#New vantagescore 0

Text

If you're frequently denied credit or only qualify for loans with high interest rates, your credit score might be the issue. Fortunately, there are numerous strategies to help improve your score.

As your score rises, you'll typically find it easier to obtain loans at more favorable rates.

How to Increase Your Credit Score

Improving your credit score requires time, patience, and financial discipline, according to Tom Quinn, vice president of strategic alliances at FICO. "There’s no quick fix for your FICO score, but focusing on behaviors that creditors value can make a significant difference," he says.

In essence, while there isn’t a magic solution, the following steps can help you boost your score:

Check Your Credit Reports and Dispute Errors

Many people worry that checking their credit report will negatively impact their score, but this is a misconception, says Christina Roman, consumer education and advocacy manager at Experian. "Consumers should regularly check their credit reports," she advises. Reports from TransUnion and Equifax also contribute to your credit score.

You can obtain a free credit report from each bureau at AnnualCreditReport.com. If you spot any errors, address them promptly, especially if they seem to be affecting your score. To dispute an error, contact both the credit bureau and the information provider with proof of the mistake.

Avoid Missing Payments

Your payment history accounts for 35% of your FICO score and is crucial for your VantageScore as well. While a slight delay might incur a fee, it won't immediately affect your score. However, payments more than 30 days overdue can be reported to credit bureaus, impacting your score.

To maintain a good score, consistently pay your bills on time. Setting up payment reminders or automatic payments can help avoid late payments. Positive payment behavior over time will gradually improve your score.

Lower Your Credit Utilization Rate

Credit utilization refers to the ratio of your credit card balance to your credit limit. For example, if you have a $1,000 limit and a $100 balance, your utilization rate is 10%. Aim to keep this rate as close to 0% as possible, rather than the commonly advised 30%, says Roman.

Reducing your balance or requesting a credit limit increase (while not using the new credit) can help. Paying down balances multiple times a month rather than in a single large payment can also be beneficial.

Avoid closing old credit cards, as this can increase your utilization rate and lower your score. However, if overspending on a card is a problem, closing it might prevent further debt.

Other Ways to Improve Your Credit Score

Become an Authorized User: If you’re new to credit and a trusted friend or family member with excellent credit adds you as an authorized user, your score could improve significantly. Ensure the primary cardholder maintains good credit practices to avoid negative impacts.

Take Out a Small Loan: Adding a new credit line can enhance your credit mix, an important factor in your score. Credit-builder loans, designed for those without a credit history, can be helpful. Use loans responsibly to build credit.

Open a Secured Credit Card: A secured card requires a deposit to establish your credit limit. Payments are reported to credit bureaus, aiding in building or rebuilding your credit score.

By following these strategies and maintaining financial responsibility, you can effectively improve your credit score over time.

0 notes

Text

New credit score models could mean more people now qualify for home loans

New Post has been published on https://petnews2day.com/pet-industry-news/pet-financial-news/new-credit-score-models-could-mean-more-people-now-qualify-for-home-loans/

New credit score models could mean more people now qualify for home loans

WEST PALM BEACH, Fla. — During a time when affordable housing is hard to find in South Florida, two new lender credit models could mean millions more Americans now qualify for home and other loans.

“I feel like I’m forced into basically living in my car,” April Wade told WPTV in May.

WPTV has extensively reported on the South Florida housing crisis through its “Priced Out of Paradise” series.

“I’m just blessed that I have this to sleep in,” Katie Rister said in August, talking about her car. “Without this, I’d be on the street.”

Renters and hopeful home buyers have been feeling the pinch. The rising cost of housing is forcing a lot of people out of South Florida.

Now, more than 10 million people could qualify for mortgages thanks to upcoming changes to lender credit models.

The Federal Housing Finance Agency said it will now require mortgage lenders to incorporate credit scores from FICO and a new credit scoring agency VantageScore.

“Right now, our credit reports are a snapshot in real time,” Paul Oster, founder of credit management firm Better Qualified, said.

Alex Hagan/WPTV

Paul Oster, founder of credit management firm Better Qualified, speaks to WPTV consumer investigative reporter Jessica Bruno about a new requirement that could help more people qualify for home loans.

Oster said that could soon change because these new credit score models will incorporate things like a one-time rent or utility payment and cellphone payments that previously weren’t included in a person’s credit score.

“It’s going to go back 24 months to look at your credit card balances, what you’ve been doing for the past two years,” Oster said. “We’re hoping that it’s going to help some people that don’t have a lot of traditional credit accounts reporting on their credit reports.”

However, Oster said, a few things need to happen before this new plan comes to fruition.

SPECIAL SECTION: ‘Priced Out of Paradise’

“We’re just hoping that A, it really does pan out for the average consumer, and are the government agencies really going to require lenders to use these scoring models?” Oster said.

If they do, Oster said, even with mortgage rates at a two-decade high right now, this will still help a lot of people finance their next home.

“There are millions of people (who are) not even on the FICO score radar,” Oster said. “They don’t have a credit score because they haven’t used traditional banking accounts, but that should not, you know, discriminate against them in terms of, you know, buying a home.”

Oster told WPTV there is currently no deadline for the government to set requirements for lenders to use these new scoring models.

WPTV will be following this developing story.

window.fbAsyncInit = function() FB.init(

appId : '207362756082470',

xfbml : true, version : 'v2.9' ); ; (function(d, s, id) var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "https://connect.facebook.net/en_US/sdk.js"; js.async = true; fjs.parentNode.insertBefore(js, fjs); (document, 'script', 'facebook-jssdk'));

0 notes

Text

The Future of Shopping - Vantage score 0 offers an innovative shopping experience that is sure to make your shopping trips a breeze!

Introduction

Introduction:

If you're looking for a shopping experience that is sure to make your shopping trips a breeze, look no further than Vantage score 0. This innovative shopping platform offers an innovative shopping experience that is sure to make your shopping trips a breeze. For one, Vantage score 0 features an intuitive interface that makes it easy to find what you're looking for. Additionally, the platform offers ample search options so you can quickly and easily find the best deals on the items you need. Finally, the platform offers a variety of payment options so you can get your Shopping spree on without spending a fortune!

What is Vantage score 0.

Vantage score 0 is a new shopping experience that allows users to save on their shopping trips by rating and reviewing products. This innovative system offers customers an innovative shopping experience that is sure to make their shopping trips a breeze! By rating and reviewing products, Vantage score 0 helps shoppers find the perfect product for them and saves them money on their next purchase. There are many benefits of using Vantage score 0, including:

- Saving time - By rating and reviewing products, shoppers can save time on their shopping trips. This allows them to shop more efficiently and stay within their budget.

- Finding the best deal - By rating and reviewing products, shoppers can find the best deals on products. This allows them to save money while still enjoying their Shopping trip.

- feeling like they own the product - by ratings and reviews, shoppers feel like they own the product they are purchasing. This allows them to feel like they are making a real difference in the product they are buying and helping others enjoy it too!

How to Get Started with Vantage score 0.

To start shopping with Vantagescore 0, you first need to set up your shopping accounts. You can create an account for free or use a subscription model. In either case, you will need to enter your personal information and select your shopping preferences. Once you have set up your accounts, you can start shopping!

Shop from Anywhere in the World

As mentioned earlier, Vantagescore 0 offers a revolutionary shopping experience that is sure to make your shopping trips a breeze! You can shop from any location in the world, and get a free shipping code if you want! Simply enter the code at checkout when placing your order.

Get a Free Shipping Code

If you're looking to save even more on your next purchase, be sure to add Vantagescore 0 to your cart and receive a free shipping code! Just enter the code at checkout and enjoy standard shipping rates as well!

Tips for Enjoying the Best Shopping Experiences with Vantagescore 0.

When planning your shopping trip, try to schedule time for shopping. This will help you find the best deals and enjoy the experience of Shopping with Vantagescore 0. By heading to one or more designated stores, you can save a lot of money on your shopping trips.

Cookiecutter Shopping Sheets

To make your shopping experiences even easier, use cookiecutter shopping sheets. These templates will help you plan your favorite shopping trips in a snap! Just print out the sheet and cut out the items you need for each visit. You’ll be ready to go from there!

Find the Right Place to Shop

If you’re looking for an amazing shopping experience but don’t have time to spend in a store, consider finding a place to shop online. With Vantage score 0, there are plenty of options available that will let you shop without feeling rushed or stressed out. Check out our website or use our search bar to find what you’re looking for quickly and easily! More information can be found on the website

Conclusion

Vantage score 0. is a powerful shopping platform that allows you to shop from anyplace in the world. By setting up your accounts and shopping from anywhere, you can enjoy the best shopping experiences possible. Additionally, Cookie cutter Shopping Sheets make it easy to find the best deals on products online. Finally, make sure to check out our other posts for more helpful tips!

#fico score#New vantagescore 0#vantagescore 3.0#vantagescore 3.0 calculation#vantagescore 3.0 scoring system#vantagescore 4.0#Post navigation

0 notes

Text

Understanding FICO As Well As Various Other Credit Score Models

Determining Which Products Are FICO® Scores

Any time you fill out an application for a bank loan, credit line, a rental home or apartment, etc., it's pretty much a guarantee your credit rating will be requested. The initial step in estimating when you will be accepted for credit or a loan is having a clear picture of what your FICO® status is (as this is the scoring product the majority of loan merchants and others depend upon).

In America, FICO® is known as a leading service provider of credit score rankings, with a precise process which spans from a minimal score of 300 to an optimum score of 850. Even though Fair Isaac & Co. (the corporation who came up with the FICO® scoring system) is not alone in providing scoring options (you will find numerous credit rating systems to select from), FICO® is definitely the most popular. There are lots of different scoring options, for instance VantageScore® (this model varies from 501 to 990, and was developed by the top credit reporting agencies), and the web began using an expression for these scores: "FAKO scores". FAKO scores are essentially those not produced by FICO®. To make things even more confusing, loan companies use their own credit ranking techniques as well. Although folks grumble about the process by which scores are typically measured, FICO®'s prevalence systematizes a things a bit. As long as FICO® remains the prominent credit ranking system, it will remain possible for individuals to calculate whether or not they may get authorized for a loan or credit.

Irrespective of whether you approve of this or not, your creditworthiness will be based upon your credit report, and nearly always your score. To be honest, your future financial stability is set, at some level by a mathematical formula. This is fairly upsetting for many. Then again, keep in mind that loan merchants undertake detailed formulas focusing on whom to give money to, utilizing many variables. Truthfully, a dadeschools of 720 will probably approve you for the greatest financial loan conditions; but a weak rating means paying more in interest payments. Even if an undesirable rating signifies you are more of a risk, this might not lead to absolute loss of services and products every time. The boost in "subprime" loan products is one result of this. In a way, analysis of credit ratings has started to become a bit more clear: beginning in 2011, any loan servicer that declines a credit request - or simply approves you for rates below the best offered - as a result of your credit history, must provide you with correspondence as well as a cost-free record of the report or score the lender utilized in their judgment.

What is the Typical FICO® Rating Today?

As per myFICO®, the mean U.S. score last year was 711. At the moment, approximately 40 percent of individuals have credit ratings of 750 or better; and around 40 percent of folks possess scores in the 699 and under range. Now, what does this suggest? First, there's lots of space to improve. The better your credit ranking, the more entitled you will be to the best loan product and credit interest rates, but only to some extent. Even though individuals chase after "bragging rights" for acquiring a score higher than 800, ordinarily, many banks will supply anyone having a 780 score the equivalent offers as a person maintaining an 820 rating. Clearly, attempting to boost your credit score is vital, however creating superior credit patterns are recommended over seeking perfection.

Now you are aware of just what the typical FICO® score is, you're probably pondering the method by which this score is determined. Fair Isaac's specific system remains unknown, and they are not publicizing the technique at this point. However, this is the method by which it functions: The three credit reporting agencies - Experian, Equifax, and TransUnion - amass your credit profile, and FICO® subsequently creates a score depending on the prior seven years of credit history in your reports.

The credit reporting agencies also can utilize an algorithm formula much like FICO®'s to create their own unique scores. These credit agency numbers aren't precisely the same as a FICO® score, and are generally termed by distinctive names (Experian's score is termed the "Experian/Fair Isaac Risk Model", Equifax's score is the "BEACON® Score", and TransUnion's score is termed "EMPIRICA®"). Nonetheless, all of them are essentially assessed just like as a FICO® score. Incidentally, those scores ought not to be correlated with the VantageScore®, which has been produced by Experian, Equifax, and TransUnion as another option besides the FICO®.

Precisely What Influences the FICO® Score?

As the information inside your credit file fluctuates (for instance, fresh things are included, other items in excess of seven years old disappear) so too will your credit scores. As a result, your rating will probably range drastically based on who's creating the scoring, and what formula is applied. To illustrate, even between the three credit reporting agencies, your score will differ a great deal. In the event that these types of variations in your scores appear, it is possibly due to the fact that information and facts in your credit file differs from the others, and/or there are actually some distinctions with the way the FICO® (or any other exclusive) formula is used.

Based on FICO®, this shows how they read the details on your credit file to figure a precise score:

1. Payment History - 35% of your score. A large amount of importance is given to relatively new elements (the last 1 to 2 years). Reliable and on time payments will definitely boost your score. Past due payments, collections reports, and bankruptcy will certainly decrease your score.

2. Credit Consumption - 30% of your see more . The amount of money you've borrowed (like consumer debt, student education loans, a home loan, etc.) is significant, especially when matched against total credit readily available. A great way to improve your score rapidly may be to pay back debts, like those found on credit cards. Carrying a balance of 0-10% of your overall credit is best.

3. Credit History Span - 15% of your credit score. Scores benefit folks who have held credit for a long time. The longer the duration you sustain credit with the same credit card company, the more significantly your score can increase.

4. Credit History Depth - 10% of your credit score. Scores are typically the most optimum for individuals who appropriately handle a variety of kinds of credit (e.g., cards, auto loans, a home loan, and so forth.).

5. New Credit Requests - 10% of your credit score. A lot of credit requests might lower your credit rating (given that it could symbolize you are in need of money). Exceptions to this include auto/home finance loan applications made inside of a 45-day time period. The fewer applications for credit you submit, the better your score should be.

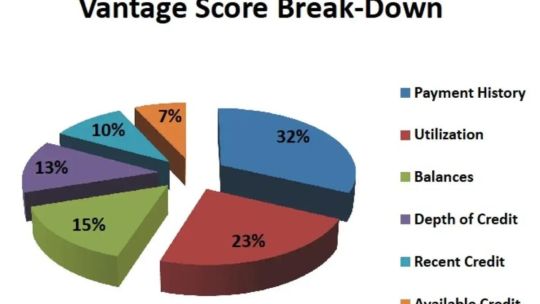

Remember, this is FICO®'s way of establishing your credit score, and alternative scoring products will probably do it other ways. To illustrate, VantageScore® implements a marginally different process.

See more information: https://mycreditfocus.com/

1 note

·

View note

Text

Moving to the USA? Learn why building credit is vital in the USA.

Most international students arrive in the U.S. with no credit history. This makes it very difficult to obtain a variety of essential services. In this article, we explain why it’s important to start building credit, and how to begin building yours upon arrival in the USA.

Students moving to the USA quickly learn that a U.S. credit score is vital for establishing themselves in the country.Without a local credit score or history, international students face a number of challenges, including getting approved for housing, credit cards, and difficulty buying, leasing or renting a vehicle or even getting a cell phone. If they are able to get approved, they typically end up paying high interest rates.

If you’re not familiar with the term “credit score,” it’s one that you will want to become familiar with during your time as an international student in the U.S. A credit score is a rating given to your financial background when assessed by a lender. When you’re applying to borrow money (like through a loan or credit card) the lender will most likely look at your credit score to see whether you are an eligible candidate.

Credit doesn’t transfer from one country to another.

As an expatriate relocating into the United States, you may not have official identification requirements like a social security number and a driver’s license. Without those essentials, it is almost impossible to establish credit.

Each country uses a different system for credit scoring, and credit does not transfer from country to country. Your credit score is what determines your creditworthiness to lenders. Since credit does not transfer from country-to-country, international students have a credit score of 0 when they first arrive in the U.S.To provide some perspective, the average American has a credit score between 600-700, and a good credit score is typically above 700.

Not having credit can make it hard to make much-needed purchases in your new country.

The chart below illustrates one example of how your credit score can affect an auto loan payment and insurance rates.

Your credit score is based on several factors.

Important transactions involve credit checks. Lenders require credit checks to obtain housing, car loans, home and auto insurance, and mobile phones. It is essential to understand what improves your overall credit score and to start building your score to give you better terms of those transactions.

In the United States, FICO®is the most common model for credit scoring, which was created by Fair Isaac & Company (FICO). Although there are competitor rating systems, this is the one you’re most likely to see during your time as an international student. A FICO®score is used to predict how reliable of a borrower you will be in terms of paying back the borrowed funds. However, typically if an individual does not have credit history that is at least six months old, they will not have a FICO®score. Additionally, different lenders will request your credit score from various sources depending on the system they use and whether they’ve adapted to the new FICO®system or use another company such as VantageScore.

When trying to build your credit there are five key factors1you need to know about that can impact your FICO®score:

1. Payment History (35%)refers to the repayments you have made on credit cards and loans in the past. Your credit score will take into consideration the speed and quantity of repayment on all the lines of credit you have taken out in the past to find the average.

2. Amount Owed (30%)The amount of your outstanding debt accounts for a large component of calculating your score. For example, does your credit card stay maxed out, or are you steadily paying it down?

3. Credit History Length (15%) The credit score will also take into consideration how long you have been building credit. If you start building credit responsibly when you are a student it will be reflected positively in your credit score. The sooner you start building your credit, the better.

4. New Credit (10%)Opening many new accounts in a short period of time suggests that you need additional forms of credit to make purchases. Using a few sources of credit wisely is better than having a large number that you can’t keep track of, or that are unnecessary.

5. Types of Credit in Use (10%)The different types of credit in your possession will be considered in your score, such as credit cards, loans and store cards. Having different forms of credit and using them responsibly can be beneficial in demonstrating how you manage your money in different areas.

Without a credit score, many establishments will not extend you credit, making it feel impossible to start building one.

So, how do you start building credit as an international student?

Open a bank account.

Check if the bank you work with in your home country has a U.S. branch near where you’re moving. If not, there are plenty of other options and your University might even have a bank on campus.

There are a couple of ways that you can build credit by using a bank account. Try opening both a checking and a saving account and regularly transfer money to your savings account if possible. This demonstrates that you’re responsible with your finances and you’re thinking long-term. It’s also a good idea to set up automatic or direct bill payments to ensure that your bills and expenses are paid on time. This is another way to demonstrate your financial responsibility, which helps build a strong credit score.

Pay utility bills.

If you are renting a property off campus you will most likely have to pay utility bills – gas, electric, phone, internet, etc. If you’re staying in on-campus accommodations you may not have all these utilities, but you will most likely need to apply for your own cell phone contract, which can also help you build credit. Making regular payments on all your utilities is another way to prove to lenders that you are responsible with your payments and will be a suitable applicant for a loan or credit option. For each of your utility bills you can request proof of your payments, which many credit providers will accept as supporting evidence of your payment background for your application.

Request store credit.

Store credit cards are used within that specific store. Just like a regular credit card, however, the store will charge you if you don’t make the payments on time. Additionally, although they’re usually easy to be approved for, store credit cards typically do not provide you with a credit limit as high as a traditional credit card. Therefore, it’s important to note that if you make minor purchases and don’t have a very high limit, your borrowed to available credit ratio could hurt your credit score.

How to get a credit card without a credit history or social security number.

Although having a credit card during your studies in the U.S. is important, it can be difficult to find a company that will allow you to open a credit card as a new international student- especially if you don’t have a Social Security Number (SSN) or credit history. However, there are some companies that will allow you to open a credit card as an international student without a SSN or credit history. Here’s how to start that process.

1. Apply for an Individual Taxpayer Identification Number (or ITIN)2

If you’re unable to get a Social Security number, you may still be able to apply for a credit card by using an Individual Taxpayer Identification Number, a tax-processing ID number assigned to individuals by the Internal Revenue Service.

Depending on the bank or credit card company, you can sometimes use an ITIN instead of a Social Security number when applying for a credit card. There are a few easy ways to apply for an ITIN.

By mail.

Through an IRS-authorized certified acceptance agentin the U.S. or abroad.

At a designated IRS taxpayer assistance center.

After applying you should hear back from the IRS within a few weeks if you qualify and your application is complete.

2. Choose banks that accept an ITIN or alternative identification3

Credit card issuers aren’t required to ask for a Social Security number on the card application, but many do anyway. The good news is that some issuers will accept an ITIN instead. Here’s a quick rundown of issuers and where their policy currently stands on this:

Capital One

Accepts ITIN or SSN only. Learn more.

SelfScore Classic MasterCard

Does not require a SSN or ITIN. Will request your passport, U.S. student visa, most recent Form I-20 and latest U.S. bank account statements. Available only to international students studying in the U.S. Learn more.

Deserve

No SSN required for International students. Credit limits up to $5,000, $0 annual fee & no foreign transaction fees and no security deposit or co-signer required. Learn more.

3. Consider a prepaid card

If you can’t yet get approved for a credit card but still want a safer and more convenient way to pay than cash, a prepaid card could be the answer to your prayers — or at least a good payment alternative in the meantime.

While they aren’t technically credit cards, prepaid cards offer a way to keep your money in one place and pay with plastic when that’s the best and easiest option. Prepaid cards can be used in the same ways you might use a traditional credit card — to pay bills online, dine out or book an airline ticket.

The only drawback is you generally can’t build credit with a prepaid card, because your payment history typically isn’t reported to the major credit bureaus.

Financing or leading a vehicle.

Being new to the U.S. can come with a number of challenges when it comes to building credit and getting around. That where we come in, however. IAS can help you start building credit and driving record when relocating to the U.S. Our exclusive vehicle financing and leasing programs view you as a privileged customer starting with a high credit rating and safe driving record, allowing you to get the car you need while also building your credit record and driving history.

Learn more and download our free guide about why it’s important for international students to start building their credit record and driving history in the USA.

You can also learn more about how IAS can provide vehicle financing, leasing and all-inclusive rentals with no credit history.

We are the vehicle experts for expats.

IAS helps you prepare and plan for your move by getting you behind the wheel so you can be productive and focus on what you are here for your studies. Our expertise in the automotive industry has helped over 50,000 foreign nationals get settled into their new countries, careers, schools, and internships with a vehicle that fits their needs.

Our Product Specialists are expert consultants, trained to identify your needs and use their extensive knowledge of the automotive market to find the right vehicle for your lifestyle and budget.

CONTACT US!

Sources:

1. “What’s in my FICO® Scores”https://www.myfico.com/credit-education/whats-in-your-credit-score

2. “How do I apply for an ITIN?” https://www.irs.gov/credits-deductions/individuals/how-do-i-apply-for-an-itin

3. “How to apply for a credit card without a Social Security Number” https://www.creditkarma.com/advice/i/credit-card-without-a-social-security-number/

1 note

·

View note

Text

If you're frequently denied credit or only qualify for loans with high interest rates, your credit score might be the issue. Fortunately, there are numerous strategies to help improve your score.

As your score rises, you'll typically find it easier to obtain loans at more favorable rates.

How to Increase Your Credit Score

Improving your credit score requires time, patience, and financial discipline, according to Tom Quinn, vice president of strategic alliances at FICO. "There’s no quick fix for your FICO score, but focusing on behaviors that creditors value can make a significant difference," he says.

In essence, while there isn’t a magic solution, the following steps can help you boost your score:

Check Your Credit Reports and Dispute Errors

Many people worry that checking their credit report will negatively impact their score, but this is a misconception, says Christina Roman, consumer education and advocacy manager at Experian. "Consumers should regularly check their credit reports," she advises. Reports from TransUnion and Equifax also contribute to your credit score.

You can obtain a free credit report from each bureau at AnnualCreditReport.com. If you spot any errors, address them promptly, especially if they seem to be affecting your score. To dispute an error, contact both the credit bureau and the information provider with proof of the mistake.

Avoid Missing Payments

Your payment history accounts for 35% of your FICO score and is crucial for your VantageScore as well. While a slight delay might incur a fee, it won't immediately affect your score. However, payments more than 30 days overdue can be reported to credit bureaus, impacting your score.

To maintain a good score, consistently pay your bills on time. Setting up payment reminders or automatic payments can help avoid late payments. Positive payment behavior over time will gradually improve your score.

Lower Your Credit Utilization Rate

Credit utilization refers to the ratio of your credit card balance to your credit limit. For example, if you have a $1,000 limit and a $100 balance, your utilization rate is 10%. Aim to keep this rate as close to 0% as possible, rather than the commonly advised 30%, says Roman.

Reducing your balance or requesting a credit limit increase (while not using the new credit) can help. Paying down balances multiple times a month rather than in a single large payment can also be beneficial.

Avoid closing old credit cards, as this can increase your utilization rate and lower your score. However, if overspending on a card is a problem, closing it might prevent further debt.

Other Ways to Improve Your Credit Score

Become an Authorized User: If you’re new to credit and a trusted friend or family member with excellent credit adds you as an authorized user, your score could improve significantly. Ensure the primary cardholder maintains good credit practices to avoid negative impacts.

Take Out a Small Loan: Adding a new credit line can enhance your credit mix, an important factor in your score. Credit-builder loans, designed for those without a credit history, can be helpful. Use loans responsibly to build credit.

Open a Secured Credit Card: A secured card requires a deposit to establish your credit limit. Payments are reported to credit bureaus, aiding in building or rebuilding your credit score.

By following these strategies and maintaining financial responsibility, you can effectively improve your credit score over time.

0 notes

Text

The Miracle Of Capital One Student Credit Card | capital one student credit card

Many or all of the articles featured actuality are from our ally who atone us. This may access which articles we address about and area and how the artefact appears on a page. However, this does not access our evaluations. Our opinions are our own.

Today’s Mass Extinction and Holocene-Anthropocene Thermal Maximum are being caused by the Super Rich – capital one student credit card | capital one student credit card

Learning to use acclaim cards responsibly is a cornerstone of your claimed banking life. The Journey® Apprentice Rewards from Capital One® is a acceptable first card because it rewards you for advantageous on time and gives you accoutrement to adviser your credit, both accomplished habits to cultivate. And alike admitting its name says “student,” you don’t accept to be a apprentice to apply for this card.

The Journey® Apprentice Rewards from Capital One® agenda gives you 1% banknote aback on aggregate you buy and pays an added 0.25% banknote aback anniversary ages when you pay on time. There’s no absolute to the bulk of banknote you can earn, and your rewards never expire.

Paying off your antithesis anniversary ages to acquire that added 0.25% banknote aback is your best practice, and the Journey® Apprentice Rewards from Capital One® card’s almost aerial absorption rate should encourage you to pay it off: The advancing APR is 26.99% Variable APR.

The best credit cards for college students: Reviewed – capital one student credit card | capital one student credit card

The Journey® Apprentice Rewards from Capital One® agenda makes it as accessible to redeem your rewards as to acquire them: You can appeal a acclaim on your account — abbreviation the bulk you owe — or you can appeal a check. If you appetite to acquire your rewards after accepting to anticipate about it, you can set an automated accretion for all of the banknote at the aforementioned time anniversary year or get your banknote back it alcove a assertive beginning ($25, $50, $100 or $200).

Another reward for responsible acclaim administration is the abeyant to access your band of credit. If you accomplish your aboriginal bristles payments on time, Capital One may accession your acclaim limit.

Why is a college acclaim absolute important? Because it will advice accession your acclaim score. One of the factors in your acclaim account is your acclaim appliance ratio, or how much credit you’re application compared with your absolute acclaim line. For example, if you accept a $500 acclaim band and you accept a antithesis of $200, your acclaim appliance arrangement is 40%. If your issuer increases your acclaim band to $1,000 and your antithesis charcoal the same, your arrangement falls to 20%. The lower your ratio, the bigger for your score. Of course, if you don’t backpack a balance, your appliance arrangement will be 0%.

Capital One Journey Student Credit Card Review | Bankrate – capital one student credit card | capital one student credit card

If you’re accepting into acceptable money habits application the Journey® Apprentice Rewards from Capital One® card, you should additionally alpha ecology your credit, which this agenda helps you do with CreditWise. Anniversary week your acclaim score, based on your TransUnion VantageScore 3.0, is adapted so you can see how your acceptable money administration is convalescent your score.

All these appearance are accessible for an anniversary fee of $0. There is additionally no adopted transaction fee, which is important for acceptance and adolescent bodies who are belief away or exploring the world.

The Journey® Apprentice Rewards from Capital One® agenda can be enrolled in Apple Pay so you can pay deeply on the go in the U.S. and in abounding countries about the world.

Capital One Credit Cards: Overview and Comparison | Credit Card .. | capital one student credit card

Students and adolescent bodies can get the Journey® Apprentice Rewards from Capital One® agenda with boilerplate acclaim and get a rewards program, too. If you aerate the rewards, you’ll additionally be acquirements amenable acclaim management, which will set you up for a acceptable banking life.

Ellen Cannon is a agents biographer at NerdWallet, a claimed accounts website. Email: [email protected]. Twitter: @ellencannon.

The Miracle Of Capital One Student Credit Card | capital one student credit card – capital one student credit card

| Allowed for you to our blog site, on this occasion I’ll show you concerning keyword. And from now on, here is the 1st image:

Best Capital One Credit Cards in Canada 14 – capital one student credit card | capital one student credit card

Think about impression preceding? is usually in which wonderful???. if you feel consequently, I’l d demonstrate a number of impression once more down below:

So, if you would like acquire the fantastic pics related to (The Miracle Of Capital One Student Credit Card | capital one student credit card), simply click save button to save the graphics to your computer. These are ready for obtain, if you like and want to have it, simply click save symbol on the article, and it’ll be instantly downloaded to your laptop computer.} Lastly if you wish to gain unique and latest image related to (The Miracle Of Capital One Student Credit Card | capital one student credit card), please follow us on google plus or save this website, we attempt our best to give you daily up grade with fresh and new pics. We do hope you enjoy staying here. For most up-dates and latest information about (The Miracle Of Capital One Student Credit Card | capital one student credit card) pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to provide you with up grade regularly with all new and fresh images, like your browsing, and find the ideal for you.

Here you are at our website, articleabove (The Miracle Of Capital One Student Credit Card | capital one student credit card) published . At this time we’re delighted to declare we have discovered an awfullyinteresting nicheto be discussed, namely (The Miracle Of Capital One Student Credit Card | capital one student credit card) Most people looking for specifics of(The Miracle Of Capital One Student Credit Card | capital one student credit card) and certainly one of these is you, is not it?

The Best Credit Cards of 14 for Every Financial Use | Money – capital one student credit card | capital one student credit card

Capital One® Journey® Student Rewards Credit Card Review (14) – capital one student credit card | capital one student credit card

Capital One Venture credit card adds redemptions for food delivery .. | capital one student credit card

This Is the Best Credit Card for Students in 14 | Money – capital one student credit card | capital one student credit card

Capital One credit card rewards are now redeemable on Amazon – capital one student credit card | capital one student credit card

What Are the Capital One Credit Score Requirements for 14?” – capital one student credit card | capital one student credit card

Amazon | capital one student credit card

Flyer design-7 – capital one student credit card | capital one student credit card

Capital Card Credit One Student ~ FUROSEMIDE – capital one student credit card | capital one student credit card

from WordPress https://www.visaword.com/the-miracle-of-capital-one-student-credit-card-capital-one-student-credit-card/

via IFTTT

0 notes

Text

International Credit Reporting: The United States vs. United Kingdom

While credit scoring systems in the United Kingdom and the United States are similar in many ways, there are some significant differences. While a credit score might seem like something that should easily travel with you across the pond, the frustrating truth is it doesn’t – meaning you have to start building credit from scratch if you immigrate.

Why are credit systems different from country to country? According to Equifax UK:

“This is partly due to having different data protection laws in different countries, and also the fact that agencies will hold information that relates to addresses in that particular country.”

Here are some of the major differences – and similarities – between the UK and US credit systems.

Table of Contents

How lenders and bureaus identify youThe differences between credit bureausCredit scoring ranges and models usedHow lenders use your credit scoreWhether closing an account helps or hurtsThe impact of income and savings on creditHard vs soft credit inquiriesFinancial associates vs. cosigners

How lenders and bureaus identify you

In the UK, lenders and credit bureaus verify your identity by using the information from your electoral register. This register contains the personal information of everyone who is registered to vote in public elections. It includes your name and address, date of birth and an electoral number, and is used to determine what constituency you are in and where to send ballot cards.

Unlike in the UK, you get no direct financial benefit from registering to vote in the US. Instead, lenders and credit bureaus use your Social Security Number (SSN) to identify you. A Social Security Number is a nine-digit number issued to US citizens, permanent residents and temporary residents.

This number should never be shared with anyone and is a unique identifier that identifies you for cases of employment, credit access and monitoring, transactions with financial institutions and more.

To find out more about Social Security Numbers and the role they play in building credit and filing taxes in the US, check out the blog on “Can You File Taxes Without a Social Security Number?”

The credit bureaus – same but different

The major bureaus in the United Kingdom are Experian, Equifax and TransUnion. The major bureaus in the United States are Experian, Equifax and TransUnion.

Yes, they are the same companies operating on both sides of the pond. However, your UK credit history does not translate to the US, and vice versa.

In both countries, these credit bureaus collect information about your credit history and credit behaviors, as well as personal information. However, that’s pretty much where the similarities stop. Among other things, how these bureaus interact with and provide information to lenders differs between the two countries.

Perhaps the most noticeable difference when it comes to the interaction between lenders and credit bureaus? Credit scoring – how it’s used, how it varies, and the credit scoring ranges themselves.

Credit scoring ranges and models used

The best way to explain the difference in credit scoring and the models used, which could easily be a novel unto itself, is to break it down, country-by-country. Let’s start with a reminder about how your credit score works in the UK.

Credit scoring in the UK

In the UK, lenders often have their own credit scores based on their own models and don’t use the scores provided by the credit bureaus. The scores and ratings at the credit bureaus are, instead, almost strictly used for educating the consumer about their credit.

According to Experian UK:

“Each company may consider different information when working out your score, depending on their criteria and what data they have access to. They may also differ in how they see your information – for example, a certain record on your report could look negative to some companies and positive to others, depending on what they’re looking for in a customer. So, your score will probably vary between the different credit reference agencies and companies.”

Nowhere is this variation more obvious than if you look at the scoring systems from bureau to bureau in the UK.

“There’s no such thing as a universal credit score, each credit score is created by lenders or credit reference agencies as a way of measuring an individual’s creditworthiness. Scores from different sources will be calculated using different formulas and criteria. They will also be rated on different scales, e.g. 1 to 700 or 1 to 1000. This is why you might get 500 on one scale and 700 on another, even if the information provided is the same,” the Equifax UK website mentions in their post on understanding credit score ranges.

Here’s a breakdown of the credit scoring ranges in the UK…

Experian UK Credit Score

Range: 0-999

Source

Equifax UK Credit Score

Range: 0-700

Source

TransUnion UK Credit Rating

Range: 1-5

Source

It’s important to note though, that TransUnion recognizes a difference between your credit rating and your credit score. We’ll get to that in a minute.

Difference between credit rating and credit scoring

From there, the differences get even more pronounced, since, according to TransUnion UK, there’s also a difference between your credit rating and your credit score in the UK:

“Don’t get your credit rating confused with your credit score. While they are similar, they’re not exactly the same and how your credit score is assessed by lenders is for them to determine, based on the information in your credit file.”

The TransUnion credit rating system in the UK provides simply an indication of the type of credit risk you might pose to lenders, based on the following factors:

How much you oweYour payment history (including late payments)The length of your credit historyBankruptcies and insolvenciesElectoral registry informationYour financial associates

These elements are, for the most part, very similar to what goes into your US credit score, with a few minor differences.

While credit bureaus in the UK share many differences, these bureaus do agree on a few things when it comes to maintaining a positive credit history and credit score, as evidenced by the following factors that impact your credit score on the Equifax site:

Info on credit report (ie how much available credit you’re using)Payment history on credit accountsHard inquiries/when/how often you apply for creditPublic records (electoral register and county court judgments)

US credit scoring ranges and models

In the US, however, the credit score ranges are similar across credit reporting agencies, and your credit score does impact lending decisions. Here, credit scores range from 300-850 at each of the three major credit bureaus (Experian, Equifax and TransUnion), with the highest number being the best your score can get.

Here’s an idea of what “good” looks like when it comes to U.S. credit scores, according to Experian.

While there are different types of scoring models used in the US (including various versions of the FICO score and the VantageScore), the FICO model is used by roughly 90% of lenders. The major scores however, all use the 300-850 scale.

“The FICO Score helps lenders make accurate, reliable and fast credit risk decisions across the customer lifecycle. The credit risk score rank-orders consumers by how likely they are to pay their credit obligations as agreed. The most widely used, broad-based risk score; the FICO Score plays a critical role in billions of decisions each year,” credit expert Barry Paperno says.

While some of the newer credit scoring models are starting to incorporate things like rent or utilities payments, in general, only certain accounts factor into your credit score in the US. These accounts typically include:

Credit cards (secured and unsecured)Personal loansAuto loansMortgage loansCertain other loans

Unlike in the UK, where utilities and rent are commonly taken into account when modeling your credit, these accounts do not typically report in the US. Even some loan products here(usually predatory in nature) do not report to the credit bureaus.

It’s also important to keep in mind that lenders do not necessarily report to – or receive information from – all three credit bureaus. So if you have a question about whether or not your US credit account will report to the credit bureaus, and which of the bureaus it will report to specifically, be sure to ask. Ultimately, to gain access to the most competitive credit products in the US, it’s important to build credit at all three reporting bureaus.

How do you do this? A good starting point is to understand the five factors that go into your US credit score. These vary slightly from score model to score model, but in general are found across all scoring models. Here they are in order of importance:

Payment historyAmounts owedNew credit applications and hard inquiriesLength of credit historyTypes of credit used

For more information on these five factors, check out “5 Components of a Credit Score.”

For more on how to build credit in the US, be sure to check out our blog post on “5 Ways New Immigrants Can Build American Credit.”

How lenders use your credit score

In the US, the credit bureaus provide lenders with access to your credit score, though it’s up to the lender which bureau they pull your score from. While your credit score is not the only thing that determines a lender’s perception of your credit worthiness, it does have an impact.

Unlike the UK, where each lender has their own separate scoring model, in the US, most lenders use some version of either the FICO score or VantageScore models, with roughly 90% of lenders using the FICO model.

While the scoring range (300-850) is the same across the major bureaus, the specific scoring model could vary slightly, impacting that score from bureau to bureau and lender to lender.

Whether closing an account could help or hurt

In the UK, there’s a bit of a discrepancy between whether or not closing your accounts could help or hurt, depending on the lender. As mentioned previously in this post, what some lenders in the UK may view as a positive, others may view as a negative, so it depends on the lender.

According to Equifax UK, “Close any unused credit accounts, as having a large overall credit limit may be viewed negatively by lenders.”

TransUnion UK also recommends that you close down outdated credit cards and cancel old agreements. However, Experian UK urges the opposite:

“Try to keep old, well-managed accounts. Credit scoring looks at the average age of your bank accounts, so try not to chop and change too much.”

In the States, no matter which scoring model or bureau you’re looking at, the experts agree – keep your old accounts open where possible, since the length of your average credit history counts for 15% of your FICO credit score.

Having a large overall credit limit, compared to the amount of credit you use, is also considered a positive in the States, even though having a large credit limit is sometimes viewed negatively in the UK.

Neither credit system counts income or savings

“It’s worth noting that your Experian Credit Score won’t be affected by things like your income, savings, employment, or health expenses, because this information isn’t recorded on your credit report. However, companies may ask questions about these factors when you apply for credit, and may use these details when calculating their own version of your score,” Experian UK mentions in a consumer guide.

The same holds true for credit scoring in the US. While individual lenders will factor in your debt-to-income ratio (the percentage of debt you have as opposed to how much money you make) when making lending decisions, this ratio does not play a role in determining your credit score.

In the US, a general rule is to keep this debt-to-income ratio to below 30% if possible. Otherwise, lenders might view you as having too much debt to responsibly and reliably pay back what you owe them.

Hard vs. soft credit inquiries are the same

Whether you live in the US or the UK, hard and soft credit inquiries are the same in both.

A hard credit inquiry happens whenever you apply for a new line of credit. In the States, the number of credit applications you complete within a given time period counts for 10% of your FICO credit score.

Each time you have a hard inquiry on your credit report, it drops your credit score by at least a few points.

In both countries, you must give your consent before a company can do a hard inquiry (sometimes known as a hard pull) on your credit.

A soft inquiry happens when either you or a company reviews your credit score or report for educational purposes only, and not in order to make lending decisions. This type of inquiry does not impact your credit score.

Financial associates vs. cosigners - similar but different

In the UK, a financial associate means someone you share either a bank account or credit account with, whether that’s a spouse or someone else.

According to Experian UK, a financial associate’s credit history doesn’t appear in your credit report, but lenders can view it when you apply for credit. This is because your financial associate’s circumstances may impact your ability to repay what you borrow.

“Lenders could take a financial associate’s financial behaviour into account even if you’re applying for new credit on your own. If your associate has poor credit history, this could potentially impact your ability to obtain a new credit agreement,” Equifax UK writes.

In the US, a cosigner is someone who specifically signs up for a loan with you. For example, you and your spouse take out a mortgage together, or your parent cosigns on a car loan with you that you might not qualify for on your own. In the case of a cosigner, only their behavior on your joint credit account impacts your personal credit, not their financial behavior in general.

So while the account you have with them could impact your overall credit score and credit history, as long as your cosigner manages your joint account responsibly, their behavior on their other credit accounts will not impact a lender’s decision regarding whether or not to extend you credit. The similarity between financial associates and cosigners? In both cases, you’re entrusting someone else with power over your credit. So choose these people wisely.

Final thoughts

While credit systems in any country can seem confusing if you don’t understand their nuances, it’s important to understand how best to be financially successful in your new home. That way, you’re more able to take advantage of premium financial products and services, and be less susceptible to predatory or less favorable options.

About the author

Lauren Jackson is the Content Marketing Manager for Self Lender and editor of their blog. She has a background writing about tech, wellness, women’s issues, and now – personal finance. She's passionate about the intersection of business and social good and devoutly dedicated to budget travel. She believes you can have an amazing life – even if you don't have the best health or the most wealth.

Read the full article

0 notes

Text

Amazon’s new rewards card targets those with bad credit

Amazon this morning announced the launch of Amazon Credit Builder, a new secured credit card offered in partnership with Synchrony Bank. As the name implies, the card is aimed at those who are looking to build their credit history — either to recover from bad credit or to establish new credit. Like other credit products Amazon has launched, the card’s big perk is cash back on Amazon.com purchases — in this case, 5% back on purchases if the cardholder is a Prime member.

The Credit Builder card also has no annual fee, offers special financing on purchases, and includes protection from unauthorized charges. As a secured card, Amazon Credit Builder requires that cardholders submit a refundable security deposit in order to get a line of credit from the bank. This funding isn’t available for purchases made with the card, but rather serves as a way to establish a credit limit.

The deposit can range from $100 to $1,000, says Amazon, and is submitted either by electronic transfer (ACH transfer on Amazon) or via mail.

To pay off purchases, the card is unique in that it allows customers to either choose to make 12 months of equal payments or 6/12/24-month 0% periods for select purchases.

Also a part of the product is the ability for cardholders to track their credit improvement over time as they use the card to make purchases on Amazon.com.

The cardholders receive access to their own personal TransUnion CreditView Dashboard, where they can view their VantageScore credit score for free, use a simulator to understand how different activities will impact that score, get fraud alerts, and access credit education to help them further improve their credit score.

Other financial education provided by Synchrony is also available.

Amazon says that Credit Builder customers may become eligible for an upgrade to the Amazon Store Card after as little as seven months after opening the Credit Builder account, at which time their initial security deposit would be refunded.

Typically, secured credit cards are offered to people looking to improve their credit — but it’s unusual for a retailer to provide their own secured card. For Amazon, however, offering credit to the under-banked or unbanked is another way of expanding its business to a broader market.

Like many online retailers today, Amazon believes that shopping online shouldn’t be a privilege only for the middle class and up. After all, e-commerce sites may often have better deals than brick-and-mortar stores, and the convenience of shopping online can help customers save both gas money and time — the latter a particular issue for those working multiple jobs to make ends meet.

To cater to the under-banked and low credit customers, Amazon already offers a low-cost version of Amazon Prime for those on government assistance programs in the U.S., including including Temporary Assistance for Needy Families (TANF), Supplemental Nutrition Assistance Program (SNAP), and Women, Infants, and Children Nutrition Program (WIC) and, as of last year, Medicaid.

More recently, it and other retailers like Walmart began participation in a USDA trial focused on allowing SNAP recipients to shop for groceries online.

While Amazon’s new card may make sense for those on a path to building better credit, it may be better for those who are looking to upgrade to the Amazon Store Card in the future, rather than simply repair their poor credit history.

The card, consumers should note, carries a high APR of 28.24% — higher than the average median APR for retail cards (25.64%).

“This is a solid option for people who are new to credit or rebuilding their credit after prior missteps, but there are some risks to be aware of,” notes Ted Rossman, Industry Analyst for CreditCards.com.

“It’s always important to pay your credit card bills in full, and that’s especially true with this card. The interest rate is very high – 28.24% – and if you fail to pay a 0% promotional offer in full by the time the term expires, you’ll be charged retroactive interest on the average daily balance going back all the way to the original purchase date,” he says.

However, Rossman concludes that when the card is used properly, the card could be useful in improving credit while receiving the cash back perk.

Customers can visit the Amazon Credit Builder page to sign up for the card.

0 notes

Text

How to Cancel a Credit Card Without Dinging Your Credit Score

New Post has been published on https://personalcoachingcenter.com/how-to-cancel-a-credit-card-without-dinging-your-credit-score/

How to Cancel a Credit Card Without Dinging Your Credit Score

You’ve heard the advice: Never cancel a credit card account or you could damage your credit scores. And while it is true that closing a credit card can be hard on your credit scores, that isn’t always the case.

Typically, it’s best to leave your credit cards open, even if you’re not using them. However, there are a few valid reasons why you may want to close a credit card account. Keep reading for a breakdown of how to cancel a card the right way.

Key Takeaways

Although it goes against general credit advice, in certain circumstances closing a credit card account is necessary.

A credit card can be canceled without harming your credit scores, if you know what you’re doing.

Closing a credit card will not shorten the age of your credit history.

Follow a checklist when canceling a credit card.

Canceling a Credit Card Without Harming Your Scores

There’s a reason why credit experts advise against closing unused credit cards. Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report, explains, “Canceling a credit card has the potential to reduce your score, not increase it.”

This potential score drop often occurs because closing a credit card can impact your credit utilization ratio. The ratio measures how much of your total available credit is being used, according to your credit reports. The more available credit you utilize (per your reports), the worse the impact will be on your scores. Here’s a simple example of how closing a $0 balance credit card could backfire.

Credit card number one has a $1,000 limit and a $1,000 balance.

Credit card number two 2 has a $1,000 limit and a $0 balance.

Your credit utilization on both cards combined is 50%. ($1,000 total balances + $2,000 in total limits = 50% utilization.)

Close credit card number two and your credit utilization jumps to 100%. ($1,000 total balances + $1,000 total limits = 100% utilization.)

You should aim to pay your credit card balances off in full every month. Doing so not only protects your credit scores; it can also save you a lot of money in interest.

Ideally, you should pay off all of your cards every month, but this is especially important before closing a credit card account. Provided all of your credit cards show $0 balances on your credit reports, you can close a card without hurting your scores.

By closing a credit card, you risk increasing your credit utilization ratio and harming your credit scores.

Reasons for Canceling a Credit Card

Canceling a credit card is usually a bad idea. Nevertheless, there are some circumstances in which a card cancellation could be in your best interest. Here are three.

Separation or Divorce

It’s best to close joint credit card accounts during a separation or divorce. As a joint card holder, you’ll be liable for any past or future charges made on the account. It’s not uncommon for an angry ex to run up excessive charges on a joint card out of spite.

If that happens—or even if routine spending occurs on a joint account after separation—the charges will be your responsibility as well. Your divorce decree might say your former spouse is responsible for the debt, but that won’t release you from your obligation in your lender’s eyes.

High Annual Fees

If your card issuer charges you a high annual fee for an account you don’t use, cancellation might be warranted. However, consider the following first.

If you receive benefits from the account that outweigh the annual fee, such as travel credits and perks, it might be well worth the cost. An annual fee on a credit card you don’t use or benefit from is another story.

Before you cancel the account, try calling your card issuer to ask for the annual fee to be waived. Be sure to mention that you’re considering closing your account. It doesn’t hurt to ask, and you might be pleasantly surprised.

Too Much Temptation

Some people find the temptation of using credit cards too much to resist. And while this might be a valid reason to close a card for some, there are other alternatives you can try to curb overspending without sacrificing your credit scores.

For example, you could remove your credit cards from your wallet and store them in a safe place. By not having your cards readily available, you may find the temptation easier to resist.

Cancellation Checklist

When canceling a credit card, here are six simple tips to help you navigate the process.

Redeem unused rewards on your account before you call to cancel.

Ideally, pay off all of your credit card accounts to $0 before canceling any card. At the very least minimize your balances as much as possible.

Call your credit card issuer to cancel and confirm that your balance on the account is $0.

Mail a certified letter to your card issuer to cancel the account. In it ask for a letter confirming your $0 balance and closed account status to be mailed to you in return.

Check your three credit reports 30 to 45 days after cancellation to make sure that (a) the account reports as closed by cardholder and (b) your balance is $0.

Dispute any incorrect information on your reports with the three credit bureaus.

Closing a Credit Card Won’t Shorten Your Age of Credit

You may have heard that closing a credit card causes you to “lose credit” for the age of the account. and hurts your age of credit (worth 15% of your FICO score). That is a myth.

Credit expert John Ulzheimer, formerly of FICO and Equifax, confirms that closing a credit card will not remove it from your credit reports. Furthermore, Ulzheimer states, “As long as the credit card remains on your report, you will still get the value of the age of the account in both the FICO and VantageScore branding credit scoring models. The only way to lose the value of the age of the card is if it’s removed from your reports.”

A closed account will remain on your reports for up to seven years (if negative) or around 10 years (if positive). As long as the account is on your reports, it will be factored into your average age of credit. FICO itself confirms that “the FICO Score considers the age of both open and closed accounts.”

The Bottom Line

Don’t close a credit card account without a good reason. Having a lot of credit cards won’t necessarily hurt your credit scores significantly if you handle them responsibly. However, if you need to cancel a card, do your best to reduce all your credit card balances first (preferably to $0), so you can either minimize or totally avoid any credit score damage.

Go To Source

#coaching#coaching business#coaching group#coaching life#coaching life style#coaching on line#coaching performance#Coaching Tips#Coaching from around the web

0 notes

Text

How Healthy is Your Credit Score?

Your credit score is one of the most critical numbers in your financial life. Whether you’re applying for a new credit card, personal loan, or a mortgage, it is vital to know your credit score so that you have the proper insight into what type of credit you qualify for and what interest rates you can anticipate. But what exactly is your credit score, and what does it consist of?

Below, we’ll discuss all the ins and outs of your credit and what you need to know about your credit score.

What is a Credit Score?

A credit score is a three-digit number, ranging from 300 to 850, that serves as an evaluation of your credit history and estimates how likely you are to repay borrowed money.

When determining your credit score, many different things are considered, such as payment history and duration of credit history, from your present and past credit reports, which we will discuss shortly.

While a low credit score may not prevent you from being eligible for credit, you may be forced to pay higher interest rates or place a considerably more substantial amount of money on deposit.

In some instances, you might also need to pay more for car insurance or put down more significant deposits on utilities. Landlords may also use your credit score to determine whether or not you are a suitable renter.

A high credit score, on the other hand, can grant you access to many more types of credit products. Additionally, you are also eligible for reduced interest rates and lower deposits.

Borrowers with credit scores above 750 also frequently have many financial possibilities, including the chance to qualify for 0% financing on automobiles, as well as credit cards with 0% introductory interest rates.

What are the Credit Score Ranges?

While each creditor has its own set of criteria for what constitutes a good credit score, the general guidelines can be found below:

Excellent Credit: 720-850

Good Credit: 690-719

Fair Credit: 630-689

Poor Credit: 629 or below

The most commonly used credit score model is the VantageScore. Although all three credit bureaus use VantageScore, each bureau looks at different factors, so a consumer’s score can vary depending on which credit bureau supplied the data.

Where Does the Information from a Credit Score Come From?

The three major credit reporting agencies – Equifax, Experian, and TransUnion – provide the information on your credit account. These agencies use the information to create the credit score, which is then provided to lenders when evaluating loan applicants.

So what does a credit score consist of? Let’s take a look.

Payment History

Payment history accounts for 35% of most credit scores. A history of missed or late payments lowers your credit rating more than any other factor. When determining your score, creditors look at how recently you missed a payment or were late on a payment, as well as the number of accounts that have previously been overdue.

For a good credit score, you need to have as clean a payment history as possible with no or few late payments.

Charge Utilization Ratio

Credit utilization is responsible for 30% of most credit scores. Your credit utilization ratio is the amount of credit that you’ve used, divided by your total available credit limit

For example, if you have multiple credit cards with a combined credit limit of $8,000 and a balance of $3,000, then your credit utilization ratio is 37.5%.

To have a good credit score, your credit utilization ratio should be roughly 30% or less. Most experts recommend 10%.

Credit Age

Credit age is used to calculate 15% of most credit scores and refers to how long you’ve used credit. More accurately, credit age is the age of the oldest account, latest accounts, and average ages of all accounts on your credit file.

For a good credit score, you should have at least one account in your credit file that’s at least six months old.

Account Mix

Account mix makes up 10% of most credit scores and refers to how many credit accounts you have. Account mix can consist of things such as mortgages, car loans, or personal loans. Revolving accounts such as credit cards and lines of credit are also considered.

For a good credit score, most lenders prefer borrowers who have a diverse combination of accounts in their credit history.

Credit Inquiries

Credit inquiries, classified into hard and soft, are used to determine 10% of most credit scores.

Hard inquiries occur when a creditor looks at your credit report because you have applied for a line of credit and can reduce your credit score by 5 to 10 points for as much as two years.

Soft inquiries, which refer to instances where you or a lender check your credit score, however, don’t affect your credit score.

While this category only accounts for 10% of your credit score, try to minimize credit inquiries as much as possible.

How Can I Improve My Credit Score?

Now that you have a better understanding as to what makes up your credit score, let’s take a look at a few ways you can start improving your credit score today.

Pay Your Bills On Time

Payment history is the most potent factor for your credit score, which is why you should always stay on top of your monthly payments. If you have a difficult time remembering to make payments, create a calendar reminder on your phone or opt to enroll in automatic payments.

If you have a SmartCredit account, you will also receive alerts for upcoming payments before they are due. This will help you avoid hits to your credit score from late payments.

Regularly Monitor Your Credit Score

Identity theft and reporting errors can quickly derail your credit score. Be sure to check your credit report throughout the year to ensure no unusual or fraudulent activity is occurring.

If you catch anything inaccurate on your report, follow the proper measures to dispute the error as soon as possible.

Consider Your Credit Mix

Lastly, credit scores take into account your ability to manage different kinds of credit. If you think your credit combination needs to diversify, consider taking on a low-interest rate loan that you know you will be able to pay on time.

Be Strategic About New Debt

While it’s smart to have a healthy mix of credit, too many hard inquiries over time may indicate that you are taking on more debt than you can manage, which can negatively affect your credit score.

However, provided that you continue to show that you’re a responsible borrower, your score should return to normal over time.

View Your Credit Score with SmartCredit Today

As you can see, credit scores are a quick way for lenders to predict consumer credit risk and credit behavior. Considering the importance of your credit score, it’s vital that you do everything you can to keep it in good standing.

If you want to take back control of your credit score, contact SmartCredit today to see where your credit stands. Find out what proactive steps you can take to start improving your credit score right away with SmartCredit.

The post How Healthy is Your Credit Score? appeared first on SmartCredit Blog.

from

https://blog.smartcredit.com/2020/09/15/how-healthy-is-your-credit-score/

source https://smartcredit1.weebly.com/blog/how-healthy-is-your-credit-score

0 notes

Text

How Healthy is Your Credit Score?

Your credit score is one of the most critical numbers in your financial life. Whether you’re applying for a new credit card, personal loan, or a mortgage, it is vital to know your credit score so that you have the proper insight into what type of credit you qualify for and what interest rates you can anticipate. But what exactly is your credit score, and what does it consist of?

Below, we’ll discuss all the ins and outs of your credit and what you need to know about your credit score.

What is a Credit Score?

A credit score is a three-digit number, ranging from 300 to 850, that serves as an evaluation of your credit history and estimates how likely you are to repay borrowed money.

When determining your credit score, many different things are considered, such as payment history and duration of credit history, from your present and past credit reports, which we will discuss shortly.

While a low credit score may not prevent you from being eligible for credit, you may be forced to pay higher interest rates or place a considerably more substantial amount of money on deposit.

In some instances, you might also need to pay more for car insurance or put down more significant deposits on utilities. Landlords may also use your credit score to determine whether or not you are a suitable renter.

A high credit score, on the other hand, can grant you access to many more types of credit products. Additionally, you are also eligible for reduced interest rates and lower deposits.

Borrowers with credit scores above 750 also frequently have many financial possibilities, including the chance to qualify for 0% financing on automobiles, as well as credit cards with 0% introductory interest rates.

What are the Credit Score Ranges?

While each creditor has its own set of criteria for what constitutes a good credit score, the general guidelines can be found below:

Excellent Credit: 720-850

Good Credit: 690-719

Fair Credit: 630-689

Poor Credit: 629 or below

The most commonly used credit score model is the VantageScore. Although all three credit bureaus use VantageScore, each bureau looks at different factors, so a consumer’s score can vary depending on which credit bureau supplied the data.

Where Does the Information from a Credit Score Come From?

The three major credit reporting agencies – Equifax, Experian, and TransUnion – provide the information on your credit account. These agencies use the information to create the credit score, which is then provided to lenders when evaluating loan applicants.

So what does a credit score consist of? Let’s take a look.

Payment History