#Investment Opportunity in IPO

Text

Explore Top Investment Opportunities in the UK for 2024 | Wills & Trusts Wealth

Discover the best investment opportunities in the UK, including ISAs, Bonds, and IPOs. Learn about the benefits, risks, and expert guidance needed for successful investments. Secure your financial future with tailored advice from Wills & Trusts Wealth Management. Contact us today to start your investment journey.

#UK investment opportunities#ISAs#Bonds#IPOs#investment strategies#financial planning#Wills & Trusts Wealth Management#secure investments#UK financial advice#2024 investment tips#UK wealth management#top UK investments

0 notes

Text

Shri Balaji Valve Components IPO Date, Price, GMP, Company profile, financials & risks: Dec 23

New Post has been published on https://wealthview.co.in/shri-balaji-valve-components-ipo/

Shri Balaji Valve Components IPO Date, Price, GMP, Company profile, financials & risks: Dec 23

Shri Balaji Valve Components IPO: Shri Balaji Valve Components Limited (SBVCL) is a manufacturer of valve components and allied products, catering to the infrastructure, power, and oil & gas sectors in India. The company boasts a 22-year track record and specializes in producing critical components like valve stems, discs, bonnets, and seat rings.

Shri Balaji Valve Components IPO Details:

Issue Dates:

Open: December 27, 2023

Close: December 29, 2023

Offer Size: ₹21.60 crore (entirely fresh issue)

Price Band: ₹95 – ₹100 per share

Listing: BSE SME Platform (tentatively January 3, 2024)

Recent News Updates:

The IPO has garnered some attention within the SME space, but analysts remain cautious due to SBVCL’s small size and limited financial track record.

Recent positive trends in the infrastructure and power sectors might offer some upside potential for the IPO.

Shri Balaji Valve Components IPO Offer Details:

Securities Offered:

The Shri Balaji Valve Components IPO will offer equity shares of the face value of ₹10 each. These shares will represent ownership in the company and entitle holders to dividends and voting rights.

Investor Category Reservation:

The issue is entirely a book-built issue, meaning there are no pre-determined reservations for different investor categories. Instead, bids from various investor types (retail, QIBs, etc.) will be collected during the subscription period, and the final allotment will be determined based on demand and price bids.

Minimum Lot Size and Investment Amount:

The minimum lot size for the IPO is 1200 shares, translating to a minimum investment amount of ₹120,000 (1200 shares * ₹100 per share). This relatively high minimum investment requirement might affect participation from smaller retail investors.

Additional Points:

The IPO is a SME IPO, meaning it will list on the BSE SME platform, a dedicated segment for small and medium-sized enterprises.

Investors should be aware that SME IPOs typically have lower liquidity and higher volatility compared to their mainboard counterparts.

Shri Balaji Valve Components Limited Company Profile:

History and Operations:

Founded in 2001, SBVCL has 22 years of experience in manufacturing critical valve components for the infrastructure, power, and oil & gas sectors.

They specialize in producing valve stems, discs, bonnets, seat rings, and other components made from various materials like carbon steel, stainless steel, and alloy steel.

The company operates two manufacturing facilities in Coimbatore, Tamil Nadu, with a combined capacity of 5,400 MT per annum.

Market Position and Share:

SBVCL is a relatively small player in the fragmented valve component market. Their exact market share is not publicly available.

They primarily cater to the domestic market, supplying components to valve manufacturers and various end-user industries.

Brands, Subsidiaries, and Partnerships:

The company primarily operates under its own brand name, “Shri Balaji Valve Components.”

They do not have any subsidiaries or major partnerships currently mentioned in publicly available reports.

Milestones and Achievements:

Increased production capacity from 1,440 MT in 2016-17 to 5,400 MT in 2022-23, showcasing expansion potential.

Received ISO 9001:2015 certification for their quality management system.

Established strong relationships with key customers in the valve manufacturing and end-user segments.

Competitive Advantages and USP:

Focused product portfolio: SBVCL concentrates on critical valve components, potentially allowing for deeper expertise and quality control.

Established customer base: Long-standing relationships with valve manufacturers and clients in core industries offer stability.

Emphasis on quality and certifications: Commitment to quality standards and certifications could attract trust from new customers.

Shri Balaji Valve Components Limited Financial Analysis:

Recent Financial Performance:

Revenue: Reportedly witnessed a sharp increase of 61.14% between FY22 and FY23, indicating potential for growth.

Profitability: Profit after tax (PAT) reportedly surged by a significant 319.07% in the same period, highlighting substantial margin improvement.

Debt Levels: Information on current debt levels or debt-to-equity ratio is unavailable in publicly available reports.

Certainly! Here’s the data in table format:

Period Ended Assets Revenue Profit After Tax Net Worth Reserves and Surplus Total Borrowing 30 Jun 2023 5,132.0 1,654.6 184.8 975.7 377.0 2,879.5 31 Mar 2023 5,023.0 6,294.1 643.2 789.1 790.9 2,878.0 31 Mar 2022 3,973.5 3,906.1 153.5 144.6 147.7 2,799.7 31 Mar 2021 1,758.6 1,616.5 -3.22 -10.9 -5.77 1,399.5

Note: Amount in ₹ Lakhs

As you can see, the company’s revenue and profit have grown significantly in the past year. This is a positive sign for the company’s future prospects.

Key Financial Ratios (based on estimates):

P/E Ratio: Assuming an offer price of ₹100 and annualized FY23 PAT of ₹6.72 crore (based on reported PAT growth), the P/E ratio would be approximately 14.9. This is relatively high compared to the average P/E of around 25 for the broader industrial sector.

EPS (Earnings per Share): Estimated at ₹5.6 per share for FY23, suggesting modest earnings potential.

KPI Values P/E Ratio 9.33 ROE (Return on Equity) 136.76% ROCE (Return on Capital Employed) 26.47% Debt/Equity Ratio 3.63 EPS (Earnings per Share) Rs. 10.72 RoNW (Return on Net Worth) 81.50%

Lead Managers and Registrar for Shri Balaji Valve Components IPO:

Lead Managers:

Hem Securities Limited: The sole book running lead manager for the IPO. While a relatively smaller player, Hem Securities has experience in managing past SME IPOs, including the successful issues of Ajanta Pharma and Karda Constructions.

Track Record: While lacking experience with large or high-profile IPOs, Hem Securities has demonstrated competence in facilitating SME offerings. This might not directly translate to success with SBVCL’s IPO, but it offers some assurance regarding their expertise in navigating the SME IPO process.

Registrar:

Bigshare Services Pvt Ltd: The registrar to the issue. Their role involves maintaining a record of shareholders, facilitating share transfers, and handling dividends and other corporate actions. They play a crucial role in ensuring the smooth and transparent execution of the IPO process.

Shri Balaji Valve Components Limited Grey Market Premium (GMP)

Current GMP: As of December 21, 2023, the GMP for Shri Balaji Valve Components IPO is reportedly between ₹4 and ₹6 per share.

Comparison to Recent Listings: This GMP is generally moderate compared to recent SME IPOs, some of which witnessed premiums exceeding ₹100 per share.

Factors Influencing GMP:

Demand for the IPO: The GMP reflects investor sentiment and anticipated demand for the IPO shares. Several factors can influence this, including:

Company’s business prospects and growth potential: SBVCL’s niche focus and positive financials might attract some interest.

Market conditions: The current market sentiment towards SME IPOs could play a role.

IPO size and offer price: Smaller IPOs like SBVCL’s often see higher volatility in the grey market.

Supply and availability of shares: Limited information and smaller lot sizes in SME IPOs can create artificial scarcity and inflate the GMP.

Potential Impact on Listing Price:

A high GMP can generate positive buzz and potentially lead to a strong opening price on the listing day. However, it also raises the risk of a correction if the hype proves unfounded.

A moderate GMP, as seen for SBVCL, suggests cautious optimism. It’s crucial to evaluate the company’s fundamentals and not solely rely on the GMP for making investment decisions.

Shri Balaji Valve Components IPO: Risks and Concerns

Investing in any IPO, especially an SME IPO like SBVCL’s, involves inherent risks. Before making a decision, it’s crucial to consider the following:

Market Volatility:

SME IPOs are generally more volatile than mainboard listings due to lower liquidity and smaller investor bases. Market fluctuations could significantly impact the post-listing price.

Recent market conditions, while positive for infrastructure and power sectors, are still subject to unforeseen changes.

Industry Headwinds:

The valve component industry is highly competitive, with established players and potential for price pressure.

Dependence on large infrastructure projects makes the company susceptible to economic downturns and project delays.

Company-Specific Challenges:

Limited financial track record makes comprehensive analysis challenging, raising concerns about future performance sustainability.

The relatively small size of the company and niche market exposure might limit growth potential.

Dependence on a few key customers increases vulnerability to client-specific risks.

Financial Health and Red Flags:

While financial performance has shown recent positive trends, the lack of detailed data hinders thorough analysis.

The high P/E ratio compared to industry benchmarks raises concerns about valuation and potential overpricing.

The high debt-to-equity ratio, although not readily available, should be investigated for potential financial strain.

Also Read: How to Apply for an IPO?

#Allotment Details#Company Profile#Financial Performance#Financial risks#Investment opportunities#Stock Basics#IPO#News

0 notes

Text

Top 5 things to know before investing in SME IPO

#IPO#Initial Public Offering#Investment Opportunities#Small Business Growth#Small Business Investments#SME Finance#SME IPO#Upcoming SME IPO

0 notes

Text

Kahan Packaging IPO Portion Finished: Most recent GMP

Kahan Packaging IPO distribution has been concluded on September 13, 2023. The financial backers who applied for the issue can check their distribution status in the recorder’s entry, which is Purva Sharegistry India Pvt Ltd.

The GMP (dim market premium) for Kahan Packaging IPO is presently ₹3. This implies that portions of the organization are exchanging at a premium of ₹3 in the dim…

View On WordPress

0 notes

Text

Indiabulls IPO: Empowering Investors in India's Financial Landscape

#Indiabulls IPO#Investment Opportunity#India Economy#Financial Market#Profit Potential#Invest In India#Smart Investing#IPO Launch#Wealth Creation#Investment Strategy

0 notes

Text

No, Uber's (still) not profitable

Going to Defcon this weekend? I'm giving a keynote, "An Audacious Plan to Halt the Internet's Enshittification and Throw it Into Reverse," on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

Bezzle (n):

1. "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it" (JK Gabraith)

2. Uber.

Uber was, is, and always will be a bezzle. There are just intrinsic limitations to the profits available to operating a taxi fleet, even if you can misclassify your employees as contractors and steal their wages, even as you force them to bear the cost of buying and maintaining your taxis.

The magic of early Uber – when taxi rides were incredibly cheap, and there were always cars available, and drivers made generous livings behind the wheel – wasn't magic at all. It was just predatory pricing.

Uber lost $0.41 on every dollar they brought in, lighting $33b of its investors' cash on fire. Most of that money came from the Saudi royals, funneled through Softbank, who brought you such bezzles as WeWork – a boring real-estate company masquerading as a high-growth tech company, just as Uber was a boring taxi company masquerading as a tech company.

Predatory pricing used to be illegal, but Chicago School economists convinced judges to stop enforcing the law on the grounds that predatory pricing was impossible because no rational actor would choose to lose money. They (willfully) ignored the obvious possibility that a VC fund could invest in a money-losing business and use predatory pricing to convince retail investors that a pile of shit of sufficient size must have a pony under it somewhere.

This venture predation let investors – like Prince Bone Saw – cash out to suckers, leaving behind a money-losing business that had to invent ever-sweatier accounting tricks and implausible narratives to keep the suckers on the line while they blew town. A bezzle, in other words:

https://pluralistic.net/2023/05/19/fake-it-till-you-make-it/#millennial-lifestyle-subsidy

Uber is a true bezzle innovator, coming up with all kinds of fairy tales and sci-fi gimmicks to explain how they would convert their money-loser into a profitable business. They spent $2.5b on self-driving cars, producing a vehicle whose mean distance between fatal crashes was half a mile. Then they paid another company $400 million to take this self-licking ice-cream cone off their hands:

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

Amazingly, self-driving cars were among the more plausible of Uber's plans. They pissed away hundreds of millions on California's Proposition 22 to institutionalize worker misclassification, only to have the rule struck down because they couldn't be bothered to draft it properly. Then they did it again in Massachusetts:

https://pluralistic.net/2022/06/15/simple-as-abc/#a-big-ask

Remember when Uber was going to plug the holes in its balance sheet with flying cars? Flying cars! Maybe they were just trying to soften us up for their IPO, where they advised investors that the only way they'd ever be profitable is if they could replace every train, bus and tram ride in the world:

https://48hills.org/2019/05/ubers-plans-include-attacking-public-transit/

Honestly, the only way that seems remotely plausible is when it's put next to flying cars for comparison. I guess we can be grateful that they never promised us jetpacks, or, you know, teleportation. Just imagine the market opportunity they could have ascribed to astral projection!

Narrative capitalism has its limits. Once Uber went public, it had to produce financial disclosures that showed the line going up, lest the bezzle come to an end. These balance-sheet tricks were as varied as they were transparent, but the financial press kept falling for them, serving as dutiful stenographers for a string of triumphant press-releases announcing Uber's long-delayed entry into the league of companies that don't lose more money every single day.

One person Uber has never fooled is Hubert Horan, a transportation analyst with decades of experience who's had Uber's number since the very start, and who has done yeoman service puncturing every one of these financial "disclosures," methodically sifting through the pile of shit to prove that there is no pony hiding in it.

In 2021, Horan showed how Uber had burned through nearly all of its cash reserves, signaling an end to its subsidy for drivers and rides, which would also inevitably end the bezzle:

https://pluralistic.net/2021/08/10/unter/#bezzle-no-more

In mid, 2022, Horan showed how the "profit" Uber trumpeted came from selling off failed companies it had acquired to other dying rideshare companies, which paid in their own grossly inflated stock:

https://pluralistic.net/2022/08/05/a-lousy-taxi/#a-giant-asterisk

At the end of 2022, Horan showed how Uber invented a made-up, nonstandard metric, called "EBITDA profitability," which allowed them to lose billions and still declare themselves to be profitable, a lie that would have been obvious if they'd reported their earnings using Generally Accepted Accounting Principles (GAAP):

https://pluralistic.net/2022/02/11/bezzlers-gonna-bezzle/#gryft

Like clockwork, Uber has just announced – once again – that it is profitable, and once again, the press has credulously repeated the claim. So once again, Horan has published one of his magisterial debunkings on Naked Capitalism:

https://www.nakedcapitalism.com/2023/08/hubert-horan-can-uber-ever-deliver-part-thirty-three-uber-isnt-really-profitable-yet-but-is-getting-closer-the-antitrust-case-against-uber.html

Uber's $394m gains this quarter come from paper gains to untradable shares in its loss-making rivals – Didi, Grab, Aurora – who swapped stock with Uber in exchange for Uber's own loss-making overseas divisions. Yes, it's that stupid: Uber holds shares in dying companies that no one wants to buy. It declared those shares to have gained value, and on that basis, reported a profit.

Truly, any big number multiplied by an imaginary number can be turned into an even bigger number.

Now, Uber also reported "margin improvements" – that is, it says that it loses less on every journey. But it didn't explain how it made those improvements. But we know how the company did it: they made rides more expensive and cut the pay to their drivers. A 2.9m ride in Manhattan is now $50 – if you get a bargain! The base price is more like $70:

https://www.wired.com/story/uber-ceo-will-always-say-his-company-sucks/

The number of Uber drivers on the road has a direct relationship to the pay Uber offers those drivers. But that pay has been steeply declining, and with it, the availability of Ubers. A couple weeks ago, I found myself at the Burbank train station unable to get an Uber at all, with the app timing out repeatedly and announcing "no drivers available."

Normally, you can get a yellow taxi at the station, but years of Uber's predatory pricing has caused a drawdown of the local taxi-fleet, so there were no taxis available at the cab-rank or by dispatch. It took me an hour to get a cab home. Uber's bezzle destroyed local taxis and local transit – and replaced them with worse taxis that cost more.

Uber won't say why its margins are improving, but it can't be coming from scale. Before the pandemic, Uber had far more rides, and worse margins. Uber has diseconomies of scale: when you lose money on every ride, adding more rides increases your losses, not your profits.

Meanwhile, Lyft – Uber's also-ran competitor – saw its margins worsen over the same period. Lyft has always been worse at lying about it finances than Uber, but it is in essentially the exact same business (right down to the drivers and cars – many drivers have both apps on their phones). So Lyft's financials offer a good peek at Uber's true earnings picture.

Lyft is actually slightly better off than Uber overall. It spent less money on expensive props for its long con – flying cars, robotaxis, scooters, overseas clones – and abandoned them before Uber did. Lyft also fired 24% of its staff at the end of 2022, which should have improved its margins by cutting its costs.

Uber pays its drivers less. Like Lyft, Uber practices algorithmic wage discrimination, Veena Dubal's term describing the illegal practice of offering workers different payouts for the same work. Uber's algorithm seeks out "pickers" who are choosy about which rides they take, and converts them to "ants" (who take every ride offered) by paying them more for the same job, until they drop all their other gigs, whereupon the algorithm cuts their pay back to the rates paid to ants:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

All told, wage theft and wage cuts by Uber transferred $1b/quarter from labor to Uber's shareholders. Historically, Uber linked fares to driver pay – think of surge pricing, where Uber charged riders more for peak times and passed some of that premium onto drivers. But now Uber trumpets a custom pricing algorithm that is the inverse of its driver payment system, calculating riders' willingness to pay and repricing every ride based on how desperate they think you are.

This pricing is a per se antitrust violation of Section 2 of the Sherman Act, America's original antitrust law. That's important because Sherman 2 is one of the few antitrust laws that we never stopped enforcing, unlike the laws banning predator pricing:

https://ilr.law.uiowa.edu/sites/ilr.law.uiowa.edu/files/2023-02/Woodcock.pdf

Uber claims an 11% margin improvement. 6-7% of that comes from algorithmic price discrimination and service cutbacks, letting it take 29% of every dollar the driver earns (up from 22%). Uber CEO Dara Khosrowshahi himself says that this is as high as the take can get – over 30%, and drivers will delete the app.

Uber's food delivery service – a baling wire-and-spit Frankenstein's monster of several food apps it bought and glued together – is a loser even by the standards of the sector, which is unprofitable as a whole and experiencing an unbroken slide of declining demand.

Put it all together and you get a picture of the kind of taxi company Uber really is: one that charges more than traditional cabs, pays drivers less, and has fewer cars on the road at times of peak demand, especially in the neighborhoods that traditional taxis had always underserved. In other words, Uber has broken every one of its promises.

We replaced the "evil taxi cartel" with an "evil taxi monopolist." And it's still losing money.

Even if Lyft goes under – as seems inevitable – Uber can't attain real profitability by scooping up its passengers and drivers. When you're losing money on every ride, you just can't make it up in volume.

Image: JERRYE AND ROY KLOTZ MD (modified) https://commons.wikimedia.org/wiki/File:LA_BREA_TAR_PITS,_LOS_ANGELES.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

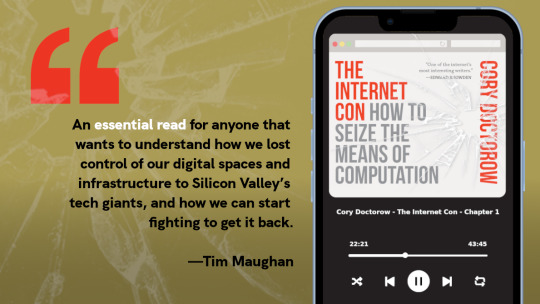

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/09/accounting-gimmicks/#unter

Image:

JERRYE AND ROY KLOTZ MD (modified)

https://commons.wikimedia.org/wiki/File:LA_BREA_TAR_PITS,_LOS_ANGELES.jpg

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#bezzles#hubert horan#uber#rideshare#accounting tricks#financial engineering#late-stage capitalism#narrative capitalism#lyft#transit#uber eats#venture predation#algorithmic wage discrimination

1K notes

·

View notes

Text

"it's only been 3 months, of course we haven't turned a profit yet" - implied Webtoons in their recent Q2 meeting following their Wall Street debut

"it's only been 3 months, what do you mean the lawyers are already here" - I choked out as I was informed of the vultures circling WT's dying corpse from above

(literally just google "webtoons investigation" and you'll come across multiple articles covering different firms with the exact same claims and ongoing investigations)

Now let's not get ahead of ourselves, vultures are vultures, as soon as one smells blood the rest of them tend to circle in to get their own place in line. At this stage, it's simply legal firms that specialize in the investment sector sliding their cards across the table towards WT's investors like, "heeeey, give us a call if you, y'know... don't make your money back in the next three months :) or the three months after that :) we can make the money happen, for a price :)"

That said, whichever vulture honed in first, I don't think they would have followed the scent if they weren't at least somewhat confident there was something to feast on. Then again, I'm not a lawyer, nor am I involved in the complex world of investing and /r/wallstreetbets, but what I can confidently say is... of course Webtoons isn't hitting their projections, this is a company that historically operates at a loss, it says so right in their own IPO documentation. This isn't even some hush hush secret anymore whispered among creators who are privileged to that information or readers who can only take their best guesses, it's now literally official that Webtoons is historically bad at making money. And now in their attempts to save themselves, they've now put themselves in debt not only to Daddy Naver, but to all the eager investors who expected this to be their next big payout. And it's hilarious.

But what isn't hilarious is how this is undoubtedly affecting the creators on the platform, both Originals and greenlit Canvas creators who are currently working their asses off to launch their series. And so I want to make it very clear that as much as I'm currently taunting Webtoons much like the Road Runner taunted Wile E. Coyote's increasingly absurd stunts that always backfired tenfold, I also have the immense privilege of not being in the shoes of those who are witnessing this and fearing they'll be losing their jobs and opportunities.

To the people who are in those positions, I have the utmost respect for what you're currently facing. You're all investors in your own right, looking down the same barrel as the Wall Street betters who are realizing Webtoons' lied to them. You're investing your time, your efforts, your work, your creative rights, your physical bodies and mental health into Webtoons with the expectation that it will payoff. And as we've seen from many creators who have come out on the other side burnt out and often poorer than they were when they went in, that payoff doesn't exist 99% of the time.

So, with the privilege that I have as someone who's not contracted with Webtoons and isn't bound by an NDA and knows fully well how much Webtoons hates their public image being laughed at... my inbox is always open and the anon button is always turned on. Do with that what you will. And know that if you're someone who's currently trying to find a way out of Webtoons, remember the power you have. Their platform is nothing without you.

#webtoon critical#fuck webtoons#and YES this applies to EVERY creator#even the creators whose work i talk shit about LOL#it doesn't matter how i personally feel about anyone's work#webtoons is a shithole and no one deserves to live in it#the art of webcomics deserve better than this predatory monopoly bullshit#and that goes far beyond my own personal feelings#WT can try all they want to monopolize webcomics but webcomics are for EVERYONE#creators deserve better treatment and pay#readers deserve transparency with where their money is going

112 notes

·

View notes

Text

Synopses

Season 3, Episode 1: "Il Mattino ha L'Oro in Boca"

Debut Date: SUNDAY, AUGUST 11

As Pierpoint gears up to take Lumi public, Eric gets a long-awaited promotion to partner, Yasmin tries to escape Harper's shadow at the desk, and Robert struggles to manage Lumi CEO Henry Muck. Meanwhile, Harper sees an opportunity to get back in the game at hedge fund FutureDawn.

Season 3, Episode 2: "Smoke and Mirrors"

Debut Date: SUNDAY, AUGUST 18

Following a bumpy IPO launch, Eric scrambles to maintain control over the floor. Meanwhile, Harper forms a new work alliance, Robert suffers a devastating loss, and Yasmin's ingenuity wins Henry's attention.

Season 3, Episode 3: N/A

Debut Date: SUNDAY, AUGUST 25

Eric, Yasmin, and Robert head to the COP Climate Conference in Switzerland to display Pierpoint's confidence in pivoting to ethical investing. But when Harper pulls a stunt that disrupts the status quo, market support for Lumi becomes threatened.

10 notes

·

View notes

Text

Bajaj Housing Finance IPO is Open!

Looking to invest in a strong and growing housing finance company? The Bajaj Housing Finance IPO is now open for subscription!

Key Details:

Price Band: ₹66-70 per share

Issue Size: ₹6,560 crore

Subscription Period: September 9-11, 2024

Don't miss this opportunity to be part of the Bajaj Group's housing finance journey!

2 notes

·

View notes

Text

Discover the most promising investment opportunities in the UK for 2024 and beyond. Learn about the potential of ISAs, Bonds, and IPOs with expert insights and tips for investors seeking sound and profitable ventures. Understand the risks and rewards as we delve into the world of UK investments.

#UK Investment Opportunities#Investment Advice#ISAs#Bonds#IPOs#Financial Planning#Investment Strategies#UK Market Trends#Personal Finance#Wealth Management#Risk Assessment#Investment Returns#Financial Expertise#UK Economy#Investment Guide

1 note

·

View note

Text

Hyatt Hotels Backed Juniper Hotels Limited IPO Date, Price, GMP, Review December 2023

New Post has been published on https://wealthview.co.in/hyatt-hotels-backed-juniper-hotels-limited-ipo/

Hyatt Hotels Backed Juniper Hotels Limited IPO Date, Price, GMP, Review December 2023

Juniper Hotels Limited IPO: Juniper Hotels Limited is a leading player in the Indian hospitality sector, operating hotels under the renowned Hyatt brand. They own and manage luxury and mid-scale hotels across India, catering to both business and leisure travelers.

Juniper Hotels Limited IPO Date, Size & Price:

Issue Dates:

Open: Not yet announced

Close: Not yet announced

Listing: Expected to be listed on both BSE and NSE.

Offer Size: Up to Rs 1,800 crore, consisting entirely of a fresh issue of equity shares. No offer for sale (OFS) component.

Price Band: Not yet determined.

News updates:

Juniper Hotels filed their DRHP (draft red herring prospectus) with SEBI in September 2023, seeking approval for the IPO.

The issue aims to raise Rs 1,800 crore, with Rs 1,500 crore earmarked for debt repayment and the remaining for general corporate purposes.

Recent positive trends in the Indian tourism sector and the Hyatt brand’s strong reputation could bode well for investor sentiment.

However, rising interest rates and potential economic slowdown could pose challenges.

The company is backed by prominent investors like Saraf Hotels and Hyatt Hotels Corporation.

Juniper Hotels boasts a healthy operational track record with consistent growth in revenues and profitability.

Juniper Hotels Limited IPO Offer Details:

Securities Offered:

Equity Shares: It’s highly likely that Juniper Hotels will offer only equity shares in their IPO. Bonds are typically issued by established companies with a long track record and stable cash flow, which isn’t necessarily the case for a young company like Juniper.

Reservation percentages:

Retail: The Indian regulatory body SEBI mandates that at least 35% of the issue in an IPO be reserved for retail investors. Juniper might decide to allocate a higher percentage depending on their strategy.

Qualified Institutional Buyers (QIBs): QIBs, which include domestic mutual funds, foreign institutional investors, and insurance companies, typically get a significant portion (around 50%) in Indian IPOs.

Non-Institutional Investors (NIIs): This category often gets 15% of the issue, but the final allocation is at the discretion of the company and the underwriters.

Minimum Lot Size and Investment Amount:

The minimum lot size is usually set to ensure wider participation from retail investors. It could be anywhere from 100 to 500 shares.

The minimum investment amount will depend on the share price, which will be fixed closer to the offer date.

Juniper Hotels Limited Company Profile

History and Operations:

Founded in 2017, Juniper Hotels Ltd. is a relatively young hospitality company operating under the renowned Hyatt brand in India.

It currently manages five operational hotels under various Hyatt sub-brands: Andaz Delhi, Hyatt Regency Chennai, Hyatt Place Gurgaon, Hyatt Regency Chandigarh, and Hyatt Regency Lucknow.

The company primarily focuses on owning and operating high-end luxury and upper-midscale hotels in key business and leisure destinations within India.

Market Position and Market Share:

Though young, Juniper Hotels holds a respectable position in the Indian luxury and upper-midscale hotel market. However, specific market share data is not readily available as the company is still private.

Its association with the established Hyatt brand provides significant recognition and trust within the target customer segment.

Prominent Brands, Subsidiaries, and Partnerships:

The company’s primary brand is Hyatt, though it operates under various sub-brands within the Hyatt portfolio.

Currently, they do not have any major subsidiaries and their key partnership lies with the Hyatt Hotels Corporation which licenses the brand and provides operational expertise.

Key Milestones and Achievements:

Successfully opening five operational hotels within five years of the company’s inception is a noteworthy achievement.

Maintaining high occupancy rates and positive guest reviews across its properties demonstrates operational excellence.

Competitive Advantages and Unique Selling Proposition:

Hyatt Brand Affiliation: The association with the well-recognized Hyatt brand provides Juniper Hotels with immediate brand recognition, operational expertise, and access to international clientele.

Focus on High-End Market: Targeting the luxury and upper-midscale segment allows Juniper Hotels to capitalize on strong growth potential and higher average room rates.

Strategic Location of Hotels: Operating in key business and leisure destinations ensures consistent demand and occupancy throughout the year.

Juniper Hotels Limited Financials (FY 2021-22)

Overall Performance:

Operating Revenue: 100 cr – 500 cr (indicating steady growth within a range)

EBITDA: Increased by 1,645.74% (significant positive improvement)

Net Worth: Decreased by 35.95% (concerns regarding decline)

Total Assets: Increased by 0.47% (slight growth)

Liabilities: Decreased by 27.87% (positive development)

Key Ratios:

Debt-to-Equity Ratio: 6.35 (moderate to high depending on industry benchmarks)

Return on Equity (ROE): -56.29% (significant loss, needs further investigation)

Breakdown of Balance Sheet:

Fixed Assets: Decreased by 1.07% (potential depreciation)

Current Assets: Increased by 24.64% (positive movement)

Current Liabilities: Decreased by 27.87% (improvement in short-term obligations)

Trade Receivables: Increased by 23.67% (positive but needs monitoring for collection)

Trade Payables: Decreased by 49.91% (improved payables management)

Current Ratio: 0.36 (low liquidity ratio, requires further analysis)

Source: Tofler.in

Please note: This analysis is based on limited data and should be used in conjunction with other research and due diligence before investing in Juniper Hotels Limited.

Juniper Hotels Limited IPO Potential Risks and Concerns

While investing in Juniper Hotels’ IPO might present promising opportunities, it’s crucial to be aware of the associated risks and challenges. Here are some key considerations:

Market Volatility:

The Indian stock market, like any other, is susceptible to unpredictable swings. Economic turmoil, geopolitical events, or global market fluctuations could negatively impact the IPO’s performance, leading to potential losses for investors.

Industry Headwinds:

The hospitality industry is sensitive to economic downturns and travel disruptions. Factors like recessionary trends, pandemics, or natural disasters could significantly affect hotel occupancy rates and revenue, impacting Juniper Hotels’ financial performance.

Company-Specific Challenges:

Dependence on Hyatt Brand: While being under the Hyatt umbrella offers advantages, Juniper Hotels’ success is heavily reliant on the broader Hyatt brand reputation and performance. Any negative perception or issues arising with Hyatt could affect investor confidence in Juniper Hotels.

Limited Operational History: As a relatively young company, Juniper Hotels lacks the long-term track record and proven profitability of established players in the market. This might raise concerns about its ability to sustain growth and manage potential challenges.

Debt Levels: While debt isn’t necessarily a red flag, it’s crucial to analyze the final debt-to-equity ratio revealed in the IPO prospectus. High debt levels could restrict the company’s financial flexibility and put it under pressure during economic downturns.

Financial Health Analysis:

Limited Transparency: As the company is still private, detailed financial information is not readily available. The official IPO prospectus will provide crucial insights into its financial health, including profitability, debt levels, and operational efficiency. Investors should carefully scrutinize these details before making a decision.

Profitability Concerns: News reports suggest the company is operating close to profitability or in a slight loss phase. While understandable for companies in expansion mode, it’s essential to analyze the sustainability of this trend and its potential impact on future earnings potential.

Investor Advice:

Conduct Thorough Research: It’s paramount to conduct thorough research beyond relying solely on this information. Read the IPO prospectus diligently, analyze financial statements, and consider independent research reports before investing.

Seek Professional Guidance: Consider consulting with a financial advisor who can assess your risk tolerance and provide personalized investment advice based on your financial goals and situation.

Invest Cautiously: IPOs can be volatile, and even companies with promising prospects can experience setbacks. Invest cautiously and only allocate a portion of your portfolio that you can afford to lose.

Remember, investing in any IPO comes with inherent risks. Carefully weigh the potential rewards against the potential risks before making any investment decisions.

Also Read: How to Apply for an IPO?

#Company Profile#Financial risks#Hyatt Hotels#India Hospitality#Investment opportunities#Juniper Hotels IPO#Market analysis#IPO#News

0 notes

Text

Welcome to the world of SME IPO in 2023! If you’re wondering what SME IPOs are and why it matters, you’re in the right place. In this blog post, we’ll break down what SME IPOs are, why they’re essential, and reveal our top picks for SME IPOs to watch in 2023. Whether you’re a seasoned investor or just getting started, this guide will help you navigate the exciting world of SME IPOs.

#SME IPO#IPO#SME Finance#Small Business Investments#Investment Opportunities#Small Business Growth#Initial Public Offering

0 notes

Text

What is an IPO?

An Initial Public Offering (IPO) is a financial process through which a private company transitions into a public company by offering its shares to the general public for the first time. This involves the issuance of new shares to investors, allowing the company to raise capital directly from the public. The IPO enables the company to access public markets and diversify its sources of funding. Additionally, it provides existing private shareholders the opportunity to sell their shares to the public, allowing them to realize the value of their investments and potentially trade their shares on stock exchanges. Overall, an IPO is a significant milestone for a company, facilitating increased visibility, liquidity, and financial resources.

6 notes

·

View notes

Text

Comparing the Top Online Trading Apps: Which One Is Right for You?

The online stock trading app industry has experienced a tremendous surge since the onset of the pandemic in 2020. Thanks to improved internet speeds and the growing interest in financial literacy, mobile-based stock trading has undergone a significant transformation. Each day, more Indians are experiencing the seamless shift towards incredibly smooth and flexible trading options, all available at the touch of a button.

As these apps continue to gain widespread adoption, even beginners can enter the world of trading with ease. These applications not only enable the buying and selling of financial assets but also offer a range of other valuable services. The only requirement is a reliable internet connection to ensure these trading apps operate smoothly.

This article has listed some of the best online trading apps so that you can choose any one of them.

Top Three Online Trading Apps

The list of the best online trading app is as follows.

1. Zerodha Kite

Zerodha boasts over 100 million active clients, contributing significantly to India's retail trading volumes, making up about 15% of the total. This app is highly recommended for both beginners and experienced traders and investors, thanks to its robust technological platform.

Zerodha's flagship mobile trading software, Kite, is developed in-house. The current Kite 3.0 web platform offers a wide array of features, including market watch, advanced charting with over 100 indicators, and advanced order types such as cover orders and good till triggered (GTT) orders, ensuring swift order placements.

Furthermore, users can also utilise Zerodha Kite as a Chrome extension, enabling features like order placement and stock tracking for added convenience.

2. Kotak Securities

Opening a trading account at Kotak Securities comes with the advantage of zero account opening fees. Additionally, there are discounted rates for investors below 30 years of age, making it a cost-effective option. The account setup process is streamlined, with minimal steps involved.

Kotak Securities enables users to engage in a wide range of financial activities, including trading in stocks, IPOs, derivatives, mutual funds, currency, and commodities. Furthermore, it offers opportunities for global investments through its trading app. This app is thoughtfully designed, featuring a user-friendly interface accessible on iOS, Android, and Windows platforms. It also provides valuable extras like margin funding, real-time portfolio tracking, and live stock quotes with charting options.

3. Upstox

Upstox PRO, supported by Tiger Global and endorsed by prominent investors like Indian tycoon Ratan Tata and Tiger Global Management, is a well-known discount broker app. It offers a range of trading and investment opportunities, encompassing stocks, currencies, commodities, and mutual funds. For experienced and seasoned investors, it is an ideal choice, featuring advanced tools such as TradingView and ChartsIQ libraries.

Online trading apps offer a diverse array of financial products and services, consolidating your investment and financial management in one convenient platform. You can engage in activities such as trading equities, participating in IPOs, trading derivatives, investing in mutual funds, placing fixed deposits, dealing in commodities, and trading currency.

2 notes

·

View notes

Text

Diversifying Your Investments: A Guide to Balancing Midcap and SIP (Systematic Investment Plan) Mutual Funds

Many investors focus their portfolios heavily on large cap stocks while ignoring midcap and small cap companies. However, diversifying your holdings across market capitalizations can provide greater growth opportunities and balance risk. Combining midcap funds with an SIP mutual fund (Systematic Investment Plan) allows you to spread your assets efficiently.

Midcap mutual funds invest in mid-sized companies that offer higher growth potential than large caps that are already well established. Though midcaps carry higher volatility, the long-term growth can outweigh short-term fluctuations. A well-managed midcap fund invested in over 50 companies can mitigate the risk through diversification. Midcap funds have delivered nearly 14% annual returns over the last decade, outperforming large cap funds.

Rather than trying to hand-pick midcap stocks, investing through a mutual fund scheme allows you to gain exposure managed by an experienced fund manager. They can identify fast-growing companies across sectors before they gain wider attention. A SIP plan spreads your investment out steadily in the fund through small periodic contributions rather than a lump sum. This lets you take advantage of rupee cost averaging and reduces the impact of market ups and downs.

SIP plans start with minimal amounts like ₹500 per month so you can begin without a large capital pool. The enforced saving discipline will help you accumulate a corpus over time without worrying about market timing. SIP instalments can be automated directly from your account, making investing completely hassle-free. As your savings grow, you can increase the SIP amount.

A prudent approach is to allocate about 30% of your portfolio to midcap funds through SIP, with the balance in large cap funds. This allows you to benefit from midcap growth while limiting risk through diversification. Avoid investing in just one midcap fund. Spread your investment across 2-3 funds from different fund houses to diversify fund manager risk.

Review and rebalance your portfolio at least annually to maintain your target allocation. As your midcap funds grow, part of those gains can be booked periodically and shifted to large cap funds. This ensures you lock in some gains and maintain your original asset allocation.

Rather than chasing the hot new IPO or small caps, a disciplined SIP plan in diversified midcap funds can help grow your wealth steadily. Focus on long term metrics like rolling returns rather than short term NAV changes. With patience and consistency, your SIP portfolio will reap the benefits of midcap investing.

2 notes

·

View notes

Text

Refer & Earn ₹500/-

Huge opportunity to Earn Extra

Referral Link

http://mosl.co/MJS692msYj

Open a FREE* Demat + Trading account and enjoy

http://mosl.co/MJS692msYj

[email protected]

http://wa.me/8448277136

Try with any one of these:

We Have

5000 Equities

30+ Mutual fund Schemes

5+ Small Ticket Size PMS Funds

Note : Open Account and Call us to Get ₹50/- instantly

Mob : +91 8448 277 136

It's all Hassle free investment at your Fingertips.

Features of Demat & Trading with us

₹0 AMC for Lifetime

Free Guidance from Market

Experts

Readymade Portfolios

One Click Investment

Learn on the Go

Mail us: [email protected]

OR WhatsApp us: 084482 77136

Follow this page for more updates

Kangfinz Pvt. Ltd.

IPOAlert #IPO #ShareMarket #Stocks #Stock

investment #trading #StockExchange #momentumstrategies #profit #motilaloswal #finance #kangfinz #nse #bse #nseindia #bseindia #niftyfifty #nifty50 #optiontrading #finance #tradingindia #momentumtrading #momentumstrategies #ShareMarketUpdate #nifty50intraday

2 notes

·

View notes