#Good News That Will Likely Avoid Cuts To Social Security And Medicare

Video

youtube

Good News That Will Likely Avoid Cuts To Social Security And Medicare

#youtube#Good News That Will Likely Avoid Cuts To Social Security And Medicare#social security#social security and medicare

0 notes

Video

youtube

Trump’s 40 Biggest Broken Promises

Trump voters. Nearly 4 years in, here’s an updated list of Trump’s 40 biggest broken promises.

1. He said coronavirus would “go away without a vaccine.”

You bought it. But it didn’t. While other countries got the pandemic under control and avoided large numbers of fatalities, the virus has killed more than 130,000 Americans*, and that number is still climbing.

2. He said he won’t have time to play golf if elected president.

But he has made more than 250 visits to his golf clubs since he took office – a record for any president – including more trips during the pandemic than meetings with Dr. Fauci. The total financial cost to America? More than $136 million.

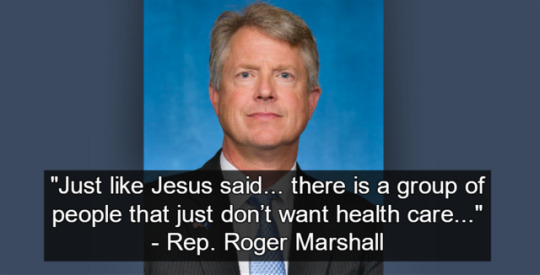

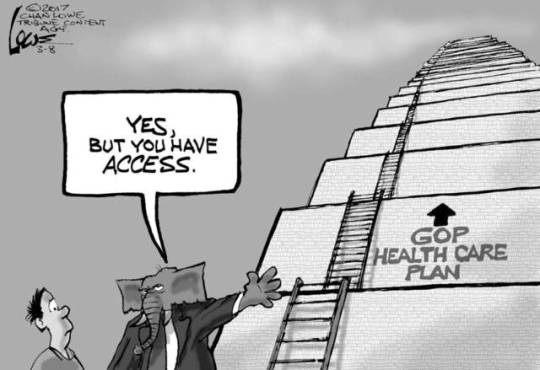

3. He said he would repeal the Affordable Care Act, and replace it with something “beautiful.”

It didn’t happen. Instead, 7 million Americans have lost their health insurance since he took office. He has asked the Supreme Court to strike down the law in the middle of a global pandemic with no plan to replace it.

4. He said he’d cut your taxes, and that the super-rich like him would pay more.

He did the opposite. By 2027, the richest 1 percent will have received 83 percent of the Trump tax cut and the richest 0.1 percent, 60 percent of it. But more than half of all Americans will pay more in taxes.

5. He said corporations would use their tax cuts to invest in American workers.

They didn’t. Corporations spent more of their tax savings buying back shares of their own stock than increasing workers wages.

6. He said he would boost economic growth by 4 percent a year.

Nope. The economy stalled, and unemployment has soared to the highest levels since the Great Depression. Just over half of working-age Americans are employed – the worst ratio in 70 years.

7. He said he wouldn’t “cut Social Security like every other Republican and I’m not going to cut Medicare or Medicaid.”

His latest budget includes billions in cuts to Social Security, Medicare, and Medicaid.

8. He promised to be “the voice” of American workers.

He hasn’t. His administration has stripped workers of their rights, repealed overtime protections, rolled back workplace safety rules, and turned a blind eye to employers who steal their workers’ wages.

9. He promised that the average American family would see a $4,000 pay raise because of his tax cuts for the wealthy and corporations.

But nothing trickled down. Wages for most Americans have barely kept up with inflation.

10. He promised that anyone who wants a test for Covid will get one.

But countless Americans still can’t get a test.

11. He said hydroxychloroquine protects against coronavirus.

No way. The FDA revoked its emergency authorization due to the drug’s potentially lethal side effects.

12. He promised to eliminate the federal deficit.

He has increased the federal deficit by more than 60 percent.

13. He said he would hire “only the best people.”

He has fired a record number of his own cabinet and White House picks, and then called them “whackos,” “dumb as a rock," and "not mentally qualified.” 6 of them have been charged with crimes.

14. He promised to bring down the price of prescription drugs and said drug companies are “getting away with murder.”

They still are. Drug prices have soared, and a company that got federal funds to develop a drug to treat coronavirus is charging $3,000 a pop.=

15. He promised to revive the struggling coal industry and bring back lost coal mining jobs.

The coal industry has continued to lose jobs as clean energy becomes cheaper.

16. He promised to help American workers during the pandemic.

But 80% of the tax benefits in the coronavirus stimulus package have gone to millionaires and billionaires. And at least 21 million Americans have lost extra unemployment benefits, with no new stimulus check to fall back on.

17. He said he’d drain the swamp.

Instead, he’s brought into his administration more billionaires, CEOs, and Wall Street moguls than in any administration in history, and he’s filled departments and agencies with former lobbyists, lawyers and consultants who are crafting new policies for the same industries they used to work for.

18. He promised to protect Americans with pre-existing conditions.

His Justice Department is trying to repeal the entire Affordable Care Act, including protections for people with preexisting conditions.

19. He said Mexico would pay for his border wall.

The wall is estimated to cost American taxpayers an estimated $11 billion.

20. He promised to bring peace to the Middle East.

Instead, tensions have increased and his so-called “peace plan” was dead on arrival.

21. He promised to lock up Hillary Clinton for using a private email server.

He didn’t. Funny enough, Trump uses his personal cell-phone for official business, and several members of his own administration, including Jared Kushner and Ivanka, have used private email in the White House.

22. He promised to use his business experience to whip the federal government into shape.

He hasn’t. His White House is in permanent chaos. He caused the longest government shutdown in our nation’s history when he didn’t get funding for his wall.

23. He promised to end DACA.

The Supreme Court ruled that his plan to deport 700,000 young immigrants was unconstitutional, and DACA still stands.

24. He promised “six weeks of paid maternity leave to any mother with a newborn child whose employer does not provide the benefit.”

He hasn’t delivered.

25. He promised to bring an end to Kim Jong-Un’s nuclear program.

Kim is expanding North Korea’s nuclear program.

26. He said he would distance himself from his businesses while in office.

He continues to make money from his properties and maintain his grip on his real estate empire.

27. He said he’d force companies to keep jobs in America, and that there would be consequences for companies that shipped jobs abroad.

Since he took office, companies like GE, Carrier, Ford, and Harley Davidson have continued to outsource thousands of jobs while still receiving massive tax breaks. And offshoring by federal contractors has increased.

28. He promised to end the opioid crisis.

Americans are now more likely to die from an opioid overdose than a car accident.

29. He said he’d release his tax returns.

It’s been nearly 4 years. He hasn’t released his tax returns.

30. He promised to tear up the Iran nuclear deal and renegotiate a better deal.

Negotiations have gone nowhere, and he brought us to the brink of war.

31. He promised to enact term limits for all members of Congress.

He has not even tried to enact term limits.

32. He promised that China would pay for tariffs on imported goods.

His trade war has cost U.S. consumers $34 billion a year, eliminated 300,000 American jobs, and cost American taxpayers $22 billion in subsidies for farmers hurt by the tariffs.

33. He promised to “push colleges to cut the skyrocketing cost of tuition.”

Instead, he’s made it easier for for-profit colleges to defraud students, and tuition is still rising.

34. He promised to protect American steel jobs.

The steel industry continues to lose jobs.

35. He promised tax cuts for the wealthy and corporations would spur economic growth and pay for themselves.

His tax cuts will add $2 trillion to the federal deficit.

36. After pulling out of the Paris Climate Accord, he said he’d negotiate a better deal on the environment.

He hasn’t attempted to negotiate any deal.

37. He promised that the many women who accused him of sexual misconduct “will be sued after the election is over.”

He hasn’t sued them, presumably because he doesn’t want the truth to come out.

38. He promised to bring back all troops from Afghanistan.

He now says: "We’ll always have somebody there.”

39. He pledged to put America first.

Instead, he’s deferred to dictators and authoritarians at America’s expense, and ostracized our allies — who now laugh at us behind our back.

40. He promised to be the voice of the common people.

He’s made his rich friends richer, increased the political power of big corporations and the wealthy, and harmed working Americans.Don’t let the liar-in-chief break any more promises. Vote him out in November.

2K notes

·

View notes

Link

In 2007, Jeff Bezos, then a multibillionaire and now the world’s richest man, did not pay a penny in federal income taxes. He achieved the feat again in 2011. In 2018, Tesla founder Elon Musk, the second-richest person in the world, also paid no federal income taxes.

Michael Bloomberg managed to do the same in recent years. Billionaire investor Carl Icahn did it twice. George Soros paid no federal income tax three years in a row.

ProPublica has obtained a vast trove of Internal Revenue Service data on the tax returns of thousands of the nation’s wealthiest people, covering more than 15 years. The data provides an unprecedented look inside the financial lives of America’s titans, including Warren Buffett, Bill Gates, Rupert Murdoch and Mark Zuckerberg. It shows not just their income and taxes, but also their investments, stock trades, gambling winnings and even the results of audits.

Taken together, it demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most. The IRS records show that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.

Many Americans live paycheck to paycheck, amassing little wealth and paying the federal government a percentage of their income that rises if they earn more. In recent years, the median American household earned about $70,000 annually and paid 14% in federal taxes. The highest income tax rate, 37%, kicked in this year, for couples, on earnings above $628,300.

The confidential tax records obtained by ProPublica show that the ultrarich effectively sidestep this system.

I recommend going to the website to read the rest of the report, but the non-interactive text parts are below. Just in case it mysteriously vanishes.

America’s billionaires avail themselves of tax-avoidance strategies beyond the reach of ordinary people. Their wealth derives from the skyrocketing value of their assets, like stock and property. Those gains are not defined by U.S. laws as taxable income unless and until the billionaires sell.

To capture the financial reality of the richest Americans, ProPublica undertook an analysis that has never been done before. We compared how much in taxes the 25 richest Americans paid each year to how much Forbes estimated their wealth grew in that same time period.

We’re going to call this their true tax rate.

The results are stark. According to Forbes, those 25 people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%.

It’s a completely different picture for middle-class Americans, for example, wage earners in their early 40s who have amassed a typical amount of wealth for people their age. From 2014 to 2018, such households saw their net worth expand by about $65,000 after taxes on average, mostly due to the rise in value of their homes. But because the vast bulk of their earnings were salaries, their tax bills were almost as much, nearly $62,000, over that five-year period.

No one among the 25 wealthiest avoided as much tax as Buffett, the grandfatherly centibillionaire. That’s perhaps surprising, given his public stance as an advocate of higher taxes for the rich. According to Forbes, his riches rose $24.3 billion between 2014 and 2018. Over those years, the data shows, Buffett reported paying $23.7 million in taxes.

That works out to a true tax rate of 0.1%, or less than 10 cents for every $100 he added to his wealth.

In the coming months, ProPublica will use the IRS data we have obtained to explore in detail how the ultrawealthy avoid taxes, exploit loopholes and escape scrutiny from federal auditors.

Experts have long understood the broad outlines of how little the wealthy are taxed in the United States, and many lay people have long suspected the same thing.

But few specifics about individuals ever emerge in public. Tax information is among the most zealously guarded secrets in the federal government. ProPublica has decided to reveal individual tax information of some of the wealthiest Americans because it is only by seeing specifics that the public can understand the realities of the country’s tax system.

Consider Bezos’ 2007, one of the years he paid zero in federal income taxes. Amazon’s stock more than doubled. Bezos’ fortune leapt $3.8 billion, according to Forbes, whose wealth estimates are widely cited. How did a person enjoying that sort of wealth explosion end up paying no income tax?

In that year, Bezos, who filed his taxes jointly with his then-wife, MacKenzie Scott, reported a paltry (for him) $46 million in income, largely from interest and dividend payments on outside investments. He was able to offset every penny he earned with losses from side investments and various deductions, like interest expenses on debts and the vague catchall category of “other expenses.”

In 2011, a year in which his wealth held roughly steady at $18 billion, Bezos filed a tax return reporting he lost money — his income that year was more than offset by investment losses. What’s more, because, according to the tax law, he made so little, he even claimed and received a $4,000 tax credit for his children.

His tax avoidance is even more striking if you examine 2006 to 2018, a period for which ProPublica has complete data. Bezos’ wealth increased by $127 billion, according to Forbes, but he reported a total of $6.5 billion in income. The $1.4 billion he paid in personal federal taxes is a massive number — yet it amounts to a 1.1% true tax rate on the rise in his fortune.

The revelations provided by the IRS data come at a crucial moment. Wealth inequality has become one of the defining issues of our age. The president and Congress are considering the most ambitious tax increases in decades on those with high incomes. But the American tax conversation has been dominated by debate over incremental changes, such as whether the top tax rate should be 39.6% rather than 37%.

ProPublica’s data shows that while some wealthy Americans, such as hedge fund managers, would pay more taxes under the current Biden administration proposals, the vast majority of the top 25 would see little change.

The tax data was provided to ProPublica after we published a series of articles scrutinizing the IRS. The articles exposed how years of budget cuts have hobbled the agency’s ability to enforce the law and how the largest corporations and the rich have benefited from the IRS’ weakness. They also showed how people in poor regions are now more likely to be audited than those in affluent areas.

ProPublica is not disclosing how it obtained the data, which was given to us in raw form, with no conditions or conclusions. ProPublica reporters spent months processing and analyzing the material to transform it into a usable database.

We then verified the information by comparing elements of it with dozens of already public tax details (in court documents, politicians’ financial disclosures and news stories) as well as by vetting it with individuals whose tax information is contained in the trove. Every person whose tax information is described in this story was asked to comment. Those who responded, including Buffett, Bloomberg and Icahn, all said they had paid the taxes they owed.

A spokesman for Soros said in a statement: “Between 2016 and 2018 George Soros lost money on his investments, therefore he did not owe federal income taxes in those years. Mr. Soros has long supported higher taxes for wealthy Americans.” Personal and corporate representatives of Bezos declined to receive detailed questions about the matter. ProPublica attempted to reach Scott through her divorce attorney, a personal representative and family members; she did not respond. Musk responded to an initial query with a lone punctuation mark: “?” After we sent detailed questions to him, he did not reply.

One of the billionaires mentioned in this article objected, arguing that publishing personal tax information is a violation of privacy. We have concluded that the public interest in knowing this information at this pivotal moment outweighs that legitimate concern.

The consequences of allowing the most prosperous to game the tax system have been profound. Federal budgets, apart from military spending, have been constrained for decades. Roads and bridges have crumbled, social services have withered and the solvency of Social Security and Medicare is perpetually in question.

There is an even more fundamental issue than which programs get funded or not: Taxes are a kind of collective sacrifice. No one loves giving their hard-earned money to the government. But the system works only as long as it’s perceived to be fair.

Our analysis of tax data for the 25 richest Americans quantifies just how unfair the system has become.

By the end of 2018, the 25 were worth $1.1 trillion.

For comparison, it would take 14.3 million ordinary American wage earners put together to equal that same amount of wealth.

The personal federal tax bill for the top 25 in 2018: $1.9 billion.

The bill for the wage earners: $143 billion.

The idea of a regular tax on income, much less on wealth, does not appear in the country’s founding documents. In fact, Article 1 of the U.S. Constitution explicitly prohibits “direct” taxes on citizens under most circumstances. This meant that for decades, the U.S. government mainly funded itself through “indirect” taxes: tariffs and levies on consumer goods like tobacco and alcohol.

With the costs of the Civil War looming, Congress imposed a national income tax in 1861. The wealthy helped force its repeal soon after the war ended. (Their pique could only have been exacerbated by the fact that the law required public disclosure. The annual income of the moguls of the day — $1.3 million for William Astor; $576,000 for Cornelius Vanderbilt — was listed in the pages of The New York Times in 1865.)

By the late 19th and early 20th century, wealth inequality was acute and the political climate was changing. The federal government began expanding, creating agencies to protect food, workers and more. It needed funding, but tariffs were pinching regular Americans more than the rich. The Supreme Court had rejected an 1894 law that would have created an income tax. So Congress moved to amend the Constitution. The 16th Amendment was ratified in 1913 and gave the government power “to lay and collect taxes on incomes, from whatever source derived.”

In the early years, the personal income tax worked as Congress intended, falling squarely on the richest. In 1918, only 15% of American families owed any tax. The top 1% paid 80% of the revenue raised, according to historian W. Elliot Brownlee.

But a question remained: What would count as income and what wouldn’t? In 1916, a woman named Myrtle Macomber received a dividend for her Standard Oil of California shares. She owed taxes, thanks to the new law. The dividend had not come in cash, however. It came in the form of an additional share for every two shares she already held. She paid the taxes and then brought a court challenge: Yes, she’d gotten a bit richer, but she hadn’t received any money. Therefore, she argued, she’d received no “income.”

Four years later, the Supreme Court agreed. In Eisner v. Macomber, the high court ruled that income derived only from proceeds. A person needed to sell an asset — stock, bond or building — and reap some money before it could be taxed.

Since then, the concept that income comes only from proceeds — when gains are “realized” — has been the bedrock of the U.S. tax system. Wages are taxed. Cash dividends are taxed. Gains from selling assets are taxed. But if a taxpayer hasn’t sold anything, there is no income and therefore no tax.

Contemporary critics of Macomber were plentiful and prescient. Cordell Hull, the congressman known as the “father” of the income tax, assailed the decision, according to scholar Marjorie Kornhauser. Hull predicted that tax avoidance would become common. The ruling opened a gaping loophole, Hull warned, allowing industrialists to build a company and borrow against the stock to pay living expenses. Anyone could “live upon the value” of their company stock “without selling it, and of course, without ever paying” tax, he said.

Hull’s prediction would reach full flower only decades later, spurred by a series of epochal economic, legal and cultural changes that began to gather momentum in the 1970s. Antitrust enforcers increasingly accepted mergers and stopped trying to break up huge corporations. For their part, companies came to obsess over the value of their stock to the exclusion of nearly everything else. That helped give rise in the last 40 years to a series of corporate monoliths — beginning with Microsoft and Oracle in the 1980s and 1990s and continuing to Amazon, Google, Facebook and Apple today — that often have concentrated ownership, high profit margins and rich share prices. The winner-take-all economy has created modern fortunes that by some measures eclipse those of John D. Rockefeller, J.P. Morgan and Andrew Carnegie.

In the here and now, the ultrawealthy use an array of techniques that aren’t available to those of lesser means to get around the tax system.

Certainly, there are illegal tax evaders among them, but it turns out billionaires don’t have to evade taxes exotically and illicitly — they can avoid them routinely and legally.

Most Americans have to work to live. When they do, they get paid — and they get taxed. The federal government considers almost every dollar workers earn to be “income,” and employers take taxes directly out of their paychecks.

The Bezoses of the world have no need to be paid a salary. Bezos’ Amazon wages have long been set at the middle-class level of around $80,000 a year.

For years, there’s been something of a competition among elite founder-CEOs to go even lower. Steve Jobs took $1 in salary when he returned to Apple in the 1990s. Facebook’s Zuckerberg, Oracle’s Larry Ellison and Google’s Larry Page have all done the same.

Yet this is not the self-effacing gesture it appears to be: Wages are taxed at a high rate. The top 25 wealthiest Americans reported $158 million in wages in 2018, according to the IRS data. That’s a mere 1.1% of what they listed on their tax forms as their total reported income. The rest mostly came from dividends and the sale of stock, bonds or other investments, which are taxed at lower rates than wages.

As Congressman Hull envisioned long ago, the ultrawealthy typically hold fast to shares in the companies they’ve founded. Many titans of the 21st century sit on mountains of what are known as unrealized gains, the total size of which fluctuates each day as stock prices rise and fall. Of the $4.25 trillion in wealth held by U.S. billionaires, some $2.7 trillion is unrealized, according to Emmanuel Saez and Gabriel Zucman, economists at the University of California, Berkeley.

Buffett has famously held onto his stock in the company he founded, Berkshire Hathaway, the conglomerate that owns Geico, Duracell and significant stakes in American Express and Coca-Cola. That has allowed Buffett to largely avoid transforming his wealth into income. From 2015 through 2018, he reported annual income ranging from $11.6 million to $25 million. That may seem like a lot, but Buffett ranks as roughly the world’s sixth-richest person — he’s worth $110 billion as of Forbes’ estimate in May 2021. At least 14,000 U.S. taxpayers in 2015 reported higher income than him, according to IRS data.

There’s also a second strategy Buffett relies on that minimizes income, and therefore, taxes. Berkshire does not pay a dividend, the sum (a piece of the profits, in theory) that many companies pay each quarter to those who own their stock. Buffett has always argued that it is better to use that money to find investments for Berkshire that will further boost the value of shares held by him and other investors. If Berkshire had offered anywhere close to the average dividend in recent years, Buffett would have received over $1 billion in dividend income and owed hundreds of millions in taxes each year.

Many Silicon Valley and infotech companies have emulated Buffett’s model, eschewing stock dividends, at least for a time. In the 1980s and 1990s, companies like Microsoft and Oracle offered shareholders rocketing growth and profits but did not pay dividends. Google, Facebook, Amazon and Tesla do not pay dividends.

In a detailed written response, Buffett defended his practices but did not directly address ProPublica’s true tax rate calculation. “I continue to believe that the tax code should be changed substantially,” he wrote, adding that he thought “huge dynastic wealth is not desirable for our society.”

The decision not to have Berkshire pay dividends has been supported by the vast majority of his shareholders. “I can’t think of any large public company with shareholders so united in their reinvestment beliefs,” he wrote. And he pointed out that Berkshire Hathaway pays significant corporate taxes, accounting for 1.5% of total U.S. corporate taxes in 2019 and 2020.

Buffett reiterated that he has begun giving his enormous fortune away and ultimately plans to donate 99.5% of it to charity. “I believe the money will be of more use to society if disbursed philanthropically than if it is used to slightly reduce an ever-increasing U.S. debt,” he wrote.

So how do megabillionaires pay their megabills while opting for $1 salaries and hanging onto their stock? According to public documents and experts, the answer for some is borrowing money — lots of it.

For regular people, borrowing money is often something done out of necessity, say for a car or a home. But for the ultrawealthy, it can be a way to access billions without producing income, and thus, income tax.

The tax math provides a clear incentive for this. If you own a company and take a huge salary, you’ll pay 37% in income tax on the bulk of it. Sell stock and you’ll pay 20% in capital gains tax — and lose some control over your company. But take out a loan, and these days you’ll pay a single-digit interest rate and no tax; since loans must be paid back, the IRS doesn’t consider them income. Banks typically require collateral, but the wealthy have plenty of that.

The vast majority of the ultrawealthy’s loans do not appear in the tax records obtained by ProPublica since they are generally not disclosed to the IRS. But occasionally, the loans are disclosed in securities filings. In 2014, for example, Oracle revealed that its CEO, Ellison, had a credit line secured by about $10 billion of his shares.

Last year Tesla reported that Musk had pledged some 92 million shares, which were worth about $57.7 billion as of May 29, 2021, as collateral for personal loans.

With the exception of one year when he exercised more than a billion dollars in stock options, Musk’s tax bills in no way reflect the fortune he has at his disposal. In 2015, he paid $68,000 in federal income tax. In 2017, it was $65,000, and in 2018 he paid no federal income tax. Between 2014 and 2018, he had a true tax rate of 3.27%.

The IRS records provide glimpses of other massive loans. In both 2016 and 2017, investor Carl Icahn, who ranks as the 40th-wealthiest American on the Forbes list, paid no federal income taxes despite reporting a total of $544 million in adjusted gross income (which the IRS defines as earnings minus items like student loan interest payments or alimony). Icahn had an outstanding loan of $1.2 billion with Bank of America among other loans, according to the IRS data. It was technically a mortgage because it was secured, at least in part, by Manhattan penthouse apartments and other properties.

Borrowing offers multiple benefits to Icahn: He gets huge tranches of cash to turbocharge his investment returns. Then he gets to deduct the interest from his taxes. In an interview, Icahn explained that he reports the profits and losses of his business empire on his personal taxes.

Icahn acknowledged that he is a “big borrower. I do borrow a lot of money.” Asked if he takes out loans also to lower his tax bill, Icahn said: “No, not at all. My borrowing is to win. I enjoy the competition. I enjoy winning.”

He said adjusted gross income was a misleading figure for him. After taking hundreds of millions in deductions for the interest on his loans, he registered tax losses for both years, he said. “I didn’t make money because, unfortunately for me, my interest was higher than my whole adjusted income.”

Asked whether it was appropriate that he had paid no income tax in certain years, Icahn said he was perplexed by the question. “There’s a reason it’s called income tax,” he said. “The reason is if, if you’re a poor person, a rich person, if you are Apple — if you have no income, you don’t pay taxes.” He added: “Do you think a rich person should pay taxes no matter what? I don’t think it’s germane. How can you ask me that question?”

Skeptics might question our analysis of how little the superrich pay in taxes. For one, they might argue that owners of companies get hit by corporate taxes. They also might counter that some billionaires cannot avoid income — and therefore taxes. And after death, the common understanding goes, there’s a final no-escape clause: the estate tax, which imposes a steep tax rate on sums over $11.7 million.

ProPublica found that none of these factors alter the fundamental picture.

Take corporate taxes. When companies pay them, economists say, these costs are passed on to the companies’ owners, workers or even consumers. Models differ, but they generally assume big stockholders shoulder the lion’s share.

Corporate taxes, however, have plummeted in recent decades in what has become a golden age of corporate tax avoidance. By sending profits abroad, companies like Google, Facebook, Microsoft and Apple have often paid little or no U.S. corporate tax.

For some of the nation’s wealthiest people, particularly Bezos and Musk, adding corporate taxes to the equation would hardly change anything at all. Other companies like Berkshire Hathaway and Walmart do pay more, which means that for people like Buffett and the Waltons, corporate tax could add significantly to their burden.

It is also true that some billionaires don’t avoid taxes by avoiding incomes. In 2018, nine of the 25 wealthiest Americans reported more than $500 million in income and three more than $1 billion.

In such cases, though, the data obtained by ProPublica shows billionaires have a palette of tax-avoidance options to offset their gains using credits, deductions (which can include charitable donations) or losses to lower or even zero out their tax bills. Some own sports teams that offer such lucrative write-offs that owners often end up paying far lower tax rates than their millionaire players. Others own commercial buildings that steadily rise in value but nevertheless can be used to throw off paper losses that offset income.

Michael Bloomberg, the 13th-richest American on the Forbes list, often reports high income because the profits of the private company he controls flow mainly to him.

In 2018, he reported income of $1.9 billion. When it came to his taxes, Bloomberg managed to slash his bill by using deductions made possible by tax cuts passed during the Trump administration, charitable donations of $968.3 million and credits for having paid foreign taxes. The end result was that he paid $70.7 million in income tax on that almost $2 billion in income. That amounts to just a 3.7% conventional income tax rate. Between 2014 and 2018, Bloomberg had a true tax rate of 1.30%.

In a statement, a spokesman for Bloomberg noted that as a candidate, Bloomberg had advocated for a variety of tax hikes on the wealthy. “Mike Bloomberg pays the maximum tax rate on all federal, state, local and international taxable income as prescribed by law,” the spokesman wrote. And he cited Bloomberg’s philanthropic giving, offering the calculation that “taken together, what Mike gives to charity and pays in taxes amounts to approximately 75% of his annual income.”

The statement also noted: “The release of a private citizen’s tax returns should raise real privacy concerns regardless of political affiliation or views on tax policy. In the United States no private citizen should fear the illegal release of their taxes. We intend to use all legal means at our disposal to determine which individual or government entity leaked these and ensure that they are held responsible.”

Ultimately, after decades of wealth accumulation, the estate tax is supposed to serve as a backstop, allowing authorities an opportunity to finally take a piece of giant fortunes before they pass to a new generation. But in reality, preparing for death is more like the last stage of tax avoidance for the ultrawealthy.

University of Southern California tax law professor Edward McCaffery has summarized the entire arc with the catchphrase “buy, borrow, die.”

The notion of dying as a tax benefit seems paradoxical. Normally when someone sells an asset, even a minute before they die, they owe 20% capital gains tax. But at death, that changes. Any capital gains till that moment are not taxed. This allows the ultrarich and their heirs to avoid paying billions in taxes. The “step-up in basis” is widely recognized by experts across the political spectrum as a flaw in the code.

Then comes the estate tax, which, at 40%, is among the highest in the federal code. This tax is supposed to give the government one last chance to get a piece of all those unrealized gains and other assets the wealthiest Americans accumulate over their lifetimes.

It’s clear, though, from aggregate IRS data, tax research and what little trickles into the public arena about estate planning of the wealthy that they can readily escape turning over almost half of the value of their estates. Many of the richest create foundations for philanthropic giving, which provide large charitable tax deductions during their lifetimes and bypass the estate tax when they die.

Wealth managers offer clients a range of opaque and complicated trusts that allow the wealthiest Americans to give large sums to their heirs without paying estate taxes. The IRS data obtained by ProPublica gives some insight into the ultrawealthy’s estate planning, showing hundreds of these trusts.

The result is that large fortunes can pass largely intact from one generation to the next. Of the 25 richest people in America today, about a quarter are heirs: three are Waltons, two are scions of the Mars candy fortune and one is the son of Estée Lauder.

In the past year and a half, hundreds of thousands of Americans have died from COVID-19, while millions were thrown out of work. But one of the bleakest periods in American history turned out to be one of the most lucrative for billionaires. They added $1.2 trillion to their fortunes from January 2020 to the end of April of this year, according to Forbes.

That windfall is among the many factors that have led the country to an inflection point, one that traces back to a half-century of growing wealth inequality and the financial crisis of 2008, which left many with lasting economic damage. American history is rich with such turns. There have been famous acts of tax resistance, like the Boston Tea Party, countered by less well-known efforts to have the rich pay more.

One such incident, over half a century ago, appeared as if it might spark great change. President Lyndon Johnson’s outgoing treasury secretary, Joseph Barr, shocked the nation when he revealed that 155 Americans making over $200,000 (about $1.6 million today) had paid no taxes. That group, he told the Senate, included 21 millionaires.

“We face now the possibility of a taxpayer revolt if we do not soon make major reforms in our income taxes,” Barr said. Members of Congress received more furious letters about the tax scofflaws that year than they did about the Vietnam War.

Congress did pass some reforms, but the long-term trend was a revolt in the opposite direction, which then accelerated with the election of Ronald Reagan in 1980. Since then, through a combination of political donations, lobbying, charitable giving and even direct bids for political office, the ultrawealthy have helped shape the debate about taxation in their favor.

One apparent exception: Buffett, who broke ranks with his billionaire cohort to call for higher taxes on the rich. In a famous New York Times op-ed in 2011, Buffett wrote, “My friends and I have been coddled long enough by a billionaire-friendly Congress. It’s time for our government to get serious about shared sacrifice.”

Buffett did something in that article that few Americans do: He publicly revealed how much he had paid in personal federal taxes the previous year ($6.9 million). Separately, Forbes estimated his fortune had risen $3 billion that year. Using that information, an observer could have calculated his true tax rate; it was 0.2%. But then, as now, the discussion that ensued on taxes was centered on the traditional income tax rate.

In 2011, President Barack Obama proposed legislation, known as the Buffett Rule. It would have raised income tax rates on people reporting over a million dollars a year. It didn’t pass. Even if it had, however, the Buffett Rule wouldn’t have raised Buffett’s taxes significantly. If you can avoid income, you can avoid taxes.

Today, just a few years after Republicans passed a massive tax cut that disproportionately benefited the wealthy, the country may be facing another swing of the pendulum, back toward a popular demand to raise taxes on the wealthy. In the face of growing inequality and with spending ambitions that rival those of Franklin D. Roosevelt or Johnson, the Biden administration has proposed a slate of changes. These include raising the tax rates on people making over $400,000 and bumping the top income tax rate from 37% to 39.6%, with a top rate for long-term capital gains to match that. The administration also wants to up the corporate tax rate and to increase the IRS’ budget.

Some Democrats have gone further, floating ideas that challenge the tax structure as it’s existed for the last century. Oregon Sen. Ron Wyden, the chairman of the Senate Finance Committee, has proposed taxing unrealized capital gains, a shot through the heart of Macomber. Sens. Elizabeth Warren and Bernie Sanders have proposed wealth taxes.

Aggressive new laws would likely inspire new, sophisticated avoidance techniques. A few countries, including Switzerland and Spain, have wealth taxes on a small scale. Several, most recently France, have abandoned them as unworkable. Opponents contend that they are complicated to administer, as it is hard to value assets, particularly of private companies and property.

What it would take for a fundamental overhaul of the U.S. tax system is not clear. But the IRS data obtained by ProPublica illuminates that all of these conversations have been taking place in a vacuum. Neither political leaders nor the public have ever had an accurate picture of how comprehensively the wealthiest Americans avoid paying taxes.

Buffett and his fellow billionaires have known this secret for a long time. As Buffett put it in 2011: “There’s been class warfare going on for the last 20 years, and my class has won.”

33 notes

·

View notes

Link

LETTERS FROM AN AMERICAN

January 14, 2021

Heather Cox Richardson

“Come Wednesday, we begin a new chapter.”

So said President-Elect Joe Biden tonight as he laid out a plan for a $1.9 trillion emergency vaccination and relief package to get the country through and past the coronavirus. The Trump administration created no federal program for the distribution of the coronavirus vaccine, leaving us woefully behind where we need to be to get our population vaccinated. And the virus is spreading fast. Over the past week, we have had an average of almost 250,000 new cases a day of coronavirus, with daily deaths on either side of 4000. We are approaching 390,000 recorded deaths from Covid-19.

Biden’s plan calls for $50 billion to ramp up Covid-19 testing, including rapid tests, and to help schools and local governments establish regular testing systems. It calls for an investment of $30 billion in the Disaster Relief Fund to make sure it can provide supplies for the pandemic.

It starts by addressing the pandemic, for both Biden and Vice President-Elect Kamala Harris believe that until people are comfortable circulating again, the economy will not rebound. But the plan also calls for federal support to rebuild the economy, a reflection of the ongoing crisis that in the last week led 965,000 Americans to turn to unemployment insurance for the first time, joining more than 5 million who have already filed claims.

The plan calls for $1400 stimulus checks for individuals, expanded unemployment benefits through September, an end to eviction and foreclosure until September 30, $30 billion to help people meet payments for rent or utilities, and a $15 minimum wage. Biden is calling for aid for child care, a $3 billion investment in the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), and $350 billion for state, local, and tribal governments to support front line workers.

Biden laid out his ambitious plan even as fallout continued from the January 6 insurrection in Washington, D.C., when Trump supporters tried to overturn his victory in the 2020 election. Today the FBI continued to track down and arrest rioters, while the pro-Trump faction of the Republican Party continued its attempt to wrest control from establishment Republicans.

But while Republican lawmakers are calling for “unity” to deflect attention from the riot and to avoid accountability, Biden used this speech, at this time, to calm tensions and call for unity to move all Americans forward.

He emphasized, as he always does, that he wants to be a president for all Americans, not just those who voted for him, and that if we work together we can accomplish anything. He tried to appeal to disaffected Republicans by highlighting his plan to bring manufacturing jobs back to America, as well as to create new, well-paying jobs in new fields and in long delayed infrastructure projects. To reach out to religious voters who were horrified last week by the vision of those who self-identify as Christians calling for the death of Vice President Mike Pence, Biden emphasized the morality in the plan: a good society should not let children go to bed hungry.

He made a sharp contrast with the current president, not only by sharing an actual plan to confront real problems, but also by empathizing with Americans who have lost loved ones to the pandemic and who are hurting in the stalled economy. “Every day matters, every person matters,” he said.

But Biden’s plan is far larger than a way to address our current crisis. It outlines a vision for America that reaches back to an older time, when both parties shared the idea that the government had a role to play in the economy, regulating business, providing a basic social safety net, and promoting infrastructure.

That vision was at the heart of the New Deal, ushered in by Democrat Franklin Delano Roosevelt after the Great Crash of 1929 and the Depression that followed it illustrated that the American economy needed a referee to keep the wealthy playing by the rules. Government intervention proved so successful and so popular that the Republican Party, which had initially recoiled from what its leaders incorrectly insisted was communism, by 1952 had adopted the idea of an activist government. Republican President Dwight Eisenhower added the Department of Health, Education, and Welfare to the Cabinet on April 11, 1953, and in 1956 signed into law the Federal-Aid Highway Act, which began the construction of 41,000 miles of interstate highways.

While this system was enormously popular, reactionary Republicans hated business regulation, the incursion of the federal government into lucrative infrastructure fields, and the taxes it took to pay for the new programs (the top marginal tax rate in the 1950s was 91%). They launched a movement to end what was popularly known as the “liberal consensus”: the idea that the government should take an active role in keeping the economic playing field level.

The liberal consensus was widely popular, these “Movement Conservatives” turned to the issue of race to break it. After the Supreme Court unanimously declared racial segregation in schools unconstitutional in the 1954 Brown vs. Board of Education decision, Movement Conservatives warned that an active government was not defending equality but redistributing the tax dollars of hardworking white men to grasping minorities through social programs.

By 1980, Movement Conservatives were gaining power in the Republican Party by calling for tax cuts and smaller government, slashing regulations and domestic programs even as they poured money into the military and their tax cuts began moving money upward. By the 1990s, Movement Conservatives had gained the upper hand in the party and, determined to take the government back to the days before the New Deal, were systematically purging it of what they called “RINOs”—Republicans in Name Only. They would, they said, make the government small enough to drown it in a bathtub.

As they dragged the country toward the right, Republicans pulled the Democrats from the New Deal toward reforms Democratic lawmakers hoped could attract the voters they had lost to the Republicans. “The era of big government is over,” President Bill Clinton famously said, although he continued to protect Social Security, Medicare, and Medicaid from Republican cuts.

The Democratic defense of an active government was popular—people actually like government regulation, social welfare programs, and roads and bridges. But Republicans continued to be determined to get rid of the liberal consensus once and for all, insisting that true liberty would free individuals to organize a booming economy. Trump’s administration was the culmination of two generations of Republican attempts to dismantle the New Deal state.

But now, the dangers of gutting our government and empowering private business to extremes have become only too clear. For four years, we have watched as a few privileged business leaders got rid of career government employees and handed their jobs to lackeys. The result has been a raging pandemic and a devastating economic collapse, as money has moved dramatically upward. Even before the pandemic, the Trump administration had added 50% to the national debt despite cuts to domestic programs. In the 2020 election, Trump offered more of the same. Americans rejected him and chose Biden.

Biden’s speech tonight marked a resurrection of the idea of an activist government as a positive good. He is calling for the government to invest in ordinary Americans rather than in the people at the top of the economy, and is openly calling for higher taxes on the wealthy to fund such investment. “Asking everyone to pay their fair share at the top so we can make permanent investments to rescue and rebuild America is the right thing for our economy,” he said. Unlike the New Dealers and Eisenhower Republicans of the mid-20th century, though, Biden’s vision is not centered on ensuring that a white man can take care of his family. It is centered on guaranteeing a fair economy for all, focusing on an idea of community that highlights the needs of women and children.

The idea of a government that supports ordinary Americans rather than the wealthy was first articulated by Abraham Lincoln in 1859 and was the system the Republicans first put in place during the Civil War. They paid for the programs with our first national taxes, including an income tax. After industrialists cut back that original system, Republican Theodore Roosevelt brought it back, and after it lapsed again in the 1920s, his Democratic cousin Franklin rebuilt it in such a profound way that it shaped modern America. With that system now on the verge of destruction yet again, Biden is making a bid to bring it back to life in a new form.

It is a new chapter indeed, but in a very traditional American story.

—-

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#sedition#insurrection#January 6 2020#political#civil war#history

3 notes

·

View notes

Text

Heather Cox Richardson:

July 26, 2020 (Sunday)

Reality is disrupting the ideology of today’s Republican Party.

For a generation, Republicans have tried to unravel the activist government under which Americans have lived since the 1930s, when Democrat Franklin Delano Roosevelt created a government that regulated business, provided a basic social safety net, and invested in infrastructure. From the beginning, that government was enormously popular. Both Republicans and Democrats believed that the principle behind it—that the country worked best when government protected and defended ordinary Americans—was permanent.

But the ideologues who now control the Republican Party have always wanted to get rid of this New Deal state and go back to the world of the 1920s, when businessmen ran the government. They believe that government regulation and taxation is an assault on their liberty, because it restricts their ability to make money.

They have won office not by convincing Americans to give up their own government benefits—most Americans actually like clean water and Social Security and safe bridges—but by selling a narrative in which “Liberals” are trying to undermine the country by stealing the tax dollars of hardworking Americans—quietly understood to be white men—and redistributing them to lazy people who want handouts, not-so-quietly understood to be people of color and feminist women. According to this narrative, legislation that protects ordinary Americans simply redistributes wealth. It is “socialism,” or “communism.”

Meanwhile, Republican policies have actually redistributed wealth upward. When voters began to turn against those policies, Republicans upped the ante, saying that “Liberals” were simply buying Black votes with handouts, or, as Carly Fiorina said in a 2016 debate, planning to butcher babies and sell their body parts. To make sure Republicans stayed in power, they suppressed voting by people likely to vote Democratic, and gerrymandered states so that even if Democrats won a majority of votes, they would have a minority of representatives.

This system rewarded those who moved to the right, not to the middle. It gave them Donald Trump as a 2016 candidate, who talked of Mexican immigrants as criminals and rapists and treated women not as equals but as objects either for sex or derision.

And, although as a candidate Trump talked about making taxes fairer, improving health care, and helping those struggling economically, in fact as president he has done more to bring about the destruction of the New Deal state than most of his predecessors. He has slashed regulations, given a huge tax cut to the wealthy, and gutted the government.

If the end of the New Deal state is going to usher in a new era of peace and prosperity, it should be now.

Instead, the gutting of our government destroyed our carefully constructed pandemic response teams and plans, leaving America vulnerable to the coronavirus. Pressed to take the lead on combatting the virus, the administration refused to use federal power, and instead relied on “public-private partnerships” which meant states were largely on their own. When governors tried to take over, the Republican objection to government regulation, cultivated over a generation, had people refusing to wear masks or follow government instructions.

As the rest of the world watches in horror, we have suffered more than 4 million infections, and are approaching 150,000 deaths.

The pandemic also crashed the economy as businesses shut down to avoid infections. It threw more than 20 million Americans out of work. Republican ideology says the government has no business supporting ordinary Americans: they should work to survive, even if that means they have to take the risk of contracting Covid-19. Schools should open, businesses should get up and going, and the economy should rebuild. As Texas’s lieutenant governor Dan Patrick said to Fox News Channel personality Tucker Carlson in March, grandparents should be willing to contract coronavirus for the U.S. to “get back to work.”

The coronavirus has brought the Republican narrative up against reality. Just 32% of Americans approve of Trump’s handling of the coronavirus, and only 38% of the country think the economy is good. Americans believe that the government should have done a better job managing the pandemic, and they do not believe they should risk their lives for the economy.

To try to deflect attention from the failure of his approach to the coronavirus, Trump is once, again, escalating the narrative. He has launched an offensive against Democratic cities, trying to convince voters he is protecting them from "violent anarchists" coddled by Democrats. He is using federal law enforcement officers in unprecedented ways, not to quell protests, but to escalate them. In Portland, Oregon, as officers have used tear gas, less-than-lethal munitions (which nonetheless fractured a man’s skull), and batons to attack protesters, the events, which had fallen to a few hundred attendees, grew again into the thousands. And now the administration is planning to send in more officers, to escalate further.

The Republicans’ ideology is also making it impossible for them to deal with the economy. We are on the verge of a catastrophe as the $600 weekly federal bonus attached to state unemployment benefits runs out this week just as the moratorium on evictions for an inability to pay rent ends. At the same time, state and local budgets, hammered by the pandemic, will mean more layoffs.

The House passed a $3 trillion bill in May to address these issues, along with providing more money to combat the coronavirus, but Republicans in the Senate rejected it out of hand. Today on CBS’s “Face the Nation,” Senator Ted Cruz (R-TX) went back to his ideological roots. “The only objective Democrats have is to defeat Donald Trump, and they've cynically decided the best way to defeat Donald Trump is shut down every business in America, shut down every school in America," he said. House Speaker "Nancy Pelosi talks about working men and women. What she's proposing is keeping working men and women from working." "Her objectives are shoveling cash at the problem and shutting America down.”

Instead, both Trump and Cruz want a payroll tax cut, which will do little to stimulate the economy since the tens of millions who have lost their jobs would not see any money, and this late in the year much of the tax has already been paid. But the payroll tax cut is popular among Republican ideologues because it funds Social Security and Medicare. Cut it, and those programs take a hit.

Today Trump’s chief of staff Mark Meadows and Treasury Secretary Steven Mnuchin took to the Sunday talk shows to try to reassure people that the Republicans would, in fact, manage to cobble together a relief bill in the next few days (after not writing one in the last two months). They are talking about passing piecemeal measures, but, recognizing that this means Republicans will call all the shots, Pelosi says no.

Meadows and Mnuchin say they want liability protection for businesses and schools if they open and people get Covid-19. They were also clear they would not agree to extending the $600 federal addition to state unemployment benefits, arguing that it simply “paid people to stay home.” They say they want to guarantee people 70% of their wages, but the reason the earlier bill had a flat $600 payment was because it appeared impossible for states to administer a complicated program based on a percentage, so this might well just be a straw argument.

The Republican approach to handling the coronavirus and the economy is apparently not to turn to our government, but to put our heads down, go on as usual, and hope for a vaccine. What will end the pandemic is “not masks. It’s not shutting down the economy," Meadows said. “Hopefully it is American ingenuity that will allow for therapies and vaccines to ultimately conquer this.”

3 notes

·

View notes

Text

July 26, 2020, Heather Cox Richardson*

Reality is disrupting the ideology of today’s Republican Party.

For a generation, Republicans have tried to unravel the activist government under which Americans have lived since the 1930s, when Democrat Franklin Delano Roosevelt created a government that regulated business, provided a basic social safety net, and invested in infrastructure. From the beginning, that government was enormously popular. Both Republicans and Democrats believed that the principle behind it—that the country worked best when government protected and defended ordinary Americans—was permanent.

But the ideologues who now control the Republican Party have always wanted to get rid of this New Deal state and go back to the world of the 1920s, when businessmen ran the government. They believe that government regulation and taxation is an assault on their liberty, because it restricts their ability to make money.

They have won office not by convincing Americans to give up their own government benefits—most Americans actually like clean water and Social Security and safe bridges—but by selling a narrative in which “Liberals” are trying to undermine the country by stealing the tax dollars of hardworking Americans—quietly understood to be white men—and redistributing them to lazy people who want handouts, not-so-quietly understood to be people of color and feminist women. According to this narrative, legislation that protects ordinary Americans simply redistributes wealth. It is “socialism,” or “communism.”

Meanwhile, Republican policies have actually redistributed wealth upward. When voters began to turn against those policies, Republicans upped the ante, saying that “Liberals” were simply buying Black votes with handouts, or, as Carly Fiorina said in a 2016 debate, planning to butcher babies and sell their body parts. To make sure Republicans stayed in power, they suppressed voting by people likely to vote Democratic, and gerrymandered states so that even if Democrats won a majority of votes, they would have a minority of representatives.

This system rewarded those who moved to the right, not to the middle. It gave them Donald Trump as a 2016 candidate, who talked of Mexican immigrants as criminals and rapists and treated women not as equals but as objects either for sex or derision.

And, although as a candidate Trump talked about making taxes fairer, improving health care, and helping those struggling economically, in fact as president he has done more to bring about the destruction of the New Deal state than most of his predecessors. He has slashed regulations, given a huge tax cut to the wealthy, and gutted the government.

If the end of the New Deal state is going to usher in a new era of peace and prosperity, it should be now.

Instead, the gutting of our government destroyed our carefully constructed pandemic response teams and plans, leaving America vulnerable to the coronavirus. Pressed to take the lead on combatting the virus, the administration refused to use federal power, and instead relied on “public-private partnerships” which meant states were largely on their own. When governors tried to take over, the Republican objection to government regulation, cultivated over a generation, had people refusing to wear masks or follow government instructions.

As the rest of the world watches in horror, we have suffered more than 4 million infections, and are approaching 150,000 deaths.

The pandemic also crashed the economy as businesses shut down to avoid infections. It threw more than 20 million Americans out of work. Republican ideology says the government has no business supporting ordinary Americans: they should work to survive, even if that means they have to take the risk of contracting Covid-19. Schools should open, businesses should get up and going, and the economy should rebuild. As Texas’s lieutenant governor Dan Patrick said to Fox News Channel personality Tucker Carlson in March, grandparents should be willing to contract coronavirus for the U.S. to “get back to work.”

The coronavirus has brought the Republican narrative up against reality. Just 32% of Americans approve of Trump’s handling of the coronavirus, and only 38% of the country think the economy is good. Americans believe that the government should have done a better job managing the pandemic, and they do not believe they should risk their lives for the economy.

To try to deflect attention from the failure of his approach to the coronavirus, Trump is once, again, escalating the narrative. He has launched an offensive against Democratic cities, trying to convince voters he is protecting them from "violent anarchists" coddled by Democrats. He is using federal law enforcement officers in unprecedented ways, not to quell protests, but to escalate them. In Portland, Oregon, as officers have used tear gas, less-than-lethal munitions (which nonetheless fractured a man’s skull), and batons to attack protesters, the events, which had fallen to a few hundred attendees, grew again into the thousands. And now the administration is planning to send in more officers, to escalate further.

The Republicans’ ideology is also making it impossible for them to deal with the economy. We are on the verge of a catastrophe as the $600 weekly federal bonus attached to state unemployment benefits runs out this week just as the moratorium on evictions for an inability to pay rent ends. At the same time, state and local budgets, hammered by the pandemic, will mean more layoffs.

The House passed a $3 trillion bill in May to address these issues, along with providing more money to combat the coronavirus, but Republicans in the Senate rejected it out of hand. Today on CBS’s “Face the Nation,” Senator Ted Cruz (R-TX) went back to his ideological roots. “The only objective Democrats have is to defeat Donald Trump, and they've cynically decided the best way to defeat Donald Trump is shut down every business in America, shut down every school in America," he said. House Speaker "Nancy Pelosi talks about working men and women. What she's proposing is keeping working men and women from working." "Her objectives are shoveling cash at the problem and shutting America down.”

Instead, both Trump and Cruz want a payroll tax cut, which will do little to stimulate the economy since the tens of millions who have lost their jobs would not see any money, and this late in the year much of the tax has already been paid. But the payroll tax cut is popular among Republican ideologues because it funds Social Security and Medicare. Cut it, and those programs take a hit.

Today Trump’s chief of staff Mark Meadows and Treasury Secretary Steven Mnuchin took to the Sunday talk shows to try to reassure people that the Republicans would, in fact, manage to cobble together a relief bill in the next few days (after not writing one in the last two months). They are talking about passing piecemeal measures, but, recognizing that this means Republicans will call all the shots, Pelosi says no.

Meadows and Mnuchin say they want liability protection for businesses and schools if they open and people get Covid-19. They were also clear they would not agree to extending the $600 federal addition to state unemployment benefits, arguing that it simply “paid people to stay home.” They say they want to guarantee people 70% of their wages, but the reason the earlier bill had a flat $600 payment was because it appeared impossible for states to administer a complicated program based on a percentage, so this might well just be a straw argument.

The Republican approach to handling the coronavirus and the economy is apparently not to turn to our government, but to put our heads down, go on as usual, and hope for a vaccine. What will end the pandemic is “not masks. It’s not shutting down the economy," Meadows said. “Hopefully it is American ingenuity that will allow for therapies and vaccines to ultimately conquer this.”

*Heather Cox Richardson is an American historian and Professor of History at Boston College, where she teaches courses on the American Civil War, the Reconstruction Era, the American West, and the Plains Indians. She previously taught at MIT and the University of Massachusetts.

1 note

·

View note

Text

Cory Booker

I'm going to start with it's good to see that all the candidates and not old straight white guys.

Opposed Brett Kavanaugh. That earns him major brownie points with me.

Criminal justice positions:

Abolish death penalty. End cash bail. Remove the sentencing differences between powder and crystal cocaine sentences. Eliminate mandatory minimum sentences. Eliminate private prisons. No bad here. I'll agree to all of it.

Election security:

Go back to paper. While I question Andrew Yang's idea to go to block chain, I don't see this as being much better. (I already vote on paper but it's counted electronically). Back tracking to lower grade tech is only going to make this take longer.

Economy:

Affordable housing:

EW says subsidize construction. Kamala and Andrew say subsidize the end user: renters and home owners.

Cory(and Julián Castro, but he's not going to November as yet) says do both.

Income inequality:

Raise taxes on wealthy and create new social programs. Along with Bern and EW, this is only trumped by Andrew Yang's UBI for this item. Kamala Harris says expand tax benefits for middle/lower class, but taxes for that bracket are already so hopelessly complex that most of them end up paying for someone to help them with it.

Minimum wage:

Andrew Yang is "leave it up to the states, and Tom Sayer is unalligned (big surprise), everyone else is "yeah let's raise it." But can we talk about a maximum wage?

Paid leave:

Most everyone is on board with a broad paid leave initiative. Andrew Yang has only stated support for leave with new parents, and Joe and Tom (big surprise) haven't made a position on known.

Reparations:

With the 400th anniversary of the first arrival of slaves here, this is a big issue. Tom Steyer has not made a position known, every one else says let's study this.

College debt:

There are a lot of positions here. Tom has avoided all of them. They range from "college should be free"(Bern, EW) to "college shouldn't be free"(Andrew Yang) with Biden opting for two years free ride, and the somewhat more ambiguous "students should not have to take on debt to go to school," that Cory, Kamala and Pete share.

He's also onboard to fix or expand current college debt relief.

Campaign finance reform:

Everyone BUT Tom has signed on for campaign finance reform. Front runners are refusing PAC donations. These guys are limiting their spending (although it's still a multi million dollar Enterprise)

Climate:

Supports nuclear power. End drilling off shore and on government land.

Farming:

Bern and EW are going for breaking up the agribusinesses. Cory and Joe are less forceful with "tighten enforcement of current laws" every one else has not given a position.

Guns:

Mandatory buyback. Universal background check. Federal gun licences. All in all, not a position of trust. I don't like it, and I don't think it will help anything.

Healthcare:

Abortion: few if any limits.

ACA: rethink the system

Medicare for all:if we can, but expanding current coverage would be ok if we can't.

Drug costs: international reference pricing!?!

DACA: citizenship for dreamers, repeal the statue that makes it illegal to cross the border without the government check in.

Marijuana:

Legalize. Joe said "decriminalize" and Tom (no surprise) has not given an opinion. Everyone else is for it.

Military:

Expand spending. Keep troops deployed.

Taxes:

Increase capital gains tax. reverse 2017 corporate tax rate cut. Expand EITC. Increase wealth taxes. All point that desperately need to happen.

In conclusion I would support Cory Booker except for his position on guns. I think it's a step too far. 4/8

4 notes

·

View notes

Link

Democrats criticized the legislation, originally known as the Tax Cuts and Jobs Act of 2017, but officially called An Act to Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018, but Republicans defended the law as a necessary overhaul to previous tax laws and a means to provide economic relief for the middle class.

The dueling partisan narratives left many taxpayers with a murky understanding of the law’s impact.

To gain a better grasp on the intricacies of the 2017 Act, professors David Kamin, Lily Batchelder, and Daniel Shaviro—tax law experts from the New York University School of Law—cowrote a paper analyzing the sweeping legislation which appears in the Minnesota Law Review.

According to the authors, “Many of the new changes fundamentally undermine the integrity of the tax code and allow well-advised taxpayers to game the new rules through strategic planning.”

Here, the authors describe how some may take advantage of the new system, and how changes to the tax laws may affect the US economy.

‘CRACKING AND PACKING’

David Kamin: One of the largest tax cuts in the legislation goes to “pass-through” businesses—where income is taxed at the level of the owner rather than the business. But, to be eligible for this tax cut, owners need to meet certain very complex criteria.

For those with higher incomes, this includes being in the “right” line of business. That means being an architect (eligible) and not a lawyer (not eligible). Selling skincare products (eligible) but not being a dermatologist (not eligible). The formalistic and largely arbitrary lines then allow for much gaming, including what we—borrowing from the election law context—call “cracking and packing,” pulling apart and combining businesses.

For instance, a dermatologist office might “crack” apart a skincare products business run out of the same office, share overhead expenses, and then try to assign as much of those overhead expenses as possible to the dermatology practice to maximize profits eligible for the deduction. Possibly abusive? Yes, but very hard for the IRS to catch.

Lily Batchelder: The bill creates large incentives for the wealthy to convert their labor income into business income. This was already an issue in the tax code because of the carried interest loophole and loopholes in the payroll tax. But the bill makes a bad situation much, much worse.

If a wealthy individual hires an elite tax advisor to make their labor income look like pass-through business income, they can cut their marginal tax rate by more than 7 percentage points. And if they don’t need to spend the income anytime soon and treat it as corporate income, they can cut their tax rate by 20 percentage points.

Theoretically, middle class families could engage in the same games but they are much less likely to do so for at least three reasons. First, middle class families would receive much smaller tax benefits from such gaming and in many cases, none. Second, they often have little leverage over their employers to restructure their compensation and, even if they did, probably would have to give up all of their employee benefits in exchange. This includes their health insurance, 401(k), and disability insurance. Last, they are less likely to be able to afford a tax advisor with the expertise to structure this kind of arrangement in the first place!

GAMING THE SYSTEM

Daniel Shaviro: One of the many disappointing aspects of the 2017 act was its failure to address the opportunities for sheltering labor income from tax at full individual rates, through use of the corporate tax. Pre-2017, the top corporate rate was far closer to the top individual rate than it is post-2017. The main rationale for the corporate rate reduction pertained to global tax competition for scarce capital. This has no bearing on the case where the owner-employee of a corporation pays herself far less than the market value of her work.

For example, suppose I create a wildly successful new start-up and pay myself zero salary, despite my becoming, in net worth terms, a billionaire via the stock appreciation. The income that my efforts yield will show up in the corporate tax base, and be taxed at only 21 percent. True, I would face a second level of tax on paying myself dividends or selling my stock, but even this would be at a reduced rate. And what’s more, I may not need to make such payments if I am sufficiently financially liquid, e.g., by reason of borrowing against the value of the stock.

Opinions in the “biz” differ on how frequently taxpayers will find it worthwhile to do this, given the difficulty of extracting funds from one’s company tax-free. What is plain, however, is that Congress in 2017 deliberately did nothing to prevent this from happening. Indeed, the final version of the 2017 Act reduced the efficacy of a provision in the House bill that would have slightly addressed the problem by setting the tax rate for “personal service corporations” (PSCs) at 25 percent rather than just 21 percent. In the final act that rate is just 21 percent, like the general corporate rate, causing the PSC rules to be close to meaningless as a defense against using corporations as a tax shelter for labor income.

Shaviro: In the international realm, the 2017 Act may actually have improved the law marginally. At a minimum, it created a new regime that could be tweaked by future Congresses to yield a better system than the previous one. However, the main new international rules that it added to the code unnecessarily created multiple opportunities for game-playing. Just to give some quick examples without getting too deep into the weeds:

The foreign-derived intangible income (FDII) rules, which provide a special deduction for exports by companies, such as Apple and Facebook, that have valuable intellectual property, create incentives for “round-tripping” goods—e.g., selling them to a foreign taxpayer, then buying them back with just enough bells and whistles to prevent the entire transaction from being disregarded.

Both FDII and the global intangible low-taxed income (GILTI) rules can create incentives to locate business assets abroad rather than at home.

The base erosion anti-avoidance tax (BEAT) can be gamed through such means as restructuring supply chains so one is purchasing sale items for customers from one’s foreign affiliates. The BEAT can also be gamed by adding lots of extra deductions (offset by lots of extra income so the sum total is a wash), so that so-called “base erosion tax benefits” will fall below an arbitrary “floor” (as a percentage of total deductions) that the BEAT imposes for no discernible reason.

VIOLATING THE WTO TREATY?

Shaviro: The FDII rules almost certainly violate the World Tax Organization treaty, of which the US is a signatory. They are expressly an export subsidy, and the WTO makes export subsidies illegal. If other treaty signatories challenge the FDII rules, there is a very high probability that they’ll be held illegal, with the consequence that peer countries will be authorized to respond with targeted provisions of their own.

In the last 30 or so years, the US has enacted illegal export subsidy rules on three separate occasions. Each time the rule was held violative and the US backed down. Why do this again? I think the main answer was cynicism, but ironically the prospect of an overturn makes the US companies that wanted favorable tax treatment more leery than they would otherwise have been of setting up complex structures to take maximum advantage of the FDII rules.

‘AN ARRAY OF MISTAKES’

Kamin: The legislation was written at an extremely rapid clip, leaving an array of mistakes—some minor and some large. An early one to emerge was the “grain glitch.” In attempting to apply the pass-through deduction to businesses organized as cooperatives, especially prevalent in agriculture, legislators wrote in an even larger loophole by accident. Effectively, farmers selling to these cooperatives (think Ocean Spray cranberries) could potentially entirely wipe out their tax liability because of the glitch.

This one was large enough—and was causing sufficient chaos in the agricultural sector—that it was fixed. But most haven’t been. So, take another: one of the largest revenue raisers in the legislation was limiting the deductibility of state and local taxes for individuals to $10,000. However, the letter of the law seems to fail to apply that to another form of cooperative, a housing cooperative.

So, owners of pricey cooperatives in NYC may be able to deduct their property taxes without limit; by contrast, owners of traditional condominiums and houses will not. And the list could go on.

MAJOR TAKEAWAYS