#Investment tips

Text

10 notes

·

View notes

Text

How you should invest in your 20s – housesofinvestors

Introduction

Investing is one of the most important things you can do for your future. It helps build wealth and gives you a chance to really see how much money you’re making over time. But it’s not always easy—especially when you’re young! Here are some tips so that you can invest in your 20s:

Get rid of any high-interest debt

High-interest debt is the worst kind of debt, and it’s one of the biggest threats to your financial future. If you have high-interest debt, it’s time to get rid of it (or at least pay off as much as possible).

Here are some tips for paying off high interest rates:

Only use credit cards when absolutely necessary. If there’s anything about credit cards that makes me want to vomit—and I mean vomit—it’s their exorbitant interest rates. The average APR on a 30 day introductory balance is around 19%. That means if you carry a $10,000 balance with an 18% APR, then every month alone adds up to almost $1,200 in interest charges! And who wants those kinds of monthly payments? No thanks! Instead make sure all purchases are made cash or debit card so that no one has access to any information about them except themselves (this goes double if they’re trying buy something expensive).

Avoid taking out new loans until after graduation day because even though borrowing money now doesn’t seem like much trouble now since everyone else seems so successful at doing this stuff without owing anyone anything back yet either end up paying huge amounts later down road when things go wrong due lack knowledge about how best manage finances during early twenties years where risk taking behavior may increase significantly due lack experience gained beforehand.”

Invest in what you know

Once you’ve completed your high school education, it’s time for the next step in your journey: investing. This may sound like a daunting task, but there are plenty of ways that you can invest in yourself and make sure that you’re doing things that are right for your interests and goals.

Investing in yourself means investing in what makes you happy—whether that’s dancing or playing tennis; volunteering at an animal shelter or helping out at an art gallery; collecting antiques or making music with friends. It also means putting down roots (literally) by moving out of home or getting married so that one day when those kids come along they don’t have to move away from their family again because their parents had big dreams but couldn’t follow through on them due to financial constraints.”

Buy term life insurance

Term life insurance is the best way to protect yourself and your family, since it protects you against the death of someone else.

Look into a Roth IRA

If you’re worried about paying taxes on your income when you invest, a Roth IRA is a great way to keep the money in your pocket—and out of the hands of Uncle Sam.

A Roth IRA can be opened by anyone who has earned income and reaches age 59½ (or 60 if they are disabled). The maximum contribution limit is $6,000 per year ($5,500 if married filing jointly). The IRS lets you contribute more than this amount if you have earned income above that threshold; however, there won’t be any tax deduction for doing so.

The advantage of opening an individual retirement account (IRA) is that once it’s open, contributions made into them don’t count toward taxable income until withdrawn or used for other purposes—so long as they aren’t withdrawn within five years after being deposited into an account

Don’t chase returns or hot stocks

When you start investing early, it’ll pay off later on in life

When you start investing early, it’ll pay off later on in life.

Investing early helps build a good foundation for your retirement. You can start with a small amount of money, and it will grow over time. This means that if the market goes up or down during the years that follow, you won’t lose everything because of bad timing or an ill-timed purchase (such as buying high and selling low).

Having more time to make up for mistakes is great! If something doesn’t work out as planned—like trying out an investment strategy that doesn’t pan out well—you’ll have more time before having to get rid of all those investments so they don’t take away from other things like rent/mortgage payments or student loans repayment plans..

My Opinion

When you start investing early, it’ll pay off later on in life. It’s important to remember that most of these ideas are things you can do today while still working a job and having fun! If nothing else, this article should give you an idea of what type of investments might be right for your specific situation.

#Tagsearly investing#invest money#invest money in your 20s#investment strategies#investment tips#writers on tumblr#finance#blogger

7 notes

·

View notes

Text

youtube

#share market#stocks market#multibagger stocks#investment tips#funny jokes#jokes#stocks#bollywood#Youtube

3 notes

·

View notes

Text

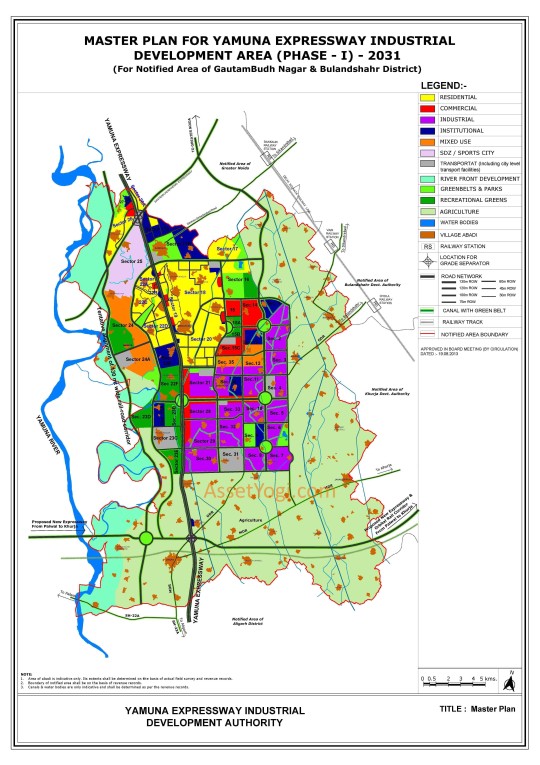

Investment in Yamuna Expressway project.

Investing in the Yamuna Expressway project. This is an important infrastructure project that will benefit the local economy and provide important transportation links. We are confident that investing in this project will yield great returns as the area is rapidly growing and developing. We encourage you to look into this project further and get in touch with our team if you have any questions or concerns. Thank you for your time and consideration.

#yamuna authority#yamuna expressway#Yamuna expressway plots#noida#realestate#real estate tips#investment tips#property#investment#yeida#yeida plots

3 notes

·

View notes

Link

🔍 Are Crypto Trading Bots Profitable? Discover how automation could transform your crypto trading strategy! 🚀💵 Our in-depth guide explores how these bots work, their profitability, and how to choose the right one for you. Ready to boost your crypto gains? 📈🤖

#crypto trading#trading bots#crypto profits#automated trading#invest smart#trading strategy#crypto gains#blockchain#investment#financial freedom#crypto tips#trading success#smart investment#crypto experts#investment tips

0 notes

Text

Transform Spare Change into Wealth with Acorns!

Discover why having acorns in your pocket can transform your spare change into a powerful investment tool. Meet Acorns, the app that rounds up your purchases—like that $3.50 coffee—to the nearest dollar and invests the extra 50 cents for you. It’s like a smarter piggy bank!

Imagine turning daily habits into a diversified portfolio of ETFs effortlessly. With options for recurring investments and retirement planning through IRAs, Acorns simplifies investing for everyone—from beginners to experts. Don’t let your change sit idle; make it work hard for you! Download Acorns today and start growing your wealth one coffee at a time.

#InvestSmart #AcornsApp

#acorns app#invest spare change#investment app#round up investing#coffee investment#diversified portfolio#ETFs explained#retirement planning#IRA accounts#money management#financial education#passive investing#easy investing#wealth growth#investment tips#beginner investing#technology finance#smart savings#financial independence#app for investing#investment strategies#savings app#grow your wealth#financial literacy#investing made simple#personal finance tips#money growth#digital piggy bank#recurring investments#financial tools

0 notes

Text

Transform Spare Change into Wealth with Acorns!

Discover why having acorns in your pocket can transform your spare change into a powerful investment tool. Meet Acorns, the app that rounds up your purchases—like that $3.50 coffee—to the nearest dollar and invests the extra 50 cents for you. It’s like a smarter piggy bank!

Imagine turning daily habits into a diversified portfolio of ETFs effortlessly. With options for recurring investments and retirement planning through IRAs, Acorns simplifies investing for everyone—from beginners to experts. Don’t let your change sit idle; make it work hard for you! Download Acorns today and start growing your wealth one coffee at a time.

#InvestSmart #AcornsApp

#acorns app#invest spare change#investment app#round up investing#coffee investment#diversified portfolio#ETFs explained#retirement planning#IRA accounts#money management#financial education#passive investing#easy investing#wealth growth#investment tips#beginner investing#technology finance#smart savings#financial independence#app for investing#investment strategies#savings app#grow your wealth#financial literacy#investing made simple#personal finance tips#money growth#digital piggy bank#recurring investments#financial tools

0 notes

Text

Here’s a Warren Buffet Investment principle:

A simple rule dictates my buying: Be fearful when others are greedy and be greedy when others are fearful.”

This simple rule shows how important Buffett thinks managing your emotions is in order to be a good investor.

Markets are made up of human beings who get overly optimistic at times and overly pessimistic at other times.

Understanding these two emotions can help you take advantage of market conditions and profit as an investor.

#warren buffett#investment#how to invest#investment tips#investment opportunities#positive mindset#positive mental attitude#positive thoughts

1 note

·

View note

Text

#Passive Income#Financial Independence#Real Estate Investments#Passive Income Strategies#Offline Income#Wealth Building#Income Streams#Rental Properties#High-Yield Savings#CD Investments#Small Business Ideas#Peer-to-Peer Lending#Royalties#Franchise Ownership#Financial Freedom#Side Hustles#Investing#Money Management#Personal Finance#Earn Money While You Sleep#Residual Income#Long-Term Investments#Property Management#Financial Security#Investment Tips#Passive Earnings#Entrepreneurship#Business Ownership#Real Estate Wealth#Savings Growth

1 note

·

View note

Text

Bull Market in a Nutshell

A bull market represents a period when the prices of assets, particularly in stock markets, are rising or are expected to rise. It is characterized by investor confidence, optimism, and expectations that strong results will continue. Understanding the dynamics of a bull market is crucial for traders and investors who wish to maximize their returns.

What is a Bull Market?

It is a financial market…

#Bull Market#Economic Growth#Economic Indicators#GDP Growth#Interest Rates#Investing#Investment Tips#Investor Confidence#Market News#Market Phases#Market Risks#Market Sentiment#Market Trends#Stock Market#Trading Strategies

0 notes

Text

Exploring the World of CFD Trading: A Comprehensive Guide

CFD trading, or Contract for Difference trading, has gained immense popularity among traders looking to capitalize on market movements without owning the underlying asset. This trading method offers a plethora of opportunities and flexibility, making it an attractive option for both novice and experienced traders. In this comprehensive guide, we'll delve into the nuances of CFD trading, its benefits, and how you can get started.

Understanding CFD Trading

CFD trading is a form of derivative trading that allows traders to speculate on the price movements of various financial instruments such as stocks, commodities, indices, and currencies.

The essence of CFD trading lies in the agreement between the trader and the broker to exchange the difference in the value of an asset from the time the contract is opened to when it is closed. Unlike traditional trading, CFD trading does not involve the actual ownership of the asset.

Benefits of CFD Trading

Leverage: Leverage lets traders control larger positions with a smaller initial investment. For instance, with leverage of 1:10, you can control a position worth $10,000 with just $1,000. However, while leverage amplifies potential profits, it also increases the risk of losses.

Diverse Market Access: CFD trading provides access to a wide range of markets. Whether you're interested in trading stocks, indices, commodities, or forex, CFDs offer a versatile platform to diversify your trading portfolio.

Short Selling: Through CFDs, traders can capitalize on both upward and downward market movements. If you believe an asset's price will decline, you can open a short position and profit from the drop in value.

No Stamp Duty: In many countries, CFD trading is exempt from stamp duty, making it a cost-effective trading method. This advantage is particularly appealing to traders who engage in frequent transactions.

Hedging Opportunities: CFDs can be used as a hedging tool to protect your existing portfolio. For instance, if you hold a long-term investment in a particular stock but anticipate a short-term decline in its price, you can open a short CFD position to offset potential losses.

Getting Started with CFD Trading

Choose a Reputable Broker: Selecting a reliable and regulated broker is crucial for a successful trading journey. Platforms like Spectra Global offer user-friendly interfaces, advanced trading tools, and comprehensive educational resources to help you get started.

Open a Trading Account: Once you've chosen a broker, the next step is to open a CFD trading account. This typically involves filling out an application form, verifying your identity, and depositing funds into your account.

Learn the Basics: Before diving into CFD trading, it's essential to understand the fundamentals. Familiarize yourself with key concepts such as margin, leverage, and risk management. Spectra Global provides a wealth of educational materials, including webinars, tutorials, and articles to enhance your trading knowledge.

Develop a Trading Strategy: A well-thought-out trading strategy is the cornerstone of successful CFD trading. Your strategy should outline your trading goals, risk tolerance, and preferred trading methods. Whether you prefer technical analysis, fundamental analysis, or a combination of both, having a clear plan will guide your trading decisions.

Practice with a Demo Account: Most reputable brokers, including Spectra Global, offer demo accounts where you can practice trading with virtual funds. This gives you the opportunity to practice trading without the risk of losing actual money. Use this opportunity to refine your trading strategy and build confidence.

Stay Informed: The financial markets are dynamic and influenced by various factors such as economic data, geopolitical events, and market sentiment. Stay updated with the latest news and market analysis to make informed trading decisions.

Managing Risks in CFD Trading

While CFD trading offers significant opportunities, it's essential to manage risks effectively. Consider these strategies for managing risk effectively:

Use Stop-Loss Orders: Stop-loss orders automatically close your position if the market moves against you beyond a certain point. These orders automatically close your positions to limit losses and protect your investment.

Limit Leverage: While leverage can amplify profits, it also increases the potential for losses. Use leverage judiciously and avoid over-leveraging your trades.

Diversify Your Portfolio: Diversification helps spread risk across different assets and markets. Spread your investments across various trades and asset classes to minimize risk.

Regularly Review Your Strategy: Continuously evaluate and adjust your trading strategy based on your performance and changing market conditions. Stay adaptable and willing to modify your approach as needed based on market conditions.

Conclusion

CFD trading presents an exciting avenue for traders to explore diverse markets and leverage opportunities for profit. With the right knowledge, strategy, and risk management practices, you can navigate the world of CFD trading successfully. Platforms like Spectra Global provide the tools and resources needed to embark on your trading journey with confidence.

Ready to Start Trading CFDs?

Take the first step towards successful CFD trading with Spectra Global. Open your account today and gain access to a world of trading opportunities. Get Started Now!

By following this guide, you can build a strong foundation in CFD trading and potentially achieve your financial goals. Happy trading!

#CFD Trading#Contract for Difference#Derivative Trading#Leverage Trading#Short Selling#Market Access#Trading Strategies#Risk Management#Financial Instruments#Trading Portfolio#Hedging Opportunities#Spectra Global#Trading Platforms#Demo Trading#Investment Tips#Trading Education#Forex Trading#Stock Trading#Commodity Trading#Indices Trading

0 notes

Text

0 notes

Text

72, 114 और 144 के नियम जान लेंगे तो निवेश में दोगुना कर सकेंगे पैसा, जानिए क्या है राज

निवेश टिप्स: 72, 114 और 144 के नियमों का उपयोग करके, आप यह पता लगा सकते हैं कि किसी निवेश विकल्प में आपके निवेश को दोगुना, तिगुना और चौगुना होने में कितना समय लगेगा।

Investment Tips: पर्सनल फाइनेंस एक्सपर्ट्स के मुताबिक, आपको हमेशा उसी निवेश विकल्प में निवेश करना चाहिए जिसकी आपको समझ हो। अगर आपको किसी निवेश के बारे में अच्छी जानकारी नहीं है, तो वहां जोखिम लेने से बचें। पर्सनल फाइनेंस एक्सपर्ट्स…

0 notes

Text

Discover how economic indicators shape the stock market and influence your investments. To know more, read the full article.

#unirav#stock market#investing stocks#economic indicators#investing#investment tips#investment#financial planning

1 note

·

View note

Link

Unlock the secrets to transforming your trading game with Coinrule! 💰🔑 Our latest article reveals the Top 5 Bot Trading Strategies that will turn beginners into pros. From automated precision to time-saving techniques, these strategies are your key to navigating the crypto jungle. 🚀✨ Discover how Coinrule can be your ultimate trading companion and pave your way to success!

Don’t miss out—start mastering these strategies today and watch your trading skills soar! 💡📈

#crypto trading#bot trading#trading strategies#trading tips#crypto success#automated trading#trading bots#blockchain#crypto jounney#investment tips#crypto market

0 notes