#vantagescore 4.0

Text

Difference between fico and vantagescore

The weight that is given to every one of your credit not entirely settled by the scoring model that is being utilized. There are two different FICO ratings that can be utilized to decide how reliable an individual is. Both of these scores are expected to be somewhere in the range of 300 and 900. The credit rating and the VantageScore both utilize a credit scoring range that reaches from 300 to 850, with larger numbers demonstrating more noteworthy reliability. You will have a superior comprehension of how these credit scoring models capability assuming you look into the essential qualifications that exist between the credit rating and the VantageScore.

Difference between fico and vantagescore

The organization that was previously known as Fair, Isaac and Co. also, was laid out in 1956 thought of the idea of the credit rating during the 1980s. The organization's previous name was Fair Isaac, yet it is presently referred to just as FICO. The credit rating was created fully intent on helping moneylenders in figuring out which borrowers had a more noteworthy penchant to default on a credit. The latest form of the credit rating is 9, however rendition 8 is as yet the one that is generally ordinarily utilized. Also, FICO creates individual scores for vehicle advances, Visa applications, and home loan applications.

The three biggest credit detailing organizations — Equifax, Experian, and TransUnion — combined efforts and laid out a joint endeavor called VantageScore Arrangements LLC in 2006. That very year, they sent off VantageScore 1.0. VantageScore was conceived out of this organization. The three organizations that are liable for announcing customers' credit data are now and again alluded to as credit agencies. VantageScore was created to guarantee that the FICO ratings furnished by these organizations are steady with each other. Since it was first evolved, the VantageScore framework has been refreshed a sum of multiple times.

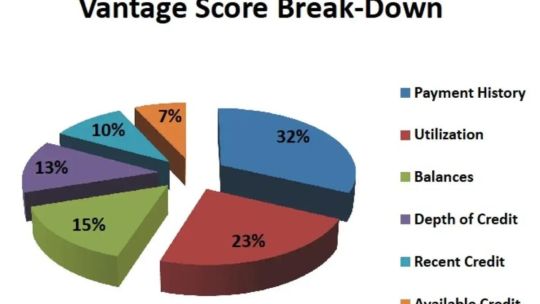

The Measures for Scoring to produce a financial assessment, the FICO scoring model requires the presence of no less than one record or tradeline that has been on favorable terms for a time of no less than a half year. Moreover, your record probably included ongoing action inside the past a portion of a year. The credit scoring model utilized by VantageScore just requires one record or tradeline to work, and there is no base required length for the record of loan repayment. Weighting While the latest rendition of VantageScore puts a more prominent accentuation on complete credit utilization and balances, FICO puts a more noteworthy accentuation on installment history. The credit scoring equation utilized by the credit rating depends on five distinct classes of data, while VantageScore 3.0 purposes six unique classifications. Five unique classes are utilized in VantageScore 4.0.

35% of the historical backdrop of installments 30% of complete obligation and sums that are owed 15% the candidate's age and the length of their financial record 10% of different kinds of credit and blends of credit 10% of new credit applications and requests

40% of past monetary history age and sort of credit represent 21% of the aggregate. 20% of the aggregate sum of credit used 11% complete equilibriums/obligation 5% of late exercises and requests in regards to credit 3% accessible credit The scoring measures were changed somewhat with the arrival of VantageScore 4.0, which merged the variables and doled out a lower weight to installment history. What's more, it doesn't give a rate to every basis; rather, it expresses how much each element adds to the general outcome.

The complete credit utilization, the equilibrium, and the accessible credit all have a critical effect. Credit blend and experience are critical variables. The historical backdrop of installments is modestly compelling. Time of record as a consumer is a component that conveys less weight. New records are essentially less powerful. The installment history considers any missed installments, considering both how much the missed installment and how as of late it happened. The age of your most seasoned account, the age of your freshest record, and the typical age of your records are all regularly thought about while assessing your record, notwithstanding the way that long it has been since you utilized every one of those records. Your credit blend is involved the different types of credit that you have utilized, for example, bank charge cards, retailer credit accounts, portion advances, finance organization records, and home loan advances. Ongoing credit conduct and new records includes deciding if you have as of late opened various new credit accounts. Potential banks will pull your credit report to decide if you are reliable for the advance or other credit extension that you have mentioned. You ought to know that a FICO rating that you get on the web will likely not impeccably match the one that the moneylender gets; nonetheless, it can in any case give you a smart thought of where you stand.

Both FICO and VantageScore have a somewhat unique way to deal with the treatment of hard requests in their models. With regards to FICO, a time of 45 days containing various hard requests is viewed as comparable to a solitary request. On the off chance that various hard requests occur inside a 14-day window, VantageScore believes those requests to be identical to a solitary request. This cycle, which is known as deduplication, can be useful when you are contrasting rates presented by different loan specialists, for example, when you are looking for a home loan.

The scope of conceivable credit ratings is from 300 to 850. The scope of scores from 300 to 850 that is utilized by FICO was embraced by VantageScore 3.0. Coming up next is a rundown of the credit levels that fall inside that reach: 781-850=Super Prime 661-780=Prime 601-660=Near Prime 500-600=Subprime 300-499=Deep Subprime In prior cycles of VantageScore, the scope of potential scores was 501 to 990. Both the VantageScore 1.0 model, which was presented in Walk 2006, and the VantageScore 2.0 model, which was presented in October 2010, relegated a letter grade to a FICO rating in view of where it fell inside the accompanying reaches: A relates to the reach 901-990, B to the reach 801-900, C to the reach 701-800, D to the reach 601-700, F to the reach 501-600, and H to high gamble. At the point when VantageScore rendition 4.0 turned out in April.

As indicated by FICO, its score doesn't consider factors like your race, variety, religion, public beginning, sex, or conjugal status, which would all be infringement of government regulation on the off chance that they were considered. Also, it doesn't consider your age, pay, occupation, or work history. Furthermore, it doesn't consider your place of home or the loan cost that is being charged to you on a Mastercard or other record. FICO likewise expresses that it doesn't figure installments for kid or family support that you are lawfully expected to make, and it doesn't change your score in view of investigations into your credit documented by you, a business, or a bank to make a limited time special or directing an occasional survey. These assertions can be tracked down on the organization's site. It likewise doesn't consider whether you are getting help from a credit guide. As per the site for VantageScore, the organization doesn't consider an individual's race, variety, religion, identity, orientation, conjugal status, age, pay, occupation, title, business, work history, complete resources, or spot of home. Neither does it consider the person's conjugal status.

The FICO rating that a potential bank will use to choose whether or not to endorse your application for credit is the one that you ought to give the most weight to while pursuing your choice. It is energetically suggested that you check your credit rating since it is utilized by most of moneylenders. You shouldn't, nonetheless, expect that to be the situation. Continuously guarantee that you ask with your moneylender in regards to the FICO rating that they will check.

You will find that most of advance suppliers take a gander at your credit rating. As indicated by FICO, their scores are utilized by 90% of the top moneylenders to settle on choices with respect to credit endorsement, advance terms, and different variables. 8 VantageScore is an option in contrast to the more normal credit rating that can be utilized by loan specialists and Mastercard organizations. As per the discoveries of a review led in 2019, in excess of 2,000 distinct monetary foundations got to in excess of seven billion VantageScores every year.

Both the VantageScore and the credit rating precisely measure an individual's record; nonetheless, the computations that they use are somewhat unique. Despite the fact that the two scores might show up at various numbers for your financial assessment, this doesn't demonstrate that one score is more exact than the other.

0 notes

Text

New lending rule will help low-credit and no-credit home buyers

New Post has been published on https://petnews2day.com/pet-industry-news/pet-financial-news/new-lending-rule-will-help-low-credit-and-no-credit-home-buyers/

New lending rule will help low-credit and no-credit home buyers

A new measure of credit

The traditional FICO credit score that Fannie Mae and Freddie Mac rely on to approve home buyers will soon be a thing of the past.

After about eight years of working toward a better solution, the Federal Housing Finance Agency (FHFA) announced a new model that will make it possible for a wider range of borrowers to qualify for home loans.

While it could take a few years to implement among lenders, the dual-score model is designed to expand credit access and make it easier for home buyers with “non-traditional credit” to get mortgage-qualified.

Giving credit where it’s due

The government-sponsored enterprises Fannie Mae and Freddie Mac are the safety net of the mortgage industry and guarantee the majority of U.S. home loans. For the last 20 years, they used the classic FICO score to help judge the creditworthiness of loan applicants.

However, traditional FICO had some blind spots and didn’t include the entire picture of a person’s financial profile. Plenty of would-be home buyers have been denied in the past, simply because they didn’t have the right type of credit history to qualify under FICO’s model.

“FHFA’s targeted adjustments… are well-timed and will improve access to credit for low- and moderate-income households, first-time buyers, and minority buyers.”

–Bob Broeksmit, president and CEO of the Mortgage Bankers Association

The new credit score model — which will use both FICO 10T and VantageScore 4.0 — will account for previously uncaptured payment histories like rent, utilities and telecommunication bills.

The change is seen as a win-win for borrowers and lenders, expected to keep mortgages safe, reduce costs and open homeownership potential to more people, according to FHFA Director Sandra Thompson.

“While implementing the newer credit score models is a significant change that will take time and require close coordination across the industry, the models bring improved accuracy and a more inclusive approach to evaluating borrowers,” Thompson said.

What this means for you, the home buyer

This should be a positive change for home buyers and open up credit access to a wider range of people, especially renters.

The change in credit scoring will be more equitable, accurate and inclusive for borrowers. Those who’ve typically been overlooked in the past because they had “thin” credit files will get fairer judgment when it’s time for them to get a mortgage.

“Given the ongoing affordability challenges facing homebuyers, FHFA’s targeted adjustments to the GSEs’ pricing framework are well-timed and will improve access to credit for low- and moderate-income households, first-time buyers, and minority buyers,” said Bob Broeksmit, president and CEO of the Mortgage Bankers Association.

“The announced updates on credit scoring models should help broaden the scope of eligible borrowers and expand access to homeownership for underserved communities,” he continued.

Apply sooner rather than later

This change should lower the barrier to homeownership for many. However, rollout is expected to take a few years.

The good news is, potential home buyers with “iffy” credit don’t have to wait for the new credit score model before applying. Even without it, there are ways to get approved for a home loan with low credit or no credit history at all.

If you’re ready to become a homeowner, reach out to a local lender today to get the ball rolling.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

0 notes

Text

The Fed approved two new credit-scoring models for Fannie Mae and Freddie Mac

The Fed approved two new credit-scoring models for Fannie Mae and Freddie Mac

Yesterday, the Federal Housing Finance Agency (FHFA) approved two new credit scoring models for use by Fannie Mae and Freddie Mac, two government-sponsored enterprises (GSEs) that guarantee most of the mortgages made in the U.S.

Both agencies are now authorized to use the FICO 10T credit score model and the VantageScore 4.0 credit score model, as opposed to relying on the classic FICO scoring…

View On WordPress

0 notes

Text

: Fannie Mae, Freddie Mac to use alternative credit scores — what that means for potential homebuyers

: Fannie Mae, Freddie Mac to use alternative credit scores — what that means for potential homebuyers

NASHVILLE — The federal government is expanding how it collects credit scores, which may allow more Americans to potentially buy homes.

The Federal Housing Finance Agency on Monday announced at the Mortgage Bankers Association’s annual conference that it had approved two credit score models, the FICO 10T, and the VantageScore 4.0, for use by Fannie Mae and Freddie Mac.

“The enterprises have long…

View On WordPress

0 notes

Text

The Future of Shopping - Vantage score 0 offers an innovative shopping experience that is sure to make your shopping trips a breeze!

Introduction

Introduction:

If you're looking for a shopping experience that is sure to make your shopping trips a breeze, look no further than Vantage score 0. This innovative shopping platform offers an innovative shopping experience that is sure to make your shopping trips a breeze. For one, Vantage score 0 features an intuitive interface that makes it easy to find what you're looking for. Additionally, the platform offers ample search options so you can quickly and easily find the best deals on the items you need. Finally, the platform offers a variety of payment options so you can get your Shopping spree on without spending a fortune!

What is Vantage score 0.

Vantage score 0 is a new shopping experience that allows users to save on their shopping trips by rating and reviewing products. This innovative system offers customers an innovative shopping experience that is sure to make their shopping trips a breeze! By rating and reviewing products, Vantage score 0 helps shoppers find the perfect product for them and saves them money on their next purchase. There are many benefits of using Vantage score 0, including:

- Saving time - By rating and reviewing products, shoppers can save time on their shopping trips. This allows them to shop more efficiently and stay within their budget.

- Finding the best deal - By rating and reviewing products, shoppers can find the best deals on products. This allows them to save money while still enjoying their Shopping trip.

- feeling like they own the product - by ratings and reviews, shoppers feel like they own the product they are purchasing. This allows them to feel like they are making a real difference in the product they are buying and helping others enjoy it too!

How to Get Started with Vantage score 0.

To start shopping with Vantagescore 0, you first need to set up your shopping accounts. You can create an account for free or use a subscription model. In either case, you will need to enter your personal information and select your shopping preferences. Once you have set up your accounts, you can start shopping!

Shop from Anywhere in the World

As mentioned earlier, Vantagescore 0 offers a revolutionary shopping experience that is sure to make your shopping trips a breeze! You can shop from any location in the world, and get a free shipping code if you want! Simply enter the code at checkout when placing your order.

Get a Free Shipping Code

If you're looking to save even more on your next purchase, be sure to add Vantagescore 0 to your cart and receive a free shipping code! Just enter the code at checkout and enjoy standard shipping rates as well!

Tips for Enjoying the Best Shopping Experiences with Vantagescore 0.

When planning your shopping trip, try to schedule time for shopping. This will help you find the best deals and enjoy the experience of Shopping with Vantagescore 0. By heading to one or more designated stores, you can save a lot of money on your shopping trips.

Cookiecutter Shopping Sheets

To make your shopping experiences even easier, use cookiecutter shopping sheets. These templates will help you plan your favorite shopping trips in a snap! Just print out the sheet and cut out the items you need for each visit. You’ll be ready to go from there!

Find the Right Place to Shop

If you’re looking for an amazing shopping experience but don’t have time to spend in a store, consider finding a place to shop online. With Vantage score 0, there are plenty of options available that will let you shop without feeling rushed or stressed out. Check out our website or use our search bar to find what you’re looking for quickly and easily! More information can be found on the website

Conclusion

Vantage score 0. is a powerful shopping platform that allows you to shop from anyplace in the world. By setting up your accounts and shopping from anywhere, you can enjoy the best shopping experiences possible. Additionally, Cookie cutter Shopping Sheets make it easy to find the best deals on products online. Finally, make sure to check out our other posts for more helpful tips!

#fico score#New vantagescore 0#vantagescore 3.0#vantagescore 3.0 calculation#vantagescore 3.0 scoring system#vantagescore 4.0#Post navigation

0 notes

Photo

Mortgage lenders more willing to loan to 'non-prime' borrowers "TransUnion finds home loans provided to subprime, near-prime borrowers were up 17.6 percent during Q3 2021 Encouraged by the performance of loans taken out during the pandemic, lenders are increasingly willing to provide mortgages and other loans to borrowers with subprime and near prime credit scores, according to an analysis by credit bureau TransUnion. Non-prime borrowers take out only a small fraction of home loans, but mortgage originations to that segment grew by 17.6 percent from a year ago during the third quarter of 2021, even as overall mortgage originations fell 12.6 percent, TransUnion found. The percentage of mortgages that are delinquent by 90 days or more fell from 1.05 percent during the fourth quarter of 2019 to 0.59 percent during the last three months of 2021, the analysis found. TransUnion’s latest quarterly Credit Industry Insights Report shows that a record 20.1 million credit card accounts were opened in the third quarter, with 9 million new accounts granted to consumers with non-prime credit scores. The 75 percent annual increase in non-prime credit card accounts led all categories, followed by personal loans (up 46.9 percent), mortgages (17.6 percent) and auto loans (5.6 percent). TransUnion defines non-prime consumers as both “subprime” borrowers scoring 300 to 600 on TransUnion’s VantageScore 4.0 scale, and “near prime” borrowers scoring 600 to 660..." - Courtesy of Inman.com There is a difference between agents, the services they provide and the results they get. Who do you know considering buying or selling? Not only will they benefit from our award-winning service, you can rest assured a very worthy cause will benefit as well. Call The Turvey Group today and Start Packing!!470-655-0956 Go Serve Big!!! #theturveygroup #turveypartners #realestate #georgiarealestate #ourrescue #endhumantrafficking #riseup #riseupforchildren #jointhefight #saveourchidren #whyifight #smile #yhsgr #winning #sellers #buyers #realestate #realtor #justlisted #property #curbappeal #homes #luxuryhome #exclusive #hustlehard #done #charity (at Your Home Sold Guaranteed or We'll Buy It - The Turvey Group) https://www.instagram.com/p/CZkGtwTuq2Z/?utm_medium=tumblr

#theturveygroup#turveypartners#realestate#georgiarealestate#ourrescue#endhumantrafficking#riseup#riseupforchildren#jointhefight#saveourchidren#whyifight#smile#yhsgr#winning#sellers#buyers#realtor#justlisted#property#curbappeal#homes#luxuryhome#exclusive#hustlehard#done#charity

0 notes

Text

Does the Type of Credit Score Matter?

When you apply for new credit, the lender will almost always check one or more of your credit reports and credit scores. Lenders and other service providers use credit scores to gauge the amount of financial risk you pose as a borrower.

If your credit scores are high, you're seen as a low credit risk—meaning you're likely to repay your debt as agreed. Alternatively, if your credit scores are low, you're considered a higher risk in lenders' eyes. And while you have dozens—or even hundreds—of credit scores, if your credit reports reflect positive credit behavior, then all of your scores will likely be good regardless of the score brand or version.

What Is a Credit Score?

A credit score is a three-digit number usually ranging from 300 to 850 that lenders use to predict your credit risk. A credit score takes into account the information appearing on your credit reports as maintained by the three national credit reporting agencies (Experian, TransUnion and Equifax). Information that is not on your credit reports is not considered by credit scoring models.

What Are the Main Credit Scoring Models?

There are two commonly used brands of credit scores in the U.S. consumer credit environment: FICO®, named for the Fair Isaac Corp., and VantageScore®. Collectively, these two scoring brands account for over 20 billion scores used annually.

VantageScore

VantageScore credit scores have been around since 2006. There have been four versions of this credit score: VantageScore 1.0, 2.0, 3.0 and 4.0. Each VantageScore version is a single model used by all three national credit reporting agencies. As a result, if your credit reports are identical across all three agencies (which is unlikely), your VantageScore credit scores would also be identical.

It's not as simple when it comes to FICO. FICO, the company, has been around since 1956, but its credit bureau scores debuted in 1989. Since then, it has released several dozen scoring models that are commercially available and in use in the United States.

FICO works with hundreds of financial institutions to provide free access to FICO scores for consumer accounts, so first check the banks in camp hill pa or credit card statements to see if your score is listed there.

Where Can I Get My Credit Scores?

With so many credit scores out there, there's little chance all of them are the same, though they are likely to be similar.

There is no shortage of places where consumers can go to see their credit scores. Some are free and some are not. The credit reporting agencies all either sell credit scores or provide them at no cost. There are also various third-party websites that will either sell you a score or give you a free credit score in exchange for you becoming a registered user of their site.

Are There Other Types of Scores?

While the FICO® and VantageScore credit scoring models certainly get most of the attention, there are other types of scores in use today. Some other examples include:

Insurance risk scores: An insurance risk score predicts either the likelihood that you will file an insurance claim or that you will be an otherwise less profitable insurance customer. FICO® builds insurance risk scores, as does LexisNexis.

Collection scores: A collection score, used by debt collectors, ranks debtors based on their likelihood of paying their collection account debts. FICO® creates collection scores.

Custom scores: Custom scores are credit scoring models built for use by one party, usually a lender or an insurance company. Custom scoring systems can take into account credit report data, credit application data and even other credit scores. Most mid- to large-sized lenders use custom scoring systems, as well as garden variety credit bureau scores.

Bankruptcy scores: Bankruptcy scores are designed to predict the likelihood that you'll file for bankruptcy protection.

1 note

·

View note

Text

Todo lo que necesita saber sobre el modelo de calificación crediticia de VantageScore 4.0

Todo lo que necesita saber sobre el modelo de calificación crediticia de VantageScore 4.0

View On WordPress

0 notes

Text

Todo lo que necesita saber sobre el modelo de calificación crediticia de VantageScore 4.0

Todo lo que necesita saber sobre el modelo de calificación crediticia de VantageScore 4.0

View On WordPress

0 notes

Text

VantageScore Solutions Publishes Model Performance Assessment of VantageScore® 4.0

Statistical bias, if any, related to the ethnicity of various consumer groups. ... There is no statistical bias in VantageScore 4.0-based credit scores with ... http://bit.ly/2K2tahq

0 notes

Text

VantageScore vs. FICO Score: Why Their Differences Matter

youtube

Some of the links in this post are from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

I once read some advice from a random person on the internet that concerns me.

Shocking, I know.

In researching credit scores, I found this advice from esteemed credit expert “Anonymous” about sites that offer your free credit score:

“[Sites like] Credit Karma show your fake TransUnion and Equifax scores, using the Vantage 3.0 system instead of the FICO system… I warn highly against using these free services because in my case, my credit scores… were inflated and inaccurate.”

OK, Anonymous. You’ve got my attention.

What is a “fake” credit score, and are the free scores I’m seeing online way off from what’s used to determine whether I get a loan or credit card?

Short answer: No, the score you see isn’t “fake,” and no, it’s not “inflated.” But, yes, it is probably different from what your bank and others see when they run a credit check.

You can get a free credit score and credit report from a site like Credit Sesame to get an idea of where you’ll stand with lenders. But it’s not exactly what they see.

Let’s find out why.

The Difference Between Credit Scores

Let’s review some of the basics…

We have three major credit-reporting agencies: TransUnion, Equifax and Experian. They keep track of your financial activity and produce reports that list your credit history.

To create your credit score, these agencies — and a bunch of smaller ones that do a similar job — each use a complicated formula to turn your credit activity into a sort of grade.

The reason there’s a difference between credit scores is partly because two models for computing your score dominate the market: FICO and VantageScore.

Both models have the same goal: to determine whether you’ll be able to repay a loan in a timely manner. They use the same information — credit reports from the three major agencies — but weigh various factors differently.

It’s like how you could always get an A on a paper in Ms. Jones’ class, but got a C from Mr. Johnson. The latter cared about word count, while Jones only graded on the quality of your writing. #TeamJones

To put it another way, Carla Blair-Gamblian, a consultant team lead at Veterans United Home Loans, told me, “A good comparison would be Celsius versus Fahrenheit. A 700 on one scale isn’t the same as a 700 on the other.”

That’s true, though the scales have become more similar in recent years. When VantageScore first came along in 2006, its scale ran from 501 to 990. But VantageScore 3.0, launched in 2013 — and the updated VantageScore 4.0, launched in 2017 — mirrors FICO’s scale of 300 to 850.

On top of these popular models, some smaller agencies might use their own models to determine your credit score. If your bank or credit card company uses one of these agencies for your credit check, it’ll see a credit score you’ve probably never seen before.

How Do You Know When You’re Looking at the Right Credit Score?

So, you want to stay on top of your credit score. You don’t want to apply for a loan or credit card with no idea how you’ll fare — that’s an unnecessary ding on your credit report.

But how do you know you’re even looking at the right information?

The bad news: You might not ever see the exact score your creditor sees when they run a credit check.

Good news: You can still arm yourself with the best information available.

“The free credit scores consumers get online are educational scores,” Blair-Gamblian explains.

Keeping an eye on the credit scores you do have available can help you make smarter decisions when you need to borrow money. Just make sure you understand what you’re looking at.

Here’s what you’ll see when you get your credit score from various sources:

When you pay to see your score from TransUnion or Experian, you’ll get a Vantage 3.0 score.

When you pay to see your score from Equifax, you’ll see a score based on its own Equifax Credit Score model.

When you sign up to see your score for free through Credit Sesame, or any of these other free credit score providers, you’ll see your VantageScore, usually from TransUnion.

If you sign up to see your free credit score from Discover Bank through its Credit Scorecard program, you’ll see your FICO score from Experian.

Your credit applications are still more likely to be evaluated using a score created by FICO, according to Credit.com.

It’s also harder to get for free than your VantageScore, although it’s available from a few sources.

Free Credit Scores Aren’t “Fake”

Sorry to hear about your experience, Anonymous, but you’re spreading bad information. Don’t be afraid to use free credit score services — just know what you’re getting.

To ensure your best chances for getting the loans or credit you need, study what actually impacts your credit score, and take some smart steps to build good credit when you’re ready to improve it.

Dana Sitar ([email protected]) is a former branded content editor at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

Original Source: thepennyhoarder.com

Curated On: https://www.cashadvancepaydayloansonline.com/

The post VantageScore vs. FICO Score: Why Their Differences Matter appeared first on Instant Advance Payday Loans Online | Cash Advance Payday Loans Online.

source https://www.cashadvancepaydayloansonline.com/vantagescore-vs-fico-score-why-their-differences-matter/?utm_source=rss&utm_medium=rss&utm_campaign=vantagescore-vs-fico-score-why-their-differences-matter

0 notes

Text

How to Remove Collections from Your Credit Report

When you’re trying to fix your credit, having one or more collections can put a huge damper on getting your score on an upward trajectory. While it can be difficult to get collections removed from your credit report, it’s not impossible. The best way to get started is learning about how exactly collections affect your credit so you know how to handle them.

There are some very sensitive rules when it comes to timelines and statutes of limitations, so it’s important to learn those before you take action. If you don’t, you could inadvertently reset the clock on your collections accounts. So settle in and get ready to go in-depth on everything you need to know about collections and getting them removed from your credit report.

How long do collections stay on your credit report?

Collection accounts can remain on your credit report for up to 7 years. Even if you pay it in full, it’s still considered a negative account and will stay on your file as a “paid collection” for 7 years.

A collection account is also separate from the original creditor’s charge off account that will more than likely also show up on your credit report.

How do collections affect your credit?

Most accounts end up in collections after four to six months without payment. During this time, your creditors may stop contacting you about the debt. For many people, renewed collection activity comes as a nasty surprise when their debts are turned over to third-party collection agencies that use aggressive tactics.

When collections first show up on your credit report, you can expect your credit scores to drop anywhere from 50 to 100 points depending on how high your credit was to start.

In general, the better your credit, the worse the hit will be. Over time, the collection account will affect your credit less and less. Before your account is sent to collections, you should receive a final notice from the original creditor. It’s best to try and make some type of payment arrangement at that time so you don’t end up with such disastrous effects on your credit score.

Quick Solution

Want to Remove Collections from Your Credit Report?

WE RECOMMEND

CLAIM YOUR FREE CONSULTATION:

(800) 220-0084

Call for a Free Consultation:

(800) 220-0084

CLICK HERE TO GET STARTED →

CLICK HERE TO CALL →

What are the most common accounts that get sent to collections?

Some of the most common accounts that get sent to collections are local utility and cable/satellite services like Comcast, Cox, Dish, DirecTV, and Time Warner. We also see a lot of cell phone services like Verizon, Sprint, AT&T, T-Mobile, and U.S Cellular on people’s credit reports.

The most common credit card accounts being sent to collections are Chase, Capital One, Bank of America, Barclaycard, Citi, and American Express. Medical debt is also very common.

If you pay off a collection will it help your credit score?

In the past, paid collections were treated the same way as unpaid collections. However, FICO has updated their credit scoring to ignore paid collection accounts. They’ve also updated it so that medical collection accounts carry less weight. Similarly, VantageScore has recently updated their algorithm to ignore paid collection accounts of all types.

With these new updates to the credit scoring models, paying off a collection does now help your credit score, as long as the lender pulling the credit score uses the most recent scoring model.

Since it takes time for new scoring programs to be rolled out in financial institutions, it may take time for you to see a result when applying for credit. You can always ask potential creditors which scores they use. If it’s FICO 9 or VantageScore 4.0, you should be able to take advantage of the lenient calculation of paid collections.

It’s still important to be careful before you decide to pay off a collection that it’s still something that you owe. Debt buyers will try to collect on debts that you don’t legally owe anymore so it’s important to have them verify the debt before you take action. Also consider your state’s statute of limitations, which we’ll discuss shortly.

How can you confirm you owe debt in collections?

Often referred to as “junk debt buyers,” debt buyers like Midland Funding LLC are debt collection agencies that go after very old debts, which they’ve purchased for as little as a few pennies on the dollar. Then, they report the collections on your credit report to try to get you to pay them. Sometimes they use unscrupulous practices like buying debts that you’ve already paid.

It’s not uncommon for a third party collection agency to buy and sell the same debts multiple times. This means you could have multiple collections accounts listed for the same debt, each one lowering your credit score even further.

Finding out which of these companies actually owns your debt at any given time can be tricky. Even then, you’ll still have to negotiate with the other agencies that have posted negative information to your credit file.

The best way to start is to send a validation request to the collection agency claiming you owe them money. First, this step requires them to stop all collection activity.

Then, they must send you proof that they own the debt and that you do indeed owe it. There’s no timeline for them to return this information to you, but they can’t take any action towards collecting the funds until they do.

What’s the difference between reporting limit and statute of limitations?

There are two distinct dates that you need to be aware of when it comes to collections accounts: the reporting limit and the statute of limitations. Although they sound similar, these two terms are very different. The reporting limit on your debts is set by the Fair Credit Reporting Act (FCRA) and is equal to seven years after the date of last activity, or DLA.

For collections accounts, this is typically seven years after the date that the account was charged off.Because most accounts are charged off after six months of missed payments, you can expect to see the collections fall off of your report seven years and six months after your last payment.

The statute of limitations on a debt varies from state to state. It can be as few as three years or as many as six (or longer for some types of debt). When the statute of limitations has passed on a debt, it is referred to as “time-barred.”

While a debt collector can continue to contact you unless you tell them to stop, they cannot legally sue you to obtain a judgment once the statute of limitations has passed. The debt may still be listed in your credit file after the statute of limitations has passed if the reporting limit hasn’t.

Some underhanded debt collectors attempt to coerce you into paying by listing a more recent date on the collections account. This is known as re-aging and is illegal under the FDCPA and the FCRA.

If you try to set up a payment plan, you could open yourself up to a lawsuit by re-starting the time creditors have to legally collect. If you’re not paying the creditor who currently owns the debt, the collections remain as an unpaid collection.

Do medical bills affect your credit?

Yes, medical bills absolutely affect your credit, which is unfortunate because most procedures aren’t something we want to do — they’re something we have to do because of an illness or injury.

With the cost of medical care continually rising, it’s common to see medical bills on your credit report. In the past, slow health care insurance billing processes hurt consumer credit score because medical debt and even medical collections appeared before people even received bills.

Luckily, recent changes to consumer law have changed the way credit bureaus are allowed to report medical debt. The new law requires that credit bureaus wait an extra 180 days before adding medical debt to your credit report, either as an amount you owe or as a collection.

This gives you an extra six months to receive bills, ensure they are correct, and figure out how to remove medical collections from your credit report.

When you receive your billing information from your providers, your first task is to ensure the information is accurate. Unfortunately, it can be confusing to understand what charges your insurance company should cover and what you’ll be responsible for.

Review your bill and compare it to your Explanation of Benefits (EOB). If you’re still not sure if you’ve been charged correctly, call your insurance company and get the details of your EOB sorted out.

Once you know the true amount you owe, figure out how you’re going to pay for it. It’s better to call the medical provider directly than to ignore bills and have them sent to collections.

You can sometimes sign up for monthly interest-free payments, or even ask for a reduction of costs. A balance forgiveness plan helps to work with your budget through either regular payments or a lump sum in exchange for a reduced balance.

Can medical bills be removed from my credit report?

Yes. Just like anything else on your credit report, medical collections can be removed. When getting medical bills removed from your credit report, it’s important to keep good records on hand. For example, maybe you paid off an outstanding balance, but it’s still listed on your credit report. Or perhaps the amount is incorrect.

Pay careful attention to each piece of information associated with the debts to give yourself the best chance of getting them removed. When figuring out how to dispute medical bills on your credit report, follow the same guidelines for any other type of collections discussed below.

How can I remove collections from my credit report?

Here is an example of collections that were deleted from a credit report:

Removing collections from your credit report can raise your credit scores dramatically. It’s often the case that there are errors on collections accounts. Because they get passed back and forth so often among debt buyers, it is not uncommon for records to be mixed up.

Your collections accounts may not have the right amount, the right date, or include any number of other mistakes that creditors don’t bother to fix.

Debt collection agencies don’t care about what they do to your credit. They only care about what it takes to get you to pay up, and they are hoping that you don’t realize that the law is on your side! It is your legal right to dispute any mistakes on your credit report and that includes collections accounts with false information or even any accounts that you deem “questionable.”

Need help getting collection accounts removed from your credit report?

This is where hiring a credit repair company can really make a difference. They help most people to remove these collections by disputing the errors for you, which means you don’t have to contact any of the debt collection companies yourself directly.

They also handle all of the tracking necessary to ensure that these companies are complying with the FCRA. On top of that, they make your credit file does not contain errors like account re-aging and multiple listings for the same collections.

If you aren’t sure where to start when it comes with disputing collections on your credit report, talk to one of their credit repair professionals and get your questions answered. You can do it on your own, but you’re likely to have more success by enlisting professional help.

They offer a no-obligation consultation to explain just how they remove collections and what they can do to help in your particular situation. Get in touch with them today and stop going in circles with creditors over your collections accounts.

Are collections hurting your credit score?

Lexington Law removed over 6 million collections in 2016 alone. If you’re sick of going through life with bad credit, give them a shot.

Want to Remove Collections from Your Credit Report?

Our rating:

Call for a Free Consultation:

(800) 220-0084

Click here to get started

The post How to Remove Collections from Your Credit Report appeared first on AAACreditGuide.

from Credit And Credit Repair https://aaacreditguide.com/collections-2018/

0 notes

Photo

How @vantagescore 4.0 will benefit borrowers when it launches this fall http://a.walla.by/2q0Wxpv http://a.walla.by/2ph4NTq

0 notes

Text

How the Newest Scoring Model Could Impact Your Credit Score

Perhaps you’ve never heard of VantageScore, but this credit scoring model is about to get revamped — and your score could be affected. VantageScore Solutions, the company behind the VantageScore credit scores, announced this week that its new VantageScore 4.0 credit scoring model will become available to lenders this fall. VantageScore Solutions launched in 2006. The company and its...

0 notes

Photo

How VantageScore 4.0 Could Benefit You http://a.walla.by/2qnJdfY

0 notes