#M2M SIM providers

Explore tagged Tumblr posts

Text

#M2M SIM card#Best M2M SIM card#M2M SIM card selection guide#Choose M2M SIM card#M2M SIM providers#Legacy IoT

0 notes

Text

Xtreme Sims is a leading B2B provider of SIM card and connectivity solutions for businesses worldwide. We specialize in delivering bulk SIM cards, global data services, and custom connectivity plans for IoT, M2M, asset tracking, smart devices, and more. Our goal is to help businesses stay connected with reliable, flexible, and cost-effective mobile solutions. With a strong focus on service, scalability, and global reach, Xtreme Sims is your trusted partner for all your SIM and data needs.

#sim#reseller#my sims#sim card#the sims community#global#business#travel#international sim#global sim#travel sim#esim travel#buy esim#esim technology#international esim#esim

3 notes

·

View notes

Text

Travel eSIM Market Global Outlook and Forecast 2024-2030

Travel eSIM Market Size, Share 2025

Industry Overview:

A travel eSIM is an electronic SIM card designed for use during international travel. It allows you to connect to local mobile networks without the need for a physical SIM card.

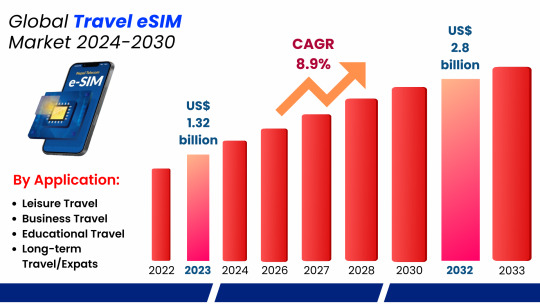

The global Travel eSIM market has shown significant growth over the past few years, with the market valued at approximately US$ 1.32 billion in 2024. This growth is set to continue, with projections indicating that the market will reach a value of US$ 2.8 billion by 2032, reflecting a Compound Annual Growth Rate (CAGR) of 8.9% from 2024 to 2032. The expanding market is driven by several factors, including the rising demand for seamless connectivity, increasing adoption of IoT devices, and the growing number of eSIM-enabled devices.

The eSIM (Embedded Subscriber Identity Module) market is revolutionising mobile connectivity by substituting a more adaptable and digital SIM card for conventional physical SIM cards. This technology is especially helpful for travellers, IoT devices, and organisations that need multi-network connectivity because it enables users to swap carriers remotely without having to change SIM cards. The business is anticipated to grow quickly as eSIM adoption rises, propelled by smartphone manufacturers, IoT applications, and linked autos. Telecom companies, device producers, and software vendors are important participants in ensuring a safe and smooth digital experience. Although there are still issues with international standardisation and compatibility, the eSIM business has a lot of room to development.

Industry Analysis by Segments

Consumer eSim to hold the highest market share: by type

In terms of type the global travel eSim industry has been segmented as Consumer eSim and Machine to Machine eSim.

The consumer eSIM category holds a dominant market share of 60-65% due to its incorporation into popular consumer devices such as wearables, tablets, and smartphones. The integration of eSIM technology into flagship products by major tech companies including as Apple, Samsung, and Google has greatly increased customer adoption.

The flexibility and ease of use that eSIMs provide have contributed significantly to this expansion. For those who travel frequently or require access to different networks, eSIMs are perfect as they enable carrier switching without the need to physically replace the card, in contrast to standard SIM cards. Users no longer need to visit a physical store to complete the activation process because they can connect to a network digitally instantaneously. To further improve the user experience, eSIMs also support dual-SIM capabilities, which enables users to manage their personal and work numbers on the same device. Demand is anticipated to be driven by the increasing number of eSIM-compatible handsets on the market as well as rising consumer knowledge of its benefits. The use of eSIM technology will probably pick up speed as 5G networks spread and consumers demand more dependable, quicker connectivity, thereby consolidating its dominance in the consumer electronics industry.

Further, the Machine-to-Machine (M2M) eSIMs hold a 35-40% share of the market. These eSIMs are critical in the growing IoT sector, where they enable devices to communicate with each other without human intervention. Their use is expanding in industries such as automotive, logistics, and smart cities.

Smart phone to hold the highest market share: by Application

With 50–55% of the market share, smartphones are the most popular application category in the eSIM industry. The increasing number of smartphones with eSIM support as a result of big manufacturers like Apple, Google, and Samsung including the technology into their most recent models is what is driving this domination. The ease that eSIMs provide—especially for travelers—is a major factor propelling this market's expansion. Since eSIMs eliminate the need to swap out traditional SIM cards, they are the perfect option for frequent travellers who need to access various networks in different areas. Customers find it more appealing when they can handle various profiles or providers on a single device rather than having to carry around multiple SIM cards.

Regional Analysis:

In terms of region the global travel eSim has been segmented as North America, Europe, Asia Pacific, Middle East and Africa and South America.

Leading the global Travel eSIM market, Europe holds a 35-40% market share. The region's advanced mobile infrastructure, high adoption of eSIM-enabled devices, and favourable regulatory environment contribute to its dominance. The travel eSIM market in Europe is quickly becoming one of the most competitive and dynamic areas in the world. Europe is a centre for the adoption of cutting-edge digital solutions like eSIMs because of its high volume of international travel, advancements in technology, and supportive regulatory environments. More and more European travellers are searching for flexible, affordable mobile connectivity options that let them stay connected without having to deal with the inconveniences of traditional SIM cards or exorbitant roaming fees. The growing consumer demand for digital-first solutions and the wide availability of eSIM-compatible products, such as wearables and smartphones, are further factors driving the need for the eSIM era.

The increasing international travel across Europe further accelerating the travel eSim market in the region, In comparison with the previous year, there were more foreign visitors arriving in Europe in 2024. In 2024, the number of inbound arrivals was approximately 708 million, which was less than in 2019. This was despite a notable annual growth.

The European Travel Commission (ETC) has published its most recent "European Tourism Trends & Prospects," which states that as of 2024, the sector is stronger than ever. Overnight stays have climbed by 7%, while the number of foreign visitors has increased by 6% from 2019.

End Use Industry Impact Analysis:

The rapid expansion of the global tour eSIM market is being driven by the rise in global tour, the development of the mobile technology, and the increasing demand for digital solutions that provide seamless connectivity.

A primary factor propelling the growth of the Asia tour eSIM market is the substantial growth of both international and intraregional travels. It is anticipated that the number of international visitor arrivals (IVAs) to Asia Pacific will rise from 619 million in 2024 to 762 million in 2026, representing a recovery rate of 111.6% in comparison to the level of 2019. By 2026, visitor arrivals in Asia are expected to reach 564.0 million, followed by those in the Americas (167.7 million) and the Pacific (30.4 million).

Saudi Arabia alone welcomed over 100 million tourists, marking a 56% increase from 2019 and a 12% rise from 2022. Furthermore more the World Travel & Tourism Council (WTTC) reported that in 2024, tourism contributed AED 220 billion to the UAE’s GDP, a figure expected to increase to AED 236 billion in 2024

According to the World Travel & Tourism Council’s (WTTC) latest Economic Impact Report (EIR), reveals the North America Travel & Tourism sector is projected to grow at an average annual rate of 3.9% over the next decade, outstripping the 2% growth rate for the regional economy and reaching an impressive $3.1 trillion in 2032.

According to the international Trade Association, International travel plays a critical role in the US economy. Prior to the COVID-19 pandemic, in 2019, international visitors spent $233.5 billion experiencing the United States; injecting nearly $640 million a day into the U.S. economy

Competitive Analysis:

Some of the key Players operating within the industry includes:

Airalo

Holafly

MAYAMOBILE

BNESIM

Dent Wirelss

Keepgo

Nomad

Sim Options

Surfroam

Airhub

TravelSim

ETravelSIM

Ubigi

Numero eSIM

Total Market By Segment:

By Type:

Consumer eSIM

M2M eSIM (Machine to Machine)

By Application:

Leisure Travel

Business Travel

Educational Travel

Short-term/Temporary Stay

Long-term Travel/Expats

By Connectivity Type:

Standalone eSIM

eSIM with Roaming

Regional eSIM

Global eSIM

By End User:

Individuals

Enterprises

Telecom Operators

Travel Agencies

By Service Offerings

Data Services

Voice Services

SMS Services

Region Covered:

North America

EuropeAsia Pacific

Middle East and Africa

South Africa

Report Coverage:

Industry Trends

SWOT Analysis

PESTEL Analysis

Porter’s Five Forces Analysis

Market Competition by Manufacturers

Production by Region

Consumption by Region

Key Companies Profiled

Marketing Channel, Distributors and Customers

Market Dynamics

Production and Supply Forecast

Consumption and Demand Forecast

Research Findings and Conclusion

Combined Plans:

There are several distinct players in the highly competitive travel eSIM market, including tech companies, eSIM providers, and mobile network carriers. Important rivals are well-known telecom giants, which use their extensive international networks and strong brand names to sell travel eSIM plans directly to customers. Specialised eSIM providers like Airalo, GigSky, and Ubigi, on the other hand, are becoming more and more popular by providing flexible data packages and multi-country plans as well as affordable, customised travel eSIM solutions that are specifically designed for travellers from outside.

Tech companies like Apple and Google also influence the competitive landscape by integrating eSIM technology into their smartphones, enabling direct access to eSIM services through their app ecosystems. This has created opportunities for third-party eSIM service providers to partner with these tech firms, enhancing their global reach.

Key industry Trends:

Integration with IoT and Connected Device:

The Internet of Things (IoT) and linked devices are integrating eSIM generation, which is greatly expanding its use cases and marketability. As the Internet of Things continues to expand, eSIMs are finding their way into a wider range of electronics than just smartphones, such as wearable’s, connected motors, and smart home appliances. There are various benefits to this integration:

Wearables: Wearables, such as fitness trackers and smart watches, can maintain independent connectivity without relying on a paired phone because of eSIMs. Customers can now benefit from instantaneous message delivery, phone calls, and mobile data access via their wearable device, enhancing functionality and user experience.

Connected Cars: eSIMs in the automotive industry enable smooth connectivity for linked automobiles, providing features like real-time navigation, remote diagnostics, and infotainment services. The incorporation of eSIMs into cars facilitates updates via the air, enhances safety features, and offers improved connectivity for telematics and navigation applications.

Smart Home products: Home automation controllers, security systems, and thermostats are examples of smart home products that are incorporating the eSIM era. Through this connection, devices can communicate with one other and with customers anywhere in the world with consistent and dependable connectivity.

The expansion of eSIM technology into these diverse applications enhances its utility and opens up new market opportunities. For device manufacturers, integrating eSIMs simplifies design and manufacturing processes by eliminating the need for physical SIM card slots, leading to more compact and robust devices. Additionally, eSIMs support global connectivity, allowing devices to operate seamlessly across different regions without the need for multiple SIM cards.

Industry Driving Factor:

Rising Demand for Flexible and Convenient Connectivity Solutions:

Due to the increasing demand for seamless communication and connectivity when on the go, consumers are placing an increasing emphasis on the flexibility and convenience of their connectivity solutions. This trend is particularly noticeable among travellers, who are searching for solutions to make staying connected in unusual locales easier. These demands are met by ESIM technology, which gives traditional SIM cards a more adaptable and user-friendly option. eSIMs, as opposed to physical SIM cards, eliminate the need for physical swaps and let users activate and manage their mobile subscriptions online. With this method, travellers will no longer need to buy and insert several SIM cards or put up with the hassle of switching SIM cards when travelling to different countries. Alternatively, they could easily switch between plans or businesses right from their device, usually through a mobile app. One further factor driving the growing demand for eSIMs is their capacity to support many profiles on a single eSIM. This feature enables users to manage private plans for personal and business use or seamlessly transition between local and international plans. This flexibility now ensures continuous connectivity and helps users avoid paying exorbitant roaming fees in addition to improving comfort. The popularity of eSIM technology is continuing to rise as more customers look for solutions that fit their busy lifestyles and travel habits. This indicates a larger trend towards more flexible, virtual, and hassle-free connectivity options.

Industry Restraining Factor:

Device compatibility is one of the major challenges facing the eSIM business. Although the eSIM technology is increasingly being included into more modern wearable, and smartphones, many older or even less advanced devices do not support eSIM functionality. Due to the fact that a significant section of the customer base still uses devices that require physical SIM cards, this issue limits the market penetration of travel eSIMs. The switch to eSIMs isn't always possible for clients with mismatched equipment, which is likely to cause annoyance and reduce the potential customer base for travel eSIM providers. The challenge of device compatibility is made more difficult by the slow rate of update or modification of older devices. The adoption of eSIM generation may be slow in many places, especially where clients are more price-sensitive or where older devices are still in widespread use. Travel eSIM providers face a challenge as a result of this delayed adoption rate because they must serve a wide range of target customers with different levels of technological proficiency.

Report Scope:

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides break down details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by types, applications, Connectivity type, end use and Service Offerings. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.Report AttributesReport DetailsReport TitleTravel eSIM Market Global Outlook and Forecast 2024-2030Historical Year2018 to 2022 (Data from 2010 can be provided as per availability)Base Year2024Forecast Year2032Number of Pages107 PagesCustomization AvailableYes, the report can be customized as per your need.

1 note

·

View note

Text

Best Global Telecommunications Services for Businesses in 2024

As the world becomes increasingly connected, businesses rely on robust telecommunications services for seamless global communication. In 2024, the best telecom services offer a mix of advanced technology, competitive pricing, and scalable solutions. Here’s a look at the top services businesses should consider:

1. International Voice Termination Services

Why It Matters: Clear and reliable international calls ensure smooth business operations across borders.

Top Features:

A-Z Voice Termination Coverage

Low Latency and High Call Quality

Competitive Call Termination Rates

Recommended Providers:

Saif Telecommunications (Fast-growing provider in the international voice industry)

BICS (Global IP voice solutions)

Tata Communications

2. SMS Aggregation and Termination Services

Why It Matters: SMS remains one of the most effective communication channels for businesses.

Top Features:

Global SMS Termination Coverage

High Delivery Rates & Low Latency

Fraud Protection and Real-Time Monitoring

Recommended Providers:

Saif Telecommunications (Experts in wholesale SMS aggregation)

Twilio (Global cloud communication platform)

Infobip (Enterprise messaging solutions)

3. Business Internet & Connectivity Services

Why It Matters: A reliable internet connection ensures uninterrupted operations, especially for cloud-based services.

Top Features:

MPLS & SD-WAN for Secure Connectivity

High-Speed Fiber Internet

24/7 Technical Support

Recommended Providers:

AT&T Business

Vodafone Global Enterprise

CenturyLink (Lumen Technologies)

4. Unified Communications as a Service (UCaaS)

Why It Matters: UCaaS integrates calling, messaging, and video conferencing into one platform.

Top Features:

VoIP, Video Calls, and Chat

Cloud-Based Access Anywhere

Multi-Device Support

Recommended Providers:

Microsoft Teams (Business Collaboration)

RingCentral (Cloud-based communication)

Zoom (Enterprise-grade communication tools)

5. IoT & M2M Communication Services

Why It Matters: IoT enables real-time data exchange for industries like logistics, healthcare, and manufacturing.

Top Features:

Global SIM Cards

Secure IoT Platforms

Scalable Data Plans

Recommended Providers:

Vodafone IoT

Verizon Business

Orange Business Services

6. Fraud Prevention & Security Services

Why It Matters: Telecom fraud can disrupt business operations and cause financial loss.

Top Features:

Real-Time Fraud Detection

AI-Based Monitoring Systems

Automated Fraud Alerts

Recommended Providers:

Saif Telecommunications (Telecom fraud prevention services)

Amdocs (Revenue and fraud management)

Syniverse (Secure data exchange services)

7. Cloud Contact Center Solutions

Why It Matters: Cloud-based call centers improve customer experience with AI-driven automation and analytics.

Top Features:

Intelligent Call Routing

Multichannel Support (Voice, Chat, Social Media)

CRM Integration

Recommended Providers:

Amazon Connect

Genesys Cloud CX

Cisco Webex Contact Center

Final Thoughts

Selecting the right telecommunications services is essential for businesses aiming for global reach and operational efficiency. With companies like Saif Telecommunications leading in international voice and SMS aggregation, businesses can rely on scalable, secure, and high-quality telecom services in 2024.

leading in international voice and SMS aggregation, businesses can rely on scalable, secure, and high-quality telecom services in 2024.

#telecom#telecommunications#telecommunication#telecommunication global#telecommunication worldwide#telecomindustry#telecommunication services#communication#voip

0 notes

Text

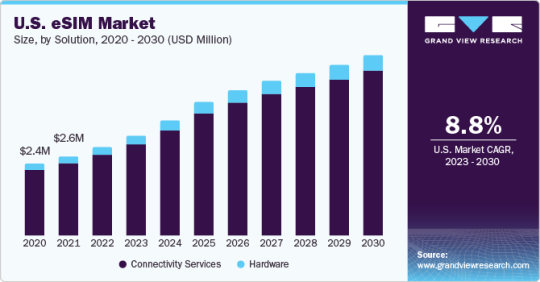

eSIM Market Product Analysis, Share by Types and Region till 2030

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Gather more insights about the market drivers, restrains and growth of the Global eSIM Market

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Browse through Grand View Research's Communication Services Industry Research Reports.

Open RAN Market: The global open RAN market size was estimated at USD 4.51 billion in 2024 and is projected to grow at a CAGR of 25.6% from 2025 to 2030.

Broadcasting And Cable TV Market: The global broadcasting and cable TV market size was estimated at USD 356.45 billion in 2024, registering a CAGR of 4.0% from 2025 to 2030.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIM Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

Smartphones

Tablets

Smartwatches

Laptop

Others

M2M

Automotive

Smart Meter

Logistics

Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Australia

South Korea

Latin America

Brazil

Mexico

Middle East and Africa

Saudi Arabia

South Africa

UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

0 notes

Text

eSIM Market 2030: Trends, Opportunities, Challenges & Leading Key Players Review

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Gather more insights about the market drivers, restrains and growth of the Global eSIM Market

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Browse through Grand View Research's Communication Services Industry Research Reports.

Open RAN Market: The global open RAN market size was estimated at USD 4.51 billion in 2024 and is projected to grow at a CAGR of 25.6% from 2025 to 2030.

Broadcasting And Cable TV Market: The global broadcasting and cable TV market size was estimated at USD 356.45 billion in 2024, registering a CAGR of 4.0% from 2025 to 2030.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIM Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

Smartphones

Tablets

Smartwatches

Laptop

Others

M2M

Automotive

Smart Meter

Logistics

Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Australia

South Korea

Latin America

Brazil

Mexico

Middle East and Africa

Saudi Arabia

South Africa

UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

0 notes

Text

Future of the eSIM Market: How It’s Revolutionizing the Telecom Industry

The global eSIM market was valued at USD 8.07 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. This market growth is primarily driven by the increasing adoption of Internet of Things (IoT)-connected devices, particularly in machine-to-machine (M2M) applications and consumer electronics. One of the key trends contributing to this growth is the rising frequency of eSIM profile downloads across consumer devices. As more and more devices become eSIM-enabled, the market continues to accelerate.

According to Mobilise, the number of eSIM-enabled devices reached 1.2 billion in 2021, and this number is expected to increase significantly to 3.4 billion by 2025, reflecting the growing integration of eSIM technology across a wide range of devices.

A significant factor in the expansion of the eSIM market is its adoption within the automobile industry. The integration of eSIM technology into vehicles has introduced remarkable flexibility in offering cellular connectivity to cars and trucks. This shift is unlocking new capabilities and features for connected vehicles. In the coming years, it is expected that all cars will be equipped with cellular connectivity, improving the driving experience through innovative linked services. Recently, the automotive industry has made a significant advancement by implementing the GSMA-embedded SIM specification. This development is set to enhance vehicle connectivity and improve the security of various connected services, further enabling the next generation of connected and smarter automobiles.

Gather more insights about the market drivers, restrains and growth of the eSIM Market

Regional Insights

North America

North America led the eSIM market in 2022, accounting for the largest revenue share of 39.1%. The region is also expected to grow at the fastest compound annual growth rate (CAGR) of 8.7% during the forecast period. This growth is primarily driven by the strong presence of network providers and the rapid pace of technological advancements within the region. North America benefits from its advanced infrastructure, robust digital ecosystem, and the increasing adoption of IoT devices, all of which support the continued growth of eSIM technology.

Europe

Europe is also projected to experience significant growth over the forecast period. European companies have historically been early adopters of new technologies, and the region is home to many key market players, including Giesecke+Devrient Mobile Security GmbH, NXP Semiconductors N.V., and STMicroelectronics, among others. Additionally, Europe is witnessing a rising demand for smart connected devices and connected vehicles, particularly with the growing adoption of eSIM-enabled smartphones, smart cars, and other IoT devices. These factors position Europe to maintain a strong market presence alongside North America during the forecast period.

Asia Pacific

Asia Pacific is expected to see substantial growth as well, fueled by the increasing number of eSIM-enabled devices, particularly in the smartphone market. Major smartphone manufacturers such as Huawei and Samsung Electronics have already introduced eSIM-enabled devices, which are driving the momentum for eSIM adoption across the region. This shift is positioning eSIM as the future mainstream SIM technology for connected devices. Additionally, several original equipment manufacturers (OEMs) in countries like China and India are developing eSIM solutions, collaborating across the ecosystem to create innovative development paths. For example, in June 2021, IDEMIA, a leading eSIM manufacturer, expanded its production capacity in India, aiming to boost global eSIM production. According to Giesecke+Devrient (G&D), a German digital solutions provider, it is projected that 25-30% of smartphones will have eSIM capabilities by 2024.

Browse through Grand View Research's Communication Services Industry Research Reports.

• The global web real-time communication market size was valued at USD 8.71 billion in 2024 and is projected to grow at a CAGR of 45.7% from 2025 to 2030.

• The global near field communication market size was valued at USD 30.85 billion in 2024 and is projected to grow at a CAGR of 12.3% from 2025 to 2030.

Key Companies & Market Share Insights

Industry players in the eSIM market are actively pursuing strategies like product launches, acquisitions, and collaborations to expand their global presence and enhance market competitiveness. For example, in September 2022, BICS, a digital communications services and IoT company, partnered with Thales, a global technology provider, to streamline the integration of eSIM for the Internet of Things (IoT). This strategic collaboration aims to build an open ecosystem for eSIM technology within the IoT sector, allowing for easier integration and more efficient deployment of eSIM solutions across various industries. The collaboration is designed to enhance connectivity and operational efficiency, which could lead to more widespread adoption of eSIM technology.

As the eSIM market grows, competition is expected to intensify, with companies focused on developing advanced, cost-effective solutions. The ability of eSIM technology to simplify the process of switching between mobile network operators is expected to drive heightened competition among service providers. The growing ease with which consumers can change operators is likely to encourage more switching, leading to a more competitive landscape in the telecommunications sector.

For instance, in September 2021, Deutsche Telekom AG announced the launch of an in-car 5G and personal eSIM networking service in partnership with Bayerische Motoren Werke AG (BMW). The collaboration utilized personal eSIM technology and MobilityConnect to link the vehicle's connectivity with the customer’s mobile network on a 5G basis, enabling a more integrated and seamless experience for connected car users. This innovative solution highlights how companies are leveraging eSIM technology to enhance connectivity and create new value-added services in the automotive sector.

The following are some of the major participants in the global eSIM market

• Arm Limited

• Deutsche Telekom AG

• Giesecke+Devrient GmbH

• Thales

• Infineon Technologies AG

• KORE Wireless

• NXP Semiconductors

• Sierra Wireless

• STMicroelectronics

• Workz

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

0 notes

Text

ESIM Imaging Market Size, Status and Forecast 2030

eSIM Industry Overview

The global eSIM market size was valued at USD 8.07 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. The market growth is driven by the rising adoption of IoT-connected devices in M2M applications and consumer electronics. There is an upsurge in the number of times eSIM profiles were downloaded across consumer devices. The eSIM market is propelling due to the rise in the adoption of eSIM-connected devices. According to Mobilise, in 2021, there were 1.2 billion eSIM-enabled devices, with the number expected to climb to 3.4 billion by 2025.

Gather more insights about the market drivers, restrains and growth of the eSIM Market

The introduction of eSIM in the automobile industry has provided tremendous flexibility in providing cellular connectivity to trucks and cars while unlocking new capabilities and features. It is expected that within the next several years, all cars will be cellular enabled, resulting in a better driving experience facilitated by novel linked services. Recently, the automotive industry took a giant step toward enabling the next generation of connected automobiles by implementing the GSMA-embedded SIM specification to strengthen vehicle connectivity. It is intended to improve security for various connected services.

The eSIM-enabled solutions offer automatic interoperability across numerous SIM operators, connection platforms, and remote SIM profile provisioning. With multiple network service providers involved in the operating chain, maintaining the security of these systems has grown complicated. Mobile Network Operators' (MNOs') credentials are collected and kept by the eSIM in the device's inbuilt software, making them vulnerable to security breaches. Furthermore, the operation of eSIM across numerous physical platforms and MNOs exposes it to several virtual environment concerns. As a result, the operational flexibility provided by eSIM may be rendered ineffective if security is breached, impeding market expansion.

Industry 4.0 is a technological breakthrough that has introduced smart machinery with automatic communication and control. Industry 4.0 refers to a networked environment in which actionable data and information are transferred between Machine to Machine (M2M) and Machine to Other (M2O) devices via the Internet of Things (IoT). Wi-Fi, sensors, RFID (radio frequency administrations), and autonomous computing software are all used in M2M systems to analyze data and send it over a network for further processing. M2M systems frequently rely on public and cellular networks for internet access. These factors enabled the integration of electronic manufacturers with eSIM (embedded SIM cards) into M2M systems, thereby contributing to market expansion. By enabling M2M communication, eSIM technology has enabled advancements in the connected ecosystem.

The increasing penetration of smartphones across countries such as China, India, Japan, and the U.S. is further anticipated to fuel market growth. Smartphone manufacturers such as Google, Samsung Electronics Co., Apple, Inc., and Motorola Mobility LLC, Ltd. have started implementing eSIM technology into their smartphones in alliance with several network service providers. For instance, Apple, Inc. has partnered with six service providers, Ubigi, MTX Connect, Soracom Mobile, GigSky, Redtea Mobile, and Truphone, to offer eSIM service. Smartphone and consumer electronics manufacturers' increasing adoption of eSIM to provide an enhanced and secure user experience is expected to bolster market growth.

Browse through Grand View Research's Communication Services Industry Research Reports.

• The global speech analytics market was valued at USD 2.82 billion in 2023 and is projected to grow at a CAGR of 15.7% from 2024 to 2030. Advancements in omnichannel integration capabilities fuel the market's growth.

• The global commerce cloud market size was estimated at USD 17.78 billion in 2023 and is expected to grow at a CAGR of 22.8% from 2024 to 2030. The market is experiencing robust growth driven by several key factors.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030) • Hardware • Connectivity services

eSIMc Application Outlook (Revenue in USD Million, 2017 - 2030) • Consumer Electronics o Smartphones o Tablets o Smartwatches o Laptop o Others • M2M o Automotive o Smart Meter o Logistics o Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030) • North America o U.S. o Canada • Europe o UK o Germany o France • Asia Pacific o China o Japan o India o Australia o South Korea • Latin America o Brazil o Mexico • Middle East and Africa o Saudi Arabia o South Africa o UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

Key Companies profiled: • Arm Limited • Deutsche Telekom AG • Giesecke+Devrient GmbH • Thales • Infineon Technologies AG • KORE Wireless • NXP Semiconductors • Sierra Wireless • STMicroelectronics • Workz

Recent Developments

• In May 2023, Lonestar Cell MTN, a South African conglomerate, introduced eSIM technology in Liberia. This advancement allows subscribers to switch to eSIM-compatible devices without the hassle of removing physical SIM cards. Customers can scan a QR code provided at any Lonestar Cell MTN service center.

• In March 2023, Gcore, a public cloud and content delivery network company, launched its Zero-Trust 5G eSIM Cloud platform. This platform offers organizations across the globe a secure and dependable high-speed networking solution. By utilizing Gcore's software-defined eSIM, companies can establish secure connections to remote devices, corporate resources, or Gcore's cloud platform through regional 5G carriers.

• In February 2023, Amdocs, a software company, collaborated with Drei Austria to introduce a groundbreaking eSIM solution. This collaboration enables Drei Austria's customers to access the advantages of digital eSIM technology through a fully app-based experience. The innovative "up" app offers a seamless and entirely digital SIM journey powered by Amdocs' eSIM technology at Drei Austria.

• In December 2022, Grover, a subscription-based electronics rental platform, joined forces with Gigs, a telecom-as-a-service platform, to introduce Grover Connect, its very own mobile virtual network operator (MVNO), in the U.S. Through Grover Connect, customers in the U.S. can effortlessly activate any eSIM-enabled technology device, eliminating the complexities associated with carrier offers and contracts that may not align with their device rental duration.

• In October 2022, Bharti Airtel, a telecommunications service provider based in India, unveiled its "Always On" IoT connectivity solutions. This offering enables seamless connectivity for IoT devices across multiple Mobile Network Operators (MNOs) through an embedded SIM (eSIM) technology. Particularly beneficial for vehicle tracking providers, auto manufacturers, and scenarios where equipment operates in remote areas, requiring uninterrupted and widespread connectivity.

0 notes

Text

eSIM Market Size To Reach USD 15,464.0 Million By 2030

eSIM Market Growth & Trends

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/esim-market

Industry 4.0 is a technological breakthrough that has introduced smart machinery with automatic communication and control. Industry 4.0 refers to a networked environment in which actionable data and information are transferred between Machine to Machine (M2M) and Machine to Other (M2O) devices via the Internet of Things (IoT). Wi-Fi, sensors, RFID (radio frequency administrations), and autonomous computing software are all used in M2M systems to analyze data and send it over a network for further processing. M2M systems frequently rely on public and cellular networks for internet access. These factors enabled the integration of electronic manufacturers with eSIM (embedded SIM cards) into M2M systems, thereby contributing to market expansion. By enabling M2M communication, eSIM technology has enabled advancements in the connected ecosystem.

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Regional Insights

North America dominated the market and accounted for the largest revenue share of 39.1% in 2022. and is expected to grow at the fastest CAGR of 8.7% over the forecast period. The growth is due to the network providers' high presence and the region's fastest technological advancements. The growth is due to the network providers' high presence and the region's fastest technological advancements.

Europe is expected to grow significantly during the forecast period. European companies are the early adopters of the latest technologies. At the same time, the regions are headquarters to several prominent market players, such as Giesecke+Devrient Mobile Security GmbH, NXP Semiconductors N.V., STMicroelectronics, and others. These areas also witness the rising adoption of smart connected devices and cars. Due to all these factors, these two regions are expected to maintain their lead during the forecast period.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIMc Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

M2M

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

Europe

Asia Pacific

Latin America

Middle East and Africa

List of Key Players in eSIM Market

Arm Limited

Deutsche Telekom AG

Giesecke+Devrient GmbH

Thales

Infineon Technologies AG

KORE Wireless

NXP Semiconductors

Sierra Wireless

STMicroelectronics

Workz

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/esim-market

0 notes

Text

Smart Card Market : Analysis of Upcoming Trends and Current Growth

The Smart card market size is projected to reach USD 16.9 billion by 2026, from USD 13.9 billion in 2021; growing at a compound annual growth rate (CAGR) of 4.0% during the forecast period.

Major drivers for the growth of the smart card market are surged demand for contactless card (tap-and-pay) payments amid COVID-19, proliferation of smart cards in healthcare, transportation, and BFSI verticals; increased penetration of smart cards in access control and personal identification applications; and easy access to e-government services and risen demand for online shopping and banking.

Download PDF: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=285

By Vertical segment, the smart card market share for telecommunications segment held the largest share of the market A subscriber identity module (SIM) card is a type of microcontroller-based smart card used in mobile phones and other devices. A SIM identifies and authenticates a subscriber to a wireless cell phone network. The telecommunications segment accounted for the maximum share of 42% of the smart card market in 2020. Expanding global mobile network and improvements in its infrastructure are boosting the growth of the market. In addition, COVID-19 led to an increased demand for connectivity. The current crisis provided a push to the trend of digitalization of business and private communication with cellular technology, along with the generalization of digital conferences. Moreover, the penetration of high-end SIM card technologies, such as LTE, 5G, M2M, eSIM, and SWP, is expected to augment the market growth in the coming years.

By Interface, contactless segment of smart card market is projected to account for largest size of the market during the forecast period A contactless smart card includes an embedded smart card secure microcontroller or equivalent intelligence, internal memory, and a small antenna; it communicates with readers through a contactless radio frequency (RF) interface. Radio-frequency identification (RFID) or near-field communication (NFC) communication technologies are primarily used for contactless smart card applications. COVID-19 is positively impacting the contactless smart card industry growth as the World Health Organization (WHO) and governments across the world are advocating the use of contactless smart cards for various purposes to ensure social distancing to contain the spread of the virus. Contactless smart cards provide ease, speed, and convenience to users. The contactless interface has become highly relevant in the current COVID-19 situation, especially for payment applications, as it facilitates safe and secure transactions without physical contact.

By Region, smart card market in APAC estimated to account for the largest size of the market. Smart card market statistics in Asia Pacific (APAC) is the largest market during forecast period. The robust financial system that is being increasingly digitized and government agencies incorporating smart chip-based systems for better monitoring of processes are propelling several APAC countries to adopt smart card solutions owing to increasing demand, specifically in the transportation, BFSI, retail, government, and healthcare sectors. Smart cards are used to purchase tickets in metros, buses, and ferries, among others, in several countries in APAC. China is projected to witness the highest demand for smart cards in the region owing to a large consumer base and the presence of a number of smart card manufacturers.

Properly implemented smart cards in all sectors have proven highly effective in combating thefts and fraud. Government projects, such as the Aadhar card in India, drive the demand for smart cards for use in a number of sectors. Moreover, security concerns, particularly within the public sphere, are also expected to fuel the growth of the market in APAC.

Top Smart Card Companies - Key Market Players Thales Group (France), IDEMIA (France), Giesecke + Devrient GmBH (Germany), CPI Card Group (US), HID Global Corporation (US), Watchdata (China), Eastcompeace (China), Inteligensa (US), ABCorp (US), and CardLogix (US) are a few major smart card companies in the market.

0 notes

Text

MVNO Market Set to Soar: Estimated Worth of $81.42 Billion in 2024, Projected to Reach $167.7 Billion by 2034

The MVNO market is expected to be worth US$ 81.42 billion in 2024. The industry is anticipated to reach a valuation of US$ 167.7 billion by 2034, rising at a CAGR of 7.5% over the forecast period. The mobile virtual network operator industry is expanding globally due to the rising demand for personalized mobile services and competitive regulations. The rise in the Internet of Things applications with technological developments is also contributing to the market’s growth.

Mobile virtual network operators cater to new and existing clients by targeting a certain demographic, selling, and branding their wireless services separately. Cloud-based solutions, virtual conventions, and the shift by organizations toward remote work increase collaboration and connectivity, driving demand for network brands and cellular plans that facilitate secure data management and remote operation.

The MVNO market is expected to grow over the forecast period due to the rising demand for services such as cloud computing, mobile money, and machine-to-machine (M2M) transactions. The adoption of e-SIM is anticipated to expand the reach of the MVNO market. The e-SIM provides MVNO vendors with convenience and flexibility through the remote provisioning standards developed by the GSMA.

Request a Sample of this Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-14659

“The telecommunication industry is evolving, leading to a rise in niche markets and innovative business models. This trend is expected to expand the mobile virtual network operator (MVNO) sector, with partnerships between MVNOs and carriers becoming more common. Technological advancements and regulatory changes are further diversifying the market, presenting opportunities for innovation and growth,” says an analyst at FMI.

Key Takeaways from the MVNO Market

The United States MVNO industry is projected to experience a sluggish CAGR of 4.4% through 2034.

Germany’s mobile virtual network operator market is expected to demonstrate a rapid CAGR of 7.0% through 2034.

The Japanese mobile virtual network operator market is anticipated to witness a promising CAGR of 8.7% through 2034.

Australia’s market showcases an impressive CAGR of 11.0% through 2034.

China’s MVNO market is expected to display a CAGR of 8.0% through 2034.

Competitive Landscape of the MVNO Market

The expansion of the MVNO market is due to the rise in innovative business models and the evolving mobile industry. With the growing demand for adaptable and personalized mobile services, partnerships between MVNOs and established carriers are likely to become more prevalent.

As 5G and other technological advancements continue to develop, generating new avenues for MVNOs to provide improved and unique services. Furthermore, regulatory changes may also impact the dynamics of the sector, promoting market expansion and competition. The MVNO market is well-positioned to continue changing and diversifying in response to changing customer needs and market trends. There are many ventures for innovation and growth in the MVNO industry.

Request for Methodology: https://www.futuremarketinsights.com/request-report-methodology/rep-gb-14659

Key Segments

By Type:

Firstly, Business

Secondly, Discount

Next, M2M

Additionally, Media

Moreover, Migrant

Furthermore, Retail

In addition, Roaming

Lastly, Telecom

By Operational Model:

On the other hand, Brand Reseller

Conversely, Service Provider

Meanwhile, Full MVNO

By Subscribers:

To begin with, Business

In contrast, Consumer

By Region:

Primarily, North America

Subsequently, Europe

Likewise, Asia Pacific

Consequently, Middle East and Africa (MEA)

Lastly, South America

0 notes

Text

What is a receive sms modem ?

A receive SMS modem is a specialized device that enables you to receive SMS messages on a computer or directly into your application. It essentially bridges the gap between a cellular network and your computer system, functioning like a cellular phone that can only receive SMS messages.

How Does it Work?

These modems typically come in two forms:

Hardware Modem: This is a physical unit that connects to your computer through a USB port, serial port, or ethernet. It houses a SIM card similar to a cellphone, allowing it to connect to a cellular network and receive SMS messages.

Software Modem: This is a program installed on your computer and functions by connecting to a cloud-based SMS gateway service. These services provide a virtual SMS modem that can receive messages.

Once connected and configured, the modem constantly monitors the cellular network for incoming SMS messages. When a message arrives, the modem translates it from cellular format into a readable text format and delivers it to your computer or application.

Applications for Receive SMS Modems

Receive SMS modems serve a variety of purposes, including:

Two-Factor Authentication (2FA): When you log in to an account that uses 2FA, a one-time passcode is sent via SMS to your phone for verification. A receive SMS modem can be used to capture this code and integrate it into your login process.

Machine-to-Machine (M2M) Communication: Devices can be programmed to send SMS alerts or data to a receive SMS modem for processing and further actions within your application.

SMS Alerts: Businesses can use receive SMS modems to capture incoming alerts from sensors, security systems, or other devices that communicate via SMS.

Data Collection: Researchers or marketing teams can leverage receive SMS modems to gather data points or responses sent via SMS for analysis.

Benefits of Receive SMS Modems

Enhanced Security: By receiving SMS verification codes directly, you can strengthen the security of your accounts and applications.

Improved Efficiency: Automate processes that rely on SMS communication, eliminating manual data entry and streamlining workflows.

Reliable Data Capture: Ensure important SMS alerts or data from devices are captured and integrated into your systems for timely action.

Cost-Effective Solution: Receive SMS modems can be a relatively inexpensive way to add SMS receiving functionality to your applications.

#sms modem#sms marketing#ejointech#sms#ejoin sms#receive sms modem#receive sms online#sms gateway hardware

0 notes

Text

eSIM Market to Witness Phenomenal Growth |

According to HTF Market Intelligence, theGlobal eSIM market to witness a CAGR of 8.79% during forecast period of 2024-2030. by Application (Connected Cars, Laptops, M2M, Smartphone, Tablets, Wearables, Others) by Type (Consumer Device, Smartphone, Tablates, Others) and by Geography (North America, South America, Europe, Asia Pacific, MEA). The eSIM market size is estimated to increase by USD Billion at a CAGR of 8.79% from 2024 to 2030.. Currently, market value is pegged at USD 10.843 Billion.

Get Detailed TOC and Overview of Report @

An embedded SIM (eSIM) is a SIM card embedded into a device, such as a smartphone or a smartwatch. Unlike traditional SIM cards, which are physical, eSIMs can be reprogrammed and activated remotely, allowing users to switch between mobile networks without needing to physically change SIM cards.

Some of the key players profiled in the study are ARM Holdings (United Kingdom), Deutsche Telekom AG (Germany), Giesecke+Devrient Mobile Security GmbH (Germany), Gemalto NV (Netherlands), Infineon Technologies AG (Germany), KORE Wireless Group (United States), NXP Semiconductors N.V. (Netherlands), Sierra Wireless (Canada), STMicroelectronics (Switzerland), Workz Group (UAE), IDEMIA (France)..

Book Latest Edition of Global eSIM Market Study @ https://www.htfmarketintelligence.com/buy-now?format=1&report=2193

About Us:

HTF Market Intelligence is a leading market research company providing end-to-end syndicated and custom market reports, consulting services, and insightful information across the globe. HTF MI integrates History, Trends, and Forecasts to identify the highest value opportunities, cope with the most critical business challenges and transform the businesses. Analysts at HTF MI focuses on comprehending the unique needs of each client to deliver insights that are most suited to his particular requirements.

Contact Us:

Craig Francis (PR & Marketing Manager) HTF Market Intelligence Consulting Private Limited Phone: +15075562445 [email protected]

0 notes

Text

M2M SIM Cards: Pioneering Seamless Machine-to-Machine Communication

Machine-to-Machine (M2M) communication is revolutionizing the way devices and systems interact with one another. At the heart of this transformative technology are M2M SIM cards, essential components that enable seamless and efficient communication between machines. In this article, we explore the world of M2M SIM cards, their features, applications, and their crucial role in advancing connectivity.

Unveiling M2M SIM Cards

Machine-to-Machine Subscriber Identity Module (M2M SIM) cards are specialized cards designed to facilitate communication between devices without human intervention. Unlike conventional SIM cards, M2M SIM cards cater to the unique requirements of M2M applications, focusing on data exchange and seamless connectivity. These SIM cards allow devices to connect to cellular networks and transfer data, enabling real-time monitoring and control.

M2M SIM cards come in various form factors, including traditional mini, micro, and nano SIMs, as well as embedded SIMs (eSIMs), providing flexibility to accommodate different types of devices.

Key Features of M2M SIM Cards

1. Robust Security:

Security is a paramount concern in M2M communication. M2M SIM cards are equipped with advanced security features, including encryption and authentication protocols, to ensure the integrity and confidentiality of data transmitted between devices.

2. Low Power Consumption:

Efficiency is a hallmark of M2M SIM cards. These SIM cards are designed to minimize power consumption during data transmission, making them suitable for devices operating on battery power or in remote areas.

3. Global Connectivity:

M2M SIM cards offer global coverage, allowing devices to connect to cellular networks across different regions and countries. This ensures that devices can operate and communicate seamlessly regardless of their location.

4. Scalability:

M2M SIM cards are highly scalable, capable of accommodating a large number of devices and data traffic. This scalability is essential as M2M applications expand and encompass a growing network of devices.

5. Customized Data Plans:

M2M SIM cards come with customized data plans tailored to the specific needs of M2M applications. These plans are often cost-effective and based on the volume of data transmitted, ensuring optimal utilization and cost-efficiency.

Applications of M2M SIM Cards

M2M SIM cards find applications across a diverse range of industries, facilitating seamless communication and integration between machines. Here are a few notable applications:

1. Fleet Management:

In the transportation sector, M2M SIM cards are crucial for fleet management. They enable real-time tracking, monitoring, and management of vehicles, optimizing routes, fuel consumption, and overall logistics.

2. Healthcare Monitoring:

In the healthcare industry, M2M SIM cards enable remote patient monitoring. Medical devices equipped with M2M SIM cards transmit critical health data securely, allowing healthcare professionals to monitor patients' health status and provide timely care.

3. Smart Grids:

M2M SIM cards are instrumental in creating smart grids in the energy sector. They facilitate communication between utility meters and central management systems, enabling efficient energy distribution and consumption.

4. Retail and Vending Machines:

M2M SIM cards power communication between vending machines and inventory management systems. This connectivity enables real-time monitoring of product levels, restocking alerts, and efficient supply chain management.

The Future of M2M SIM Cards

As technology continues to advance, M2M SIM cards will evolve to meet the increasing demands of interconnected devices. With the ongoing rollout of 5G networks and the emergence of edge computing, M2M SIM cards will play a pivotal role in shaping the future of communication. Enhanced data speeds, reduced latency, and expanded coverage will drive the growth of M2M communication, underpinned by the capabilities of M2M SIM cards.

In conclusion, M2M SIM cards are vital components of the M2M communication ecosystem, enabling secure, efficient, and scalable connectivity. Their specialized features and adaptability make them essential for innovation across various industries. As we embrace the era of interconnected devices, the role of M2M SIM cards in powering this future is undeniable.

0 notes

Text

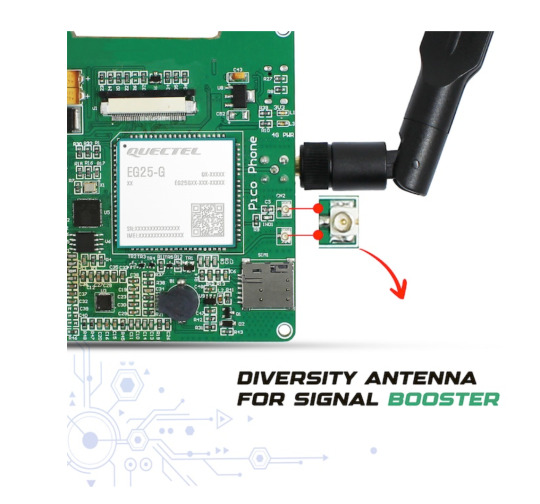

Raspberry Pi RP2040 MCU featuring the Quectel EG25-G 4G LTE cellular module in PicoCell 4g

Introducing the revolutionary PicoCell 4G device, powered by the Raspberry Pi RP2040 MCU and featuring the Quectel EG25-G 4G LTE cellular module. In today’s world, where connectivity and innovation are key, this cutting-edge technology seamlessly combines the power of the RP2040 chip with the connectivity prowess of the Quectel EG25-G 4G LTE module. The PicoCell 4G is not your ordinary device; it transcends boundaries and redefines the way we connect, create, and communicate.

With its Multi-Constellation GNSS support, the PicoCell 4G can quickly and accurately determine your location, regardless of where you are. It acts like a bridge connecting people worldwide with call and messaging coverage that knows no borders. The EG25-G variant is like a world traveller, supporting a wide range of LTE FDD and TDD frequencies, UMTS options, and GSM. In simple terms, it keeps you connected no matter where you go. Are you seeking a dependable and swift wireless connection while on the move? Consider the PicoCell 4G as your solution. This adaptable device functions not only as a communication tool but also as a high-speed data server that supports technical features such as HTTP and TCP/IP. With the convenience of its dongle feature, you can enjoy lightning-fast LTE speeds of up to 150Mbps (DL) and 50Mbps (UL) while on the go. Essentially, it’s like having your high-speed internet connection that can be easily carried in your pocket. Perfect for the Tech-Enthusiast Attention tech enthusiasts!

The PicoCell 4G is specifically designed for M2M and IoT applications and acts like a superhero for connected devices, guaranteeing their optimal performance. It comes with a diverse antenna that provides a strong signal even in challenging situations. You can customize it to meet your specific needs with additional GPIO options. It is also energy-efficient, ensuring that it won’t run out of power when you need it the most. Furthermore, it features a status LED that offers real-time updates on network and satellite connections, making it easy to stay informed. It supports Quectel Enhanced AT Commands, which makes controlling your devices a breeze, ensuring that everything is effortless. Hello, the PicoCell 4G is a powerful device that caters to M2M and IoT applications with its exceptional features. It is powered by the plate number 1 chip with a 32-bit dual ARM Cortex-M0+ microcontroller and 8MB flash, and equipped with the Quectel EG25-G 4G LTE cellular module, supporting nano SIM cards. The device features dual Type C interfaces for programming and accessing the 4G module, a 3.2” Touch Display with a resolution of 320x240 pixels, driven by the plate number 2 Display Driver and plate number 3 capacitive touch controller. It comes in a range of vibrant RGB colours and offers additional GPIO options for peripheral connections. Furthermore, the device includes boot buttons for Pico, a power button for manually turning the 4G module on/off, an onboard microSD card for data logging, a battery connector with a charging circuit for portable use, a 3.5mm Audio Jack for headphones, and even includes speaker support for attaching a speaker. Additionally, the device provides indicator LEDs for board supply, module power, network status, and system status. The PicoCell 4G is an exceptional device optimized for M2M and IoT applications. It offers worldwide coverage and supports MIMO and DFOTA. With a multi-constellation GNSS receiver, you can track precise locations with ease. The 4G module supports various network bands and different speech codec modes. It has low power consumption for efficient operation and delivers LTE Max. 150Mbps DL/50Mbps UL data speeds. The PicoCell 4G is a game-changer that’s here to redefine the way we connect and create. Check out the Product Page and join the journey to experience connectivity without limits.

TO KNOW MORE : bit.ly/3RalKua

#PicoCell4G#WirelessWonder#ConnectAnywhere#MiniCellTower#CellularFreedom#PocketPower#4GOnTheGo#SignalSaver#StayConnected#MobileNetworkBoost

0 notes

Text

BLIIoT 4G Ethernet SMS RTU Smart Water Gateway S475 Applied to Sewage Monitoring

BLIIoT 4G Ethernet SMS RTU Smart Water Gateway S475 provides 8 digital inputs, 6 analog(ultra high 24 bit resolution) or PT100 Resistance Temperature Detector (RTD) inputs, 4 relay outputs, 1 ambient sensor input for monitoring onsite temperature and humidity, 1 Ethernet RJ45 port for connect internet WAN or LAN, supports dual nano sim card, with 2 RS485 serial port, supports 224 mapping registers via Modbus RTU protocol. It can monitoring and operates the I/O ports by SMS, APP, Web Server, internet, timers and programmed inter-lock events automatically.

0 notes