#GST registration queries

Explore tagged Tumblr posts

Text

GST Accountants in Delhi by SC Bhagat & Co.

Are you looking for trusted GST accountants in Delhi to manage your tax compliance and GST filings seamlessly? Look no further than SC Bhagat & Co., a renowned chartered accountancy firm with decades of experience in delivering precise, professional, and timely GST solutions for businesses of all sizes.

Why GST Accounting Matters

Since the implementation of the Goods and Services Tax (GST) in India, businesses have had to adapt to a unified indirect tax regime. Navigating the GST system involves multiple tasks including:

GST registration

Timely GST return filings (GSTR-1, GSTR-3B, GSTR-9, etc.)

Input Tax Credit (ITC) reconciliation

E-way bill and e-invoice compliance

GST audit and annual return preparation

Dealing with notices from GST authorities

To handle all these effectively, having a reliable and knowledgeable GST accountant becomes crucial.

GST Services Offered by SC Bhagat & Co.

At SC Bhagat & Co., we provide end-to-end GST services tailored to your business requirements. Our experienced team of GST accountants in Delhi ensures that your compliance is error-free, timely, and in line with the latest amendments.

1. GST Registration & Advisory

We help new businesses get GST registration quickly and offer consulting on applicable tax structures.

2. Monthly/Quarterly GST Filing

Our team ensures accurate and timely submission of GSTR-1, GSTR-3B, and other applicable forms to avoid penalties.

3. Input Tax Credit (ITC) Optimization

We conduct ITC audits and help you maximize your credit claims with proper reconciliation.

4. GST Audit & Annual Return

We assist with GSTR-9 and GSTR-9C filings and conduct GST audits as per legal mandates.

5. Handling GST Notices

Have you received a GST notice? Our team responds to GST queries and notices with complete documentation support.

6. Industry-Specific GST Solutions

Whether you're in e-commerce, manufacturing, real estate, or services—our accountants are equipped with domain-specific GST knowledge.

Why Choose SC Bhagat & Co.?

✔ Over 20 Years of Experience ✔ Registered Chartered Accountants with In-Depth GST Knowledge ✔ PAN-India Clientele ✔ Transparent Pricing & Customized Packages ✔ Dedicated Support for SMEs and Startups

We pride ourselves on providing accurate, timely, and ethical GST accounting services in Delhi. Our goal is to help you stay compliant while you focus on growing your business.

Who Needs GST Accounting Services?

Startups and new businesses

Small and Medium Enterprises (SMEs)

E-commerce sellers

Exporters & Importers

Service providers with interstate operations

Any business with GST obligations

Get in Touch with the Best GST Accountants in Delhi

If you’re seeking reliable GST accountants in Delhi, connect with SC Bhagat & Co. for a free consultation. Whether you need help with monthly filings, audits, or notice handling, we ensure hassle-free compliance and peace of mind.

Let SC Bhagat & Co. be your trusted partner for GST compliance!

FAQs

Q1: Do I need a GST accountant even if I file returns online myself? Yes. A professional accountant ensures accuracy, maximizes your ITC, and avoids legal penalties.

Q2: How often do I need to file GST returns? Generally, GST returns are filed monthly (GSTR-1, GSTR-3B) and annually (GSTR-9, GSTR-9C).

Q3: What happens if I miss a GST return deadline? You may face interest and late fees. Our accountants help you stay on track and avoid such situations.

Boost your tax compliance and save time with SC Bhagat & Co.—the top GST accountants in Delhi.

#taxation#gst#taxationservices#accounting services#direct tax consultancy services in delhi#accounting firm in delhi#tax consultancy services in delhi#remittances#beauty#actors

4 notes

·

View notes

Photo

NEW DELHI: Union finance minister Nirmala Sitharaman on Friday advised taxmen to make the Goods and Services Tax registration course of simpler, seamless, and extra clear with using expertise and risk-based parameters. Union finance minister Nirmala Sitharaman requested CBIC to make the GST registration simpler, seamless, and extra clear for taxpayers (PIB) Addressing a conclave of the Central Board of Indirect Taxes and Customs (CBIC), Sitharaman advised officers to arrange an motion plan to enhance varied parameters equivalent to GST registration, processing of refunds, and dealing with taxpayers��� grievances. The conclave was attended by principal chief commissioners, chief commissioners and director generals and subject formations of the CBIC in New Delhi. During the conclave, CBIC highlighted the efficiency of customs and CGST zones on key indicators equivalent to grievance redressal, refunds, audit and enforcement. The common time for grievance disposal has been diminished to simply 9 days, considerably higher than the stipulated 21-day timeline, the finance ministry mentioned in a press release. On refunds, 85% of claims had been processed inside the statutory 60-day restrict, it mentioned. GST audit protection went up from 62.21% in 2022–23 to 88.74% in 2024–25. Detection of GST evasion had improved to ₹2,23,170 crore in 2024–25, with voluntary funds totalling ₹28,909 crore. The variety of taxpayers repeated for audit greater than as soon as in three years is zero, it mentioned. In the world of enhanced commerce facilitation, facilitation of cargo via the chance administration system (RMS) has steadily elevated, with 86% of cargo being facilitated in 2025, up from 82% in 2022. Similarly, in 2024-25, 2140.35 kgs of seized gold had been disposed of by handing it over to SPMCIL, it mentioned. The finance minister additionally directed the Central GST (CGST) formations to launch focused consciousness campaigns amongst taxpayers, commerce associations, and business our bodies concerning the obligatory documentation required for GST registration, notably these associated to the principal office, it mentioned. This would assist cut back rejections and delays in registration and allow sooner processing of purposes, she mentioned. The minister additionally directed CGST zonal heads to have a devoted helpdesk for GST registrations to facilitate the taxpayers within the software course of. Sitharaman highlighted the necessity to make sure that GST ‘seva kendras’ and customs ‘turant suvidha kendras’ are well-staffed, accessible, and correctly maintained, in order that taxpayers obtain well timed and high quality help. Emphasising taxpayer belief, she known as for a focused and sustained concentrate on grievance redressal, making certain the well timed decision of queries and complaints via improved techniques and accountability. Sitharaman additionally known as for the speedy closure of investigations for Customs and CGST circumstances, and pressured the necessity to search options to cut back the hole between detection and restoration. At the identical time, the minister emphasised the necessity for stopping tax evasion and wrongful Input Tax Credits (ITC) claims. NTRS 2025Sitharaman additionally launched the fifth version of the National Time Release Study -- NTRS 2025. According to the report, India has seen important enchancment within the common cargo launch time in all 4 classes -- seaports, inland container depots (ICDs), built-in examine posts (ICPs) and air cargo complexes (ACCs). The time launch examine (TRS) is a efficiency measurement device that gives a quantitative evaluation of the time taken for cargo launch, serving to to judge the effectivity of the clearance course of. Since 2019, TRS has been carried out at 15 main places, together with seaports, ACCs, ICDs, and ICPs. In the import section, common launch time (ART) has declined between 2023 and 2025 throug

0 notes

Text

CorporatEdge - World Trade Center Delhi | Premium Serviced Offices, Meeting rooms, Virtual & Co-working spaces

In the city center at the hub of business and prestige, CorporatEdge World Trade Center Delhi is a model of modern work space solutions. We present a mix of functionality, professionalism and sophistication which we at CorporateEdge bring to our clients in New Delhi, also we have serviced offices, virtual office options, and very high tech meeting rooms.

For companies that want to take a stand in the city without the typical issues of office ownership, CorporatEdge has a solution which is at once efficient, elegant, and scalable.

Business Name - CorporatEdge - World Trade Center Delhi | Premium Serviced Offices, Meeting rooms, Virtual & Co-working spaces Address - Level 2, World Trade Center, Tower E, Nauroji Nagar, New Delhi, Delhi 110029 Phone no. - 082875 66777 Website - https://www.thecorporatedge.com/work-space/premium-office-space-newdelhi/corporatedge-world-trade-center/

What does CorporatEdge do at World Trade Center, Delhi?

The World Trade Center at Connaught Place in New Delhi is more than a commercial hub it is a landmark for business excellence. At this global stage of business CorporatEdge brings to you:.

A prestigious business location

High-end infrastructure

Fully equipped, ready-to-move-in office spaces

Professional business support

Customizable plans for every need

Whether you are a multi national, a start up, or a growing business, at CorporatEdge in New Delhi we see your company on the path to success.

Premium Serviced Offices in New Delhi

Serviced offices at CorporatEdge World Trade Center in Delhi are for today’s growing companies. We have at our guests’ disposal ergonomic furniture, secure IT infrastructure, high speed internet, printing services and administrative support. What also sets us apart is that which which we provide .

Furnished to Move In Elegantly designed suites.

Flexible leasing options hourly, daily, monthly, or long term packages.

Reception and Administrative Support Our on site team will welcome clients and address their queries.

IT and Telecom Infrastructure Safe Wi-Fi, dedicated lines, and VPN support.

At all times our site is secured by CCTV surveillance, biometric entry systems, at your service round the clock.

These offices are for more than space they are about productivity, presence and professionalism.

Modern work spaces for flexibility and collaboration.

In CorporatEdge World Trade Center Delhi we present to you a great option for freelancers, remote teams and agile businesses. We have designed a community oriented environment which is a hub for networking and innovation.

Features of Co-working Spaces:

Hot desks and dedicated desks

Access into meeting spaces and break out areas.

Complimentary beverages and lounge areas

Interaction with a dynamic business community

Budget conscious monthly plans that are non binding.

Whether you require a desk for a day or a dedicated space for your team we provide you with the flexibility you need right in the heart of New Delhi.

Virtual offices the prestige address you’re looking for

For entrepreneurs, consultants, and international companies which wish to set up shop in India’s capital we at CorporatEdge World Trade Center Delhi have the ideal solution.

Virtual Office Plans Include:

Premium business address in Connaught Place

Mail and courier handling

Local phone number and call answering services.

Access to use of meeting rooms and private offices as needed.

GST registration and compliance assistance

This service provides you a professional touch and access to a high end location no physical space required.

State-of-the-art Meeting Rooms & Conference Facilities

Looking to book a professional setting for your next business presentation, client meeting, or team discussion? At CorporatEdge we have world-class meeting and board rooms which offer:.

High-speed internet and AV equipment

Video conferencing and presentation tools

On-demand catering and hospitality services

Whiteboards, notepads, and stationery

Booking by the hour or daily.

These are the spaces for board meetings, workshops, interviews and brainstorming sessions we bring it to you with professional discretion.

Ideal for All Types of Businesses

Whether you’re:

A foreign company entering India.

A start-up looking for cost-effective workspaces

A team that is growing which requires flexible desk arrangements.

A consultant which requires a prestigious business address.

CorporatEdge at World Trade Center Delhi provides the base, setting and support which you need to put your energy into what is most important to you your business growth.

Why are serviced offices popular with businesses in New Delhi

New in New Delhi which is the heart of Indian politics and economy we see that is the reason for its choice by any business. But what we see is that issues in real estate, administration, and IT implementation do in fact delay things and also increase costs.

That’s what we see as a solution in New Delhi they allow you to skip the initial investment and hit the ground running.

With CorporatEdge what you also get:

Access to like-minded professionals

Zero CapEx model

Scalability as your team grows

Complete facility management

Hassle-free operations with premium business amenities

Book Your Tour Today

If in search of a serviced office in New Delhi that which is convenient, credible and classy CorporatEdge World Trade Center Delhi is the choice for you. We present to you work spaces that are thoughtfully designed, professional in management and which are to be found in what is the preeminent business address in India.

0 notes

Text

‼️ 5 Days to Go ‼️ 🔹 MASTERCLASS IN TKR & UKR – 2025 🚨 FIRST TIME EVER: Hands-On Experience on MAKO Total Knee 2.0

🗓 Date: Sunday, 22nd June 2025 🕘 Time: 9:00 AM to 5:00 PM 📍 Venue: Hyatt Regency, Pune

🔬 Workshop Highlights: ✅ Hands-on with MAKO Total Knee 2.0 – Powered by STRYKER ✅ Advanced Digital Tensioner & Functional Knee Positioning™️ ✅ Exclusive STRYKER Instruments ✅ In-depth Learning with Industry Experts ✅ Designed for Residents, Physiotherapists & Consultants

💳 Registration Fees: 👨⚕️ Residents & Physios: ₹1000 + 18% GST = ₹1180 👨⚕️ Consultants: ₹2000 + 18% GST = ₹2360

📝 Register Now: https://tinyurl.com/OrthoTV-MasterClass-TKR 🎯 Limited Seats | High-Demand Workshop

First Time Ever in a Conference! Hands-On Experience on MAKO Total Knee 2.0

Dear Doctor,

We are excited to invite you to the Masterclass in TKR & UKR — a unique academic experience designed to sharpen your skills in Robotic Knee Replacement.

🦿 Be among the first to get hands-on with the revolutionary MAKO Total Knee 2.0 , powered by STRYKER – only at our Masterclass.

📞 For Queries: Avani Kalyani – +91 91363 63508 📧 [email protected]

🚀 Masterclass in TKR & UKR – Precision. Innovation. Confidence.

📺 Media Partner: OrthoTV Global

#MasterclassTKRUKR #MAKOTotalKnee #RoboticTKR #UKRWorkshop #StrykerMAKO #KneeReplacementTraining #OrthopaedicWorkshop #RoboticSurgery #OrthoTVGlobal #HyattPune #TKRUKR2025

0 notes

Text

Set Up Smarter: How a Virtual Office in Kochi Can Simplify Business Registration

As India continues to lead the digital-first revolution, more entrepreneurs are discovering efficient ways to launch and scale their businesses. One trend gaining rapid traction is the use of virtual offices — an ideal solution for startups, solopreneurs, e-commerce sellers, and consultants.

If you're looking for a virtual office for business registration in India, especially in thriving hubs like Kochi, VOspaces is your go-to partner.

What is a Virtual Office and Who Needs It?

A virtual office provides your business with a legal, physical address in a commercial location — without the need for renting a dedicated office space. You can use this address for:

Company registration (MCA compliance)

GST registration

Bank account setup

Business mail and courier handling

Whether you're a remote founder, digital agency, or D2C brand, a virtual office for GST registration and business compliance saves you both time and money — while keeping things 100% legal.

Why Choose a Virtual Office in Kochi?

Kochi is one of the fastest-growing business cities in South India. With its rising IT ecosystem, port connectivity, and startup-friendly infrastructure, setting up a virtual office in Kochi allows you to tap into new markets while maintaining operational flexibility.

Benefits of choosing VOspaces in Kochi:

Prime business addresses in commercial zones

Government-compliant documentation (NOC, Rent Agreement, Utility Bill)

Mail and courier handling

Optional access to meeting rooms or coworking desks

Key Benefits of VOspaces Virtual Office Solutions

Here’s why VOspaces is trusted by hundreds of founders across India:

1. Seamless Business Registration

We provide complete documentation for using our addresses as your virtual office for business registration in India, helping you get MCA approval with zero hassles.

2. Hassle-Free GST Registration

Our documentation is GST-ready and accepted by state and central GST departments across India — making VOspaces the perfect virtual office for GST registration.

3. Professional Business Address in India

Get a credible, trustworthy image for your brand with a professional business address in India. Impress clients, investors, and vendors with your presence in key business zones.

4. Zero Overheads, Full Flexibility

Avoid fixed office costs. Choose flexible monthly or yearly plans with zero physical overhead and full scalability as your business grows.

VOspaces Makes It Easy

Setting up a virtual office with VOspaces is simple, fast, and 100% compliant:

Choose a city (like Kochi or others across India)

Submit basic KYC and business details

Get your NOC, Rent Agreement, and Utility Bill within 24–48 hours

Use the documents for GST, ROC, or current account opening

We even assist with verification queries if any arise from authorities.

Conclusion: Register Smart. Grow Faster.

A traditional office setup is no longer essential to run a successful company. With VOspaces, you can legally register your business, get GST-compliant, and access a professional business address in India — all without renting expensive commercial space.

Whether you need a virtual office for GST registration, want to expand into Kerala with a virtual office in Kochi, or need a reliable solution for business registration anywhere in India — VOspaces has you covered.

#virtual office#virtual office for business registration#virtual office for GST registration#VOspaces

0 notes

Text

Why Hiring a CA in Delhi Is Essential for Your Financial Success

Delhi, the heart of India’s economy, is home to numerous businesses and individuals who need expert financial guidance. Whether you're a business owner navigating the complexities of corporate finances or an individual seeking help with taxes, a CA in Delhi can be a game-changer. Chartered Accountants (CAs) provide essential services that ensure financial growth, tax compliance, and smooth business operations. In this blog, we will explore why a CA in Delhi is an indispensable ally in managing your finances effectively.

The Growing Importance of a CA in Delhi

Delhi is home to a fast-paced business environment with a diverse range of industries. From startups to large corporations, every entity needs expert financial advice to succeed. Here's why you need a CA in Delhi:

Expert Knowledge in Taxation: Understanding and complying with India’s complex tax system can be challenging. A CA in Delhi specializes in the latest tax laws and ensures you’re following them correctly, minimizing your tax liabilities while maximizing savings.

Business Planning and Strategy: Managing finances is vital for businesses of all sizes. A CA in Delhi plays a pivotal role in creating financial strategies that help businesses grow, reduce costs, and plan for the future.

Navigating Legal Requirements: Delhi’s business environment is governed by a host of regulations, from GST to company law compliance. A CA ensures that your business follows all the legal requirements, avoiding penalties and maintaining smooth operations.

Key Services Provided by a CA in Delhi

Chartered Accountants in Delhi offer a wide range of services for both individuals and businesses. These services help ensure that finances are managed optimally, whether it’s dealing with taxes, audits, or complex corporate structures. Here’s a list of common services offered by CAs in Delhi:

Taxation Services:

Income Tax Filing: CAs assist individuals and businesses in filing their tax returns, ensuring that all deductions are claimed and taxes are paid accurately.

GST Services: For businesses, staying compliant with GST is crucial. A CA in Delhi can help with GST registration, filing returns, and addressing any queries regarding GST laws.

Tax Planning: CAs provide strategic tax planning advice to minimize tax liabilities and help individuals and businesses optimize their finances.

Auditing and Accounting:

Bookkeeping: CAs help businesses maintain accurate and up-to-date financial records, making it easier to track expenses, revenue, and profits.

Statutory Audits: CAs perform audits to ensure that businesses comply with all relevant laws and that financial statements are accurate.

Preparation of Financial Statements: A CA in Delhi prepares income statements, balance sheets, and cash flow statements to give businesses insights into their financial health.

Business Advisory:

Financial Planning and Budgeting: A CA helps businesses create comprehensive financial plans, set budgets, and monitor their financial performance to ensure they stay on track.

Mergers and Acquisitions (M&A): If you're planning to merge or acquire a business, a CA provides valuable advice on valuation, structuring the deal, and ensuring regulatory compliance.

Business Valuation: Accurate business valuation is crucial for selling or acquiring a business. A CA provides detailed insights into the financial worth of your business.

Corporate Law and Compliance:

Company Registration: CAs assist with registering a new business in Delhi, helping choose the correct business structure (LLP, Pvt Ltd, etc.) and completing all legal paperwork.

Regulatory Compliance: Businesses need to follow many legal requirements, including filing annual returns, maintaining financial records, and adhering to statutory rules. CAs ensure that all compliance requirements are met.

Other Specialized Services:

NRI Taxation: Non-resident Indians (NRIs) often have unique tax considerations. CAs offer expert advice to ensure that NRIs meet their Indian tax obligations and optimize their finances.

Forensic Accounting: CAs investigate financial discrepancies, fraud, or financial mismanagement within a business through forensic accounting services.

International Tax Advisory: CAs offer guidance on international tax issues, helping businesses manage cross-border taxation and avoid double taxation.

Tips for Choosing the Right CA in Delhi

When searching for a CA in Delhi, it's important to choose one that suits your specific needs. Here are some factors to consider:

Experience and Specialization: Not all CAs are the same. Choose a CA with experience in the services you require. If you're a business owner, look for a CA who specializes in corporate taxation and auditing. For personal tax assistance, seek a CA who focuses on individual financial planning and tax filings.

Credentials and Reputation: Ensure that the CA you choose is registered with the Institute of Chartered Accountants of India (ICAI). A good reputation and solid client reviews are important indicators of reliability.

Clear Communication: A good CA should be able to explain complex financial concepts in an easy-to-understand manner. Choose a CA who communicates clearly and keeps you updated on all financial matters.

Personalized Approach: Every financial situation is unique. Look for a CA who offers a personalized approach and takes the time to understand your needs, whether you’re managing personal finances or a growing business.

The Contribution of a CA to Business Success

CAs in Delhi play an integral role in the financial success of businesses. Here’s how:

Strategic Advice: A CA helps businesses formulate strategic financial decisions that improve cash flow, reduce costs, and set the stage for long-term growth.

Cost Optimization: Through careful financial analysis, CAs help businesses identify areas for cost reduction, increasing overall profitability.

Business Sustainability: CAs help businesses mitigate risks by identifying financial weaknesses and providing strategies for long-term sustainability.

Conclusion

Hiring a CA in Delhi is not just a smart financial decision—it’s an essential step toward ensuring your financial success. Whether you’re an individual trying to manage your taxes or a business striving for growth, a CA offers the expertise, advice, and services needed to navigate the complexities of the financial world. By partnering with a skilled CA, you can ensure that your financial affairs are in expert hands, allowing you to focus on what matters most: achieving your financial goals and securing a prosperous future.

1 note

·

View note

Text

How to Find the Right NIC Code for Your Kirana Store?

Starting or registering at a Kirana Store and confused about the NIC Code? You’re not alone! Many small shop owners struggle with identifying the right business classification. But don’t worry — this guide will help you understand and find the correct NIC Code quickly and easily.

✅ What is NIC Code?

NIC (National Industrial Classification) Code is a number assigned by the Government of India to classify businesses based on their core activity.

It is essential for:

GST Registration

Udyam (MSME) Registration

Income tax filings

Licensing & schemes

If you run a Kirana Store, selecting the correct NIC Code helps the government identify the nature of your retail trade and offer the correct benefits.

📊 2-Digit NIC Code for Kirana Store

At the top level, businesses are categorized using 2-digit codes.

For Kirana Stores, the 2-digit NIC code is 47.

This code covers retail trade (excluding motor vehicles).

🔍 Breakdown of NIC Code for Grocery Shops

To be more specific, here is the full classification:

Level NIC Code Description

2-Digit Code 47 Retail trade, except of motor vehicles and motorcycles

4-Digit Code 4711 Retail sale in non-specialized stores with food, beverages, or tobacco

5-Digit Code 47110 Kirana Store sells everyday grocery items, snacks, packaged goods, etc.

So, if you’re running a Kirana Store, your most appropriate code is 47110.

📥 Where is NIC Code Required?

You’ll need to mention your NIC Code when registering for:

GSTIN

Udyam Aadhaar (for MSME benefits)

Shop & Establishment License

FSSAI Registration (if food products sold)

If you're operating a Kirana Store, make sure to use the correct code to avoid rejections or delays in government processes.

💡 Why It’s Important to Use the Right Code

Using the wrong NIC Code can lead to:

Rejection of your application

Missing out on subsidies or benefits

Incorrect tax treatment

Legal and compliance issues

For a Kirana Store, code 47110 ensures that you’re correctly classified under retail grocery business and eligible for related schemes and tax benefits.

Using these phrases in your application and website content helps improve search visibility and accuracy during verification.

📌 Pro Tips Before You Apply

✅ Always verify your business activity before selecting an NIC code.

🧾 Keep your product list ready — it helps during GST and MSME registration.

📄 Apply using government portals like udyamregistration.gov.in.

💬 If confused, consult a CA or registration expert to avoid errors.

🧾 Example Use Case

Ravi runs a Kirana Store in Lucknow. When registering for Udyam Aadhaar, he selected NIC Code 47110, which clearly defined his store as a retail grocery shop. As a result, he successfully availed MSME benefits, including zero-cost registration, loan eligibility, and government schemes.

📝 Summary

Choosing the right NIC Code for your Kirana Store is a simple but crucial step in your business journey. It helps you comply with government rules, access financial benefits, and classify your business properly.

✅ Final NIC Code for Kirana Store: 47110

(2-Digit Code: 47 → Retail Trade)

Want to know more about business registration for Kirana Stores or get help with GST? Drop your query in the comments or contact our experts!

#KiranaStore#NICCode#RetailBusinessIndia#MSMERegistration#UdyamAadhaar#GroceryStoreStartup#GSTRegistration#SmallBusinessTips#RetailShopOwner#BusinessRegistrationIndia

0 notes

Text

Company Registration in Delhi: A Complete Guide by CompaniesNext

Starting a business in Delhi, the national capital of India, can be a promising and profitable endeavor. As the commercial and political hub of the country, Delhi offers a vast market, strong infrastructure, and easy access to central government institutions. One of the first and most important steps for any aspiring entrepreneur or startup in the city is company registration in Delhi.

In this comprehensive guide by CompaniesNext, we’ll walk you through everything you need to know about registering a company in Delhi, including the types of companies, required documents, registration process, costs, benefits, and how CompaniesNext can help you through it all.

Why Register a Company in Delhi?

Delhi is a hotspot for startups, SMEs, and multinational corporations. Registering your company in Delhi comes with numerous benefits:

Types of Companies You Can Register in Delhi

Before diving into the registration process, it’s crucial to choose the right business structure. Here are the most common types of company registration options available in Delhi:

1. Private Limited Company (Pvt Ltd)

2. Limited Liability Partnership (LLP)

3. One Person Company (OPC)

4. Partnership Firm

5. Sole Proprietorship

6. Public Limited Company

Documents Required for Company Registration in Delhi

Here’s a checklist of documents typically required for registering a company in Delhi:

For Directors and Shareholders:

For Registered Office:

Step-by-Step Process for Company Registration in Delhi

At CompaniesNext, we streamline the registration process into these simple steps:

Step 1: Choose a Company Name

Step 2: Obtain Digital Signature Certificate (DSC)

Step 3: Apply for Director Identification Number (DIN)

Step 4: Draft MOA & AOA

Step 5: File SPICe+ Form

Step 6: Pay Government Fees

Step 7: Certificate of Incorporation

Step 8: Open Bank Account

Timeframe and Cost of Company Registration in Delhi

Timeframe:

Cost (Approximate):

Note: Costs may vary based on the number of directors, authorized capital, and professional service charges.

Benefits of Registering with CompaniesNext

At CompaniesNext, we specialize in making company registration in Delhi simple, fast, and affordable. Here’s what sets us apart:

✅ End-to-End Service: From name approval to post-incorporation compliance ✅ Expert Guidance: Team of experienced CA, CS, and legal professionals ✅ Transparent Pricing: No hidden charges or surprise costs ✅ Dedicated Support: Personal advisor for all your queries ✅ Compliance Alerts: Stay on top of your ROC and MCA deadlines ✅ Business Setup Assistance: Help with GST registration, trademark filing, accounting & more

Common Challenges in Delhi Company Registration

While the process is mostly digital, here are some common hurdles entrepreneurs face:

By partnering with CompaniesNext, you can avoid these pitfalls and ensure a smooth registration experience.

Post-Incorporation Compliances

Once your company is registered, here are a few mandatory post-registration steps:

Failure to comply may lead to penalties or even disqualification of directors.

Conclusion

Registering a company in Delhi is a smart move for entrepreneurs aiming to establish a credible and scalable business. The city offers unmatched opportunities, infrastructure, and a vast network of consumers and professionals. However, navigating the legal and procedural requirements can be challenging without expert help.

That’s where CompaniesNext comes in. With our professional expertise, user-friendly process, and dedicated support, you can get your company registered in Delhi efficiently—so you can focus on growing your business while we handle the paperwork.

Ready to Get Started?

Start your journey with CompaniesNext today. Whether you want to register a Private Limited Company, LLP, OPC, or any other entity in Delhi, we’ve got you covered.

👉 Contact us now to speak with an expert or get a free consultation.

0 notes

Text

No Collateral? No Problem! Best Working Capital Loans for Small Businesses & Startups in India (Low Interest, Quick Approval)

Starting Up? Or Facing Cash Flow Issues? This Guide Is for You.

Every startup or small business in India hits a moment where funds get tight, but the ambition stays big. Whether you’re waiting for client payments, need to buy inventory, or want to seize a new opportunity, working capital loans can keep your business engine running.

In this 2025 guide, we’re breaking down the best working capital loan options in India—with low interest, no collateral, and instant approvals. We’ll also answer your top queries and help you compare the right lenders.

Let’s explore how you can get business capital fast, even if you’re a startup without financial proof or assets to pledge.

What Is a Working Capital Loan?

A working capital loan is a type of business financing that helps meet your company’s short-term operational needs, like rent, salaries, inventory purchases, marketing, or bills. It's not meant for long-term asset investments like machinery or real estate.

Whether you’re an established SME or just launched your startup, a working capital loan acts like your business survival fund when cash flow slows down.

Why Startups & Small Businesses Need Working Capital Loans

Many Indian entrepreneurs today are:

Running bootstrapped startups

Managing seasonal businesses

Facing delayed payments from clients

Needing funds for bulk purchases

If that sounds like you, business working capital loans can solve your liquidity crunch, without selling equity or pledging property.

Let’s talk about your options.

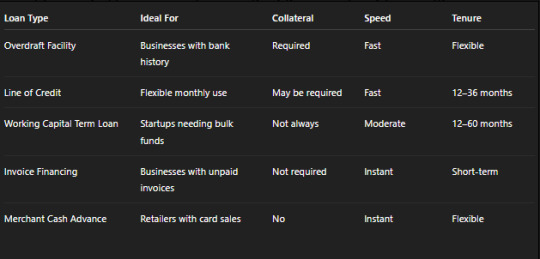

Types of Working Capital Loans in India (2025)

Top Benefits of Working Capital Loans for Startups & SMEs

No Collateral Required (in many cases)

Fast Disbursal – Some offer funds within 24–48 hours

Improves Cash Flow without diluting equity

Customizable Tenures as per business cycle

Builds Credit Score for your enterprise

If you’re worried about long paperwork and high rejection rates, don’t be. With fintech platforms, you can now apply for a working capital loan online in minutes!

Working Capital Loan Eligibility in India – 2025 Guidelines

While exact criteria vary by lender, here’s what most NBFCs, fintechs, and banks look for:

Business vintage of 6–12 months (some accept 3 months for startups)

Monthly turnover of ₹50,000+ (varies)

Valid GST registration or business proof

Indian citizen aged 21–65

Basic KYC documents and bank statements

Even if you’re a new business or have no ITR, some lenders offer a working capital loan without collateral by assessing cash flows and digital sales.

Where to Apply for Working Capital Loans in India?

Here are the best platforms to consider for 2025:

Tip: Always compare working capital loan interest rates and repayment terms before applying. Online aggregators help you do this easily.

How to Apply for a Working Capital Loan (Step-by-Step)

Applying for a working capital loan in India is now easier than ever:

Choose a lender or aggregator (Razorpay, Lendingkart, etc.)

Fill out a basic application form online

Upload KYC and bank statement docs

Get eligibility check instantly

Receive funds directly in your business account

Some platforms offer pre-approved working capital loans for small businesses based on UPI or GST data. So, no need to wait for days!

Real Human Insight: This Loan Saved My Startup!

When my B2B startup faced a payment delay from a key client, we were nearly out of cash. I applied for an instant working capital loan from Lendingkart. Funds hit my account in 48 hours. It literally saved my team’s salaries.

— Ritika Sharma, SaaS Founder, Bengaluru

This is the real-world power of business capital loans. They’re not just numbers—they protect dreams, jobs, and growth.

Use Case Examples: Where These Loans Help

Retail shop owners restocking seasonal inventory

Freelancers needing to scale with a team or tools

E-commerce sellers bridging logistics gaps

MSMEs are waiting for invoice clearance

Service providers handling short-term bulk orders

Frequently Asked Questions (FAQs)

1. Can I get a working capital loan without collateral?

Yes, many fintech lenders and NBFCs in India now offer working capital loans without collateral, especially to startups and digitally active businesses.

2. What is the interest rate for working capital loans in India?

It typically ranges between 11% to 24% p.a., depending on the lender, tenure, and business health. Always compare the working capital loan interest rate before applying.

3. Are working capital loans good for startups?

Absolutely. Many working capital loans for startups require minimal documents and offer quick access to funds. They're ideal when you need money fast but don't want to give up equity.

4. What is the tenure of a Working Capital Term Loan?

Tenures usually range from 12 months to 60 months, but short-term options (like invoice financing) may be for 3–6 months only.

5. How much loan can I get as a small business?

Amounts range from ₹50,000 to ₹2 Crore, depending on turnover, credit score, business vintage, and lender policies.

Final Words: Get the Right Working Capital Loan Today

If you're running a startup or SME in India, you don't need to struggle alone with cash flow gaps. With instant business loans in India, low interest rates, and no collateral requirements, 2025 has opened doors to faster, smarter funding.

Whether you’re just starting out or growing fast, there’s a business capital loan built for your goals. Choose wisely, compare options, and apply online to unlock the next level of your business journey.

#working capital loan#working capital loans for small business#business working capital loans#instant working capital loan#working capital loan in india#working capital loan eligibility#working capital loan without collateral#apply for working capital loan#working capital loan interest rate#business capital loan#Working Capital Term Loan#working capital loans for startups

1 note

·

View note

Text

B K Goyal & Co LLP – Your Trusted CA in Jaipur for Comprehensive Financial Solutions

In a rapidly evolving financial and regulatory environment, having the right chartered accountant by your side is essential. Whether you're a business owner, a startup, an investor, or an individual looking for reliable financial planning, finding the best CA in Jaipur can transform the way you manage your finances. This is where B K Goyal & Co LLP stands out as the best chartered accountant in Jaipur, offering tailored, professional, and ethical financial services.

With decades of experience, in-depth knowledge of the Indian tax system, and a commitment to client success, B K Goyal & Co LLP is more than just a service provider—it is a financial partner you can trust.

Why Choose a Professional CA in Jaipur?

A chartered accountant is not just someone who files taxes. They are strategic advisors, compliance experts, audit specialists, and financial consultants. Whether it’s tax planning, GST returns, company registration, auditing, or advisory services, a professional CA in Jaipur can help you stay compliant, maximize savings, and focus on growing your business.

With increasing scrutiny from regulatory bodies and the need for transparent financial management, having a CA firm like B K Goyal & Co LLP ensures peace of mind and financial clarity.

Meet the Best CA in Jaipur – B K Goyal & Co LLP

Recognized as one of the most trusted and experienced CA firms in the city, B K Goyal & Co LLP has built a legacy of excellence, serving a wide range of clients—from small businesses and startups to large corporations and individual taxpayers.

What makes us the best chartered accountant in Jaipur?

A team of experienced CAs and finance professionals

Personalized solutions tailored to your unique needs

Up-to-date knowledge of tax laws, company laws, and industry regulations

Transparent, ethical, and client-centric approach

Technology-driven processes for seamless service delivery

From routine compliance to complex audits and financial restructuring, B K Goyal & Co LLP offers a full spectrum of services under one roof.

Our Comprehensive Services

As the best CA in Jaipur, we offer end-to-end services that cater to individuals, businesses, and institutions alike:

1. Taxation Services

Income Tax Return Filing

Tax Planning & Advisory

TDS/TCS Compliance

GST Registration & Filing

Representation before Tax Authorities

2. Audit & Assurance

Statutory Audit

Internal Audit

Tax Audit

Stock & Revenue Audit

3. Business Setup Services

Company Registration (Private Limited, LLP, OPC)

Partnership Firm & Proprietorship Setup

Startup India Registration

MSME Registration

4. Compliance & Legal

ROC Filing & Annual Compliance

MCA Compliance for Companies

FEMA & RBI Regulations

5. Financial Advisory

Budgeting & Forecasting

Project Reports & CMA Data

Investment Advisory

Business Valuation

Whether you’re looking for basic tax assistance or high-level financial consulting, our firm delivers accurate, timely, and actionable solutions.

Serving Diverse Clients Across Sectors

Our clientele includes:

Startups & SMEs

Hospitals & Healthcare Providers

Real Estate & Construction Firms

Retailers & E-commerce Brands

Educational Institutions

High Net-Worth Individuals (HNIs)

At B K Goyal & Co LLP, every client—big or small—receives the same level of commitment, expertise, and attention to detail.

Why Our Clients Trust Us

Transparent pricing and no hidden charges

On-time delivery and 24/7 support for urgent queries

Sound guidance that helps clients make informed decisions

Deep understanding of both local Jaipur businesses and national compliance structures

When you work with B K Goyal & Co LLP, you're not just hiring a CA—you’re gaining a strategic partner in your financial journey.

Book a Consultation Today

Looking for a reliable and experienced CA in Jaipur? Whether it’s tax filing, business registration, or audit services, B K Goyal & Co LLP is your one-stop solution for all your financial and compliance needs.

0 notes

Text

GST Registration in Dwarka

RBG Consultant simplifies GST registration in Dwarka by guiding customers through every step, from document preparation to final submission. Their experts ensure all paperwork is accurate, reducing errors and delays. They offer personalized support, answer queries, and handle compliance requirements, making the process stress-free. By staying updated on GST rules, RBG Consultant helps clients avoid penalties and maximize benefits. Their efficient service saves time and ensures businesses in Dwarka can focus on growth while staying legally compliant.

0 notes

Text

GST Registration Services in Delhi by SC Bhagat & Co.

Navigating the complexities of GST registration can be challenging for businesses. If you're looking for expert GST Registration Services in Delhi, SC Bhagat & Co. is your trusted partner. With years of experience and a dedicated team of professionals, we ensure a seamless GST registration process for businesses of all sizes.

Why Choose SC Bhagat & Co. for GST Registration in Delhi?

SC Bhagat & Co. is a leading tax and accounting firm, offering comprehensive GST solutions to individuals, startups, and enterprises. Our team of experts simplifies the GST registration process and ensures compliance with all legal requirements.

Our Key GST Services

GST Registration & Compliance

New GST Registration

GST Amendments & Modifications

GST Cancellation & Revocation

Filing of GST Returns

GST Advisory & Consultancy

GST Impact Analysis

Input Tax Credit (ITC) Planning

GST Rate Classification

Compliance Management

GST Return Filing & Compliance

Monthly, Quarterly & Annual GST Returns

GSTR-1, GSTR-3B, and GSTR-9 Filing

Reconciliation of GST Data

GST Audit & Assessment

GST Litigation & Representation

Assistance in GST Notices & Appeals

GST Refund Processing

Representation before GST Authorities

Advisory on Anti-Profiteering Laws

Benefits of GST Registration for Your Business

Legal Recognition: Get a valid GSTIN for your business operations.

Tax Benefits: Avail input tax credit and reduce tax liabilities.

Expand Business Reach: Register under GST to operate across India.

Compliance & Credibility: Build a strong financial reputation.

Avoid Penalties: Stay compliant and avoid legal complications.

Why Businesses Trust SC Bhagat & Co.?

Experienced Tax Experts: In-depth knowledge of GST laws and regulations.

Hassle-Free Process: Quick and easy GST registration with minimal documentation.

Affordable Pricing: Transparent and cost-effective service packages.

Dedicated Support: Personalized assistance for all GST-related queries.

Get in Touch with SC Bhagat & Co.

Looking for GST Registration Services in Delhi? SC Bhagat & Co. is here to assist you with all your GST needs. Let us handle your GST compliance while you focus on growing your business.

#gst#taxation#accounting firm in delhi#accounting services#tax consultancy services in delhi#direct tax consultancy services in delhi#taxationservices

5 notes

·

View notes

Text

Why Consulting a CA in Gurgaon Is No Longer a Year-End Affair

For most people, a Chartered Accountant enters the picture only in March—right before the tax filing deadline. But in reality, your CA shouldn’t just be someone you call once a year. They should be the person helping you avoid those last-minute tax surprises in the first place.

Whether you're a salaried employee, a startup founder, a freelancer juggling multiple clients, or someone investing in property—having a trusted CA in Gurgaon can bring structure and peace of mind to your financial decisions.

So, When Should You Actually Consult a CA?

If your answer is “during tax season,” you’re missing the bigger picture. Let’s look at some common life scenarios where timely guidance from a CA can save you money, time, and unnecessary stress.

1. Starting a Business? Get It Right from Day One

Thinking of launching a startup or side business in Gurgaon? A CA can help you decide whether to register as a sole proprietorship, LLP, or private limited company. Each has different tax liabilities and compliance requirements.

From GST registration to setting up your books, your CA lays the foundation so that your operations are legally sound from the start.

2.When Selling or Buying Property

If you’ve sold a flat or a plot recently, chances are you’ll owe capital gains tax. But did you know you can save that tax by reinvesting under Section 54 or 54EC? A good CA helps you structure the deal properly and avoid surprises when filing returns later.

3. When You’re a One-Person Business

Freelancers often don’t realise they’re supposed to pay advance tax quarterly. Add GST and TDS into the mix, and things can get messy fast. A CA can help track your income, manage cash flow, and file returns without triggering notices or penalties.

4. If you Have Multiple Sources of Income

Have a salary from one company, dividends from investments, capital gains from stocks, and rental income on the side? Mixing all this without proper tax treatment can lead to misreporting. Your CA consolidates everything and ensures deductions and exemptions are applied correctly.

5. When you Get a Tax Notice

Sometimes, a mismatch in TDS or a high-value transaction can trigger scrutiny. An experienced CA knows how to decode the notice, respond with the right documents, and resolve the issue before it escalates. This is where having a CA in Gurgaon with real-time experience helps.

Why People Trust CA Sujeet Choudhary

CA Sujeet Choudhary is not just another tax professional. Based in Gurgaon, he has built a solid reputation by offering practical, timely, and reliable advice to individuals and businesses alike.

From handling complex tax filings and GST issues to advising on audits and company formation, his team provides full-service CA support tailored to your unique needs. You won’t just get a return filed—you’ll get clarity, insight, and a plan.

What makes them stand out is the personal attention they offer. Whether it’s a salaried person confused about HRA claims or a founder preparing for a tax audit, every query is handled with care.

Your Finances Deserve Year-Round Attention

Don’t wait until March 31st to get serious about your taxes. The earlier you plan, the more you save—not just in taxes but also in peace of mind.

If you’re looking for a reliable CA in Gurgaon who understands your financial goals and helps you stay one step ahead, CA Sujeet Choudhary is someone you can count on.

Book your consultation today—and take control of your finances the right way.

0 notes

Text

What is the process for a tenant to request NOCs from their landlord while filing GST returns?

Here's a clear explanation of the process for a tenant to request a No Objection Certificate (NOC) from their landlord when filing GST returns:

Why is a NOC Needed from the Landlord?

If you're using a rented commercial property as your principal place of business for GST registration or filings, the GST department may require:

Proof of ownership of the property, and

Consent from the landlord (NOC) to use it for business purposes.

✅ When is a NOC Required?

While applying for GST registration using a rented address.

When changing the principal place of business in GST records.

During GST verification or audit, if additional documentation is needed.

Steps to Request a NOC from the Landlord

1. Draft a Formal Request Letter or Email: Politely request a NOC from your landlord, stating: Your name and business name The address of the rented premises The purpose (e.g., GST registration or update) Assurance that this won’t affect ownership rights

2. Landlord Issues a NOC Letter: The landlord prepares and signs a NOC on plain paper or letterhead, mentioning: Consent to use the premises for business Name of the tenant and address of the property PAN details (optional but preferred) Signature and contact details

3. Attach Supporting Documents: Along with the NOC, you should also have: A copy of the Rent Agreement (registered or notarized) A utility bill or property tax receipt in the landlord’s name

4. Upload While Filing or Updating GST: If registering for GST, upload the NOC and rent agreement in the Place of Business section of the GST portal. If submitting during a departmental query, upload via the reply submission option in the GST portal.

Sample Format of NOC from Landlord

Date: [DD/MM/YYYY]

TO WHOMSOEVER IT MAY CONCERN

This is to certify that I, [Landlord's Name], S/o [Father's Name], owner of the premises located at [Full Address], have rented the said property to [Tenant Name / Business Name] for commercial purposes.

I hereby have no objection to the tenant using the above premises as their principal place of business for GST registration purposes.

Sincerely, [Signature] [Landlord’s Name] [Address] [Contact Number] [PAN Number (optional)]

Contact Bahuguna and company for Best GST service provider in Noida and Best GST consultant in Noida.

#gst compliance#bahuguna and company#gst registration#income tax#gst services#hemant bahuguna#new gst services

0 notes

Text

What Documents Are Required for L1 Comparison on GeM Portal?

If you're selling on the GeM Portal, you've likely heard about L1 Comparison. But what does it really take to rank as L1 and win those high-value government orders? It’s not just about having the lowest price — it’s about being fully compliant too.

In this post, we’ll break down what documents are required for L1 Comparison on GeM Portal, how the process works, and how sellers like you can improve your chances of becoming the L1 vendor.

First, What Is L1 in GeM?

L1 on GeM refers to the seller offering the lowest rate for a product or service that meets the buyer’s exact requirement. It doesn’t mean you’re the cheapest in general — it means you're the best match with the lowest price for that particular order.

But GeM doesn't just go by price alone. Your documentation, compliance, and listing quality matter. Without the right documents, even the most competitive prices can get rejected.

Required Documents for L1 Comparison on GeM Portal

Here’s a simple checklist of documents that most sellers need to submit for L1 eligibility:

1. Product Specification Sheet

Your listing must clearly match the product category. Technical specs must be aligned with GeM standards.

2. OEM Authorization Certificate

If you're not the manufacturer, an OEM Authorization Certificate is required to prove that you’re an approved seller for that brand.

3. GST & PAN

These are basic requirements, but they must match your GeM registration details to avoid rejection.

4. Brand Registration (if applicable)

If you're selling under a registered brand, make sure your Brand is approved on the GeM Portal. Attach proof if needed.

5. Performance or Experience Certificate (for services)

Some service bids require past work proof. Upload relevant documents if the bid demands it.

6. Brochures or Product Images

These help verify that your product matches buyer expectations.

Having these documents ready and properly uploaded helps ensure you qualify during the GeM L1 Comparison process.

How to Make L1 in GeM by Seller

Many sellers wonder — how can I actually make L1 in GeM without compromising on margins?

Here’s how:

Stay Updated on Market Prices: Regularly check what your competitors are quoting for similar products.

Improve Offer Value: Instead of reducing price alone, offer better delivery time, warranty, or service terms.

Avoid Listing Errors: One wrong spec or mismatched brand can disqualify your listing from L1 Comparison on GeM Portal.

Respond Quickly: When you get queries from buyers, fast response improves your rating — and ratings help during selection.

GeM L1 Comparison Limit – Is There One?

There's no strict limit on how many vendors can be part of the GeM L1 Comparison, but only those who meet all the criteria (correct category, documents, specs, and competitive pricing) are shortlisted.

This means documentation is just as important as price. You might offer the lowest cost — but if your paperwork doesn’t match, you’re out.

What About the Fees for L1 Comparison on GeM Portal?

Here’s the good news: There’s no separate fee just for L1 Comparison on the GeM Portal. However, sellers do pay a transaction charge to GeM when they win an order, which varies based on the order value.

Some third-party service providers may charge for helping sellers prepare or manage their L1-related submissions — but GeM itself does not.

Final Thoughts

Getting selected in L1 Comparison on GeM is about more than just price. It’s a mix of smart pricing, complete documentation, and compliance with buyer needs.

So if you’re aiming to improve your L1 performance, start by organizing the documents required for L1 Comparison on GeM Portal, analyze the competition, and fine-tune your listings.

And if you're still unsure how to make L1 in GeM as a seller, don't worry — that's where we can help.

Need Help With L1 Compliance or Document Preparation? At Bidz Professional, we assist sellers in preparing for L1 comparison, optimizing listings, and staying compliant with GeM requirements.

📞 Contact us today and start winning more government orders.

0 notes

Text

From Business Dreams to UK Reality: One Entrepreneur’s Journey to Securing a Business Visa

Breaking Barriers: One Visa, Big Dreams

Raj Mehta had always been a dreamer. From the crowded streets of Pune to late nights perfecting pitches and business models, he was chasing something bigger — international success. His product was ready. Investors were curious. But the one thing standing between him and expanding into the global market?

The Problem: Ambition Meets Bureaucracy

It all started when Raj landed a potential partnership with a retail chain in London. His software solution promised to cut their logistics costs in half. But during the negotiations, the UK partners insisted on face-to-face meetings and an extended on-ground presence. “You need to be here,” they said. That’s when the daunting search for how to get a UK business visa from India began.

Raj was quickly overwhelmed. Between visa types, confusing eligibility criteria, financial requirements, and ever-changing immigration policies, he was drowning in paperwork and contradictory advice. He wasn’t looking to settle permanently — just explore partnerships, attend conferences, and register his business presence.

Every rejected application story he came across online made him more anxious. What if his documents weren’t “perfect”? What if a small error cost him his business opportunity?

The Research Phase: Understanding Business Visa Requirements for the UK

Determined, Raj began researching thoroughly. He discovered that the right option for his short-term goal was the “UK Standard Visitor Visa for Business Purposes.” This visa allowed him to:

Attend business meetings or conferences

Arrange deals or negotiate contracts

Participate in trade fairs or exhibitions

Conduct site visits or explore joint ventures

He learned that unlike work visas, this visa didn’t allow employment or long-term stay. The key was clear intent and strong documentation.

The critical business visa requirements for the UK included:

A valid passport

Proof of business activities in India

Letters of invitation from UK business partners

Financial documents showing he could support himself

A travel itinerary with return ticket

Proof of business ownership or employment

The Hurdles: Delays, Misguidance, and Sleepless Nights

Despite having the documents ready, Raj still struggled. He faced issues like:

Not knowing how to frame a strong cover letter that explained his business purpose.

Confusion between the UK Business Visitor Visa and Start-Up Visa (which was not applicable to his case).

Scheduling biometric appointments in a city where slots were limited.

Doubts about the sufficiency of his financial proof and whether his invitation letter met the format.

Time was running out. His UK partner was waiting. The trade expo was in three weeks.

The Turning Point: Organizing the Application Strategically

Instead of panicking, Raj decided to take a methodical approach. He grouped his documents under clear categories:

1. Identity & Travel

Passport with at least 6 months validity

Recent passport-size photo

Confirmed return flight booking

2. Business Purpose

Invitation letter from the UK company

Expo registration details

Letter from his company explaining the visit purpose

3. Financial Evidence

Bank statements from the last 6 months

ITR returns

Business account balance sheet

4. Supporting Documents

Company registration certificate

GST filings

LinkedIn profile screenshots, media coverage

The Relief: Visa Approved!

Within 10 business days, Raj received the email: “Your UK business visa has been approved.” He was relieved. More than that, he was empowered. His trip to London became the turning point in his business — not just because of the deals he struck but because of the confidence he gained from navigating international regulations successfully.

Business Visa Tips from Raj’s Experience

If you’re planning to apply for a business visa for the UK from India, here’s what Raj recommends:

Use long-tail search queries like “how to apply for UK business visa from India for meetings” or “UK standard visitor visa for business purpose” to get targeted information.

Keep your intent clear and your documentation stronger than required.

Make sure your UK contacts mention the visit’s purpose explicitly in their invitation.

Don’t mix up business visitor visas with work or startup visas — they are entirely different.

Submit documents that show your financial stability and ties to India.

Why the UK is a Strategic Destination for Indian Business Owners

The United Kingdom remains one of the most strategic global markets for Indian entrepreneurs. Whether it’s FinTech, software services, fashion, or hospitality — the UK offers:

Access to one of the world’s most powerful financial hubs (London)

Strong trade relations with India

Frequent business expos and B2B networking events

Multicultural support and communities

If you’re planning to expand your business network, explore funding, or build international partnerships, applying for a business visa to the UK is your gateway to global growth.

Conclusion: Business Visas Open Doors to New Possibilities

A business visa is not just a travel document — it’s a bridge between ambition and achievement. Like Raj, many Indian entrepreneurs face fear and confusion when dealing with international travel paperwork. But with a little guidance, thorough research, and preparation, the path becomes clear.

If you’re searching “how to get business visa for UK from India,” know that you’re not alone. Whether it’s your first time or a recurring journey, each business visa application brings you closer to your international goals. Here You Can Apply for Best Visa Services.

1 note

·

View note