#India Solar Energy Market

Text

India Solar Energy Market Projections Point to Robust Growth in 2029

Growing awareness of less carbon emission and favorable government regulations are the factors driving the market growth in the forecast period.

According to TechSci Research report, “India Solar Energy Market - By Region, Competition, Forecast & Opportunities, 2029F”, the India Solar Energy Market is anticipated to register robust growth during the forecast period 2025 - 2029. Since between 2014 and 2021 year, according to Prime Minister Mr. Narendra Modi's statement in June 2022, the prospect for renewable energy in India expanded by 250%. In 2021, a global attempt to accelerate the development of clean energy was established in India under the name Mission Innovation Cleantech Exchange. As of October 2022, India’s installed renewable energy capacity (including hydro) stood at 165.94 GW, representing 40.6% of the overall installed power capacity. Owing to the rising government initiatives and growing renewable energy capacity in the nation, the India Solar Energy Market is anticipated to generate high CAGR in the future period.

Additionally, the growing demand of electricity is another factor driving the market growth. For instance, according to the Central Electricity Authority, India's electricity requirements, are expected to increase and reach 817 GW by 2030. The real estate and transportation sectors will generate the majority of the demand.

India Solar Energy Market is segmented based on Technology, Solar Module, Application, End-Use, and Region. Based on region, the market is divided into West, North, South and East.

Based on Technology, the market is divided into Solar Photovoltaic (PV) and Concentrated Solar Power (CSP). Solar Photovoltaic (PV) segment is expected to dominate the market in the forecast period. The market for solar energy benefits from the rapid expansion of electric vehicle use by increasing demand for solar-powered EV charging infrastructure. In addition, lowering costs and government incentives have helped the PV system industry in India grow significantly in the recent years. Furthermore, solar energy is likely to become more popular as governments all over the world give it a higher priority, opening up prospects for industry innovation and expansion.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on” India Solar Energy Market.”

https://www.techsciresearch.com/report/india-solar-energy-market/15652.html

Based on Solar Module, the market is divided into Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon Cells, and Others. By gaining more than half of the market shares for solar energy in 2022, the polycrystalline sector was the industry-leading sector, nationally, and it is predicted that this pattern would continue throughout the forecast period. This can be attributed to the fact that now a days calculators and smartwatches are often made in the electronics sector using new multi-Si (mc-Si) technology. Additionally, consumers' rising standard of living and rising disposable income have increased the need for electronics and smart devices, which is anticipated to drive up the demand for polycrystalline module.

Based on Application, the market is divided into Residential, Commercial, and Industrial. In terms of application, the industrial sector captured more than two-fifths of the solar energy market share in 2022, and it is predicted that this trend would continue over the course of the projection period. The nation's rapid industrialization and population growth have increased demand for a variety of commercial products. -.

Based on End-Use, the market is divided into Electricity Generation, Lighting, Heating, and Charging, where Electricity Generation segment is expected to dominate the market in the forecast period. Solar concentrators were developed as a result of the hunt for alternate power-generating methods brought on by the rising awareness of the environmental effects of greenhouse gases. Furthermore, the lack of fossil fuel resources in developing nations like India has prompted the development of solar-powered power plants as an alternative way of generating electricity.

Key market players in the India Solar Energy Market include:

Adani Enterprises Limited

Emmvee Photovoltaic Power Private Limited

Azure Power India Pvt Ltd.

JinkoSolar Holding Co., Ltd.

NTPC Limited

The Tata Power Company Limited

Torrent Power Limited

Mahindra Susten Private Limited

Vikram Solar Limited

Vivaan Solar Private Limited

Download Free Sample Report

https://www.techsciresearch.com/sample-report.aspx?cid=15652

Customers can also request for 10% free customization on this report.

“India’s solar energy market is expanding as a result of rising energy consumption driven by the country's expanding population. Additionally, rise in demand for renewable energy sources has been seen across the country, along with supportive government laws that have sped up industry expansion. These laws emphasize lowering reliance on fossil fuels and aid in reducing environmental pollution. Thus, the demand for renewable energy sources like solar energy is consequently boosted.” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based global management consulting firm.

“India Solar Energy Market by Technology (Solar Photovoltaic (PV) and Concentrated Solar Power (CSP)), By Solar Module (Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon Cells, Others), By Application (Residential, Commercial, Industrial), By End-Use (Electricity Generation, Lighting, Heating, Charging), By Region, Size, Share, Trends, Opportunity, and Forecast, 2029F”, has evaluated the future growth potential of India Solar Energy Market and provides statistics and information on market structure, size, share, and future growth. The report is intended to provide cutting-edge market intelligence and help decision-makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities present in the India Solar Energy Market.

Browse Related Research

Vietnam Fuel Cell Market

https://www.techsciresearch.com/report/vietnam-fuel-cell-market/19872.html

Vietnam Battery Market

https://www.techsciresearch.com/report/vietnam-battery-market/17245.html

Vietnam UPS Market

https://www.techsciresearch.com/report/vietnam-ups-market/14921.html

Contact

TechSci Research LLC

420 Lexington Avenue,

Suite 300, New York,

United States- 10170

M: +13322586602

Email: [email protected]

Website: https://www.techsciresearch.com

#India Solar Energy Market#India Solar Energy Market Size#India Solar Energy Market Share#India Solar Energy Market Trends#India Solar Energy Market Growth

0 notes

Text

What Effect Is the Solar Market Growth Having on the Power Sector in India?

India's power sector is being significantly impacted by the rapid growth of the solar market in that country. This article examines the various ways that solar energy is changing the supply of electricity in India. We will examine the significance of increased solar capacity.

Reducing dependency on fossil fuels and fostering energy independence are two ways to improve energy security.

Reducing the cost of power generation: Solar power is an economical means of producing electricity, which could result in lower consumer prices.

Greening the grid: By reducing reliance on conventional, carbon-emitting power sources, solar power integration helps to create a cleaner energy mix.

Improving grid flexibility: In order to integrate solar power efficiently, grid modernization and innovation are required due to its variable nature.

We'll also talk about some of the possible drawbacks to this quick expansion, like problems with grid integration and guaranteeing a steady supply of electricity. This study offers insightful information about the changing dynamics of India's electricity industry and the revolutionary impact of the country's expanding solar market.

0 notes

Text

Small-Cap Solar Power Multibagger Share

#solar energy#solar power#renewable energy#small cap stocks#multibagger stocks India#investing#finance#stock market#business#economy

0 notes

Text

Solar Powered Outdoor Lights Market Analytical Overview and Growth Opportunities by 2032

The solar-powered outdoor lights market has been experiencing significant growth due to increasing environmental awareness and the growing adoption of sustainable energy solutions. Solar-powered outdoor lights utilize solar panels to convert sunlight into electricity, eliminating the need for traditional power sources. These lights are widely used for outdoor illumination in residential, commercial, and industrial settings.

Analysis:

The solar-powered outdoor lights market is expected to witness robust growth during the forecast period, driven by the increasing demand for sustainable lighting solutions.

North America and Europe are anticipated to dominate the market due to stringent regulations promoting renewable energy adoption.

Asia Pacific region is expected to experience significant growth, supported by rapid urbanization and government initiatives in countries like China and India.

Technological advancements, such as improved solar panel efficiency and battery storage capabilities, are expected to drive market growth.

Key challenges include the high upfront cost of solar-powered outdoor lights and the limited availability of sunlight in certain regions. However, declining solar panel costs and advancements in battery technology are mitigating these challenges.

Growth Opportunities:

Increasing government initiatives promoting renewable energy and energy-efficient lighting solutions.

Growing demand for smart solar-powered outdoor lights integrated with advanced technologies like motion sensors and remote control capabilities.

Rapid urbanization and infrastructure development in emerging economies, driving the need for reliable and sustainable lighting solutions.

Rising consumer awareness about the benefits of solar energy and the need to reduce carbon footprints.

Technological advancements leading to improved efficiency, longer battery life, and enhanced aesthetics of solar-powered outdoor lights.

Key Points:

Solar-powered outdoor lights offer significant cost savings over traditional lighting solutions, as they eliminate electricity bills and reduce maintenance costs.

These lights are environmentally friendly, as they do not emit harmful greenhouse gases and reduce reliance on fossil fuels.

Solar-powered outdoor lights provide reliable illumination even in remote areas without access to electricity grids.

The market is witnessing increased collaborations and partnerships among key vendors to expand their product portfolios and geographical presence.

The integration of solar-powered outdoor lights with smart home systems and IoT technologies is opening up new opportunities for market growth.

We recommend referring our Stringent datalytics firm, industry publications, and websites that specialize in providing market reports. These sources often offer comprehensive analysis, market trends, growth forecasts, competitive landscape, and other valuable insights into this market.

By visiting our website or contacting us directly, you can explore the availability of specific reports related to this market. These reports often require a purchase or subscription, but we provide comprehensive and in-depth information that can be valuable for businesses, investors, and individuals interested in this market.

“Remember to look for recent reports to ensure you have the most current and relevant information.”

Click Here, To Get Free Sample Report: https://stringentdatalytics.com/sample-request/solar-powered-outdoor-lights-market/6229/

Market Segmentations:

Global Solar Powered Outdoor Lights Market: By Company

• Greenshine New Energy

• SBM-SolarTech

• Signify Holding

• Jiawei

• LEADSUN

• OkSolar

• SEPCO Solar Electric Power Company

• SOKOYO

• Solar Street Lights USA

• Sunna Design SA

Global Solar Powered Outdoor Lights Market: By Type

• Less than 39W

• 40W to 149W

• More than 150W

Global Solar Powered Outdoor Lights Market: By Application

• Residential

• Commercial

• Industrial

• Goverment

Global Solar Powered Outdoor Lights Market: Regional Analysis

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Solar Powered Outdoor Lights market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Visit Report Page for More Details: https://stringentdatalytics.com/reports/solar-powered-outdoor-lights-market/6229/

Reasons to Purchase Solar Powered Outdoor Lights Market Report:

• To obtain insights into industry trends and dynamics, including market size, growth rates, and important factors and difficulties. This study offers insightful information on these topics.

• To identify important participants and rivals: This research studies can assist companies in identifying key participants and rivals in their sector, along with their market share, business plans, and strengths and weaknesses.

• To comprehend consumer behaviour: these research studies can offer insightful information about customer behaviour, including preferences, spending patterns, and demographics.

• To assess market opportunities: These research studies can aid companies in assessing market chances, such as prospective new goods or services, fresh markets, and new trends.

• To make well-informed business decisions: These research reports give companies data-driven insights that they may use to plan their strategy, develop new products, and devise marketing and advertising plans.

In general, market research studies offer companies and organisations useful data that can aid in making decisions and maintaining competitiveness in their industry. They can offer a strong basis for decision-making, strategy formulation, and company planning.

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs

Contact US:

Stringent Datalytics

Contact No - +1 346 666 6655

Email Id - [email protected]

Web - https://stringentdatalytics.com/

#Solar Powered Outdoor Lights Market Analytical Overview and Growth Opportunities by 2032#The solar-powered outdoor lights market has been experiencing significant growth due to increasing environmental awareness and the growing#eliminating the need for traditional power sources. These lights are widely used for outdoor illumination in residential#commercial#and industrial settings.#Analysis:#•#The solar-powered outdoor lights market is expected to witness robust growth during the forecast period#driven by the increasing demand for sustainable lighting solutions.#North America and Europe are anticipated to dominate the market due to stringent regulations promoting renewable energy adoption.#Asia Pacific region is expected to experience significant growth#supported by rapid urbanization and government initiatives in countries like China and India.#Technological advancements#such as improved solar panel efficiency and battery storage capabilities#are expected to drive market growth.#Key challenges include the high upfront cost of solar-powered outdoor lights and the limited availability of sunlight in certain regions. H#declining solar panel costs and advancements in battery technology are mitigating these challenges.#Growth Opportunities:#Increasing government initiatives promoting renewable energy and energy-efficient lighting solutions.#Growing demand for smart solar-powered outdoor lights integrated with advanced technologies like motion sensors and remote control capabili#Rapid urbanization and infrastructure development in emerging economies#driving the need for reliable and sustainable lighting solutions.#Rising consumer awareness about the benefits of solar energy and the need to reduce carbon footprints.#Technological advancements leading to improved efficiency#longer battery life#and enhanced aesthetics of solar-powered outdoor lights.#Key Points:#1.#Solar-powered outdoor lights offer significant cost savings over traditional lighting solutions#as they eliminate electricity bills and reduce maintenance costs.

0 notes

Text

Solar Thermal Collector Market – Industry Trends and Forecast to 2028

Solar thermal collector market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses the solar thermal collector market to account to USD 81.76 billion growing at a CAGR of 13.38% in the above-mentioned forecast period.

A truthful SOLAR THERMAL COLLECTOR MARKET business report contains a chapter on the universal SOLAR THERMAL COLLECTOR market and all its linked companies with their profiles, which presents valuable data pertaining to their outlook in terms of finances, product portfolios, investment plans, and marketing and business strategies. This market research report not only saves precious time but also add credibility to the work. By keeping end users at the centre point, a team of researchers, forecasters, analysts and industry experts work exhaustively to formulate this market report. SOLAR THERMAL COLLECTOR market analysis document offers the professional and in-depth study on the current state for the ABC industry.

Global SOLAR THERMAL COLLECTOR market report contains numerous aspects of the market analysis which many businesses call for. This market research report comprises of a chapter on the global market and all of its associated companies with their profiles, which gives important information and data pertaining to their outlook in terms of finances, product portfolios, investment plans, and marketing and business strategies. The large scale SOLAR THERMAL COLLECTOR report also presents a profound overview of product specification, technology, applications, product type and production analysis considering major factors such as revenue, cost, and gross margin about ABC industry.

Get free sample copy of the report here:

https://www.databridgemarketresearch.com/request-a-sample?dbmr=global-solar-thermal-collector-market

Market Analysis and Insights of Global Solar Thermal Collector Market

Solar thermal collector is used to heat water and air. Active solar systems have thermal collectors used to absorb heat energy, supplied by the sun, water heaters and space temperatures. Roof solar panels (collectors) are the main source of heat generation, used in conjunction with a boiler, collector or immersion heater. The solar collector uses the sun's rays to heat the transfer fluid, which is usually a mixture of water and glycol. Glycol acts as an anti-freeze and prevents water from freezing. In concentrated solar power plants, other complex types of solar thermal collectors are used to generate electricity.

Lack of sunlight in adequate quantity in several nations and high installation cost is a challenge for solar thermal collector market. However, less awareness among consumers regarding the benefits of making use of solar energy in underdeveloped and developing economies is a restraint in growth of solar thermal collector market during the forecast period of 2021-2028.

Solar Thermal Collector Market Scope and Market Size

Based on product outlook, the solar thermal collector market is segmented into concentrating and non-concentrating. Non-concentrating is further segmented into flat plate, evacuated tube, unglazed water collectors and air collectors.

Based on application outlook, the solar thermal collector market is segmented into commercial, residential and industrial.

Based on collector type, the solar thermal collector market is segmented into evacuated tube collector, flat plate collector, unglazed water collector and air collector.

Solar thermal collector market has also been segmented based on types of system, into thermosiphon solar heating system and pumped solar heating system.

Solar Thermal Collector Market Country Level Analysis

The countries covered in the solar thermal collector market report are U.S.

Canada and Mexico in North America

Germany

France

K.

Netherlands

Switzerland

Belgium

Russia

Italy

Spain

Turkey

Rest of Europe in Europe

China

Japan

India

South Korea

Singapore

Malaysia

Australia

Thailand

Indonesia

Philippines

Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC)

Saudi Arabia

A.E

Israel

Egypt

South Africa

Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

Brazil

Argentina and Rest of South America as part of South America.

Solar Thermal Collector Market Share Analysis

Solar thermal collector market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to solar thermal collector market.

Leading Players

The major players covered in the solar thermal collector market report are TVP Solar

Alternate Energy Technologies

LLC

Sunmaster Ltd.

Solar Millennium AG

SunMaxx Solar

Solar Skies Mfg.LLC

Airlight Energy

Thermomax

Cogen Microsystems

Suncor Energy Inc.

AES

Solarus

Absolicon Solar Collector AB

Solarkilns Pty Ltd

Sunplate Corporation

Artic Solar

Boen Solar Energy

Trevi Systems

SUNRAIN

Greenonetec Solarindustrie GmbH.

LINUO RITTER INTERNATIONAL CO. LTD

Photon Energy Systems Limited among other domestic and global players. Market share data is available for Global

North America

Europe

Asia-Pacific (APAC)

Middle East and Africa (MEA) and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Get Full access of Report

MAJOR TOC OF THE REPORT

Chapter One: Introduction

Chapter Two: Market Segmentation

Chapter Three: Market Overview

Chapter Four: Executive Summary

Chapter Five: Premium Insights

Chapter Six: solar thermal collector market

Get TOC Details

Browse Related Reports

Coal Power Generation Market

Nanoceramics Market – Industry Trends and Forecast to 2027

Polyfilm Market – Industry Trends and Forecast to 2028

Fire Protection Materials Market – Industry Trends and Forecast to 2029

Industrial Networking Solutions Market – Industry Trends and Forecast to 2029

Electric Vehicle Charging Stations Market

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market.

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: [email protected]

#Solar Thermal Collector Market#Solar Thermal Collector Market scope#solar collector#energy and power market#solar collector price in india#solar thermal power plant#short note on solar energy#types of solar energy

0 notes

Text

Millions of solar panels are piling up in warehouses across the Continent because of a manufacturing battle in China, where cut-throat competition has driven the world’s biggest panel-makers to expand production far faster than they can be installed.

The supply glut has caused solar panel prices to halve. This sounds like great news for the EU, which recently pledged to triple its solar power capacity to 672 gigawatts by 2030. That’s roughly equivalent to 200 large nuclear power stations.

In reality, though, it has caused a crisis. Under the EU’s “Green Deal Industrial Plan”, 40pc of the panels to be spread across European fields and roofs were meant to be made by European manufacturers.

However, the influx of cheap Chinese alternatives means that instead of tooling up, manufacturers are pulling out of the market or becoming insolvent. Last year 97pc of the solar panels installed across Europe came from China.[...]

The best estimates suggest that about 90 gigawatts worth of solar panels are stashed around Europe. That solar power capacity roughly equates to 25 large nuclear power stations the size of Hinkley Point C.[...]

The sheer scale of the problem was revealed in a recent report from the International Energy Agency (IEA).

It warned that although the world was installing at record rates of around 400 gigawatts a year, manufacturing capacity was growing far faster.

By the end of this year solar panel factories, mostly in China, will be capable of churning out 1,100 gigawatts a year – nearly three times more than the world is ready [sic] for. For comparison, that’s about 11 times [!!!!] the UK’s entire generating capacity.

For some solar power installers, it’s a dream come true. Sagar Adani is building solar farms across India’s deserts, with 54 in operation and another 12 being built.

His company, Adani Green Energy, is constructing one solar farm so large that it will cover an area five times the size of Paris and have a capacity of 30 gigawatts – equal to a third of the UK’s entire generating capacity.

“I am installing tens of millions of solar panels across these projects,” says Adani. “Almost all of them will have been imported from China. There is nowhere else that can supply them in such numbers or at such prices.

“China saw the opportunity before others, it looked forward to what the world is going to set up 10 years on. And because they scaled up in the way they did, they were able to reduce costs substantially as well.”

That scaling up meant the capital cost of installing solar power fell from around £1.25m per megawatt of generating capacity in 2015 to around £600,000 today – a decrease of more than 50pc – making it cheaper than almost any other form of generation, including wind.[...]

“Up to 2012 there was a healthy looking European solar panel industry but it was actually very reliant on subsidies and preferential treatment.

“But then European governments and other customers started buying from China because their products were so much cheaper. And China still has cheap labour and cheap energy plus a massive domestic market. It’s hard to see Europe recovering from those disadvantages.”

Trying sososo hard to make this sound like a bad thing [23 Mar 24]

#sowwy ur nationalistic fever dream got outcompeted#free market innit#now shut up and install the fucking panels#shocking revelation: combatting a global problem isnt most efficiently done through local solutions#'we cant install that many' yeah you can lol#wheres that 'become an accompished scientist' meme

467 notes

·

View notes

Text

"Passed in February [2024], a massive subsidy program to help Indian households install rooftop solar panels in their homes and apartments aims to provide 30 gigawatt hours of solar power to the nation’s inventory.

The scheme, called PM-Surya Ghar, will provide free electricity to 10 million homes according to estimates, and the designing of a national portal—a sort of Healthcare.gov for solar panels—will streamline the process of installation and payment.

The program was cooked up because India had fallen woefully behind on its planned installations for rooftop solar. In many parts of the subcontinent, the sun is absolutely brutal and relentless, but by 2022, Indian rooftop solar power generation topped out at 11 gigawatts, which was 29 gigawatts under a national target set a decade ago.

Part of the challenge, Euronews reports, is that approval from various agencies and departments—as many as 21 different signatures in some cases—was needed to place a solar array on your house. Aside from this bureaucratic nightmare, the cost of installation was often higher than $5,000; more than half the average yearly income for a working Indian urbanite.

Under PM-Surya Ghar, subsidies for a 2-kilowatt solar array will cover as much as 60% of the installation costs, falling to 40% for arrays 3 kilowatts or higher. Loans set at around 7% interest rates will help families in need get started. 750 billion Indian rupees, or $9 billion has been set aside for the project.

Even in New Delhi, which can be covered in clouds and smog for days, solar users report saving hundreds during summer time on their electricity costs, with one apartment shaving $700 every month off energy bills.

PM-Surya Ghar is also seen as having the potential to cause a boom in the Indian solar market. Companies no longer have to go running around for planning and permitting requirements, and the government subsidies ensure their customer base can grow beyond the limits of household income."

-Good News Network, April 10, 2024

#india#new delhi#solar#solar panels#clean energy#solar power#renewables#rooftop solar#climate policy#climate action#climate hope#renewable energy#good news#hope

269 notes

·

View notes

Text

What would you want to tell the next U.S. president? FP asked nine thinkers from around the world to write a letter with their advice for him or her.

Dear Madam or Mr. President,

Congratulations on your election as president of the United States. You take office at a moment of enormous consequence for a world directly impacted by the twin challenges of energy security and climate change.

Democrats and Republicans disagree on many aspects of energy and climate policy. Yet your administration has the chance to chart a policy path forward that unites both parties around core areas of agreement to advance the U.S. national interest.

First, all should agree that climate change is real and worsening. The escalating threat of climate change is increasingly evident to anyone walking the streets of Phoenix in the summer, buying flood insurance in southern Florida, farming rice in Vietnam, or laboring outdoors in Pakistan. This year will almost certainly surpass 2023 as the warmest year on record.

Second, just as the energy revolution that made the United States the world’s largest oil and gas producer strengthened it economically and geopolitically, so will ensuring U.S. leadership in clean energy technologies enhance the country’s geostrategic position. In a new era of great-power competition, China’s dominance in certain clean energy technologies—such as batteries and cobalt, lithium, graphite, and other critical minerals needed for clean energy products—threatens America’s economic competitiveness and the resilience of its energy supply chains. China’s overcapacity in manufacturing relative to current and future demand undermines investments in the United States and other countries and distorts demand signals that allow the most innovative and efficient firms to compete in the global market.

Third, using less oil in our domestic economy reduces our vulnerability to global oil supply disruptions, such as conflict in the Middle East or attacks on tankers in the Red Sea. Even with the surge in U.S. oil production, the price of oil is set in the global market, so drivers feel the pain of oil price shocks regardless of how much oil the United States imports. True energy security comes from using less, not just producing more.

Fourth, energy security risks extend beyond geopolitics and require investing adequately in domestic energy supply to meet changing circumstances. Today, grid operators and regulators are increasingly warning that the antiquated U.S. electricity system, already adjusting to handle rising levels of intermittent solar and wind energy, is not prepared for growing electricity demand from electric cars, data centers, and artificial intelligence. These reliability concerns were evident when an auction this summer set a price nine times higher than last year’s to be paid by the nation’s largest grid operator to power generators that ensure power will be available when needed. A reliable and affordable power system requires investments in grids as well as diverse energy resources, from cheap but intermittent renewables to storage to on-demand power plants.

Fifth, expanding clean energy sectors in the rest of the world is in the national interest because doing so creates economic opportunities for U.S. firms, diversifies global energy supply chains away from China, and enhances U.S. soft power in rapidly growing economies. (In much the same way, the Marshall Plan not only rebuilt a war-ravaged Europe but also advanced U.S. economic interests, countered Soviet influence, and helped U.S. businesses.) Doing so is especially important in rising so-called middle powers, such as Brazil, India, or Saudi Arabia, that are intent on keeping their diplomatic options open and aligning with the United States or China as it suits them transactionally.

To prevent China from becoming a superpower in rapidly growing clean energy sectors, and thereby curbing the benefits the United States derives from being such a large oil and gas producer, your administration should increase investments in research and development for breakthrough clean energy technologies and boost domestic manufacturing of clean energy. Toward these ends, your administration should quickly finalize outstanding regulatory guidance to allow companies to access federal incentives. Your administration should also work with the other side of the aisle to provide the market with certainty that long-term tax incentives for clean energy deployment—which have bipartisan support and have already encouraged historic levels of private investment—will remain in place. Finally, your administration should work with Congress to counteract the unfair competitive advantage that nations such as China receive by manufacturing industrial products with higher greenhouse gas emissions. Such a carbon import tariff, as proposed with bipartisan support, should be paired with a domestic carbon fee to harmonize the policy with that of other nations—particularly the European Union’s planned carbon border adjustment mechanism.

Your ability to build a strong domestic industrial base in clean energy will be aided by sparking more domestic clean energy use. This is already growing quickly as market forces respond to rapidly falling costs. Increasing America’s ability to produce energy is also necessary to maintain electricity grid reliability and meet the growing needs of data centers and AI. To do so, your administration should prioritize making it easier to build energy infrastructure at scale, which today is the greatest barrier to boosting U.S. domestic energy production. On average, it takes more than a decade to build a new high-voltage transmission line in the United States, and the current backlog of renewable energy projects waiting to be connected to the power grid is twice as large as the electricity system itself. It takes almost two decades to bring a new mine online for the metals and minerals needed for clean energy products, such as lithium and copper.

The permitting reform bill recently negotiated by Sens. Joe Manchin and John Barrasso is a good place to start, but much more needs to be done to reform the nation’s permitting system—while respecting the need for sound environmental reviews and the rights of tribal communities. In addition, reforming the way utilities operate in the United States can increase the incentives that power companies have not just to build new infrastructure but to use existing infrastructure more efficiently. Such measures include deploying batteries to store renewable energy and rewiring old transmission lines with advanced conductors that can double the amount of power they move.

Grid reliability will also require more electricity from sources that are available at all times, known as firm power. Your administration should prioritize making it easier to construct power plants with advanced nuclear technology—which reduce costs, waste, and safety concerns—and to produce nuclear power plant fuel in the United States. Doing so also benefits U.S. national security, as Russia is building more than one-third of new nuclear reactors around the world to bolster its geostrategic influence. While Russia has been the leading exporter of reactors, China has by far the most reactors under construction at home and is thus poised to play an even bigger role in the international market going forward. The United States also currently imports roughly one-fifth of its enriched uranium from Russia. To counter this by building a stronger domestic nuclear industry, your administration should improve the licensing and approval process of the Nuclear Regulatory Commission and reform the country’s nuclear waste management policies. In addition to nuclear power, your administration should also make it easier to permit geothermal power plants, which today can play a much larger role in meeting the nation’s energy needs thanks to recent innovations using technology advanced by the oil and gas sector for shale development.

Even with progress on all these challenges, it is unrealistic to expect that the United States can produce all the clean energy products it needs domestically. It will take many years to diminish China’s lead in critical mineral supply, battery manufacturing, and solar manufacturing. The rate of growth needed in clean energy is too overwhelming, and China’s head start is too great to diversify supply chains away from it if the United States relies solely on domestic manufacturing or that of a few friendly countries. As a result, diminishing China’s dominant position requires that your administration expand economic cooperation and trade partnerships with a vast number of other nations. Contrary to today’s protectionist trends, the best antidote to concerns about China’s clean technology dominance is more trade, not less.

Your administration should also strengthen existing tools that increase the supply of clean energy products in emerging and developing economies in order to diversify supply chains and counter China’s influence in these markets. For example, the U.S. International Development Finance Corp. (DFC) can be a powerful tool to support U.S. investment overseas, such as in African or Latin American projects to mine, refine, and process critical minerals. As DFC comes up for reauthorization next year, you should work with Congress to provide DFC with more resources and also change the way federal budgeting rules account for equity investments; this would allow DFC to make far more equity investments even with its existing funding. Your administration can also use DFC to encourage private investment in energy projects in emerging and developing economies by reducing the risk investors face from fluctuations in local currency that can significantly limit their returns or discourage their investment from the start. The U.S. Export-Import Bank is another tool to support the export of U.S. clean tech by providing financing for U.S. goods and services competing with foreign firms abroad.

Despite this country’s deep divisions and polarization, leaders of both parties should agree that bolstering clean energy production in the United States and in a broad range of partner countries around the world is in America’s economic and security interests.

I wish you much success in this work, which will also be the country’s success.

11 notes

·

View notes

Text

Budget 2024 - What It Means for The Real Estate Industry - Part III

The Indian Union Budget 2024 has been released, and its implications for the real estate sector are substantial. This article will delve into the various facets of the budget, examining how the proposed changes will impact the real estate industry. As one of the most dynamic real estate markets in India, Gurugram's developments are keenly watched by investors, developers, and homebuyers alike. For a comprehensive overview of real estate in Gurugram and to stay updated on market trends, visit Ehouzer.

Key Highlights of Budget 2024

Increased Infrastructure Investment

One of the most significant announcements in the 2024 Budget is the increased allocation for infrastructure development. The government has earmarked an additional ₹2 trillion for infrastructure projects, which includes improvements in transportation, urban planning, and public utilities. This investment is expected to have a ripple effect on the real estate sector.

For Gurugram, this means enhanced connectivity and infrastructure. New roads, metro lines, and better public services will make the city more attractive to investors and homebuyers. Improved infrastructure typically leads to an increase in property values and a boost in real estate activities.

Affordable Housing Incentives

The Budget 2024 continues to emphasize affordable housing, a key focus area for the government. The introduction of new incentives for developers who build affordable housing projects is expected to drive the construction of more budget-friendly residential options. This initiative aligns with the government's goal of providing housing for all and is likely to stimulate demand in the residential real estate sector.

In Gurugram, the demand for affordable housing has been on the rise due to the influx of professionals and the growing population. With these new incentives, developers are likely to invest more in affordable housing projects in the region. For detailed insights into the real estate opportunities in Gurugram, explore Ehouzer

Tax Reforms and Benefits

The Budget introduces several tax reforms that are expected to benefit both developers and homebuyers. Key among these is the increase in the tax deduction limit on home loan interest payments. Homebuyers will benefit from higher deductions, making homeownership more affordable.

For developers, the Budget proposes tax incentives for the construction of green buildings and eco-friendly projects. This shift towards sustainability is expected to influence real estate development trends, encouraging the adoption of green building practices.

These tax reforms will likely boost the real estate market in Gurugram, as more homebuyers and developers take advantage of these benefits. To understand how these changes may impact your real estate investments, visit Ehouzer.

Impact on Residential Real Estate

Demand for Residential Properties

The combination of increased infrastructure investment and affordable housing incentives is expected to drive up demand for residential properties. In Gurugram, the residential real estate market is likely to see a surge in demand as more people look to invest in property due to improved infrastructure and attractive housing options.

This uptick in demand is also anticipated to influence property prices. While affordable housing projects may provide budget-friendly options, the overall rise in property demand could lead to increased prices in other segments of the residential market.

Shift Towards Sustainable Living

The Budget’s emphasis on green building incentives is expected to accelerate the shift towards sustainable living. Developers in Gurugram are likely to adopt more eco-friendly practices and technologies in their projects. This shift not only aligns with global sustainability trends but also meets the growing demand from environmentally-conscious homebuyers.

Sustainable living features, such as energy-efficient appliances, solar panels, and green spaces, are becoming increasingly popular. Homebuyers in Gurugram will benefit from these developments, gaining access to more sustainable and energy-efficient housing options.

Commercial Real Estate Developments

Growth in Office Spaces

The infrastructure investment outlined in the Budget is likely to benefit the commercial real estate sector, particularly the office space market. Enhanced connectivity and improved urban infrastructure will make Gurugram an even more attractive location for businesses.

Companies are expected to seek out modern, well-connected office spaces to accommodate their growing operations. This increased demand for office space will drive commercial real estate development in Gurugram, with new projects and expansions likely to emerge.

Retail and Mixed-Use Developments

The commercial real estate market in Gurugram will also see growth in retail and mixed-use developments. The increased focus on infrastructure and urban development will attract more retail businesses and mixed-use projects, which combine residential, commercial, and recreational spaces.

These developments are expected to enhance the urban landscape of Gurugram, providing residents and visitors with more shopping, dining, and entertainment options. For insights into the latest commercial real estate trends and opportunities, visit Ehouzer.

Investment Opportunities

Real Estate Investment Trusts (REITs)

The Budget 2024 includes provisions for the growth of Real Estate Investment Trusts (REITs), which offer a viable investment option for those looking to invest in real estate without directly purchasing property. REITs provide an opportunity to invest in a diversified portfolio of real estate assets and benefit from rental income and capital appreciation.

Investors in Gurugram should consider exploring REITs as a way to diversify their investment portfolio and gain exposure to the commercial real estate market. The growth of REITs in India presents new opportunities for both individual and institutional investors.

Affordable Housing Projects

With the new incentives for affordable housing, developers are likely to focus on projects that cater to the budget segment. Investors looking to capitalize on this trend can explore opportunities in affordable housing projects in Gurugram. These projects are expected to offer attractive returns due to the high demand for affordable housing.

For more information on investment opportunities in the real estate sector, including affordable housing and REITs, visit Ehouzer.

Regulatory Changes and Their Impact

Simplified Land Acquisition Processes

The Budget proposes measures to simplify land acquisition processes, which is expected to benefit real estate developers. Streamlined procedures will reduce delays and lower costs associated with land acquisition, facilitating faster project completion.

In Gurugram, these regulatory changes will likely lead to a more efficient real estate development process. Developers will be able to expedite their projects, which will, in turn, enhance the overall growth of the real estate market in the region.

Enhanced Transparency and Accountability

The Budget emphasizes the need for greater transparency and accountability in the real estate sector. New regulations are expected to address issues such as project delays, non-compliance, and financial transparency. These changes aim to build trust among investors and homebuyers.

For stakeholders in Gurugram, these regulatory changes will contribute to a more transparent and reliable real estate market. Developers and investors can benefit from the increased clarity and accountability in real estate transactions.

Challenges and Considerations

Potential Impact on Property Prices

While the Budget's initiatives are likely to boost the real estate sector, there are concerns about the potential impact on property prices. Increased demand for residential and commercial properties may lead to higher prices, which could affect affordability for some buyers.

Homebuyers and investors in Gurugram should consider these factors when making real estate decisions. It is essential to stay informed about market trends and property price movements to make well-informed investment choices.

Balancing Supply and Demand

The growth in real estate development, driven by increased infrastructure investment and affordable housing incentives, must be balanced with supply and demand dynamics. Overbuilding or misalignment between supply and demand could impact the stability of the real estate market.

Developers and investors in Gurugram should carefully assess market conditions and demand trends to ensure that new projects align with the needs of the market.

Conclusion

The Union Budget 2024 presents a range of opportunities and challenges for the real estate industry, with significant implications for the market in Gurugram, Haryana. Increased infrastructure investment, incentives for affordable housing, tax reforms, and regulatory changes are set to shape the future of real estate in the region.

As the real estate landscape evolves, stakeholders in Gurugram must stay informed and adapt to the changes to leverage new opportunities and address potential challenges. For more detailed insights into the real estate market in Gurugram and to explore investment opportunities, visit Ehouzer.

For personalized advice and assistance with your real estate investments, contact us.

#realestate#budget 2024#gurugram#housingmarket#infrastructure#affordablehousing#commercial real estate#residential property#investment#sustainableliving#greenbuilding#urban development#property#realestateinvesting#homebuyers#propertyinvestment#realestatemarket#realestatenews#realestatetips#housing development#economicgrowth#urban planning#propertyvalue

2 notes

·

View notes

Text

At this year’s UN Cop28 climate summit the issue of air conditioning will be at the forefront of discussions as some of the world’s largest economies have signed up to the first ever global cooling pledge, led by the UN environment programme.

So far, more than 50 signatories have signed on to cut their cooling emissions by 68% by 2050.

India, however, is not expected to join. The country’s market for ACs is growing faster than almost anywhere else in the world. Higher incomes, rising temperatures in an already hot and humid climate and increasing affordability and access are driving more and more Indians towards buying or renting one as soon as they can afford it – and sometimes even when they cannot.

Between 8% and 10% of the country’s 300m households – home to 1.4 billion people – have an AC, but that number is expected to hit close to 50% by 2037, according to government projections. A report by the International Energy Agency (IEA) predicts that by 2050, India will have more than 1bn ACs in operation.

It could have significant implications for the global effort to keep temperature rises within 1.5C. Around the world, ACs are still largely inefficient and use a huge amount of electricity mostly generated by fossil fuels.

En masse, they can drive up outside temperatures as they pump out heat from indoors to outdoors. They contain chemical refrigerants which, if leaked, can be almost 1,500 times more environmentally destructive than CO2.

The vast amount of electricity that India’s growing number of ACs will require presents a significant challenge. Already during peak summertime hours, ACs have accounted for 40% to 60% of total power demand in the cities of Delhi and Mumbai.

According to the IEA, by 2050, the amount of power India consumes solely for air conditioning is expected to exceed the total power consumption of all of Africa.

Most of this electricity is produced by burning coal, and while India’s capacity from renewables such as solar power is expanding, it is happening nowhere near as fast as the growth of the AC market, which will soon outpace all other household appliances.

X

3 notes

·

View notes

Text

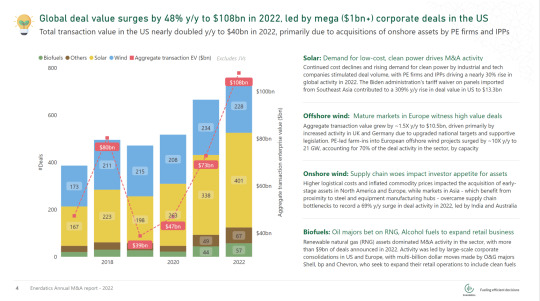

Renewable Energy M&A hits a record high of $100bn!

The global deal value surged by 48% y/y to $108bn in 2022; transacted capacity more than doubled to 740 GW. Corporate consolidations in the US and acquisitions of offshore wind assets in Europe were the major contributors to this rise.

Enerdatics has published its annual analysis of renewable energy transactions, globally. To access the full copy of this report, kindly visit enerdatics.com.

In the US, large, integrated power producers and oil majors expanded their presence in the onshore wind, solar and biofuels segments, fueled by incentives offered under the Inflation Reduction Act (IRA). The Biden administration’s waiver of import tariffs on solar panels from certain Southeast Asian countries improved the outlook for the US’s solar sector, contributing to a 309% y/y rise solar deal value during the year. Meanwhile, clean fuel tax credits and the rising demand to decarbonize domestic heating and power spurred billion-dollar investments in renewable natural gas (RNG) and alcohol fuels assets by bp and Chevron.

In Europe, private equity (PE)-led farm-ins in offshore wind assets, primarily in the UK and Germany accounted for ~40% of the region's transaction value. Ambitious government targets and supportive legislation, such as Germany’s Easter Package, drove deal activity. Further, the EU's plan to offset 3.5 billion cubic metres of Russian gas annually and efforts to decarbonize fossil fuel-based power and heating is spurring investments in renewable natural gas and energy-from-waste platforms. Shell and KKR led activity in the sector during the year.

APAC accounted for $19bn of transactions during the year, with India emerging as the premier market in the region. Onshore wind M&A activity surged by 69% y/y, as countries in the region overcame supply chain bottlenecks due to proximity to steel and equipment manufacturing hubs. Additionally, continued elevated prices of oil, coal, and LNG drove C&I customers to turn to corporate power purchase agreements, leading to a surge in interest for assets backed by bilateral contracts

LatAm deal value surged by 314% y/y, with Brazil accounting for 84% of the region’s transaction value. A 2021 regulation that allows companies to sign dollar-denominated PPAs incentivized foreign investment in Brazil's renewables sector by reducing forex risk. Meanwhile, Chile recorded $1bn of deals in 2022, however, transmission bottlenecks continue to impact investor appetite in the country.

PS: The above analysis is proprietary to Enerdatics’ energy analytics team, based on the current understanding of the available data. The information is subject to change and should not be taken to constitute professional advice or a recommendation.

12 notes

·

View notes

Text

Global Thin film Solar Cell Market Is Estimated To Witness High Growth Owing To Increasing Adoption of Renewable Energy Sources

The global Thin film Solar Cell Market is estimated to be valued at US$ 33.01 Bn in 2022 and is expected to exhibit a CAGR of 19.4% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights.

A) Market Overview:

Thin film solar cells are made from semiconductor materials that convert sunlight into electrical energy. These solar cells offer various advantages such as flexibility, lightweight, and superior aesthetics compared to traditional solar panels. The need for clean and sustainable energy sources is driving the demand for thin film solar cells as they provide an efficient way to generate electricity from the sun. With the increasing focus on reducing carbon emissions and combating climate change, the demand for renewable energy sources like thin film solar cells is expected to witness significant growth.

B) Market Key Trends:

One key trend in the thin film solar cell market is the increasing investment in research and development activities to enhance the efficiency of these solar cells. Researchers and manufacturers are investing in developing new materials and technologies to improve the conversion efficiency of thin film solar cells. For example, Oxford Photovoltaics, one of the key players in the market, is developing perovskite-based solar cells that have shown promising results in terms of efficiency and cost-effectiveness. This trend is driving innovation in the market and is expected to lead to the commercialization of more efficient thin film solar cell products.

C) PEST Analysis:

Political: Governments around the world are implementing favorable policies and incentives to promote the adoption of renewable energy sources. This is creating a conducive environment for the growth of the thin film solar cell market.

Economic: The declining cost of thin film solar cells, coupled with the increasing demand for clean energy, is driving the economic feasibility of these solar cells. This is attracting investments from both government and private entities.

Social: The increasing awareness about the environmental impact of traditional energy sources is driving the social acceptance and demand for renewable energy solutions like thin film solar cells. Additionally, the aesthetics and design flexibility offered by these solar cells are appealing to consumers.

Technological: Advances in thin film solar cell technologies are improving their efficiency and performance. New materials and manufacturing processes are being developed, leading to the commercialization of more efficient and cost-effective products.

D) Key Takeaways:

Paragraph 1: The Global Thin Film Solar Cell Market Demand is expected to witness high growth, exhibiting a CAGR of 19.4% over the forecast period, due to increasing adoption of renewable energy sources. The need for clean and sustainable energy solutions is driving the demand for thin film solar cells.

Paragraph 2: The Asia Pacific region is expected to dominate the thin film solar cell market, with countries like China, India, and Japan leading the way in terms of installation and production capacity. The region's favorable government policies, abundant solar resources, and growing energy demand are contributing to its fast-paced growth in the market.

Paragraph 3: Key players operating in the global thin film solar cell market are Ascent Solar Technologies, Inc., FIRST SOLAR, Kaneka Corporation, MiaSolé Hi-Tech Corp., and Oxford Photovoltaics. These companies are investing in research and development activities to improve the efficiency and performance of their thin film solar cell products. They are also focusing on strategic collaborations, partnerships, and mergers and acquisitions to expand their market presence.

#Thin Film Solar Cell Market#Thin Film Solar Cell Market Demand#Solar Cells#Thin Film Solar Cell Market GRowth#Thin Film Solar Cell Market Trends#Coherent Market Insights

3 notes

·

View notes

Text

Bright Future: Unlocking Investment in India's Solar PV Market

India's solar photovoltaic (PV) market is rapidly growing, driven by the nation's commitment to renewable energy. With ambitious government targets and abundant sunlight, the sector offers lucrative opportunities for investors. Explore how innovative renewable energy projects are transforming India's energy landscape, reducing carbon footprints, and generating sustainable power. Dive into the potential, incentives, and future trends shaping the solar PV market, making it a shining star in India's renewable energy revolution.

0 notes

Text

How to Invest in Solar Energy Stocks in India

Identify the right solar energy stocks to invest in.

When selecting solar energy stocks to invest in, it is important to consider the following factors:

Financial performance: Look at the company's financial performance over the past few years, including its revenue growth, profitability, and debt levels.

Management team: Assess the experience and track record of the company's management team.

Competitive landscape: Consider the company's competitive positioning within the Indian solar energy sector.

Valuation: Compare the company's valuation to its peers and to the broader market.

0 notes

Text

global building integrated photovoltaics (BIPV) market size at USD 14.06 billion in 2022. During the forecast period between 2023 and 2029, BlueWeave expects global building integrated photovoltaics (BIPV) market size to grow at a significant CAGR of 21% reaching a value of USD 44.45 billion by 2029. Major growth drivers for the global building integrated photovoltaics market include an increasing adoption of renewable energy sources, a growing focus on sustainable construction practices, supportive government incentives and regulations, rapid technological advancements in BIPV, and rising demand for green buildings. The market is further propelled by a strong emphasis on energy efficiency and sustainable development, with expectations of continued growth in the forecast period. Global awareness and adoption of solar power have been driven by countries prioritizing energy security and self-sufficiency. Supportive government legislations and commitments to reduce greenhouse gas emissions further fuel market growth. Key countries driving the transition to solar energy include Germany, Italy, France, the United Kingdom, the United States, China, Japan, and India. With these favorable conditions, the solar panel market is poised for significant expansion in the upcoming years. However, high initial costs of investments and complexity of building integrated photovoltaics (BIPV) installations are anticipated to restrain the overall market growth during the period in analysis.

Global Building Integrated Photovoltaics Market – Overview

The global building integrated photovoltaics (BIPV) market refers to the integration of photovoltaic materials into building elements, such as windows, facades, and roofs, to generate electricity while simultaneously serving their functional purposes. BIPV technology enables the seamless incorporation of solar panels into the building's design, allowing for the production of renewable energy on-site. This innovative approach combines the benefits of solar power generation with the aesthetics and functionality of building materials. BIPV systems can contribute to energy efficiency, reduce reliance on traditional power sources, and lower carbon emissions. The global BIPV market encompasses various technologies, materials, and applications aimed at integrating solar power generation into the built environment to meet the increasing demand for sustainable and energy-efficient buildings.

Sample Request @https://www.blueweaveconsulting.com/report/building-integrated-photovoltaics-market/report-sample

2 notes

·

View notes