#vantagescore 3.0 scoring system

Text

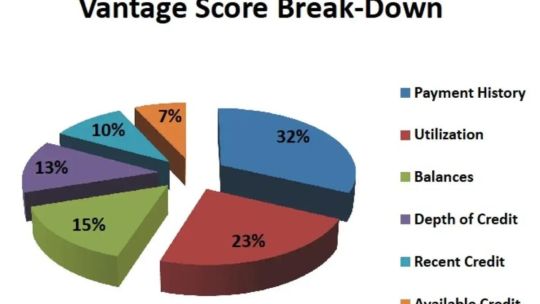

What Is a VantageScore? Your VantageScore, like your FICO score, grades your credit history.

What Is a VantageScore? Your VantageScore, like your FICO score, grades your credit history.

VantageScore is a credit standing system collectively developed by the three main credit score bureaus — Equifax, TransUnion and Experian — to assist lenders weigh a borrower’s creditworthiness. VantageScore has varied fashions, however essentially the most generally used, VantageScore 3.0, has a credit score rating vary from 300 to 850, similar to your FICO Rating.

What’s…

View On WordPress

0 notes

Text

The Future of Shopping - Vantage score 0 offers an innovative shopping experience that is sure to make your shopping trips a breeze!

Introduction

Introduction:

If you're looking for a shopping experience that is sure to make your shopping trips a breeze, look no further than Vantage score 0. This innovative shopping platform offers an innovative shopping experience that is sure to make your shopping trips a breeze. For one, Vantage score 0 features an intuitive interface that makes it easy to find what you're looking for. Additionally, the platform offers ample search options so you can quickly and easily find the best deals on the items you need. Finally, the platform offers a variety of payment options so you can get your Shopping spree on without spending a fortune!

What is Vantage score 0.

Vantage score 0 is a new shopping experience that allows users to save on their shopping trips by rating and reviewing products. This innovative system offers customers an innovative shopping experience that is sure to make their shopping trips a breeze! By rating and reviewing products, Vantage score 0 helps shoppers find the perfect product for them and saves them money on their next purchase. There are many benefits of using Vantage score 0, including:

- Saving time - By rating and reviewing products, shoppers can save time on their shopping trips. This allows them to shop more efficiently and stay within their budget.

- Finding the best deal - By rating and reviewing products, shoppers can find the best deals on products. This allows them to save money while still enjoying their Shopping trip.

- feeling like they own the product - by ratings and reviews, shoppers feel like they own the product they are purchasing. This allows them to feel like they are making a real difference in the product they are buying and helping others enjoy it too!

How to Get Started with Vantage score 0.

To start shopping with Vantagescore 0, you first need to set up your shopping accounts. You can create an account for free or use a subscription model. In either case, you will need to enter your personal information and select your shopping preferences. Once you have set up your accounts, you can start shopping!

Shop from Anywhere in the World

As mentioned earlier, Vantagescore 0 offers a revolutionary shopping experience that is sure to make your shopping trips a breeze! You can shop from any location in the world, and get a free shipping code if you want! Simply enter the code at checkout when placing your order.

Get a Free Shipping Code

If you're looking to save even more on your next purchase, be sure to add Vantagescore 0 to your cart and receive a free shipping code! Just enter the code at checkout and enjoy standard shipping rates as well!

Tips for Enjoying the Best Shopping Experiences with Vantagescore 0.

When planning your shopping trip, try to schedule time for shopping. This will help you find the best deals and enjoy the experience of Shopping with Vantagescore 0. By heading to one or more designated stores, you can save a lot of money on your shopping trips.

Cookiecutter Shopping Sheets

To make your shopping experiences even easier, use cookiecutter shopping sheets. These templates will help you plan your favorite shopping trips in a snap! Just print out the sheet and cut out the items you need for each visit. You’ll be ready to go from there!

Find the Right Place to Shop

If you’re looking for an amazing shopping experience but don’t have time to spend in a store, consider finding a place to shop online. With Vantage score 0, there are plenty of options available that will let you shop without feeling rushed or stressed out. Check out our website or use our search bar to find what you’re looking for quickly and easily! More information can be found on the website

Conclusion

Vantage score 0. is a powerful shopping platform that allows you to shop from anyplace in the world. By setting up your accounts and shopping from anywhere, you can enjoy the best shopping experiences possible. Additionally, Cookie cutter Shopping Sheets make it easy to find the best deals on products online. Finally, make sure to check out our other posts for more helpful tips!

#fico score#New vantagescore 0#vantagescore 3.0#vantagescore 3.0 calculation#vantagescore 3.0 scoring system#vantagescore 4.0#Post navigation

0 notes

Text

Does the Type of Credit Score Matter?

When you apply for new credit, the lender will almost always check one or more of your credit reports and credit scores. Lenders and other service providers use credit scores to gauge the amount of financial risk you pose as a borrower.

If your credit scores are high, you're seen as a low credit risk—meaning you're likely to repay your debt as agreed. Alternatively, if your credit scores are low, you're considered a higher risk in lenders' eyes. And while you have dozens—or even hundreds—of credit scores, if your credit reports reflect positive credit behavior, then all of your scores will likely be good regardless of the score brand or version.

What Is a Credit Score?

A credit score is a three-digit number usually ranging from 300 to 850 that lenders use to predict your credit risk. A credit score takes into account the information appearing on your credit reports as maintained by the three national credit reporting agencies (Experian, TransUnion and Equifax). Information that is not on your credit reports is not considered by credit scoring models.

What Are the Main Credit Scoring Models?

There are two commonly used brands of credit scores in the U.S. consumer credit environment: FICO®, named for the Fair Isaac Corp., and VantageScore®. Collectively, these two scoring brands account for over 20 billion scores used annually.

VantageScore

VantageScore credit scores have been around since 2006. There have been four versions of this credit score: VantageScore 1.0, 2.0, 3.0 and 4.0. Each VantageScore version is a single model used by all three national credit reporting agencies. As a result, if your credit reports are identical across all three agencies (which is unlikely), your VantageScore credit scores would also be identical.

It's not as simple when it comes to FICO. FICO, the company, has been around since 1956, but its credit bureau scores debuted in 1989. Since then, it has released several dozen scoring models that are commercially available and in use in the United States.

FICO works with hundreds of financial institutions to provide free access to FICO scores for consumer accounts, so first check the banks in camp hill pa or credit card statements to see if your score is listed there.

Where Can I Get My Credit Scores?

With so many credit scores out there, there's little chance all of them are the same, though they are likely to be similar.

There is no shortage of places where consumers can go to see their credit scores. Some are free and some are not. The credit reporting agencies all either sell credit scores or provide them at no cost. There are also various third-party websites that will either sell you a score or give you a free credit score in exchange for you becoming a registered user of their site.

Are There Other Types of Scores?

While the FICO® and VantageScore credit scoring models certainly get most of the attention, there are other types of scores in use today. Some other examples include:

Insurance risk scores: An insurance risk score predicts either the likelihood that you will file an insurance claim or that you will be an otherwise less profitable insurance customer. FICO® builds insurance risk scores, as does LexisNexis.

Collection scores: A collection score, used by debt collectors, ranks debtors based on their likelihood of paying their collection account debts. FICO® creates collection scores.

Custom scores: Custom scores are credit scoring models built for use by one party, usually a lender or an insurance company. Custom scoring systems can take into account credit report data, credit application data and even other credit scores. Most mid- to large-sized lenders use custom scoring systems, as well as garden variety credit bureau scores.

Bankruptcy scores: Bankruptcy scores are designed to predict the likelihood that you'll file for bankruptcy protection.

1 note

·

View note

Text

How to get a credit card with no credit

CNN

–

CNN Underscored checks financial products like credit cards and bank accounts based on their total value. We may receive a commission through the LendingTree partner network when you apply for a card and are approved, but our reporting is always independent and objective.

Credit building can seem impossible when you are just starting out, and this is especially true when you have no credit at all. That’s because credit card issuers and lenders, by and large, shy away from consumers with no credit history because they cannot assess your creditworthiness and have no idea how to handle credit if you had access to it.

Fortunately, there are some unique credit card products aimed at consumers with limited credit history or no credit history at all. So, if you don’t have a credit history but want to get a credit card, it is time to learn more about your options. Let’s see how to get a credit card with no credit history and what other steps you can take to build credit over time.

For the latest list of the best credit cards for those with no credit history, click here.

Not having a credit history is different from having bad credit. Bad credit means you have had a history of credit abuse, while a lack of credit history means you never had access to credit, so your credit report will not include any credit movements. Without information about your credit reports, lenders will not know enough about you to assess your creditworthiness.

Also, having no credit history doesn’t mean you have a zero credit score. This is an important difference as a zero credit rating is not even possible based on the most popular credit rating systems. If you don’t have a credit history then you simply don’t have a credit history.

However, once you start using credit, the credit bureaus have information that they can use to calculate a credit score for you. The most widely used type of credit score is the FICO score, which ranges from 300 to 850, with higher scores being far superior:

Exceptional: 800 and higher

Very good: 740 to 799

Good: 670 to 739

Mass: 580 to 669

Bad: 579 and lower

If you’re not sure whether you have a credit history or a credit score, you can find out for free on AnnualCreditReport.com, which provides a free report once a year from each of the three major credit bureaus. This is the only official website that offers free credit reports. So make sure you use the correct link when requesting a report.

After reviewing your credit report, if you have information about it, you can determine whether there is enough data to calculate a credit score for you. While there is no official creditworthiness website as there is for credit reports, luckily there are many ways you can do a credit check for free.

You can start by signing up with a credit monitoring service that offers a free credit score or a program that offers free credit tracking tools. For example, Capital One’s CreditWise gives consumers a free look at their TransUnion VantageScore 3.0, and you don’t have to be a customer to use it.

Connected: How can you check your credit score for free?

Without any credit history, you are only eligible for a select few types of credit cards. The first is a secured credit card, which is a credit card that requires a cash deposit as security.

When you apply for a secured credit card, your initial deposit is typically $ 200 or more and the money you put on deposit will be used to secure your line of credit. This also means that your initial credit limit is usually low. In fact, a $ 200 deposit usually means an initial line of credit of $ 200, a deposit of $ 500 means an initial credit limit of $ 500, and so on.

iStock

Even people without a credit history have options for obtaining a credit card.

The good news is, with a secured credit card, you will get your deposit back if you close your account in good condition (i.e. you have paid back any funds used up to that point). This applies regardless of whether you close your credit card account with a balance of USD 0 or upgrade your card to an unsecured option from the same issuer.

There are also some unsecured card options for those with no credit history, which means you don’t have to deposit any cash, but they are few and far between. Unsecured credit cards for those with no credit history usually come with low credit limits and potential fees, although this is not always the case. However, if you don’t have a credit history and are looking for an unsecured credit card, make sure you choose one that doesn’t come with high fees.

Check to see if you qualify for one of these credit cards for those with no credit history.

Before applying for a credit card without a credit history, there are a few key questions you need to ask yourself:

Have I checked my credit report and score? Don’t assume that you don’t have a credit history without taking the time to check it out. It is possible that you have information about your credit report from financial institutions that you have worked with in the past and that you have a credit rating as a result.

Am I willing to leave a cash deposit as security? A secured credit card is often the easiest way to start building a loan, although you will have to put up with collateral. If you don’t have a lot of cash to spare, look for secure card options that only allow you to deposit $ 49.

Am I ready to take construction loans seriously? Before getting a credit card, make sure that you are ready to prove your creditworthiness. This usually means that you are able and willing not to hit your credit card limit and pay your credit card bill on time and ideally in full each month.

Another way to build your credit score is to make someone else with an existing credit card – such as a family member – an authorized user for their account. This means your account will appear on your credit report and you will benefit from their good credit history.

However, if that person abuses their credit, the resulting negative mark may appear on your report as well. So make sure you choose a person who will be responsible for their own credit.

Save money with these credit card offers for those with no credit history.

Without any credit history, your credit card options are limited and, frankly, not that great. However, it is important to know that some credit card offers are exceptionally better than others for those without credit. When comparing all of your options, here are some pitfalls to avoid:

fees: Avoid credit cards that charge registration fees, monthly maintenance fees, or high annual fees. There are many secured credit cards with no annual fee as well as unsecured credit cards that you may be eligible for and that do not have an annual fee.

High annual percentage rateCredit cards for bad or no credit usually have much higher interest rates or annual percentage rates. Choosing a card with a high APR may be fine, but you should strive to pay off your credit card balance in full each month so that you can avoid interest charges altogether.

Yourself: Make sure you are ready to avoid serious credit mistakes in the first place. Most importantly, you have to pay your credit card bills early or on time each month. Also, avoid exhausting your available credit.

Compare available credit card offers for those with limited credit history.

iStock

A new credit card can help you build a credit history and open the doors to new credit options.

Whether you choose a secured credit card or an unsecured credit card, you want to know how best to use your card to your advantage so that you can start building a credit history. Your first step is to know and understand the factors that go into determining your creditworthiness. Here are the factors used by the credit reporting agencies to calculate a FICO credit score:

Payment history: 35%

Amounts owed: 30%

Loan History Duration: 15%

New credit: 10%

Credit mix: 10%

As you can see, your payment history is the largest part of your credit score at 35%. So the most important thing you can do is pay your credit card bill early or on time each month. No exceptions!

The second most important factor is the amount you owe in relation to your credit limit – this is 30% of your creditworthiness. In general, it’s best to use 10% or less of your available credit at any given time, but no more than 30% if you want good credit.

This means that you won’t have more than $ 50 to $ 150 in debt if you have a credit card limit of $ 500, and only $ 20 to 60 in debt if your credit limit is $ 200. Since your first credit card is likely to have a low credit limit, you should take extra care to keep your balance very low or $ 0 for the best results.

The next factor – the length of your credit history – is one that you can only improve on over time. New loan is based on how many lines of credit you have applied for in the recent past, and you can do well in this category by avoiding opening too many new accounts at once.

After all, your credit mix is another factor that can take care of itself over time. Once you have a credit history and good credit score, you can expand the range of credit products you need to include revolving accounts, installment loans, and maybe even a mortgage or car loan.

In the end, it can feel like a chicken-and-egg situation – how can you get a credit card to build your credit history when lenders don’t give you a credit card with no credit? History? But by strategically using secured credit cards, unsecured cards, and maybe even an authorized user account owned by a friend or family member, you can be on the right track and soon you will have a solid credit history and many more credit options to choose from.

Learn about the best credit cards you can get with no credit history.

Check out CNN Underscored’s list The best credit cards in 2021.

Get the latest in personal finance offers, news and advice at CNN Underscored Money.

source https://www.cassh24sg.com/2021/06/29/how-to-get-a-credit-card-with-no-credit/

0 notes

Text

Credit Karma Score: Best Credit Karma Fico Score Review 2021

Credit Karma Score: Best Credit Karma Fico Score Review 2021

Schedule A Consultation 👉 https://houstonmcmiller.net/consultation

Get Access To DIY Credit System 👉 https://houstonmcmiller.net/credit%20repair

youtube

If you been watching the news, you’ll know the talk about credit karma credit score. People are realizing that their credit scoring system is not reliable for getting credit.

We’ll before we start bashing them let’s look at who they are and what they do, and why so many people use them.

How accurate is Credit Karma?

Their credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Why is my credit karma score higher than FICO?

Credit Karma uses two of the three major credit bureaus and scores your creditworthiness according to the widely-used (but not quite as widely used as FICO) VantageScore system. … If your Credit Karma score isn’t accurate, the problem is probably elsewhere.

Why is my credit karma score wrong?

Credit Karma only factors in information from two credit bureaus. … Credit Karma relies on your credit reports from Equifax and TransUnion to determine your credit score. Since they leave out one source of information, it is possible that their scores are less accurate than if they used all three credit reports.

Should I use Credit Karma credit score for a mortgages?

Although, The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and you see on Credit Karma does not have all the data points to determine your qualification for a mortgage

What FICO score does credit karma use?

Which credit scores does Credit Karma offer? The model used for credit scores on Credit Karma is VantageScore® 3.0. While VantageScore® credit scores aren’t used as widely as FICO® scores for credit decisions, they can still give you a good idea of where your credit stands

Which is better credit karma or Experian?

Credit Karma will provide those, as well as regular alerts of any issues that affect your credit. But, if you’re looking for a higher level of credit monitoring, and you prefer getting it from one of the three major credit bureaus, Experian should definitely be your first choice.

Why is my FICO score less than Credit Karma?

It’s up to lenders to decide which information they report to the major credit agencies — and which agencies they report to in the first place. Since your FICO Scores depend on the data listed on your credit reports, you might not see the exact same score from every credit-reporting agency.

Should, I apply for a credit card thru Credit Karma?

Even though, credit karma offers credit score and credit reports, many have to have been denied.

The reason you may be denied that credit card is because they don’t show all the information in your file. Which gives you a false credit score that may seem higher on their site.

Conclusion:

if you’re looking to get credit that credit karma credit score is not your best reference. Although, many rely on them because they give you access to 2 of the 3 credit bureaus, the information may not be accurate.

Now, if you want to see what your real credit score is when trying to get credit cards and loans check out myfico.

https://houstonmcmiller.net/

https://www.instagram.com/houstonmcmiller/

https://twitter.com/houstonmcmiller

https://www.facebook.com/Houstonwins

https://www.linkedin.com/in/houstonmcmiller

0 notes

Text

Credit Karma Score: Best Credit Karma Fico Score Review 2021

Credit Karma Score: Best Credit Karma Fico Score Review 2021

Schedule A Consultation 👉 https://houstonmcmiller.net/consultation

Get Access To DIY Credit System 👉 https://houstonmcmiller.net/credit%20repair

youtube

If you been watching the news, you’ll know the talk about credit karma credit score. People are realizing that their credit scoring system is not reliable for getting credit.

We’ll before we start bashing them let’s look at who they are and what they do, and why so many people use them.

How accurate is Credit Karma?

Their credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Why is my credit karma score higher than FICO?

Credit Karma uses two of the three major credit bureaus and scores your creditworthiness according to the widely-used (but not quite as widely used as FICO) VantageScore system. … If your Credit Karma score isn’t accurate, the problem is probably elsewhere.

Why is my credit karma score wrong?

Credit Karma only factors in information from two credit bureaus. … Credit Karma relies on your credit reports from Equifax and TransUnion to determine your credit score. Since they leave out one source of information, it is possible that their scores are less accurate than if they used all three credit reports.

Should I use Credit Karma credit score for a mortgages?

Although, The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and you see on Credit Karma does not have all the data points to determine your qualification for a mortgage

What FICO score does credit karma use?

Which credit scores does Credit Karma offer? The model used for credit scores on Credit Karma is VantageScore® 3.0. While VantageScore® credit scores aren’t used as widely as FICO® scores for credit decisions, they can still give you a good idea of where your credit stands

Which is better credit karma or Experian?

Credit Karma will provide those, as well as regular alerts of any issues that affect your credit. But, if you’re looking for a higher level of credit monitoring, and you prefer getting it from one of the three major credit bureaus, Experian should definitely be your first choice.

Why is my FICO score less than Credit Karma?

It’s up to lenders to decide which information they report to the major credit agencies — and which agencies they report to in the first place. Since your FICO Scores depend on the data listed on your credit reports, you might not see the exact same score from every credit-reporting agency.

Should, I apply for a credit card thru Credit Karma?

Even though, credit karma offers credit score and credit reports, many have to have been denied.

The reason you may be denied that credit card is because they don’t show all the information in your file. Which gives you a false credit score that may seem higher on their site.

Conclusion:

if you’re looking to get credit that credit karma credit score is not your best reference. Although, many rely on them because they give you access to 2 of the 3 credit bureaus, the information may not be accurate.

Now, if you want to see what your real credit score is when trying to get credit cards and loans check out myfico.

https://houstonmcmiller.net/

https://www.instagram.com/houstonmcmiller/

https://twitter.com/houstonmcmiller

https://www.facebook.com/Houstonwins

https://www.linkedin.com/in/houstonmcmiller

0 notes

Text

Credit Karma Score: Best Credit Karma Fico Score Review 2021

Credit Karma Score: Best Credit Karma Fico Score Review 2021

Schedule A Consultation 👉 https://houstonmcmiller.net/consultation

Get Access To DIY Credit System 👉 https://houstonmcmiller.net/credit%20repair

youtube

If you been watching the news, you’ll know the talk about credit karma credit score. People are realizing that their credit scoring system is not reliable for getting credit.

We’ll before we start bashing them let’s look at who they are and what they do, and why so many people use them.

How accurate is Credit Karma?

Their credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Why is my credit karma score higher than FICO?

Credit Karma uses two of the three major credit bureaus and scores your creditworthiness according to the widely-used (but not quite as widely used as FICO) VantageScore system. … If your Credit Karma score isn’t accurate, the problem is probably elsewhere.

Why is my credit karma score wrong?

Credit Karma only factors in information from two credit bureaus. … Credit Karma relies on your credit reports from Equifax and TransUnion to determine your credit score. Since they leave out one source of information, it is possible that their scores are less accurate than if they used all three credit reports.

Should I use Credit Karma credit score for a mortgages?

Although, The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and you see on Credit Karma does not have all the data points to determine your qualification for a mortgage

What FICO score does credit karma use?

Which credit scores does Credit Karma offer? The model used for credit scores on Credit Karma is VantageScore® 3.0. While VantageScore® credit scores aren’t used as widely as FICO® scores for credit decisions, they can still give you a good idea of where your credit stands

Which is better credit karma or Experian?

Credit Karma will provide those, as well as regular alerts of any issues that affect your credit. But, if you’re looking for a higher level of credit monitoring, and you prefer getting it from one of the three major credit bureaus, Experian should definitely be your first choice.

Why is my FICO score less than Credit Karma?

It’s up to lenders to decide which information they report to the major credit agencies — and which agencies they report to in the first place. Since your FICO Scores depend on the data listed on your credit reports, you might not see the exact same score from every credit-reporting agency.

Should, I apply for a credit card thru Credit Karma?

Even though, credit karma offers credit score and credit reports, many have to have been denied.

The reason you may be denied that credit card is because they don’t show all the information in your file. Which gives you a false credit score that may seem higher on their site.

Conclusion:

if you’re looking to get credit that credit karma credit score is not your best reference. Although, many rely on them because they give you access to 2 of the 3 credit bureaus, the information may not be accurate.

Now, if you want to see what your real credit score is when trying to get credit cards and loans check out myfico.

https://houstonmcmiller.net/

https://www.instagram.com/houstonmcmiller/

https://twitter.com/houstonmcmiller

https://www.facebook.com/Houstonwins

https://www.linkedin.com/in/houstonmcmiller

0 notes

Text

Credit Karma Score: Best Credit Karma Fico Score Review 2021

Credit Karma Score: Best Credit Karma Fico Score Review 2021

Schedule A Consultation 👉 https://houstonmcmiller.net/consultation

Get Access To DIY Credit System 👉 https://houstonmcmiller.net/credit%20repair

youtube

If you been watching the news, you’ll know the talk about credit karma credit score. People are realizing that their credit scoring system is not reliable for getting credit.

We’ll before we start bashing them let’s look at who they are and what they do, and why so many people use them.

How accurate is Credit Karma?

Their credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Why is my credit karma score higher than FICO?

Credit Karma uses two of the three major credit bureaus and scores your creditworthiness according to the widely-used (but not quite as widely used as FICO) VantageScore system. … If your Credit Karma score isn’t accurate, the problem is probably elsewhere.

Why is my credit karma score wrong?

Credit Karma only factors in information from two credit bureaus. … Credit Karma relies on your credit reports from Equifax and TransUnion to determine your credit score. Since they leave out one source of information, it is possible that their scores are less accurate than if they used all three credit reports.

Should I use Credit Karma credit score for a mortgages?

Although, The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and you see on Credit Karma does not have all the data points to determine your qualification for a mortgage

What FICO score does credit karma use?

Which credit scores does Credit Karma offer? The model used for credit scores on Credit Karma is VantageScore® 3.0. While VantageScore® credit scores aren’t used as widely as FICO® scores for credit decisions, they can still give you a good idea of where your credit stands

Which is better credit karma or Experian?

Credit Karma will provide those, as well as regular alerts of any issues that affect your credit. But, if you’re looking for a higher level of credit monitoring, and you prefer getting it from one of the three major credit bureaus, Experian should definitely be your first choice.

Why is my FICO score less than Credit Karma?

It’s up to lenders to decide which information they report to the major credit agencies — and which agencies they report to in the first place. Since your FICO Scores depend on the data listed on your credit reports, you might not see the exact same score from every credit-reporting agency.

Should, I apply for a credit card thru Credit Karma?

Even though, credit karma offers credit score and credit reports, many have to have been denied.

The reason you may be denied that credit card is because they don’t show all the information in your file. Which gives you a false credit score that may seem higher on their site.

Conclusion:

if you’re looking to get credit that credit karma credit score is not your best reference. Although, many rely on them because they give you access to 2 of the 3 credit bureaus, the information may not be accurate.

Now, if you want to see what your real credit score is when trying to get credit cards and loans check out myfico.

https://houstonmcmiller.net/

https://www.instagram.com/houstonmcmiller/

https://twitter.com/houstonmcmiller

https://www.facebook.com/Houstonwins

https://www.linkedin.com/in/houstonmcmiller

0 notes

Text

Credit Karma Score: Best Credit Karma Fico Score Review 2021

Credit Karma Score: Best Credit Karma Fico Score Review 2021

Schedule A Consultation 👉 https://houstonmcmiller.net/consultation

Get Access To DIY Credit System 👉 https://houstonmcmiller.net/credit%20repair

youtube

If you been watching the news, you’ll know the talk about credit karma credit score. People are realizing that their credit scoring system is not reliable for getting credit.

We’ll before we start bashing them let’s look at who they are and what they do, and why so many people use them.

How accurate is Credit Karma?

Their credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Why is my credit karma score higher than FICO?

Credit Karma uses two of the three major credit bureaus and scores your creditworthiness according to the widely-used (but not quite as widely used as FICO) VantageScore system. … If your Credit Karma score isn’t accurate, the problem is probably elsewhere.

Why is my credit karma score wrong?

Credit Karma only factors in information from two credit bureaus. … Credit Karma relies on your credit reports from Equifax and TransUnion to determine your credit score. Since they leave out one source of information, it is possible that their scores are less accurate than if they used all three credit reports.

Should I use Credit Karma credit score for a mortgages?

Although, The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and you see on Credit Karma does not have all the data points to determine your qualification for a mortgage

What FICO score does credit karma use?

Which credit scores does Credit Karma offer? The model used for credit scores on Credit Karma is VantageScore® 3.0. While VantageScore® credit scores aren’t used as widely as FICO® scores for credit decisions, they can still give you a good idea of where your credit stands

Which is better credit karma or Experian?

Credit Karma will provide those, as well as regular alerts of any issues that affect your credit. But, if you’re looking for a higher level of credit monitoring, and you prefer getting it from one of the three major credit bureaus, Experian should definitely be your first choice.

Why is my FICO score less than Credit Karma?

It’s up to lenders to decide which information they report to the major credit agencies — and which agencies they report to in the first place. Since your FICO Scores depend on the data listed on your credit reports, you might not see the exact same score from every credit-reporting agency.

Should, I apply for a credit card thru Credit Karma?

Even though, credit karma offers credit score and credit reports, many have to have been denied.

The reason you may be denied that credit card is because they don’t show all the information in your file. Which gives you a false credit score that may seem higher on their site.

Conclusion:

if you’re looking to get credit that credit karma credit score is not your best reference. Although, many rely on them because they give you access to 2 of the 3 credit bureaus, the information may not be accurate.

Now, if you want to see what your real credit score is when trying to get credit cards and loans check out myfico.

https://houstonmcmiller.net/

https://www.instagram.com/houstonmcmiller/

https://twitter.com/houstonmcmiller

https://www.facebook.com/Houstonwins

https://www.linkedin.com/in/houstonmcmiller

0 notes

Text

Credit Karma Score: Best Credit Karma Fico Score Review 2021

Credit Karma Score: Best Credit Karma Fico Score Review 2021

Schedule A Consultation 👉 https://houstonmcmiller.net/consultation

Get Access To DIY Credit System 👉 https://houstonmcmiller.net/credit%20repair

youtube

If you been watching the news, you’ll know the talk about credit karma credit score. People are realizing that their credit scoring system is not reliable for getting credit.

We’ll before we start bashing them let’s look at who they are and what they do, and why so many people use them.

How accurate is Credit Karma?

Their credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Why is my credit karma score higher than FICO?

Credit Karma uses two of the three major credit bureaus and scores your creditworthiness according to the widely-used (but not quite as widely used as FICO) VantageScore system. … If your Credit Karma score isn’t accurate, the problem is probably elsewhere.

Why is my credit karma score wrong?

Credit Karma only factors in information from two credit bureaus. … Credit Karma relies on your credit reports from Equifax and TransUnion to determine your credit score. Since they leave out one source of information, it is possible that their scores are less accurate than if they used all three credit reports.

Should I use Credit Karma credit score for a mortgages?

Although, The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and you see on Credit Karma does not have all the data points to determine your qualification for a mortgage

What FICO score does credit karma use?

Which credit scores does Credit Karma offer? The model used for credit scores on Credit Karma is VantageScore® 3.0. While VantageScore® credit scores aren’t used as widely as FICO® scores for credit decisions, they can still give you a good idea of where your credit stands

Which is better credit karma or Experian?

Credit Karma will provide those, as well as regular alerts of any issues that affect your credit. But, if you’re looking for a higher level of credit monitoring, and you prefer getting it from one of the three major credit bureaus, Experian should definitely be your first choice.

Why is my FICO score less than Credit Karma?

It’s up to lenders to decide which information they report to the major credit agencies — and which agencies they report to in the first place. Since your FICO Scores depend on the data listed on your credit reports, you might not see the exact same score from every credit-reporting agency.

Should, I apply for a credit card thru Credit Karma?

Even though, credit karma offers credit score and credit reports, many have to have been denied.

The reason you may be denied that credit card is because they don’t show all the information in your file. Which gives you a false credit score that may seem higher on their site.

Conclusion:

if you’re looking to get credit that credit karma credit score is not your best reference. Although, many rely on them because they give you access to 2 of the 3 credit bureaus, the information may not be accurate.

Now, if you want to see what your real credit score is when trying to get credit cards and loans check out myfico.

https://houstonmcmiller.net/

https://www.instagram.com/houstonmcmiller/

https://twitter.com/houstonmcmiller

https://www.facebook.com/Houstonwins

https://www.linkedin.com/in/houstonmcmiller

0 notes

Text

FICO vs. VantageScore: What's the Difference?

You probably know your credit score, but you may or may not know the details of credit score calculation or the scoring model. In fact, according to a recent survey, 4 in 10 Americans have no idea what factors determine their credit score.

But even though it’s important to understand the factors that determine your score, that’s only one piece of the puzzle. There are actually different types of credit scores that come from different scoring models.

Have you ever noticed that your score is slightly different depending on when and where you check it? Even though it’s normal to see slightly different numbers when you check your score, part of the reason for the discrepancy in numbers is due to different credit scoring models.

Here’s what you need to know about scoring models and the ways they can affect your score.

What is a scoring model?

Credit scoring is a mathematical process that lenders and other businesses use to decide credit eligibility and loan terms. The factors used in the process can include payment history, amount and type of accounts you have, timeliness, outstanding debts and more.

After they collect the information, creditors input the information into an automated system that creates an individual score. But here’s where it gets interesting — not all scoring systems are exactly the same. Creditors and other companies can create their own scoring models based on risk.

Different companies have different models

The Federal Trade Commission clearly states that every company can use a unique scoring model. In addition, companies can use different scoring models for different types of credit or loans. And lastly, companies may also use a generic model developed by a scoring company. In other words, companies have the choice to create their own scoring model or use a scoring model created by a third-party like FICO or VantageScore.

But even though credit scoring models can change from one company to the next, they all must adhere to similar standards. According to the Federal Trade Commission, all credit scoring models must adhere to the guidelines from the Equal Credit Opportunity Act (ECOA):

“Under the ECOA, a creditor’s scoring system may not use certain characteristics — for example, race, sex, marital status, national origin, or religion — as factors. The law allows creditors to use age, but any credit scoring system that includes age must give equal treatment to applicants who are elderly.”

Why companies use scoring models

Lenders use credit scoring models because they are a simple and fair way to determine how risky it is to lend to a potential customer. Lenders want to reduce risk because lower risk means that the customer is more likely to repay the loan. For lenders, credit scoring models are an important part of doing business.

Barry Paperno, credit expert and writer, explains why scoring models are important for lenders.

“Credit scores enable lenders to make automated credit decisions that are objective, faster, and more consistent and accurate than decisions made subjectively without credit scores.”

FICO vs. VantageScore

Whether or not you know what it stands for, you’ve probably heard of “FICO” before, and there’s a good reason for that. Until VantageScore entered the credit scoring marketplace about ten years ago, FICO was the primary credit scoring company in the United States. Founded by Bill Fair and Earl Isaac in 1956, the Fair Isaac Corporation was the first credit scoring company.

Today, lenders use both credit scoring models for lending decisions. Even though FICO and VantageScore aren’t the only scoring models, they are the most popular. Because of that, it’s important to understand the differences.

What you need to know about VantageScore

VantageScore uses a credit scoring model developed by the company. In earlier VantageScore versions, the credit scores ranged from 501 to 990. However, the VantageScore 3.0 model updated the score ranges so they more closely resemble other credit scoring models. Today, the credit scores range from 300 to 850.

Factors that impact your VantageScore

According to VantageScore, different factors impact your VantageScore credit score and some factors are more important than others. Here are the factors that influence your credit score,ranked in order of importance by VantageScore:

Total credit usage, balance and available credit: This is the most important factor for VantageScore and it essentially looks at the total amount of credit you’re able to use, the total amount you’re actually using and how much is leftover. Total credit mix and experience: This is about the type of credit you have — credit cards, car loans, mortgage — and how long you’ve had the accounts. Payment history: This factor focuses on whether you pay your bills on time.Age of credit history: Although this is second to last, the length of your credit history is still important.New accounts: This factor is about how many new accounts you have, how recently you opened them and how many hard credit inquiries are on your report.

In reality, both scoring models are similar and use the same information. For example, both penalize you for late payments or missed payments. But even beyond that, you can get access to credit scores from both companies through the three major credit bureaus: Equifax, TransUnion and Experian.

“Most FICO and VantageScore models are offered by all three bureaus. FICO score models are custom-developed for each of the three credit bureaus. With VantageScore, a single model is developed and applied at each bureau,” says Paperno.

The main difference

The main factor that distinguishes VantageScore from FICO is how long you have to build credit before you have a credit score.

Paperno explains that FICO requires at least one account opened more than six months ago, while VantageScore requires only one month of history.

This is significant because it means that more customers are able to receive a score and as a result, those consumers are able to get access to credit. In fact, according to VantageScore, millions of additional consumers have been able to receive a score as a result of their scoring model:

“The VantageScore 3.0 model, which is the most recently introduced model, provides a score to 30–35 million adult consumers who otherwise would be virtually invisible to mainstream lenders. So when lenders use the VantageScore model, they can provide credit to more consumers at the most appropriate terms.”

How to check your VantageScore

Thanks to innovations in technology, it’s easier than ever to check your VantageScore for free. In fact, if you check your credit score through CapitalOne, Chase or Self Lender, you’ve seen your VantageScore. If you’re interested in checking your score, VantageScore has a complete list of free credit score providers.

What you need to know about FICO

Like VantageScore, FICO is a company that provides credit scores that range from 300 to 850. In other words, a FICO score is a particular brand of credit score. Historically, FICO scores have been the gold-standard for credit scores and according to Paperno, that’s still true today:

“FICO claims their scores are used in more than 90% of credit card, auto, mortgage and other credit decisions. VantageScore, the newer product, does not appear to have been adopted by many lenders for their lending decisions.”

The Consumer Financial Protection Bureau echoes Paperno and explains:

“Today, other companies also have credit scoring formulas (‘models’), but most lenders still use FICO scores when deciding whether to offer you a loan or credit card, and in setting the rate and terms.”

Factors that impact your FICO score

Even though the factors that impact your FICO and VantageScore are the same, the order of importance is slightly different.

Here are the factors that impact your FICO score ranked in order of importance.

Payment history: This factor looks at whether you pay your bills on time. Amounts owed: For this, the FICO model looks at how much you owe on your various accounts in relation to how much credit you have available. Length of credit history: This is about how long you’ve had credit or loan accounts. Credit mix: This factor is about the types of credit you have — installment accounts, mortgage loans, auto loans and more. New accounts: For this, FICO looks at how recently you’ve opened new accounts and during what time frame.

Something that’s interesting to note is that everyone actually has three different FICO scores, one from each credit bureau. This is because FICO score models are custom-developed for each credit bureau.

According to Paperno, lenders choose which score they use to make a lending decision based on their own past experience. Lenders tend to use the scores that have been most reliable in predicting future risk.

How to check your FICO score

Checking your FICO score is a little complicated because the scores online are often different from the scores that lenders use. This is partly because FICO scores change regularly, and they’re not free to get.

According to FICO, it’s best to find out exactly what score a lender is using so you know which score you need to buy from FICO:

“If you're planning on making a major purchase, you probably want to check your FICO Score and not just any credit score. If you really want to be sure that you are seeing the same information that your lender is judging you by, then ask the lender which score they are using and then purchase that exact score, or set of scores.”

Bottom line

The truth about FICO and VantageScore is that they are very similar.

“Since most credit scoring models essentially do the same thing — predict risk — lenders tend to use the models and credit bureaus that over time have proven to be most reliable in their experience,” Paperno explains.

This is good news for your credit because if you work to improve your credit score or build credit for one model, you’ll probably improve your credit for the other model as well.

About the author

Dion Rostamian is a personal finance writer who has also written for Credit Karma, Chime, Acorns and Policy Genius, among others.

Read the full article

0 notes

Text

VantageScore vs. FICO Score: Why Their Differences Matter

youtube

Some of the links in this post are from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

I once read some advice from a random person on the internet that concerns me.

Shocking, I know.

In researching credit scores, I found this advice from esteemed credit expert “Anonymous” about sites that offer your free credit score:

“[Sites like] Credit Karma show your fake TransUnion and Equifax scores, using the Vantage 3.0 system instead of the FICO system… I warn highly against using these free services because in my case, my credit scores… were inflated and inaccurate.”

OK, Anonymous. You’ve got my attention.

What is a “fake” credit score, and are the free scores I’m seeing online way off from what’s used to determine whether I get a loan or credit card?

Short answer: No, the score you see isn’t “fake,” and no, it’s not “inflated.” But, yes, it is probably different from what your bank and others see when they run a credit check.

You can get a free credit score and credit report from a site like Credit Sesame to get an idea of where you’ll stand with lenders. But it’s not exactly what they see.

Let’s find out why.

The Difference Between Credit Scores

Let’s review some of the basics…

We have three major credit-reporting agencies: TransUnion, Equifax and Experian. They keep track of your financial activity and produce reports that list your credit history.

To create your credit score, these agencies — and a bunch of smaller ones that do a similar job — each use a complicated formula to turn your credit activity into a sort of grade.

The reason there’s a difference between credit scores is partly because two models for computing your score dominate the market: FICO and VantageScore.

Both models have the same goal: to determine whether you’ll be able to repay a loan in a timely manner. They use the same information — credit reports from the three major agencies — but weigh various factors differently.

It’s like how you could always get an A on a paper in Ms. Jones’ class, but got a C from Mr. Johnson. The latter cared about word count, while Jones only graded on the quality of your writing. #TeamJones

To put it another way, Carla Blair-Gamblian, a consultant team lead at Veterans United Home Loans, told me, “A good comparison would be Celsius versus Fahrenheit. A 700 on one scale isn’t the same as a 700 on the other.”

That’s true, though the scales have become more similar in recent years. When VantageScore first came along in 2006, its scale ran from 501 to 990. But VantageScore 3.0, launched in 2013 — and the updated VantageScore 4.0, launched in 2017 — mirrors FICO’s scale of 300 to 850.

On top of these popular models, some smaller agencies might use their own models to determine your credit score. If your bank or credit card company uses one of these agencies for your credit check, it’ll see a credit score you’ve probably never seen before.

How Do You Know When You’re Looking at the Right Credit Score?

So, you want to stay on top of your credit score. You don’t want to apply for a loan or credit card with no idea how you’ll fare — that’s an unnecessary ding on your credit report.

But how do you know you’re even looking at the right information?

The bad news: You might not ever see the exact score your creditor sees when they run a credit check.

Good news: You can still arm yourself with the best information available.

“The free credit scores consumers get online are educational scores,” Blair-Gamblian explains.

Keeping an eye on the credit scores you do have available can help you make smarter decisions when you need to borrow money. Just make sure you understand what you’re looking at.

Here’s what you’ll see when you get your credit score from various sources:

When you pay to see your score from TransUnion or Experian, you’ll get a Vantage 3.0 score.

When you pay to see your score from Equifax, you’ll see a score based on its own Equifax Credit Score model.

When you sign up to see your score for free through Credit Sesame, or any of these other free credit score providers, you’ll see your VantageScore, usually from TransUnion.

If you sign up to see your free credit score from Discover Bank through its Credit Scorecard program, you’ll see your FICO score from Experian.

Your credit applications are still more likely to be evaluated using a score created by FICO, according to Credit.com.

It’s also harder to get for free than your VantageScore, although it’s available from a few sources.

Free Credit Scores Aren’t “Fake”

Sorry to hear about your experience, Anonymous, but you’re spreading bad information. Don’t be afraid to use free credit score services — just know what you’re getting.

To ensure your best chances for getting the loans or credit you need, study what actually impacts your credit score, and take some smart steps to build good credit when you’re ready to improve it.

Dana Sitar ([email protected]) is a former branded content editor at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

Original Source: thepennyhoarder.com

Curated On: https://www.cashadvancepaydayloansonline.com/

The post VantageScore vs. FICO Score: Why Their Differences Matter appeared first on Instant Advance Payday Loans Online | Cash Advance Payday Loans Online.

source https://www.cashadvancepaydayloansonline.com/vantagescore-vs-fico-score-why-their-differences-matter/?utm_source=rss&utm_medium=rss&utm_campaign=vantagescore-vs-fico-score-why-their-differences-matter

0 notes

Text

CapitalOne Creditwise Free VantageScore Credit Report from TransUnion

Article Summary

CapitalOne provides free credit scores for credit card holders through their CreditWise monitoring product. When you sign up for a credit card with CapitalOne, you get access to CreditWise as a free add-on service.

CreditWise uses TransUnion data to provide CapitalOne credit card holders with a credit score calculated using the VantageScore 3.0 credit score calculation, which has a credit scale ranging from 300-850. The credit score calculated by VantageScore 3.0 is similar to a FICO score, which is the most popular mechanism for assessing credit.

To access CreditWise information, CapitalOne credit card holders can login to their CapitalOne online account, where they will see their CreditWise score listed on the dashboard of their credit card account. Clicking on the score allows you to see the details of your CreditWise score, including factors that influence the score and how those have changed recently.

You probably know CapitalOne most from their commercials where they always ask, “What’s in your wallet?”

Well, it just so happens that I have a CapitalOne Sparks Business card in my wallet. I use it to purchase most of what we buy for our family’s vinyl decor business. After using a Chase credit card prior to that, I shopped for a card that had a better reward offer, and I liked that the Sparks Business card offered 2% cash back, twice what I was getting on my Chase card.

I’ve never been one to recommend getting a credit card for the purpose of collecting rewards points. I think that’s a bad idea, and simply doesn’t make sense. There are lots of personal finance and debt management experts who are adamantly opposed to using credit cards for any reason. The practice of going after credit card points and earning them with the intent of spending them on travel and other leisure items is especially criticized by Dave Ramsey, who argues that, “Credit card points are nothing but bad news—especially for people who don’t follow a budget and are tempted to overspend.”

If you are one of those millions of people who are not disciplined enough to spend your money with purpose, if you are kind of a sucker for “free” things that end up costing you much more than what you anticipated, getting a credit card is always a bad idea, no matter what the reason.

However, if you are among that group who use a budget, who spend according to their budget and who ensure that their spending habits are in alignment with their value system and financial goals, having a credit card can be a benefit to you.

Having a Sparks Business card doesn’t induce me at all to spend more money simply to earn more points, or to do so recklessly. Instead, I just keep the card on file with my suppliers, who charge it when we place orders for shipping boxes, vinyl material, and other things we use to fulfill customer orders. In fact, spending more using the card is an indication that my business is growing. So, you could say that I am inclined to spend more each month, but ultimately that extra spending is based on my business growth efforts. It’s a good thing. In a typical month, rather than getting $200 back, we get twice that amount. An extra $200+ per month in rewards is worth having and using a Sparks Business credit card instead of one that returns have the rewards percentage (1%) that is standard with the majority of personal and business credit cards.

CapitalOne’s CreditWise Service

After I set up my CapitalOne account, including registering for their online credit card management portal, I was pleasantly surprised to see that there was a section on my dashboard that showed my VantageScore number, and that allowed me to see how my financial activities were affecting that score.

youtube

CreditWise Mobile Apps

One of the benefits of using CapitalOne’s CreditWise credit monitoring service is that there are mobile apps available for use with both iOS and Android devices. If you’re the type who likes to be able to monitor your credit score and related activity directly from an app instead of logging in through a browser, these apps come in handy.

You can download the app that works for your device from either Apple’s App Store (for iOS powered devices) or from the Google Play store (for Android powered devices).

CreditWise Available Without CapitalOne Credit Card Account

Even though it’s great that CreditWise is a free service added on top of having a CapitalOne credit card, you can also access the service for free outside of even being required to be a CapitalOne cardholder. You can simply go to the CreditWise portal and sign up for the service without having to pay for it. You’ll be required to provide information that helps CapitalOne identify you, including your name, social security number, and some other information required to verify your identity, similar (not quite as extensive) to what you provide when purchasing a full credit report.

Using CreditWise Doesn’t Negatively Affect Your Credit

People often worry about checking their credit too often, having heard that doing so will damage your credit and negatively affect your score. A service like CreditWise (similar to the alternatives I’ll describe below) does not have that affect. CreditWise data is accessed using what’s called a soft credit pull or soft pull, meaning that the information is retrieved in a way that’s not connected with actually applying for more credit. When you’re actually submitting an application for a home loan, a car loan, a new credit card, or other types of credit, a full credit check is done using a hard credit pull or hard pull. These interactions between lenders and the credit bureaus signify that you’re actively seeking additional credit, and having too many of them is looked at negatively.

Soft pulls don’t show up on credit reports. Hard pulls typically do, and they pull down your overall score.

CreditWise Monitors Your Credit Based on Your Social Security Number

Besides simply providing a credit score and some advice on how to improve it, CreditWise actually monitors your social security number to keep you alerted in a situation where it shows up on the dark web or wherever else identify fraud could occur. If you have a CreditWise account, the service assertively checks the web and other venues where credit information transpires to see whether there is any activity associated with your social security number. You can set up alerts to be notified when CreditWise finds anything that could be related to your identity.

Alternatives to CapitalOne’s CreditWise Service

I have noticed that many of the credit card issuers are doing something similar. Here are just a few of the ones I’ve seen as I’ve been shopping for credit cards and setting up accounts with ones that work best for me and my personal and business needs.

Discover offers your FICO score for free with their Discover Credit Scorecard.

Citi provides a similar FICO score summary and details of what factors feed into the score when you have a Citi credit card. Citi’s Visa card is also the official credit card of Costco, which makes that card appealing to my family. We use this card to pay for most of our personal and family expenses because of its rewards benefits and because it also serves as the Costco membership card.

Using the various credit reporting and credit monitoring services available through credit card accounts can give you a better idea of what’s happening with your credit, including showing you what might be negatively affecting your overall score and providing details on how to improve your score.

CapitalOne’s CreditWise has been a perk for me as a business credit card user in addition to the extra rewards I receive when I make business purchases.

The post CapitalOne Creditwise Free VantageScore Credit Report from TransUnion appeared first on The Handbook for Happiness, and Success, and Prosperity Prosperopedia.

from WordPress https://ift.tt/2pQyiNj

via IFTTT

0 notes

Text

Is it safe to trust Credit Karma?

Note from Mr. SR: Your credit score is an indicator of your financial health. Perhaps even more importantly, it’s what lenders and even utility providers will use to judge your trustworthiness. Having a good credit score can save you thousands in interest and other fees over your lifetime.

Personally, my biggest concern about credit is identity theft.

To make sure your score is progressing and that there is no suspicious activity using your Social Security number, it’s best to regularly monitor your credit report and credit score.

My friend Chris from Money Stir wrote this awesome review of Credit Karma that I’m excited to share with you today. Could it be a good option for your and your family to stay informed about your credit report? Plus, is it safe to trust Credit Karma?

Seeing your credit score and viewing your credit reports has become a necessity in this day and age. Everything is becoming digitized, and new websites are launching all the time. But it can be hard to know if sites and apps like Credit Karma are safe or if they are a scam.

Credit Karma provides a free and easy way of viewing your financial history. I discovered Credit Karma earlier this year, and it has drastically simplified my life.

However, it’s always wise to confirm the company you are using is legitimate and safe before jumping in. Is it safe to trust Credit Karma?

The reality is that you should be paranoid about giving any person or company your social security number. If the wrong people get that info, that can easily lead to identity theft or having your financial accounts drained.

Or they might show up at your house asking for money. And nobody wants that.

Before we dive into talking about whether Credit Karma is safe, let’s first look at why you should want to view your credit report.

Your credit score matters A LOT. Here is why:

When you borrow money, companies need a way to figure out if you will pay back the money or not. The best way to do that is to dive into your financial past and see if you have any monsters lurking.

Do you make payments on time?

How much debt do you currently have?

Are you currently trying to spend money like a Kardashian?

Have you defaulted on any loans in the past?

Are there other reasons someone should be concerned about lending you money?

Your credit score and reports help fill this void. It provides a high-level summary of your financial situation and past.

But with that said, having a high credit score doesn’t necessarily mean you are great with money or have a strong financial foundation. The primary questions your credit score attempts to answer: “Is this person financially reliable, and are they currently overextended?”

If you want to get any kind of loan, whether that is for a home, car, credit card, etc. you want to have as high of a credit score as possible. Rates and credit limits are determined by your credit history and credit score. So it is in your best interest to make sure you stay on top of your financial picture.

If there is incorrect information in your credit report, this could have a negative impact on your credit score. But you can’t fix what you are unaware of. This idea is why it is crucial to view your credit score and credit reports periodically.

It would be a shame to apply for a home mortgage, only to find out you’ve been denied for the loan. You also may find yourself applying for a job, and the prospective company pulls up your credit report.

Don’t be taken off guard! Check your credit score and report.

At the very least, having a stellar credit score ensures that you’ll qualify for the lowest interest rates possible, potentially saving you thousands of dollars in interest payments.

About Credit Karma

Credit Karma was created in 2007 to provide consumers with their credit score for free and on-demand.

A summary of what they provide is the following:

View credit scores from Equifax and TransUnion (using VantageScore 3.0)

Access Equifax and TransUnion credit reports

Easily view the accounts you have opened or have closed, with the balances reported on your credit reports

Provides a way to dispute errors on your credit report

Easily signup for new credit cards, loans, and insurance policies, which are recommended based on your credit score

Other features that aren’t as obvious include:

Viewing an estimated value for your vehicles

Seeing your “insurance score”, which can be used in calculating your chances in lowering your car insurance rate

Comparing home loan rates with what you are currently paying

Get estimated rates and approval estimates on personal loans

See which credit cards you have a high likelihood in qualifying for

Free tax filing service

View and post reviews of credit cards

And one of the best features of Credit Karma? Their service is 100% FREE.

Ever since I started using Credit Karma, I’ve made it a habit in logging in once a month. I love being able to quickly pull up my credit score and see how things have changed over time. This feature is an excellent reason to signup for the service ASAP, as you can see how your credit score changes over your financial history. Each time you pull up your score, it will keep that info in their database that you can access at any point.

As part of our strategy in playing financial catch-up, we plan on continuing to use Credit Karma and feel the service provides incredible value.

I recently closed a few credit card accounts, and I noticed my credit score started going down a few points. I expected this to happen, and I’m relieved that Credit Karma is, in fact, pulling in my real credit report.

Should I trust Credit Karma with my information?

When you are entering your private information, one vital aspect is how safe your data is in their system.

The great news is that Credit Karma has taken the necessary steps in keeping your personal information safe. They currently have around 85+ million members and are growing at a rapid pace.

Being such a massive company, you know the government is keeping a close eye on how they are using data. They also cover the main things you would expect a major company to do in order to keep things secure:

They use a DigiCert EV SSL certificate, which is the highest grade authentication available

128-bit encryption and they limit who and how your SSN is accessed

A detailed privacy policy that is certified by TRUSTe

Credit Karma will not sell your personal information to 3rd parties

They regularly go to 3rd parties to run security audits

A bug bounty program that pays people to find vulnerabilities and issues in their system

But even though Credit Karma has top notch security practices, doesn’t mean someone couldn’t get access to your account. That’s why you should ensure you are using a secure password and setting answers to your security questions that people can’t guess the answers to.

If you look at the Credit Karma IOS app, you’ll notice they have 130,000 reviews with an average of 5/5 stars. Apparently, I’m not the only one who loves Credit Karma!

Credit Karma’s mobile app is fantastic. They make you set a security pin, and on my iPhone, I can enable Face ID to make it fast and straightforward in logging into my account. Clearly, they prioritize security and the amount of effort in making every aspect of their system user-friendly shows when you start using their service.

Just like any other site or service, Credit Karma could come under attack and have their systems compromised, but it’s clear to me that they are very proactive in doing everything they can to avoid that.

But how does Credit Karma make money?

It would be a huge red flag if a company were collecting your most personal information, and it was unclear how they made money.

This is not an issue with Credit Karma.

It is true their services and website are 100% free. The way they make money is from the products and services that are recommended once you log in. Any time someone signs up for a credit card, loan, or service through the Credit Karma website, they earn a hefty commission.

And given how many people use their platform, you know they are probably bringing in big bucks. According to this article, the company had over $500 million in revenue in 2016. The amount of money they bring in is excellent news because you know security has to be a top concern for Credit Karma. And this confirms they have plenty of money to make sure your data is safe and secure.

But with that said, there are no guarantees that a data breach can’t happen in the future. But from what I can tell, I don’t think the risk of this happening with Credit Karma is more significant than any other large company or bank. Most of the risk lies in someone guessing your password, so make sure you are using a secure password.

The pain of viewing your credit score and credit report before Credit Karma

Before Credit Karma, I was accessing my credit reports for free through AnnualCreditReport.com. This site allows you to view your credit report from the top three companies once a year, for free.

The issue in using AnnualCreditReport.com is that you don’t get access to your credit score, and you can only view your credit reports once per year.

I was also accessing my credit scores through my credit card websites that provided a credit score feature. This process worked okay, but each of them would use a different score, and it was time-consuming pulling each one up. In most cases, they only update your credit score once per month.

I’ve also used other companies in the past that allow you to pull up your credit score and reports, but they often came with significant monthly charges. Before I found Credit Karma, I was seriously contemplating signing up for one of these services.

Credit Karma’s philosophy is that they want to give everyone access to their credit score and reports for free. The more information you have about your financial picture, the more you can make informed decisions about your future. You can use this information in helping put together a livable budget that is sustainable and realistic.

Credit Karma provides much more than your credit score

At first, you might think the main benefit of Credit Karma is being able to view your credit score.

But the best feature of Credit Karma is that it also has a credit monitoring service (which is also FREE). Once enabled, you will be notified when there are significant changes to your credit report.

In other words, you immediately get minions working for you that send notifications any time something significant happens on your credit report.

This is a huuuuuge deal.

Let’s say someone manages to get your info and signs up for a new credit card. The only way you would know this happened is by manually viewing your credit report, or getting something in the mail about a new account that you didn’t open.

With Credit Karma, you would get an email (or mobile notification) when that new account shows up on any of your two credit reports. This notification allows you to jump onto this identity fraud ASAP.

A few weeks ago, I was able to test out this feature. I signed up for a new credit card, and a few days later, I ended up getting two emails with the new account that showed up on both of my credit reports in Credit Karma. Ask anyone who has had their identity stolen, and they will scream this is a massive benefit.