#efiling

Text

Income Tax e - filing Online Course. Upgrade your Tax e filing Practice through tyariexamki.com. Job Oriented Course

For more information

Visit us:- https://www.tyariexamki.com/.../Income-Tax-Return-E...

2 notes

·

View notes

Text

Supreme Court Approves eFiling Guidelines for Civil Cases in Trial Courts

The Supreme Court En Banc, during its session on August 20, 2024, approved the Guidelines on Submission of Electronic Copies of Pleadings and Other Court Submissions Being Filed Before the Lower Courts Pursuant to the Efficient Use of Paper Rule (Guidelines for eFiling).

One of the key outcomes under the Strategic Plan for Judicial Innovations 2022-2027 is Innovation. A key activity under…

#AM 10-3-7-SC#efiling#electronic filing#guidelines efiling#lawyer blogger#lawyer&039;s blog#viral blog

0 notes

Text

How to File Form 1099-NEC Electronically

Learn the steps to file Form 1099-NEC electronically with our comprehensive guide. Save time and ensure accuracy with detailed instructions and helpful tips. Streamline your filing process and avoid common pitfalls with ease.

#Form1099NEC#Efiling#IRS#Form1099Online#Form1099MISCwithNEC#File1099NECOnline#Online1099NECFiling#1099NEC

0 notes

Text

Simplify Your Form 2290 E-filing

Discover how Truck2290 simplifies e-filing for truckers by offering a user-friendly platform for quick and efficient tax form submissions. With step-by-step guidance and 24/7 customer support, Truck2290 ensures truckers can easily meet their IRS requirements. Enjoy hassle-free tax filing, saving time and reducing stress on the road.

#Form2290#Efiling#Truck2290#form2290duedate#2290forminstructions#schedule1form2290#whenisform2290due

0 notes

Text

What are the top 7 benefits of Company Registration in Delhi and why choose eFilingCompany?

Registering a company in Delhi offers numerous advantages, and choosing an e-filing service can streamline the process. Here are the top 7 benefits of Company Registration in Delhi, along with reasons to choose an e-filing company:

Top 7 Benefits of Company Registration in Delhi

Legal Recognition and Protection

Benefit: Registering a company provides it with legal recognition as a separate entity, distinct from its owners.

Why Important: This offers protection against personal liability, safeguarding personal assets from business debts and obligations.

Access to Funding

Benefit: Registered companies can attract investors and secure loans more easily.

Why Important: Banks, venture capitalists, and angel investors prefer dealing with registered entities, facilitating easier access to capital.

Enhanced Credibility and Brand Image

Benefit: Being a registered entity enhances your business's credibility and trustworthiness.

Why Important: Customers, suppliers, and potential partners are more likely to engage with a registered company, enhancing your market reputation.

Perpetual Succession

Benefit: A registered company enjoys perpetual succession, meaning it continues to exist regardless of changes in ownership.

Why Important: This ensures business continuity and stability, which is crucial for long-term planning and investment.

Tax Benefits

Benefit: Registered companies can avail various tax exemptions and benefits under Indian tax laws.

Why Important: This can lead to significant savings and better financial management.

Ease of Transferability

Benefit: Ownership of a registered company can be easily transferred through the sale of shares.

Why Important: This flexibility aids in the smooth transition of ownership and can be an attractive feature for investors.

Government Schemes and Incentives

Benefit: Registered companies are eligible for various government schemes and incentives aimed at promoting business.

Why Important: These schemes can provide financial aid, subsidies, and other support crucial for growth and development.

Why Choose an E-filing Company?

Convenience and Efficiency

Benefit: E-filing companies streamline the registration process, making it faster and more efficient.

Why Important: It saves time and effort compared to traditional paper-based filing methods, allowing you to focus on your business.

Expert Guidance

Benefit: E-filing companies provide expert guidance through the registration process.

Why Important: This ensures compliance with all legal requirements and reduces the risk of errors that could delay registration.

Cost-Effective

Benefit: E-filing services are often more cost-effective than hiring a legal advisor or doing it manually.

Why Important: Reducing costs during the startup phase is crucial for maintaining financial health.

24/7 Accessibility

Benefit: Online platforms offer 24/7 accessibility for filing documents and tracking the registration status.

Why Important: This flexibility is especially beneficial for entrepreneurs who may have varying schedules.

Real-Time Updates

Benefit: E-filing services provide real-time updates on the status of your application.

Why Important: Keeping informed helps you to plan better and stay prepared for the next steps in your business setup.

Document Management

Benefit: E-filing companies manage all your documents digitally.

Why Important: Digital storage and management of documents simplify record-keeping and retrieval, ensuring all paperwork is organized and easily accessible.

Compliance Assurance

Benefit: E-filing services ensure that all filings comply with the latest regulations and standards.

Why Important: Staying compliant avoids legal issues and potential fines, ensuring smooth operation from the start.

By leveraging the advantages of Company Registration and utilizing the benefits of e-filing services, entrepreneurs can set up their businesses efficiently and effectively in Delhi.

0 notes

Text

ITR Filing For Professionals | Bizfoc

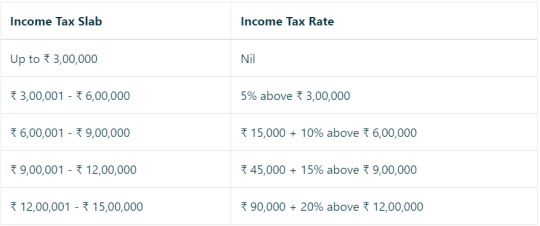

Professionals in India need to file their Income Tax Return (ITR), which means they have to submit a form to declare their income to the government. This is required if their total yearly income goes beyond the basic exemption limit, which is currently set at 3 lakh rupees.

Penalties for Non-Filing Income Tax Returns in India are as follow:

Late Filing Charges

Interest on Outstanding Taxes

Legal Action and Imprisonment

Forfeiture of Deductions

Impact on Credit Rating

1 note

·

View note

Text

Modernizing Legal Procedures: A Closer Look at eFiling and eRecording Lis Pendens in California

Introduction: As technology continues to shape various facets of our lives, the legal sector is no exception. In California, the adoption of electronic filing (eFiling) and electronic recording (eRecording) has streamlined many legal processes, including the submission of lis pendens. This critical legal notice alerts interested parties to pending litigation affecting real property titles. Let's delve into the logical steps involved in eFiling and eRecording lis pendens in California and explore the benefits of these digital advancements.

Understanding Lis Pendens: A lis pendens serves as a formal notice that a lawsuit has been filed concerning real property. It warns potential buyers or lenders of the property's disputed status, safeguarding against transactions that could complicate or jeopardize the litigation outcome.

eFiling Lis Pendens: The process begins with meticulous preparation. The lis pendens document must accurately detail the parties involved, property description, and a brief overview of the lawsuit. Utilizing California's electronic filing system, accessible through designated court websites or the California Courts Portal, filers submit the document online. This digital platform ensures efficiency and accuracy, allowing for easy review and submission.

eRecording Lis Pendens: Following eFiling, the next step is eRecording with the county recorder's office where the property is located. Approved electronic recording platforms facilitate this process. Filers upload the document, provide necessary indexing information, and pay recording fees electronically. This streamlined approach ensures prompt and accurate recording, reducing administrative burdens.

Benefits of Electronic Filing and Recording: The transition to electronic methods offers numerous advantages. Firstly, it expedites processes, minimizing delays associated with traditional paper-based methods. Secondly, electronic systems enhance accuracy and reduce errors, as submissions can be reviewed and edited before finalization. Additionally, digital records are easily searchable and accessible, promoting efficiency and transparency.

Moreover, eFiling and eRecording contribute to environmental sustainability by reducing paper consumption and carbon emissions associated with physical document delivery. This aligns with broader initiatives aimed at promoting eco-friendly practices in all sectors.

Ensuring Compliance and Notification: Throughout the eFiling and eRecording processes, strict adherence to legal requirements is crucial. This includes ensuring the lis pendens document is complete and accurate and promptly paying associated fees. Proper service of the lis pendens on relevant parties is essential to comply with California law and ensure all stakeholders are notified of the pending litigation.

Conclusion: The implementation of eFiling and eRecording has revolutionized legal procedures in California, including the submission of lis pendens. These digital advancements streamline processes, enhance accuracy, and promote efficiency and transparency. As technology continues to evolve, embracing electronic methods ensures the legal sector remains agile and accessible, serving the needs of a modern society. By leveraging digital innovations, California's legal system continues to pave the way for a more efficient, equitable, and sustainable future.

0 notes

Text

Enjoy Seamless GST Registration with eFilingCompany

Welcome to efilingcompany, your trusted partner for seamless GST registration. With a track record of 48k projects completed and 95k hours worked, we take pride in being a reliable service provider. Our team, available 24/7, has served 450 happy clients, ensuring a quick turnaround time and building long-term relationships.

GST Registration, a mandatory process for businesses with an annual turnover exceeding Rs. 40 lakhs, is simplified with efilingcompany.com. For just Rs. 999, get your GST number in 2 weeks, with our team handling all paperwork and filing. Our online GST registration process eliminates the need for physical visits, and we offer support for various types of registrations, such as Regular, Composition Scheme, Casual Taxable Person, and more.

Our transparent pricing, expert guidance, and compliance with GST regulations make us the preferred choice. We also offer monthly packages starting from INR 999 for bookkeeping and GST return filing. Explore the benefits of GST registration, including input tax credit, control over tax evasion, and improved logistics efficiency with our One Country, One Tax Scheme.

Connect with us at [email protected] or +91 9953004166 to start your GST registration journey. Experience the efilingcompany.com difference – Empowering Your Business with Insights!

1 note

·

View note

Text

"If rest becomes a form of recovery from work, as is the case today, it loses its specific ontological value. It no longer represents an independent, higher form of existence and degenerates into a derivative of work. Today's compulsion of production perpetuates work and thus eliminates that sacred silence. Life becomes entirely profane, desecrated."

—Han Byung-Chul, The Disappearance of Rituals (trans. Daniel Steuer)

#quotes for keeping#maybe this is on me for not reading kierkegaard#or really any modern western philosophers at all hhh#but I'd never thought of rest as something independent from recovery#there's a lot being said about the need to rest and give time for yourself these days#but rest is always framed as a way to recover and recharge before diving back into work (production)#and not like. the end in and of itself. the stillness that grants access to sacred silence#UGH WHY DIDN'T MY EFILE HAVE THE TRANSLATOR'S NAME. GOD.#IT'S ALMOST LIKE WE DON'T VALUE THE WORK OF PROFESSIONAL TRANSLATORS. WOW

5K notes

·

View notes

Text

Who needs to file a 1099 Tax Misc Form?

🌟 Simplify tax season with Form1099online.com! If you've paid an independent contractor $600 or more, file your 1099 MISC Form online effortlessly. Trust us for the best deals and lowest prices—making tax season a breeze! 💨💼✨

#form1099#form1099online#1099misc#form1099misc#taxfiling#onlinetaxfiling#easytaxfiling#taxseason2023#efiling

1 note

·

View note

Text

📢 REMINDER: BELATED INCOME TAX RETURN fILING

If you missed filing within the due date, you can still file a belated return before December 31, 2023

Happy Christmas day & New Year 2024

0 notes

Text

Filing 1099-MISC and 1099-NEC Online

Filing Form 1099-MISC and 1099-NEC electronically enhances efficiency and accuracy, streamlining the reporting process for miscellaneous income and nonemployee compensation. Electronic filing reduces errors and ensures timely submission, meeting IRS deadlines and requirements. Utilizing e-filing platforms also simplifies record-keeping and provides immediate confirmation of receipt.

0 notes

Text

Simplify your Form 2290 filing process with Truck2290.com's intuitive online platform.

Simplify your Form 2290 filing process with Truck2290.com's intuitive online platform, offering a user-friendly interface for quick and accurate submissions. Enjoy seamless e-filing with step-by-step guidance and real-time error checking. Save time and avoid penalties with fast, reliable, and secure services tailored for truck owners.

#Form2290#TruckTax#Efiling#Truck2290#TaxFiling#IRSCompliance#TruckingIndustry#TaxSimplified#OnlineFiling#TruckOwners

0 notes

Text

Update: Kansas Courts Confirm Data Theft, Ransom Demand After Cyberattack

The incident affected multiple systems, including eFiling, electronic payment, and case management systems. The affected services are still offline. The incident also involved a data breach, with hackers threatening to leak stolen data.

View On WordPress

0 notes

Text

What is E-filing

What is E-filing? E-filing is an abbreviation for electronic income tax filing. E-filing is the process of electronically filing your income tax returns online for a specific year. This means you no longer need to physically visit the nearest Income Tax Department office to file your returns. Instead, you log on to the internet and complete the task. The process of submitting tax returns over the internet using tax preparation software that has been preapproved by the relevant tax authority, such as the U.S. Internal Revenue Service (IRS) or the Canada Revenue Agency, is known as electronic filing.

0 notes