#MetaTrader API Bridge

Explore tagged Tumblr posts

Text

Best MetaTrader API Bridge Solutions for Copy Trading

Copy trading has revolutionized the financial markets, making it possible for traders to mimic the trades of experienced professionals. Among the most effective ways through which one can perform copy trading is by the use of a MetaTrader API Bridge, which connects trading platforms with other external systems for the smooth execution of trade. In this article, we shall seek to explore the best MetaTrader API Bridge solutions for copy trading, the benefits, and how they enhance trading efficiency. A MetaTrader API Bridge is a kind of software that connects MetaTrader 4 or MetaTrader 5 with the outside trading system, liquidity providers, or multi-accounts seamlessly. This makes it possible to automate trade executions, replicate strategies between accounts, and enhance trading performance in general. An API bridge is required for copy trading as it will ensure real-time trade synchronization, low-latency execution, and efficient trade distribution across multiple accounts. Advantages of MetaTrader API Bridge for Copy Trading 1. Instant Execution of Traded Orders Trades get executed in real-time across connected accounts with MetaTrader API Bridge. This guarantees no delay which could affect profit generation. 2. Multi-Account Trading The bridge enables the management of multiple accounts at the same time, making it suitable for professional traders and portfolio managers. 3. Automated Copy Trading API bridges enable automated trade replication, thereby eliminating the need for manual interventions. 4. Reduced Latency Latency is a significant issue in copy trading. High-speed API bridges minimize execution delays, ensuring that copied trades are placed at the best possible prices. 5. Customizable Trade Allocation Traders can use the trade allocation according to their account size, risk preferences, or predefined strategies. 6. Enhanced Risk Management Advanced risk management settings on the MT5 API Bridge can be used for stop-loss and take-profit protective measures for the copied trades. 7. Easy Integration with Algo Trading Traders that use algorithmic trading strategies can integrate their MT5 API Bridge with pre-configured bots that can automatically carry out optimized trades. Best MetaTrader API Bridge for Copy Trading 1. Combiz Services API Bridge Combiz Services API Bridge is one of the most reliable solutions, providing fast trade execution, real-time synchronization, and advanced copy trading features. It is perfect for traders looking for a robust and scalable solution. 2. Trade Copier for MT4 & MT5 This solution enables instant trade replication between multiple MetaTrader accounts, making it ideal for those traders who manage several clients. 3. One-Click Copy Trading API This bridge provides a friendly user interface and one-click trade copying for the comfort of beginner and professional traders. 4. FX Blue Personal Trade Copier A very powerful free tool, it can copy trades between accounts with very low latency, allowing customizable settings of trade copy parameters. 5. Social Trading Platforms with API Bridges Many social trading networks provide built-in API bridge functionality, enabling users to copy trades from expert traders directly to their MetaTrader accounts. How to Choose the Right MetaTrader API Bridge for Copy Trading When selecting an API bridge for copy trading, consider the following factors: Latency and Execution Speed: Choose a bridge that offers fast trade execution with minimal slippage. Multi-Account Compatibility: Ensure that the solution supports multiple trading accounts. Risk Management Features: This is a feature of a good bridge that allows having the stop-loss, take-profit, and risk allocation settings. Customization and Automation: The ultimate choice should allow support for custom trading strategies and algo trading integrations. Reliability and Support: A bridge must have a good track record with reliable customer support.

0 notes

Text

Unlock Lightning-Fast Market Data with Alltick – The Bloomberg Terminal Alternative for Real-Time Trading

In today's hyper-competitive financial markets, access to real-time, low-latency data isn’t just an advantage—it’s a game-changer. While Bloomberg Terminal has long been the industry standard, its high cost and complexity leave many traders and firms searching for a more agile solution. Alltick’s Market Data API bridges this gap, delivering institutional-grade data at a fraction of the cost, with unmatched speed and reliability.

Why Alltick is the Superior Alternative to Bloomberg Terminal

✅ Ultra-Low Latency – Get millisecond-level market updates for equities, forex, futures, and crypto—no delays. ✅ Global Market Depth – Seamless access to NASDAQ, NYSE, CME, EUREX, HKEX, and crypto exchanges in one unified feed. ✅ High-Frequency Trading Optimized – WebSocket & FIX protocol support for algorithmic and HFT strategies. ✅ Cost-Effective – No expensive terminal subscriptions—pay only for the data you need. ✅ Developer-Centric – Robust REST & WebSocket APIs with SDKs for Python, Java, C++, and more.

Who Can Leverage Alltick’s Market Data API?

🔹 Quant Funds & Algo Traders – Backtest and deploy strategies with real-time tick data. 🔹 Proprietary Trading Firms – Gain an edge with sub-millisecond execution speeds. 🔹 Fintech Startups – Build next-gen trading platforms without Bloomberg’s hefty fees. 🔹 Retail Traders – Access institutional-level data previously out of reach.

The Hidden Edge: Dark Pool & Block Trade Intelligence

Traditional market data misses a critical component—hidden liquidity. Alltick’s API provides:

Real-time dark pool print tracking

Block trade detection

Order flow analysis to uncover institutional activity

With this intelligence, traders can anticipate large moves before they hit public order books.

How Alltick Enhances Your Trading Workflow

📊 Tick-by-Tick Analysis – Spot microtrends and liquidity imbalances. ⚡ Instant Execution – Capitalize on fleeting arbitrage and HFT opportunities. 🔄 Seamless Integration – Plug into MetaTrader, TradingView, or custom quant platforms.

Make the Switch Today

Bloomberg Terminal was built for an older era of finance. Alltick’s API is engineered for today’s high-speed, data-driven markets.

🚀 Start Your Free Trial – Alltick.co

0 notes

Text

Decoding Quantitative Finance: How Algorithms Are Shaping the Future of Investing

In the fast-paced world of financial markets, instincts and gut feelings are being replaced by algorithms, data, and mathematical models. Welcome to the world of quantitative finance—where investing meets data science and complex math drives decision-making. If you've ever wondered how hedge funds make split-second trades or how financial analysts forecast market movements with precision, this is your gateway to understanding the game-changing force behind it all.

What Is Quantitative Finance, Really?

At its core, quantitative finance (or "quant finance") uses mathematical models, computer algorithms, and statistical tools to analyze financial markets and securities. Instead of making decisions based on news headlines or market sentiment, quants rely on hard data—price trends, volatility patterns, historical returns, and more—to predict future outcomes and execute trades.

This approach is used extensively by:

Hedge funds and asset management firms

Investment banks

Proprietary trading desks

Financial technology (FinTech) startups

From Wall Street to Dalal Street: The Global Rise of Quants

Quantitative finance isn’t just the secret sauce of Wall Street giants anymore. With the explosion of data and advances in computing, quant strategies are now being adopted across the globe—including in India’s bustling financial hubs like Mumbai, Bangalore, and Kolkata.

Algo trading, high-frequency trading (HFT), and machine learning-based portfolio optimization are no longer buzzwords—they're fundamental tools reshaping the financial landscape.

Popular Quantitative Finance Strategies

Let’s break down a few of the most commonly used strategies that quants deploy:

1. Statistical Arbitrage

Stat arb strategies look for pricing inefficiencies between correlated securities. When two stocks that usually move together diverge in price, an algorithm might buy one and short the other—profiting when the prices revert to the mean.

2. High-Frequency Trading (HFT)

HFT involves executing thousands of trades in milliseconds to capture tiny price movements. This requires powerful computers, ultra-low latency systems, and real-time data feeds.

3. Factor Investing

This strategy involves identifying key "factors" (like value, momentum, size, volatility) that explain returns across a portfolio. Quants build models to tilt investments toward favorable factors.

4. Machine Learning in Finance

Quants now use machine learning algorithms—like decision trees, neural networks, and reinforcement learning—to detect complex patterns and improve prediction accuracy.

Tools of the Trade: What Quants Use

To work in quant finance, one must be fluent in the language of data. Here's a glimpse into the toolkit of a typical quant:

Programming Languages: Python, R, MATLAB, C++, and Julia

Statistical Techniques: Regression analysis, time series modeling, Monte Carlo simulations

Software Platforms: Bloomberg Terminal, QuantConnect, MetaTrader, Jupyter Notebooks

Data: Financial APIs (Yahoo Finance, Quandl), market feeds, and alternative data sources like satellite imagery or social media sentiment

Why Kolkata Is Emerging as a Hotspot for Quant Talent

While Mumbai and Bangalore have long been seen as India’s financial powerhouses, Kolkata is quietly building its reputation as a promising city for finance and analytics careers. The city has witnessed a surge in financial institutions, FinTech startups, and educational centers focused on preparing professionals for modern finance roles.

This is where Certification Courses for Financial Analytics in Kolkata play a crucial role. These programs are designed to bridge the gap between traditional finance education and the cutting-edge skills required in quant finance today.

Certification Courses for Financial Analytics in Kolkata: A Smart Career Move

Whether you're a recent graduate in commerce or an experienced professional in finance, enrolling in Certification Courses for Financial Analytics in Kolkata can give your career a much-needed boost. Here’s why:

Industry-Relevant Curriculum: Learn about financial modeling, machine learning, Python for finance, and risk analytics.

Hands-On Learning: Solve real-world financial problems using datasets and algorithmic trading simulators.

Expert Mentorship: Get trained by professionals with experience in investment banking, hedge funds, and global markets.

Placement Support: Many courses offer job placement support with banks, financial firms, and startups.

If you’re looking to transition into roles like Quant Analyst, Financial Data Scientist, or Algorithmic Trader, these certification programs can be your launchpad.

Careers in Quant Finance: Where Can It Take You?

The opportunities in quantitative finance are vast and growing. Here are a few high-paying, in-demand roles:

Quantitative Analyst (Quant)Build models to price derivatives and forecast risk.

Algorithmic TraderDesign and execute automated trading strategies.

Financial Data ScientistUse AI and ML to make sense of big financial data.

Risk ModelerAssess and predict risk in portfolios and market operations.

Portfolio Manager (Quantitative)Manage investment portfolios based on systematic models.

Final Thoughts: Is Quant Finance for You?

Quant finance isn’t just about crunching numbers—it’s about solving some of the most complex and intellectually stimulating problems in the financial world. It demands a curious mind, strong mathematical aptitude, and comfort with technology.

If you're fascinated by the fusion of finance, coding, and analytics, this could be your calling. And with institutions now offering Certification Courses for Financial Analytics in Kolkata, the path is more accessible than ever.

0 notes

Text

API Bridges Work in Algo Trading

API Bridges are a crucial part of algorithmic trading, which allows trading platforms, brokers, and custom trading algorithms to work seamlessly together. They provide real-time data transfer and order execution, thus making the trading strategy more efficient, faster, and accurate. In this article, we will explain how API bridges work in algo trading and further explore their importance for traders and developers, especially in India.

What is algorithmic trading? Algorithmic trading is the use of computer algorithms to automatically execute trades based on pre-defined criteria such as market conditions, technical indicators, or price movements. Unlike manual trading, algorithmic trading allows traders to make faster decisions and execute multiple orders simultaneously, minimizing human error and maximizing potential profits.

Understanding API Bridges in Algo Trading API bridges are the connector layer between different software platforms through which they can communicate with each other. In algo trading, an API bridge is used to bridge your trading algorithm running from platforms like Amibroker, MetaTrader 4/5, or TradingView to the broker's trading system for automated execution of orders.

Important Functions of API Bridges in Algorithmic Trading Data Feed Integration: API bridges enable direct access to live market data by the algo trader, such as current stock prices, volumes, and order books, from the broker's system. This will serve as the basis of information that the algorithm should interpret for better decision-making. Once the algorithm determines a suitable trading opportunity, the API bridge sends the buy or sell order directly to the broker’s trading system. This process is automated, ensuring timely execution without manual intervention.

Backtesting: API bridges enable traders to backtest their algorithms using historical data to evaluate performance before executing real trades. This feature is particularly useful for optimizing strategies and reducing risks.

Risk Management: An effective API bridge helps implement the risk management protocol in trading algorithms, for example, stop-loss or take-profit orders. When specific conditions are met, such orders are automatically entered to eliminate emotional decision-making and loss. Trade Monitoring: The API bridge continuously monitors trade execution with real-time updates on orders, positions, and account balances. The traders stay informed and make adjustments in their algorithms.

ALSO READ

Why API Bridges are the Need of Algo Trading? Speed and Efficiency: API bridges allow high-frequency trading (HFT), which enables traders to execute thousands of trades per second with minimal delay. This speed is very important in fast-moving markets where timing is everything to profitability.

Customization: With custom-built algorithms interacting with a multitude of brokers through the API bridge, traders can personalize their strategies, thus being able to implement advanced trading strategies that otherwise would not be possible to manually implement.

Integration is smooth. API bridges enable traders to connect their favorite platforms, such as Amibroker or TradingView, with brokers like Angel One, Alice Blue, or Zerodha. In other words, traders can continue using the software they are familiar with while availing of the execution capabilities of the broker's platform.

Cost-Effective: In comparison to hiring a dedicated team of traders or using expensive proprietary systems, API bridges are more cost-effective for algo traders. They allow traders to use the power of automation without the high overhead costs. Improved Risk Management: By automating risk controls, such as setting limits for loss and profits, the algorithmic system ensures that the trades are executed with minimal risk, thus helping traders in India and worldwide to manage the risk exposure better.

API Bridges Working with Popular Trading Platforms Amibroker: Amibroker is a more popular software used by algo traders for technical analysis and backtesting. The integration of Amibroker with API bridge enables traders to execute a strategy in real-time against their preferred broker's interface, which enriches trading experience.

MetaTrader MT4/MT5: MetaTrader is also a widely used platform for algorithmic trading. Through an API bridge, traders can link their trading robots (Expert Advisors) to brokers supporting the MT4 or MT5 platforms to automatically execute trades based on their algorithms.

TradingView: The most renowned trading view is a charting platform famous for its user-friendly interface and powerful scripting language called Pine Script. With an API bridge, users can send real-time trading signals to their brokers for the broker to execute.

The Best API Bridges for Algo Trading in India are by Combiz Services Pvt. Ltd.: Combiz Services Pvt. Ltd. provides customized API solutions that ensure seamless integration between brokers and trading platforms. Their API bridges support a wide range of trading platforms such as Amibroker, MetaTrader, and TradingView, which makes it a good option for Indian traders seeking flexibility and speed in algorithmic trading.

AlgoTrader: AlgoTrader provides an advanced algorithmic trading platform that supports integration with various brokers through API bridges. It is known for its scalability and high-speed trading capabilities, making it a favorite among professional traders.

Interactive Brokers API: Interactive Brokers offers a robust API that allows traders to link their algorithms directly to their trading platform. With a rich set of features such as market data feeds and execution capabilities, the Interactive Brokers' API bridge is highly regarded by the algo traders.

How to Set Up an API Bridge for Algo Trading

Select a Trading Platform and Broker: You may select Amibroker or MetaTrader as the trading platform. Then, go for a broker who gives access to APIs, such as Zerodha or Alice Blue. Connect API: Once you have made a selection of the above-mentioned platforms and broker, you must connect the API bridge with your algorithm in relation to the broker's system. In this step, generally, it involves configuration settings and keys of the APIs. Create or Select Algorithm: If you are a new algo trader, you can make use of pre-built strategies or create your own using programming languages like Python or AFL (AmiBroker Formula Language).

Backtest and test the algorithm: Before you deploy the algorithm, backtest it with historical data to ensure it performs as expected.

Monitor and Adjust: After you have deployed the algorithm, monitor its performance and make adjustments according to the changing market conditions.

Conclusion API bridges are a must-have tool in the world of algorithmic trading, providing smooth integration, faster execution, and improved risk management. Using Amibroker, MetaTrader, or TradingView platforms, API bridges make sure that your trading strategy is executed efficiently and effectively. The power of API bridges enables traders to stay ahead in the competitive world of algo trading and maximize opportunities in the Indian stock market.

For someone seeking a robust and highly customizable solution for algo trading needs, Combiz Services Pvt. Ltd. has the best API bridge services that guarantee seamless integration and faster trade execution.

0 notes

Text

Best Algo Trading Software in India: A Comprehensive Guide

In the fast-paced world of financial markets, algorithmic trading (or algo trading) has become increasingly popular. Traders and investors are leveraging technology to execute trades efficiently, minimize risks, and optimize returns. If you’re looking for the best algo trading software in India, you’ve come to the right place. In this article, we’ll explore some top-notch options that cater to both beginners and seasoned traders.

1. Algoji: India’s Leading Algo Trading Software

Algoji has been at the forefront of algo trading in India since 2018. Here’s why it stands out:

Genuine API Bridge™: Algoji API Bridge™ is a powerful tool that allows you to trade with custom strategies or follow strategies by India’s top advisors. Whether you’re a seasoned trader or a beginner, APIBridge™ provides the flexibility you need.

Privacy Protection: Unlike other platforms, APIBridge™ ensures the privacy of your trading strategies. Your intellectual property remains confidential.

Cost-Effective: Reduce your trading costs by up to 0.1% per order. Every penny saved matters!

Integration: APIBridge™ seamlessly integrates with popular platforms like TradingView, Amibroker, MetaTrader, and Excel-VBA. You can trade using charts or screeners for hundreds of stocks.

Signals: APIBridge™ works with four types of signals: Long Entry (LE), Long Exit (LX), Short Entry (SE), and Short Exit (SX). This flexibility allows you to execute your strategies effectively.

2. TradeTron: Simplified Algo Trading

Easy-to-Use: TradeTron is perfect for traders who want to automate their quant strategies without any coding. You can deploy up to 100 strategies and create unlimited private strategies.

Paper Trading: Test your strategies without risking real money. TradeTron’s paper trading feature lets you fine-tune your approach.

3. Zerodha Streak: Backtesting Made Easy

Technical Analysis: Zerodha Streak is ideal for backtesting and technical analysis. Explore various strategies and find what works best for you.

4. RoboTrade: Reliable and Efficient

Automated & Manual Trading: RoboTrade offers a balance between automated and manual trading. Customize your approach based on your preferences.

5. Robotrader: Cost-Effective Solution

Affordable: Robotrader provides a cost-effective solution for algo trading. It’s suitable for traders on a budget.

Conclusion

When choosing the best algo trading software in India, consider factors like ease of use, privacy, integration options, and cost-effectiveness. Whether you’re a beginner or an experienced trader, these platforms offer the tools you need to succeed in the dynamic world of algorithmic trading.

For More Information Chek Our Website:- www.algoji.com

0 notes

Text

GMI Edge Broker Review ( Legit Or Scam?)

GMI Edge - Global Market Index (GMI) Review: Your Gateway to Advanced Forex Trading

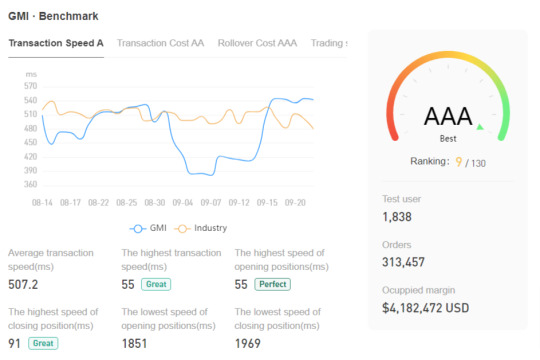

In this comprehensive review, we'll delve into the features, offerings, and reputation of GMI Edge Broker - Global Market Index (GMI), also known as Global Market Index Limited. With over a decade of experience in the financial markets, GMI has become a prominent player in the forex trading industry. Let's explore the key aspects that make GMI stand out in the crowded world of forex brokers.

Introduction to GMI:

GMI Edge , established in 2009, has earned its place as a respected forex broker. It strongly emphasizes delivering lightning-fast and stable order execution through modern technology. GMI provides a wide range of tradable assets, including currency pairs, precious metals like gold and silver, crude oil, and global indices. With a presence in over 30 countries and a user base of more than 1 million traders, GMI Edge operates through seven trading centers worldwide, making it a truly global brokerage.

Copy Trading Service:

One notable feature of GMI Edge is its copy trading service, allowing both novice and busy traders to replicate successful trading strategies and check top trading performance in GMI. This feature opens the door for traders to potentially boost their profitability by learning from experts in the field.

Awards and Recognitions:

GMI Edge has received industry awards, including recognition as the Best Liquidity Provider Platform, Best Broker Support for Traders, Best Trading Platform for Traders, and Best Trading Environment for Traders. These accolades reflect GMI's commitment to excellence in serving its clients and maintaining high standards in the industry.

Apart from the retail traders offering, the GMI Edge brings an advanced proprietary software that includes MT4 and MT5 bridges, tailored partnership programs for Institutional Trader, Money Managers, White Label and APIs via FIX connectivity network.Indeed, it is obvious that the main pro of GMI is a technology and software, which also was recognized by many awards received for special achievements within the industry and overall ratings.

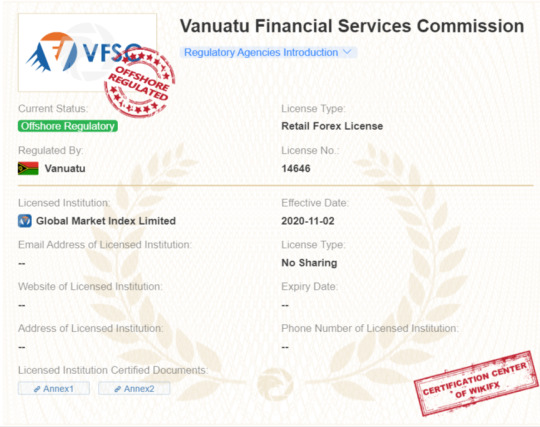

GMI Edge Regulatory Oversight:

Global Market Index Limited operates under various regulatory bodies and entities across the globe. Notably, GMIUK, based in London, is authorized by the Financial Conduct Authority (FCA). Additionally, GMINZ is registered in New Zealand, authorized by VFSC, and GMIVN operates in Vanuatu. The GMI Group also includes entities registered in Hong Kong, further enhancing its global reach.

GMI Trading Platforms:

GMI Edge broker offers a diverse range of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are renowned for their user-friendly interfaces and advanced trading tools. GMI's technology-driven approach ensures ultra-low latency and FIX API connectivity, making it a preferred choice for active traders seeking rapid order execution.

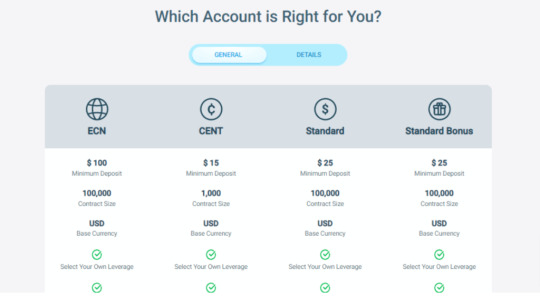

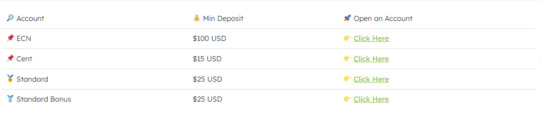

Account Types and Sign-Up Bonus:

GMI caters to various trader profiles by offering different account types, including ECN, Cent, Standard, Standard Bonus, and Risk-Free Demo accounts. The minimum deposit required to open a GMI Professional live trading account is just $15 USD. Additionally, GMI offers a deposit bonus of up to 30% on initial deposits, providing an extra edge to traders.

Safety and Security:

The safety and security of traders' funds are paramount at GMI. The brokerage operates under the umbrella of Global Market Index Limited (GMI), a group of companies registered in several jurisdictions. Each entity complies with the regulatory requirements of its respective jurisdiction, ensuring a high level of security and transparency.

Conclusion: Is GMI Edge Right for You?

In conclusion, GMI is a technology-driven brokerage solution that offers transparent pricing, advanced systems, multiple customer support options, and an array of software proposals. Its diverse range of trading instruments, including Forex, Indices, Cryptocurrencies, and CFDs, appeals to traders seeking variety in their portfolios. However, it's worth noting that GMI may be better suited for professional and active traders rather than beginners due to its highly developed technology and advanced features. The broker's commitment to regulatory compliance, awards, and global presence make it attractive for those looking for a trusted partner in the forex trading world. Whether you're an experienced trader seeking rapid execution or a newcomer looking to learn from the best through copy trading, GMI offers a comprehensive solution to meet your trading needs. Our GMI review highlights a well-regulated firm with a global presence in key financial hubs, known for its transparent trading conditions and advanced technological connectivity. However, a few drawbacks include limited information on the website, the absence of educational support, and a relatively high initial deposit requirement of $2,000. On a positive note, GMI impresses with its extensive range of diverse trading platforms, catering to the needs of traders across the spectrum, from beginners to experienced professionals, both institutional and retail. Read the full article

0 notes

Text

MT5 Gateway or A Liquidity Bridge

What should a broker choose: MT5 Gateway or a Liquidity Bridge?

Forex brokerage setup can be a complicated process with multiple choices that can impact the success of the business. One of the vital decisions is selecting the right technology solution to connect the broker's trading platform to the liquidity providers' network.

Two popular solutions for this purpose are MT5 Gateway and Liquidity Bridge. In this blog post, we will discuss the differences between the two and the factors that brokers should consider when choosing between them.

MT5 Gateway

The prominent MetaTrader 4 & 5 trading platforms were created by Meta Quotes, who also created the MT5 Gateway technology solution. A server-side plugin called MT5 Gateway links the broker's MT5 trading interface to the network of liquidity providers. By transferring trade requests and price quotations back and forth between the trading platform and the liquidity providers, the plugin serves as a bridge.

Key Benefits of MT5 Gateway

The MT5 Gateway's interaction with the MT5 trading platform is one of its key benefits. Without further development or customization, brokers who already use MT5 as their trading platform can quickly incorporate MT5 Gateway.

Additionally, a variety of order types, such as limit orders, stop orders, and market orders are supported by the plugin, enabling brokers to provide their customers with a flexible trading environment.

Additional risk management options provided by MT5 Gateway include negative balance protection, adjustable margin call and stop-out thresholds, and negative balance protection.

Additionally, the plugin allows multi-currency accounts, enabling brokers to give their customers the choice of holding money in other currencies.

But MT5 Gateway's restricted connectivity with other trading platforms is one of its key drawbacks.

Brokers who employ a different trading platform than MT5 will have to create a unique interface with MT5 Gateway, which can be a time-consuming and expensive procedure.

Limited support is now available for non-Forex products including stocks and commodities through the MT5 Gateway.

Liquidity Bridge

A liquidity bridge is a technological solution that uses a unique API to link the broker's trading platform to the network of liquidity providers.

A liquidity bridge can be integrated with any trading platform that allows API integration, unlike MT5 Gateway, which is platform-specific. The bridge can also handle a variety of instruments, including Forex, equities, and commodities, and a large range of order types.

Key Benefits of Liquidity Bridge

A liquidity bridge's flexibility is one of its key benefits. Brokers who don't utilize MT5 can easily integrate the bridge through API integration without having to pay for special development.

Furthermore, compared to MT5 Gateway, a liquidity bridge provides greater customization options, enabling brokers to adjust the bridge to their own requirements. Support for non-Forex instruments is another benefit of a liquidity bridge.

Many liquidity providers give access to additional asset classes, including equities and commodities, which can be added to the broker's trading platform using the bridge.

Brokers are now able to provide a wider variety of instruments to their clients, expanding their opportunity to generate income.

However, the higher cost and complexity of implementation are two of the key drawbacks of a liquidity bridge. A development team will need to collaborate with brokers who utilize liquidity bridges to customize the bridge and connect it with their trading platform.

The cost may also increase due to potential continuing maintenance and improvements needed for the bridge.

Considerations while choose between the MT5 Gateway and the Liquidity Bridge

Brokers should take into account a number of variables when selecting between MT5 Gateway and Liquidity Bridge, including:

Trading platform: Integrating MT5 Gateway may be simpler for brokers who currently use MT5 as their trading platform. Brokers who utilize a separate trading platform, however, must think about a liquidity bridge.

Customization: A liquidity bridge may be a preferable solution for brokers who demand a high level of customization because it provides more flexibility in terms of customizing possibilities.

Asset classes: Liquidity bridges may be a preferable choice for brokers who wish to give their clients access to a variety of asset classes, including non-Forex instruments like equities and commodities.

Cost: Brokers must take into account both the one-time and continuing costs related to any solution. For brokers who already use MT5, MT5 Gateway might be a more affordable solution, although a liquidity bridge might need a bigger initial investment but offer more long-term flexibility and earning potential.

Support and upkeep: Brokers should take into account the degree of upkeep and support needed for any solution. A liquidity bridge might need continuing development and maintenance, whereas MT5 Gateway is typically simpler to set up and operate.

Final paragraph

The broker's needs and priorities must be carefully taken into account while deciding between MT5 Gateway & Liquidity Bridge. MT5 Gateway in Forex brokerage setup may be a simpler and more affordable choice for brokers who already use MT5 as their trading platform and who primarily offer Forex trading.

A liquidity bridge, however, might be a better choice for brokers who need more customization choices and want to offer a wider variety of asset classes. Brokers should, in the end, carefully assess their requirements and weigh the advantages and disadvantages of each solution before choosing.

#forex#forexbrokeragesetup#forexnews#business brokerage#stock market#start your own forex brokerage#liquidity#liquidity bridge

0 notes

Text

1 note

·

View note