#Nifty Monday prediction

Explore tagged Tumblr posts

Text

Nifty Prediction For Monday, May 12: Volatility Remains High Amid India-Pak Tensions, Key Support At 23,800 - News18

Last Updated:May 10, 2025, 12:58 IST Market experts attributed the selloff to geopolitical concerns following Operation Sindoor Nifty Prediction For May 12. Indian equity markets closed sharply lower on Friday, May 9, amid escalating tensions between India and Pakistan. Both benchmark indices—Sensex and Nifty 50—fell over 1%. The Sensex dropped 880.34 points, or 1.10%, to 79,454.47, while the…

View On WordPress

#geopolitical impact on markets#India VIX#India-Pakistan tensions#Indian stock market forecast#market volatility#Nifty 50 forecast#Nifty 50 levels#Nifty chart analysis#Nifty Monday prediction#Nifty prediction#Nifty support and resistance#Nifty technical analysis#operation sindoor#Sensex and Nifty news#stock market outlook

0 notes

Text

शेयर बाजार में ब्लैक मंडे का खतरा: ट्रंप के टैरिफ से गिफ्ट निफ्टी 1,000 अंक लुढ़का, वैश्विक बाजारों में हाहाकार!

Share Market News: 7 अप्रैल 2025 को सुबह का सूरज उगने के साथ ही शेयर बाजार में काले बादल छा गए हैं। ट्रंप के टैरिफ ऐलानों ने दुनियाभर के बाजारों को हिलाकर रख दिया है, और भारत भी इससे अछूता नहीं है। आज सुबह 7:18 बजे तक गिफ्ट निफ्टी में 1,000 अंकों की भारी गिरावट दर्ज की गई, जो निफ्टी के लिए 21,964 के आसपास शुरुआत का संकेत दे रही है। यह स्तर 4 मार्च का निचला स्तर है। विशेषज्ञों ने चेतावनी दी है कि…

#Black Monday 2025#Dow Jones Drop#Gift Nifty Crash#global market crash#Hang Seng Index#NIFTY PREDICTION#Nikkei 225 Fall#share market updates#stock market news#Trump Tariffs Impact

0 notes

Text

India vote count shows Modi alliance heading to majority but no landslide

NEW DELHI, June 4 (Reuters) - Indian Prime Minister Narendra Modi's alliance was winning a majority of seats about halfway through the count in the general election on Tuesday, but the numbers were well short of the landslide predicted in exit polls, TV channels said.

Modi's own Bharatiya Janata Party (BJP) was falling short of a majority of its own in the 543-member parliament, the trends showed. Having to depend on allies to form the government could introduce some uncertainty in policy-making as Modi has ruled with an authoritative hold in the last decade.

The Hindu nationalist BJP won a majority of its own when it swept to power in 2014, ending India's era of unstable coalition governments, and repeated the feat in 2019.

The prospect of Modi having to rely on allies spooked markets with stocks falling steeply. The blue-chip NIFTY 50 (.NSEI), opens new tab was down 4.8% and the S&P BSE Sensex (.BSESN), opens new tab was down 4.7% at 0833 GMT.

The rupee also fell sharply against the dollar and benchmark bond yields were up.

"A narrower-than-expected victory for Modi's alliance may raise doubts about the new government's ability to push through politically difficult reforms seen as crucial to sustain India's economic growth, which is already the world's fastest," said Vasu Menon, managing director of investment strategy at OCBC in Singapore.

"Despite this, the fact remains that the BJP-led alliance is still set to win a third term, which means continuity in the government's infrastructure and manufacturing-led drive to boost economic growth."

Markets had soared on Monday after exit polls on June 1 projected Modi and BJP would register a big victory, and the ruling National Democratic Alliance (NDA) was seen getting a two-thirds majority and more.

At 0900 GMT, TV channels showed the NDA was ahead in nearly 300 of the 543 elective seats in parliament, where 272 is a simple majority, with about half the votes counted.

Full results are likely in several hours.

They showed BJP accounted for under 250 of the seats in which the NDA was leading, compared to the 303 it won in 2019.

The opposition INDIA alliance led by Rahul Gandhi's centrist Congress party was leading in over 220 seats, higher than expected. Congress alone was leading in nearly 100 seats, almost double the 52 it won in 2019 - a surprise jump that is expected to boost Gandhi's standing.

However, politicians and analysts said it was too early to get a firm idea of the voting trends since counting still had some way to go.

"It's a fair assessment to say 400 at the moment certainly looks distant," BJP spokesperson Nalin Kohli told the India Today TV channel, referring to some projections that gave over 400 seats to the NDA.

"But we need to wait...to have a final picture of the seats because the exit polls speak of a massive sweep, (and) the counting trends currently don't seem to match that," he said.

"The BJP-NDA will form the government, that trend is very clear from the start," he added.

POLICY SLOWDOWN

TV exit polls broadcast after voting ended on June 1 projected a big win for Modi, but exit polls have often got election outcomes wrong in India. Nearly one billion people were registered to vote, of which 642 million turned out.

However, if Modi's victory is confirmed even by a slim margin, his BJP and its allies will have triumphed in a vitriolic campaign in which parties accused each other of religious bias and of posing a threat to sections of the population.

Investors had cheered the prospects of another Modi term, expecting it to deliver further years of strong economic growth and pro-business reforms, while the anticipated two-thirds majority in parliament would allow major changes to the constitution.

"The biggest disappointment for the market is the fact that BJP does not have a majority (yet)...that opens up a Pandora's box because all the other players...are all quite volatile," said Dipan Mehta, founder director at Elixir Equities in Mumbai.

Bank of Baroda economist Sonal Badhan said the lack of a majority for BJP on its own could mean "some slowdown in policy decisions can be expected".

The seven-phase, seven-week poll that began on April 19 was held in searing summer heat with temperatures touching nearly 50° Celsius (122° Fahrenheit) in some parts.

More than 66% of registered voters turned out, just one percentage point lower than the previous election in 2019, squashing pre-poll concerns that voters might shun a contest thought to be a foregone conclusion in Modi's favour.

Modi, 73, who first swept to power in 2014 by promising growth and change, is seeking to be only the second prime minister after India's independence leader Jawaharlal Nehru to win three straight terms.

2 notes

·

View notes

Text

Nifty 50, Sensex today: What to expect from Indian stock market in trade on April 9 ahead of RBI policy

The Indian stock market benchmark indices, Sensex and Nifty 50, are likely to open lower on Wednesday, influenced by negative global cues.

The trends on Gift Nifty also indicate a negative start for the Indian benchmark index. The Gift Nifty was trading around 22,442.50 level, a discount of 187.85 points from the Nifty futures’ previous close.

The Reserve Bank of India (RBI) will announce its monetary policy today. The RBI Governor Sanjay Malhotra-led Monetary Policy Committee (MPC) is expected to cut repo rate amid cooling inflation and slowing economic growth.

On Tuesday, the domestic equity market witnessed a sharp relief rally, with the benchmark Nifty 50 closing above 22,500 level.

The Sensex surged 1,089.18 points, or 1.49%, to close at 74,227.08, while the Nifty 50 settled 374.25 points, or 1.69%, higher at 22,535.85.

Here’s what to expect from Sensex, Nifty 50 and Bank Nifty today:

Sensex Prediction

Sensex bounced back sharply on Tuesday and rallied by 1,089 points, closing above the 74,200 level.

“Promising reversal formation and higher bottom formation on intraday charts suggesting pullback formation is likely to continue in the near future. For day traders now, 73,500 would be a key level to watch for Sensex; above this level, a pullback wave could move up to 75,000, with further upside potentially lifting the Sensex index to 75,200. Conversely, a dismissal of 73,500 could accelerate selling pressure. If this level is breached, Sensex could retest 73,000–72,800,” said Shrikant Chouhan, Head equity Research, Kotak Securities.

According to him, the current market texture is extremely volatile and uncertain; thus, a level-based trading strategy would be ideal for day traders.

Nifty OI Data

Nifty derivative data continues to reflect a cautious-to-bearish tone. Call writers have remained aggressive, outnumbering their put counterparts and adding to the negative bias. The 23,000 strike saw a massive call OI (Open Interest) buildup of 1.02 crore contracts, confirming its status as a formidable resistance level. On the flip side, solid put writing was visible at the 22,500 strike (67.90 lakh contracts), which indicates firm support at lower levels, said Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities.

Nifty 50 Prediction

Nifty 50 continued its follow-through upmove on April 8 and closed the day with handsome gains of 374 points.

“A reasonable positive candle was formed on the daily chart with long upper and lower shadow. Technically, this market action signals a formation of a high wave type candle pattern, which indicates ongoing high volatility in the market. The recent sharp opening downside gap of Monday has been challenged and has been filled partially. As per the gap theory, the said down gap could be considered as a bullish exhaustion gap and that is likely to be filled soon around 22,850 levels on the higher side,” said Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities.

Normally, bullish exhaustion gaps are more often associated with important bottom reversals. Immediate support is placed at 22,270, he added.

Om Mehra, Technical Research Analyst, SAMCO Securities noted that the Nifty 50 rebounded from the oversold zone — potentially a dead cat bounce, and has retraced to the 38.2% Fibonacci level, connecting the recent swing high and low.

“Nifty 50 remains below the 9, 20, and 50 EMAs (Exponential Moving Average) on the daily chart- a minor concern for a sustainable trend reversal. On a positive note, the hourly chart reflects a constructive development, with the previous resistance at 22,250 now acting as a support level, thereby strengthening the short-term bullish structure,” Mehra said.

The daily RSI and MACD are yet to cross above their respective averages, reflecting ongoing weakness and suggesting that market momentum is still in search of firm footing. A sustained move above 22,650 could pave the way for further upside in the upcoming session. The 50% Fibonacci retracement level at 22,800 remains a key resistance to watch, he added.

VLA Ambala, Co-Founder of Stock Market Today, highlighted that after the gap opening, the Nifty 50 moved in a 300-point range and formed a “high-wave doji” candlestick pattern on the daily chart.

“Amid these ongoing market developments, Nifty 50 can find support between 22,270 and 23,400 and meet resistance near 22,930 and 23,000,” said Ambala

Intensify Research Services is a professional stock consultive firm in Indore in share market latest news. We provide expert investment advice and guidance to individuals and High Net-Worth Individuals (HNIs), valuable trading tips and strategies for maximum profit. Visit us at Intensify Research Services to learn more.

#sharemarketing#stockinvestment#stock market#shareinvestor#sharetrader#sharemarket#stocks#sharetrading#share this post#investment

0 notes

Text

Stock market outlook for Monday | Parkavi Finance

Monday market forecast | Stock market technical analysis | Parkavi Finance market update

Get detailed insights into Monday’s stock market outlook. Will Nifty and Bank Nifty show bullish momentum or face a correction? This video covers key factors such as FIIs selling, DIIs buying, and crucial technical levels for Nifty and Bank Nifty. Stay informed with our comprehensive market forecast for the week ahead.

Topics covered in this video:

Quick recap of last week's Dalal Street Week Ahead video: Reviewing last week's market performance and how it sets the stage for this week.

Recap of Markets last week: Key insights into the movements of Nifty50, Midcap, and NSE500, highlighting trends and opportunities.

FIIs selling impact & DIIs buying

DII & FII Activities: Analyzing how continuous FIIs selling and DIIs buying are impacting the market's momentum.

Nifty prediction & Bank Nifty forecast

Nifty in Uncharted Territory: A closer look at Nifty’s current technical levels with focus on support and resistance zones—Is a breakout or correction on the horizon? Nifty support and resistance

Global market cues

Global Cues and Economic Data: Understanding how factors like U.S. jobless claims data, inflation rates, and global market cues might affect Nifty and Bank Nifty.

Read English article: https://www.parkavifinance.com/2024/10/stock-market-predictions-for-monday.html

Watch Tamil video: https://youtu.be/SgQXFtL_LHs

Watch English video: https://youtu.be/gq3cRYqFrf0

Read Tamil article: https://tamilparkavifinance.blogspot.com/2024/10/nifty-bank-nifty-weekly-forecast-will.html

Detailed stock market outlook for Monday. Learn about Nifty and Bank Nifty’s key technical levels, FIIs selling, DIIs buying, and global economic cues. Stay updated with our weekly market forecast. Watch the video and read the articles for complete insights.

#MarketThisWeek #NiftyPrediction#BankNiftyForecast #FIISelling #DIIBuying#StockMarketOutlook #TechnicalAnalysis#GlobalCues #MondayMarketForecast#ParkaviFinance #tamilshare

1 note

·

View note

Text

[ad_1] Infosys is up against high expectations as investors increasingly fret over a potential market correction. | Representational4 min read Last Updated : Oct 11 2024 | 7:38 AM IST By Harshita Swaminathan, Rachel Yeo, Reina Sasaki and Justina T Lee Infosys Ltd., Wipro Ltd. and HCL Technologies Ltd. are up against high expectations as investors increasingly fret over a potential market correction. Click here to connect with us on WhatsApp The 2025 financial year has been seen as one of recovery for Indian IT companies after a slowdown in spending from US-based clients brought revenue growth down to the low single-digits in the previous year. While April-June quarter earnings did show an improvement, elevated full-year expectations might prove hard to beat. “While demand is improving, it is not beating existing estimates,” analysts at HSBC Global Research wrote. The recovery seen so far in banking, media and telecommunications won’t be enough to beat consensus views, they said. Commentary on the effects of rate cuts and the finalization of 2025 budgets from some US firms will be key. This is against a backdrop of speculation of a looming market correction in India, amplifying the scrutiny on whether earnings across sectors can justify expensive valuations after the Nifty 50’s bull run in the past year, especially after larger rival Tata Consultancy Services Ltd. missed profit expectations on Thursday. Elsewhere in Asia, Taiwan Semiconductor Manufacturing Co. and Contemporary Amperex Technology Co. also likely emerged from their own challenges. TSMC saw a better-than-expected 39 per cent rise in quarterly revenue ahead of its full results, amid concerns on whether AI-driven growth momentum will last. CATL is set to have pushed through intense battery competition to post accelerating profit growth. Highlights to look out for: Saturday: Avenue Supermarts (DMART IN) likely saw double-digit profit growth in the second quarter, although slower store additions may affect future earnings. The company already reported a 14 per cent rise in revenue from operations in the period, lower than Citi’s estimate of 19 per cent. Citi added it’s cautious about earnings as an adverse product mix may have hurt the gross margin. Monday: HCL Technologies (HCLT IN) should maintain full-year services revenue growth guidance of 3 per cent to 5 per cent, Nuvama Institutional Equities said. HCL’s near-term expansion may be held back by cautious discretionary IT spending by telecommunications, media and technology clients, Bloomberg Intelligence said. Reliance Industries’ (RELIANCE IN) earnings were likely helped by Jio’s price hikes, which made the digital services segment’s revenue the fastest-growing among all its verticals. Still, the mainstay petrochemicals businesses, which brings in the biggest revenue share, likely saw profit dip. Refining margins also probably more than halved, analysts at Emkay Research wrote. Thursday: Infosys (INFO IN) is widely expected to raise its full-year revenue guidance closer to market consensus, while Wipro’s (WPRO IN) report is expected to be less eventful. Commentary on opportunities for projects related to generative artificial intelligence will be closely watched. Consensus estimates predict margins should expand for both companies, which analysts at Emkay Research attribute to absence of visa costs and expense-optimization measures across the sector. TSMC (2330 TT) is expected to weather challenges from softer demand for Apple Inc.’s iPhone 16, potentially denting chip orders. The firm is expected to reiterate healthy fourth-quarter revenue guidance, JPMorgan said. Delays in Nvidia Corp.’s Blackwell chips and how that would impact TSMC will also be in focus. Nestle India (NEST IN) will probably report single-digit quarterly sales growth, consensus estimates show. The firm likely implemented price hikes in response to rising commodity prices, analysts at Motilal Oswal said.

Friday: CATL (300750 CH) probably saw strong quarterly growth, even as global battery demand and prices fell. The battery manufacturing company’s scale and cost advantages contributed to margin stability, allowing it to fend off intense competition, while new growth is generated from the energy-storage business, said BI. Building on its electric car battery success, the firm has unveiled new technologies for heavy-duty vehicles.First Published: Oct 11 2024 | 7:38 AM IST [ad_2] Source link

0 notes

Text

[ad_1] Infosys is up against high expectations as investors increasingly fret over a potential market correction. | Representational4 min read Last Updated : Oct 11 2024 | 7:38 AM IST By Harshita Swaminathan, Rachel Yeo, Reina Sasaki and Justina T Lee Infosys Ltd., Wipro Ltd. and HCL Technologies Ltd. are up against high expectations as investors increasingly fret over a potential market correction. Click here to connect with us on WhatsApp The 2025 financial year has been seen as one of recovery for Indian IT companies after a slowdown in spending from US-based clients brought revenue growth down to the low single-digits in the previous year. While April-June quarter earnings did show an improvement, elevated full-year expectations might prove hard to beat. “While demand is improving, it is not beating existing estimates,” analysts at HSBC Global Research wrote. The recovery seen so far in banking, media and telecommunications won’t be enough to beat consensus views, they said. Commentary on the effects of rate cuts and the finalization of 2025 budgets from some US firms will be key. This is against a backdrop of speculation of a looming market correction in India, amplifying the scrutiny on whether earnings across sectors can justify expensive valuations after the Nifty 50’s bull run in the past year, especially after larger rival Tata Consultancy Services Ltd. missed profit expectations on Thursday. Elsewhere in Asia, Taiwan Semiconductor Manufacturing Co. and Contemporary Amperex Technology Co. also likely emerged from their own challenges. TSMC saw a better-than-expected 39 per cent rise in quarterly revenue ahead of its full results, amid concerns on whether AI-driven growth momentum will last. CATL is set to have pushed through intense battery competition to post accelerating profit growth. Highlights to look out for: Saturday: Avenue Supermarts (DMART IN) likely saw double-digit profit growth in the second quarter, although slower store additions may affect future earnings. The company already reported a 14 per cent rise in revenue from operations in the period, lower than Citi’s estimate of 19 per cent. Citi added it’s cautious about earnings as an adverse product mix may have hurt the gross margin. Monday: HCL Technologies (HCLT IN) should maintain full-year services revenue growth guidance of 3 per cent to 5 per cent, Nuvama Institutional Equities said. HCL’s near-term expansion may be held back by cautious discretionary IT spending by telecommunications, media and technology clients, Bloomberg Intelligence said. Reliance Industries’ (RELIANCE IN) earnings were likely helped by Jio’s price hikes, which made the digital services segment’s revenue the fastest-growing among all its verticals. Still, the mainstay petrochemicals businesses, which brings in the biggest revenue share, likely saw profit dip. Refining margins also probably more than halved, analysts at Emkay Research wrote. Thursday: Infosys (INFO IN) is widely expected to raise its full-year revenue guidance closer to market consensus, while Wipro’s (WPRO IN) report is expected to be less eventful. Commentary on opportunities for projects related to generative artificial intelligence will be closely watched. Consensus estimates predict margins should expand for both companies, which analysts at Emkay Research attribute to absence of visa costs and expense-optimization measures across the sector. TSMC (2330 TT) is expected to weather challenges from softer demand for Apple Inc.’s iPhone 16, potentially denting chip orders. The firm is expected to reiterate healthy fourth-quarter revenue guidance, JPMorgan said. Delays in Nvidia Corp.’s Blackwell chips and how that would impact TSMC will also be in focus. Nestle India (NEST IN) will probably report single-digit quarterly sales growth, consensus estimates show. The firm likely implemented price hikes in response to rising commodity prices, analysts at Motilal Oswal said.

Friday: CATL (300750 CH) probably saw strong quarterly growth, even as global battery demand and prices fell. The battery manufacturing company’s scale and cost advantages contributed to margin stability, allowing it to fend off intense competition, while new growth is generated from the energy-storage business, said BI. Building on its electric car battery success, the firm has unveiled new technologies for heavy-duty vehicles.First Published: Oct 11 2024 | 7:38 AM IST [ad_2] Source link

0 notes

Text

[ad_1] Understanding choices buying and selling will be difficult, however understanding the basics akin to expiry dates might help merchants navigate by way of it with extra ease. Expiry dates decide when an choices contract will develop into invalid and are essential for planning your buying and selling technique. There are numerous weekly, month-to-month, quarterly, and long-term expiries with distinct benefits and drawbacks. On this article, we’ll discover the assorted varieties of expiry in choices buying and selling that will help you make knowledgeable selections. Sorts of Expiry in Choices Buying and selling One of many basic ideas in possibility buying and selling fundamentals is knowing expiry dates. Choices buying and selling has several types of expiry as beneath: 1. Month-to-month Expiry Month-to-month expiry in choices buying and selling in India refers to contracts that expire on the final Thursday of each month. Merchants use these month-to-month expiries to align their methods with longer-term market actions and traits. The predictability of the month-to-month expiry date permits for higher planning and execution of trades, making it a well-liked alternative amongst those that want a extra prolonged time horizon for his or her choices positions. This sort of expiration is especially essential for managing danger and optimizing returns inside the choices market. 2. Weekly Expiry Weekly expiry in choices buying and selling refers to contracts that expire on particular days of the week, relying on the index or inventory. For example, NIFTY choices expire each Thursday, BANKNIFTY choices each Wednesday, FINNIFTY choices each Tuesday, MIDCAP NIFTY choices each Monday, SENSEX choices each Friday, and BANKEX choices each Monday. This frequent expiry schedule permits merchants to capitalize on short-term market actions and volatility thereby permitting extra alternatives for buying and selling and hedging. Weekly expirations are particularly well-liked amongst energetic merchants who wish to exploit fast market modifications since they provide flexibility in addition to potential fast features. 3. Contract Cycles Contract cycles seek advice from the completely different durations for which choices contracts can be found earlier than they expire. These cycles are categorized into three sorts: Close to Month, Subsequent Month, and Far Month. Close to Month contracts have 30 days or much less till expiry, Subsequent Month contracts have 60 days or much less, and Far Month contracts have 90 days or much less. This classification permits merchants to decide on contracts based mostly on their most popular time horizon and danger tolerance. By providing varied contract cycles, the market offers flexibility for each short-term and long-term buying and selling methods, enabling merchants to align their positions with their market outlook and commerce objectives. Conclusion Understanding the several types of expiry in choices buying and selling might help you make extra knowledgeable selections and align your methods together with your buying and selling objectives. Weekly, month-to-month, and contract Cycles expiries every provide distinctive benefits and dangers, so select the one that matches your wants greatest. For extra complete studying, go for inventory market programs in Hindi and English on Upsurge.membership to deepen your information and improve your buying and selling abilities. [ad_2] Supply hyperlink

0 notes

Text

Nifty Prediction For Monday, April 15: Will Market Extend Gains? GIFT Nifty Indicates Gap-Up Open

Last Updated:April 14, 2025, 13:22 IST Nifty Prediction For Tomorrow: GIFT Nifty up 246 points hints at strong start for Nifty on April 15; Global cues, earnings in focus Nifty Prediction For Tomorrow: GIFT Nifty up 246 points hints at strong start for Nifty on April 15 GIFT Nifty Signals Positive Start for Nifty on April 15: On April 14, while domestic equity markets remained closed in…

0 notes

Video

youtube

Nifty Prediction For Monday | 1 July 2024 | Intraday Trading Good Idea ...

For more knowledge about Nifty trading please subscribe, like and follow this channel #nifty live trading #bank nifty live trading #live trading bank nifty #nifty live trading today #live trading #option trading #nifty #live day trading #live options trading #live intraday trading #bank nifty option trading strategy#nifty prediction #trading options live

0 notes

Text

Trade Setup For July 23: Nifty Dips Amid Budget Anticipation, Analysts Predict Volatility

The Nifty ended slightly lower at 24,509 on Monday, as the markets remained cautious a day prior to the Union budget announcement and with the growth forecast in the economic survey released during the day. The broader market indices—Nifty Midcap 100 and Nifty Small Cap 100—outperformed the headline indices and closed higher by around 1%. Auto, metals and pharma gained more than 1%, while IT,FMCG, realty and energy were the sectors that lost to the tune of 0.5%. From a technical standpoint, the market is currently exhibiting non-directional activity around the 24,500/80,400 level following a reversal formation. "With Budget Day looming, we anticipate heightened volatility. The 24,500/80,400 level serves as critical support for the bulls, while 24,850/81,600 could pose as the primary resistance zone for traders," according to Shrikant Chouhan, head of equity research at Kotak Securities.

Chouhan recommends reducing long positions during rallies as long as the market is trading below 24,850/81,600. "Buying is advisable only at major support levels (24,150/79,000 and 24,000/78,600) with a medium- to long-term perspective. If the market surpasses 24,850/81,600, it has the potential to advance towards 25,000/82,000 and 25,300/83,000 levels," he said. According to Siddhartha Khemka,head of retail research at Motilal Oswal Financial Services Ltd., "Though the budget is largely expected to be growth-oriented, with the announcement of some measures aimed at addressing rural economies, this is largely factored in by the market. Investors will look out for signs of further traction." He expects "some volatility, along with sector- and stock-specific actions," on Tuesday. As long as the index remains below 24,855, a sell-on-rise strategy needs to be adopted in Nifty, according to Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

0 notes

Text

Nifty 50, Sensex today: What to expect from Indian stock market in trade on March 10

The Indian stock market benchmark indices, Sensex and Nifty 50, are likely to open lower on Monday, tracking mixed cues from global markets.

The trends on Gift Nifty also indicate a negative start for the Indian benchmark index. The Gift Nifty was trading around 22,605 level, a discount of nearly 45 points from the Nifty futures’ previous close.

On Friday, the domestic equity market ended flat, with the Nifty 50 holding above 22,550.

The Sensex eased 0.01%, to close at 74,332.58, while the Nifty 50 settled 7.80 points, or 0.03%, higher at 22,552.50.

Here’s what to expect from Sensex, Nifty 50 and Bank Nifty today:

Sensex Prediction

Sensex has formed a reversal formation on both daily and weekly charts, supporting a further uptrend from the current levels

“A long bullish candle on the weekly charts and an uptrend continuation formation on intraday charts also support the uptrend. We are of the view that 74,000 and 73,700 would be key support zones for positional traders. If Sensex succeeds in trading above these levels, it could bounce back to the 20-day SMA or 75,200. Further upside may continue, potentially lifting the indices up to 75,700,” said Amol Athawale, VP-Technical Research, Kotak Securities.

On the flip side, he believes if Sensex falls below 73,700, the sentiment could change, and traders may prefer to exit their long positions.

Nifty OI Data

The derivatives market indicates a cautiously optimistic outlook, with put writers demonstrating greater conviction than call writers, signaling growing confidence among market participants.

“Substantial open interest at the 22,800-call strike (84.88 lakh contracts) solidifies this level as a critical resistance point. Conversely, strong put writing at the 22,300 strike (84.98 lakh contracts) establishes a solid support level. The 22,500–22,000 range is witnessing robust put writing, while higher strike call writing further reinforces the building bullish sentiment,” said Dhupesh Dhameja, Derivatives Analyst, SAMCO Securities.

Though the Put-Call Ratio (PCR) has dipped marginally from 1.18 to 1.09, it still highlights the improving market outlook. The Max Pain level at 22,500 suggests that bulls are likely to continue absorbing selling pressure despite market fluctuations, he added.

Nifty 50 Prediction

Nifty 50 shifted into a consolidation movement with range bound action on March 7 and closed the day higher by 7 points. Over the past week, Nifty 50 has surged 1.93%, highlighting a bullish undertone.

“A small positive candle was formed on the daily chart with a reasonable upper shadow. Technically, this market action signals a consolidation movement at the overhead resistance. The immediate hurdle of opening the downside gap of 28th February has been filled and Nifty 50 closed above it at 22,500 levels,” said Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities.

According to him, the underlying short-term trend of Nifty 50 remains positive and a sharp move above 22,750–22,800 levels is likely to bring bulls back into action. Any dips from here could find support around 22,250 levels.

Om Mehra, Technical Analyst, SAMCO Securities, noted that the daily MACD is on the cusp of a positive crossover, which could reinforce upward momentum and potentially lead to the filling of the unfilled gap above 22,668.

“Any minor retracement towards the 22,430–22,450 zone will likely present an attractive buying opportunity, aligning with the ongoing recovery. The 20 DMA, currently placed at 22,750, serves as a crucial resistance level. Meanwhile, market breadth continues to improve, indicating that the broader trend is poised to remain neutral to positive in the near term,” Mehra said.

VLA Ambala, Co-Founder of Stock Market Today, highlighted that the Nifty 50 formed a High Wave candlestick pattern on the daily chart, while on the weekly chart, it formed a bullish Belt Hold candlestick pattern, with its RSI at 40.

“Currently, the Nifty index faces crucial resistance at 22,720. However, if the index closes above this level, it could test the 23,000 mark within 1 to 2 weeks. We must view this situation as a pullback movement, as the overall trend remains downward. However, traders may consider a sell-on-rise strategy if prices rise toward 23,500. Nifty can expect support between 22,450 and 22,380, while resistance can be found near 22,730 and 22,900 in the next session,” said Ambala.

Bank Nifty Prediction

Bank Nifty concluded the session at 48,497.50, registering a decline of 0.27%. However, on a weekly basis, the index managed to edge up by 0.32%, indicating a phase of consolidation within a broader range of 47,840 to 48,840.

“Bank Nifty has found support at the horizontal zone of 47,800, which aligns with the 100-week EMA (Exponential Moving Average). Following three consecutive weeks of negative closing and a volatile trading week, the Bank Nifty index managed to close in positive territory. However, it remains below the 21-day and 55-day EMAs. The immediate resistance is placed at 48,900, coinciding with the 21-day EMA. A breakout above this level could drive the index towards 49,500,” said Puneet Singhania, Director at Master Trust Group.

The RSI is currently at 42, indicating weak momentum. A breach below 47,800 may lead to further downside toward 47,200. Considering the prevailing technical setup, the preferred strategy would be to sell on a rise near resistance levels, Singhania added.

Om Mehra notes that on the hourly chart, the Bank Nifty index is positioned near a descending trendline, which aligns with the hourly Supertrend indicator at 48,720.

“A decisive breakout above this level could trigger a fresh upward move, potentially driving the index towards the 49,000 mark. The immediate support is placed at 48,200, with a critical cushion at 48,120. The broader structure suggests a consolidative bias, where a breach of key resistance levels could pave the way for renewed bullish momentum,” said Mehra.

Intensify research services At Intensify Research, we specialize in identifying Best SEBI registered research analyst indore. that provide stable, Top high accuracy stock market tips site for investor. the best low risk investment options long-term growth. .In Invest confidently and watch your money grow with our carefully curated recommendations.To visit- intensify research.com »

#sharemarketing#sharetrading#sharemarket#investment#shareinvestor#stockinvestment#stock market#stocks#share this post#sharetrader

0 notes

Text

Maharashtra Election Results: A New Chapter for the Indian Stock Market?

https://businessviewpointmagazine.com/wp-content/uploads/2024/11/1-Maharashtra-Election-Results_-A-New-Chapter-for-the-Indian-Stock-Market_-Source-business-standard.com_.jpg

Latest News

News

Stock Market Update: Nifty 50 Movement, Trade Setup, and Top Stock Picks

News

Markets on Edge: Indian Indices Dip, Bitcoin Hits Record, and Global Trends Shape the Week Ahead

News

BlueStone Jewellery Plans ₹1,000 Crore IPO with Fresh Issue and OFS

Positive Sentiment Boosts Market Outlook

The decisive victory of the BJP-led National Democratic Alliance (NDA) in the Maharashtra election result for the 2024 Assembly Elections has sparked discussions about its implications for the Indian stock market. Market analysts predict a surge in investor confidence and a shift toward aggressive investment strategies, marking a departure from the defensive approach adopted after the Lok Sabha elections. The strong mandate is expected to provide political stability and continuity, fostering a conducive environment for economic growth.

According to Palka Arora Chopra, Director at Master Capital Services, the pro-business policies championed by the BJP are set to favor sectors like infrastructure, urban development, and manufacturing. “This result is likely to instill confidence among investors, as political stability often correlates with a bullish market sentiment,” she noted.

Santosh Meena, Head of Research at Swastika Investmart, echoed similar views, stating, “The market already rallied on Friday in anticipation of this victory. With the official results confirming the NDA’s dominance, we expect a continuation of this trend as markets resume trading on Monday.”

Sectoral Focus Shifts to Infrastructure, Banking, and Railways

The Maharashtra election results are expected to steer investors toward infrastructure, banking, and railway stocks. Mahesh M Ojha, AVP of Research at Hensex Securities, highlighted a potential shift in market strategy. “Previously, investors gravitated toward defensive sectors like FMCG and pharmaceuticals. Now, the focus may pivot to infrastructure and railways, areas of keen interest for both central and state governments,” he said.

Avinash Gorakshkar, Head of Research at Profitmart Securities, emphasized the ripple effect on banking stocks. “With infrastructure companies requiring substantial credit lines, banking stocks could witness heightened activity. The government’s focus on rail and infra projects will likely drive these sectors’ growth,” he explained.

This renewed focus on development-oriented sectors aligns with the BJP’s agenda, which has consistently prioritized infrastructure and economic reforms. Analysts believe that a stable government in Maharashtra will enable seamless execution of these projects, further solidifying investor trust.

Technical Indicators Point Toward a Rally

On the technical front, stock indices are showing signs of a bullish trend. Santosh Meena noted, “The Nifty index has rebounded strongly, finding support at 23,200, a critical level aligned with the 61.8% retracement of its previous rally. Reclaiming the 200-DMA with a bullish candlestick formation indicates a potential trend reversal.” He added that a breakout above the immediate resistance at 24,030 could propel the Nifty to 24,550 or even 25,000 levels. Similarly, Bank Nifty’s resilience near its 200-DMA underscores strong support, with resistance zones at 51,300–53,300.

The optimistic outlook stems from both the political certainty brought by the Maharashtra election results and the technical resilience of the market. With pro-business policies likely to dominate the government’s agenda, experts anticipate a period of robust market activity, particularly in development-focused sectors.

As markets open on Monday, investors will closely monitor these trends, seeking opportunities in sectors aligned with the government’s priorities. The Maharashtra election results not only reflect a political mandate but also signal a promising phase for the Indian economy and its financial markets.

#india#chowkidarchorhai#narendramodi#maharashtra#amitshah#arunjetly#modimadedisaster#manoharparrikar#sushmaswaraj#kejriwal#yogguru#jumlaparty#chowkidarpurechorhai#bjpfails

0 notes

Text

Election Euphoria: Indian Stocks Hit All-Time Highs!

On Monday, June 3, 2024, the Indian stock markets experienced an unprecedented surge that sent waves through the financial world. Driven by optimistic exit polls predicting a decisive victory for the Bharatiya Janata Party (BJP)-led National Democratic Alliance (NDA) in the Lok Sabha elections, robust economic indicators, and positive global cues, the Nifty 50 and Sensex soared to record…

View On WordPress

0 notes

Text

📊 The Ultimate Guide to Statistical Analysis in Stock Markets (2025)

Stock markets thrive on numbers, patterns, and probabilities. But how can investors decode the chaos? This complete guide breaks down statistical analysis in stock markets, showing how professionals—from Wall Street to Dalal Street—leverage data-driven strategies for smarter investing 📈. Whether you're a beginner or a pro, understanding these statistical foundations can sharpen your market game 🚀.

🤔 Why Is Statistical Analysis the Backbone of Stock Trading Success?

Markets are unpredictable, yet patterns emerge when data is analyzed statistically. Statistical analysis helps investors:

✅ Identify trends and market cycles ✅ Test trading hypotheses ✅ Manage risk effectively

Take the Indian stock market: Between 2008 and 2020, the Nifty 50 showed cyclical trends that technical traders exploited using regression models and time series analysis. Legendary economist Eugene Fama's Efficient Market Hypothesis (EMH) suggested markets are fully efficient—but in India, multiple studies (IIM Ahmedabad, 2019) revealed semi-strong efficiency, meaning room exists for statistical arbitrage.

A real-world case? The 2020 pandemic crash. Traders using statistical volatility models like GARCH (Generalized Autoregressive Conditional Heteroskedasticity) successfully predicted sharp rebounds in sectors like Pharma, outpacing the Nifty’s average recovery.

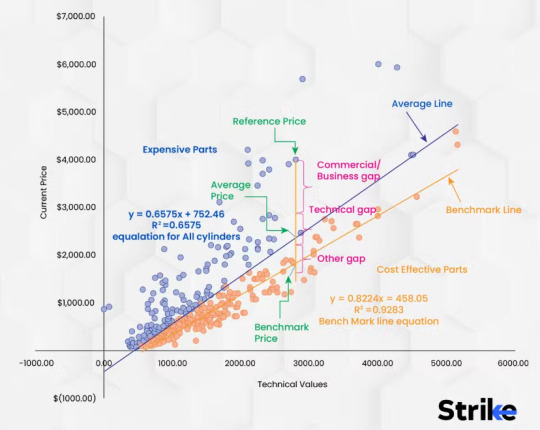

🧮 The Essential Statistical Methods Every Trader Must Know

Statistical tools aren't optional—they're your toolkit 🧰. Here’s what powers market decisions:

✨ Probability Theory: The backbone of predicting outcomes. For example, when Infosys announces earnings, traders calculate probabilities of price jumps based on historical volatility.

🔍 Regression Analysis: Measures relationships between variables. ICICI Bank’s stock might be regressed against interest rate changes to forecast movements.

🎯 Hypothesis Testing: Checks if trading strategies outperform random chance. A popular hypothesis? "Does the 'Monday Effect' (stocks dip on Mondays) hold in the Indian context?" Research from NSE (2021) showed a weak but noticeable pattern in small-cap stocks.

📈 Time Series Analysis: Stock prices are time-bound data. ARIMA models (AutoRegressive Integrated Moving Average) are used to forecast indices like the Sensex, especially during high-volatility periods.

🔬 Deep Dive: Powerful Statistical Models for Stock Market Forecasting

Want to predict where the market is heading? These models lead the way:

🌀 AR and ARIMA Models: Applied to the Nifty’s closing prices, ARIMA has shown strong predictive accuracy during stable periods (source: RBI Bulletin, 2022).

🎲 Monte Carlo Simulations: Imagine simulating 10,000 possible paths for Tata Motors’ stock—this model does exactly that. Fund managers use it to price derivatives and stress-test portfolios.

⚖️ Black-Scholes Model: Essential for options trading. Indian traders frequently apply it when dealing with Nifty options, calculating fair prices and hedging effectively.

📊 CAPM (Capital Asset Pricing Model): Helps calculate expected returns. For instance, HDFC’s Beta (measure of volatility) relative to the Nifty is key to understanding its risk profile.

These models aren't abstract—they're integrated into tools like Strike Money, a robust charting and analysis platform many Indian traders rely on to visualize and backtest these statistical strategies in real time 📊.

🚨 Mastering Risk Management and Portfolio Optimization with Statistics

Markets are thrilling—but risky. Statistical analysis allows traders to balance risk and return smartly.

💼 Harry Markowitz’s Modern Portfolio Theory (MPT): Emphasizes diversification. Indian mutual funds apply MPT rigorously to create balanced portfolios across sectors like IT, Pharma, and FMCG.

📏 Sharpe Ratio: Measures returns adjusted for risk. Between 2015-2020, Axis Bluechip Fund maintained a Sharpe ratio of 1.4—higher than the market average—making it a popular choice.

⚠️ Value at Risk (VaR): Predicts potential loss. During the 2020 market crash, institutional investors used VaR to recalibrate exposure to sectors like Aviation and Tourism.

By applying these concepts through charting tools like Strike Money, retail investors can access institutional-level risk metrics, making smarter, data-driven decisions.

🤖 How Machine Learning is Supercharging Statistical Analysis in the Indian Market

We’re entering a new era: AI and machine learning (ML) are redefining statistical analysis.

In India, quant funds and tech-savvy traders use ML models like Random Forests and Neural Networks to sift through terabytes of data. Notably, Renaissance Technologies, the world's top quant hedge fund, inspired Indian quant startups (e.g., Qplum, Algonauts) to blend traditional statistics with deep learning for advanced predictions.

A 2023 study by IIT Bombay demonstrated that ML models outperform traditional ARIMA during volatile periods by 15%, especially in mid-cap stocks.

Strike Money has also rolled out ML-integrated tools that allow users to build and test AI-powered trading models—bringing Wall Street-level tech to Indian traders 🇮🇳.

⚠️ Why Statistical Models Sometimes Fail—and What You Can Do About It

Statistics isn’t magic ✋. Even the best models have pitfalls:

❗ Overfitting: A model fits historical data too closely but fails in real time. Example: A 2018 backtest on Bank Nifty showed a 200% return—yet the live strategy flopped due to overfitting biases.

❗ Data Snooping Bias: Testing so many variables that one “appears” to work by chance. Traders should guard against this by using out-of-sample testing.

📉 Market Shifts: The 2016 demonetization in India broke many statistical models as liquidity and patterns shifted overnight—highlighting that no model can predict black swan events.

A smart way to mitigate? Regularly recalibrate your models using updated data—Strike Money makes this refresh seamless, ensuring your strategy evolves with the market 🔄.

🚀 Tools, Data, and Learning Paths to Get Started with Statistical Trading

Ready to dive in? Here's how to start strong in statistical stock trading:

💻 Tools You Need:

Strike Money: Charting + backtesting powerhouse with India-specific data

Bloomberg Terminal & Reuters Eikon: Institutional-grade data feeds

Yahoo Finance API: Free, good for beginners

🧑💻 Languages to Learn: Python & R are the gold standards for statistical computing. Indian communities on GitHub and Stack Overflow are thriving, making learning collaborative.

📚 Where to Learn:

CFA Institute: Financial statistics modules

Coursera & edX: Courses like “Financial Engineering & Risk Management”

Indian forums: Traderji, Zerodha Varsity

A 2024 SEBI report showed that over 65% of active traders in India now use some form of quantitative/statistical method—a testament to the growing importance of this skill 💥.

🔑 Final Thoughts: Why Statistical Analysis is Your Trading Superpower

The stock market is part art, part science—but the science part is increasingly statistical. By mastering techniques like regression, time series forecasting, and risk metrics, you can turn random noise into actionable insights. The Indian stock market—rich with data and opportunity—offers a playground for those equipped with the right tools and mindset.

Platforms like Strike Money democratize access, allowing retail investors to harness the same models once reserved for elite institutions. Whether you're trading Nifty futures or small-cap stocks, remember: In the world of investing, data doesn’t lie—but how you interpret it makes all the difference 🔍📈.

0 notes

Text

Nifty Prediction : Nifty may see some dips | Buy on dips | Look for opportunities at upper levels

Daily Forecast – Share Market – March 22nd, 2024 Nifty may see some dips | Buy on dips | Look for opportunities at upper levels Last working day before one long weekend. Monday, because of Holi festival, markets will be Continue reading Nifty Prediction : Nifty may see some dips | Buy on dips | Look for opportunities at upper levels

View On WordPress

0 notes