#Swing Trading

Explore tagged Tumblr posts

Text

9months pregnant never looked this good…😘

#thick wife#hotwomen#hotmomsclub#hornyposting#hornythoughts#happy wife#hotttttt#hottties#shared with permission#wifey type#i will fuck your wife#sharing is caring#swing trading

7 notes

·

View notes

Text

The Market's Unfurling Script: My Personal Deciphering in Bengaluru

The tapestry of the stock market, vast as the Bengaluru skyline on a clear day, once felt like an ancient script I was condemned to read without a key. For what seemed like endless seasons, I’d pore over its intricate patterns, hearing distant murmurs, hoping to divine a hidden message, to snatch even a fleeting hint of what might be the best stocks to swing trade. It was an exhaustive, often disheartening exercise, leaving me more bewildered than illuminated. Then, slowly, almost imperceptibly, the jumble began to resolve. A profound inner clarity took root, a sense of having finally understood the market’s authentic language, thanks to two distinct, yet profoundly harmonious instruments: the patient wisdom of a seasoned linguist and the piercing clarity of an advanced textual analyzer.

My true journey into this newfound understanding began not with a grand strategy, but with a simple, almost aching, desire for genuine interpretation. This led me to a SEBI Registered Investment Advisor. Before this, the notion of "market wisdom" often drifted from a cacophony of unverified whispers from online forums or well-meaning, but ultimately discordant, advice. Connecting with my advisor—an individual whose credentials are not just recognized, but rigorously upheld by SEBI itself—instilled an immediate, deep sense of grounded reassurance. They didn't just hand me a pre-written translation guide. Instead, we sat, unhurriedly, and they helped me discern my unique financial narrative, understanding my true emotional resonance with risk, and how the intricate, living breath of the broader Indian equities market was truly articulating itself on this very Monday in early June 2025. This deeply personalized discourse didn't just offer direction; it sculpted my mindset, transforming reactive discord into a thoughtfully constructed, enduring financial philosophy. It was like finally learning the grammar of the market's secret language.

To profoundly enhance that invaluable human teaching, I’ve meticulously woven Trade Ideas into the fabric of my daily analytical ritual. This isn't just software; for me, it acts as an incredibly diligent, high-speed textual sentinel, ceaselessly sifting through the immense ocean of market data. Imagine trying to manually identify subtle shifts in a massive, constantly evolving text—a fractional change in a word's nuance, an unexpected, almost imperceptible tremor in a sentence structure, or precise grammatical patterns that often precede a major narrative shift. It’s a sensory feat beyond human capacity. Yet, Trade Ideas performs this relentless audit, allowing me to define exactly what kind of "nuance" or "surge" I'm listening for, instantly highlighting the handful of market passages that resonate. It genuinely extends my own observational capacity, enabling me to perceive market intricacies I’d undoubtedly miss from my quiet workspace here in Bengaluru. It's like having a hyper-attuned ear for the market's subtle, powerful prose, particularly when seeking the best stocks to swing trade.

My current engagement with the market embodies a seamless, powerful duet between these two indispensable components. I begin, almost instinctively, by letting Trade Ideas sweep the vast market lexicon, pinpointing potential signals that align with my strategy. These aren't final pronouncements, but rather intriguing points of resonance, moments demanding a closer listen. Then, with this carefully curated list of textual cues, I turn to my SEBI Registered Investment Advisor for a comprehensive consultation. This collaborative session represents the vital convergence of raw market data and seasoned human acumen. My advisor provides invaluable, qualitative context—perhaps a more profound understanding of a company's underlying narrative, insights into impending shifts in industry discourse, or a critical evaluation of how these potential ventures align with my overarching financial blueprint and the prevailing market sentiment. It’s this thoughtful synergy—the rapid, piercing insight from Trade Ideas intertwining with the nuanced, experienced judgment of my SEBI Registered Investment Advisor—that I find truly empowers my decisions in the realm of stock market advisory.

So, for anyone else here in Bengaluru, or indeed across India, grappling with the profound complexities of the stock market right now, I wholeheartedly recommend exploring this dual journey. Seek out reliable, SEBI Registered Investment Advisors for their invaluable, tailored guidance, and consider incorporating powerful analytical tools like Trade Ideas to profoundly sharpen your market perception, particularly when seeking the best stocks to swing trade. It’s about more than just numbers; it’s about building a robust, informed, and deeply personal framework for navigating your financial journey with greater clarity and strategic intent.

0 notes

Text

Swing Trading vs. Scalping with Prop Firms: Which Is Better?

In the dynamic world of trading, selecting the right strategy can make all the difference. Swing trading and scalping offer distinct paths to profit, each appealing to different styles and time commitments.

Prop firms are reshaping the trading landscape by providing the capital and support needed to excel. With the right firm, you can focus on refining your skills while minimizing personal financial risk. Discover how to maximize your potential in trading today.

Introduction to Swing Trading and Scalping

Understanding Swing Trading and Scalping Strategies

Swing trading and scalping are two ways people trade stocks. They fit different types of traders and work best in different situations.

Trading Flexibility: Swing traders hold their trades for days or even weeks. They try to catch bigger price moves. Scalpers do the opposite. They make lots of quick trades in one day.

Trade Frequency: Swing traders trade less often but aim for bigger profits each time. Scalpers trade many times a day, making small profits on each trade.

Position Holding Period: Swing traders keep their positions longer and wait patiently for the right moment. Scalpers act fast, making decisions based on instant market changes.

Swing Trading Definition and Characteristics

Swing trading means trading for a medium time, like several days or weeks.

Swing Traders: They think patiently and pick their trades carefully.

Medium-Term Price Movements: They try to earn money from price changes over days or weeks.

Patient Approach: Swing traders wait for good chances instead of jumping in too soon.

Selective Trades: They choose only the best opportunities to reduce risk and increase gains.

Scalping Definition and Characteristics

Scalping is all about fast trades to get small profits quickly.

Scalper Profile: Scalpers focus hard and react super fast.

Quick Decision-Making: They use live data to spot chances in seconds.

High-Frequency Trading: Scalpers make many trades every day, holding positions for just seconds or minutes.

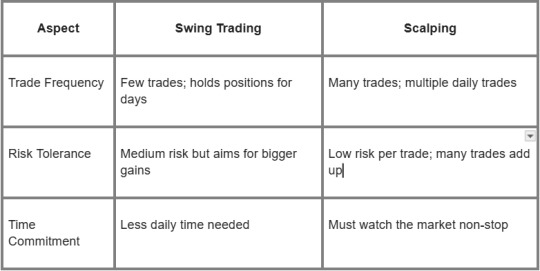

Key Differences Between Swing Trading and Scalping

Both swing trading and scalping can help you make money. Your choice depends on how much time you want to spend, how much risk you can take, and how involved you want to be with the markets.

Swing Trading in a Crypto Prop Firm Environment

Swing trading means holding positions for days or weeks to catch medium-term moves.

Crypto prop firms offer funded trading accounts and more trading capital for this style. These firms provide steady funding that helps traders grow their careers. They cut down on personal money risks and offer tools to trade better.

Crypto prop trading mostly focuses on digital assets but often supports other markets too. This lets traders mix up their strategies. With funded accounts, swing traders get bigger capital pools than their own money allows. That boosts possible profits without risking personal funds.

Working with a good prop firm gives swing traders a stable setup focused on steady results, not quick trades. This setup helps traders build skills and succeed long term in the wild crypto markets.

Benefits of Using Prop Firm Capital for Swing Trading

Using prop firm capital comes with several perks:

More Trading Capital: You get bigger funds than your own account.

Bigger Gains: Larger capital can boost profits when trades go well.

Good Profit Split: Many funded trader programs share profits at 70% or more.

Fast Funding: After passing evaluations, you can start prop firm challenge today and begin trading right away.

These perks let swing traders focus on trading instead of stressing about money limits. The Concept Trading’s system pushes steady funding and pays out quickly—usually within 48 hours—to keep traders motivated and cash flowing.

Challenges of Swing Trading within a Prop Firm Framework

Swing trading with a prop firm also has some tough spots:

Evaluation Pressure: You must hit targets during tests, which can clash with longer hold times swing trading needs.

Risk Rules: Strict drawdown limits force careful sizing of positions and stops to protect firm money.

Drawdown Limits: Going past loss limits might reset or end your account; managing losses is key to staying in the game.

Knowing these rules helps traders adjust methods and follow firm policies. Staying flexible but disciplined keeps success coming in this kind of setup.

Features of Crypto Prop Firms for Swing Traders

Crypto prop firms offer features that suit swing traders well:

Flexibility to Hold Positions Overnight/Weekends

Many crypto prop firms let you hold positions overnight and trade on weekends. This fits swing trading because it needs multi-day moves without forcing you to close early.

No-Time Limit Evaluations

Some firms don’t set strict deadlines for passing evaluations. That takes off pressure so swing traders can wait as trades unfold over time without rushing.

Swing-Friendly Leverage

Leverage options match moderate risk levels typical for swings—not high-risk scalp trades. Position sizes stay balanced by setting limits that fit longer holds, keeping risk in check.

Support for Multiple Instruments

Top crypto prop firms go beyond crypto, letting you trade stocks, indices, metals, and more. This variety gives swing traders chances to balance portfolios across different markets.

Competitive Profit Splits

Profit splits stay attractive at many leading crypto prop firms—often above 70%. Fast payouts mean you get your earnings soon after closing profitable trades.

This rundown shows how The Concept Trading’s platform fits swing traders with flexible rules and strong funding made just for their needs in today’s changing markets.

Understanding Scalping in a Prop Firm Context

Scalping means trading quickly to catch small price changes. Traders who use the scalper trading style make many trades each day. They often hold positions for only seconds or minutes.

Prop firms let scalpers trade with bigger money through funded trader programs. This helps them grow profits without using their own cash.

Many prop firms offer crypto prop trading and other markets. These are good places for scalpers who need fast execution and sharp focus. Unlike swing traders, scalpers close trades fast. This is typical for day trading and short-term trading styles.

Advantages of Scalping with Prop Firms

Scalping at prop firms gives you some clear perks:

Trading Capital: You get more money to trade than your own savings.

Instant Funding: Some firms fund you right after you pass their test.

Prompt Payouts: You can withdraw profits quickly, often in just two days.

Leverage in Trading: Firms let you use leverage to boost gains while controlling risks.

Execution Speed: Fast platforms help grab quick price moves.

Quick Decision-Making: Rules let you act fast without delays or extra approvals.

These points make it easier for scalpers to work fast and earn more without risking their own money much.

Challenges of Scalping within a Prop Firm Environment

Scalping with prop firms also has tough spots:

Trading Risk Management: You must follow strict stop-loss rules to protect money.

Evaluation Pressure: Passing funding tests can stress you because results matter a lot.

Psychological Adjustment: Fast trading needs strong nerves to handle losses and quick choices.

High Stress Levels: Staying alert all the time can wear you down if you don’t take breaks.

Knowing these challenges helps traders get ready mentally before they start.

Choosing the Right Prop Firm for Scalping

The best prop firms balance clear rules with risk control. They help short-term traders scale up without risking too much. Look for firms known for being honest and quick to respond. That makes trading scalp strategies smoother and safer.

Swing Trading vs. Scalping: A Detailed Comparison

Swing trading and scalping are two common trading styles. Swing traders hold their trades for days or weeks. They aim to catch medium-term price moves using swing trading strategies.

Scalpers, by contrast, make very fast trades. Their trades last seconds or minutes, using scalping techniques that grab small profits quickly.

The big difference is how often they trade and manage risk. Swing traders set wider profit targets and stop-loss orders based on technical analysis of chart patterns and momentum indicators.

This helps them handle moderate price swings while keeping risk in check with strict drawdown limits. Scalpers trade many times daily with tight stop-losses but face more risk because they must make fast decisions.

Knowing these differences can help you pick a style that fits your goals and personality.

Profit Potential and Risk Tolerance

Swing trading can bring high profit potential by catching bigger price moves over time. Traders control risk with clear rules like daily drawdown limits that stop big losses in wild markets.

Scalping looks for smaller wins per trade but makes up for it with lots of trades. But it needs perfect timing to keep losses small because many trades add risk.

Both styles rely on strict stop-loss orders—swing traders use broader stops while scalpers use tighter ones—to protect money and grow steadily.

Time Commitment and Effort

Scalping needs intense focus during market hours. It’s fast-paced and demands quick decisions under pressure. That stress means scalpers must stay sharp for hours at a time.

Swing trading asks for less constant watching since trades last days or weeks. This lower time commitment suits people who want flexibility without losing steady portfolio growth.

Which one works better depends on your schedule and how you handle stress while the market is live.

Technical Analysis Requirements

Both swing traders and scalpers depend on technical analysis but use it in different ways:

Swing Trading: Looks for clear chart patterns like head-and-shoulders or flags, plus momentum indicators such as RSI to see trend strength.

Scalping: Focuses on very short-term charts, watching order flow closely, and reading support/resistance quickly to decide when to jump in or out.

Learning the right tools helps no matter what style you pick. Swing trading needs deeper pattern recognition over longer times, while scalping calls for split-second calls.

Psychological Demands

Trading psychology matters a lot in both styles:

Swing Traders: benefit from patience and good emotional control while waiting through price moves.

Scalpers: must handle stress from rapid decisions where hesitation might cost money.

Sticking to rules keeps traders from making impulsive mistakes caused by fear or greed—problems that hit both styles hard.

Choosing the Right Strategy for Your Trading Style

Picking between swing trading versus scalping starts with knowing yourself—your personality, skills, and what fits your lifestyle best if you want long-term success at places like The Concept Trading.

Self-Assessment of Trading Preferences and Skills

Here’s what typical trader types look like:

Swing traders tend to be patient. They pick their trades carefully. They follow rules well and don’t mind holding positions overnight even if prices move moderately.

Scalpers like quick action. They can focus long hours staring at screens. They make split-second choices over and over without losing calm.

Knowing which sounds like you helps pick a style that won’t wear you out or give uneven results.

Alignment of Strategy with Personal Goals and Resources

Think about what fits your goals best:

Choose the style that matches your resources. It should also help keep your work-life balance healthy alongside money goals.

By knowing these key differences between swing trading vs. scalping—and thinking about your strengths—you can pick the approach that fits you best inside prop firms offering flexible funding designed for steady performance growth.

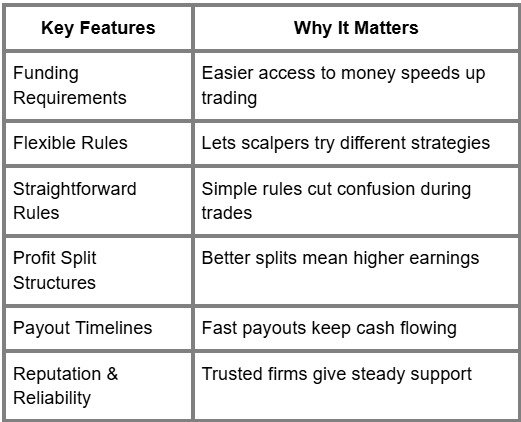

Selecting the Right Prop Firm for Your Trading Strategy

Picking the right prop firm matters a lot. You want one that fits your swing trading or scalping style. Start by checking their account sizes and leverage options. Bigger accounts with flexible leverage let you scale trades without risking too much.

Profit split setups can be very different between prop trading firms. Look for clear profit sharing that pays well, maybe over 70%. Quick payouts matter too. Firms that pay within 48 hours keep your cash moving and your spirits up.

Reputation is key when you pick funded trader programs. Read reviews, check if they follow rules, and see what other traders say. Instant funding can help you start live trading fast after passing evaluation. Easy account verification saves time too.

Transparent execution means no hidden fees or slippage eating your gains. Choose firms known for fair trades and clear funding requirements. These points help make a good fit for your trading style.

Tools and Techniques for Success in Prop Firm Trading

Good risk management keeps your profits safe in prop firm trading. Always use stop-loss orders to cut losses early. Set take-profit points to lock gains at planned levels.

Position size should match both your account and how wild the market is. Don’t risk more than 1-2% of your account on one trade.

Try trailing stops to keep profits as prices move up. Hedging can protect you from sudden market swings.

Use both technical and fundamental analysis to pick better trades. Look at chart patterns, moving averages, RSI, and MACD for tech analysis. Watch news and economic reports for fundamentals.

Know how different order types work (market, limit) and how fast your platform executes them. Fast execution means less chance of bad price fills during volatile times.

Review your trades often using dashboards with metrics like win rate, average return, and drawdown. This helps improve your strategy step by step.

Adapting Your Strategy to Market Conditions

Market conditions change all the time because of news or events. Good traders change their plans to fit those shifts instead of sticking too hard to one way.

In markets trending strongly over days or weeks, trend-following setups work best. Use momentum indicators like MACD there.

If markets move sideways between support and resistance levels, mean-reversion strategies do better.

Crypto markets jump around more than normal assets. That means you might want smaller position sizes or wider stops because of big overnight moves or weekend gaps.

Be careful around big economic data releases; spreads might widen and swap charges could rise if you hold positions overnight.

Sentiment tools like on-chain analytics help with crypto trades too. Also look at project health before trading when things feel uncertain.

Guidance on Selecting the Best Approach

Your choice depends on your goals, time, money, and career plans in trading. If you want less screen time with careful setups, swing trading fits well. If you like pressure and quick results by being active in the market, scalping works better.

Pick a strategy that matches your lifestyle to grow steadily as a trader in a prop firm. Make choices based on honest self-checks to boost your success over time.

Prompt Payouts, Streamlined Process, and 24/7 Support at The Concept Trading

The Concept Trading pays out profits quickly—usually within 48 hours. Their process is simple, so you get funding without waiting or extra hassle. They also offer support any time of day or night.

This setup helps both swing traders and scalpers focus on trading while keeping paperwork easy.

Highlighting The Concept Trading's Advantages

The Concept Trading works well for different styles—including swing trading support. Its platform runs smoothly on many devices and offers strong tools to manage risks.

Joining here means you get clear rules, fair profit shares, and an environment that cares about helping you grow as a trader with funded accounts.

FAQs

What Is the Role of Trading Risk Management in Prop Firm Trading?

Trading risk management is essential for safeguarding capital by implementing strategies such as stop-loss orders and drawdown limits. It helps maintain consistent trading performance while minimizing the impact of significant losses.

How Can Traders Scale Their Accounts Using Prop Firms?

Prop firms enable account scaling by increasing capital allocation as traders achieve profit milestones and adhere to established risk parameters consistently. This structured approach encourages responsible trading behavior.

What Types of Funding Evaluations Do Prop Firms Use?

Prop firms typically employ phased funding evaluations. These evaluations assess traders through specific profit target percentages and maximum drawdown limits to ensure they demonstrate discipline and effective risk management before receiving funded accounts.

How Does Leverage in Trading Affect Swing Trading vs. Scalping?

In swing trading, moderate leverage is utilized for positions held over several days, which helps to mitigate overnight risks. Conversely, scalping often requires lower or adjustable leverage for rapid, intraday trades, allowing traders to better manage the effects of market volatility.

What Support Services Do Prop Firms Offer to Help Trader Career Growth?

Prop firms provide a range of support services, including 24/7 assistance, mentorship programs, performance analytics, and educational resources. These services are designed to empower traders and enhance their overall trading potential.

Why Is Psychological Adjustment Crucial in Scalper Trading Style?

Psychological adjustment is vital for scalpers due to the high-pressure environment created by quick decision-making and frequent trades. Maintaining emotional control is key to preserving discipline and avoiding impulsive mistakes.

How Do Trading Tools Assist with Strategy Optimization in Prop Firm Environments?

Trading tools such as dashboards, performance metrics, technical indicators, and various order types enable traders to make data-driven decisions. These tools facilitate ongoing improvement and strategic optimization in trading results.

What Are Common Challenges Faced During the Funding Evaluation Phase?

During the funding evaluation phase, traders often encounter challenges such as performance pressure, rigid risk management rules, and the need to maintain consistent profitability while adhering to drawdown limits.

How Do Market Volatility and Cryptocurrency Volatility Impact Swing Trades?

Market volatility can lead to price fluctuations that significantly influence stop-loss levels and position sizing. Traders must adjust their strategies, either by widening stops or reducing position sizes, to effectively manage risk in volatile conditions.

Key Elements for Successful Prop Firm Trading

Strict trading discipline keeps losses low with stop-loss orders and daily drawdown limits.

Effective capital allocation balances position size relative to account value.

Using performance metrics like win rate and average return guides continuous improvement.

Employing both technical analysis (chart patterns, momentum indicators) and fundamental analysis (crypto asset fundamentals, news) supports better trade setups.

Understanding order types, such as limit or market orders, helps control trade execution latency.

Managing overnight risk carefully when holding positions during weekends or economic data releases.

Leveraging trader support services, including mentorship and community forums, fosters skill development.

Navigating prop trading challenges, such as evaluation pressure and strict risk rules, requires mental strength.

Choosing firms with transparent profit split structures, quick profit withdrawal, and flexible funding requirements improves the overall experience.

Adjusting strategies for different market conditions, including trending or range-bound markets, enhances trading scalability.

For more post about prop firm trading tips click here.

#prop trading firms#prop trading tips#forextrading#the concept trading#fx trading#swing trading#scalping

0 notes

Text

In the world of trading, forex swing trading is a strategy that aims to capitalise on short- to medium-term price movements. Swing trading is a popular approach. It involves making short- to medium-term investments in stocks or other financial assets, typically holding onto them for a few days to a few weeks. Looking at the bigger picture and the financial health of what they’re trading. Let us understand in depth the swing trading forex meaning in this article.

0 notes

Text

Top Swing Trading Strategies That Actually Work

Master the Market with Proven Techniques Backed by Real Experience

Understanding the Power of Swing Trading

In the fast-paced world of forex and financial markets, swing trading stands out as one of the most effective strategies for capturing short- to medium-term gains. Unlike day trading, which requires constant screen time, or long-term investing that demands immense patience, swing trading offers a balanced approach—allowing traders to capitalize on price movements that occur over several days or weeks.

But success in swing trading doesn’t come from guesswork. It requires discipline, a solid plan, and the right tools. In this guide, we break down top swing trading strategies that actually work, supported by expert insight and a real-life success story from a trader who turned knowledge into profit.

What Is Swing Trading?

Swing trading is a trading style that focuses on capturing price “swings” within a trend. Traders use a mix of technical and fundamental analysis to enter positions during corrective phases or breakouts and aim to hold them from a few days to a few weeks. This approach allows for flexibility and reduces exposure to overnight market risks compared to day trading.

This strategy is particularly well-suited for forex traders who want consistent returns without the high-pressure demands of intraday trading.

Top Swing Trading Strategies That Deliver Results

1. Trend Following Strategy

This strategy focuses on identifying and trading in the direction of a well-established trend. Swing traders using this technique look for retracements in an uptrend or downtrend and enter trades at key support or resistance levels.

Key Indicators:

Moving Averages (50-day and 200-day)

MACD (Moving Average Convergence Divergence)

Trendlines

Why It Works: Markets tend to move in trends, and riding the momentum increases the probability of success. By entering during pullbacks, traders gain a better risk-reward ratio.

2. Breakout Trading

Breakouts occur when the price moves beyond a well-established support or resistance level with increased volume. Swing traders seek to enter at the beginning of the breakout and ride the wave until the momentum slows.

Key Tools:

Volume Indicators

Bollinger Bands

Price Channels

Pro Tip: Always confirm breakouts with volume spikes to avoid false breakouts.

Click Now

3. Fibonacci Retracement Strategy

Fibonacci retracement levels are used to predict potential reversal zones during market pullbacks. Swing traders often combine Fibonacci levels with other indicators to time their entries and exits.

Common Levels: 38.2%, 50%, and 61.8% Best Used With: RSI (Relative Strength Index) or candlestick patterns

This strategy works especially well in trending markets, where traders aim to enter at the retracement and exit near the previous swing high or low.

4. Support and Resistance Trading

Trading based on horizontal support and resistance levels is a classic swing trading approach. When the price approaches a significant level, traders anticipate either a bounce or a breakout.

Tools for Identification:

Price action analysis

Historical chart data

Advantage: This method offers clear entry and exit points, reducing guesswork.

5. Moving Average Crossover Strategy

This strategy involves using two different moving averages—typically a short-term and a long-term one. When the short-term MA crosses above the long-term MA, it generates a buy signal, and vice versa for sell signals.

Common Pairings:

10-day and 50-day

20-day and 100-day

Benefit: This system is straightforward and effective for spotting trend changes early.

Real-Life Trader Success Story: How Sarah Mastered Swing Trading

Sarah Henderson, a 34-year-old marketing executive from the UK, ventured into forex trading as a side hustle. Initially overwhelmed by market volatility, she sought a method that suited her busy schedule. That’s when she discovered swing trading.

Sarah opened an account with FP Markets, drawn by their tight spreads and access to advanced charting tools. She focused on swing trading strategies—particularly trend-following and Fibonacci retracements. Using their MetaTrader 4 platform, she was able to backtest her strategies and identify profitable setups.

Within her first year, Sarah achieved a 27% return on her trading capital. Her most successful trade came during a GBP/USD rally, where she entered on a retracement at the 50% Fibonacci level and exited after a 250-pip move. “The key was not trading every day, but making every trade count,” Sarah shares.

Today, she continues to swing trade part-time while educating new traders through her blog, attributing her success to a disciplined strategy and the right broker.

Why Choosing the Right Broker Matters?

No matter how good your strategy is, a poor brokerage platform can derail your success. Swing traders require:

Fast trade execution

Low spreads and commissions

Reliable charting tools

Strong customer support

Trustworthy regulation

FP Markets ticks all these boxes. With access to MT4/MT5, ultra-low latency execution, and multi-regulated oversight, they are a top choice for serious forex swing traders.

FAQs – FP Markets & Forex Swing Trading

1. Is FP Markets good for swing trading? Yes, FP Markets offers competitive spreads, advanced charting platforms, and excellent execution speeds—making it ideal for swing trading.

2. What trading platforms does FP Markets offer? FP Markets supports MetaTrader 4, MetaTrader 5, and Iress. For swing traders, MT4 and MT5 provide a wide range of tools for technical analysis.

3. Does FP Markets allow holding positions overnight? Absolutely. FP Markets supports overnight positions, which is essential for swing trading. Just be mindful of swap/rollover fees depending on the instrument.

4. How can I manage risk while swing trading with FP Markets? Use proper stop-loss and take-profit orders, apply sound risk management (e.g., risking only 1-2% per trade), and backtest strategies on FP Markets’ demo accounts before going live.

5. Is FP Markets regulated and secure? Yes, FP Markets is regulated by ASIC (Australia), CySEC (Europe), and other financial authorities. This multi-jurisdictional regulation enhances trader security and transparency.

youtube

Final Thoughts: Swing Trading as a Path to Financial Freedom

Swing trading isn't just a strategy—it’s a mindset. With the right approach, tools, and broker, traders can systematically profit from the natural ebb and flow of market prices. Whether you're just starting or refining your edge, the strategies shared above are time-tested and battle-proven.

Platforms like FP Markets give you the foundation you need, but your discipline, patience, and education will ultimately determine your success. Take inspiration from traders like Sarah, and remember—mastering swing trading starts with understanding the market and respecting your plan.

Learn More

0 notes

Text

youtube

0 notes

Text

Swing vs. Day Trading: Which Gold Strategy Works Best?

In this blog, we will break down what each strategy involves, their pros and cons, and how they apply to online gold trading. By the end, you will be better equipped to decide which approach aligns with your trading goals, risk tolerance, and lifestyle.

0 notes

Text

Unlock Forex Profits with QMR Trading – Watch My 6-Minute Live Breakdown!

Are you ready to boost your Forex game with a secret strategy that can change the way you trade? If you’re juggling a 9-to-5 job and still want to conquer the markets, my latest YouTube video is the perfect match for you. Watch it here: What Is QMR and Why Should You Care? In just under six minutes, I take you through a dynamic live breakdown of the QMR pattern—a technique I learned from a top…

#AUD#Australian Dollar#Day Trading#Financial Markets#forex#Forex Education#Forex Signals#Forex Trading#New Zealand Dollar#NZD#QMR#QMR Trading#Raw Forex Trades#Risk Management#Stop Loss#Swing Trading#Take Profit#Technical Analysis#Trade Setup#Trading Strategy

0 notes

Text

Feeling Lost in the Stock Market? Here's How to Find Your Way with Confidence

Ever stare at stock charts, feeling a mix of fascination and utter confusion? You're not alone. The stock market, with its promise of growing your hard-earned money, can often feel like a vast, unpredictable ocean. It's easy to get swept away by the latest headlines or tempting tips, only to find yourself adrift. But what if you could navigate these waters with a clear map and a reliable navigator? That’s precisely what a smart approach to stock market advisory offers, bringing together the wisdom of a SEBI registered investment advisor and the sharp precision of tools like Trade Ideas.

Your Personal Guide: The SEBI Registered Investment Advisor

Think about embarking on any important journey. You wouldn't just wander off without a plan, right? You'd seek advice from someone who truly understands the terrain. In the world of investing, that's your SEBI registered investment advisor. These aren't just market enthusiasts; they're professionals in India who are legally and ethically bound by SEBI to act in your best interest. That's a huge deal, because it means their guidance is designed for your financial well-being, not just to sell you something.

Your advisor steps in to do more than just pick stocks. They’ll actually sit down with you, listen to your life goals, and understand what keeps you up at night about money. What's your comfort level with risk? Are you saving for a house, retirement, or something else entirely? They take all of this in, then help you craft a truly personal investment plan. And when the market inevitably gets choppy – because it always does – your advisor becomes your calm, objective voice. They'll help you resist the urge to panic-sell or chase every fleeting trend, keeping your long-term vision firmly in view. It’s that human understanding and tailored advice that truly sets them apart.

Your Market Scanner: Unlocking Insights with Trade Ideas

Now, imagine giving your expert guide an incredible super-tool. That's what platforms like Trade Ideas bring to the table. In today's market, information can be overwhelming. Trying to manually find opportunities amidst thousands of stocks is like looking for a needle in a haystack – blindfolded! Trade Ideas cuts through all that noise, acting like your personal market detective.

This clever piece of technology doesn't replace your judgment; it makes your judgment smarter and faster. It empowers you (and your advisor) to pinpoint opportunities with incredible precision:

Customized Searches: Instead of sifting through endless charts, you tell Trade Ideas exactly what you're looking for. Want stocks with unusual volume? Companies hitting new highs? Specific technical patterns appearing? It instantly sifts the entire market to show you only the relevant few.

Spotting What Others Miss: It’s designed to pick up on subtle shifts and emerging trends that might signal a big move, well before the general public catches on. This gives you a real advantage in discovering potential gems.

Testing Your Game Plan: Ever wonder if a trading idea you have would actually work? Trade Ideas lets you "backtest" your strategies against historical market data. It’s like a practice run, allowing you to fine-tune your approach before you commit actual money.

Real-Time Alerts: The market moves fast. Trade Ideas can send you instant alerts when a stock meets your specific criteria, ensuring you're always informed and ready to act on emerging opportunities.

It saves you time, cuts down on mental fatigue, and sharpens your focus, turning raw data into actionable insights.

The Powerful Duo: A Holistic Stock Market Advisory

So, what happens when you bring these two forces together – the personal touch of a SEBI registered investment advisor and the analytical might of Trade Ideas? You get a stock market advisory experience that's truly built for confidence and clarity.

It’s about having a dedicated partner who understands your individual goals and risk appetite, crafting a strategy that fits your life. And it’s about equipping that strategy with the most advanced tools to quickly identify promising opportunities and manage your investments with precision. This combination takes the guesswork and anxiety out of market participation, replacing it with informed decisions and a clear path forward.

0 notes

Text

Unlocking the Power of TradingView: The Best Charting Platform for Traders

A sleek and modern TradingView dashboard displaying real-time charts, candlestick patterns, and powerful technical indicators like RSI and MACD. Are you looking for a powerful, easy-to-use charting tool to enhance your trading? Whether you’re a beginner or an experienced trader, TradingView is one of the best platforms for technical analysis, market insights, and strategy building. And here’s…

#Affiliate Marketing#Automated trading#Candlestick patterns#Crypto trading#Day trading#Forex trading#Investing#MACD#Market analysis#Online trading#passive income#RSI#Stock market#Swing trading#Technical analysis#Trading alerts#Trading bots#Trading platform#Trading signals#Trading strategies#Trading tools#TradingView#TradingView charts#TradingView indicators#TradingView plans#TradingView pricing#TradingView review

0 notes

Text

PERFORMANCE OF CALL TRACKER 🤩🤩 Date - 28TH FEB 2025 Profit - 56975/-🔥🔥 Investment- 40 Lac

#banknifty#stockmarket#banking#bankniftytrading#bankniftypattern#tradingreport#my post#market trends#viralpost#trade results#trade war#earnings#people over profit#global#futures#profitability#stocks#share market#ipo#financenews#swing trading#stock trading#investing stocks#shares#like

0 notes

Text

📈 Master the Forex Market with Patience Consistency beats luck in Forex. The best trades aren’t forced.....they’re executed with precision and patience. Stay disciplined, stay profitable. 💡

PipInfuse - Your expert Forex Trading and Investment management consulting partner

#forex traders#forex analysis#forex market#forex trading#crypto#swing trading#online trading#day trading#investment#pipinfuse

0 notes

Text

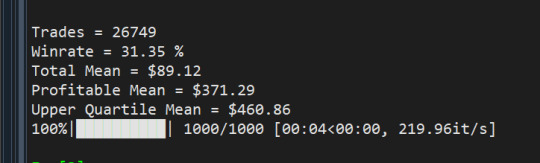

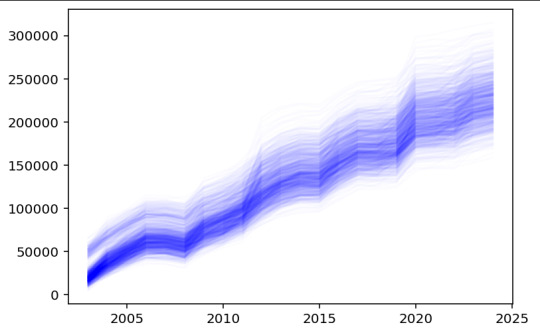

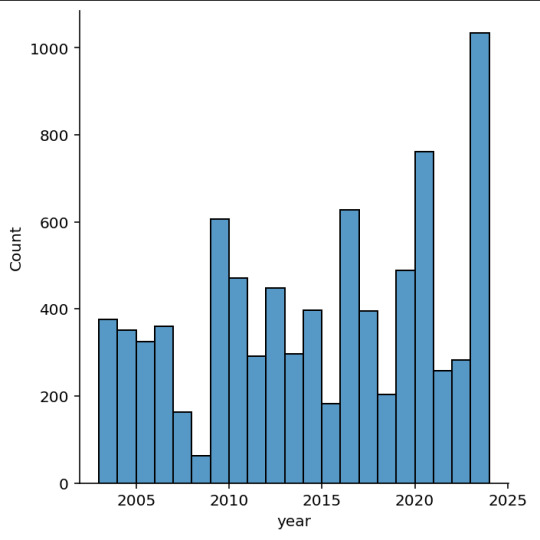

4/9-Weekly EMA Crossover Strategy

I recently came across a reddit post from some random guy in Brazil. He mentioned the 4/9 EMA cross was pretty successfull so I wanted to try it.

Period = Weekly Initial Size = $1000 Stop Loss = -$50 Opening Condition = 4 period EMA > 9 period EMA Closing Conditions = Close < 20EMA

0 notes

Text

Having a 🍑y day!

#hotwomen#thick wife#happy wife#hotmomsclub#shared with permission#sharing is caring#swing trading#wifey type

6 notes

·

View notes