#Income efiling

Text

Trust Registration Service Provider in India

TDS Return Service Provider in India.Taxation Company in Sirsa, Tax Sirsa,

Tax, Income tax, Sirsa, Taxation Services in Sirsa,

Taxation Services in Haryana, Taxation Services in India.

Contact

Email: [email protected]

Phone: +91-9254066001, 01666-225717

Please Visit: https://taxser.in/

0 notes

Text

Income Tax e - filing Online Course. Upgrade your Tax e filing Practice through tyariexamki.com. Job Oriented Course

For more information

Visit us:- https://www.tyariexamki.com/.../Income-Tax-Return-E...

2 notes

·

View notes

Text

ITR Filing For Professionals | Bizfoc

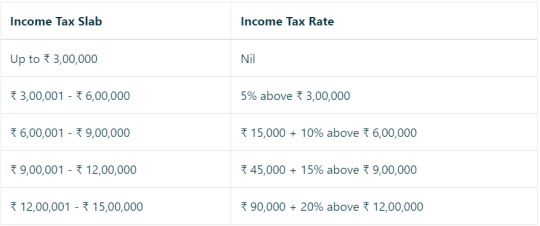

Professionals in India need to file their Income Tax Return (ITR), which means they have to submit a form to declare their income to the government. This is required if their total yearly income goes beyond the basic exemption limit, which is currently set at 3 lakh rupees.

Penalties for Non-Filing Income Tax Returns in India are as follow:

Late Filing Charges

Interest on Outstanding Taxes

Legal Action and Imprisonment

Forfeiture of Deductions

Impact on Credit Rating

1 note

·

View note

Text

Every individual whose income exceeds the basic exemption limit has to compulsorily file Income Tax Return. Every company on the other hand has to file its Income Tax Return irrespective of its Total Income. Those individuals whose total income includes any income generated from foreign assets or who are beneficial owners of a foreign asset or has any interest in an entity located outside India also has to file their return of income irrespective of their basic exemption limit.

File your Income Tax hassle free with EazyBahi Solutuions.

0 notes

Text

📢 REMINDER: BELATED INCOME TAX RETURN fILING

If you missed filing within the due date, you can still file a belated return before December 31, 2023

Happy Christmas day & New Year 2024

0 notes

Text

What is E-filing

What is E-filing? E-filing is an abbreviation for electronic income tax filing. E-filing is the process of electronically filing your income tax returns online for a specific year. This means you no longer need to physically visit the nearest Income Tax Department office to file your returns. Instead, you log on to the internet and complete the task. The process of submitting tax returns over the internet using tax preparation software that has been preapproved by the relevant tax authority, such as the U.S. Internal Revenue Service (IRS) or the Canada Revenue Agency, is known as electronic filing.

0 notes

Text

Top Best Business Advisory Firm in India

India's most trusted Tax & Compliance Platform & Best Business Advisory firm in India. IndianSalahkar offer accounting audit services, business setup, business advisory, taxation and support services.

#accounting audit services#business setup#business advisory#taxation and support services#Trademark Registration Services#Brand Registration#best accounting firm in India#GST registration service provider#company registration in India#Income tax efiling

1 note

·

View note

Photo

ITR Filing Online

Effortlessly file your Income Tax Returns (ITR) online with the help of professional guidance from experts. Streamline your tax filing process and ensure compliance with tax regulations. Trust the experienced team at Legal Pillers for seamless and efficient online ITR filing services, making your tax management convenient and hassle-free.

#income tax efiling#itr filing#itr filing online#income tax india e filing#file income tax return online india#online ITR filing

0 notes

Text

Want to E-file Income Tax Return? Avail our Income Tax Return Filing Services Online and get filed your return by team of CA. Step by step guide for E-filing. Contract Now.

#income tax efiling Services in Noida#income tax efiling Services in greater Noida#income tax efiling Services in delhi

0 notes

Text

TDS Return Service Provider in India

TDS Return Service Provider in India.Taxation Company in Sirsa, Tax Sirsa,

Tax, Income tax, Sirsa, Taxation Services in Sirsa,

Taxation Services in Haryana, Taxation Services in India.

Contact

Email: [email protected]

Phone: +91-9254066001, 01666-225717

Please Visit: https://taxser.in/

0 notes

Text

GST Return Filing services in India

GST return filing services in Indiawill assist you with the complicated procedure that is considered vital in order to establish yourself as a businessman. A GST return is essentially a record that contains all of the facts of your sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). After filing GST returns, you must pay the resultant tax liability (money that you owe the government). This whole thing makes GST return filing in India one of the important things to look after.

#Income Tax efiling Services India#Online TDS returns filing India#Tax consultation services in India#Online GST registration India

0 notes

Text

Incometax Efiling Website

The Kamjontax website appears to be a private tax preparation an incometax efiling website based in India. They offer services for preparing and filing income tax returns, GST returns, and TDS returns. They also offer a range of other financial services, such as bookkeeping, accounting, and financial consulting. If you have any questions about the services they offer all the process of e-filing your tax returns through their website, You'll be able to finish your taxes fast and simply any way. And, if you have any questions, the Kamjontax customer service team is always available to help. So, if you're looking for a simple, easy, and affordable way to file your income tax return online, Kamjontax is the perfect choice.

#it return filing online#income tax return filing online#incometax efiling website#income tax online filing

0 notes

Link

The income tax efiling 2.0 new feature is user-friendly and designed considering the digital advancement in India. It is a great move by the Income Tax Department to ease the E-filing process for taxpayers. This is all about the new income tax e-filing 2.0 portal. For any further clarification on Income Tax E-Filing Portal - 2.0, feel free to contact professionals at ASC Group.

0 notes

Text

E file income

E-filing is an abbreviation for electronic income tax filing. E-File income is the process of electronically filing your income tax returns online for a specific year. This means you no longer need to physically visit the nearest Income Tax Department office to file your returns. Instead, you log on to the internet and complete the task.

0 notes

Text

Income Tax e-filing portal 2.0 provides a range of features and services for taxpayers. The portal allows users to file their income tax returns, make payments, view their tax information, and more. The portal also provides a range of resources for tax professionals, including a searchable database of tax laws and regulations, a calendar of tax events, and more.

0 notes

Text

Best Public Limited Company Registration Fees Online in India

Get public limited company registration fees at an affordable price with the best quality clientele service from a leading CA firm in India.

#accounting audit services#business setup#business advisory#taxation and support services#Trademark Registration Services#Brand Registration#best accounting firm in India#GST registration service provider#company registration in India#Income tax efiling

0 notes