#GST e-invoicing

Explore tagged Tumblr posts

Text

GST E-Invoicing: A Guide for Businesses

The Goods and Services Tax (GST) is a comprehensive indirect tax system that was introduced in India in July 2017. The GST e-invoicing system is an electronic invoicing system that is used to generate and transmit invoices for GST transactions. The e-invoicing system is designed to improve the efficiency and transparency of GST compliance.

Who is required to use GST e-invoicing?

The GST e-invoicing system is mandatory for businesses with a turnover of more than Rs.5 crore in any financial year. The system is also mandatory for businesses that are involved in inter-State supplies of goods and services.

What are the benefits of GST e-invoicing?

The GST e-invoicing system offers a number of benefits for businesses, including:

Increased efficiency: The e-invoicing system eliminates the need for manual data entry, which can help to improve the efficiency of GST compliance.

Improved transparency: The e-invoicing system makes it easier for businesses to track and verify GST transactions, which can help to reduce fraud and errors.

Reduced compliance costs: The e-invoicing system can help to reduce the compliance costs associated with GST, such as the cost of printing and storing invoices.

Improved data security: The e-invoicing system uses a secure electronic platform to transmit invoices, which can help to protect sensitive data.

How does GST e-invoicing work?

The GST e-invoicing system is a two-step process:

The supplier generates an e-invoice using an approved e-invoicing software.

The supplier transmits the e-invoice to the buyer using the Invoice Registration Portal (IRP).

The IRP is a secure electronic platform that is managed by the GST Network (GSTN). The IRP validates the e-invoice and generates a unique Invoice Reference Number (IRN). The IRN is a 16-digit alphanumeric code that is used to uniquely identify the e-invoice.

The buyer can view and verify the e-invoice on the IRP. The buyer can also download a copy of the e-invoice for their records.

What are the penalties for non-compliance with GST e-invoicing?

Businesses that fail to comply with the GST e-invoicing system may be subject to penalties. The penalties for non-compliance can be significant, and they may vary depending on the severity of the violation.

Some of the penalties for non-compliance with GST e-invoicing include:

Fine of up to Rs.50,000

Imprisonment of up to six months

Both fine and imprisonment

Conclusion

The GST e-invoicing system is a new and important compliance requirement for businesses in India. The system offers a number of benefits for businesses, including increased efficiency, improved transparency, and reduced compliance costs. Businesses that are required to use the GST e-invoicing system should ensure that they are aware of the requirements and that they are taking steps to comply.

0 notes

Text

Common Mistakes to Avoid When Managing GST Ledgers in Tally

Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST). GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

#accounting automation software#GST Ledgers#GST#tally on cloud#automated bank statement processing#e invoice in tally#tally solutions

2 notes

·

View notes

Text

MCA Chief Urges GST Revival, Warns SST Expansion Burdens Public

PETALING JAYA: MCA president Datuk Seri Dr Wee Ka Siong criticized the Sales and Services Tax (SST) expansion, saying it burdens people and allows businesses to hike prices. Speaking at an MCA E-Invoice Seminar on Saturday, he called SST opaque and unsustainable compared to the transparent, efficient Goods and Services Tax (GST). Wee urged reintroducing GST with exemptions for SMEs and vulnerable…

#latest Malaysia news#mca e-invoice seminar#politics malaysia#sst burdens all the people#wee ka siong wants gst revival

0 notes

Text

Optech Software offers one of the most reliable and user-friendly Billing Software in Coimbatore, tailored to meet the needs of businesses of all sizes. Whether you run a retail store, a wholesale unit, or a service-based company, Optech Software provides a seamless billing experience with features like GST invoicing, inventory management, e-invoice generation, and real-time reporting

#gst billing software#billing software#invoice software development bd#e-invoice#billing software in coimbatore

0 notes

Text

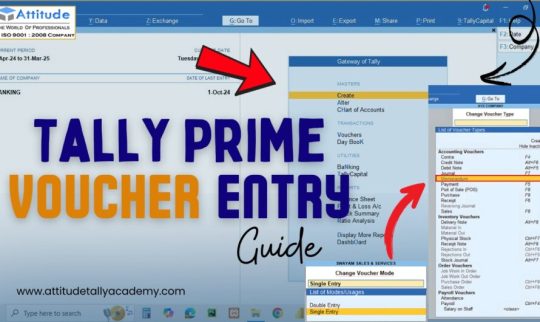

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

Activities to be Undertaken for GST Compliances of FY 2024-25

As the FY 2024-25 comes to an end, businesses need to complete important tasks to stay GST-compliant and smooth transition into the new financial year. Key important points to consider:

Submission of Letter of Undertaking (LUT)

Compliance with Rule 96A of CGST Rules, 2017

Opting for the Composition Scheme

Quarterly Return Monthly Payment (QRMP) Scheme Selection

Implementation of the New Invoice Series

Reassessment of Aggregate Turnover

Check Applicability of E-Invoice

Check the Applicability of the E-Way Bill

Reconciliation of Outward Supplies

Issuance of Credit Notes

GST TDS/TCS credit

Reconciliation of Input Tax Credit (ITC)

Common ITC Reversal at the year-end

Compliance with Goods Sent on Approval Basis

Check the requirement to register as an Input Service Distributor (ISD)

GST Amnesty Scheme 2025

#Input Tax Credit#GST Amnesty#GST TDS/TCS credit#E-Way Bill#E-Invoice#96A of CGST Rules#uja global advisory

0 notes

Text

0 notes

Text

EASY BILL - Basic Overview of SGST ✨ 2025

VISIT : https://sites.google.com/view/easy-billing-software/blog/basic-overview-of-sgst

EASY BILL - Basic Overview of SGST 2025 is a user-friendly platform designed to simplify the billing process for businesses in India. This tool integrates seamlessly with the Goods and Services Tax (GST) system, offering a clear understanding of SGST (State Goods and Services Tax) for the year 2025. EASY BILL helps businesses generate accurate invoices while automatically calculating SGST rates based on the state-specific tax structure. With its intuitive interface, users can efficiently manage tax compliance, ensure accurate reporting, and stay updated with the latest regulations. EASY BILL streamlines SGST management for enhanced efficiency and compliance.

#easy billing software#easy billing#gst easy bill#easy gst billing software#easy gst#invoice easy#free billing software for mobile#easy gst software#online billing software free#online software for billing#software for billing#easy accounting software#gst billing software online#simple billing#easy invoice#e billing software#quick bill software

1 note

·

View note

Text

GST: Updates On E-Way Bill And E-Invoice Systems You Must Know

GST: Updates On E-Way Bill And E-Invoice Systems You Must Know GST: The GSTN has issued an advisory on updates related to e-way bill and e-invoice systems. The advisory is produced as under: GSTN is pleased to announce that NIC will be rolling out updated versions of the E-Way Bill and E-Invoice Systems effective from 1st January 2025. These updates are aimed at enhancing the security of the…

0 notes

Text

5 Tips to Streamline Your Billing Process

Efficient billing is the backbone of successful business operations. The streamlined process not only saves time but also improves customer satisfaction and ensures steady cash flow. Here are five actionable tips to simplify and enhance your billing process using TRIRID Accounting and Billing Software:

Automate Repetitive Tasks

Manual invoicing is time-consuming and prone to errors. With TRIRID, you can automate recurring invoices, set reminders for payments, and generate GST-compliant bills with ease. This automation eliminates delays and reduces human errors.

Leverage Real-Time Reporting

Keep yourself updated with the real-time reporting feature of TRIRID. Track pending invoices, payment statuses, and overall financial health with a click. This transparency helps in taking timely actions to manage receivables.

Cloud-Based Solution

TRIRID's cloud-based platform provides you with access to your billing data at any time and from anywhere. Whether in the office or on the go, you can securely manage invoices, payments, and customer records from any device.

Simplify GST Compliance

Managing taxes can be challenging, but TRIRID makes it easy. Generate GST-ready invoices, calculate tax rates automatically, and stay compliant with the latest regulations—all within the software.

Integrate Billing with ERP Systems

Make your billing software integrate with other business tools such as ERP or inventory management systems to ensure seamless workflow. TRIRID compatibility ensures smooth data flow and enhances efficiency.

Why Choose TRIRID Accounting and Billing Software?

You get a robust solution designed to simplify complex billing processes with TRIRID. The user-friendly interface, customization options, and advanced features make it the go-to choice for businesses of all sizes.

Ready to transform your billing process? Contact us today!

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#TRIRID Biz Accounting and Billing Software#Best Accounting & Billing Software In India#Best GST e-Invoicing Software for Business#Top 10 Easy To Use Billing and Invoicing Software in India#Best e-Invoicing Software for SMBs in India

0 notes

Text

QueueBuster, as a recognized GST Suvidha Provider (GSP), simplifies the invoicing process for tax professionals by allowing direct uploads to the IRP without relying on third-party platforms. This significantly reduces the complexity and cost associated with managing multiple platforms for e-invoicing software.

0 notes

Text

Navigating the GST E-Invoice Mandate: A Practical Guide for SAP Users

As business compliance rapidly evolves, India’s Goods and Services Tax (GST) mandated electronic invoices are an integral component. Over time, this system was implemented to simplify business operations while increasing tax compliance; beginning October 1st, 2020, electronic invoicing became mandatory for companies with over INR 500 crore turnover during 2019-2020. This blog discusses how SAP…

View On WordPress

0 notes

Text

Understanding GST Invoice: A Comprehensive Guide

In the world of business and taxation, a GST invoice is a fundamental document. It serves as proof of supply of goods or services and is critical for both sellers and buyers to claim input tax credit. This blog post will guide you through the essentials of GST invoices, including the required GST invoice format, key elements, and best practices for creating and managing these invoices effectively.

0 notes

Text

A complete guide to free billing software

Free billing software refers to a type of software that is designed to automate the process of generating bills for products and services offered by a business to its clients. Billing software free makes the creation, management, and tracking of billing easy, and it also ensures accurate and on-time billing.

The GST billing software free has the following functions:

Easy and quick billing: The primary function of GST billing software free is to create bills automatically based on existing templates and custom layouts. GST software free includes client’s information, lists of products and services offered, cost details, taxes, discounts, and other payment terms.

Automation of billing: Free billing software eliminates the manual work by automating repetitive tasks like invoice generation, recurring billing, and sending bills to customers through email or other digital means.

Accurate tax calculation: Many free billing software have tax calculation features like GST, VAT, and sales tax that are based on the rules and rates applicable in the jurisdiction of the business.

Payment Processing: Billing software integrates with payment processing to facilitate online payments directly from bills. GST billing software free offers various modes of payment, like credit cards, debit cards, and bank transfers. Online payment offers convenience to both businesses and customers.

Reporting and Analytics: Billing software helps in generating reports and analytics on sales, revenue, outstanding invoices, payment status, and other financial things. These insights help businesses track their financial performance and make informed decisions.

Easily Integrates with Accounting Software: Free billing software integrates with other accounting software like QuickBooks to smooth the reconciliation of bills with financial records, ensuring accuracy in financial reporting and accounting processes.

Customer Relationship Management (CRM): Billing software free also offers CRM functionalities to deal with customer information, monitor interactions, and maintain a database of customer billing history.

Security: Billing software prioritizes data security to protect sensitive customer and financial information. It follows data protection regulations and may have features like encryption, secure data storage, and access controls.

Customization: Billing software also facilitates customization of billing that fulfills specific needs of businesses, like branding invoices with company logos, adjusting templates, and offering contact information, among others.

How do you select the best GST billing software for your business?

Selecting the best GST billing software free for your business depends on the following factors:

Identify Your Business Requirements: Considering the business requirements is important before selecting billing software free. Make a list of all the required features that you want from the free billing software, like tax calculations and all.

GST Compliance: Check that the GST billing software is compliant with GST regulations or not. And it should automate the GST calculations.

Inventory Management: Make sure that the free billing software includes features like monitoring stock levels, managing purchase orders, and generating stock reports.

Data Security: Check the data security system provided by the free billing software to protect important financial data and ensure they have strong data protection regulations.

Customer Support: Check the availability of the customer support team and their responsiveness to complaints, and also inquire whether they are offering technical support or training resources regarding problem solving or not.

Feedback and Reviews: Always check the reviews and feedback from other users to learn about their experiences with the billing software.

By following these steps, you can select the best free billing software that enhances efficiency, compliance, and overall business operations.

Parting Words This guide gives you complete and comprehensive details on free billing software. So, if you want to grow your business, then you should select Eazybills as your GST software free.

#billing software#free billing software#billing software free#gst billing software free#gst software free#gst billing software#invoicing software#invoice software#e invoicing software#invoice software for pc

0 notes