#Intel HPC

Explore tagged Tumblr posts

Text

Aurora is a supercomputer built jointly by Intel and Cray and based with Intel Xeon processors.

Cray is a subsidiary company of Hewlett Packard Enterprise (HPE).

It is one of the most powerful and fastest supercomputer in the world today.

#Intel HPC#Cray#Intel processor based supercomputers#Intel Xeon#Hewlett Packard Enterprise#HPE#Intel HPC solutions

0 notes

Text

Boost Enterprise Computing with the HexaData HD-H252-3C0 VER GEN001 Server

The HexaData HD-H252-3C0 VER GEN001 is a powerful 2U high-density server designed to meet the demands of enterprise-level computing. Featuring a 4-node architecture with support for 3rd Gen Intel® Xeon® Scalable processors, it delivers exceptional performance, scalability, and energy efficiency. Ideal for virtualization, data centers, and high-performance computing, this server offers advanced memory, storage, and network capabilities — making it a smart solution for modern IT infrastructure. Learn more: HexaData HD-H252-3C0 VER GEN001.

#High-density server#2U rack server#Intel Xeon Scalable server#Enterprise server solutions#Data center hardware#HexaData servers#Virtualization-ready server#Multi-node server#Server for HPC workloads#Scalable infrastructure

0 notes

Text

The history of computing is one of innovation followed by scale up which is then broken by a model that “scales out”—when a bigger and faster approach is replaced by a smaller and more numerous approaches. Mainframe->Mini->Micro->Mobile, Big iron->Distributed computing->Internet, Cray->HPC->Intel/CISC->ARM/RISC, OS/360->VMS->Unix->Windows NT->Linux, and on and on. You can see this at these macro levels, or you can see it at the micro level when it comes to subsystems from networking to storage to memory. The past 5 years of AI have been bigger models, more data, more compute, and so on. Why? Because I would argue the innovation was driven by the cloud hyperscale companies and they were destined to take the approach of doing more of what they already did. They viewed data for training and huge models as their way of winning and their unique architectural approach. The fact that other startups took a similar approach is just Silicon Valley at work—the people move and optimize for different things at a micro scale without considering the larger picture. See the sociological and epidemiological term small area variation. They look to do what they couldn’t do at their previous efforts or what the previous efforts might have been overlooking.

- DeepSeek Has Been Inevitable and Here's Why (History Tells Us) by Steven Sinofsky

45 notes

·

View notes

Text

Intel Introduces New AI Solutions with Xeon 6 and Gaudi 3

Intel has launched its latest AI solutions featuring the Xeon 6 processors and Gaudi 3 AI accelerators. These advancements promise improved performance and efficiency for AI tasks. With the new Xeon 6, you get better AI and HPC workloads, while Gaudi 3 offers enhanced throughput and cost-effectiveness. Perfect for powering the next generation of AI applications! 🚀

#IntelAI #Innovation #TechNews

Read More Here

2 notes

·

View notes

Text

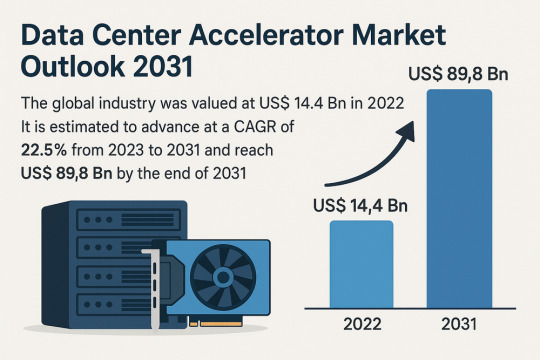

Data Center Accelerator Market Set to Transform AI Infrastructure Landscape by 2031

The global data center accelerator market is poised for exponential growth, projected to rise from USD 14.4 Bn in 2022 to a staggering USD 89.8 Bn by 2031, advancing at a CAGR of 22.5% during the forecast period from 2023 to 2031. Rapid adoption of Artificial Intelligence (AI), Machine Learning (ML), and High-Performance Computing (HPC) is the primary catalyst driving this expansion.

Market Overview: Data center accelerators are specialized hardware components that improve computing performance by efficiently handling intensive workloads. These include Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), Field Programmable Gate Arrays (FPGAs), and Application-Specific Integrated Circuits (ASICs), which complement CPUs by expediting data processing.

Accelerators enable data centers to process massive datasets more efficiently, reduce reliance on servers, and optimize costs a significant advantage in a data-driven world.

Market Drivers & Trends

Rising Demand for High-performance Computing (HPC): The proliferation of data-intensive applications across industries such as healthcare, autonomous driving, financial modeling, and weather forecasting is fueling demand for robust computing resources.

Boom in AI and ML Technologies: The computational requirements of AI and ML are driving the need for accelerators that can handle parallel operations and manage extensive datasets efficiently.

Cloud Computing Expansion: Major players like AWS, Azure, and Google Cloud are investing in infrastructure that leverages accelerators to deliver faster AI-as-a-service platforms.

Latest Market Trends

GPU Dominance: GPUs continue to dominate the market, especially in AI training and inference workloads, due to their capability to handle parallel computations.

Custom Chip Development: Tech giants are increasingly developing custom chips (e.g., Meta’s MTIA and Google's TPUs) tailored to their specific AI processing needs.

Energy Efficiency Focus: Companies are prioritizing the design of accelerators that deliver high computational power with reduced energy consumption, aligning with green data center initiatives.

Key Players and Industry Leaders

Prominent companies shaping the data center accelerator landscape include:

NVIDIA Corporation – A global leader in GPUs powering AI, gaming, and cloud computing.

Intel Corporation – Investing heavily in FPGA and ASIC-based accelerators.

Advanced Micro Devices (AMD) – Recently expanded its EPYC CPU lineup for data centers.

Meta Inc. – Introduced Meta Training and Inference Accelerator (MTIA) chips for internal AI applications.

Google (Alphabet Inc.) – Continues deploying TPUs across its cloud platforms.

Other notable players include Huawei Technologies, Cisco Systems, Dell Inc., Fujitsu, Enflame Technology, Graphcore, and SambaNova Systems.

Recent Developments

March 2023 – NVIDIA introduced a comprehensive Data Center Platform strategy at GTC 2023 to address diverse computational requirements.

June 2023 – AMD launched new EPYC CPUs designed to complement GPU-powered accelerator frameworks.

2023 – Meta Inc. revealed the MTIA chip to improve performance for internal AI workloads.

2023 – Intel announced a four-year roadmap for data center innovation focused on Infrastructure Processing Units (IPUs).

Gain an understanding of key findings from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=82760

Market Opportunities

Edge Data Center Integration: As computing shifts closer to the edge, opportunities arise for compact and energy-efficient accelerators in edge data centers for real-time analytics and decision-making.

AI in Healthcare and Automotive: As AI adoption grows in precision medicine and autonomous vehicles, demand for accelerators tuned for domain-specific processing will soar.

Emerging Markets: Rising digitization in emerging economies presents substantial opportunities for data center expansion and accelerator deployment.

Future Outlook

With AI, ML, and analytics forming the foundation of next-generation applications, the demand for enhanced computational capabilities will continue to climb. By 2031, the data center accelerator market will likely transform into a foundational element of global IT infrastructure.

Analysts anticipate increasing collaboration between hardware manufacturers and AI software developers to optimize performance across the board. As digital transformation accelerates, companies investing in custom accelerator architectures will gain significant competitive advantages.

Market Segmentation

By Type:

Central Processing Unit (CPU)

Graphics Processing Unit (GPU)

Application-Specific Integrated Circuit (ASIC)

Field-Programmable Gate Array (FPGA)

Others

By Application:

Advanced Data Analytics

AI/ML Training and Inference

Computing

Security and Encryption

Network Functions

Others

Regional Insights

Asia Pacific dominates the global market due to explosive digital content consumption and rapid infrastructure development in countries such as China, India, Japan, and South Korea.

North America holds a significant share due to the presence of major cloud providers, AI startups, and heavy investment in advanced infrastructure. The U.S. remains a critical hub for data center deployment and innovation.

Europe is steadily adopting AI and cloud computing technologies, contributing to increased demand for accelerators in enterprise data centers.

Why Buy This Report?

Comprehensive insights into market drivers, restraints, trends, and opportunities

In-depth analysis of the competitive landscape

Region-wise segmentation with revenue forecasts

Includes strategic developments and key product innovations

Covers historical data from 2017 and forecast till 2031

Delivered in convenient PDF and Excel formats

Frequently Asked Questions (FAQs)

1. What was the size of the global data center accelerator market in 2022? The market was valued at US$ 14.4 Bn in 2022.

2. What is the projected market value by 2031? It is projected to reach US$ 89.8 Bn by the end of 2031.

3. What is the key factor driving market growth? The surge in demand for AI/ML processing and high-performance computing is the major driver.

4. Which region holds the largest market share? Asia Pacific is expected to dominate the global data center accelerator market from 2023 to 2031.

5. Who are the leading companies in the market? Top players include NVIDIA, Intel, AMD, Meta, Google, Huawei, Dell, and Cisco.

6. What type of accelerator dominates the market? GPUs currently dominate the market due to their parallel processing efficiency and widespread adoption in AI/ML applications.

7. What applications are fueling growth? Applications like AI/ML training, advanced analytics, and network security are major contributors to the market's growth.

Explore Latest Research Reports by Transparency Market Research: Tactile Switches Market: https://www.transparencymarketresearch.com/tactile-switches-market.html

GaN Epitaxial Wafers Market: https://www.transparencymarketresearch.com/gan-epitaxial-wafers-market.html

Silicon Carbide MOSFETs Market: https://www.transparencymarketresearch.com/silicon-carbide-mosfets-market.html

Chip Metal Oxide Varistor (MOV) Market: https://www.transparencymarketresearch.com/chip-metal-oxide-varistor-mov-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected] of Form

Bottom of Form

0 notes

Text

ABF Substrate (FC-BGA) Market Growth Analysis 2025

The global market for ABF (FCBGA) Substrate was valued at US$ 5.16 billion in the year 2023, is projected to reach a revised size of US$ 10.2 billion by 2030, growing at a CAGR of 9.86% during the forecast period 2024-2030.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/318/abf-substrate-fc-bga

PCBs are key component of various electronic products. They are used in computers, communications, and various consumer electronic products and equipment. In recent years, they have been widely used in the automotive, industrial, medical, military and aerospace industries. Therefore, the development of this industry is driven by the advancement of modern science and technology, and is closely related to the demand of various end products.

Currently the ABF (FCBGA) Substrates are mainly produced in Japan, China Taiwan, South Korea, Southeast Asia and China Mainland, etc.

The Japan market for ABF (FCBGA) substrates was valued at US$ 1,684 million in 2023 and will reach US$ 2,746 million by 2030, at a CAGR of 7.21% during the forecast period of 2024 through 2030.

The China Taiwan market for ABF (FCBGA) substrates was valued at US$ 2,011 million in 2023 and will reach US$ 3,079 million by 2030, at a CAGR of 6.03% during the forecast period of 2024 through 2030.

The South Korea market for ABF (FCBGA) substrates was valued at US$ 614 million in 2023 and will reach US$ 1,677 million by 2030, at a CAGR of 12.97% during the forecast period of 2024 through 2030.

The China Mainland market for ABF (FCBGA) substrates was valued at US$ 654 million in 2023 and will reach US$ 2,284 million by 2030, at a CAGR of 18.92% during the forecast period of 2024 through 2030.

The global key manufacturers of ABF (FCBGA) substrates include Unimicron, Ibiden, Nan Ya PCB, Shinko Electric Industries, Kinsus Interconnect, AT&S, Semco, Kyocera, and TOPPAN, etc. In 2023, the global top five players had a share approximately 73% in terms of revenue.

Asia Pacific is the largest market, holds a share about 78%, key consumers��in Asia are Chinese Taiwan, South Korea, Japan, China mainland, and Southeast Asia.

In terms of products, 4-8 Layers ABF substrates are the most common used products, due to the strong demand from PC. In next few years, the segment over 10 layers ABF substrate will be widely used, driven by the demand of AI, HPC chips, high end servers and 5G.

Key end users are Intel, AMD, Nvidia, Apple, and Samsung, etc. In 2023, the key end users are heating up competition to win more capacity support from suppliers of ABF substrates needed to process their HPC chips through at least 2025. Almost all of ABF substrates manufacturers have plans to expand production capacity in next few years, and there also several companies have planned to enter to produce ABF substrates, such as Anhui Splendid Technology, Aoxin Semiconductor Technology (Taicang), and Keruisi Semiconductor Technology (Dongyang) etc. The global competitive situation will be totally different after two or five years, filled with uncertainty.

Report Scope

This report aims to provide a comprehensive presentation of the global market for FC-BGA, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding FC-BGA.

The FC-BGA market size, estimations, and forecasts are provided in terms of output/shipments (K Square Meters) and revenue ($ millions), considering 2023 as the base year, with history and forecast data for the period from 2019 to 2030. This report segments the global FC-BGA market comprehensively. Regional market sizes, concerning products by Type, by Application, and by players, are also provided.

For a more in-depth understanding of the market, the report provides profiles of the competitive landscape, key competitors, and their respective market ranks. The report also discusses technological trends and new product developments.

The report will help the FC-BGA manufacturers, new entrants, and industry chain related companies in this market with information on the revenues, production, and average price for the overall market and the sub-segments across the different segments, by company, by Type, by Application, and by regions.

Market Segmentation

By Company

Unimicron

Ibiden

Nan Ya PCB

Shinko Electric Industries

Kinsus Interconnect

AT&S

Semco

Kyocera

Toppan

Zhen Ding Technology

Daeduck Electronics

Shenzhen Fastprint Circuit Tech

Zhuhai Access Semiconductor

LG InnoTek

Shennan Circuit

by Type

4-8 Layers ABF Substrate

8-16 Layers ABF Substrate

Others

by Application

PCs

Server & Data Center

HPC/AI Chips

Communication

Others

Production by Region

China Mainland

Japan

South Korea

China Taiwan

Southeast Asia

Consumption by Region

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe)

Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of APAC)

The Middle East and Africa (Middle East, Africa)

South and Central America (Brazil, Argentina, Rest of SCA)

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/318/abf-substrate-fc-bga

0 notes

Text

HPE Servers' Performance in Data Centers

HPE servers are widely regarded as high-performing, reliable, and well-suited for enterprise data center environments, consistently ranking among the top vendors globally. Here’s a breakdown of their performance across key dimensions:

1. Reliability & Stability (RAS Features)

Mission-Critical Uptime: HPE ProLiant (Gen10/Gen11), Synergy, and Integrity servers incorporate robust RAS (Reliability, Availability, Serviceability) features:

iLO (Integrated Lights-Out): Advanced remote management for monitoring, diagnostics, and repairs.

Smart Array Controllers: Hardware RAID with cache protection against power loss.

Silicon Root of Trust: Hardware-enforced security against firmware tampering.

Predictive analytics via HPE InfoSight for preemptive failure detection.

Result: High MTBF (Mean Time Between Failures) and minimal unplanned downtime.

2. Performance & Scalability

Latest Hardware: Support for newest Intel Xeon Scalable & AMD EPYC CPUs, DDR5 memory, PCIe 5.0, and high-speed NVMe storage.

Workload-Optimized:

ProLiant DL/ML: Versatile for virtualization, databases, and HCI.

Synergy: Composable infrastructure for dynamic resource pooling.

Apollo: High-density compute for HPC/AI.

Scalability: Modular designs (e.g., Synergy frames) allow scaling compute/storage independently.

3. Management & Automation

HPE OneView: Unified infrastructure management for servers, storage, and networking (automates provisioning, updates, and compliance).

Cloud Integration: Native tools for hybrid cloud (e.g., HPE GreenLake) and APIs for Terraform/Ansible.

HPE InfoSight: AI-driven analytics for optimizing performance and predicting issues.

4. Energy Efficiency & Cooling

Silent Smart Cooling: Dynamic fan control tuned for variable workloads.

Thermal Design: Optimized airflow (e.g., HPE Apollo 4000 supports direct liquid cooling).

Energy Star Certifications: ProLiant servers often exceed efficiency standards, reducing power/cooling costs.

5. Security

Firmware Integrity: Silicon Root of Trust ensures secure boot.

Cyber Resilience: Runtime intrusion detection, encrypted memory (AMD SEV-SNP, Intel SGX), and secure erase.

Zero Trust Architecture: Integrated with HPE Aruba networking for end-to-end security.

6. Hybrid Cloud & Edge Integration

HPE GreenLake: Consumption-based "as-a-service" model for on-premises data centers.

Edge Solutions: Compact servers (e.g., Edgeline EL8000) for rugged/remote deployments.

7. Support & Services

HPE Pointnext: Proactive 24/7 support, certified spare parts, and global service coverage.

Firmware/Driver Ecosystem: Regular updates with long-term lifecycle support.

Ideal Use Cases

Enterprise Virtualization: VMware/Hyper-V clusters on ProLiant.

Hybrid Cloud: GreenLake-managed private/hybrid environments.

AI/HPC: Apollo systems for GPU-heavy workloads.

SAP/Oracle: Mission-critical applications on Superdome Flex.

Considerations & Challenges

Cost: Premium pricing vs. white-box/OEM alternatives.

Complexity: Advanced features (e.g., Synergy/OneView) require training.

Ecosystem Lock-in: Best with HPE storage/networking for full integration.

Competitive Positioning

vs Dell PowerEdge: Comparable performance; HPE leads in composable infrastructure (Synergy) and AI-driven ops (InfoSight).

vs Cisco UCS: UCS excels in unified networking; HPE offers broader edge-to-cloud portfolio.

vs Lenovo ThinkSystem: Similar RAS; HPE has stronger hybrid cloud services (GreenLake).

Summary: HPE Server Strengths in Data Centers

Reliability: Industry-leading RAS + iLO management. Automation: AI-driven ops (InfoSight) + composability (Synergy). Efficiency: Energy-optimized designs + liquid cooling support. Security: End-to-end Zero Trust + firmware hardening. Hybrid Cloud: GreenLake consumption model + consistent API-driven management.

Bottom Line: HPE servers excel in demanding, large-scale data centers prioritizing stability, automation, and hybrid cloud flexibility. While priced at a premium, their RAS capabilities, management ecosystem, and global support justify the investment for enterprises with critical workloads. For SMBs or hyperscale web-tier deployments, cost may drive consideration of alternatives.

0 notes

Text

Top Companies Leading the Liquid Cooling Revolution

The exponential growth of power-hungry applications—including AI, high-performance computing (HPC), and 5G—has made liquid cooling a necessity rather than a niche solution. Traditional air-cooling systems simply cannot dissipate heat fast enough to support modern server densities. Liquid cooling dramatically lowers data center cooling energy from around 40% to less than 10%, offering ultra-compact, whisper-quiet operations that meet performance demands and sustainability goals

Data center liquid cooling companies are ranked based on revenue, production capacity, technological innovation, and market presence.The data center liquid cooling market is projected to grow from USD 2.84 billion in 2025 to USD 21.14 billion by 2032, at a CAGR of 33.2% during the forecast period.

Industry Leaders Driving Innovation

Nvidia, in collaboration with hardware partners like Supermicro and Foxconn, is spearheading the liquid cooling revolution. Their new GB200 AI racks, cooled via tubing or immersion, demonstrate that cutting-edge chips require liquid solutions — reducing overhead cooling and doubling compute density . Supermicro, shipping over 100,000 GPUs in liquid-cooled racks, has become a dominant force in AI server deployments HPE and Dell EMC also lead with hybrid and direct-to-chip models, gaining momentum with investor confidence and production scale

Specialized Cooling Specialists

Beyond hyperscalers, several specialized firms are redefining thermal efficiency at scale. Vertiv, with $352 million in R&D investment and a record of collaboration with Nvidia and Intel, offers chassis-to-data-center solutions—including immersion and direct-chip systems—that reduce carbon emissions and enhance density Schneider Electric, through its EcoStruxure platform, continues to lead in sustainable liquid rack modules and modular data centers, merging energy management with cutting-edge cooling in hyperscale environments

Pioneers in Immersion and Two‑Phase Cooling

Companies like LiquidStack, Green Revolution Cooling (GRC), and Iceotope are pushing the envelope on immersion cooling. LiquidStack’s award-winning two-phase systems and GRC's CarnotJet single-phase racks offer up to 90% energy savings and water reductions, with Cortex-level PUEs under 1.03 Iceotope’s chassis-scale immersion devices reduce cooling power by 40% while cutting water use by up to 96%—ideal for edge-to-hyperscale deployments Asperitas and Submer focus on modular immersion pods, scaling efficiently in dense compute settings

Toward a Cooler, Greener Future

With the liquid cooling market expected to exceed USD 4.8 billion by 2027, and power-dense servers now demanding more efficient thermal solutions, liquid cooling is fast becoming the industry standard Companies from Nvidia to Iceotope are reshaping how we approach thermal design—prioritizing integration, scalability, sustainability, and smart control. As computing power and environmental expectations rise, partnering with these liquid-cooling leaders is essential for organizations aiming to stay ahead.

Download PDF Brochure :

Data Center Liquid Cooling Companies

Vertiv Group Corp. (US), Green Revolution Cooling Inc. (US), COOLIT SYSTEMS (Canada), Schneider Electric (France), and DCX Liquid Cooling Systems (Poland) fall under the winners’ category. These are leading players globally in the data center liquid cooling market. These players have adopted the strategies of acquisitions, expansions, agreements, and product launches to increase their market shares.

As the demand for faster, denser, and more energy-efficient computing infrastructure accelerates, liquid cooling is no longer a futuristic option—it’s a critical necessity. The companies leading this revolution, from global tech giants like Nvidia and HPE to specialized innovators like LiquidStack and Iceotope, are setting new benchmarks in thermal efficiency, sustainability, and system design. Their technologies not only enhance performance but also significantly reduce environmental impact, positioning them as key enablers of the digital and green transformation. For data center operators, IT strategists, and industry experts, aligning with these pioneers offers a competitive edge in a world where every degree and every watt counts.

#liquid cooling#data center cooling#immersion cooling#direct liquid cooling#Nvidia#Supermicro#Vertiv#LiquidStack#Schneider Electric#Iceotope

0 notes

Text

Ultra Ethernet Consortium publishes 1.0 specification, readies Ethernet for HPC, AI

In mid-2023, a host of big name networking vendors including Cisco, Arista, HPE and Intel got together to form the Ultra Ethernet Consortium (UEC). The goal is to make Ethernet better for the needs of AI and high-performance computing (HPC). Now, nearly two years later, the UEC is delivering on its initial promise with the release of the first UEC 1.0 specification. The specification details…

0 notes

Text

Next-Gen 2U Server from HexaData – High Performance for Cloud & HPC

The HexaData HD-H261-N80 Ver: Gen001 is a powerful 2U quad-node server designed to meet the demands of modern data centers, AI workloads, and virtualization environments. Powered by up to 8 x Intel® Xeon® Scalable processors, it delivers unmatched density, performance, and flexibility.

This high-efficiency server supports Intel® Optane™ memory, VROC RAID, 10GbE networking, and 100G Infiniband, making it ideal for HPC, cloud computing, and enterprise-grade applications.

With robust remote management via Aspeed® AST2500 BMC and redundant 2200W Platinum PSUs, the HD-H261-N80 ensures reliability and uptime for mission-critical workloads.

Learn more and explore configurations: Hexadata HD-H261-N80-Ver: Gen001|2U High Density Server Page

#2u high-density server#DataCenters#HexaData Server Solutions#2U High Density Server India#Intel Xeon Scalable Server#Enterprise Server for Virtualization#HPC & Cloud Server#Optane Memory Server#Data Center Infrastructure#Rack Servers India

0 notes

Text

kAI: A Mexican AI Startup, Improves The Everyday Activities

Mexican AI

kAI, a Mexican AI startup, simplifies and improves the convenience of managing daily tasks.

kAI Meaning

“Künstliche Intelligenz” (German for “Artificial Intelligence”) refers to AI technology, techniques, and systems. The word “kAI” may refer to AI-based solutions that use machine learning, data analysis, and other AI methods to improve or automate activities.

AI startup business kAI is based in the technological center of Mexico and is creating an AI-powered organizing software called kAI Tasks. With the help of this software, users can easily arrange their personal days and focus their efforts on the things that really important. With kAI, creating an agenda takes less than a minute because of artificial intelligence’s intuitive capabilities. WatchOS-based smartwatches, tablets, and smartphones running Android and Apple can all use kAI Tasks.

The Problem

In an environment where there are always fresh assignments and meetings, being productive is crucial. Regrettably, rather of increasing user productivity, existing to-do apps actually decrease it. Either important functionality is missing, the user experience is not straightforward enough, or the system does not support the users’ regular daily chores.

The Resolution

The mobile task management software from kAI makes it simple for end users to plan, schedule, and arrange their workdays. Compared to conventional to-do management apps and tools, this can be completed in a fraction of the time because of artificial intelligence.

Block planning appears on one screen daily when using kAI Tasks.Image Credit To Intel

The following are a few of the benefits and features that make the tool so alluring:

Intelligent task management: kAI provides tailored recommendations and reminders to help you stay on track by learning from end users’ behaviors and preferences.

Easy event planning: Arrange agendas and schedules with ease, freeing you time to concentrate on the important things.

Constant adaptation: The more you use the tool, the more it learns about your requirements and adjusts accordingly, personalizing your everyday experience.

AI Tasks may be tailored to the requirements of the final user

To optimize everyday objectives, kAI Tasks may be used in conjunction with a smartphone or wristwatch. The end user may easily control his or her productivity and maintain organization with this configuration.

By the end of September 2024, kAI hopes to provide additional features including wearables and the creation of a bot for Telegram and WhatsApp, among other things. With the aid of these connections, the business will be able to expand its user base and make everyday job organization easier without requiring the usage of another software.

“The foundation of an excellent lifestyle is personal organization. They are redefining time and task management at kAI. Its modern equipment boosts productivity, well-being, and stress reduction. You may easily accomplish your business and personal objectives with kAI while maintaining the ideal balance in your life. According to Kelvin Perea, CEO of kAI, “All of us can even do more in less time because their company is a part of the Intel Liftoff Program.”

kAI chores, which is compatible with almost all smart devices, makes it simple to arrange daily chores. Task management is made more simpler and more straightforward with the aid and assistance of AI, as the software gradually learns the end user’s behavior.

Are you prepared to further innovate and grow your startup? Enroll in the Intel Liftoff program right now to become a part of a community that is committed to fostering your ideas and promoting your development.

Intel Liftoff

Liftoff for Startups using Intel

Take Down Code Barriers, Release Performance, and Turn Your Startup Into a Scalable, AI Company that Defines the Industry.

Early-stage AI and machine learning businesses are eligible to apply for Intel Liftoff for startups. No matter where you are in your entrepreneurial career, this free virtual curriculum supports you in innovating and scaling.

Benefits of the Program for AI Startups

Startups may get the processing power they need to address their most pressing technological problems with Intel Liftoff. The initiative also acts as a launchpad for collaborations, allowing entrepreneurs to improve customer service and strengthen one other’s offers.

Superior Technical Knowledge and Instruction

Availability of the program’s Slack channel

Free online seminars and courses

Engineering advice and assistance

Reduced prices for certification and training

Invitations to forums and activities with experts

Advanced Technology and Research Resources

Offers for Intel Developer Cloud free cloud credits

Cloud service provider credits

Availability of Intel developer tools, which provide several technological advantages

Use the Intel software library to access devices with next-generation artificial intelligence

Opportunities for Networking and Comarketing

Boost consumer awareness using Intel’s marketing channels.

Venture exhibitions at trade shows

Introductions at Intel around the ecosystem

Establish a connection with Intel Capital and the worldwide venture capital (VC) network

Developer Cloud Intel Tiber

Take down the obstacles to hardware access, quicken development times, and increase your AI and HPC processes’ return on investment (ROI).

Register to get instant access to the newest Intel software and hardware innovations, enabling you to write, test, and optimize code more quickly, cheaply, and effectively.

AI Pioneers Who Discovered Intel Liftoff for Startups as Their Launchpad

Their companies are breaking new ground in a variety of AI-related fields. Here’s how they sum up their time in the program and the benefits they’ve received in terms of improved performance.

Enabling businesses to develop and implement vision AI solutions more quickly and consistently

By processing crucial machine learning tasks with AI Tools, the Hasty end-to-end vision AI platform opens up new AI use cases and makes application development more approachable.

“Using Intel OneAPI to unlock computationally demanding vision AI tasks will be a stepwise shift for critical industries like disaster recovery, logistics, agriculture, and medical.”

Use particle-based simulation tools to assist engineers in creating amazing things

Using the Intel HPC Toolkit and the Intel Developer Cloud, Dive Solutions improves their cloud-native computational fluid dynamics simulation software for state-of-the-art hardware.

“It’s used parts from the Intel HPC Toolkit to optimize their solver performance on Intel Xeon processors in an economical manner. The workloads are currently being prepared to execute on both CPU and GPU architectures.

Using a hyperconverged, real-time analytics platform to address the difficulties posed by big data

Using oneAPI, the Isima low-code framework optimizes for cost and performance in the cloud while enabling real-time use cases that drastically shorten time-to-value.

Read more on govindhtech.com

#MexicanAIStartup#EverydayActivities#MexicanAI#machinelearning#smartwatches#artificialintelligence#WhatsApp#smartdevices#IntelLiftoff#IntelOneAPI#IntelDeveloperCloud#IntelHPC#IntelXeonprocessors#hpc#intel#DeveloperCloud#AdvancedTechnology#technology#technews#news#govindhtech

0 notes

Text

Liquid Cooling for Data Center Market Growth Analysis, Market 2025

The global Liquid Cooling for Data Center market was valued at approximately USD 1,982 million in 2023, and it is projected to reach USD 11,101.99 million by 2032, reflecting a robust CAGR of 21.10% during the forecast period. This rapid growth trajectory is attributed to the increasing need for efficient thermal management in data centers, especially as organizations adopt AI, IoT, and other data-intensive technologies.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/913/Liquid-Cooling-for-Data-Center-Market+

Liquid cooling for data centers refers to the use of liquid-based technologies typically water or specialized coolants to absorb and dissipate heat generated by high-performance computing (HPC) systems, servers, storage devices, and networking hardware. The global liquid cooling for data centre market is experiencing rapid growth as hyperscale and enterprise data centres face increasing demands for high performance and energy efficiency. Traditional air cooling methods are struggling to manage the heat generated by high-density computing workloads, especially with the rise of AI, machine learning, and high-performance computing (HPC). As a result, liquid cooling technologies such as direct-to-chip and immersion cooling are gaining traction due to their ability to reduce power usage effectiveness (PUE) and support sustainable operations.

For instance, Meta announced plans to deploy immersion cooling technologies across select data centres to reduce energy consumption and carbon footprint highlighting a shift toward environmentally conscious infrastructure.

Market Size

Global Liquid Cooling for Data Center Market Size and Forecast

In North America, the market was estimated at USD 720.15 million in 2023 and is anticipated to expand at a CAGR of 18.09% from 2025 through 2032. The United States leads the regional market due to the presence of numerous hyperscale data centers and cloud service providers.

The market expansion is also supported by growing investments in green data center infrastructure, along with regulatory mandates aimed at improving energy efficiency and reducing greenhouse gas emissions. The long-term outlook for the liquid cooling market is promising, with continued innovation and adoption of advanced technologies across the globe.

Market Dynamics (Drivers, Restraints, Opportunities, and Challenges)

Drivers

Rising Data Processing Demands Are Driving the Shift to Liquid Cooling

The rise in data processing demands, especially from AI, big data analytics, and high-performance computing (HPC), is one of the main factors propelling the expansion of liquid cooling in data centers. Compared to conventional applications, these workloads produce a lot more heat, which makes air cooling ineffective and expensive. Liquid cooling technologies such as direct-to-chip and immersion cooling offer up to 1,000 times greater heat dissipation efficiency than air-based systems.

For instance, Intel and Submer collaborated to implement next-generation immersion cooling in Intel's data centers, claiming better thermal performance for AI workloads and lower energy consumption. This is in line with a larger trend in the industry, where liquid cooling is being used more and more by hyperscale data centers to preserve operational stability and satisfy ESG objectives.

Restraints

High Initial Investment and Infrastructure Complexity Limit Adoption

Despite its benefits, the high initial cost and difficulty of integrating these systems into the current data center infrastructure pose serious barriers to the widespread use of liquid cooling technologies. Large-scale server rack, plumbing, and safety system redesigns are frequently necessary when retrofitting legacy buildings with liquid cooling, which can interfere with ongoing operations and raise the risk of downtime.For instance, many small to medium-sized data centre operators hesitate to adopt liquid cooling because the costs and operational challenges outweigh the immediate benefits, slowing widespread market penetration.

Opportunities

Growing Demand from Hyperscale Data Centres

A major growth opportunity for the liquid cooling market is the quick development of hyperscale data centers, which are being fueled by cloud computing giants like Microsoft Azure, Google Cloud, and Amazon Web Services. To handle the excessive heat loads produced by dense server configurations, these facilities need cooling solutions that are both scalable and extremely efficient.One efficient method for raising energy efficiency and lowering operating expenses on a large scale is liquid cooling.Moreover the growing demand for high-performance computing and AI workloads has led to significant investments in liquid cooling technologies. Companies are forming strategic partnerships to enhance cooling efficiency and reduce environmental impact.

For instance, in May 2025, Microsoft and NVIDIA announced a collaboration to integrate NVIDIA's next-generation GPUs with Microsoft's liquid cooling systems. This partnership aims to optimize AI workloads by providing efficient thermal management solutions. The integration is expected to enhance computational performance while maintaining energy efficiency.

Challenges

Lack of Industry Standards and Interoperability Slows Adoption

The absence of unified industry standards and interoperability frameworks for liquid cooling systems presents a significant challenge. Data centre operators often deal with proprietary solutions that lack compatibility with diverse server hardware, which complicates integration and raises vendor lock-in concerns.For example, while companies like Submer, LiquidStack, and Vertiv offer cutting-edge immersion and direct-to-chip solutions, their systems can differ widely in design, connector types, and thermal interface materials. This fragmentation makes it difficult for operators to scale or transition between providers without major redesigns.

According to a survey by Castrol, For the industry to continue seeing performance gains, experts predict that immersion cooling must be implemented within the next three years. Those who don't do this run the risk of lagging behind competitors at a time when data centers are under a lot of strain due to AI surges.

Regional Analysis

Market Trends by Region

North America remains at the forefront of adopting liquid cooling technologies, primarily driven by the escalating demands of AI and high-performance computing workloads. Meta has initiated a transition to direct-to-chip liquid cooling for its AI infrastructure, aiming to enhance energy efficiency and support higher-density computing. Europe is witnessing significant advancements, propelled by stringent sustainability goals and innovative collaborations. In Germany, Equinix has partnered with local entities to channel excess heat from its Frankfurt data centres into a district heating system, set to supply approximately 1,000 households starting in 2025. Similarly, in the Netherlands, Equinix signed a letter of intent with the Municipality of Diemen to explore utilizing residual heat from its AM4 data centre to support local heating needs.Asia-Pacific is emerging as a dynamic market for liquid cooling solutions. In Japan, NTT Communications, in collaboration with Mitsubishi Heavy Industries and NEC, commenced a demonstration of two-phase direct-to-chip cooling in an operational Tokyo data centre. This initiative aims to enhance cooling capacity without significant modifications to existing facilities, aligning with energy-saving and CO₂ reduction goals.South America's data centre market is experiencing significant growth, driven by the increasing adoption of cloud services, digital transformation initiatives, and a focus on sustainable infrastructure.Amazon Web Services (AWS) announced a $4 billion investment to establish its first data centres in Chile, marking its third cloud region in Latin America after Brazil and Mexico.The MEA region is witnessing a surge in data centre developments, fueled by digital transformation, increased internet penetration, and government initiatives promoting technological advancement

Competitor Analysis

Major Players and Market Landscape

The Liquid Cooling for Data Center market is moderately consolidated with several global and regional players competing based on product innovation, energy efficiency, scalability, and reliability.

Key players include:

Vertiv: Offers integrated liquid cooling systems with scalable modularity.

Stulz: Specializes in precision cooling and modular cooling technologies.

CoolIT Systems: Known for direct-to-chip liquid cooling.

Schneider Electric: Provides EcoStruxure cooling systems for high-density environments.

Submer and Green Revolution Cooling: Leaders in immersion cooling solutions.

Most companies are focusing on partnerships, R&D investments, and strategic acquisitions to strengthen their market position and expand their product portfolios.

2025, Intel advanced its Superfluid cooling technology, utilizing microbubble injection and dielectric fluids to improve heat transfer. This innovation supports Nvidia's megawatt-class rack servers, addressing the thermal demands of high-performance AI infrastructures.

October 2024,Schneider Electric agreed to buy a majority share in Motivair Corp.for about USD 850 million, a leader in liquid cooling for high-performance computing. By taking this action, Schneider Electric hopes to improve its standing in the data center cooling industry.

December 2024, Vertiv acquired BiXin Energy (China), specializing in centrifugal chiller technology, enhancing Vertiv's capabilities in high-performance computing and AI cooling solutions.

December 2023,Equinix, Inc.a global digital infrastructure company, announced plans to extend support for cutting-edge liquid cooling technologies, such as direct-to-chip, to over 100 of its International Business Exchange® (IBX®) data centers located in over 45 metropolitan areas worldwide.

December 2023, Vertiv expanded its portfolio of cutting-edge cooling technologies with the acquisition of CoolTera Ltd (UK), a business specializing in liquid cooling infrastructure solutions.

Global Liquid Cooling for Data Center Market: Market Segmentation Analysis

This report provides a deep insight into the global Liquid Cooling for Data Center Market, covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and assessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Liquid Cooling for Data Center Market. This report introduces in detail the market share, market performance, product situation, operation situation, etc., of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Liquid Cooling for Data Center Market in any manner.

Market Segmentation (by Cooling Type)

Direct-to-Chip (Cold Plate) Cooling

Immersion Cooling

Other Liquid Cooling Solutions

Market Segmentation (by Data Center Type)

Hyperscale Data Centers

Enterprise Data Centers

Colocation Providers

Modular/Edge Data Centers

Cloud Providers

Market Segmentation (by End Use Industry)

IT & Telecom

BFSI (Banking, Financial Services, and Insurance)

Healthcare

Government & Defense

Energy & Utilities

Manufacturing

Cloud & Hyperscale Providers

Others

Key Company

Vertiv

Stulz

Midas Immersion Cooling

Rittal

Envicool

CoolIT

Schneider Electric

Sugon

Submer

Huawei

Green Revolution Cooling

Eco-atlas

Geographic Segmentation

North America (USA, Canada, Mexico)

Europe (Germany, UK, France, Russia, Italy, Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific)

South America (Brazil, Argentina, Columbia, Rest of South America)

The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Rest of MEA)

FAQs :

▶ What is the current market size of the Liquid Cooling for Data Center Market?

As of 2023, the global Liquid Cooling for Data Center market was valued at approximately USD 1,982 million.

▶ Which are the key companies operating in the Liquid Cooling for Data Center Market?

Major players include Vertiv, Stulz, CoolIT Systems, Schneider Electric, Submer, Huawei, and Green Revolution Cooling, among others.

▶ What are the key growth drivers in the Liquid Cooling for Data Center Market?

Key growth drivers include rising power densities in data centers, the demand for energy-efficient solutions, and the growing deployment of AI and HPC applications.

▶ Which regions dominate the Liquid Cooling for Data Center Market?

North America currently leads the market, followed by Europe and Asia-Pacific. Asia-Pacific is expected to witness the fastest growth in the forecast period.

▶ What are the emerging trends in the Liquid Cooling for Data Center Market?

Emerging trends include the growing adoption of immersion cooling, development of sustainable coolant technologies, and integration of AI-based monitoring systems for thermal management.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/913/Liquid-Cooling-for-Data-Center-Market+

0 notes

Text

Arquitetura Espectral Optoeletrônica: Um Paradigma Contínuo e Sustentável para Computação de Alta Performance e Inteligência Artificial Física

Autor: Renato Ferreira da Silva Email: [email protected] ORCID: 0009-0003-8908-481X

Resumo

Este artigo propõe uma nova arquitetura computacional baseada em operadores espectrais de Schrödinger acoplados a uma malha fotônica reconfigurável tridimensional. Denominada "Arquitetura Espectral Optoeletrônica", a proposta substitui interconexões elétricas convencionais por filetes ópticos com multiplexação por comprimento de onda (WDM), reduzindo drasticamente latência, consumo energético e dissipação térmica. O sistema permite inferência contínua, criptografia nativa e simulação de sistemas físicos em tempo real. Comparações com GPUs (NVIDIA H100) e chips neuromórficos (Intel Loihi) evidenciam uma ordem de magnitude superior em eficiência energética (5 fJ/op), latência (< 21 ps) e escalabilidade funcional. São apresentados os fundamentos teóricos, o projeto de hardware, casos de uso e um roadmap para implementação nacional e soberana.

1. Introdução

O colapso energético de arquiteturas baseadas em CMOS e a crescente demanda de IA e HPC tornam insustentável a continuidade de sistemas como GPUs convencionais. O presente trabalho propõe uma alternativa: uma arquitetura baseada na evolução espectral de operadores físicos, com comunicação óptica em alta densidade e integração vertical CMOS-fotônica. Este paradigma contínuo supera barreiras de latência, energia e reconfiguração encontradas em Loihi, TrueNorth e GPUs NVIDIA.

2. Fundamentos Teóricos

Modela-se a computação como a evolução de autovalores de um operador de Schrödinger, o que permite representar estados computacionais em um domínio contínuo e físico, evitando a discretização lógica convencional. Essa abordagem elimina a necessidade de clock global, buffers e instruções booleanas, reduzindo significativamente overheads energéticos e temporais típicos de arquiteturas digitais tradicionais: Lψ(x)=−d2dx2ψ(x)+V(x)ψ(x)=λψ(x) O potencial V(x) é parametrizado dinamicamente via moduladores ópticos e sintetizado em base de Hermite. Os autovalores λ representam estados computacionais contínuos. Essa estrutura é suportada por guias de onda de SiN com espaçamento de 200 nm e canais WDM (C-band, 50 GHz).

3. Arquitetura Física

Unidades Computacionais (UCs): Núcleos CMOS 5nm com front-end óptico (moduladores, detetores). A comunicação entre UCs ocorre por meio de filetes ópticos acoplados a divisores de potência (splitters), multiplexadores/demultiplexadores WDM e acopladores direcionais. Essa infraestrutura permite roteamento passivo ou programável de sinais ópticos entre camadas e regiões distintas do chip. (UCs)**: Núcleos CMOS 5nm com front-end óptico (moduladores, detetores).

Conectividade: Filetes ópticos paralelos com até 32 canais WDM por filete (1.28 Tbps).

Stack 3D: Camadas conectadas por TSVs ópticos verticais.

Controle espectral: Reconfiguração em tempo real via metassuperfícies ou phase-change materials (PCM).

4. Inovações Técnicas Integradas

Codificação espectral adaptativa com IA física (PINNs)

Feedback óptico analógico de baixa latência

Criptografia nativa via modulação de fase espectral

Integração com materiais 2D e detecção quântica

Compatibilidade com interface óptico-quântica (SFWM)

Segurança intrínseca e verificação espectral em tempo real

5. Comparação com Arquiteturas Atuais

MétricaEspectral OptoeletrônicoIntel LoihiNVIDIA H100Energia/operação5 fJ~10–20 pJ~500 pJLatência intra-chip21 ps~1 µs40–80 nsBanda por interconexão1.28 Tbps/filete<1 Gbps~900 GbpsSegurança embutidaSim (óptica)NãoNãoEscalabilidade 3DAlta (vias ópticas)MédiaBaixaCusto unitário em escalaUS$ 300–800~US$ 1500~US$ 3000

6. Aplicações Estratégicas

Inferência contínua em IA embarcada

Diagnóstico médico óptico em tempo real (Raman)

Simulação de materiais e química quântica

Sistemas defensivos autônomos com criptografia física

Modelagem climática de alta granularidade energética

7. Viabilidade Econ��mica e Soberania Tecnológica

Custo de implantação nacional: US$ 800 milhões – 1.3 bilhão (vs. US$ 10–15 bilhões/ano em infraestrutura NVIDIA).

Compatibilidade com foundries nacionais (GlobalFoundries, SkyWater).

Potencial para liderar uma nova era de computação verde e soberana.

8. Conclusão

A arquitetura espectral optoeletrônica redefine a computação física como um processo contínuo, sustentável e seguro. Com base em fundamentos matemáticos robustos e viabilidade tecnológica clara, representa uma resposta prática à crise energética computacional global. Propõe-se sua adoção estratégica em programas governamentais, defesa e medicina, com potencial de exportação soberana.

Referências

Odlyzko, A. M., The $10^{20}$-th Zero of the Riemann Zeta Function, 1992.

Berry, M. V., Keating, J. P., The Riemann Zeros and Eigenvalue Asymptotics, 1999.

Raissi, M. et al., Physics-Informed Neural Networks, J. Comput. Phys., 2019.

Connes, A., Noncommutative Geometry, Academic Press, 1994.

NVIDIA, H100 Tensor Core GPU Architecture, 2023.

0 notes

Text

High-Performance Computing Market Size, Share, Analysis, Forecast, and Growth Trends to 2032: Powering Advanced Scientific Research

High-Performance Computing Market was worth USD 47.07 billion in 2023 and is predicted to be worth USD 92.33 billion by 2032, growing at a CAGR of 7.80 % between 2024 and 2032.

High-Performance Computing Market is undergoing a dynamic transformation as industries across the globe embrace data-intensive workloads. From scientific research to financial modeling, the demand for faster computation, real-time analytics, and simulation is fueling the rapid adoption of high-performance computing (HPC) systems. Enterprises are increasingly leveraging HPC to gain a competitive edge, improve decision-making, and drive innovation.

High-Performance Computing Market is also seeing a notable rise in demand due to emerging technologies such as AI, machine learning, and big data. As these technologies become more integral to business operations, the infrastructure supporting them must evolve. HPC delivers the scalability and speed necessary to process large datasets and execute complex algorithms efficiently.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/2619

Market Keyplayers:

NEC Corporation

Hewlett Packard Enterprise

Sugon Information Industry Co. Ltd

Intel Corporation

International Business Machines Corporation

Market Analysis

The HPC market is characterized by strong investment from both government and private sectors aiming to enhance computational capabilities. Healthcare, defense, automotive, and academic research are key segments contributing to the rising adoption of HPC. The proliferation of cloud-based HPC and integration with AI are redefining how organizations manage and process data.

Market Trends

Increasing integration of AI and ML with HPC systems

Growing popularity of cloud-based HPC services

Shift towards energy-efficient supercomputing solutions

Rise in demand from genomics, climate modeling, and drug discovery

Accelerated development in quantum computing supporting HPC evolution

Market Scope

The potential for HPC market expansion is extensive and continues to broaden across industries:

Healthcare innovations powered by HPC-driven diagnostics and genomics

Smart manufacturing leveraging real-time data analysis and simulation

Financial analytics enhanced by rapid processing and modeling

Scientific research accelerated through advanced simulation tools

Government initiatives supporting HPC infrastructure development

These evolving sectors are not only demanding more robust computing power but also fostering an ecosystem that thrives on speed, accuracy, and performance, reinforcing HPC's pivotal role in digital transformation.

Market Forecast

The future of the HPC market holds promising advancements shaped by continuous innovation, strategic partnerships, and increased accessibility. As industries push for faster processing and deeper insights, HPC will be central in meeting these demands. The convergence of HPC with emerging technologies such as edge computing and 5G will unlock new possibilities, transforming how industries analyze data, forecast outcomes, and deploy intelligent systems. The market is poised for exponential growth, with cloud solutions, scalable architectures, and hybrid models becoming the norm.

Access Complete Report: https://www.snsinsider.com/reports/high-performance-computing-market-2619

Conclusion

The High-Performance Computing Market is more than a technological trend—it is the backbone of a data-driven future. As industries demand faster insights and smarter decisions, HPC stands as a transformative force bridging innovation with execution. Stakeholders ready to invest in HPC are not just adopting new tools; they are stepping into a future where speed, intelligence, and precision define success.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#High-Performance Computing Market#High-Performance Computing Market Scope#High-Performance Computing Market Trends

0 notes

Text

【COMPUTEX 2025】MiTAC 神雲科技端新品,首發支援 Xeon 6 的 AI 與雲端伺服器登場

神雲科技(MiTAC Computing Technology)宣布將在 COMPUTEX 2025 正式發表旗下最新一代伺服器平台,成為首批支援 Intel Xeon 6 處理器(P-core) 的系統供應商之一。本次展出將橫跨 AI 推論、高效能運算(HPC)、雲端架構到企業內部部署,瞄準 AI 與資料密集型應用日益普及的趨勢。 Continue reading 【COMPUTEX 2025】MiTAC 神雲科技端新品,首發支援 Xeon 6 的 AI 與雲端伺服器登場

0 notes