#Merchant Service Provider

Explore tagged Tumblr posts

Text

Who Provides Merchant Accounts?

#Who Provides Merchant Accounts?#merchant account#merchant account providers#merchant services#merchant accounts#merchant account pricing#merchant account fees#merchant account rates#merchant service provider#high risk merchant accounts#merchant services sales#merchant account processing#what is a merchant account#merchant account provider#high-risk merchant account providers#merchant#frozen merchant account#the best high-risk merchant account providers#timeshare merchant accounts

1 note

·

View note

Note

i've seen you posting about cohost and i've been poking around and i've seen some references to making payments to support the site. do you know if those payments are mandatory for all users, or if they're similar to tumblr's current style of optionally paying for additional services/merch or opt-in monthly payments?

It's completely non-mandatory, & very similar to what Tumblr is currently doing. Cohost is fully free to sign up & use, and currently the people behind it are very firm on the position of all base site features being free forever. Optionally, a Cohost Plus subscription is 5$ a month/50$ a year, which gives you a higher image upload size limit and some exclusive subscriber emojis, there's also some other silly & cosmetic stuff planned for the future. Nothing vital. They also sell some merch through the anti-software software club website.

#*guy who knows weirdly too much about merchant services providers voice* also it looks like they run their payments through Stripe#which is very upstanding of them imo. and inspires confidence.

10 notes

·

View notes

Text

#Echeck#Electronic Check#Merchant Services#Payment Processing#Merchant Account#Payment Processing Companies#Payment gateway providers#Best Merchant Services#High Risk Merchant Account#Echeck Account#Echeck Payment Processor#Echeck Payment#Echeck Payment Processing#Electronic Check Payment#what is an echeck#Check 21#echeck casino#e commerce payment processing

3 notes

·

View notes

Text

#merchant payment gateway#payment gateway#payment gateway integration#payment gateway service provider

0 notes

Text

iSmart Payments team member Greg teaching the staff at Davenport Foundation Repair about our PayAnywhere PAX A77 mobile payment terminals. Now they can take customer payment wherever the foundation repair job is.

#payments#smallbusiness#construction#business#mobilepayments#cardmachine#credit card processing#merchant services#accept credit card payments#payment solutions#payment service providers

1 note

·

View note

Text

#merchant bank account open in uk#merchant bank account for ecommerce business#best merchant account for small business uk#best merchant bank account uk#merchant account services provider

0 notes

Text

Grow Your Business With American Credit Card Processing Solutions

Do you need reliable credit card processing for your business? American Merchant Provider offers tailored solutions with fast approval, competitive rates, and secure transactions. Using their American credit card processing solutions, you can accept all major credit cards, enhance customer experience, and increase sales. Take your business to the next level with trusted services that prioritize your growth. Contact American Merchant Provider to learn more about their customizable processing solutions and start growing your business today!

0 notes

Text

How Can You Select an Effective Ecommerce Service Provider in 2024?

With so many service providers available today, selecting the appropriate ecommerce provider for your online business is of vital importance for its success, as there are various factors to take into consideration when searching for an ideal service provider.

Factors to Consider

Reputation and Experience

A reliable and experienced ecommerce service provider will likely offer high-quality services that match up well with your business needs. Look for providers with proven success serving businesses similar to your own.

Range of Services Offered

Explore Your Needs Assess your requirements to make sure the service provider offers a full suite of services, such as website development, hosting, payment processing, inventory management and marketing tools.

Examine Pricing Structure

Prioritize services that fit within your budget and business goals by reviewing the pricing structures of different providers. Keep an eye out for hidden fees or long-term costs associated with using them while keeping in mind any long-term costs related to using them.

Customer Support and Communication

Effective customer communication and responsive support services are crucial in quickly resolving issues or addressing concerns quickly. Make sure the service provider you select offers exceptional support through various channels.

Security and Compliance

Compliance with industry regulations is of utmost importance in online commerce. When selecting your service provider, make sure they employ robust security measures that comply with data protection laws.

Scalability and Flexibility

Your business requirements may change over time, so choose a service provider with solutions that are flexible enough to adapt to any changes in requirements without incurring significant disruptions.

Researching Ecommerce Service Providers

Read online reviews and testimonials to gauge client satisfaction levels of service providers.

Case Studies and Success Stories

Review case studies and success stories to gain an understanding of how the service provider has assisted other businesses to meet their goals and overcome any challenges that have been presented to them.

Industry Recommendations and Awards

Be wary of service providers that lack recommendations from industry leaders or have yet to earn awards or accolades for excellence in ecommerce services.

Making Your Decision

Compare Options. In order to narrow your options down further, compare key features, pricing structures and reputation of various service providers before making your final selection.

Request Proposals and Demos

Request proposals and demos from shortlisted service providers to gain insight into their offerings and capabilities.

Evaluating Contracts and SLAs

Review all contracts and service level agreements (SLAs) to ensure they cover every aspect of service offered as well as provide sufficient protection to your business.

Begin By Gathering References

Reach out to existing clients of the service provider to obtain feedback and insights from them.

Conclusion

Selecting the ideal ecommerce service provider requires careful research, consideration of various factors and careful assessment of options. By adhering to these steps and taking time for informed decision-making, you can find a partner to support your ecommerce endeavors and drive success in 2024.

FAQ's

Q: How important is it to choose the right ecommerce service provider?

The importance of choosing the correct ecommerce service provider is critical to the success of your online business - as it directly impacts website performance, security, and customer experience.

Q: What factors should be taken into account when assessing an ecommerce service provider?

These include reputation, experience, services offered, pricing structure, customer support services, security measures and scalability of solutions.

Q: How can I research eCommerce service providers efficiently?

It is to effectively research ecommerce service providers, read reviews online and testimonials provided, evaluate case studies and success stories, as well as seek recommendations from industry experts before asking providers for proposals and demos.

Q: What should I consider when selecting an ecommerce service provider with an SLA agreement?

A: An SLA should outline all services and responsibilities clearly, from uptime guarantees and response times for support requests to data security measures and dispute resolution procedures.

Q: How can I ensure a seamless transition when switching ecommerce service providers?

To ensure a successful transition, communication between your current provider and a new one must remain open, key data must be backed up securely, team training on the new platform must take place seamlessly, and any issues regarding migration must be identified quickly and addressed as quickly as possible.

0 notes

Text

Offshore Company Registrations with Bank Account?

In today's globalized economy, businesses are increasingly looking beyond domestic borders to "optimize their operations", reduce costs, and gain access to international markets. One strategy that has gained popularity among entrepreneurs and investors is the establishment of offshore companies. In this comprehensive guide, we'll explore the concept of "offshore company registrations", their benefits, considerations, and the process of setting up an offshore company with a bank account.

Understanding Offshore Companies

Definition and characteristics of offshore companies

"Offshore companies are entities registered" in a jurisdiction different from where they conduct their primary business activities or where their owners reside. These companies often enjoy favorable tax treatment, regulatory advantages, and enhanced privacy compared to domestic entities.

Reasons why businesses choose to register offshore Businesses may opt for "offshore company registrations" for various reasons, including tax optimization, asset protection, confidentiality, access to global markets, and simplified regulatory requirements.

Legal and financial implications of offshore company registration While offshore companies offer several benefits, they also come with legal and financial considerations. It's crucial to understand the regulatory environment, tax implications, and compliance requirements associated with offshore operations.

Benefits of Offshore Company Registrations

Tax advantages Offshore companies often benefit from low or zero corporate tax rates, allowing businesses to minimize their tax liabilities and retain more profits.

Asset protection By holding assets offshore, businesses can shield them from potential legal claims, creditors, or other financial risks.

Privacy and confidentiality Offshore jurisdictions typically offer strict confidentiality laws, ensuring the privacy of company ownership and financial information.

Access to global markets Offshore companies can facilitate international trade and investment by providing a platform to conduct business across borders more efficiently.

Simplified regulatory requirements Some offshore jurisdictions have lenient regulatory frameworks, reducing administrative burdens and compliance costs for businesses.

Considerations Before Registering an Offshore Company

Jurisdiction selection Choosing the right jurisdiction is critical, as it determines the regulatory environment, tax implications, and overall suitability for the business's objectives.

Legal requirements and regulations Businesses must comply with the legal and regulatory requirements of both the offshore jurisdiction and their home country to avoid legal issues and potential penalties.

Banking and financial considerations Access to banking services is essential for offshore companies. However, some jurisdictions may have restrictions or challenges in opening and maintaining bank accounts.

Costs involved in setting up and maintaining an offshore company While "offshore company registrations" offer potential cost savings, businesses should consider the upfront and ongoing expenses associated with incorporation, administration, and compliance.

Risks and challenges associated with offshore operations Offshore companies may face risks such as regulatory changes, political instability, reputational damage, and increased scrutiny from tax authorities.

Steps to Register an Offshore Company with Bank Account

Conducting thorough research Before proceeding with offshore company registration, businesses should conduct comprehensive research on potential jurisdictions, legal requirements, and service providers.

Choosing the right jurisdiction Selecting a jurisdiction that aligns with the business's objectives, preferences, and industry requirements is crucial for successful offshore operations.

Hiring professional services Engaging legal, financial, and other professional services is advisable to navigate the complexities of "offshore company registrations" and ensure compliance with relevant laws and regulations.

Preparing and submitting necessary documents Businesses must gather and submit the required documents, such as identification proofs, business plans, and incorporation forms, to the offshore jurisdiction's authorities.

Opening a bank account for the offshore company Securing banking services is an integral part of "offshore company registrations in UK". Businesses should approach reputable banks in the chosen jurisdiction and fulfill their account opening requirements.

Compliance with ongoing regulatory requirements Once the "offshore company" is registered and the bank account is opened, it's essential to maintain compliance with ongoing regulatory requirements, including filing annual reports, tax returns, and other obligations.

Common Challenges and Solutions

Regulatory compliance issues Navigating complex regulatory frameworks and staying compliant with evolving laws and "regulations can be challenging for offshore companies". Seeking professional advice and regular updates on regulatory changes is essential.

Banking restrictions and challenges Some offshore jurisdictions may "face banking restrictions" or challenges due to regulatory scrutiny or international sanctions. Exploring alternative banking options or engaging specialized banking services can help overcome these challenges.

Tax implications and controversies Offshore companies may face scrutiny and controversies related to tax avoidance or evasion. Maintaining accurate records, adhering to tax laws, and seeking tax advice from experts can mitigate tax-related risks.

Reputation risks associated with offshore entities Offshore companies often face stigma and negative perceptions due to associations with tax evasion, money laundering, or illicit activities. Maintaining transparency, ethical business practices, and good corporate governance can help mitigate reputational risks.

#Offshore Company Registration#Offshore payment processors#Offshore high risk payment gateway#Offshore payment gateway high risk#Offshore online payment processing#Offshore payment service provider#Offshore merchant payment services#Offshore bitcoin debit card#Offshore Company#Offshore companies#Offshore company in UK#Offshore company in USA#Offshore company Registration in UK#Offshore company Registration in USA#Offshore company formation#Offshore incorporation services

0 notes

Text

#Echeck#Electronic Check#Merchant Services#Payment Processing#Merchant Account#Payment Processing Companies#Payment gateway providers#Best Merchant Services#High Risk Merchant Account#Echeck Account

1 note

·

View note

Text

How much does it cost to open a merchant account?

(Human directed ai content.)

Opening a merchant account is a crucial step for businesses looking to accept credit and debit card payments. Whether you operate a brick-and-mortar store or an online business, having the ability to process card payments can significantly expand your customer base and streamline transactions. However, the cost of opening and maintaining a merchant account can vary depending on several factors. In this article, we'll explore the typical expenses associated with setting up a merchant account and factors that influence these costs.

Initial Setup Fees:

One of the primary costs associated with opening a merchant account is the initial setup fee. This fee covers the administrative costs of establishing the account and can range from zero to several hundred dollars. Some merchant account providers may offer promotions or waive setup fees for new customers, so it's essential to shop around and compare offers before committing to a provider.

Monthly Service Fees:

In addition to the setup fee, most merchant account providers charge a monthly service fee to maintain the account. This fee covers ongoing support, account maintenance, and access to payment processing services. Monthly service fees can vary widely depending on the provider and the level of service you require. Basic accounts may have lower monthly fees, while accounts with additional features or higher transaction volumes may incur higher fees.

Transaction Fees:

Every time a customer makes a purchase using a credit or debit card, a transaction fee is charged. This fee typically consists of a flat rate plus a percentage of the transaction amount. The exact transaction fee can vary depending on factors such as the type of card used (credit or debit), the card network (Visa, Mastercard, etc.), and the volume of transactions processed each month. It's essential to understand the transaction fee structure offered by your merchant account provider and how it will impact your overall costs.

Discount Rates:

In addition to transaction fees, merchants are also charged a discount rate on each transaction. The discount rate is a percentage of the transaction amount that is deducted by the merchant account provider as a processing fee. This fee is typically higher for credit card transactions than for debit card transactions, reflecting the higher risk and processing costs associated with credit cards. Like transaction fees, discount rates can vary depending on factors such as card type, card network, and transaction volume.

Additional Fees:

In addition to the fees mentioned above, merchants may also encounter other charges, such as:

Chargeback fees: Charged when a customer disputes a transaction and the funds are reversed.

PCI compliance fees: Charged to ensure compliance with Payment Card Industry Data Security Standards.

Equipment costs: If you require hardware such as card readers or point-of-sale terminals, there may be additional costs associated with purchasing or leasing this equipment.

Factors Influencing Costs:

Several factors can influence the cost of opening and maintaining a merchant account, including:

Business type: Certain industries, such as high-risk businesses or those with a history of chargebacks, may face higher fees and stricter requirements.

Processing volume: Higher transaction volumes may qualify you for lower fees or preferential rates with some providers.

Contract terms: Long-term contracts may offer lower rates but can also lock you into a provider with limited flexibility.

Provider reputation: Established providers with a track record of reliability and excellent customer service may charge higher fees than newer or less reputable providers.

Conclusion:

The cost of opening a merchant account can vary significantly depending on your business needs, transaction volume, and the provider you choose. While there are several fees to consider, including setup fees, monthly service fees, transaction fees, discount rates, and additional charges, it's essential to evaluate these costs in the context of the value and convenience that accepting card payments can bring to your business. By comparing offers from multiple providers and negotiating terms where possible, you can minimize costs and find a merchant account solution that meets your needs without breaking the bank.

#merchant account#merchant account pricing#merchant account fees#merchant account rates#how to get a merchant account#merchant account providers#what is a merchant account#merchant account processing#how to open a merchant account#merchant services#merchant account application#how does a merchant account work#how to open merchant account without ssn#how to set up a merchant account#how to create a merchant account#are you able to open merchant account with itin

1 note

·

View note

Text

Radiant Pay, a leading name in the realm of financial services, offers cutting-edge Credit Card Processing Services tailored specifically for merchants in the United Kingdom. With a commitment to facilitating seamless payment solutions, Radiant Pay has established itself as a trusted partner for businesses of all sizes. Our Credit Card Processing Services are designed to empower merchants with the ability to effortlessly accept payments via credit cards, providing convenience to both businesses and their customers. Radiant Pay ensures swift and secure transaction processing, enhancing the overall shopping experience. Our services are driven by advanced technology and a dedication to compliance with the latest industry standards, guaranteeing the utmost security for sensitive financial data. Radiant Pay understands the dynamic nature of businesses and provides customizable solutions to cater to individual merchant requirements.

#credit card processing#credit card payment processing#Credit Card Processing Services#merchant account for creditcard processing#credit card merchant account in UK#merchant account solution for creditcard processing#credit Card payment solutions in UK#Credit Card Payment Processing london#online payment processing solutions in UK#Best Credit Card Processing Service Provider#Merchant Account Solutions in Europe

0 notes

Text

#Echeck#Electronic Check#Merchant Services#Payment Processing#Merchant Account#Payment Processing Companies#Payment gateway providers#Best Merchant Services#High Risk Merchant Account#Echeck Account#Echeck Payment Processor#Echeck Payment#Echeck Payment Processing#Electronic Check Payment#what is an echeck#Check 21#echeck casino#e commerce payment processing

4 notes

·

View notes

Text

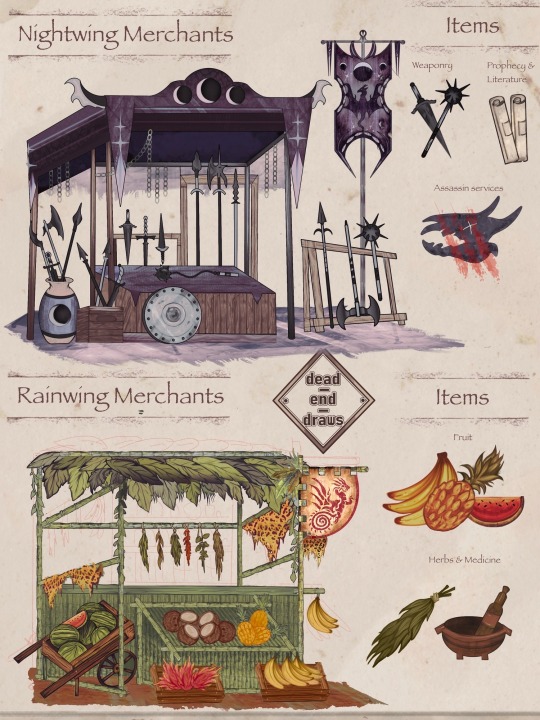

WOF tribe Merchant/Trading booth concepts:

Hey folks! This one was the recent winner of this WOF poll, so here’s my concept art that headcannons trading in Pyrrhia.

Read below cut for close-ups of the individual booths + the thought process / headcannons behind the design choices: 👇

Skywings: The Sky Kingdom’s mountain ranges provide plenty of pasture for raising sheep. As such, Skywing shepherds benefit from traveling to sell their wool, dyes, fabric, and woven tapestries. Many of these merchant tables also include herbs grown exclusively in the mountains, or ibex drinking horns that can be strapped on a dragon’s shoulder & carried in flight.

Along with goods, Skywing merchants may offer sewing services to fix tears, burn marks, or other fabric damage. They are sought out for their quality clothing, and most fabric across Pyrria originated from a Skywing’s talons.

Mudwings: Mudwings’ abundant food & cooking skills are envied almost anywhere in Pyrrhia. Their swamps have fertile soil, responsible for hosting diverse crops which can be purchased as produce at merchant stalls. For those lucky enough to find a traveling Mudwing merchant, the promise of a delicious dish can be whipped up and served at the stall in no time. Along with produce goods, Mudwings sell weaved baskets, spices, and cooking ware.

Sandwings: Sandwing booths offer luxuries of the desert: It’s most common to find accessories such as gold carved jewelry or musical instruments such as drums, lyres, & mandolins for sale. Though, even more sought out across Pyrrhia is Sandwing tattoos/piercings, which are done within the merchant areas. Ink etchings on papyrus paper are stationed outside their tents to showcase designs. All which can be selected, and poked into the skin with a tapping stick and plant dye ink by a trained talon.

Seawings: SeaWings sell a variety of ocean related goods; taking a share in the fish market with Icewings. Outside of food, there are den decorations like driftwood carvings, accessories such as seashell & pearl jewelry, and rope nets weaved by expert Seawing sailors. Some Seawings even sell fishing equipment, canoes, or offer sailor knot tying instructions to curious dragon buyers.

Nightwings: During the war, it was near impossible to find a Nightwing merchant. Most refused to participate in merchant territory, mostly as a way to keep up with their tribe’s mysterious nature.

Though in the more shady, unground parts of the market you can buy from a huge selection of obsidian weaponry, the sharpest in Pyrrhia. No one knew initially how Nightwings smithed so many weapons, or why, until their secret volcano kingdom and the intention to invade the rainforest was discovered. Then forging armor & weapons became clear. Along with a vast armory, for the right price, some Nightwing merchants offer Prophecies & Nightwing Literature (not always guaranteed to always be reliable) and assassin services as well (very reliable).

Rainwings: Though Rainwings haven’t been part of Pyrrhia trading for years, they have a vast hold on dragon medicine. An apothecary of herbs, salves, and remedies are all offered for various ailments due to the rainforest’s abundant resources. Along with medicinal goods, many Rainwings are fruit vendors, promising to any hesitant meat-eating dragons that such an array of flavors isn’t to be missed. Though, their fruit selling pitches often fall flat to most other predominantly meat-eating tribes.

Icewings: Icewings have everything a dragon could need to brace the cold, with a selection of goods only found in the most frigid regions of Pyrrhia. Furs, bone jewelry, and fresh fish (thanks to frost breath) are served on ice. Though Icewings themselves don’t require fur to withstand the cold, it’s considered fashionable and common in upper ranks to wear fur as a status symbol. Since metal is hard to smith without fire & in cold temperatures, fur and bone are more accessible to Icewings for clothing statements.

#art#illustration#bookart#wings of fire#wof#dragon#concept art#concept design#dragons#dragon art#wings of fire art#wingsoffire#wings of fire fanart#wof art#wof headcanon#wof tribes#skywing#Seawing#Mudwing#sandwing#rainwing#icewing#nightwing wof#nightwing#wof fanart#wings of fire headcanons#illustrative art#worldbuilding

4K notes

·

View notes

Text

Greg & Michelle of iSmart Payments from 2012 back in the day. Just a bit of history we thought we would share.

#payments#cardmachine#possystem#acceptcreditcards#smallbusiness#business#mobilepayments#entrepreneur#credit card processing#merchant services#payment service providers#mobilesolutions#getpaid

0 notes

Text

why online payments and how to fix them in 2024

Have you ever experienced the frustration of a failed online payment? It can be incredibly frustrating, especially when you're in a hurry or trying to complete a purchase

Ever clicked the "Buy Now" button only to see your screen freeze? Or receive that annoying "Transaction Failed" message? It’s frustrating, isn’t it? I’ve experienced it too.

Online payments are like the lifeblood of e-commerce. They’re what makes it possible for us to shop from the comfort of our homes, pay bills, and handle transactions with just a few clicks. However, just like any system, online payments can sometimes encounter problems. From technical glitches to issues with payment methods or security concerns, These issues can mess up your shopping and make you frustrated. Whether it’s a problem with processing, card declines, or connectivity issues, understanding the root causes of payment failures is crucial. By addressing these issues head-on and knowing how to fix them, you can ensure a smoother and more reliable payment experience. This means fewer disruptions, happier customers, and a more efficient operation for your business. In the following sections, we’ll dive into the common reasons why online payments fail and offer practical solutions to keep your transactions running smoothly.

Read more...

#online payment gateway in UAE#Secure payment gateway#online payment UAE#online payment integration#Online payment solutions in dubai#UAE#Payment gateway provider uae#payment gateway in UAE#Foloosi business in sharjah#Digital payment solution abu dhabi#merchant service UAE

0 notes