#Kyc

Explore tagged Tumblr posts

Text

if you're in any line of work that involves a secure verification of someone's identity you've probably encountered the acronym "kyc". it stands for "know your customer" and it's shorthand for a range of methods that verify the person is who they say they are

it does NOT help that the word "know" is not a K-sound word so upon encountering the acronym my brain just goes "kill your customer"

112 notes

·

View notes

Text

4 notes

·

View notes

Text

KYC Solutions Provider

KYC Italy provides a KYC solution to help businesses to verify the identity of their customers. Their KYC API is easy to use and can integrate easily with any existing system. Our API helps for seamless client onboarding and secure business transactions.

2 notes

·

View notes

Text

I have an interview tomorrow and I’m shit scared.

#mine: text#bpd#college#currently watching#identity crisis#dark academia#exams#movies#job interview#finance#aml#kyc

3 notes

·

View notes

Text

Sweden's Exemplary Anti-Corruption Stand: A Deep Dive into KYC and AML Practices

In the realm of global integrity and transparency, Sweden stands tall as the paragon of virtue, earning the coveted title of the world's least corrupt country, as per the Corruption Perceptions Index (CPI). Behind this remarkable achievement lies Sweden's unwavering commitment to combat corruption through robust Anti-Money Laundering (AML) laws, particularly focusing on stringent Know Your Customer (KYC) protocols. These protocols require financial institutions to verify the identity of their customers and any transactions they make. Furthermore, Sweden has implemented measures to protect whistleblowers and to ensure that any instances of corruption are investigated and prosecuted.

The Pillars of Trust: KYC in Sweden

Sweden's success in maintaining its reputation for integrity is deeply rooted in its proactive approach to KYC. The KYC process, an integral part of financial and business operations, plays a pivotal role in preventing corruption and money laundering by ensuring thorough identification and verification of customers. Sweden has invested heavily in its KYC system, building a comprehensive database of customer information. It has also implemented strict regulations requiring companies to report suspicious activity to the government. As a result, Sweden has become a world leader in the fight against financial crime.

KYC Solutions: More than a Mandate

KYC in Sweden goes beyond mere compliance; it serves as a comprehensive solution to safeguard the financial ecosystem. The emphasis on accurate customer identification, risk assessment, and ongoing monitoring establishes a formidable defense against illicit financial activities. Sweden's KYC system also promotes customer trust and increases customer convenience. By streamlining the onboarding process, customers can easily open an account and start trading. Additionally, the KYC system provides customers with better control over their money, as they can easily monitor their account activity.

Compliance at the Core

Sweden's commitment to compliance is evident in its KYC practices. Striking a delicate balance between stringent regulations and practical implementation, the country has fostered an environment where businesses operate with transparency and adhere to the highest ethical standards. Sweden's KYC regulations are designed to prevent money laundering and financial crime. The country has put in place a comprehensive set of measures, including customer due diligence, to ensure that businesses comply with the law. Additionally, Sweden has implemented a reporting system that allows authorities to track suspicious activity in real time.

AML Laws in Sweden: A Global Benchmark

Sweden's AML laws are not just a legal requirement but a testament to its commitment to global financial integrity. The country's legal framework provides a solid foundation for detecting and preventing money laundering activities, contributing significantly to its stellar position on the CPI. Sweden also has a strong commitment to international cooperation and information sharing, which helps to further strengthen the AML legal framework. Additionally, the country has implemented strict regulations on financial institutions, including requirements to report suspicious transactions.

KYC Service Providers – KYC Sweden Leading the Way

Sweden has emerged as a frontrunner in KYC solutions, with a focus on providing efficient and reliable services. KYC service providers in Sweden leverage advanced technologies and methodologies to offer the best-in-class identification and verification processes, setting the gold standard for global counterparts. Swedish KYC providers also provide the highest level of security, protecting customer data and complying with all local regulations. Furthermore, Swedish KYC providers offer a wide range of services, including onboarding, identity verification, and fraud prevention.

KYC for Swedish Businesses: A Necessity, not an Option

For businesses operating in Sweden, KYC is not merely a regulatory checkbox but a fundamental practice. The stringent KYC requirements ensure that businesses are well-acquainted with their clients, mitigating the risk of involvement in any illicit or corrupt activities. It also helps to protect the rights of customers, as it ensures that they are aware of who is handling their data. KYC also helps businesses to identify any potential risks associated with doing business with a particular customer.

Global Impact: KYC Sweden's Ripple Effect

Sweden's commitment to KYC and AML has a ripple effect beyond its borders. Businesses operating globally, including Swedish enterprises with international footprints, benefit from the robust KYC measures in place. This not only safeguards these businesses but also contributes to the overall global effort against corruption. As a result, other countries and organizations are encouraged to implement strong KYC and AML measures, which help to create a safer business environment for everyone. Additionally, these measures help to protect consumers from malicious actors and financial crimes.

Conclusion

Sweden's standing as the world's least corrupt country is a testament to its meticulous implementation of KYC and AML laws. By placing compliance, integrity, and transparency at the forefront of its financial practices, Sweden has set a precedent for nations worldwide. As businesses and governments grapple with the challenges of maintaining trust and financial integrity, KYC Sweden's model of KYC and AML serves as an exemplary beacon guiding the way forward. The integration of KYC solutions is not just a legal requirement for Sweden; it is a proactive strategy that continues to fortify its position as a global leader in the fight against corruption.

#compliance#kyc#kyc compliance#kyc solutions#kyc and aml compliance#kyc api#kyc services#kyc verification#digital identity#kyc sweden

2 notes

·

View notes

Text

Discover a new era of banking possibilities with Simplici

Simplify and elevate your banking operations with Simplici’s cutting-edge solutions. Our transformative technologies empower banks to stay ahead of the competition, deliver seamless experiences, and drive customer loyalty.

2 notes

·

View notes

Text

Confused About Your PF? FundWise Has Got You Covered!

Having trouble withdrawing your PF, transferring accounts, or completing KYC? You are not the only one, and definitely not alone - FundWise is here to help.

Our FAQ is designed for your most common questions about:

🔸 PF claim rejections - see why you were rejected and what you can do about it.

🔸 PF withdraw - what you should do, when and who qualifies, and the documents required

🔸 PF transfers - move your PF while changing jobs, without the usual confusion.

🔸 KYC related issues - correct your incorrectly matched data or any absence of data that can hold up your benefits.

With our expert assistance, you are getting more than answers, you are getting practical solutions. We not only explain your issue but we facilitate getting it all resolved properly and quickly.

📍 Whether you are a first-time user or stuck in an angry thread, come to FundWise for easy user guidance and reliable outcomes.

Your PF journey begins now. Ask. Learn. Move forward.

#FundWise#ProvidentFundHelp#PFWithdrawal#KYC#FinancialPlanning#TaxHelp#PFTransfer#FAQSupport#EPFO#FundwiseExperts

0 notes

Text

Complete Your KYC and Earn Instant Rewards!

Maya stared at her phone screen, hesitating over the “Complete KYC Verification” button. She’d been putting it off for weeks, dreading the tedious process of uploading documents and waiting for approval. The new trading platform seemed promising, but the verification requirements felt like a barrier she wasn’t ready to tackle. “Just get it over with,” she muttered, finally tapping the…

0 notes

Photo

RFP Template for the Supply and Implementation of a Know Your Customer (KYC) System https://fintechrfps.com/product/rfp-template-for-the-supply-and-implementation-of-a-know-your-customer-kyc-system/?utm_source=tumblr&utm_medium=social&utm_campaign=fintechrfps

0 notes

Text

KYC Deadline Approaching? Here's the Fastest New Way to Comply

Big KYC update relief! RBI now allows Business Correspondents (BCs) to update KYC for bank accounts, making the process faster and more accessible. Learn how this change benefits you, which banks are participating, and step-by-step guidelines to complete your KYC hassle-free. Stay compliant with RBI’s simplified KYC norms—act now! The Reserve Bank of India (RBI) has introduced groundbreaking…

0 notes

Text

How to Do DIR-3 KYC Filing Online in India – Easy Guide

Are you a company director in India? Then buckle up, because DIR-3 KYC Filing Online and DIR-3 KYC Filing are not optional—they're mandatory! Whether you're a first-time director or a seasoned entrepreneur, ensuring your DIN is active through annual KYC filing is crucial to maintaining your role legally and professionally.

0 notes

Text

Blanqueo de Capitales: Un Análisis Completo desde la Perspectiva Penal y Administrativa en España

Sure, I can help you with that. Here’s a draft article about money laundering for your law firm’s website, gatellasociados.com, designed to be easy to understand and comprehensive, covering both criminal and administrative aspects, Spanish legislation, real-world examples, KYC mechanisms, and international norms. Blanqueo de Capitales: Un Análisis Completo desde la Perspectiva Penal y…

0 notes

Text

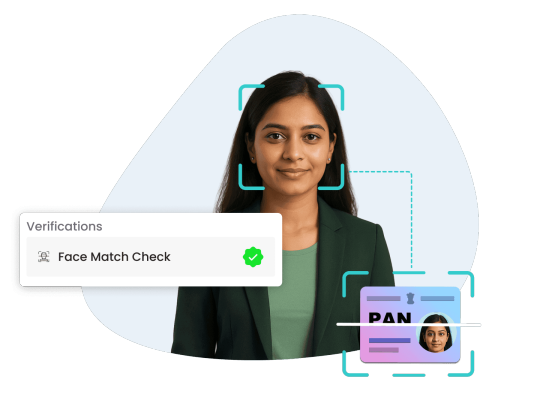

Face Match: The Future of Identity Verification Is Here

In today’s fast-paced digital world, verifying a person’s identity quickly and securely is more critical than ever. Whether it’s onboarding a new employee, authenticating a user during KYC, or reducing fraud in digital services, identity verification must be accurate, fast, and reliable. This is where face match technology steps in as a transformative solution.

Face match, also known as facial recognition or face verification, refers to the process of comparing a live image of a person's face with the photo on their official ID to verify if they are the same person. OnGrid’s Face Match Check enhances this process by not only ensuring visual similarity but also detecting real-time presence through advanced liveness detection.

How Does OnGrid’s Face Match Check Work?

OnGrid’s Face Match Check is powered by advanced AI algorithms that compare the user's live selfie or video with their ID document photo. Here’s how it simplifies and strengthens the verification process:

Face Comparison: Matches facial features between a live image and the ID photo with high accuracy.

Liveness Detection: Ensures that the person is physically present and not using a static image, video spoof, or mask.

Real-time Results: Verification is completed instantly, enabling seamless onboarding or access control.

Scalable Integration: The service can be easily embedded into web or mobile platforms via API.

Why Businesses Are Adopting Face Match Verification

Face match technology has rapidly gained adoption across sectors like BFSI, HR tech, gig platforms, healthcare, and edtech. Here’s why:

Improved Security: It eliminates impersonation, identity theft, and document tampering by relying on real-time biometric verification.

Faster Onboarding: With instant facial recognition, users don’t need to visit physical offices or submit paperwork—everything happens online.

Regulatory Compliance: It supports compliance with KYC/AML regulations by verifying identities accurately and audibly.

User Convenience: A selfie is all it takes to verify identity—making the process user-friendly and contactless.

Use Cases of Face Match in Real Life

Digital KYC: Verifying users in financial services, lending platforms, or wallets.

Employment Verification: Ensuring that candidates' identities match submitted ID documents during background checks.

Gig Economy: Quickly verifying freelancers or delivery personnel without in-person interaction.

Access Control: Granting entry to physical or digital spaces only after identity is confirmed.

Why Choose OnGrid for Face Match Verification?

OnGrid brings its credibility as a trusted background verification and digital identity service provider in India. Its Face Match Check is:

Accurate: Built on strong AI and ML models trained on diverse datasets.

Secure: End-to-end encrypted with data privacy compliance.

Customizable: API-first design that integrates seamlessly into your workflow.

Conclusion

Face match technology isn’t just a digital convenience—it’s a necessity in a world where trust and verification go hand in hand. With OnGrid’s Face Match Check, organizations can make identity verification smarter, faster, and more secure.

#FaceMatch#IdentityVerification#DigitalOnboarding#LivenessDetection#KYC#FacialRecognition#OnGrid#SecureVerification#DigitalIdentity#BackgroundVerification#RealTimeVerification#ContactlessVerification#FaceMatchTechnology#AIinKYC#VerificationSolutions

0 notes

Text

Leading Background Screening Solutions by Top Background Verification Companies

In today’s fast-paced corporate environment, ensuring the authenticity of candidates and vendors is no longer optional—it’s essential. That’s where professional background screening steps in. As one of the trusted background verification companies, Netrika delivers precise and comprehensive screening solutions tailored to your business needs.

We specialize in a full suite of background checks, including employment verification, criminal history, education validation, reference checks, and more. Our rigorous processes help organizations mitigate risks, comply with regulations, and build trustworthy teams and partnerships. Whether you're hiring for a startup or scaling a global enterprise, our checks are conducted with speed, accuracy, and confidentiality.

With headquarters in India and operations across borders, Netrika is known for its cutting-edge tools, experienced investigators, and commitment to quality. Choose a background screening partner that understands your industry’s unique challenges—choose Netrika.

For more detail please visit on Netrika Consulting India

To Contact Us Click Here…

1800 121 300000

#BackgroundScreening#BackgroundVerificationCompanies#EmploymentVerification#Netrika#RiskManagement#HiringSolutions#PreEmploymentScreening#IndiaBackgroundCheck#CorporateSecurity#WorkforceVerification#EmployeeScreening#TrustedVerification#KYC#DueDiligenceIndia#ComplianceReady

0 notes

Text

Five Tips for Enhancing Your KYC Compliance and AML Procedures

In today's rapidly evolving regulatory landscape, maintaining robust Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance processes is more crucial than ever for businesses. These processes go beyond mere regulatory requirements; they form the cornerstone of secure operations, global expansion, customer trust, and data-driven insights. In this article, we'll delve into five essential tips to optimize your KYC processes and ensure AML compliance.

Understanding KYC and AML Compliance

KYC, short for Know Your Customer, refers to the practice of verifying and assessing the identities and risk levels of your customers. This procedure is vital for adhering to regulatory mandates and mitigating risks associated with financial crimes like money laundering and fraud. KYC plays a pivotal role in maintaining a secure business environment and building trust with clients.

Non-compliance with KYC regulations can lead to severe repercussions such as hefty fines, legal actions, reputational damage, and business disruptions. Therefore, adhering to KYC regulations is not just a necessity; it's a protective measure for your business.

1. Screening Against Current Lists

Efficient KYC begins with screening customers against relevant, up-to-date lists. Utilizing comprehensive KYC solutions equipped with advanced technology and access to databases containing sanction lists, politically exposed persons (PEPs) databases, and other watchlists enhances the accuracy of your screening processes.

By incorporating these KYC screening tools, you minimize risks and ensure compliance while reducing false positives, which ultimately saves valuable time and resources.

2. Integration with Risk Assessment

Integrating KYC into your broader risk assessment framework is crucial for maintaining an effective process. Customer information can change rapidly, necessitating continuous monitoring. Regularly reviewing and updating KYC data enables you to adapt to shifting risk profiles and make informed decisions.

Furthermore, integrating KYC data into your risk assessment facilitates a seamless link to ongoing due diligence processes. For instance, if a customer's risk profile changes due to a new business venture, you can proactively adjust your risk mitigation strategies.

3. Establishing Scalability

Keeping up with new clients and evolving compliance requirements requires a flexible and scalable KYC process. Onboarding new clients, regardless of their type, should be a consistent and streamlined process rather than a burden.

Investing in a scalable KYC solution capable of handling increasing data volumes and simplifying onboarding processes is key. Such a solution enables instant screening and efficient onboarding, allowing you to focus on growth without hindrances.

4. Preparing for Regulatory Challenges

The landscape of AML and KYC compliance is continually evolving, with regulators worldwide tightening their grip on financial institutions. Preparing for these challenges by embracing technology-driven KYC solutions can lead to automation, enhanced accuracy, and improved customer experiences.

Automated KYC solutions provide the means to avoid the hefty fines and regulatory scrutiny associated with non-compliance. Staying ahead of regulatory changes through technology-driven approaches is a strategic move for safeguarding your business.

5. Seeking Expert Assistance

In the face of complex regulatory requirements and the ever-changing landscape of AML and KYC compliance, seeking expert assistance can prove invaluable. Companies like KYC Sweden offer AML platforms that seamlessly integrate KYC responses with transaction monitoring.

This integration allows for quick identification of unusual transaction behavior, reducing the risk of being unwittingly involved in money laundering or terrorist financing. Outsourcing transaction monitoring to experts through a Managed Service can streamline your compliance efforts.

In conclusion, optimizing your KYC and AML processes is not only about regulatory compliance but also about safeguarding your business and fostering trust with clients. By following these five tips, incorporating technology-driven solutions, and staying prepared for regulatory changes, you can streamline your KYC and AML compliance, ensuring a secure and successful business journey.

Is your business prepared for the potential consequences of regulatory audits? Have you integrated transaction monitoring with your KYC processes? If you seek further guidance on these crucial matters, don't hesitate to contact us at KYC Sweden.

#kyc sweden#kyc#kyc solutions#kyc services#kyc verification#kyc api#kyc compliance#kyc and aml compliance#compliance#digital identity#digital world

2 notes

·

View notes

Text

2 notes

·

View notes