#Mint Account Aggregation

Text

There are differences between UPI and Account Aggregator

Imagine having a central platform to look up your financial assets information for all of your account savings, fixed deposit and investment plans and pension savings, insurance premiums and more, all at the same time. There is no need to log and downloading financial information from different platforms, simple access, and a single view of your financial situation,

Because of the Bank Account Aggregator framework this framework is no longer restricted to the realms of imagination

The idea for Account Aggregator was conceived through the Reserve Bank of India to make it easier to access and share of financial information. In simpler terms, it acts as a "data bridge" between different participants in the financial industry.

The Account Aggregator framework is changing the method by which financial data is distributed. According to experts, it is likely to be a replica of the enormous UPI's success. UPI.

There is plenty of common ground among UPI as well as Account Aggregator it's important to understand what the distinction is since these differing concepts solve distinct issues.

This blog is designed to assist you to understand the differences between Account Aggregator and UPI.

What exactly is UPI and what are the problems UPI address?

Unified Payment Interface (UPI) is a mobile-based electronic payments system that allows you to transfer funds from bank accounts using a your mobile phones.

One of the most important benefits that comes with UPI payment is that it allows immediate real-time transactions without disclosing the bank's details. This creates a safe swift, simple and easy payment method. You don't have for carrying cash debit card or credit card. This makes it easier to make transactions while on the move.

The benefits of UPI isn't limited to transferring money between accounts. Through UPI the ability to seamlessly pay for your utilities or recharge your mobile phone. You can also perform quick and secure transactions via e-commerce platforms and pay for insurance premiums make investments in mutual funds as well as facilitate transactions using barcodes. There are numerous possibilities and this makes UPI an incredibly flexible and well-loved payment option for a wide range of applications.

What is Account Aggregator? how does it help solve problems?

Account Aggregator was created through the Reserve Bank of India (RBI) in order to make it easier for information exchange across Financial Information Providers (FIPs) as well as Financial Information Users (FIUs) with the consent of the customer.

Account Aggregator lets you easily access and examine the financial data from various sources like account balances, stocks and tax information, insurance policies specific to investments and many more in one screen. This comprehensive view of financial assets makes it easier to manage of financial assets and allows better-informed decision making.

Account aggregation also allows the secure exchange of financial data with financial institutions. This makes it simpler to join and transact with, as well as combine a variety of financial services. Use cases for Account Aggregator are vast ranging from getting loan or collaborating with wealth management professionals to organize and improve investment portfolios, and detecting potential fraud risks and reducing risk

The difference between UPI and Account Aggregator are stark.

Integration with financial institutions from other countries

UPI is a quick payment method that allows money transfers between two accounts. This means that its infrastructure is only connected to banks. However Account Aggregator provides an even greater scope since its use and impact can be extended to all financial institutions as well as all four regulatory bodies.

The focus area

Both UPI as well as Account Aggregator are both digital public infrastructures, this is the point where simjlarity ceases.. UPI is primarily concerned with the 'transfer of funds', whereas Account Aggregator is specifically focused on the transfer of financial information'.

The UPI infrastructure connects only to banks. AA connects every financial institution, including Banks as well as NBFCs, insurance companies, broking businesses, CRAs and more which makes it much more broad in terms of application and scope.

Authority to govern

National Payments Corporation of India (NPCI) is a not-for-profit organization established through the Government of India regulates UPI transactions. It also sets the standards and guidelines that govern how the system is used. NPCI assures the security as well as security for UPI transactions in addition to promoting the expansion and use of electronic payments across India. In contrast, Account Aggregator is an authorized by the RBI, and is expected to conform to various rules and rules which the RBI established to encourage responsible and fair behavior. Regulations of the RBI ensure the privacy and security of the customers is protected, and ensure that banks are committed to ethical lending policies. Sahamati additionally plays an important function in strengthening and promoting the ecosystem of Account Aggregators. Sahamati is an alliance of industry that functions as a self-organized organization in order to help facilitate coordination between all the players of the Account Aggregator community. The alliance establishes the fundamental rules and an ethical code to the entire community.

#Sahamati Account Aggregator#Account Aggregator Rbi#Account Aggregation Apps#Account Aggregator Nbfc#Rbi Account Aggregator#Account Aggregation Service#Account Aggregator Vendors#Yodlee Account Aggregation#Financial Account Aggregators#Mint Account Aggregation#Plaid Account Aggregation#Nbfc Account Aggregators#Best Account Aggregation App#Bank Account Aggregator App#Tink Account Aggregation

1 note

·

View note

Text

So I used a personal finance management app that aggregates all the accounts I have in one place. The company that owns it shut it down at the end of the last year and transitioned it to another site they own. It does absolutely fucking nothing that I need it to do, which includes:

show me balances from all my connected accounts

track spending

sort/recategorize/tag transactions

set budgets

Literally the only functionality it retains is the ability to sell me shit. Which I was fine with (lights gotta stay on somehow) when I got use out of the site, but now it has been enshittified.

The other thing this experience has reminded me of is you should find a service that aggregates all your bank accounts. Empower is the one I'm using because it's got the same functionality as Mint, but there are other options*. Your bank/credit union might also offer a similar service.

It's a lot like using a password manager--it's a giant pain to set up initially, but it will ultimately make your life so much easier. All your account balances in one place** so you don't have to log in to each individual site to check! A unified view of your finances!

It is, of course, not a solution for not having enough money, but clarity on your purchases and subscriptions can help you identify things you don't want/need, as well as overcharges and discrepancies.

I know better money management is a popular new year's resolution, and this is a pretty easy step towards that. You don't have to add all your accounts at once. But I find it satisfying to see the picture become clearer. Also, graphs.

--

* Search "mint pfm alternatives" if you want to know more. Most options I found were paid but maybe you're a person who would shell out for useful features. Monarch looks amazing for people with shared finances.

** It's totally safe. I deal with this shit for a living. I can explain more if you want but it's boring.

26 notes

·

View notes

Text

Wedding Cake Gras

Wedding Cake Gras is once in a while called Pink Cookies. We referenced its most generally acknowledged genealogy, however some seed banks recommend that it’s really a Triangle Mints aggregate.

420 Fams agrees that it’s bound to be the Cherry Pie + GSC hereditary qualities on account of how having parents that are both landrace Sativa strains like Durban Poison have impacted the outcomes.

Wedding Cake Gras inclines towards Indica (60/40) and like GSC has leaves that are both dim and light green, with thick buds, and various sweet precious stones.

The strain’s terpenes favor Humulene at the top and afterward in less lofty sums, Limonene and Terpinolene. Humulene is the woody, fiery terpene that provides a great deal of strains with the novel taste of earth and pepper.

You might remember it as the flavor of bounces, which additionally contains Humulene.

#wedding cake gras#wedding cake strain#gras online kaufen#gras kaufen#weed bestellen#weed#gras#weed online kaufen#weed online bestellen#gras online bestellen#gras kaufen online#cannabis kaufen online

3 notes

·

View notes

Text

TikTok's Impact on American Culture

TikTok, a popular app, has become a significant part of American culture, with its memes and content viewed millions of times.

The House of Representatives passed a bill in March to force Chinese owners of TikTok to sell to a non-Chinese owner or face a ban.

The Chinese government could use the app to obtain sensitive U.S. user data or influence content to serve its interests.

The legislation would require the Senate to pass, survive lawsuits from TikTok and creators, and buyers to clear regulatory approval.

The app has become Hollywood's favorite marketing machine, influencing music, movies, beliefs, product success, and celebrity definitions.

The app's influence extends beyond the app, influencing the music, movies, and the definition of a celebrity.

Hollywood's Response to TikTok's Impact

Hollywood initially dismissed TikTok's arrival in 2018, leading to denial and fear among young adults.

However, Hollywood now sees TikTok as indispensable, with films like "Anyone But You" and "M3gan" gaining significant success due to TikTok users re-enacting credit sequences.

TikTok has also served as a ticket-selling machine for films, like "Wonka" and "Barbie."

The platform's user-centric approach has led to the creation of videos that provide behind-the-scenes "realness," making it a popular platform for news aggregation and analysis.

TikTok's Influence on News Discourse

V Spehar, a social media influencer, has used TikTok to share videos explaining missed events, making him a regular at White House briefings.

Pew Research Center found that about one-third of 18- to 29-year-olds get news regularly on TikTok, outpacing other age groups.

In 2023, about 14% of American adults regularly got news on TikTok, compared to just 3% in 2020.

The appeal of TikTok has raised concerns about accuracy and context as original reporting is funneled through other accounts.

TikTok's Impact on Conspiracy Theories

TikTok has become a platform for debunking conspiracy theories, with posts illustrating a flimsy patchwork of assumptions and coincidences.

The platform's recommendation algorithms and low barrier to entry have made such posts thrive.

Conspiracy theories, which draw high engagement, are one of the most profitable categories on TikTok.

TikTok's Influence on Music Industry and National Security

TikTok's Controversy

Two young men promoted a toothpaste theory that colored dots on toothpaste tubes correspond to natural, medicinal, or chemical ingredients.

The theory was quickly retweeted, copied, and stitched into reaction videos.

Colgate, a major toothpaste manufacturer, denied the rumor.

Even silly rumors can lead to real-world harm, with recommendations for homemade alternatives.

TikTok's Impact on Music Industry

TikTok has become a potent promotional outlet for the music industry.

The platform has become vital in the race to mint a new hit.

Universal Music Group withdrew the rights to its music on the app, saying TikTok was trying to "bully" the company to accept low terms.

Swift, who releases her music through Universal but has owned the copyrights to her work since 2018, broke ranks and put her songs back on TikTok.

TikTok's Potential as a Propaganda Tool

The algorithm is wrapped in a mystery, provided by engineers working for ByteDance, the Chinese company that controls the platform.

The Chinese government has issued regulations that require Beijing’s regulators to grant permission before any ByteDance algorithms can be licensed to outsiders.

There is always a possibility of ByteDance's algorithm becoming a pipeline for influencing citizens and voters in subtle and not-so-subtle ways.

Senator Mark Warner, the chairman of the Senate Intelligence Committee, noted that TikTok has emerged as a news source and, it collects data on users that the Chinese government could find useful, even crucial.

The real question is whether anyone gets to look under the hood of TikTok.

Southern Alamance Middle School's Solution to "Toilet TikToks"

Southern Alamance Middle School in Graham, N.C., implemented a solution to combat student distractions from social media, known as "Toilet TikToks."

The school removed the bathroom mirrors used for filming TikToks and introduced an online system for students to be excused from class.

The system has led to a significant decrease in bathroom visits from students asking to be excused just to make videos.

The school is among dozens of other U.S. districts that have filed lawsuits accusing social media platforms, including TikTok, of unfairly ensnaring young people.

The school's acting superintendent, Kristy Davis, emphasizes the importance of addressing the negative impacts of social media on students' well-being.

TikTok's popularity has disrupted other social media platforms, with rivals attempting to replicate its image but failing to reproduce its hypnotic energy.

TikTok is also trying to compete with YouTube and introduce an e-commerce platform to rival Instagram.

TikTok's Brain Activity and its Impact on the Brain

TikTok's algorithm selects videos based on past use, increasing brain activity related to reward, attention, and social processing.

TikTok users reported experiencing, a "flow state" associated with engaging but not frustrating activities, compared to Instagram users.

The app's immersive quality may induce enjoyment, concentration, and time distortion.

TikTok's Role in Fashion and the Met Gala

TikTok has been invited to be an honorary host of the annual Met Gala, growing influence in the fashion industry.

The company's CEO, Shou Chew, has been named an honorary of the gala, alongside Loewe designer Jonathan Anderson.

Despite the prohibition of all social media inside the party, TikTok's influence has grown significantly, with over 75 billion views associated with the #TikTokfashion hashtag and almost 500 million with #2023Gala alone.

Luxury brands regularly sign up TikTok stars as brand ambassadors, creating a cycle where TikTok feeds the gala machine, which feeds TikTok.

TikTok's Impact on Mental Health and Campaigns

TikTok's algorithm has led to a downward spiral of mental health content, with users often exposed to repetitive content.

The surge in mental health content has increased self-diagnosis among young people, with ADHD and anxiety disorders diagnosed more frequently during the pandemic.

Profit motives may influence these trends, with platforms often featuring advertising from app-based mental health services and influencers having sponsorship deals.

Research warns that TikTok videos can deliver misinformation, with around one-fifth of videos mentioning cognitive behavioral therapy being inaccurate.

Despite these concerns, some users credit TikTok for breaking open the national conversation around mental illness.

President Biden's TikTok campaign, which uses the platform to reach potential voters, has gained significant attention.

The campaign relies on young, digitally fluent aides to host its TikToks, which can sometimes be offensive or dismissive.

The @bidenhq account has around 299,000 followers, but the campaign's success is attributed to its ability to engage with its audience.

Kiara Springs earns significant income from her TikTok posts, earning between $10,000 and $12,000 for getting people to buy what she suggests.

TikTok's Role in Marketing and Product Development

TikTok's Addiction and Advertising

TikTok's addictive, cost-effective content is a part of many brands' marketing strategies.

Brands believe their videos with everyday people can go viral more easily than on platforms like Instagram.

The average user spends nearly an hour on the platform daily.

TikTok's Shopping Feed

Last year, the app launched a shopping feed, allowing direct purchases from various vendors.

Some brands consider creating TikTok content for their products before developing them.

Impact of Viral Products

Viral products on TikTok can lead to increased sales.

Examples include Stanley tumblers, feta cheese, and a drugstore mainstay.

Some products, like Cat Crack Catnip, sold out quickly after being shared on TikTok.

TikTok's Influence on Recipes

The platform has transformed cooking by presenting recipes over time in videos.

The platform favors concepts over recipes, allowing viewers to watch and make them.

TikTok's Data Collection

TikTok, owned by a Chinese company, collects significant information from users.

This includes your IP address, location, contacts, messages, and viewing history.

The company can also look for phone or email addresses in other users' address books unless privacy settings are turned off.

TikTok's Influence on Adult Life and Financial Advice

Shelley Polanco, a senior at Brandeis, seeks guidance on adulthood through TikTok accounts featuring older women of culture.

@itsrealllylola, who shares her life lessons and advice on ignoring judgments.

She also seeks support from Dr. Amanda Hanson, a "midlifemuse," and Shera Seven, a 40-year-old woman offering dating advice.

Shannon, a TikTok transformation coach, helped her visualize her future self and write goals.

Hannah Williams, a content creator, uses the platform to help people understand their potential earnings.

FinTok, the money, and personal finance community app, has changed how we accept advice from strangers and how much ordinary people are willing to share about their financial status.

Vivian Tu, a 30-year-old former Wall Street trader, offers practical advice on high-yield savings accounts and retirement savings.

57% of Gen Z users like or leave a comment after watching a video on the platform.

However, there are concerns about crypto scams and potential gains on TikTok, and commenters often offer corrections when scams or bad advice crop up.

TikTok has been influential in getting people to watch their screens upright instead of sideways; a phenomenon spreading to other platforms like Apple, a professional Spanish soccer league, and major news publishers.

0 notes

Text

Stader Labs has introduced a new Liquid Restaked Token (rsETH) on testnet that allows users to stake the same ETH on multiple networks simultaneously.

The recently launched rsETH token builds on EigenLayer’s restaking protocol and is designed to boost staking rewards by leveraging liquid staking tokens like Lido’s stETH and Coinbase Wrapped Staked ETH (cbETH).

Restaking enables users to earn staking rewards on ETH while retaining liquidity. During a recent interview with The Block, Stader Labs co-founder Dheeraj Borra explained the benefit of such a system.

rsETH is more than just a token; it is an entry point to more rewards and opportunities in the crypto landscape, allowing users to aggregate rewards from various different sources to maximize their holdings

Stader Labs co-founder Dheeraj Borra

The rsETH token works by letting users deposit liquid staked ETH tokens and mint rsETH representing fractional ownership. These assets are distributed to node operators within Stader’s network to earn a share of staking rewards.

Holders can trade rsETH on decentralized exchanges (DEXs), use it in decentralized finance (DeFi) protocols, and redeem the underlying assets anytime. The token is currently live on Ethereum testnet with launch on mainnet to be announced soon, according to statements shared with The Block.

The platform already supports liquid staking on Ethereum, Polygon, BNB Chain, Near, Fantom and Hedera with $124 million total value locked. The rsETH launch aims to simplify access to restaking rewards but could raise concerns about re-staking the same ETH multiple times, an issue highlighted by Ethereum’s co-founder Vitalik Buterin in a late May blog post.

In his post, Buterin argues that “re-staking” techniques used by protocols like EigenLayer to allow Ethereum validators to simultaneously stake on other networks brings systemic risks. The main concern is overloading Ethereum’s social consensus and essentially “recruiting” it to serve other protocols’ purposes beyond just validating Ethereum transactions.

For example, some restaking designs rely on the threat of Ethereum forking away malicious validators who misbehave on the other network. This stretches Ethereum consensus into policing activities on entirely different blockchains.

Buterin warns this has no limiting principle and risks pulling Ethereum into “uncomfortable choices” as its community gets pressured to make more judgement calls on behalf of other networks. He argues this could fracture Ethereum’s social cohesion over time as it takes on more “mandates.” It also creates perverse incentives for large projects to become “too big to fail” and demand preferential treatment in case of failures.

Instead, Buterin advocates that restaking designs should avoid creating expectations that Ethereum consensus will intervene to solve problems. Validators should only be accountable according to the specific protocol’s rules, not rely on Ethereum slashing or forking.

This keeps Ethereum focused purely on its own protocol rules and avoids over-burdening its community with responsibilities spanning multiple blockchains. While dual staking itself has risks, stretching social consensus is seen as a threat.

Source

0 notes

Text

Finance Apps: 10 Must-Haves for Your Smartphone

In our tech-driven era, managing finances effectively has never been more accessible. With just a touch, swipe, or tap, users can view, handle, and optimize their finances on the go. For those wanting to manage their money better or those just starting to explore the world of finance, here’s a deep dive into ten essential finance apps you should consider having on your smartphone.

1. Introduction to Finance Apps

From budgeting and investing to credit monitoring and expense tracking, finance apps encompass a wide range of tools designed to simplify and enhance money management. Not only do these apps offer convenience, but they also empower users with insights and tools previously available only to finance professionals.

2. Mint: Holistic Financial Overview

Overview: Mint is a widely recognized budgeting app that aggregates all your financial accounts in one place.

Features: Automatic categorization of expenses, budget setting, credit score tracking, and monthly bill reminders.

Why It's Essential: With its user-friendly interface, Mint provides a clear picture of your financial health and offers tailored tips to save money.

3. YNAB (You Need a Budget): Proactive Budgeting

Overview: YNAB is more than just a budget tracker; it's a philosophy.

Features: Customizable budget categories, debt paydown tools, goal tracking, and reports that break down spending patterns.

Why It's Essential: YNAB encourages users to "give every dollar a job," promoting proactive financial planning and discouraging mindless spending.

4. Acorns: Investing with Spare Change

Overview: Acorns is designed for beginner investors, turning spare change into investment opportunities.

Features: Automatic round-ups from daily purchases to invest, diversified portfolios, and educational content on investing basics.

Why It's Essential: Acorns removes the intimidation from investing, allowing users to grow their wealth incrementally.

5. Credit Karma: Credit Monitoring and More

Overview: Credit Karma offers free credit score updates and insights to improve it.

Features: Credit score updates from two major bureaus, credit monitoring alerts, and tailored financial product recommendations.

Why It's Essential: Monitoring credit can detect potential fraud and provides insights to enhance creditworthiness.

6. Robinhood: Stock Trading Simplified

Overview: Robinhood provides a commission-free trading platform for stocks, ETFs, and cryptocurrencies.

Features: Streamlined trading interface, extended trading hours, and a premium option for margin trading.

Why It's Essential: Ideal for those venturing into stock trading, Robinhood offers an uncomplicated platform without traditional trading fees.

7. Expensify: Expense Reports Made Easy

Overview: Expensify is a must-have for professionals and business owners needing to track and report expenses.

Features: Receipt scanning, auto-matching with bank transactions, mileage tracking, and automatic expense report generation.

Why It's Essential: Expensify streamlines the cumbersome process of expense reporting, saving time and ensuring accuracy.

8. PocketGuard: Spend Within Your Means

Overview: PocketGuard helps users make informed spending decisions based on their available 'pocket' money.

Features: Links to bank accounts to calculate "in my pocket" money, bill negotiation assistance, and subscription optimizer.

Why It's Essential: By showing how much money you truly have left after bills, savings, and essentials, PocketGuard prevents overspending.

9. Personal Capital: Wealth Management at Your Fingertips

Overview: Beyond budgeting, Personal Capital offers tools for investments and retirement planning.

Features: Net worth calculator, portfolio breakdown, retirement planner, and fee analyzer.

Why It's Essential: Personal Capital caters to individuals looking for a comprehensive financial management tool with a focus on long-term planning.

10. Splitwise: Effortless Expense Sharing

Overview: Splitwise is perfect for those who often share expenses with friends or roommates.

Features: Bill splitting, IOU tracking, and PayPal/Venmo integration for easy repayments.

Why It's Essential: Say goodbye to complicated calculations when sharing bills. Splitwise ensures everyone pays their fair share without the fuss.

11. Honeydue: Couples’ Finances, Uncomplicated

Overview: Honeydue helps couples manage shared finances transparently.

Features: Joint account monitoring, bill reminders, and monthly spending limits.

Why It's Essential: Honeydue fosters financial communication and trust between partners, promoting shared financial goals.

12. Conclusion: Navigating the Financial World with Ease

With technology at our fingertips, managing finances has never been more straightforward. From daily expenses to long-term investments, there's an app to help navigate every financial challenge. By leveraging these tools, individuals can gain control, clarity, and confidence in their financial journeys. As always, while apps provide tools and insights, individual research and perhaps consultation with financial professionals can ensure well-informed decisions. Happy budgeting, investing, and saving!

0 notes

Text

What is an bank account aggregator?

It is a bank account aggregator is a financial technology that allows users to keep track of all the account balances and transactions at one time. This could include accounts from several financial institutions, including credit unions and banks as well as other financial institutions.

Bank account Agrégers can be useful for those having difficulty managing their financial affairs. They can also be useful for people who would like to review their financial status in one place.

There are many bank account aggregators available. Some of them are free, while others charge a monthly fee.

One well-known bank account aggregator is Mint. Mint is a no-cost website and application that provides users with the ability to view all of their financial accounts together in one place. Mint provides additional features, such as budgeting, bill payments, and monitoring of credit scores.

One other bank account aggregator is YNAB, which stands for "You need to Budget." YNAB is a paid app which helps users control their funds and keep on top of their financial situation. YNAB also offers a no-cost trial of 34 days.

There are a few things to be aware of when making use of an bank account aggregator. It is crucial to make sure the aggregator is secured. Furthermore, some aggregators have agreements with specific financial institutions. If you have accounts with multiple banks, you may not be able to view all of them at once.

In the end the bank account aggregaters can be a helpful tool for people who want to stay in control of their finances. They allow you to see all your account details in one location. Make sure you select a secure aggregator and be aware of the banks that work for the program.

What are the ways that bank account aggregators work?

A bank account aggregator is a type of technology in the field of finance (fintech) that offers a platform for people to see all their financial accounts in one place. This includes bank accounts, credit cards as well as loans, investments and many other things.

The objective of a bank account aggregator is to provide users with a complete view of their financial situation and help them make better choices. For instance, one could use a bank account aggregator to see the amount of money they have in all of their accounts and to find ways to save money.

Account aggregators for banks account aggregators typically work through connecting to an individual's financial accounts via their online banking login credentials. Once connected, the aggregator will collect data from all of the person's accounts and present it in one place. Some banks account aggregators also have tools for budgeting and suggestions, financial advice from experts, and more.

There are several banks and account aggregators available today like Mint, Personal Capital, and YNAB. Each has slightly different characteristics, which is why it's essential to evaluate them all to determine the right one for your needs.

If you're in search of ways to get a more accurate picture of your financial situation and budget, a bank account aggregator could be a good option for you.

What are the advantages of the use of a bank account aggregator?

An bank account aggregator is a kind of financial technology that enables users to see the entirety of their account information in one place. This includes bank accounts, credit cards or loans, as well as investments. The aim of the bank account aggregator is to give the users a complete view of their finances , so they can make better decisions.

There are many advantages to making use of a bank account aggregator. First, it helps users save time by eliminating the need to sign in to multiple accounts to view their balance and transactions. It can also help users save money by identifying potential costs and help them avoid the costs. Thirdly, it can assist users make better-informed decisions regarding their finances, by giving an accurate picture of their financial status.

If you're looking for ways to simplify your financial situation and get more insight into your money and spending habits, the bank account aggregator may be an ideal choice for you.

Are there any potential risks when using an bank account aggregator?

If you link your bank account to any third-party financial services, such as an online budgeting tool , or an automatic savings application by giving the company access to account details. This method, referred to as account aggregation, can be convenient because it allows you to access all of your financial details in one place. But it also comes with some risks.

It is true that your banking account is one of the most sensitive aspects of personal information you've ever had. If a company that has access to your account makes use of that information and subsequently misuses it, it could have severe consequences for your finances and your privacy.

There have been a handful of notable cases of account aggregation gone wrong. In 2017, Equifax, one of the largest credit reporting agencies within the United States, experienced a breach of its data that exposed personal information of 145 million people. In the breach, hackers gained access into Equifax's systems through exploiting a feature that allowed them to view account data from other companies that were compiled by Equifax.

In a different case one company, ZenLedger was accused of selling customer data which it gathered through account aggregate. The company was accused of selling data about cryptocurrency transactions of customers in the hands of government officials. U.S. government.

These cases highlight the dangers that come with the use of the account aggregator. When you grant a company access to your bank account you're putting your trust in the fact that they will protect your personal information and act in a responsible manner. If they don't, you may become the target of fraud or identity theft.

Before you link an account with your financial institution account to a third-party provider look up the company and make sure that you are able to trust them with your personal information. It's an excellent idea to study the terms of service and privacy policy in order to understand how your information will be used and disclosed.

How do I find the most effective bank account aggregator for me?

In the realm of personal finance there are lots of choices for managing your finances. The one option which has grown more popular in recent years is using a bank account aggregator.

An bank account aggregator is a tool that allows you to look over all your bank accounts together. This can be a helpful way to track your spending habits and keep an eye on your finances. There are many various banks and account aggregaters to choose from, but how do you choose the best one for you?

Here are some points to keep in mind when selecting the right bank account aggregator:

1. Usability A tool that is easy to learn and use. Look for an aggregator with a clear interface and is simple to use.

2. Supported banks: Make sure the aggregator you select supports the banks you work with. If not, you won't be in a position to view all your accounts together in one spot.

3. Features: Look at the options each aggregator has to offer. The most common features are the ability to monitor your spending, see all your transactions in one place and establish budgeting goals. Select the software that has the features that are the most important to you.

4. Price: There's both pay and free account aggregators on the market. Take a look at your budget and select which option makes the most sense to you.

5. Support for customers If you're having difficulties using the aggregator it is important to be able to get assistance from customer service. You should look for an aggregator that provides live chat or phone support in case you need assistance.

Spend some time comparing the various bank account aggregators that are available, and then choose one that comes with all the features you need at a price you're comfortable with. With the right tool, you can take control over your financial affairs and manage your cash.

0 notes

Text

After Ethereum's long-awaited Merge, it's a perfect time to consider how we can likewise enhance wise agreements. Basically apps that work on blockchains, wise agreements are an essential part of our Web3 applications. Engaging with them stays rather harmful, specifically for non-developers. Much of the occurrences where users lose their crypto properties are triggered by buggy or destructive wise agreements. As a Web3 app designer, this is an obstacle I consider typically, specifically as waves of brand-new users keep onboarding into different blockchain applications. To completely trust a wise agreement, a customer requires to understand precisely what it's going to do when they make a deal-- due to the fact that unlike in the Web2 world, there's no client assistance hotline to call and recuperate funds if something fails. Presently, it's almost difficult to understand if a clever agreement is safe or reliable. Related: Liquid staking is essential to interchain security One option is to make wallets themselves smarter. What if wallets could inform us if a wise agreement is safe to communicate with? It's most likely difficult to understand that with 100% certainty, however wallets could, at minimum, aggregate and show a great deal of the signals that designers currently search for. This would make the procedure easier and more secure, particularly for non-developers. Here's a much deeper take a look at the benefits and drawbacks of wise agreements, why they appear like the Wild West now, and how we may enhance the UX for utilizing them. The pledge and hazard of clever agreements For designers, utilizing a clever agreement as the backend for their app has huge capacity. It likewise increases the capacity for bugs and exploits. It's excellent that clever agreements can be produced by designers without asking anyone for approval, however that can likewise expose users to significant threat. We now have apps negotiating numerous countless dollars without any security assurances. As it stands, we just need to rely on that these apps are bug-free and do what they guarantee. Many non-developers aren't even familiar with the security problems included and do not take the suitable preventative measures when communicating with blockchain-based apps. The typical user may sign a deal believing it's going to do something, just to find the clever agreement does something else completely. It's why harmful wise agreements are a main attack vector for bad stars. Why are clever agreements the Wild West? When a Web3 app makes a wise agreement call, you do not understand precisely what the deal will do till you really do it. Will it mint your nonfungible token (NFT), or will it send your cash and tokens to a hacker? This unpredictability holds true of any online application, obviously, not simply Web3 apps; forecasting what code will do is really difficult. It's a larger problem in the Web3 world because many of these apps are naturally high stakes (they're developed for managing your cash), and there's so little defense for customers. The App Store is mostly safe due to Apple's evaluation procedure, however that does not exist in Web3. If an iOS app begins taking users' cash, Apple will take it down immediately to reduce losses and withdraw the account of its developer. Related: Latin America is all set for crypto-- Just incorporate it with their payment systems Malicious clever agreements, on the other hand, can't be removed by any person There's likewise no other way to recuperate taken possessions. If a destructive agreement drains your wallet, you can't merely contest the deal with your charge card business. If the designer is confidential, as is normally the case with destructive agreements, there frequently isn't even an alternative to take legal action. From a designer's viewpoint, it is better if the code for a wise agreement is open source. Popular wise agreements do normally release their source code-- a substantial enhancement over Web2 apps.

Even then, it's simple to miss what's actually going on. It can likewise be really hard to forecast how the code will run in all circumstances. (Consider this long, frightening Twitter thread by a knowledgeable designer who nearly succumbed to an intricate phishing fraud, even after checking out the agreements included. Just upon a 2nd closer assessment did he observe the make use of.) Compounding these issues, individuals are frequently forced to act rapidly when engaging with clever agreements. Think about an NFT drop promoted by influencers: Consumers will be stressed over the collection rapidly offering out, so they'll typically attempt to make a deal as quick as they can, disregarding any warnings they may experience along the method. In short, the extremely exact same functions that make clever agreements effective for designers-- such as permissionless publishing and programmable cash-- make them rather harmful for customers. I do not believe this system is essentially flawed. There is a heap of chance for Web3 designers like me to offer much better guardrails for customers utilizing wallets and wise agreements today. The UX of wallets and clever agreements today In lots of methods, wallets like MetaMask seem like they were developed for designers. They show a great deal of deep technical information and blockchain minutiae that work when constructing apps. The issue with that is that non-developers likewise utilize MetaMask-- without comprehending what whatever implies. No one anticipated Web3 to go mainstream so rapidly, and wallets have not rather overtaken the requirements of their brand-new user base. Related: Learn from Celsius-- Stop exchanges from taking your cash MetaMask has currently done a terrific task of rebranding the "mnemonic expression" to "secret expression" to avoid customers from unsuspectingly sharing it with hackers. There's plenty more space for enhancement. Let's have a look at MetaMask's interface (UI), followed by a number of mock-ups I developed detailing some prospective enhancements that might assist customers into the " pit of success" (By the method, MetaMask here works as a referral because it's greatly utilized throughout the Web3 world, however these UI concepts ought to likewise use to basically any wallet app.) A few of these style fine-tunes might be developed today, while others may need technical bear down the clever agreement side. The image listed below screens what the existing MetaMask wise agreement deal window appears like. We see the address of the wise agreement we're communicating with, the site that started the deal, and after that a great deal of information about the funds we're sending out to the agreement. There's no indicator of what this agreement call does or any indication that it's safe to engage with. Potential options to enhance wise agreements What we 'd truly like to see here are signals that assist us as end users to figure out whether we trust this wise agreement deal or not. As an example, think of the little green or red lock in the address bar of contemporary web internet browsers, which suggests whether the connection is encrypted or not. This color-coded indication assists guide unskilled users far from possible threats, while power users can quickly disregard it if chosen. As a visual example, here are 2 fast user experience (UX) style mock-ups of MetaMask deals-- one that's most likely to be safe, and one that's less particular. Here are a few of the signals in my mock-up: Is the agreement source code released? Open-source agreements are usually more trustable due to the fact that any designer can read them to discover bugs and destructive code. MetaMask currently consists of different links to Etherscan, so this would be a basic and hassle-free signal to include. Audit rating. A third-party audit is another signal that can figure out credibility. The primary application concern here is how to identify this rating. Exist any accepted requirements

for this currently? If not, an easy method might be to utilize Etherscan, which supports submitting audits. MetaMask, in this example, might likewise keep its own list of auditors, or count on a list of 3rd parties. (From what I can inform, MetaMask currently does this for NFT APIs and token detection.) In the future, it's simple to envision a decentralized self-governing company for figuring out audit ratings in a more decentralized method. What can this deal do? Can it call external agreements, and if so, which ones? This would be really challenging to figure out completely, however I question if an easy variation for open-source agreements would be practical. There are currently a lot of automated smart-contract vulnerability scanners out there. If this isn't possible for Solidity, I question if we might develop a wise agreement shows language that does permit this level of fixed analysis. Possibly private functions might state the consents they require, and the compiler might ensure conformance. Security suggestions and education. If a clever agreement does not have numerous signals of dependability (see mock-up above on the right), the UI might suggest a proper set of safety measures to take, such as inspecting if the agreement address is right and utilizing a various account. These are tips made in the orange text, instead of red, given that an absence of signals isn't always hazardous; here, we're merely suggesting that users decide to be a bit more careful about their next actions. Like numerous existing functions in MetaMask, these proposed functions might be switched off in the settings. Toward a much safer future In the future, there will likely be numerous safety-focused tools developed on the primitive elements that blockchains supply. It's most likely we'll see insurance coverage procedures that safeguard users from buggy wise agreements end up being commonplace. (These exist currently, however they're still relatively specific niche.) Related: What will drive crypto's most likely 2024 bull run? However, customers are currently utilizing Web3 apps, even in these early days, so I 'd like to see the dev neighborhood include more defenses for them now Some easy enhancements to wallets might go a long method. A few of the abovementioned concepts would assist safeguard unskilled users while all at once enhancing the deal procedure for Web3 veterans. From my point of view, anything beyond trading crypto possessions on Coinbase (or other huge business) is still far too dangerous for the typical customer. When loved ones inquire about establishing a self-custody crypto wallet to utilize Web3 apps (let's face it-- generally, in order to purchase NFTs), constantly begin by alerting them of the threats. This frightens a few of them away, however the more determined individuals wish to utilize them anyhow. When our wallets are smarter, we'll have the ability to feel far better about onboarding the next wave of brand-new users to Web3. Devin Abbott( @ dvnabbott) is the creator of Deco, a start-up gotten by Airbnb. He focuses on style and advancement tools, React and Web3 applications, most just recently with The Graph. This post is for basic details functions and is not meant to be and ought to not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author's alone and do not always show or represent the views and viewpoints of Cointelegraph. Read More

0 notes

Text

Retail loans hit a festive high in September

New Post has been published on https://petnews2day.com/pet-industry-news/pet-financial-news/retail-loans-hit-a-festive-high-in-september/

Retail loans hit a festive high in September

MUMBAI : Retail loan growth surged 20% in September, the fastest since the covid-19 outbreak in 2020, unfazed by higher borrowing costs, signalling a robust revival in consumer demand during the festive season.

Loan demand was seen across categories for purchases of vehicles, consumer durables and homes, the mainstay of retail credit.

View Full Image

Buyers revenge

Home loans, which account for nearly half of all retail loans, grew 16% to ₹18.05 trillion between 24 September 2021 and 23 September 2022, data released by the Reserve Bank of India showed.

The other personal loans category, which accounts for 26% of aggregate bank loans to individuals, grew an even faster 24.4% to ₹9.73 trillion as of 23 September.

The personal loans category mainly includes credit for domestic consumption, medical expenses, travel, marriage, other social ceremonies, and loans for debt repayment.

Growth in all sub-segments took total retail loans to over ₹37 trillion at the end of September.

“As per the high-frequency indicators (HFIs) for the recent months, private consumption—especially urban demand—has remained healthy,” RBI governor Shaktikanta Das said on Wednesday at a conference organized by lobby groups Ficci and the Indian Banks’ Association.

The contact-intensive services have continued to make a smart rebound, aided by the unfettered resumption of activities and full-fledged celebration of festivals after two-and-a-half years, Das said.

“You see a huge amount of participation. We all saw it during the Ganpati festival in Maharashtra and other places and Diwali. As the data is trickling in, we find that retail sales of various white goods and other fast-moving consumer goods have improved considerably,” he said.

RBI data showed that consumer durables loans grew 60.7% in September from a year earlier.

Bankers said they witnessed consumer demand across segments during the festive season as India geared up for full-fledged celebration after two years of muted festivities. Demand for vehicle loans also rebounded in September amid an 11% increase in sales.

“Not just housing, this time around, there is demand for consumer durables as well as vehicle loans,” said the head of retail credit at a public sector bank, requesting anonymity.

He added that while the asset quality of the retail sector is healthy at the moment, the sector needs constant attention to ensure people repay on time.

Mint reported on 24 October that for 13 banks that declared their quarterly earnings till then, covid-19 recast loans worth ₹10,019 crore—primarily to individuals—have turned sour in the six months to 30 September.

In a 31 October note, analysts at ICICI Securities said that overall retail credit growth momentum is continuing.

Of the monthly incremental retail credit accretion of ₹54,100 crore in September, 37% was accounted for by housing loans, 9% by vehicle loans, 4% by education loans, 7% were advances against fixed deposits, and 38% towards other retail loans.

��Over the past 12 months, retail loans saw annual accretion of ₹6.1 trillion, of which 41% was towards housing, which is lower than its proportion of 49% in the total retail book,” the ICICI Securities report said.

Others said that the recent sectoral credit deployment data showed that the spate of recent repo rate hikes has failed to dent demand.

“While a low base can be a part of the reason, credit growth seems solid this year in the first six months. The other key reasons are a return to pre-pandemic conditions and a revival in demand. As our domestic demand is expected to remain fairly insulated from global growth slowdown, and with the onset of the festive season (October to December), we believe credit demand to remain steady in the second half as well,” said Sonal Badhan, economist, Bank of Baroda.

Badhan cautioned that downside risks could emerge from the impact on export demand if major economies enter into a recession.

<![CDATA[.authorSearchmargin:20px; border-radius: 4px; border: solid 1px #e0e0e0; background:#fff; .authorInp height:40px; width:86%; padding:11px 16px; color:#212121; border:0; box-sizing:border-box; float:left; font-size:14px; font-weight:700; .authorInp::placeholder color: #bdbdbd; .authorBtn background:url(https://images.livemint.com/static/icon-sprite.svg) no-repeat -24px -10px #fff; cursor:pointer; float:right; width:20px; height:20px; border:0; margin:11px 16px 0 0 .authoeSlider background:#f5f5f5; box-sizing:border-box; margin-bottom:9px; white-space:nowrap; width:100%; overflow-x:unset; padding:0; .authoeSlider a display:inline-block; cursor: pointer; margin:0 10px; border-bottom:3px solid #f5f5f5; padding:9px 0; font-size:12px; color:#212121; font-weight:400; font-family: 'Lato Regular',sans-serif; .authoeSlider a.activeborder-color:#f99d1c; color:#f99d1c; font-weight:900; font-family: 'Lato Black',sans-serif; .authoeSlider a:hovercolor:#f99d1c; .authorSecpadding:0 20px 20px; .authorBox width:48.5%; padding: 12px; float:left; margin-top:16px; border-radius: 4px; border: solid 1px #e0e0e0; background-color: #fff; box-sizing:border-box; .authorBox:nth-child(odd)margin-right:7px; .authorBox:nth-child(even)margin-left:7px; .authorImg width:62px; height:62px; border:1px solid #f99d1c; float:left; padding:4px; box-sizing:border-box; border-radius:50%; .authorImg img width:54px; height:53px; border-radius:50%; .authorDesc margin:0 0 0 9px; float:Left; width: calc(100% - 71px); .authorDesc h2margin:0; padding:0; font-weight:900; color:#000; font-size:16px; font-family: 'Lato Black',sans-serif; margin-bottom:5px; white-space:nowrap; overflow: hidden; text-overflow: ellipsis; .authorDesc h2 acolor:#000; .authorDesc h2::after display:none; .authorDesc h1 display: block; float: none; width: 100%; padding: 0; .authorDesc h5 display: block; width: 100%; font-weight:400; color:#757575; font-size:14px; font-family: 'Lato Regular',sans-serif; margin-bottom:5px; white-space:nowrap; overflow: hidden; text-overflow: ellipsis; .twitterAuthor background:url("https://images.livemint.com/dev/ico-tw.svg") no-repeat 0 0; width:20px; height:20px; margin-right:18px; float:left; margin-top:2px; .emailAuthor background:url("https://images.livemint.com/dev/ico-emai.svg") no-repeat 0 0; width:20px; height:20px; float:left; margin-top:2px; .followAuthor padding:4px 11px; font-weight:900; color:#424242; font-size:12px; font-family: 'Lato Black',sans-serif; border:1px solid #d2d2d2; float:right; border-radius:25px; .followAuthor spanmargin-left:6px; .authorBox2 width:100%; padding: 12px; margin-top:16px; margin-bottom:5px; background-color: #fff; box-sizing:border-box; .authorInfoborder-top: solid 1px #e4e4e4; margin-top:10px; padding:10px; font-weight:400; color:#424242; font-size:16px; line-height:22px; font-family: 'Lato Regular',sans-serif; .fs16 font-size:16px; a.authorlinkmargin: 0; padding-top: 0; background-position: right center; font-size:12px; text-transform:uppercase; .noAuthorbackground:#fff; padding:100px; text-align:center; margin-bottom:5px; .noAuthor strong display:block; font-weight:700; color:#2f2f2f; font-size:16px; font-family: 'Lato bold',sans-serif; margin-bottom:8px; .noAuthor span display:block; font-weight:400; color:#757575; font-size:14px; font-family: 'Lato Regular',sans-serif; margin-bottom:12px; .noAuthor afont-weight:900; padding:13px 27px; text-transform:uppercase; display:inline-block; color:#fff; font-size:12px; background:#f99d1c; font-family: 'Lato Black',sans-serif; border-radius:4px; .authorSubHead font-weight:900; color:#757575; font-size:12px; font-family: 'Lato Black',sans-serif; padding:0 20px 12px; .authorsHolder padding:0 16px; a.authorsName padding:7px 41px 7px 12px; border:1px solid #d2d2d2; font-weight:900; color:#424242; font-size:14px; font-family: 'Lato Black',sans-serif; display:inline-block; background:url("https://images.livemint.com/dev/add-author.svg") no-repeat 90% center; margin:0 2px 10px; border-radius: 25px; a.authorsName.selected background-image:url(https://images.livemint.com/dev/added-author.svg); background-color:rgba(249, 157, 28, 0.1); border-color:#f99d1c; .selectedAuthors margin-top:20px; .authoeSlider .swiper-containerpadding:0; .authoeSlider .swiper-container .swiper-button-next, .authoeSlider .swiper-container .swiper-button-prevmargin-top:-14px; .authoeSlider .swiper-container .swiper-button-prevmargin-left:0; .authoeSlider .swiper-slidewidth:auto; .authoeSlider .swiper-container .swiper-button-next span, .authoeSlider .swiper-container .swiper-button-prev spanmargin-top:5px; .authorBoxSecmargin:16px 20px; .authorBox2.authorBox2Storypadding: 16px; border-radius: 4px; border: solid 1px #e4e4e4; background-color: #fbfbfb; .authorBox2.authorBox2Story .authorImgwidth:37px; height:37px; .authorBox2.authorBox2Story .authorImg img width: 28px; height: 28px; border-radius: 50%; .authorBox2.authorBox2Story .authorInfofont-size:14px; line-height:22px; padding-bottom:0; .authorBox2.authorBox2Story .authorDesc h5 margin-bottom:0; margin-top:4px .authorHeader text-transform:uppercase; font-size: 12px; font-weight: 900; color:#757575; font-family: 'Lato Black',sans-serif; margin-bottom:10px; @media(max-width:767px) .authorSearchmargin:16px; .authorBoxwidth:100%; float:none; .authorSecpadding: 0 16px 16px; .noAuthorpadding:100px 20px; .authorSubHead padding:0 16px 12px; .authorsHolder padding:0 12px; .selectedAuthors margin-top:16px; .authorBoxSecmargin:16px; .authorBox:nth-child(odd)margin-right:0; .authorBox:nth-child(even)margin-left:0; .authorBox2margin-top:0; ]]><![CDATA[ .author-widgetborder: 2px solid #f99d1c;margin: 20px;padding: 10px;border-radius: 5px; .author-widget .authorBox2 width:100%; padding: 0; margin-top:0; margin-bottom:0;background-color: #fff; box-sizing:border-box; .author-widget .authorImg margin-top: 5px;width:62px; height:62px; border:1px solid #f99d1c; float:left; padding:4px; box-sizing:border-box; border-radius:50%; .author-widget .authorImg img width:54px; height:53px; border-radius:50%; .author-widget .authorDesc margin:0 0 0 9px; float:Left; width: calc(100% - 71px); .author-widget .authorDesc h2margin:0; padding:0; font-weight:900; color:#000; font-size:16px; font-family: 'Lato Black',sans-serif; margin-bottom:5px; white-space:nowrap; overflow: hidden; text-overflow: ellipsis; .author-widget .authorDesc h2 acolor:#000; .author-widget .authorDesc h2::afterdisplay:none; .author-widget .authorDesc h1 display: block;float: none;width: 100%;padding: 0; .author-widget .authorDesc h5display: block;width: 100%;font-weight:400; color:#757575; font-size:14px; font-family: 'Lato Regular',sans-serif; margin-bottom:5px; white-space:nowrap; overflow: hidden; text-overflow: ellipsis; .author-widget .authorInfoborder-top: 0;margin-top: 0;padding: 0;font-weight:400; color:#424242; font-size:16px; line-height:22px; font-family: 'Lato Regular',sans-serif;display: -webkit-box;-webkit-line-clamp: 3;-webkit-box-orient: vertical;overflow: hidden; .author-widget .title font-weight: 700;color: #757575;padding: 10px; .author-widget .author-read-morecolor: #f99d1c;text-decoration: underline;font-size: 17px; .author-widget .authorDesc .marZero .flcolor: #000 !important; @media (max-width: 767px) .author-widget .authorInfo -webkit-line-clamp: 4; ]]>

Catch all the Industry News, Banking News and Updates on Live Mint.

Download The Mint News App to get Daily Market Updates.

More

Less

Topics

0 notes

Text

Opinion: Your portfolio needs diversification. Here’s the best way to go about it in these volatile times

New Post has been published on https://medianwire.com/opinion-your-portfolio-needs-diversification-heres-the-best-way-to-go-about-it-in-these-volatile-times/

Opinion: Your portfolio needs diversification. Here’s the best way to go about it in these volatile times

If you’re trying to figure out how to make sure you’ve always got the best mix of investments, there are general rules, questionnaires about risk and all sorts of academic approaches. But it can be hard to translate the conclusions to your situation, especially if you, like most people, have a complicated financial life with many unrelated accounts.

A working adult might have a 401(k), IRA, Roth IRA, a taxable brokerage account and a money-market account. You might also have a crypto wallet or two, a high-yield savings account with CDs, a TreasuryDirect.gov account for I-bonds and other Treasurys, pensions, or other retirement plans lingering at old employers. Double that if you’re married.

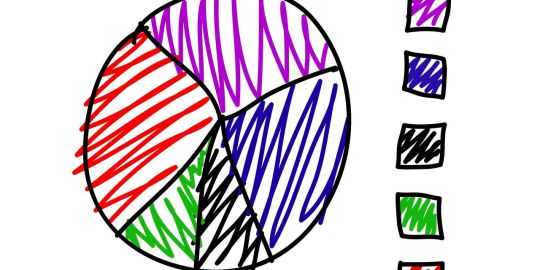

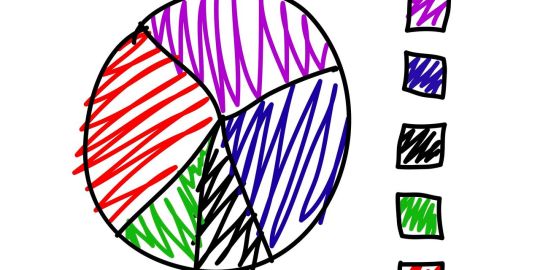

Take the classic 60/40 portfolio construction, which means putting 60% of your investments in stocks and 40% in bonds, or other fixed-income investments. If you were relying on that, you’d be pretty confused right now. In today’s market, the 60/40 portfolio is either dying or rising from the dead, depending on whom you ask. And if you have money in many different places, what parts of it count toward that portfolio ratio?

You can always value the underlying message of the 60/40 portfolio, which is about diversification. You need both stocks and bonds as a hedge, because typically when one is up, the other is down, and you can cut your losses this way.

The bull market run-up after the 2008-2009 Great Recession seemed to change that equation. People needed extra convincing to stay in bonds, given how minuscule yields were.

Then this year both stock

DJIA,

-0.10%

SPX,

-0.33%

and bond markets

TMUBMUSD10Y,

3.899%

tumbled (hence the death knells). Yet others already see the light at the end of the tunnel. “We think the long-term outlook has brightened quite a bit,” says Barry Gilbert, asset allocation strategist for LPL Financial.

Given today’s economic conditions, it’s time to think broadly about all of your accounts together and reassess what you need to do going forward into unknown economic territory, no matter what your personal ratio.

Messy accounts for a reason

It might seem like a mess, but you need an array of accounts because they serve different purposes for your goals, which have distinct time horizons. Your retirement, for instance, might be 20 years away, and you benefit from the tax deferment. But the money you keep in your brokerage account might be for a coming large purchase.

Diversifying your money across accounts also helps you avoid the biggest mistake most advisers see in a downturn, which is cashing out and missing the upswing. “A year ago, we were reminding people that fixed-income has a role. Now we’re reminding people that both stocks and bonds are important, because they all ask: Should I just be in cash?” says Nathan Zahm, head of goal-based investing research for Vanguard.

Consider those who have a trading account, like one of Robinhood’s

HOOD,

+2.11%

14 million monthly active users. Those accounts are mostly in stocks, as the platform doesn’t trade bonds (or mutual funds), although some might hold bond or money-market ETFs. These investors will want to calculate what portion of their financial holdings are in that taxable account and weigh that against their other money, to make sure they have a balance that’s appropriate for them.

Some brokerage overviews or services like Mint will aggregate a wide view for you. But at the end of the day, it might take a spreadsheet to really see what you have, because not all your accounts will talk to each other.

Remember that if you track this manually, it will just be for a moment in time. Your list would not update dynamically as the value of the accounts change, and that’s what matters most for the necessary rebalancing that would keep you aligned with your goals. You’d be 60/40 until the market close on that day, and then come what may.

Should your target asset mix really be 60/40?

For the most part, 60/40 is a philosophical starting point. “The 60/40 portfolio isn’t automatically best. Practically speaking, you’d want to be at the level that’s right for you,” says Gilbert.

That optimal mix will depend on your age, the size of your nest egg and your goals, and it’s not a magic or a static number. It doesn’t even have to be a round number. One way to figure it out is to look at the way target-date funds for retirement use a “glide path” that shifts more conservative over time. Even if you don’t invest in target-date funds, you want to create a similar slope for yourself, and not just stick with 60/40 for decades.

For instance, Vanguard explains that its target-date funds basically only hit 60/40 around age 60, and then continue getting more conservative from there.

Schwab generally sets its funds to hit 60/40 at about five to six years from the target retirement age. “It’s one point in time. For any allocation, you have to evolve,” says Jake Gilliam, managing director for research at Schwab.

A sample from Schwab’s Target 2065 Index Fund

Schwab also adjusts the stocks and bonds within the allocation. “Younger customers will have more international, small cap or emerging markets. As you move older, we’re adjusting those sub-asset class allocations,” Gilliam adds.

This kind of sloped setup still allows for side money if you want to take a portion of your holdings and put it in crypto, meme stocks or keep it in cash under your mattress. It’s just human nature. “We know behaviorally that it can actually drive better discipline,” says Zahm. “If somebody has a side pool of money that’s a few percent to have fun with, then they behave better with the main 95%.”

Just make sure to count your side account in with your big picture eventually and make sure you’re not letting those positions pull you away from your target asset mix, whether that’s 60/40 or another ratio.

“There’s nothing wrong with thinking in buckets, but eventually all the small buckets go into one big bucket,” says Gilbert.

More from MarketWatch

Investors have been tested this year — do you have what it takes to succeed?

Reset your retirement calculator now for today’s bleaker stock markets and make sure you’re still on track

No matter your age, here’s how to tell if your finances are on the right track

Why the 60/40 portfolio is a worthy strategy even though stocks and bonds are weak

Here’s one way to potentially get more from a 60/40 portfolio

Read the full article here

0 notes

Text

Moneywiz 2 de paga gratis

#Moneywiz 2 de paga gratis software

#Moneywiz 2 de paga gratis download

^ 'Become a personal finance wiz this new year with MoneyWiz 2 for iPhone and iPad'.

Cite has empty unknown parameter: |coauthors= (help) 'Top 5 Best New Year's Resolution Apps For iPhone and iPad'.

^ Wilhide, Brendan (5 September 2012).

'Money Talks: SilverWiz Shares Secrets Of Its Breakout Finance App, MoneyWiz'.

^ 'MoneyWiz 2 - Personal Finance on the App Store on iTunes'.

^ a b '27 Year Old Developer Strikes Gold Again With His 4th Startup: SilverWiz'.

That allows it to support more banks in more countries than other finance apps. Puedes configurar todos tus recibos para obtener recordatorios y estimaciones.

#Moneywiz 2 de paga gratis software

While traditional finance apps, such as Mint would only use one data aggregation platform to provide the bank sync, MoneyWiz is the first (and currently only) finance software that uses two data providers simultaneously. Se trata de una fantstica aplicacin que te facilita la visualizacin completa de todas tus finanzas personales y a la vez te permite centrarte en todas las mejoras posibles para finiquitar todas las deudas pendientes. 2 MESES GRATIS PRIMA 49,99 / ao Sincronizacin bancaria con ms de 40.000 bancos Sincronizacin en la nube entre dispositivos Actualizaciones gratuitas con nuevas funciones Soporte prioritario por correo electrnico y chat SUSCRIBIR PRIMA 4,99 / mes Sincronizacin bancaria con ms de 40.

#Moneywiz 2 de paga gratis download

MoneyWiz connects to over 16,000 banks in over 51 countries around the world, to allow its users to download & categorize new transactions automatically. citation needed MoneyWiz has received awards and recognition which include being named the. MoneyWiz is a money management application that runs on Microsoft Windows, Google's Android, and Apple platforms including iOS and macOS.MoneyWiz is developed by SilverWiz and is the top selling personal finance app outside of the United States as well as a Top 10 Finance App on the U.S. Version 2.2.1: Bug fixes & stability improvements Small UI improvements. Have all your accounts, budgets and bills in one place! MoneyWiz can import it! Be it a CSV, QIF, OFX, QFX or MT940 file, MoneyWiz can handle it all. Simplify your financial life with MoneyWiz. Title: MoneyWiz 2 – Personal Finance Genre: Finance Developer: SILVERWIZ LLC. MoneyWiz 2 – Personal Finance v2.9.1 (Paid) APK. How To PROTECT Yourself Against Online Scams. 2 out of every Rs 5 the govt spends is borrowed money. MoneyWiz 2 app review: your personal finance assistant To achieve financial stability, you need to keep track of your expenditure.

0 notes

Text

A Better Investment Strategy in the DeFi World: X METAVERSE PRO ($XMETA) Unleashes the Potential Value of Cryptocurrencies

DeFi has been dominating the cryptocurrency market for the last few years, and has been making fortunes in several areas such as mining, staking, and derivatives. Until now, the free DeFi financial market is still full of infinite vitality and energy, with more and more new projects moving in and launching aggregated eco-applications. In this ecosystem, users break through geographical boundaries and have the pleasure of “trading anywhere, anytime”. Among the many projects, a quality project called X METAVERSE PR has made a perfect performance in the market and has attracted the attention of investors from all walks of life.

What is X METAVERSE PRO?

X METAVERSE PRO is a typical decentralized financial platform in the industry, which can also be seen as a decentralized reserve currency protocol backing its token $XMETA. $XMETA is backed by a basket of digital properties that adds liquidity through BNB, USDT, ETH, BTC, LP TOKEN, etc., thus supporting the value of $XMETA.

In the X METAVERSE ecology, one thing is crucial — a unique “liquidity-as-a-service” platform. The platform can help other projects to develop protocols with a liquidity mechanism. In addition, $XMETA doesn’t base on US dollar, instead, it programs monetary policies into smart contracts and manage it by community governance at different degrees and decentralized methods. In this way, $XMETA has become a better option to replace liquid currency which is widely acclaimed in the industry.

X METAVERSE PRO is committed to creating a financial service platform and cryptocurrency system that aims to generate revenue for the platform through traffic growth and wealth creation, and bring economic stability and wealth appreciation through $XMETA. In a virtuous ecological operation, $XMETA will become a global reserve currency and play an important role as a medium of exchange and a unit of account operation. In addition, holders will benefit from $XMETA’s DAO governance and participate in important matters such as voting, collaboration, and protocol regulation.

For the next phase, X METAVERSE PRO has a clearly plan and vision. X METAVERSE PRO will incentivize long-term sticky liquidity; attract capital to create momentum and increase product popularity; and focus on distributing tokens to put “decentralized governance of the protocol” into practice.

What is $XMETA exactly?

$XMETA is the core ecological token of X METAVERSE PRO, which aims to become a fully decentralized DeFi 2.0 reserve currency based on the X Metaverse Ecology and WEB 3.0. It is worth mentioning that X METAVERSE PRO’s protocol vault holds a portion of the reserve, which provides the $XMETA token holders with a free-floating value and gives the token an intrinsic value.

Each $XMETA token is backed by a USDT. When the value of $XMETA is above 1 USDT, the protocol will use the premium to mint more $XMETA and distribute it to all $XMETA holders; when the value of $XMETA is below 1 USDT, the protocol will buy back $XMETA and destroy it to bring the price back up to at least 1 USDT by reducing the circulation.

At the same time, X METAVERSE PRO solves the liquidity problem by “providing bonds for a small fee”. X METAVERSE PRO can help the protocol to gain its own liquidity, so that it no longer needs to pay high incentives to rent liquidity, it can also ensure the liquidity durability on this basis and thus facilitate trading. In addition, the staking mechanism helps to regulate the supply and expansion of $XMETA. Users can stake $XMETA tokens and LP tokens to automatically receive compound $XMETA rewards.

X METAVERSE PRO uses innovative thinking to create $XMETA that takes into account both the need for supply growth and price appreciation. So, no matter how volatile the market is, $XMETA can always maintain its strong purchasing power.

0 notes

Text

Free checkbook register software

#FREE CHECKBOOK REGISTER SOFTWARE FULL#

#FREE CHECKBOOK REGISTER SOFTWARE WINDOWS 10#

The application is easy and flexible at the same time. With the help of the scheduling module firms can format periodic transactions and send computerized prompts on due dates.Users can use the Income/Expense tool for categorizing flow of cash and generating a profit and loss statement.With the portfolio feature, users can monitor stock markets and gather appropriate information online.The interface is plain and typically accountant.Those who do online banking can easily find their whereabouts Mint is a boon for those who are doing money management for the first time. The application links all accounts of users to one bank in a minute. It’s excellent in breaking down transactions – Users can break down subcategories for easy sorting of their monthly spending.īelow are some of the features of this application.A pie chart system shows users how their income and expenditures break down.Users can adjust these charts for seeing spending for definite accounts, categories, and time- periods. This feature helps users adjust their spending habits. Users can generate budgets for several categories that include custom categories.The application automatically fills them in. With some use, they can automatically track their spending. The Budgets and savings targets that show up as bar graphs help users make instant financial decisions.Personal Capital acts as a monetary aggregator for all accounts of users. This include savings, investments, loan accounts, checking, and credit cards. Users can assemble their whole fiscal life in one platform. The application also accepts retirement plans sponsored by employers. Users can track their spending patterns by looking at their spending categories and individual transactions.The monthly summaries feature help users know where their money is going The application monitors the income and expenses of users from all of their linked financial accounts.Thus, users can set fiscal targets and develop tactics for reaching them. While many people join in employer-subsidized retirement plans not many know their hidden investment fees.This application shows the cost of each fund in a plan. This application helps users stay in line with their retirement objectives.īased on this, uses get alternative provisions into more economical funds.Thus, they can make the necessary changes for situations that include a career change. It helps users track their assets and liabilities for ascertaining their net worth and thus ascertaining their overall financial standing.

#FREE CHECKBOOK REGISTER SOFTWARE FULL#

This is an accounting software for individual use that is full of features. The features make managing accounts, payees, budgets, and expenses a breeze. The straightforward and intuitive interface suits both novice and veteran users.

#FREE CHECKBOOK REGISTER SOFTWARE WINDOWS 10#

FREE CHECKBOOK REGISTER SOFTWARE WINDOWS 10.

1 note

·

View note

Text

Evolution of Decentralized Exchange where you can earn money with BiryaniSwap

Blockchain technology gives us the true meaning of digital currency which is completely transparent without any manipulation. In Blockchain Space, of course, we need Safe Assets such as Stable Coin for various things that support transaction processes such as trading, swapping, or payments. Even though currently there are various platforms, they still have various drawbacks and weaknesses, that is why the Biryani Swap is different from other platforms in that it has more advantages and unique features, not just an ordinary platform.

What is BiryaniSwap?

Biryani Swap is a decentralized exchange (DEX) running on Binance Smart Chain BSC with Yield Farming and Raita Pools, a spin feature that lets you earn and win tokens.

Daily Spin Earn free token by Lucky Spin up to the worth of $10, $50, $100, $500, $1000, the first attempt is free and you can buy for the next try.

Advantages of having DEXs

While centralized exchanges currently dominate cryptocurrency trading activity, emerging decentralized exchanges (DEXs), that facilitate peer-to-peer trading by relying on automated smart contracts to execute trades without an intermediary, have increased in popularity. However, not all DEXs employ the same underlying infrastructure. While some retain conventional order book models, others use emergent liquidity protocols. In addition to exchange and liquidity protocols, aggregation tools are emerging to address the disjointed liquidity inherent to decentralized exchanges.

Decentralized Exchange Evolution

Although centralized exchanges account for the vast majority of market activity since they offer security, regulatory oversight, and oftentimes insurance, the growth of decentralized finance (DeFi) has created room for the development of decentralized crypto exchange protocols and aggregation tools. Platforms like Uniswap, Curve, and Balancer display the potential of simple, user-friendly platforms that rely on liquidity protocols rather than order books. As the DEX market matures, the proliferation of new protocols and supporting mechanisms will likely only accelerate.

Why BiryaniSwap?

As all farming dex are increasing their supply and burning less here we are unique than others like never mint single “Biryani” token more than 100k, another advantage of using or farming in Biryaniswap is they will get total 2 kinds of tokens, one is our main dex token and another is Raita as a bonus, it’s free to sell anytime, but 50% of Biryani token will be locked for 1 Year.

Basic work by BiryaniSwap?