#Digital Account App

Text

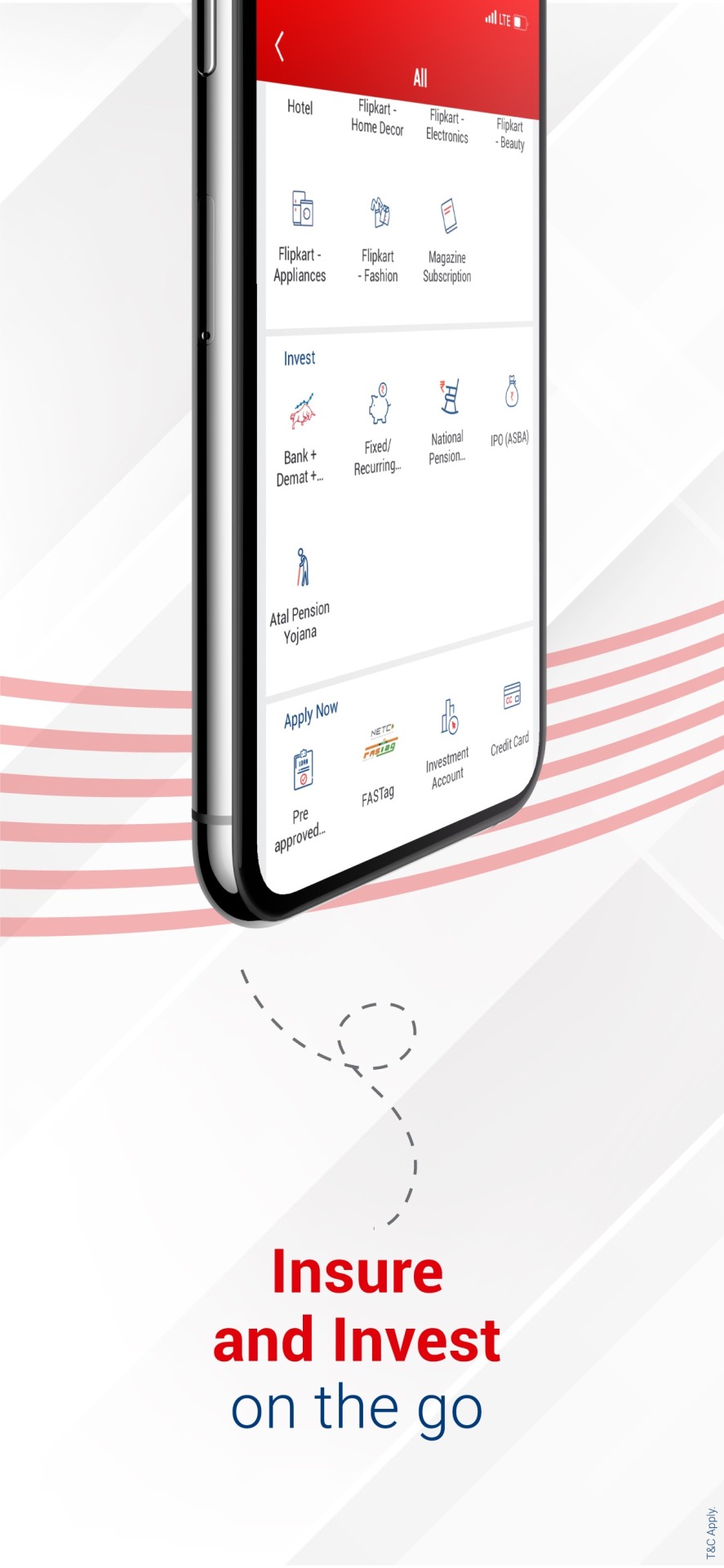

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#best banking app#premium banking#mobile banking app#digital account app#secure net banking#phone banking app#zero balance account#e banking app#online bank

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#best banking app#premium banking#mobile banking app#digital account app#secure net banking#phone banking app#zero balance account#e banking app#online bank

0 notes

Text

Eligibility and Documents Required to Obtain a Credit Card

Credit cards have become an essential financial tool, offering convenience and flexibility in managing expenses, since it is optional to get one. It involves meeting certain eligibility criteria and submitting specific documents to the issuing bank or financial institution. You can now try it on a digital account by opening the app itself. Many of you may need a credit card but don't know how. Understanding these requirements is crucial for them to ensure a smooth application process and increase the chances of approval. So, let us clarify the eligibility to apply for a credit card.

Factors influencing credit card eligibility:

Banks and financial institutions establish specific eligibility criteria to assess an individual's creditworthiness before approving a credit card application. While the eligibility criteria may vary slightly among different issuers, the following are common factors considered:

Age - Applicants must usually be at least 18 to be eligible for a credit card. Age requirement may differ for various financial institutions.

Income - A regular source of income is a primary factor in determining eligibility. The income requirement varies based on the type of card and the issuing bank.

Employment Status - Whether you're salaried, self-employed, or a business owner, your employment status plays a role in eligibility.

Credit History - A good credit history will be a positive sign to get a credit card. Issuers may consider your credit score, which reflects your creditworthiness.

Nationality and Residence - Credit card eligibility is often restricted to citizens or residents of the country where the card is issued. Some institutions also consider the duration of your stay in that country.

Existing Debts - Your existing debt obligations, such as loans or outstanding credit card balances, might influence your eligibility. A high debt-to-income ratio could lead to a rejection.

Documents Required:

You'll be instructed to submit specific documents along with your credit card application to substantiate your eligibility and provide the necessary information. The exact list of required documents may vary by institution, but generally, the following are commonly requested:

1. Identity Proof includes documents such as a valid passport, driver's license, Aadhaar card, or voter ID card.

2. Address Proof - Utility bill payments, rental agreements, or a recent bank statement can serve as address proof.

3. Income Proof - Salaried individuals usually must provide salary slips for the last few months. Self-employed individuals might need to submit income tax returns or audited financial statements.

4. Passport-sized Photographs - These are required for identity verification.

5. Employment Proof - For salaried applicants, an employment verification or appointment letter can be requested.

6. Bank Statements- Some issuers might ask for your recent bank statements to assess your financial stability.

7. PAN Card - The Permanent Account Number (PAN) card is essential for income verification and tax purposes.

8. Business Proof - If you're self-employed or a business owner, you might need to provide documents related to your business, such as business registration certificates.

Closing thoughts:

Many digital account opening apps provide the facility to apply for a credit card online. Acquiring a credit card requires meeting specific eligibility criteria and submitting essential documents that validate your identity, financial stability, and creditworthiness.

#digital account app#new bank account open app#apply online account opening#open bank account#zero account opening online#online new account open#account opening form online#best online account opening

0 notes

Photo

And that’s not all!

Mid-month cash crunch or an emergency? Get your salary in advance!

Kotak Payday Loan is available with just a few taps. Repay the loan when your salary gets credited next month.

Features of Payday Loan:

• Get a loan within seconds starting at Rs.3,000

• Pay interest as low as Re.1 per day

• Avail loan with no documentation

Eligible users can apply from the ‘Apply Now’ section.

#Digital Account App#Bank Open Account Online#Online Open Bank Account App#Digital India Banking App#Online Digital Account Opening#Bank Account Check#Money Transfer#Banking App#kotak#kotka 811

1 note

·

View note

Text

Okay so last night I complained about being glued to my screen more than I’d like to be. So this morning I decided I’ll do something about it <3 the purpose of documenting it here is so that I hold myself accountable on my blog instead of writing it down in my notes app and negating it like two seconds later. And also so it’s easier for me to be like “bitch enough” whenever I catch myself scrolling through my Tumblr when I absolutely should not be. I plan on increasing these rules (progressive overload) or decreasing them (too much too soon) depending on results, but for the next week it’s:

Cannot get on my phone until I’ve drunk water, done my am skincare routine/taken my am shower, and taken my am supplements.

Phone in the morning for 15 minutes max. Otherwise I cannot be on my phone until noon (I wake up pretty early so this gives me like 4 hours of no phone time).

Also cannot get on my phone after noon unless I’ve studied at least two hours beforehand.

Need to study 2 hours for every 1 hour I’m on my phone until 6 pm.

Can use my phone liberally after 6 pm ONLY if I’ve: hit my study goals, done my Anki flash cards that are due, and finished my workout (or walk) of the day. Otherwise, the previous rule applies.

Need to read a book for at least 30 minutes in the day. This can be thrown in whenever, but preferably before bed.

Need to set aside 20 minutes after 6 pm to do pm skincare routine/take pm shower.

#anyone looking at this post will be like ‘is this bitch a productivity blog now’ NO I’m not ok.#i am but a 21 year old girl who’s trying to heal her relationship w her phone after being given an iPad at age 11#this goes for Pinterest too bc god knows I waste too much time on that app#will try to update this on a regular basis so I can better hold myself accountable 🤞#p#digital detox

230 notes

·

View notes

Text

youtube ads becoming first one 5-second ad then two 5-second ads in a row or one 15-second ad then a million unskippable ads in the middle of videos instagram quietly inserting one ad in-between every 5 or 10 ig stories then 2 in-between 4 ig stories not to mention the new reel- and explore page ads. a quiet tumblr ad banner at the top of your dash then photo ads in-between posts then video ads then video ads in-between every 3 or 5 posts that play audio automatically while youre trying to read a textpost. the most popular, paid subscription, news apps adding ads between their articles, then in articles, then paywalling new articles further with a new "news +" subscription and putting ads in those as well. once every 15 tweets there being an ad, then every 5, then theres also an ad if you scroll to the replies. you cant look at tweets without logging in anymore, theres just no option for anon scrolling. facebook ai mining on instagram, facebook ai profiles hyping up ai generated photos im fucking going insane ai temu ads and gallery app ads and printer app ads and higher subscriptions while still seeing ads and i cant fucking do this anymore!!!!! its fucking shameless and worst of all its silent and nobody talks about how half the things we see anymore are fucking ads and we dont own a single thing we pay for and companies can just randomly raise their prices through the roof and nobody says anything about it

#im going insane???#we dont own anything movies are digital every fucking app and software i subscription based AND THEN THEY HAVE THE FUCKING GALL#TO PUT ADS IN THOSE AS WELL!!!!#20 bucks a month for a software that i have to watch banner ads on! its fucking insane#the entire world is owned by four corporations and ads are fucking everywhere i feel like i see more ads than posts nowadays#and it didnt use to be like this!!!! thats the insane part to me!!!!!!#i started social media in 2014 10 years ago and there wasnt a single ad on instagram#but the worst is that nobody fucking complains about it . everybodys like oh its bad that netflix isnt allowing people-#-outside of one wifi to use one account even tho theyve paid for it for like. two weeks#and then we go back to normal. no complaining no yelling no real backlash! and everybody keeps their subscriptions#im going insane genuinely i dont know what the fuck#rant#vent#anti capitalism#ads#advertisement#advertisements#advertising#social media#instagram#tumblr#facebook#twitter#UGH

14 notes

·

View notes

Text

Ok guys!!! Lest say no to AI art!!!!!!!!!!!! Find me @/gelubabosa or link

The page is kinda slow but I like the style

Whoever wants to follow me is free to do so. I'll keep using Instagram but I will slowly stop posting there if Meta doesn't fix their AI shit...

#the babosa is talking#stupid post#stupid stuff#screenshot#cara#cara app#digital artist#social media#new social media#new account

10 notes

·

View notes

Photo

Jigglypuff 🎤🎵 💞

#pokemon#pokémon#pokemon fanart#pokémon fanart#jigglypuff#cute#digital art#digital illustration#art#illustration#digital painting#procreate#procreate app#digital artist#support small artists#small artist#small art account#cute art#cute artwork#pink#pinkcore#strawbunnycakeart

369 notes

·

View notes

Text

OC-tober Day 30: Magic

Mimosa's an alchemist by trade, but she's also an incredibly skilled wizard, which, in this world, requires a bond with a magic conduit. Omen (the horse one) and Jet (dragon-looking guy) are her familiars, which are born from the connection between a wizard and their conduit.

The part that confuses those around her is that she has two familiars. No one can bond with more than one conduit (and Mimosa only seems to have the one anyway), but both Omen and Jet are definitely tied to Mimosa.

#art#digital art#oc#oc-tober#bweirdoctober#App's art#Mimosa Tamar#Omen#Jet#Neon Lights#MultiVerse Chronicles#October2023#OC-tober2023#actual line art? on my blog? apparently#fun fact: Mimosa is missing multiple fingers on account of having no sense of self-preservation#she'd probably be down a full hand if not for the valiant efforts of her long-suffering roommate#Christopher will never be paid enough to deal with her nonsense

7 notes

·

View notes

Text

the oldest internet drawings i’ve ever made from what i can find💀

#i know i probably have older drawings#but i can’t find my old account on this app called color therapy. which is where i first did digital art#i have like 6 accounts on there and i can only find 3#there is soooo much art from me on there and i can’t get rid of it cause i don’t remember the password for my most used account#ok i just looked and i have 1168 posts on there FROM ONE ACCOUNT#wow#i actually still post on there like once every 2 months#i met one of my best internet friends on there#it was a lot of fun while it lasted but my 3 years on that app are over#i still look back on it it was good times#digital art#??#☎️

5 notes

·

View notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open zero balance account#digital account app#mobile banking app#open bank account app#digital account opening app#online new account opening app#instant account opening app#best mobile banking app

0 notes

Photo

🖤 Delicate green tea feat. Sailor Pluto 🍵 Getting polaroids printed of all the senshi soon!

#sailor pluto#dark sailor#black aesthetic#sailor guardians#procreate app#procreate art#outer senshi#outer sailor senshi#sailor moon aesthetic#green tea#anime tea#tea fan#digital anime drawing#digital anime art#digital artist#small account#small art account#anime girl#anime women#magical anime#magical girls#dark cute#elegant woman#otona#sailor pluto fan#sailor pluto fanart#sailor moon fandom#sailor moon fanart

13 notes

·

View notes

Text

Features of a zero minimum balance account

A savings account with minimum restrictions is a dream for the majority of the working class. You can deposit your funds in a savings account, which is a deposit account service offered by the bank. Typically, banks will provide you with a savings account as long as you keep a certain minimum balance in the account. If not, you'll be required to pay a maintenance fee.

However, some people start Instant Online Bank Account Opening to create an account known as a zero-balance savings account which does not require a minimum amount. Simple in concept, there is no requirement to keep a minimum balance in a savings account in order to maintain this kind of account.

Read some of the features of a zero minimum balance account:

No minimum balance

As its name would suggest, this account requires no minimum balance to be present in it. As a result, you are not required to keep a minimum balance. Therefore, if there is a zero balance, there is no penalty. When people open this kind of account, this is what draws them in the most.

Restricted transactions

The number of transactions you can make each month on zero-balance accounts is restricted. Banks often limit withdrawals to four per month. The bank will turn your account into a standard Savings Account if you do make more withdrawals than are allowed. For these additional transactions, some banks might even impose a small fee.

What are the different types of zero-balance accounts?

Zero-balance savings accounts come in a variety of forms. The three primary forms of zero-balance accounts are digital savings zero-balance accounts, Basic Savings Bank Deposit Accounts, or BSBDA, and BSBDA Small Accounts.

The e-KYC procedure allows for the immediate opening of digital savings accounts online. To open the account, you must have a PAN card and an identification number. In this process, the OTP issued to the registered mobile number is used to verify the biometric information. These accounts initially have some limitations under central bank standards.

Economically challenged people without bank accounts who possess the required KYC documents can open a Basic Savings Bank Deposit Account or BSBDA. This requires zero balance.

Performing Instant Online Bank Account Opening for BSBDA Small accounts can be opened by those without the necessary KYC documentation with the aid of an introducer. Small savings account holders are limited to holding a certain amount. Additionally, consumers have a year to submit the necessary KYC documentation.

A limited number of savings accounts

According to new restrictions issued by central banks, there can only be one zero-balance account at one bank. Additionally, if you have a zero-balance savings account with one bank, you are not permitted to have any other savings accounts with that bank. You must provide a declaration to the bank saying that you do not already have a zero-balance savings account with another bank when you apply for one.

Final thoughts

While having its own benefits, a zero-balance savings account may have an impact on your financial situation. An Account Opening App is helpful if you encounter unanticipated financial situations that require numerous withdrawals. Having a minimum balance in your savings account may therefore be advantageous.

#kotak#kotak811#Instant Online Bank Account Opening#Payment Bank#Digital Account Opening App#Online Bank Accounts Opening#नेट बैंकिंग#नेट बैंकिंग एप्प#Banking App#Money Transfer#Bank Account Check#Online Digital Account Opening#Online Open Bank Account App#Bank Open Account Online#Online Bank Account Opening App Sbi#Digital Account App#Open Saving Account Online#Zero Balance Account Online#Instant Open Bank Account

1 note

·

View note

Text

With a web app development virtual assistant committed to your company, you can turn website visitors into customers, develop your own apps, and maintain the security and updates of your website. Pankh Consultancy Pvt. Ltd provide a broad range of virtual assistant support services in the areas of digital marketing, branding, web development, mobile development, and design and strategy consulting. Contact Now ! +1 (646-609-7473)

#web app development virtual assistant#graphic designer virtual assistant#mobile development virtual assistant#financial accounting virtual assistant#seo specialist virtual assistant#ppc specialist virtual assistant#social media manager virtual assistant#digital marketing virtual assistant#cost accounting virtual assistant#software development virtual assistant#top-rated virtual assistants worldwide

1 note

·

View note

Text

it’s officially that time apparently! have seen two damn near spoilers for npmd today alone (like as close to spoilers as you can get without the show being out)

so i am officially blocking the tags ‘npmd’ and ‘nerdy prudes must die’ and their spoiler variants for the simple prevention of the temptation to click links

i have no money right now but am so so tempted to get a digital ticket because i don’t know if i can physically and psychologically wait that long to see the show on youtube

#the tags will be blocked until i either see the show via digital ticket or when it comes to youtube#am prepared for the long long waiting game and will delete this app (not my account) from my phone to avoid the temptations#in the meantime i will remain here until it either gets spoiled untagged (please don’t do that)#or if i just need to remove myself from the platform to avoid the spoilers#i do not want spoilers my dudes#this is the first new show starkid’s done since i joined the fandom#please no spoilers#starkid#dikrats#team starkid#starkid productions#starkid returns#npmd#nerdy prudes must die#npmd spoilers#nerdy prudes must die spoilers#hatchetfield#hatchetverse#hatchetfield spoilers#starkid spoilers#musical theatre#nick lang#jeff blim#mariah rose faith#joey richter#lauren lopez#angela giarratana

12 notes

·

View notes

Text

I’m picking up Artfol again since they’re banning AI art😌✌️

Come join and gimme a follow!

#it’s also a pretty good app#from the little I used it in 2021#it’s specifically made for us artists so it’s pretty nice✌️#Imma be spam posting to try and get the account up to speed dkdneifn#art#myart#artfolapp#artfol#artist#digitalart#digital artist#digital art#digitalartist

2 notes

·

View notes