#Harami Cross candlestick pattern

Explore tagged Tumblr posts

Text

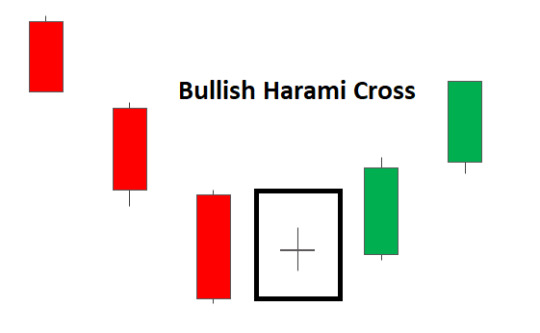

How to Trade the Harami Cross (Bullish) Pattern: A Complete Guide

The Harami Cross (Bullish) pattern is a powerful and reliable candlestick formation in technical analysis that signals a potential reversal from a downtrend to an uptrend. Understanding how to identify and trade this pattern can give traders an edge in timing entry points and managing risk effectively. In this post, we’ll break down the Harami Cross (Bullish) pattern, explain its significance,…

#Best bullish reversal patterns#Best strategy for trading bullish Harami Cross in stock market#Bullish candlestick pattern strategy#Bullish Harami Cross strategy#Bullish Harami trading strategy#bullish momentum shift#Bullish reversal candlestick patterns#candlestick chart reversal signals#Candlestick patterns for beginners#Doji candlestick meaning#Harami Cross Bullish Pattern#Harami Cross candlestick pattern#Harami Cross chart example#Harami Cross confirmation signal#Harami Cross pattern entry and exit points#Harami Cross strategy for beginners in technical analysis#Harami Cross technical analysis#Harami Cross trading setup with confirmation#Harami Cross vs Bullish Harami#Harami Cross with volume confirmation strategy#How to identify and trade the Harami Cross candlestick pattern#How to identify Harami Cross#How to trade Harami Cross#How to use RSI with bullish Harami Cross#Japanese candlestick patterns#learn technical analysis#Price action trading strategy#Profitable candlestick patterns for swing traders#reliable candlestick signals#Step-by-step guide to bullish Harami Cross pattern

0 notes

Text

Unlocking Reversals with the Harami Cross Candlestick Pattern

As a seasoned trader, I’ll never forget the moment I first spotted a Harami cross on my chart. It was during a volatile market downturn, and my screen was littered with red numbers. But then, this tiny candle—flanked by two larger ones—popped up, signaling a potential turnaround. My heart raced. Was this a coincidence, or had I just unlocked a key to the market’s hidden language? That pattern,…

0 notes

Text

BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital Options BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital OptionsThe ultimative Price Action guide (7 edition) for any kind of financial instrument (Binary Options, Forex, FX Options, Digital Options) any kind of time frame from 1 min over 5 min up to 15 min, 30 min and above and any kind of broker. This ebook is all you need, especially as a binary option turbo trader or Forex day trader to get profit out of the market, to get out of debt, make yourself a living or help your friends and family and to archieve financial freedom. Don't miss the opportunity to get this ultimative Price Action guide (7 edition)File Size: 12597 KBPrint Length: 118 pagesPublisher: BO Turbo Trader; 7 edition (October 24, 2018)Publication Date: October 24, 2018Content:Mindset for consistent profits- Practice- Win Rate- Discipline- Money Management- Emotions Candlestick Patterns- Hammer, Inverted Hammer, Takuri Line, Shooting Star and Hanging man- Dragonfly Doji, Gravestone Doji- spinning top - long-legged doji, high wave and rickshaw man- Pinbar - Pin Bar - Pinocchio bar or Kangaroo Tail - Tweezer Top and Tweezer Bottom- bearish harami, bullish harami and bullish harami cross and bearish harami cross- three inside down, three inside up- descending hawk and homing pigeon- bearish meeting line - counterattack line and bullish meeting line- bearish belt hold - black opening shaven head - black opening marubozu- bullish belt hold - white opening shaven bottom - white opening marubozu- bearish kicker signal - bullish kicker signal- matching high and matching low- bearish stick sandwich and bullish stick sandwich - bearish breakaway and bullish breakaway- ladder top and ladder bottom - tower top and tower bottom- three stars in the north and three stars in the south- bearish sash pattern and bullish sash pattern- engulfing candlestick pattern or the big shadow pattern- (bearish) dark cloud cover and (bullish) piercing line- Breakaway gap, exhaustion gab, continuation gap and common gaps- rising window and falling window- marubozu and big belt- inside bar and mother bar- evening star, morning star and evening doji star and morning doji star- three white soldiers and three black crowsChart Patterns- Double Top - M Formation - Mammies and Double Bottom - W Formation - Wollahs- J-Hook pattern and inverted J-Hook candlestick pattern- bearish last kiss - bearish pullback and bullish last kiss and bullish breakout- Head and Shoulders and inverted Head and Shoulders Pattern- Trend Channel - uptrend and downtrend- symmetrical triangle- ascending triangle and descending triangle- bullish flag and bearish flag - bullish pennant and bearish pennant - rising wedge and falling wedge- Broadening Bottoms and Broadening Tops- Rectangle Bottoms and Rectangle TopsConcepts- Candlestick Mathematics- Rejection - market move - weak snr and strong snr- trending and ranging market- minor and major trend- adapting forex strategies to binary options turbo trading- proper rejection - invalid rejection- false breakouts - channel breakouts- reversal and retracements- highest probability trading setups- high probability techniques- market pressures and types of market pressures- upper shadow and lower wick or tail- advanced candlestick charting techniques- overbought and oversold - oscilator - RSI CCI Stochastic Oscilator- different market conditions and market conditions examples- cycle of market emotions, psychology and dynamics- trading setups without rejections as confirmation - multiple time frame trading concept, system, methology and strategy- candlestick momenting- direction of candlestick momentum- inside swing and outside swing- support and resistance - minor snr and major snr and much more concepts ... Also by the same author: BOTT Mentorship Self-Study Video Pack 1-4 BOTT Price Action Indicator BOTT Price Action Bible by BO Turbo Trader

0 notes

Text

0 notes

Text

What Is Price Action Trading And Why You Should Learn It!

Traders use a variety of chart compositions to improve their ability to recognise and understand trends, breakouts, and reversals. Technical analysis is a subset of price action because it uses historical prices in calculations that may subsequently influence trading decisions. A price action course can help you recognise these tendencies.

The fluctuation of a security's price over time is called price action. Price action underpins any technical analysis of a stock, commodity, or other asset chart. Consequently, many short-term traders base their trading choices only on price action and the patterns and trends drawn from it.

When charted over time, the up and down movement of a security's price is referred to as price action. Different appearances may be added to a chart to make price action trends visible to traders. Price activity generates technical analysis formations and chart patterns.

Moving averages, for example, are generated from price movement and projected into the future to influence trades. Candlestick charts are popular among traders because they assist to better visualising price movements by presenting the open, high, low, and close values in the context of up or down sessions.

Visually interpreted price activity can be seen in candlestick patterns such as the Harami cross, engulfing pattern, and three white soldiers. In addition, many different candlestick patterns are formed due to price activity to set up anticipation of what will happen next. These similar forms may be used in various charts, such as point and figure charts, box charts, and box plots, among others.

Price movement is not commonly seen as a trading tool, such as an indicator, but rather as the data source upon which all other instruments are based. Swing and trend traders prefer to work most closely with price movement, ignoring fundamental research favouring focusing only on support and resistance levels to forecast breakouts and consolidation.

Even these traders must pay attention to elements other than the current price. For example, the volume of trading and the periods utilised to define levels all affect the possibility of their readings being correct.

Price action interpretation is very subjective, however. When two traders analyse the same price movement, it is normal for them to reach different conclusions. For example, one trader may detect a negative downturn, while another believes that the market movement indicates a possible near-term reversal.

The critical point to remember is that trading forecasts based on market activity on any period are speculative. The more tools you can use to corroborate your trade prediction, the better. In the end, though, a security's previous price activity is no assurance of future price action.

Chart Commando is one of the few institutions that provide price action courses in Hindi and Marathi. You can learn from experts to interpret the right way and start earning money. An options buying course is also available. Visit Chart Commando now!

0 notes

Photo

[100% OFF] Candlestick Trading Ninja: 10 Hour Glossary & DIY Strategy What you Will learn ? Learn complex Candlestick Patterns for Stock Trading like Marubozu, Bearish Harami Cross & Tweezer Bottoms…

0 notes

Text

Trading the Bullish Harami Pattern

New Post has been published on https://forexsuccesstips.net/trading-the-bullish-harami-pattern/

Trading the Bullish Harami Pattern

Learn to Trade the Bullish Harami

The Bullish Harami consists of two candlesticks and hints at a bullish reversal in the market. The Bullish Harami candlestick should not be traded in isolation but instead, should be considered along with other factors to achieve Bullish Harami confirmation.

This article will cover:

What is a Bullish Harami Pattern

How to Identify a Bullish Harami on a trading chart

How to trade the Bullish Harami candlestick pattern

What is a Bullish Harami Pattern?

The Bullish Harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. It consists of a bearish candle with a large body, followed by a bullish candle with a small body enclosed within the body of the prior candle. As a sign of changing momentum, the small bullish candle ‘gaps’ up to open near the mid-range of the previous candle.

The opposite of the Bullish Harami is the Bearish Harami and is found at the top of an uptrend.

The Bullish Harami Cross

Traders will often look for the second candle in the pattern to be a Doji. The reason for this is that the Doji shows indecision in the market. The colour of the Doji candle (black, green, red) is not of too much importance because the Doji itself, appearing near the bottom of a downtrend, provides the bullish signal. The Bullish Harami Cross also provides an attractive risk to reward potential as the bullish move (once confirmed) is only just starting.

How to Identify a Bullish Harami on Trading Charts

The Bullish Harami will look different on a stock chart compared to the 24- hour forex market, but the same tactics apply to identify the pattern.

Bullish Harami Checklist:

Spot an existing downtrend

Look for signals that momentum is slowing/reversing (stochastic oscillators, bullish moving average crossover, or subsequent bullish candle formations).

Ensure that the body of the small green candle measures no more that 25% of the previous bearish candle. Stocks will gap up, showing the green candle mid-way up the previous candle. Forex charts will mostly show the two candles side by side.

Observe that the entire bullish candle is enclosed within the length of the previous bearish candle’s body.

Look for confluence with the use of supporting indicators or key levels of support.

Formation of the Bullish Harami Pattern in the Forex market

The forex market operates on a 24/5 basis which means when one candle closes, another opens at virtually the same level of the previous candle’s closing price. This is often observed under normal market conditions but can change during periods of high volatility. The Bullish Harami pattern in forex will often look something like this:

The small green candle opens at the same level that the prior bearish candle closed at. This is typically observed in the forex market.

Formation of the Bullish Harami Pattern on Stock Charts

Stocks on the other hand, have specified trading hours during the day and are known to gap at the open for many reasons. Some of those might be:

Company news released after the close of trade

Country/sector economic data

Rumoured takeover bids or mergers

General market sentiment

Therefore, the traditional Harami pattern appears, as seen below for Societe General (GLE FP) which trades on the CAC 40:

Notice how there are numerous areas on the chart where the market has gapped – showing wide open spaces between candles. This is often observed in the stock market.

How to trade the Bullish Harami Candlestick Pattern

Traders can adopt the Bullish Harami using the five-step checklist mentioned earlier in the article. Looking at the below chart on GBP/USD we can observe the following

There is a clear downtrend.

A Bullish Hammer appears before the Bullish Harami and provides the first clue that the market may be about to reverse.

The bullish candle is no more than 25% the length of the previous candle.

The bullish candle opens and closes within the length of the previous candle.

The RSI provides an indication that the market is oversold. This could mean that downward momentum is bottoming but traders should wait for the RSI to cross back over the 30 line for confirmation.

Stops can be placed below the new low and traders can enter at the open of the candle following the completion of the Bullish Harami pattern. Since the Bullish Harami appears at the start of a potential uptrend, traders can include multiple target levels to ride out a new extended uptrend. These targets can be placed at recent levels of support and resistance.

How Reliable is the Bullish Harami?

The validity of the Bullish Harami, like all other forex candlestick patterns, depends on the price action around it, indicators, where it appears in the trend, and key levels of support. Below are some of the advantages and limitations of this pattern.

Advantages

Limitations

Attractive entry levels as the pattern appears at the start of a potential uptrend

Should not be traded based on its formation alone

Can offer a more attractive risk to reward ratio when compared to the Bullish Engulfing pattern

Where the pattern occurs within the trend is crucial. Must appear at the bottom of a downtrend

Easy to identify for novice traders

Requires understanding of supporting technical analysis or indicators.

Popular: Stochastics and RSI

Further Reading on Candlestick Patterns

The Bullish Harami is just one of many candlestick patterns commonly used to trade the financial markets.

Candlesticks form an important role in the analysis of forex trading. Learn How to Read a Candlestick Chart.

If you are just starting out on your forex trading journey it is essential to understand the basics of forex trading in our New to Forex guide.

Source link Forex Trading Benefits

0 notes

Link

Bearish Harami Cross - candlestick Definition and Example What Is a Harami Cross? A harami cross is a Japanese candlestick pattern that consists of a large candlestick that moves in the direction of the trend, followed by a small doji candlestick. The doji is completely contained within the prior candlestick’s body. The harami cross pattern suggests that the previous trend may be about to reverse. The pattern can be either bullish or bearish. The bullish pattern signals a possible price reversal to the upside, while the bearish pattern signals a possible price reversal to the downside. KEY TAKEAWAYS A bullish harami cross is a large down candle followed by a doji. It occurs during a downtrend. The bullish harami cross is confirmed by a price move higher following the pattern. A bearish harami cross is a large up candle followed by a doji. It occurs during an uptrend. The bearish pattern is confirmed by a price move lower following the pattern. Understanding the Harami Cross A bullish harami cross pattern forms after a downtrend. The first candlestick is a long down candle (typically colored black or red) which indicates that the sellers are in control. The second candle, the doji, has a narrow range and opens above the previous day’s close. The doji candlestick closes near to the price it opened at. The doji must be completely contained with the real body of the previous candle. The doji shows that some indecision has entered the minds of sellers. Typically, traders don't act on the pattern unless the price follows through to the upside within the next couple of candles. This is called confirmation. Sometimes the price may pause for a few candles after the doji, and then rise or fall. A rise above the open of the first candle helps confirm that the price may be heading higher. A bearish harami cross forms after an uptrend. The first candlestick is a long up candle (typically colored white or green) which shows buyers are in control. This is followed by a doji, which shows indecision on the part of the buyers. Once again, the doji must be contained within the real body of the prior candle. If the price drops following the pattern, this confirms the pattern. If the price continues to rise following the doji, the bearish pattern is invalidated. #haramicross #bearishharami

0 notes

Link

Expert Technical Analysis & Candlestick Trading Hacks For Forex, Stock Trading, Day Trading & Swing Trading in 1 course. What you’ll learn Learn complicated Candlestick Patterns for Stock Trading like Marubozu, Bearish Harami Cross & Tweezer Bottoms Comprehending Different type of Candlestick Chart Patterns in supply trading Learn Candlestick Chart about Stock Trading Learn easy […]

0 notes

Text

5 Bearish Candlestick Patterns Every Bitcoin Trader Must Know

5 Bearish Candlestick Patterns Every Bitcoin Trader Must Know:

As discussed in a previous article on bullish candlestick patterns, trading using Japanese candlesticks is the most popular method for analyzing price action by crypto traders.

There are many patterns worth learning and understanding — some of the most essential bearish patterns are discussed below. It is important to note, once again, that context and candle placement are essential in identifying patterns.

The same exact candlestick can be bullish when located in a different place on the chart.

Bearish Harami

The Bearish Harami is a two candle pattern that signals a likely reversal in price. In this pattern, the first candle is large and green and is followed by a red candle with a smaller body.

To be valid, the second candle must be completely within the range of the body of the first candle. Another notable version of this pattern is the Bearish Harami Cross, where the second candle is a perfect doji.

In Japanese, the term “Harami” is the word for pregnant. In this pattern, the green candlestick is the “mother” and the small candlestick is the “baby.”

Dark Cloud Cover

Price action following this pattern is often as ominous as its name, Dark Cloud Cover. This is another 2 candle pattern that signals a likely bearish reversal at the top of a bullish movement. The first candle is generally large, always green, and is followed by a similar red candle.

The second candle opens with a gap up to a fresh high but closes the session more than halfway into the body of the first day’s candle. This is a signal that bears have dominated the session, pushing the price down with the intention of following through on future candles.

The Evening Star

The Evening Star is a bearish reversal pattern that appears at the top of an uptrend with a large bullish candle, followed by a gap up to a small-bodied candle and a gap down to a red candle that closes below the midpoint of the first day.

The first candlestick in the evening star must be green and have a relatively large real body. The second candlestick is the star, which has a short real body that does not touch the real body of the first candle — it is the gap between the real bodies of the two candlesticks that makes a doji or a spinning top qualify as an evening star.

This pattern is confirmed by the candlestick that follows the star, which must be a red candle that closes well into the body of the first candlestick.

In legacy markets, there must be gaps between each of the candles. However, since crypto trades 24/7 and gaps are rare, some technical analysts argue that this pattern is still valid without the gaps.

Shooting Star

Similar to the previously discussed patterns, the shooting star is a bearish reversal pattern. This two candle pattern appears during an uptrend and signals an upcoming reversal to a bearish bias.

The first candle is green, followed by a green or red candle that has a long upper wick and small body. The second candle looks like an inverted hammer, which is bullish when located at the bottom of a trend.

The long wick as an indication that bulls controlled much of the session, before losing ground to bears, who pushed the price back down to close near the daily open. This is a signal that price depreciation is likely and is confirmed when followed by a bearish candle.

Hanging Man

The Hanging Man is a single candle pattern that indicates a likely reversal from bullish price action to bearish price action. This candle has a long lower shadow and a small body and appears at the top of a trend or during an uptrend.

Once again, when this candle is at the bottom of a downtrend, it is called a hammer and signals a bullish reversal — context matters. This candle shows that sellers were able to take control during a portion of the period. It indicates that bears defended the current price and are likely to continue selling through the subsequent candle.

Get to know these candlestick patterns — they are essential to understand as a crypto trader!

The views and opinions expressed here are solely those of the author (@HorusHughes) and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

0 notes

Link

As discussed in a previous article on bullish candlestick patterns, trading using Japanese candlesticks is the most popular method for analyzing price action by crypto traders.

There are many patterns worth learning and understanding — some of the most essential bearish patterns are discussed below. It is important to note, once again, that context and candle placement are essential in identifying patterns.

The same exact candlestick can be bullish when located in a different place on the chart.

Bearish Harami

The Bearish Harami is a two candle pattern that signals a likely reversal in price. In this pattern, the first candle is large and green and is followed by a red candle with a smaller body.

To be valid, the second candle must be completely within the range of the body of the first candle. Another notable version of this pattern is the Bearish Harami Cross, where the second candle is a perfect doji.

In Japanese, the term “Harami” is the word for pregnant. In this pattern, the green candlestick is the “mother” and the small candlestick is the “baby.”

Dark Cloud Cover

Price action following this pattern is often as ominous as its name, Dark Cloud Cover. This is another 2 candle pattern that signals a likely bearish reversal at the top of a bullish movement. The first candle is generally large, always green, and is followed by a similar red candle.

The second candle opens with a gap up to a fresh high but closes the session more than halfway into the body of the first day’s candle. This is a signal that bears have dominated the session, pushing the price down with the intention of following through on future candles.

The Evening Star

The Evening Star is a bearish reversal pattern that appears at the top of an uptrend with a large bullish candle, followed by a gap up to a small-bodied candle and a gap down to a red candle that closes below the midpoint of the first day.

The first candlestick in the evening star must be green and have a relatively large real body. The second candlestick is the star, which has a short real body that does not touch the real body of the first candle — it is the gap between the real bodies of the two candlesticks that makes a doji or a spinning top qualify as an evening star.

This pattern is confirmed by the candlestick that follows the star, which must be a red candle that closes well into the body of the first candlestick.

In legacy markets, there must be gaps between each of the candles. However, since crypto trades 24/7 and gaps are rare, some technical analysts argue that this pattern is still valid without the gaps.

Shooting Star

Similar to the previously discussed patterns, the shooting star is a bearish reversal pattern. This two candle pattern appears during an uptrend and signals an upcoming reversal to a bearish bias.

The first candle is green, followed by a green or red candle that has a long upper wick and small body. The second candle looks like an inverted hammer, which is bullish when located at the bottom of a trend.

The long wick as an indication that bulls controlled much of the session, before losing ground to bears, who pushed the price back down to close near the daily open. This is a signal that price depreciation is likely and is confirmed when followed by a bearish candle.

Hanging Man

The Hanging Man is a single candle pattern that indicates a likely reversal from bullish price action to bearish price action. This candle has a long lower shadow and a small body and appears at the top of a trend or during an uptrend.

Once again, when this candle is at the bottom of a downtrend, it is called a hammer and signals a bullish reversal — context matters. This candle shows that sellers were able to take control during a portion of the period. It indicates that bears defended the current price and are likely to continue selling through the subsequent candle.

Get to know these candlestick patterns — they are essential to understand as a crypto trader!

The views and opinions expressed here are solely those of the author (@HorusHughes) and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

0 notes

Link

Profitable Stock Trading Strategies – Master Fundamental & Technical Analysis, Chart Pattern Trading & Fibonacci Trading

STOCK TRADING

Created by Saad T. Hameed (STH), Outliers EdTech

Last updated 10/2019

English

English [Auto-generated]

What you’ll learn

Learn complex Candlestick Patterns for Stock Trading like Marubozu, Bearish Harami Cross & Tweezer Bottoms

Learn complex Chart Patterns for Stock Trading like Flag & Peanut Pattern, Cartier Diamond Pattern & Others

Learn Advance Technical indicators like MACD, RSI & VIX etc which work wonders in stock market

Understand Stock Trading through Sector News & its Effects

Understanding Different kinds of Gaps in stock trading

Complete Trade Planning along with Stock Investment Tips for stock market

You will learn how Fear & Greed effect your trading & the broader Stock Market

Learn how Sector News Effects your trading

Learn concepts and Standards of technical analysis

Learn to pick trends and make successful trades

Have complete understanding and confidence when investing in the Stock Market.

Requirements

They should have a Stock Brokerage Investment Account.

Willingness to learn Stock Market

Anyone who wants to learn Technical Analysis

You commit that after the course you will do demo trading on this strategy for at-least 6 Months.

Description

*** Course access includes quizzes & homework exercises, 1-on-1 instructor support and LIFETIME access! ***

Hear why this is one of the TOP-NOTCH Trading Course on Udemy:

I really enjoyed this course, and have learnt a great deal from it.

-Basil Beker

Very well explained the practical part .

-Samanta Rednap

This guy IS a trading Ninja! Indicators and theories are well introduced and then explained on real charts. This way, you’ll learn how to use those theories in practice. If you want to learn how to trade, this is the course for you. Thank you Saad for this great course.

-Mahyar Haghdoust

TOP-NOTCH Stock Trading Instructor:

I currently have 71 Knowledge programs with 20,520+ Minutes of Content (342 hours in total) with 112,000+ Satisfied Students enrolled. That’s 14+ days of learning material!

I am currently mentioned in “Most Popular Instructors” tab on Udemy Business/Finance Section.

Stock Market / Trading Course Details:

Learn how to trade like a Expert Stock trader!

No matter how much experience you have with the stock market, you can trust me to teach you technical analysis, and get you started on the right track!

Unfortunately, many people do not receive the key educational information and best practices that make the difference between success and failure when investing in stocks.

Stock Trading is a Specialized field and I will teach you complex Technical analysis Stuff.

This Trading Course is not a get rich scheme but a Process that acts like a candle light in a dark Cave.

This Stock Trading Course comes with a 30 day money back guarantee.

I will touch each and every Technical analysis Aspect related to trading, as Stock trading is an art.

Investing in the stock market can be mastered by anyone and for those who really learn the key concepts and best practices they will be able to reach their most challenging stock trading goals and lead the life they dream about.

Make Stock Market your darling and you will never see losses.

This course will teach you How Trading Works & How to become a stock trading expert.

Learn secrets of trading, and make profits investing today! Learn Pro Technical Analysis to Predict Stock Market.

Disclaimer Note: This Trading course is for educational and informational purposes only. Not recommending of any particular investments such as a particular stock or mutual fund.

Other Reviews:

Very good content and good explanation

-D Chandra Shekar Rao

great… a good course for those in stocks trading .

-Alesson Mayer

Who this course is for:

Learn VIX

Learn Trade Planning

Learn Gann Trendlines

Learn Gaps

Learn 52 Week High or low ways to trade.

Learn Candlestick charts

Learn Chart Patterns

Learn MACD and much More

Course is perfect for the Beginner or Newer Investor who wants to learn all the key practical aspects when investing in stocks as they will become an expert by the end of the course.

Size: 4GB

DOWNLOAD TUTORIAL

The post STOCK TRADING NINJA: DIY TRADING FOUNDATION CERTIFICATION appeared first on GetFreeCourses.Me.

0 notes

Text

Candlestick Trading Ninja: 10 Hour Candlestick Certification

Candlestick Trading Ninja: 10 Hour Candlestick Certification

Expert Technical Analysis & Candlestick Trading Hacks For Forex, Stock Trading, Day Trading & Swing Trading in 1 course. What you’ll learn

Learn complex Candlestick Patterns for Stock Trading like Marubozu, Bearish Harami Cross & Tweezer Bottoms

Understanding Different kinds of Candlestick Chart Patterns in stock trading

Learn Candlestick Chart in respect to Stock Trading

Learn…

View On WordPress

0 notes

Link

Swing Trading Ninja: Complete Swing Trading Course (12+Hour) ##realdiscount ##Udacity #12Hour #Complete #Ninja #Swing #Trading Swing Trading Ninja: Complete Swing Trading Course (12+Hour) *** Course access includes quizzes & homework exercises, 1-on-1 instructor support and LIFETIME access! *** Hear why this is one of the TOP-NOTCH Swing Trading course on Udemy: TOP-NOTCH Instructor I currently have 64 Courses with 17280+ Minutes of Content (286 hours in total) with 60,000+ Satisfied Students enrolled. That’s 11+ days of learning material! Swing Trading Course Details: Are you thinking to learn Advance skills? Do you know why Swing traders succeed where others fail? If not then this course is for you as this course not only discusses how to Swing trade but also on how to read the market along with Secrets of swing trading. My Advanced Swing Trading Ninja Strategy is the only complete course, that not only show you how to enter a trade but also how to exit and how to manage risk. Swing Trading is a Complex topic and this course focuses on strengthening your basics and gives you the ability to read the market as a price action trader. I will train you to read and correctly interpret Trends in Swing Trading. You will be able to predict which way a stock will most likely move in the near future as you will be using different complex indicators to access the market. Technical Analysis gives you a glimpse of the future, and is a must have arsenal in your tool book. The Swing trading strategy I teach in this course will provide you with a plan for entering and exiting trades with confidence. This Swing Trading course comes with guarantee that you can always apply for 100% Refund within 30 days. In this Stock Trading Course we will discuss Charts to show you how to enter and exit along with Risk management. My Complete Focus in this course is on, how to stop losses and how to let your profitable swing trade run. Swing Trading strategy Essentials: You will learn each and every single details that is necessary, to successfully swing trade. However Before diving into the strategy, I will first teach you the essential price action points, especially designed to strengthen your knowledge base. In this course, I will teach you different indicator that will help you understand the swing trading game. I will show you my own strategy which uses complex indicators that I use for all of my Buy and Sell Signals, and it's accuracy rate is very high as the strategy comes with high risk management techniques. Two of the most important lessons included in this course are how to handle a false Buy Signal to keep losses to an absolute minimum, and when to lock in profits to maximize your stock trading gains. I will teach you different (Stock Trading) Technical analysis tools like Parabolic SAR CCI Stoch RSI Not only this I will dive into Multiple Forex or Stock Trading Risk Management Techniques like Risk Tolerance Trailing Stop Order Fixed Stop Loss Discretionary Take Profit Discretionary Stop Loss - A Forex or Stock trader don't need huge capital to invest for Swing Trading. If you follow the Advanced Swing Trading Strategy then you will enter at the very beginning of of the trend, with extreme risk management. As my aim is to reduce risk and let profitable stock or forex trade run. As trading without losses will always help you to end in profit. I will not stop here, I will also increase your Forex or Stock Trading knowledge through Chart patterns Rising Wedge Chart Pattern Falling Wedge Chart Pattern Cartier Diamond Chart Pattern Flag and peanut Chart Pattern Symetrical Triangle Chart Pattern Again I will not stop here, but will also discuss Simple and Complex Candlestick patterns for Forex or stock trading like Marubozu Spinning Top 3 White Soldier Bullish Harami Cross Doji I will also discuss odd but effective Swing trading tools that no other course discusses Gann Fan Check Short Sale Metrics Sources of short interest data Irving Fisher Debt Deflation Theory This Swing Trading course comes with guarantee that you can always apply for 100% Refund within 30 days. Who this course is for: Forex and Stock market Swing traders. Traders, who needs a Profitable & Complete Swing Trading Strategy Traders, Who wants to master Swing Trading. Traders, who wants to strengthen their trading skills through world's most powerful price action based Swing trading strategy. Swing Traders, who wants to improve their skills on technical analysis Swing Traders, who wants to earn consistent profit from the market by turning their losing years into winning swing trading years by catching forex or Stock market trend. Swing Traders, who wants to maximize their winning trades by following the Advanced Swing Trading Strategy. 👉 Activate Udemy Coupon 👈 Free Tutorials Udemy Review Real Discount Udemy Free Courses Udemy Coupon Udemy Francais Coupon Udemy gratuit Coursera and Edx ELearningFree Course Free Online Training Udemy Udemy Free Coupons Udemy Free Discount Coupons Udemy Online Course Udemy Online Training 100% FREE Udemy Discount Coupons https://www.couponudemy.com/blog/swing-trading-ninja-complete-swing-trading-course-12hour/

0 notes

Text

PHP Daytrader's Candlestick Pattern Hunter v1.0 (News Tickers)

WHAT IS THE PHP DAYTRADER’S CANDLESTICK PATTERN HUNTER SCRIPT? The PHP Daytrader’s Candlestick Pattern script is a “powerful” PHP / jQuery / Javascript script takes a FREE near-real time stock quote feed (from Tradier.com) to build a “live” full featured highstock combination chart (see Highsoft) that shows a stock’s “price action” in a reponsive webpage that can be monitor in a desktop, laptop, tablet or mobile computer/phone. Candlesticks are generated every minute (5 or 15 mins – delayed quotes) for any stock in the NYSE, Nasdaq and any others found in the following list of exchanges (click here for all the exchanges Tradier.com supports). In addition to displaying a stock’s price action, this script also hunts for the most common candlestick patterns and flags them in the chart, for daytraders to use to forecast behavior (bullish, bearish, neutral) of all the stock’s in their portfolio. This script is configurable so that daytraders can also define their very own patterns to monitor for also! WHAT ARE CANDLESTICK CHARTS AND PATTERNS? The candlestick techniques stock daytraders use today originated in the style of technical charting used by the Japanese for over 100 years before the West developed the bar and point-and-figure analysis systems. In the 1700s, a Japanese man named Homma, a trader in the futures market, discovered that, although there was a link between price and the supply and demand of rice, the markets were strongly influenced by the emotions of traders. He understood that when emotions played into the equation, a vast difference between the value and the price of rice occurred. This difference between the value and the price is as applicable to stocks today as it was to rice in Japan centuries ago. The principles established by Homma are the basis for the candlestick chart analysis, which is used to measure market emotions surrounding a stock. <tbody> Compared to traditional bar charts, many traders consider candlestick charts more visually appealing and easier to interpret. Each candlestick provides an easy-to-decipher picture of price action. Immediately a trader can compare the relationship between the open and close as well as the high and low. The relationship between the open and close is considered vital information and forms the essence of candlesticks. </tbody> Green (bullish) candlesticks, where the close is greater than the open, indicate buying pressure. Red (bearish) candlesticks, where the close is less than the open, indicate selling pressure. Candlestick patterns are a series of consecutive candlesticks that can be used to forecast future behavior of a stock – uptrend, downtrend, reversal, breakaways, consolidations, etc. See next section for more details. WHICH PATTERNS WILL THIS SCRIPT HUNT FOR “OUT OF THE BOX”? This script hunts for known candlestick patterns that are used by traders to predict the behavior of the stock. The following is the list of these patterns: <tbody> DOJI (neutral) – Dojis form when a security’s open and close are virtually equal. The length of the upper and lower shadows can vary, and the resulting candlestick looks like, either, a cross, inverted cross, or plus sign. Doji convey a sense of indecision or tug-of-war between buyers and sellers. Prices move above and below the opening level during the session, but close at or near the opening level. DRAGONFLY DOJI (bullish) – A Doji where the open and close price are at the high of the day. Like other Doji patterns, this one normally appears at market turning points. GRAVESTONE DOJI (bearish) – A doji line that develops when the Doji is at, or very near, the low of the day.. HAMMER (bullish) – A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above opening price. This pattern forms a hammer-shaped candlestick, in which the body is at least half the size of the tail or wick. It’s is to referred to as a hammer, when this pattern occurs after a downtrend and a hanging man after a uptrend. GRAVESTONE DOJI (bearish) – A doji line that develops when the Doji is at, or very near, the low of the day.. HANGING MAN (bearish) – A hanging man is a bearish candlestick pattern that forms at the end of an uptrend. It is created when there is a significant sell-off near the market open, but buyers are able to push this stock back up so that it closes near (but below) the opening price. Generally, the large sell-off is seen as an early indication that the bulls (buyers) are losing control and demand for the asset is waning. PIERCING PATTERN (bullish) – A technical trading signal that is marked by a closing down day with a good-sized trading range, followed by a trading gap (drop) lower the following day that covers at least half of the upward length of the previous day’s real body (the range between the opening and closing prices), and then closes up for the day. A piercing pattern often signals the end of a small to moderate downward trend. DARK CLOUD (bearish) – A technical trading signal that is marked by a closing up day with a good-sized trading range, followed by a trading gap (rise) higher the following day that covers at least half of the downward length of the previous day’s real body (the range between the opening and closing prices), and then closes down for the day. A piercing pattern often signals the end of a small to moderate upward trend. BEARISH HARAMI (bearish) – A bearish Harami is a trend indicated by a large green candlestick followed by a much smaller red candlestick with a that body is located within the vertical range of the larger geen candle body. Such a pattern is an indication that the previous upward trend is coming to an end. BULLISH HARAMI (bullish) – A bullish Harami is a trend indicated by a large red candlestick followed by a much smaller green candlestick with a that body is located within the vertical range of the larger red candle body. Such a pattern is an indication that the previous downward trend is coming to an end. BULLISH ENGULFING (bullish) – A bullish engulfing pattern is a chart pattern that forms when a small red candlestick is followed by a large green candlestick that completely eclipses or engulfs the previous candlestick. The shadows or tails of the small candlestick are short, which enables the body of the large candlestick to cover the entire candlestick from the previous cycle. Such a pattern is an indication that the previous downward trend is coming to an end. BEARISH ENGULFING (bullish) – A bearish engulfing pattern is a chart pattern that forms when a small green candlestick is followed by a large red candlestick that completely eclipses or engulfs the previous candlestick. The shadows or tails of the small candlestick are short, which enables the body of the large candlestick to cover the entire candlestick from the previous cycle. Such a pattern is an indication that the previous downward trend is coming to an end. INVERTED HAMMER (bullish) – A doji line that develops when the Doji is at, or very near, the low of the day.A doji line that develops when the Doji is at, or very near, the low of the day.A doji line that develops when the Doji is at, or very near, the low of the day. A doji line that develops when the Doji is at, or very near, the low of the day. When this pattern occurs during a downtrend, it is refered to as an inverted hammer, a bullish signal. SHOOTING STAR – A doji line that develops when the Doji is at, or very near, the low of the day.A doji line that develops when the Doji is at, or very near, the low of the day.A doji line that develops when the Doji is at, or very near, the low of the day. A doji line that develops when the Doji is at, or very near, the low of the day. When this pattern occurs during a downtrend, it is refered to as an shooting star, a bearish signal. MORNING STAR (bullish) – A morning star is a bearish candlestick pattern consisting of three candles that have demonstrated the following characteristics: the first bar is a large red candlestick located within an downtrend; the middle bar is a small-bodied green candle, that closes below the first red bar; and, the last bar is a large green candle that opens below the middle candle and closes near the center of the first bar’s body. This pattern is used by traders as an early indication the downtrend is about to reverse. EVENING STAR (bearish) – An evening star is a bearish candlestick pattern consisting of three candles that have demonstrated the following characteristics: the first bar is a large green candlestick located within an uptrend; the middle bar is a small-bodied red candle, that closes above the first green bar; and, the last bar is a large red candle that opens below the middle candle and closes near the center of the first bar’s body. This pattern is used by traders as an early indication the uptrend is about to reverse. BULLISH KICKER (bullish) – A two-bar candlestick pattern that is used to predict a change in the direction of the trend for an asset’s price. This pattern is characterized by a very sharp reversal in price over the span of two candlesticks; traders use it to determine which group of market participants is in control of the direction. The bullish version is a two pattern from red to green. BEARISH KICKER (bearish) – A two-bar candlestick pattern that is used to predict a change in the direction of the trend for an asset’s price. This pattern is characterized by a very sharp reversal in price over the span of two candlesticks; traders use it to determine which group of market participants is in control of the direction. The bearish version is a two pattern from green to red. </tbody> HOW DO YOU SET UP YOUR OWN PATTERNS? The “real power” of this script is that it allows the seasoned daytrader to create their own custom candlestick patterns that this script then hunts for (in near real time from any desktop, laptop, tablet or mobile computer/phone). To define a custom pattern, simply edit the file called config.php found in the php folder off the root (/php/config.php). In this file you will find the array ”$patternSettings” that contains the “out of the box” patterns this script searches for. See the previous section for the list. To add your own pattern, simply add to this array. The properties of each array object are pretty self explanatory. The last 15 candlesticks on your chart are objects you can reference in an “if condition” (see “eval” property below) that defines your custom pattern. $value is the object of the most recent candlestick created, $valueMinus1 is the previous candlestick, $valueMinus2 is the one before that and so on until $valueMinus15. The open, high, low, close values are just properties in the object (e.g. $value->open, $valueMinus1->close, $valueMinus15->high…). For example, see below the definition for the bullish harami pattern: array( “ID”=>”blHaram”, “eval” => “return ($valueMinus2->open > $valueMinus2->close && $valueMinus1->open > $valueMinus1->close && $valueMinus1->open > $value->close && $value->close > $value->open && $valueMinus1->close < $value->open);”, “title” => “BH”, “description” => “Bullish Harami”, “color” => ”#7dd0b6”, “text” => ‘<table style=’clear:both;height:113px;width:400px;’><tr><td style=’height:113px;width:70%;’>BULLISH HARAMI (bullish) – A bullish Harami is a trend indicated by a large red candlestick followed by a much smaller green candlestick with a that body is located within the vertical range of the larger red candle body. Such a pattern is an indication that the previous downward trend is coming to an end.<img src=’http://candlestickhunter.dataninja.biz/img/pattern-bullishharami.png'></td></tr></table>' ), NARRATIVE DESCRIPTION: Here is a narrative description of the definition above. First look at the rule in “eval” property. It says look at the two previous candlesticks ($valueMinus1 and $valueMinus2) and make sure they are in a downtrend (e.g. their close values are less than their opens). Then look at the current candle’s ($value) close and make sure it is less than the previous candle’s ($valueMinus1) open and finally make sure current candle’s open is greater than previous one’s close. The rest of the properties are pretty self explanatory: ID – unique ID for the pattern eval – (we just taled about above) title – letters that appear in the flag description – friendly description of the pattern color – color of the flag text – html of what appears in the “hover” bubble for the patterns flag HOW TO USE THE SCRIPT To install/run the script, unzip the contents of the purchased zip file into the root folder of your domain/subdomain and then enter URL in a browser(e.g. http://stocktracker.dataninja.biz or http://yourdomain.com or http://yoursubdomain.yourdomain.com, etc) Enter the ticker symbols of the stocks you want to track. They can be from the following list of exchanges – (click here for all the exchanges Tradier.com supports) Select the candlestick patterns you would like this script to hunt for. This is based on the patterns defined in /php/config.php file. (See instructions on defining patterns in previous section) Select the interval duration of your candstick (e.g. 1 minute, 5 minute or 15 minute) Select the type of moving average you want displayed on your chart (e.g. SMA – simple moving average, EMA – exponential moving average, etc) They can be from the following list (click here for all the exchanges alphavantage.co supports). Moving averages are used by daytraders to determine support and resistance levels of stocks. Graphing this value is included in this script (see orange lines) Select the moving average period to use for orange line (e.g. 10 day average, 15 day average, 30 or 60 or 90 or 120 day averages) WHAT ARE THE SCRIPT’S KEY FEATURES? FEATURES – see blue squares above This script’s main panel is a combination highstock chart (see highsoft.com) that is fed “near realtime” from two FREE stock quote API calls. Realtime and historical stock price information comes from a service called Tradier (see tradier.com and the technical anlaysis (moving averages, etc) comes from a service called Alpha Vantage (see alphavantage.co). The combination chart displays stock quote area line graph on top pane, a candlestick chart in the main pane, volume chart in the third from top pane and then range finder for the entire chart in the bottom pane. (the foundation can be found in the following Highstock demo page – click here) Real time 1 minute, 5 minute and 15 minute candlesticks, generated as trading day progresses. Candlesticks that follow defined pattern are hunted for and identified by these circular flags. Gray flag means neutral behavior (e.g. doji’s), green flag means bullish behavior (e.g. bullish engulfing, etc), red flag means bearish behavior (e.g. bearish engulfing) Mouseover (hover) over a flag and popup (tooltip) description of the pattern found is displayed. Technical indicator line charts (see orange line – e.g. simple moving average, exponential moving average) are overlayed on top of price and candlestick charts, to help with identifying ssupport and resistance levels. Real time stock price quote in a area line chart Real time stock volume in a column chart Highstock range selector to zoom in and out of chart’s date ranges Highstock range panning. For desktop/laptop, use shift+leftmouse and drag to pan. For tablet/mobile device, use two finger swipe. More zooming – toggle to zoom in by highlighting area to zoom into. OHLC (open, high low, close) quote every 5 seconds Countdown to when next candlestick will get generated Repsonsive nav bar to navigate to different stocks’ charts Top menu icons for liding panels – settings, stock quote detail, candlestick realtime data, pattern flags sorted by counts <tbody> FUTURE IMPROVEMENTS – FROM THE NINJA I would like this to be the beginning of a series of visualization tools for day traders. With all the amazing backend stock investing related web services available today, it would be great to move the needle in the types of tools available for the independent daytrader. </tbody> This would include establishing a community (like open source in software) where fellow traders can help each other be successful. Daytrading is small enough that it does not need to be zero sum game. e.g. everyone can win. From technical standpoint, I would like to see any functionality found in these scripts (especially real time feeds) incorporated into my popuplar dashboard scripts. -Data Ninja AUTHOR’S NOTE ON SCRIPT: see blog post – Author’s Note: PHP Daytrader’s Candlestick Hunter REMINDER ON EXTENDED LICENSES: Just a friendly reminder that there are two different license levels at codecanyon.net. The regular license is for single FREE user use. If you have multiple clients or charging clients for functionality from this script, then an extended license is the appropriate level. It’s only fair as I do spend a lot of time tuning these scripts. And more sales/revenues means I can code more features and it has come to my attention that many purchasers are using my script for commercial (for pay) purposes with just the regular license. Thanks for you support. Click for more details – Regular vs. Extended License Comparison NOTE ON INSTALLATION Purchase script from codecanyon.net Unzip contents on the ROOT folder of your domain or subdomain. DO NOT TRY TO RUN FROM A FOLDER IN YOUR DOMAIN. WILL NOT WORK Sign up for API key from alphavantage.co and enter in the /php/config.php file Sign up for access token from developer.tradier.com and enter in the /php/config.php file Sign up for an appropriate highsoft license for your project (note this script uses a hosted version of the highstock plug in. No installation necessary for highsoft plug in) This script includes 100% of source code. You can customize to integrate into your software/web application. Please see REMINDER ON EXTENDED LICENSES to make sure you a purchasing the correct license level. SYSTEM REQUIREMENTS Any browser that supports HTML5/Javascript, jQuery (2.1.4). Tested with Chrome Version 49.0.2623.110 (64-bit), Safari Version 5.1.7 (7534.57.2), Internet Explorer 11.0.9600.18230, Firefox 5.0.2 A PHP/MySQL supported webserver is required for jsfiddle features (preview, share, save) and render script options #3 and #4 – click here for phpinfo for PHP/MySQL versions and configuration options of the server serving up the demo. IMPORTANT: make sure to compare with phpinfo of your installation. Many PHP/MySQL errors stem from configuration options of customer php server instances. This script uses hosted libraries for Highsoft (code.highcharts.com, etc) and no installation required. It does require you to procure the appropriate Highsoft (Highcharts, Highmaps, Highstock) license based on your use. Click here for details. See ‘Note on installation’ to install this script on your server. VERSION HISTORY – PHP Daytrader’s Candlestick Hunter VERSION 1.0 (9/4/2017) – Initial launch version This script’s main panel is a combination highstock chart (see highsoft.com) that is fed “near realtime” from two FREE stock quote API calls. Realtime and historical stock price information comes from a service called Tradier (see tradier.com and the technical anlaysis (moving averages, etc) comes from a service called Alpha Vantage (see alphavantage.co). The combination chart displays stock quote area line graph on top pane, a candlestick chart in the main pane, volume chart in the third from top pane and then range finder for the entire chart in the bottom pane. (the foundation can be found in the following Highstock demo page – click here) Real time 1 minute, 5 minute and 15 minute candlesticks, generated as trading day progresses. Candlesticks that follow defined pattern are hunted for and identified by these circular flags. Gray flag means neutral behavior (e.g. doji’s), green flag means bullish behavior (e.g. bullish engulfing, etc), red flag means bearish behavior (e.g. bearish engulfing) Mouseover (hover) over a flag and popup (tooltip) description of the pattern found is displayed. Technical indicator line charts (see orange line – e.g. simple moving average, exponential moving average) are overlayed on top of price and candlestick charts, to help with identifying ssupport and resistance levels. Real time stock price quote in a area line chart Real time stock volume in a column chart Highstock range selector to zoom in and out of chart’s date ranges Highstock range panning. For desktop/laptop, use shift+leftmouse and drag to pan. For tablet/mobile device, use two finger swipe. More zooming – toggle to zoom in by highlighting area to zoom into. OHLC (open, high low, close) quote every 5 seconds Countdown to when next candlestick will get generated Repsonsive nav bar to navigate to different stocks’ charts Top menu icons for liding panels – settings, stock quote detail, candlestick realtime data, pattern flags sorted by counts My Other Scripts at Codecanyon: - (BRAND NEW!!!) PHP Uber-style GeoTracker- PHP Dashboard v4.0 Collaborative Social Dashboards- PHP Dashboard v2.7 – Responsive Carousels/D3js/Highcharts/Highmaps/MySQL- PHP Dashboard v3.0 – For Mobile Devices- HTML5 Cloud Dashboard Designer- HTML5 Streetmaps- PHP Streetmaps About Author – Data Ninja at Codecanyon.net Data Ninja Portfolio at Codecanyon.net Data Ninja’s Wordpress blog Data Ninja’s Youtube Video Channel Data Ninja’s Email:: [email protected] OTHER LINKS

0 notes