#vantagescore 3.0

Text

Difference between fico and vantagescore

The weight that is given to every one of your credit not entirely settled by the scoring model that is being utilized. There are two different FICO ratings that can be utilized to decide how reliable an individual is. Both of these scores are expected to be somewhere in the range of 300 and 900. The credit rating and the VantageScore both utilize a credit scoring range that reaches from 300 to 850, with larger numbers demonstrating more noteworthy reliability. You will have a superior comprehension of how these credit scoring models capability assuming you look into the essential qualifications that exist between the credit rating and the VantageScore.

Difference between fico and vantagescore

The organization that was previously known as Fair, Isaac and Co. also, was laid out in 1956 thought of the idea of the credit rating during the 1980s. The organization's previous name was Fair Isaac, yet it is presently referred to just as FICO. The credit rating was created fully intent on helping moneylenders in figuring out which borrowers had a more noteworthy penchant to default on a credit. The latest form of the credit rating is 9, however rendition 8 is as yet the one that is generally ordinarily utilized. Also, FICO creates individual scores for vehicle advances, Visa applications, and home loan applications.

The three biggest credit detailing organizations — Equifax, Experian, and TransUnion — combined efforts and laid out a joint endeavor called VantageScore Arrangements LLC in 2006. That very year, they sent off VantageScore 1.0. VantageScore was conceived out of this organization. The three organizations that are liable for announcing customers' credit data are now and again alluded to as credit agencies. VantageScore was created to guarantee that the FICO ratings furnished by these organizations are steady with each other. Since it was first evolved, the VantageScore framework has been refreshed a sum of multiple times.

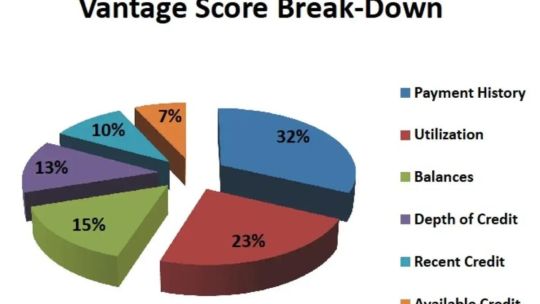

The Measures for Scoring to produce a financial assessment, the FICO scoring model requires the presence of no less than one record or tradeline that has been on favorable terms for a time of no less than a half year. Moreover, your record probably included ongoing action inside the past a portion of a year. The credit scoring model utilized by VantageScore just requires one record or tradeline to work, and there is no base required length for the record of loan repayment. Weighting While the latest rendition of VantageScore puts a more prominent accentuation on complete credit utilization and balances, FICO puts a more noteworthy accentuation on installment history. The credit scoring equation utilized by the credit rating depends on five distinct classes of data, while VantageScore 3.0 purposes six unique classifications. Five unique classes are utilized in VantageScore 4.0.

35% of the historical backdrop of installments 30% of complete obligation and sums that are owed 15% the candidate's age and the length of their financial record 10% of different kinds of credit and blends of credit 10% of new credit applications and requests

40% of past monetary history age and sort of credit represent 21% of the aggregate. 20% of the aggregate sum of credit used 11% complete equilibriums/obligation 5% of late exercises and requests in regards to credit 3% accessible credit The scoring measures were changed somewhat with the arrival of VantageScore 4.0, which merged the variables and doled out a lower weight to installment history. What's more, it doesn't give a rate to every basis; rather, it expresses how much each element adds to the general outcome.

The complete credit utilization, the equilibrium, and the accessible credit all have a critical effect. Credit blend and experience are critical variables. The historical backdrop of installments is modestly compelling. Time of record as a consumer is a component that conveys less weight. New records are essentially less powerful. The installment history considers any missed installments, considering both how much the missed installment and how as of late it happened. The age of your most seasoned account, the age of your freshest record, and the typical age of your records are all regularly thought about while assessing your record, notwithstanding the way that long it has been since you utilized every one of those records. Your credit blend is involved the different types of credit that you have utilized, for example, bank charge cards, retailer credit accounts, portion advances, finance organization records, and home loan advances. Ongoing credit conduct and new records includes deciding if you have as of late opened various new credit accounts. Potential banks will pull your credit report to decide if you are reliable for the advance or other credit extension that you have mentioned. You ought to know that a FICO rating that you get on the web will likely not impeccably match the one that the moneylender gets; nonetheless, it can in any case give you a smart thought of where you stand.

Both FICO and VantageScore have a somewhat unique way to deal with the treatment of hard requests in their models. With regards to FICO, a time of 45 days containing various hard requests is viewed as comparable to a solitary request. On the off chance that various hard requests occur inside a 14-day window, VantageScore believes those requests to be identical to a solitary request. This cycle, which is known as deduplication, can be useful when you are contrasting rates presented by different loan specialists, for example, when you are looking for a home loan.

The scope of conceivable credit ratings is from 300 to 850. The scope of scores from 300 to 850 that is utilized by FICO was embraced by VantageScore 3.0. Coming up next is a rundown of the credit levels that fall inside that reach: 781-850=Super Prime 661-780=Prime 601-660=Near Prime 500-600=Subprime 300-499=Deep Subprime In prior cycles of VantageScore, the scope of potential scores was 501 to 990. Both the VantageScore 1.0 model, which was presented in Walk 2006, and the VantageScore 2.0 model, which was presented in October 2010, relegated a letter grade to a FICO rating in view of where it fell inside the accompanying reaches: A relates to the reach 901-990, B to the reach 801-900, C to the reach 701-800, D to the reach 601-700, F to the reach 501-600, and H to high gamble. At the point when VantageScore rendition 4.0 turned out in April.

As indicated by FICO, its score doesn't consider factors like your race, variety, religion, public beginning, sex, or conjugal status, which would all be infringement of government regulation on the off chance that they were considered. Also, it doesn't consider your age, pay, occupation, or work history. Furthermore, it doesn't consider your place of home or the loan cost that is being charged to you on a Mastercard or other record. FICO likewise expresses that it doesn't figure installments for kid or family support that you are lawfully expected to make, and it doesn't change your score in view of investigations into your credit documented by you, a business, or a bank to make a limited time special or directing an occasional survey. These assertions can be tracked down on the organization's site. It likewise doesn't consider whether you are getting help from a credit guide. As per the site for VantageScore, the organization doesn't consider an individual's race, variety, religion, identity, orientation, conjugal status, age, pay, occupation, title, business, work history, complete resources, or spot of home. Neither does it consider the person's conjugal status.

The FICO rating that a potential bank will use to choose whether or not to endorse your application for credit is the one that you ought to give the most weight to while pursuing your choice. It is energetically suggested that you check your credit rating since it is utilized by most of moneylenders. You shouldn't, nonetheless, expect that to be the situation. Continuously guarantee that you ask with your moneylender in regards to the FICO rating that they will check.

You will find that most of advance suppliers take a gander at your credit rating. As indicated by FICO, their scores are utilized by 90% of the top moneylenders to settle on choices with respect to credit endorsement, advance terms, and different variables. 8 VantageScore is an option in contrast to the more normal credit rating that can be utilized by loan specialists and Mastercard organizations. As per the discoveries of a review led in 2019, in excess of 2,000 distinct monetary foundations got to in excess of seven billion VantageScores every year.

Both the VantageScore and the credit rating precisely measure an individual's record; nonetheless, the computations that they use are somewhat unique. Despite the fact that the two scores might show up at various numbers for your financial assessment, this doesn't demonstrate that one score is more exact than the other.

0 notes

Text

Unlock the Benefits of a 700 How Credit Repair Can Help You!

Unlock the Benefits of a 700 How Credit Repair Can Help You! Having a good credit score is essential for so many reasons. It can help you get the best rates when you need to borrow money and can even help you get a job. But what is a good credit score? Is 700 a good credit score? Having a good credit score is essential for so many reasons? In this article, we’ll answer all of these questions and more. We’ll also look at how credit repair can help you get a good credit score and the services that credit repair companies offer.

Benefits of Having a Good Credit Score

Having a good credit score comes with many benefits. Here are just a few:

Better interest rates. Lenders will offer you better terms on loans and credit cards if you have a good credit score. This can save you a lot of money in the long run.

Access to more credit. Having a good credit score can open doors to more credit opportunities. You may qualify for higher credit limits, better rewards programs, and more.

Easier to get utilities and services. If you have a good credit score, it is easier to get utilities and services such as phone, internet, and cable.

Job opportunities. Having a good credit score can make you a more attractive job candidate, as many employers will check your credit score during the hiring process.

Credit Repair: How it Can Help You

If you have a low credit score, it can be difficult to get approved for loans and credit cards. Fortunately, there is a way to improve your credit score: credit repair. Credit repair involves disputing errors on your credit report that could be affecting your score. This can help you improve your credit score, which can lead to better terms on loans and access to more credit.

Credit repair companies can also help you manage your debt and create a plan to get out of debt. They can provide you with resources to help you manage your finances and increase your credit score.

Credit Repair Services

Credit repair companies offer a range of services to help you improve your credit score. These services include:

Dispute errors on your credit report. Credit repair companies will review your credit report and dispute any errors that could be negatively affecting your score.

Help you manage debt. Credit repair companies can help you manage your debt by creating a plan to pay off debt and negotiate with creditors.

Monitor your credit. Credit repair companies can monitor your credit and alert you to any changes that could affect your score.

Provide resources. Credit repair companies can provide you with resources to help you improve your credit score, such as budgeting tools and credit counseling services.

Conclusion

Having a good credit score is essential for many reasons. A good credit score can help you get the best terms on loans, access to more credit, and even job opportunities. The most common credit scoring model is VantageScore 3.0, which has a range of 300–850, with a score of 700 or higher considered “good.” Credit repair can help you get a good credit score by disputing errors on your credit report and helping you manage your debt. Credit repair companies offer a range of services to help you improve your credit score.

Don’t forget to Repair, Protect and Improve your credit with Credit Army! With the right credit repair services, you can unlock the benefits of a 700 credit score and start enjoying the perks of having good credit.

#fix credit fast buy house#guide to credit repair#credit repair business consulting#online credit repair companies#repair credits#debt repair#debt management programs near me#cost to fix credit score#need help fixing my credit#top ten credit repair companies#my credit repair website#credit collection solutions

0 notes

Text

What Is a VantageScore? Your VantageScore, like your FICO score, grades your credit history.

What Is a VantageScore? Your VantageScore, like your FICO score, grades your credit history.

VantageScore is a credit standing system collectively developed by the three main credit score bureaus — Equifax, TransUnion and Experian — to assist lenders weigh a borrower’s creditworthiness. VantageScore has varied fashions, however essentially the most generally used, VantageScore 3.0, has a credit score rating vary from 300 to 850, similar to your FICO Rating.

What’s…

View On WordPress

0 notes

Text

The Future of Shopping - Vantage score 0 offers an innovative shopping experience that is sure to make your shopping trips a breeze!

Introduction

Introduction:

If you're looking for a shopping experience that is sure to make your shopping trips a breeze, look no further than Vantage score 0. This innovative shopping platform offers an innovative shopping experience that is sure to make your shopping trips a breeze. For one, Vantage score 0 features an intuitive interface that makes it easy to find what you're looking for. Additionally, the platform offers ample search options so you can quickly and easily find the best deals on the items you need. Finally, the platform offers a variety of payment options so you can get your Shopping spree on without spending a fortune!

What is Vantage score 0.

Vantage score 0 is a new shopping experience that allows users to save on their shopping trips by rating and reviewing products. This innovative system offers customers an innovative shopping experience that is sure to make their shopping trips a breeze! By rating and reviewing products, Vantage score 0 helps shoppers find the perfect product for them and saves them money on their next purchase. There are many benefits of using Vantage score 0, including:

- Saving time - By rating and reviewing products, shoppers can save time on their shopping trips. This allows them to shop more efficiently and stay within their budget.

- Finding the best deal - By rating and reviewing products, shoppers can find the best deals on products. This allows them to save money while still enjoying their Shopping trip.

- feeling like they own the product - by ratings and reviews, shoppers feel like they own the product they are purchasing. This allows them to feel like they are making a real difference in the product they are buying and helping others enjoy it too!

How to Get Started with Vantage score 0.

To start shopping with Vantagescore 0, you first need to set up your shopping accounts. You can create an account for free or use a subscription model. In either case, you will need to enter your personal information and select your shopping preferences. Once you have set up your accounts, you can start shopping!

Shop from Anywhere in the World

As mentioned earlier, Vantagescore 0 offers a revolutionary shopping experience that is sure to make your shopping trips a breeze! You can shop from any location in the world, and get a free shipping code if you want! Simply enter the code at checkout when placing your order.

Get a Free Shipping Code

If you're looking to save even more on your next purchase, be sure to add Vantagescore 0 to your cart and receive a free shipping code! Just enter the code at checkout and enjoy standard shipping rates as well!

Tips for Enjoying the Best Shopping Experiences with Vantagescore 0.

When planning your shopping trip, try to schedule time for shopping. This will help you find the best deals and enjoy the experience of Shopping with Vantagescore 0. By heading to one or more designated stores, you can save a lot of money on your shopping trips.

Cookiecutter Shopping Sheets

To make your shopping experiences even easier, use cookiecutter shopping sheets. These templates will help you plan your favorite shopping trips in a snap! Just print out the sheet and cut out the items you need for each visit. You’ll be ready to go from there!

Find the Right Place to Shop

If you’re looking for an amazing shopping experience but don’t have time to spend in a store, consider finding a place to shop online. With Vantage score 0, there are plenty of options available that will let you shop without feeling rushed or stressed out. Check out our website or use our search bar to find what you’re looking for quickly and easily! More information can be found on the website

Conclusion

Vantage score 0. is a powerful shopping platform that allows you to shop from anyplace in the world. By setting up your accounts and shopping from anywhere, you can enjoy the best shopping experiences possible. Additionally, Cookie cutter Shopping Sheets make it easy to find the best deals on products online. Finally, make sure to check out our other posts for more helpful tips!

#fico score#New vantagescore 0#vantagescore 3.0#vantagescore 3.0 calculation#vantagescore 3.0 scoring system#vantagescore 4.0#Post navigation

0 notes

Text

@shadow-hikari

I used to work for a big bank doing customer service for their credit cards so most of this was Bootstraps(tm) combined with my insider knowledge and also doing my homework

All the bad shit on my file was from upwards of a decade ago so I basically was starting from scratch. Nothing bad on my report but nothing good either. Nothing at all period. I knew I wanted to start over with a secured credit card and after doing a lot of research I applied for the Discover IT chrome secured card with a $300 deposit, which was my limit. I made small purchase every month and put my Netflix bill and Sephora Play! subscription box on it and paid in full (PIF) either manually or thru autopay. After they reported to the credit bureaus and I got a FICO score of 650 or so, I kept it nice and easy. Small purchases, PIF. Kept my utilization (how much I spent vs total limit) very low. Score kept creeping up. After a few months when I hit low 700s I applied for a regular non-secured card (Capital One QuicksilverOne) and got it, albeit with a tiny limit. But I used the same principles as with the Discover. Kept utilization low, put a small recurring bill on it (this time, Hulu), PIF every month.

The nice thing about Discover is that as long as you keep paying on time and show responsible use of the card, they graduate you to the unsecured version of the IT Chrome after about 9-12 months. I “graduated” at 9 months and they bumped me up to $1500 limit and returned my security deposit. 1 1/2 years later I have a wallet full of rewards cards with significantly higher limits including a couple of semi-premium travel cards, Chase is throwing mortgage preapprovals at me when I’m not even in the market for property, and my credit union is practically begging me to get an auto loan from them. That humble $300 Discover secured card has grown into the best rewards card Discover offers (I was able to upgrade the regular chrome to the regular IT) and is responsible for all of this, all with my hard work and discipline.

A lot of ppl are afraid especially if they’ve gotten in trouble in the past with them but it’s honestly the “quickest” way to start. I like secured cards for this especially because they have such tiny limits that you have to try really fuckin hard to fuck up. It’s like a training wheels card to help you (re)build a sense of discipline. I have color coded calendars and spreadsheets for my CCs.

Stay away from predatory subprime lenders like CreditOne. They charge insane fees and prey on desperate ppl. Discover is fucking amazing and imo has the best secured card on the market (it’s the only one I’ve ever seen with any kind of rewards program) as well as amazing non-outsourced customer service but IT Chrome is not the easiest secured card to qualify for. If you can’t get that then Capital One has one. Best yet if your bro can qualify for a credit union membership (and it’s easier than you may think), they tend to have secured ones available also.

A word about CreditKarma, NerdWallet, etc. I use them but I caution people. First of all any time something is”free”, that means you’re the one for sale. In this case, these sites make money off referral links for the credit card application links they throw at you (their “approval odds” are similarly tainted bc of this). Secondly the “FICO” score they give you a something credit card hobbyists call a Fake-O score; it’s something called VantageScore 3.0 which virtually no lenders use to determine eligibility for credit. FICO 8 is what lenders use. VS are generally inflated by comparison BUT if you take them with a grain of salt they can give you a decent ballpark estimate of whether or not your score is on the right track. That’s how I use those apps.

I will say though that depending on where you live there may be non-profits or gov’t agencies that do free financial counseling if he wants help specific to his situation. In NYC the Dept of Consumer Affairs runs Finanical Empowerment Centers in conjunction with local non-profits to offer free one on one counseling.

Biggest advice: be patient. It won’t happen overnight. Plant the seeds and watch them grow.

35 notes

·

View notes

Text

FICO score

With the help of Rocket HomesSM, a subsidiary of Rocket Mortgage, you can check your credit score. You can manage and understand your credit profile with the help of Rocket Homes. On Rocket Homes, you can view both your VantageScore® 3.0 credit score as well as your TransUnion® credit report. To ensure that you always have the most latest information, TransUnion® updates your credit report every week. Once you are aware of your credit score, you can consider your options for a conventional loan or a government-sponsored loan. When you're ready, you can submit an application for a mortgage.

If you want to buy a property, your credit score is essential. Along with establishing your loan eligibility, your FICO score may also change the terms of your mortgage. To find out if you have enough to buy a property, check your credit score for the type of loan you want. Since the year's commencement, mortgage rates have risen, increasing the cost of obtaining a home loan. It's more important than ever to keep an eye on your credit score and keep it in good standing because doing so will help you earn a lower interest rate. Simply put, one thing is wrong. It may be difficult to obtain the credit scores that the majority of mortgage lenders utilise because there are so many different types.

John Ulzheimer, a credit expert who formerly worked at FICO and Equifax, claims that mortgage lenders are required to use a specific brand and generation of credit score. This is not the case with other sorts of loans. It's unlikely that your bank will use the same credit score that your mortgage lender will use to evaluate what interest rate you might receive. Here are the credit scores that matter when trying to buy a home or refinance an existing mortgage, along with what you can do to improve your scores as much as you can.

Lenders often request all three of your credit reports—one from each credit bureau—along with a FICO® Score based on each report when you apply for a mortgage. The FICO® Scores they require, nevertheless, are frequently out of date because of rules set by government-backed mortgage companies Fannie Mae or Freddie Mac. When trying to buy a property, being aware of these several FICO score versions may be helpful. Mortgages can be obtained with less-than-perfect credit. However, lenders who are aware of your likelihood of default will provide you with more options and lower interest rates if your credit score is high.

0 notes

Text

How to Fix Your Credit Score in 3 Simple Steps

A poor credit score can make it difficult to get a loan, rent an apartment, or even get a job. Luckily, there are ways to fix your credit score in 3 simple steps.

Credit scores are calculated by looking at factors such as how much debt you owe and how often you’ve missed payments on those debts. You can easily improve your credit score by paying off your debt, paying your bills on time, and not missing any payments.

What is a credit score?

A credit score is a numerical representation of your creditworthiness. It is calculated by taking into account your payment history and other factors such as how much debt you have, how long it has been since you last made a payment, and the length of your credit history.

The higher the score, the more likely it is that you will be approved for loans or credit cards. There are three major types of scores used in the United States: FICO score, VantageScore 3.0, and TransUnion Empirica Score.

What are Your Options for Fixing Your Credit Score?

There are many ways to improve your credit score. These include paying down debt, using a credit card wisely, and being careful with your spending. However, if you're looking for a quick fix, there are also some options that can help you get back on track and improve your score fast.

Credit repair services

Credit monitoring services

Debt consolidation loans

Step 1: Get a Personal Loan with Bad Credit

If you have bad credit, it can be difficult to get a personal loan. However, there are some lenders who are willing to offer personal loans with bad credit.

Some of the lenders will require you to provide collateral in order for them to offer the loan. This means that they will want you to put up something of value such as your car or your house as collateral against the loan.

A lot of people use personal loans with bad credit when they need a quick cash flow and don't have time for waiting for an approval from a bank or other financial institution.

Step 2: Improve your Credit Score by Making Smart Money Moves

As the credit score becomes more and more important in our everyday lives, it is important to know how to improve your credit score. Here are some smart money moves that you can make to increase your chances of getting a good credit score.

- Pay off all debts in full. This will show that you have a consistent track record of paying off your debts and that you are not carrying any debt around.

- Make sure that you are making timely payments on your loans and other debts. This shows good management skills and that you may be able to get a loan in the future if needed.

- Make sure that all of your accounts have a zero balance, which means no overdraft fees or interest charges on those accounts at all times.

Step 3 - Finding the Right Settlement or Debt Consolidation Option

When it comes to settling a debt, people usually focus on how much they can save in interest. They don’t think about the long-term consequences of the debt settlement and what it means for their credit score.

In this, we will discuss some of the most common ways in which people can improve their credit score. We will also talk about how to find the right settlement option for your particular situation.

Credit scores are important when you are looking at settling a debt or getting a loan from your bank or from any other institution. You should know what factors contribute to your credit score and make sure that you have a good one before applying for any loans or getting a settlement from your creditors.

How to Monitor Your Credit Score on a Monthly Basis and Track Progress Over Time

Monitoring your credit score on a monthly basis is a good way to track progress over time. It also helps you identify any changes that need to be made.

There are various credit monitoring services available online, such as Credit Repair in my area.

Monitoring your credit score on a monthly basis is important because it provides you with an overview of your financial situation. That way, if you see any changes in your score, you can take the appropriate steps to improve it.

Conclusion - The Benefits of Getting Corrected

The benefits of getting corrected are pretty obvious. It gives you a chance to learn and grow as a writer while also focusing on what you are good at - creativity and emotions.

Call on(888) 804-0104 & Fix your credit score now!

#fix your credit score#credit score#improve your credit score#credit monitoring services#debt consolidation loans

1 note

·

View note

Photo

‼️Credit Facts‼️ Most people associate credit scores with FICO, and with good reason. And while there are many credit scoring models out there, the other main scoring model is VantageScore. FICO scores aren’t the only credit scores you’ll see. The other main scoring model is VantageScore 3.0 https://www.instagram.com/p/Cca34r4LU4r/?igshid=NGJjMDIxMWI=

0 notes

Text

710 Credit Score: Is It Good or Bad?

710 Credit Score: Is It Good or Bad?

A 710 credit score falls solidly into the “good” band (690-719) of a typical 300-850 range. It’s a little below the 716 average score on the FICO 8 credit model as of the second quarter of 2021, but higher than the average VantageScore 3.0 score of 695 in the same period.

You’re likely to qualify for some credit cards and loans, provided you meet other requirements.

You may not qualify for the…

View On WordPress

0 notes

Text

Does the Type of Credit Score Matter?

When you apply for new credit, the lender will almost always check one or more of your credit reports and credit scores. Lenders and other service providers use credit scores to gauge the amount of financial risk you pose as a borrower.

If your credit scores are high, you're seen as a low credit risk—meaning you're likely to repay your debt as agreed. Alternatively, if your credit scores are low, you're considered a higher risk in lenders' eyes. And while you have dozens—or even hundreds—of credit scores, if your credit reports reflect positive credit behavior, then all of your scores will likely be good regardless of the score brand or version.

What Is a Credit Score?

A credit score is a three-digit number usually ranging from 300 to 850 that lenders use to predict your credit risk. A credit score takes into account the information appearing on your credit reports as maintained by the three national credit reporting agencies (Experian, TransUnion and Equifax). Information that is not on your credit reports is not considered by credit scoring models.

What Are the Main Credit Scoring Models?

There are two commonly used brands of credit scores in the U.S. consumer credit environment: FICO®, named for the Fair Isaac Corp., and VantageScore®. Collectively, these two scoring brands account for over 20 billion scores used annually.

VantageScore

VantageScore credit scores have been around since 2006. There have been four versions of this credit score: VantageScore 1.0, 2.0, 3.0 and 4.0. Each VantageScore version is a single model used by all three national credit reporting agencies. As a result, if your credit reports are identical across all three agencies (which is unlikely), your VantageScore credit scores would also be identical.

It's not as simple when it comes to FICO. FICO, the company, has been around since 1956, but its credit bureau scores debuted in 1989. Since then, it has released several dozen scoring models that are commercially available and in use in the United States.

FICO works with hundreds of financial institutions to provide free access to FICO scores for consumer accounts, so first check the banks in camp hill pa or credit card statements to see if your score is listed there.

Where Can I Get My Credit Scores?

With so many credit scores out there, there's little chance all of them are the same, though they are likely to be similar.

There is no shortage of places where consumers can go to see their credit scores. Some are free and some are not. The credit reporting agencies all either sell credit scores or provide them at no cost. There are also various third-party websites that will either sell you a score or give you a free credit score in exchange for you becoming a registered user of their site.

Are There Other Types of Scores?

While the FICO® and VantageScore credit scoring models certainly get most of the attention, there are other types of scores in use today. Some other examples include:

Insurance risk scores: An insurance risk score predicts either the likelihood that you will file an insurance claim or that you will be an otherwise less profitable insurance customer. FICO® builds insurance risk scores, as does LexisNexis.

Collection scores: A collection score, used by debt collectors, ranks debtors based on their likelihood of paying their collection account debts. FICO® creates collection scores.

Custom scores: Custom scores are credit scoring models built for use by one party, usually a lender or an insurance company. Custom scoring systems can take into account credit report data, credit application data and even other credit scores. Most mid- to large-sized lenders use custom scoring systems, as well as garden variety credit bureau scores.

Bankruptcy scores: Bankruptcy scores are designed to predict the likelihood that you'll file for bankruptcy protection.

1 note

·

View note

Text

How to get a credit card with no credit

CNN

–

CNN Underscored checks financial products like credit cards and bank accounts based on their total value. We may receive a commission through the LendingTree partner network when you apply for a card and are approved, but our reporting is always independent and objective.

Credit building can seem impossible when you are just starting out, and this is especially true when you have no credit at all. That’s because credit card issuers and lenders, by and large, shy away from consumers with no credit history because they cannot assess your creditworthiness and have no idea how to handle credit if you had access to it.

Fortunately, there are some unique credit card products aimed at consumers with limited credit history or no credit history at all. So, if you don’t have a credit history but want to get a credit card, it is time to learn more about your options. Let’s see how to get a credit card with no credit history and what other steps you can take to build credit over time.

For the latest list of the best credit cards for those with no credit history, click here.

Not having a credit history is different from having bad credit. Bad credit means you have had a history of credit abuse, while a lack of credit history means you never had access to credit, so your credit report will not include any credit movements. Without information about your credit reports, lenders will not know enough about you to assess your creditworthiness.

Also, having no credit history doesn’t mean you have a zero credit score. This is an important difference as a zero credit rating is not even possible based on the most popular credit rating systems. If you don’t have a credit history then you simply don’t have a credit history.

However, once you start using credit, the credit bureaus have information that they can use to calculate a credit score for you. The most widely used type of credit score is the FICO score, which ranges from 300 to 850, with higher scores being far superior:

Exceptional: 800 and higher

Very good: 740 to 799

Good: 670 to 739

Mass: 580 to 669

Bad: 579 and lower

If you’re not sure whether you have a credit history or a credit score, you can find out for free on AnnualCreditReport.com, which provides a free report once a year from each of the three major credit bureaus. This is the only official website that offers free credit reports. So make sure you use the correct link when requesting a report.

After reviewing your credit report, if you have information about it, you can determine whether there is enough data to calculate a credit score for you. While there is no official creditworthiness website as there is for credit reports, luckily there are many ways you can do a credit check for free.

You can start by signing up with a credit monitoring service that offers a free credit score or a program that offers free credit tracking tools. For example, Capital One’s CreditWise gives consumers a free look at their TransUnion VantageScore 3.0, and you don’t have to be a customer to use it.

Connected: How can you check your credit score for free?

Without any credit history, you are only eligible for a select few types of credit cards. The first is a secured credit card, which is a credit card that requires a cash deposit as security.

When you apply for a secured credit card, your initial deposit is typically $ 200 or more and the money you put on deposit will be used to secure your line of credit. This also means that your initial credit limit is usually low. In fact, a $ 200 deposit usually means an initial line of credit of $ 200, a deposit of $ 500 means an initial credit limit of $ 500, and so on.

iStock

Even people without a credit history have options for obtaining a credit card.

The good news is, with a secured credit card, you will get your deposit back if you close your account in good condition (i.e. you have paid back any funds used up to that point). This applies regardless of whether you close your credit card account with a balance of USD 0 or upgrade your card to an unsecured option from the same issuer.

There are also some unsecured card options for those with no credit history, which means you don’t have to deposit any cash, but they are few and far between. Unsecured credit cards for those with no credit history usually come with low credit limits and potential fees, although this is not always the case. However, if you don’t have a credit history and are looking for an unsecured credit card, make sure you choose one that doesn’t come with high fees.

Check to see if you qualify for one of these credit cards for those with no credit history.

Before applying for a credit card without a credit history, there are a few key questions you need to ask yourself:

Have I checked my credit report and score? Don’t assume that you don’t have a credit history without taking the time to check it out. It is possible that you have information about your credit report from financial institutions that you have worked with in the past and that you have a credit rating as a result.

Am I willing to leave a cash deposit as security? A secured credit card is often the easiest way to start building a loan, although you will have to put up with collateral. If you don’t have a lot of cash to spare, look for secure card options that only allow you to deposit $ 49.

Am I ready to take construction loans seriously? Before getting a credit card, make sure that you are ready to prove your creditworthiness. This usually means that you are able and willing not to hit your credit card limit and pay your credit card bill on time and ideally in full each month.

Another way to build your credit score is to make someone else with an existing credit card – such as a family member – an authorized user for their account. This means your account will appear on your credit report and you will benefit from their good credit history.

However, if that person abuses their credit, the resulting negative mark may appear on your report as well. So make sure you choose a person who will be responsible for their own credit.

Save money with these credit card offers for those with no credit history.

Without any credit history, your credit card options are limited and, frankly, not that great. However, it is important to know that some credit card offers are exceptionally better than others for those without credit. When comparing all of your options, here are some pitfalls to avoid:

fees: Avoid credit cards that charge registration fees, monthly maintenance fees, or high annual fees. There are many secured credit cards with no annual fee as well as unsecured credit cards that you may be eligible for and that do not have an annual fee.

High annual percentage rateCredit cards for bad or no credit usually have much higher interest rates or annual percentage rates. Choosing a card with a high APR may be fine, but you should strive to pay off your credit card balance in full each month so that you can avoid interest charges altogether.

Yourself: Make sure you are ready to avoid serious credit mistakes in the first place. Most importantly, you have to pay your credit card bills early or on time each month. Also, avoid exhausting your available credit.

Compare available credit card offers for those with limited credit history.

iStock

A new credit card can help you build a credit history and open the doors to new credit options.

Whether you choose a secured credit card or an unsecured credit card, you want to know how best to use your card to your advantage so that you can start building a credit history. Your first step is to know and understand the factors that go into determining your creditworthiness. Here are the factors used by the credit reporting agencies to calculate a FICO credit score:

Payment history: 35%

Amounts owed: 30%

Loan History Duration: 15%

New credit: 10%

Credit mix: 10%

As you can see, your payment history is the largest part of your credit score at 35%. So the most important thing you can do is pay your credit card bill early or on time each month. No exceptions!

The second most important factor is the amount you owe in relation to your credit limit – this is 30% of your creditworthiness. In general, it’s best to use 10% or less of your available credit at any given time, but no more than 30% if you want good credit.

This means that you won’t have more than $ 50 to $ 150 in debt if you have a credit card limit of $ 500, and only $ 20 to 60 in debt if your credit limit is $ 200. Since your first credit card is likely to have a low credit limit, you should take extra care to keep your balance very low or $ 0 for the best results.

The next factor – the length of your credit history – is one that you can only improve on over time. New loan is based on how many lines of credit you have applied for in the recent past, and you can do well in this category by avoiding opening too many new accounts at once.

After all, your credit mix is another factor that can take care of itself over time. Once you have a credit history and good credit score, you can expand the range of credit products you need to include revolving accounts, installment loans, and maybe even a mortgage or car loan.

In the end, it can feel like a chicken-and-egg situation – how can you get a credit card to build your credit history when lenders don’t give you a credit card with no credit? History? But by strategically using secured credit cards, unsecured cards, and maybe even an authorized user account owned by a friend or family member, you can be on the right track and soon you will have a solid credit history and many more credit options to choose from.

Learn about the best credit cards you can get with no credit history.

Check out CNN Underscored’s list The best credit cards in 2021.

Get the latest in personal finance offers, news and advice at CNN Underscored Money.

source https://www.cassh24sg.com/2021/06/29/how-to-get-a-credit-card-with-no-credit/

0 notes

Text

Lo que debe saber sobre el modelo de calificación crediticia VantageScore 3.0

Lo que debe saber sobre el modelo de calificación crediticia VantageScore 3.0

View On WordPress

0 notes

Text

Lo que debe saber sobre el modelo de calificación crediticia VantageScore 3.0

Lo que debe saber sobre el modelo de calificación crediticia VantageScore 3.0

View On WordPress

0 notes

Text

American Express Platinum Card Review: Can You Really Get A Free Amex Platinum Card No Annual Fees?

American Express Platinum Card Review: Can You Really Get A Free Amex Platinum Card No Annual Fees?

Schedule Consultation 👉 https://houstonmcmiller.net/consultation

youtube

Can you truly have a Free American Express Card? The answer to that is absolutely, kind of.

When people say Free American Express Card, what they mean is no annual fees. So there are 3 ways to accomplish this with the Amex Platinum card which cost about $550 annually.

However, before we dive into those three ways let look at some of the Q and A’s on what it takes to get the American Express Platinum card.

What credit score do I need to get an American Express Platinum card?

The Amex Platinum credit score requirement is 700 or higher for good approval odds. Applicants need a good credit score or better to be approved for the American Express Platinum Card in most cases

Is the American Express Platinum Card worth it?

Although many of these premium credit cards carry high annual fees, the benefits, credits and earning potential can be worth more than the annual fee for some cardmembers. … Today we’ll consider the Platinum Card® from American Express, which has a $550 annual fee (see rates and fees).

How much do you have to spend to get an American Express Platinum card?

Right now, the public welcome offer on the Amex Platinum is 75,000 Membership Rewards points after you spend $5,000 in purchases in the first six months of account opening.

Which is better Amex gold or platinum?

The American Express Gold Card also is the better choice for people who spend a lot on dining. On the other hand, the American Express Platinum Card tops Amex Gold in terms of total rewards value. Amex Platinum offers more bonuses and also provides more points on travel purchases.

What FICO score does American Express use?

What credit score does American Express MyCredit Guide provided? The score provided by American Express MyCredit Guide is the VantageScore® 3.0 credit score by TransUnion®.

Does Amex Platinum have a limit?

The American Express Platinum card has no pre-set credit limit. That does not give cardholders unlimited purchasing power. It means American Express won’t give you a specific credit limit once you’re approved for the card.

Now, that we have some knowledge about the American Express Platinum Card, let’s look at the 3 ways to get it for free.

First, you have the Charles Schwab American Express credit Card.

Here are the details to get the Free American Express Card through their company.

Schwab Appreciation Bonus

Receive a $100 Card statement credit if your qualifying Schwab holdings are equal to or greater than $250,000 or receive a $200 Card statement credit if your qualifying Schwab holdings are equal to or greater than $1,000,000, when measured following Card account approval and annually thereafter. For information on qualifying Schwab holdings, please refer to the FAQs.‡

Membership Rewards® Points

Earn one Membership Rewards® point for every eligible dollar you spend.‡

Invest with Rewards

Earn Membership Rewards® points that you can turn into deposits to your eligible Schwab account. (For example, 60,000 points = $750).‡

Second way to get a Free American Express card is thru Morgan Stanly.

Here are a few details on their American Express Platinum Credit Card:

Platinum CashPlus Account, clients may be eligible to receive a $550 Annual Engagement Bonus7 from Morgan Stanley when they become Card Members of the Platinum Card from American Express Exclusively for Morgan Stanley. Platinum Cardholders also enjoy enhanced benefits as well as:

An Additional Platinum Card for no annual fee, exclusive to Morgan Stanley clients

Invest with Rewards points that can be used for deposits by Morgan Stanley clients into their qualifying CashPlus Account

CashPlus Accounts feature fee avoidance criteria8 for clients who don’t want to pay the monthly account fee. These criteria include opening and/or maintaining an additional eligible Morgan Stanley investment account, enrollment in Morgan Stanley Online, and:

For Premier CashPlus Accounts — either $2,500 in total monthly deposits or social security deposits of any amount or $25,000 in average daily Bank Deposit Program (BDP) balance

For Platinum CashPlus Accounts – both $5,000 in total monthly deposits or social security deposits of any amount and $25,000 in average daily BDP balance.

The 3rd great way to get the American Express Platinum Card for FREE is to take advantage of all the card benefits.

Here are a few of the Amex Platinum Card benefits:

Eligible U.S. Consumer Platinum Card Members will now see even more value when they shop online, with new offers available through June 30, 2021:

Up to $180 in statement credits with PayPal: Consumer Platinum Card Members can receive up to $180 back ($30/month via statement credits) on purchases made at eligible merchants with PayPal through June 30, 2021. Terms apply.

Up to $1,700 in Value Through Amex Offers: Eligible Consumer Platinum Card Members2 who had the Card as of November 1, 2020, can access up to $1,700 in statement credits after they enroll in Amex Offers with select merchants through June 30, 2021. These offers include:

Avis Car Rental – Spend $250+ on eligible purchases, Get $75 back, up to two times

BestBuy.com – Spend $50+ on eligible purchases, Get $50 back, up to two times

Goldbelly – Spend $100+ on eligible purchases, Get $50 back, up to three times

Home Chef – Spend $50+ on eligible purchases, Get $50 back, up to three times

HomeDepot.com – Spend $50+ on eligible purchases, Get $50 back, up to two times

Instacart – Spend $250+ on eligible purchases, Get $50 back, up to two times

Samsung – Spend $1,000+ on eligible purchases, Get $200 back, one time

Scribd – Spend $9.99+ on eligible purchases, Get $9.99 back, up to five times

The Container Store – Spend $150+ on eligible purchases, Get $50 back, up to two times

Virtual Personal Training by Equinox – Spend $780+ on eligible purchases, Get $130 back, up to five times

Wine Insiders – Spend $30+ on eligible purchases, Get $30 back, up to two times3

Conclusion:

You really can get a Free American Express Card, if you know where to look. So don’t let that $550 annual fee for the Amex Platinum Card discourage you from having a prestige credit card.

If your goal is to have premium credit and to get high limit credit cards and you need some coaching then check out 3waycredit.com

Social

===============================================

Get Free Business Credit Videos On Our Blog BLOG:

https://houstonmcmiller.net/

https://www.instagram.com/houstonmcmiller/

https://twitter.com/houstonmcmiller

https://www.facebook.com/Houstonwins

https://www.linkedin.com/in/houstonmcmiller

0 notes

Text

American Express Platinum Card Review: Can You Really Get A Free Amex Platinum Card No Annual Fees?

American Express Platinum Card Review: Can You Really Get A Free Amex Platinum Card No Annual Fees?

Schedule Consultation 👉 https://houstonmcmiller.net/consultation

youtube

Can you truly have a Free American Express Card? The answer to that is absolutely, kind of.

When people say Free American Express Card, what they mean is no annual fees. So there are 3 ways to accomplish this with the Amex Platinum card which cost about $550 annually.

However, before we dive into those three ways let look at some of the Q and A’s on what it takes to get the American Express Platinum card.

What credit score do I need to get an American Express Platinum card?

The Amex Platinum credit score requirement is 700 or higher for good approval odds. Applicants need a good credit score or better to be approved for the American Express Platinum Card in most cases

Is the American Express Platinum Card worth it?

Although many of these premium credit cards carry high annual fees, the benefits, credits and earning potential can be worth more than the annual fee for some cardmembers. … Today we’ll consider the Platinum Card® from American Express, which has a $550 annual fee (see rates and fees).

How much do you have to spend to get an American Express Platinum card?

Right now, the public welcome offer on the Amex Platinum is 75,000 Membership Rewards points after you spend $5,000 in purchases in the first six months of account opening.

Which is better Amex gold or platinum?

The American Express Gold Card also is the better choice for people who spend a lot on dining. On the other hand, the American Express Platinum Card tops Amex Gold in terms of total rewards value. Amex Platinum offers more bonuses and also provides more points on travel purchases.

What FICO score does American Express use?

What credit score does American Express MyCredit Guide provided? The score provided by American Express MyCredit Guide is the VantageScore® 3.0 credit score by TransUnion®.

Does Amex Platinum have a limit?

The American Express Platinum card has no pre-set credit limit. That does not give cardholders unlimited purchasing power. It means American Express won’t give you a specific credit limit once you’re approved for the card.

Now, that we have some knowledge about the American Express Platinum Card, let’s look at the 3 ways to get it for free.

First, you have the Charles Schwab American Express credit Card.

Here are the details to get the Free American Express Card through their company.

Schwab Appreciation Bonus

Receive a $100 Card statement credit if your qualifying Schwab holdings are equal to or greater than $250,000 or receive a $200 Card statement credit if your qualifying Schwab holdings are equal to or greater than $1,000,000, when measured following Card account approval and annually thereafter. For information on qualifying Schwab holdings, please refer to the FAQs.‡

Membership Rewards® Points

Earn one Membership Rewards® point for every eligible dollar you spend.‡

Invest with Rewards

Earn Membership Rewards® points that you can turn into deposits to your eligible Schwab account. (For example, 60,000 points = $750).‡

Second way to get a Free American Express card is thru Morgan Stanly.

Here are a few details on their American Express Platinum Credit Card:

Platinum CashPlus Account, clients may be eligible to receive a $550 Annual Engagement Bonus7 from Morgan Stanley when they become Card Members of the Platinum Card from American Express Exclusively for Morgan Stanley. Platinum Cardholders also enjoy enhanced benefits as well as:

An Additional Platinum Card for no annual fee, exclusive to Morgan Stanley clients

Invest with Rewards points that can be used for deposits by Morgan Stanley clients into their qualifying CashPlus Account

CashPlus Accounts feature fee avoidance criteria8 for clients who don’t want to pay the monthly account fee. These criteria include opening and/or maintaining an additional eligible Morgan Stanley investment account, enrollment in Morgan Stanley Online, and:

For Premier CashPlus Accounts — either $2,500 in total monthly deposits or social security deposits of any amount or $25,000 in average daily Bank Deposit Program (BDP) balance

For Platinum CashPlus Accounts – both $5,000 in total monthly deposits or social security deposits of any amount and $25,000 in average daily BDP balance.

The 3rd great way to get the American Express Platinum Card for FREE is to take advantage of all the card benefits.

Here are a few of the Amex Platinum Card benefits:

Eligible U.S. Consumer Platinum Card Members will now see even more value when they shop online, with new offers available through June 30, 2021:

Up to $180 in statement credits with PayPal: Consumer Platinum Card Members can receive up to $180 back ($30/month via statement credits) on purchases made at eligible merchants with PayPal through June 30, 2021. Terms apply.

Up to $1,700 in Value Through Amex Offers: Eligible Consumer Platinum Card Members2 who had the Card as of November 1, 2020, can access up to $1,700 in statement credits after they enroll in Amex Offers with select merchants through June 30, 2021. These offers include:

Avis Car Rental – Spend $250+ on eligible purchases, Get $75 back, up to two times

BestBuy.com – Spend $50+ on eligible purchases, Get $50 back, up to two times

Goldbelly – Spend $100+ on eligible purchases, Get $50 back, up to three times

Home Chef – Spend $50+ on eligible purchases, Get $50 back, up to three times

HomeDepot.com – Spend $50+ on eligible purchases, Get $50 back, up to two times

Instacart – Spend $250+ on eligible purchases, Get $50 back, up to two times

Samsung – Spend $1,000+ on eligible purchases, Get $200 back, one time

Scribd – Spend $9.99+ on eligible purchases, Get $9.99 back, up to five times

The Container Store – Spend $150+ on eligible purchases, Get $50 back, up to two times

Virtual Personal Training by Equinox – Spend $780+ on eligible purchases, Get $130 back, up to five times

Wine Insiders – Spend $30+ on eligible purchases, Get $30 back, up to two times3

Conclusion:

You really can get a Free American Express Card, if you know where to look. So don’t let that $550 annual fee for the Amex Platinum Card discourage you from having a prestige credit card.

If your goal is to have premium credit and to get high limit credit cards and you need some coaching then check out 3waycredit.com

Social

===============================================

Get Free Business Credit Videos On Our Blog BLOG:

https://houstonmcmiller.net/

https://www.instagram.com/houstonmcmiller/

https://twitter.com/houstonmcmiller

https://www.facebook.com/Houstonwins

https://www.linkedin.com/in/houstonmcmiller

0 notes