#Bullish reversal candlestick patterns

Explore tagged Tumblr posts

Text

How to Trade the Harami Cross (Bullish) Pattern: A Complete Guide

The Harami Cross (Bullish) pattern is a powerful and reliable candlestick formation in technical analysis that signals a potential reversal from a downtrend to an uptrend. Understanding how to identify and trade this pattern can give traders an edge in timing entry points and managing risk effectively. In this post, we’ll break down the Harami Cross (Bullish) pattern, explain its significance,…

#Best bullish reversal patterns#Best strategy for trading bullish Harami Cross in stock market#Bullish candlestick pattern strategy#Bullish Harami Cross strategy#Bullish Harami trading strategy#bullish momentum shift#Bullish reversal candlestick patterns#candlestick chart reversal signals#Candlestick patterns for beginners#Doji candlestick meaning#Harami Cross Bullish Pattern#Harami Cross candlestick pattern#Harami Cross chart example#Harami Cross confirmation signal#Harami Cross pattern entry and exit points#Harami Cross strategy for beginners in technical analysis#Harami Cross technical analysis#Harami Cross trading setup with confirmation#Harami Cross vs Bullish Harami#Harami Cross with volume confirmation strategy#How to identify and trade the Harami Cross candlestick pattern#How to identify Harami Cross#How to trade Harami Cross#How to use RSI with bullish Harami Cross#Japanese candlestick patterns#learn technical analysis#Price action trading strategy#Profitable candlestick patterns for swing traders#reliable candlestick signals#Step-by-step guide to bullish Harami Cross pattern

0 notes

Text

10 Candlestick Patterns for Effective Trading

Candlestick patterns are a powerful tool for traders to analyze price movements and predict future market behavior. Developed in Japan over 300 years ago, these patterns are widely used in modern technical analysis. This article will explore ten essential candlestick patterns that can help traders make informed decisions and enhance their trading strategies. What are Candlestick…

#Bearish Patterns#Bullish Patterns#Candlestick Patterns#Downtrend#Entry and Exit Points#Forex#Forex Traders#Forex Trading#Market Reversal#Price Movements#Risk Management#Stop-Loss#Take-Profit#Technical Analysis#Trading Psychology#Trading Strategies#Trading Strategy#Trend Direction#Trend Identification#Uptrend

1 note

·

View note

Text

#risk management#market capitalization#india#bullish reversal#market trends#chart pattern#candlestick pattern

0 notes

Text

Unlock the Secrets of Trading with Top Chart Patterns! Explore the world of chart patterns with Funded Traders Global. From understanding the basics of technical analysis to recognizing common chart patterns like head and shoulders, double tops, and flags, our blog equips you with the knowledge to enhance your trading skills. Discover advanced patterns like pennants, wedges, and harmonic patterns, and gain practical tips for effective trading. Improve your risk management, pinpoint entry and exit points, and combine chart patterns with technical indicators. Start your journey towards trading success today with Funded Traders Global!

#Advanced Chart Pattern#and Descending Triangles#and mini trading#Ascending#Basics of Technical Analysis#Benefits of Recognizing in Chart Pattern#Bullish and Bearish Flags Pattern#candlestick#candlestick Pattern#career in forex trading#chart patterns#classic reversal pattern#common chart patterns#cup and handle pattern#Double top and double bottom patterns#drawdown#financial markets#Forex trading financial freedom#FTG#ftg prop firm#ftg trading#Funded Traders Global#Gaps#Harmonic Patterns#Head and Shoulders Pattern#how to scale into a forex trade#Macro#Master the Market with These Top Chart Patterns for Trading#mastering Forex trading#micro

0 notes

Link

#CandlestickAnalysis#candlestickpatterns#chartpatterns#ForexTrading#markettrends#MomentumTrading#priceaction#ReversalPatterns#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendContinuation

2 notes

·

View notes

Text

Hammer Candlestick: Make Reversal Opportunities

In the world of technical analysis, identifying potential market reversals is important for traders seeking to maximize their profits and minimize their losses. One of the most reliable patterns for spotting these reversals is candlestick patterns, especially hammer candlestick

What Is a Hammer Candlestick?

A hammer candlestick pattern is a specific type of candlestick pattern used in technical analysis to indicate a potential reversal in a downtrend. It appears at the bottom of a downward trend and is characterized by a small body at the upper end of the trading range with a long lower shadow. The length of the lower shadow is at least twice the length of the body. This pattern suggests that despite the sellers pushing prices down significantly during the trading period, strong buying pressure drove the prices back up near the opening price by the end of the period, indicating a possible reversal to the upside.

Types of Hammer Candlestick

Hammer Candlestick The hammer candlestick pattern appears at the bottom of a downtrend and is characterized by a small body with a long lower shadow and little to no upper shadow. The lower shadow should be at least twice the length of the body.

Inverted Hammer Candlestick The inverted hammer candlestick pattern also appears at the bottom of a downtrend but is characterized by a small body with a long upper shadow and little to no lower shadow. The upper shadow should be at least twice the length of the body.

Limitations of Hammer Candlestick

Confirmation Required: A hammer candlestick alone does not guarantee a trend reversal. Subsequent bullish price action is needed to validate it.

No Price Target: The pattern does not provide a specific price target for the potential reversal, requiring other tools for determining exit points.

Context-Dependent: The hammer pattern is most reliable at the bottom of a downtrend and may not be valid in other market conditions.

False Signals: In highly volatile markets, hammer patterns can occur frequently without indicating a true reversal.

Additional Indicators Needs: It will be more effective with other technical analysis tools, rather than relying solely on the hammer candlestick.

Learn more: https://finxpdx.com/hammer-candlestick-how-to-spot-reversal-opportunities/

5 notes

·

View notes

Text

Bitcoin, the leading cryptocurrency, has recently faced a significant downturn, trading around $56,697.32. Despite this bearish phase, there are signs of a potential rebound. The Relative Strength Index (RSI) stands at 28.41, indicating oversold conditions typically seen as buying opportunities. Candlestick patterns with long lower shadows suggest buying pressure at lower levels, hinting at a price reversal.

Influential analyst CryptoJack is optimistic, predicting Bitcoin will surpass $100,000 despite the current downturn. He believes Bitcoin is near its bottom, aligning with technical indicators suggesting an oversold market.

Market data from CoinMarketCap shows Bitcoin’s market cap at $1.12 trillion, a 2.63% increase in one day, while the 24-hour trading volume has decreased by 38.03% to $31.91 billion, indicating consolidation. Traders are cautious, but the oversold RSI and bullish patterns support the possibility of a rebound. Watching for signs of reversal could signal the start of a recovery phase.

4 notes

·

View notes

Text

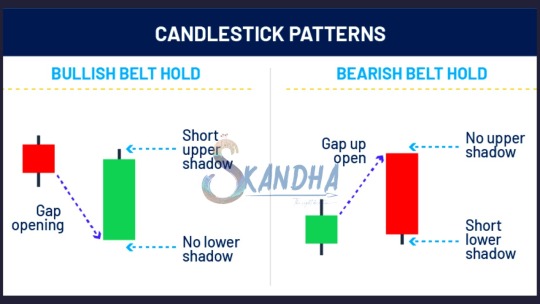

A belt hold pattern suggests that a trend may be reversing and indicates investor sentiment may have changed. When looking at them historically, there will often be a clear trend in one direction, followed by a clear trend in the other direction as the color of the candlestick changes.

There are two types of belt hold candlestick: one bullish and one bearish.

#skandhatrade #belthold #support #resistance #stock #chart #Trade #signal #patterns

#trend #Technicals #analysis #strategies #candlestick #priceaction #entry #supply #demand

To Learn More DM us

We Offer Paid Courses And Training Contact us Via

Email : [email protected]

https://forms.gle/8rWzz1gUuerxwVM49

Website: https://skandhatrade.com/

To Register for Learning:

2 notes

·

View notes

Text

Inverted Hammer Pattern Explained: Spot Market Reversals Like a Pro

Are you spotting the right reversal signals in the market?

Understanding candlestick patterns can provide a critical edge in trading, especially when it comes to identifying potential trend reversals. One such pattern is the Inverted Hammer—a powerful single-candle formation that often signals a possible shift from bearish to bullish momentum. However, recognizing it isn’t enough. Traders must understand the psychology behind the candle, its context within a trend, and how to confirm its validity with other indicators.

In our latest article, we break down the Inverted Hammer Pattern in detail: how to spot it, what it really means, and how to use it effectively in your trading strategy.

Start making smarter trading decisions today.

Read the full guide here:

#CandlestickPatterns#TradingForBeginners#InvertedHammer#StockMarket#TechnicalAnalysis#PriceAction#SmartTrading

0 notes

Text

How to read candlestick charts and patterns for better trades?

Candlestick charts are a powerful tool for making better trading decisions. Each candle shows the open, high, low, and close price for a specific time frame. Patterns like Doji, Hammer, Engulfing, and Shooting Star can signal potential reversals or trend continuations.

To read them effectively:

Look for pattern confirmation with volume.

Understand bullish vs. bearish signals.

Combine candlestick analysis with support and resistance levels or indicators like RSI.

Learning to read these patterns takes practice and guided learning. At Empirical Academy, we offer hands-on training in technical analysis, including live candlestick chart reading.

📚 Learn to trade with clarity and confidence. 👉 Enroll now: https://www.empiricalacademy.net

0 notes

Text

Mastering Indian Stock Market Trading & Investing: Technical Analysis for Smart Decisions

If you've ever found yourself staring at stock charts, wondering what those zigzag lines really mean or how seasoned traders predict market moves so accurately—it’s time to dive deep into the fascinating world of technical analysis.

Whether you're a beginner aiming to make your first trade or a budding investor who wants to understand market trends better, technical analysis is your gateway to reading the stock market like a pro. It’s not magic. It’s strategy—and with the right mindset, tools, and a bit of practice, anyone can learn it.

In this guide, we’ll explore what technical analysis is, how it's used in Indian stock market trading, and why mastering it can be a game-changer for your financial future.

What is Technical Analysis, Really?

At its core, technical analysis is about analyzing price movements and patterns. Instead of focusing on a company’s balance sheet or profits (which is fundamental analysis), technical analysis zooms in on stock charts, volume trends, support/resistance levels, and indicators like RSI, MACD, and moving averages.

Here’s the idea: history often repeats itself in the markets. Traders believe that past price movements can provide clues about future behavior.

But don’t worry—it’s not about memorizing hundreds of formulas. It’s about recognizing patterns, understanding market psychology, and using tools that are available to everyone.

Why is Technical Analysis Crucial in Indian Stock Market Trading?

India’s stock market, with major exchanges like NSE and BSE, is vibrant, fast-moving, and full of opportunities. With retail participation increasing and more young investors entering the scene, understanding technical analysis is not just a skill—it’s a competitive edge.

Here's why it matters:

📈 Volatility is Opportunity: Indian stocks often experience sharp movements. Technical analysis helps you time entries and exits better.

🔍 Helps Filter the Noise: News, opinions, and rumors? Technical charts let the price action speak for itself.

🕒 Perfect for Short-term & Swing Trading: Want to catch trends that last a few days or weeks? TA is your best friend.

💼 Complements Long-Term Investing: Even if you’re a long-term investor, knowing when to buy a fundamentally strong stock can greatly enhance returns.

Core Principles of Technical Analysis

To make smart decisions, you need a few essentials in your toolkit. Let’s break them down.

1. Price Discounts Everything

This is the first rule of technical analysis. Every known factor—earnings, news, expectations—is already reflected in the price.

2. Trends are Key

Markets move in trends: upward (bullish), downward (bearish), or sideways. Identifying the trend early can give you a head start.

3. History Tends to Repeat Itself

Humans drive the markets. Emotions like fear and greed lead to recurring price patterns.

Must-Know Tools and Indicators for Beginners

Learning technical analysis doesn’t mean staring blankly at complex graphs. Start with these basic tools:

🟢 Moving Averages (MA)

They smoothen price data to help you identify the trend. A simple 50-day and 200-day MA combo can reveal bullish or bearish signals.

🟣 Relative Strength Index (RSI)

A momentum indicator that tells you if a stock is overbought or oversold. It works on a scale of 0-100. Typically, above 70 means overbought; below 30 means oversold.

🔵 MACD (Moving Average Convergence Divergence)

Used to catch trend reversals. It gives crossover signals that many day traders live by.

🟡 Support and Resistance

Support is a level where buyers enter; resistance is where sellers dominate. Price tends to bounce between these zones.

🔴 Candlestick Patterns

Japanese candlesticks offer visual insights into market psychology. Patterns like Doji, Hammer, and Engulfing tell a story of potential reversals.

A Real-World Example: Let’s Analyze a Stock

Let’s say you’re looking at Infosys. You open the daily chart and notice:

The RSI is around 80 ➜ The stock might be overbought.

It’s near a resistance level it couldn’t cross twice before.

A bearish engulfing candle forms.

This is a potential short signal.

On the flip side, if the stock is near its 200-day MA, RSI is around 35, and a hammer pattern appears near support—you might consider buying.

The beauty of technical analysis? These setups repeat over time.

Day Trading vs Swing Trading vs Investing: How Does TA Fit?

✅ Day Trading

Entry and exit in the same day.

Requires strict discipline and quick decision-making.

TA is essential—especially 5-min, 15-min, hourly charts.

✅ Swing Trading

Positions held for days or weeks.

Based on short-to-medium-term trends.

Ideal for working professionals.

✅ Investing

Long-term horizon, but TA helps in timing your entry.

For example: Buying at a support level during a correction can improve returns significantly.

How to Start Learning Technical Analysis the Smart Way?

The internet is full of content, but not all of it is structured or beginner-friendly. If you’re serious about mastering it, choose a comprehensive, beginner-to-advanced course that focuses on the Indian stock market context.

We highly recommend starting with this Indian Stock Market Trading | Investing: Technical Analysis!! course. It’s perfect for beginners, filled with practical charting tips, live examples, and Indian stock-specific case studies.

Not only will it teach you chart reading, but you’ll also learn how to:

Use charting platforms effectively

Apply 20+ indicators in real-world scenarios

Build your trading strategy

Avoid beginner mistakes

Read volume like a pro

Whether you want to trade Bank Nifty, mid-cap stocks, or explore intraday and positional strategies, this course brings clarity and depth in a step-by-step format.

Common Mistakes New Traders Make (and How to Avoid Them)

Many new traders jump in with high hopes and little prep. Here’s how not to fall into the same traps:

❌ Trading Without a Plan: Always have entry, stop-loss, and target.

❌ Overusing Indicators: More isn’t better. Stick to 2–3 that suit your style.

❌ Ignoring Risk Management: Never risk more than 1–2% of your capital on a single trade.

❌ Letting Emotions Rule: Fear and greed are your biggest enemies.

Consistency comes from mindset, not just methods.

Building Your Trading System with Technical Analysis

Once you get the basics, build your own trading system—a repeatable strategy that aligns with your risk appetite.

Ask yourself:

What’s my trading style? (Scalping, Intraday, Positional)

What’s my entry signal? (Crossover, pattern, breakout)

What’s my stop-loss logic? (Fixed %, below support)

What are my exit rules? (Trailing stop, fixed reward ratio)

Test your system. Backtest it. Paper trade. And once it works—scale it.

Is Technical Analysis Foolproof?

No system is perfect. Technical analysis gives probabilities, not certainties. But when used correctly, it dramatically tilts the odds in your favor.

It's not about predicting the future. It's about reading the present clearly enough to make informed decisions.

That’s the edge that sets apart successful traders from the rest.

Final Thoughts: Why Now is the Best Time to Learn Technical Analysis

With rising retail participation in India’s stock market and easy access to free and paid charting tools, this is the perfect time to learn technical analysis.

Whether you're doing it to:

Create a side income,

Manage your investments better,

Or someday trade full-time,

Mastering technical analysis opens a whole new dimension in your financial journey.

And the best part? You don’t need a finance degree or fancy tools—just curiosity, a good course, and a willingness to learn.

Start your journey with confidence. Explore the Indian Stock Market Trading | Investing: Technical Analysis!! course today and take your first step toward smarter investing.

0 notes

Text

PCR Ratio vs Other Indicators: Why It Matters in Options Trading

In the world of trading and investing, understanding market sentiment can be just as important as analyzing technical charts or financial statements. One powerful tool traders use for this is the Put Call Ratio, often abbreviated as the PCR Ratio. This indicator plays a crucial role in options trading and can provide insights into potential market direction.

Understanding the Basics of PCR Ratio

The Put Call Ratio is a simple yet effective tool that compares the trading volume of put options to call options. The formula is:

PCR Ratio = Volume of Put Options / Volume of Call Options

This ratio is used to gauge the mood of the market participants—whether they are leaning bearish (put-heavy) or bullish (call-heavy).

A PCR Ratio greater than 1 implies that more puts are being traded than calls, often signaling bearish sentiment.

A PCR Ratio less than 1 indicates that more calls are being bought, typically suggesting bullish sentiment.

A PCR Ratio close to 1 signals a balanced market.

Why the Put Call Ratio Matters

The Put Call Ratio is not just a number. It reflects investor psychology. Many professional traders consider it a contrarian indicator, meaning if the PCR is too high, it might actually signal a potential bullish reversal, as the market may be oversold. On the flip side, a very low PCR could hint that investors are overly optimistic, which could lead to a correction.

How to Interpret PCR Ratio in Real-Time

Let’s say the PCR Ratio is 1.3. This means the number of put options traded is 30% higher than call options. At first glance, it might look like investors are pessimistic. However, if this high ratio is unusual compared to historical averages, traders may interpret this as an opportunity to go long, expecting a rebound.

Conversely, a PCR Ratio of 0.6 might indicate overconfidence in the market. Too many calls could signal a saturated bullish sentiment, suggesting a possible market top.

Use Cases of PCR Ratio in Options Trading

Swing Trading: Traders use changes in the PCR Ratio to identify short-term reversals.

Trend Confirmation: A rising market with a falling PCR could confirm a strong bullish trend.

Risk Management: PCR helps in gauging market mood and planning entry/exit points more precisely.

Nifty or Index Tracking: The Nifty PCR Ratio is often used by institutional traders to forecast index movements.

Limitations of PCR Ratio

While the Put Call Ratio is a powerful tool, it should not be used in isolation. It's best combined with other indicators like RSI, MACD, or candlestick patterns. Additionally, PCR can vary across different sectors and timeframes, so it's important to contextualize its values.

Also, a spike in the PCR Ratio doesn’t always mean the market will move up. If the increase in puts is due to hedging by institutions, it might not be a bearish signal at all.

Final Thoughts

The PCR Ratio is one of the most useful sentiment indicators in options trading. Whether you're a beginner or an experienced trader, incorporating the Put Call Ratio into your trading strategy can offer valuable insights. But like any tool, it works best when used alongside proper research and risk management.

Understanding the balance between puts and calls helps traders decode market psychology, identify possible reversals, and make informed decisions. Keep an eye on the PCR Ratio, and you’ll start to see the hidden story behind market moves.

0 notes

Text

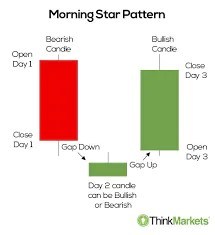

Mastering the Morning Star Pattern: A Step-by-Step Guide

Title: Mastering the Morning Star Pattern: A Step-by-Step Guide Introduction:The world of technical analysis offers traders a plethora of tools to identify potential trend reversals and market opportunities. One such powerful pattern is the Morning Star pattern, a three-candlestick formation that signals a potential bullish reversal after a downtrend. In this step-by-step guide, we will explore…

View On WordPress

#bullish reversal#candlestick patterns#comprehensive trading approach.#confirmation factors#doji candle#downtrend#false signals#market sentiment#momentum shift#Morning Star pattern#position sizing#price action#resistance levels#Risk Management#spinning top#stop-loss#support levels#technical analysis#trading strategy#trading volume#Trend Reversal#volume analysis

0 notes

Text

Decoding the Bullish Abandoned Baby Pattern for Market Reversals and Entrepreneurial Insights

When the stock market feels like a rollercoaster, it’s easy to get lost in the noise. But for those who’ve mastered the art of reading candlestick patterns, every dip and peak can tell a story. One such story is the Bullish Abandoned Baby, a rare yet powerful signal that has helped traders and entrepreneurs spot shifts in momentum. Imagine a scenario where a once-dominant bearish trend suddenly…

0 notes

Text

How to Trade Using Candlestick Patterns for Better Trade Decisions

Candlestick patterns are one of the most widely used tools in technical analysis. They provide valuable insights into market sentiment and potential price movements by analyzing the open, close, high, and low of each trading period. By understanding and using candlestick patterns, traders can make more informed decisions, anticipate market reversals, and optimize entry and exit points.

Here’s how you can use candlestick patterns effectively in your trading strategy.

1. What are Candlestick Patterns?

A candlestick pattern is formed by one or more candlesticks that represent price movements within a given timeframe. Each candlestick shows:

Open price: The price at which the asset opened during the time period.

Close price: The price at which the asset closed during the time period.

High price: The highest price reached during the period.

Low price: The lowest price reached during the period.

Candlestick patterns can be either bullish (indicating an upward price movement) or bearish (indicating a downward price movement), depending on the relationship between the open and close prices.

2. Popular Bullish Candlestick Patterns

Bullish candlestick patterns signal potential upward price movement. Here are a few common ones to look out for:

Bullish Engulfing Pattern: This pattern consists of a small bearish candlestick followed by a larger bullish candlestick that completely engulfs the previous one. It indicates strong buying pressure and often signals the beginning of an uptrend.

Hammer: A hammer candlestick has a small body and a long lower shadow, which indicates that sellers tried to push the price lower, but buyers stepped in and drove the price back up. It suggests a potential reversal from a downtrend to an uptrend.

Morning Star: This pattern consists of three candlesticks: a long bearish candlestick, followed by a small-bodied candlestick, and then a long bullish candlestick. The morning star indicates a potential trend reversal from bearish to bullish.

3. Popular Bearish Candlestick Patterns

Bearish candlestick patterns suggest potential downward price movement. Here are a few common bearish patterns to look for:

Bearish Engulfing Pattern: The opposite of the bullish engulfing pattern, the bearish engulfing consists of a small bullish candlestick followed by a larger bearish candlestick that completely engulfs it. This pattern indicates strong selling pressure and often signals the start of a downtrend.

Shooting Star: The shooting star has a small body and a long upper shadow, signaling that buyers tried to push the price higher but were unable to sustain it. This pattern suggests a potential reversal from an uptrend to a downtrend.

Evening Star: The evening star is the opposite of the morning star, consisting of a long bullish candlestick, followed by a small-bodied candlestick, and then a long bearish candlestick. This pattern indicates a potential reversal from bullish to bearish.

4. Using Candlestick Patterns for Entry and Exit

Candlestick patterns can be used to make more informed decisions about when to enter and exit trades:

Entry: When you identify a bullish reversal pattern (like a bullish engulfing or hammer) at support levels, it could be an indication to enter a long position. Similarly, a bearish reversal pattern (like a bearish engulfing or shooting star) at resistance levels could signal a short position.

Exit: Candlestick patterns can also help with determining exit points. For example, if you are in a long position and a bearish reversal pattern (like an evening star) forms near a resistance level, it might be a signal to close your position or set a stop-loss order to protect your profits.

5. Combining Candlestick Patterns with Other Indicators

While candlestick patterns can provide valuable insights, they work best when combined with other technical indicators to confirm the signals. Here are some tools you can use alongside candlestick patterns:

Support and Resistance: Look for candlestick patterns that form at key support or resistance levels. For example, a bullish engulfing pattern at a support level has a higher probability of success.

Moving Averages: Combine candlestick patterns with moving averages (e.g., 50-day or 200-day MA) to confirm the overall trend. A candlestick pattern that aligns with the trend can be more reliable.

RSI (Relative Strength Index): Use RSI to confirm whether an asset is overbought or oversold. A candlestick reversal pattern accompanied by an overbought or oversold condition can strengthen your trade decision.

6. Practice Patience and Wait for Confirmation

Candlestick patterns should never be used in isolation. They work best when you wait for confirmation before entering a trade. For example:

Volume: If a candlestick pattern forms with high volume, it’s a stronger signal. Volume confirmation helps validate the strength of the pattern.

Other Indicators: Look for confirmation from indicators like RSI or moving averages. For example, a bullish engulfing pattern near a moving average support level combined with an RSI showing oversold conditions may provide a more reliable signal.

Waiting for confirmation ensures you’re not jumping into a trade based on an isolated pattern, which could turn out to be a false signal.

Final Thought: Master Candlestick Patterns for Smarter Trading

Candlestick patterns are a powerful tool that can enhance your trading strategy. By understanding and recognizing common bullish and bearish patterns, you can make more informed decisions about entry and exit points, improve timing, and manage risk more effectively.

Ready to trade smarter with expert-backed strategies? Download Univest — the SEBI-registered trading app that helps you identify profitable candlestick patterns, follow expert strategies, and trade with confidence. Stay ahead of the market and improve your trading success.

0 notes

Text

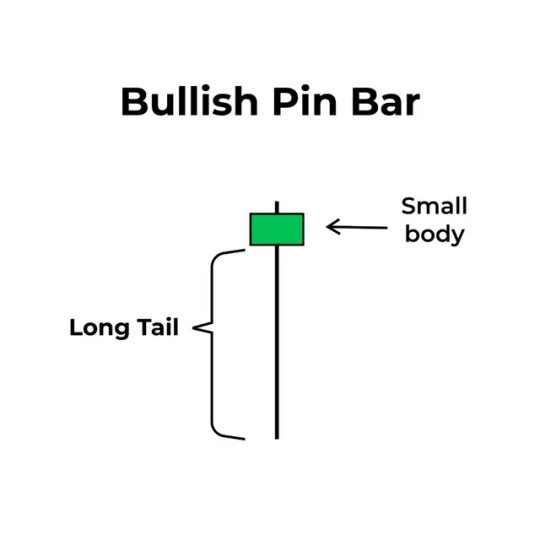

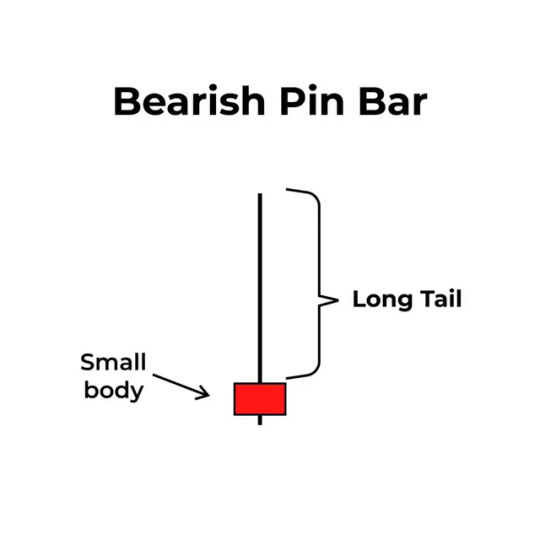

Pin Bar Candlestick Pattern: A Trader’s Guide to Smart Entries and Exits

Have you ever noticed a candle on a chart that looks like a pin or a needle? That structure is known as a pin bar, and it can give traders powerful insights into future price movement. Whether you're entering or exiting a trade, the pin bar can help you make smarter, more strategic decisions.

If you've found it challenging to recognize or understand this pattern, you're not alone. In this Market Investopedia guide, we’ll walk you through everything you need to know about pin bars—how they work, their pros and cons, and how to trade them effectively.

What Is a Pin Bar?

A pin bar is a candlestick formation that signals a potential price reversal or continuation. It’s made up of:

A small body (green or red),

A long wick on one end,

And a short wick on the opposite end.

This structure reveals price rejection—meaning the market attempted to move in one direction but was strongly pushed back, hinting at an upcoming shift.

Key Features of a Pin Bar

To identify a pin bar, look for the following elements on your chart:

Small Candle Body

The body should be short, showing little difference between the opening and closing prices. This indicates a balance—or struggle—between buyers and sellers.

Wicks (Shadows)

There are two wicks on a pin bar. One is very long, and the other is short. The long wick reveals where the price was rejected, and it's the most important part of the pin bar.

Closed Candle

Never trade a pin bar that hasn’t closed yet. Wait for the candle to close before making a decision based on its signal.

Types of Pin Bars

Bullish Pin Bar

Appears during a downtrend

Has a small green body

Features a long lower wick

Signals a potential upward reversal

The long lower wick suggests sellers pushed the price down, but buyers fought back, rejecting the lower levels. This often indicates a buying opportunity.

Bearish Pin Bar

Appears during an uptrend

Has a small red body

Features a long upper wick

Signals a potential downward reversal

Here, buyers tried to push the price higher, but sellers stepped in and rejected the highs. This often signals a selling opportunity.

How to Trade Using Pin Bars

1. Identify a Pin Bar

Scan your chart (preferably 4-hour, daily, or weekly) for a small-bodied candle with a long wick on one end and a short wick on the other.

2. Use Confirmation Tools

Combine pin bars with tools like:

RSI (Relative Strength Index)

Fibonacci Retracement

Bollinger Bands These indicators can help confirm whether the signal is strong enough to act on.

3. Trade Reversals

When a pin bar forms at a key support or resistance level, it often signals a reversal. Trade in the direction opposite the long wick.

4. Trade Trend Continuations

Not every pin bar signals a reversal. In some cases, especially during a trend pause, a pin bar can indicate that the current trend is about to continue. For example, a bullish pin bar during an uptrend suggests that buyers are still in control.

How to Spot High-Quality Pin Bars

Not all pin bars are equal. Here's what to look for in a strong setup:

Key Levels: Look for pin bars forming at significant support or resistance zones.

Longer Time Frames: Pin bars on 4H, daily, or weekly charts tend to be more reliable than those on 5-minute or 15-minute charts.

Wick Length: The longer the wick (at least two-thirds of the candle's length), the stronger the signal.

Smaller Body: A smaller body means less indecision and more rejection.

Volume Confirmation: Higher trading volume strengthens the validity of the pattern.

Pros of Trading Pin Bars

Easy to recognize, even for beginners

Work well with various assets—Forex, stocks, crypto, commodities Clearly define potential entry and exit levels

Combine well with trendlines, moving averages, and other tools Suitable for multiple timeframes

Cons of Trading Pin Bars

Less effective in choppy or sideways markets

Relies on probabilities—there’s no guarantee the signal will play out

Can produce false signals without proper confirmation

Final Thoughts

The pin bar candlestick is a powerful yet simple tool that traders can use to spot trend reversals or continuations. It's easy to learn, and when combined with other forms of analysis, it can provide high-probability trade setups.

However, like any trading method, pin bars are not foolproof. It's important to assess each one carefully, confirm the signal, and avoid trading them in low-quality setups or during erratic market conditions.

Ready to dive deeper into price action and trading strategies? Explore more articles on Market Investopedia or join our free webinar for hands-on learning with real chart examples.

0 notes