#Zero Balance Account Online

Text

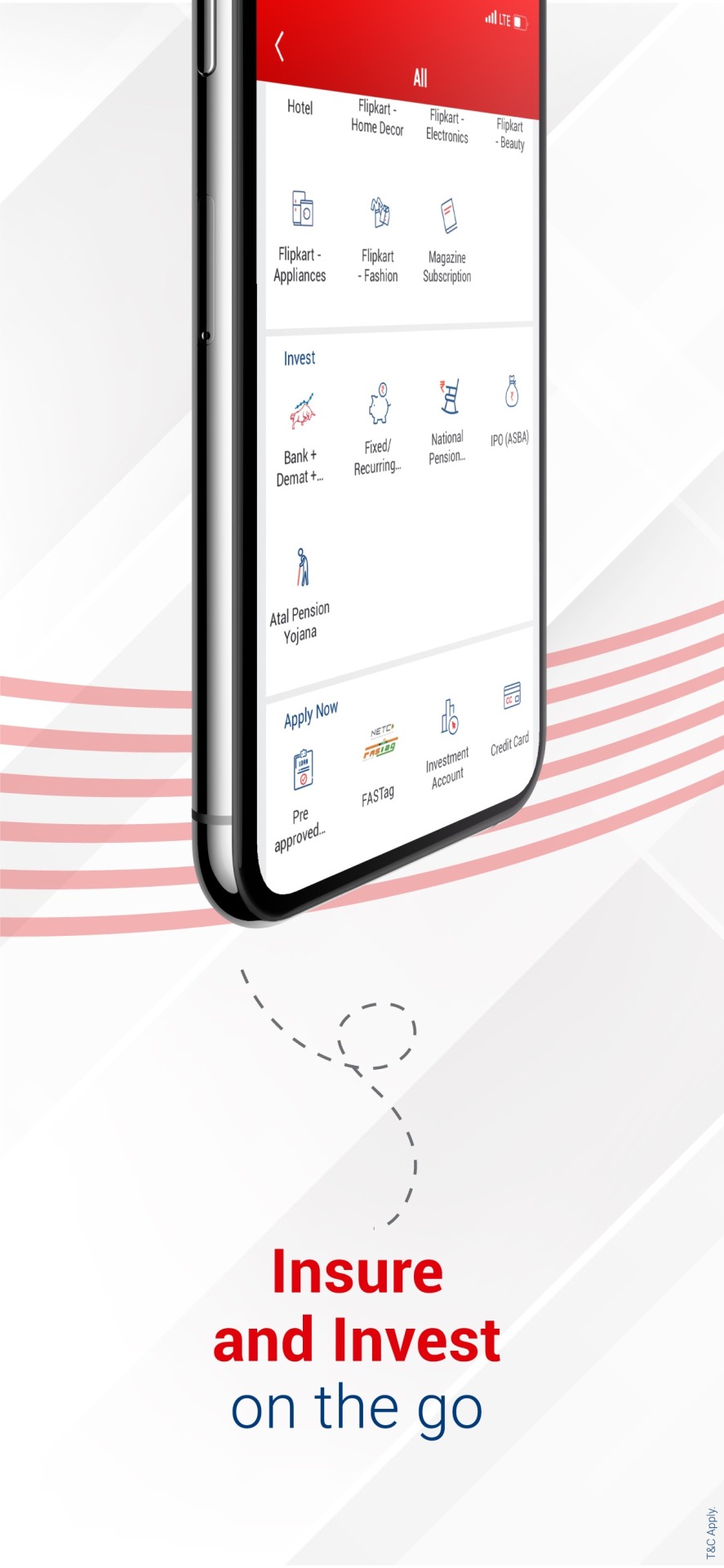

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#saving account#zero balance account online#debit card online apply#open new account online#digital account#zero balance account open#open savings account#digital banking app#premium banking#mobile banking app#new account open bank online 0 balance

1 note

·

View note

Text

Reasons to switch to online banking

Recent years have seen significant changes in the banking industry, and many people now find banking simpler due to technological advancements. Those days of waiting in a queue at the bank or spending hours on the phone to resolve transactions are long gone. With a free online bank account, you may accomplish all of your daily tasks from the convenience and privacy of your home. Indeed, this has become a very popular banking approach in the last several years. Here mentioned are the reasons to switch to online banking:

No monthly fees:

Your checking and savings accounts are maintained by most traditional banks every month for a cost. These needless fees deplete your hard-earned money. For certain accounts, if you keep a specific balance or get a certain amount of direct deposits each month, the monthly maintenance charge is waived. However, you shouldn't have to worry about whether you can meet those obligations every month.

Convenience:

Money management is easy with online banking. You can check your bank statements, make bill payments, and transfer money whenever you can access the Internet. Bank-to-bank transfers, bill payments, mobile cheque deposits, and paperless statements are popular aspects of Internet banking. Certain online banks have tools and apps on their websites that are intended to help you save more money.

Stay in control:

You should consider free online bank accounts because they make it easier to maintain financial control. You have quick and simple access to watch what comes in and goes out of your account, keep an eye on your spending, schedule payments, and carry out financial activities. You gain complete comfort and convenience in handling your finances and bank accounts, making it much easier to maintain control over your finances.

No balance requirement:

For savings and checking accounts, large banks may have multiple balance requirements. Additionally, they might ask you to keep a minimum daily balance. Not everyone can accomplish this. Less stringent balance requirements apply to online banks. Many have no requirements at all for a starting deposit. Usually, the ones that do are a few. Most also don't demand you to keep a specific monthly balance.

Save time:

Giving online banking a try is also encouraged because many individuals are surprised by how much time and hassle they may save using its services. It used to take a lot of time for customers to call bank employees or to visit offices and wait in long lines. You can easily handle everything online from the comfort of your home when you have internet banking, so this is no longer a problem. You can handle your finances much more quickly and easily as a result.

Bottom line:

These are just a few reasons to make opening an online bank account wise. An online new account open has made simpler nowadays. Due to benefits like reasonable rates, no fees, and digital capabilities that can make managing your accounts and increasing your savings easier, online banks frequently provide substantial advantages over traditional banks.

#open online bank account#bank online account open#online opening account#bank account online opening#zero balance account online#online banking app#open new account online#online open bank account app#open savings account

0 notes

Text

Importance of having a zero-balance account online

A zero-balance account is a service offered by a bank or financial institution for you to deposit your funds. It can be thought of as a deposit account or a type of ordinary savings account. Most of the time, banks provide zero-balance accounts online to keep a minimum amount in the account. You must pay a maintenance fee if you disregard the rules. Below mentioned is the importance of having a zero-balance account online:

No minimum balance:

As the name implies, the significant advantages of a zero-balance account are that there is no requirement to keep any form of balance in the account and that you can use the funds up to the last penny. For students and salaried workers, it is regarded as excellent. Additionally, non-maintenance prevents consumers from paying the low-maintenance penalty associated with a typical savings account in the event of any default. It is better to have a zero-balance account in the current world.

Attractive interest rates:

Account users can earn income on their money in zero-balance accounts online, like in ordinary savings accounts. They are a fantastic choice for those who are just beginning out financially. While most banks offer competitive interest rates on these accounts, you must remember that rates differ from bank to bank. Compare interest rates offered by different banking partners.

Easy to open:

One more conventional approach is visiting a bank branch and opening an account, just like any other savings account. A zero-balance savings account can be selected when opening the bank website with which you want an account. This is another quick and easy method. Upload your documents in digital form, and presto. In only a few minutes, your account will be accessible.

Mobile banking:

Suppose you are someone who works during the week and is unable to visit a bank branch. The bank is at your fingertips with features like net banking and mobile banking. You can access banking services with a few clicks on your desktop or mobile device. This is one of the most significant benefits of a zero-balance account that draws users in.

No transaction charges:

A zero-balance account has many benefits, including no transaction fees. There are no deductions or transaction fees to worry about if you wish to transfer money or withdraw some cash. A zero-balance account is fairly basic in design. It was introduced to open up banking to everyone. There is no doubt that this account offers the most basic financial services. You may receive free monthly account statements and a passbook facility. Selected banks may also provide more sophisticated banking facilities like a safe deposit box, paper checks, anywhere branch banking capability, etc.

Bottom line:

Considering the advantages of a zero-balance account, you must pick the online account opening bank zero balance Pnb for your needs. With net banking and mobile banking, a person can make payments through this account. General utility payments can be made in seconds, including those for phone, water, power, recharge, and other services.

#zero balance account online#zero balance account opening#zero balance account app#zero balance savings account online#zero balance account opening app#zero balance account open

0 notes

Text

Unravelling the mystery of debit cards and how it works:

A debit card is a kind of plastic money or currency. Even if you don’t have any cash, you can still utilise it to make transactions. Banks generally issue debit cards for savings account holders that are connected to their accounts. Your bank statement contains specific information about each transaction made with your debit card. You may keep track of your costs and card-related transactions with the aid of the statement. Consumers can instantly access money from their bank accounts by using debit cards, which combine the key characteristics of an ATM card with a credit card. Instead of writing a cheque, you can use a debit card to purchase online, offline, or even through a mobile wallet application.

How does a debit card work?

You usually utilise a card reader to complete the transaction when using your debit card offline. Using a debit card, one of the credit card application apps, to make a purchase is remarkably quick and easy. Enter your special PIN after the merchant has entered the amount, and you will be informed that the transaction has been completed. When a merchant uses a debit card to make a purchase, your bank handles the request and distributes the needed funds.

You must provide the three-digit CVV number, the 16-digit expiration date, and the 16-digit debit card number to use your debit card for online purchases. After the details are finished, an OTP is delivered to your registered mobile number, and you must enter it on the merchant's website to complete the purchase.

How to get a debit card:

When you open a bank account, debit cards are generally provided without charge, although you might need to request one. You must follow the card’s activation requirements after acquiring the card.

Your PIN is set during the activation process. When making purchases at the point of sale, asking for cash back, or taking money out of an ATM, you must enter your PIN. Many banks still offer prepaid debit cards, even if you don’t have a bank account.

If you choose to use one, be mindful that some prepaid debit cards include monthly fees that could reduce your deposits.

What is the minimum period to obtain a debit card?

You should be aware that each bank has minimum age requirements for receiving debit cards. Nevertheless, it might be conceivable to give a debit card to a person as young as 7, depending on the bank and the type of account.

These accounts, also called teen checking accounts, need a parent or legal guardian as the co-account holder. A person can lawfully open a bank account in their name without a joint account holder once they turn 10 years old.

Parting words:

Finally, debit cards give you the choice to use a card rather than a cheque to make offline and online payments. Consider all available payment alternatives, including credit cards, debit cards, and prepaid cards. Matching the cards in your wallet with your spending preferences is crucial. Combining all three will provide your desired amount of flexibility and easy access to cash for your daily needs.

#debit card#debit card online apply#digital india banking app#internet banking#easy net banking app#zero balance account online

1 note

·

View note

Text

Features of a zero minimum balance account

A savings account with minimum restrictions is a dream for the majority of the working class. You can deposit your funds in a savings account, which is a deposit account service offered by the bank. Typically, banks will provide you with a savings account as long as you keep a certain minimum balance in the account. If not, you'll be required to pay a maintenance fee.

However, some people start Instant Online Bank Account Opening to create an account known as a zero-balance savings account which does not require a minimum amount. Simple in concept, there is no requirement to keep a minimum balance in a savings account in order to maintain this kind of account.

Read some of the features of a zero minimum balance account:

No minimum balance

As its name would suggest, this account requires no minimum balance to be present in it. As a result, you are not required to keep a minimum balance. Therefore, if there is a zero balance, there is no penalty. When people open this kind of account, this is what draws them in the most.

Restricted transactions

The number of transactions you can make each month on zero-balance accounts is restricted. Banks often limit withdrawals to four per month. The bank will turn your account into a standard Savings Account if you do make more withdrawals than are allowed. For these additional transactions, some banks might even impose a small fee.

What are the different types of zero-balance accounts?

Zero-balance savings accounts come in a variety of forms. The three primary forms of zero-balance accounts are digital savings zero-balance accounts, Basic Savings Bank Deposit Accounts, or BSBDA, and BSBDA Small Accounts.

The e-KYC procedure allows for the immediate opening of digital savings accounts online. To open the account, you must have a PAN card and an identification number. In this process, the OTP issued to the registered mobile number is used to verify the biometric information. These accounts initially have some limitations under central bank standards.

Economically challenged people without bank accounts who possess the required KYC documents can open a Basic Savings Bank Deposit Account or BSBDA. This requires zero balance.

Performing Instant Online Bank Account Opening for BSBDA Small accounts can be opened by those without the necessary KYC documentation with the aid of an introducer. Small savings account holders are limited to holding a certain amount. Additionally, consumers have a year to submit the necessary KYC documentation.

A limited number of savings accounts

According to new restrictions issued by central banks, there can only be one zero-balance account at one bank. Additionally, if you have a zero-balance savings account with one bank, you are not permitted to have any other savings accounts with that bank. You must provide a declaration to the bank saying that you do not already have a zero-balance savings account with another bank when you apply for one.

Final thoughts

While having its own benefits, a zero-balance savings account may have an impact on your financial situation. An Account Opening App is helpful if you encounter unanticipated financial situations that require numerous withdrawals. Having a minimum balance in your savings account may therefore be advantageous.

#kotak#kotak811#Instant Online Bank Account Opening#Payment Bank#Digital Account Opening App#Online Bank Accounts Opening#नेट बैंकिंग#नेट बैंकिंग एप्प#Banking App#Money Transfer#Bank Account Check#Online Digital Account Opening#Online Open Bank Account App#Bank Open Account Online#Online Bank Account Opening App Sbi#Digital Account App#Open Saving Account Online#Zero Balance Account Online#Instant Open Bank Account

1 note

·

View note

Text

Seamless Digital Account Solutions | Digi Khata

Digi Khata makes it effortless to open a PhonePe digital account online, providing a quick and secure way to manage your finances. Additionally, our platform supports Paytm zero balance account opening, allowing you to enjoy the benefits of a Paytm account without maintaining a minimum balance. Whether you're looking to open a Paytm account online or manage your finances through PhonePe, Digi Khata offers a streamlined and user-friendly experience. Enjoy the convenience of modern digital banking with our comprehensive account opening services.

#open a PhonePe digital account online#Paytm zero balance account opening#open a Paytm account online

0 notes

Text

How To Open A Business Bank Account In Dubai And The UAE

Starting a new business in Dubai or the UAE is an exciting journey. The business-friendly tax policies and the nation’s strong economy attract investors and entrepreneurs seeking to establish their future here. It is no surprise that the UAE ranks as the top global investment destination, with numerous successful enterprises and ventures thriving in the region. Every business here, whether well-established or a startup, must open a business bank account to manage its finances effectively. However, there are specific rules and requirements when opening a business bank account.

This blog aims to provide you with the necessary knowledge about opening a corporate bank account in UAE and Dubai. It covers the process, eligibility criteria, required documents, and expected banking fees.

#open a business bank account dubai#zero balance business bank account in uae#fab business account#adcb business account#open business account online uae#business bank account dubai#adcb business account opening#best zero balance business account in uae

0 notes

Text

A simple guide to opening a Zero-Balance Savings Account online

Do you want to save money but only have a little to spare? Opening a Zero-Balance Savings Account online is a simple and convenient way to start your savings journey ideally. With just some basic and easy steps, you can set up your account from your home. Here is a guide to help you open the account:

Choose the right bank

First, choose the right bank for a Zero-Balance Account opening online. Look for banks that provide online account opening services and compare their features and benefits. Before deciding, consider factors such as interest rates, fees, and convenience.

Visit the bank's website

Once you have selected the bank, visit its official website to start the process. Look for open a Savings Account online, usually displayed on the homepage or in the banking services section.

Click on 'open an account'

Click on ‘open the account’ option or link to start the application process. You may be directed to a page where you can choose the account you want to open. Select the Zero-Balance Savings Account option from the list provided.

Fill out the online application form

Next, fill out the online application form with your details. This typically includes name, address, contact information, date of birth, and identification proof such as an Aadhaar, PAN card, or passport. Make sure to double-check your information for accuracy before submitting the form.

Upload the required documents

After completing the application form, you may be prompted to upload scanned copies of the mentioned documents. These may include your ID proof, address proof, and passport-sized photograph. Ensure that the documents are clear and legible to avoid any delays in the verification process.

Review terms and conditions

Before proceeding, take time to review the terms of the Zero-Balance Savings Account, including any fees, interest rates, and other essential details. Make sure you understand and agree to all the terms before moving forward.

Submit the application

Once completed all the steps and reviewed the terms, submit your application for processing. You might receive an email or SMS for confirmation with further instructions on the next steps.

Verify your identity

After you submit your application, your chosen bank verifies your identity and the documents provided. Depending on the bank's policies, this may involve a telephone or in-person process.

Receive your account details

Once your identity is verified, you get your account details, like account number and login credentials, through email or SMS. You can now use your Zero-Balance Savings Account to deposit money and begin saving for your financial goals.

Conclusion

Opening a Zero-Balance Savings Account online is a hassle-free process that lets you quickly save money. Following these simple steps, you can set up your account quickly and take the first step towards financial security.

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#best banking app#premium banking#mobile banking app#digital account app#secure net banking#phone banking app#zero balance account#e banking app#online bank

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#best banking app#premium banking#mobile banking app#digital account app#secure net banking#phone banking app#zero balance account#e banking app#online bank

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online bank accounts opening#zero balance account#phone banking#saving account#bank online#open online bank account app#online open account bank#create bank account online#free bank account opening online

0 notes

Text

A Simplified Guide for Education Loan Repayment

Education loans are beneficial for people achieving their academic dreams. But the repayment process can often filled with lots of confusions. Getting educational loan isn't that much hard as you think. With an online open savings bank account and necessary documents, you can easily apply for an educational loan. However, with a structured approach and understanding of available options, managing education loan repayments becomes manageable. If you are thinking about getting an education loan or have already got one, this guide explores actionable steps to ensure a smooth repayment journey.

Understanding Loan Terms and Conditions

Before discussing repayment, thoroughly review the terms and conditions of your education loan. Understand interest rates, repayment schedules, and any additional fees associated with the loan. Evaluate your current financial status to determine how much you can afford to repay each month. Consider factors such as income, expenses, and other financial obligations to make the best deals.

Setting Up a Zero Balance Bank Account

To streamline repayment, consider zero balance account opening app specifically dedicated to loan repayments. This account ensures that your loan payments are separated from your regular expenses, making it easier to track and manage repayments. This account will serve as the primary channel for efficiently managing your education loan payments.

Exploring Repayment Options

Familiarize yourself with the various repayment options available for education loans. These may include standard repayment plans, income-driven repayment plans, or refinancing options. Select the repayment plan that most closely matches your financial circumstances and objectives. Develop a repayment strategy based on your financial capabilities and loan terms. Determine whether you'll make fixed monthly payments or opt for a flexible repayment plan. Set realistic goals and timelines to stay on track with your repayment journey.

Automating Loan Payments

Take advantage of automatic payment options offered by lenders or banking institutions. Automating your loan payments ensures timely and consistent repayments, reducing the risk of missed deadlines and late fees. Incorporate loan repayments into your monthly budgeting process. Prioritize loan payments alongside essential expenses to ensure they're accounted for each month. As your income or expenses fluctuate, make the necessary adjustments to your budget.

Seeking Assistance if Needed

Banks provide you with a particular period called a moratorium period, which denotes the time period between your course completion and your first EMI. You may get a job immediately or not. Depending on your situation, the period will differ. If you encounter financial difficulties or anticipate challenges in meeting repayment obligations, don't hesitate to reach out to your lender. Many lenders offer assistance programs or loan modification options to help borrowers manage their loans effectively.

Monitoring Progress and Making Adjustments

Monitor your loan repayment progress regularly and make adjustments as necessary. Stay informed about your remaining balance, interest accrual, and any changes to repayment terms. Adjust your strategy if your financial situation or goals evolve over time.

Final thoughts

Education loan repayment doesn't have to be overwhelming. By following this simplified guide and leveraging available resources, you can navigate the repayment process with confidence and achieve financial freedom. Many banks offer the convenience of online open savings bank account. Take advantage of this facility to establish a designated account for loan repayments.

#kyc service#kyc for low risk customers#kyc search#bank balance#upi transaction id status check#upi transaction tracking#transaction status check#track upi transaction#upi transaction check online#check my transaction status#verify bank statement online#zero balance account opening#zero balance minor account opening online

0 notes

Text

Top banking mistakes you cannot afford to make

Although banking offers numerous benefits, most people need help with the procedure. Every time you conduct a banking transaction, you and your bank communicate. Such as cashing out from an ATM or depositing a check, among many other things. It is normal to make mistakes, but doing so while conducting financial transactions with your bank could cost you more. So, while doing banking activities, you should be more cautious because a single mistake can lead to big losses.

Source : https://luxurystnd.com/top-banking-mistakes-you-cannot-afford-to-make/

#zero balance account open#online open bank account app#bank account open online#savings account#open savings account#open online account#bank account opening online#opening bank account

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#zero balance account opening app#open zero balance account#online account open#bank account app#mobile banking account app#mobile banking app#open bank account app

0 notes

Text

Easy Paytm Zero Balance Account Opening with Digi Khata

Digi Khata makes Paytm Zero Balance Account Opening simple and hassle-free. Now you can easily open Paytm account online without worrying about maintaining a minimum balance. Whether you're a student, professional, or business owner, Digi Khata offers a seamless process to help you set up your Paytm account in just a few steps. With a zero-balance account, enjoy the flexibility of managing your finances, making payments, and transacting securely. Choose Digi Khata for quick and efficient Paytm Zero Balance Account Opening and experience the convenience of digital banking at your fingertips.

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open zero balance account#digital account app#mobile banking app#open bank account app#digital account opening app#online new account opening app#instant account opening app#best mobile banking app

0 notes