#TradingView pricing

Explore tagged Tumblr posts

Text

Unlocking the Power of TradingView: The Best Charting Platform for Traders

A sleek and modern TradingView dashboard displaying real-time charts, candlestick patterns, and powerful technical indicators like RSI and MACD. Are you looking for a powerful, easy-to-use charting tool to enhance your trading? Whether you’re a beginner or an experienced trader, TradingView is one of the best platforms for technical analysis, market insights, and strategy building. And here’s…

#Affiliate Marketing#Automated trading#Candlestick patterns#Crypto trading#Day trading#Forex trading#Investing#MACD#Market analysis#Online trading#passive income#RSI#Stock market#Swing trading#Technical analysis#Trading alerts#Trading bots#Trading platform#Trading signals#Trading strategies#Trading tools#TradingView#TradingView charts#TradingView indicators#TradingView plans#TradingView pricing#TradingView review

0 notes

Text

youtube

🧱 Comment utiliser l’indicateur Renko en 5 minutes

Le Renko est un indicateur puissant, souvent ignoré, qui peut rendre vos graphiques plus clairs, plus lisibles et vos décisions plus efficaces. En seulement 5 minutes, découvrez comment l’utiliser pour filtrer le bruit et identifier les tendances avec précision.

📌 Dans cette vidéo, vous apprendrez : ✅ Ce qu’est l’indicateur Renko et comment il fonctionne ✅ Comment l’utiliser pour repérer les meilleures tendances ✅ Mais aussi quels sont ses inconvénients

Un outil simple mais redoutablement efficace. À tester d’urgence !

#stock market#Renko#indicateur Renko#Renko trading#graphique Renko#comprendre Renko#utiliser Renko#analyse technique#indicateur tendance#price action#stratégie Renko#trading Renko#chartisme#Renko débutant#Renko expliqué#filtre bruit marché#brique Renko#trading pro#Renko Forex#Renko crypto#Renko simple#tradingview#prorealtime#Youtube

0 notes

Text

Stock Price Forecast: United Rentals Could Hit $3,000 by 2029 – Here’s Why

Discover why United Rentals Inc. is a top stock pick for 2024 and beyond. Explore stock price forecasts, and investment insights. #UnitedRentalsstockforecast #UnitedRentals #URI #UnitedRentalsinvestmenttips #Dividendincreasestocks #Beststockstobuynow

United Rentals Inc. is the largest equipment rental company in the world, with a vast network of 1 686 rental locations across North America, Europe, Australia, and New Zealand. They offer a wide range of equipment rentals, sales, servicing, and safety training. Continue reading Stock Price Forecast: United Rentals Could Hit $3,000 by 2029 – Here’s Why

#Best stocks to buy now#Dividend increase stocks#High-growth stocks#Investment#Investment Insights#Long-term growth stocks#Stock Forecast#Stock Insights#Stock market correction opportunities#Stock price prediction#Stock price pullback strategy#TradingView stock analysis#United Rentals 2029 price target#United Rentals dividend yield#United Rentals financial performance#United Rentals Inc#United Rentals investment tips#United Rentals market cap#United Rentals stock forecast#URI

0 notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

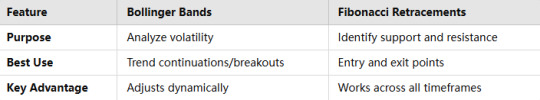

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Text

FP Markets Review ☑️ Top Forex Brokers Review (2025)

Welcome to our in-depth FP Markets Review, where we explore everything you need to know about this well-established forex and CFD broker. Whether you're a seasoned trader or just starting your trading journey, this review will provide valuable insights into FP Markets' services, features, and its position in the competitive forex market of 2025. As part of our analysis, we’ll also touch on the broader forex market landscape and how FP Markets compares to its competitors. This review is brought to you by Top Forex Brokers Review, your trusted source for unbiased and detailed broker evaluations.

FP Markets Overview

Company Background

FP Markets, founded in 2005, is an Australian-based broker with a strong reputation for reliability and transparency. Over the years, it has grown into a global brand, offering a wide range of trading instruments and services. Headquartered in Sydney, FP Markets has achieved several milestones, including expanding its regulatory footprint and introducing advanced trading platforms to cater to a diverse clientele.

Regulation and Security

FP Markets is regulated by multiple top-tier authorities, including:

Australian Securities and Investments Commission (ASIC)

Cyprus Securities and Exchange Commission (CySEC)

Capital Markets Authority of Kenya (CMA)

Financial Sector Conduct Authority in South Africa (FSCA).

This robust regulatory framework ensures that FP Markets adheres to strict financial standards, providing a secure trading environment. Additionally, the broker segregates client funds from its operational capital, further enhancing safety and trustworthiness.

Services and Features

Trading Platforms

FP Markets offers a variety of trading platforms to suit different trading styles and preferences:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These industry-standard platforms are known for their advanced charting tools, automated trading capabilities, and user-friendly interfaces. They are available on desktop, web, and mobile devices.

cTrader: This platform is ideal for traders who value the depth of market visibility and advanced order capabilities. It also supports algorithmic trading through cAlgo.

IRESS Platform: Designed for trading equities, indices, and futures CFDs, IRESS offers a high level of customization and transparency in market pricing.

TradingView Integration: FP Markets integrates with TradingView, a popular platform for technical analysis and social networking among traders.

Account Types

FP Markets provides several account types to cater to different trading needs:

Standard Account: Aimed at beginners, this account requires a minimum deposit of AUD 100 and offers spreads starting at 1.0 pips with no commissions.

Raw Account: Designed for experienced traders, it also requires an AUD 100 minimum deposit but offers spreads from 0.0 pips with a commission of $3.50 per lot per trade.

IRESS Accounts: These include Standard, Platinum, and Premier accounts, each with varying minimum deposits and brokerage fees. They are tailored for active traders and offer Direct Market Access (DMA).

Islamic Accounts: Swap-free accounts adhering to Sharia law are available for both MetaTrader and IRESS platforms.

Range of Tradable Instruments

FP Markets boasts an impressive range of over 10,000 tradable instruments, including:

Forex: Over 70 currency pairs, covering both major and exotic pairs.

Shares: Access to more than 13,000 global shares.

Indices, Commodities, and Cryptocurrencies: A wide selection of indices, commodities like gold and oil, and cryptocurrency CFDs 9.

Leverage and Spreads

FP Markets offers competitive leverage options, with forex leverage up to 500:1. The Raw ECN account provides spreads starting from 0.0 pips, making it an attractive choice for cost-conscious traders

Additional Services

FP Markets goes beyond trading by offering:

Educational Resources: Webinars, trading guides, and video tutorials to help traders improve their skills.

Market Analysis: Daily market updates and insights to keep traders informed.

Customer Support: 24/7 multilingual support via live chat, email, and phone.

User Reviews and Feedback Customer Satisfaction

FP Markets generally receives positive feedback from users, particularly for its:

Competitive Pricing: Low spreads and transparent fee structures are frequently praised.

Platform Variety: The availability of multiple platforms like MetaTrader, cTrader, and IRESS is well-received.

Customer Support: The broker's 24/7 multilingual support is highly rated.

Common Criticisms

Some users have noted areas for improvement, such as:

Limited features in the proprietary mobile app compared to industry leaders.

Higher spreads on the Standard account, which may not be ideal for traders seeking commission-free options.

Forex Market Landscape in 2025

Geopolitical and Economic Factors

The forex market in 2025 is shaped by several key trends:

Geopolitical Tensions: Ongoing conflicts and rising tensions between major powers like the US and China are driving market volatility.

US Political Climate: The return of Donald Trump to the White House is expected to influence the US dollar through policies like tariffs and increased spending.

Central Bank Policies: Interest rate adjustments by central banks like the Federal Reserve and the European Central Bank are pivotal in shaping currency values.

Technological and Regulatory Developments

AI in Forex Trading: The integration of AI tools is democratizing market analysis, enabling traders to make more informed decisions.

Regulatory Changes: Enhanced oversight in forex trading is improving transparency but may increase operational costs.

Implications for FP Markets

FP Markets is well-positioned to thrive in this dynamic landscape by leveraging its advanced trading platforms and robust regulatory compliance. Its focus on emerging markets and technological innovation further strengthens its competitive edge

Competitive Analysis

Top Competitors

FP Markets faces competition from brokers like IC Markets, Pepperstone, and XM. While these brokers also offer competitive pricing and advanced platforms, FP Markets stands out for its extensive range of tradable instruments and strong regulatory framework

Strengths and Weaknesses

Strengths: Regulatory compliance, competitive pricing, and platform variety.

Weaknesses: Limited mobile app features and higher spreads on Standard accounts

Conclusion

FP Markets is a reliable and well-regulated broker that offers a comprehensive range of services and features. Its competitive pricing, extensive platform offerings, and robust regulatory framework make it a strong choice for traders in 2025. While there are areas for improvement, such as mobile app features and Standard account spreads, the overall user feedback is positive. For traders seeking a secure and versatile trading environment, FP Markets is undoubtedly worth considering.

2 notes

·

View notes

Text

Bitcoin Price Falls Below $54,000 as Crypto Liquidations Reach $665 Million

The cryptocurrency market experienced a significant downturn on July 5th, with Bitcoin taking the brunt of the bearish sentiment. The price of Bitcoin plummeted to a four-month low of $53,499 on major exchange Coinbase, following news of a large Bitcoin transfer from the defunct Mt. Gox exchange. According to TradingView data, Bitcoin’s sharp decline began around 4:19 am UTC, marking its lowest…

3 notes

·

View notes

Text

Crypto trading mobile app

Designing a Crypto Trading Mobile App involves a balance of usability, security, and aesthetic appeal, tailored to meet the needs of a fast-paced, data-driven audience. Below is an overview of key components and considerations to craft a seamless and user-centric experience for crypto traders.

Key Elements of a Crypto Trading Mobile App Design

1. Intuitive Onboarding

First Impressions: The onboarding process should be simple, guiding users smoothly from downloading the app to making their first trade.

Account Creation: Offer multiple sign-up options (email, phone number, Google/Apple login) and include KYC (Know Your Customer) verification seamlessly.

Interactive Tutorials: For new traders, provide interactive walkthroughs to explain key features like trading pairs, order placement, and wallet setup.

2. Dashboard & Home Screen

Clean Layout: Display an overview of the user's portfolio, including current balances, market trends, and quick access to popular trading pairs.

Market Overview: Real-time market data should be clearly visible. Include options for users to view coin performance, historical charts, and news snippets.

Customization: Let users customize their dashboard by adding favorite assets or widgets like price alerts, trading volumes, and news feeds.

3. Trading Interface

Simple vs. Advanced Modes: Provide two versions of the trading interface. A simple mode for beginners with basic buy/sell options, and an advanced mode with tools like limit orders, stop losses, and technical indicators.

Charting Tools: Integrate interactive, real-time charts powered by TradingView or similar APIs, allowing users to analyze market movements with tools like candlestick patterns, RSI, and moving averages.

Order Placement: Streamline the process of placing market, limit, and stop orders. Use clear buttons and a concise form layout to minimize errors.

Real-Time Data: Update market prices, balances, and order statuses in real-time. Include a status bar that shows successful or pending trades.

4. Wallet & Portfolio Management

Asset Overview: Provide an easy-to-read portfolio page where users can view all their holdings, including balances, performance (gains/losses), and allocation percentages.

Multi-Currency Support: Display a comprehensive list of supported cryptocurrencies. Enable users to transfer between wallets, send/receive assets, and generate QR codes for transactions.

Transaction History: Offer a detailed transaction history, including dates, amounts, and transaction IDs for transparency and record-keeping.

5. Security Features

Biometric Authentication: Use fingerprint, facial recognition, or PIN codes for secure logins and transaction confirmations.

Two-Factor Authentication (2FA): Strong security protocols like 2FA with Google Authenticator or SMS verification should be mandatory for withdrawals and sensitive actions.

Push Notifications for Security Alerts: Keep users informed about logins from new devices, suspicious activities, or price movements via push notifications.

6. User-Friendly Navigation

Bottom Navigation Bar: Include key sections like Home, Markets, Wallet, Trade, and Settings. The icons should be simple, recognizable, and easily accessible with one hand.

Search Bar: A prominent search feature to quickly locate specific coins, trading pairs, or help topics.

7. Analytics & Insights

Market Trends: Display comprehensive analytics including top gainers, losers, and market sentiment indicators.

Push Alerts for Price Movements: Offer customizable price alert notifications to help users react quickly to market changes.

Educational Content: Include sections with tips on technical analysis, crypto market basics, or new coin listings.

8. Social and Community Features

Live Chat: Provide a feature for users to chat with customer support or engage with other traders in a community setting.

News Feed: Integrate crypto news from trusted sources to keep users updated with the latest market-moving events.

9. Light and Dark Mode

Themes: Offer both light and dark mode to cater to users who trade at different times of day. The dark mode is especially important for night traders to reduce eye strain.

10. Settings and Customization

Personalization Options: Allow users to choose preferred currencies, set trading limits, and configure alerts based on their personal preferences.

Language and Regional Settings: Provide multilingual support and regional settings for global users.

Visual Design Considerations

Modern, Minimalist Design: A clean, minimal UI is essential for avoiding clutter, especially when dealing with complex data like market trends and charts.

Color Scheme: Use a professional color palette with accents for call-to-action buttons. Green and red are typically used for indicating gains and losses, respectively.

Animations & Micro-interactions: Subtle animations can enhance the experience by providing feedback on button presses or transitions between screens. However, keep these minimal to avoid slowing down performance.

Conclusion

Designing a crypto trading mobile app requires focusing on accessibility, performance, and security. By blending these elements with a modern, intuitive interface and robust features, your app can empower users to navigate the fast-paced world of crypto trading with confidence and ease.

#uxbridge#uxuidesign#ui ux development services#ux design services#ux research#ux tools#ui ux agency#ux#uxinspiration#ui ux development company#crypto#blockchain#defi#ethereum#altcoin#fintech

2 notes

·

View notes

Text

Bagaimana cara melakukan market timing di crypto?

Hal ini memang terdengar sedikit "tidak mungkin" karena memang faktanya market timing adalah hal yang paling sulit di dunia, namun apabila di perhatikan Akademi Crypto berhasil melakukan banyak market timing dari target pergerakan harga Bitcoin hingga melakukan market timing berbagai narrative yang belum terjadi bahkan dari tahun sebelumnya?

#1 Memanfaatkan data historis

Untuk melakukan forecasting tentang apa yang akan terjadi selanjutnya, data utama yang kita butuhkan merupakan data historis atau data pergerakan harga dari masa lalu. Dengan menggunakan data sebelumnya bisa diramalkan apa yang akan terjadi selanjutnya dan berapa lama hal tersebut mungkin terjadi. Data historis merupakan elemen utama yang bisa dimanfaatkan untuk melakukan forecasting.

#2 Mempelajari market cycle

Salah satu kesalahan utama yang dilakukan oleh "para pemula" adalah mereka tidak mengetahui tentang market cycle dan kapan Bitcoin akan naik dan akan turun padahal seluruh market tergantung dengan Bitcoin. Dengan mengetahui mengenai market cycle kita bisa melakukan estimasi kapan "market akan top" dan dengan mengetahui potensi market akan top kita bisa mempertimbangkan kapan suatu target dapat dicapai dengan keadaan price action yang ada saat ini.

#3 Memanfaatkan fibonacci, diagonal line, dan horizontal line

"Alat teknikal" yang bisa dimanfaatkan untuk melakukan "market timing" ada banyak. Alat utama yang bisa digunakan adalah fibonacci dimana fibonacci bisa kita gunakan untuk mengetahui target harga. Sedangkan diagonal dan horizontal line apabila dikombinasikan dapat dijadikan suatu alat untuk mengestimasi secara presisi dari segi waktu "kapan akan terjadinya".

#4 Gunakan forecast projection dan bars pattern

Dua alat lain yang bisa digunakan yang mana biasanya bisa ditemukan di trading platform seperti Tradingview adalah forecast projection dan bars pattern. Forecast projection bisa digunakan untuk mengestimasi target dari segi waktu, sedangkan bars pattern bisa digunakan dengan menafaatkan facade harga sebelumnya untuk mengestimasi kapan target harga dapat dicapai.

Semoga bermanfaat!

2 notes

·

View notes

Text

Exploring the Main Functions of TradingView: A Comprehensive Guide

TradingView has emerged as a leading charting platform for traders and investors, offering a wide range of functionalities that cater to various aspects of market analysis. This blog post delves into the main functions of TradingView, providing a comprehensive guide for both beginners and seasoned users.

Customizable Charts

At the heart of TradingView lies its highly customizable charts. Users can personalize their charting experience with an array of options, from selecting different chart types to adjusting timeframes for detailed analysis. The platform's flexibility allows traders to tailor their charts to fit their specific trading styles and preferences.

Technical Indicators and Drawing Tools

TradingView boasts an extensive library of technical indicators and drawing tools, enabling users to conduct in-depth technical analysis. Whether you're looking to apply moving averages, Fibonacci retracements, or trend lines, the platform provides all the necessary tools to identify potential trading opportunities and analyse market trends.

Keyboard Shortcuts

Efficiency is key in trading, and TradingView's keyboard shortcuts offer users a quick way to navigate and interact with the platform. From opening quick search with Ctrl + K to saving chart layouts with Ctrl + S, these shortcuts streamline the trading process, making it more intuitive and time-efficient.

Social Community Features

One of the unique aspects of TradingView is its robust social community. Traders can share ideas, learn from others, and network with a global community of like-minded individuals. This social aspect fosters a collaborative environment and provides a platform for traders to gain insights and perspectives from a diverse group of market participants.

Trading Platform Integration

TradingView supports integration with various trading platforms, allowing users to trade directly through the charting interface. This seamless integration simplifies the trading workflow, as traders can analyse the markets and execute trades without switching between different applications.

Alerts and Notifications

Staying informed is crucial, and TradingView's alert system ensures that users never miss important market movements. Traders can set up custom alerts based on price levels, indicators, or other criteria, receiving notifications through the platform, email, or mobile app.

Accessibility and Web-Based Platform

As a web-based platform, TradingView offers accessibility from any device with an internet connection. This means traders can access their charts and analysis tools from anywhere, at any time, without the need for downloading or installing software.

TradingView is a must-have for anyone in the financial world. It's got everything you require—from customizable charts to technical analysis tools, social networking, and seamless trading integration. Whether you're just starting out or a seasoned trader, TradingView has what it takes to elevate your market analysis and trading game.

And if you want to dive deeper into all that TradingView offers, there are guides and tutorials available to walk you through every feature and help you make the most of the platform. So, get ready to trade with confidence and make the most of your investments!

Remember, while crypto trading can offer profit opportunities, it also carries inherent risks. Proceed with caution and always prioritize protecting your investment capital.

2 notes

·

View notes

Text

How to See Resistance and Support in TradingView

In the world of trading, the concepts of resistance and support levels are fundamental to understanding market movements and making informed decisions. TradingView, a popular charting platform used by traders worldwide, offers a comprehensive set of tools and indicators to help traders identify these critical levels. Here's a guide on how to see resistance and support in TradingView:

Step 1: Choose Your Chart First, select the asset you want to analyze on TradingView. You can do this by entering the name or ticker of the asset in the search bar at the top of the platform.

Step 2: Select the Timeframe Choose an appropriate timeframe for your analysis. Timeframes can range from 1 minute to 1 month, depending on your trading strategy. Short-term traders might prefer shorter timeframes, while long-term investors might look at daily or weekly charts.

Step 3: Use Trend Lines To identify resistance and support levels, you can use the Trend Line tool in TradingView. Click on the Trend Line icon (it looks like a diagonal line) in the toolbar on the left side of the screen. Then, draw a line connecting the price highs to identify resistance, and another line connecting the price lows to identify support.

Step 4: Apply Horizontal Lines For more defined levels, use the Horizontal Line tool in the toolbar. Place a horizontal line at a price level where the asset has shown difficulty in moving above (resistance) or below (support). These levels often indicate where buyers or sellers are concentrated.

Step 5: Incorporate Indicators TradingView offers various indicators that can help identify resistance and support levels. The Moving Average, Fibonacci Retracement, and Volume Profile are popular choices. To add an indicator, click on the "Indicators" button at the top of the screen and search for the one you want to use.

Step 6: Analyze Price Action Pay attention to how the price reacts around these levels. Resistance or support is confirmed when the price bounces off these levels multiple times. The more times the price touches these levels without breaking through, the stronger they are considered.

Step 7: Monitor Breakouts or Breakdowns A breakout (price moves above resistance) or breakdown (price moves below support) can signal a potential trend change. Use TradingView's alert system to notify you when the price crosses these critical levels.

Exploring TradingView Alternatives: FastBull

While TradingView is a popular choice among traders, it's always beneficial to explore alternatives. FastBull is an emerging platform that offers a range of features for market analysis. Here's what makes FastBull stand out:

User-Friendly Interface FastBull is designed with simplicity in mind, making it accessible to both novice and experienced traders. Its intuitive interface allows for easy navigation and quick access to essential features.

Advanced Charting Tools FastBull provides advanced charting capabilities similar to TradingView, including a variety of chart types, drawing tools, and technical indicators, enabling comprehensive market analysis.

Real-Time Data and Alerts The platform offers real-time market data and customizable alerts, ensuring traders stay updated with the latest market movements and can react promptly to trading opportunities.

Social Trading Features FastBull incorporates social trading elements, allowing users to follow and interact with other traders. This community aspect can offer valuable insights and foster a sense of camaraderie among users.

Educational Resources For those looking to expand their trading knowledge, FastBull provides a wealth of educational content, including tutorials, articles, and webinars, catering to all levels of experience.

Mobile Accessibility Recognizing the need for on-the-go access, FastBull offers a mobile app that delivers the full functionality of its desktop platform, ensuring traders can monitor the markets and execute trades from anywhere.

Conclusion

while TradingView remains a top choice for many traders, platforms like FastBull are providing compelling alternatives that cater to the evolving needs of the trading community. Whether you stick with TradingView or explore FastBull, the key is to use the tools and resources available to enhance your trading strategy and decision-making process.

2 notes

·

View notes

Text

Bitcoin wipes nearly a week of gains in 20 minutes, falling under $41K

The price of Bitcoin (BTC) briefly fell below $41,000 following a sudden 6.5% drawdown from $43,357 to as low as $40,659 in just 20 minutes at 2:15am on Dec. 11 (UTC). At the time of publication, Bitcoin was trading slightly up from the local low at $41,960 per TradingView data. According to data from CoinGlass the brief drop caused more than $271 million worth of long positions to be…

View On WordPress

2 notes

·

View notes

Text

Mastering Relative Volatility Trading: A Comprehensive Guide

Trading in financial markets can be daunting, especially with the plethora of strategies available. One of the sophisticated yet effective methods is trading based on relative volatility. This approach helps traders understand market movements better and make more informed decisions. In this detailed guide, we’ll delve into the concept of relative volatility, its significance, how to calculate…

View On WordPress

#Bloomberg Terminal#Financial data analysis#Financial Markets#Market Sentiment#Market Volatility#MetaTrader#Online trading courses#Pair trading#Portfolio diversification#Price movements#Quandl#Relative Volatility#Relative Volatility Index (RVI)#Risk Management#Standard deviation#stock trading#Stop-loss levels#Take-Profit Levels#Technical Indicators#Thinkorswim#Trading Education#trading signals#Trading Strategies#TradingView#Trend Analysis#Volatility convergence#Volatility indicators#Volatility spread trading#Volatility Trading#Yahoo Finance

0 notes

Text

youtube

🧠Comment utiliser les Points et Figures pour trader plus facilement !

Vous voulez une méthode claire, efficace, visuelle et sans bruit de marché pour mieux entrer et sortir de vos trades ?

📌 Dans cette vidéo, vous apprendrez : ✅ Ce que sont les graphiques en Points & Figures et comment ils fonctionnent ✅ Comment les utiliser pour repérer les cassures de tendance et les retournements ✅ Pourquoi ils offrent un avantage unique par rapport aux chandeliers classiques ; mais aussi leurs inconvénients

🎯 Une méthode ancienne à découvrir

#stock market#indicateurs trading#stratégie trading#tradingview#prorealtime#bougies japonaises#signaux trading#day trading#scalping#swing trading#crypto trading#analyse boursière#trading rentable#tendance haussière#tendance baissière#astuces trading#price action trading#points et figures#point & figure trading#stratégie de trading#graphique boursier#points figures#point and figure chart#trading efficace#retournement bourse#price action#méthode trading visuelle#Youtube

0 notes

Text

US Dollar Slides as Fed’s Favorite Inflation Gauge Comes Below Expectations

PCE REPORT KEY POINTS:

May U.S. consumer spending rises 0.1% m-o-m, one-tenth of a percent below expectations

Core PCE climbs 0.3% monthly, bringing the annual rate to 4.6% from 4.7%, also below estimates

U.S. dollar extends losses following weaker-than-forecast spending and core inflation data

The U.S. Department of Commerce released this morning income and outlays data from last month. According to the agency, personal consumption expenditures, which make up more than two-thirds of the country’s gross domestic product, grew 0.1% m-o-m in May versus a forecast of 0.2%, a sign that the American consumer is losing some staying power, but not yet faltering.

Meanwhile, personal income ticked up by 0.4% following a 0.3% gain in April, slightly above consensus estimates. Although no major conclusions should be drawn from one single report, the solid increase in earnings can help households sustain spending heading into the second half of the year, creating a more constructive backdrop for the economy and preventing a hard landing.

Focusing on price indexes, headline PCE rose 0.1% m-o-m and 3.8% y-o-y. Meanwhile, core PCE, the Federal Reserve’s favorite inflation indicator, which reflects the overall price trend in the economy, climbed 0.3 % m-o-m, bringing the annual rate to 3.6% from 3.7%, one-tenth of a percent below market projections.

Source: Daily FX Calendar

Softer household spending, coupled with weaker inflationary pressures, may give the Fed the cover it needs to adopt a less aggressive stance. While policymakers may still be inclined to raise borrowing costs by 25 basis points in July, given the recent resilience of the U.S. economy, a September hike may be less likely, preventing interest rate expectations from shifting in a more hawkish direction. This situation may cap Treasury yields going forward, creating the right conditions for a U.S. dollar pullback.

Immediately following this morning’s report, the U.S. dollar, as measured by the DXY index, took a turn to the downside, falling as much as 0.3%, while bond yields retreated across the curve, erasing some of their advances from the previous session. That said, if incoming data continues to cooperate, today’s moves in the FX and fixed-income markets could have legs.

US DOLLAR (DXY) AND YIELDS CHART

Source: TradingView

#financialservices#forextrading#gambit#marketing#forexbot#youtube#accounting#forex online trading#forex#forex trading#finance#wealthmanagement#financial#economy#investing#profit#investments

3 notes

·

View notes

Text

As much as this got me excited, it's almost kind of disinformation :(

Yes it did drop, this is technically correct

But when you look at bigger time scales, this is really no big deal to them. Their entire stock cycle looks like this, and so far they've only dropped to about baseline the past 5 years.

Also, tesla executives sold billions in stock during this and basically turned it into a pump and dump.

So they are continuing to line their pockets and we need to keep attacking this harder and longer before we make a real difference.

The big red crash is only this year, 2025. The next one is over 5 years, and the last one is over the life of the company. Source: https://www.tradingview.com/symbols/NASDAQ-TSLA/

This is the source about the stock sales:

I want to take special note of this part

She was sued by the shareholders for excessive compensation. THE FUCKING SHAREHOLDERS who's only purpose for existing is initial funding and then stealing the profits of the workers' labor for rest of the life of the company, ya know, the greediest fuckers in capitalism, SUED HER FOR EXCESSIVE COMPENSATION. They settled for 1 billion. She made 43 billion on selling tesla stock since February 3rd.

We need to keep dropping the stock until these fuckers actually hurt

likes to charge, reblogs to cast

116K notes

·

View notes

Text

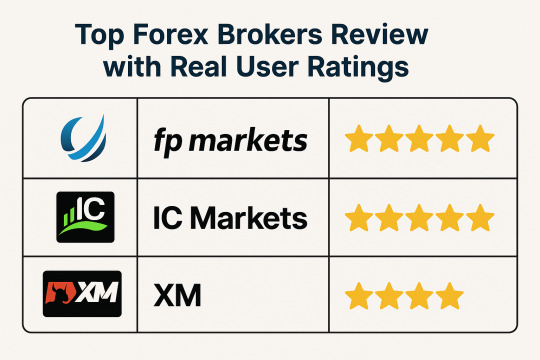

Top Forex Brokers Review with Real User Ratings

Choosing the right forex broker can be a critical step in a trader’s journey. In this Top Forex Brokers Review, we provide a clear and professional evaluation of the most trusted brokers in the market, incorporating real user ratings and insights. Whether you're a novice or an intermediate trader, this guide will help you compare the best platforms based on regulation, features, platform performance, and overall user satisfaction.

Key Qualities of a Top Forex Broker

Before diving into the Top Forex Brokers Review, it's important to understand what distinguishes a reliable broker:

Strong regulatory oversight by ASIC, FCA, or CySEC

Tight spreads with transparent fee structures

High-speed order execution

Dependable trading platforms such as MetaTrader 4, MetaTrader 5, or cTrader

Solid customer support and educational resources

Positive user reviews and community feedback

Broker Reviews Based on Features and User Experience

Eightcap

Regulated by ASIC and SCB with tight spreads

Integrates TradingView with MT4 and MT5

Offers a wide range of crypto CFDs and forex instruments

Eightcap is favored by traders who value innovation and advanced charting tools. Its crypto offering adds a competitive edge for diversified traders.

FP Markets

Licensed by ASIC and CySEC, providing strong regulatory safety

ECN-style execution with access to Iress, MT4, and MT5

Consistently high user ratings for customer service and execution speed

FP Markets is ideal for serious traders who want reliable pricing and a platform that’s proven to perform well under market pressure.

FBS

Regulated by IFSC and CySEC with flexible account types

Offers high leverage up to 1:3000 and strong promotional bonuses

Known for user-friendly support and localized services

FBS attracts beginners with its low entry requirements and variety of learning tools. Many users rate it highly for customer support responsiveness.

XM

Regulated by ASIC, IFSC, and CySEC with multi-lingual support

Low spreads from 0.0 pips and negative balance protection

Praised for educational materials and community outreach

XM remains a user favorite for its consistent performance and excellent learning ecosystem. It’s a well-rounded platform suitable for most traders.

IC Markets

Overseen by ASIC, CySEC, and FSA with true ECN trading

Raw pricing with ultra-low spreads and deep liquidity

Popular among algorithmic and professional traders

IC Markets consistently receives high user ratings for its stable infrastructure and efficient execution. A top choice for experienced traders.

FxPro

Regulated by FCA, CySEC, and FSCA with NDD execution

Offers MT4, MT5, and cTrader platforms

Rated highly for reliability and order transparency

FxPro is suitable for traders who value a mix of automation and discretion. Users commend its consistent uptime and trade execution.

Axi

Regulated by ASIC, FCA, and FMA with global recognition

Offers MT4 with integrated PsyQuation analytics

Well-rated for analytical tools and trader support

Axi provides a data-driven edge for traders who like to track performance and optimize strategies. Its educational services are also appreciated.

Pepperstone

Regulated by ASIC, FCA, and DFSA for broad international access

Offers low-latency trading with MetaTrader, cTrader, and TradingView

Frequently top-rated for speed and reliability

Pepperstone is a go-to broker for fast execution and deep liquidity. Scalpers and technical traders give it consistent five-star ratings.

HFM (HotForex)

Overseen by FCA, FSCA, and DFSA for global credibility

Offers multiple account types including Zero, PAMM, and copy trading

Rated well for its comprehensive educational content

HFM is a strong choice for both individual and social traders. New users often cite its ease of use and well-structured training programs.

Octa

Regulated by CySEC and FSA with bonus offers

Provides cashback and commission-free trading options

Known for a user-friendly mobile trading experience

Octa is best for entry-level traders who need simplicity and mobile-first functionality. User reviews highlight its intuitive platform and reward systems.

Real User Success Story: Learning Through Experience

Carlos Mendoza, a 29-year-old engineer from Peru, started trading part-time in 2022 with Pepperstone. Initially, he was drawn to the platform’s fast execution and tight spreads. Carlos spent months refining his strategy through demo accounts and later shifted to a live ECN account. With consistent support and educational tools, he scaled his capital from $500 to over $12,000 in 18 months. Carlos credits his growth to Pepperstone’s transparent pricing and the support of a strong online trading community.

How to Check If a Broker's Website is Safe?

Security is a vital concern when trading online. Here's how to assess a forex broker’s website for safety:

Regulatory Proof: Check for valid licenses from financial authorities such as ASIC, FCA, or CySEC.

SSL Encryption: Look for “https” and a padlock icon in the address bar.

Two-Factor Authentication: A secure platform will offer 2FA to protect user accounts.

Fund Segregation: Ensure client funds are kept separate from broker operational funds.

Clear Legal Documentation: Terms, privacy policies, and risk warnings should be readily available.

Click Now

Frequently Asked Questions (FAQs)

How can I tell if a broker is regulated?

Visit the official website and scroll to the footer where license numbers are usually listed. Verify them on the regulator’s site.

What’s the best platform for beginners?

Platforms like XM and FBS offer beginner-friendly tools, demo accounts, and educational resources for starting out.

Can I make money in forex with little capital?

Yes, but it requires discipline, strategy, and realistic expectations. Brokers like FBS and Octa offer micro and cent accounts.

What’s the difference between raw spreads and standard spreads?

Raw spreads come with lower pip differences but include commissions. Standard spreads are wider but often commission-free.

Are mobile trading apps reliable?

Yes, if offered by reputable brokers like Pepperstone, Octa, or IC Markets. Always download apps from official stores.

youtube

Final Words: Make an Informed Choice

This Top Forex Brokers Review provides a transparent look at the best forex brokers as rated by real users. From Pepperstone to XM and FBS, each platform has its unique advantages. The right choice depends on your trading needs, experience level, and desired features. Take time to compare offerings, use demo accounts, and ensure platform safety. With informed decision-making, you’ll be well-positioned to succeed in your forex journey. Revisit this Top Forex Brokers Review anytime you need guidance on choosing the right broker.

0 notes