#How to Get Maximum Interest in PPF

Explore tagged Tumblr posts

Text

#business news in Hindi#How to Get Maximum Interest in PPF#how to maximise PPF interest#How to Maximize PPF Returns#Investment tips#Personal Finance#PPF#PPF benefits#PPF calculator#PPF Interest Calculation#PPF Interest rate#PPF tax benefits#Public Provident Fund#tips for PPF interest#Tips to Earn Maximum Interest on PPF Account#Which is the best month to invest in PPF

0 notes

Text

How to Save Tax Legally in 2025: Top Deductions & Exemptions You Should Know

Introduction

These days, a tax plan is not just a yearly event in a global market; it has become a clever technique that can relieve you of enormous amounts of money if you are a U. S. citizen residing abroad or an NRI who is involved in cross-border income. Tax-smart does not mean being a year 2025 unfolds, it means understanding the deductions and exemptions you can legally claim. Be it a salaried professional, a business owner, or a freelancer, these tax-saving tips are for all of you.

At Accelero Corporation, our squad of specialist Chartered Accountants and international tax analysts is committed to providing you with assistance when dealing with the intricacies of USA and INDIA Taxes. Come along to explore together the main deductions and exemptions, which will give you the possibility to settle your tax debt for 2025 without breaking any regulations.

1. Standard Deduction – The Classic Saver

Regardless of whether you get a salary or pension, the standard deduction of ₹50,000 is still a no-brainer. It’s directly applied, thus no additional work is needed. This is the simplest method to lower your taxable income.

2. HRA (House Rent Allowance)

People living in a rented apartment and receiving HRA from their employer can claim a deduction under the head of house property by following their actual rent, salary, and the city they live. This dispensation can really come in handy for salaried professionals residing in the metro cities.

3. Your Tax-saving Toolbox– Section 80C

In Section 80C, you are allowed to make investments in such a manner that you can claim a deduction of up to ₹1.5 lakh annually.

ELSS (Equity-Linked Saving Scheme)

PPF (Public Provident Fund)

Life Insurance Premiums

5-Year Fixed Deposit

Hot tip: ELSS has the shortest lock-in period and also gives you market benefits—perfect if you want growth along with tax savings.

4. Health is Wealth (and Savings)– Section 80D

In case you have paid medical insurance premiums for your own family, then you can get deductions of up to ₹25,000 (₹50,000 for senior citizens). This one is not only tax-friendly but also life-friendly with the increasing cost of medical treatment.

5. Education Loan Interest – Section 80E

Is it your plan to study either in India or abroad? The interest on the education loan can be written off against your income tax for a maximum of 8 years. An excellent means to not only make your repayment lighter but also to reduce your tax burden.

6. NRI & Expat Benefits – Plan Smart, Pay Less

If you are a USA Tax Filer in India, a Green Card Holder, your tax obligations can get confusing very quickly. However, this is the place where Accelero Corporation comes in. Our expertise lies in helping expats and U.S. citizens with the deductions that are available for them through double taxation treaties and India Foreign Tax Credit in Hyderabad.

When you get income in both the U.S. and India, you may be liable for double taxation. But, it is a fact that you can claim the Foreign Tax Credit (FTC) to neutralize this. If you have the proper planning and the correct documents, you will never be liable to pay more than your legal tax.

7. Capital Gains Exemptions

Did you sell assets such as property or stocks? You might be eligible for exemptions under Sections 54, 54EC, or 54F. Putting the money gained from the sale into approved instruments such as NHAI/REC bonds within six months is one way to save taxes on those gains.

8. Home Loan Benefits

According to Section 24(b), a deduction is allowed up to ₹2 lakh for interest paid on the home loan. If you also include the 80C principal repayment benefits, then you are saving a lot.

9. Donations Under Section 80G

Planning to be generous? Contributions made to some relief funds and charitable organizations may be tax-deductible, possibly at some 50% or 100% of the donation, according to the entity.

Final Thoughts: Make 2025 Your Smartest Tax Year Yet

The tax laws are modified each year, and keeping track of them can be a stressful experience, especially for NRIs, expats, or U.S. citizens who are dealing with two tax systems. To make sure that no rupee (or dollar) is left unclaimed for you, Accelero Corporation has come up with customized USA Citizen Tax Services in Hyderabad.

Honestly speaking, there is no need for tax saving to be done on the wrong side of the law, nor should it be a stressful matter. By having the right knowledge, you can legally decrease your tax liability and save more of your income. Particularly, the experts at Accelero Corporation are ready to help you with their individualized advice, so don’t hesitate to take them up on their offer, and let’s go through tax season successfully.

0 notes

Text

How to Open a PPF Account Online and Why It’s a Smart Financial Move

In an era where digital convenience is transforming banking, securing your financial future is just a few clicks away. One such reliable and rewarding way to save and invest is through a PPF account online. If you've ever wondered how to open a PPF account, what the PPF account benefits are, or how it compares with the saving account interest rate in India, you’re in the right place.

Why a PPF Account Should Be Part of Your Financial Plan

Let’s start with the basics. The Public Provident Fund (PPF) is a government-backed, long-term savings scheme. It was introduced to encourage small savings by offering a blend of security, attractive interest rates, and tax-saving benefits.

A PPF account has a lock-in period of 15 years, making it ideal for retirement planning or building a corpus for long-term goals like your child’s education.

Step-by-Step Guide on How to Open a PPF Account

Wondering how to open a PPF account without visiting a bank branch? Thanks to digital banking, opening a PPF account online is quick and easy.

Here’s how to do it:

Log into your net banking account with a participating bank like the Bank of Maharashtra.

Navigate to the 'Public Provident Fund' section.

Fill in your details – nominee name, deposit amount, and verification information.

Submit the application online. In some cases, a one-time offline verification may be required.

Confirmation: You'll receive a PPF account number once your application is processed.

Note: You must have a savings account with the bank and your Aadhaar and PAN should be linked.

What Makes the PPF Account Benefits So Attractive?

The PPF scheme offers a basket of benefits that make it one of the best long-term investment tools in India.

Here are the key PPF account benefits:

Tax Efficiency: Get deductions up to ₹1.5 lakh under Section 80C. Plus, interest earned and maturity amount are tax-free.

Guaranteed Returns: As a government-backed scheme, it assures safety of principal and accrued interest.

Current Interest Rate: The PPF interest rate is 7.1% p.a. (compounded annually as of the latest update).

Loan and Withdrawal Options: Loans can be availed from the 3rd year, and partial withdrawals are allowed after the 7th year.

Flexibility: Minimum deposit is ₹500; maximum is ₹1.5 lakh per year.

Account Extension: After 15 years, you can extend the account in blocks of 5 years, with or without additional contributions.

PPF vs. Savings Account – Understanding the Interest Rate Gap

For day-to-day banking, savings accounts are vital. But when it comes to returns, they lag behind long-term instruments like PPF.

Let’s look at the saving account interest rate in India (as of recent data):

Public sector banks: ~2.7% to 3.5% per annum.

Private banks: ~3.5% to 6% per annum depending on the balance.

Small finance banks: Up to 7% per annum.

In contrast, PPF consistently offers higher interest, compounded annually and backed by the government, which adds to its appeal.

PPF: A Long-Term Winner Compared to Savings Accounts

While savings accounts are best for short-term needs and liquidity, PPF works as a long-term wealth builder. A dual approach works best: use a savings account for operational needs and a PPF account for secure, long-term growth.

If you're planning for big future expenses or looking to strengthen your retirement fund, a PPF account is a smart, tax-efficient tool. With the option to open a PPF account online, there’s no reason to delay.

Why Choose Bank of Maharashtra for Your PPF and Savings Account?

Bank of Maharashtra offers both modern digital banking tools and the reliability of a trusted public sector bank. You can effortlessly open a PPF account online, enjoy competitive savings account features, and benefit from personalized customer support.

Final Thoughts

Building a sound financial plan starts with the right tools. Knowing how to open a PPF account, understanding the PPF account benefits, and staying updated on the saving account interest rate in India gives you a solid foundation. With digital platforms making the process easier than ever, it's time to take charge of your financial journey.

Start your savings journey today with Bank of Maharashtra – your partner in progress.

0 notes

Text

Paint Protection Film for Cars: A Simple Guide

Car ownership is not just an advantage; it is a great way of making a good investment. Regardless of the kind of car you own, a small personal car or a flashy brand car you need to protect its looks. Paint Protection Film, more widely referred to as PPF, is probably one of the best methods that can be used to ensure your car’s external appearance does not fade quickly.

What is a Paint Protection Film?

Paint Protection Film as the name suggests is a highly flexible layer of clear material that can be applied directly over your car. It’s most crucial function is to take the brunt of abrasion, small dents, staining, and minor damage.

Made from flexible and transparent material, PPF is often formed out of polyurethane or a similar type of plastic. They also have the function of a body armor shielding your cars paint from things like gravel, dust, stones and in effect the harsh rays of the sun.

See also: Getting Started with WebdriverIO: A Modern Approach to Web Automation

How Does PPF Work?

When applied on the surface of your car, it forms a layer that reduces the chances of your paint coming into contact with harmful elements. This layer also absorbs most of the minor impacts from scratching or chipping the paint on the car.

The majority of contemporary PPFs have the property of auto healing. This implies that, if the film experiences a minor damage, it can repair itself when exposed to some heat, like sun, or warm water. This makes your car stays smooth and shiny for longer compared to using other polishes.

It is also hydrophobic so it also helps in the repelling of water and dirt, and so your car will be easier to clean and less effort.

1. Protects Against Everyday Damage

Driving exposes your car to the small stones, gravel, and other materials on the roads. These can leave little scratch or dents on the surface of the paint coat. PPF thus serve to protect against this damage.

2. Prevents Fading

Exposure to the sun’s UV rays can cause your car’s paint to fade, losing its original brightness and shine. PPF shields your car’s from the sun’s UV rays and helps maintain the vehicle’s colour bright and new.

3. Maintains Your Car’s Value

If a car’s paint has no scratches, it is a more attractive sight for potential buyers. Since PPF will help in preventing the paint of your car from fading you will be in a position to retain its value in case you decide to sell the car in future or trading it with another car.

4. Easy Maintenance

Known as PPF, your car becomes more resistant to dirt and stains. Cleaning your car is less time consuming and less demanding because the film minimises the possibility of stains.

5. Long Lasting Protection

PPF is a material that has a very long-life span, with high quality material on average used for about several years. This makes it to be an investment on the side of ensuring that your car is well taken to have a polished look.

Is PPF Suitable for All Cars?

Yes, Paint Protection Film can be applied on any type of automobile, or say on a new as well as old car. Nevertheless, it is especially loved by people interested in automotive and car lovers who possess expensive and luxurious cars and would like to maintain their cars in the most optimum manner.

PPF is most commonly applied to high impact areas of the car, such as:

The front bumper

Bonnet (hood)

Side mirrors

Door edges

Headlights

If one wants to go for the entire car coverage, to ensure maximum protection is offered, then they opt for the PPF. Contact us for more information on PPF for cars.

Source URL By: https://abdellatifturf.com/paint-protection-film-for-cars-a-simple-guide/

1 note

·

View note

Text

Mutual Fund SIP Vs PPF

Investing wisely is like planting a tree. The effort you put in today ensures financial shade for the future. Among popular investment options in India, Mutual Fund Systematic Investment Plans (SIPs) and Public Provident Fund (PPF) stand out. But which one is right for you? Let’s break it down step by step.

What is a Mutual Fund SIP?

A Systematic Investment Plan (SIP) is a method of investing a fixed amount in mutual funds regularly, say monthly or quarterly. It’s like setting up an auto-debit to grow your wealth over time.

How SIP Works

SIPs allow you to buy units of a mutual fund scheme consistently, regardless of market conditions. This spreads your investment risk through rupee cost averaging while harnessing the power of compounding returns.

Types of Mutual Funds

Equity Funds: Invest in stocks, offering high growth but higher risk.

Debt Funds: Safer with stable returns.

Hybrid Funds: A mix of equity and debt, balancing risk and returns.

What is a PPF?

The Public Provident Fund (PPF) is a long-term savings scheme backed by the Government of India. It is a go-to choice for risk-averse investors.

How PPF Works

You open a PPF account, deposit money annually (minimum ₹500, maximum ₹1.5 lakh), and enjoy tax-free interest. With a 15-year lock-in period, PPF is ideal for creating a retirement corpus or meeting long-term financial goals.

Benefits of PPF

Guaranteed Returns: Fixed interest declared by the government.

Tax Savings: Enjoy deductions under Section 80C of the Income Tax Act.

Low Risk: Your money is as safe as it gets.

Key Differences Between SIP and PPF

Returns on Investment

SIP returns vary as they depend on market performance. Historically, equity funds have delivered 12-15% annual returns over the long term.

PPF offers fixed interest rates (currently around 7.1%) but lacks the potential for higher growth.

Risk Involved

SIPs come with market risk but offer higher reward potential.

PPF is risk-free, thanks to its government backing.

Investment Tenure

SIPs are flexible—you can stop or withdraw anytime.

PPF has a 15-year lock-in, with partial withdrawals allowed after 7 years.

Liquidity

SIPs are highly liquid, and you can redeem units when needed.

PPF withdrawals are limited, making it less liquid.

Tax Benefits

ELSS (Equity Linked Savings Scheme) SIPs offer Section 80C benefits. However, returns above ₹1 lakh are taxable.

PPF is fully exempt under EEE (Exempt-Exempt-Exempt) status.

Pros and Cons of Mutual Fund SIP

Pros

High growth potential

Flexible investment

Suitable for all income levels

Cons

Market volatility risk

No guaranteed returns

Pros and Cons of PPF

Pros

Guaranteed returns

Triple tax benefits

No market dependency

Cons

Long lock-in period

Lower returns compared to equity investments

When Should You Choose SIP?

If you’re willing to take calculated risks and aim for wealth creation, SIP is your best friend. It’s ideal for long-term goals like children’s education, buying a house, or retirement.

When Should You Choose PPF?

PPF is perfect if you seek stability and security. It’s ideal for conservative investors focused on safe savings for retirement or emergencies.

Comparative Analysis: SIP Vs PPF

Short-term Goals: SIP wins due to liquidity and flexibility.

Long-term Goals: Both SIP and PPF work, but a mix of the two can balance growth and safety.

Combining SIP and PPF for Balanced Investing

Why choose one when you can have both? Diversify! Invest in SIPs for higher returns while securing a portion in PPF for stability.

Conclusion

Mutual Fund SIPs and PPFs serve different purposes. While SIPs are about growth and wealth creation, PPF ensures safety and guaranteed returns. Choosing between them depends on your risk appetite, financial goals, and time horizon.

FAQs

Can I invest in both SIP and PPF simultaneously?Yes, combining the two can help balance risk and returns in your portfolio.

Which one is better for retirement planning?Both are excellent, but SIPs offer higher growth, while PPF provides assured returns.

Are SIP returns guaranteed?No, they are market-linked and can fluctuate.

How does the PPF interest rate change over time?The government revises it quarterly based on economic factors.

Can I withdraw SIP investments partially?Yes, SIPs are liquid, and you can redeem your units anytime.

0 notes

Text

How to Claim Home Loan Tax Benefits in India

Buying a home in India comes with several tax benefits, especially if you have taken a home loan. These benefits can reduce your taxable income and make your home loan more affordable. Here’s how you can claim home loan tax benefits in 2024:

1. Deduction on Interest Paid (Section 24(b))

You can claim a deduction on the interest paid on your home loan under Section 24(b) of the Income Tax Act. For a self-occupied house, you can get a deduction of up to ₹2 lakh per year on the interest paid. If the house is rented out, there’s no maximum limit for the interest deduction, but the overall loss that can be adjusted against other income is capped at ₹2 lakh.

The loan must be taken for buying or constructing the house.

The construction must be completed within five years from the end of the financial year in which the loan was taken.

2. Deduction on Principal Repayment (Section 80C)

The principal amount of your home loan is eligible for a tax deduction under Section 80C. You can claim up to ₹1.5 lakh on the principal repayment, along with other eligible investments like life insurance, PPF, etc., under the same section.

The loan should be for buying or building a new house.

The property must not be sold within five years of taking possession; otherwise, the deduction will be reversed.

3. Additional Deduction for First-Time Homebuyers (Section 80EEA)

If you are a first-time homebuyer, you can claim an extra deduction of up to ₹1.5 lakh on the interest paid under Section 80EEA. This is over and above the deduction available under Section 24(b).

The loan must be sanctioned between April 1, 2019, and March 31, 2024.

The property’s stamp duty value should not exceed ₹45 lakh.

4. Joint Loan Benefits

In the case of a joint home loan, both borrowers can claim tax benefits separately, as long as they are co-owners. Each borrower can claim up to ₹2 lakh on interest and ₹1.5 lakh on principal repayment, potentially doubling the tax savings.

Conclusion

Claiming home loan tax benefits in India can significantly reduce your tax liability while helping you achieve homeownership. Ensure you meet the eligibility criteria under the respective sections, maintain proper documentation, and claim these benefits while filing your Income Tax Return (ITR) to maximize your savings.

1 note

·

View note

Text

Take Care of These 3 Things, and Get Rich with PPF!

Hey Reddit! 🌟 When it comes to safe, long-term investments, the Public Provident Fund (PPF) stands out as one of the smartest options in India. It’s backed by the government, offers solid returns, and comes with some sweet tax benefits. If you’re ready to grow your wealth steadily, here are 3 things you need to do with your PPF to maximize its potential!

1. Withdraw at Maturity for Maximum Gains

Your PPF account matures after 15 years. At this point, you can withdraw the entire amount, along with the interest—completely tax-free! Yes, all the interest you’ve accumulated over the years is yours to keep, no taxes involved. 🙌

Don’t forget, you can invest up to ₹1.5 lakh every year, which qualifies for tax exemption under Section 80C of the Income Tax Act. So not only does your investment grow, but you’re also saving on taxes each year. Win-win, right?

2. Extend for Another 5 Years to Keep Earning

When the 15-year period ends, it doesn’t mean your PPF journey is over. You can extend the account in blocks of 5 years and keep earning interest on your balance. You’re still free to make withdrawals if needed, but the best part? Your money keeps working for you without opening a new account. Oh, and the tax benefits? Yep, they’re still in place!

3. Let Your Money Grow Even Without New Deposits

Don’t feel like contributing more after 15 years? No problem. Your PPF will continue to earn interest on the existing balance, even if you don’t add more funds. It’s a passive way to keep growing your wealth without any effort. Your balance just keeps compounding, and you’re building a bigger nest egg!

Why PPF is a No-Brainer Investment

Guaranteed Returns: Since it’s backed by the government, your investment is super safe, and the returns are assured.

Tax-Free Gains: Both the interest and the maturity amount are tax-free, plus you get Section 80C tax benefits on annual contributions up to ₹1.5 lakh.

Perfect for Long-Term Savings: A 15-year maturity means you’re naturally building a strong savings habit.

Partial Withdrawals Allowed: Need funds before maturity? You can make partial withdrawals after 5 years.

Better Returns than FDs: The interest rate (currently 7.1%) usually beats traditional bank FDs, and PPF comes with added tax advantages.

How to Open a PPF Account

Anyone can open a PPF account: salaried employees, self-employed professionals, even minors (with a guardian). Just visit your nearest bank or post office. You'll need:

Identity proof (Aadhar, PAN, Voter ID)

Address proof

A couple of passport-sized photos

A filled account-opening form (available at banks or online)

Start depositing as little as ₹500 annually to keep the account active. The maximum you can invest is ₹1.5 lakh per year, so get started early to let your wealth snowball!

Final Thoughts

PPF is a tried-and-true investment option for anyone looking to grow their wealth safely. With guaranteed returns, tax benefits, and flexibility beyond its maturity, it’s a great way to build your future. Whether you're saving for retirement, your child’s education, or any long-term goal, PPF can help you get there! 💰💪

Happy investing!

1 note

·

View note

Text

Maximize Your Returns: A Complete Guide to Using a PPF Calculator

Investing in a Public Provident Fund (PPF) is a popular choice for individuals seeking a secure and tax-efficient savings option in India. To make the most of your PPF investment, leveraging a PPF calculator is essential. This tool helps you estimate your returns and plan your investments strategically. Here’s a complete guide to using a PPF calculator and maximizing your returns.

Understanding the PPF Calculator

A PPF calculator is an online tool that computes the maturity amount and interest earned on your PPF investments. By inputting details such as the annual investment amount, interest rate, and tenure, you can get an accurate estimate of your total savings at the end of the investment period.

Benefits of Using a PPF Calculator

Accurate and Quick Results:

Manual calculations of PPF returns can be complex and prone to errors. A PPF calculator provides precise results instantly, saving you time and effort.

Effective Financial Planning:

By knowing the expected returns in advance, you can plan your finances better. This helps in aligning your investment strategy with your long-term financial goals, such as retirement planning, children's education, or buying a home.

Comparison and Decision-Making:

A PPF calculator allows you to compare different investment scenarios. You can adjust the annual deposit amount, tenure, and interest rates to see how they affect your maturity amount, helping you make informed decisions.

Flexibility:

The calculator provides flexibility by letting you experiment with various input values. This helps you determine the optimal investment strategy to maximize your returns.

How to Use a PPF Calculator

Using a PPF calculator is straightforward. Follow these steps to get the most out of it:

Enter the Annual Investment Amount:

Input the amount you plan to invest in the PPF account each year. The maximum permissible investment is ₹1.5 lakh per financial year.

Select the Tenure:

The default tenure for a PPF account is 15 years. However, you can extend the tenure in blocks of 5 years after maturity. Choose the tenure based on your financial goals.

Input the Interest Rate:

Enter the prevailing interest rate for PPF. The government revises this rate quarterly. Ensure you use the current rate for accurate calculations.

Compounding Frequency:

PPF interest is compounded annually. The calculator automatically considers this compounding frequency to provide accurate results.

Calculate:

Click the 'Calculate' button to get the estimated maturity amount and total interest earned over the chosen tenure.

Example Calculation

Suppose you decide to invest ₹50,000 annually in a PPF account with an interest rate of 7.1% per annum for a tenure of 15 years. By entering these values into the PPF calculator, you can instantly see that the maturity amount would be approximately ₹13,05,032, with a total interest earning of ₹5,55,032.

Tips to Maximize Your Returns

Invest Early in the Financial Year:

Investing at the beginning of the financial year ensures that your money earns interest for the maximum period, thereby increasing your overall returns.

Consistent Annual Investments:

Regular and consistent investments help in compounding your returns effectively. Try to invest the maximum permissible amount annually to take full advantage of the PPF scheme.

Extend the Tenure:

After the initial 15-year tenure, you can extend the PPF account in blocks of 5 years. Extending the tenure allows your investments to grow further, enhancing your returns.

Conclusion

A PPF calculator is an invaluable tool for anyone looking to invest in the PPF scheme. It simplifies the calculation process, provides accurate results, and aids in effective financial planning. By using a PPF calculator, you can make informed decisions, compare different investment scenarios, and ultimately maximize your returns. Start using a PPF calculator today to take control of your financial future and achieve your long-term savings goals.

0 notes

Text

PPF Withdrawal for NRI

PPF withdrawals by NRIs can be done after following a certain procedure. We at NRI FinServ Ltd. assist you with getting your PPF withdrawals.

Public Provident Fund (PPF) is a safe saving scheme for NRI people and gives more tax benefits to each of them. Anybody can invest money for 15 years and the maximum amount to be invested is 1.5 Lacs. But one should keep up to date about the changes in new PPF with drawl rules when he shifts in foreign country to become non resident Indian.

In brief Indian govt. said in October 2017, those non resident PPF accounts would be converted to normal saving account who are likely near to move in a foreign country soon. But later subsequently government made a big change to the current scenario where non-residents can continue their PPF account even if they change their citizenship. PPF withdrawal gives flexibility to its account holder in which an account holder can partially debit amount after completion of 7 years if he needs any time. One major advantage of PPF account is that interests and amount deposited both are free from tax when someone withdraws it.

NRIWAY is trusted partner for NRI for resolving all kinds of requests put by them instantly. So PPF withdraws for NRI is an easier task today with us and get highly satisfied on time always seeking for NRI queries.

Premature Closing of PPF Account

PPF account may be closed even before the maturity of 15 years in some conditions and to take advantage of taxation people usually go for PPF opening scheme. PPF account provides flexibility to withdrawal amount partially either after 5 years or 7 years as per someone need for the health-related problem or educational purposes. So main thing to be noticed here is you can apply for closing a PPF account after a minimum of 5 financial years.

Important Facts about PPF Account

You are planning to invest in PPF scheme then need to know essential facts about it.

A minimum amount of 500 Rs. and 1, 50, 000 Rs. is necessary to be deposited in a financial year.

You can invest up to a maximum of 15 years.

An account can be extended in a block chain of a minimum 5 years period.

Deposits can be done in a maximum of 12 times during a financial year.

A fair interest rate is grabbed at 8% in most of the banks which are exempted from Income Tax under section 80 C.

1% of interest rate is minimized on the total accumulated amount when you partially withdrawal after 5 years of partial maturity.

Anyone can deposit amount in form of cash, cheque, online funds transfer which may differ from one bank to another.

PPF Partial Withdrawl Rules after 15 years extension

Under PPF scheme, partial withdrawal of ppf amount is allowed and in case you want to opt some money at any time after 5 years of partial maturity, check out below-mentioned points-

You can withdrawal up to 50% of the money deposited once the 5th financial year completed before making such a request.

Only one partial withdrawal is allowed within a financial year.

The requestor must submit a passbook along with application request form.

The withdrawal amount is tax-free.

What are PPF Withdrawl rules followed by an account holder?

To know everything about PPF account opening, tax benefits to withdrawal rules- follow our complete article. When you need to withdrawal some amount someone needs to fill Form C with the concerned branch of the bank where you manage your PPF account. There are 3 sections of this form:

Declaration Section: In this section, you just need to provide your PPF account number, amount of money you want to withdraw. Along with that, you must tell how many years already passed over since the account is maintained.

Office Usage Section: It consists of the following:

Date of PPF account opening

Total balance available in PPF account

Total withdrawal amount needed

Date and signature of service manager

Previous date of withdrawal request

Bank Detail Section: Under this section, a bank name, branch, etc. are to be taken where PPF amount is being credited. A PPF passbook also required to be attached with PPF withdrawal form.

Which account does an NRI need to invest in the PPF account?

An NRI cannot invest in the PPF account. Nevertheless, if somebody's residential status subsequently transforms to NRI, the account is permitted to be run till it reaches maturity. PPF account is a 15-year scheme that can be extended for an indefinite period in blocks of five years.

What is Tax Implication on Public Provident Fund Withdrawal?

The following table will assist you to understand the taxability on withdrawal of PPF with no trouble:

Serial No

Scenario

Taxability

1

Amount withdrawn is < Rs 50,000 before completion of 5 years of uninterrupted service

No TDS.

On the other hand, if the individual falls under the chargeable group, he has to present such PPF withdrawal in his return of income

2

Amount withdrawn is > Rs 50,000 before completion of 5 years of uninterrupted service

TDS at 10% if PAN is provided;

No TDS in case Form 15G/15H is provided

3

Withdrawal of PPF after 5 years of uninterrupted service

No TDS.

Additionally, the individual need not present the same in the return of income as such withdrawal is excused from income tax

4

Relocation of PF from one account to a new account upon a change of job

No TDS.

In addition, the individual should not present the same in return of income as it is not liable to tax.

5

Before completion of 5 years of uninterrupted service\ if

service is terminated due to the employee’s poor health

The business of the owner is suspended

or the reasons for withdrawal are ahead of the worker’s control

No TDS.

Moreover, the person need not present the same in the return of income as such withdrawal is not liable to tax

FREQUENTLY ASKED QUESTIONS (FAQs)

I had made an investment in PPF about 15 years before when I was a resident Indian. The account is going to mature in 2018, but I am an NRI at the moment. If I put in the matured amount in fixed deposits, will it be liable to tax?

Under the Public Provident Fund Scheme, NRIs are not entitled to open a PPF account. Nevertheless, they are permitted to invest in PPF in India on a non-repatriation base till maturity of the Public Provident Fund account that was opened when he/she was the inhabitant of India.

On 3 October 2017, a notice was published by the ministry of finance modifying the provisions of the PPF Scheme indicating that an Indian resident who opened an account under the PPF scheme shortly turns into a non-resident throughout the currency of the maturity period, the PPF account is supposed to be deemed to be closed from the date of amendment of residential status from resident to non-resident.

On the other hand, the recent amendment notice has been kept in abeyance till additional orders by an Office Order from the ministry of finance in February 2018. Therefore, an NRI can carry on contributing towards PPF in India on a non-repatriation base till maturity if the Public Provident Fund account was opened when the person was resident of India.

Under the income tax law, any amount acquired from the Public Provident Fund account is excused from tax in India, regardless of the residential status. As soon as you put in the matured amount in fixed deposits in India sustained in an NRO account, the interest income from these fixed deposits will be liable to tax in India, contingent on any respite under India’s Double Tax Avoidance Agreement with the country in which you might be a tax resident that can be availed by providing a tax residency official document along with other specified details.

Can PPF withdrawals be repatriated?

The balance in the NRO account can be repatriated in a foreign country up to a limit of USD 1 million per financial year.

I am an NRI living in the USA many years ago? Would there be an income tax liability on PF withdrawal after more than five years of service? If yes, which form do I need to submit?

Of course, the PPF withdrawal will be liable to tax as income, and you are supposed to incorporate it into your ITR under the subtitle 'Income from Salary.'

You ought to fill in the PF Withdrawal Forms recognized as Form 19 that can be downloaded without problems by logging on to the authorized PPF website at www.epfindia.org.in.

Can NRI close PPF account before maturity?

An NRI cannot invest in the PPF account. Nevertheless, if somebody's residential status subsequently transforms to NRI, the account is permitted to be run till it reaches maturity. PPF account is a 15-year scheme that can be extended for an indefinite period in blocks of five years. On the other hand, for a resident turned NRI, the extension is not permissible.

Is PPF withdrawal taxable after five years?

Of course, the PPF withdrawal will be liable to tax as income, and you are supposed to incorporate it into your ITR under the headline 'Income from Salary.'

I am an NRI living in the USA. What would be offering interest rate if I close my PPF account?

The Ministry of Finance, Government of India declares the rate of interest for Public Provident Fund account each quarter. The present interest rate effectual from 1 October 2018 is 8.0% Per Annum' (compounded once a year).

I am an NRI living in Abroad. Should I reopen or continue my PPF account in India?

Non-Resident Indians (NRIs) are not allowed to open a Public Provident Fund account. If an individual turns out to be an NRI after opening the Public Provident Fund account, he or she can carry on to maintain his account but is not allowed to extend its period further as soon as the term is completed.

What does the most recent news about NRI Public Provident Fund Account meant for NRIs?

The Non-Resident Indians cannot invest in Public Provident Fund. However, if somebody's residential status later changes to Non-Resident Indian; the account is permitted to be run till maturity. Public Provident Fund is a 15-year scheme that can be extended until further notice in blocks of five years. On the other hand, for a resident turned Non-Resident Indian, the extension is not permitted.

How NRI Withdrawal PPF In India, What Are Steps To PPF withdrawl In India For NRI, PPF Withdrawal For NRI, NRI PPF, PPF Withdrawal Rules, PPF Withdrawal Rules For NRI, PPF Withdrawal For NRI, PPF Withdrawal Rules After 15 Years, PPF Withdrawal Rules, PPF For NRI, Close PPF Account NRI, Can We Withdraw Money From PPF Account Before Maturity, PPF Withdrawal Rules After Maturity, PPF Withdrawal After 15 Years Extension, Can I Close PPF Account Before Maturity, PPF Withdrawal Form, Tax On PPF Withdrawal After 5 Years India, PPF Withdrawal After 7 Years, PPF Extension Rules.

#NRI #PPF #India #PPFIndia

2 notes

·

View notes

Text

Covid-19’s Impact on the Rise of Video Games and How It Still Affects Me Today

Price and Demand Increases During Covid:

When I was younger, video games occupied the majority of my free time after school. I was always on my iPad playing Diner Dash, or on the computer playing Minecraft or Roblox with friends. But during middle school and the beginning of high school, I found myself too busy with after school activities like lacrosse practice and academic team meetings. When I came home from school, I would always be short on time and had to start homework almost immediately. I still enjoyed video games but since I only found time to actually play on Sundays, the majority of my video game fixation was fulfilled by having gameplay Youtube videos play in the background while doing homework or eating.

However, after the pandemic started, my typical after school activities were cut and I was allowed to stay home the entire day for virtual school. Like everyone else, I had much more freetime and I wasn’t as physically tired as before. So again, like everyone else, my interest in video games increased and I wanted to get my hands on the newest releases like the Nintendo Switch game: Animal Crossing: New Horizons. Everyone’s collective newfound (or renewed) interest during the pandemic increased overall demand for the video game market.

Many gaming companies took notice of the rise of demand for their games, leading them to increase their prices on current ones or new/future releases in order to keep up with demand growth.

Here’s a graph of the data collected on price increases during Covid-19 for Retro Video Games:

Graph from: https://www.prnewswire.com/news-releases/retro-video-game-values-increase-33-since-the-start-of-covid-lockdowns-301263836.html

According to PriceCharting.com, after compiling price data on video games, notice that the average price increased for every major gaming console on the market. In the graph above, you can see that the average price increased by about $5.26 or 33.5%. This means that there might have been a chance that I could buy the new Animal Crossing game for 33.5% less if there wasn’t a pandemic!

PPF (Production Possibility Frontiers) and Opportunity Cost on Personal Gaming Habits:

After coming to UCI, I no longer have the right PC or laptop with me for the types of games that I gained interest in during the pandemic. Because of this, I typically go to PC Cafe’s here in Irvine or the UCI Esports Lounge where they have the right equipment that can run the games I want to play without delays. I try to balance the amount of time I spend at the Esports Lounge (Fridays) so that I only play to the point that both satisfies my hobby and leaves me with the right amount of time to study that day. Sometimes, I won’t have any assignments due or have time to do them later in the weekend so I’m able to play my maximum amount of time (5 hours). But, during weeks where I have major assignments, exams, or I feel as if I’m falling behind in classes, I need to consider the opportunity costs of me spending my Fridays playing games. This means I either reduce the amount of time I spend playing video games or I don’t play at all.

If I spend a certain amount of hours at the Esports Lounge or at my desk studying that is in the pink colored region, then I will be left feeling unsatisfied which might cause me to cope by watching gameplay videos on Youtube. Since I limit myself to 5 hours maximum at the Esports Lounge every Friday, the x-intercept cannot go past 5 hours. And, since going over 5 hours of studying on my Fridays makes me unhappy and extremely tired after an entire week of classes, it’s not feasible for the y-intercept to be greater than 5 hours either.

Works Cited:

PriceCharting.com. “Retro Video Game Values Increase 33% since the Start of Covid Lockdowns.” PR Newswire, 7 Apr. 2021, https://www.prnewswire.com/news-releases/retro-video-game-values-increase-33-since-the-start-of-covid-lockdowns-301263836.html.

Beyonce Hu

ID#:16062928

Econ 20A Friday, 12pm

0 notes

Text

How Much Tax Can Be Saved By A Salaried Person In India?

Income tax is the bitter reality that every salaried employee who falls in the taxable bracket has to swallow, it has to be paid. As the filing season closes by, every salaried class person gets anxious about the payable taxes he/she must take out for that financial year. The only question that is on everybody’s mind is, ‘How to lower down the tax outgo on the earned salary? ’ As per the government regulations, there are various tax saving opportunities, which when utilized in the right manner can cut a big chunk out of one’s tax outgo. The common sections of the tax act that can be utilized by the salaried employees to save on taxes are 80C, 80D, 80CCD (1B) and 24 (b).In order to do so, one should know their Pay Slips well and every component of it. The salaried employee should also have a sound understanding of their tax slab and should make wise and timely investment accordingly so as to minimize the impact of taxation on their salary. Ways to minimize the tax outgo on your salary House Rent Allowance (HRA) - HRA - the most significant part of one’s pay slip, as per the Indian Income Tax Act, is tax exempted. If an employee stays in a rented house, he can claim tax benefits on his HRA. This tax benefit can be claimed by filling out the rent details in the form 12BB at the end of the financial year and submitting the rent receipts along with it. Gratuity Pay - The gratuity pay that is received on separation from the corporate you are working with (can be due to retirement, becoming incapacitated, on termination or voluntarily leaving the job) is exempted from tax. The maximum exemption allowed per employee, on gratuity pay is INR 3,50,000. Meal Coupons - If you receive meal coupons from your employer as part of your payroll, these meal coupons are exempted from tax up to an amount of INR 2600 per month. Telephone/Internet expense - You should always save your telephone/internet bill payment receipts as it can help you later on. You can either get your telephone expenses reimbursed by your employer and if your company does not reimburses such expenses you can claim tax benefits on it. Home Loan - You can claim tax benefits on the interest payment of your home loan under section 24 of the Indian tax act,1961. The limit of deduction for home loan interest payment on your taxable income is INR 2,00,000. Benefits of tax saving on the second home loan: As per the tax act, if you get another home loan for a new house, while your first home loan is still running, there is no tax deduction limit on the interest paid for that second home loan. Investments under 80C - Certain investments that come under section 80C deductions give you tax rebate on your income. Whatever amount is invested by you is deducted from your taxable income. The maximum limit for 80C deduction is INR 1,50,000. List of investments that come under section 80C - PPF account - EPF account - Equity Linked Saving Scheme (ELSS) - Sukanya Samirddhi Yojna - Tax Saving FD - National Saving Certificate - Senior Citizen Saving Scheme Author’s Tip You should always follow the statutory HR policies to get tax deduction benefits. No fraudulent ways should be acquired. #HRMS #Spine #PayRoll #Assets #HR

#HRMS#HRIS#Spine Technologies#Mumbai#India#Best Payroll Software#HR and Payroll Software#section 80c

1 note

·

View note

Text

Benefits Of PPF Investment

PPF or public provident fund was introduced by the government of India in 1968 in India. The main objective of PPF is to help investors achieve their long-term investment goals by offering stable returns. PPF investment is best suited for those who want to get tax benefits and at the same time earn stable returns to build your retirement corpus. In this article, we are going to learn about PPF investment, how to use a PPF calculator, and its benefits.

Features of PPF investments

PPF investments provide a stable and risk free return. Currently, it provides an interest rate of 7.1% per annum.

The minimum investment amount to start investing in PPF is Rs. 500 and the maximum investment amount is Rs. 1.5 lakh per annum.

The tenure of PPF investment is 15 years.

Investors can claim tax deductions up to INR 1.5 lakh under section 80 C.

PPF investors can use PPF calculators to calculate the maturity amount but one thing you need to keep in mind is that the interest rates keep on changing with the help of the PPF calculator we can keep track of changing rates.

Benefits of PPF investment

Tax benefits

Investors can avail of tax benefits and claim deductions up to INR 1.5 lakh by investing in PPF U/S 80C of the Income Tax Act. The interest earned on PPF invested along with the maturity amount will be tax-free.

Extension of tenure

The minimum tenure of PPF investment is 15 years. However, the account holder has the option to extend the tenure for another 5 years and the option to continue the investment contribution or not.

Safe investment

PPF investment is considered safe as it is a government-backed scheme. Investors with a low-risk appetite can prefer to invest in PPF and earn a stable rate of interest.

Loan availability against PPF

Investors can avail of loans against their PPF account from the third to fifty years of PPF account opening. It is ideal for those who want to apply for short-term loans and at the same time do not want to pledge any securities.

Partial withdrawal

Investors can have the benefits of partial withdrawals from their PPF account after five years from the date of opening their PPF account. However, one can take a loan against their PPF balance if they have partially withdrawn their PPF amount.

To conclude, investing in PPF can be an ideal option for those who want to earn stable and risk-free returns. Also, they are government-backed investment options and are not market-linked. Most importantly offer tax-saving benefits. You can use the PPF calculator to find out the returns you are going to earn from your investment. However, various alternative investment options offer better returns than PPF.

0 notes

Text

Use PPF to Analyze My Romantic Relationship with Her

Throughout the entire quarter of learning economy, I gradually realize that all these theorems serve to describing the way of how the real world operates as the combination of decisions and behaviors made by every rational individual in the market. It is a wonderful experience to learn how to use scientific methods to describe and summarize the world, and it is also an interesting challenge to analyze the world from the economic perspective. In this post, I would like to elaborate my thoughts regarding my girlfriend under an economic model - PPF.

Brief Review of Terms regarding to Production Possibility Frontier

Trade-offs: budgeting inevitably involves sacrificing some of X to get more of Y. All decisions in real world involve trade-offs.

Opportunity cost: what you give up (X) to get some more of Y is the opportunity cost of Y.

A marginal change is a trivial incremental adjustment to a plan.

Marginal cost & Marginal benefit

Incentive: something that induces people to make decisions and act.

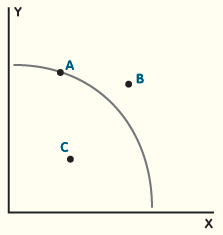

This following graph is a Production Possibility Frontier which is a curve describing the relationship between the two possible outputs under a fixed amount of output.

The First Step: Let’s assume that both of us in this romantic relationship are rational. In other words, we are sober enough to make rational decisions to seek maximum benefits (pleasure feeling) in this relationship in the terms of time as our cost.

Then, let’s analyze our relationship and discussing how the economic terms above playing roles in our daily life.

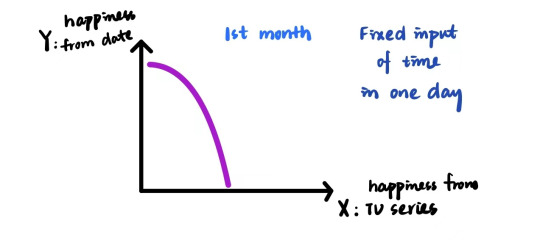

Her major interest is watching TV series. Set the value of constant happiness she could gain from watching TV series is 100 units per day and the total amount of spare time in one day is 5 hours.

After we met, she has to allocate her spare time to date with me. Due to the favorable impression and feeling of freshness, the initial value of happiness of dating with me is 150 units per day. Now, the benefit of dating is 30 units of happiness per hour and the cost of dating is 20 units of happiness per hour. And the marginal benefit of dating with me is 10 units as she giving up time of watching TV series. Then compare with watching TV series, the happiness of dating with me is greater so that she choose to spend all time to date with me in the first month.

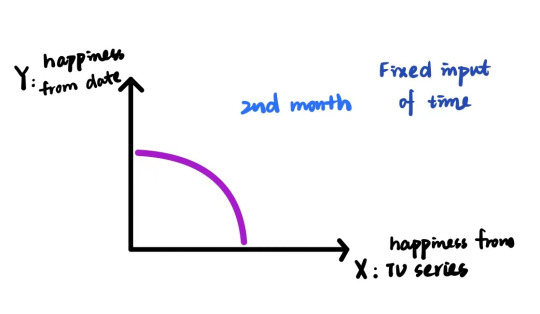

In the second month, as we getting more and more familiar with each other, the feeling of freshness is declined. Then value of happiness of dating with me decrease to 100 units per day. Now, the benefit of dating is 20 units of happiness per hour and the cost of watching TV series is 20 units of happiness per hour. Hence, the marginal cost is 0 now since the level of happiness from two activities is the same so there would not be any loss of happiness due to choosing one and giving up one.

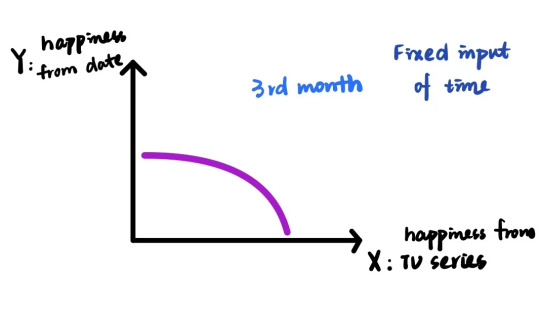

In the third month, since in the process of getting along with each other, some of my shortcomings that were covered up intentionally before are gradually revealed. Then value of happiness of dating with me decrease to 50 units per day. Now, the benefit of dating is 16 units of happiness per hour and the benefit of watching TV series is constantly 20 units of happiness per hour. Hence, the marginal cost of dating is 4 units of happiness as well as the marginal benefit of watching series is 4 units of happiness per hour. In this situation, the cost of dating is increased and the marginal benefit of it is decreased, then the better allocation plan for her is to spend time on watching TV series to seek for maximized value of happiness in a fixed amount of time.

For the graphs above, the purple curve is the Production Possibility Frontier that describes the trade-offs between dating and watching TV series for my girlfriend. If the input of time is fixed and other conditions remain the same, then the total happiness she can gain from these two activities can not go beyond the boundary of the PPF.

This brought a possible solution for my situation if I want to win her time back - expanding the boundary of Production Possibility Frontier. In the other words, increasing the efficiency of generating happiness in unit amount of time. That means I should improve myself to be a better person to win this game of love!

Name: Jinrui Zhang

Student ID:72973424

March 10

0 notes

Text

How to invest money in your 20s in India

1. Mutual Funds

Mutual Funds are money that is pooled together by many investors and managed professionally by a fund manager. It's a trust that collects money on behalf of investors who share a common investment goal. The money can be invested in equities or bonds, as well as other financial instruments. Each investor owns a percentage of the fund's total assets.

Mutual funds can be a great investment option for early-stage investors, as they are easy and affordable to research and purchase. Most mutual funds require a minimum lump-sum investment of Rs. 1000 to Rs. Investors can invest as little as Rs. These funds allow investors to start a SIP for as low as Rs.100 each month. High-risk Mutual funds can offer annualized returns up to 30-35%. Section 80C allows mutual funds to be exempt from tax.

These are the top Mutual Funds that you can invest in.

ICICI Prudential Focused Bluechip Equity Fund

Aditya Birla Sun Life Small & Midcap Fund

Tata Equity PE Fund

HDFC Monthly Income Plan- MTP

L&T Tax Advantage Fund

2. Life Insurance Policies

The younger and more healthy you are, the less expensive life insurance will be. Because you get older, your chances of developing health problems that can increase the cost or make you uninsurable are higher. Life insurance policies are essential in your 20s.

Life insurance can be a smart financial decision. It provides a safety net for your loved one and beneficiaries in the event of your death. Your family might be dependent on your income, and you may have large educational loan debts. Your premium will not change if you purchase a policy for more than 30 years when you are still in your 20s. If you wait 15 years, your premium will increase. It is a good idea to buy insurance policies as soon as possible. You should have the following insurance plans in your portfolio:

Life insurance

Health Insurance

Personal accident/Disability coverage

Financial experts recommend against investing in Life Insurance policies as they have had poor returns.

3. Shares/ETFs

Simply put, investing in shares is like investing in businesses. You buy shares in a company and invest your money in its business. In return, the company pays dividends. Your investment in the company will increase as the company performs well.

Your 20s is a great age to learn about the share market and how you can invest in shares of different companies. Although the stock market can be volatile, it is crucial to identify the best companies to invest in. This is done by performing fundamental analysis as well as technical analysis of the company’s share price over time.

The right company can be very profitable over the long-term if you invest in it. For example, if 1 Lakh INR was invested in HAVELLS shares back in 2005, it would have grown 100x to 1 Crore by 2021. This is why it's important to invest in the right stocks in order to get more returns.

ETFs, also known as Exchange Traded Funds, are security products that track an Index sector or commodity. However, they can be bought or sold on the same stock exchange as regular stocks. NIFTY 50, a benchmark Indian stock exchange index, is the weighted average 50 largest Indian companies that are listed on the National Stock Exchange. These indexes can be invested in just like shares of any other company. Indexes are used to measure the performance of a particular sector, commodity, or asset and therefore are less risky than investing in shares.

4. Purchasing a House/ Investing in Real Estate

Buying a house is probably the biggest life goal for Indians between the ages group 22 to 45. A 2019 survey by Aspiration Index found that Indians aged 22 to 45 consider buying a house and saving money for their children's education to be the top long-term goals. A house is a good investment choice. A home is the most tangible asset that you can invest in, given India's obsession with tangible assets. Owning a home has the obvious financial advantage of price appreciation, which builds home equity. A home purchase can also bring tax benefits. Section 24 of the I-T Act allows interest deductions up to Rs 2 Lakh, which includes 1/5th interest earned during construction.

Although buying a home in your early years of working life can seem overwhelming, as you may not have sufficient capital to make a downpayment on a house during this time, it is possible to save enough money in your late 20s and start saving up for the down payment so that you can consider purchasing a house.

5. Fixed Deposits (FDs) and Recurring Deposits

Fixed deposits are a great way to increase savings while maintaining maximum safety. You can make a lump sum deposit with your bank/financier, and then choose the tenure that suits you best. The tenure ends and the deposit earns interest for the duration of the term at the rate you have set.

Like an emergency fund, it is always a good idea to have a short-term savings plan. You can keep an RD for 6 months to one year, which will ensure you have enough cash on hand. Many banks offer interest rates between 6% and 7%.

If you are looking for low-risk investment options that offer both security and liquidity, FDs or RDs can be a good option. You can begin investing in these instruments as early as your 20s.

6. Investing in Precious metals – Gold/Silver

India's people love to invest in precious metals such as Gold and Silver because they are a sought-after commodity for centuries. The rare and highly liquid asset of gold is unique. It is used to hedge currency risk and protect against inflation losses. Gold is a better investment than Silver because Silver prices are constantly under the shadow of the Gold market.

Let's compare the prices of 10 grams of Gold back in 2000 and 2021 to put the situation in perspective. The price for 10g of 24K gold in 2000 was as low as 4400 INR. In 2021, the price is almost 50,000 INR. This represents a gain of 1036% over 21 years (CAGR 12.27%). You can see that Gold is a smarter investment option than fixed deposits in Banks (7%) and low-risk mutual funds (8-10%).

If you are looking for an investment that is safe, liquid and offers decent annual returns, then Gold can be considered. Investing in Gold comes with storage risks and theft risks. Therefore, one should be careful and plan for safety and storage before investing.

7. PPFs

The central government has created the PPFs, a long-term retirement savings scheme that currently offers 7.6% interest per year. It is best to start investing at the beginning of FY (beginning at Rs. To reap maximum benefits, you should invest between 500 and 1.5 lakhs. It can be extended in five-year increments after maturity. All interest, capital, and proceeds are exempt from tax (also known as EEE benefits).

If you don't want to take greater risks with your savings, but still wish to invest for tax benefits and average returns, PPFs might be a good option.

8. Cryptocurrencies

Cryptocurrencies are a popular, but risky, investment option that is gaining popularity. Cryptocurrencies can offer higher returns over a shorter period of time. BITCOIN is becoming a popular buzzword and investors are increasingly interested in investing in it.

Cryptocurrencies are digital currencies that use cryptography to protect their privacy and security. Blockchain technology is the basis of security. It is simply a shared digital ledger that is linked in blocks and then made available to the public in a shared network. Due to the complexity of interbank transactions globally, exchange rates must be considered. This can lead to higher transaction costs. Because they accept the same rate globally, cryptocurrencies solve the problem and allow transactions to be completed much quicker than the existing process. Cryptocurrencies will be used to make transactions quicker and easier for larger businesses as well as people who need to travel frequently to other countries.

It is important to learn about the various projects and understand the importance of cryptocurrency before you decide to invest. Bitcoin is the most widely used cryptocurrency and has the highest market capitalization. Ethereum and Binance Coin are close behind.

The 20-year-olds are the most risk-averse and have some money after other investments. Keep in mind that cryptocurrency prices can fluctuate and one should only put money that they are willing to risk in the event that things don't go according to plan.

0 notes

Text

What are the Important Tax Saving Schemes?

There is a famous saying as “a penny saved is a penny earned”. Tax planning is one of the ways by which you can save on taxes and increase your income. The income tax act provides deductions for various investments, savings, and expenditures incurred by the taxpayer throughout the financial year. There are many smart ways to save taxes and enjoy the maximum savings. A smarter approach is to start investing in the early quarters of the financial year so that one can get time to plan sensibly and can obtain a maximum return on investing in different tax-saving investments.

While choosing the right tax saving investment plan, it is important to consider the factors such as safety, returns, and liquidity. Before moving to the list of best tax-saving investments schemes, it is important to have a proper understanding of how the returns would be taxed and about the Online Income Tax Act i.e, section 80C. Most forms of the tax saving schemes work under the parameter of section 80C of Income Tax Act. As per the Act, the investment made by the investor are eligible for tax exemption up to a maximum limit of 1,50,000.

Some of the tax-free investment schemes include Equity Linked Saving Schemes (ELSS), Fixed Deposits, Life Insurance, Public Provident Fund, National Saving Schemes, National Pension Systems, and Loans.

Life Insurance

Tax benefits along with protections and savings makes life insurance an exceptional financial tool. You can avail tax benefits on the premiums paid for self, spouse, and children under 80C of Income Tax Act. The maximum deduction allowed is 1.5 lakhs. You can get adequate knowledge regarding investment from a financial consultant in Chennai. The tax benefits are also available for maturity proceeds received, subjected to prevailed tax laws.

Fixed Deposits (FD)

You can obtain a tax benefit of 1.5 lakhs for the investment made in fixed deposits under section 80C of the Income Tax Act. All banks offer fixed deposits and they are easy to open and operate.

Funds Notified by the Central Government

Investments made in funds notified by the central government such as National Defense Fund, Prime Minister’s Drought Relief Fund, Swachh Bharath Kosh, etc. are eligible for a tax deduction. However, the amount invested must not be more than 10% of the adjusted gross total income.

Equity Linked Saving Scheme (ELSS)

In diversified equity mutual funds, the investment made in ELSS is subjected to tax benefits up to 1.5 lakhs per financial year under section 80C.

Public Provident Fund(PPF)

Deposits made in the Public Provident Fund are qualified for tax deduction under 80C. Before making an investment, it is advisable to get a better understanding of the best investment consultants in Chennai. You can claim a maximum deduction of 1.5 lakhs in a financial year. The accumulated interest and the amount are also exempt from tax during withdrawal.

National Saving Certificate(NSC)

Available at the designated post office, with a lock-in period of 5 years, you can tax deduction on an investment made in NSCs. you can avail of tax benefits on investments made up to 1.5 lakhs in NSCs for a fiscal year.

Employee’s Provident Fund (EPF)

An avenue that helps you save tax and build a tax-free corpus, the contribution you as an employee make through EPF qualifies the tax benefits under 80C. The maximum limit is 1.5 lakhs. It is also to be noted that the interest earned by the employers declared every year is tax-free.

National Pension System (NPS)

The National Pension System is started by the government for those working in an unorganized sector to receive a pension after retirement. NPS is a prudent tax-saving instrument. You can claim the tax deduction for the investment of a maximum limit of 1.5 lakhs under 80C. You can also claim an additional deduction of Rs. 50,000 under 80 CCD.

Loans

You can also save taxes on interest paid on home loans and educational loans. While in the case of, educational loan the amount paid as interest for a particular financial year is eligible for deduction without any limit, but for home loans, it is Rs. 50000 per year subject to certain conditions. Exide Life Insurance has a host of tax-friendly life insurance policies for your needs.

Investments in these tax-saving instruments are an ideal way to reduce tax liability. It is more important for you to understand the pros and cons of the tax-saving instruments before making an effective investment decision.

Disclaimer: Trading and investments in Equities and Commodities are subject to market risk, there is no assurance or guarantee of the returns. These are the suggestions to make you familiar with the process. Get a word from an expert before investing.

0 notes

Link

Know well about ITR forms

Who can file Income Tax Returns?

Individuals, HUFs, AOPs, BOIs, firms and companies are mandated to file the income tax return (ITR) if the income earned is taxable. Each of these taxpayers is taxed differently under the Income Tax laws of India wherein the domestic companies and firm have fixed a 22 per cent tax rate but the individuals are taxed as per the tax slabs.

Advantages of filing income tax returns (ITRS)

It has often seen that many individuals believe that if their salaries fall below the taxable bracket then they don’t need to file an income tax return (ITR). However, that is not true! Even if your earned income is not taxable, you should file ITR as it will benefit you in different ways. Listed out the following advantages of filing income tax returns:

Avoid Penalties:

Easy Loan Approval:

Address Proof:

Compensate for Losses in the next Financial Year:

Hassle-free Visa Processing:

Filing ITR timely can help you avoid penalties imposed by the Income Tax Department for belated return that could cost you extra interest.

In India, ITR is one of the important documents asked by banks in sanctioning a loan to an individual. Many banks and NBFCs ask for ITR receipts of the latest 3 years when applying for the loan such as home loan, car loan etc. Such lenders consider ITR as the most authentic document of verifying an individual’s income. Hence, an individual who is filing ITR on time can benefit from hassle-free loan approval.

Income Tax Return (ITR) receipts can serve as a residential proof as it is sent directly to your registered address.

If you are eligible to file ITR but didn’t then you would not be able to carry forward the losses of the current financial year to the next financial year. Hence, it is vital to file the ITR to claim the losses in the future years.

At the time of applying for Visa, the embassies generally ask for past ITR receipts to process the Visa application of an individual. So, filing ITR before the due date can help you in quick Visa processing at the time of Visa application.

Things to remember before filing an Income Tax Return

Income tax return filing is very important and if you have not filed your return yet, it’s a good idea to get going and try to do it as early as possible. Tax filing involves a lot of paperwork, confusion and queries. To ensure a seamless process, give yourself enough lead-time for a smooth and timely return filing. Unfortunately, there are penalties to be paid, if the deadlines are missed. These fines range between Rs. 5,000 to 10,000, depending on the delay.

You can get help from professionals to file your tax return who can advise you on how to save tax, the available deductions and exemptions under 80C and assist you with investment planning. But, if you are planning to file returns yourself, here are a few important things you could keep in mind.

First of all, make sure to collect all the required documents that you will need to file your ITR Form such as Form 16, Form 26AS, investment documents, premium payments, loan statements, salary slips, bank statements, and proof of capital gains (if any) that will help you in providing the details of tax deducted at source (TDS) and to compute the gross taxable income of yours in that financial year.

Similar to this, if you have redeemed mutual fund units within that year, you can reach out to your mutual fund house to provide you with the transaction statements and capital gain statements. Remember, if the gains exceed Rs. 1 lakh, you will be required to pay tax on LTCG. Once you finished computing your total income, the next thing is to calculate your tax liability by applying the tax rates as per your income slab.

Important Things To Remember While Filing Income Tax Returns

Know Your ITR Forms Well

The Central Board of Direct Taxes (CBDT) has made few amendments in the ITR forms to ease the process of filing Income Tax returns. The number of forms to be used by taxpayers has been reduced from 9 to 7. For individuals with annual taxable income (from salary, interest, one house property) of up to Rs. 50 lakh, ITR 1 is required to be filed. Whereas, for individuals with annual taxable income of more than Rs. 50 lakh, ITR 2 is required to be filed.

Mandatory Disclosure

Following up on the Central Government's efforts on demonetisation, the Income Tax department has made it mandatory to disclose cash deposits of Rs. 2 lakh and more in bank accounts. This was first initiated during the demonetisation period and continues to this day. The Income Tax department requires a declaration in a separate column giving details of money deposited along with bank details in the income tax returns. To prevent being taxed at 60% plus surcharge and cess, tax payers need to explain all sources or forms of income or investment.

Carefully Select the Assessment Year and Financial Year

Assessment Year and Financial Year are not the same and you need to be familiar with them in order to correctly file your taxes. Financial Year is the period or year within which you earn the income, whereas Assessment Year is the period or year that follows Financial Year and it is in this year that you file your tax return. Every Financial Year and Assessment Year begins on the 1st of April and ends on 31st of March. Assessment Year always comes after Financial Year.

Since your income is taxed in the Assessment Year, you have to select Assessment Year while filing your income tax return.

Check For Deductions Under 80C

Section 80C entitles you to certain deductions from the gross total income, up to a maximum limit of Rs. 1.5 lakh. It is the most widely used option to save income tax. The investments and expenditures that qualify for deduction under section 80C are investments in National Savings Certificates (NSC), Kisan Vikas Patra (KVP), notified Equity Linked Saving Scheme (ELSS) of a mutual fund, five-year post office term deposits, five-year bank fixed deposits, contribution to Employee Provident Fund (EPF), Public Provident Fund (PPF), Superannuation Funds and premiums paid for life insurance, annuity plan and Unit-Linked Insurance Plans (ULIP), etc.

These investments can not only be claimed as deduction while calculating your total taxable income but can also generate good returns. Moreover, investment in PPF, superannuation funds, etc. also help in accumulating funds for retirement planning.

Check TDS on Form 26A

Form 26A is an important document for tax filing. It provides details of the income paid to you, the tax deducted on that income and the amount of TDS deposited by the payer with the Government. The form also contains details of any refund applicable to you. To check your tax deduction on Form 26A, you have to go to https://incometaxindiaefiling.gov.in and login to your account. Next, you have to go to ‘My Account’ and click on ‘View Form 26AS’ in the drop down.

Conclusion

While filing your income tax return, ensure that you know the relevant ITR forms well, make the necessary disclosures, select appropriate assessment year, take advantage of 80C deductions and verify your TDS from Form 26A. This will ensure a smooth and hassle-free tax filing process.

For reference: http://www.incometaxindiaefiling.gov.in/main/ListOfITRsAndOtherForms

0 notes