#Inheritance Tax Specialists

Text

Understanding Inheritance Tax Specialists and Living Trust Inheritance Tax in the UK

In the realm of estate planning and inheritance, navigating the intricacies of taxes can be daunting. In the UK, inheritance tax is a significant consideration for many individuals and families. This is where inheritance tax specialists come into play, offering expertise and guidance to ensure that assets are managed and passed down efficiently. Additionally, living trusts can be a valuable tool in mitigating inheritance tax liabilities. Let's delve deeper into these concepts.

How Inheritance Tax Specialists Can Help

Inheritance tax specialists are professionals who specialize in providing advice and assistance with inheritance tax planning. They possess in-depth knowledge of tax laws and regulations, helping individuals and families minimize their inheritance tax liabilities legally. These specialists work closely with their clients to develop bespoke strategies tailored to their unique financial circumstances.

How Inheritance Tax Works in the UK

In the UK, inheritance tax is levied on the estate of a deceased person above a certain threshold. As of 2024, this threshold stands at £325,000 for individuals. Anything above this threshold is subject to a tax rate of 40%. Inheritance tax applies to assets such as property, investments, savings, and possessions.

How Inheritance Tax Specialists Provide Guidance

Inheritance tax specialists assess their clients' estates and financial situations to identify opportunities for tax planning. They offer recommendations on various strategies, such as making use of exemptions and reliefs, gifting assets, setting up trusts, and drafting wills. By implementing these strategies, individuals can reduce the value of their estate subject to inheritance tax, ultimately preserving more wealth for future generations.

How Living Trusts Can Help

A living trust, also known as a revocable trust, is a legal arrangement in which assets are placed into a trust during one's lifetime. The individual creating the trust, known as the grantor, retains control over the assets and can modify or revoke the trust as needed. Upon the grantor's death, the assets held in the trust are distributed to the beneficiaries according to the terms outlined in the trust document.

How Living Trusts Address Inheritance Tax

Living trusts can play a crucial role in minimizing inheritance tax liabilities. By transferring assets into a trust, the value of those assets is effectively removed from the grantor's estate for inheritance tax purposes. This can result in significant tax savings, as the assets held in the trust are not subject to the same tax rates as those held directly by the individual.

How Living Trusts Offer Flexibility

One of the key advantages of living trusts is their flexibility. Unlike wills, which become public documents upon the grantor's death and are subject to probate proceedings, trusts offer privacy and expedited asset distribution. Additionally, living trusts can be structured in a way that allows for ongoing management of assets, ensuring that beneficiaries are provided for according to the grantor's wishes.

How to Establish a Living Trust

Establishing a living trust typically involves drafting a trust document outlining the terms and conditions of the trust, appointing a trustee to manage the trust assets, and transferring assets into the trust's name. While setting up a living trust requires careful consideration and legal expertise, the benefits it offers in terms of estate planning and inheritance tax mitigation can be substantial.

How to Seek Professional Advice

For individuals and families seeking to optimize their estate planning and minimize inheritance tax liabilities, consulting with inheritance tax specialists and legal professionals is essential. These experts can provide personalized advice and guidance tailored to individual circumstances, helping to ensure that assets are protected and passed down efficiently to future generations.

In conclusion, inheritance tax specialists play a vital role in assisting individuals and families with estate planning and inheritance tax mitigation in the UK. By leveraging their expertise and guidance, along with tools such as living trusts, individuals can navigate the complexities of inheritance tax laws and preserve more of their wealth for their loved ones.

0 notes

Text

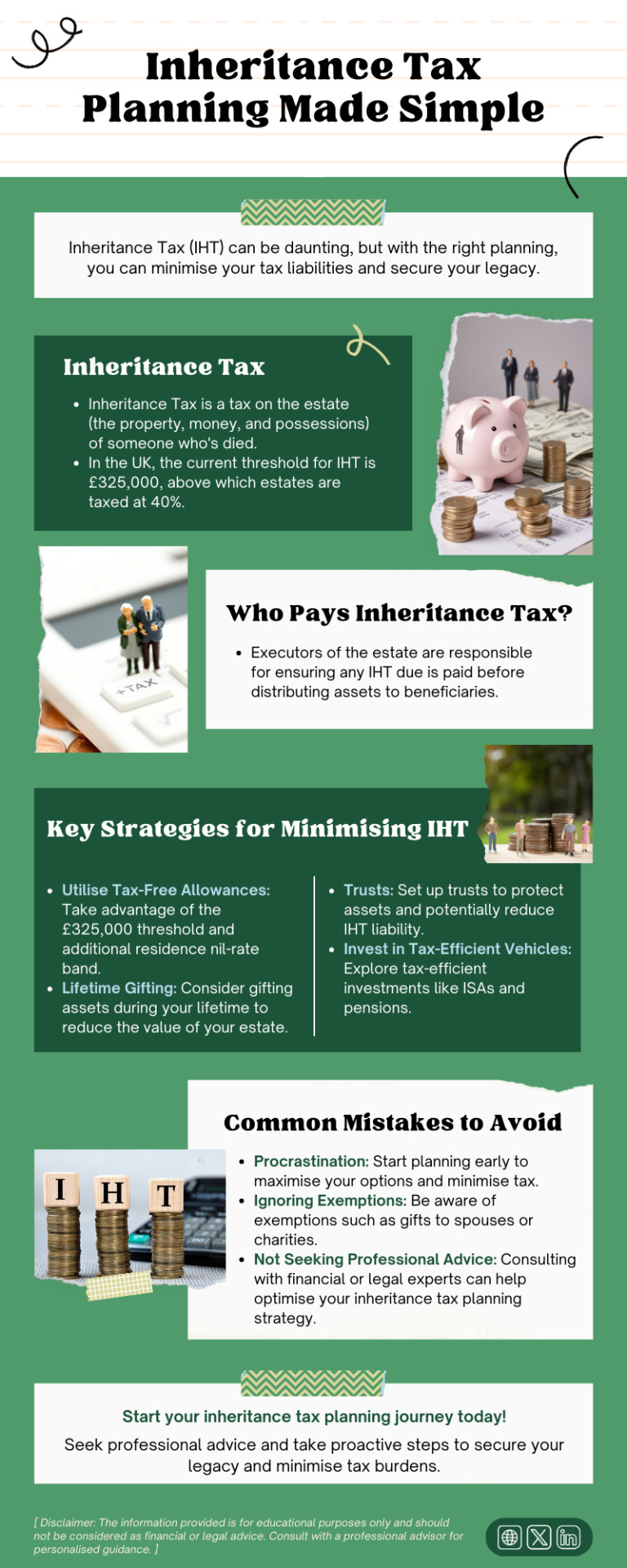

Inheritance Tax (IHT) can be daunting, but with the right planning, you can minimise your tax liabilities and secure your legacy. This infographic provides a simple and straightforward guide to inheritance tax planning.

#Inheritance tax planning#Inheritance tax advice#Inheritance tax advisor#Inheritance tax specialist#inheritance tax advice london#Inheritancetaxplanning

2 notes

·

View notes

Text

Discover essential advice on inheritance tax to help you understand your obligations and options. This resource covers key strategies for minimising tax liabilities, understanding exemptions, and planning your estate effectively. Equip yourself with the knowledge to protect your assets and ensure a smooth transfer to your beneficiaries.

#Inheritance tax planning#Inheritance tax advice#Inheritance tax advisor#Inheritance tax planning advice#Inheritance tax specialist#inheritance tax advice london

1 note

·

View note

Text

Inheritance Tax Planning and Strategies | Inheritance-tax.co.uk

Inheritance tax planning and strategies are essential for anyone looking to protect their assets and pass them on to their loved ones. In the UK, inheritance tax is a tax paid by the inheritor on the value of their inheritance, and the more valuable the inheritance, the higher the tax paid. However, there are several ways to reduce or even eliminate inheritance tax, and we have outlined some of them below:

Use Trusts: Trusts are a legal arrangement between you and another person or organization that allows you to give property or money away without having to pay inheritance tax on it. There are several types of inheritance tax planning trusts you can use, including bare trusts, interest in possession trusts, discretionary trusts, accumulation trusts, mixed trusts, trusts for a vulnerable person, and non-resident trusts.

Life Insurance Policy: A life insurance policy can help to pay any inheritance tax due, and placing your policy in a trust can help to ensure that it is not included in your estate for inheritance tax purposes.

Make Pension Plans: Pensions are not included in your estate for inheritance tax purposes, and by making pension plans, you can pay only 20% tax at retirement, as opposed to 40% inheritance tax. You can decide whether to withdraw your pension starting at age 55 or pass it on as an inheritance.

Give Away Gifts: You can give away gifts amounting to £3,000 each tax year, and these gifts will be counted toward your inheritance tax exemption. This can be an effective way to keep your estate tax-free over time.

Donate to Charity: Donating to charity is an excellent way to reduce your inheritance tax liability. Your estate won’t be subject to inheritance tax on anything you leave to charity, and the inheritance tax charged on the remaining part of your estate is reduced from 40% to 36% if you decide to donate at least 10% of your assets to charity.

Alternate Investments Market (AIM): The AIM is a market where you can invest in shares of smaller companies that are not listed on the main stock exchange. By investing in AIM shares that qualify for Business Relief, you can reduce the amount of inheritance tax due on your wealth.

Utilize Business Reliefs: Business reliefs enable you to remove your assets from your estate, relieving you of the burden of inheritance tax. By holding onto your assets for a few years, you can use business reliefs to remove them from your estate.

Overall, it's important to work with a trusted inheritance tax professional for inheritance tax planning advice. They can help you navigate the complex landscape of inheritance tax planning and ensure that your loved ones can pass on their assets without undue financial stress.

For More Information Visit Us: https://inheritance-tax.co.uk/area/inheritance-tax-planning-and-strategies/

#inheritance tax#inheritance#inheritance tax planning#tax planning#tax#property tax#finance#business#planning#inheritance tax specialist#planning and strategies#Estate planning#Paying Inheritance Tax#reduce the inheritance tax#calculate your taxable estate#calculated your taxable estate#inheritance tax advice#inheritance tax advice in London

0 notes

Note

god the Omeagorverse is brilliant brilliant brilliant. so good so delicious so nutritious to me. thank you thank you thank you for sharing it. i am actively considering taking pen to paper to physically draw out the family tree and draw like hearts and smiley faces and stars around the vile nasty rot :)

MWAH even though i still think its embarrassing im glad people are enjoying it<3 and oh dont worry i have a family tree of like nearly 900 characters at this point. It Is Evil For Me.... It's Terminal,... ten pages of character explanations below the cut do NOT click unless u want to walk around in my lovecraftian mind palace (shed of dumb ideas and deviantart OCs)

865 characters in what five months. God,

jae: hes maegor's firstborn with vis :3 maegor thinks he's lame and not good enough. jae is also oedipally insane about viserys because maegor was gross about it so he's got mommy issues about vis. he marries ceryse' niece as like an apology gift to the hightowers like sorry we did polygamy and disrespected you and inventented gay marriage sorry about that. he was also betrothed to aerea (shore up inheritance + appease rhaena) but viserra took aerea on the world's worst bachelorette party to valyria and only viserra returned alive :3. jae gots nutso after vis dies and starts bringing in boy youths as court favourites and maris kills him in a fit of rage due to his grossness and also maris has her own shit going on (lesbian drama, dw about it)

viserra: married into the lannisters to keep the iron throne's federal reserve in the clear and cos raising taxes spells real doom. she femdoms her husband and then kills him as a blood sacrifice to have kids (only death can pay for life). became regent for a while before house lannister kicked her out. marries into harrehal (lucamore the lusty is her hubby) kills him too. marries a couple more times, has a coupe kids, ends up trying to fly her dragon (vhagar btw) into the sun or moon or something. not 100% on her death yet.

daenys: oh poor baby girl. vis marries her into the starks to keep her safe from court + there was stark rebellion drama. has weird tension with her mother-in-law whos a bolton and her husband sucks too. she has 13 kids (9 make it to adulthood). daenys ends up killing maegor its a whole thing, hush hush. goes nutso after and she and vis die together codependently as one theyre the same person etcetc

aegon: jae's eldest, momma's boy. momma's special heir to the throne special boy. hates his twin brother aerion because aerion is daddy's favourite and jae obviously wishes aerion was heir instead. marries a lannister cousin and a velaryon who hate each other and it causes a succession crisis when he dies. he has a horrible emotionally and physically incestuous relationship with his sister helaena. aerion ends up kidnapping helaena and it causes a minor civil war where aegon and aerion both die RIP

aerion: jae's second, twin to aegon, daddy's specialist evil son. whats a little child endangerment between kids. kills the high septon when hes 14 cos the high septon was abusing helaena and gets exiled to essos at FOURTEEN cos he refused to admit why he did it (didnt wanna ruin helaena's reputation). he was just like lol #yolo he was cringe anyway. gets radicalised in essos cos why tf should cringe aegon get the throne when aerion is way cooler. kidnaps helaena but also in their minds its somewhat of a rescue cos everyone in westeros is weird about helaena. him and aegon die together :3 also he has a bastard with a martell bastard who does Rhoynish Restoration in essos with her three dragons she takes over volantis and burns the rot out of it at one point but thats not important. she's doing her own thing. ALSO HE CLAIMED BALERION that's also why he's so cunty about getting the throne he's like um you got vhagar the girl dragon and i got the cool old valyria dragon that granddaddy aegon rode so 🤨

helaena: helen of troy :3 she's one of grrms favourite historical girls; 6 year old who is breathtakingly gorgeous and everyone is weird about it. her cradle egg dragon is called urrax after the story of daeryssa and serwyn and also she befriended dreamfyre cos dreamfyre got depressed after rhaena died and started terrorising oldtown cos rhaelle was there. helaena did her horsegirl magic on dreamfyre and saved oldtown and so oldtown loves her. every man in the world wants to marry her but shes literally 13???? that does fucked up things to your psyche. has weird relationships with aegon and aerion due to them being her protectors and the only men growing up who werent weird about her but guess what babygirl. all feudal men are weird :3

daenerys: named after daenys which of course made the evil destiny stars align. she's basically the middle child so she's mostly ignored by both her parents. her dragon is called seafoam :3 she thinks both aegon and aerion are too neurotic to be king and she would be wayyy better. somewhat worships maegor cos he didnt gaf about primogeniture. gets married off to corlys velaryon (he still exists here) but she doesn't mind to much cos she likes exploring essos with corlys. best friends with aegon's velaryon wife and HATES the lannister wife soooo much. after aegon dies, viserys takes the throne which makes her sooooo fucking mad but she gets to be hand of the king with corlys. after viserys dies she and corlys swoop in and do the westerosi regency era until her grand-nephew comes of age. absentee mother because she's too busy girlbossing her way through the red keep

viserys: babyboy you were never gonna be normal with a name like that. jae is weird about him cos viserys looks exactly like his namesake he's also soft and likes non-reptillian animals and being nice to people which is not very targaryen of him. jae has him trained by his kingsguard to beat the pussy out of him but it just makes vis an even sadder kitten. has clinical depression (diagnosed at 5 years old) so cant even get angry and rage and blow up the red keep like he wishes he could. forced to marry aerion's spurned betrothed who's their distant cousin alyssa arryn (half targ herself, i had vaella survive and marry rodrik similar to daella). alyssa is crazygirl she gets radicalised by a red priestess from asshai 😈 they agree to have a sexless unconssumated marriage though. viserys gets voted king after aerion and aegon die (aegon's kids and wives have their own drama going on so a council is necessary) and he's like what if i just kill myself but he's got a slightly evil kingsguard boyfriend whos like nooo dont kill urself youre so powerful now ahaha. pretty okay king, basically lets daenerys rule cos he's too busy being depressed and wanting to khs :( poor baby. anyway alyssa hears a prophecy about TPTWP and AA and goes megacuckoo and does blood magic to have kids and that's its whole drama dw about it. he does end up getting to kill himself though good for him 😭

maegelle: poor baby. gets married off to the hightowers at FOURTEEN cos jae thinks she's weird and autistic and needs her outta the red keep. he's like dont u wanna be lady of the hightower? its so big!! and shes like no because my special interest is religion and prophetic dragon dreams. she weirds him out too much with her prophesies of his death etc. ends up achieving religious euphoria ecstasy etc after getting visions and doing some miracles and abandons her husband and daughters to live in a convent. she doesnt realise she's just trying to escape the cycle of targ torment the only way she knows how :(

anyway thats just like 9 of my guys i invented. i mostly do this so i have something for my brain to think about when im trying to go to sleep but The Thoughts are tormenting me. can you tell im a little funny in the brain. anyway if u made it this far i love u i love u i love u♡

#rhaena was hand of the king btw ^_^ she and maegor hate each other#sorry for the long post. keep in mind it could be way worse#au:omaegorverse#cringe oc warning#tw oc#ask#darling1darling#KISS genuinely kiss on the cheek for you im sorry to have infected you but im glad we can sit in the plague pit together :3

19 notes

·

View notes

Text

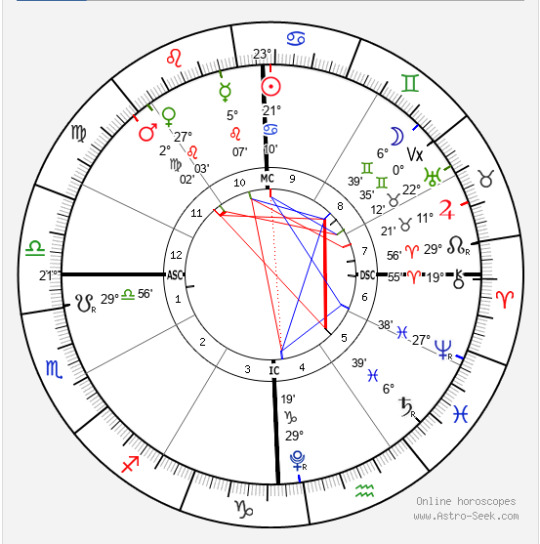

Lunar Return July 13-August 8 2023

LR Moon in 8H

Focus on ancestors, ceremonies in connection with the dead, tax and bill collectors, the dead (matters connected with), death, joint finances, friends of one’s parents, generative system, graveyards, heirs/heirlooms, inheritances, insurance, legacies, life after death, money of others, mortality, occultism, spiritual/mental regeneration, surgery, taxation, wills

Waning Crescent Moon Phase

The conclusion of the cycle. Reaping what you have sown. Carrying out your mission. Culminating karma. A time to rest and recuperate; reflect and meditate. Letting go of the past. Embracing the future.

Libra Ascendant (Theme of the Month)

Alliances, fine arts, lower half of the back, beauty/beauty parlors, bedrooms, boutiques, companionship, contracts, compromises, decorators, diplomacy, florists/flowers, fashion, fancy goods, friendliness, social gatherings, intermediaries, jewelry, justice, kidneys, love, lumbar region of the body, marriage, music, negotiations, partners, one’s dealings with the public, refinement, renal disorders, social affairs, spine (mainly lumbar region), truces, unions, weddings

Ascendant Ruler in 11H

Ankles, batteries, broadcasts, leg calves, clubs, colleagues, electricity, electronics, friends, idealism, humanitarianism, inventions, legs, motion pictures, nerve specialists, organizations, new teachings and occupations, photography, progressive, psychology, radio, rebellions, reform, research, science in general, sociability, societies, phones, tv, Internet, social media, advanced or free thought, hopes and wishes

Edit 7/17: Electronics/tv/Internet was unavailable due to a 12 hour power outage. UGH.

Other Things

Area of life important for the month= Ascendant at 21° Sagittarius degree= abundance, advertising, religious/philosophical books, ceremonies, churches, colleges, commerce, counselors, higher education, intestinal disorders, exploration, religious faith, foreign countries/travel, hips, judges/judicial matters, legal affairs, upper legs, liver, pelvis, philanthropy, philosophy, publishing, religion/spirituality, sciatic nerve, spine/sacral region of the spine, sportsmen/sporting goods, thighs, prophecy/visions

Cancer in 10H (where in your life you are able to work out some of your emotional challenges this month) = achievements, ancestors, bones, one’s career, cousins from the father’s side in a woman’s horoscope, employers, one’s father (in general) or the more authoritative parent, one’s goals, government, honors, knees, matters outside the home, one’s reputation, prestige, one’s profession, promotions, one’s public appearance, public life

Sun conjunct MC= Putting your attention on your career, reputation. Focusing more on success than home life

Chiron conjunct DC= May try to hide from your inner wounds and put on a mask of confidence. Try not to project your own wounds on to others

Venus conjunct 11H cusp= Cheerfulness, harmony with friendships, clubs, colleagues, organizations

Neptune conjunct 6H cusp= Glamour, spirituality, illusion, compassion, delusion, idealism with care and health of body, clothing, comforts, cooks/cooking, diet, doctors, employees, father’s relatives, food, hygiene, illness, labor, nutrition, public health, restaurants, school strikes, stores, workplace environment

Moon square Saturn= Hard to connect to others. May feel sad and lonely

7 notes

·

View notes

Text

I don’t know if I ever said on here that I did pass that test I had to take for work. We finally got the results and they finally let us know when we’ll get our bonuses. 71% lmao sounds about right for me! But it was a pass and that’s all that matters. So I’m now technically a Certified Customs Specialist, oOoOo. But, I don’t actually have the job title “customs specialist” because I don’t actually want to be one lmao. I’m happy with my lowly “customs analyst” job. But it’s just nice to have, in case I ever do decide to try moving up, or want to switch companies, pfft.

I’m going to try saving most of my bonus because my mom mentioned looking into Disney trips after she gets her part of her “inheritance” from after my Pa died. She has to wait until 2023 to do his final taxes and then see how much is left to split between her and my two uncles. It won’t be a lot once it’s split three ways but possibly just enough for us to actually do something like that, which would be awesome. And if I save mine and put some of my money towards it too, that would help. Plus we get our annual bonuses at work around the same time as tax time so it’d all add up.

I was also thinking of getting a PS5 and like, I do want one, but I also don’t? Like my PS4 is still doing its job well enough so I’m going back and forth on if I should get the PS5 or continue waiting on that, pfft. I could get a PS5 and still have plenty to put towards a trip but eeeeehhhh. I might just buy a few hundred dollars worth of manga instead lmaooo.

4 notes

·

View notes

Text

Affordable Protective Property Trust Will Costs with IWC Probate and Will Services

When dealing with the estate of a deceased loved one, probate can be a complex and emotionally taxing process. In the UK, many citizens turn to expert advice to navigate this legal procedure effectively. Probate is the legal process that confirms a deceased person’s will and grants the executor the authority to manage and distribute their estate. If there’s no will, the process can be even more complicated, often leading to disputes and delays. While some cases may be straightforward, others involve larger estates or disputes that require detailed knowledge of inheritance law.

Protective property trust will cost law can be intricate, with varying rules depending on the size of the estate and its assets. For example, different tax obligations might arise based on the value of the property, savings, or investments left behind. Professional advice helps citizens understand these nuances, ensuring that legal procedures are followed and that financial obligations are met.

In addition to the legal hurdles, handling probate often coincides with grieving a loved one. Seeking advice from probate specialists or organisations like Citizens Advice can provide emotional relief, offering support during a difficult time.

These experts can assist with paperwork, legal terms, and negotiations, easing the burden on families. Probate errors can lead to significant financial loss. Getting advice ensures that executors don’t overlook any legal requirements, helping to settle estates more quickly and fairly.

For many, seeking probate advice is not just about following the law, but about achieving peace of mind during an emotional period. IWC Is a one-stop trusted name in the UK to get protective property trust will cost services.

0 notes

Text

The impact of Inheritance Tax on small business owners | Inheritance-tax.co.uk

As a small business owner, you have spent years building your company from the ground up. You have invested countless hours and money into your business, and it has become a significant part of your life. However, have you considered the impact of inheritance tax on your business? Inheritance tax is a tax levied on an estate after a person's death, and it can have a significant impact on small business owners. In this post, we will explore the impact of inheritance tax on small business owners and provide advice on how to navigate this tax.

Inheritance tax can be a significant burden on small business owners.

Small business owners are often cash-poor, and their businesses represent a significant portion of their wealth. Inheritance tax can be a significant burden on small business owners, as it requires the payment of tax on the value of the business at the time of the owner's death. This tax can be especially challenging to pay for small business owners who have little liquidity, and it can force the sale of the business to cover the tax bill. This can be a devastating outcome for small business owners who have spent years building their company and do not want to see it sold.

Planning ahead can mitigate the impact of inheritance tax on small business owners.

Planning ahead is crucial for small business owners who want to mitigate the impact of inheritance tax on their business. There are several strategies that small business owners can use to reduce their inheritance tax liability. For example, small business owners can transfer ownership of their business to family members or employees before their death, reducing the value of their estate and the amount of inheritance tax due. Additionally, small business owners can use trusts and other estate planning tools to reduce their inheritance tax liability.

Professional inheritance tax advice can help small business owners navigate the tax system.

Inheritance tax is a complex tax, and small business owners may benefit from professional inheritance tax advice UK. An inheritance tax specialist can provide small business owners with advice on how to structure their estate to reduce their tax liability. Additionally, an inheritance tax specialist can provide guidance on the use of trusts and other estate planning tools to mitigate the impact of inheritance tax on small business owners.

Business property relief can be a valuable tax break for small business owners.

Business property relief is a valuable tax break for small business owners, as it can provide relief from inheritance tax on the value of qualifying business assets. Qualifying business assets include shares in unlisted companies, and business property such as buildings and land used for the purposes of the business. Small business owners should be aware of the rules surrounding business property relief and ensure that their business qualifies for the relief.

The impact of inheritance tax on small business owners can be mitigated with life insurance.

Life insurance can be a valuable tool for small business owners looking to mitigate the impact of inheritance tax on their business. Small business owners can take out life insurance policies that pay out on their death, providing the funds necessary to pay their inheritance tax bill without having to sell their business. This can provide small business owners with peace of mind knowing that their business will not have to be sold to cover the tax bill.

Conclusion

In conclusion, inheritance tax can have a significant impact on small business owners, but there are strategies that can be used to mitigate its impact. Planning ahead, seeking professional inheritance tax advice UK, and utilizing tax breaks such as business property relief can help small business owners reduce their tax liability. Additionally, life insurance can be a valuable tool for small business owners looking to ensure that their business is not sold to cover the tax bill. By taking proactive steps to address the impact of inheritance tax on their business, small business owners can ensure that their hard work and investment are protected for future generations.

#Inheritance tax#inheritance tax advice UK#inheritance tax specialist#tax planning#tax#property tax#finance#inheritance

1 note

·

View note

Video

youtube

Labour Hint Of Wealth Tax, Higher Inheritance and Capital Gains Taxes In “Painful” October Budget

Prime Minister Sir Kier Starmer and Chancellor Rachel Reeves say “thing will get worse”, and refuse to rule out a “painful” October Budget.

Concerns over potential tax hikes, as the Labour Party hints at plans to raise Inheritance Tax (IHT), Capital Gains Tax (CGT), and even introduce a wealth tax, are already causing an exodus of the rich.

Watch full video version - https://youtu.be/P0WTdbIAuks

The prospect of higher taxes under a Labour government is causing unease among property owners and investors alike.

Inheritance Tax is a particular area of concern, as Labour has suggested that the current threshold could be lowered, increasing the tax burden on estates. Currently, IHT is levied at 40% on estates worth over £325,000, but this could change, leading to more families being caught in the tax net.

Capital Gains Tax is also on Labour’s radar, with proposals to align CGT rates more closely with income tax rates. This could see higher earners paying significantly more on profits from property sales, stocks, and other investments.

Additionally, Labour’s discussions around a potential wealth tax are causing further anxiety. Such a tax would target the richest individuals, potentially impacting those with significant property holdings, investments, and savings.

As the political landscape evolves, investors and property owners are advised to stay informed and consider their options carefully. Whether you're thinking of selling, buying, or holding onto your assets, understanding how these potential tax changes could affect you is crucial.

How will Labour’s new Renters Rights Bill 2024 affect buy-to-let landlords?

The Labour Party’s Renters' Rights Bill 2024 is poised to bring significant changes to the UK’s rental market, impacting both tenants and buy-to-let landlords. Understanding these changes is crucial for landlords to navigate the evolving landscape effectively.

Watch video version - https://youtu.be/Wx1HXgVW1bM

Section 24 Landlord Tax Hike

Interview with Chartered Accountant and property tax specialist who reveals options and solutions to move your properties from your own name into a limited company or LLP whilst mitigating the potential HMRC pitfalls.

Email [email protected] for a free consultation on how to deal with Section 24.

Watch video now: https://youtu.be/aMuGs_ek17s

For more insights into how to navigate these uncertain times, keep an eye on market trends and consult with a financial advisor to plan effectively for the future.

#PropertyMarket #TaxChanges #InheritanceTax #CapitalGainsTax #WealthTax #LabourParty #UKProperty #FinancialPlanning #equityrelease #section24tax #kierstarmer #finances #moneytraining

0 notes

Text

How Banks Assist with Estate Planning

How Banks Assist with Estate Planning

Estate planning is a crucial part of managing your finances and ensuring that your assets are distributed according to your wishes after your death. While many people think of estate planning as something only for the wealthy, it's actually important for anyone who wants to protect their loved ones and their legacy. Banks can play a significant role in estate planning by offering a range of services and expertise. Let's explore how banks can assist with estate planning and why it's beneficial to include them in your planning process.

ALSO READ - Advocate Ayush Garg

1. Providing Trust Services

One of the primary ways banks assist with estate planning is by offering trust services. Trusts are legal arrangements that allow you to place assets under the management of a trustee, who then manages these assets according to the terms you set. Banks can act as professional trustees, managing the trust’s assets on behalf of the beneficiaries. This can be particularly useful for complex estates or when there is a need to ensure that assets are managed prudently over a long period.

Banks have the expertise and resources to handle the various responsibilities of a trustee, such as investing the trust assets, managing real estate, paying bills, and distributing assets to beneficiaries according to the trust's terms. By serving as a trustee, banks provide a level of professionalism and impartiality that might be difficult for a family member or friend to offer.

ALSO READ- Ayush Garg High Court Advocate

2. Offering Estate Planning Advice and Guidance

Banks often have a wealth management division staffed with financial advisors and estate planning specialists. These professionals can provide valuable advice on how to structure your estate to minimize taxes, avoid probate, and ensure that your assets are distributed according to your wishes. They can help you understand the different types of trusts, the benefits of a will, and how to set up power of attorney and health care directives.

By working with a bank's estate planning experts, you can gain a clearer understanding of your financial situation and develop a comprehensive estate plan that meets your goals. They can also work in conjunction with your attorney and accountant to create a coordinated plan that covers all aspects of your estate.

ALSO READ- Ayush Garg

3. Managing Investment Accounts

Part of estate planning involves ensuring that your investments are managed effectively to grow your wealth and provide for your loved ones after you're gone. Banks can help with this by managing investment accounts and providing financial planning services. This includes developing an investment strategy that aligns with your estate planning goals and adjusting the strategy as needed to reflect changes in your circumstances or market conditions.

Banks can also manage specialized investment accounts like Individual Retirement Accounts (IRAs) or 401(k)s, which have specific rules regarding inheritance and distribution. By working with a bank, you can ensure that these accounts are managed properly and that your beneficiaries receive the maximum benefit.

ALSO READ- Cyber Crime Advocate

4. Offering Safe Deposit Boxes and Digital Vaults

A key component of estate planning is ensuring that important documents, such as wills, trusts, insurance policies, and deeds, are stored safely and can be easily accessed by your executor or trustee when needed. Banks offer safe deposit boxes that provide a secure location for storing these documents and other valuable items.

In addition to physical safe deposit boxes, many banks now offer digital vaults. These are secure online storage solutions where you can store digital copies of important documents. Digital vaults are particularly useful because they allow your executor or trustee to access necessary documents from anywhere, making it easier to manage your estate.

5. Assisting with the Probate Process

After someone passes away, their estate often goes through a legal process called probate, where the deceased's assets are distributed according to their will or state law. Banks can assist with the probate process by providing executor services. An executor is responsible for managing the estate, paying off debts, and distributing assets to beneficiaries.

Banks can act as executors, offering a professional and impartial approach to managing the estate. This can be especially helpful if the estate is complex or if there are family disputes that might complicate the distribution of assets. By acting as an executor, the bank ensures that the estate is handled according to the law and the wishes of the deceased.

ALSO READ- High Court Advocate

6. Minimizing Estate Taxes

Estate taxes can significantly reduce the value of your estate if not properly planned for. Banks can help minimize estate taxes by advising on various strategies, such as setting up trusts, making charitable donations, or gifting assets during your lifetime. These strategies can reduce the taxable value of your estate, ensuring that more of your wealth is passed on to your beneficiaries.

Banks' estate planning experts can work closely with your attorney and accountant to develop a tax-efficient estate plan. They can help identify opportunities to reduce taxes and ensure that all legal requirements are met to avoid any issues with the IRS.

7. Supporting Charitable Giving

If you wish to include charitable giving in your estate plan, banks can help facilitate this process. They can set up charitable trusts or donor-advised funds, which allow you to donate assets to charity while also receiving tax benefits. Banks can also manage these charitable funds, ensuring that your donations are used according to your wishes.

By working with a bank, you can create a charitable giving plan that reflects your values and provides ongoing support to the causes you care about. This not only helps you leave a lasting legacy but also offers potential tax advantages for your estate.

8. Providing Financial Education for Beneficiaries

In addition to managing your estate, banks can provide financial education for your beneficiaries. This can include guidance on how to manage inherited wealth, investment strategies, and financial planning. By educating your beneficiaries, banks can help them make informed decisions about their inheritance and ensure that the wealth you leave behind is used wisely.

Financial education is particularly important for younger beneficiaries who may not have experience managing significant assets. Banks can offer resources and support to help them understand their financial options and make smart choices for the future.

Conclusion

Banks offer a wide range of services that can greatly assist with estate planning. From acting as a trustee or executor to providing investment management and financial education, banks bring a level of expertise and professionalism that can help ensure your estate is managed according to your wishes. By incorporating a bank into your estate planning process, you can gain peace of mind knowing that your assets will be handled with care and that your loved ones will be well taken care of.

FAQs

What is the role of a bank in estate planning?

Banks can act as trustees, executors, provide investment management, and offer financial planning and tax advice as part of estate planning.

How can banks help minimize estate taxes?

Banks can advise on strategies like setting up trusts, making charitable donations, or gifting assets to reduce the taxable value of your estate.

What are trust services, and how do banks provide them?

Trust services involve managing assets placed in a trust according to the terms set by the trustor. Banks can act as professional trustees, managing these assets for the benefit of the beneficiaries.

Why use a bank as an executor for an estate?

A bank offers professional and impartial management of an estate, which can be particularly useful for complex estates or in situations where family disputes may arise.

Can banks help with charitable giving in estate planning?

Yes, banks can assist in setting up charitable trusts or donor-advised funds to facilitate charitable giving and provide tax benefits.

0 notes

Text

Nachhulfe Steuerrecht Düsseldorf

Elevate Your Tax and Accounting Skills with BuchungsSchatz

In today’s competitive environment, proficiency in tax law and accounting is pivotal for a range of professionals, from aspiring tax consultants to established accountants. BuchungsSchatz stands at the forefront of educational services, offering specialized online tutoring designed to master these complex fields. Here's how BuchungsSchatz can empower your career through tailored learning experiences.

Master Tax Law and Accounting with Expert Tutoring

At BuchungsSchatz, we understand the critical importance of detailed and robust knowledge in tax law and accounting. Whether you’re a student, trainee, or a professional such as a tax advisor, tax specialist, or accountant, our tailored online tutoring services are crafted to enhance your expertise. We prepare you for exams, assist in clarifying complex tax queries, and provide comprehensive support with custom learning plans and professional advice. Our flexible offerings are designed to help you advance in your career and pursue further training effectively.

Specialized Tax Advisory Services

BuchungsSchatz isn’t just about tutoring; we also offer specialized tax advisory services. Operating both in Düsseldorf and digitally across Germany, we cater to private individuals, entrepreneurs, and freelancers among others. Our services range from preparing income tax returns to advising on inheritance tax returns and handling accounting for startups and influencers.

Our specialized consultation in areas like sales tax issues and procedural law ensures that your tax matters are handled with the utmost competence. We support tax advisors by creating detailed reports, aiding in the digitalization of tax processes, and navigating the complexities of procedural law. With BuchungsSchatz, you gain a partner who brings your practice into the future with progressive tax advice.

Why Choose BuchungsSchatz?

1. Premium Service with Experienced Tutors: Our tutors are not just experts in their fields; they are passionate educators committed to making learning enjoyable and effective.

2. Flexibility and Accessibility: Learn from anywhere, at any time. Our online platform provides the flexibility to fit your learning into your busy schedule without compromising on the quality of instruction.

3. Customized Learning Plans: Every learner is unique, and our educational approach reflects this. We provide individualized learning plans that are specifically designed to meet your educational goals and challenges.

4. Wide Range of Services: From tax law to accounting, our services cover a broad spectrum to ensure comprehensive support for all your educational needs.

Start Your Learning Journey Today

Are you ready to boost your knowledge and skills in tax law and accounting? Book your first tutoring session with BuchungsSchatz and embark on a learning adventure that promises not just to educate but to inspire. With our commitment to making learning fun and our dedication to providing expert, individualized support, BuchungsSchatz is your ideal partner in professional growth.

Join the many professionals and students who have advanced their careers with the help of BuchungsSchatz. Visit our website to learn more about our services and how we can help you achieve your professional and academic goals. #OnlineTutoring #LearningMustBeFun #ExpertTeam #IndividualSupport

Transform your understanding of tax law and accounting with BuchungsSchatz – where learning meets excellence.

0 notes

Text

The Importance of Probate Valuations in Estate Management

Probate valuations are a crucial part of managing a deceased person's estate. They ensure that all assets are accurately valued, which is essential for legal, tax, and distribution purposes. Understanding probate valuations can help make the estate administration process smoother and more efficient.

What is a Probate Valuation?

A probate valuation is an assessment of the deceased person's assets at the time of their death. This includes property, personal possessions, financial assets, and any other valuables. The valuation is used to calculate inheritance tax and to ensure the correct distribution of the estate according to the will or intestacy rules.

Why Are Probate Valuations Important?

Legal Requirement: In many jurisdictions, a probate valuation is required by law to obtain a Grant of Probate or Letters of Administration.

Tax Calculation: Accurate valuations are essential for calculating any inheritance tax due on the estate. Over- or under-valuing assets can lead to significant legal and financial issues.

Fair Distribution: To ensure that beneficiaries receive their correct share of the estate, all assets must be accurately valued.

Avoiding Disputes: Clear and accurate valuations help prevent disputes among beneficiaries and other interested parties.

How to Conduct a Probate Valuation

Hiring a Professional Valuer: It's advisable to hire a professional valuer, especially for high-value or complex assets like property and antiques. Professional valuations carry more weight in legal and tax matters.

Inventory of Assets: Create a comprehensive list of all assets, including bank accounts, investments, property, vehicles, jewelry, and other personal belongings.

Documenting Values: Collect all relevant documentation that can help establish the value of assets. This might include bank statements, property appraisals, and receipts for valuable items.

Date of Death Valuation: Ensure that all assets are valued as of the date of death. This is crucial for tax calculations and legal purposes.

Challenges in Probate Valuation

Valuing Unique Items: Items like art, antiques, and collectibles can be challenging to value and may require specialist appraisers.

Market Fluctuations: Property and investment values can fluctuate, complicating the valuation process.

Hidden Assets: Discovering all assets, especially those not listed in official documents, can be a complex task.

Benefits of Professional Probate Valuation Services

Accuracy: Professionals provide accurate and defensible valuations.

Expertise: They have the expertise to value a wide range of assets.

Compliance: Professional valuations ensure compliance with legal and tax requirements.

Peace of Mind: Knowing that the estate is accurately valued can provide peace of mind during a difficult time.

Conclusion

Probate valuations are an essential part of estate management, ensuring legal compliance, accurate tax calculation, and fair distribution of assets. Engaging professional valuers can make this complex task much easier and ensure that all assets are properly accounted for. Accurate probate valuations not only fulfill legal requirements but also help provide clarity and fairness for all parties involved.

0 notes

Text

Understanding the Basics of Trust Fund Inheritance Tax: A Beginner's Guide

Trust fund inheritance tax is a complex topic that many people find confusing. However, understanding the basics of trust fund inheritance tax is essential for effective estate planning. In this beginner's guide, we'll break down the key concepts and provide clarity on this important aspect of wealth transfer.

What Is Trust Fund Inheritance Tax?

Trust fund inheritance tax, also known as estate tax, is a tax imposed on the transfer of assets from one individual to another through a trust fund upon the death of the grantor or beneficiary. The tax is based on the value of the trust assets at the time of transfer and is subject to applicable tax laws and regulations.

Key Components of Trust Fund Inheritance Tax:

Taxable Estate: The taxable estate includes all assets held in trust at the time of the grantor's or beneficiary's death, including real estate, investments, cash, and personal property. Certain deductions and exemptions may apply, depending on the jurisdiction and the size of the estate.

Tax Rates: Inheritance tax rates vary by jurisdiction and are subject to change over time. The tax rates may be progressive, meaning that higher-value estates are subject to higher tax rates. It's essential to consult with tax professionals familiar with local tax laws to understand the applicable rates.

Exemptions and Deductions: Certain exemptions and deductions may apply to reduce the taxable value of the estate for inheritance tax purposes. Common exemptions include the marital deduction, charitable deduction, and annual exclusion gifts. Understanding these provisions can help minimize tax liabilities.

Filing Requirements: Executors or trustees responsible for administering the trust fund may be required to file inheritance tax returns, such as the IHT100 form in the United Kingdom. Compliance with filing requirements is essential to avoid penalties and ensure proper tax reporting.

Tax Planning Strategies: Various tax planning strategies can help minimize trust fund inheritance tax liabilities, such as establishing irrevocable trusts, utilizing annual exclusion gifts, and exploring charitable giving options. Working with inheritance tax planning 0

specialists can help you develop a comprehensive tax strategy tailored to your specific needs.

By understanding the basics of trust fund inheritance tax and implementing effective tax planning strategies, you can navigate the complexities of estate planning with confidence. Take proactive steps to protect your assets and ensure a smooth transfer of wealth to future generations.

inheritance tax consultant

1 note

·

View note

Text

Know About the Living Trust Inheritance Tax in the UK

A living trust inheritance tax is a legal arrangement where assets are transferred into a trust during a person's lifetime. This setup allows the person creating the trust to manage or delegate the management of these assets for the benefit of beneficiaries. While living trusts are a useful tool for estate planning, it is essential to understand how they interact with the UK inheritance tax (IHT).

Living Trust Inheritance tax in the UK is charged at 40% on estates above the nil-rate band. However, when assets are placed into a living trust, they are typically considered a "potentially exempt transfer" (PET) if the settler survives for seven years after making the transfer.

If the settler passes away within this seven-year period, the transferred assets may be subject to inheritance tax, although the tax rate can be reduced on a sliding scale depending on how many years have passed since the transfer.

For trusts created during a settler’s lifetime, there are also periodic charges known as the "ten-year anniversary charges" and "exit charges."

The ten-year anniversary charge occurs every ten years after the trust's creation and is levied at up to 6% of the trust’s value above the nil-rate band.

The exit charge applies when assets are removed from the trust and is proportional to the time elapsed since the last ten-year charge.

Living trusts offer flexibility in managing assets and can provide tax advantages, but they require careful planning to avoid unexpected tax liabilities.

It's advisable for individuals considering a living trust to consult with a financial advisor or tax specialist to navigate the complex inheritance tax landscape and ensure that their estate is managed in the most tax-efficient manner possible.

0 notes

Text

5 Factors Lda Pro Paralegals Consider While Providing You With Living Trust Services

Living Trust Services are essential for anyone who wishes to ensure that their assets are distributed according to their wishes after they pass away. A Living Trust is a legal document that specifies the management and distribution of an individual's assets both during and after their lifetime. A specialist who can assist you with every aspect of living trust services is an LDA Pro Paralegal.

LDA Pro Paralegals takes several things into account when offering Living Trust Services to make sure the client's needs are satisfied. You will explore a few of the factors that LDA Pro Paralegals take into account when offering Living Trust Services in this blog.

Hiring Lda Pro To Avail Of The Living Trust Services: 5 Factors They Usually Keep In Mind

Here listed below are all the 5 factors that LDA Pro considers while drafting your living trust

Client’s Goals And Objectives

The first and most important factor that LDA Pro Paralegals consider while providing Living Trust Services is the client's goals and objectives. Before drafting a living trust, it is essential to understand what the client wants to achieve. For example, if the client wants to ensure that their assets are distributed to their children in the event of their death, the LDA Pro Paralegal will draft a living trust that reflects these wishes.

Assets And Liabilities

When offering living trust services, LDA Pro Paralegals also takes the client's assets and liabilities into account. They must be aware of all the assets the client possesses, such as personal belongings, bank accounts, investments, and real estate. They must also be aware of any obligations or debts the client may have that could influence how their assets are divided.

Tax Implications

When providing Living Trust Services, LDA Pro Paralegals considers the potential tax implications. They need to find out how to lower the tax liability and if estate taxes will apply to the client's estate. Also, they might provide clients with tax-saving asset structuring advice.

Trustee Selection

The choice of trustee will also be taken into account by the LDA Pro Paralegal when offering living trust Services. The trustee holds the responsibility of overseeing the trust's assets and allocating them according to the client's desires. Selecting a dependable and accountable trustee who will honor the client's wishes is crucial.

Beneficiary Designations

Beneficiary designations are another consideration that LDA Pro Paralegals take into account when offering Living Trust Services. Beneficiary designations are significant because they specify the person who will inherit the trust's assets upon the client's passing. Working with clients, LDA Pro Paralegals will make sure beneficiary designations accurately represent their desires and are current.

So here are all the 5 factors Lda pro paralegals consider while providing you the Living Trust Services, if you find this blog useful, then do visit our official website today and explore more about our other services like flawless drafting of Gift deeds in California which is available at a reasonable price range.

0 notes