#apply for bank account online

Text

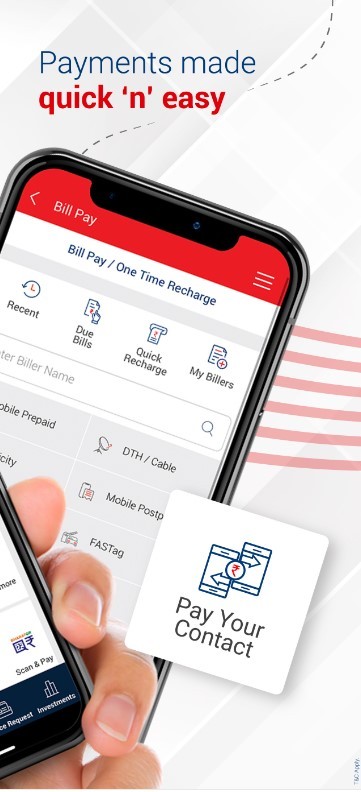

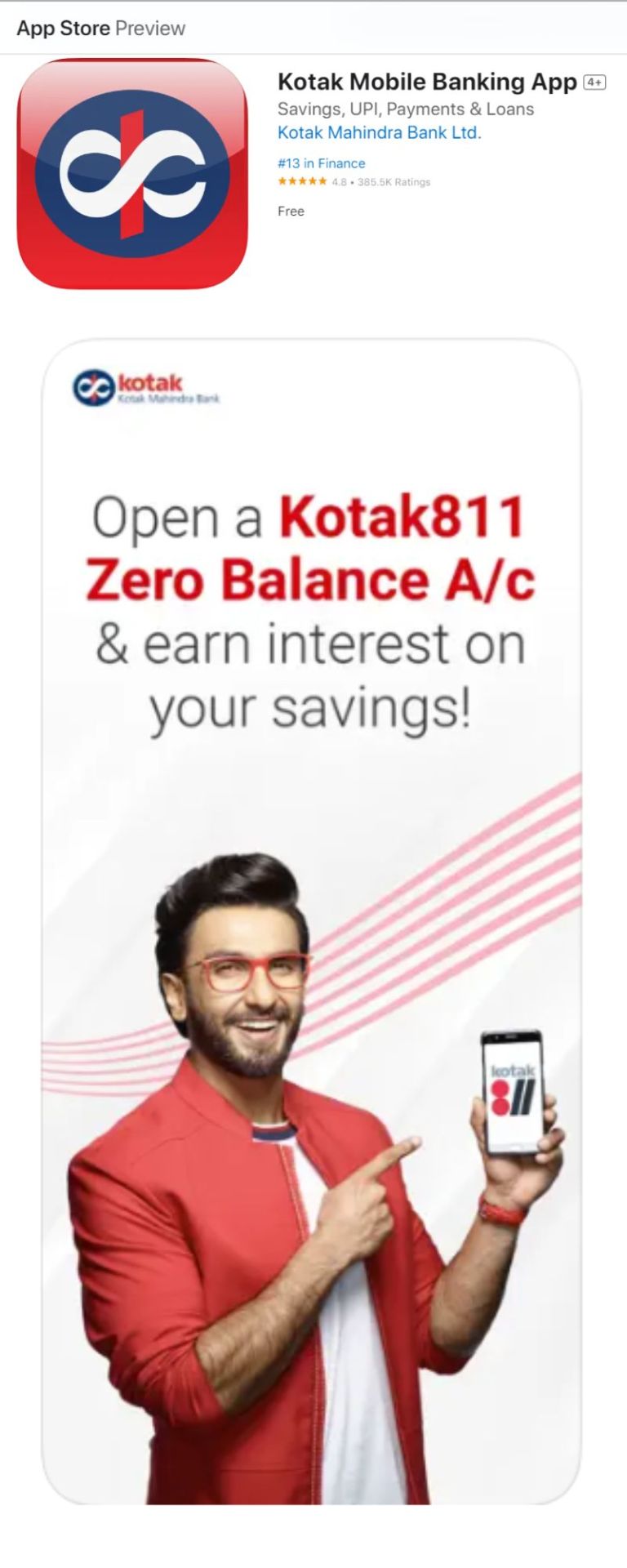

Kotak Mobile Banking app for iPhone

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://apps.apple.com/in/app/kotak-mobile-banking-app/id622363400

#online banking account opening#bank new account opening online#account opening online#create bank account online#apply for bank account online#free bank account opening online#apply online account opening#new bank account open app

1 note

·

View note

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#mobile banking account opening#premium banking#open bank account app#online open account bank#apply online bank account#online open account#account opening online#create bank account online#apply for bank account online#mobile banking app

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open new account online#digital account#online open bank account app#open savings account#apply for bank account online#mobile banking app#mobile banking apps#mobile banking account#account online opening#opening account online

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open new account online#digital account#open savings account#apply online bank account#apply for bank account online#mobile banking app#mobile banking apps#online new account open#online banking#saving account opening

0 notes

Text

Open a zero balance savings account online in a few simple steps!

Welcome To Your Online Zero Balance Savings Account From Kotak!

Get an instant online bank account number & CRN (Customer Registration Number) so you can start banking immediately on the Kotak 811 app.

#0 balance account opening bank#account open instantly#application for account opening in bank#apply for bank account online#bank account online#bank account open instantly

0 notes

Text

Kotak Mobile Banking App

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online bank account opening app#apply online bank account#bank new account opening online#apply for bank account online#free bank account opening online#online banking app#mobile banking apps#online new account open

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#apply for bank account online#new bank account open app#banking app#bank online account opening#new bank account open#new bank account opening app#online banking#account opening app#digital savings account#instant online bank account opening

0 notes

Text

Why is digital banking the future?

The banking sector has changed significantly throughout the years due to the introduction of digital technologies. Since customers may now access banking services from anywhere and at any time, thanks to the growth of digital banking, the sector has become more effective and practical. Digital banking is on pace to become the industry norm due to the rapid development of digital technologies. You should make the best out of Digital Account Opening App today itself because digital banking is the future; the below points are justifications for the statement:

Banking on mobile

Customers now prefer to use their cell phones to make banking transactions, which has increased the popularity of mobile banking. Because it is so convenient and straightforward to use, mobile banking, with the help of theDigital Account Opening App, has gained popularity among many users. According to statistics, 1.75 billion people will use mobile banking by 2024. As mobile banking services gain popularity, banks that need to be more active in adopting them risk losing consumers.

Transactions without paper

Typical manual processes are expensive, cumbersome, and ineffective. Replace these internal systems with more productive paperless ones as part of an organization's digital transformation ambitions. In addition to being more effective, paperless transactions are also easier to manage. If you centralize your operations and preserve a digital record of every financial transaction, your processes will be considerably more effective and improve your record-keeping. Instead of employing a one-size-fits-all approach, services may be adapted to each customer's needs.

Automation

Creating a system where software intelligence performs routine and repetitive tasks, reducing the cost of human labor, is known as workflow automation. Organizations could streamline mundane processes by implementing a workflow management system, freeing resources for more crucial activities. This also frees up human resources and their limitations, allowing them to concentrate on higher-level strategic planning. This can result in a lower cost of service or larger margins for these businesses.

AI

The way traditional financial institutions operate internally and provide customer services is changing as AI-driven banking quickly establishes itself as the norm. As an illustration, AI-driven chatbots are now being utilized to provide customer care at banking branches, promptly responding to simple questions. Banks can use big data analytics to understand their clients' spending patterns better and provide tailored advice on products like investments or debt consolidation. AI algorithms also aid in automating some standard internal procedures, such as audit trails for fraud prevention and regulatory compliance. AI would become a dominant force in the banking sector by developing new business models and providing users with better user experiences and quicker decision-making capabilities.

A cloud service

Companies that provide financial services are beginning to shift their operations to the cloud in more significant numbers. More scalability is provided. As a result, they are making it easier to satisfy growing client demand. In addition, they are more secure and simpler to construct than present systems.

Bottom line:

It is the world of digitalization and technology; you are just living in it. Also, the Credit Card Apply App is available today; you can apply online and can, get access to it and can enjoy all the benefits it offers.

#apply for bank account online#digital account opening app#account opening form online#digital account

0 notes

Text

i went into a chase bank today to see if i could close my account because i am tired of getting charged $12/month for being broke and unemployed and while the banker was trying to convince me not to do this she was like "i just love us so i don't like seeing people leave us" and like first of all maybe try cutting out the bullshit fees then and also refunding me but second whoooooo shills for jp morgan chase like that. "i just love us" ??????????? girl i know they are not paying you enough to act like that. she also tried to get me to get a credit card but i declined. and then immediately walked across the street to a local bank to ask them about getting a credit card.

#i can't close my fucking account because my shit idiot brother pressured me into investing in meme stocks four years ago and i havent had#the balls to ask him to refund me for that ridiculous venture and he still thinks The Squeeze will happen and he will make millions#anyway i still have that investment account so i have to have the other chase account open too. is the point.#she did switch it to a kind of account with less fees only like $6 now 🥴#and the card for the other bank is apply online only and now that i'm thinking about it i wish i had asked other questions because a friend#told me the interest rate applies every DAY you havent paid the bill and i definitely thought it was like an end of the month thing?#but whatever i'm sure i can find this information online credit cards are just so fucking mysterious to me#me

6 notes

·

View notes

Text

I'm debating if it would just be easier to get a whole new phone/phone number and just have my grandpa cancel my line once I get it

#the thing is ive had this number since i got my first phone#so i would have to contact a LOT of places about the updated number#including: literally any job ive applied for. health insurance. uni. ALL online accounts that ask for phone number. friends. banks.#but on the other hand. i KNOW my grandpa will make it as difficult as possible#as in: i will have to do everything myself if he agrees to let me remove my number from the line#he will complain every second of having to unlock it#and i will have to spend hours with that man figuring out how to remove the number#meanwhile. i COULD just go down to a provider and ask about getting a new phone.#get a new phone/phone plan for myself (bc i dont wanna stay w this provider it sucks). and just tell him to cancel my line#i could transfer everything over after getting the new line/before he cancels my old one so if anything needs a verification i can do it#just fine - especially the uni and bank stuff#or maybe wait until my semester starts and i have a job already so that if i do have any issues transferring stuff#my uni tech help is more likely to be open and if i have a job i could easily update my resume and just like#contact whoever im working for with updating the number#i might just do that actually#it will suck getting a whole new number tho bc my current number is so easy and again ive had it for years so it is ingrained in my mind#amber's shit you can ignore

3 notes

·

View notes

Text

The IRS LOOOVE to ask me questions like

Have you ever:

never not received dividends of a divisionary nature through the operation of a state or federal corporal mutual fund, and paid pecuniary expenses related to Article 805A(b).e, or

been gifted more than $2,000,000 cash or the equivalent in yachts or racing horses from a foreign monarch, and

not been actively involved in assessing fewer than two digital assets prior to 2021, or not more that two non-relational nontaxable assets after Jun 7th, 2022 (see Schedule 8, box 17a)

☐ Yes ☐ No ☐ Other

#& before anyone tries to recommend me some nice simple online tax preparation thing; srry but i am legally not allowed to#bc I'm a dual citizen living abroad 🙃 So I have to pay an accountant $500/year to fill it out for me instead#Hey Americans! Did u know if you ever permanently move abroad you actually still have to file US tax returns for the rest of your life?#And report the balances of all your bank accounts to the US government? With potential fines of tens of thousands of dollars#PER year PER form that you don't fill out?#Fun fact: this also applies in many many cases if you were born abroad to a US parent and have never even been to the US!!!#Fun fact: the US government doesn't tell you this! There are thousands of people all over the world#who are considered tax evaders by the US and stand to be immediately arrested or fined the minute they set foot on US soil!!!#Most of this is hardly ever enforced ofc bc the IRS simply doesn't have the manpower to do so#but it's a handy little sword of Damocles hanging over the head of every US citizen all over the world#so that if anyone ever steps out of line - whoopsieee! looks like you haven't been filing your FBARs huh?#Would be a pity if you were extradited and arrested for tax evasion :)#One more fun fact: apart from the US the only other country to require lifelong taxation and tax filing from its citizens abroad is Eritrea#a totalitarian dictatorship with one of the worst human rights records in the world#But thank god the America is such a paragon of freedom and democracy <3 🙃🙃🙃

12 notes

·

View notes

Text

Who are the ideal candidates for a zero balance account?

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#upi application#mobile finance app#payment bank#bank account check#debit card online apply#bank fd rates#account check karne wala app#bank balance app download#paisa check karne wala app#check bank account balance#bank balance check karne wala app#check my bank balance#bank balance enquiry app

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#upi money transfer app#highest fd rates in bank#payment bank#paise check karne wala app#debit card online apply#online money transfer app#e fund transfer#online money transfer services#bank balance check app download#account balance check#account balance check app#finance application#bank fd interest rates#latest fd interest rates

0 notes

Text

#Technological Displacement Part 11 Machine Learning#AI#Sponsored by: Robert F Geissler| MLO#NMLS ID 2605994#Motto Mortgage Invictus NMLS ID 2581029#Each office is independently owned and operated#9 Court Theophelia Saint Augustine#Florida 32084#Direct Line 609-774-1764#[email protected]#Apply now: http://www.robertfgeissler.com#Equal Opportunity Housing#We will never request wire information via email. Please contact your LO if you get any message asking for bank account details#personal documents/information#or your password to any system online. Keep your identity safe by never clicking any links in a suspicious email.#Disclaimer#The content provided on this Mortgage 101 YouTube channel is for informational and educational purposes only and should not be construed as#While we strive to provide accurate and up-to-date information#we make no representations or warranties of any kind#express or implied#about the completeness#accuracy#reliability#suitability#or availability of the information#products#services#or related graphics contained in our videos for any purpose. Any reliance you place on such information is strictly at your own risk.#Investing in financial markets involves risk#and you should be aware of your risk tolerance and seek professional advice where necessary. Past performance is not indicative of future r

1 note

·

View note

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#saving account#zero balance account online#debit card online apply#open new account online#digital account#zero balance account open#open savings account#digital banking app#premium banking#mobile banking app#new account open bank online 0 balance

1 note

·

View note

Text

Latest technologies used in the banking sector

Gaining a thorough understanding of operations can help you perform better. Technology integration in banking has shown a whole new range of capabilities. The global financial services ecosystem is changing quickly due to technological advancements. A thorough understanding of operations can help you perform better, as technology integration in banking has revealed a whole new spectrum of capabilities. Due to technological advancements today, many people apply online bank accounts and enjoy doing banking on their phones. Here you can see about technologies used in the banking sector:

Wearable technology

Imagine your bank is with you with just a simple gesture or touch. Wearable technology makes it conceivable now but a few years ago, it might not have been. By collecting data via technologies like sensors on smartwatches, fitness trackers, communication devices, and more, wearable technology is designed to give you an immersive experience. To assist in identifying users and prevent fraudulent transactions, these digital gadgets save consumers' payments and other crucial information. Customers can gain insights by interacting with other applications, too. Data is gathered and analyzed with the aid of servers, analytics engines, and decision support tools to assist businesses in making best choices for enhancing customer experiences.

Hyper-personalized banking

Personalized banking experiences increase customer loyalty. For this reason, banks today use a variety of tactics and tools, like omnichannel banking, purchase now pay later, and financial advice tools, to customize their products. For instance, omnichannel banking enables customers to communicate with banks through various channels while offering a uniform, customer-centric picture of their financial information. Personalized advice and investment guidelines are also provided through wealth management and financial advising tools, increasing investor and client satisfaction.

Banking of things

The banking sector is using IoT to collect data effectively. This automates data collecting for expediting banking procedures, including KYC and loans, to provide real-time event response. For instance, IoT-enabled smart, automated teller machines transmit alerts when there is insufficient cash or something wrong, ensuring prompt maintenance. Additionally, customers can make purchases using IoT-enabled digital wallets incorporated into their smartphones and wearables. Due to the real-time delivery of customer-specific data through linked devices, IoT in banking facilitates fraud detection, which reduces loss. Due to the advent of technology, many people fill out bank account online application and open digital bank accounts.

Artificial intelligence

The greater usage of artificial intelligence in banking is another one of the major banking technology trends that may be anticipated in 2023. Banks can lower financial crime risk and increase fraud detection with this technology. For instance, banking software and applications can use machine learning to monitor real-time transaction data and automatically send notifications or halt transactions if suspicious behavior is found. AI can also aid in the banking industry's process optimization. By cutting expenses and improving the effectiveness of their operations, banks can save time and resources by automating activities. Banks and other financial institutions can use AI to improve customer service and make more accurate choices.

Parting words Hopefully, you will learn about the technologies used in the banking sector. A fast-growing field, banking technology has a wealth of prospects for the financial industry. This technology development stimulates many people to open digital accounts by completing the bank account online application form.

#apply for bank account online#free bank account opening online#mobile banking app#online banking app#best mobile banking app

0 notes