#Net Banking App

Text

Safe Mobile Banking: What to Consider When Choosing Mobile Banking App?

You can easily access your bank account with mobile banking apps. You can check your history, make transactions, pay invoices, and examine account balances. Locating an online banking app with these common features is relatively easy. Numerous financial organizations provide banking services via their mobile apps. While online banking is also available from banks and credit unions, the advantages of mobile banking apps that operate without physical locations are typically higher. When choosing amobile banking app, you must consider a few important things to have a safe online banking experience. Continue reading about what to consider when selecting a mobile banking app:

Fees and ATM Network

Consumers may find fees like overdrafts, ATM transactions, and monthly payments inconvenient. Choose the expenses that will affect you the most and look for mobile banking apps that charge little or nothing for those services. ATM users should regularly see if an app has nearby locations and what network it operates on. ATM networks help you save money on each transaction by lowering or eliminating ATM fees. ATM transactions are fee-free with certain mobile banking apps.

Ease of Use

The mobile app for your bank should be easy to use and simple, and it should work on both Apple and Android smartphones. On your first app usage, allow yourself around half an hour to find everything you need, depending on how comfortable you are with mobile applications. It could be a better app, but it will irritate you later if it initially looks overwhelming. Digital wallets can be integrated with a good banking app.

Account Minimums

Mobile banking app frequently set minimum deposit and balance requirements. Sadly, some of these minimums exceed what most individuals want or can pay. If the minimum balance on your account is not met, they could charge you fees. Make a shortlist of the mobile banking apps that offer minimal payments that are less than your means. Certain banks make opening a checking or savings account simpler by not having any minimum requirements.

Compare features and functions

Different mobile banking apps have different features. While some include more sophisticated features like budgeting tools, investing alternatives, and rewards programs, others only provide basic services like bill payment, balance checking, and fund transfers. Depending on your habits and aspirations, you could seek an app to help you reach your financial goals or include the features and functionalities you use most frequently. For instance, you can look for an app with goal-setting tools, automatic savings plans, or cash-back incentives if your objective is to save more money.

Mobile Deposit

The best banking applications provide features like mobile check capture and electronic check deposit. With just a few taps on the app, you can enter the deposit amount, snap pictures of the front and back of the check, and quickly get confirmation that the bank has received and is processing your deposit.

Bottom Line

When you are looking for a UPI application choose one with good features. Then, search for one that provides a safe and easy way to access your accounts from your smartphone whenever possible. With the right mobile banking app, you can watch your spending, save money, raise or lower your credit score, and have access to budgeting and financial tools.

#mobile banking account app#upi bank app#phone banking#net banking app upi#banking mobile upi#internet banking app#upi account create#bank online account#net banking#upi net banking#upi bank#bank account online#net banking app#mobile banking apps in india#best net banking app#phone banking app#internet banking#fixed deposit account

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#net banking app#phone banking#phone banking app#mobile banking application#internet banking app#digital account#digital banking#check balance#fd account app#transfer mobile banking app

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#net banking app#phone banking#phone banking app#mobile banking application#internet banking app#digital account#digital banking#check balance#fd account app#transfer mobile banking app

0 notes

Text

Kotak Mahindra Bank’s official mobile banking application for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

If you are an existing Kotak customer, you can use the 250+ features of the app to Bank, Pay bills, Invest, Shop and access services.

One of our recent additions to the 250+ features is our new Pay Your Contact feature, where you can now send money to anyone using just their mobile Number

#fast mobile banking#net banking app#upi bank#net banking#e banking#digital account#kyc bank account#internet banking#bank account check app#fd mobile app#transfer mobile banking app#bank transfer application

1 note

·

View note

Text

Unlocking Convenience: The Power of Kotak Mobile Banking App in the Digital Banking Era

In the age of Digital India, banking has transcended traditional boundaries, offering unparalleled convenience and efficiency. Kotak Mahindra Bank stands at the forefront of this digital revolution with its innovative mobile banking app. Let's delve into the myriad benefits of the Kotak Mobile Banking App and how it's transforming the way we bank online.

Seamlessly Bank Online with Kotak Mobile Banking App

Gone are the days of long queues and paperwork. With the Kotak Mobile Banking App, banking becomes a seamless and hassle-free experience. Whether you're on the go or relaxing at home, access your accounts, pay bills, and manage transactions with just a few taps on your smartphone. Say hello to convenience as you embrace the power of digital banking at your fingertips.

Open Bank Account with Ease

The Kotak Mobile Banking App simplifies the process of opening a bank account, making it accessible to everyone. Say goodbye to cumbersome paperwork and lengthy procedures. With the app's intuitive interface, you can open a bank account in minutes, right from the comfort of your home. Experience the joy of instant account opening and step into the world of digital banking effortlessly.

Empowering UPI Payments with Kotak

Say hello to fast and secure payments with the Kotak Mobile Banking App's UPI payment feature. Whether you're splitting bills with friends or making online purchases, UPI payments offer unparalleled convenience. Link your bank account seamlessly, generate UPI IDs, and experience instant fund transfers like never before. With Kotak, sending and receiving money is as easy as a few taps on your smartphone.

Embracing Digital Banking with Kotak

The Kotak Mobile Banking App epitomizes the essence of digital banking in India. With its cutting-edge features and user-friendly interface, it caters to the diverse needs of modern-day consumers. From net banking functionalities to e-banking services, Kotak leaves no stone unturned in providing a comprehensive digital banking experience. Join the digital revolution with Kotak and embark on a journey of seamless banking.

Conclusion

In conclusion, the Kotak Mobile Banking App emerges as a beacon of convenience and efficiency in the realm of digital banking. With its robust features, secure transactions, and user-friendly interface, it redefines the way we bank online. From opening bank accounts to making UPI payments, Kotak empowers individuals to take control of their finances with ease. Embrace the future of banking with Kotak and unlock a world of possibilities at your fingertips.

Experience the convenience of Kotak Mobile Banking App—your gateway to digital banking in India.

#bank online#open bank account#upi payment app#net banking app#payment bank#mobile banking#digital india banking app#digital banking app#e banking#digital banking india#payment app

0 notes

Text

Is Instant Bank Account Opening Online very safe

The current age of online banking is what everyone is making noise about. With the high level of security in place with online banking platforms these days, it is not surprising that people choose to bank online more. You can decide to Open New Bank Account Online based on what works for you. Most people have benefited from these online accounts by linking them to their businesses. With these linking done, it seems everything is working accordingly. Benefiting from this world will definitely help you in pushing your business to the next level as you wish for it to be.

Visit your bank account from home

The PC at home, cybercafe, or work where transactions can be done. However, for your own safety restrict using devices that you alone have access to. If you do not do this, you will end up having to deal with breaches into your computer. This is because hackers who access those public computers will be able to access your account and that doesn’t help at all. When you do not consider these security precautions, it can become a problem. That is why you need to be very careful with the decisions you make. In choosing to move with an Instant Bank Account Opening Online, have this move made to ensure every decision is made to suit you. Even when you are at home, you can access your bank account from home. That is a good thing.

Your safety can be trusted

Ensure your computer is well secured. If you have an antivirus software installed onto your device, it helps to keep your device safe all round. Also, you need to ensure the internet connection you have is safe and strong. Online banks decide to take these things very seriously these days. They do not want to be in trouble with their customers. Also, they do not want to mess up their brand. That is why they do their best to keep their servers and apps safe. Naturally, online transactions can be trusted where safety is concerned. Deciding to Open New Bank Account Online via the wrong locations is what leads to problems. If you do not want to have issues of hacking into your account, you need to preserve your info and remain safe all the time. Some fraudsters try to create fake websites that are just like online banks. So, when you decide to link up with them or access them, they end up having access to your system which is bad.

Movement of money with extreme convenience

Choosing to have money moved or transferred from your online bank account to other accounts is simple. Since everything is done online, you do not lose a thing. Remember, when you decide to Open New Bank Account Online, you get to have that unique experience that counts and this is a great move. You can be lying down in your bed and be browsing through your financial statements. So, you get to know the right information about your finances without any form of pressure. One of the reasons people like to link these accounts to their businesses is due to their easy accessibility and their unique features that helps to move online businesses to the fore.

Conclusion

Deciding to go through with an Instant Bank Account Opening Online will keep you happy and fulfilled. Getting to know how these instant banking processes work is how to benefit from them. So, be ready to delve in.

#kotak811#kotak#Mobile App#Payment Bank#Upi Bank App#Money Transfer#E Banking#Digital Account Opening#Digital India Banking App#Digital Account App#Upi App Download#Net Banking App#Digital Account

1 note

·

View note

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History

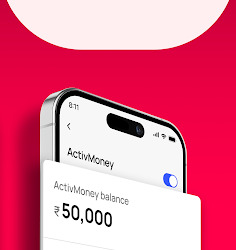

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#mobile banking account#upi mobile banking app#safe mobile banking#fast mobile banking#mobile banking account app#phone banking#net banking app upi#banking mobile upi#upi net banking#contactless banking#fd easy#mobilebanking app upi#upi account check#open fd#digital account#app upi mobile banking#upi enabled app#upi net banking app#fd account yearly#quick fd account

2 notes

·

View notes

Text

Benefits of handling Digital Payments by using UPI

In ancient times, people used some types of coins for purchasing purposes. Then, they used the commodity exchange method. After that, we are using money in the form of paper and coins. We used to give cash in a physical form for every purchase, even if it was a single penny or a large amount. To give or receive money from someone, we have to appear physically. Then only we can get the amount if you want to send money to anyone through the bank, which also takes some time. But now we have an option for quick money transferthrough UPI transfer. Let’s look at the benefits of UPI transactions in the post.

UPI

UPI stands for Unified Payments Interface. The UPI method was introduced by the National Payments Corporation of India (NPCI) in 2016. UPI is a digital payment platform, even though you can use banks to send money to anyone by deposit into their account. However, it needs the account number, name, and IFSC, and you have to wait and spend your most valuable time in the bank. We must wait to take the Demand Draft, deposit the checks, and all. By using UPI money transfer,we made money transactions easy.

Digital Payment

Digital payments make our transactions more efficient through UPI money transfer.UPI is nothing but sending or receiving money using any mobile application. Now, it is more effective for everyone. To make a UPI payment, we don’t need to register the secondary person’s account details on our own. We just need the phone number linked to their bank account. One more way of digital payment is scanning the QR code to send money.

Benefits of UPI Payment

There is no need to carry cash, card, or wallet everywhere.

Caring for a mobile phone as a digital wallet is enough to make our payments.

You can instantly send money to anyone by using mobile phones.

It provides 24/7 support for money transactions.

It helps us to reduce the transaction fees from banks.

Can integrate more than one bank account under one UPI ID.

Can pay all bills by the use of UPI Payment.

You can shop for anything online by using it.

Many digital platforms provide cashback and offer reward points by using UPI Payment.

Everyone can use UPI Payment as it is a user-friendly platform.

It helps to save our time.

The Bottom line

After the UPI Payment's introduction, most payments are paid as digital payments. Everyone highly welcomes this payment method. Malls, Cinema Theaters, Department Stores, Showrooms, Educational Institutions, Hotels, Hospitals, and even very small merchandise shops also now have the digital payment method. Given the easy accessibility of the platform, the usage of UPI Payment is becoming more common nowadays. The UPI Paymenthas made a big change and created a revolution in Indian payment, making it more accessible to non-residential Indians. Now, this quick money transfermade us feel a stress-free life.

#banking upi mobile#upi mobile banking#upi registration#digital account app#upi banking app#upi net banking app#upi bank account#mobile banking upi#upi account#mobile banking account app#digital account#app upi mobile banking#net banking app upi#upi mobile banking app#safe mobile banking#upi enabled app#mobilebanking app upi

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#upi account#easy net banking app#contactless banking#fast mobile banking#net banking app#bank app#mobile banking apps#मोबाइल बैंकिंग ऐप्स#e banking app#premium banking#net banking#digital banking#ebanking#upi mobile banking#mobile banking upi#mobilebanking app upi#fd account app#upi mobile banking app

0 notes

Text

UPI: The Force Behind Inclusion and Economic Growth

In this rapidly evolving world of digital finance, the Unified Payments Interface (UPI) has emerged as a powerful driver of economic growth and financial inclusion. UPI has revolutionized the way transactions are handled. It plays an important role in promoting a more inclusive and robust economic landscape.

Download App :

#net banking app upi#upi bank#fast mobile banking#bank account online#bank upi#contactless banking#mobile banking apps in india#safe mobile banking#quick fd account creation#app upi mobile banking#upi account number check#banking mobile upi#phone banking#upi mobile banking app#upi account check#new bank account#bank online account#mobilebanking app upi

2 notes

·

View notes

Text

Top benefits of using a QR code scanner:

Nowadays, it's impossible to live in the modern world without QR codes and contactless payments. Because they are so simple and adaptable, these decades-old technologies have many uses in industry and transportation.

Only recently have contactless payments and QR codes begun to permeate the consumer sphere; COVID-19's concerns about social isolation helped their widespread adoption. In this post, you will learn a lot about QR code scanner:

It's simple to begin taking touch-free payments with QR codes:

It might not be worthwhile redesigning your payment process or investing in new equipment merely to take a few touch-free payments, as many touch-free payment methods call for a specific payment terminal.

On the other hand, all you need to use QR codes is a regular printer. Accepting remote payments only takes a few seconds once you print your QR code.

Payments with QR codes are safe:

How secure are QR code payments for your customers? A QR code connects your account to the customer's payment app, not sensitive payment data. Customers can pay you without disclosing sensitive information like account numbers because the app encrypts their payment data.

Appeal to the Crowd:

Furthermore, customers find QR codes a convenient alternative to searching for their wallet or handbag because they can easily scan them using their smartphone. This is particularly helpful for processing payments at outdoor events and festivals, where space is frequently restricted, and transactions may need to be completed promptly.

Boost Loyalty to Brands:

Additionally, you may strengthen your ties with customers and boost customer loyalty by creating customized promos only available to buyers who scan QR codes. For example, you may provide rewards points for consistently using QR code scanner payments or discounts exclusively available through these methods.

Hassle is eliminated from the consumer journey with QR codes:

The easier it is for customers to check out, the fewer processes involved. Here's where QR codes come in handy. Before they could finish checking out in the past, consumers had to locate their register, scrabble to find their card, scan it, and confirm their details.

You can allow clients to conveniently finish their transactions from their mobile devices with a few taps by utilizing QR codes for payments. It's quick and practical.

Scans of QR codes can be tracked:

Businesses can utilize QR codes to gather data insights about customer habits and transaction trends because they can be tracked.

For instance, is there a certain time or day of the week when more sales are being made? Do customers immediately make a purchase after scanning a QR code, or do they just browse your website after scanning a QR code? How often do they bounce back? Utilize QR codes to find the answers to these queries and improve your future tactics.

Extremely versatile:

Finally, you are open regarding personalization as QR codes are quite flexible and allow you to change the design to suit your requirements. Encrypted data transmissions are also possible with QR codes to offer even more protection when making payments.

Bottom Line:

The above points clearly explain the benefits of QR code scanners. If you are going to a shop without cash in your hand, using the Upi app, you can just scan the QR code scanner and pay whatever your bill is.

#mobilebanking app upi#safe mobile banking#upi enabled app#digital account#app upi mobile banking#fd account yearly#upi mobile banking app#internet banking app#phone banking#net banking app upi#banking mobile upi#best net banking app#internet banking#fd mobile app

1 note

·

View note

Text

Kotak811 Mobile Banking Check A/c balance & transaction history, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#banking upi mobile#upi mobile banking#upi registration#digital account app#upi bank account#fd account app#upi banking app#fd account#mobile banking upi#upi account#digital account#fd account benefits#upi net banking app#fd account yearly#mobile banking account app#fixed deposit account#upi account number check#open fd#Fd transfer status#instant fd account setup

0 notes

Text

Best Mobile Banking app Features

Nowadays, mobile banking app has become a daily part of your lives, providing convenience, accessibility, and security like never before. As technology grows, mobile banking apps are constantly updated to fit client’s needs. Now, let us look at some of the best features of mobile banking apps.

Download App:

#upi registration#digital account app#upi net banking app#upi bank account#fd account app#upi account#upi enabled app#app upi mobile banking#digital account#upi account number check#fd account benefits#banking mobile upi#मोबाइल बैंकिंग#phone banking#upi mobile banking app#upi account check#upi banking app#fd account yearly#new bank account#bank online account#mobile banking account#mobile banking account app#phone banking app#net banking app upi#upi bank#fast mobile banking#upi bank app#bank account online#bank upi#mobile banking application

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Download App:

#bank balance check karne wala app#check my bank balance#check bank balance app#upi app download#finance application#balance check karne wala app#latest fd rates#banking mobile upi#upi bank account#app upi mobile banking#net banking app upi#upi transfer app#upi account number check

1 note

·

View note

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#digital account#app upi mobile banking#upi enabled app#upi net banking app#fd account yearly#quick fd account#mobile banking account#upi mobile banking app#safe mobile banking#fast mobile banking#mobile banking account app#phone banking#net banking app upi#banking mobile upi#upi net banking#contactless banking#fd easy#mobilebanking app upi#upi account check#open fd

0 notes

Text

Secure UPI Payments, Scan QR, Check Balance & View Transaction History

Kotak811 is your one-stop solution for all banking needs—whether it's quick UPI transfers, checking your account balance, or reviewing transaction history. Don't miss out on our high-interest Fixed Deposits to accelerate your savings!

#banking upi mobile#upi mobile banking#upi registration#digital account app#fd account app#upi banking app#upi net banking app#upi bank account#mobile banking upi#upi account

0 notes