#Not having either on iterators can be a unique challenge that forces me to practice my body language more

Text

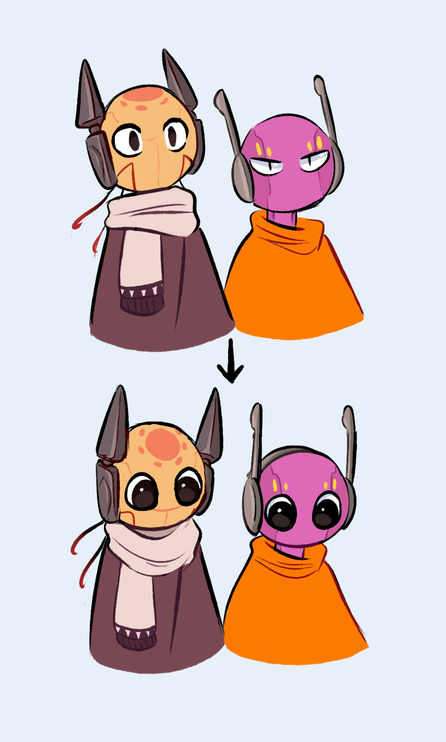

Experiments with pupils and mouths that devolved into shenanigans :)

#you can really tell I was having a normal one when I drew these#I like many of the pupil experiments but don't really like mouths on my iterators#i've seen some people do mouths on itties well though#...really enjoyed noisy cat spearmaster with a mouth tbh#no plans on changing how i usually draw things rn. this was just for fun#Sometimes I miss having pupils and mouths to work with (on slugcats and itties)#Not having either on iterators can be a unique challenge that forces me to practice my body language more#which I like drawing anyways so it works out#antennae are suuuper fun to use for expressions too#rain world#flickerdoodles#art#group pic

2K notes

·

View notes

Text

Simpleplanes mac

#Simpleplanes mac for free

#Simpleplanes mac install

#Simpleplanes mac mods

#Simpleplanes mac simulator

Nadia Oxford, a writer for Gamezebo gave SimplePlanes a 4/5 for its realistic flight challenges, sandbox mode and the amount of building options. The biggest issue critics had was the process of building. SimplePlanes received 'mixed or average' reviews, according to Metacritic, where it garnered a score of 67/100. The challenges involve short tutorial-type activities (such as the 'take-off tutorial' and the 'landing tutorial') but can get more advanced with missions (such as 'SAM Evasion' (a 4 stage level which gets increasingly difficult) and 'Trench Run' (a race through a canyon-like area on the game map) > There are also weapons (bombs, wing guns and miniguns, missiles, rockets and torpedoes) in the game for the player to use on their creations. SimplePlanes contains challenges which the player can do. The game also gives players the ability to build cars, boats, trains and mechanical objects. Each island has a unique name, such as Maywar, Krakabola, Snowstone or Wright. The five islands each provide a different experience to the player, with interactive targets. When the creation or build is finished, the player can fly/drive/sail it around the map which contains 5 different islands with unique features, (4 on IOS or Android) and/or upload it to the SimplePlanes website. Planes (or other creations) created by the community can also be downloaded from the website. In SimplePlanes the player is given the freedom of building anything they want to create using the materials and objects provided, and players can additionally use XML modifications on their creation.

#Simpleplanes mac mods

Users/ Your Mac user/Library/Application Support// Mods and put it in there. Download the mod, either click on the download or open your file browser. 27 Wright Helipads Kakhikotchauri1 5 days ago. Create Help Parts Maps Tools Backgrounds.

#Simpleplanes mac for free

DOWNLOAD AIRPLANES Over 100,000 airplanes are available to download for free from Find anything from old WW2 bombers to next generation fighters to sci-fi spacecrafts. Design and attach wings and then strap yourself into the cockpit and see how it flies.

#Simpleplanes mac install

Since I'm on Mac, Finder tells me to select an application to install the.spmod file into, and it won't let me select Simpleplanes. I haven't installed any mods yet, and I'm trying to install overload. You might need to have discussions with students about the appropriate use of weapons in any work they do, though.In the main menu, there used to be a mods tab where you could view your mods. Use this before assigning your "build a frisbee-throwing robot" final project as an introduction to the kinds of thinking, iterative processes, trial-and-error, prediction, and collaboration that such work requires.

#Simpleplanes mac simulator

The specifics of aerodynamics might be a stretch for most high school physics classes, but a flight simulator and the prospect of video gaming in class might be enough to hook some kids into getting interested in force vectors, at the very least.įor engineering-flavored physics projects or engineering elective classes, SimplePlanes is a great way to experiment with prototyping and design principles without the mess and material overhead. When discussing centers of mass and motion - and lift, drag, and three-dimensional force generally - you can include this app for some hands-on practice, especially if live demonstrations aren't practical for some reason. You'll need to pair SimplePlanes with solid lessons that dive into the mathematics and dynamic systems at play here.

0 notes

Text

Actually, The Sequel Was Better

Often times, not just in gaming but with entertainment in any medium, there can be a tendency to look upon the first in a series as the definitive, superior entry, with all others to follow damned to never be able to measure up. The original titles gain an almost religious reverence and deference shown to them, with them continuing to be pointed to as the standard bearer for later titles to attempt to measure up to. Sometimes the original may indeed be the superior entry, but often it seems to me this consideration being shown to it truly stems from its place chronologically in the series rather than any objective consideration of its merits compared to the sequels, with the reasons for why being manufactured after the opinion is formed, rather than serving as the basis for it.

I dispute this whole notion. The original games in a series tend to excite because it is our first time being exposed to its various elements: the characters, big picture story of those characters’ world, the core gameplay mechanics, the set of weapons and abilities available, and so on. However, while these elements may be good, often the excitement that’s felt for them has more to do with the sensation of freshness from not having seen these things before compounding on their solid quality, rather than being as purely based on their quality as such “original is the best” devotees would lead you to believe. Essentially, when an original game in a series is good, we all will tend to enjoy a sort of “honeymoon” phase with it where we’re caught up by all its good qualities. Some simply remain in that phase, hence the loyalty to the original.

The problem with such unquestioning loyalty to the originals is that it misses the shortcomings they can and do often have, encouraging a stagnation that never fixes them. The thing about the first iteration of game series is that the ideas are just being tested out for the first time in the wild as it were, and things that overly complicate and slow down character progression, make the pacing of the narrative feel off, don’t satisfy in their depth on customization and so on can be missed during a studios internal testing and never discovered until the trial by fire that is being opened up to gamers to explore. Some of these mistakes could go to misjudgments arising from the studio, whether general bad calls or simply learning the nature of their new IP and what does and doesn’t work in how they should handle it. Other things aren’t mistakes at all in the short term necessarily, but with time giving greater perspective, namely from sequels coming around and improving on the formula, come to feel like mistakes, or it at least feeling like certain elements feel dated because of the various quality-of-life improvements and greater refinement those elements have been able to be shown with time.

On this other end, besides sequels being able to cut those bad or unnecessary elements and refine those solid but imperfect elements, they are also able to benefit from hindsight in having what new elements are introduced to excite players being based off that understanding and more likely to be more consistently well-executed, satisfying and exciting than the new elements in the original, which are inescapably a mix.

Undoubtedly some examples would make this whole case better than exposition, so let’s get into it.

Rock Band 2 is one of the simpler examples of the case I’ve been making. The original felt perfectly fine for its time, but RB2 expanded the base song list in the game natively as well as providing much greater support for expanding on that content with regular new DLC song packs to download, smartly making these available to buy in smaller doses rather than forcing you to buy an entire album or album’s worth of material, undoubtedly making them greater sales from fans more willing to part with a little spare cash for a song they love regularly while also satisfying fans with that formatting so they never felt obligated to have to spend money on unwanted content. This was a clever encouragement for replay value as well: checking back to see what new songs were added, seeing a handful you really enjoyed and getting excited about whacking out the drumbeats of one of these new options or watching your friend and “bandmate” attempt to do its vocals knowing he’d fail hilariously got you excited to play all over again. Speaking of your bandmates, the greatly improved customization system for the look of your characters and your instruments while performing and being able to use that in collaboration with your friends to come up with a look and feel for the in-game band you created together that you all loved was a really simply but greatly satisfying improvement.

Now, Rock Band isn’t a series that I do see the original being revered over the sequels with, but I wanted to bring it up to illustrate the point I was making more clearly about how sequels can benefit from the understanding of how the basics of a game concept have been received.

Now we can turn to a couple case that do more fully deal with the issue I’m talking about. One would be Pokémon. The Red and Blue Versions and the first generation roster of Pokémon are often held up as highlights of the series, not just by fans, but even in practice by those making the newer games, with new pre-evolutions or evolutions or forms for that generation’s Pokémon being implemented in the sequels that have occurred since in far greater numbers and with far greater regularity than any other generation. Yet...those games and that roster actually represent some of the weakest the series has had to offer. With the games more generally, the region design wasn’t particularly interesting in retrospect, there wasn’t much of a story to speak of, the battle mechanics - while not bad for their time - have been greatly outclassed by the later changes made to it, the representation of types was poorly handled in some cases - the one Ghost type line seeming weak to the Psychic types they were on paper supposed to be strong against or Dragon types seeming weaker to Ice than they were because of their only lines final form being extra weak to it, for example, and an extremely limited post-game involving one small new area to explore and one new Legendary Pokémon to catch. The biggest problem with that roster I already mentioned in the mishandling of the type distribution across the different lines in the games, but beyond that is just the simpler facts that subsequent generations have had more interesting designs, better typings and more interesting evolutions methods to attain them.

With almost every single specific element of those original games, putting aside the new features not introduced until later, we can find a sequel generation in that series which did it better: every generation except the fourth has had better region design, third and fifth had excellent world stories while the new eighth generation tells an excellent Gym Challenge-related story, second through fourth - with arguments to be made for others - made needed improvements on the core battle mechanics, basically every subsequent generation has had better type distributions across the new roster, and the second and third generations especially had excellent postgame content with revisiting Kanto for the former and the Battle Frontier for the latter greatly expanding the time you wanted to play beyond the Championship.

All of this, understand, isn’t to say the first generation of games or their roster of new Pokémon were bad, just that in comparison to what has come since, they are far from the pinnacle of what the series stands to offer you and certainly not deserving the infallible status some ascribe to them.

Now, let’s turn from Nintendo’s flagship franchise to Microsoft’s. With Halo it is considered considerably more contentious than with Pokémon to challenge the original’s superiority. To be fair, Combat Evolved stands the test of time better than Red and Blue versions do for Pokémon. The story’s tone of desperation juxtaposed with Master Chief’s badass capabilities and heroism is a great dynamic, which along with the sense of awe looking around the environments and the sense of exploration and decision on which objectives to approach and how all serve to be strong benchmarks for the series to make it a point to reach, either directly or in some equivalent sense. However, the reuse of multiple levels along with the general monotony of the Library level’s design, overly frail allies with questionable decision making hurting their survivability, often confused multiplayer map design that can complicate efforts to strategize with a team, and the overly centralizing Pistol and Scorpion making use of most other weapons and vehicles moot are all rough points to it.

Much was made of Halo 2′s more linear level design and cliffhanger ending, and to some extent not having more time to play as the Chief (though this has died for the most part over time) and it has some of its own unique problems, but what we do have makes it my overall favorite in the series: characters in general are more developed, new characters are interesting, the development of the backstory to your enemies is fantastic and remains relatively unique among all games I’ve played, the level variety is great and your objectives often feel more epic and important. The music within the Campaign is some of the best in the series, arguably its overall best, which does matter given its ties for setting the tone to accompany the narrative. With gameplay, the change to destructible vehicles and the ability to board them both looks cool and provides needed balance to their power while boost added onto Covenant vehicles helps differentiate the feel of them from the human vehicles better. Of course, there was also the addition of dual-wielding to note as well. As I’m a more competitive player, this isn’t something I made much use of personally, but it was aesthetically a really cool thing to be able to do and for my less competitive friends who enjoy the series is something they really loved and have missed since it was cut as a staple element from the series’ gameplay, so it certainly secured its place as a beloved element, too. Last, but certainly not least, is easily the best multiplayer map design the series has ever had. Taken together, this made for Halo 2 to be more satisfying overall - and certainly more satisfying long-term - than its predecessor. Other games in the series have also done various elements better than it, or even better than Halo 2 in some cases as well.

Ditto again on this kind of case when it comes to Sony’s flagship franchise in God of War as well, which notably goes out of its way more than any of the other series I’ve mentioned to not be beholden to the original as anything sacred and a baseline off which to model itself. The results here are telling: with greater character development and a more emotionally-driven story than anyone ever would have expected, a simultaneously more complex and more refined combat system, a satisfying upgrade system, revamped mission structure and much more, it has all the perfect ingredients to not just make it an excellent entry in that series, but the best yet, in spite of being the fifth. If a mentality of “the original is the best” had been held and it had been developed from that perspective, fans of the series and those the newest just drew in all would be devoid of this gem as it is, however.

There are of course other series - many more - to which illustrate my case, but I’ll consider these flagship franchises by the Big Three sufficient to make my case as is. Undoubtedly, you can think of other examples yourself. What all of these go to show is in actuality a relatively simple truth: sequels are often, if we are objective about their qualities, better than the originals and deserve to be respected as such. Being the first doesn’t inherently make something the best; that is only a status we’ve arbitrarily applied to how we approach thinking of games, or perhaps entertainment more broadly. Failing to take an honest look at how well sequels do on these different elements and the impact that has on their overall quality not only negatively impacts the individual gamer, who is preventing themselves from enjoying their games more, but also negatively impacts gaming culture, as it sends the message to developers that stagnation in the further work they do is not only acceptable, but to be encouraged.

When they aren’t encouraged to try bold new ideas they think could improve the formula for what a series stands to offer and instead play it safe, we are denied who knows how many exciting gaming moments we could have otherwise enjoyed, instead left with something akin to the original, but feeling more like a cheap imitation than a true sequel. In this way, that “original is best’ mentality becomes self-fulfilling prophesy, as we inadvertently encourage the very kind of lackluster experiences with sequels that can make the original seem like the best an IP can give us. I think we have a duty as gamers to take a step back more and instead of just being critical of games, also consider being critical of our thought process for how we approach looking at them for this kind of behavior and to rectify that when we find it within ourselves, for the sake of our own happiness and that of the gaming community.

So, the next time you find yourself thinking “the original is best,” look deeper. Maybe it really is. But maybe, just maybe, you’ll be surprised what you find.

-------

Thanks for reading! If you enjoy my content, please consider liking, commenting, following and especially reblogging so it can reach more people. Any support you show is greatly appreciated.

#video games#gaming#online gaming#nintendo#microsoft#sony#pokemon#pokemon red#pokemon blue#pokemon sword#pokemon shield#God of War#rock band#rock band 2#critique#sequels

23 notes

·

View notes

Note

Between KH2 and KH3, which game did you like more, both story and gameplay-wise?

Ah is this that KH2 vs 3 debate I hear is ongoing? Well if you’re in for a sit I can answer that.

Gameplay:

From this angle I quite bluntly find KH2 Final Mix more fun. I’m not going to argue what was arguably better or worse, gameplay preference is a matter of…well preference no matter how many wish to deny this fact.

Not that you do but I”m sure some lover or hater of one will see this and try to retort. o3ob

Anyway; I felt Kh2 final mix was more technical and “harder” if I had to describe the feeling. Like 3 KH2 is normally overly easy but when put on critical mode it’s technicalities shine.I had to learn tactics, I couldn’t spam X or △, and I learned uses for summons. Which I found ironic since the 2 summons are far more useful when you dont initiate their moves.

Like if I let Stitch wander the screen he’ll deflect projectiles and keep my MP full. Chicken Little is a great early Magnet substitute and Peter Pan+Tinker Bell gives you a Phoenix Down.This was an improvement to KH1 in which only Tinker Bell was a spell with decent combat use. 1′s other summons had more supplemental uses imo.

KH3′s summons were nearly win buttons I felt. Simba in particular, while damn spectacle, felt broken. I never bothered to learn them as I didn’t need them. Which I’m sure they have their own uses but I’m not really fond of many control schemes for them so I opt out of it.

In terms of the magic system I felt 2 and 3 were opposites. In KH3 magic is far too powerful, something many have noted. And while you dont ‘have’ to use it that’s not an excuse for a problem. You should choose not to use it not force yourself to ignore it for challenge.

KH2 on the opposite spectrum made magic nearly useless I felt. Many enemies didn’t stun nor have elemental damage. Fire’s AOE animation was good for early Critical game and Blizzard helps that first Hollow Bastion visit but many enemies shrug the base spells off later.In contrast, KH2′s Magnet and Thunder spells can be OP. Reflect in of itself is practically the only spell you’d ever need to use due to it’s nature.

So while many have long rants on either’s magic system I dont really think one trumps the other. each one is equally flawed with issues I dont see ever being addressed.

In terms of keyblade combat I preferred KH2′s because I felt like Sora was automated in 3. I spam X cause I’m a scrub at timing presses (DMC5 is helping me overcome that) and due to this I noticed real quick that Sora’s combos just felt really automated.

Like I’d press X for one hit and get three. In contrast, KH2′s combat is harder. Sora animates combos as fast as my lazy ass can spam X and I’m not floating around like a final fantasy god.

I’m not really sure how to put this feeling into words but I do feel Kh2 keyblades are funner or snappier to combo whereas in KH3 I’m playing a watered down FFXV with it’s hold/press X for combo string.

Both games are so similar outside this issue that I dont see no reason to list likes or dislikes. If anything, from here, KH3 had great quality of life changes. The menu system was easier on the eyes and I’d be a damned soul if I didn’t admit I like switching keyblades mid-combat.

I also really appreciate KH3 finally using Re:Coded’s keyblade ideas. It’s been there since that DS game yet no one every expanded on making keyblades unique since. It was a very foolish step backward to me.

I love that keyblades level up, I love that each one has a preference and the only way that could’ve been better is if they adapted Coded’s system entirely and gave each keyblade (or most) it’s own unique combo.

KH2 quite frankly just falls short in a hindsight perspective since keyblades were “stat sticks” and you only ever chose weaker ones for an ability. Which, back then, was a huge step up from KH1.

So KH3 wins in this area I also dont really hate on Kh2 for it since KH2 is a product of the era. This idea of keyblades growing with you didn’t happen till Re:Coded.

As for Shotlocks…I dont like them. I hated them in BBS and I hate them here. It’s not even a comparison to KH2 type of opinion. I hate Shotlocks, I never use shotlocks so I’m going to skip those.

I mean sure, KH2 had limits but the only limits I use are Knocksmash so I can’t exactly praise KH2′s half of that either.

And when it comes to Forms vs Transformations I think both have pros and cons the other lacks. For example, some Transformations are really cool, I love the hammer weapons or the dual pistols.

I also believe the staff transformation is what KH2′s wisdom form should’ve been in terms of how it does magic or basic attacks.

That said, I also really dislike many second forms keyblades have. I never evolve the pistols into the bazooka, I never turn the hammer into the drill, I have those second forms. It’s to the extent I prefer keyblades that have one form such as the staff.

I’m also not fond of the Kingdom Key’s 2nd form change. It’s a neat throwback and I love the outfit recolor but I dont find it fun to use.

Between the two games my favorite forms are Valor Form, Anti-Form, and the Staff Transformation. Odds are I wont use anything else unless I feel particularly bored.

I might use others more often if KH3 forced me to rely on them for tactics but as of right now it does not. This may change with 3 gets it’s Critical Mode DLC. Similar to how KH2FM forced me to rely on forms I hate like Wisdom or Final.

As a concept I will admit that I dislike transformations. I dont like the idea of keyblades becoming magical swiss army knives. KH3 pulled the idea off better than I expected but I dont like it all the same.

The only, and I mean only, thing I felt KH2 did better was tie forms to a meter. In KH3 the commands appear randomly (and often) and I dont gain consequences for using them.

In KH2 this was tied to your Drive Gauge. You had to plan what you used and this is an issue I felt KH3 had as a whole. Rather than shotlocks, I’d have preferred that Focus Gauge to be reserved for my summons and forms so that I could have better control of what I picked and to reduce how broken they are in-game.

The rest is miscellaneous opinions so I’ll rapid fire:

Gummi Ships: always hated them, BBS did Gummi Ships best. Point goes to KH3 here since I can at least skip most of it.

Minigames: I’ve never found a KH minigame fun. No one wins here

Worlds: KH3 wins this aspect too. World towns have actual people in them and when it uses original plots the worlds are quite good. I also appreciate the power to explore and soft platform again. It gives me a more immersive feeling than later titles ever have. (although I feel KH1 was still better than both here)(entirely because of how many small details/cameos/secrets a KH1 world had compared to sequels)

I dont really have a more technical opinion than that. I do however think Arendelle was a horrendous world and I hate to even be there. For a myriad of reasons….reasons that would be a rant post of it’s own.

Lil Chef: I never use the food. I dont care if it’s a good spot for ingredients. If I want to cook stuff I’ll do some irl or play FFXV.

Enemies: KH3 used nobodies more than KH2 did and I find that a damn crying shame. I also felt Unversed were underutilized. KH2 still takes the point here due to the combat points I mentioned above.

KH3 fodder is prettier and can be more elaborate but KH2 is funner to play and destroy them in so KH2.

The Disney Rides: I don’t use them, they break the game. I do like the choo choo though since it’s situational to specific battles. KH2 has nothing akin to these so there’s no comparison, I just wish the rides could be disabled or that they worked more like the train. (set to key fights)

KH2 vs KH3 Commands: Eh both aren’t that good. KH3 spams you commands to shift through and KH2 has so many for spectacles sake that the games get easy. There is no winner here, if anything KH2 should’ve restricted these like KH3 restricts the Train ride summon.

Final Fantasy: I dont like FF games but I consider the ones of Kh1 part of the main cast. Their alternate KH selves are important to me. The lack and fading of FF over the years is quite honestly something I dislike and 3′s total lack of them is inexcusable to me. KH2 takes this point since I got to at least meet Leon and crew again.

Then there’s the story.

Anyone that’s followed the blog or met me knows I strongly dislike the direction of KH’s story. It’s not a matter of things others debate, I do not like it. I hate it and I’m still teetering on quitting.

I wont even go into the points cause I’ve made a whole series of posts about my story gripes. I wont link them since this isn’t a shameless plug, I just want to iterate that my issues with the story has driven me to make 20+ tangents plus the older more angry rants.

Others liking it is fine I think, I get easily annoyed if someone tries to excuse something out of nostalgia or adoration, but generally anyone that likes it while admitting faults or agreeing to disagree is fine. (you do you folks)

If I had to rank them I feel KH2 is where a lot of issues started and I feel a lot of issues got worse after since the sequels tried to “fix” that mess. If left alone KH2 would’ve been a poorly written entry and a good stopping point for any disillusioned fan.

KH3 as a contrast tied up everything after 2 up til 3 itself. I do not consider the story good, the pacing is very jarring because it lacks a mid point, it’s weighed down by all the BS prior to it.

I do not feel attachment for the “trios” of the series, I find the repetition of them annoying. I find it a shame most have more dev time than the originals they’re cloned based on.

And I frankly dislike Xehanort as a villain. He’s not interesting, his motives seem to switch with several report entries and I dont eve get the satisfaction of ending him like I did Xemnas or Ansem.

I was entirely indifferent to the entirety of this game’s narrative as I played it. Something that worried my friend @blackosprey because I was so tired I could not even care enough to hate it.

I did fine the trios reunions well done. I dislike them for a list of reasons but they were coming back anyway, their fates sucked prior, so those were well done. I finally felt hype when the LW appeared (only to vanish, fuck you nomura) and in the final battle.

The ending was confusing to me. So many got a happy ending so I fail to see the logic of Sora vanishing. The Luxu reveal, which I found fucking hilarious, was the only sequel bait needed.To have Sora just up and die felt like a stupid decision and I’m sure many more found it insulting.

And when mentioning Luxu I dont mean it in a sarcastic fashion. I genuinely find him funnier in retrospect due to this retroactive change. Nearly every line or scene he’s said is now funny as hell because he’s this ancient troll. I consider it the first legitimately earned twist Nomura has made in ages.

Still, KH2′s writing and story isn’t great either. I could rant why, I have ranted why, but despite it’s flaws it was an “ending” to me.So if asked 2 or 3 I will pick 2. The writing in Kh2 is bad for lots of reasons but if I ignore the Ansem reports it’s no a story about Xehanort.

Ignoring one KH2 report let’s me live this simpler story of Sora and a scientist gone mad and the journey to stop him. It had a lot of stupid things or one of the worst “twists for twists sake” moments ever in the ‘two ansems’ reveal.

But still, I can play Kh2 and be in a KHverse where Xehanorts, Keyblade Wars, Ceremonies, timelines, sleeping worlds, data world abuse, and clones upon clones dont exist.

It’s not nostalgia so much as everything I came to dislike was post KH2. KH3 was all about these things I dont like. My favorite for key and nostalgic reasons is KH1, my pick of the question is Kh2.

KH3′s best assets that can’t be contested was it’s graphical evolution. I played KH3 three times back to back due to this, I came away from KH3 wishing KH1 or 2 looked like this. No game prior contests the look.

So all in all, as I reread this, it’s largely a mixed bag. Neither game is grand but I prefer KH2 because combat is more fun to me and it’s not tied down by a narrative and mythology I’ve come to hate.

I can play KH1, CoM, and KH2 and never be annoyed about something I loved going in a direction I hated.

10 notes

·

View notes

Text

CPS Interviews

Interview with Graphic Designer

1. How do you generate ideas?

My ideas often come to me when I'm not sitting down to work. Usually my ideas will be sparked by something I see when I'm driving to work, at the park, or when I'm doing a repetitive task like brushing my teeth. I have noticed that letting my mind wander helps me to come up with creative solutions to problems.

I am very curious and inspired by the difficulties every human faces and the use of creativity to overcome and grow from those experiences. In the past few years, I have had the opportunity to branch out and make connections with people who are creative in different ways. Being able to connect with musicians, garment makers, bakers, and gardeners has opened my eyes to the variety of different ways people express themselves and exercise their creativity, and the necessity of a creative outlet for happiness. These relationships have helped me retain a sense of wonder when going about my daily life, and have inspired me to live in the present, accept my mind wandering, and give myself room to see where my wildest ideas will lead me.

The biggest obstacle I face is fear, particularly a fear of not being able to execute an idea the way I see it in my head. Sometime this holds me back from trying out an idea, but I have found that by reframing my thinking and reminding myself that I will not learn if I do not try, I am able to overcome that feeling of fear. I have started to practice this not only in my art, but also in other areas of my life such as traveling, rock climbing, and trying out new hobbies.

2. What process(es) do you use to solve problems?

Whether it be a problem at work or a problem in my personal life, I try to be as objective as possible and see all sides of a situation. I try to approach solutions analytically, using all the info I have to inform my decisions. For example, I work as a designer for a small restaurant company that has had a decrease in beer sales lately. I am tasked with developing a campaign to help push beer. My first step is determining the target audience. In this case, adults age 21 to 35 (the area of our target demographic that can drink alcohol). Second, I will identify the best platform to convey this message. In our case, we have a high concentration of adults in this demographic on Instagram and Facebook. My best bet is an ad campaign on those platforms. Third, I will determine the correct messaging to help identify our restaurant as a place with not only great beer, but a great experience. We have a promotion where we sell half-priced pints one night each week -- this is appealing to the 21-35 age demographic because they are price sensitive and our restaurants are located in college markets. I will then develop a few different options for designs and text, such as "Half-Off Pints!" or "Pints as low as $1.50" and test each campaign to see which performs better. From there, I will choose the winning campaign to use in future promotions.

I will also have to work with the Operations team and our menu management team to ensure that they are aware and on board with the campaign and ensure that all areas are considered.

Interview with Commercial Real Estate Agent

1. How do you generate ideas?

Ideas can come from anywhere, but as much as I'd like to pretend that I think of my ideas all on my own, they are almost always drawn from one of two places, either something I've seen that inspires my idea, or born out of my own trials of a way to accomplish something. When working to come up with an idea, I really make an effort to come up with something totally unique and on my own. That stems partly from having some success working on my own, but mostly from pride that I believe that I can come up with a great idea without help. It may be the most challenging way to accomplish something, but I feel like its necessary to try my own way first.

When that doesn't work, I look to people who are successful in the field I'm focusing on to see what processes they use to come up with ideas. If I'm struggling with something at work, I talk to more experienced coworkers about what they do, then try to find the parts of their methods that I feel would work for me. Sometimes its necessary to pull heavily from others to get to the idea that you're looking for.

The biggest obstacle I face when coming up with a new idea is when I zero in on one idea that doesn't quite work, but am trying to force it through for some reason. Maybe I feel that I've sunk too much time setting up a process that I don't want to start over, or have written too many pages of a story before realizing that the ending would work better if the character's development was different. Essentially its a fear of wasting time starting over. To avoid this problem, I try to be as unstructured as possible at the beginning and focus on the goals of the idea before putting anything down on paper. Once I know my desired end goal, what I wish to accomplish or what emotion I exactly want to elicit, then its easier to fill in the words, images, or steps that lead to that point.

2. What process(es) do you use to solve problems?

Assuming that this is a more intellectual, less "rush to the emergency room" type of emergency, I take a little bit of time to fully understand the problem, where it stems from, and what a solution may look like. For example, if the problem is that I don't know what to write my short story about, then I know that the solution looks like a a completed short story. If my problem is I need assemble a huge list of leads to contact, then call them and track how my conversations went, then I know that my solution looks like a long spreadsheet full of leads. Once you know what the solution has to look like, its easier to look at the space between there and where I am and figure out the best way to fill it. From there I want to either research or think about how best start my process, really understanding the type of information I need to complete the solution. Form there I start to push forward, filling up the space in the best way I could gather. As I'm working forward, its vital to be constantly evaluating my process. If things aren't going as I want them too then I have to be ok with changing course and starting over. The key for me is to make the big problem into many little problems, so that I feel like I'm making progress and don't feel overwhelmed, plus its easier to solve a tiny problem than a huge one.

Interview with Director of Marketing & Technology

1. How do you generate ideas?

I am a huge ‘brainstormer’ and ‘white boarder’. This seems to help me refine and iterate on ideas. I use a white board, tablet PC or large format display to sketch and throw ideas up on the wall visually and then start to group/edit/delete down. I may do this over and over, refining the concept or going off in new directions. Doing this on the computer allows me to retain my history visually which is a great feature—I can roll back, copy, switch around, etc. This works for me for both my own benefit or when working with others. I find the visual nature of the affinity diagram one of the best tools. It’s kind of like a sketch pad, quickly tearing off brainstorming ideas then gathering and sorting them into conceptual groups.

Keep track of everything so you can go back to it—I manage projects, problems, requests, or ideas needing focus through Planner (which is kind of a Kanban tool for simplifying this) I may also just randomly search the web for key words on the problem or project at hand, a lot of times using the image gallery more so than the text results to let the web do some initial brainstorming for me. Gathering snips of ideas, whiteboarding those along with notes. I start with a large, ‘fuzzy’ funnel and iterate around ideas I like, continuously narrowing my results until I start to finalize a concept. That might feed into a new round of refinement, but the nature of the PC let’s me go through far more rounds of edits faster than ever before.

Inspiration is a tricky one, it can be all sorts of triggers. For design or technology these are usually sparked with something I’ve read or seen. I am a voracious consumer of information in my professional disciplines (technology and marketing). I subscribe to hundreds of feeds of news sources, blogs, and reference materials. Using a good newsreader I can casually skim hundreds of articles a day and pin the ones I want to revisit. A lot of times a random article on an unrelated topic may generate thoughts on a problem or design at hand.

So key thoughts for both these items:

Read read read (even if only skimming) in things revolving around your discipline). You need raw materials for new ideas and solutions.

Keep an electronic scrapbook for ideas (I use OneNote, MS Whiteboard, MS Planner, sticky notes, and longer form documents and sketches, all electronically) Whiteboard and brainstorm when faced with narrowing your thoughts Save your thought processes for later and revisit (sometimes sparks new ideas!)

2. What process(es) do you use to solve problems?

One thing that’s critical—identifying the actual problem. I do root cause analysis of issues first before going down the solutions path. This is a key factor often missed. Many times you’ll be in a meeting where people mention an issue or problem (or, ech, sugar coating it with ‘opportunity’) and immediately people begin to problem solve. The first step is always finding the root cause or issue, it may or may not be related in any way to the discussion. Getting people to pull back for big picture is important so you can solve the real problem, then focus down on solutions with a tool like brainstorming, research or diagnostics.

One other critical piece is learning what’s a priority—if everything is an emergency, nothing is. Are you solving a problem that affects a tiny fraction of your overall function? Are you designing systems or solutions around the edge case? Knowing what’s key to your process so you hit the important things first is a core principal for me. The old 80/20 rule revised for the 21st century is probably more 90/10 or 95/5: but is 5% of your process generating 95% of your problems? Or are you solving for the 95% first? Being able to do this lets you focus on the priorities.

0 notes

Text

Ama Marston and Stephanie Marston on Type R: An interview by Bob Morris

Ama Marston is an entrepreneur, internationally recognized strategy and leadership expert, and the coauthor of TYPE R: Transformative Resilience for Thriving in a Turbulent World. (Hachette book Group; 2018). She has worked on five continents with global leaders like Mary Robinson and Joseph Stiglitz, FTSE Index and Fortune 500 companies, the United Nations, Oxford University, NGOs, and numerous others. Ama has contributed to and been featured in the Guardian, the New York Times, Forbes, Investors Business Daily, Harvard Business Review, Nasdaq and Cheddar among others. She was one of the opening speakers at the 2018 South by Southwest Conference and has presented at numerous thought leadership venues such as Silicon Valley’s Watermark Conference, the United States’ largest women’s conference, alongside leaders like Madeleine Albright, as well as Seattle Town Hall and the Los Angeles World Affairs Council.

Stephanie Marston is a veteran psychotherapist with more than thirty years experience and is an internationally recognized resilience and work-life expert. She is the coauthor of TYPE R: Transformative Resilience for Thriving in a Turbulent World. Stephanie has appeared frequently on radio and television including The Oprah Show, The Today Show, and CNN’s “Headline News”. Stephanie is the founder of “30 Days to Sanity”, a stress and work/life online platform. She has served on the WebMD clinical advisory board. She has also assisted Fortune 500 companies, global corporations, women’s and health-care organizations, and professional associations in reducing employee stress, increasing productivity, and creating a culture of satisfaction in the workplace. Some of her clients include Whirlpool Corporation, Xerox Corporation, Morgan Stanley, and The Mayo Clinic. Stephanie is also the mother of Type R coauthor Ama Marston.

Their highly acclaimed book, Type R: Transformative Resilience for Thriving in a Turbulent World, was published by PublicAffairs/Hachette Group (2018).

* * *

The greatest impact on your professional development? How so?

Stephanie: The pioneering family therapist Virginia Satir was my mentor. Her work on systems theory significantly influenced my thinking not only on how families work, but how organizations and communities best function as well.

Ama: My mother has been a lifelong role model for me as someone who has continued to evolve, break boundaries and innovate as well as being an unwavering advocate for me. That said, working with Mary Robinson broadened my horizons immensely -- she became one of the only female senators in Ireland at age 25 and later went on to become the first female President. She is a formidable advocate on a range of economic and social issues. And she has raised a family and nurtured a career as an equal with her husband with whom she studied at law school. Though I don’t have political ambitions, it changed the lens for me in terms of envisioning what was possible in my career, my thinking about the ways in which I contribute to issues of economic, social and global significance, as well as the kind of personal life I create for myself.

Years ago, was there a turning point (if not an epiphany) that set you on the career course you continue to follow? Please explain.

Stephanie: When Ama was a toddler, we were in a horrific car accident. I broke my back and both legs and wasn’t expected to walk again. I had to fight to regain the physical strength I had always assumed I could count on, and in the process, something within me had been fundamentally changed. I knew that I had to start truly living. I discovered a renewed sense of compassion and appreciation, and a desire to make a contribution to the lives of others. And so the accident planted the seed for my future career as a psychotherapist, with a focus on helping people deal with stress.

Ama: In 2012 I hurt my back after one of the most stressful periods of my life, juggling family illness, the impacts of the financial crisis as a new business owner and growing immigration pressures, among other things. I found myself alone living overseas and having to rest and rebuild for several months. I was forced to let go of control, adapt, and rebuild while my back healed. I had to take the time to ask, ‘What’s most important to me and what do I want next?’ And in the process I had new insights about the extent to which what we offer to the world in terms of leadership, our work in businesses and international organizations, and the way we engage in large global challenges like climate change has to start with ourselves.

Recent research indicates that, on average, less than 30% of employees in a U.S. company are actively and productively engaged. The others are either passively engaged (“mailing it in”) or actively disengaged, undermining the success of their organization? How do you explain this situation? What’s the problem?

Ama & Stephanie: While not the only factor, a significant contributor is the extent to which many of our workplaces and organizations and thus employees have lost a deeper sense of purpose. Whether or not people feel that they are making a contribution to something larger that they believe in and that aligns with their values is reflected in engagement. This is particularly true for younger people and Millennials who rate “purpose” as being of equal if not greater importance than finance in terms of what will attract them to and keep them happy in a job. Additionally almost half of them have chosen not to undertake a task at work because it went against their personal values or ethics, according to Deloitte research. This increases to 61% among those in senior positions.

A lack of engagement can also be a sign of employees being neglected, underutilized or not having their skills be further developed. For instance 63% of Millennials say their leadership skills are not being fully developed and it contributes to them having one foot out the door.

In your opinion, what specifically must be done immediately to increase the percentage of actively and productively engaged employees?

Ama & Stephanie: Build purpose into the core of people’s jobs as opposed to giving them a day to do pro-bono volunteer work one day a year. It’s also important to provide people with the larger vision-- allow them to see how their jobs contribute to a larger whole and what they are building or how it will change people’s lives and it will motivate them in whole new ways.

Making people feel valued is also crucial and pays dividends in times of crisis in terms of their loyalty and willingness to stay in the boat when it starts rocking. This includes having face time with the boss and being given stretch-roles that give them responsibility and allow them to further develop more so than just financial incentives.

Looking ahead (let’s say) 3-5 years, what do you think will be the greatest challenge that CEOs will face? Any advice?

Ama & Stephanie: Research shows that over 50% of CEOs have experienced more than two crises in the past three years. These leaders expect that this will only increase in the next few years. The sheer amount of pressure that CEOs are under and the amount of disruptive change they face, often confronting 21st century challenges they haven’t dealt with before, is among the greatest challenges and will continue to grow as a problem for leaders.

First and foremost, research increasingly shows that our mindsets form the foundation for our ability to be successful, learn and grow from setbacks. Leaders should reflect on when something difficult happens if they are inclined to catastrophize or to believe they have the ability to weather this and draw something positive from it.

Get comfortable with uncertainty. If you haven’t had practice with this organically in your life start practicing on a small scale. Think about what your comfort level is with risk and uncertainty by reflecting on the lessons you learned about them from your family or the larger culture starting with the basics as a child or young adult. Then ask how this might affect your current instinctual response to uncertainty or risk when it arises. Is there something you can do differently the next time a situation comes up where the outcome is uncertain rather than defaulting to your normal response?

The notion of the all-knowing leader is also a thing of the past in the face of our challenges. And yet ‘expert-leadership’ is still among one of the most common leadership styles- drawing heavily on the notion that CEOs can primarily lead with technical knowledge. Collaboration, crowd-sourcing ideas, navigating relationships and people dynamics, iterative thinking and continual learning all are increasingly important and are interwoven with Type R skills and our ability to transform challenges into opportunities.

Now please shift your attention to Type R. For those who have not as yet read it, hopefully your responses to these questions will stimulate their interest and, better yet, encourage them to purchase a copy and read the book ASAP. When and why did you decide to write it, and do so in collaboration?

Ama & Stephanie: After a handful of years that were particularly challenging for both of us personally and professionally our conversations began to crystalize into the idea for this book. This book is a culmination of our personal and professional interests and significant expertise in how stresses have converged in a unique and challenging way and yet why so many people don’t just cope with, but grow from adversity.

For both of us, in times of crisis, change, and stress, inaction was not an option. We knew we had to adapt and evolve. But we’ve also come to the conclusion that while resilience is important, it’s not enough. There’s no going back to who or where we were before challenging times. “Bouncing back” is not only a poor choice, it’s often not possible. For us it was clear that the only choice was to use these challenges to our advantage and continue to grow.

Briefly, what are the most significant differences between "the realities we're living today" and those (let's say) 10-15 years ago?

Ama & Stephanie: The world has dramatically changed from the one the Boomers were born into. Now the challenges we face are often not just personal, but global. Ama’s generation, Gen X, as well as Millennials have been impacted by the ubiquity of digital technology and social media along with the multiple crises—global terrorism, climate change and the financial crisis--that have shaped the way they experience everyday events and have sent shock waves through all aspects of their lives. Inequality is also increasing significantly, posing challenges for many and contributing to growing extremes in politics and the rise of trends like populism and anti-immigrant sentiment.

In your opinion, why do so many "past approaches to resilience no longer work"?

Ama & Stephanie: With the challenges we face, we need a new generation of thinking—one that brings with it a fresh focus not only on coping with an ever-changing and turbulent world, but on undergoing a transformation that makes us better able to thrive in this new reality.

Most people say after a difficult situation, “I can’t wait to get back to normal,” but the reality is that that normal no longer exists. And the notion of bouncing back as referred to in traditional resilience is not only a poor choice, but often isn’t possible. There often is no going back following significant stresses, upheaval and crises -- there’s only moving forward and using challenges to learn & grow.

The difference between those who fold and those who flourish in such situations is not resilience in the traditional sense of the word, but one better suited for these tumultuous times—Transformative Resilience, the ability to turn challenge into opportunity and spring forward.

What are the defining characteristics of the Type R mindset?

Ama & Stephanie: Through our research and our years of experience with everyone from friends, co-workers and family members to world leaders and corporations, we’ve found that there are common characteristics and skills that support the mindset of Type Rs- the individuals, leaders, businesses, families and even communities that turn challenges into opportunities and create Transformative Resilience. The six characteristics are, adaptability, healthy relationship to control, continual learning, sense of purpose, leveraging support, and active engagement.

Which skills must be mastered in order to develop that mindset?

Ama & Stephanie: As we previously alluded to with respect to leaders, the most important skill is the ability to reframe and shift the way we view adversity, challenges, and stress. This means identifying the default frame or lens through which we view things. Are we negative, positive, fearful or inquisitive when something difficult happens? The starting point for any change is to identify our existing mindset (which for groups is closely linked to organizational culture) and our default modes of operating.

It’s also important to call upon stories that remind us of times when we successfully navigated difficulties — whether as a team, a business, a family, or even an entire nation. These stories bolster confidence. They also may provide insights on what worked or was helpful even if that means finding lessons and skills that are transferable between different contexts or circumstances. But keep in mind that no matter who we are or what our abilities are today, we can always increase them tomorrow.

How specifically do Type Rs differ significantly from everyone else when a major crisis develops unexpectedly?

Ama & Stephanie: The major difference in how Type Rs approach a crisis or stress is that they view the situation as an opportunity for learning, growth, and innovation. This is not to say they don’t take some time to acknowledge setbacks, but they don’t get caught in rumination. What defines Type R is an attitude that embraces uncertainty and accepts--even welcomes--change, failure, and disruption with the recognition that wisdom and progress are often born from adversity and failure.

* * *

Ama and Stephanie cordially invite you to check out the resources at these websites:

Type-r-resilience link

Ama Marston link

Stephanie Marston link

from personivt2c http://employeeengagement.ning.com/xn/detail/1986438:BlogPost:198451

via http://www.rssmix.com/

0 notes

Text

New Post has been published on OmCik

New Post has been published on http://omcik.com/30-under-30-part-1-young-life-health-and-annuity-stars/

30 Under 30, Part 1: Young Life, Health and Annuity Stars

(Image: iStock)

Here’s a three-part list to make you think: the ThinkAdvisor Life Health 30 Under 30 award winners for 2017.

This is a look at young life, health and benefits professionals who have already started to make a mark.

We collected nominations in January and have been reviewing and processing the entries ever since.

One startling fact about these young financial services professionals: They are all millennials, but, depending on what definition of the term “millennial” we use, this could be one of the last such lists we compile in which all of the people who make the final cut are millennials. Some say that the millennial generation ran from 1977 to 1995. Some say the youngest millennials were born in 2000. Either way: Some of the youngest people working in U.S. insurance company and insurance agency offices today are members of the post-millennial generation. The bright-eyed kid in your own office who goes out to get the bagels may really be a member of the iGeneration.

(Related: 30 Under 30: Meet the Millennials Who Are Transforming the Insurance Industry)

The millennials in this year’s class of 30 Under 30 professionals are a formidable bunch:

They have seen rapid change in their personal lives. In the course of a few years, they went from rewinding videotapes to watch their favorite cartoons to watching their shows online.

They are tough. They have done well in spite of starting their careers in a time when health insurance faces endless turmoil in Congress, the U.S. Department of Labor has applied new rules to annuity sellers, and low interest rates are making it difficult for insurers to write interest-sensitive products.

They, and the companies they are affiliated with, work harder than the rest at identifying opportunities. They tweet. They have up-to-date LinkedIn pages. They, or someone who’s looking out for them, noticed our 30 Under 30 call for entries. They seem to be better than average at noticing all sorts of things.

They think. They had to fill out extensive questionnaires to participate in this year’s 30 Under 30 search. Their answers paint an impressive picture of how the financial services market might change over the next few decades.

For a look at the first 10 people on the 2017 list, read on. Note that we’ve based these entries on information provided by the nominators, the nominees, the nominees’ LinkedIn entries, and the nominees’ employers’ websites. The ages, job titles and other biographical bits reflect how things were when the nominators submitted their nomination forms.

Michael Alvarez

28

Atlanta

Vice President, Client Advisor, Insurance Solutions Group

Voya Investment Management

ThinkAdvisor Life Health: Why did you choose a career in insurance or financial services?

Michael Alvarez: I graduated college with the goal of landing a job in strategy and came across what I thought was a pretty unique opportunity to join ING U.S. (now Voya Financial) just as it was beginning its separation from ING Group. I was able to land an analyst role on the four-person Strategy & Corporate Development team, which was responsible for spearheading the separation efforts. In preparation for the initial public offering, our team worked closely with the bankers and lawyers along with internal teams throughout the organization to crystalize how ING U.S. would convey its strategy and competitive advantages to the market. It was an amazing learning experience and a whirlwind introduction to the insurance industry.

I then moved into the investment management division and held several roles before the opportunity came up to focus solely on working with insurance companies on their investment portfolios. From my past experience on the strategy team, I had a high level understanding of the complexities of insurance investing and thought that the intricacies of the industry could provide a knowledgeable client advisor with the opportunity to add significant value. I jumped at the chance to shift my work back into the insurance space.

Describe what you do.

While insurance companies have broadly similar goals for their investment portfolios, each one has a unique set of specific objectives and constraints based on their liabilities, regulatory environment, capital position, and history. My first responsibility is to work with the chief investment officer of these insurance companies and his or her staff to deeply understand their specific set of circumstances. Based on these needs and objectives and using Voya’s deep investment resources, our team provides tailored recommendations and designs, builds, and manages customized investment solutions for insurance companies. In my role, I get to be in the center of the iterative process employed to develop and implement these ideas.

Share an achievement you are especially proud of.

Winning my first wrestling match in college. I walked on to the varsity wrestling team at the start of my freshman year and ended up in the starting lineup for almost the entire season due to injuries. I went the whole first year without winning a match (0-19). At the end of the year, I sat down with my coach to decide what to do about next season without any proof that I could actually compete at the Division I level (I hadn’t been recruited anywhere, I hadn’t beaten a Division I wrestler, and I hadn’t even won the wrestle-off for my starting spot). One option was stopping then, but we decided on an off-season training program and giving it at least one more year. The dedication paid off, and I won eight matches the next season. While I never became an outstanding Division I wrestler, I am proud of the individual progress I made as well as the team success we had over the next three years, culminating with a winning record in our league for the first time in 23 years while I was captain.

What is the biggest challenge you see in the industry, or what is the one thing you would change?

A huge challenge for the insurance industry, and one that is extremely pertinent to my role, is the low yield environment, which has put enormous pressure on the investment income and profitability of insurance companies. The persistence of low interest rates and muted global growth has forced insurers to reinvest cash flows from maturing investments and new premium into investments yielding less than the overall portfolio yield for years. These falling yields have forced insurers to rethink their investment portfolios as they try to meet the return targets assumed in the pricing of their products. While there are prudent mitigating steps insurance companies can take, there are always trade-offs, and balancing these trade-offs between risk, liquidity, duration, capital efficiency, and yield is an enormous challenge. The industry would be greatly helped by a gradual rising rate environment to ease some of this pressure on profitability.

What is the biggest opportunity you see in the industry?

In my view, rapid advances in the technology will create a massive opportunity for new winners to emerge in the insurance industry. We have seen changing technology completely reshape numerous industries over past decades, and I don’t think insurance will be any different over the long run. The companies that are able to skillfully adopt, apply, and/or develop new technology will have an enormous advantage over their peers in serving clients efficiently and profitably, and ultimately generating healthy returns on equity for investors.

What do you think millennials are looking for in an advisor? How can advisors best serve this market?

While it doesn’t appear to be the popular answer to this question, I don’t know that millennials are that much different from the generations that came before them. I believe people (including millennials) crave integrity, service, and reliability. I believe they are looking for an advisor who listens and understands their individual needs — and someone they can trust to put their own needs in front of the advisor’s personal incentives. And I also believe that people of all generations are convenience-minded.

Advisors that can blend reliable, thoughtful and individually-tailored advice with a convenient and painless customer experience will continue to be highly valuable to people of all generations, including millennials.

What is the No. 1 piece of advice you would give to a young person looking to enter this industry?

My advice for any young person, including one in the insurance industry, is to evaluate potential opportunities not by the specific role being offered but by the people that you will work for in that role. I believe the most efficient way to start and grow a career is to work for people that are highly successful in your desired field and to align yourself with those that will allow you to trade your hard work and energy for their wisdom and guidance. Highly successful people have already spent years honing their craft, figuring out best practices, and learning from past mistakes. Working hard for them and adding value to their career is what gives you access to those lessons. Trying to recreate all of this knowledge and wisdom on your own instead can be highly inefficient and costly.

(Related: 10 Top ACA Individual Risk-Adjustment Bills)

Doug Amis

27

Cary, North Carolina

President

Cardinal Retirement Planning Inc.

ThinkAdvisor Life Health: Why did you choose a career in insurance or financial services?

Doug Amis: Like a lot of my fellow graduates I wanted to make a positive impact and do more than just work as a cog in a machine. I worked with one of my economics professors to narrow down just how I could help people most: advising. This field let me play to my analytical strengths without sacrificing the value of face-to-face service. The business provides me a path for professional and personal development and a foundation for a rewarding future.

Describe what you do:

I started out in the field as a stockbroker and it gave me a taste for financial advising, but I found my stride working as an independent advisor and financial planner. Working with my mentor we chartered an RIA to provide our clients individual service under a fiduciary standard. Being able to offer sound advice and provide a professional level of service while implementing investment and insurance recommendations has empowered my clients to rest easier and feel more secure about their retirement. My day is filled with planning for retirement income and protecting against risks like long-term care. Our firm places a great deal of importance on consumer education, helping people make the right decisions when it comes to risk management and investing. I work one-on-one with families and heirs both before and during retirement and throughout any financial crises.

Share an achievement you are especially proud of.

We have a number of families that have faced demanding healthcare crises and whenever I can go above and beyond it makes me feel especially proud. One client had been living in Florida for decades apart from his family. Following a diagnosis of dementia and a relocation to North Carolina, I helped him and his family recover close to $2,000 in unclaimed property. These lost checks were due to escheat to the state but a few internet searches allowed me to put this money back in the client’s pocket. The opportunity to help them unexpectedly in their time of need really made me value the little things we can do as an advisor.

What is the biggest challenge you see in the industry, or what is the one thing you would change?

The biggest challenge I see for the industry is how to best deliver the necessary advice to consumers that need our help. As more and more consumers look to fiduciaries, firms are going to need to listen. I would encourage the insurance industry to work alongside a qualified advisors providing comprehensive planning. The combination of conflict-free advice with a professional insurance advisor is a winning recipe.

What is the biggest opportunity you see in the industry?

The baby boomer population is a huge opportunity for advisors. There is a great need for specialized distribution planning and advice. On top of the various on-going changes to regulation, advisors need to respond to the changing financial markets. Having a multi-disciplined approach that combines risk management, conservative investing, and tax and estate planning can help advisors serve all markets of investors.

What do you think millennials are looking for in an advisor? How can advisors best serve this market?

I think millennial investors are looking for a competent advisor that can provide actionable advice. Millennials are often associated with the tech-savvy; providing education to these individuals empowers them to act independently. An advisor can best serve the millennial market by being flexible: flat fee, hourly fees, and recurring fee structures with a defined scope of work can attract these “do-it-yourself” investors. More and more millennial clients prefer to maintain control but want to have the safety of consulting a professional — without a sales pitch.

What is the No. 1 piece of advice you would give to a young person looking to enter this industry?

This industry is becoming harder and harder to access. Career agencies have limited recruitment, and many entry-level jobs start in a call center environment. Looking for a company that can provide you a place to grow is important. Find the company that fosters responsibility and develops you by putting you in a position to make an impact. Do not underestimate the importance of having a mentor that challenges you to think outside of yourself: you can learn something new every day in this industry.

(Related: 4 Ways to Bridge the $12 Trillion Life Insurance Gap)

Whicliff Bihayi

26

Concord, New Hampshire

Competitive services consultant

Lincoln Financial Group

ThinkAdvisor Life Health: Why did you choose a career in insurance or financial services?

Whicliff Bihayi: Growing up I actually wanted to work for the United Nations, like my dad. But he had a different plan for me, and he suggested I consider majoring in economics/finance and go into a career in financial services. And just as he’s done throughout my life, he didn’t let me down.

I was admitted into Lincoln’s leadership development program once I graduated college, which is a highly competitive program designed to accelerate professional development and be prepared to handle more complex roles.

Once I got established in my role and saw the impact we could have in people’s lives and their financial wellbeing — I was convinced that this was the right career for me.

The same altruistic reason why wanted to work for the United Nations, applied in financial services where we’re able to help our clients every day.

In insurance and financial services, you’re able to make an impact, which was important to me.

Describe what you do.

I help financial advisors and agents sort through the vast option of products at their disposal. Our Competitive Services Group is pretty unique in the industry in that we go out and educate producers on ‘which product when’, without necessarily touting one product over another. The objectivity in the work that we do has resonated extremely well with the field, as we don’t split commissions or anything like that.

And on the backend, I work on hundreds of live cases where a producer or advisor is either a) conducting their due diligence and wants to make sure the product they’re offering their client is indeed the best in the marketplace, and b) requesting a thorough review of their clients’ existing policies to see if they are meeting goals and if there’s perhaps a better product today.

My focus is on the life insurance industry and the long-term care industry.

Share an achievement you are especially proud of.

I wouldn’t point to one specific achievement, but a series of accomplishments that solidify the work I do. When we’re able to educate advisors on the merits of certain products and services and we’re able to see their book of business grow overtime, is what gives me the most satisfaction. When an advisor goes from a $1 million book of business, and we’re able to grow that into a $3 million book — that is something I am continuously proud of.

What is the biggest challenge you see in the industry, or what is the one thing you would change?

I believe as we think about the next wave of clients — Gen Xers and millenials — they’re very autonomous and inquisitive… but they want ‘simple’. Android phones are arguably better phones, but I’ve had iPhones for 8 consecutive years now. The Yellow-Cab driver may have 20 years of experience in the business and knows the roads better than anyone in the city, but I order an Uber every time.

Transparency and ease of doing business is now more important than ever — and I think we can all agree that the insurance industry lags behind. Making illustrations simpler and easier to read — and everything from the application to underwriting need to be adjusted to reflect the fact that it’s 2017 and self-driving cars are being tested as we speak. Really though… self-driving cars…

What is the biggest opportunity you see in the industry?

Talent. I believe we work in an industry that’s ripe for innovation and fresh ways of thinking. I think millennials, who are digital natives, have the potential to grow the industry in new ways and make a much bigger impact. I do concede that the industry needs to do a better job of recruiting the right talent. But I do believe that the next stream of young insurance professionals has the potential to take the industry to new heights. The tech ‘know-how’ of this generation creates immeasurable potential across every fact of the industry.

What do you think millennials are looking for in an advisor? How can advisors best serve this market?

Millennials are extremely inquisitive, have access to more information than any generation that’s ever existed, and you may recommend a product to them…and within 2 hours, the millennial can request feedback on said product on a blog and have 147 strangers offering their input. Having access to such information makes this generation unbelievably knowledgeable, but it can also be a hindrance. What that means is millennials need to have a clear and established relationship with an advisor, before any business is done. Trust, transparency, and inclusion are vital to reaching a millennial. Because millennials have access to so much information, they need to be included in the decision-making process, and have to be given different options. Although the advisor may have done 99% of the work, the millennial needs to feel as though he/she did their homework, explored options, and made the decision themselves.

What is the No. 1 piece of advice you would give to a young person looking to enter this industry?

Be a problem solver, create relationships, and establish your board of directors. Think about problem solving not only in the vein of, “here’s an isolated issue, and how can I fix it?”, but also proactively looking at the processes/interactions you have with your clients and peers, and how to make it easier and more impactful to interact with them on an ongoing basis.

Relationships will be the basis of everything you accomplish. No one has ever been successful in this industry without putting a great deal of effort into relationships. Get out there, shake hands and meet people, attend as many functions as you can, conduct as many pro-bono workshops as you can, and hand out as many business cards as you can. Those fruits will bear overtime.

Creating a personal board of directors will give you frank advice not only on what skills you need to develop, but also a) what goals you should be setting to reach the next step in your career, and b) provide input when you’re making important decisions.

(Related: Manulife Names Roy Gori President)

Jason Buchanan

25

Santa Barbara, California

Account executive

HUB International Insurance Services.

ThinkAdvisor Life Health: Why did you choose a career in insurance or financial services?

Jason anan: My father is an insurance agent and also my biggest role model. He started his own agency and grew it into one of the most respected insurance agencies in the community. I always looked up to the way that he provided for my family and how hard he worked to give us the life we had. There was always someone that he knew when we went out somewhere as a family and that was due to him having worked with them before. From watching him I learned that you can make some amazing connections within your community and also provide an excellent life for your family in this industry. When the time was nearing for me to graduate college and move on to the professional world, I knew that this was the right path for me and wanted to follow in his footsteps.

Describe what you do.

I work with business owners to find the proper insurance coverage so they can maintain a healthy, safe, and well-functioning business. Whether it is finding the proper health insurance for their employees, or making sure that they are adequately insured in their liability coverage, business owners need a keen eye to navigate the complicated and confusing path of insurance. That is where I come in. For some, insurance can seem like a foreign language and my job is to translate this language into something that they can make sense of. I work side by side with them throughout the year to continuously provide support and peace of mind. My goal is to establish myself as a trusted member of their business and someone that they can come to at any time for assistance.

Share an achievement you are especially proud of.