#FundingOptions

Text

How Accounting Firms Can Help Your Business Navigate Financial Challenges During Economic Downturns

Economic downturns can be challenging for businesses of all sizes. When the economy takes a hit, companies often face financial stress, fluctuating revenue, and uncertain market conditions. In such times, having a trusted partner by your side can make all the difference. Accounting firms in Abu Dhabi are uniquely positioned to provide crucial support during these difficult periods. Here’s how these firms can help your business navigate financial challenges and emerge stronger.

1. Financial Analysis and Forecasting

During an economic downturn, understanding your financial situation is paramount. Accounting firms in Abu Dhabi offer comprehensive financial analysis and forecasting services to help you:

Assess Cash Flow: Accurate cash flow analysis helps you understand your current liquidity position and plan for future cash needs. This is critical for managing day-to-day operations and avoiding liquidity crises.

Develop Financial Projections: By analyzing market trends and your business’s historical data, accounting firms can help you create realistic financial projections. These forecasts assist in budgeting and planning for different scenarios, ensuring you’re prepared for potential fluctuations.

2. Cost Management and Efficiency

Managing costs effectively is crucial when facing economic challenges. Accounting firms in Abu Dhabi can assist with:

Expense Review: Conducting a thorough review of your expenses to identify areas where cost-cutting is possible without compromising essential operations. This might include renegotiating contracts or finding more cost-effective suppliers.

Operational Efficiency: Providing insights into streamlining processes and improving operational efficiency. They can recommend changes that reduce waste and enhance productivity, helping you maintain profitability even in tough times.

3. Strategic Financial Planning

Strategic planning becomes even more important during economic downturns. Accounting firms can help by:

Developing Contingency Plans: Creating contingency plans to prepare for various financial scenarios. This includes strategies for managing reduced revenue, handling increased expenses, and navigating potential financial pitfalls.

Assessing Financial Risks: Identifying and evaluating financial risks specific to your industry and business. Accounting firms help you understand these risks and develop strategies to mitigate them.

4. Tax Planning and Compliance

Economic downturns often lead to changes in tax regulations and policies. Accounting firms in Abu Dhabi provide:

Tax Optimization: Advising on tax strategies to minimize liabilities and maximize deductions. They can help you take advantage of any available tax relief or incentives designed to support businesses during economic hardships.

Regulatory Compliance: Ensuring that your business complies with all relevant tax laws and regulations. This helps avoid penalties and ensures that your financial statements accurately reflect your situation.

5. Access to Financing

Securing financing can be challenging during economic downturns, but accounting firms can assist by:

Preparing Financial Statements: Helping prepare accurate and compelling financial statements required for loan applications or investor pitches. Well-prepared documents increase your chances of securing necessary funding.

Advising on Funding Options: Providing advice on various funding options, including traditional loans, government grants, or alternative financing solutions. They can help you choose the best option based on your business’s needs and situation.

6. Business Valuation

Understanding the value of your business is essential, especially if you’re considering restructuring or seeking investment. Accounting firms offer:

Accurate Valuation Services: Performing detailed business valuations to determine the fair market value of your company. This information is crucial for making informed decisions about selling, merging, or attracting investors.

7. Financial Reporting and Monitoring

Regular financial reporting and monitoring are essential for staying on top of your financial health. Accounting firms in Abu Dhabi provide:

Detailed Reports: Generating regular financial reports to track performance, monitor key metrics, and identify any emerging issues early. Timely reports enable you to make informed decisions and address problems proactively.

Performance Analysis: Analyzing financial performance against industry benchmarks and historical data to gauge your company’s standing and make necessary adjustments.

8. Expert Advice and Support

During uncertain times, having expert advice is invaluable. Accounting firms offer:

Strategic Consultation: Providing expert advice on navigating economic challenges and implementing effective strategies. Their insights can guide you through difficult decisions and help you find opportunities for growth.

Ongoing Support: Offering continuous support and guidance to help you adapt to changing circumstances and maintain financial stability.

Conclusion

Economic downturns present significant challenges, but partnering with a skilled accounting firm in Abu Dhabi can provide the support and expertise needed to navigate these difficulties successfully. From financial analysis and cost management to strategic planning and compliance, accounting firms offer essential services that help businesses stay resilient and thrive despite economic adversity. By leveraging their expertise, you can better manage your financial situation, optimize operations, and position your business for long-term success.

If you’re facing financial challenges and need expert guidance, consider reaching out to a trusted accounting firm in Abu Dhabi. Their professional support can make a crucial difference in steering your business through uncertain times and emerging stronger on the other side.

#AccountingFirmsAbuDhabi#FinancialChallenges#EconomicDownturn#BusinessFinancialPlanning#CostManagement#TaxPlanning#FinancialForecasting#StrategicPlanning#CashFlowManagement#BusinessValuation#FinancialSupport#AbuDhabiAccountants#BusinessResilience#FinancialConsulting#ExpenseReview#FundingOptions#RegulatoryCompliance#FinancialMonitoring#ExpertAdvice#BusinessRecovery

0 notes

Text

Starting a Successful Business with Little to No Capital: A Comprehensive Guide

Starting a business can be a daunting task, especially when you have little to no capital. However, with the right mindset, strategy, and resources, it's possible to build a successful business from scratch. In this guide, we'll explore the steps to take, the options to consider, and the tips to keep in mind when starting a business with limited funds.

Step 1: Discover Your Business Idea

Identify a business idea that aligns with your passions, skills, and market demand. Research your competition and target audience to validate your concept.

Step 2: Create a Comprehensive Business Plan

Develop a detailed plan outlining your business goals, target market, marketing strategies, financial projections, and operational plan. This roadmap will guide your business and help secure funding

Step 3: Determine Your Business Organization

Select a business structure that aligns with your goals and needs, such as a sole proprietorship, partnership, Limited Liability Company (LLC), or corporation. Carefully consider factors like personal liability, tax implications, and ownership control to make an informed decision.

Step 4: Legally Establish Your Business

Register your business with the appropriate state and local authorities to obtain necessary licenses and permits. This ensures legal operation and avoids potential issues.

Step 5: Build a Strong Online Presence

Create a professional website and social media accounts to showcase your products or services. Utilize digital marketing strategies like SEO, content marketing, and email marketing.

Step 6: Secure Funding

Explore alternative funding options like crowdfunding, small business loans, and grants. Consider bootstrapping or seeking investors.

Step 7: Develop a Marketing Strategy

Create a marketing plan that includes advertising, promotions, and public relations. Utilize free or low-cost marketing channels like social media and content marketing.

Step 8: Build a Strong Team

Hire talented individuals who share your vision. Consider freelancers, interns, or part-time employees to save costs.

Step 9: Monitor Financial Performance and Progress

Track your financials, sales, and customer engagement to make informed decisions and adjust your strategy as needed. Regularly analyze your data to ensure your business is on the right track.

Step 10: Embrace Ongoing Refinement

Maintain a growth mindset and continuously refine your business strategy. Be open to learning from both successes and setbacks, using them as opportunities to adapt and improve. By following these steps, you'll be well on your way to building a prosperous and sustainable business.

Step 11: Continuously Learn and Improve

Stay updated on industry trends, and attend workshops and webinars to enhance skills and knowledge.

Step 12: Be Adaptable and Resilient

Embrace changes, learn from failures, and persist through challenges to achieve long-term success.

*Tips:

Tap into local expertise: Small Business Development Centers (SBDCs) offer free consulting, low-cost training, and other resources to help you grow your business.

Build a strong online presence: Leverage social media, content marketing, and email marketing to reach and engage with your target audience.

Prioritize customer satisfaction: Focus on delivering exceptional customer service to build a loyal customer base and drive word-of-mouth marketing.

Stay adaptable and agile: Continuously evaluate and refine your business strategy to stay competitive and respond to changing market conditions.

*Resources:

Small Business Development Centers (SBDCs): Find your local SBDC for free consulting, training, and resources.

Online courses and webinars: Utilize platforms like Coursera, Udemy, and LinkedIn Learning for affordable training and skill-building.

Social media marketing tools: Leverage platforms like Hootsuite, Buffer, and Canva to streamline your social media marketing efforts.

Customer relationship management (CRM) software: Use tools like HubSpot, Zoho, or Freshsales to manage customer interactions and data.

Conclusion:

Starting a successful business with little to no capital requires creativity, hard work, and perseverance. By following these steps and tips, you can build a thriving business that generates revenue and creates value for your customers. Remember to stay flexible, adapt to changes, and continuously learn and improve.

#BusinessStartup#Entrepreneurship#Bootstrapping#SmallBusiness#BusinessPlan#OnlinePresence#FundingOptions#MarketingStrategy#TeamBuilding#FinancialManagement#ContinuousLearning#Adaptability#Resilience#CustomerSatisfaction#SBDC#OnlineCourses#SocialMediaMarketing#CRMSoftware

0 notes

Text

Startup India registration | DIPP Registration in India | MAS.

Startup India registration, also known as DIPP (Department for Promotion of Industry and Internal Trade) registration in India, is a government initiative aimed at promoting and supporting startups. It provides various benefits and incentives to eligible startups, such as tax exemptions, funding opportunities, and access to resources and networks, to foster innovation and entrepreneurship in the country.

https://masllp.com/startup-registration/

#BusinessInIndia#StartupIndia#Entrepreneurship#IndianBusiness#BusinessIdeas#SmallBusiness#InvestmentOpportunities#IndianMarket#BusinessRegistration#LegalCompliance#Taxation#GovernmentPolicies#BusinessLicensing#FundingOptions

0 notes

Text

#realestateinvestment#SchaumburgInvestment#FundingOptions#ConventionalLenders#PrivateInvestors#InvestmentGoals#real estate portfolio#investmentproperty#Schaumburg#financing#risks#fundingoptions#conventionallenders#privateinvestors#investmentgoals#guidance#informeddecision

0 notes

Text

🚀 The Best Small Business Loans in 2024

Explore top funding options tailored to help your small business thrive in 2024! From flexible terms to competitive rates, these loans cater to various business needs.

1. SBA Loans 💼

Description: Backed by the Small Business Administration, these loans offer favorable terms and lower interest rates.

Best For: Established businesses looking for long-term financing.

2. Term Loans 🏦

Description: Traditional loans with fixed interest rates and repayment schedules.

Best For: Businesses needing a significant amount of capital for expansion or large projects.

3. Business Line of Credit 🔄

Description: Flexible credit line that allows businesses to withdraw funds as needed.

Best For: Managing cash flow and covering short-term expenses.

4. Equipment Financing ⚙️

Description: Loans specifically for purchasing business equipment.

Best For: Businesses looking to acquire machinery, vehicles, or technology.

5. Invoice Financing 💳

Description: Advances based on outstanding invoices.

Best For: Businesses facing cash flow issues due to slow-paying clients.

6. Microloans 📈

Description: Small, short-term loans for startups and small businesses.

Best For: New businesses or those with limited credit history.

7. Merchant Cash Advances 💰

Description: Lump sum of cash in exchange for a percentage of future sales.

Best For: Businesses with high credit card sales needing quick funding.

8. Peer-to-Peer (P2P) Loans 🤝

Description: Loans funded by individual investors via online platforms.

Best For: Businesses seeking alternative funding sources with competitive rates.

9. Commercial Real Estate Loans 🏢

Description: Loans for purchasing or renovating commercial property.

Best For: Businesses looking to buy or upgrade their physical location.

10. Franchise Financing 🌟

Description: Specialized loans for opening or expanding a franchise.

Best For: Entrepreneurs investing in a franchise opportunity.

Choose the right loan to fuel your small business growth and achieve your entrepreneurial dreams in 2024! 🌟

#SmallBusiness #BusinessLoans #Entrepreneurship #2024BusinessGoals #FundingOptions

4 notes

·

View notes

Text

Securing Equity-Free Funding for Startups: Strategies and Insights for Indian Entrepreneurs

In the dynamic landscape of startup funding in India, securing the right financial support is crucial for success. With various options available, understanding how to navigate the funding ecosystem can significantly impact a startup's growth trajectory. This blog delves into the concept of equity free funding and explores how startup investor platform is making it easier for startups to thrive without relinquishing ownership.

Understanding Startup funding in India

Startup funding in India has seen a dramatic evolution over the past decade. From traditional venture capital and angel investments to new-age funding models, the opportunities for startups have expanded. However, equity free funding has emerged as a game-changer for many entrepreneurs who wish to retain full control of their businesses while securing necessary capital.

What is equity free funding?

Equity free funding refers to financial support provided to startups without requiring them to give away a portion of their equity. This type of funding is particularly attractive for founders who prefer to maintain complete ownership of their company. It typically includes grants, revenue-based financing, and other non-dilutive funding sources.

The rise of startup investor platforms

Startup investor platforms have become instrumental in facilitating equity free funding for startups. These platforms connect startups with investors and financial institutions that offer non-dilutive funding options. By leveraging these platforms, startups can access various funding opportunities that do not involve giving up equity.

Klub is one such platform that has been at the forefront of providing equity free funding solutions. By partnering with innovative startups, Klub helps them secure capital while preserving their equity, enabling them to focus on scaling their businesses without the pressure of equity dilution.

Types of equity free funding available

Grants: Various government and private organisations offer grants to startups. These funds are typically provided for specific projects or research and do not require repayment or equity stake.

Revenue-based financing: This model allows startups to secure funding in exchange for a percentage of future revenue. Unlike traditional loans, repayment is tied to the startup's performance, making it a flexible option.

Crowdfunding: Platforms like Kickstarter and Indiegogo offer a way for startups to raise money from the public. Backers contribute funds in exchange for rewards or pre-orders, rather than equity.

Competitions and Challenges: Many organisations and incubators host competitions where startups can win equity free funding as part of the prize. These opportunities often come with additional perks like mentorship and visibility.

How to leverage startup investor platforms

Startup investor platforms are designed to streamline the funding process. By creating a compelling profile and pitching effectively, startups can attract interest from investors who are keen on providing equity free funding. These platforms often offer tools and resources to help startups improve their chances of securing financial support.

Klub stands out in this space by offering tailored funding solutions that cater specifically to the needs of startups looking for equity free fundingoptions. Their platform not only connects startups with suitable funding sources but also provides valuable insights and support throughout the funding process.

Key takeaways

Navigating the world of startup funding in India can be complex, but equity free funding offers a viable path for many entrepreneurs. By utilising startup investor platforms, startups can access a range of funding options without diluting their equity. Understanding these options and leveraging available resources can help startups achieve their growth objectives while maintaining full control of their business.

In conclusion, the landscape of startup funding in India is evolving, and equity free funding is becoming an increasingly popular choice. Platforms like Klub are leading the way in providing innovative solutions that empower startups to secure the capital they need without giving up ownership.

#startup investor platform#startup funding in india#equity free funding#equity free funding for startups

0 notes

Video

youtube

"BINGX" GUIDE: HOW TO TRADE THE HOTTEST CRYPTOCURRENCY OF 2024

#BingX #CryptocurrencyExchange #CryptocurrencyTrading #2024HottestCryptocurrency #Bitcoin #Blockchain #DigitalAssets #TradingPlatform #CryptoMarket #Volatility #RegulatoryLandscape #SecurityMeasures #SocialTrading #CopyTrading #MobileApp #EducationalWebinars #KYC #FundingOptions #TradingBasics #DemoAccount #SpotTrading #MarginTrading #FuturesTrading #RiskManagement #StopLossOrders #Diversification #ChartingTools #RealTimeMarketData #BingXCommunity #CautionInTrading #PatienceAndDiscipline #HaveFun

0 notes

Text

DSCR- Rental Finance*

Infinity Capital Finance offers an industry-leading rental loan program. Our loans are specifically catered to serious investors. We have one of the best and most flexible DSCR rental loan program on the market today. Better terms, easier qualification, and a simple process you can trust.

For more information:http://dlvr.it/SvyP8B

#InfinityCapitalFinance

#FinancialSolutions

#BusinessFunding

#SmallBusinessLoans

#FinanceYourDreams

#CapitalForSuccess

#Entrepreneurship

#FundingOptions

#MoneyMatters

#GrowYourBusiness

#FinancialFreedom

#InvestInYourFuture

#BusinessGrowth

#LoanOptions

#SmartFinance

0 notes

Text

Accounting Firms in Abudhabi

#AccountingFirmsAbuDhabi#FinancialChallenges#EconomicDownturn#BusinessFinancialPlanning#CostManagement#TaxPlanning#FinancialForecasting#StrategicPlanning#CashFlowManagement#BusinessValuation#FinancialSupport#AbuDhabiAccountants#BusinessResilience#FinancialConsulting#ExpenseReview#FundingOptions#RegulatoryCompliance#FinancialMonitoring#ExpertAdvice#BusinessRecovery

0 notes

Photo

#Repost @kingrio_1 & I'll repost you back ・・・ I can swiftly obtain up you to $500K so you can purchase more trucks & and hire drivers. DM me or text me: 305-986-6427 for any questions or visit the link in my bio to submit a 1page application, 6 months business bankstatements & 24 hrs for your offer.💯💲📈🤝💰💰💵💵 #entrepreneurs #freightliner #smallbusinessowners #businessowner #businessman #businesswomen #smallbiz #localbusinesses #entrepreneurs #entrepreneurship #entrepreneur #entrepreneurlife #entrepreneurlifestyle #biz #businessmindset #BBB #empire #buildyourempire #legacy #fundingoptions #truckdriver #truckbusiness (at Downtown Miami)

#entrepreneur#biz#businessowner#truckbusiness#bbb#businessman#entrepreneurlifestyle#businesswomen#repost#truckdriver#entrepreneurs#buildyourempire#fundingoptions#entrepreneurship#smallbusinessowners#empire#localbusinesses#freightliner#entrepreneurlife#smallbiz#businessmindset#legacy

1 note

·

View note

Text

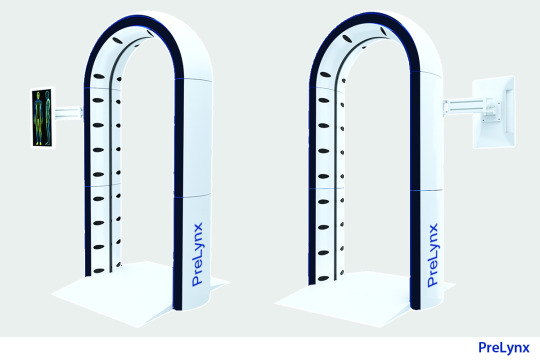

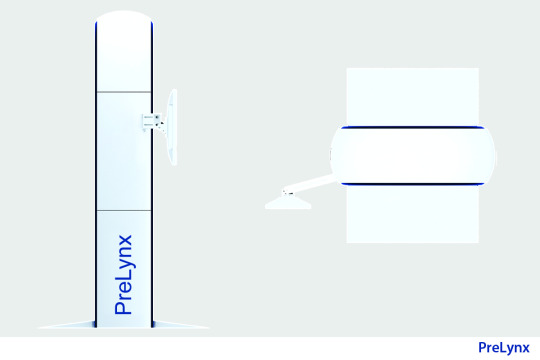

PRELYNX PORTAL, CORONA VIRUS (COVID-19) FIRST RESPONSE SCANNER + SANITIZER

Currently our nation is under siege from a deadly virus COVID-19 or i.e. CoronaVirus and we aren’t sure where to turn or who to trust. Innovation and technology will solve this crisis.

PreLynx Portal uses known and proven technology in an innovative way to bring peace of mind to your company, your employees, and your passengers.

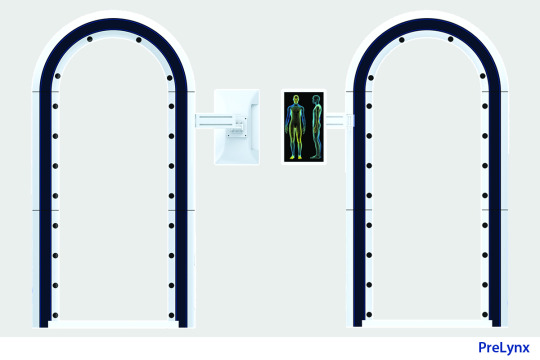

The PreLynx is a First Response Scanner + Sanitizer and can be much more with additional software modules. The basic passive mode of the PreLynx Portal scans body heat as one passenger at a time passes beneath. The light bar turns from blue to green when a person’s body temperature is within expected parameters.

If it is high, the light bar will flash amber and the person passing through can be steered aside and questioned regarding their knowledge of their current health status. This provides an early warning system to take proper precautions immediately and will help stop the spread of COVID 19.

This basic portal has the capability to provide additional steps of security with software module add-ons.

Module #1—The Sanitizer

Based on the technology utilized in labs and quarantine rooms, as you step through the portal, a hi-powered blast of a nano-polymer disinfectant vapor covers the person passing beneath. The U.S. EPA has qualified the disinfectant for use against COVID-19 through the agency's Emerging Viral Pathogen program. This colorless vapor disinfectant uses a potent virucidal agent which inactivates all of the lipophilic viruses (e.g., herpes, vaccinia, influenza and Corona virus) and many hydrophilic viruses (e.g., adenovirus, enterovirus, rhinovirus, and rotaviruses) on a person’s surface. The viral cells will immediately start dying and within twenty minutes they will all be dead.

Module #1 alone makes the PreLynx Portal a boon for ANY business, but especially cruise lines, as it can allow you to reopen and provide your cruisers the vacation they were dreaming of without fear of being trapped. Taking control over the COVID-19 pandemic will restart the economy and go a long way toward providing reassurance to wary passengers.

How much would you pay for that reassurance?

However, 123 Designs had much more in mind when designing the Prelynx Portal…

Upgrade Module #2—The Sniffer

Module #2 has been programmed to detect trace amounts of explosives, chemical warfare agents, toxic chemicals or narcotics. Custom programming can be added to increase the 40 agents the Sniffer software is currently programmed to identify. These Portals will stem the flow of smuggled narcotics and enhance security’s ability to deal with terrorism helping your reputation with cruisers.

Upgrade #3—The Metal Detector

Module #3 detects multiple types of metal that may be used in bombs, guns, and explosive devices. In some cases it may denote someone smuggling cultural artifacts. Module #3, while ancient technology in today’s exponentially changing environment, is a strong deterrent to those with ill intent on their agenda. PreLynx Portal sends an alert to those manning the portals.

In conjunction with Module #2, this Portal will provide assurance to your passengers that their safety and security is of utmost importance to you.

All three modules will fit within the basic structure of the PreLynx.

PreLynx is currently in development. In order to get full production on line, we need preorders for 100 units. The base unit starts at $5,000. Once the initial startup is met, we expect to have the first PreLynx rolling out the door in sixty days. For more information and pricing please contact [email protected] or feel free to call (941) 366-7500.

https://youtu.be/1APwq1df6Mw

Read the full article

#funding#fundingawell#fundingadoption#fundingcampaign#fundingchange#FundingCollegeDebtFree#fundingcuts#fundingdeals#fundingfuel#fundinggap#fundinggenocide#fundinghub#fundingloans#fundingoptions#fundingoptionsforbusinesseswithbadcredit#fundingparadise#FundingPlatform#fundinground#fundingsimplesolutions#fundingsolutions#fundingsuccess#fundingterrorism#fundingthatfitsyou#fundingthefuture

0 notes

Link

#uk house prices#fundingofficerbri#randomactfunding#fundingpost#artsfunding#fundingoptionsforbusinesseswithbadcredit#fundingteam#fundingoptions

0 notes

Photo

#CarreraFinance offer their clients a true ‘one stop shop’ for #Commercial & #BusinessFinance. Our core competence is to provide a fully managed and professional service to secure the most competitive #funding available. In addition we can organise the #propertyvaluations, #insurances and #legalsupport necessary to complete transaction. Whatever your #Commercial #Funding requirements, #CarreraFinance offer a #free, #impartial and a #confidential initial consultation to quickly assess the #fundingoptions available to you. Whatever your funding needs contact us today! https://www.instagram.com/carrerafinanceltd/p/BwCUd9LBciC/?utm_source=ig_tumblr_share&igshid=1dp8cu301t5bw

#carrerafinance#commercial#businessfinance#funding#propertyvaluations#insurances#legalsupport#free#impartial#confidential#fundingoptions

0 notes

Text

Tips To Choose The Right Small Business Lender For Your Needs In The USA?

No matter where you are in your business life cycle, you need outside financing to run and grow your small business. But with plenty of small business financing options available for SMEs, choosing the right lender is always a challenging and time-consuming task. You want to be confident that the lender you’re going to pick is reliable and will be able to help you with all your business funding needs.

Here are some of the many top tips while searching for your small business loan provider, including how to compare different SMBs lenders and their offers.

Identify the Types of Loans the Lender Offers

Since there are a plethora of lending options available to small business, you need to decide if the lender you’re going to work with offers the loan type you need in the present. Different financing options – like traditional bank loans, startup loans, lines of credit, AR financing, loans from Small Business Administration, Merchant Capital Advance, and equipment financing from different lenders may make sense for your small business. Your business is different, so are the loan options. You should have your pick of the litter when it comes to the kind of financing loans to use.

Compare Best Loan Offers through Lending Marketplace

Small business owners usually choose traditional routes to secure funding to meet their various business requirements. This is a traditional approach and you need to broaden your search and look beyond these small business financing options to secure the best loan.

Nowadays, there are a lot of online lending marketplaces in the world that offer a variety of loan offers from multiple lenders to small businesses. These lending platforms are the best way to make some solid comparison of interest rates, fees, repayment terms, lending time, and more. So, compare lenders before making the final decision and choose the one that best meets your business needs.

Check the Credibility of the Loan Provider

It’s significant to do in-depth research on the lenders before finalizing one. It’s important to only secure loans from a small business lender that is accredited in the US. Besides, do background research about the lenders and check honest reviews and testimonials online to get some feedback. You can also ask your friends, relatives, and connections who may have used small business financing for their financing needs. Besides, don’t forget to check the Better Business Bureau rating of the various lenders.

Go For Lenders that Offer Top-Notch Customer Service

Whether it’s a small business financing company or some other type of business, one of the most important aspects of any organization is the level of customer service they offer to their clients. Business lending companies should have the tools and technology to serve their clients better. Moreover, their customer relationship executives should be available 24*7 to solve clients’ queries or questions. They should make themselves easily available through a variety of channel communications, including email, phone, message, or live chat.

Besides, a professional SME lender must have talented, experienced, and knowledgeable staff that can help you get funding easily and in the least possible times. Financing can be tough, so choose a business loan provider who is patient, friendly, and helpful.

Bottom Line

Whether you need money to increase your cash flow, expand your booming business, start a new venture, or buy business’ equipment, the right lender may be able to help you. Choose any of the futuristic small business lending platform that can help you apply and secure the best business loans that fit your budget and needs. Fill out one simple application form, provide your business’ basic information, and compare business loan options from 40+ lenders. Book a Demo to experience it.

#businesslending#businessfinancing#lendingusa#smelender#smallbusinessfinancingcompany#lendingplfatforms#onlinemarketplace#fundingmarketplace#fundingoption#fundingtip#tipsforbusiness

1 note

·

View note

Photo

Buy Inventory for your e-commerce business

with unsecured credit lines at 0% interest

https://tinyurl.com/getneededfunding

2 notes

·

View notes

Photo

We offer several #BusinessFinancingOptions. What do you need?

Fill out our contact form at onlinecheck.com to request more information and apply online #businessloanapproval #businessfinancing #businessloanprograms #fundingoptions

2 notes

·

View notes