#Online Digital Account Opening

Text

Importance of Financial Literacy for Students

Financial literacy is not just a theoretical concept but a practical life skill that is crucial for students to navigate the complexities of personal finance confidently. Beyond classroom instruction, understanding the fundamentals of banking, including the process of opening and managing a bank account online, is essential for students to build a solid foundation for financial independence. Here are the reasons why financial literacy is important for students:

1. Practical Application: Learning about banking concepts in the classroom enables students to apply theoretical knowledge to real-world situations. Understanding account types, interest rates, and financial terminology empowers students to make informed decisions regarding loans, investments, and savings. By gaining practical banking knowledge, students develop a sense of financial responsibility early on, setting them up for wise financial management throughout their lives.

2. Growing Up Responsibility: Teaching banking education in schools enhances students' financial responsibility. Managing an online bank account involves accounting for transactions, saving, and budgeting, which instills important financial skills in students. Early financial education fosters disciplined money management habits, preparing students to handle their finances confidently as they transition into adulthood.

3. Building Credit and Trust: Financial literacy education helps students understand the importance of building credit and maintaining a trustworthy banking record. Responsible banking practices, such as making timely payments and managing accounts effectively, contribute to a favorable credit score. By learning about credit and trust within the financial sector, students can establish a solid foundation for responsible borrowing and financial credibility in the future.

4. Exploring Technology: Incorporating banking education into school curricula equips students with the necessary skills to navigate the digital financial landscape. Students learn about digital transactions, online banking app, and financial technology, preparing them for a future driven by technology. Familiarity with digital banking platforms enables students to conduct secure transactions and manage their finances conveniently and safely.

5. Avoiding Financial Pitfalls: Financial literacy education helps students identify and avoid common financial pitfalls. By understanding concepts such as debt management and financial traps, students can make informed decisions and develop healthy financial habits early on. By learning about appropriate financial practices, students can safeguard their financial well-being and avoid potential financial challenges in the future.

In conclusion, integrating financial literacy programs into school curricula is essential for equipping students with essential life skills related to banking and personal finance. By understanding the importance of financial literacy, students can build a strong foundation for financial independence and make informed financial decisions throughout their lives.

#online banking app#online banking account opening#online banking account open#online banking account open app#online bank open account#online digital account opening#account online opening

1 note

·

View note

Text

Features to look for when opening a digital savings account

It can be tricky to open a bank account for savings because many banks offer similar interest rates and features. Since most people use savings bank accounts for simple financial operations, most don't offer much more than essential banking services. It is the account that receives your monthly wage and is used to make regular payments for the majority of you.

But what happens if you want to open a digital savings account? It should provide a lot more benefits than a standard savings account. So, in this article, you can read about the benefits of a digital account opening compared to a regular savings account.

Easy to open and operate

Documentation and in-person trips to the bank are usually required when creating a savings bank account. The procedure can be laborious because you need to fill out paper paperwork and submit copies of your identity documents. Here's where an online savings account comes in handy.

Opening a modern digital savings account is simple when you make use of techniques like video-KYC and e-verification of electronic papers. If you have a smartphone and good internet access, opening an online savings account is very simple.

Quick activation of linked services

A digital savings account has significantly shorter service activation times than a traditional savings account. You don't have to wait to get a lot of features because you can do everything online.

Beyond purchases, the virtual debit card in a digital account app offers additional features. Furthermore, it enables you to promptly initiate Internet and mobile banking as soon as you receive the card. This means that as soon as you finish the account application, you can begin using more than 250 financial services.

Access to a wide range of digital services

A digital savings account should offer all of the banking services you need, be conveniently accessible from anywhere else, and be simple to set up and quickly activate.

You should be able to transfer money, pay bills, create statements, and more through services like Internet and mobile banking. Your personal finance needs should also be accessible through a single portal. This covers long-term savings, investments, and much more.

Added benefits and offers

Doing daily transactions isn't the only thing a modern digital savings account should be used for. Along with providing transaction benefits and reward points, it should compensate you for your usage. You should also be able to readily access all of the information whenever and whenever you want it.

For example, several banks offer you a variety of offers on the virtual debit card you receive right away after activating your digital savings account. They also offer cashback for online purchases for making specific purchases at a specific time. This feature in credit cards helps you enjoy offers while increasing your credit score.

Final thoughts

It could be time to switch to a new digital बचत खाता if your current savings account doesn't meet all of the requirements listed above. Not only is opening a digital savings account quick and easy, but it also moves you one step closer to the banking of the future.

#digital account opening app#online digital account opening#digital account opening#instant account opening bank#बचत खाता#bank khata kholna#best banking app#online bank account opening app#open bank account online app#bank online account#open online bank account

0 notes

Text

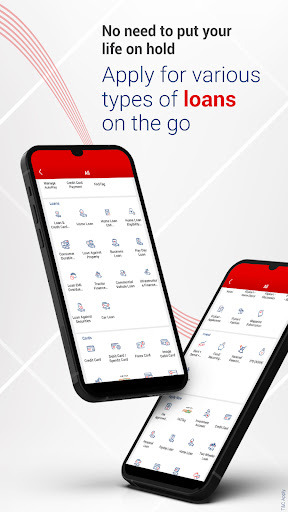

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Digital Savings account or an 811 digital bank account by visiting your nearest branch.

#digital savings account#online digital account opening#online digital bank account opening#digital account opening#digital banking india#digital banking#digital account

0 notes

Photo

And that’s not all!

Mid-month cash crunch or an emergency? Get your salary in advance!

Kotak Payday Loan is available with just a few taps. Repay the loan when your salary gets credited next month.

Features of Payday Loan:

• Get a loan within seconds starting at Rs.3,000

• Pay interest as low as Re.1 per day

• Avail loan with no documentation

Eligible users can apply from the ‘Apply Now’ section.

#Digital Account App#Bank Open Account Online#Online Open Bank Account App#Digital India Banking App#Online Digital Account Opening#Bank Account Check#Money Transfer#Banking App#kotak#kotka 811

1 note

·

View note

Text

I decided I'm taking the L and applying for the car part assembly place that my former neighbor works at cause A) she can vouch for me which increases my chances of actually getting it, B) all the places I actually wanted to work at either aren't hiring or never got back to me but this place is always hiring, and C) it's full-time and pays $17.75 an hour and I've looked at the rent prices for nearby apartments and calculated that with that pay I should be able to move out in about a year give or take so even though I won't enjoy it it'll be worth it in the long run.

#i also decided recently that freelance graphic artist is the career path i wanna take#so while i'm working there i'm gonna look for a good online graphic design course i can take#and then maybe while i'm at it i'll finally learn how to do digital art#and then i can actually start using my deviantart account and take commissions#y'know to make some extra money on the side#and then eventually when i get all that off the ground i can find an apartment over in kansas city and move there cause blue springs sucks#this is like the first time in my life i've actually had a long-term game plan for the foreseeable future so hopefully it actually works ou#but yeah the evening shift at this car place is from 2 pm to 10 pm#so i'm gonna find one of those online courses where you can do everything at your own pace#so that way i can do that in the mornings and work in the afternoons#also i'd be able to keep a consistent gym schedule#cause i could go to the gym early in the morning#i prefer going to the gym like as soon as it opens cause that's when it's the least crowded#so yeah fingers crossed all this shit goes according to plan i guess#former neighbor gave me a number to call some lady but obviously i'll have to wait til monday for that#cause she definitely won't be there on the weekend#shut up tristan

3 notes

·

View notes

Text

Seamless Digital Account Solutions | Digi Khata

Digi Khata makes it effortless to open a PhonePe digital account online, providing a quick and secure way to manage your finances. Additionally, our platform supports Paytm zero balance account opening, allowing you to enjoy the benefits of a Paytm account without maintaining a minimum balance. Whether you're looking to open a Paytm account online or manage your finances through PhonePe, Digi Khata offers a streamlined and user-friendly experience. Enjoy the convenience of modern digital banking with our comprehensive account opening services.

#open a PhonePe digital account online#Paytm zero balance account opening#open a Paytm account online

0 notes

Text

Let's Discover Payecards Privileges Together

In today's interconnected world, managing your finances seamlessly and securely is more important than ever. Introducing Payecards, a cutting-edge digital banking solution that empowers you to navigate international payments, money transfers, and Bitcoin trading with ease. With Payecards, not only can you open a bank account online in just a few simple steps, but you also gain access to a suite of innovative financial services designed to optimize your financial transactions.

International Payments

In today's interconnected world, international payments have become a crucial aspect of both business and personal finance. Services that facilitate these transactions have evolved significantly, catering to the growing demand for seamless, fast, and cost-effective solutions. To successfully navigate the complexities of international payments, it is essential to understand the mechanisms involved, the fees associated, and the various platforms available.

The Mechanisms Behind International Payments

International payments typically leverage the SWIFT network, allowing banks to communicate securely, or use modern alternatives such as blockchain technology. This evolution not only enhances the efficiency of sending money across borders but also improves transparency and reduces the risk of fraud.

Fees and Exchange Rates

When making international payments, it's important to be aware of the fees charged by financial institutions. This includes transaction fees and potential markups on the exchange rates. The choice of service provider can significantly impact the overall cost, so it's beneficial to compare options before making a transaction.

Platforms for International Payments

Several platforms specialize in international payments, each offering unique features. Digital banking services and e-wallets have emerged as user-friendly options, providing customers with the ability to manage their funds more efficiently. Moreover, many platforms allow users to open a bank account online quickly, eliminating the need for physical branches. This convenience is particularly beneficial for businesses engaged in global trade.

As the landscape of international payments continues to evolve, staying informed about the latest tools and services will help individuals and businesses optimize their transaction processes, ultimately allowing for smoother money transfer experiences across borders.

Money Transfer

In today's fast-paced digital landscape, money transfer services have become essential for anyone looking to send or receive funds quickly and securely. With the rise of international payments, individuals and businesses alike benefit from various options that cater to their specific needs, whether they are transferring money across borders or domestically.

One of the most significant advancements in money transfer technology is the integration of Bitcoin trading. Cryptocurrency has revolutionized the way people think about value exchange, allowing for instant transfers without the need for traditional banking intermediaries. This not only lowers costs but also provides greater transparency and security.

Moreover, digital banking platforms have streamlined the money transfer process, enabling users to manage their finances from anywhere with internet access. By choosing to open a bank account online, customers gain access to various money transfer features that simplify transactions, making it easier than ever to send money to friends, family, or businesses worldwide.

Whether you’re using mobile apps, online platforms, or cryptocurrency, the landscape of money transfers continues to evolve, ensuring that people have the tools they need to engage in reliable and efficient financial transactions.

Bitcoin Trading

Bitcoin trading has emerged as a significant aspect of the cryptocurrency landscape, providing investors an opportunity to engage in the digital economy. The rise of Bitcoin has transformed how individuals view international payments and money transfer, as more people recognize the advantages of using cryptocurrencies in these transactions. Investing in Bitcoin is not just about purchasing the currency; it involves understanding market trends, trading strategies, and the dynamics of digital banking.

One of the primary reasons for engaging in Bitcoin trading is its potential for high returns. The volatile nature of Bitcoin prices allows traders to capitalize on price fluctuations, which can lead to substantial profits. However, it is essential to approach Bitcoin trading with caution, as volatility also brings risks. Conducting thorough research and utilizing trading platforms equipped with real-time analytics can help mitigate these risks.

For those looking to start trading Bitcoin, several digital banking platforms facilitate this process seamlessly. Many of these platforms allow users to open a bank account online, which simplifies the process of funding their Bitcoin purchases and transfers. By integrating traditional banking with cryptocurrency trading, many financial services are making it easier for users to navigate both realms.

Moreover, Bitcoin trading also plays a crucial role in the international payments landscape. By utilizing Bitcoin, users can transfer funds across borders with minimal fees and faster transaction times compared to traditional banking methods. This capability enhances the financial inclusion of individuals in regions where access to conventional banking services might be limited.

In summary, Bitcoin trading represents a key aspect of the evolving financial ecosystem. As digital banking continues to grow, those interested in trading must stay informed about market trends and leverage technology to enhance their trading strategies effectively.

Digital Banking

Digital banking has transformed the way individuals and businesses conduct their financial transactions. With the rise of technology, it has become increasingly essential, especially for those engaging in international payments, money transfer, and even Bitcoin trading. Today’s consumers expect convenience and speed, and digital banking provides just that.

Unlike traditional banking, which often requires physical branch visits, digital banking allows customers to open a bank account online, access funds, and manage their finances from anywhere in the world. This is particularly advantageous for frequent travelers or expatriates involved in international payments, as they can perform transactions without being bound to a specific location.

Furthermore, digital banking platforms typically come equipped with robust security measures, ensuring that customers feel safe conducting transactions and managing their financial activities. As the financial landscape continues to evolve, embracing digital banking can yield numerous benefits, such as lower fees, flexible options for money transfers, and easier access to cryptocurrency trading like Bitcoin.

In conclusion, digital banking is a crucial element in the modern financial ecosystem. It not only simplifies everyday banking tasks but also empowers users with a wide array of financial services designed to meet the demands of a global economy.

Open Bank Account Online

Open bank account online has become increasingly popular due to its convenience and the speed of the application process. With advancements in technology, many banks now offer seamless digital banking experiences that allow customers to handle their financial needs from the comfort of their homes.

Benefits of Opening an Account Online

When you opt to open a bank account online, you unlock a variety of benefits:

Convenience: The online application process is straightforward and available 24/7, so you can apply at any time that suits you.

Quick Setup: Many banks allow immediate account setup, allowing you to start managing your finances or making international payments right away.

Access to Digital Banking Tools: Enjoy advanced tools for managing your account, including budgeting features, transaction tracking, and investment options like Bitcoin trading.

What You Need to Open an Account

To get started with opening a bank account online, you typically need the following:

Personal identification such as a driver's license or passport.

Proof of address, like a utility bill or lease agreement.

Your Social Security number or Tax Identification Number for compliance with regulations.

A valid email address and phone number for communication and account verification.

Choosing the Right Bank for Your Needs

Before you proceed, it's essential to research various banks and their offerings. Consider factors such as:

Fee Structure: Look for banks with low or no monthly maintenance fees and competitive transaction rates for international payments.

Digital Banking Features: Ensure that the bank you choose provides a robust online and mobile banking interface that supports your financial activities, including money transfers and Bitcoin trading.

Customer Support: Check the quality and availability of customer support as you may need assistance with online transactions or account management.

In summary, opening a bank account online is a convenient solution that enables effective management of your finances, facilitating easy money transfers, international payments, and digital assets like Bitcoin. By understanding your needs and comparing options, you can find a banking solution that works for you.

0 notes

Text

Kotak Mahindra Bank’s official mobile banking application for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

If you are an existing Kotak customer, you can use the 250+ features of the app to Bank, Pay bills, Invest, Shop and access services.

One of our recent additions to the 250+ features is our new Pay Your Contact feature, where you can now send money to anyone using just their mobile Number

#credit card on upi#instant fd account setup#open fd online#fund transfer status#transfer payment bank#money transfer bank account#emi card to bank transfer#fd account#upi money transfer app#fixed deposit account#highest fd rates in bank#digital banking india

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#saving account#zero balance account online#debit card online apply#open new account online#digital account#zero balance account open#open savings account#digital banking app#premium banking#mobile banking app#new account open bank online 0 balance

1 note

·

View note

Text

open zero balance bank account

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://play.google.com/store/apps/details?id=com.msf.kbank.mobile

online bank open account

#saving account opening#mobile banking#online open account#apply online account opening#digital account opening app#best online account opening#open bank account online free#zero balance account opening app#online bank open account#zero balance savings account online#online open saving account#zero balance account opening#instant account opening app#account online open

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online open bank account app#bank account open online#savings account#open savings account#open online account#bank account opening online#opening bank account#digital banking app#bank account online#premium banking

0 notes

Text

Features of a zero minimum balance account

A savings account with minimum restrictions is a dream for the majority of the working class. You can deposit your funds in a savings account, which is a deposit account service offered by the bank. Typically, banks will provide you with a savings account as long as you keep a certain minimum balance in the account. If not, you'll be required to pay a maintenance fee.

However, some people start Instant Online Bank Account Opening to create an account known as a zero-balance savings account which does not require a minimum amount. Simple in concept, there is no requirement to keep a minimum balance in a savings account in order to maintain this kind of account.

Read some of the features of a zero minimum balance account:

No minimum balance

As its name would suggest, this account requires no minimum balance to be present in it. As a result, you are not required to keep a minimum balance. Therefore, if there is a zero balance, there is no penalty. When people open this kind of account, this is what draws them in the most.

Restricted transactions

The number of transactions you can make each month on zero-balance accounts is restricted. Banks often limit withdrawals to four per month. The bank will turn your account into a standard Savings Account if you do make more withdrawals than are allowed. For these additional transactions, some banks might even impose a small fee.

What are the different types of zero-balance accounts?

Zero-balance savings accounts come in a variety of forms. The three primary forms of zero-balance accounts are digital savings zero-balance accounts, Basic Savings Bank Deposit Accounts, or BSBDA, and BSBDA Small Accounts.

The e-KYC procedure allows for the immediate opening of digital savings accounts online. To open the account, you must have a PAN card and an identification number. In this process, the OTP issued to the registered mobile number is used to verify the biometric information. These accounts initially have some limitations under central bank standards.

Economically challenged people without bank accounts who possess the required KYC documents can open a Basic Savings Bank Deposit Account or BSBDA. This requires zero balance.

Performing Instant Online Bank Account Opening for BSBDA Small accounts can be opened by those without the necessary KYC documentation with the aid of an introducer. Small savings account holders are limited to holding a certain amount. Additionally, consumers have a year to submit the necessary KYC documentation.

A limited number of savings accounts

According to new restrictions issued by central banks, there can only be one zero-balance account at one bank. Additionally, if you have a zero-balance savings account with one bank, you are not permitted to have any other savings accounts with that bank. You must provide a declaration to the bank saying that you do not already have a zero-balance savings account with another bank when you apply for one.

Final thoughts

While having its own benefits, a zero-balance savings account may have an impact on your financial situation. An Account Opening App is helpful if you encounter unanticipated financial situations that require numerous withdrawals. Having a minimum balance in your savings account may therefore be advantageous.

#kotak#kotak811#Instant Online Bank Account Opening#Payment Bank#Digital Account Opening App#Online Bank Accounts Opening#नेट बैंकिंग#नेट बैंकिंग एप्प#Banking App#Money Transfer#Bank Account Check#Online Digital Account Opening#Online Open Bank Account App#Bank Open Account Online#Online Bank Account Opening App Sbi#Digital Account App#Open Saving Account Online#Zero Balance Account Online#Instant Open Bank Account

1 note

·

View note

Text

Maximizing Your Small Business with a Business Savings Account

In the realm of small business management, having a dedicated business savings account plays a pivotal role in ensuring financial stability and flexibility. By leveraging the features of a business savings account, entrepreneurs can effectively manage their finances and navigate through various challenges. Here's how a savings account can bolster your small business:

1. Emergency Fund Protection:

A business savings account serves as a safety net, allowing you to set aside funds for unexpected emergencies or downturns in your business. Much like personal savings, having a financial cushion can provide peace of mind and prevent you from making hasty decisions during challenging times.

2. Access to Liquid Assets:

By regularly depositing funds into your business savings account, you create a readily accessible pool of liquid assets. This ensures that you have quick access to cash whenever you encounter unexpected expenses or opportunities that require immediate financial support.

3. Credit Rating Enhancement:

Maintaining a business savings account demonstrates financial responsibility and can positively impact your company's credit rating. A strong credit score enhances your credibility with banks and lenders, making it easier to secure loans or financing for future business endeavors.

4. Contribution to Retirement Funds:

In addition to serving as a buffer for emergencies, funds accumulated in your business savings account can also contribute to your retirement planning. These savings can complement other retirement accounts, such as IRAs, and provide financial security for your post-business years.

By prioritizing the establishment of a business savings account, entrepreneurs can effectively safeguard their businesses, improve their financial standing, and plan for future growth. Explore options for free bank account opening online to access the best mobile banking app and streamline your small business finances with ease and efficiency.

#online banking app#best mobile banking app#apply online account opening#new bank account open app#mobile banking account app#digital account opening app

0 notes

Text

Hassle-Free Digital Account Opening | Digi Khata

Digi Khata offers a seamless solution for free digital account opening, making it easy to manage your finances without the hassle of paperwork. With our platform, you can open a free digital account online in just a few simple steps, ensuring quick and secure access to your funds. Our instant account opening process ensures that you can start managing your money right away. Experience the convenience of digital banking with Digi Khata, designed to simplify your financial life.

0 notes

Text

Welcome to Payecards CARD

Payecards is a versatile platform offering secure and convenient prepaid card solutions for online and offline transactions. With Payecards, users can easily manage their finances and make purchases with ease. The platform provides a range of prepaid cards that cater to different needs, ensuring safety and flexibility in handling payments. Whether for personal use or business expenses, Payecards aims to simplify financial management with user-friendly features and robust security measures.

#crypto#banking#finance#cards#Open bank account online#digital banking#Bitcoin trading#money transfer#international payments#crypto wallet#cryptocurrency exchange#Payecards Business Account#Payecards UK#Payecards Bank#Payecards Card

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open new account online#digital account#online open bank account app#open savings account#apply for bank account online#mobile banking app#mobile banking apps#mobile banking account#account online opening#opening account online

1 note

·

View note