily chart.

#marketing#financialservices#forextrading#gambit#forexbot#accounting#forex online trading#wealthmanagement#forex#youtube#forex trading#trading bot

3 notes

·

View notes

Text

Unlocking the Power of TradingView: The Best Charting Platform for Traders

A sleek and modern TradingView dashboard displaying real-time charts, candlestick patterns, and powerful technical indicators like RSI and MACD. Are you looking for a powerful, easy-to-use charting tool to enhance your trading? Whether you’re a beginner or an experienced trader, TradingView is one of the best platforms for technical analysis, market insights, and strategy building. And here’s…

#Affiliate Marketing#Automated trading#Candlestick patterns#Crypto trading#Day trading#Forex trading#Investing#MACD#Market analysis#Online trading#passive income#RSI#Stock market#Swing trading#Technical analysis#Trading alerts#Trading bots#Trading platform#Trading signals#Trading strategies#Trading tools#TradingView#TradingView charts#TradingView indicators#TradingView plans#TradingView pricing#TradingView review

0 notes