#Bootstrapping

Explore tagged Tumblr posts

Text

‘But the [Jordan] Peterson crying videos mostly make me sad for him because of how seriously he takes himself, and how rarely, one finds the man laughing. These videos also make me think of something even sadder than—as Slavoj Zizek once remarked—how difficult it is to “elicit from [Peterson] a joke”: the life and death of Friedrich Nietzsche.

Self-reliant bootstrapping rhetoric draws heavily on the Nietzschean exaltation of the Ubermensch and the will to power. Yet ironically, Nietzsche’s death was sadly unNietzschean. Lonely, physically ailing, driven to madness, and plagued by an “urge for the truth” (which he “so detested”), he found himself calling into question the worldview he constructed upon the rejection of all external authorities.’

— Stephen G. Adubato: “Beyond the Cult of Self-Reliant Bootstrapping”

#Stephen G. Adubato#nietzsche#bootstrapping#self-reliance#givenness#jordan peterson#cracks in postmodernity

8 notes

·

View notes

Text

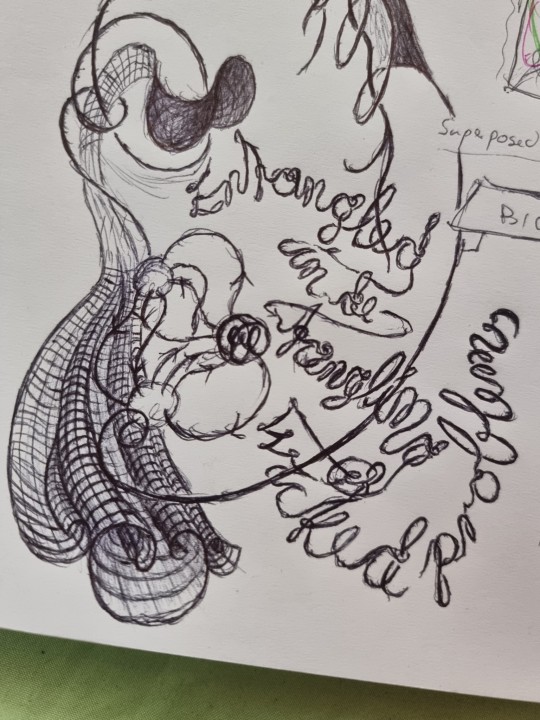

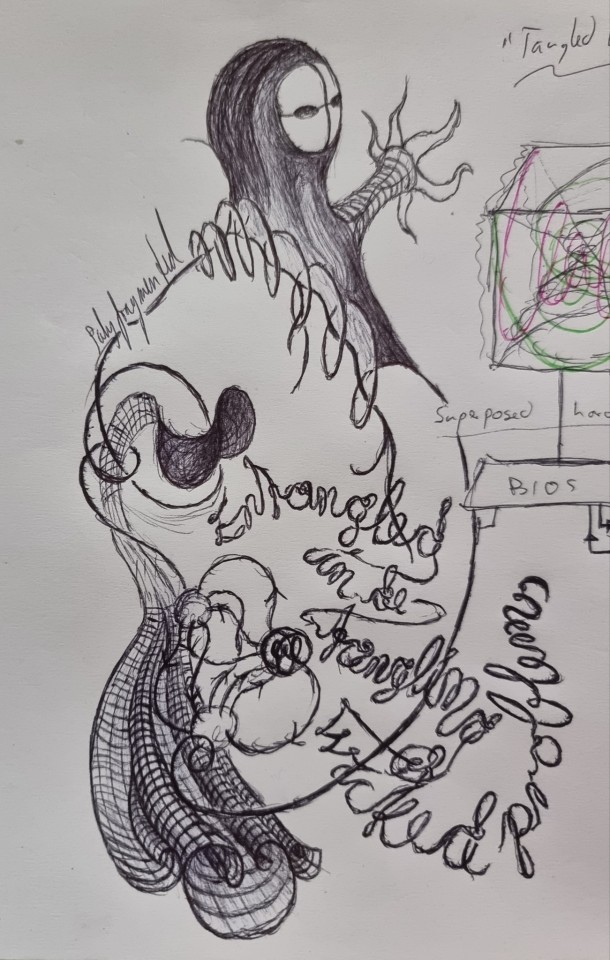

"Entangled in de-tangling wicked problems".

...feels like pulling yourself up by your bootstraps...

#I am tired of how much effort I put into my recovery.... and how small the effect it actually brings....#The exhausting effort approaches infinity while the result remains close to zero...#recovery#trauma recovery#cptsd recovery#surrealism#surreal#art#my art#drawing#entangled in de-tangling wicked problems#wicked problems#analogy#analogies#bootstrapping#analogy soup#brewing analogy soup#artsy#surreal soup#soupy noodle brain#brain soup

15 notes

·

View notes

Text

Looking for an easy way to launch the website for your new SaaS? Look no further, here's a Carrd.co template that you will love.

Pricing table, FAQ section, Feature section, header with a hero this template has it all.

Get the template

3 notes

·

View notes

Text

Think going "all in" is risky? 🤔 Our latest blog flips that script for small business owners. Discover why full commitment (and your own funds) might be the safest long-term strategy. Read now: #SmallBusinessWisdom #EntrepreneurialMindset #GoAllIn

#All In#Bootstrapping#Commitment#Debt#entrepreneurship#Failure#Financial Risk#leadership#Personal Finance#Personal Investment#Risk vs Reward#Skin in the Game#small business#Startup Funding#success

0 notes

Text

🚀 Bootstrapping: Navigating the Advantages & Disadvantages of Self-Financing 💼

Launching a business is an exhilarating journey filled with dreams, challenges, and pivotal decisions. One of the most critical choices entrepreneurs face is determining how to fund their venture. While external investments and loans are common routes, many opt for bootstrapping—a self-financing approach that relies on personal savings and reinvested profits. This method offers unparalleled control but comes with its own set of challenges. Let's delve into the intricacies of bootstrapping, exploring its benefits and potential pitfalls.

What is Bootstrapping? 🤔

Bootstrapping refers to the process of starting and growing a business using personal finances or the company's own revenue, without external funding sources like venture capital or bank loans. This approach emphasizes lean operations, cost efficiency, and organic growth. Notably, several global giants began their journeys through bootstrapping:

Mailchimp: Started as a self-funded email marketing platform and evolved into a multi-million-dollar enterprise.

GoPro: Founder Nick Woodman utilized his savings to develop the first GoPro camera, now a renowned brand.

Spanx: Sara Blakely launched Spanx without any investors, transforming it into a billion-dollar company.

These success stories underscore the potential of bootstrapping when executed with diligence and strategic planning.

✅ Advantages of Bootstrapping

1. Complete Control and Ownership 🏆

Bootstrapping allows entrepreneurs to retain full ownership of their business. Without external investors, founders can make decisions aligned with their vision, values, and long-term goals, ensuring the company's direction remains uncompromised.

2. Financial Discipline and Efficiency 💰

Operating with limited resources necessitates meticulous budgeting and prioritization. This constraint fosters a culture of financial discipline, encouraging businesses to focus on profitability and efficient resource allocation from the outset.

3. Flexibility in Decision-Making 🔄

Without the need to consult investors or meet external expectations, bootstrapped businesses can pivot quickly in response to market changes, customer feedback, or new opportunities, enhancing their adaptability.

4. Reduced Financial Risk from Debt 📉

By avoiding external loans or investments, entrepreneurs sidestep the pressures of debt repayments and investor returns. This autonomy can lead to more sustainable growth and reduced financial stress.

5. Cultivation of Innovation and Resourcefulness 💡

Limited funds often drive creativity. Bootstrapped businesses are compelled to find innovative solutions, optimize processes, and leverage unconventional strategies to achieve their objectives.

⚠️ Disadvantages of Bootstrapping

1. Limited Access to Capital 💸

Relying solely on personal funds or business revenue can restrict the ability to invest in essential areas like product development, marketing, or hiring, potentially hindering growth and competitiveness.

2. Increased Personal Financial Risk ⚠️

Investing personal savings into a business amplifies the financial stakes for entrepreneurs. If the venture faces challenges or fails, the personal financial repercussions can be significant.

3. Slower Growth Trajectory 🐢

Without substantial capital injections, scaling operations or entering new markets may progress at a slower pace, potentially allowing competitors to capture market share more rapidly.

4. Limited External Support and Mentorship 🤝

External investors often bring valuable networks, industry insights, and mentorship. Bootstrapped businesses might miss out on these benefits, which can be instrumental in navigating complex business landscapes.

5. Potential for Burnout 🧠

Managing multiple roles, from operations to finance, can be overwhelming. The cumulative stress of wearing many hats without external support can lead to burnout and affect overall business performance.

🧭 Is Bootstrapping Right for You?

Deciding to bootstrap depends on various factors:

Business Model: Does your venture require significant upfront investment, or can it start lean?

Risk Tolerance: Are you comfortable with the financial risks associated with self-funding?

Growth Objectives: Are you aiming for rapid expansion or steady, organic growth?

Personal Resources: Do you have sufficient savings or revenue streams to support the business initially?

Reflecting on these questions can guide your decision-making process.

💡 Tips for Successful Bootstrapping

Prioritize Profitability: Focus on generating revenue early to sustain operations and fund growth.

Maintain Lean Operations: Optimize expenses, avoid unnecessary costs, and invest in areas with the highest ROI.

Leverage Technology: Utilize affordable digital tools and platforms to streamline processes and enhance productivity.

Build a Strong Network: Even without investors, seek mentors, advisors, and peer support to gain insights and guidance.

Stay Resilient: Embrace challenges as learning opportunities and remain adaptable in the face of obstacles.

🌟 Conclusion

Bootstrapping offers a path to build a business grounded in autonomy, discipline, and innovation. While it presents challenges, the rewards of owning a venture shaped entirely by your vision can be immensely fulfilling. If you're considering this route, equip yourself with knowledge, plan meticulously, and embrace the journey with determination.

For a deeper exploration of bootstrapping, including real-world examples and strategic insights, visit this comprehensive guide: Bootstrapping: Advantages & Disadvantages of Self-Financing

0 notes

Text

[Bootstrapping.]

0 notes

Text

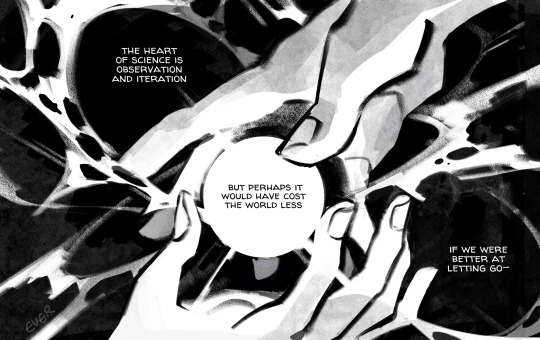

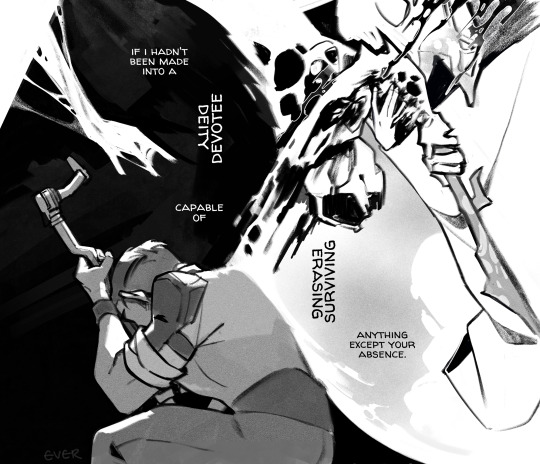

#arcane#jayce talis#viktor#jayvik#ever makes art#big romance is when u and ur partner create a bootstrap paradox together bc defying space-time is easier than accepting a world without you

13K notes

·

View notes

Text

youtube

The Bootstrapping Blueprint: Lessons in Grit, Growth, and Greatness

From the Build Your Business Podcast with Matt and Chris Reynolds

Starting a business often feels like stepping into the unknown. But according to Matt and Chris Reynolds on the latest episode of the Build Your Business Podcast, that uncertainty is where the magic happens—especially when you’re bootstrapping.

Bootstrapping isn’t just about saving money. It’s about developing the resilience, resourcefulness, and discipline that set you up for long-term success. In this episode, the brothers share their personal stories and practical advice for entrepreneurs who are ready to embrace the grind.

Why Bootstrapping Works 💡

Chris Reynolds doesn’t mince words: “Bootstrapping is the right choice for 99% of businesses.” Why? Because it forces you to operate with discipline and focus from the start.

When you bootstrap, your limited resources drive smarter decisions. You’re not throwing money at problems—you’re solving them with creativity and grit. As Matt explains, “The hunger that comes with bootstrapping can’t be replicated. It’s the pressure of knowing that if you fail, it’s on you.”

The Reynolds brothers agree that bootstrapping:

Builds a Profit-First Mindset: When it’s your own money on the line, every dollar matters.

Keeps You Agile: Without outside investors, you’re free to pivot and adapt.

Strengthens Resourcefulness: Limited funds push you to think outside the box.

For eight years, Chris bootstrapped his first business, scaling it to 100 employees. “We didn’t have a roadmap,” he recalls. “We just worked harder, longer, and smarter.”

The Cost of Raising Capital Too Soon 💸

While raising capital might seem appealing, Matt and Chris warn against it, especially in the early stages. “When you take on outside funding, you lose control,” Matt says. “And worse, you can fall into the trap of overspending.”

Chris adds, “It’s easy to get complacent with someone else’s money. You stop thinking like an owner and start thinking like an employee.”

Instead of chasing venture capital or angel investors, the brothers recommend focusing on building a lean, profitable business. “If you bootstrap and get the fundamentals right, you’ll be in a stronger position to raise capital later—if you even need it.”

Lessons from the Grind 🔥

Bootstrapping isn’t for everyone. It’s hard. It’s messy. But it’s also transformative.

Chris recalls a pivotal moment early in his career: “We had no money. My wife and I lived off her small salary, and I sold everything I could to keep the business alive. That hunger drove me to work harder than I ever thought possible.”

Matt adds, “There’s something powerful about choosing the hard path. It builds resilience and grit. You learn to embrace the challenge because you know it’s shaping you into the person you need to be.”

For the Reynolds brothers, bootstrapping was more than a business strategy—it was a life lesson. It taught them:

The Value of Time and Effort: When capital is scarce, your energy becomes your greatest resource.

The Importance of Adaptability: The ability to pivot is critical. “Our first business idea didn’t pan out, but we kept iterating until we found the right fit,” says Chris.

The Power of Grit: Success isn’t about avoiding challenges—it’s about thriving in the face of them.

When to Consider Outside Funding 🤔

While bootstrapping is ideal for most businesses, there comes a time when raising capital makes sense. Matt and Chris recommend waiting until:

You’ve proven your business model.

Your company is generating profits.

You need additional resources to scale effectively.

“The key,” Chris explains, “is to start lean, build momentum, and only seek funding when it’s strategically necessary—not because you’re desperate.”

Finding the Right Size for Your Business 🏆

Not every business needs to be the next Amazon or Tesla. Matt emphasizes, “It’s okay to build a business that fits your lifestyle. Success doesn’t have to mean billions in revenue. For some, it’s about creating a steady income and enjoying the journey.”

Chris agrees, sharing his vision of owning a portfolio of mid-sized companies: “You don’t need to chase unicorn status to build a meaningful business. Sometimes, staying small and profitable is the best path.”

Closing Thoughts: Build the Founder, Not Just the Business 🌟

Matt and Chris leave us with a profound insight: “You think you’re building a business, but what you’re really building is yourself as a founder.”

Bootstrapping isn’t just about funding your business—it’s about shaping your mindset, honing your skills, and discovering what you’re truly capable of. The journey is tough, but the rewards go beyond financial success.

Whether you’re starting your first venture or scaling an existing business, the lessons from this podcast are clear: Embrace the grind. Learn from the challenges. And most importantly, stay hungry.

🎧 Listen to the full episode of the Build Your Business Podcast for more actionable advice and inspiring stories from Matt and Chris Reynolds. If you found this post helpful, please share it and leave a review!

1 note

·

View note

Text

How to Get the Right Funding for Your Startup Growth and Success

Starting a business is fun but also a bit challenging. One of the main things to think about is how to Get the Right Funding for Your Startup Growth and Success. Many people find it hard to decide the best way to get the money they need. Luckily, there are different ways to get money, and each way has good and bad points. In this blog, we’ll talk about different ways to get money for your new business, like using your own savings, crowdfunding, angel investors, vFenture capital, grants, and startup help centers.

1. Bootstrapping: Using Your Own Money to Start

Bootstrapping means using your own money to fund your business. Many people start this way because it doesn’t require giving away any part of the business. With bootstrapping, you use personal savings, credit cards, or other money to help start your business.

Advantages of Bootstrapping:

Full Control: You make all the decisions because it’s your money.

No Debt: You don’t have to pay back loans or deal with interest.

Freedom: You can run your business however you want without anyone telling you what to do.

Challenges of Bootstrapping:

Risk: If the business fails, you could lose your personal savings.

Limited Funds: You may not have enough money to grow your business fast.

Slow Growth: With less money, expanding your business might take longer.

Bootstrapping works well if you have the money and are okay with some risk. But it might not be the best choice if you need a lot of money right away.

2. Crowdfunding: Raising Small Amounts from Many People

Crowdfunding is a popular way for people to raise money for their business by asking many people to give small amounts of money. Websites like Kickstarter, Indiegogo, and GoFundMe let you make a page where people can donate to your project. In exchange, they might get a gift, your product, or just help you with your idea.

Advantages of Crowdfunding:

Reach a lot of people: Crowdfunding helps you connect with people all over the world, making it easier to get the money you need.

Check if people like your idea: It lets you see if people are interested in your product before you even start selling it. If your campaign works, it means your idea is popular.

No need to give up ownership or take on debt: Unlike other types of funding, like angel investors, you don’t have to give up any part of your business or take a loan.

Challenges of Crowdfunding:

Takes a lot of time: Running a crowdfunding campaign takes effort. You’ll need to spend time telling people about your idea and getting them to contribute.

Uncertainty: Not all campaigns succeed. You might not reach your goal, and there’s no guarantee that you’ll get the money you want.

Your idea is out in the open: When you share your startup idea online, others might copy it or use it to create competition.

#startupgrowth#startup#crowdfunding#venturecapital#bootstrapping#entrepreneurship#entrepreneurlife#businessowner#accounting

0 notes

Text

Le bootstrapping , ou l'autofinancement, est une méthode populaire parmi les entrepreneurs pour lancer et faire croître une startup sans dépendre de financements externes. Cette approche présente des avantages significatifs, mais elle comporte également des défis. Voici une analyse des avantages et inconvénients du bootstrapping pour les startups. 1. Avantages du Bootstrapping 1.1 Contrôle Total Description : En autofinançant votre entreprise, vous conservez un contrôle total sur les décisions stratégiques et opérationnelles. Explication : Sans investisseurs externes, vous n'avez pas à rendre de comptes à d'autres parties ni à partager la propriété de votre entreprise. Cela vous permet de diriger votre startup selon votre vision et vos valeurs. 1.2 Flexibilité Description : Le bootstrapping vous permet d’être plus flexible dans la gestion de votre entreprise. Explication : Sans pression externe pour générer des rendements rapides, vous pouvez ajuster vos stratégies et prendre des décisions à long terme qui favorisent la croissance durable de votre startup. 1.3 Focus sur la Rentabilité Description : Le manque de financement externe pousse les startups à se concentrer sur la rentabilité dès le début. Explication : En utilisant des ressources limitées, vous êtes incité à développer des produits ou services qui génèrent rapidement des revenus, ce qui renforce la viabilité de votre entreprise. 1.4 Motivation et Résilience Description : Le bootstrapping peut renforcer votre détermination et votre résilience en tant qu’entrepreneur. Explication : Travailler avec des ressources limitées vous oblige à être ingénieux et à maximiser chaque dollar investi, ce qui peut conduire à des solutions innovantes et à une gestion rigoureuse des coûts. 2. Inconvénients du Bootstrapping 2.1 Ressources Limitées Description : L'absence de financement externe signifie que vous devez vous débrouiller avec des ressources limitées. Explication : Le manque de capital peut limiter votre capacité à investir dans des outils, des talents, ou des campagnes marketing, ce qui peut freiner la croissance rapide de votre entreprise. 2.2 Risque Personnel Élevé Description : En finançant votre entreprise avec vos économies personnelles ou vos revenus, vous assumez un risque financier élevé. Explication : Si l'entreprise échoue, vous pourriez perdre vos économies personnelles ou vous endetter. Ce risque peut être stressant et peut limiter votre capacité à prendre des risques calculés. 2.3 Croissance Plus Lente Description : Sans l'injection de fonds externes, la croissance de votre startup peut être plus lente. Explication : Le manque de capital peut vous obliger à vous concentrer sur des actions générant des revenus à court terme plutôt que sur des stratégies de croissance à long terme. Cela peut retarder l'expansion de votre entreprise et limiter votre capacité à capturer des parts de marché rapidement. 2.4 Difficulté à Attirer des Talents Description : Avec des ressources limitées, il peut être difficile d'attirer et de retenir des talents de haut niveau. Explication : Le bootstrapping implique souvent de limiter les dépenses, y compris les salaires. Vous pourriez avoir du mal à concurrencer les entreprises mieux financées pour attirer des professionnels expérimentés qui exigent des salaires élevés ou des avantages sociaux généreux. 2.5 Manque de Réseautage et de Conseils Description : Sans investisseurs, vous manquez également des opportunités de réseautage et des conseils stratégiques qu'ils peuvent offrir. Explication : Les investisseurs apportent souvent plus que du capital : ils apportent également des conseils, des connexions et des ressources précieuses qui peuvent aider à accélérer la croissance de votre startup. Le bootstrapping peut être une stratégie viable pour les entrepreneurs qui souhaitent conserver un contrôle total sur leur startup et se concentrer sur la rentabilité dès le début. Cependant, cette approche présente également

des défis, notamment des ressources limitées, un risque personnel élevé, et une croissance potentiellement plus lente. En pesant soigneusement les avantages et les inconvénients, vous pouvez décider si le bootstrapping est la bonne approche pour votre startup ou s'il est préférable de chercher des financements externes pour soutenir votre croissance. https://savoirentreprendre.net/?p=15686&feed_id=13038

0 notes

Text

Bootstrapping Your Startup: Challenges and Opportunities

Bootstrapping your startup involves self-financing and maintaining full control over your business operations. Although bootstrapping often results in slower startup growth and limited resources, it can provide long-term stability and independence. This approach is ideal for entrepreneurs who value autonomy and are prepared to manage finances carefully to sustain their startup.

#bootstrapping#bootstrap#bootstrappingyourstartup#BootstrapFunding#bootstrappingchallenges#BootstrappingOpportunities#StartupBootstrapping

0 notes

Text

0 notes

Text

🤔 Bootstrapping or Venture Capital? 🤔 Which funding path is RIGHT for YOU?

Starting a business is tough! Finding the right funding can make or break your journey.

This article breaks down the pros and cons of bootstrapping vs. venture capital:

Learn about:

Financial independence and control with bootstrapping

The power of VC funding and its impact on growth

Key factors to consider when choosing your funding route

Hybrid approaches that combine the best of both worlds

Don't go it alone! Get the knowledge you need to make the BEST decision for YOUR startup.

Share your thoughts! Have you bootstrapped or taken VC funding? What are your experiences and advice for fellow entrepreneurs?

Let's discuss in the comments! 👇

#startup#funding#entrepreneur#business#venturecapital#bootstrapping#growth#investment#fintech#technology#advice

0 notes

Text

7 Proven Strategies to Start a Business with No Money

Start a business with no money by leveraging your skills, utilizing free resources, and employing smart strategies. This guide will show you how to kickstart your entrepreneurial journey without a hefty initial investment. 7 Proven Strategies to Start a Business with No Money1. Leverage Your Skills and TalentsIdentify Your Unique SkillsCreate a Service-Based Business2. Utilize Free Online…

#bootstrapping#business startup#business tips#crowdfunding#entrepreneurship#free business tools#small business#social media marketing#start a business with no money#zero capital business

0 notes

Text

"They're soulmates" oh it's way worse than that

~ quote from marsadist

#arcane#arcane league of legends#arcane s2 spoilers#jayvik#viktor arcane#mage viktor#jayce talis#viktor 'our entire relationship hinges on a bootstrap paradox that I created bc there has to be a world with you and me in it' ...arcane#if I could get harry lloyd to say these lines with that soft cadence I think I could die happy#sorry for so much mage viktor posting i have#a certain fondness for old(er??) haggard lonely and insane time traveler viktor#you know my type

4K notes

·

View notes