#GoldStandard

Explore tagged Tumblr posts

Text

Tired of fiat currency losing value? Goldbacks are the solution! A real layer of 24K gold in a durable note. Start now—secure wealth! http://buygoldnotes.com

2 notes

·

View notes

Text

Nesara & Gesara: Rumor or Real?

NESARA (National Economic Security and Reformation Act) and GESARA (Global Economic Security and Reformation Act) are two interconnected conspiracy theories that have gained significant traction in recent years. These theories often involve promises of debt forgiveness, increased income, and a new, more just world order. According to the anti defamation league, NESARA/GESARA refers to a conspiracy theory, promoted by Shaini Goodwin (also known as the "Dove of Oneness"), that all debts will be wiped out in a radical reset of the U.S. economy. It is a reference to the National Economic Security and Recovery Act (NESARA), a set of U.S. economic reforms proposed in the 1990s, which included abolishing compound interest on loans, replacing income tax with a national sales tax and returning U.S. currency to the gold standard. While the proposals were never actually introduced before Congress, conspiracy theorists like Goodwin claim that they were secretly passed by Congress and then suppressed by George W. Bush in the wake of the 9/11 attacks.

youtube

#conspiracy#conspiracytheory#nesara#gesara#debtforgiveness#debt forgiveness#economicreform#newworldorder#anti defamation league#shainigoodwin#goldstandard#economic reset#james carner#jamescarner#pastor james carner#cause before symptom#podcast#illuminati#occult#esoterica#esoteric#mkultra#freebooks#research#library#monarch#Youtube

2 notes

·

View notes

Text

Gold Prices All Time High: Riding the Waves of Bullion Brilliance

Gold, that timeless symbol of wealth, is now breaking records and capturing headlines with its all-time high prices. The bullion market is experiencing a surge like never before, leaving both investors and enthusiasts intrigued. In this article, we will navigate through the waves of this precious metal’s value spike, exploring the factors contributing to the historic peak, and understanding the…

View On WordPress

#gold#goldbar#goldbug#goldcoins#goldetf#goldfutures#goldilockseconomy#goldinvestment#goldjewelry#goldmoney#goldprice#goldpricesalltimehigh#goldreserves#goldrush#goldrush2023#goldsqueeze#goldstandard#investingingold

2 notes

·

View notes

Link

0 notes

Link

0 notes

Link

0 notes

Link

0 notes

Text

The Gold Standard

Several decades ago, when I was still a young man just beginning in ministry, the Lord showed me during a time of prayer that He was going to begin purifying my life. I got so excited, I told Lisa, “God is going to remove my impurities!” I proceeded to tell her all the undesirable things God would be removing. (She may have even added a few I had left off the list!)

Then, for the next three months, nothing happened. As a matter of fact, things worsened in my life, and I was even more in need of purification. I went to the Lord and asked, “Why are my bad habits getting worse, not better?”

“Son,” He responded. “I said that I was going to purify you. You have been trying to do it in your own strength. Now I will do it My way.” I had no idea that I was about to move into my first wilderness journey and that it would last eighteen months.

Please understand—God is not looking for an outward form of holiness. He wants an inward change of heart—for a pure heart will produce pure conduct. The wilderness is one of the crucibles God uses to purify our motives and intentions.

The process in which God purifies is likened to the process in which gold is refined. Gold has a beautiful yellow color, emitting a soft metallic glow. It is widely found in nature but always in small quantities and rarely in a pure state. When purified, gold is soft, pliable, and free from corrosion or other substances.

If gold is mixed with other metals (copper, iron, or nickel), it becomes harder, less pliable, and more corrosive. This mixture is called an alloy. The higher the percentage of another metal, the harder the gold becomes. Conversely, the lower the percentage of an alloy, the softer and more flexible it is.

Immediately, we see the parallel: A pure heart before God is like pure gold. A pure heart is soft, tender, and pliable. The book of Malachi shows how Jesus will refine His church from the influence of the world, just as a refiner purifies gold.

In the refining process, gold is ground into powder and then mixed with a substance called flux. The two are then placed in a furnace and melted by an intense fire. The alloys or impurities are drawn to the flux and rise to the surface. The gold, which is heavier, remains at the bottom. The impurities, or dross (such as copper, iron, and zinc, combined with flux), are then removed.

The fire God uses for refining is trials and tribulations. The heat of these challenges separates our impurities from the character of God in our lives—thus creating a pure vessel. Interestingly, another characteristic of gold in its purest state is its transparency. Once you are purified by the fiery trials, you become transparent! A transparent vessel brings no glory to itself, but it glorifies what it contains.

Once we are refined, the world again will see Jesus.

God, Where Are You?! With John Bevere: Day 4 • Devotional https://www.bible.com/reading-plans/13545/day/4?segment=0

0 notes

Text

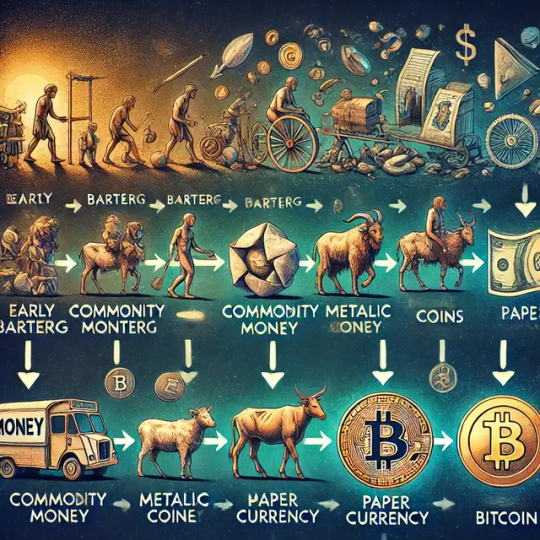

The Evolution of Money: From Barter to Bitcoin

Money has always been an essential part of human society, serving as a tool for exchange, value storage, and facilitating trade. From the early days of barter systems to the modern era of digital currencies, money has evolved in fascinating ways. In this post, we will explore the history of money—from the simple barter systems to the rise of Bitcoin as a potential solution for today's monetary challenges.

1. Barter System In the earliest days of human society, people used a barter system to trade goods and services directly. If someone had surplus grain and needed a tool, they would find someone who had that tool and was in need of grain. While this system worked on a small scale, it had significant limitations. The "coincidence of wants" problem made it impractical—both parties had to want what the other had, and this was often not the case. As societies grew more complex, a more efficient system was needed.

2. Emergence of Commodity Money To overcome the inefficiencies of barter, societies began using commodity money—items that had intrinsic value and were widely accepted in trade. Items like shells, cattle, and metals became mediums of exchange. Commodity money solved the "coincidence of wants" issue and allowed for more standardized trade. However, challenges persisted, such as portability, divisibility, and the ability to assess value consistently.

3. Metallic Coins and Standardization The introduction of metallic coins marked a significant leap forward. Coins made from precious metals like gold, silver, and copper had inherent value and could be easily transported and traded. Standardization played a key role—authorities like kings and governments minted coins to certify their value, providing public trust in the monetary system. Metallic coins facilitated commerce and expanded trade networks, but they also required oversight and protection from debasement or counterfeiting.

4. Paper Money and Government Backing To address the practicality of carrying large quantities of coins, societies transitioned to using paper money. Initially, these paper notes acted as promissory notes that represented a claim on a specific amount of gold or silver stored by a bank. Central banking systems were established to manage these reserves, and eventually, governments began issuing paper currency backed by their promise of value. This emergence of government-backed fiat currency allowed for much greater flexibility and convenience in managing the money supply.

5. The Gold Standard and Its Demise For much of the 19th and early 20th centuries, many countries adhered to the gold standard, where paper money was directly linked to a fixed amount of gold. This system aimed to stabilize currencies and prevent excessive inflation. However, during the Great Depression in 1933, the U.S. government made owning significant amounts of gold illegal and confiscated gold holdings from citizens to stabilize the economy and provide more control over the money supply. By the early 1970s, the gold standard was completely abandoned, and fiat currency—money not backed by any physical commodity—became the global norm.

6. The Fiat Era and Modern Challenges Fiat currency, backed solely by the trust and authority of governments, allowed countries to control their monetary policies and react to economic challenges. However, there are notable downsides. Governments can print more money to fund expenditures, leading to inflation. In recent years, countries worldwide have been printing money at an unprecedented rate, leading to a compounding effect that reduces the purchasing power of their currencies. This widespread money printing not only creates inflation but also contributes to economic instability. Due to the interconnected nature of the global economy, these actions often have ripple effects, creating financial uncertainty and challenges for individuals worldwide.

7. The Advent of Bitcoin Bitcoin emerged in 2009 as a response to the perceived failings of the traditional monetary system. It introduced a digital, decentralized alternative to traditional forms of money. Bitcoin is built on a peer-to-peer network that operates without the need for intermediaries like banks. Its limited supply of 21 million coins ensures scarcity, and its transparent, decentralized ledger—the blockchain—addresses many of the issues related to trust and inflation. Bitcoin represents a bold step forward in the evolution of money, one that resists censorship, preserves value, and operates independently of centralized authorities.

8. Comparison: Bitcoin vs. Fiat Currency Bitcoin offers key advantages over fiat currency. Unlike fiat, which can be printed at will, Bitcoin's supply is fixed and predictable. Its decentralized nature makes it resistant to censorship and government intervention. While fiat currency benefits governments by allowing them to control economic policy, Bitcoin's transparent and decentralized framework empowers individuals and offers a new level of financial sovereignty.

Conclusion The evolution of money has been shaped by humanity's ongoing quest for convenience, fairness, and stability. From barter systems to commodity money, metallic coins, paper currency, and now digital assets, each stage reflects our changing needs. Bitcoin represents the next step in this evolution, offering a solution to the challenges of fiat currency—such as inflation, centralization, and lack of transparency. As the world continues to change, it's worth considering whether Bitcoin might be the foundation for a more resilient and fair financial system in the future.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#EvolutionOfMoney#HistoryOfMoney#BarterToBitcoin#Bitcoin#Cryptocurrency#FinancialHistory#DigitalCurrency#MoneyMatters#EconomicHistory#FiatCurrency#GoldStandard#CommodityMoney#FutureOfMoney#Blockchain#FinancialEducation#Decentralization#MoneyEvolution#BitcoinRevolution#SoundMoney#UnpluggedFinancial#financial experts#finance#financial empowerment#financial education#globaleconomy#unplugged financial

3 notes

·

View notes

Text

Fiat Collapse Is Coming—GoldBack Won’t Fail

When fiat crumbles, will your wealth vanish or stand tall with gold?

Follow RTD to stay in the loop on the latest events happening around the world and more.

Share so others can watch, listen & learn. 👊🏾

Click the link here to find out more: http://buygoldnotes.com ㅤ

#GoldBack#GoldBackedCurrency#FiatCollapse#Hyperinflation#USdollarCollapse#WealthPreservation#GoldStandard#ZimbabweDollar#VenezuelanBolivar#EconomicCrisis

2 notes

·

View notes

Text

Gold Prices in Kuwait: Latest Updates and Trends

Gold is one of the most sought-after commodities in the world, and Kuwait, known for its vibrant economy and strategic location in the Gulf, holds a significant place in the global gold market. The gold market in Kuwait is dynamic, reflecting the ebb and flow of international prices, local demand, and economic conditions. This blog aims to delve into the intricate world of gold prices in Kuwait, shedding light on factors influencing the market, historical trends, and its significance in the Kuwaiti economy.

Kuwait's love affair with gold spans centuries, deeply rooted in its culture and traditions. Gold plays a pivotal role in Kuwaiti society, symbolizing wealth, prosperity, and social status. From weddings to religious ceremonies, gold is a cherished element, often given as gifts and used as a hedge against inflation and currency devaluation. This cultural affinity for gold fuels a robust domestic demand, making Kuwait a key player in the Middle East's gold market.

The price of gold in Kuwait is influenced by a multitude of factors. On the global stage, the primary determinants include geopolitical tensions, interest rates, inflation, and the strength of the US dollar. When geopolitical uncertainties rise, investors flock to gold as a safe-haven asset, driving up its price. Similarly, when inflation rates increase or when the US dollar weakens, gold prices tend to rise as it is seen as a store of value.

Locally, Kuwait's gold prices are affected by economic policies, import duties, and local market dynamics. The Kuwaiti Dinar (KWD), being one of the strongest currencies globally, also plays a crucial role. Any fluctuations in the exchange rate between the KWD and USD can impact gold prices, given that gold is globally traded in USD. Additionally, seasonal demand, particularly during festive periods and wedding seasons, can lead to temporary price spikes.

Kuwait's gold market operates through a network of specialized gold souks, retail outlets, and online platforms. The gold souks are bustling marketplaces where buyers can explore a variety of gold jewelry, coins, and bars. These souks are not just commercial hubs but also cultural landmarks, attracting tourists and locals alike. Retailers and jewelers in Kuwait often offer intricate designs that blend traditional and modern aesthetics, catering to a diverse clientele.

Online platforms have also revolutionized the gold market in Kuwait. These platforms provide real-time updates on gold prices, allowing consumers to make informed purchasing decisions. Moreover, many retailers now offer online purchasing options, enhancing convenience and accessibility for buyers. This digital transformation has expanded the reach of the gold market, making it easier for people to invest in gold from the comfort of their homes.

Investing in gold is a popular choice for Kuwaitis, driven by its potential to provide long-term financial security. Gold is perceived as a stable investment, capable of preserving wealth over time. In Kuwait, individuals can invest in gold in various forms, including jewelry, coins, bars, and even gold-backed financial instruments like ETFs. Each form of investment has its advantages and caters to different investment goals and risk appetites.

Gold jewelry remains a favorite due to its dual role as an adornment and a financial asset. Coins and bars, on the other hand, are preferred by those looking for pure investment opportunities. Gold ETFs and other financial instruments offer a modern investment approach, allowing investors to gain exposure to gold without physically owning it. These instruments provide liquidity and ease of trading, making them suitable for those who prioritize flexibility.

The Kuwaiti government also recognizes the strategic importance of gold. The Central Bank of Kuwait maintains gold reserves as part of its foreign exchange reserves. These reserves play a crucial role in bolstering the country's financial stability and providing a cushion against economic shocks. Moreover, gold reserves are seen as a means of diversifying the central bank's asset portfolio, reducing reliance on a single type of asset.

Kuwait's gold industry is not just about trade and investment; it also contributes significantly to the country's economy. The industry provides employment opportunities, supports allied sectors like jewelry design and manufacturing, and drives tourism. Tourists often flock to Kuwait's gold souks, drawn by the promise of high-quality gold products and competitive prices. This influx of tourists boosts local businesses and enhances the country's economic prospects.

In recent years, the global gold market has faced several challenges, including price volatility, regulatory changes, and shifting consumer preferences. The COVID-19 pandemic, for instance, disrupted supply chains and impacted demand patterns. However, gold proved resilient, with its prices soaring during the early stages of the pandemic as investors sought safe-haven assets. Kuwait's gold market, too, demonstrated adaptability, leveraging online sales channels and maintaining consumer confidence.

Looking ahead, the future of Kuwait's gold market appears promising. With a stable economy, a strong currency, and a deep-rooted cultural affinity for gold, the country is well-positioned to navigate the complexities of the global gold market. Moreover, ongoing efforts to modernize the gold industry, enhance regulatory frameworks, and promote sustainable practices will further strengthen Kuwait's position as a key player in the global gold market.

In conclusion, gold remains an integral part of Kuwait's economic and cultural fabric. Its significance extends beyond mere ornamentation, serving as a vital investment tool and a symbol of enduring value. As the global economy evolves, Kuwait's gold market will continue to adapt, driven by a blend of tradition, innovation, and economic foresight. For those looking to invest in or understand the dynamics of the gold market, Kuwait offers a fascinating case study of resilience and opportunity.

#goldprices#Kuwaitgold#goldmarket#goldinvestment#goldjewelry#safehaven#preciousmetals#goldtrends#investmentopportunities#financialsecurity#goldreserves#middleeastgold#economicstability#digitalgold#goldindustry#goldbuyers#Kuwaitculture#wealthmanagement#goldpricefluctuations#goldtrading#goldbars#goldcoins#goldETFs#luxuryjewelry#sustainablegold#KuwaitiDinar#goldstandard#traditionandmodernity#economicgrowth#Kuwaittourism

0 notes

Text

Best Place to Buy High-Quality SEMI Pure Unrefined GOLD Dore BARS

As the Best Quality SEMI Pure Unrefined GOLD Dore BARS Exporters from Australia, Gold Standard Industries is committed to delivering top-quality gold that meets rigorous industry demands. Whether for investment or industry applications, our semi-pure unrefined gold bars offer the value and reliability you need. Contact us for tailored export solutions.

0 notes

Text

TRONFORM Premium Gold Polo Shirt Elevate your wardrobe with the TRONFORM Premium Gold Polo Shirt—a symbol of sophistication and timeless style. Designed for those who demand the best, this polo shirt is more than just a piece of clothing; it’s a statement of luxury.

🔹 Luxurious Design: Crafted with precision, featuring the iconic TRONFORM gold logo that exudes elegance and power. 🔹 Unmatched Comfort: Soft, breathable fabric ensures all-day comfort, while maintaining a sharp, premium look. 🔹 Versatile Style: Perfect for business meetings, casual outings, or making an impression anywhere you go.

Step into a world of refinement with TRONFORM. Make your mark in gold.

Secure Yours Now 👉 www.tronform.co/products/tronform-premium-gold-polo-shirt

✨ Available now ✨

#TRONFORM #LuxuryFashion #PoloPerfection #GoldStandard #FashionForward #EleganceRedefined #TRONFORMStyle #TimelessStyle #LuxuryLifestyle

#TRONFORM Premium Gold Polo Shirt#Elevate your wardrobe with the TRONFORM Premium Gold Polo Shirt—a symbol of sophistication and timeless style. Designed for those who deman#this polo shirt is more than just a piece of clothing; it’s a statement of luxury.#🔹 Luxurious Design: Crafted with precision#featuring the iconic TRONFORM gold logo that exudes elegance and power.#🔹 Unmatched Comfort: Soft#breathable fabric ensures all-day comfort#while maintaining a sharp#premium look.#🔹 Versatile Style: Perfect for business meetings#casual outings#or making an impression anywhere you go.#Step into a world of refinement with TRONFORM. Make your mark in gold.#Secure Yours Now 👉 www.tronform.co/products/tronform-premium-gold-polo-shirt#✨ Available now ✨#TRONFORM#LuxuryFashion#PoloPerfection#GoldStandard#FashionForward#EleganceRedefined#TRONFORMStyle#TimelessStyle#LuxuryLifestyle

0 notes

Text

In a world of uncertainty, gold is the answer. Secure yours today

#GoldInvestment#WealthCreation#FinancialFreedom#GoldRush#InvestSmart#GoldMarket#SecureYourFuture#WealthPreservation#LuxuryLifestyle#GoldenOpportunity#GoldStandard#InvestmentGoals#InflationProtection#BuyGold#FutureWealth#SafeInvestment#GoldIsKing#GoldPortfolio#FinancialSecurity#PreciousMetals#WealthBuilding#MarketOpportunity#GoldStrategy#LegacyInvestment#TimelessWealth

0 notes

Text

Rettet euer Vermögen JETZT: Euer persönlicher Gold-Standard, bevor die Inflation euer Geld vernichtet!

#GoldInvestment#InflationProtection#WealthPreservation#SafeHaven#InvestInGold#GoldStandard#FinancialSecurity#ProtectYourWealth#GoldStrategy#InflationHedge#FutureProof#GoldAssets#EconomicSecurity#GoldBroker#PreciousMetals#emastechnology#goldinvest

0 notes

Text

Reality or Illusion? The truth about the cryptocurrency market

Currently Bitcoin serves as an alternative means of settlement and savings. Yet, it can’t be considered an indispensable asset. Several factors contribute to this from volatility to scalability. These factors ultimately limit crypto’s widespread adoption.

Cryptocurrencies emerged due to the shortcomings of the modern financial system. The gold standard’s prevalence would have rendered the concept of digital currencies inconceivable. Since this standard was abandoned, a new era began where the value of currencies is based on consensus rather than tangible assets. The consequences that followed contributed to the emergence of cryptocurrencies.

Read more in the article

0 notes