#New York Bankruptcy Law

Text

New York Bankruptcy Law

Bodner Law PLLC offers legal services under different practice areas like litigation, food law, bankruptcy, transaction, etc. in New Jersey, New York City, and Long Island. It provides services to businesses of different sizes and individuals with professional attorneys in their team.

0 notes

Text

SAG-AFTRA Takes Up Bethenny Frankel’s Fight To Unionize Reality Show Contestants & End “Exploitative Practices”

August 10, 2023

"SAG-AFTRA, which covers the hosts but not the contestants on reality TV competition shows, said today that it’s working “toward the protection of the reality performers” in an effort to end “the exploitative practices that have developed in this area” and “to engage in a new path to union coverage.”

“We are tired of studios and production companies trying to circumvent the union in order to exploit the talent that they rely upon to make their product,” the guild said.

The announcement comes after Bethenny Frankel, a former star of The Real Housewives of New York City, suggested that reality performers should go on strike in order to win residuals for their work and to combat abuses in the workplace. Reality show hosts, but not contestants, are covered by the guild’s Network Code, which is not part of its strike against films and scripted TV shows.

“Why isn’t reality TV on strike?” Frankel said in a recent TikTok video. “I got paid $7,250 for my first season of reality TV, and people are still watching those episodes.” Reality stars, she said, “are the stepchildren, the losers, the mules, the pack horses. The ones that the entertainment industry is going to rely on, right now, to carry the water and do the heavy lifting when real stars, real A-list Hollywood is on strike.”

She added, “Reality television exploits affairs, bankruptcy, falling off the wagon, not really having what you say you have, something inappropriate, risking cancellation every single time the camera goes on.”

To address the alleged abuse of reality stars, she’s engaged high-powered attorneys Bryan Freedman and Mark Geragos to investigate the alleged abuse of reality stars.

In a statement today, SAG-AFTRA said that it “has engaged in discussions with Bryan Freedman at the Freedman + Taitelman, LLP law firm who has been retained by Bethenny Frankel around the subject of treatment of reality performers. SAG-AFTRA is the union that represents reality performers. Depending on the structure of the production and the performers involved, we can cover these performers under our Network Code Agreement.

“We stand ready to assist Bethenny Frankel, Bryan Freedman and Mark Geragos along with reality performers and our members in the fight and are tired of studios and production companies trying to circumvent the Union in order to exploit the talent that they rely upon to make their product.

“We encourage any reality performers and/or members to reach out to SAG-AFTRA’s Entertainment Contracts Department so that we may work together toward the protection of the reality performers ending the exploitative practices that have developed in this area and to engage in a new path to union coverage.”

“Please be advised that the day of reckoning has arrived,” Freedman, working with Geragos, said in a letter sent to NBCUniversal on Aug. 3. “While our investigation is still ongoing, we have reason to believe that cast members and crewmembers on NBC reality TV shows have been subjected to disturbing mistreatment by NBCUniversal and/or its employees, contractors, and third-party affiliates.”

Building off Frankel’s union aims, the list of such mistreatment that Freedman lays out includes:

Deliberate attempts to manufacture mental instability by plying cast members with alcohol while depriving them of food and sleep.

Denying mental health treatment to cast members displaying obvious and alarming signs of mental deterioration.

Exploiting minors for uncompensated and sometimes long-term appearances on NBC reality TV shows.

Distributing and/or condoning the distribution of nonconsensual pornography.

Covering up acts of sexual violence.

Refusing to allow cast members the freedom to leave their shows, even under dire circumstances.

In response, an NBCUniversal spokesperson told Deadline that the company is “committed to maintaining a safe and respectful workplace for cast and crew on our reality shows. At the outset, we require our third-party production partners to have appropriate workplace policies and training in place. If complaints are brought to our attention, we work with our production partners to ensure that timely, appropriate action is or has been taken, including investigations, medical and/or psychological support, and other remedial action that may be warranted such as personnel changes.”

@bethennyfrankel on Tiktok: This is a union. I’ve defined fair & reasonable terms & consider those making $0 on the bachelor to a housewife making millions. This is a 1st pass & how I’d negotiate, w/ my institutional knowledge & wisdom in this industry w/ over a decade on 8 tv, w/ 10 books, 5 podcasts, multiple businesses & what was the fastest growing spirits business in history. I know a contract. Looking into traditional TV residuals is like looking inside “a beautiful mind.” Content used later with no profit sharing & l exploitation of hard working talent is as archaic as calling empowered independent women “housewives,” a term setting back women 100 years then using them for drama.

This is the REALITY RECKONING aka THE REALITY REVOLUTION. The is the new BETHENNY CLAUSE. Reality TV has existed for decades & sustained entertainment during the last strike & exploded. This isn’t for people like me, who have thrived & succeeded and clawed their way to the top despite the odds. This is for the next generation. These are broad stroke terms subject to modification. This fight is just getting started. We’re rogue & nimble & not entangled & unwieldy. The intention here is to affect change, get things done and make history.

I’ve listed some names who have contacted me & want to get involved. People not on this list are Vanderpump rules talent & the Kardashians, ironically the most powerful entities in entertainment right now, with the most leverage. They should fight for others who paved the way & for those after them. Shows like Summer House and others in production should stand down. Viewers should not watch this content. This paves the way for nurses and teachers, essential workers, production members & glam teams that will be inspired to create a model of their own reckoning.

Change takes courage. I’ve alienated this industry & burned bridges with the entire network and streaming community in one fell swoop. This is not for the faint of heart but it’s for the greater good. This is correct. We will be sending these terms by email with the subject line: “Reality Reckoning” starting emails with: imwithbethenny Who’s with me?"

2K notes

·

View notes

Text

One of America’s most corporate-crime-friendly bankruptcy judges forced to recuse himself

Today (Oct 16) I'm in Minneapolis, keynoting the 26th ACM Conference On Computer-Supported Cooperative Work and Social Computing. Thursday (Oct 19), I'm in Charleston, WV to give the 41st annual McCreight Lecture in the Humanities. Friday (Oct 20), I'm at Charleston's Taylor Books from 12h-14h.

"I’ll believe corporations are people when Texas executes one." The now-famous quip from Robert Reich cuts to the bone of corporate personhood. Corporations are people with speech rights. They are heat-shields that absorb liability on behalf of their owners and managers.

But the membrane separating corporations from people is selectively permeable. A corporation is separate from its owners, who are not liable for its deeds – but it can also be "closely held," and so inseparable from those owners that their religious beliefs can excuse their companies from obeying laws they don't like:

https://clsbluesky.law.columbia.edu/2014/10/13/hobby-lobby-and-closely-held-corporations/

Corporations – not their owners – are liable for their misdeeds (that's the "limited liability" in "limited liablity corporation"). But owners of a murderous company can hold their victims' families hostage and secure bankruptcies for their companies that wipe out their owners' culpability – without any requirement for the owners to surrender their billions to the people they killed and maimed:

https://pluralistic.net/2023/08/11/justice-delayed/#justice-redeemed

Corporations are, in other words, a kind of Schroedinger's Cat for impunity: when it helps the ruling class, corporations are inseparable from their owners; when that would hinder the rich and powerful, corporations are wholly distinct entities. They exist in a state of convenient superposition that collapses only when a plutocrat opens the box and decides what is inside it. Heads they win, tails we lose.

Key to corporate impunity is the rigged bankruptcy system. "Debts that can't be paid, won't be paid," so every successful civilization has some system for discharging debt, or it risks collapse:

https://pluralistic.net/2022/10/09/bankruptcy-protects-fake-people-brutalizes-real-ones/

When you or I declare bankruptcy, we have to give up virtually everything and endure years (or a lifetime) of punitive retaliation based on our stained credit records, and even then, our student debts continue to haunt us, as do lawless scumbag debt-collectors:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

When a giant corporation declares bankruptcy, by contrast, it emerges shorn of its union pension obligations and liabilities owed to workers and customers it abused or killed, and continues merrily on its way, re-offending at will. Big companies have mastered the Texas Two-Step, whereby a company creates a subsidiary that inherits all its liabilities, but not its assets. The liability-burdened company is declared bankrupt, and the company's sins are shriven at the bang of a judge's gavel:

https://pluralistic.net/2023/02/01/j-and-j-jk/#risible-gambit

Three US judges oversee the majority of large corporate bankruptcies, and they are so reliable in their deference to this scheme that an entire industry of high-priced lawyers exists solely to game the system to ensure that their clients end up before one of these judges. When the Sacklers were seeking to abscond with their billions in opioid blood-money and stiff their victims' families, they set their sights on Judge Robert Drain in the Southern District of New York:

https://pluralistic.net/2021/05/23/a-bankrupt-process/#sacklers

To get in front of Drain, the Sacklers opened an office in White Plains, NY, then waited 192 days to file bankruptcy papers there (it takes six months to establish jurisdiction). Their papers including invisible metadata that identified the case as destined for Judge Drain's court, in a bid to trick the court's Case Management/Electronic Case Files system to assign the case to him.

The case was even pre-captioned "RDD" ("Robert D Drain"), to nudge clerks into getting their case into a friendly forum.

If the Sacklers hadn't opted for Judge Drain, they might have set their sights on the Houston courthouse presided over by Judge David Jones, the second of of the three most corporate-friendly large bankruptcy judges. Judge Jones is a Texas judge – as in "Texas Two-Step" – and he has a long history of allowing corporate murderers and thieves to escape with their fortunes intact and their victims penniless:

https://pluralistic.net/2021/08/07/hr-4193/#shoppers-choice

But David Jones's reign of error is now in limbo. It turns out that he was secretly romantically involved with Elizabeth Freeman, a leading Texas corporate bankruptcy lawyer who argues Texas Two-Step cases in front of her boyfriend, Judge David Jones.

Judge Jones doesn't deny that he and Freeman are romantically involved, but said that he didn't think this fact warranted disclosure – let alone recusal – because they aren't married and "he didn't benefit economically from her legal work." He said that he'd only have to disclose if the two owned communal property, but the deed for their house lists them as co-owners:

https://www.documentcloud.org/documents/24032507-general-warranty-deed

(Jones claims they don't live together – rather, he owns the house and pays the utility bills but lets Freeman live there.)

Even if they didn't own communal property, judges should not hear cases where one of the parties is represented by their long term romantic partner. I mean, that is a weird sentence to have to type, but I stand by it.

The case that led to the revelation and Jones's stepping away from his cases while the Fifth Circuit investigates is a ghastly – but typical – corporate murder trial. Corizon is a prison healthcare provider that killed prisoners with neglect, in the most cruel and awful ways imaginable. Their families sued, so Corizon budded off two new companies: YesCare got all the contracts and other assets, while Tehum Care Services got all the liabilities:

https://ca.finance.yahoo.com/news/prominent-bankruptcy-judge-david-jones-033801325.html

Then, Tehum paid Freeman to tell her boyfriend, Judge Jones, to let it declare bankruptcy, leaving $173m for YesCare and allocating $37m for the victims suing Tehum. Corizon owes more than $1.2b, "including tens of millions of dollars in unpaid invoices and hundreds of malpractice suits filed by prisoners and their families who have alleged negligent care":

https://www.kccllc.net/tehum/document/2390086230522000000000041

Under the deal, if Corizon murdered your family member, you would get $5,000 in compensation. Corizon gets to continue operating, using that $173m to prolong its yearslong murder spree.

The revelation that Jones and Freeman are lovers has derailed this deal. Jones is under investigation and has recused himself from his cases. The US Trustee – who represents creditors in bankruptcy cases – has intervened to block the deal, calling Tehum "a barren estate, one that was stripped of all of its valuable assets as a result of the combination and divisional mergers that occurred prior to the bankruptcy filing."

This is the third high-profile sleazy corporate bankruptcy that had victory snatched from the jaws of defeat this year: there was Johnson and Johnson's attempt to escape from liability from tricking women into powder their vulvas with asbestos (no, really), the Sacklers' attempt to abscond with billions after kicking off the opioid epidemic that's killed 800,000+ Americans and counting, and now this one.

This one might be the most consequential, though – it has the potential to eliminate one third of the major crime-enabling bankruptcy judges serving today.

One down.

Two to go.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/16/texas-two-step/#david-jones

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#texas two-step#bankruptcy#houston#texas#mess with texas#corruption#judge david jones#fifth circuit#southern district of texas#elizabeth freeman#yescare#corizon#prisons#private prisons#prison profiteers#Michael Van Deelen#Office of the US Trustee#sacklers#bankruptcy shopping#johnson and johnson#impunity

259 notes

·

View notes

Text

Austerity has been biting since 2010, when George Osborne slashed the amount of money councils could receive from central government in one of his first acts as chancellor.

Between 2010 and 2020, they lost more than 50% of their government grants in real terms. Six councils have already gone ‘bankrupt’ in the last two years while more than half of the rest say they could follow, meaning they could be taken over by Whitehall or replaced by new authorities.

[...]

Councils are responsible for 800 different services, including meeting Britain’s soaring demand for social care. They also run schools, public health, housing, planning and licensing. “Everyone thinks that councils [just] collect the bins and fix the roads,” said Revans. “We do so, so much more.”

Most council services are mandatory, meaning they must legally be delivered. But others – including leisure centres, pest control, museums, and youth clubs – are discretionary, meaning councils can choose whether to offer them or not.

[...]

When David Cameron and Nick Clegg formed the coalition government in 2010, they declared that: “The time has come to disperse power more widely in Britain today.” A year later, the Localism Act became law, giving councils “the legal capacity to do anything that an individual can do”.

In practice, that meant not a lot, because councils continue to be fiscally dependent on Westminster. London, for example, relies on strings-attached central government grants for 68.8% of its funding. New York, by comparison, only depends on central government for 26% of its budget, and Paris just 16.3%.

Councils can also generate revenue from council tax and business rates, an equivalent tax on business premises. But the Localism Act prevents councils from raising council tax annually above a cap – which is currently 5% – set by the government.

Austerity, then, has seemingly overridden any attempt at decentralisation. Fourteen years ago, your council could do a lot more for you, especially if you were in a tight spot. But year after year, it has pared back what it offers to the point that some campaigners fear residents expect less in the first place.

31 notes

·

View notes

Text

Trump is a loser. Tell a friend.

January 11, 2024

ROBERT B. HUBBELL

Readers frequently comment on my newsletters by writing, “You used word X; you should have used word Y.” Sometimes the comments are well-taken, but much of the time, my (silent) reaction is, “We aren’t going to change the course of history through vocabulary.” But Trump's effort to return to power may be the exception.

Trump is a loser. A spectacular one. He is the living embodiment of the punchline to the joke, “How do you make a small fortune in New York real estate?” Answer: “Start out with a large one.” His companies have been through half-a-dozen bankruptcies. The failure of his Taj Mahal Casino helped turn Atlantic City into a “ghost town.” He is such an unreliable credit risk that American banks stopped dealing with him in the 1990s.

Trump is a loser. He is the only president ever to be impeached twice. He is the only major presidential candidate to lose the popular vote twice. He is the only major presidential candidate to be indicted once—let alone four times. He is the first president in nearly a century to lose the House, the Senate, and re-election. He is the only major presidential candidate who has been adjudged (in a civil case) to have raped a woman.

Trump is a loser. When he traveled internationally as president, foreign leaders laughed at him behind his back. When he addressed the UN Assembly, world leaders laughed at him to his face. He has made some of the most ignorant comments ever by a US president, suggesting that Covid victims “inject bleach” and that they “shine a light inside their bodies.” And during an eclipse visible from Washington, D.C., Trump did the one thing that observers of eclipses are NEVER supposed to do—he removed his protective eye gear to look directly at the sun.

Despite the fact that Trump is a historic loser, he has somehow convinced tens of millions of Americans that he is “a stable genius” who would defeat a combined presidential ticket of George Washington and Abraham Lincoln. We should not add to Trump's false mythology by unintentionally ascribing stature or influence he does not have.

Two days ago, readers of this newsletter posted a link in the Comment section to an article by Jason Sattler published on the Substack blog, Framelab. The article is entitled, Why Trump wants you to compare him to Hitler | Because then you’re not calling him a loser.

Sattler’s article is brilliant, and I highly recommend it. But in case you don’t get around to reading the article, the gist of Sattler’s argument is that Trump wants us to compare him to Hitler—because that comparison normalizes the notion that Trump will regain power as an autocratic strongman.

Sattler writes:

Ruth Ben-Ghiat, an expert on authoritarianism, seems to think the Hitler stuff is a trial balloon. Trump is seeking to “dehumanize immigrants now so the public will accept your repression of them when you return to office.”

[T]hat thought gets us talking about exactly what Trump wants on our minds — him in power. He’s preemptively framing himself — as a strongman, an agent of revenge, and the ultimate enforcer of unsustainable hierarchies.

Sattler goes further, asserting that we are doing a favor for Trump by calling him Hitler:

When you’re calling Trump a dictator, think about what you’re not calling him.

You’re not calling him a loser who never has and never will win the popular vote. A fraud. A traitor. Instead, you’re repeating his slander of immigrants and propping up his stature. You’re doing him a huge favor.

Basically, we’re getting fooled again.

There is wisdom in Sattler’s analysis—to a point. We should not fall into the trap of assuming that Trump will succeed in becoming a Hitler-like dictator who will impose martial law on “day one” of his second term in office. If we do that, we make it more likely that Trump will succeed in his effort to be re-elected.

In other words, we should not grant Trump superpowers he does not possess. The man is a loser and a miserable human being who is disliked by almost everyone who has the misfortune of dealing directly with him.

But Trump is not only a small, insecure, petulant loser; he also exercises outsized influence over tens of millions of Americans. It would be foolish to stop talking about the existential danger that Trump presents to our democracy. For example, we know that Trump asked his former Secretary of Defense why federal troops couldn’t “shoot protestors” on the National Mall protesting the murder of George Floyd.

Two things are simultaneously true—and they are not in contradiction: Trump is a loser and he is a dangerous threat to our democracy. We can prevent him from becoming Hitler’s protege by reminding voters that he is a loser who has lost more than any other presidential candidate in history—and that he will lose again in 2024.

Don’t build an aura of inevitable victory around Trump. Instead, build an aura of inevitable defeat around Trump. He is a loser. He has always been a loser. And he will always be a loser.

[Robert B. Hubbell Newsletter]

13 notes

·

View notes

Text

Over the past few decades, much of the media and policy debate around labor issues have focused on low wages. Labor issues related to work schedules have received far less attention. In fact, 17% of the U.S. labor force works on unpredictable or unstable schedules with short advance notice (Golden 2015). They are disproportionately concentrated in lower paid occupations in the retail and service sectors. According to a national survey on retail jobs, 87% of retail workers report hour variations in the past month with the average variation equivalent to 48% of their usual work hours, 50% report a week or less advance notice, and 44% say that their employer decides their work hours without their input (Lambert et al. 2014). The prevalence and the rapid growth of unpredictable and unstable schedules has resulted in many social issues, including difficulties arranging childcare and threats to households’ economic security (Henly and Lambert 2014).

The economic trade-off of predictable schedules and the ongoing policy debate

Unpredictable and unstable schedules are so prevalent in service businesses, because labor accounts for a significant part of the operating cost of service businesses, especially in retail, food, and hospitality services. Having just enough (but not too many) workers on hand is essential to balancing customer service and profitability. As firms try to strike that balance, many—especially those in the service and retail sectors—practice “just-in-time” (JIT) scheduling, which entails managers scheduling their employees “on the fly” based on immediate workplace needs. By using just-in-time scheduling, service firms mitigate the uncertainty they often face in customer demand and employee no-shows. This helps them reduce the labor hours needed and thus labor cost (Terwiesch and Cachon 2012). While JIT scheduling can be effective in reducing firms’ labor costs, it also leads to highly unpredictable and fluctuating schedules for workers, which negatively impact their quality of life, especially among low-income workers. In short, firms have been using JIT scheduling to transfer business risks to their employees.

Recent local and state policies aim to reduce this practice. Since 2014, one state (Oregon) and multiple cities (e.g., Chicago, Los Angeles, New York, Philadelphia, San Francisco, Seattle, and Emeryville, California), have passed various forms of “predictive scheduling laws,” sometimes also referred to as “fair workweek laws.” In general, they require employers to post work schedules in advance and provide additional pay for any last-minute schedule changes. Some versions of such laws, (e.g., the ones in New York City, Seattle and Emeryville, California), also require employers to offer part-time workers the chance to increase their hours before adding new staff (Wolfe et al 2018).

Service firms, especially those in the retail, food, and hospitability industries, argue that such requirements remove the staffing flexibility they need to operate their businesses effectively, which may lead to bankruptcy and eventually loss of jobs. Indeed, such policies have received strong resistance from employers in the service and retail sectors and are still pending or have failed to pass in many cities and states across the U.S. States including Arkansas, Georgia, Iowa, and Tennessee even prohibit jurisdictions within the states from passing predictable scheduling laws. Predictable scheduling laws also differ in the level of advance notice they require firms to inform their workers about their schedules. For example, the city of New York requires 72 hours advance notice (for its retail workers) and the state of Oregon initially required one-week advance notice but later increased to 14 days, while most other cities require 14 days advance notice.

Is JIT scheduling really that beneficial to service firms?

In light of this debate, Masoud Kamalahmadi (University of Miami), Yong-Pin Zhou (University of Washington) and I conducted a study to answer whether and to what extent the flexibility created through just-in-time scheduling benefits the firm and how policy makers can better design predictable scheduling laws (Kamalahmadi et al. 2021). On the one hand, it is clear that just-in-time scheduling helps firms reduce their labor cost as explained earlier. On the other hand, the potential impact of just-in-time scheduling on the workers’ productivity, and thus the firm’s revenue, was not well understood. It was the goal of our study to seek objective evidence that can shed light on this important issue.

10 notes

·

View notes

Text

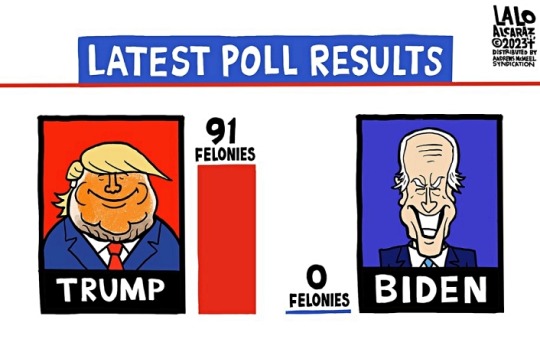

Trump's problems with the law are not limited to the 91 felony counts in the four indictments mentioned in the cartoon.

Trump’s business empire could collapse ‘like falling dominoes’ after ruling

According to Michael Cohen, his former attorney and fixer, Trump is already effectively “out of business” in New York after Judge Arthur Engoron on Tuesday rescinded the licenses of the Trump Organization and other companies owned by Trump and his adult sons, Eric and Don Jr.

“Those companies will end up being liquidated … the judge has already determined that the fraud existed,” Cohen told CNN, hailing Engoron’s pretrial ruling in a civil case brought by Letitia James, the New York attorney general.

On Wednesday morning, in a confrontational post on his Truth Social website that branded the judge a “political hack”, Trump said Engoron “must be stopped”.

At a hearing on Wednesday afternoon, Trump’s legal team asked Engoron if his ruling meant Trump’s assets and businesses must be sold, or if they could continue to operate under receivership.

Engoron said he would address the issue at the non-jury trial beginning on 2 October, and extended to 30 days his original 10-day deadline for both parties to suggest names to act as receivers for the various companies.

The lawyers have said they will appeal the rescinding of the licenses, the appointment of receivers, and Engoron’s assertion that Trump and executives lived in a “fantasy world” of routinely, repeatedly and illegally overvaluing property values and his personal net worth to gain favorable loan terms and reduced insurance premiums.

But if the appeals are unsuccessful, the collapse of the Trump empire, upon which the former reality TV host staked his reputation as a successful business tycoon, could be imminent.

Trump's undeserved reputation as a brilliant businessman has more to do with his defunct TV show than with real life. So-called "reality shows" seldom have anything to do with everyday reality.

Trump's had six bankruptcies – and if he didn't get a huge amount of money from his wealthy father, he'd be lucky to own even a bodega in Queens.

At least in New York State, the Trump Organization may now be going out of business.

#donald trump#trump's legal problems#trump's four indictments#trump's 91 counts of felonies#trump's collapsing businesses#the trump organization#trump's 6 bankruptcies#lock him up!#arthur engoron#michael cohen#lalo alcaraz

12 notes

·

View notes

Note

https://www.reuters.com/legal/litigation/johnson-johnson-sues-researchers-who-linked-talc-cancer-2023-07-13/

Sounds like J&J is a good, well-meaning company with nothing to hide but its love for people..

Standard procedure, or is this a new one they've got going now.

J&J alleges researchers used "junk science" to disparage company's products

Defendants say the lawsuits are meant to "silence" scientists

July 12 (Reuters) - Johnson & Johnson has sued four doctors who published studies citing links between talc-based personal care products and cancer, escalating an attack on scientific studies that the company alleges are inaccurate.

J&J's subsidiary LTL Management, which absorbed the company's talc liability in a controversial 2021 spinoff, last week filed a lawsuit in New Jersey federal court asking it to force three researchers to "retract and/or issue a correction" of a study that said asbestos-contaminated consumer talc products sometimes caused patients to develop mesothelioma.

One of the researchers, Richard Kradin, declined to comment. The other two, Theresa Emory and John Maddox, did not respond to requests for comment. Lawyers who have represented the three researchers in similar litigation in the past declined to comment.

J&J is facing more than 38,000 lawsuits alleging that the company's talc products, including its Baby Powder, were contaminated by asbestos and caused cancers including ovarian cancer and mesothelioma. J&J is attempting to resolve those lawsuits, as well as any future talc lawsuits, through an $8.9 billion settlement in bankruptcy court.

J&J says that its talc products are safe and do not contain asbestos.

J&J has stopped selling talc-based Baby Powder in favor of cornstarch-based products, citing an increase in lawsuits and "misinformation" about the talc product's safety.

The company in 2021 began exploring bankruptcy as a potential solution to the lawsuits, which saw a mixed record at trial, including several defense wins but also a $2.1 billion verdict awarded to 22 women who blamed their ovarian cancer on asbestos in the company's talc products. J&J said in bankruptcy court filings in April that the costs of its talc-related verdicts, settlements and legal fees have reached about $4.5 billion.

Last week's lawsuit against Emory and Maddox, pathologists affiliated with Peninsula Pathology Associates in Newport News, Virginia, and Kradin, a pulmonologist who worked at Massachusetts General Hospital Cancer Center before his retirement, comes on the heels of another complaint LTL filed in late May against another doctor, Jacqueline Moline, who works at Northwell Health in Great Neck, New York, on similar grounds.

Moline published an article in 2019 studying 33 patients who said their only exposure to asbestos came from talc products, and Emory, Kradin and Maddox followed up with a 2020 study of 75 similar patients.

All four doctors have provided expert testimony in lawsuits against J&J, and their research has been cited in lawsuits where they have not testified, according to the complaints.

LTL said the researchers concealed the fact that some or all of the patients involved in their studies had been exposed to asbestos from other sources.

The company is also asking the court to force the researchers to disclose the patients' identities.

The lawsuits allege product disparagement and fraud, among other claims.

Adam Zimmerman, a professor at the University of Southern California Gould School of Law, said companies rarely file lawsuits over research they disagree with. It will be very difficult for LTL to prove that the researchers intentionally harmed J&J's reputation, which is required for product disparagement cases in New Jersey, but the company may view the lawsuits as a way to discourage other researchers or reclaim the narrative about talc safety, Zimmerman said.

"When a litigant starts suing opposing experts, that's very aggressive," Zimmerman said. "It sends a message that the gloves are off."

Moline has argued in court papers that LTL's litigation would have a profoundly chilling effect on future medical research if the company were allowed to unmask patients "in the hopes of publicly smearing them." Her court filings say that LTL's lawsuit was meant to "attack and silence" scientists, and that she has an ethical obligation to protect the identities of her research subjects.

LTL's lawsuits allege that the doctors' research allowed them to collect millions of dollars from plaintiffs' lawyers to push a "false narrative" about J&J. The complaint against Moline, for example, said she had made a "small fortune" testifying as a paid expert in lawsuits, receiving over $3 million from her work on asbestos lawsuits. LTL alleged that Kradin also made more than $3 million testifying as a plaintiffs' expert.

The researchers could not immediately be reached for comment.

LTL had filed similar lawsuits against the researchers in December 2022, but those complaints were linked to LTL’s first bankruptcy filing and were dismissed along with the rest of the bankruptcy in April.

The cases are LTL Management v. Moline and LTL Management v. Emory, U.S. District Court for the District of New Jersey, Nos. 23-cv-02990 and 23-cv-03649.

For LTL: Peter Harvey of Patterson Belknap Webb & Tyler; Allison Brown of Skadden, Arps, Slate, Meagher & Flom; and Kristen Fournier of King & Spalding

For Moline: Kevin Marino and John Tortorella of Marino Tortorella & Boyle

For Emory, Kradin and Maddox: Not yet available Read more:

J&J unit files for second bankruptcy to pursue $8.9 billion talc settlement

Cancer plaintiffs drill down on J&J's support for $8.9 billion talc deal

U.S. court rejects J&J bankruptcy strategy for thousands of talc lawsuits

Reporting by Dietrich Knauth; additional reporting by Brendan Pierson

__________________________________

This one could go either way, I don't blame them for trying either it's a lot of money.

Also gotta consider the timing since after 3 years of "trust the science" people are actually getting less prone to trusting the science after all the times the science changed its mind in those 3 years.

Tell me about that vaccine making me impervious to covid all over again science, I need to hear it one more time.

If the initial finding is correct, they'll need lots of their own baby shampoo, gotta clear up the tears somehow.

if not correct, that could change some things up too, piss some people off at the same time, so yayyyyy

10 notes

·

View notes

Text

The Archdiocese of San Francisco, known for its outspoken conservative leadership, has filed for Chapter 11 bankruptcy reorganization, Archbishop Salvatore J. Cordileone announced on Monday. The filing is intended to protect the archdiocese from what Archbishop Cordileone described as more than 500 civil lawsuits filed against it under a state law passed in 2019 that extended the statute of limitations for civil claims in child sexual abuse cases.

“We believe the bankruptcy process is the best way to provide a compassionate and equitable solution for survivors of abuse while ensuring that we continue the vital ministries to the faithful and to the communities that rely on our services and charity,” Archbishop Cordileone said in a letter addressed to Catholics in San Francisco.

Archbishop Cordileone signaled the bankruptcy earlier this month, warning publicly that the filing was “very likely.”

San Francisco is the third archdiocese in the state to file for bankruptcy this year. The dioceses of Oakland and Santa Rosa filed in the spring, citing the number of sexual abuse lawsuits filed against them. The diocese of San Diego, one of the largest in the state, announced in May that it planned to file later this year.

Overall, about a dozen dioceses and archdioceses in the United States are currently in bankruptcy proceedings, according to a list maintained by Marie T. Reilly, a professor at Penn State Law. Still more have emerged from bankruptcy.

The vast majority of documented abuses in Catholic institutional settings took place decades ago, making it challenging for victims to seek legal recourse. But some states, including California and New York, where the majority of pending bankruptcies are, have enacted a “look-back window” in recent years that allows victims to bring civil claims that would otherwise be barred by statutes of limitations.

The Archdiocese of San Francisco, which includes about 450,000 Catholics, is the only diocese in the state to not have released a list of clergy credibly accused of sex abuse, according to lawyers and survivors’ advocacy groups. Instead, the archdiocese maintains a list of priests and deacons in good standing, and removes men from the list if they are under investigation for child sexual abuse.

Archbishop Cordileone, who has led the archdiocese since being appointed to the role by Pope Benedict XVI in 2012, is an outspoken voice in the ultraconservative wing of the American Catholic Church. He helped lead Catholic efforts to pass Prop 8, a 2008 state constitutional amendment intended to ban same-sex marriage in the state.

More recently, he has repeatedly confronted former Speaker Nancy Pelosi, a Catholic who represents much of San Francisco, over her support for abortion rights, saying last year that she would not be permitted to receive communion in the archdiocese.

The filing of Chapter 11 bankruptcy will halt claims against the archdiocese, while it develops a reorganization plan based on its assets and insurance.

The archdiocese itself is the only entity included in the filing, Archbishop Cordileone said in the statement. Parochial schools and individual parishes, which the archdiocese said are independently managed and self-financed, will not be affected.

7 notes

·

View notes

Text

Who is the worst founding father?

Round 3: George Clinton vs James Monroe

George Clinton (July 26, 1739 – April 20, 1812) was an American soldier, statesman, and Founding Father of the United States. A prominent Democratic-Republican, Clinton served as the fourth vice president of the United States from 1805 until his death in 1812. He also served as the first Governor of New York from 1777 to 1795 and again from 1801 to 1804.

He became one of the most prominent opponents to the ratification of the proposed United States Constitution, which would grant several new powers to the federal government. After New York and other states had ratified the Constitution, Clinton focused on passing constitutional amendments designed to weaken the powers of the federal government.

James Monroe (April 28, 1758 – July 4, 1831) was an American statesman, lawyer, and diplomat who served as the fifth president of the United States from 1817 to 1825. A member of the Democratic-Republican Party, Monroe was the last president who was a Founding Father as well as the last president of the Virginia dynasty. He is perhaps best known for issuing the Monroe Doctrine, a policy of opposing European colonialism in the Americas while effectively asserting U.S. dominance, empire, and hegemony in the hemisphere. He also served as governor of Virginia, a member of the United States Senate, U.S. ambassador to France and Britain, the seventh Secretary of State, and the eighth Secretary of War.

After his service in the war, Monroe resumed studying law under Jefferson and continued until 1783. He was not particularly interested in legal theory or practice, but chose to take it up because he thought it offered “the most immediate rewards” and could ease his path to wealth, social standing, and political influence.

As president, Monroe signed the Missouri Compromise, which admitted Missouri as a slave state and banned slavery from territories north of the 36°30′ parallel.

Monroe sold his small Virginia plantation in 1783 to enter law and politics. Although he owned multiple properties over the course of his lifetime, his plantations were never profitable. Although he owned much more land and many more slaves, and speculated in property, he was rarely on site to oversee the operations. Overseers treated the slaves harshly to force production, but the plantations barely broke even. Monroe incurred debts by his lavish and expensive lifestyle and often sold property (including slaves) to pay them off. The labor of Monroe’s many slaves were also used to support his daughter and son-in-law, along with a ne'er-do-well brother and his son.

Two years into his presidency, Monroe faced an economic crisis known as the Panic of 1819, the first major depression to hit the country since the ratification of the Constitution. The severity of the economic downturn in the U.S. was compounded by excessive speculation in public lands, fueled by the unrestrained issue of paper money from banks and business concerns.

Before the onset of the Panic of 1819, business leaders had called on Congress to increase tariff rates to address the negative balance of trade and help struggling industries. As the panic spread, Monroe declined to call a special session of Congress to address the economy. When Congress finally reconvened in December 1819, Monroe requested an increase in the tariff but declined to recommend specific rates. Congress would not raise tariff rates until the passage of the Tariff of 1824. The panic resulted in high unemployment and an increase in bankruptcies and foreclosures, and provoked popular resentment against banking and business enterprises.

The collapse of the Federalists left Monroe with no organized opposition at the end of his first term, and he ran for reelection unopposed. A single elector from New Hampshire, William Plumer, cast a vote for John Quincy Adams, preventing a unanimous vote in the Electoral College. He did so because he thought Monroe was incompetent.

#founding father bracket#worst founding father#founding fathers#amrev#brackets#polls#george clinton#james monroe

17 notes

·

View notes

Text

The Role of a Business Transaction Lawyer in Long Island Bankruptcy Law

In the dynamic realm of business, challenges are inevitable, and financial downturns can lead companies to seek refuge in the intricate landscape of bankruptcy law. Long Island, a bustling hub of economic activities, often witnesses businesses grappling with financial crises. In such turbulent times, the expertise of a Business Transaction Lawyer becomes paramount, offering a guiding hand through the complexities of Long Island Bankruptcy Law.

The Foundation of Sound Transactions

A proficient Business Transaction Lawyer plays a pivotal role in establishing the foundation for successful business dealings. By ensuring that contracts are meticulously crafted and adhere to legal standards, these legal professionals safeguard their clients from potential pitfalls. In Long Island, where business transactions are the lifeblood of the economy, the role of a skilled lawyer becomes even more crucial in mitigating risks and promoting fair dealings.

Financial Crisis Management

In the face of financial adversity, businesses on Long Island often turn to bankruptcy law for relief. Business Transaction Lawyers specializing in bankruptcy law bring a wealth of experience to the table, helping companies navigate the intricacies of Chapter 7, Chapter 11, or Chapter 13 bankruptcy. Their expertise becomes a beacon, guiding businesses through the legal processes and ensuring compliance with Long Island's specific bankruptcy regulations.

Negotiating with Creditors

When a business is in financial distress, negotiating with creditors becomes a delicate yet essential aspect of the recovery process. Business Transaction Lawyers adept in Long Island Bankruptcy Law act as skilled negotiators, working tirelessly to secure favorable terms for their clients. By striking equitable deals with creditors, these legal professionals play a vital role in facilitating the restructuring and revitalization of struggling businesses on Long Island.

Litigation Support in Bankruptcy Proceedings

In the unfortunate event that bankruptcy proceedings escalate to litigation, having a seasoned Business Transaction Lawyer by one's side is invaluable. Long Island's legal landscape demands a nuanced understanding of both transactional and litigation aspects. Business Transaction Lawyers proficient in bankruptcy law bring a holistic perspective to legal proceedings, strategically navigating courtrooms and advocating for their clients' best interests.

Conclusion

In the intricate dance between business transactions and bankruptcy law on Long Island, Business Transaction Lawyers emerge as indispensable partners.

#Business Transaction Lawyer#Business Transaction Lawyer new york#Business Litigation Lawyers#General Business Law#New York Bankruptcy Law#New York Bankruptcy Lawyer

0 notes

Text

Speak with Our Long Island Bankruptcy Lawyer Today to Get a New Financial Start!

Speak with Our Long Island Bankruptcy Lawyer Today to Get a New Financial Start!

Are you struggling to make ends meet while facing overwhelming debt? A bankruptcy lawyer or attorney on Long Island could help you through the difficult process of declaring bankruptcy. Finding an experienced and competent lawyer who can guide you through the process and help you start over is essential, regardless of whether you are thinking about filing for Chapter 7 or Chapter 13 bankruptcy.

Bankruptcy: What is it?

A legal procedure called bankruptcy enables people or companies to get rid of or restructure their debt. Although there are many forms of bankruptcy, Chapter 7 and Chapter 13 bankruptcy are the most prevalent for people. While Chapter 13 bankruptcy is setting up a repayment plan that enables you to pay off your obligations over time, Chapter 7 bankruptcy involves selling assets to satisfy creditors.

Benefits of Bankruptcy Filing

Although declaring bankruptcy can be a challenging choice, there are several benefits to doing so. For instance, filing for bankruptcy can help you get rid of some debt, stop receiving harassment from creditors, and prevent foreclosure or repossession. Furthermore, filing for bankruptcy might give you a fresh start and the opportunity to reestablish your credit and financial security.

Locating a Lawyer or Attorney for Bankruptcy on Long Island

It's critical to locate a Long Island bankruptcy lawyer or attorney with extensive experience practicing bankruptcy law. This entails locating an individual who is knowledgeable about both the intricacies of New York State bankruptcy law and the bankruptcy court system. Additionally, you want to seek out a lawyer who is prepared to listen to you explain your particular financial circumstances and offer tailored counsel.

A Long Island Bankruptcy Lawyer's or Attorney's Benefits

Employing a bankruptcy lawyer or attorney on Long Island has several advantages. An attorney, for instance, can assist you in deciding which kind of bankruptcy is best for you, evaluating your eligibility for bankruptcy, and assisting you with the bankruptcy procedure. A lawyer can also help you with any legal difficulties that may come up during the bankruptcy procedure and represent you in court.

In summary

In the event that you are facing excessive debt and are thinking about declaring bankruptcy, a bankruptcy lawyer or attorney on Long Island can assist you in navigating the procedure and getting a fresh start. You may take charge of your finances and proceed with confidence by locating a skilled and experienced lawyer who is committed to offering individualized counsel and direction. A Long Island bankruptcy lawyer or attorney may assist you in achieving the necessary financial stability and peace of mind, regardless of whether you are thinking about filing for Chapter 7 or Chapter 13 bankruptcy.

Professionals at Pryor & Mandelup, LLP can be reached in two ways. To get a free service quotation and to complete out a simple questionnaire, you may visit their official website at https://pryormandelup.com/ or give them a call at (516) 997-0999.

#Long Island Bankruptcy Lawyer#Long Island Bankruptcy Attorney#Long Island Chapter 7 Attorney#Long Island Chapter 13 Lawyer

2 notes

·

View notes

Text

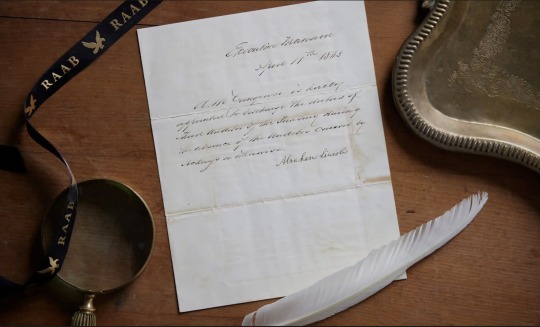

An original document signed by President Abraham Lincoln four days before his assassination on 15 April 1865. Photograph: Raab Collection

* * * *

LETTERS FROM AN AMERICAN

February 18, 2024

HEATHER COX RICHARDSON

On the third Monday in February, the U.S. celebrates Presidents Day, a somewhat vague holiday placed in 1968 near the date of George Washington’s birthday on February 22, 1732, but also traditionally including Abraham Lincoln, who was born on February 12, 1809. This year, that holiday falls on February 19.

That the American people in the twenty-first century celebrate Abraham Lincoln as a great president would likely have surprised Lincoln in summer 1864, when every sign suggested he would not be reelected and would go down in history as the man who had permitted a rebellion to dismember the United States.

The news from the battlefields in 1864 was grim. In May, General U. S. Grant had taken control of the Army of the Potomac and had launched a war of attrition to destroy the Confederacy. In May and June, more than 17,500 Union soldiers were killed or wounded at the Battle of the Wilderness, 18,000 at Spotsylvania, and another 12,500 at Cold Harbor. As the casualties mounted, so did criticism of Lincoln.

Those Republican leaders who thought Lincoln was far too conservative both in his prosecution of the war and in his moves toward abolishing enslavement had plotted with the humorless Treasury Secretary Salmon P. Chase, who perennially hankered to run the country, to replace Lincoln with Chase on the 1864 ticket.

In February they went so far as to circulate a document signed by Senator Samuel Pomeroy of Kansas, a key party leader, saying that “even were the re-election of Lincoln desirable, it is practically impossible against the union of influences which will oppose him.” Even if he could manage to pull off a reelection, the Pomeroy circular said, he was unfit for office: “his manifest tendency towards compromises and temporary expedients of policy” would make the “dignity and honor of the nation…suffer.”

This was no small challenge: Chase had been in charge of remaking the finances of the United States, and he had both connections and Treasury employees all over the country who owed their jobs to him. In an era in which political patronage meant political victories, he had a formidable machine.

Lincoln managed to quell the rebellion from the radicals. In June 1864, soon after the party—temporarily renamed the National Union Party to make it easier for former Democrats to feel comfortable voting for Republicans—met to choose a presidential candidate, Chase threatened to resign from the Cabinet, as he had done repeatedly. In the past, Lincoln had appeased him. This time, Lincoln accepted his resignation.

But conservatives, too, were in revolt against Lincoln.

Crucially, Thurlow Weed, New York’s kingmaker, thought Lincoln was far too radical. Weed cared deeply about putting his own people into the well-paying customs positions available in New York City, and he was frequently angry that Lincoln appointed nominees favored by the more radical faction.

That frustration went hand in hand with anger about policy. Weed was upset that the Republicans were remaking the government for ordinary Americans. The 1862 Homestead Act, which provided western land for a nominal fee to any American willing to settle it, was a thorn in his side. Until Congress passed that law, such land, taken from Indigenous tribes, would be sold to speculators for cash that went directly to the Treasury. Republicans believed that putting farmers on the land would enable them to pay the new national taxes Congress imposed, thus bringing in far more money to the Treasury for far longer than would selling to speculators, but Weed foresaw national bankruptcy.

Even more than financial policy, though, Weed was unhappy with Lincoln’s 1863 Emancipation Proclamation, which moved toward an end of human enslavement far too quickly for Weed.

On August 22, Weed wrote to his protégé Secretary of State William Henry Seward that he had recently “told Mr. Lincoln that his re-election was an impossibility…. [N]obody here doubts it; nor do I see anybody from other states who authorises the slightest hope of success.”

“The People are wild for Peace,” he wrote, and suggested they were unhappy that “the President will only listen to terms of Peace on condition Slavery be ‘abandoned.’” Weed wrote that Henry Raymond, another protégé who both chaired the Republican National Committee and edited the New York Times, “thinks Commissioners should be immediately sent to Richmond, offering to treat for Peace on the basis of Union.”

On August 23, 1864, Lincoln asked the members of his Cabinet to sign a memorandum that was pasted closed so they could not read it. Inside were the words:

“This morning, as for some days past, it seems exceedingly probable that this Administration will not be re-elected. Then it will be my duty to so co-operate with the President elect, as to save the Union between the election and the inauguration; as he will have secured his election on such ground that he can not possibly save it afterwards. — A. Lincoln”

But then his fortunes turned.

Just a week after Weed foretold his electoral doom, the Democrats chose as a presidential candidate General George McClellan, formerly commander of the Army of the Potomac, in a transparent attempt to appeal to soldiers. But to appease the anti-war wing of the party, they also called for an immediate end to the war. They also rejected the new, popular measures the national government had undertaken since 1861—the establishment of state colleges, the transcontinental railroad, the new national money, and the Homestead Act—insisting on “State rights.”

Americans who had poured their lives and fortunes into the war and liked the new government were not willing to abandon both to return to the conditions of three years before.

Then news spread that Rear Admiral David Farragut had taken control of Mobile Bay, the last port the Confederates held in the Gulf of Mexico east of the Mississippi River. On September 2, General William T. Sherman took Atlanta, a city of symbolic as well as real value to the Confederacy, and set off on his March to the Sea, smashing his way through the countryside and carving the eastern half of Confederacy in half again.

Reelecting Lincoln meant committing to fight on until victory, and voters threw in their lot. In November’s election, Lincoln won about 55% of the popular vote compared to McClellan’s 45%, and 212 electoral votes to McClellan’s 12. Lincoln won 78 percent of the soldiers’ vote.

After his reelection, Lincoln explained to a crowd come to serenade him why it had been important to hold an election, even though he had expected to lose it:

“We can not have free government without elections; and if the rebellion could force us to forego, or postpone a national election it might fairly claim to have already conquered and ruined us.”

Happy Presidents Day.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#History#Abraham Lincoln#Heather Cox Richardson#Letters from An American#defense of democracy#American Civil War

8 notes

·

View notes

Note

Sorry if this is a stupid question, but in 2S2S, the one thing I just can't get is why Schwartz dismissed his original motion that had been filed back in 2020, to start this new (time-barred) one. What did he throw it out for?

According to the defendant's motion to dismiss, the 2020 lawsuit was void because it was filed while the airline was in bankruptcy proceedings. I know next to nothing about bankruptcy law, but if there is a valid argument that the 2020 case was merely suspended and could have continued after the airline emerged from bankruptcy, Schwartz et al. did not make it.

While I can't know for sure, what I suspect is this: Schwartz et al. didn't realize this claim was covered by a treaty, so they thought the normal New York 3-year statute of limitations applied. So whether he thought the defendant was correct about the case being void, or he just didn't think it was worth the fight trying to argue that it wasn't void and that the bankruptcy merely suspended the case, he decided to just dismiss the case and refile it. Because if it was governed by the 3-year SOL, there would not have been any issues, and it would probably be simpler than having the fight.

Again, I can't know for sure, but that's my best guess.

19 notes

·

View notes