#Financial risks

Text

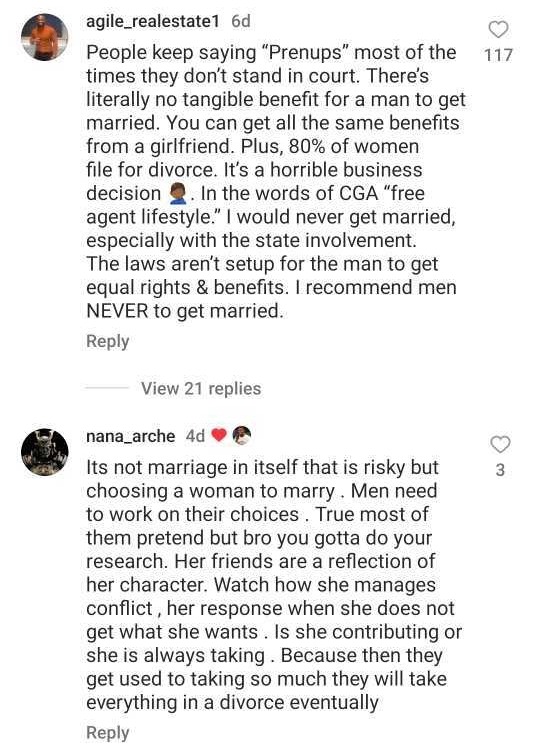

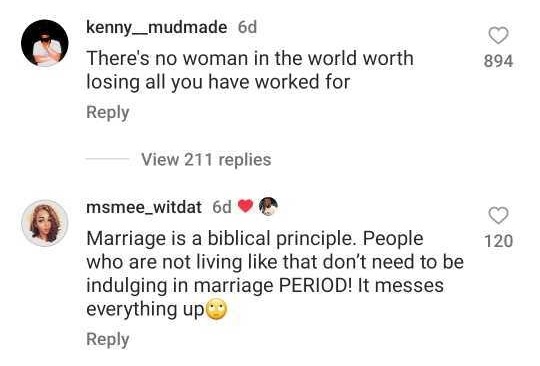

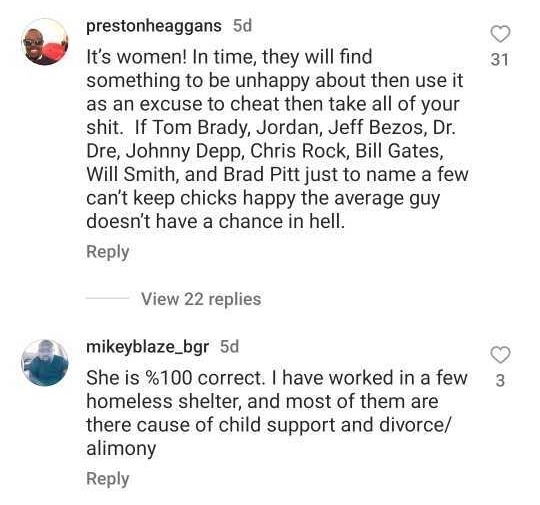

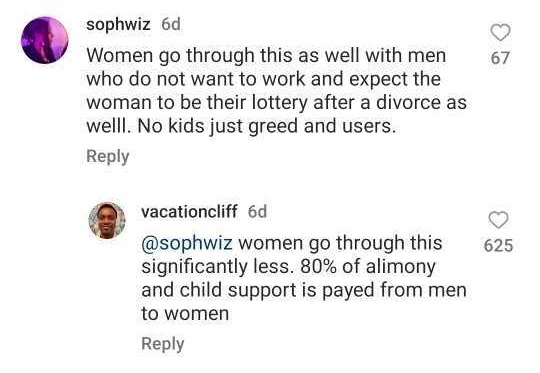

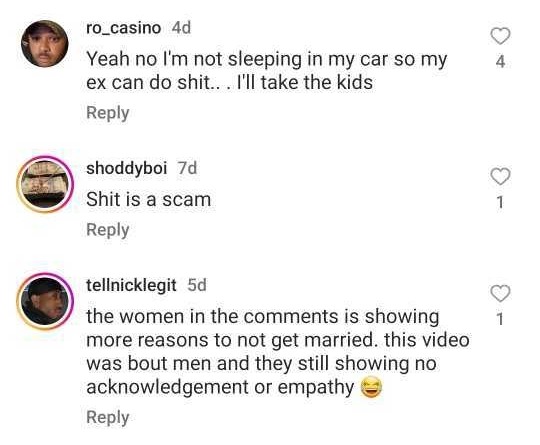

this year i learned that there's a thing called "permanent alimony" (support paid to the lesser-earning spouse until the death of the payor, the death of the recipient, or the remarriage of the recipient). that alone is reason to NOT get married. nahhhh.

#social issues#marriage#divorce#marriage risks#relationship challenges#marriage pitfalls#financial risks#post-divorce struggles#family law#marital concerns#divorce settlement#marriage advice

335 notes

·

View notes

Text

Commonwealth Games Australia offers Scotland multimillion-dollar cash to save 2026 event

Commonwealth Games Australia offers Scotland multimillion-dollar cash to save 2026 event #2026 #Australia

0 notes

Text

FirstMeridian Business services IPO Date, Price, GMP, Review, Company Profile, Financials, Risk, Allotment Details 2023

New Post has been published on https://wealthview.co.in/firstmeridian-business-services-ipo/

FirstMeridian Business services IPO Date, Price, GMP, Review, Company Profile, Financials, Risk, Allotment Details 2023

FirstMeridian Business Services IPO: FirstMeridian Business Services Ltd. (FBSL) is a leading Mumbai-based human resource (HR) and staffing company, operating in a booming Indian outsourcing market. They’re the third-largest in terms of revenue (FY21) and offer a wide range of services, including:

General staffing: Temporary and permanent staffing solutions for various industries.

Allied services: Payroll management, training and development, and compliance solutions.

Global technology solutions: IT staffing and recruitment services for MNCs and Indian companies.

Other HR services: Managed services, background verification, and HR consulting.

FirstMeridian Business services IPO Details:

The FBSL IPO was originally planned for May 2022 with an offer size of Rs. 800 crore. However, after reshaping the proposal, the company received SEBI approval in February 2023 for a slightly smaller IPO of Rs. 740 crore. Here’s the updated breakdown:

Issue Size: Rs. 740 crore

Components:

Fresh Issue: Rs. 50 crore

Offer for Sale (OFS): Rs. 690 crore (by promoters and investors)

Price Band: Rs. 277 – Rs. 291 per share

Dates (tentative):

Issue Open: Not yet announced

Issue Close: Not yet announced

Listing: Not yet announced

Recent News Updates:

The FBSL IPO has garnered moderate attention in the market. Recent developments that might impact investor sentiment include:

Positive market sentiment: The Indian markets have rallied over the past few months, creating a favorable environment for IPOs.

Growing HR outsourcing market: The Indian HR outsourcing market is expected to reach USD 5.7 billion by 2027, offering significant growth potential for FBSL.

Competition: FBSL faces stiff competition from established players like ManpowerGroup and TeamLease Services. Additionally, several tech-enabled startups are disrupting the market.

FirstMeridian Business Services IPO Offer Details

Securities Offered:

Equity Shares: The FBSL IPO will only offer equity shares of the company. No bonds or debentures will be issued.

Face Value: Rs. 10 per share

Reservation Percentages:

The total offer size of Rs. 740 crore will be divided among different investor categories as follows:

Retail Individual Investors (RII): 35%

Qualified Institutional Buyers (QIBs): 50%

Non-Institutional Investors (NIIs): 15%

Minimum Lot Size and Investment Amount:

Minimum Lot Size: One lot will comprise 50 equity shares.

Minimum Investment Amount: Based on the price band of Rs. 277 to Rs. 291 per share, the minimum investment amount per lot will range from approximately Rs. 13,850 to Rs. 14,550.

FirstMeridian Business Services Company Profile:

History and Operations:

Founded in 1997, FirstMeridian boasts over 25 years of experience in the Indian HR and staffing space.

Originally known as ‘InnovSource,’ it rebranded to encompass its growing portfolio of established brands:

V5 Global Services: Focuses on IT and non-IT staffing for MNCs and Indian companies.

Affluent Global Services: Specializes in professional recruitment and executive search.

CBSI Global: Offers business process outsourcing (BPO) and managed services.

RLabs Enterprise Services: Provides tech-enabled HR solutions and automation.

Operates through a network of 3500+ branch offices across India, serving 1200+ clients and placing over 126,000 associates annually.

Market Focus: Key sectors include Telecom, Retail, BFSI, IT, ITES, E-Commerce, Manufacturing, Engineering, and Logistics.

Market Position and Share:

Ranked as the 3rd largest Indian staffing company by revenue (FY21) with a market share of approximately 7%.

Faces competition from established players like ManpowerGroup and TeamLease Services, as well as tech-enabled startups.

Prominent Brands and Partnerships:

Collaborates with global brands like Amazon, Microsoft, Samsung, and Coca-Cola.

Partnered with government initiatives like National Skill Development Corporation (NSDC) to upskill the workforce.

Key Milestones and Achievements:

Awarded the “Best Employer Brand Award” by Aon Hewitt in 2018 and 2019.

Featured in the “Great Place to Work® India” list for over 8 consecutive years.

Received the “Fastest Growing Staffing Company” award by Frost & Sullivan in 2020.

Competitive Advantages and USP:

Diversified Service Portfolio: Offers a one-stop solution for diverse HR needs across various industries.

Strong Track Record: Established brand with over 2 decades of experience and consistent growth.

Nationwide Network: Extensive reach through an expansive network of branch offices.

Focus on Technology: Investing in HR tech solutions to enhance efficiency and service delivery.

Social Impact: Committed to skilling the workforce and creating employment opportunities.

FirstMeridian Business Services Financials:

Recent Financial Performance:

Revenue Growth: While the exact figures for FY23 are not yet available, FBSL reportedly achieved significant revenue growth compared to FY22. Sources indicate a year-on-year increase of around 40%, exceeding pre-pandemic levels.

Profitability: The company has shown consistent profitability with operating margins hovering around 4-5% in recent years. However, net profit margins are lower due to finance costs associated with debt.

Debt Levels: FBSL maintains a moderate debt level with a debt-to-equity ratio around 0.7 as of March 2023. While the upcoming IPO aims to further reduce debt, investors should continue to monitor this aspect.

Key Financial Ratios (as of March 2023):

Price-to-Earnings (P/E) Ratio: Not yet available due to pending IPO and lack of post-issue market price.

Earnings per Share (EPS): INR 3.74 for FY23 (estimated).

Debt-to-Equity Ratio: 0.70.

Industry Benchmarks:

The average P/E ratio for staffing companies in India is around 20-25.

The average EPS for comparable companies is in the range of INR 6-8.

The industry standard for debt-to-equity ratio in the staffing sector is typically below 1.

Objectives of the FirstMeridian Business Services IPO:

Reasons for Going Public:

FirstMeridian Business Services (FBSL) has outlined several key reasons for pursuing an IPO:

Capital Raising: The primary objective is to raise Rs. 740 crore, with Rs. 50 crore from a fresh issue and Rs. 690 crore from an offer for sale (OFS) by promoters and investors. This capital will be used to fuel future growth initiatives.

Brand Visibility and Credibility: Public listing can enhance FBSL’s brand image and recognition in the market, potentially attracting new clients and talent.

Improving Liquidity and Shareholder Base: Access to public markets can create investor interest and liquidity for existing shareholders, facilitating easier exits and value realization.

Facilitating Future Acquisitions and Partnerships: Publicly traded status can make FBSL a more attractive partner for potential mergers, acquisitions, or strategic collaborations.

Utilization of Raised Funds:

FBSL plans to utilize the proceeds from the fresh issue as follows:

Debt Repayment: A portion of the funds will be used to reduce existing debt, lowering financing costs and improving financial stability.

Expansion and Investments: The company aims to invest in technology infrastructure, digital initiatives, branch network expansion, and new service offerings to drive organic growth.

Working Capital Requirements: The remaining funds will be used to meet working capital needs and support ongoing operations.

Alignment with Future Growth Strategy:

FBSL’s stated objectives for the IPO clearly align with its future growth strategy, which focuses on:

Organic Growth: Expanding core staffing and allied services businesses, diversifying into adjacent HR solutions like RPO and managed services.

Geographic Expansion: Exploring potential entry into new domestic markets and collaborating with global players for international reach.

Technology Adoption: Investing in AI, automation, and other HR tech solutions to improve efficiency, productivity, and client service.

Enhanced Brand and Talent Acquisition: Leveraging the public company status to attract and retain top talent and strengthen brand reputation.

FirstMeridian Business Services IPO Risks:

While the FirstMeridian Business Services IPO offers promising prospects, it’s crucial to acknowledge and carefully consider the associated risks before investing. Here are some key areas to examine:

Industry Headwinds:

The HR outsourcing industry in India faces potential headwinds like automation and technology replacing some traditional staffing roles.

Dependence on certain sectors like IT and BFSI can expose the company to vulnerabilities if these sectors experience downturns.

Increasing competition from established players and tech-enabled startups could put pressure on market share and profitability.

Company-Specific Challenges:

While FBSL boasts a track record, its reliance on its top management personnel raises concerns about succession planning and potential impact if key individuals leave.

The company’s moderate debt levels, though manageable, should be monitored closely, as high debt can restrict future growth or financial flexibility.

Dependence on temporary staffing services might be impacted by economic fluctuations or changes in labor laws and regulations.

Financial Health Analysis:

While FBSL demonstrates consistent profitability, its net profit margins are lower due to finance costs associated with debt.

The upcoming IPO aims to reduce debt, but investors should monitor the post-issue debt-to-equity ratio to assess financial stability.

The recent financial performance (FY23) is still preliminary, and investors should wait for the final audited reports before making investment decisions.

Red Flags for Investors:

High dependence on specific sectors and limited geographic diversification.

Moderate debt levels and reliance on traditional staffing services.

Lack of clarity on the final lead managers and their track record in similar offerings.

FirstMeridian Business Services Limited – DRHP

Also Read: How to Apply for an IPO?

#Allotment Details#Company Profile#Financial Performance#Financial risks#IPO#IPO date#Lead Managers#Lot Size#UPCOMING IPO#News

0 notes

Text

Private Equity and Hedge Funds.

Private equity (PE) is a type of equity investment in private companies that are not listed on the stock exchanges. The primary aim of investments by a PE firm is to get involved in the business, increase the value of the business, and sell shares in the business to get the desired payoff. PE strategies involve leveraged buyouts, venture capital, growth capital, distressed investments, and mezzanine capital. The different types of PE funds are categorized as leverage buyout funds, venture capital funds, growth equity funds, and special situation funds. Venture capital is a type of PE investment for promoting new technology, new marketing concepts, and new products. A hedge fund is an alternative investment fund that is available to institutional investors and high net-worth individuals with significant assets. Hedge funds are highly leveraged and invest in high-risk financial derivatives. Popular hedge fund strategies can be categorized as equity-based strategies, arbitrage-based strategies, opportunistic strategies, and multiple strategies. Some of the major investment strategies of hedge funds are equity long strategy, fixed income strategy, convertible arbitrage strategy, funds of fund strategy, global macro, relative value arbitrage, and managed futures.

Learn more on Private Equity and Hedge Funds.

#hedge funds#investment strategies#financial risks#Venture capital#Private equity (PE)#international day of banks#4 december#alternative investment fund

0 notes

Text

The Role of Governance in Risk Management and Financial Controls

Governance Role in Financial Controls

Reliable financial reporting and legal/regulatory compliance are core governance responsibilities of the board. The audit committee has a crucial role in overseeing financial controls and compliance via activities like:

Reviewing significant accounting policies and estimates for reasonableness

Evaluating the adequacy and effectiveness of internal control systems

Assessing the integrity of financial statements and disclosures

Monitoring compliance with legal/regulatory requirements

Overseeing internal and external audit processes

Investigating tips/complaints regarding financial misconduct

0 notes

Text

Student's Guide to Avoid Credit Card Debt & Build Financial Health

In today’s society, credit cards have become ubiquitous and are often considered a convenient financial tool. However, when it comes to college students, obtaining a credit card can have serious repercussions on their financial well-being. This blog aims to shed light on the potential dangers of credit card usage for college students, backed up by relevant statistics. By understanding these…

View On WordPress

#a man of credit#college students&039; finances#credit card#credit card debt#credit card usage#credit cards in college#credit scores#debt accumulation#financial education#financial independence#financial literacy#financial responsibility#financial risks#helpful tips for students#high interest rates#long-term financial stability#money#personal finance management#responsible spending#student life

0 notes

Text

also don't let ur friends/society/tumblr posts/whatever convince u to start smoking or drinking or whatever if u don't want to. there are health risks there are social and financial aspects to consider and it's totally fine and normal to not want to. there's no moral aspect to it you can drink and do drugs or whatever if u want and that's chill but u should know what ur doing and do research and if u decide u dont want to that's chill and anyone who tries to shame u for it can go fuck themselves

#text#DORRY FOR ALL THE POSTING THIS MORNING this isnt even super related ifve just been thinking abt it a lot#bc the new thing is posting about how smoking is hot. Dont start smoking kids. genuinely#u r GOING to fuck up ur life and ur health and ur lungs and ur bank account probably. dont start smoking#like all jokes aside. do not. or at least know the risks and know what ur getting into#u r not immune to addiction u r not immune to health risks u r not immune to additional financial strain

4K notes

·

View notes

Text

How to Safeguard Your Organization From Social Media Threats?

Cyber-security threats: Social media is nowadays being used by hackers and other people with malicious intent to spread malware and facilitate phishing attacks. Small businesses face the highest risk of cybersecurity threats, as reports suggest that businesses that employ less than 500 employees lose close to $2.5M every time a cyber attack occurs. Businesses with social media presence face issues like phishing attacks, Malware attacks, Ransomware, and Insider attacks, which need to be avoided at all costs. Read more.

0 notes

Text

Next time we invent life changing technology we cant let capitalists get their hands on it

#thinking abt the guy who officially trademarked thw cool S#but instead of financial reasons he did it to preserve it. W move#yapping#once in a while I will remember how we could use AI and automation to reduce risk and injury in dangerous jobs#like harvesting resources. and instead its a buzzword for dumb shit like chat GPT and art theft#or how in a darker timeline insulin wasnt patented for a dollar as lifesaving medicine and we would be so fucked

103 notes

·

View notes

Note

Question. How do you think all 3 Grandma's (Grandma Draconia, Grandma Bucchi, and Grandma Felmier) would look like as a friend group. Do you think they'd make a bad ass granny group or would they just drink tea and knit?

They would be a badass granny group!!

And get into some trouble (especially if their grandchildren are involved/in danger).

At first, they wouldn't even seem harmless, I mean, they would meet up to have tea, gossip, and even share embarrassing stories about their grandchildren! The possibilities are endless and I die laughing just imagining them interacting!

Grandma Felmier and Bucchi would be the friendliest of the group... I think the only one who would be more scary would be Grandma Draconia.

#twst#twisted wonderland#ask#I think Grandma Felmier would even bring Epel's baby photos to brag about#Grandma Buchi wouldn't have so many photos due to financial reasons#and she certainly wouldn't want to risk losing the few photos she has of Ruggie#Grandma Draconia would probably take them to see the thousands of Malleus' paintings#like a museum

48 notes

·

View notes

Text

i WISH i could attach a screenshot of what I’m referring to here where kara tells you that swomp tried to teach eclaire to beatbox but the internet actively hates any image of this game existing on it and i can’t scrub through a playthrough for fear of them never encountering the dialogue and also i forgot to ask my sibling to screenshot it when we got the dialogue on xer game but it’s REAL i PROMISE

#the art gallery#going under#going under game#our drawings princess movie has been a meme as of late#you may know it as Beat Boxing Puppy or This Was A Huge Financial Risk Please Feel Free To Revisit The Movie At Least Once A Year#but anyway going under came out 3 years ago our drawings came out a couple months ago#otherwise i would’ve though going under was referencing it with the idea of eclaire beatboxing#good night now

139 notes

·

View notes

Note

Before we call anon rude because let’s see it from their perspective, imagine getting an entire feast to eat. That can be pretty hard to start with so much that’s going on, but if they start with one thing they know they’ll like (aka one character they like) that can be the start for them leaping to other characters to finish the story and the bigger story. I struggle the same way to start book series if I don’t have at least one character that drives me to read it, it’s all about what can be the hook to push them through. Sounds like the anon is neurodivergent (just a guess) so they might genuinely not see it as rude and see it as a solution to even play the game to start with.

Btw absolutely adore the game, the complex and rich characters making them all so unique is amazing. The art is so pleasing to the eyes I love it!! I’m waiting for it all to get out at once so I don’t get too impatient. Shae however interests me the most, which routes will have the most lore for them? Will there be routes that give more lore in general based on decisions you make or do they all share the same amount? (I mean general lore not just Shae lore)

Apologies; we are not trying to accuse any asker of being rude! We are simply explaining our perspective as the developers / are trying to broadly encourage folks to dip their toes into other areas of the story outside of the main route(s) they're interested in, especially considering some routes will be made available sooner than others, and these other routes will likely contain additional scenes/lore of everyone's fave(s) regardless! We want to give each main cast member an equal amount of love (and lore) regardless of their overall popularity, so our goal is not to tut-tut anyone for having strong preferences for one character over the others, but rather to explain that you may be surprised by how much *more* you learn about your preferred characters in the other routes. That's all!

For Shae... Well, they were a foot soldier for one of the worst periods of the War. Lore wise, any other story that touches on the War will likely have content relevant to them and their experiences. ^^

#ask#clotho answers#edit/final note: we got a *few* asks on this subject and will not likely answer all of them for the sake of our followers' dashboards#but we also want to note that part of our encouragements here come from the fact that Flan/Keagan are our most popular characters by a lot#and we want to do what we can to gently nudge folks who may not want to romance the fem / nb characters into checking out their stories#despite not being into them romantically. this is half of why we have platonic routes to begin with#we recognize veterans to the dating sim world may feel less inclined to romance characters that don't align with their irl orientations#this isn't a bad thing. some people steer clear of dating sims altogether because they're aro or just not interested in romance stories etc#but the unintentional side effect of this is it has a chilling effect on developers even in the indie sphere to make less diverse stories#if Flan and Keagan are our most popular characters then they will be our most *profitable* characters in the long run#and as much as we would love to not care about money and just produce the story we want to tell#we live in a society (tm) and need to eat#if at the end of ndm's development we see that 90% of our engagement went toward the boys it is hard to ignore the financial incentive#to redirect our energy toward leaning into the 'tried and true' formula that assures we can buy groceries and make rent#basically what i am candidly saying here is capitalism is pretty bad for creative liberty unless you're already rich / able to self finance#which we are not. and currently none of the core devs make *anything* from ndm#it would be nice if it does turn a profit but that isn't a guarantee - which the team has accepted as a normal risk in game development#anyway this is getting rambly but the Point is that this goes beyond us wanting to make sure all sides of our story are equally appreciated#it is *partly* that - we do want players to experience the entirety of our artwork#but it's not just for our egos - it's so we can keep making art like this#i considered including this in the body of the post but money talk suuucks man#and i don't want anyone to think we're glaring at them in a holier than thou 'ah-ha! you don't want to play maeve's route because she's a#woman!' sort of way because i think that's a reductive way to look at things#people like what they like and there's nothing intrinsically wrong with that#but if you like that we're making a diverse story#with masc routes fem routes and nb routes#even if you don't personally want to romance x or y#it would help us if y'all play the platonic routes#we are trying our very very best to make the fem/nb routes interesting for Everyone so those stories don't get sidelined#and if you don't like them for their own sake - fair enough! can't win em all and we'll deeply appreciate that you tried anyway!

26 notes

·

View notes

Text

SPC Life Sciences IPO Date, Price, Review, Company Profile, Risk, Financials 2023

New Post has been published on https://wealthview.co.in/spc-life-sciences-ipo/

SPC Life Sciences IPO Date, Price, Review, Company Profile, Risk, Financials 2023

SPC Life Sciences IPO: SPC Life Sciences Ltd. is a leading manufacturer of advanced intermediates used in critical active pharmaceutical ingredients (APIs) for therapeutic areas like cardiovascular, vasodilator, anti-psychotic, and anti-depressants. They cater to both domestic and international markets, serving renowned pharmaceutical companies.

SPC Life Sciences IPO Details:

Dates: SPC Life Sciences IPO hasn’t officially launched yet.

Offer Size: The planned offer size is around ₹300 crores (~US$36 million), comprising a fresh issue of ₹300 crores and an offer for sale (OFS) of up to 89.39 lakh equity shares.

Price Band: The price band hasn’t been announced yet.

Recent News Updates:

SEBI Approval: SPC Life Sciences received approval from the Securities and Exchange Board of India (SEBI) in March 2023 to launch the IPO. However, there haven’t been any significant updates since then.

Market Conditions: The current market scenario might impact investor sentiment towards the IPO. The global economic slowdown and ongoing geopolitical tensions have led to volatility in the stock market, which could dampen investor enthusiasm for new issuances.

Industry Growth: Despite market fluctuations, the pharmaceutical intermediates market is projected to grow steadily in the coming years, driven by factors like rising demand for generic drugs and increasing R&D in complex APIs. This could be a positive signal for SPC Life Sciences’ long-term potential.

SPC Life Sciences Company Profile:

Founded in 2006 in Vadodara, Gujarat, SPC Life Sciences has emerged as a leading manufacturer of advanced intermediates for critical Active Pharmaceutical Ingredients (APIs). Their journey can be summarized in key milestones:

2006: Established with a focus on basic and advanced intermediates for cardiovascular and vasodilator drugs.

2010: Expanded operations to include anti-psychotic and anti-depressant APIs.

2014: Achieved USFDA and EDQM certifications, opening doors to international markets.

2018: Set up a dedicated R&D facility, focusing on developing custom APIs and complex molecules.

2023: Received SEBI approval for the proposed IPO, aiming to raise capital for further expansion.

Operations and Market Position:

SPC Life Sciences operates across three state-of-the-art manufacturing facilities in India, catering to both domestic and international pharmaceutical companies. They boast a diverse product portfolio of over 150 advanced intermediates, with a strong presence in therapeutic areas like:

Cardiovascular

Vasodilator

Anti-psychotic

Anti-depressant

Anti-diabetic

Their market share in specific niche segments within these areas is noteworthy, particularly for certain complex intermediates. However, the overall market share for the entire Indian API and intermediates industry is fragmented, with a large number of players.

Key Facts:

Founded: 2006

Headquarters: Vadodara, Gujarat, India

Facilities: 3 state-of-the-art manufacturing units

Products: 150+ advanced intermediates

Therapeutic Areas: Cardiovascular, vasodilator, anti-psychotic, anti-depressant, anti-diabetic

Certifications: USFDA, EDQM

Prominent Brands, Subsidiaries, and Partnerships:

While SPC Life Sciences primarily operates under its own brand name, they also manufacture intermediates for several renowned pharmaceutical companies. They maintain strategic partnerships with leading players in the industry but currently don’t have any major subsidiaries.

Competitive Advantages and Unique Selling Proposition:

SPC Life Sciences’ competitive edge lies in:

Strong focus on niche, high-value advanced intermediates: This caters to the growing demand for complex APIs used in innovative drugs.

Commitment to quality and regulatory compliance: USFDA and EDQM certifications ensure adherence to international standards.

Experienced team and robust R&D capabilities: Their expertise in process development and optimization allows them to tailor solutions for specific customer needs.

Cost-effective production: Utilizing advanced technology and efficient processes, they offer competitive pricing.

Unique Selling Proposition: SPC Life Sciences positions itself as a reliable and innovative partner for pharmaceutical companies seeking high-quality, cost-effective advanced intermediates for complex APIs. Their focus on niche segments and commitment to R&D differentiates them in the competitive API and intermediates market.

Analyzing SPC Life Sciences’ financials in detail is currently not possible due to the lack of finalized IPO documents and audited financial statements beyond FY22. However, based on available information and preliminary reports, here’s an overview of their financial performance and future prospects:

Recent Financial Performance:

Revenue Growth: SPC Life Sciences has demonstrated consistent revenue growth, with FY22 seeing a 7% increase to Rs. 146 crore compared to Rs. 136 crore in FY21. This upward trend is expected to continue in FY23, with reports suggesting sales reaching Rs. 132.72 crore in 9MFY23.

Profitability: The company has also exhibited healthy profitability, with a 16% increase in profit before tax (PBILDT) to Rs. 25 crore in FY22 and an 18% rise in net profit to Rs. 19 crore. Their PAT margin stood at 32.59% in FY22.

Debt Levels: While the exact debt details haven’t been officially disclosed, reports suggest modest debt levels with an overall gearing ratio of 0.79 times as on March 31, 2022. The company intends to use a portion of the IPO proceeds for debt reduction, further improving its financial health.

Future Growth Prospects and Earnings Drivers:

SPC Life Sciences possesses promising potential for future growth driven by several factors:

Rising Demand for APIs and Intermediates: The global API and intermediates market is projected to grow steadily, fueled by increasing R&D in complex APIs and generic drug demand.

Strong Product Portfolio and Niche Focus: Their diverse product portfolio catering to niche, high-value advanced intermediates positions them well in this growing market segment.

Expansion Plans: The planned IPO funds will enable them to expand their manufacturing capacity, introduce new products, and strengthen R&D capabilities, boosting future growth.

Focus on Quality and Regulatory Compliance: Adherence to stringent international standards like USFDA and EDQM opens doors to global markets and attracts major pharmaceutical clients.

SPC Life Sciences IPO objectives:

Reasons for Going Public:

SPC Life Sciences plans to raise around Rs. 300 crore through its proposed IPO with two primary objectives:

Funding Expansion Plans: The company intends to utilize a major portion of the raised funds for expanding its manufacturing capacity. This includes setting up Phase-II of their Dahej facility, enabling them to introduce new product offerings and cater to the growing demand for their advanced intermediates.

Debt Reduction and Working Capital Improvement: They plan to allocate a portion of the IPO proceeds towards repaying existing debt and strengthening their working capital. This will improve their financial health and provide flexibility for future operations.

Alignment with Growth Strategy:

These objectives align well with SPC Life Sciences’ stated future growth strategy, which focuses on:

Strengthening their position in niche segments: Expanding their manufacturing capacity allows them to cater to the increasing demand for their existing high-value advanced intermediates and potentially venture into new niche segments within the API and intermediates market.

Investing in R&D: They plan to utilize a portion of the funds for R&D activities, allowing them to develop new innovative intermediates and optimize production processes, furthering their technological edge.

Improving operational efficiency: Reducing debt and bolstering working capital will enhance their financial stability and operational efficiency, making them more competitive in the market.

SPC Life Sciences IPO Risks:

Investing in any IPO involves inherent risks, and SPC Life Sciences is no exception. Before making any investment decisions, it’s crucial to consider the following potential risks and concerns.

Industry Headwinds:

The API and intermediates market is subject to various external factors beyond the company’s control, such as:

Regulatory changes: Stringent regulations and quality standards can significantly impact production costs and timelines.

Raw material availability and pricing: Fluctuations in the availability and cost of raw materials can affect profitability.

Competition: The Indian API and intermediates market is fragmented, with numerous players competing for market share. This can pressure pricing and margins.

Company-Specific Challenges:

While SPC Life Sciences boasts a strong track record, some concerns need consideration:

Limited track record as a publicly traded company: As a new entrant to the public market, there’s limited historical data for investors to analyze.

Reliance on few customers: The company derives a significant portion of its revenue from a few major customers. If any of these clients discontinue their business with SPC Life Sciences, it could negatively impact their finances.

Debt repayment: Although they plan to utilize a portion of the IPO proceeds for debt reduction, their current debt-to-equity ratio might still be a concern for some investors.

Also Read: How to Apply for an IPO?

#Allotment Details#Company Profile#Financial Performance#Financial risks#Financials#IPO#IPO analysis#IPO date#Lead Managers#UPCOMING IPO#News

0 notes

Note

do you sell your stuff at cons?

I don't unfortunately, my country has Armageddon once a year but it's money to book a table and I think my art / although enjoyed online / would be a bit too niche amongst all the pretty mainstream anime hahah

#also I kinda enjoy being the one going round and stalking others and buying their wares like a creature.#One day when it won't be a big financial risk or I have more variety I would like to give it a try :)#kittchats

87 notes

·

View notes

Text

I hate hustle culture/grindset/girlboss shit as much as the next person but being financially independent or at the very least having your own source of income is one of the most important safety measures you can take as a woman

#not dating men is another safety measure#but financial dependence on a partner of either sex is always a massive risk#and every single woman who got fucked over by it thought that it wouldn’t happen

28 notes

·

View notes

Text

Hot

and by hot I mean look at how pleasing these forearms in the sketch look :

must be the best forearms I've ever drawn.

oh and also I hate doing this but this one is on my InPrnt if you ever wish to have it in real paper and not, you know, in the fleeting form of a bunch of transistors.

#destiny#destiny 2#destiny art#destiny fanart#inprint is kinda costly so don't put yourself at financial risk!!#I really gotta talk to the local print#but that takes time#and time is not money it's sleep#my art#I really did forgot that one tag ._.

430 notes

·

View notes