#Financial Account Aggregators

Text

There are differences between UPI and Account Aggregator

Imagine having a central platform to look up your financial assets information for all of your account savings, fixed deposit and investment plans and pension savings, insurance premiums and more, all at the same time. There is no need to log and downloading financial information from different platforms, simple access, and a single view of your financial situation,

Because of the Bank Account Aggregator framework this framework is no longer restricted to the realms of imagination

The idea for Account Aggregator was conceived through the Reserve Bank of India to make it easier to access and share of financial information. In simpler terms, it acts as a "data bridge" between different participants in the financial industry.

The Account Aggregator framework is changing the method by which financial data is distributed. According to experts, it is likely to be a replica of the enormous UPI's success. UPI.

There is plenty of common ground among UPI as well as Account Aggregator it's important to understand what the distinction is since these differing concepts solve distinct issues.

This blog is designed to assist you to understand the differences between Account Aggregator and UPI.

What exactly is UPI and what are the problems UPI address?

Unified Payment Interface (UPI) is a mobile-based electronic payments system that allows you to transfer funds from bank accounts using a your mobile phones.

One of the most important benefits that comes with UPI payment is that it allows immediate real-time transactions without disclosing the bank's details. This creates a safe swift, simple and easy payment method. You don't have for carrying cash debit card or credit card. This makes it easier to make transactions while on the move.

The benefits of UPI isn't limited to transferring money between accounts. Through UPI the ability to seamlessly pay for your utilities or recharge your mobile phone. You can also perform quick and secure transactions via e-commerce platforms and pay for insurance premiums make investments in mutual funds as well as facilitate transactions using barcodes. There are numerous possibilities and this makes UPI an incredibly flexible and well-loved payment option for a wide range of applications.

What is Account Aggregator? how does it help solve problems?

Account Aggregator was created through the Reserve Bank of India (RBI) in order to make it easier for information exchange across Financial Information Providers (FIPs) as well as Financial Information Users (FIUs) with the consent of the customer.

Account Aggregator lets you easily access and examine the financial data from various sources like account balances, stocks and tax information, insurance policies specific to investments and many more in one screen. This comprehensive view of financial assets makes it easier to manage of financial assets and allows better-informed decision making.

Account aggregation also allows the secure exchange of financial data with financial institutions. This makes it simpler to join and transact with, as well as combine a variety of financial services. Use cases for Account Aggregator are vast ranging from getting loan or collaborating with wealth management professionals to organize and improve investment portfolios, and detecting potential fraud risks and reducing risk

The difference between UPI and Account Aggregator are stark.

Integration with financial institutions from other countries

UPI is a quick payment method that allows money transfers between two accounts. This means that its infrastructure is only connected to banks. However Account Aggregator provides an even greater scope since its use and impact can be extended to all financial institutions as well as all four regulatory bodies.

The focus area

Both UPI as well as Account Aggregator are both digital public infrastructures, this is the point where simjlarity ceases.. UPI is primarily concerned with the 'transfer of funds', whereas Account Aggregator is specifically focused on the transfer of financial information'.

The UPI infrastructure connects only to banks. AA connects every financial institution, including Banks as well as NBFCs, insurance companies, broking businesses, CRAs and more which makes it much more broad in terms of application and scope.

Authority to govern

National Payments Corporation of India (NPCI) is a not-for-profit organization established through the Government of India regulates UPI transactions. It also sets the standards and guidelines that govern how the system is used. NPCI assures the security as well as security for UPI transactions in addition to promoting the expansion and use of electronic payments across India. In contrast, Account Aggregator is an authorized by the RBI, and is expected to conform to various rules and rules which the RBI established to encourage responsible and fair behavior. Regulations of the RBI ensure the privacy and security of the customers is protected, and ensure that banks are committed to ethical lending policies. Sahamati additionally plays an important function in strengthening and promoting the ecosystem of Account Aggregators. Sahamati is an alliance of industry that functions as a self-organized organization in order to help facilitate coordination between all the players of the Account Aggregator community. The alliance establishes the fundamental rules and an ethical code to the entire community.

#Sahamati Account Aggregator#Account Aggregator Rbi#Account Aggregation Apps#Account Aggregator Nbfc#Rbi Account Aggregator#Account Aggregation Service#Account Aggregator Vendors#Yodlee Account Aggregation#Financial Account Aggregators#Mint Account Aggregation#Plaid Account Aggregation#Nbfc Account Aggregators#Best Account Aggregation App#Bank Account Aggregator App#Tink Account Aggregation

1 note

·

View note

Text

How Can CART Revolutionize Bank Statement Analysis for Financial Institutions?

Novel Patterns’ CART (Credit Assessment and Robotic Transformation), is an AI-powered solution that automates bank statement analysis, delivering faster and more accurate insights into an applicant’s financial history. This article explores how CART revolutionizes the process of credit underwriting by providing accurate data, preventing fraud, and improving overall operational efficiency.

Automated bank statement analysis for faster credit decisions.

Detects fake bank statements and fraudulent activity with AI.

Provides real-time insights into financial health and spending patterns.

Improves decision accuracy with advanced data parsing and machine learning.

Reduces Turnaround Time (TAT) by 40–70%, speeding up loan approvals.

Predictive analytics to reduce Non-Performing Assets (NPA) by 40–60%.

Helps lenders make informed financial decisions with clear, actionable data.

Scales effortlessly to handle high application volumes with cloud-based infrastructure.

What is a Bank Statement Analysis? : A Key to Financial Health and Risk Management

With CART, this process is automated and enhanced with machine learning. The system collects data from bank statements, processes it through bank statement analyzers, and generates real-time reports on financial behavior. CART does more than just include monthly figures for income and expenses — it delivers actionable insights, flagging any anomalies that could indicate potential fraud or fraudulent activity.

Key Features of CART for Advanced Bank Statement Analysis

1. Advanced AI-Powered Data Parsing for Financial Data

In addition to processing traditional bank statement analysis, CART is designed to detect fake bank statements by identifying inconsistencies or missing transaction patterns. This ensures the accuracy of the financial data used to assess credit risk and improves overall decision-making.

2. Automated Credit Decision Support

The system highlights key risk factors, such as missed payments or irregular deposits, and suggests whether further investigation is needed. This automation reduces the manual workload and improves processing times by up to 70%. CART has been shown to cut Turnaround Time (TAT) by 40–70%, leading to quicker loan approvals.

3. Real-Time Decision-Making with AI-Driven Insights

This not only improves credit assessment but also aids in the detection of potential fraud. For instance, if an applicant attempts to manipulate their financial health by submitting fake bank statements, CART can quickly detect discrepancies and flag the application for further review.

4. Reducing Non-Performing Assets (NPA) Through Predictive Analytics

How CART Optimizes the Credit Underwriting Process

1. Fraud Detection and Prevention

One of the most significant challenges for financial institutions is the detection of fraudulent activity and fake bank statements. CART employs anomaly detection algorithms that learn from past fraudulent cases to identify new threats. It flags inconsistencies in financial data, unusual transaction patterns, and other red flags that could signal fraud.

For instance, the system is adept at spotting sudden, large deposits that don’t align with the applicant’s regular income. Such anomalies are flagged for manual review, allowing lenders to mitigate the risk of fraud early in the credit assessment process.

2. Enhanced Workflow and Scalability

CART integrates seamlessly with existing core banking and loan management systems, making it an ideal solution for financial institutions of all sizes. The platform’s API-based architecture ensures real-time communication between different systems, optimizing workflow and reducing bottlenecks in the credit underwriting process.

As financial institutions grow, the demand for scalable solutions increases. CART is built on cloud-based infrastructure, which enables it to scale effortlessly to accommodate high volumes of applications. This scalability is crucial for large lending institutions that handle millions of loan applications each year.

3. Customizable Credit Risk Framework

Every financial institution has its own credit risk policies. CART offers a customizable rule-based engine that allows lenders to tailor their credit scoring models based on their unique requirements. Whether it’s assessing personal loans, business loans, or mortgages, CART adapts to meet the specific needs of the institution.

Technical Architecture: The Engine Behind CART

1. Data Ingestion Layer

The data ingestion layer is responsible for extracting financial data from various document formats. CART uses Optical Character Recognition (OCR) to convert unstructured data into a readable format, enabling the system to extract income, expenses, and account balances from bank accounts.

2. AI and Machine Learning Core

Once the data is ingested, it passes through the AI and machine learning layer, which categorizes transactions and detects anomalies. The system is trained to identify fraudulent activity, flagging any unusual behavior in financial data that could indicate potential fraud.

This layer ensures that CART integrates seamlessly with external systems, such as Loan Origination Systems (LOS) and Customer Relationship Management (CRM) platforms. The integration layer is essential for ensuring real-time data flow between various systems, making CART a vital part of any lending institution’s digital ecosystem.

The Business Case for CART: Why Choose This Bank Statement Analyzer?

Time and Cost Efficiency: By automating bank statement analysis, CART reduces manual labor costs and accelerates the loan approval process. This results in significant cost savings — up to 55%—for financial institutions.

Fraud Prevention: CART is equipped with advanced algorithms to detect fake bank statements and prevent financial fraud, ensuring that lenders only approve legitimate applicants.

Data-Driven Insights: The AI-powered system offers detailed insights into income, expenses, and spending patterns, allowing lenders to make better financial decisions. The ability to track effective cash flow management also enables institutions to assess an applicant’s capacity to repay loans.

Regulatory Compliance: CART adheres to stringent data security and compliance standards, making it suitable for financial institutions that deal with sensitive customer information. The system ensures that all data is encrypted and handled in compliance with regulations.

Re-wind up: Transforming Bank Statement Analysis with CART

The future of bank statement analysis lies in automation and AI-driven insights. Novel Patterns’ CART offers financial institutions a solution that not only improves effective cash flow management and credit decision-making but also mitigates risks such as potential fraud and fake bank statements.

With its advanced AI models, customizable framework, and robust fraud detection systems, CART is poised to redefine the credit underwriting process, ensuring that financial institutions can make more informed decisions with speed and precision.

#cart#fintech#novel patterns#account aggregator#bfsi#myconcall#credit underwriting#finance#wealth management#bank statements#bank statement analysis#bank statement analyzer#Credit Assessment#genesis#financial institutions#Financial Health

0 notes

Text

KNOWING ALL ABOUT ACCOUNT AGGREGATOR NETWORK

The Finance Ministry last week unveiled the Account Aggregator (AA) network in banking with eight of India’s largest banks. An Account Aggregator Network is a financial data – sharing system. The network will revolutionize the investment and credit markets, and shall give millions of customers greater access and control over their financial records and expanding the potential pool of customers for lenders and fintech companies. It is a kind of dashboard of all our financial data.

About Account Aggregator

The Account Aggregator (AA) empowers the individual with control over their personal financial data.

Impact of Account Aggregator on the common man’s life

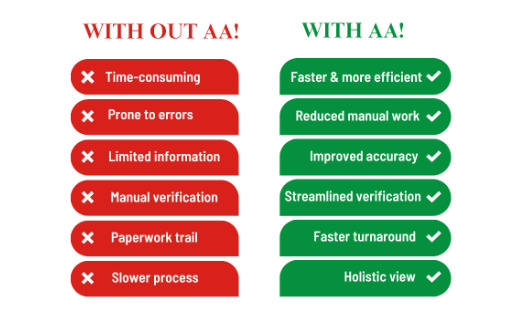

Indian Financial system involves many processes for consumers today - sharing of physical signed and scanned copies of bank statements, running around to notarize and stamp documents or to share personal username and password to give your financial history to third party. The AA network would replace all these with a simple, mobile based and safe digital data access & sharing process.

The Individual’s bank only needs to be connected to the AA Network. AA system in banking has been launched with the eight largest banks in India, four are already sharing data on a consent basis (Axis, ICICI, HDFC and IndusInd Bank) and four are going to be enabled soon (SBI, Kotak Mahindra Bank, IDFC First Bank and Federal Bank).

Type of Data that can be Shared

Read more: https://www.acquisory.com/ArticleDetails/87/Knowing-All-About-Account-Aggregator-Network

#account aggregator network#account management#indian financial system#financial system#financial consultant

0 notes

Text

So, let me try and put everything together here, because I really do think it needs to be talked about.

Today, Unity announced that it intends to apply a fee to use its software. Then it got worse.

For those not in the know, Unity is the most popular free to use video game development tool, offering a basic version for individuals who want to learn how to create games or create independently alongside paid versions for corporations or people who want more features. It's decent enough at this job, has issues but for the price point I can't complain, and is the idea entry point into creating in this medium, it's a very important piece of software.

But speaking of tools, the CEO is a massive one. When he was the COO of EA, he advocated for using, what out and out sounds like emotional manipulation to coerce players into microtransactions.

"A consumer gets engaged in a property, they might spend 10, 20, 30, 50 hours on the game and then when they're deep into the game they're well invested in it. We're not gouging, but we're charging and at that point in time the commitment can be pretty high."

He also called game developers who don't discuss monetization early in the planning stages of development, quote, "fucking idiots".

So that sets the stage for what might be one of the most bald-faced greediest moves I've seen from a corporation in a minute. Most at least have the sense of self-preservation to hide it.

A few hours ago, Unity posted this announcement on the official blog.

Effective January 1, 2024, we will introduce a new Unity Runtime Fee that’s based on game installs. We will also add cloud-based asset storage, Unity DevOps tools, and AI at runtime at no extra cost to Unity subscription plans this November.

We are introducing a Unity Runtime Fee that is based upon each time a qualifying game is downloaded by an end user. We chose this because each time a game is downloaded, the Unity Runtime is also installed. Also we believe that an initial install-based fee allows creators to keep the ongoing financial gains from player engagement, unlike a revenue share.

Now there are a few red flags to note in this pitch immediately.

Unity is planning on charging a fee on all games which use its engine.

This is a flat fee per number of installs.

They are using an always online runtime function to determine whether a game is downloaded.

There is just so many things wrong with this that it's hard to know where to start, not helped by this FAQ which doubled down on a lot of the major issues people had.

I guess let's start with what people noticed first. Because it's using a system baked into the software itself, Unity would not be differentiating between a "purchase" and a "download". If someone uninstalls and reinstalls a game, that's two downloads. If someone gets a new computer or a new console and downloads a game already purchased from their account, that's two download. If someone pirates the game, the studio will be asked to pay for that download.

Q: How are you going to collect installs?

A: We leverage our own proprietary data model. We believe it gives an accurate determination of the number of times the runtime is distributed for a given project.

Q: Is software made in unity going to be calling home to unity whenever it's ran, even for enterprice licenses?

A: We use a composite model for counting runtime installs that collects data from numerous sources. The Unity Runtime Fee will use data in compliance with GDPR and CCPA. The data being requested is aggregated and is being used for billing purposes.

Q: If a user reinstalls/redownloads a game / changes their hardware, will that count as multiple installs?

A: Yes. The creator will need to pay for all future installs. The reason is that Unity doesn’t receive end-player information, just aggregate data.

Q: What's going to stop us being charged for pirated copies of our games?

A: We do already have fraud detection practices in our Ads technology which is solving a similar problem, so we will leverage that know-how as a starting point. We recognize that users will have concerns about this and we will make available a process for them to submit their concerns to our fraud compliance team.

This is potentially related to a new system that will require Unity Personal developers to go online at least once every three days.

Starting in November, Unity Personal users will get a new sign-in and online user experience. Users will need to be signed into the Hub with their Unity ID and connect to the internet to use Unity. If the internet connection is lost, users can continue using Unity for up to 3 days while offline. More details to come, when this change takes effect.

It's unclear whether this requirement will be attached to any and all Unity games, though it would explain how they're theoretically able to track "the number of installs", and why the methodology for tracking these installs is so shit, as we'll discuss later.

Unity claims that it will only leverage this fee to games which surpass a certain threshold of downloads and yearly revenue.

Only games that meet the following thresholds qualify for the Unity Runtime Fee:

Unity Personal and Unity Plus: Those that have made $200,000 USD or more in the last 12 months AND have at least 200,000 lifetime game installs.

Unity Pro and Unity Enterprise: Those that have made $1,000,000 USD or more in the last 12 months AND have at least 1,000,000 lifetime game installs.

They don't say how they're going to collect information on a game's revenue, likely this is just to say that they're only interested in squeezing larger products (games like Genshin Impact and Honkai: Star Rail, Fate Grand Order, Among Us, and Fall Guys) and not every 2 dollar puzzle platformer that drops on Steam. But also, these larger products have the easiest time porting off of Unity and the most incentives to, meaning realistically those heaviest impacted are going to be the ones who just barely meet this threshold, most of them indie developers.

Aggro Crab Games, one of the first to properly break this story, points out that systems like the Xbox Game Pass, which is already pretty predatory towards smaller developers, will quickly inflate their "lifetime game installs" meaning even skimming the threshold of that 200k revenue, will be asked to pay a fee per install, not a percentage on said revenue.

[IMAGE DESCRIPTION: Hey Gamers!

Today, Unity (the engine we use to make our games) announced that they'll soon be taking a fee from developers for every copy of the game installed over a certain threshold - regardless of how that copy was obtained.

Guess who has a somewhat highly anticipated game coming to Xbox Game Pass in 2024? That's right, it's us and a lot of other developers.

That means Another Crab's Treasure will be free to install for the 25 million Game Pass subscribers. If a fraction of those users download our game, Unity could take a fee that puts an enormous dent in our income and threatens the sustainability of our business.

And that's before we even think about sales on other platforms, or pirated installs of our game, or even multiple installs by the same user!!!

This decision puts us and countless other studios in a position where we might not be able to justify using Unity for our future titles. If these changes aren't rolled back, we'll be heavily considering abandoning our wealth of Unity expertise we've accumulated over the years and starting from scratch in a new engine. Which is really something we'd rather not do.

On behalf of the dev community, we're calling on Unity to reverse the latest in a string of shortsighted decisions that seem to prioritize shareholders over their product's actual users.

I fucking hate it here.

-Aggro Crab - END DESCRIPTION]

That fee, by the way, is a flat fee. Not a percentage, not a royalty. This means that any games made in Unity expecting any kind of success are heavily incentivized to cost as much as possible.

[IMAGE DESCRIPTION: A table listing the various fees by number of Installs over the Install Threshold vs. version of Unity used, ranging from $0.01 to $0.20 per install. END DESCRIPTION]

Basic elementary school math tells us that if a game comes out for $1.99, they will be paying, at maximum, 10% of their revenue to Unity, whereas jacking the price up to $59.99 lowers that percentage to something closer to 0.3%. Obviously any company, especially any company in financial desperation, which a sudden anchor on all your revenue is going to create, is going to choose the latter.

Furthermore, and following the trend of "fuck anyone who doesn't ask for money", Unity helpfully defines what an install is on their main site.

While I'm looking at this page as it exists now, it currently says

The installation and initialization of a game or app on an end user’s device as well as distribution via streaming is considered an “install.” Games or apps with substantially similar content may be counted as one project, with installs then aggregated to calculate the Unity Runtime Fee.

However, I saw a screenshot saying something different, and utilizing the Wayback Machine we can see that this phrasing was changed at some point in the few hours since this announcement went up. Instead, it reads:

The installation and initialization of a game or app on an end user’s device as well as distribution via streaming or web browser is considered an “install.” Games or apps with substantially similar content may be counted as one project, with installs then aggregated to calculate the Unity Runtime Fee.

Screenshot for posterity:

That would mean web browser games made in Unity would count towards this install threshold. You could legitimately drive the count up simply by continuously refreshing the page. The FAQ, again, doubles down.

Q: Does this affect WebGL and streamed games?

A: Games on all platforms are eligible for the fee but will only incur costs if both the install and revenue thresholds are crossed. Installs - which involves initialization of the runtime on a client device - are counted on all platforms the same way (WebGL and streaming included).

And, what I personally consider to be the most suspect claim in this entire debacle, they claim that "lifetime installs" includes installs prior to this change going into effect.

Will this fee apply to games using Unity Runtime that are already on the market on January 1, 2024?

Yes, the fee applies to eligible games currently in market that continue to distribute the runtime. We look at a game's lifetime installs to determine eligibility for the runtime fee. Then we bill the runtime fee based on all new installs that occur after January 1, 2024.

Again, again, doubled down in the FAQ.

Q: Are these fees going to apply to games which have been out for years already? If you met the threshold 2 years ago, you'll start owing for any installs monthly from January, no? (in theory). It says they'll use previous installs to determine threshold eligibility & then you'll start owing them for the new ones.

A: Yes, assuming the game is eligible and distributing the Unity Runtime then runtime fees will apply. We look at a game's lifetime installs to determine eligibility for the runtime fee. Then we bill the runtime fee based on all new installs that occur after January 1, 2024.

That would involve billing companies for using their software before telling them of the existence of a bill. Holding their actions to a contract that they performed before the contract existed!

Okay. I think that's everything. So far.

There is one thing that I want to mention before ending this post, unfortunately it's a little conspiratorial, but it's so hard to believe that anyone genuinely thought this was a good idea that it's stuck in my brain as a significant possibility.

A few days ago it was reported that Unity's CEO sold 2,000 shares of his own company.

On September 6, 2023, John Riccitiello, President and CEO of Unity Software Inc (NYSE:U), sold 2,000 shares of the company. This move is part of a larger trend for the insider, who over the past year has sold a total of 50,610 shares and purchased none.

I would not be surprised if this decision gets reversed tomorrow, that it was literally only made for the CEO to short his own goddamn company, because I would sooner believe that this whole thing is some idiotic attempt at committing fraud than a real monetization strategy, even knowing how unfathomably greedy these people can be.

So, with all that said, what do we do now?

Well, in all likelihood you won't need to do anything. As I said, some of the biggest names in the industry would be directly affected by this change, and you can bet your bottom dollar that they're not just going to take it lying down. After all, the only way to stop a greedy CEO is with a greedier CEO, right?

(I fucking hate it here.)

And that's not mentioning the indie devs who are already talking about abandoning the engine.

[Links display tweets from the lead developer of Among Us saying it'd be less costly to hire people to move the game off of Unity and Cult of the Lamb's official twitter saying the game won't be available after January 1st in response to the news.]

That being said, I'm still shaken by all this. The fact that Unity is openly willing to go back and punish its developers for ever having used the engine in the past makes me question my relationship to it.

The news has given rise to the visibility of free, open source alternative Godot, which, if you're interested, is likely a better option than Unity at this point. Mostly, though, I just hope we can get out of this whole, fucking, environment where creatives are treated as an endless mill of free profits that's going to be continuously ratcheted up and up to drive unsustainable infinite corporate growth that our entire economy is based on for some fuckin reason.

Anyways, that's that, I find having these big posts that break everything down to be helpful.

#Unity#Unity3D#Video Games#Game Development#Game Developers#fuckshit#I don't know what to tag news like this

6K notes

·

View notes

Text

#account aggregator#finserve#aa#api integration#technology service provider'#fintech#rbi#digital platforms#financial institutions#digital signature

0 notes

Text

Between 2000 and 2020, the total number of Americans owing federal student loans more than doubled from 21 million to 45 million, and the total amount they owed more than quadrupled from $387 billion to $1.8 trillion, growing much faster than any other form of household debt. Figure 1 shows the growth in student loan borrowers and balances

Prior to 2020, when payments were temporarily frozen, a million students defaulted each year, and millions more struggled with their loans and failed to make payments. As recently as 2018, the Congressional Budget Office expected taxpayers to earn a profit on federal student lending programs. It now expects new loans issued over the next decade will instead cost $393 billion—more than will be spent on Pell grants for low-income undergraduates (Congressional Budget Office 2024). Moreover, that prospective cost estimate excludes hundreds of billions of write-downs on existing loans expected because of new policies that will reduce borrowers’ payments and provide debt forgiveness. Compounding these financial costs, many students left college without a degree or with a degree of dubious value, having missed out on the opportunity to rise up the economic ladder. What went wrong?

Since federal student lending programs started in the 1950s, such programs have exhibited boom-and-bust credit cycles. Legislation expanding financial aid to increase educational opportunities led to increased enrollment but also to the proliferation and expansion of institutions providing low-quality education to riskier students. The subsequent deterioration of student outcomes—and reports of scandals—caused Congress to limit lending using so-called “accountability rules,” regulating how postsecondary institutions participate in federal lending programs. When these new rules constrained opportunities for some would-be students, Congress would then whittle away at the rules, allowing student loans to expand again, until a new range of concerns appeared.

After a previous student loan crisis in the 1980s was arrested by new accountability rules passed by Congress, those rules were gradually loosened in the late 1990s. Almost immediately, college enrollment and student borrowing accelerated, particularly among groups that had historically been underrepresented at traditional institutions—students who were lower-income; first-generation students; Black and Hispanic; older; enrolled less than full time; pursuing degrees other than a B.A.; and much more likely to rely on federal aid not just for tuition but also for other costs of attendance, like living expenses. Expanding educational opportunities for these groups is clearly desirable and a key purpose of financial aid programs. But from the perspective of student lending, these new borrowers were much riskier, partly because of their socioeconomic backgrounds and partly because of the institutions they attended.

The institutions that enrolled this new wave of borrowers were disproportionately not traditional four-year institutions with strong educational and economic outcomes. Starting around 2000, for-profit institutions tripled their enrollment and community college students tripled their rate of borrowing. In 2000, only one of the top ten schools in terms of aggregate student loan volume was for-profit. By 2014, for-profits accounted for eight of the ten schools whose students owed the most (Looney and Yannelis 2015). In general, the schools that enrolled the surge of new students were those with high default rates and low student loan repayment rates, where few students complete their intended degrees, or where graduates’ earnings are the lowest. This influx of disadvantaged borrowers to lower-quality schools was catastrophic for those students’ finances, aggregate student loan outcomes, and the federal student loan budget. Between 2000 and 2014, the student loan default rate rose by 75% (Looney and Yannelis 2015).

Today’s student loan crisis—and the fact that it is one of a series—highlights the challenges of using a student loan financial aid system to promote access to educational opportunities that vary enormously (but in opaque ways) in their quality, value, and student outcomes. Today, the student loan program is the most costly federal program for subsidizing higher education. In contrast to other federal aid to students, however, loan eligibility is not means tested, and few guardrails exist to prevent using loans to pursue low-quality or excessively costly programs. As a result, the program’s budget cost and its distributional effects are delegated to the program’s beneficiaries themselves—the institutions, which enroll students and set the cost of attendance, and the students, who decide where to enroll and how much to borrow. Schools’ payments are only very weakly linked to students’ outcomes. As a result of these misaligned incentives, students—particularly disadvantaged students and those historically underrepresented at universities—face high costs, variable quality, and inequity in who goes to college and graduate school.

6 notes

·

View notes

Note

In terms of just the lost deposits, bank collapses don't affect most people due to deposit insurance. This seems to be set at $250k in the US. There are other concerns like individuals' liquidity, and systemic risk. But it seems like in cases of bank collapse with no systemic risk, most people are financially better off not bailing it out, as it means more of loss lies with the well off.

this isn't true! TL;DR it probably used to be true, but for ex in the case of SVB, there were a number of payroll providers in the bank, and if they go under, every person who works for one of the companies that uses those payroll providers can't get paid:

When Rippling’s bank recently went under, there was substantial risk that paychecks would not arrive at the employees of Rippling’s customers. Rippling wrote a press release whose title mostly contains the content: “Rippling calls on FDIC to release payments due to hundreds of thousands of everyday Americans.”

Prior to the FDIC et al’s decision to entirely back the depositors of the failed bank, the amount of coverage that the deposit insurance scheme provided depositors was $250,000 and the amount it afforded someone receiving a paycheck drawn on the dead bank was zero dollars and zero cents.

This is not a palatable result for society. Not politically, not as a matter of policy, not as a matter of ethics.

Every regulator sees the world through a lens that was painstakingly crafted over decades. The FDIC institutionally looks at this fact pattern and sees this as a single depositor over the insured deposit limit. It does not see 300,000 bounced paychecks.

Payroll providers are the tip of the iceberg for novel innovations in financial services over the last few decades. There exist many other things which society depends on which map very poorly to “insured account” abstraction. This likely magnifies the likely aggregate impact of bank failures, and makes some of our institutional intuitions about their blast radius wrong in important ways.

61 notes

·

View notes

Text

J.5.7 Do most anarchists think mutual credit is sufficient to abolish capitalism?

The short answer is no, they do not. While the Individualist and Mutualist Anarchists do think that mutual banking is the only sure way of abolishing capitalism, most anarchists do not see it as an end in itself. Few think that capitalism can be reformed away in the manner assumed by Proudhon or Tucker.

In terms of the latter, increased access to credit does not address the relations of production and market power which exist within the economy and so any move for financial transformation has to be part of a broader attack on all forms of capitalist social power in order to be both useful and effective. In short, assuming that Individualist Anarchists do manage to organise a mutual banking scheme it cannot be assumed that as long as firms use wage-labour that any spurt in economic activity will have a long term effect of eliminating exploitation. What is more likely is that an economic crisis would develop as lowering unemployment results in a profits squeeze (as occurred in, say, the 1970s). Without a transformation in the relations of production, the net effect would be the usual capitalist business cycle.

For the former, for mutualists like Proudhon, mutual credit was seen as a means of transforming the relations of production (as discussed in section G.4.1, unlike Proudhon, Tucker did not oppose wage-labour and just sought to make it non-exploitative). For Proudhon, mutual credit was seen as the means by which co-operatives could be created to end wage-labour. The organisation of labour would combine with the organisation of credit to end capitalism as workers would fund co-operative firms and their higher efficiency would soon drive capitalist firms out of business. Thus “the Exchange Bank is the organisation of labour’s greatest asset” as it allowed “the new form of society to be defined and created among the workers.” [Proudhon, Correspondance, vol. 2, pp. 307–8] “To organise credit and circulation is to increase production,” Proudhon stressed, “to determine the new shapes of industrial society.” [Op. Cit., vol. 6, p. 372] So, overtime, co-operative credit would produce co-operative production while associated labour would increase the funds available to associated credit. For Proudhon the “organisation of credit and organisation of labour amount to one and the same” and by recognising this the workers “would soon have wrested alienated capital back again, through their organisation and competition.” [No Gods, No Masters, vol. 1, pp. 59–60]

Bakunin, while he was “convinced that the co-operative will be the preponderant form of social organisation in the future” and could “hardly oppose the creation of co-operatives associations” now as we find them necessary in many respects,” argued that Proudhon’s hope for gradual change by means of mutual banking and the higher efficiency of workers’ co-operatives were unlikely to be realised. This was because such claims “do not take into account the vast advantage that the bourgeoisie enjoys against the proletariat through its monopoly on wealth, science, and secular custom, as well as through the approval — overt or covert but always active — of States and through the whole organisation of modern society. The fight is too unequal for success reasonably to be expected.” [The Basic Bakunin, p. 153 and p. 152] Thus capitalism “does not fear the competition of workers’ associations — neither consumers’, producers’, nor mutual credit associations — for the simple reason that workers’ organisations, left to their own resources, will never be able to accumulate sufficiently strong aggregations of capital capable of waging an effective struggle against bourgeois capital.” [The Political Philosophy of Bakunin, p. 293]

So, for most anarchists, it is only in combination with other forms of working class self-activity and self-management that mutualist institutions could play an important role in the class struggle. In other words, few anarchists think that mutualist credit or co-operatives are enough in themselves to end capitalism. Revolutionary action is also required — such as the expropriation of capital by workers associations.

This does not mean anarchists reject co-operation under capitalism. By creating a network of mutual banks to aid in creating co-operatives, union organising drives, supporting strikes (either directly by gifts/loans or funding consumer co-operatives which could supply food and other essentials free or at a reduced cost), mutualism can be used as a means of helping build libertarian alternatives within the capitalist system. Such alternatives, while making life better under the current system, also play a role in overcoming that system by aiding those in struggle. Thus Bakunin:

“let us co-operate in our common enterprise to make our lives a little bit more supportable and less difficult. Let us, wherever possible, establish producer-consumer co-operatives and mutual credit societies which, though under the present economic conditions they cannot in any real or adequate way free us, are nevertheless important inasmuch they train the workers in the practices of managing the economy and plant the precious seeds for the organisation of the future.” [Bakunin on Anarchism, p. 173]

So while few anarchists think that mutualism would be enough in itself, it can play a role in the class struggle. As a compliment to direct action and workplace and community struggle and organisation, mutualism has an important role in working class self-liberation. For example, community unions (see section J.5.1) could create their own mutual banks and money which could be used to fund co-operatives and support social struggle. In this way a healthy communalised co-operative sector could develop within capitalism, overcoming the problems of isolation facing workplace co-operatives (see section J.5.11) as well as providing solidarity for those in struggle.

Mutual banking can be a way of building upon and strengthening the anarchistic social relations within capitalism. For even under capitalism and statism, there exists extensive mutual aid and, indeed, anarchistic and communistic ways of living. For example, communistic arrangements exist within families, between friends and lovers and within anarchist organisations. Mutual credit could be a means of creating a bridge between this alternative (gift) “economy” and capitalism. The mutualist alternative economy would help strength communities and bonds of trust between individuals, and this would increase the scope of the communistic sector as more and more people help each other without the medium of exchange. In other words, mutualism will help the gift economy that exists within capitalism to grow and develop.

#community building#practical anarchy#practical anarchism#anarchist society#practical#faq#anarchy faq#revolution#anarchism#daily posts#communism#anti capitalist#anti capitalism#late stage capitalism#organization#grassroots#grass roots#anarchists#libraries#leftism#social issues#economy#economics#climate change#climate crisis#climate#ecology#anarchy works#environmentalism#environment

6 notes

·

View notes

Text

I'm back with an update for this post. Sadly, after 3 weeks, none of the blogs I approached about not reblogging posts with Curseforge links ever responded or took action.

But before I get to that, one thing I want to say about this is that some of the aggregate blogs out there have drawn the line at reblogging posts that include link shorteners or content that is still in the early access period, but can't find it in them to exclude direct or indirect links to Curseforge. Most of them aren't getting paid for running their blogs in any way, so they have no financial/livelihood stake in perpetuating the proliferation of Curseforge links across simblr, and yet...

I don't know if it's laziness, apathy, or ego, but, whatever the basis, the end result is still inhumane.

This, of course, is not to say that creators that still use Curseforge are absolved because they do have a monetary stake in it, but that the aggregators have such a low bar for advocating for the resistance and still cannot manage it. It's disheartening and makes me angry.

Anyway. I know there are loads of aggregate blogs out there, but I limited my list to ones that I actually use or follow. There are 2 others not listed here, but I haven't decided how to address them yet. That said...

sssvitlanz - no response, no blog policy update, still reblogging posts with Curseforge links (up to today)

ts4-poses - no response, no blog policy update, still reblogging posts with Curseforge links (up to yesterday)

maxismatchccworld - no response, no blog policy update, but no new posts since Jan 6th - NOTE: The blog runner has their own Curseforge account for their own CC, so…

public-ccfinds - no response, no blog policy update, but no new posts since Jan 11th; one of the blog admins is on hiatus and the other hadn't been active since a couple days before my ask, but popped up this month

Do with that what you will.

#curseforge boycott#curseforge#boycott#simblr#black simblr#black simmer#ts4 screenshots#simblring#public wcif

4 notes

·

View notes

Text

Hello, Oldie Chinese Diaspora Anon™️ here. I have to say, I was really surprised with the response to my last post – thank you for all the responses! And thank you for the questions as well. As I’ve always said, I really appreciate the questions. I hope you will find the answers adequate, too.

Q: “I thought the social credit system was mostly about crime and financial metrics? why would the government care about what’s going on in the bjd hobby?”

A: R-vv has it right! The Government doesn’t really care about BJDs. It cares about people’s aggregate behaviour, both online and in person. However, since you need your real information (name/age/address/etc.) in order to apply for an online account (of any kind), it’s easy to link the two. After that, anything you post online can be linked to you, there is no anonymity. The government, therefore, tracks online activity like the pulse of the nation. One’s online behaviour can lead to significant real-life consequences. For a more exaggerated example, you may remember how the popular fanfiction repository, Archive of Our Own, was completely shut out of China several years back. Most folks chalk it up to China activating its infamous Great Firewall and start clamouring about free speech and all, but the reality is nothing of the sorts. The reason why AO3 was shut out of China was due to rabid fan behaviour leading to large luxury brands dropping their Chinese spokesperson and losing a large amount of money (for more information, here: https://www.sixthtone.com/news/1005262/fan-fiction-site-blocked-in-china-after-celebs-stans-complain ). The reason why the government is interested in anything in specific is because of their social implication and financial impact. Simply put, China is a place that cannot stand social dissidence. It doesn’t matter why there was dissidence, dissidence simply cannot be tolerated.

Q: If that’s how their credit system works and it effects them that much and they hate recasts then why don’t they all just bully Luo into a lower social credit rating and stop his business from operating?

A: Well, you see… there’s a simple answer to this question that, and when broken down to its basic elements, can be rather silly. Without an interaction, you cannot contribute to someone’s social credit score – it can be something physical like an altercation, something systematic like the hiring or firing of a person, or it can be financial like a purchase. Since the Chinese doll circle detest Luo, they refuse to have anything to do with anything related to him. If there’s no interaction, there’s no way to contribute to the downfall of his social credit system. Besides, online bullying (like the AO3 example above) actually lowers the scores of all people who were involved, including the complaining stans (they are “rabble rousers” and a “mob”). It’s a lose-lose situation if anyone even attempts it in the first place.

Q: Social credit applies when you want to get a loan? / I know in US your personal finances and credit is separate from your company if you own an LLC. There must be some loophole he is using if it’s not affecting him.

A: Interestingly, Luo would have a pretty good social credit score – it has something to do with the marking scheme being based on what is “socially productive” for China. It’s only got tangential ties to morals. Luo’s factory has an annuals sales volume of $2.5 to 5 million USD, according to his own company profile (https://chinabjd.en.alibaba.com/company_profile.html ). This is on the background of a region where the yearly average income is $50,147RMB ($7035USD) per year (http://tjj.jiangxi.gov.cn/art/2022/6/2/art_38582_3982696.html ). He is considered one of the largest factories in the region, supporting not just the families of his workers but also both upstream and downstream manufacturers. Even if he needs a loan, it’d be more than easy to get one (Chinese people do not like leverage much when doing business, it’s considered highly risky behaviour – over-leveraging caused the housing market to crash in 2022.) One of the Tieba members from a previous link (this one: http://c.tieba.baidu.com/p/7792470874?pn=1 ) where a commentator mentioned that Luo’s factory is considered a “protected” business by the local government. Normal companies simply cannot compete.

Note 1: Online selling platforms such as Taobao and Xianyu are touted as being safer due to their customer service and protection policies. Therefore most doll owners strongly urge other (usually new) users to use a platform instead of sending money through transfer services such as Weixin or Zuan-zuan (think of them as F&F Paypal and Venmo). On these platforms, every transaction leaves a record. And if you have been blocked by another user, or you have a history of returns, complaints or bad ratings, these records will directly impact your social credit score. The system is set up for you to follow it and be voluntarily tracked because following the rules is considered “safer”.

Note 2: Just like what I said in the last post (https://the-bjd-community-confess.tumblr.com/post/707455091551109120/hello-oldie-chinese-diaspora-anon-here-where ), the Chinese boomers don’t share the same moral values as their children do (or their children’s children). The boomers in the government are more interested in keeping the nation docile and productive (read: keep earning foreign currency) than worrying about copyright. It’s a process that’s still happening today: https://lisamerriam.com/kfcs-success-in-china-breeds-imitators/ There has been changes to copyright law and better enforcement, but this should not be taken as a change of heart. There’s nothing like Chinese pragmatism – these changes are made to ensure that it can still attract outside investors without them running away in fear of imitators and other malicious competitors.

~Anonymous

33 notes

·

View notes

Text

Exciting news from Sony this evening, with the announcement that not only is a new Sly Cooper game at last in the works, it will be the first video game created entirely by AI.

The move was unveiled by Sony CEO Robert Sony Jr., who is battling ongoing accusations from shareholders that he is running the company his father founded into the ground. No journalists were invited to the press event, with Sony instead speaking the details into an automatic speech-to-text tool which was then improved with Grammarly(r) and emailed out to outlets that his Microsoft Outlook account considered to be relevant.

"AI has made impressive strides in muscling living, breathing humans out of various artistic fields permanently. With these programs now handling your dumb hobbies, you don't need to waste your time churning out paintings or poems or whatever and can now focus on your office job sixty hours a week," Sony reminded us.

To that end, every element of the upcoming Sly Cooper game will be procedurally generated from aggregated data pools. The series' famous art style will be briskly assembled via machine learning. Sly and friends will speak in recreations of their original actors' voices, uncanny both in their undeniable recognisability and their stilted, inhuman cadences. Their dialogue will be generated based on neural-network analysis of their previous adventures. Given the relatively short length of the series, however, Sony will also draw from other sources to fill out this last dataset, primarily Marvel movies and Sonic the Hedgehog games. That just happened - way past cool!

"Granted, that's the easy part," conceded Sony. "AI tools can easily replace writers, artists, and voice actors, but gameplay is another question. How hard could it really be, though? Code is code."

It's been a rough year for Sony financially, as the media and electronics giant only made a net profit of eleven billion dollars - far, far short of projected potential earnings of eleven and a half billion dollars. Sony has admitted this shortfall is unacceptable, firing seven thousand employees as a corrective measure. He hopes this experiment could turn his fortunes around.

"Nate Fox. Dev Madan. Kevin Miller, Matt Olsen, Chris Murphy, and whoever voices Carmelita," said Sony. "All of these are people we no longer need to pay. Hell, we didn't even pay the robot. What does it care? It's not like it's in a union. 100% of the profits will be going to the true backbone of society: faceless men in suits who used their pre-existing wealth to buy the legal rights to things. Like me!"

Once the AI generates the script, gameplay, art assets, voice lines, and any new characters, it will then blend these elements together in what Sony assures investors will most certainly be a video game.

"Just buy the damn thing," he concluded, prematurely loosening his tie. "If you love Sly Cooper, the only way to show it is to give me, the current rights holder, money. Do you kids still like NFTs? We can put an NFT in it too. That's not worth its own press conference though."

Sly Cooper: A Thief is a Person Who Takes Another Person's Property or Services Without Consent will be on sale, like, next week.

#april fools#fake news#listen. LISTEN#I swore that I would enter ''sly cooper game cover'' into some shitty online AI program and use the first result#but HOLY FUCK I WASN'T READY#the fear-laughter this image invoked in me was intense#anyway hope you enjoyed checking in with my oc Robert Sony Junior

28 notes

·

View notes

Text

Transform Your Financial Data Management with

Novel Patterns’ Account Aggregator Ecosystem — CART

Introduction to Account Aggregator

In today’s digital age, managing financial data across various platforms can be a daunting task. The emergence of the Account Aggregator (AA) ecosystem is set to revolutionize this space, offering a seamless, secure, and efficient way to share financial information across different institutions with user consent. This innovative system is regulated by the Reserve Bank of India (RBI), ensuring compliance and security.

Account Aggregators act as a bridge, facilitating the transfer of financial data from Financial Information Providers (FIPs) to Financial Information Users (FIUs) in a structured manner. This system empowers users by giving them control over their data, allowing for informed decision-making and improved financial planning. The AA ecosystem not only enhances user experience but also drives financial inclusion by making data accessible to various stakeholders in the financial sector.

The Role of Novel Patterns

At the forefront of this technological advancement is Novel Patterns, a leading Fintech solutions provider. Their CART platform is designed to streamline the integration of FIUs and FIPs into the AA ecosystem, providing a comprehensive solution for data sharing and management. The CART platform is built with advanced APIs, robust security measures, and compliance with regulatory standards, ensuring a smooth and secure data exchange process.

Key Features and Benefits

Seamless Integration — The CART platform is engineered for easy integration with existing financial systems, reducing the complexities associated with adopting new technologies. This seamless integration enhances operational efficiency and ensures minimal disruption to business processes.

Advanced Analytics — The CART platform offers advanced analytics capabilities, providing FIUs and FIPs with actionable insights. These insights help optimize AA integrations, uncover growth opportunities, and make data-driven decisions. By leveraging these analytics, financial institutions can improve their services and better meet customer needs.

Data Security — Security is paramount when dealing with financial data. Novel Patterns employs top-tier security measures to protect sensitive information throughout the integration process. Their platform adheres to stringent security protocols, ensuring that data is safeguarded against unauthorized access and breaches.

Compliance and Certification — Navigating the regulatory landscape can be challenging for financial institutions. The CART platform facilitates the necessary certifications and approvals, ensuring compliance with regulatory standards. This helps FIUs and FIPs stay ahead of regulatory requirements and avoid potential legal issues.

User-Centric Design — The CART platform is designed with the end-user in mind. Its intuitive design enhances user satisfaction and engagement, making it easy for users to navigate and manage their financial data. This user-centric approach ensures that the platform meets the needs of both FIUs and FIPs.

Scalability — As financial institutions grow, their data management needs evolve. The CART platform is built to scale, accommodating increasing data volumes and expanding with organizational growth. This scalability ensures that the platform can support the long-term needs of financial institutions.

Comprehensive Solutions for Financial Institutions

Novel Patterns’ CART platform offers a wide range of solutions tailored to the needs of financial institutions. These solutions are designed to streamline processes, enhance efficiency, and ensure compliance with regulatory standards.

Data and Consent Management — Efficient data and consent management is crucial for the success of the AA ecosystem. The CART platform simplifies consent processes, allowing users to easily grant or revoke access to their financial data. This ensures that data sharing is always done with user consent, promoting transparency and trust.

KYC/AML Compliance — Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are critical components of the financial industry. The CART platform helps financial institutions comply with these regulations by providing comprehensive tools for customer verification and monitoring. This ensures that institutions can prevent fraud and maintain the integrity of their operations.

Risk Assessment and Credit Scoring — Accurate risk assessment and credit scoring are essential for making informed lending decisions. The CART platform leverages comprehensive risk assessment tools and credit scoring algorithms to provide FIUs with the information they need to assess the creditworthiness of borrowers. This helps reduce the risk of default and improve lending outcomes.

Underwriting and Financial Analysis — Efficient underwriting processes are key to the success of financial institutions. The CART platform streamlines underwriting processes, allowing FIUs to quickly evaluate loan applications and make informed decisions. Additionally, the platform provides tools for detailed financial analysis, helping institutions better understand the financial health of their customers.

Why Choose Novel Patterns?

Choosing the right partner for integrating into the AA ecosystem is crucial for financial institutions. Novel Patterns stands out for several reasons:

Personalized Support — Novel Patterns offers personalized support to their clients, ensuring that they have the assistance they need throughout the integration process. Their team of experts is available to provide guidance and address any issues that may arise.

Transparent Pricing — Transparency in pricing is a key consideration for financial institutions. Novel Patterns offers transparent pricing models, allowing institutions to understand the costs involved and budget accordingly. This transparency helps build trust and ensures that there are no hidden fees.

Unified Platform — Novel Patterns’ CART platform provides a unified solution for managing invoices, support, and billing inquiries. This simplifies the management process and ensures that all aspects of the integration are handled efficiently.

Scalability and Growth — The CART platform is built to scale, ensuring that it can support the long-term growth of financial institutions. As data volumes increase and business needs evolve, the platform can adapt to meet these changing requirements.

Success Stories

Novel Patterns has a proven track record of successfully integrating financial institutions into the AA ecosystem. Their clients have reported significant improvements in operational efficiency, data management, and customer satisfaction. By leveraging Novel Patterns’ solutions, these institutions have been able to enhance their services, expand their customer base, and achieve their business goals.

Future Prospects

The future of the AA ecosystem looks promising, with increasing adoption and continuous innovation. Novel Patterns is committed to staying at the forefront of this evolution, continually enhancing its CART platform to meet the growing needs of financial institutions. By investing in research and development, they aim to introduce new features and capabilities that will further streamline data management and enhance the user experience.

Get Started

To experience the transformative power of Novel Patterns’ AA solutions, connect with us today. Explore how their innovative Fintech SaaS offerings can elevate your business and drive success in the ever-evolving financial landscape.

#cart#fintech#novel patterns#myconcall#account aggregator#bfsi#credit underwriting#finance#Financial Institution

1 note

·

View note

Text

By: Preston Cooper

Published: May 8, 2024

Key Points

This report estimates return on investment (ROI) — how much college increases lifetime earnings, minus the costs of college — for 53,000 different degree and certificate programs.

Bachelor’s degree programs have a median ROI of $160,000, but the payoff varies by field of study. Engineering, computer science, nursing, and economics degrees have the highest ROI.

Associate degree and certificate programs have variable ROI, depending on the field of study. Two-year degrees in liberal arts have no ROI, while certificates in the technical trades have a higher payoff than the typical bachelor’s degree.

Nearly half of master’s degree programs leave students financially worse off. However, professional degrees in law, medicine, and dentistry are extremely lucrative.

Around a third of federal Pell Grant and student loan funding pays for programs that do not provide students with a return on investment.

Executive Summary

In recent years, young Americans have expressed more skepticism about the financial value of higher education. While prospective students often ask themselves if college is worth it, this report shows the more important question is when college is worth it.

This report presents estimates of return on investment (ROI) for 53,000 degree and certificate programs ranging from trade schools to medical schools and everything in between. I define ROI as the increase in lifetime earnings that a student can expect when they enroll in a certain degree program, minus the costs of tuition and fees, books and supplies, and lost earnings while enrolled. My preferred measure of ROI accounts for the risk that some students will not finish their programs.

This report updates FREOPP’s previous research on ROI, utilizing new data from the U.S. Department of Education’s College Scorecard.

The findings show that college is worth it more often than not, but there are key exceptions. ROI for the median bachelor’s degree is $160,000, but that median belies a wide range of outcomes for individual programs. Bachelor’s degrees in engineering, computer science, nursing, and economics tend to have a payoff of $500,000 or more. Other majors, including fine arts, education, English, and psychology, usually have a smaller payoff — or none at all.

Alternatives to the traditional four-year degree produce varied results. Undergraduate certificates in the technical trades tend to have a stronger ROI than the median bachelor’s degree. However, many other subbaccalaureate credentials — including associate degrees in liberal arts or general education — have no payoff at all. Field of study is the paramount consideration at both the baccalaureate and subbaccalaureate levels.

The ROI of graduate school is also mixed. Professional degrees in law, medicine, and dentistry tend to have a strong payoff, often in excess of $1 million. However, nearly half of master’s degree programs have no ROI, thanks to their high costs and often-modest earnings benefits. Even the MBA, one of America’s most popular master’s degrees, frequently has a low or negative payoff.

The report introduces a new metric — the mobility index — to quantify the aggregate financial impact of each degree or certificate program. The mobility index multiplies each program’s ROI by the number of students it enrolls, thus rewarding programs for both financial value and inclusivity. Bachelor’s degrees in nursing and business administration dominate the top ranks of the mobility index.

Finally, the report estimates how much federal government funding flows to programs that leave students with no ROI. Around 29 percent of federal Pell Grant and student loan dollars over the last five years were used at programs that leave students with a negative ROI. The results point to a role for federal policymakers in improving the ROI of higher education.

While ROI should not be the only consideration for students approaching the college decision, the ROI estimates presented in this report can help students and their families make better choices regarding higher education. The estimates may also be of interest to other stakeholders, including policymakers, researchers, journalists, and institutions.

The full ROI estimates for undergraduate programs are available here. The full ROI estimates for graduate programs are available here.

[ Continued... ]

==

The article includes an interactive graph which allows you to choose from various majors and find the ROI. Some samples.

Controversial opinion: While there may be an argument to waiving or subsidizing college loans for courses that strongly benefit society, no program with a negative ROI should ever be given loan forgiveness or federal funding.

If you want to study Ancient Mesopotamian Interpretive Dance - or even more uselessly, Gender Studies - for your own pleasure and enjoyment, that's your business. And your financial responsibility; the bill for that resides with you. As far as society and our tax dollars are concerned, forgiving that loan or funding that course is just setting fire to money.

Reminder that you may be better off at a trade school. Courses are often shorter, more targeted and cheaper, so you end up working quicker, earning money more rapidly and have a lower debt that's paid off sooner.

#higher education#student loans#loan forgiveness#return on investment#college#college loans#academic merit#trade school#religion is a mental illness

3 notes

·

View notes

Text

Wells Notice Crypto

Learn what a Wells Notice is and how to respond to one in the world of cryptocurrency. TRES Finance offers expert guidance on responding to regulatory notifications and provides essential crypto accounting compliance best practices. Discover how TRES Finance & cutting-edge Web3 technology can revolutionize your financial data management, streamlining your finance, auditing, and compliance operations. With powerful data aggregation, contextual ledger, and token and fiat reconciliation capabilities, TRES Finance can help you drive growth and stay ahead of the competition.

2 notes

·

View notes

Text

#account aggregator#api integration#framework#aa#financial information#banks#nbfc#rbi#artificial intelligence#machine learning#data transfer

0 notes

Text

Can I do BCOM after 12th Science?

Yes, you can pursue a Bachelor's of Commerce (BCOM) degree after completing your 12th in Science stream. While Science and Commerce may seem like very different fields, they share several commonalities, including strong analytical skills, problem-solving abilities, and attention to detail. Here's a look at how you can make the transition from Science to Commerce.

Admission Process

The admission process for BCOM is similar to other undergraduate programs. Most universities and colleges require a minimum of 50% aggregate marks in 12th or equivalent examination from a recognized board. However, some universities may have different admission criteria, so it is important to check the requirements of the specific institution you wish to apply to.

Course Curriculum

BCOM is a three-year undergraduate degree program that covers a wide range of topics related to business and commerce. Some of the core subjects include Accounting, Finance, Economics, Business Law, Management, Marketing, and Taxation. Students also have the option to choose from various elective subjects, such as Human Resource Management, International Business, and Information Technology.

The curriculum of BCOM is designed to equip students with the necessary knowledge and skills to work in various fields such as accounting, finance, marketing, and human resources. BCOM is an excellent option for those who are interested in pursuing a career in the field of commerce.

Skills Required

To succeed in BCOM, students require strong analytical and mathematical skills, as well as excellent problem-solving abilities. They should be able to think critically and logically to solve complex business problems. Good communication skills and the ability to work in teams are also important, as commerce is a highly collaborative field.

Career Opportunities

BCOM graduates have a wide range of career opportunities available to them, including accounting, finance, marketing, human resources, and more. They can work in various industries such as banking, insurance, retail, and hospitality, among others.

Some of the popular career options for BCOM graduates include:

Accountant - Accountants are responsible for maintaining financial records, preparing financial statements, and ensuring compliance with tax laws and regulations.

Financial Analyst - Financial analysts analyze financial data, prepare reports, and make recommendations on investment opportunities and financial decisions.

Marketing Manager - Marketing managers create and implement marketing strategies to promote products and services, as well as to increase brand awareness and customer loyalty.

Human Resource Manager - Human resource managers are responsible for recruiting, hiring, and managing employees, as well as ensuring compliance with labor laws and regulations.

Entrepreneur - BCOM graduates can also choose to start their own business or become self-employed.

Conclusion

In conclusion, pursuing a BCOM degree after 12th Science is an excellent option for students who are interested in pursuing a career in the field of commerce. BCOM provides a solid foundation in business and commerce, which prepares students for various careers in accounting, finance, marketing, human resources, and more. With the right qualifications, experience, and networking, BCOM graduates can build a successful and fulfilling career in any of these fields.

2 notes

·

View notes